Exhibit 99.1

| | Contact: |

| | Ed Dickinson |

| | Chief Financial Officer, 636.916.2150 |

FOR IMMEDIATE RELEASE

LMI AEROSPACE, INC. ANNOUNCES RESULTS FOR THE

FOURTH QUARTER AND FULL-YEAR 2006

Consistent with February 2007 Announcement

ST. LOUIS - March 14, 2007 - LMI Aerospace, Inc. (Nasdaq: LMIA), a leading provider of structural components, assemblies and kits to the aerospace, defense and technology industries, today announced financial results for the three and twelve-month periods ended December 31, 2006.

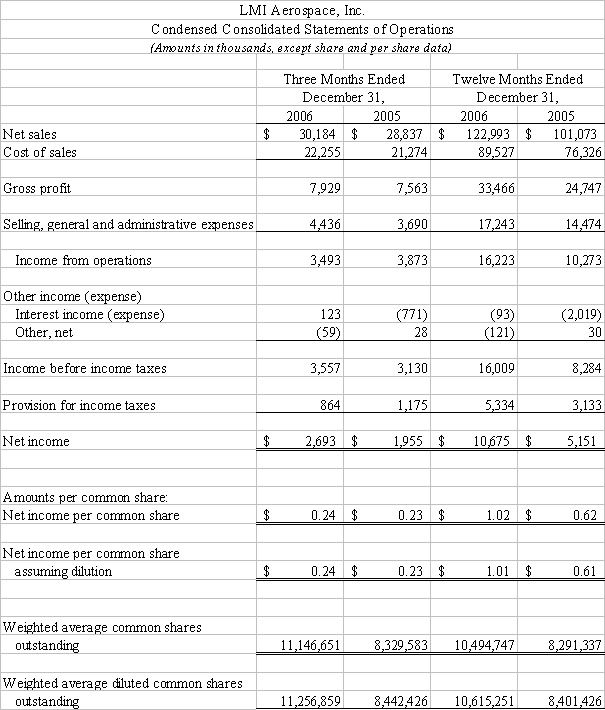

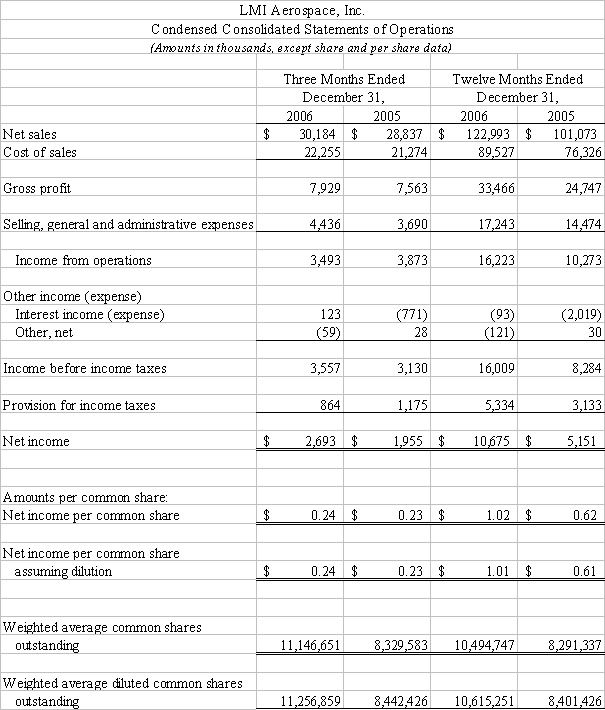

For the fourth quarter of 2006 LMI reported net sales of $30.2 million, an increase of 5 percent from $28.8 million in the fourth quarter of 2005. Net income for the fourth quarter of 2006 was $2.7 million or $0.24 per diluted share, compared to $2.0 million or $0.23 per diluted share in the fourth quarter of 2005.

For the full-year 2006, net sales increased 22 percent to $123.0 million from $101.1 million in 2005. Net income for 2006 was $10.7 million or $1.01 per diluted share, compared to $5.2 million or $0.61 per diluted share in 2005. These results are consistent with the preliminary information announced in the news release of February 15, 2007.

Gross profit for the fourth quarter of 2006 was $7.9 million or 26.3 percent of net sales, up from $7.6 million or 26.4 percent of net sales for the fourth quarter of 2005. The beneficial impact of growing revenues and improved efficiencies in the fourth quarter of 2006 was offset by year-end standard cost adjustments for finished goods inventory items. Gross profit for 2006 was $33.5 million or 27.2 percent of net sales, compared to $24.8 million or 24.4 percent of net sales in 2005.

Selling, general and administrative expenses were $4.4 million in the fourth quarter of 2006, up from $3.7 million the year-ago quarter. For 2006, selling, general and administrative expenses were $17.2 million, compared to $14.5 million in 2005. The increases for the quarter and the year were due to higher payroll and fringe benefits, as staffing levels have increased to support the growth in revenue, and the acquisition of Technical Change Associates, Inc. in early 2006.

Interest income for the fourth quarter of 2006 was $123,000, compared to $771,000 of interest expense in the year-ago period. For 2006, net interest expense was $93,000 compared to $2.0 million in 2005. During the first quarter of 2006, LMI completed a public offering of common stock and used a portion of the proceeds to repay debt and invested the balance in short-term securities.

Income taxes were $0.9 million for the fourth quarter of 2006, compared to $1.2 million for the prior-year quarter. Income tax expense for the fourth quarter of 2006 was reduced by $0.4 million from the use of a previously reserved capital loss carry forward and recognition of research and experimentation tax credits earned for all of 2006. Income taxes for 2006 were $5.3 million compared to $3.1 million in 2005.

Backlog at December 31, 2006, was approximately $140 million compared to $106 million at December 31, 2005.

“Net sales for 2006 grew as production rates of commercial and corporate aircraft increased, and market share in the military sector expanded because of new orders for rotorcraft products,” Ronald S. Saks, President and Chief Executive Officer of LMI, said. “In order to meet the growing demand for our aerospace components and subassemblies, we are adding 150,000 square feet of new facility space for manufacturing, assembly, heat treating and processing, distribution and offices to the existing 660,000 square feet at our nine plants. Capital expenditures for manufacturing equipment and software systems in 2006 were $6.7 million, and we expect to spend an additional $7.0 million in 2007. We are adding employees to our manufacturing, supply chain and information systems groups to manage projected sales increases in 2007. In addition, we are reviewing potential acquisition opportunities that address our need for added capacity, as well as provide new capabilities and product offerings to our customers.”

“Guidance for 2007 remains unchanged from the information presented in our February 15, 2007, news release,” Saks said. “We expect sales to expand throughout 2007, as inventory corrections abate at certain customers and new programs are introduced on both newly designed aircraft, including the Boeing 787 model, and legacy aircraft, including added awards for components and subassemblies on existing military programs.”

LMI Aerospace, Inc. is a leading provider of structural components, assemblies and kits to the aerospace, defense and technology industries. The company fabricates, machines, finishes and integrates formed, close tolerance aluminum and specialty alloy components and sheet metal products primarily for large commercial, corporate and military aircraft. LMI Aerospace, Inc. manufactures more than 30,000 products for integration into a variety of aircraft platforms manufactured by leading original equipment manufacturers and Tier l aerospace suppliers.

This news release includes forward-looking statements related to LMI Aerospace, Inc.’s outlook for 2007 that are based on current management expectations. Such forward-looking statements are subject to various risks and uncertainties, many of which are beyond the control of LMI Aerospace, Inc. Actual results could differ materially from the forward-looking statements as a result, among other things, of the factors detailed from time to time in LMI Aerospace, Inc.’s filings with the Securities and Exchange Commission.

LMI AEROSPACE, INC. | |

CONSOLIDATED BALANCE SHEETS | |

(Amounts in thousands, except share and per share data) | |

| | | December 31 | |

| | | 2006 | | 2005 | |

| Assets | | | | | |

| Current assets: | | | | | |

| Cash and cash equivalents | | $ | 24,411 | | $ | 35 | |

| Short-term investments | | | 2,243 | | | - | |

Trade accounts receivable - net of allowance of $311 at December 31, 2006 and $244 at December 31, 2005 | | | 14,658 | | | 16,088 | |

| Inventories | | | 33,956 | | | 25,333 | |

| Prepaid expenses and other current assets | | | 1,760 | | | 1,205 | |

| Deferred income taxes | | | 2,210 | | | 1,610 | |

| Income taxes receivable | | | 232 | | | - | |

| Total current assets | | $ | 79,470 | | $ | 44,271 | |

| | | | | | | | |

| Property, plant & equipment, net | | | 19,514 | | | 18,162 | |

| Goodwill | | | 5,653 | | | 5,653 | |

| Intangible assets, net | | | 3,425 | | | 3,114 | |

| Other assets | | | 548 | | | 757 | |

| Total assets | | $ | 108,610 | | $ | 71,957 | |

| | | | | | | | |

| Liabilities and stockholders' equity | | | | | | | |

| Current liabilities: | | | | | | | |

| Accounts payable | | $ | 9,758 | | $ | 7,407 | |

| Accrued expenses | | | 3,916 | | | 6,077 | |

| Short term deferred gain on sale of real estate | | | 147 | | | - | |

| Current installments of long term debt | | | 238 | | | 1,846 | |

| Total current liabilities | | | 14,059 | | | 15,330 | |

| | | | | | | | |

| Long term deferred gain on sale of real estate | | | 2,493 | | | - | |

| Long-term debt, less current installments | | | 583 | | | 14,462 | |

| Subordinated debt | | | - | | | 1,000 | |

| Deferred income taxes | | | 965 | | | 1,333 | |

| Total long-term liabilities | | | 4,041 | | | 16,795 | |

| Stockholders' equity: | | | | | | | |

| Common stock, $.02 par value per share; authorized 28,000,000 shares; issued | | | | | | | |

| 11,577,631 shares in 2006 and 8,797,909 shares in 2005 | | | 232 | | | 176 | |

| Preferred stock, $.02 par value per share; authorized 2,000,000 shares; none | | | | | | | |

| issued in both periods | | | - | | | - | |

| Additional paid-in capital | | | 66,104 | | | 26,307 | |

| Treasury stock, at cost, 389,732 shares in 2006 and 433,972 shares in 2005 | | | (1,849 | ) | | (2,059 | ) |

| Retained earnings | | | 26,023 | | | 15,408 | |

| Total stockholders' equity | | | 90,510 | | | 39,832 | |

| Total liabilities and stockholders' equity | | $ | 108,610 | | $ | 71,957 | |