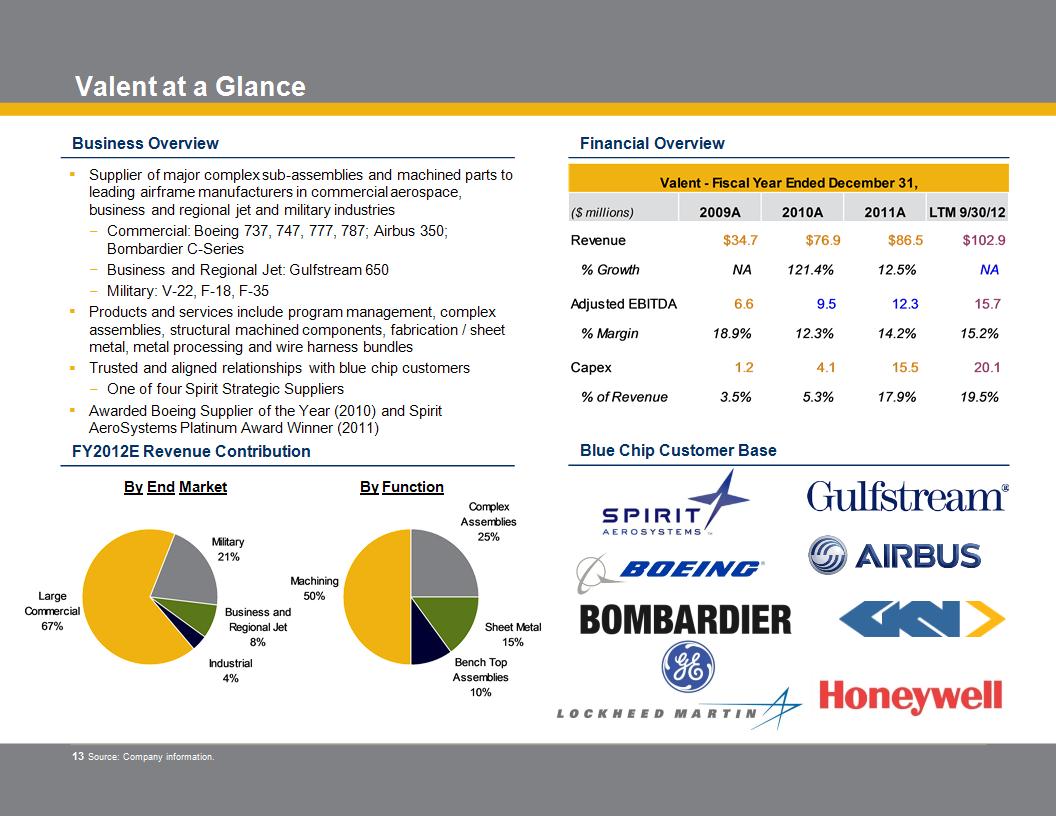

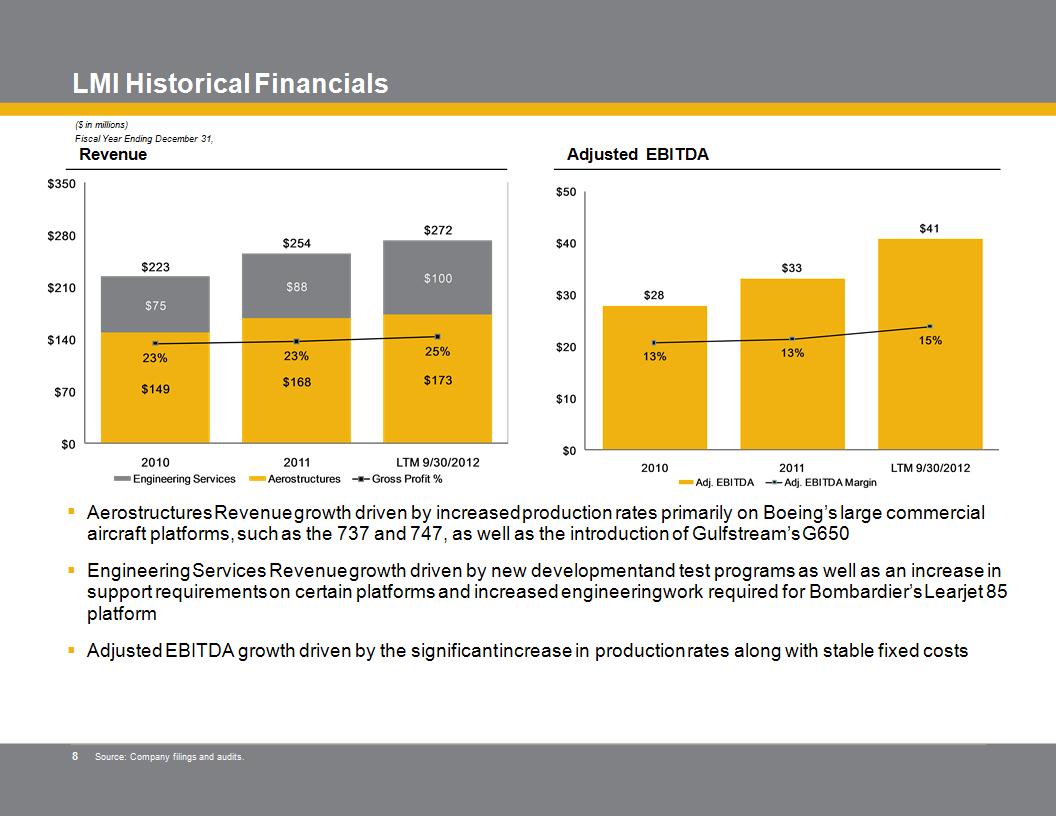

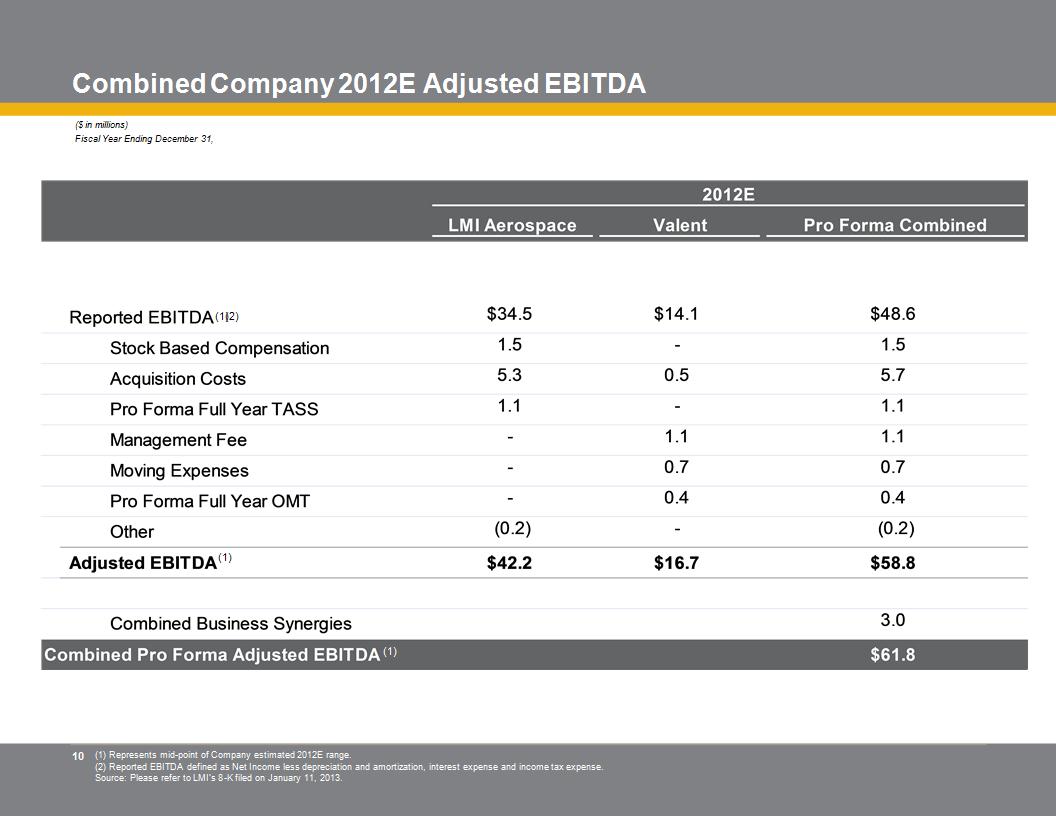

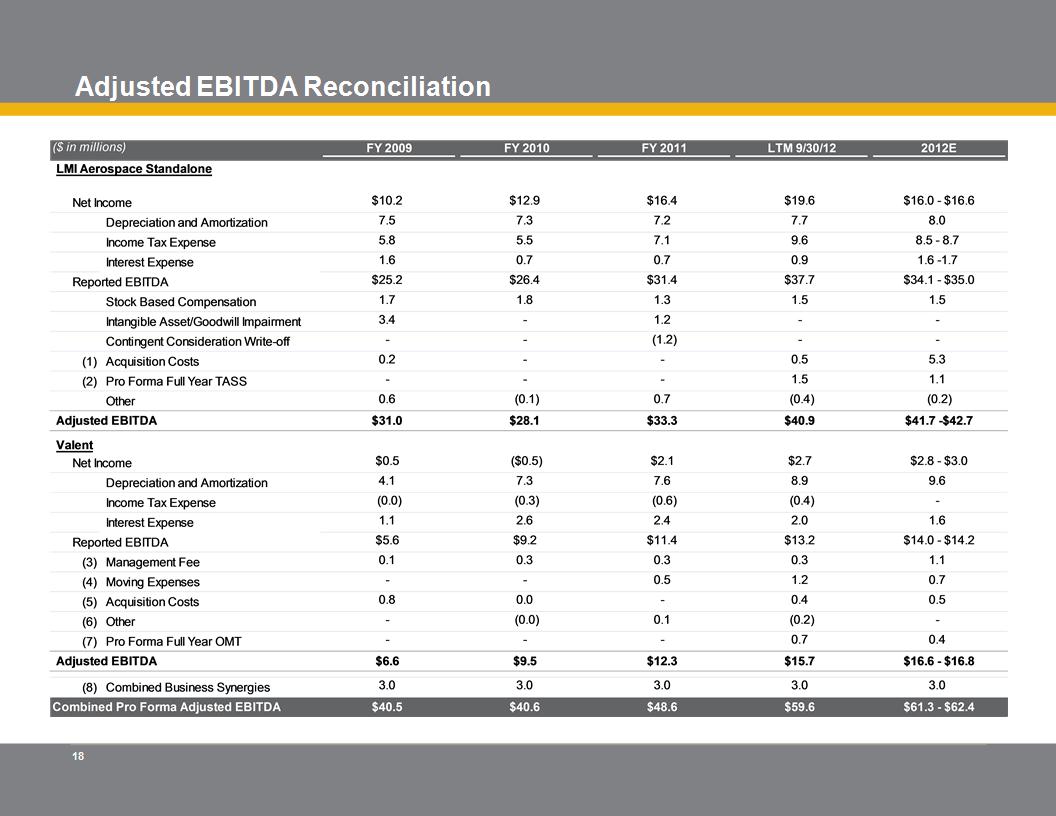

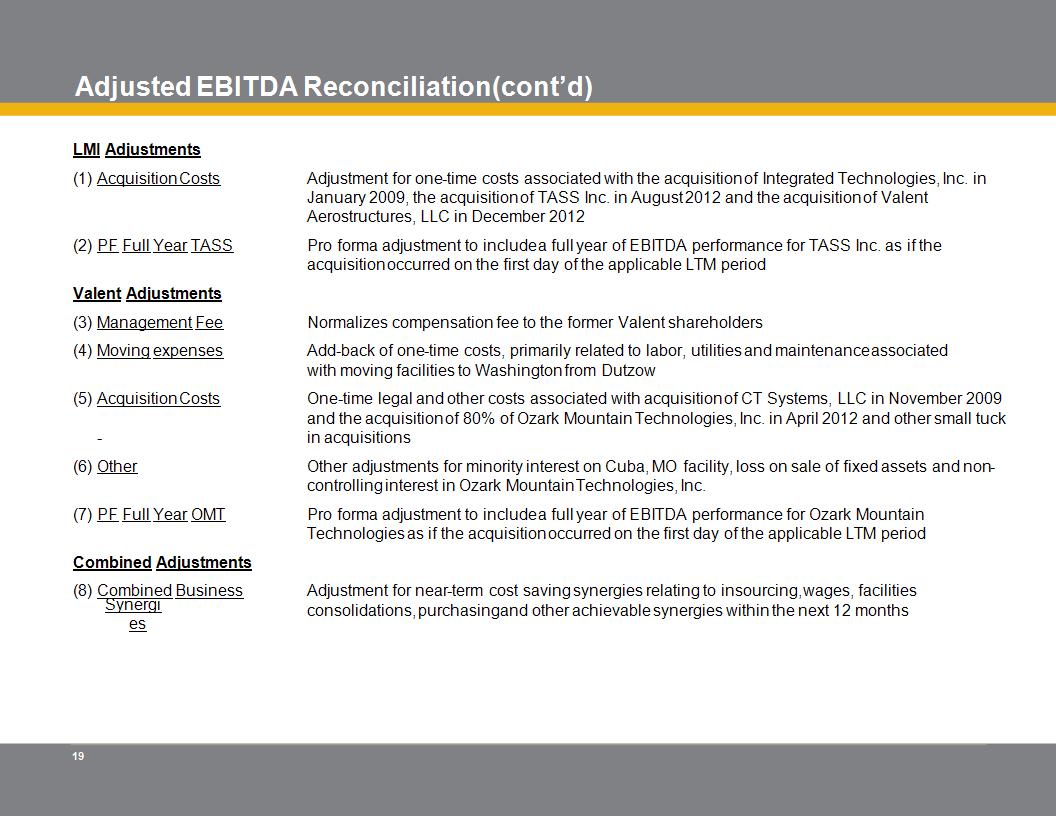

* Non-GAAP Disclaimer References in these slides to “Adjusted EBITDA” are to earnings, before interest, taxes, depreciation and amortization, adjusted to (a) exclude stock based compensation, Acquisition expenses, management fees and moving expenses, and (b) include pro forma EBITDA resulting from the acquisition of TASS, Inc. and Ozark Mountain Technologies, LLC, for such periods for LMI Aerospace and Valent Aerostructures, LLC. Our estimated Adjusted EBITDA and estimated synergies contained in this presentation are forward-looking statements based on currently available preliminary information, estimates and assumptions and reflect the best judgment of our management, but involve a number of risks and uncertainties that could cause actual results to differ materially from those set forth in our estimates and from past results, performance or achievements. Such estimates have not been subject to our normal year-end closing and review procedures and adjustments. Such results should not be viewed as a substitute for full financial statements prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) and audited by our auditors. In addition, the preceding estimates do not include the impact of purchase accounting adjustments with the exception of the related acquisition expenses and write-off of deferred financing fees that are expected to be incurred. Consequently, there can be no assurances that any item of estimated Adjusted EBITDA (or any item thereof) or the amount of estimated synergies contained in this presentation will reflect the actual results, and any variation between our actual results and the estimates set forth above may be material. We believe that Adjusted EBITDA provides useful information about our financial performance to interested parties, such as our lenders, since these groups have historically used EBITDA-related measures in our industry, along with other measures, to, among other uses, evaluate a company’s leverage capacity and its ability to meet its debt service requirements. We further believe this measure provides additional transparency to investors that augments but does not replace the GAAP reporting of net income and provides a good comparative measure. Since Adjusted EBITDA is a non-GAAP measure that does not have a standardized meaning, it may not be comparable to similar measures presented by other issuers. In addition to the cautionary language set forth above regarding the forward-looking nature of our estimated Adjusted EBITDA, you are cautioned that this non-GAAP measure is not based on any comprehensive set of accounting rules or principles and should be considered only in conjunction with, and not as a substitute for, or superior to, net income as determined in accordance with GAAP as an indicator of performance. A reconciliation of this non-GAAP measure to its closest U.S. GAAP measure is included in this presentation.