SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| | |

| ¨ | Confidential, For use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| | |

| x | Definitive Proxy Statement |

| | |

| ¨ | Definitive Additional Materials |

| | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

| GENEREX BIOTECHNOLOGY CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

Payment of Filing Fee (Check the appropriate box):

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| | 4) | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

GENEREX BIOTECHNOLOGY CORPORATION

33 Harbour Square

Suite 202

Toronto, Ontario, Canada M5J 2G2

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD WEDNESDAY, JULY 28, 2010

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Generex Biotechnology Corporation ("Generex") that will be held on Wednesday, July 28, 2010, at 10:00 a.m. (local time), at the Terrence Donnelly Centre for Cellular and Biomolecular Research, University of Toronto, 160 College Street, Toronto, Ontario, Canada M5S 3E1, for the following purposes, as set forth in the accompanying Proxy Statement:

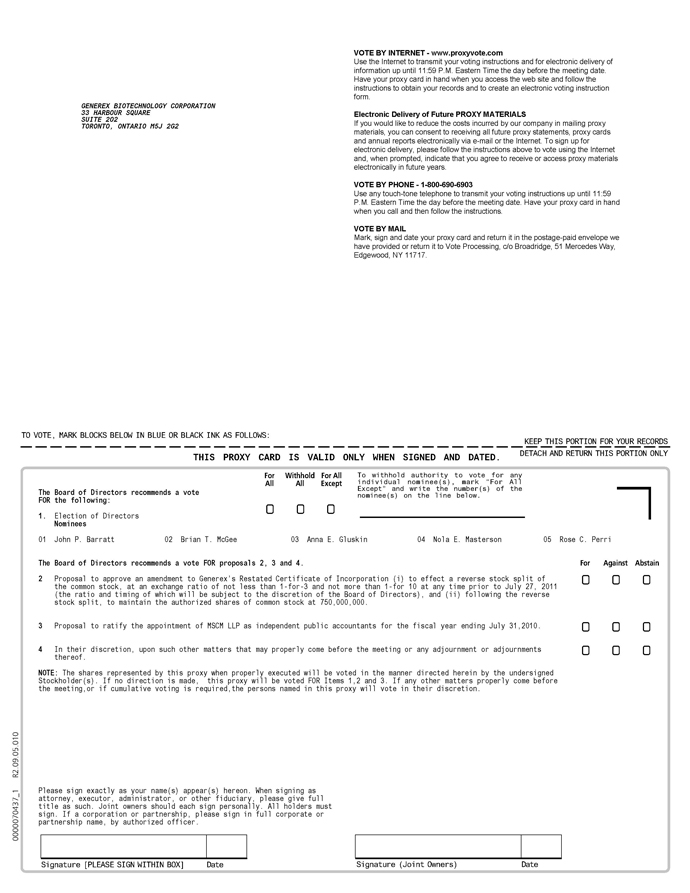

| | 1. | To elect five directors; |

| | 2. | To approve an amendment to our Restated Certificate of Incorporation (i) to effect a reverse stock split of our common stock, at an exchange ratio of not less than 1-for-3 and not more than 1-for 10 at any time prior to July 27, 2011 (the ratio and timing of which will be subject to the discretion of the Board of Directors), and (ii) following the reverse stock split, to maintain the authorized shares of common stock at 750,000,000; |

| | 3. | To ratify the appointment of MSCM LLP as independent public accountants for the fiscal year ending July 31, 2010; and |

| | 4. | To transact such other business as may properly come before the annual meeting and any adjournment or postponement of the meeting. |

The Board of Directors has established the close of business on June 3, 2010, as the record date for the determination of stockholders entitled to receive notice of, and to vote at, the annual meeting and any adjournment or postponement thereof. Generex is complying with the Securities and Exchange Commission rule that permits us to furnish proxy materials to stockholders on the Internet. This Notice and the Proxy Statement are being made available to stockholders on or about June 18, 2010.

Your vote is very important. Whether or not you plan to attend the 2010 annual meeting of stockholders, we urge you to vote and to submit your proxy over the Internet, by telephone or by mail. If you are a registered stockholder and attend the meeting, you may revoke the proxy and vote your shares in person. If you hold your shares through a bank or broker and want to vote your shares in person at the meeting, please contact your bank or broker to obtain a legal proxy.

By order of the Board of Directors,

| /s/ Rose C. Perri |

| |

| Rose C. Perri |

| Secretary |

| |

| June 15, 2010 |

GENEREX BIOTECHNOLOGY CORPORATION

33 Harbour Square

Suite 202

Toronto, Ontario, Canada M5J 2G2

PROXY STATEMENT

TABLE OF CONTENTS

| | | Page |

| | | | |

| About the 2010 Annual Meeting and Voting at the Meeting | | 1 | |

Election of Directors (Item 1 on the Proxy Card) | | 5 | |

| Independence and Compensation of Directors | | 7 | |

| Director Independence | | 7 | |

| Non-Employee Directors’ Compensation | | 7 | |

| Corporate Governance | | 8 | |

| Code of Ethics | | 8 | |

| Board Meetings and Committees; Annual Meeting Attendance | | 8 | |

| Audit Committee | | 8 | |

| Compensation Committee | | 8 | |

| Corporate Governance and Nominating Committee | | 9 | |

| Director Nominations by Stockholders | | 9 | |

| Communications with Directors | | 10 | |

Approval of an Amendment to the Company’s Restated Certificate of Incorporation to Effect a Reverse Stock Split and to Maintain the Authorized Shares of Common Stock at 750,000,000 (Item 2 on the Proxy Card) | | 10 | |

Ratification of the Appointment of MSCM LLP as Generex’s Independent Public Accountants for Fiscal Year 2010 (Item 3 on the Proxy Card) | | 18 | |

| Audit Matters | | 19 | |

| Fees Paid to Generex’s Independent Public Accountants | | 19 | |

| Policy for Pre-Approval of Audit and Non-Audit Services | | 19 | |

| Report of the Audit Committee | | 20 | |

| Compensation Matters | | 21 | |

| Summary Compensation Table | | 21 | |

| Compensation Elements; Employment Agreements and Agreements Providing Payments Upon Retirement, Termination or Change in Control for Named Executives | | 22 | |

| Outstanding Equity Awards at 2009 Fiscal Year-End | | 23 | |

| Nonqualified Deferred Compensation | | 25 | |

| Other Benefit Plans | | 25 | |

| Certain Transactions | | 26 | |

| Change in Control | | 26 | |

| Certain Relationships and Related Transactions | | 26 | |

| Security Ownership of Certain Beneficial Owners and Management | | 27 | |

| Section 16(a) Beneficial Ownership Reporting Compliance | | 30 | |

| Other Information | | 30 | |

| Annual Report. | | 30 | |

| Stockholder Proposals for the Next Annual Meeting | | 30 | |

| Appendix A – Form of Certificate of Amendment to Restated Certificate of Incorporation | | A-1 | |

ABOUT THE 2010 ANNUAL MEETING AND VOTING AT THE MEETING

Why am I being furnished this Proxy Statement?

This Proxy Statement is provided to the stockholders of Generex in connection with the solicitation by our Board of Directors of proxies for use at our annual meeting of stockholders to be held on Wednesday, July 28, 2010 at 10:00 a.m. (local time), at the Terrence Donnelly Centre for Cellular and Biomolecular Research, University of Toronto, 160 College Street, Toronto, Ontario, Canada M5S 3E1, and any adjournments or postponements thereof. Generex’s Annual Report to Stockholders in respect of the fiscal year of Generex ended July 31, 2009, including financial statements, accompanies this Notice and Proxy Statement, but is not incorporated as part of the Proxy Statement and is not to be regarded as part of the proxy solicitation material.

What are the items of business for the meeting?

The items of business for the meeting are as follows:

| · | To elect five directors; |

| · | To approve an approve an amendment to our Restated Certificate of Incorporation (i) ) to effect a reverse stock split of our common stock, at an exchange ratio of not less than 1-for-3 and not more than 1-for 10 at any time prior to July 27, 2011 (the ratio and timing of which will be subject to the discretion of the Board of Directors), and (ii) following the reverse stock split, to maintain the authorized shares of common stock at 750,000,000; |

| · | To ratify the appointment of MSCM LLP as our independent public accountants for the fiscal year ending July 31, 2010; and |

| · | To transact such other business as may properly come before the annual meeting and any adjournment or postponement of the meeting. |

Who is soliciting my proxy?

The Board of Directors is soliciting your proxy in order to provide you with an opportunity to vote on all matters scheduled to come before the meeting whether or not you attend the meeting in person.

What if I received in the mail a Notice of Internet Availability of Proxy Materials?

In accordance with rules adopted by the Securities and Exchange Commission (SEC), we are providing access to our proxy materials over the Internet. Accordingly, on or about June 18, 2010, we are mailing to our record and beneficial stockholders a Notice of Internet Availability of Proxy Materials, which contains instructions on how to access our proxy materials over the Internet. If you received a Notice of Internet Availability of Proxy Materials, you will not receive a printed copy of our proxy materials by mail unless you request one. You may request a printed copy of our proxy materials for the 2010 annual meeting. If you wish to receive a printed copy of our proxy materials, you should follow the instructions for requesting those materials included in the Notice of Internet Availability of Proxy Materials.

Who is entitled to vote?

You may vote if you owned shares of Generex’s common stock as of the close of business on June 3, 2010, which is the record date. You are entitled to one vote for each share of common stock that you own. As of June 3, 2010, we had 266,055,346 shares of common stock outstanding.

How do I vote before the meeting?

If you hold your shares in your own name as the stockholder of record, you have three options for voting and submitting your proxy before the meeting:

| | · | By Internet — We encourage you to vote and submit your proxy over the Internet at www.proxyvote.com. |

| · | By Telephone — You may vote and submit your proxy by calling 1-800-690-6903. |

| · | By Mail — If you received your proxy materials by mail, you may vote by completing, signing and returning the enclosed proxy card. |

If you are a street-name stockholder, you will receive instructions from your bank, broker or other nominee describing how to vote your shares. Certain of these institutions offer telephone and Internet voting. Please refer to the information forwarded by your bank, broker or other nominee to see which options are available to you.

What shares can I vote?

You may vote all shares owned by you as of the close of business on June 3, 2010, the record date. These shares include:

| · | Shares held directly in your name as the stockholder of record; and |

| · | Shares of which you are the beneficial owner but not the stockholder of record (typically referred to as being held in “street name”). These are shares that are held for you through a broker, trustee or other nominee such as a bank. |

May I vote at the meeting?

You may vote your shares at the meeting if you attend in person. If you hold your shares through an account with a bank or broker, you must obtain a legal proxy from the bank or broker in order to vote at the meeting. Even if you plan to attend the meeting, we encourage you to vote your shares by proxy over the Internet, by telephone or by mail.

How do I revoke my proxy?

If you are the stockholder of record, you may revoke your proxy at any time before the polls close at the meeting. You may change you vote by:

| · | Signing another proxy card with a later date and returning it to us prior to the meeting. |

| · | Voting again over the Internet or by telephone prior to 11:59 p.m., Eastern Time, on July 27, 2010. |

| · | Voting at the meeting if you are the stockholder of record. |

| · | Voting at the meeting if you are the beneficial owner and have obtained a legal proxy from your bank or broker. |

Our principal executive offices are located at 33 Harbour Square, Suite 202, Toronto, Ontario, Canada M5J 2G2, and our telephone number is (416) 364-2551.

Will my shares be voted if I do not return my proxy?

If your shares are registered directly in your name, your shares will not be voted if you do not vote over the Internet, vote by telephone, return your proxy, or vote by ballot at the 2010 annual meeting.

If your shares are held in “street name,” your brokerage firm, under certain circumstances, may vote your shares for you if you do not return your proxy. Brokerage firms have authority to vote customers’ unvoted shares on some routine matters. If you do not give a proxy to your brokerage firm to vote your shares, your brokerage firm may either vote your shares on routine matters, or leave your shares unvoted. Item 3, to ratify the appointment of MSCM LLP as our independent public accountants, is considered a routine matter. Item 1, to elect five directors, and Item 2, to approve the reverse stock split, are considered non-routine matters. Your brokerage firm cannot vote your shares with respect to Item 1 or Item 2 unless they receive your voting instructions. We encourage you to provide voting instructions to your brokerage firm by giving your proxy. This ensures your shares will be voted at the 2010 annual meeting according to your instructions. You should receive directions from your brokerage firm about how to submit your proxy to them at the time you receive this proxy statement.

What if I return my proxy card but do not provide voting instructions?

Proxy cards that are signed and returned but do not contain instructions will be voted as follows:

| · | FOR the election of the nominees for director named on page 5 of this proxy statement. |

| · | FOR the approval of an amendment to our Restated Certificate of Incorporation (i) to effect a reverse stock split of our common stock, at an exchange ratio of not less than 1-for-3 and not more than 1-for 10 at any time prior to July 27, 2011 (the ratio and timing of which will be subject to the discretion of the Board of Directors), and (ii) following the reverse stock split, to maintain the authorized shares of common stock at 750,000,000. |

| · | FOR the ratification of the appointment of MSCM LLP as our independent public accountants for the fiscal year ending July 31, 2010. |

| · | In accordance with the best judgment of the individuals named as proxies on the proxy card on any other matters properly brought before the meeting. |

What does it mean if I receive more than one Notice of Internet Availability of Proxy Materials or one proxy card?

Your shares are probably registered in more than one account. You should vote all of your shares. We encourage you to consolidate all of your accounts by registering them in the same name, social security number and address. For assistance consolidating accounts where you are the stockholder of record, you may contact our transfer agent, StockTrans, at 1-800-733-1121.

May stockholders ask questions at the meeting?

Yes. Generex representatives will answer stockholders’ questions of general interest at the end of the meeting.

How many votes must be present to hold the meeting?

In order for us to conduct our meeting, a majority of our outstanding shares of common stock as of June 3, 2010 must be present in person or by proxy at the meeting. This is referred to as a quorum. Your shares are counted as present at the meeting if you attend the meeting and vote in person or if you properly return a proxy by mail. Shares voted by banks or brokers on behalf of beneficial owners are also counted as present at the meeting. In addition, abstentions and broker non-votes will be counted for purposes of establishing a quorum with respect to any matter properly brought before the meeting. Broker non-votes occur on a matter when a bank or broker is not permitted under applicable rules and regulations to vote on a matter without instruction from the beneficial owner of the underlying shares and no instruction has been given.

If a quorum is not present, we expect that the 2010 annual meeting will be adjourned until we obtain a quorum.

How many votes are needed for each proposal and how are the votes counted?

Election of Directors (Item 1 on the Proxy Card). The five nominees for director receiving the highest number of votes FOR election will be elected as directors. This is called a plurality. Abstentions are not counted for purposes of electing directors. Starting this year, if your shares are held by your broker in “street name” and if you do not vote your shares, or instruct your broker how to vote with respect to this item, your broker may not vote with respect to this proposal and those votes will be counted as “broker non-votes.” If the broker does not vote your unvoted shares, there will be no effect on the vote because these “broker non-votes” are not considered to be voting on the matter. You may vote FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors and will have no effect on the results of the vote.

Approval of an Amendment of the Restated Certificate of Incorporation to Effect a Reverse Stock Split and to Maintain the Authorized Shares of Common Stock at 750,000,000 (Item 2 on the Proxy Card). To approve the reverse stock split proposal, stockholders holding a majority of the outstanding shares of Generex common stock must vote FOR the proposal. If your shares are held by your broker in “street name” and if you do not vote your shares, your brokerage firm may not have the authority to vote your unvoted shares held by the firm on this proposal, in which case this will have the same effect as a vote AGAINST the proposal. If you vote to ABSTAIN on this proposal, your shares will not be voted in favor of the proposal, will not be counted as votes cast or shares voting on the proposal, and will have the same effect as a vote AGAINST the proposal.

Ratification of the Appointment of MSCM LLP as Generex’s Independent Public Accountants for Fiscal Year 2010 (Item 3 on the Proxy Card). To ratify the appointment of MSCM LLP as our independent public accounts for fiscal year 2010, a majority of the votes cast by stockholders present in person or by proxy and voting on the matter must vote FOR the proposal. If your shares are held by your broker in “street name,” and if you do not vote your shares, your brokerage firm has authority to vote your unvoted shares held by the firm on this proposal. If the broker does not vote your unvoted shares, there will be no effect on the vote because these “broker non-votes” are not considered to be voting on the matter. If you vote to ABSTAIN on this proposal, your shares will not be voted in favor of the proposal, will not be counted as votes cast or shares voting on the proposal, and will have no effect on the vote.

Any other proposal that might properly come before the meeting will require the affirmative vote of the holders of a majority of the shares of commons stock present in person or by proxy at the meeting in order to be approved. On any such proposal, abstentions will be counted as negative votes in the tabulation of the votes cast by stockholders. Broker non-votes will not be counted in the tabulation of the votes cast on the proposal but will be counted for purposes of establishing a quorum.

How will proxies be voted on other items or matters that properly come before the meeting?

If any other items or matters properly come before the meeting, the proxies received will be voted on those items or matters in accordance with the discretion of the proxy holders.

Is Generex aware of any other item of business that will be presented at the meeting?

The Board of Directors does not intend to present, and does not have any reason to believe that others will present, any item of business at the annual meeting other than those specifically set forth in the notice of the meeting. However, if other matters are properly brought before the meeting, the persons named on the enclosed proxy will have discretionary authority to vote all proxies in accordance with their best judgment.

Where do I find the voting results of the 2010 annual meeting?

We will report the voting results in a Form 8-K within four business days after the end of the 2010 annual meeting.

Who bears the costs of soliciting these proxies?

We have hired Morrow & Co., LLC to assist us in soliciting proxies. We will pay Morrow’s fees, which we expect to be approximately $5,500, plus all expenses for such services. In addition, our directors, officers, and employees may solicit proxies by telephone, e-mail, and in person, without additional compensation. Upon request, we will also reimburse brokerage houses and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for distributing proxy materials to stockholders. All costs and expenses of any solicitation, including the cost of preparing this proxy statement and posting it on the Internet and mailing the Notice of Internet Availability of Proxy Materials, will be borne by Generex.

Will the directors be in attendance at the meeting?

We currently expect all of our director nominees to be in attendance at the 2010 annual meeting of stockholders. It has been customary for our directors to attend our annual meetings of stockholders. All of the director nominees attended the 2009 annual meeting of stockholders.

ELECTION OF DIRECTORS

(Item 1 on the Proxy Card)

How many directors will be elected at the meeting?

Five directors are to be elected at the annual meeting of stockholders.

What is the term of office for each director elected at the meeting?

All directors will be elected to hold office until the next annual meeting of stockholders following election and until their successors are duly elected and qualified.

Who are the nominees for election as directors?

The persons named below have been approved by our full Board of Directors as nominees for election as directors. All nominees currently serve as our directors

| Name | | Age | | Position Held with Generex | | Director Since |

| | | | | | | |

| Anna E. Gluskin | | 58 | | Chairperson, President, Chief Executive Officer and Director | | September 1997 |

| | | | | | | |

| Rose C. Perri | | 42 | | Chief Operating Officer, Chief Financial Officer, Treasurer, Secretary and Director | | September 1997 |

| | | | | | | |

| John P. Barratt | | 65 | | Independent Director | | March 2003 |

| Brian T. McGee | | 49 | | Independent Director | | March 2004 |

| | | | | | | |

| Nola E. Masterson | | 62 | | Independent Director | | May 2007 |

Biographical Information of Nominees for Directors:

Anna E. Gluskin: Director since September 1997. Ms. Gluskin has served as the President and Chief Executive Officer of Generex since October 1997 and the Chairperson of the Generex Board of Directors since November 2002. She held comparable positions with Generex Pharmaceuticals Inc. from its formation in 1995 until its acquisition by Generex in October 1997. Ms. Gluskin is one of the founders of Generex.

Rose C. Perri. Director since September 1997. Ms. Perri has served as Treasurer and Secretary of Generex since October 1997 and as Chief Operating Officer since August 1998. She served as Acting Chief Financial Officer from November 2002 until April 2005 when she was appointed Chief Financial Officer. She was an officer of Generex Pharmaceuticals Inc. from its formation in 1995 until its acquisition by Generex in October 1997. Along with Ms. Gluskin, Ms. Perri is one of the founders of Generex.

John P. Barratt. Independent Director since March 2003. Mr. Barratt is currently the Chairman of the Generex Compensation Committee and a member of the Generex Audit Committee and Corporate Governance and Nominating Committee. Mr. Barratt served as the Board Liaison Officer of The Caldwell Partners International from July 2006 until May 2009. From April 2005 to July 2006, Mr. Barratt served as Chief Operating Officer of The Caldwell Partners International. The Caldwell Partners International is a Canadian-based human capital professional services company. Mr. Barratt from January 2002 until February 2007 served as the court-appointed Responsible Person and Liquidation Manager of Beyond.com Corporation, Debtor-in-Possession, a U.S. Chapter 11 Bankruptcy case, in which capacity Mr. Barratt reported to the bankruptcy court and to the U.S. Trustee’s Office. From September 2000 to January 2002, Mr. Barratt acted in the capacity of Chief Operating Officer of Beyond.com Corporation, an electronic fulfillment provider. Between 1996 and 2000, Mr. Barratt was partner-in-residence with the Quorum Group of Companies, an international investment partnership specializing in providing debt and/or equity capital coupled with strategic direction to emerging technology companies. Between 1988 and 1995, Mr. Barratt held a number of positions with Coscan Development Corporation, a real estate development company, the last position of which was Executive Vice-President and Chief Operating Officer. Mr. Barratt currently serves on a number of Boards of Directors, including Brookfield Investments Corporation and BAM Split Corporation, and is a member of the Board of Directors and Chairman of the Risk Policy Committee of the Bank of China (Canada). Mr. Barratt also serves as Chairman of the Independent Review Committees of BAM Split Corp. and Brookfield Investment Funds Management Inc. In addition, Mr. Barratt is a member of the Advisory Board and also served as interim Chief Financial Officer of Crystal Fountains Inc from September 2008 to May 2009.

Brian T. McGee. Independent Director since March 2004. Mr. McGee is currently the Chairman of the Generex Audit Committee and a member of the Generex Compensation Committee and Corporate Governance and Nominating Committee. Mr. McGee has been a partner of Zeifmans LLP ("Zeifmans") since 1995. Mr. McGee began working at Zeifmans shortly after receiving a B.A. degree in Commerce from the University of Toronto in 1985. Zeifmans is a Chartered Accounting firm based in Toronto, Ontario. A significant element of Zeifmans’ business is public corporation accounting and auditing. Mr. McGee is a Chartered Accountant. Throughout his career, Mr. McGee has focused on, among other areas, public corporation accounting and auditing. In 1992, Mr. McGee completed courses focused on International Taxation and Corporation Reorganizations at the Canadian Institute of Chartered Accountants and in 2003, Mr. McGee completed corporate governance courses on compensation and audit committees at Harvard Business School. In April 2004 Mr. McGee received his CPA designation from The American Institute of Certified Public Accountants.

Nola E. Masterson. Independent Director since May 2007. Ms. Masterson is currently a Chairperson of the Generex Corporate Governance and Nominating Committee and a member of the Generex Audit Committee and Compensation Committee. Since 1982, she has been the chief executive officer of Science Futures Inc., an investment and advisory firm. Ms. Masterson is currently Managing Member and General Partner of Science Futures LLC, I, II and III, which are venture capital funds invested in life science funds and companies. She also serves as a Senior Advisor to TVM Techno Venture Management, an international venture capital company, and as Chairperson of the Board of Directors of Repros Therapeutics Inc., a development stage biopharmaceutical company formerly known as Zonagen, Inc. (currently trading on The NASDAQ Global Market under the symbol “RPRX”). Ms. Masterson was the first biotechnology analyst on Wall Street, working with Drexel Burnham Lambert and Merrill Lynch, and is a co-founder of Sequenom, Inc., a genetic analysis company located in San Diego and Hamburg, Germany. She also started the BioTech Meeting in Laguna Nigel, CA, the annual Biopharmaceutical Conference in Europe, and was nominated to the 100 Irish American Business List in 2003. Ms. Masterson began her career at Ames Company, a division of Bayer, and spent eight years at Millipore Corporation in sales and sales management. Ms. Masterson has 31 years of experience in the life science industry. She received her Masters in Biological Sciences from George Washington University, and continued Ph.D. work at the University of Florida.

Are there any family relationships among Generex’s officers and directors?

There are no family relationships among our officers and directors.

What if a nominee is unable or unwilling to serve?

If, for any reason, any of the nominees shall become unavailable for election, the shares represented by proxies may be voted for any substitutes proposed by the Corporate Governance and Nominating Committee and approved by the Board of Directors. At this time, the Board of Directors knows of no reason why any of the nominees might be unavailable to serve.

What if I return my proxy card but do not provide voting instructions with respect to the election of directors?

The individuals named in the accompanying proxy intend to vote all proxies received by them for the nominees listed above unless otherwise instructed.

What if I do not wish to vote for a particular nominee?

If you do not wish your shares to be voted for any of the nominees, you may so indicate.

How does the Board of Directors recommend that I vote?

We recommend that you vote For the election of each of the five nominees named in this proxy statement to the Board of Directors.

INDEPENDENCE AND COMPENSATION OF DIRECTORS

Director Independence

The Board of Directors currently consists of five members, three of whom are “independent” as defined under applicable rules of the SEC and The NASDAQ Stock Market LLC. The three independent members of the Board of Directors are John P. Barratt, Brian T. McGee and Nola E. Masterson.

For a director to be considered independent, the Board must determine that the director has no relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

All members of the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee must be independent directors under NASDAQ rules. Members of the Audit Committee also must satisfy a separate SEC independence requirement, which provides that they may not accept directly or indirectly any consulting, advisory or other compensatory fee from the Company or any of its subsidiaries other than their directors’ compensation. In addition, under SEC rules, an Audit Committee member who is an affiliate of the issuer (other than through service as a director) cannot be deemed to be independent.

Non-Employee Directors' Compensation

In fiscal 2009 our policy for compensation of non-employee directors was as follows.

| · | Nonemployee directors receive an annual cash base retainer. Each nonemployee director serving on the Board of Directors as of May 27, 2008 is entitled to an annual cash retainer of $40,000. Each new nonemployee directors will initially receive a cash retainer of $20,000, increasing to $30,000 for the second year, and $40,000 thereafter. |

| · | At the discretion of the full Board of Directors, nonemployee directors may receive stock options to purchase shares of our common stock or shares of restricted stock each fiscal year. The number and terms of such options or shares is within the discretion of the full Board of Directors. |

| · | Nonemployee directors serving on committees of the Board of Directors receive additional cash compensation as follows: |

| Committee | | Chairperson | | | Member | |

| Audit Committee | | $ | 15,000 | | | $ | 5,000 | |

| Compensation Committee | | $ | 15,000 | | | $ | 5,000 | |

| Governance & Nominating Committee | | $ | 5,000 | | | $ | 2,000 | |

Directors who are officers or employees of Generex do not receive separate consideration for their service on the Board of Directors. The compensation received by Ms. Gluskin and Ms. Perri as employees of Generex is show in the Summary Compensation Table above.

Fiscal Year 2009 Director Compensation Table

| Name | | Fees Earned or Paid in Cash | | | Stock Awards (1) | | | Option Awards (2) | | | All Other Compensation | | | Total | |

| John P. Barratt | | $ | 62,000 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 62,000 | |

| Nola E. Masterson | | $ | 55,000 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 55,000 | |

| Brian T. McGee | | $ | 62,000 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 62,000 | |

| (1) | As of July 31, 2008, the aggregate number of shares underlying stock awards granted to each non-employee director was as follows: Mr. Barratt (150,000), Ms. Masterson (100,000) and Mr. McGee (150,000). |

| (2) | As of July 31, 2009, the aggregate number of stock options held by each non-employee director was as follows: Mr. Barratt (275,714) and Mr. McGee (205,714). |

CORPORATE GOVERNANCE

Code of Ethics

Generex has adopted a code of ethics that applies to its directors and the following executive officers: the President, Chief Executive Officer, Chief Financial Officer (principal financial/accounting officer), Chief Operating Officer, any Vice-President, Controller, Secretary, Treasurer and any other personnel performing similar functions. We also expect any consultants or advisors whom we retain to abide by this code of ethics. The Generex Code of Ethics has been posted on Generex's Internet web site - www.generex.com.

Board Meetings and Committees; Annual Meeting Attendance

The business affairs of Generex are managed under the direction of our Board of Directors. During the fiscal year ended July 31, 2009, our Board of Directors held five meetings and took action by unanimous consent six times. During the fiscal year ended July 31, 2009, no director attended fewer than 75% of the Board of Directors meetings that were held.

The Board of Directors has established a standing Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee.

Audit Committee

The Audit Committee, which was established on March 1, 2000 in accordance with Section 3(a)(58)(A) of the Securities Exchange Act, met four times during the fiscal year ended July 31, 2009. During fiscal 2009, the Audit Committee consisted of Brian T. McGee (Chairperson), John P. Barratt and Nola E. Masterson, each of whom satisfied the independence requirements under NASDAQ Listing Rules for audit committee members. Members of the Audit Committee also satisfied the separate SEC independence requirement, which provides that members of the Audit Committee may not accept directly or indirectly any consulting, advisory or other compensatory fee from Generex or any of its subsidiaries other than their directors’ compensation. All of the members of the Audit Committee attended all of the meetings that they were eligible to attend during fiscal 2009.

The Audit Committee reviews and discusses with Generex's management and its independent auditors the audited and unaudited financial statements contained in Generex's Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, respectively. Although Generex's management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls and disclosure controls and procedures, the Audit Committee reviews and discusses the reporting process with management on a regular basis. The Audit Committee also discusses with the independent auditors their judgments as to the quality of Generex's accounting principles, the reasonableness of significant judgments reflected in the financial statements and the clarity of disclosures in the financial statements, as well as such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards. The Audit Committee has adopted a written charter, which was amended on October 30, 2003. A copy of the Audit Committee charter is reproduced as Appendix A to our 2008 Proxy Statement.

Compensation Committee

The Compensation Committee was formed on July 30, 2001 and met three times during the fiscal year ended July 31, 2009. During the fiscal year ending July 31, 2009, the Compensation Committee consisted of three non-employee directors: John P. Barratt (Chairperson), Nola E. Masterson and Brian T. McGee. In fiscal 2009, all of the members of the Compensation Committee attended all of the meetings of the Compensation Committee that they were eligible to attend.

The Compensation Committee is responsible for reviewing and recommending to the Board of Directors compensation programs and policies for our President and Chief Executive Officer, our Chief Operating Officer, Chief Financial Officer, Treasurer and Secretary, and our Executive Vice President and General Counsel, who comprise Generex’s executive management team. The Compensation Committee has the authority to use a compensation consultant to assist the Compensation Committee in the evaluation of the compensation of our executive management team and other executive officers and to consult with other outside advisors to assist in its duties to the Company. The Compensation Committee does not have a written charter.

In fiscal 2009, the Compensation Committee did not engage any compensation consultants in its determination of executive compensation. In fiscal 2009, the Compensation Committee reviewed, among other information, publicly available executive compensation information for Generex’s peer companies and executive compensation information as reported in biotechnology and pharmaceutical industry publications. We do not typically use compensation consultants to assist us with director compensation.

The Compensation Committee does not delegate its authority. The President and Chief Executive Officer typically presents the Compensation Committee with her recommendations regarding salaries, bonuses and long term incentives for members of the executive management team and support for such recommendations The compensation of our Vice President, Medical Affairs, who has no involvement in the day-to-day operations of Generex, is set forth in his employment agreement with Generex, including his annual equity award in the form of a warrant to purchase shares of Generex common stock. From time to time, the President and Chief Executive Officer may make recommendations to the Compensation Committee or to the full Board of Directors with respect to the compensation of our Vice President, Medical Affairs. Members of our senior management team and other executive officers do not attend meetings of the Compensation Committee.

Corporate Governance and Nominating Committee

The Board of Directors formed the Corporate Governance and Nominating Committee on May 29, 2007 and appointed Messrs. Barratt and McGee and Ms. Masterson as members. Ms. Masterson currently serves as the chairperson of this committee. The Corporate Governance and Nominating Committee did not meet during fiscal 2009. The Corporate Governance and Nominating Committee has a charter, which was adopted on May 29, 2007. A copy of the charter is attached as Appendix B to our 2008 proxy statement.

The Corporate Governance and Nominating Committee will consider candidates whom the stockholders of Generex put forward. The name, together with the business experience and other relevant background information of a candidate, should be sent to Mark Fletcher, Executive Vice-President and General Counsel of Generex, at Generex’s principal executive offices located at 33 Harbour Square, Suite 202, Toronto, Ontario, Canada M5J 2G2. Mr. Fletcher will then submit such information to the chairperson of the Corporate Governance and Nominating Committee for the Committee’s review and consideration. The process for determining whether to nominate a director candidate put forth by a stockholder is the same as that used for reviewing candidates submitted by directors. After full consideration, the stockholder proponent will be notified of the decision of the committee.

The Corporate Governance and Nominating Committee will seek to identify director candidates with the highest personal and professional ethics, integrity and value and diverse experience in business, finance, pharmaceutical and regulatory matters, and other matters relevant to a company such as Generex. The Corporate Governance and Nominating Committee is expected to develop a formal list of qualifications for members of the Board of Directors as mandated by its charter. Additionally, the Corporate Governance and Nominating Committees will require that director nominees have sufficient time to devote to the company’s affairs.

In accordance with our bylaws, the Board of Directors is permitted to increase the number of directors and to fill the vacancies created by the increase until the next annual meeting of stockholders.

To date, the Corporate Governance and Nominating Committee has not engaged any third party to assist it in identifying director candidates.

Director Nominations by Stockholders

Any stockholder entitled to vote for the election of directors may nominate a person for election to the Board of Directors at the annual meeting. Any stockholder wishing to do so must submit a notice of such nomination in writing to the Secretary of Generex at Generex's principal offices located at 33 Harbour Square, Suite 202, Toronto, Ontario, Canada M5J 2G2 not less than 60 nor more than 90 days prior to the annual meeting. In the event that less than 70 days notice or prior disclosure of the date of the meeting is given or made to stockholders, notice of nomination by a stockholder to be timely must be received not later than the close of business on the 10th day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made. The stockholder's notice of nomination must provide information about both the nominee and the nominating stockholder, as required by Generex's bylaws. A copy of these bylaw requirements will be provided upon request in writing to Mark Fletcher, Executive Vice-President and General Counsel of Generex, at Generex’s principal executive offices.

Communications with Directors

Interested parties who wish to make any concerns known to non-management directors may submit communications at any time in writing to: Mark Fletcher, Executive Vice-President and General Counsel, Generex Biotechnology Corporation, 33 Harbour Square, Suite 202, Toronto, Ontario, Canada M5J 2G2. The General Counsel will determine, in his good faith judgment, which communications will be relayed to the non-management directors.

APPROVAL OF AN AMENDMENT TO THE COMPANY’S RESTATED CERTIFICATE OF INCORPORATION

TO EFFECT A REVERSE STOCK SPLIT AND

TO MAINTAIN THE AUTHORIZED SHARES OF COMMON STOCK AT 750,000,000

(Item 2 on the Proxy Card)

What am I voting on?

You are voting on a proposal to approve an amendment to our Restated Certificate of Incorporation (i) to effect a reverse stock split of our common stock at an exchange ratio of not less than 1-for-3 and not more than 1-for 10 at any time prior to July 27, 2011 (the ratio and timing of which will be subject to the discretion of the Board of Directors) (the “Reverse Stock Split”), and (ii) following the Reverse Stock Split, to maintain the current authorized number of shares of our common stock at 750,000,000 (collectively, the “Amendment”), without further approval of the stockholders, upon a determination by the Board of Directors that such Amendment is in the best interests of Generex and its stockholders.

The Board of Directors has unanimously authorized the proposed Amendment to our Restated Certificate of Incorporation to effect the Reverse Stock Split and to maintain the authorized shares of common stock at 750 million. The form of the proposed Amendment is attached to this proxy statement as Appendix A and is incorporated herein by reference.

Why is the Reverse Stock Split necessary?

The Board of Director’s primary objective in proposing the Reverse Stock Split is to raise the per share trading price of our common stock. The Board of Directors believes that by increasing the market price per share of our common stock, we may regain and maintain compliance with the NASDAQ listing requirements.

On July 23, 2008, we received notice from The NASDAQ Stock Market that we were not compliance with Marketplace Rule 4310(c)(4) (now known as Listing Rule 5550(a)(2)), which requires us to have a minimum bid price per share of at least $1.00 for thirty (30) consecutive business days. In accordance with this Rule, we had 180 calendar days, or until January 20, 2009, subject to extension, to regain compliance with this Rule. Our initial compliance period of 180 calendar days ending on January 20, 2009 was subsequently extended until November 9, 2009 due to NASDAQ’s temporary suspension of the minimum bid price requirement from October 16, 2008 until August 3, 2009.

On November 9, 2009, we received a second letter from NASDAQ indicating that we had not regained compliance with the $1.00 minimum bid price required for continued listing under Listing Rule 5550(a)(2) within the grace period previously allowed by NASDAQ following the initial notice of noncompliance on July 23, 2008. Pursuant to Listing Rule 5810(c)(3)(A), NASDAQ gave us an additional 180 calendar day compliance period because we met all other initial inclusion criteria (other than the minimum bid price requirement) as of January 6, 2009. We had 180 calendar days, or until May 5, 2010, to regain compliance with the rule. NASDAQ noted that if we failed to regain compliance with this rule during the grace period, our common stock would be subject to immediate delisting. To regain compliance with the minimum bid price requirement, the closing bid price of our common stock had to close at $1.00 per share or more for a minimum of ten consecutive business days.

On May 5, 2010, our stock closed at $0.3999. On May 6, 2010, we received a delisting determination letter from the staff of The Nasdaq Stock Market due to our failure to regain compliance with The Nasdaq Capital Market's minimum bid price requirement for continued listing. We are appealing the Nasdaq Staff's determination. The hearing occurred on June 10, 2010, and we are awaiting the determination of the Hearings Panel. The appeal to the Hearings Panel will stay the suspension of our securities and the filing of a Form 25-NSE with the SEC. The filing of a Form 25-NSE would remove our stock from listing and registration on The Nasdaq Stock Market.

The delisting determination letter states that historically, the Hearings Panel has generally viewed a reverse stock split in 30 to 60 days as the only definitive plan acceptable to resolve a bid price deficiency, but that the Hearings Panel could allow up to 180 calendar days from the date of the Staff determination to accomplish a split if the Hearings Panel deems it appropriate. The Board of Directors approved the Reverse Stock Split proposal in part as a potential means of increasing the share price of our common stock in anticipation of our receipt of a delisting notice from NASDAQ.

There can be no assurance that the Hearing Panel will grant our request for continued listing. If we are not successful in such an appeal, our stock would be delisted from the NASDAQ Capital Market and likely trade on NASDAQ’s over-the-counter bulletin board, assuming we meet the requisite criteria.

.

The Reverse Stock Split is intended to raise the bid price of the common stock to satisfy the $1.00 minimum bid price requirement. However, there can be no assurance that the Reverse Stock Split, if implemented, will have the desired effect of sufficiently raising the common stock price.

What will happen if Generex’s common stock is delisted from NASDAQ?

If our common stock is delisted, the stock would then be eligible for quotation on the Over-The-Counter (OTC) Bulletin Board maintained by NASDAQ, on another over-the-counter quotation system or on the “pink sheets.”

If our common stock is delisted from NASDAQ and our public float falls below $75 million, we may become ineligible to use the SEC Form S-3 to register additional shares of common stock for issuance by us in certain circumstances and to register additional shares of common stock for resale by others. This will make it more difficult and more expensive for us to register any additional securities, which may adversely affect our ability to raise additional funds.

In addition, if our common stock is delisted from NASDAQ, the liquidity and marketability of shares of our common stock would decrease. As a result, an investor might find it more difficult to dispose of, or to obtain accurate quotations as to the market value of our common stock. If our common stock were to be delisted and the trading price of the common stock were to continue to be less than $1.00 per share, trading in our common stock would also be subject to certain rules under the 1934 Act which require additional disclosure by broker-dealers in connection with any trades involving a stock defined as a “penny stock” involving persons other than established customers and accredited investors. The additional burdens imposed upon broker-dealers might discourage broker-dealers from effecting transactions in our common stock, which might further affect the liquidity of our common stock. For these reasons, we believe that current and prospective investors will view an investment in our common stock more favorably if the shares remain listed on The NASDAQ Capital Market than if our common stock trades on the OTC Bulletin Board or similar trading systems.

Why is the Board requesting discretion to determine the reverse split ratio and to effect the Reverse Stock Split?

The Board of Directors believes that the availability of a range of reverse split ratios will provide the Board with the flexibility to implement the Reverse Stock Split in a manner designed to maximize the anticipated benefits for Generex and its stockholders. In determining which reverse stock split ratio to implement, if any, following the receipt of stockholder approval, the Board of Directors may consider, among other things, factors such as:

| | · | the historical trading price and trading volume of the common stock; |

| | · | the then prevailing trading price and trading volume of the common stock and the anticipated impact of the Reverse Stock Split on the trading market for the common stock; |

| | · | which reverse split ratio would result in the greatest overall reduction in Generex’s administrative costs; and |

| | · | prevailing general market and economic conditions. |

To effect the Reverse Stock Split, the Board would set the timing for such a split and select the specific ratio from the range of ratios described in this proxy statement. No further action on the part of stockholders will be required to either implement or abandon the Reverse Stock Split. If the proposal is approved by stockholders, and the Board determines to implement any of the reverse stock split ratios, we would communicate to the public, prior to the effective date of the Reverse Stock Split, additional details regarding the Reverse Stock Split, including the specific ratio the Board selects.

Although the Board of Directors requests stockholder approval of the proposed amendment to the Restated Certificate of Incorporation, the Board reserves the authority to decide, in its discretion, to abandon or delay the Reverse Stock Split after such vote. For example, the Board may decide in its discretion to abandon or delay the Reverse Stock Split if Generex were to gain compliance with the NASDAQ Capital Market continued listing requirements at the time of the annual meeting or soon thereafter. If the Board fails to effect the Reverse Stock Split within twelve months after the annual meeting, stockholder approval again would be required prior to implementing any subsequent reverse stock split.

What are the anticipated effects of the Reverse Stock Split on existing stockholders of Generex?

The number of shares of common stock held by each stockholder will be reduced as a result of the Reverse Stock Split. For example, if the Board of Directors selects a reverse split ratio of 1-to-5, a stockholder holding 5,000 shares of common stock before the Reverse Stock Split would hold 1,000 shares of common stock immediately after the Reverse Stock Split. Any outstanding options or warrants would also be adjusted by the same reverse split ratio. We will not issue fractional shares of common stock. Where a stockholder would have been entitled to a fractional share, we will round up fractional shares to the nearest whole share. Each stockholder's proportionate ownership of outstanding shares of common stock would remain the same, except for minor differences resulting from the rounding up of fractional shares. A reverse stock split may leave certain stockholders with one or more "odd lots," which are stock holdings in amounts of fewer than 100 shares of common stock. These odd lots may be more difficult to sell than shares of common stock in even multiples of 100. Stockholders selling odd lots created by the Reverse Stock Split may incur increased brokerage commissions in selling such shares.

Except for de minimis adjustments that may result from the treatment of fractional shares as described above, the Reverse Stock Split will not have any dilutive effect on our stockholders since each stockholder would hold the same percentage of our common stock outstanding immediately following the Reverse Stock Split as such stockholder held immediately prior to the Reverse Stock Split. The relative voting and other rights that accompany the shares of common stock would not be affected by the Reverse Stock Split.

Although the Reverse Stock Split will not have any dilutive effect on our stockholders, the proportion of shares owned by our stockholders relative to the number of shares authorized for issuance will decrease because the Amendment maintains the current authorized number of shares of common stock at 750 million.

The following table shows the number of shares that would be (a) issued and outstanding, (b) authorized and reserved for issuance upon the exercise of outstanding capital stock options and warrants (assuming vesting of all nonvested shares underlying such options and warrants), and (c) authorized and unreserved for issuance, in each case upon the implementation of the Reverse Stock Split at a ratio of 1-for-3 and a ratio of 1-for-10 based on our capitalization as of the record date of June 3, 2010.

| | Shares Issued and Outstanding | | | Shares Authorized and Reserved for Issuance(1) | | | Shares Authorized and Unreserved | | | Total Authorized | |

| Pre-Split | | | 266,055,346 | | | | 44,828,883 | | | | 439,115,771 | | | | 750,000,000 | |

| If 1-for -3 stock split enacted | | | 88,685,115 | | | | 14,942,961 | | | | 646,371,924 | | | | 750,000,000 | |

| If 1-for -10 stock split enacted | | | 26,605,535 | | | | 4,482,888 | | | | 718,911,577 | | | | 750,000,000 | |

| (1) | Shares which are authorized and reserved for issuance upon the exercise of outstanding options and warrants, assuming the vesting of all nonvested shares underlying such options and warrants. |

The additional authorized but unissued shares of common stock that would become available if the Reverse Stock Split is effected may be used for various purposes, including, without limitation, raising capital, providing equity incentives to employees, officers or directors, effecting stock dividends, and establishing strategic relationships with other companies and expanding Generex’s business or product lines through the acquisition of other businesses or products. In order to support our projected need and timetable for additional equity capital and to provide flexibility to raise the capital necessary to finance ongoing operations, the Board of Directors believes the number of shares of common stock we are authorized to issue should be maintained at 750 million.

At the present time, we do not currently have any plans to issue any of the authorized but unissued shares of common stock that would become available for issuance if the Reverse Stock Split of our outstanding shares of common stock is approved by our stockholders and subsequently effected by the Board of Directors. Even if the Reverse Stock Split is effected, we will be required to obtain stockholder approval prior to the issuance of authorized stock, in certain circumstances, including if (1) the issuance would result in a change of control of Generex, (2) shares are issued to purchase the stock or assets of another company if a director, officer or substantial stockholder of Generex had a 5% or greater interest (or such persons had collectively a 10% or greater interest) in the company or assets to be acquired, or in consideration to be paid in the transaction, and certain other conditions applied, (3) greater than 20% of Generex’s common stock or voting power outstanding prior to the issuance of shares is issued, and (4) if shares are issued pursuant to a new or amended employee option plan.

What are the anticipated effects of the Reverse Stock Split on the market for our common stock?

The Board of Directors believes that an increased stock price could enhance the appeal of our common stock to the financial community, including institutional investors, and the general investing public. Because of the trading volatility often associated with low-priced stocks, many brokerage firms and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Some of these policies and practices pertain to the payment of brokers' commissions and to time-consuming procedures that make the handling of lower-priced stocks unattractive to brokers from an economic standpoint. We believe that the anticipated higher market price resulting from a reverse stock split would better enable institutional investors and brokerage firms with such policies and practices to invest in our common stock. There can be no assurance that this will be the case, however.

What are the anticipated effects of the Amendment on our authorized and outstanding shares?

If and when the Board of Directors elects to effect the Reverse Stock Split, the authorized number of shares of our common stock will remain at 750 million. Accordingly, there will be no reduction in the number of authorized shares of our common stock in proportion to the Reverse Stock Split ratio. As a result, the proportion of shares owned by our stockholders relative to the number of shares authorized for issuance will decrease, and the additional authorized shares of common stock will be available for issuance at such times and for such purposes as the Board of Directors may deem advisable without further action by our stockholders, except as required by applicable laws and regulations. Because our common stock is traded on The NASDAQ Capital Market, stockholder approval must be obtained, under applicable NASDAQ rules, prior to the issuance of shares for certain purposes, including the issuance of shares of Generex’s common stock equal to or greater than 20% of the then outstanding shares of common stock in connection with a private refinancing or an acquisition or merger, unless an exemption is available from such approval. Such an exemption would be available if the Board authorized the filing of an application with NASDAQ to waive the shareholder vote requirement if it believed the delay associated with securing such vote would seriously jeopardize our financial viability and NASDAQ granted us such an exemption.

The additional shares of our common stock to be authorized will be a part of the existing class of common stock and, if and when issued, would have the same rights and privileges as the shares of our common stock presently issued and outstanding.

What are the anticipated effects of the Reverse Stock Split on our stock plans?

The Reverse Stock Split, when implemented, will affect outstanding stock awards and options to purchase our common stock. Each of Generex’s 2000 Stock Option Plan, 2001 Stock Option Plan, as amended, and 2006 Stock Plan, as amended (collectively, the "Plans"), includes provisions for appropriate adjustments to the number of shares of common stock covered by each such plan and to stock options and other grants of stock-based awards under the Plan, as well as the per share exercise price. If stockholders approve the Reverse Stock Split and the Board of Directors selects a reverse split ratio of 1-to-5, an outstanding stock option to purchase five shares of common stock would thereafter evidence the right to purchase one share of common stock consistent with the reverse stock split ratio, and the exercise price per share would be a corresponding multiple of the previous exercise price. For example, a pre-split option for 500 shares of common stock with an exercise price of $0.50 per share would be converted post-split into an option to purchase 100 shares of common stock with an exercise price of $2.50 per share. Further, the number of shares of common stock reserved for issuance under the plans will be reduced by the same ratio.

Will the Reverse Stock Split have any effect on Generex?

We expect our business and operations to continue as they are currently being conducted and the Reverse Stock Split is not anticipated to have any effect upon the conduct of our business. We expect to incur expenses of approximately $50,000 to effect the Reverse Stock Split.

What effect will the Reverse Stock Split on Generex’s registration under the Exchange Act?

Our common stock is currently registered under Section 12(b) of the Securities Exchange Act of 1934 ("Exchange Act"), and we are subject to the periodic reporting and other requirements of the Exchange Act. As of May 3, 2010, we had 669 holders of record of our common stock (although we have significantly more beneficial holders). We do not expect the Reverse Stock Split and the rounding up of fractional shares to result in a significant reduction in the number of record holders. We do presently does not intend to seek any change in our status as a reporting company for federal securities law purposes, either before or after the Reverse Stock Split.

If the Reverse Stock Split is implemented, we currently expect that the common stock will continue to be traded on the NASDAQ Capital Market under the symbol "GNBT", provided that we meet the continued listing requirements (although NASDAQ would likely add the letter "D" to the end of the trading symbol for a period of 20 trading days to indicate that the Reverse Stock Split has occurred).

Will the Reverse Stock Split have any potential anti-takeover or dilutive effect?

The purpose of maintaining our authorized common stock at 750 million after the Reverse Stock Split is to facilitate our ability to raise additional capital to support our operations, not to establish any barriers to a change of control or acquisition of the company. The common shares that are authorized but unissued provide our Board of Directors with flexibility to effect, among other transactions, public or private refinancings, acquisitions, stock dividends, stock splits and the granting of equity incentive awards. However, these authorized but unissued shares may also be used by the Board of Directors, consistent with and subject to its fiduciary duties, to deter future attempts to gain control of us or make such actions more expensive and less desirable. The Amendment would give our Board of Directors authority to issue additional shares from time to time without delay or further action by the shareholders except as may be required by applicable law or the NASDAQ rules. The Amendment is not being recommended in response to any specific effort of which we are aware to obtain control of Generex, nor does the Board of Directors have any present intent to use the authorized but unissued common stock to impede a takeover attempt.

In addition, the issuance of additional shares of common stock for any of the corporate purposes listed above could have a dilutive effect on earnings per share and the book or market value of our outstanding common stock, depending on the circumstances, and would likely dilute a shareholder’s percentage voting power in the company. Holders of our common stock are not entitled to preemptive rights or other protections against dilution. Our Board of Directors intends to take these factors into account before authorizing any new issuance of shares.

Are their risks associated with the Reverse Stock Split?

Yes, there are certain risks associated with the Reverse Stock Split, including without limitation those described below.

There can be no assurance that the total market capitalization of our common stock (the aggregate value of all Generex common stock at the then market price) after the implementation of the Reverse Stock Split will be equal to or greater than the total market capitalization before the Reverse Stock Split or that the per share market price of our common stock following the Reverse Stock Split will increase in proportion to the reduction in the number of shares of our common stock outstanding before the Reverse Stock Split.

There can be no assurance that the market price per share of our common stock after the Reverse Stock Split will remain unchanged or increase in proportion to the reduction in the number of old shares of our common stock outstanding before the Reverse Stock Split. For example, based on the closing price of our common stock on June 3, 2010 of $0.42 per share, if the Board were to implement the Reverse Stock Split and utilize a ratio of 1-for-5, we cannot assure you that the post-split market price of our common stock would be $2.10 (that is, $0.42 × 5) per share or greater. In many cases, the market price of a company’s shares declines after a reverse stock split.

Accordingly, the total market capitalization of our common stock after the Reverse Stock Split, when and if implemented, may be lower than the total market capitalization before the Reverse Stock Split. Moreover, in the future, the market price of our common stock following the Reverse Stock Split may not exceed or remain higher than the market price prior to the Reverse Stock Split.

The Reverse Stock Split may not increase our stock price over the long-term, which may prevent us from qualifying for listing with NASDAQ.

While we expect that the Reverse Stock Split, together with other actions required to meet applicable listing standards, will enable our shares to qualify for listing with NASDAQ and that we will be able to continue to meet on-going quantitative and qualitative listing requirements, we cannot be sure that this will be the case. Negative financial results, adverse clinical trials developments, or market conditions could adversely affect the market price of our common stock and jeopardize our ability to meet or maintain applicable NASDAQ listing requirements. Furthermore, in addition to its enumerated listing and maintenance standards, NASDAQ has broad discretionary authority over the initial and continued listing of securities, which it could exercise with respect to our shares.

If the Reverse Stock Split is effected, the resulting per-share stock price may not attract institutional investors or investment funds and may not satisfy the investing guidelines of such investors and, consequently, the trading liquidity of our common stock may not improve.

While the Board believes that a higher stock price may help generate investor interest, there can be no assurance that the Reverse Stock Split will result in a per-share price that will attract institutional investors or investment funds or that such share price will satisfy the investing guidelines of institutional investors or investment funds. As a result, the trading liquidity of our common stock may not necessarily improve.

A decline in the market price of our common stock after the Reverse Stock Split is implemented may result in a greater percentage decline than would occur in the absence of the Reverse Stock Split, and the liquidity of our common stock could be adversely affected following the Reverse Stock Split.

If the Reverse Stock Split is effected and the market price of our common stock declines, the percentage decline may be greater than would occur in the absence of the Reverse Stock Split. The market price of our common stock will, however, also be based on our performance and other factors, which are unrelated to the number of shares of common stock outstanding. Furthermore, the liquidity of our common stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Stock Split.

How will the Reverse Stock Split be effected?

If approved by shareholders at the annual meeting and our Board of Directors concludes that it is in the best interests of Generex and its stockholders to effect the Reverse Stock Split, the Amendment will be filed with the Delaware Secretary of State. The actual timing of the filing of the Amendment with the Delaware Secretary of State to effect the Reverse Split will be determined by the Board of Directors but will be no later than twelve months following the approval of this Item 2. Also, if for any reason the Board of Directors deems it advisable to do so, the Reverse Split may be abandoned at any time prior to the filing of the Amendment, without further action by our shareholders. The Reverse Split will be effective as of the date of filing with the Delaware Secretary of State (the “Effective Time”). We will issue a press release and file a Form 8-K pre-announcing the filing of the Amendment prior to its effective filing date.

Upon the filing of the Amendment, without further action on the part of us or the stockholders, the outstanding shares of common stock held by stockholders of record as of the Effective Time would be converted into a lesser number of shares of common stock based on a reverse split ratio of one-for-three to one-for-ten. For example, if you presently hold 1,000 shares of our common stock, you would hold between 334 and 100 shares of our common stock following the Reverse Stock Split.

Will Generex issue fractional shares in connection with the Reverse Stock Split?

The Board of Directors does not currently intend to issue fractional shares in connection with the Reverse Stock Split. Therefore, we do not expect to issue certificates representing fractional shares. Stockholders of record who would otherwise hold a fractional share because the number of shares of common stock they hold before the Reverse stock Split is not evenly divisible by the split ratio will be entitled to have their fractional share rounded up to the next whole number.

How do I exchange my pre-reverse stock split certificates for new post-reverse stock split certificates?

If we implement the Reverse Stock Split, our transfer agent will act as our exchange agent for purposes of implementing the exchange of stock certificates.

On or after the Effective Time, the exchange agent will mail a letter of transmittal to each stockholder. Each stockholder will be able to obtain a certificate evidencing his, her or its post-Reverse Stock Split shares only by sending the exchange agent the stockholder’s old stock certificate(s), together with the properly executed and completed letter of transmittal and such evidence of ownership of the shares as we may require. Stockholders will not receive certificates for post-Reverse Stock Split shares unless and until they surrender their old certificates. You should not forward your certificates to the exchange agent until you receive the letter of transmittal, and you should only send in your certificates with the letter of transmittal. If you elect to receive a new stock certificate in the letter of transmittal, the exchange agent will send you a new stock certificate after receipt of your properly completed letter of transmittal and old stock certificate(s). If you surrender your old stock certificate(s) but do not elect to receive a new stock certificate in the letter of transmittal, you will hold that your shares electronically in book-entry form with our transfer agent as described below. You will not have to pay any service charges in connection with the exchange of your certificates.

Certain of our registered holders of common stock hold some or all of their shares electronically in book-entry form with our transfer agent. These shareholders do not have stock certificates evidencing their ownership of our common stock. They are, however, provided with a statement reflecting the number of shares registered in their accounts. If you hold all of your shares of common stock electronically in book-entry form with our transfer agent, you do not need to take any action as your holdings will be electronically adjusted by our transfer agent to give effect to the Reverse Stock Split.

Upon the Reverse Stock Split, we intend to treat shares of common stock held by stockholders in "street name," that is, through a bank, broker or other nominee, in the same manner as stockholders whose shares of common stock are registered in their names. Banks, brokers or other nominees will be asked to effect the Reverse Stock Split for their beneficial holders holding the common stock in "street name." However, these banks, brokers or other nominees may have different procedures than registered stockholders for processing the Reverse Stock Split. If you hold shares of common stock with a bank, broker or other nominee and have any questions in this regard, you are encouraged to contact your bank, broker or other nominee directly.

You should not send your certificates now. You should send them only after you receive the letter of transmittal from our exchange agent.

What are the accounting consequences of the Reverse Stock Split?

The par value per share of our common stock will remain unchanged at $0.001 per share after the Reverse Stock Split. As a result, as of the Effective Date, the stated capital on Generex’s consolidated balance sheet attributable to Generex common stock will be reduced and the additional paid-in-capital account will be increased by the amount by which the stated capital is reduced. Per share net income or loss will be increased because there will be fewer shares of common stock outstanding. We do not anticipate that any other accounting consequences, including changes to the amount of stock-based compensation expense to be recognized in any period, will arise as a result of the Reverse Stock Split.

What are the federal income tax consequences of the Reverse Stock Split?

The following is a summary of certain U.S. federal income tax consequences relating to the Reverse Stock Split as of the date hereof. This summary addresses only U.S. holders who hold their shares of Common Stock as a capital asset for U.S. federal income tax purposes (i.e., generally, property held for investment).

For purposes of this summary, a “U.S. holder” means a beneficial owner of common stock who is any of the following for U.S. federal income tax purposes: (i) an individual who is a citizen or resident of the United States, (ii) a corporation created or organized in or under the laws of the United States, any state thereof, or the District of Columbia, (iii) an estate the income of which is subject to U.S. federal income taxation regardless of its source, or (iv) a trust if (1) its administration is subject to the primary supervision of a court within the United States and one or more U.S. persons have the authority to control all of its substantial decisions, or (2) it has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person.

This summary is based on interpretations of the Internal Revenue Code of 1986, as amended (the “Code”), and regulations, rulings and judicial decisions as of the date hereof. These authorities may be changed, perhaps retroactively, and may adversely affect the U.S. federal income tax consequences described herein. This summary does not discuss all of the tax consequences that may be relevant to particular stockholders or to stockholders subject to special treatment under U.S. federal income tax laws (such as banks and other financial institutions, insurance companies, real estate investment trusts, regulated investment companies, personal holding companies, foreign entities, nonresident alien individuals, broker-dealers, tax-exempt entities, partnerships, and stockholders who hold common stock as part of a position in a straddle or as part of a hedging, conversion or integrated transaction).

Moreover, this description does not address the U.S. federal estate and gift tax, alternative minimum tax, state, local, foreign or other tax consequences of the Reverse Stock Split.

You should consult your own tax adviser concerning the particular U.S. federal tax consequences of the Reverse Stock Split, as well as any consequences arising under the laws of any other taxing authority, such as any state, local or foreign income tax consequences to which you may be subject.

To ensure compliance with Treasury Department Circular 230, each holder of common stock is hereby notified that: (a) any discussion of U.S. federal tax issues in this proxy statement is not intended or written to be used, and cannot be used, by such holder for the purpose of avoiding penalties that may be imposed on such holder under the Code; (b) any such discussion has been included by Generex in furtherance of the Reverse Stock Split on the terms described herein; and (c) each such holder should seek advice based on its particular circumstances from an independent tax advisor.