QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrantý

|

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to Rule 14a-12

|

MIPS TECHNOLOGIES, INC. |

(Name of Registrant as Specified in its Charter) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | 1) | | Title of each class of securities to which transaction applies:

|

| | | 2) | | Aggregate number of securities to which transaction applies:

|

| | | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | 4) | | Proposed maximum aggregate value of transaction:

|

| | | 5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | 1) | | Amount Previously Paid:

|

| | | 2) | | Form, Schedule or Registration Statement No.:

|

| | | 3) | | Filing Party:

|

| | | 4) | | Date Filed:

|

September 24, 2002

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of MIPS Technologies, Inc., a Delaware corporation, to be held on Wednesday, November 13, 2002 at our corporate offices at 1225 Charleston Road, Mountain View, California commencing at 2:00 p.m., local time.

At the Annual Meeting:

- 1.

- Holders of Class A common stock will be asked to consider and vote upon the election of one Class A director and holders of Class B common stock will be asked to consider and vote upon the election of two Class B directors; and

- 2.

- Holders of Class A and Class B common stock will be asked to consider and vote upon the ratification of the appointment of Ernst & Young LLP as our independent auditors for the 2003 fiscal year.

Only holders of Class A common stock are entitled to vote in the election of the Class A director and only holders of Class B common stock are entitled to vote in the election of the Class B directors. The attached Proxy Statement presents the details of these proposals.

Our board of directors has unanimously nominated the Class A director nominee and Class B director nominees and approved Proposal No. 2 above and recommends a vote FOR the Class A director nominee, a vote FOR the Class B director nominees and a vote FOR the approval and adoption of Proposal No. 2.

Your participation and vote are important. The election of the Class A director will not be effected without the affirmative vote of the holders of at least a majority of the outstanding Class A common stock present in person or represented by proxy and voting at the Annual Meeting and the election of the Class B directors will not be effected without the affirmative vote of the holders of at least a majority of the outstanding Class B common stock present in person or represented by proxy and voting at the Annual Meeting. The adoption of Proposal No. 2 will not be effected without the affirmative vote of at least a majority of the outstanding Class A and Class B common stock present in person or represented by proxy and voting at the Annual Meeting.

For further information regarding the matters to be voted on at the Annual Meeting, I urge you to carefully read the accompanying Proxy Statement. If you have more questions about these proposals or would like additional copies of the Proxy Statement, you should contact Kevin C. Eichler, Chief Financial Officer of MIPS Technologies, Inc., 1225 Charleston Road, Mountain View, California 94043; telephone: (650) 567-5000. Even if you plan to attend the Annual Meeting in person, please complete, sign, date, and promptly return the enclosed proxy card in the enclosed postage-prepaid envelope or by electronic means. This will not limit your right to attend or vote at the Annual Meeting.

| | | Sincerely, |

|

|

|

|

|

John E. Bourgoin

Chairman, Chief Executive Officer

and President |

The accompanying Proxy Statement is dated September 24, 2002 and is first being mailed to stockholders on or about October 2, 2002.

NOTICE OF THE ANNUAL MEETING OF STOCKHOLDERS

NOVEMBER 13, 2002

To the Stockholders of

MIPS TECHNOLOGIES, INC.:

NOTICE IS HEREBY GIVEN that the 2002 Annual Meeting of Stockholders of MIPS Technologies, Inc., a Delaware corporation, will be held at our corporate offices at 1225 Charleston Road, Mountain View, California on November 13, 2002. The Annual Meeting will begin at 2:00 p.m. local time, for the following purposes:

- 1.

- To elect one Class A director to serve a three-year term, one Class B director to serve a three-year term and one Class B director to serve a two-year term;

- 2.

- To ratify the appointment of Ernst & Young LLP as our independent auditors for the 2003 fiscal year; and

- 3.

- To transact such other business as may properly come before the Annual Meeting and any adjournment(s) thereof.

Only stockholders of record at the close of business on September 19, 2002 are entitled to notice of and to vote at the Annual Meeting. Only holders of Class A common stock are entitled to vote in the election of the Class A director and only holders of Class B common stock are entitled to vote in the election of the Class B directors.

All stockholders are cordially invited to attend the Annual Meeting in person.However, to ensure your representation at the Annual Meeting, you are urged to complete, sign, date and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purposeor by electronic means. Any stockholder attending the Annual Meeting may vote in person, even though he or she has previously returned a proxy.

| | | By Order of the Board of Directors of

MIPS Technologies, Inc. |

|

|

|

| | | Sandy Creighton

Vice President, General Counsel and Secretary |

Mountain View, California

September 24, 2002

YOUR VOTE IS IMPORTANT

In order to ensure your representation at the Annual Meeting, you are requested to

complete, sign and date the enclosed proxy as promptly as possible and return

it in the enclosed envelopeor by electronic means.

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

This Proxy Statement is being furnished by our board of directors to holders of our Class A and Class B common stock, par value $0.001 per share, in connection with the solicitation of proxies by our board of directors for use at the annual meeting of MIPS Technologies, Inc. ("MIPS") stockholders to be held on Wednesday, November 13, 2002, at our corporate offices at 1225 Charleston Road, Mountain View, California commencing at 2:00 p.m., local time, and at any adjournment or postponement thereof. The purposes of the annual meeting are set forth in this Proxy Statement and in the accompanying Notice of the Annual Meeting of Stockholders.

Our complete mailing address is MIPS Technologies, Inc., 1225 Charleston Road, Mountain View, California 94043, and our telephone number is (650) 567-5000.

This Proxy Statement and the accompanying form of proxy are first being mailed to our stockholders on or about October 2, 2002.

Stockholders Entitled to Vote; Quorum and Vote Required

The MIPS board of directors has fixed the close of business on September 19, 2002 as the record date for the determination of the stockholders entitled to notice of and to vote at the Annual Meeting. Accordingly, only holders of record on this date will be entitled to notice of, and to vote at, the Annual Meeting. As of the record date, there were outstanding and entitled to vote 14,673,423 Class A shares and 25,057,715 Class B shares, constituting all of the voting stock of MIPS. As of the record date, there were 57 holders of record of Class A shares and 4,654 holders of record of Class B shares. Each holder of record of our common stock on the record date is entitled to one vote per share, which may be cast either in person or by proxy, at the Annual Meeting. Only holders of Class A common stock are entitled to vote in the election of the Class A director and only holders of Class B common stock are entitled to vote in the election of the Class B directors. In all other matters submitted to a vote of stockholders, holders of Class A and Class B common stock will vote together as a single class.

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Class A and Class B common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum for purpose of the ratification of the appointment of Ernst & Young LLP as our independent auditors for fiscal year 2003. The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Class A common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum for purposes of the election of the Class A director. The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Class B common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum for purposes of the election of the Class B directors. Shares of our common stock present, in person or by proxy, will be counted for the purpose of determining whether a quorum is present at the Annual Meeting. Shares that abstain from voting, and shares held by a broker nominee in "street name" which indicates on a proxy that it does not have discretionary authority to vote as to a particular matter, will be treated as shares that are present and entitled to vote at the Annual Meeting for purposes of determining whether a quorum exists, but will not be considered as votes cast. Accordingly, these shares will have no effect on the outcome of the vote with respect to the matters to be brought before the Annual Meeting.

The Class A director will be elected by a plurality of the vote of shares of Class A common stock present, in person or by proxy, at the meeting and actually cast. The Class B directors will be elected by a plurality of the vote of shares of Class B common stock present, in person or by proxy, at the meeting and actually cast. The affirmative vote of a majority of the outstanding shares of Class A and Class B common

1

stock present, in person or by proxy, and voting is required to ratify the board of directors' selection of Ernst & Young LLP.

Proxies

This Proxy Statement is being furnished to you in connection with the solicitation of proxies by, and on behalf of, our board of directors for use at the Annual Meeting, and is accompanied by a form of proxy.

All shares of our common stock represented at the Annual Meeting by properly executed proxies that have not been revoked will be voted at the Annual Meeting in accordance with the instructions indicated on such proxies. If no instructions are indicated (other than in the case of broker non-votes), such proxies will be voted as recommended by our board of directors.

We have not received notice, as required by our by-laws, of any other matter to be brought before the Annual Meeting. If any other matters are properly presented at the Annual Meeting for consideration, including, among other things, consideration of a motion to adjourn such Annual Meeting to another time and/or place (including, without limitation, for the purposes of soliciting additional proxies), the persons named in the enclosed form of proxy and acting thereunder will have discretion to vote on such matters in accordance with their judgment.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by (i) filing with the Secretary of MIPS, at or before the taking of the vote at the Annual Meeting, a written notice of revocation bearing a later date than the proxy, (ii) duly executing a later dated proxy relating to the same shares and delivering it to MIPS before the taking of the vote at the Annual Meeting or (iii) attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute a revocation of the proxy). Any written notice of revocation or subsequent proxy should be sent to MIPS Technologies, Inc., 1225 Charleston Road, Mountain View, California 94043, Attention: Secretary, or hand delivered to the Secretary of MIPS at or before the taking of the vote at the Annual Meeting.

MIPS will pay the cost of soliciting proxies. In addition to solicitation by use of the mails, proxies may be solicited from MIPS stockholders by directors, officers and employees of MIPS in person or by telephone, telegram or other means of communication. Such directors, officers and employees will not be additionally compensated, but may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation. Arrangements will be made with brokerage houses, custodians, nominees and fiduciaries for forwarding of proxy materials to beneficial owners of shares held of record by such brokerage houses, custodians, nominees and fiduciaries and for reimbursement of their reasonable expenses incurred in connection therewith.

2

PROPOSAL NO. 1—ELECTION OF DIRECTORS

DIRECTORS AND NOMINEES FOR DIRECTOR

Pursuant to our Amended and Restated Certificate of Incorporation, holders of the Class B common stock are entitled to elect 80% of the members of our board of directors (rounded upwards, if necessary) and holders of the Class A common stock are entitled to elect our remaining directors (but in no event less than one director). Our board members serve staggered three-year terms. The board of directors has the ability to change the size and composition of our board of directors. However, to ensure that there will be at least one Class A director at all times, our board of directors may not consist of fewer than five members.

Our board of directors currently consists of six directors, divided into three classes as set forth in the following table:

Class

| | Expiration of Term

| | Board Members

|

|---|

| Class I | | 2002 Annual Meeting | | Class A Director:

Anthony B. Holbrook |

| | | | | Class B Directors:

John E. Bourgoin

Kenneth L. Coleman |

| Class II | | 2003 Annual Meeting | | Class B Directors:

Fred M. Gibbons

Benjamin A. Horowitz |

| Class III | | 2004 Annual Meeting | | Class B Director:

William M. Kelly |

Due to past changes in the size of the board of directors, our three current Class I directors, whose terms expire at the Annual Meeting, represent one-half of the entire board. In order to maintain the number of directors in each class as nearly equal as possible, our board of directors has, pursuant to the provisions of our Amended and Restated Certificate of Incorporation, apportioned two of the three positions to be voted upon at the Annual Meeting to Class I and the third position to Class III. The terms of the Class II and Class III directors whose terms do not expire at the Annual Meeting will not be affected by this apportionment.

The persons named as proxies in the enclosed form of proxy intend to vote proxies for holders of the Class A and Class B common stock for the re-election of the three nominees named below, unless otherwise directed. If, contrary to our expectations, a nominee should become unavailable for any reason, votes may be cast pursuant to the accompanying form of proxy for a substitute nominee designated by the board of directors.

One Class I director will be elected to our board of directors at the Annual meeting by holders of our Class A common stock for a three-year term ending in 2005. Mr. Holbrook is the nominee for this position. Only holders of Class A common stock are entitled to vote in the election of the Class A director. Holders of our Class B common stock will elect one Class I director and one Class III director at the Annual Meeting, for a three-year term ending in 2005 and a two-year term ending in 2004, respectively. Mr. Bourgoin is the nominee for the Class I position and Mr. Coleman is the nominee for the Class III position. Only holders of Class B common stock are entitled to vote in the election of the Class B directors.

3

Nominee

NAME

| | PRINCIPAL OCCUPATION AND BUSINESS EXPERIENCE

|

|---|

Anthony B. Holbrook

Class A Director

Age: 63

Board Member since July 1998 | | Retired Chief Technical Officer of Advanced Micro Devices, Inc. or AMD. Mr. Holbrook retired as Chief Technical Officer of AMD in August 1994. Mr. Holbrook joined AMD in 1973 and served in a number of executive capacities. He was elected a corporate officer in 1978 and in 1982 was named 98 Executive Vice President and Chief Operating Officer. In 1986, Mr. Holbrook was named President of AMD and was elected to the board of directors. In 1989, he moved from Chief Operating Officer to Chief Technical Officer and in 1990 from President to Vice Chairman, a position he held until April 1996. |

John E. Bourgoin

Class B Director

Age: 56

Board Member since May 1999 |

|

Chief Executive Officer and President of MIPS Technologies, Inc. Mr. Bourgoin has served as our Chief Executive Officer since February 1998 and our President since September 1996. Mr. Bourgoin also served as a Senior Vice President of Silicon Graphics, Inc. or SGI from September 1996 through 7 May 1998. Prior to joining SGI and since 1976, Mr. Bourgoin was employed at AMD and held various positions including Group Vice President, Computation Products Group of AMD. |

Kenneth L. Coleman

Class B Director

Age: 60

Board Member since January 1998 |

|

Founder, Chairman and Chief Executive Officer of ITM Software Corporation, an enterprise software company. Before founding ITM Software, Mr. Coleman was a senior executive at SGI. Mr. Coleman retired in August 2001, after fourteen years in various senior executive positions. Mr. Coleman 1998 joined SGI in 1987 and held such positions as Executive Vice President of Global Sales, Service and Marketing, Senior Vice President, Customer and Professional Services and Senior Vice President, Administration. Prior to SGI, Mr. Coleman was Vice President of Product Development at Activision, Inc. Mr. Coleman is a member of the Board of Directors of ITM Software, Acclaim Entertainment, an interactive entertainment software company and United Online, an internet service provider. |

4

Continuing Directors

NAME

| | PRINCIPAL OCCUPATION AND BUSINESS EXPERIENCE

|

|---|

Fred M. Gibbons

Class B Director

Age: 52

Board Member since July 1998 | | Partner, Concept Stage Venture Management. Since 1999, Mr. Gibbons has been a partner with Concept Stage Venture Management, an investment firm based in California. From 1995 through 1998, Mr. Gibbons was a lecturer at the Stanford University Graduate School of Engineering. In 1981, Mr. Gibbons founded Software Publishing Corporation based in San Jose, California, a company engaged in the development of software systems for personal computer applications, and was its Chief Executive Officer through 1994. |

Benjamin A. Horowitz

Class B Director

Age: 36

Board Member since November 2001 |

|

Chief Executive Officer and President, Opsware Inc., formerly Loudcloud, Inc., a provider of information technology automation software. In 1999, Mr. Horowitz co-founded Loudcloud, Inc. Previously, Mr. Horowitz was vice president and general manager of the E-commerce Platform division of America Online, Inc., an internet service provider. Mr. Horowitz ran several product divisions at Netscape Communications, Inc., a provider of browser software, from 1995 to 1999. Prior to joining Netscape, Mr. Horowitz worked at Lotus Development Corp., where he held various senior marketing positions. Mr. Horowitz is a member of the Board of Directors of Opsware Inc., Omnicell, Inc., and Propel Software Corporation. |

William M. Kelly

Class B Director

Age: 49

Board Member since January 1998 |

|

Partner, with the law firm of Davis Polk & Wardwell. Prior to joining Davis, Polk & Wardwell in January 2000, Mr. Kelly served in several capacities for Silicon Graphics, Inc. or SGI. Mr. Kelly joined SGI in 1994 as Vice President, Business Development, General Counsel and Secretary and, from 1997 to 1999, served as Senior Vice President, Corporate Operations of SGI. During 1996, Mr. Kelly also served as Senior Vice President, Silicon Interactive Group of SGI and as acting Chief Financial Officer of SGI from May 1997 to February 1998. |

Board Of Directors' Meetings And Committees

Our board of directors held four regular and one special meeting during fiscal 2002. Our board of directors has an Audit Committee and a Compensation Committee, which also fulfills the functions of a nominating committee.

During fiscal year 2002, the members of the Audit Committee were Mr. Kelly (Chairman), Mr. Gibbons and Mr. Holbrook. The Audit Committee met four times during fiscal year 2002. The responsibilities of the Audit Committee include selecting, evaluating and approving the compensation of our independent accountants, reviewing and discussing with management and our independent accountants our quarterly and annual financial statements, reviewing with management and the independent accountants our internal control policies and their effectiveness and, as may be requested from time to time by our board of directors, performing investigations and reviewing related party transactions. The Audit Committee operates under a written charter adopted by the board, which is attached to this Proxy Statement as Appendix A. The Audit Committee is composed only of non-employee directors, each of whom is "independent" as defined in the listing standards of the Nasdaq National Market.

5

During fiscal year 2002, the members of the Compensation Committee were Mr. Coleman (Chairman), Mr. Gibbons and Mr. Holbrook. The Compensation Committee met six times and took action by unanimous written consent fourteen times during fiscal year 2002. The responsibilities of the Compensation Committee include administering the 1998 Long-Term Incentive Plan (the "1998 Plan") and 2002 Non-Qualified Stock Option Plan (the "2002 Plan"), reviewing and approving grants under the 1998 Plan and 2002 Plan and approving other performance-based compensation, which is intended to be excluded from the deductibility limitations imposed by Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"), developing performance criteria for and periodically evaluating the performance of our Chief Executive Officer, reviewing and recommending the salary, bonus and stock incentive compensation of our Chief Executive Officer, reviewing the salaries, bonuses and stock incentive compensation of our other officers as proposed by our Chief Executive Officer and reviewing candidates and recommending nominees for election as directors. The Compensation Committee will consider nominees recommended by stockholders.

No director or nominee attended fewer than 75% of the aggregate number of meetings of the board of directors and meetings of the committees of the board on which he served during fiscal year 2002, except Mr. Horowritz, who attended two of the four meetings of the board of directors that were held following his election to the Board in November 2001.

Our board of directors may, from time to time, establish certain other committees to facilitate the management of MIPS.

Director Compensation

Directors who do not receive compensation as officers or employees of MIPS or any of our affiliates receive an annual board membership fee, which is paid in four quarterly installments. The annual board membership fee was $10,000 for the first three-quarters of fiscal 2002 and was increased to $20,000 for the fourth quarter. The chairmen of the Audit and Compensation Committees receive an additional annual fee of $5,000, which is also paid in quarterly installments. In addition, non-employee directors receive $1,000 per meeting for attendance at board and committee meetings and are reimbursed for reasonable expenses incurred in attending.

Our Directors' Stock Option Plan, as amended, authorizes 600,000 shares of Class A common stock for issuance plus an annual increase each July 1 equal to the least of (1) 100,000 shares, (2) the number of shares subject to options granted in the prior one-year period, or (3) a lesser amount determined by our board of directors. Upon a non-employee director's election or appointment to our board of directors, he or she will automatically receive an initial nonstatutory stock option to purchase 40,000 shares of Class A common stock. Each non-employee director who has been a director for at least six months will automatically receive an annual renewal nonstatutory stock option to purchase 10,000 shares of Class A common stock each year on the date of the annual stockholder meeting. All stock options are granted with an exercise price equal to the fair market value of Class A common stock on the date of grant. The vesting schedule for both the initial and annual option grants were adjusted, effective immediately, in January 2002. Under the new vesting schedule, initial grants vest monthly over a 36-month period and annual grants vest immediately. The change to the vesting schedule of the initial grant was designed to align the vesting period with the three-year period for which a director holds office. The change to the vesting schedule of the annual grant was designed to increase the independence of the board of directors by not making compensation contingent upon continued service. Prior to that time initial grants vested as to 24% of the total shares on the first anniversary of the grant date and as to 2% of the total shares each month thereafter over a 38-month period; annual stock option grants vested as to 2% of the total shares each month over a 50-month period from the date of grant prior to the change. In February 2002, the board of directors adjusted the vesting schedule of outstanding options under the Directors' Stock Option Plan to be consistent with these new vesting schedule, which resulted in the vesting of the remaining unvested portions of initial option grants that had been granted prior to February 1999 to Messrs. Gibbons and

6

Holbrook, in the accelerated vesting of a portion of the remaining unvested initial option grants to Messrs. Coleman, Horowitz and Kelly and in vesting of all unvested annual grants.

In May 2002, a special grant of non-statutory stock options was made under the 1998 Long-Term Incentive Plan to non-employee directors in respect of, and covering the same number of shares of Class A common stock as, then-outstanding stock options held by these directors having an exercise price of $11.45 or above. Options to purchase an aggregate of 140,000 shares of Class A common stock with an exercise price of $8.01 per share were granted to Messrs. Coleman, Gibbons, Holbrook and Kelly under this special grant. These new options are vested, or will vest, to the same extent and schedule as the existing options in respect of which they were granted and will expire the earlier of (i) ten years from the date of grant or (ii) the date that is six months and one day following the date on which the average of the closing sale price for the twenty consecutive preceding trading days of our Class A common stock equals or exceeds the exercise price of the existing option to which they relate.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during fiscal 2002 were Kenneth L. Coleman, Fred M. Gibbons and Anthony B. Holbrook. Mr. Coleman, Mr. Gibbons and Mr. Holbrook are all "non-employee directors" under Rule 16b-3 of, and have no interlocking relationships as defined by, the Securities Exchange Act of 1934, as amended.

PROPOSAL NO. 2—RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

Our board of directors upon the recommendation of our Audit Committee has appointed Ernst & Young LLP as our independent auditors, to audit our consolidated financial statements for the 2003 fiscal year. This appointment is being presented to the stockholders for ratification at the Annual Meeting. Ernst & Young LLP has served as our independent auditors since 1998. Representatives of Ernst & Young LLP are expected to be present at the meeting and will be given the opportunity to make a statement should they desire to do so, and are expected to be available to respond to appropriate questions from the stockholders.

Fees Paid To The Independent Auditors

During fiscal 2002, the aggregate fees billed by Ernst & Young LLP for professional services were as follows:

Audit Fees. $313,000 for professional services rendered in connection with the audit of the annual financial statements and for the review of the quarterly financial statements.

Financial Information Systems Design and Implementation Fees. No professional services were rendered during the fiscal year in connection with information system design and implementation.

All Other Fees. $103,000 for consulting services regarding fiscal year 2002 transactions and tax matters.

The Audit Committee of the Board of Directors has determined that the non-audit services provided by Ernst & Young are compatible with maintaining the independence of Ernst & Young.

Our board of directors has unanimously approved the appointment of Ernst & Young LLP as our independent auditors for the 2003 fiscal year and recommends that you vote FOR approval of the appointment of Ernst & Young LLP.

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of August 30, 2002, certain information regarding the beneficial ownership of the Class A common stock and the Class B common stock by

- •

- each stockholder known by us to own beneficially more than 5% of either Class A common stock or Class B common stock,

- •

- each of our directors,

- •

- each executive officer listed in the Summary Compensation Table below and

- •

- all directors and executive officers as a group.

In the table below, percentage ownership is based upon 14,673,423 shares of Class A common stock and 25,057,830 shares of Class B common outstanding as of August 30, 2002. Common stock subject to options that are currently exercisable or exercisable within 60 days of August 30, 2002 are deemed to be outstanding and to be beneficially owned by the person holding such options for the purpose of computing the percentage ownership of such person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated, the persons named have sole voting and investment power over the shares as being beneficially owned by them subject to community property laws. Where information is based on Schedules 13G filed by the named stockholder, the number of shares owned is as of the date for which information was provided in such schedules.

| | Shares Beneficially Owned

| |

|---|

| | Class A Common Stock

| | Class B Common Stock

| |

| |

|---|

Name of Beneficial Owner

| | Number

| | Percentage of Class

| | Number

| | Percentage of Class

| | Percentage of Total

Common Stock

| |

|---|

| 5% Stockholders: | | | | | | | | | | | |

FMR Corp.

82 Devonshire Street

Boston, MA 02109 | | 2,656,020 | (1) | 18.10 | % | 2,526,427 | (2) | 10.08 | % | 13.04 | % |

Capital Group International, Inc.

11100 Santa Monica Boulevard

Los Angeles, CA 90025 | | 1,724,730 | (3) | 11.75 | % | 1,845,900 | (4) | 7.37 | % | 8.99 | % |

Royce & Associates, LLC(5)

1414 Avenue of the Americas

New York, NY 10019 | | 2,239,400 | | 15.26 | % | — | | — | | 5.64 | % |

Joseph L. Harrosh(6)

40900 Grimmer Blvd.

Fremont, CA 94538 | | — | | — | | 1,620,342 | | 6.47 | % | 4.08 | % |

Capital Research and Management Company(7)

333 South Hope Street

Los Angeles, CA 90071 | | — | | — | | 1,294,070 | | 5.16 | % | 3.26 | % |

Pilgrim Baxter & Associates, Ltd.(8)

1400 Liberty Ridge Drive

Wayne, PA 19087-5593 | | 897,800 | | 6.12 | % | — | | — | | 2.26 | % |

Essex Investment Management Company(9)

125 High Street

Boston, MA 02110 | | 819,845 | | 5.59 | % | — | | — | | 2.06 | % |

8

Directors and Executive Officers: |

|

|

|

|

|

|

|

|

|

|

|

| John E. Bourgoin | | 585,906 | (10) | 3.99 | % | 632 | | * | | 1.48 | % |

| Kenneth L. Coleman | | 93,507 | (10) | * | | 5,214 | | * | | * | |

| Fred M. Gibbons | | 80,000 | (10) | * | | — | | — | | * | |

| Anthony B. Holbrook | | 90,000 | (10) | * | | — | | — | | * | |

| Benjamin Horowitz | | 12,222 | (10) | * | | — | | — | | * | |

| William M. Kelly | | 92,222 | (10) | * | | 3,746 | | * | | * | |

| Victor Peng | | 170,278 | (10) | 1.16 | % | — | | — | | * | |

| Sandy Creighton | | 291,723 | (10) | 1.99 | % | — | | — | | * | |

| Kevin C. Eichler | | 182,579 | (10) | 1.24 | % | — | | — | | * | |

| Derek Meyer | | 188,605 | (10) | 1.29 | % | 1 | | * | | * | |

| Directors and executive officers as a group (11 persons) | | 1,836,542 | | 12.52 | % | 9,593 | | * | | 4.65 | % |

- (1)

- As reported by FMR Corp. on a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2002, these shares may also be deemed to be beneficially owned by Fidelity Management & Research Company, Fidelity Growth Company Fund, Edward C. Johnson and/or Abigail Johnson.

- (2)

- As reported by FMR Corp. on a Schedule 13G filed with the Securities and Exchange Commission on March 11, 2002, these shares may also be deemed to be beneficially owned by Fidelity Management & Research Company, Fidelity Growth Company Fund, Edward C. Johnson and/or Abigail Johnson.

- (3)

- As reported by Capital Group International, Inc. on a Schedule 13G as filed with the Securities and Exchange Commission on February 11, 2002, these shares may also be deemed to be beneficially owned by Capital Guardian Trust Company.

- (4)

- As reported by Capital Group International, Inc. on a Schedule 13G as filed with the Securities and Exchange Commission on February 11, 2002, these shares may also be deemed to be beneficially owned by Capital Guardian Trust Company.

- (5)

- As reported by Royce & Associates, LLC on a Schedule 13G as filed with the Securities and Exchange Commission on July 10, 2002.

- (6)

- As reported by Joseph L. Harrosh on a Schedule 13G/A as filed with the Securities and Exchange Commission on January 2, 2002.

- (7)

- As reported by Capital Research and Management Company on a Schedule 13G as filed with the Securities and Exchange Commission on February 11, 2002.

- (8)

- As reported by Pilgrim Baxter & Associates, Ltd. on a Schedule 13G as filed with the Securities and Exchange Commission on February 13, 2002.

- (9)

- As reported by Essex Investment Management Company on a Schedule 13G as filed with the Securities and Exchange Commission on February 2, 2000.

- (10)

- The table includes the following shares subject to acquisition upon exercise of options on August 30, 2002 or within 60 days thereof: Mr. Bourgoin 560,916; Mr. Coleman 92,222; Mr. Gibbons 80,000; Mr. Holbrook 90,000; Mr. Horowitz 12,222; Mr. Kelly 92,222; Mr. Peng 166,295; Ms. Creighton 271,800; Mr. Eichler 160,829; Mr. Meyer 185,580; and Directors and Executive Officers as a group 1,761,586.

In connection with the divestiture by SGI in June 2000, we adopted a Rights Plan. Under this Plan, as amended, our stockholders received the right to purchase shares of our preferred stock upon the occurrence of specified events. The documents evidencing the Rights Plan, as amended, have been filed with the Securities and Exchange Commission as an exhibit to an amended registration statement on Form 8-A.

The following pages contain reports of MIPS' Compensation Committee and Audit Committee and a Performance Graph. Stockholders should be aware that under the rules of the SEC, this information is not

9

considered to be "soliciting material", nor to be "filed", under the Securities Exchange Act of 1934. This information shall not be deemed to be incorporated by reference in any past or future filing by MIPS under the Securities Exchange Act of 1934 or the Securities Act of 1933 unless and only to the extent that MIPS specifically incorporates this information by reference.

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD ON EXECUTIVE COMPENSATION

Composition of the Committee

During fiscal year 2002, the Compensation Committee of the board of directors of MIPS consisted of Mr. Kenneth L. Coleman (Chairman), Mr. Anthony B. Holbrook and Mr. Fred M. Gibbons.

Each of Mr. Holbrook, Mr. Gibbons and Mr. Coleman is an "outside director" within the meaning of Section 162(m) of the Internal Revenue Code and meets the definition of "non-employee director" under Rule 16b-3 of the Exchange Act.

Charter

The Compensation Committee is a standing committee of our board of directors whose primary objectives are to be the administrator of our Non-Qualified Stock Option Plan and our Long Term Incentive Plan, including use of this plan for the purpose of executive compensation, to oversee, review and approve compensation for our executive officers, evaluate the performance of our Chief Executive Officer, and nominate prospective members of the board of directors.

Executive Compensation Philosophy

As a high-level strategy guideline, we invest to grow our business in a manner consistent with increasing stockholder value. To that end, the Compensation Committee has designed our executive compensation program to align it with achievement of our financial goals and key business objectives.

Components of Executive Compensation at MIPS

Compensation for our executive officers generally consists of base salary, an annual bonus incentive and stock option awards. The Compensation Committee assesses the past performance and/or anticipated future contribution of each executive officer in establishing the total amount and mix of each element of compensation.

Base Salary

The Compensation Committee established the objective of positioning executive base salary and total cash compensation at a level similar to that offered by comparably sized companies in the high technology industry. The salaries of the executive officers, including the Chief Executive Officer, are evaluated annually by the Compensation Committee with reference to relevant surveys of compensation paid to executives with similar responsibilities at comparable companies. The Compensation Committee retains outside compensation consultants to periodically review competitive compensation data.

In addition to analyzing competitive data, the Compensation Committee evaluates performance to determine appropriate compensation amounts to reflect our philosophy of compensating for performance. The Compensation Committee considers the recommendations of the Chief Executive Officer with respect to the compensation of the other executive officers. Awards of compensation, for the Chief Executive Officer and the other executive officers, are determined or recommended by the Compensation Committee so as to be consistent with stockholders' objectives.

10

Based on individual and team performance and competitive compensation data for fiscal year 2001, the Compensation Committee recommended to the full board of directors to not increase the base salary of the Chief Executive Officer, John Bourgoin, for fiscal year 2002. Mr. Bourgoin was paid a base salary of $375,000 during fiscal year 2002.

The Compensation Committee has recommended to the full board of directors to decrease by 10% the base salary of the Chief Executive Officer, John Bourgoin, for the new fiscal year beginning July 1, 2002, to $337,500.

Annual Bonus Incentive

The Compensation Committee established the goals and measurements for the bonus plan to align executive pay with achievement of critical strategies and operating goals. The targets for executive officers were set at 50% of base salary for the Chief Executive Officer and 40% of base salary for the other officers.

The Compensation Committee determined to base one-half of the bonus on achievement of revenue and profit goals, and the other half on achievement of specific strategic objectives. The Compensation Committee determined that there would be no payout for the portion based on revenue and profit unless at least 90% of the revenue and profit goals were met. Under the parameters established by the annual bonus incentive program, the Compensation Committee could approve up to twice the target bonus for achievement over plan.

Under the fiscal year 2002 annual bonus incentive plan, the Compensation Committee recommended to the full board of directors that no bonus be paid to Mr. Bourgoin, as Chief Executive Officer, or to the other executive officers, because the planned revenue and planned profit goals were not met for fiscal 2002.

Long Term Incentives

Stock options are designed to align the interests of executives with the long-term interests of the stockholders. The Compensation Committee believes that stock options directly motivate our executive officers to maximize long-term stockholder value. The options also utilize vesting periods in order to encourage these key employees to continue in the employ of MIPS. The Compensation Committee determines the number of shares that will be subject to stock option grants based on our business plans, the executive's level of responsibility, individual performance, historical award data and competitive practice of comparable positions in similar high technology companies. All options to date have been granted at not less than the fair market value of the underlying shares on the date of grant.

The Compensation Committee recommended and granted upon approval of the board of directors option grants to executive officers in July 2002, after the close of fiscal year 2002, including a grant of 200,000 stock options for Mr. Bourgoin. These grants vest 2% each month over a 50-month period from the date of grant.

2001 Stock Option Exchange Program

In October 2001, we implemented a stock option exchange program because many of our then outstanding options had exercise prices that were significantly higher than the then current market price of our common stock. By making this offer, we intended to maximize stockholder value by creating better performance incentives for, and thus increasing retention of, our employees. Under the program, each employee who held outstanding options to purchase shares of Class A common stock under the 1998 Long-Term Incentive Plan (the "1998 Plan") was provided the opportunity to exchange that option for a new option under the 1998 Plan for the same number of shares to be granted not sooner than six months and one day after the date of the cancellation of the submitted options. Employees were required to exchange any options granted within six months and one day prior to the offer date to be able to

11

participate in the option exchange program. For certain of our executive officers, including all of the named executive officers, the exercise price of the replacement options was to be equal to the higher of the closing price of our common stock on the grant date of the replacement options or the closing price on the date of cancellation. The replacement options have an immediate vesting of 12% of the shares on the date of grant with the remaining shares vesting in equal monthly installments over 36 months.

On November 15, 2001, we accepted for exchange and cancellation options to purchase an aggregate of 4,471,121 shares of the company's Class A common stock representing 50.2% of the options eligible to be tendered and cancelled under the program. On May 17, 2002, we granted new options to purchase an aggregate of 4,391,121 shares of the company's Class A common stock to replace the eligible options that had been tendered and cancelled under the program. The exercise price per share for the new options was $8.01, the last reported trading price of the company's Class A common stock on the grant date. For certain of our executive officers, including all of the named executive officers that participated, the exercise price per share for the new options was $8.31, the closing price of our common stock on the date of cancellation.

The following table provides certain information concerning our named executive officers who tendered eligible options in the option exchange program and the options that were cancelled pursuant to that program. The members of our board of directors were ineligible to participate in the program.

Ten-Year Option Repricings

Name and Position

| | Date of

Cancellation

| | Number of

Securities

Underlying

Options at Time

of Cancellation

| | Market Price of

Stock at Time of

Cancellation ($)

| | Exercise Price

at Time of

Cancellation ($)

| | New Exercise

Price of

Replacement

Options ($)

| | Length of Original

Option Term

Remaining

at Date

of Cancellation

|

|---|

John E. Bourgoin

Chief Executive Officer and President | | 11/15/01

11/15/01

11/15/01 | | 150,000

200,000

350,000 | | $

$

$ | 8.31

8.31

8.31 | | $

$

$ | 34.3125

36.5000

13.9800 |

* | $

$

$ | 8.31

8.31

8.31 | | 7.73 years

8.65 years

9.70 years |

Sandy Creighton

Vice President, General Counsel and Secretary |

|

11/15/01

11/15/01

11/15/01 |

|

55,000

70,000

100,000 |

|

$

$

$ |

8.31

8.31

8.31 |

|

$

$

$ |

34.3125

36.5000

13.9800 |

* |

$

$

$ |

8.31

8.31

8.31 |

|

7.73 years

8.65 years

9.70 years |

Kevin C. Eichler

Vice President, Chief Financial Officer and Treasurer |

|

11/15/01

11/15/01

11/15/01 |

|

55,000

70,000

125,000 |

|

$

$

$ |

8.31

8.31

8.31 |

|

$

$

$ |

34.3125

36.5000

13.9800 |

* |

$

$

$ |

8.31

8.31

8.31 |

|

7.73 years

8.65 years

9.70 years |

Derek Meyer

Vice President, Worldwide Field Operations |

|

11/15/01

11/15/01

11/15/01 |

|

50,000

70,000

100,000 |

|

$

$

$ |

8.31

8.31

8.31 |

|

$

$

$ |

34.3125

36.5000

13.9800 |

* |

$

$

$ |

8.31

8.31

8.31 |

|

7.73 years

8.65 years

9.70 years |

- *

- This option was granted within six months of October 15, 2001 and was required to be exchanged by the executive officer to participate in the stock option exchange program.

Policy Regarding Section 162(m) of the Internal Revenue Code

MIPS is subject to Section 162(m) of the Code, which limits the deductibility of certain compensation payments to its executive officers. This section also provides for certain exemptions to the limitations, specifically compensation that is performance based within the meaning of Section 162(m). The Compensation Committee has endeavored to structure our executive compensation plans to achieve deductibility under Section 162(m) while retaining flexibility and objectives. However, deductibility is not the sole factor

12

used in designing and determining appropriate compensation. The Compensation Committee may, in the future, enter into compensation arrangements that are not deductible under Section 162(m).

Conclusion

The Compensation Committee believes that company and individual performance and achievement enhance long-term stockholder value. The compensation plans the Compensation Committee has adopted for our executive officers are based on achievement of performance goals, as well as competitive pay practices. The Compensation Committee believes that one of its most important functions in serving the interests of the stockholders is to attract, motivate and retain talented executive officers in this competitive environment.

The Compensation Committee

Kenneth L. Coleman, Chairman

Anthony B. Holbrook

Fred M. Gibbons

13

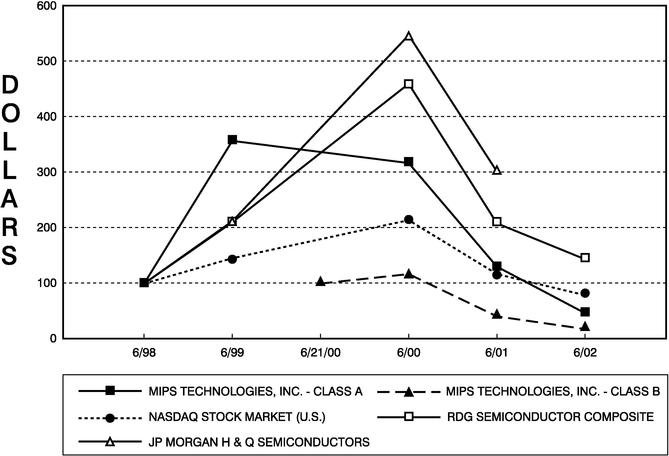

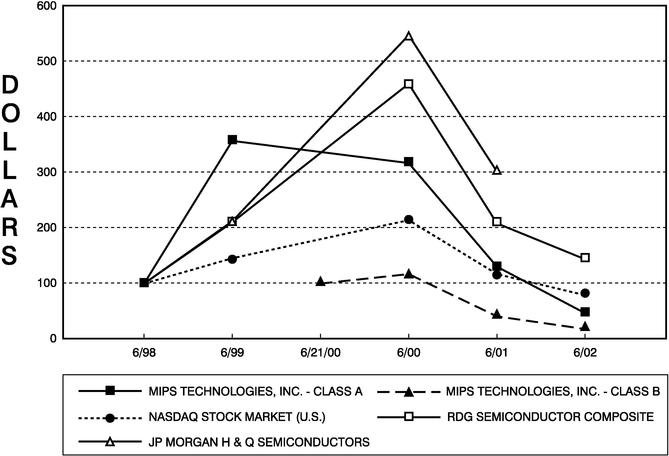

PERFORMANCE GRAPH

The following graph compares the cumulative total return to stockholders for our Class A common stock, our Class B common stock, the Nasdaq Stock Market Index—U.S., the RDG Semiconductor Composite Index and, through June 30, 2001, the JP Morgan H&Q Semiconductor Index. The graph assumes that $100 was invested in our Class A common stock and in each index on June 30, 1998, the date of our IPO, and in our Class B common stock on June 21, 2000, the first date of public trading following SGI's stock dividend distribution, assuming reinvestment of dividends. No dividends have been declared or paid on our Class A or Class B common stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns. In our prior proxy statements we have included in the performance graph the JP Morgan H&Q Semiconductor Index as a published industry index. JP Morgan H&Q has ceased to publish this index, and we have elected to use the RDG Semiconductor Composite Index as the published industry index in its place.

COMPARISON OF 4 YEAR CUMULATIVE TOTAL RETURN*

AMONG MIPS TECHNOLOGIES, INC.—CLASS A, MIPS TECHNOLOGIES, INC.—

CLASS B, THE NASDAQ STOCK MARKET INDEX (U.S.)

THE RDG SEMICONDUCTOR COMPOSITE INDEX

AND THE JP MORGAN H & Q SEMICONDUCTORS INDEX

14

EXECUTIVE COMPENSATION

The following table summarizes compensation information for the last three fiscal years for our Chief Executive Officer and each of the other four most highly compensated executive officers whose salary and bonus exceeded $100,000 during the fiscal year ended June 30, 2002. These officers are referred to as the named executive officers.

Summary Compensation Table

| |

| |

| |

| | Long-Term

Compensation

Awards

| |

| |

|---|

| | Annual Compensation

| | Securities

Underlying

Options/SARs

(3)

| |

| |

|---|

Name and Principal Position

| | All Other

Compensation ($)

| |

|---|

| | Year

| | Salary

| | Bonus

| |

|---|

John E. Bourgoin

Chief Executive Officer

and President | | 2002

2001

2000 | | $

$

$ | 375,000

375,000

340,000 | |

$ | —

—

200,000 | | 1,050,000

200,000

150,000 | | | —

—

— | |

Victor Peng (1)

Vice President, Engineering | | 2002

2001

2000 | | $

$

| 236,500

219,333

— | |

$

| —

22,902

— | | 125,000

50,000

— | | | —

—

— | |

Sandy Creighton

Vice President, General Counsel and Secretary | | 2002

2001

2000 | | $

$

$ | 236,500

236,500

215,000 | |

$ | —

—

100,000 | | 325,000

70,000

55,000 | | | —

—

— | |

Kevin C. Eichler

Vice President, Chief Financial Officer and Treasurer | | 2002

2001

2000 | | $

$

$ | 236,500

236,500

215,000 | |

$ | —

—

100,000 | | 375,000

70,000

55,000 | | | —

—

— | |

Derek Meyer (2)

Vice President, Worldwide Field Operations | | 2002

2001

2000 | | $

$

$ | 236,500

236,500

210,000 | |

$ | —

—

100,000 | | 320,000

91,000

50,000 | | $

| 142,886

—

— | (4)

|

- (1)

- Mr. Peng became an executive officer upon his appointment as Vice President, Engineering, effective November 1, 2000.

- (2)

- Mr. Meyer resigned his position as Vice President, Worldwide Field Operations, effective June 30, 2002.

- (3)

- Stock options granted during fiscal year 2002 includes the following shares granted under the 2001 Stock Option Exchange Program: Mr. Bourgoin 700,000; Ms. Creighton 225,000; Mr. Eichler 250,000; and Mr. Meyer 220,000.

- (4)

- In June 2002, Mr. Meyer received a severance payment equal to six months' base salary and additional payments to cover the cost of benefits.

Option Grants in Fiscal Year 2002

The following table provides details regarding all stock options granted to the named executive officers in fiscal 2002. All options were granted under our Long-Term Incentive Plan and generally have exercise prices equal to the fair market value on the date of grant except for those shares granted under the 2001 Stock Option Exchange Program, in which the exercise price of the replacement option was equal to the closing price on the date of cancellation, which was higher than the closing price of our common stock on the grant date of the replacement options. In general, the options vest in fifty equal monthly installments, unless otherwise noted.

15

Potential realizable value assumes that the stock price increases from the date of grant until the end of the option term (10 years) at the annual rate specified (5% and 10%). The 5% and 10% assumed annual rates of appreciation are mandated by SEC rules and do not represent our estimate or projection of the future common stock price. We believe that this method may not accurately illustrate the potential value of a stock option.

Option Grants in Fiscal Year 2002

| | Individual Grant

| | Potential Realizable Value at

Assumed Annual Rates of

Stock Price Appreciation for

Option Term

|

|---|

| | Number of

Securities

Underlying

Options Granted

| | % of Total

Options Granted

to Employees in

Fiscal Year

| |

| |

|

|---|

| | Exercise Price

($/share)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| John E. Bourgoin | | 350,000

700,000 | (1)

(2) | 4.6%

9.3% | | $

$ | 13.98

8.31 | | 07/26/11

05/17/12 | | $

$ | 3,077,181

3,316,212 | | $

$ | 7,798,182

8,726,114 |

| Victor Peng | | 125,000 | | 1.7% | | $ | 13.98 | | 07/26/11 | | $ | 1,098,993 | | $ | 2,785,065 |

| Sandy Creighton | | 100,000

225,000 | (1)

(2) | 1.3%

3.0% | | $

$ | 13.98

8.31 | | 07/26/11

05/17/12 | | $

$ | 879,195

1,065,925 | | $

$ | 2,228,052

2,804,822 |

| Kevin C. Eichler | | 125,000

250,000 | (1)

(2) | 1.7%

3.3% | | $

$ | 13.98

8.31 | | 07/26/11

05/17/12 | | $

$ | 1,098,993

1,184,361 | | $

$ | 2,785,065

3,116,469 |

| Derek Meyer | | 100,000

220,000 | (1)

(2) | 1.3%

2.9% | | $

$ | 13.98

8.31 | | 07/26/11

05/17/12 | | $

$ | 879,195

1,042,238 | | $

$ | 2,228,052

2,742,493 |

- (1)

- Shares were cancelled on November 15, 2001 under the 2001 Stock Option Exchange Program.

- (2)

- Shares issued under the 2001 Stock Option Exchange Program on May 17, 2002 with an immediate vesting of 12% of the shares upon date of grant and remaining shares vesting in equal monthly installments over 36 months.

Aggregate Option Exercises in Fiscal Year 2002 and Fiscal Year-End Values

The following table sets forth the number and value of unexercised, in-the-money options held by our named executive officers at June 30, 2002.

Stock Option Exercises and

Fiscal 2002 Year-End Values

| |

| |

| | Number of Unexercised

Options at June 30, 2002

| | Value of Unexercised

In-the-Money Options at

June 30, 2002(1)

|

|---|

Name

| | Shares

Acquired on

Exercise

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| John E. Bourgoin | | — | | — | | 473,281 | | 610,079 | | — | | — |

| Victor Peng | | — | | — | | 128,713 | | 204,783 | | — | | — |

| Sandy Creighton | | — | | — | | 236,348 | | 201,452 | | — | | — |

| Kevin C. Eichler | | — | | — | | 127,408 | | 218,365 | | — | | — |

| Derek Meyer | | — | | — | | 171,444 | | — | | — | | — |

- (1)

- The amounts in this column reflect the difference between the closing market price of our Class A common stock on June 28, 2002, which was $6.17, and the option exercise price. The actual value of unexercised options fluctuates with the market price of our Class A common stock.

16

Change in Control Agreements

We have entered into change in control agreements with our executive officers providing for certain benefits following a change in control of MIPS and certain terminations of employment during the 24-month period following such a change in control. A "change in control" is generally defined in the agreements to encompass significant transactions resulting in a change of the corporate control of MIPS, including, among other things, an acquisition of 30% of the class of our common stock entitled to elect a majority of our directors (currently Class B), a business combination pursuant to which more than 75% of the class of our common stock entitled to elect a majority of our directors (currently Class B) is transferred to different holders and the unapproved replacement of a majority of our directors.

In the event of a change in control, each executive's options and shares of restricted stock will become fully vested and the executive may elect, within six months following the change in control, to have his or her options "cashed out" at a price determined in the agreements. If an executive's employment is terminated other than for cause or if an executive resigns for good reason (as such terms are defined in the agreements), in either case within 24 months after a change in control, the executive will be entitled to receive a lump sum cash payment equal to 24 months' salary.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

We entered into a severance agreement with Mr. Meyer in June 2002. Under this agreement, Mr. Meyer resigned as Vice President Worldwide Field Operations. Under the severance agreement, Mr. Meyer received six month's base salary and additional payments to cover the cost of benefits. In addition, in the event Mr. Meyer is not employed within six months following his resignation, Mr. Meyer would be eligible to receive base salary and benefits for each month he has not found employment for up to an additional six months. Stock options that would have vested during the next twelve months following the resignation date were immediately vested and the post termination exercise period of any such options was extended to eighteen months. Mr. Meyer agreed that for a period of twelve months following his resignation, he would not solicit our employees, customers or suppliers. He also agreed to maintain the confidentiality of any of our proprietary information.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under Section 16(a) of the Exchange Act, our directors, executive officers, and any persons holding more than 10% of our common stock are required to report to the Securities and Exchange Commission and the Nasdaq National Market their initial ownership of our stock and any subsequent changes in that ownership. Based on a review of Forms 3, 4 and 5 filed pursuant to the Exchange Act furnished to us, we believe that during fiscal year 2002, our officers, directors and holders of more than 10% of our common stock filed all Section 16(a) reports on a timely basis.

REPORT OF THE AUDIT COMMITTEE

The management of MIPS is responsible for establishing and maintaining internal controls and for preparing the financial statements of MIPS. The independent auditors are responsible for auditing the financial statements. It is the responsibility of the Audit Committee to oversee these activities. The charter of the Audit Committee as amended in July and September 2002 is attached as Appendix A to this Proxy Statement.

The Audit Committee has reviewed and discussed with MIPS' management the audited financial statements for the fiscal year ended June 30, 2002.

The Audit Committee has discussed with Ernst & Young LLP, the company's independent auditors, the matters required to be discussed by Statement on Auditing Standards No. 61, Communications with Audit Committees.

17

The Audit Committee has received and reviewed the written disclosures and the letter from Ernst & Young LLP required by Independence Standard No. 1, "Independence Discussions with Audit Committees", and the Audit Committee has discussed with Ernst & Young LLP their independence.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in MIPS' annual report on Form 10-K for the fiscal year ended June 30, 2002.

THE AUDIT COMMITTEE

William M. Kelly, Chairman

Fred M. Gibbons

Anthony B. Holbrook

Deadline For Receipt Of Stockholder Proposals For 2003 Annual Meeting

If you want us to consider including a proposal in next year's Proxy Statement, you must deliver it in writing to MIPS at 1225 Charleston Road, Mountain View, California 94043, Attention: Secretary, no later than June 4, 2003.

Our by-laws provide that stockholders wishing to nominate a director or present a proposal at next year's annual meeting, but not wishing to have such nomination or proposal included in our Proxy Statement, must submit specified information in writing to MIPS at the above address no later than September 13, 2003 but no sooner than August 14, 2003, which dates are subject to change if our next annual meeting occurs more than a specified minimum number of days before or after the first anniversary date of our 2002 Annual Meeting.

| | | By Order of the Board of Directors |

|

|

|

| | | Sandy Creighton

Vice President, General Counsel and Secretary |

18

APPENDIX A

MIPS Technologies, Inc.

Audit Committee Charter

Organization

The Audit Committee is a standing committee of the Board of Directors. The Audit Committee will consist of at least three members of the Board of Directors, all of whom are "independent" as defined in applicable stock exchange rules and are otherwise free of any relationship that in the opinion of the Board of Directors would interfere with their exercise of independent judgment. All committee members must be able to read and understand fundamental financial statements, including the company's balance sheet, income statement and cash flow statement. At least one member must have past employment experience in finance or accounting, requisite professional certification in accounting or other comparable experience or background which results in the individual's financial sophistication, including a current or past position as a chief executive or financial officer or other senior officer with financial oversight responsibilities. The Board will designate committee members and the committee chair annually.

Statement of Policy

The primary objective of this committee is to assist the Board in fulfilling its fiduciary responsibilities relating to accounting, finance and reporting practices of the company, including its internal controls and the integrity of its financial reports. In meeting this objective, the committee is responsible for maintaining a free and open means of communication between the directors, the independent accountants, and the Company's management. The committee has the power to confer with and direct corporate officers of the corporation to the extent necessary to accomplish its charter. The independent accountants are ultimately accountable to the Board of Directors and the Audit Committee.

Responsibilities

To best carry out its responsibilities, the committee's policies and procedures should remain flexible in order to address changing conditions. Specific responsibilities of the committee include:

- •

- Appointment of the independent accountants.

- •

- Select and evaluate the independent accountants to be ratified by the shareholders to audit the Company's accounts, or where appropriate, the replacement of the independent accountants, and approve the compensation of the independent accountants for audit services.

- •

- Evaluate the independence of the independent accountant, including a review of non audit-related services provided by and related fees charged by the independent accountant.

- •

- Obtain a formal written statement, as required by the Independence Standards Board, from the independent accountant delineating relationships between the accountant and the company and actively engage in dialogue with the independent accountants regarding matters that might reasonably be expected to affect their independence.

- •

- Pre-approving all audit and non-audit services to be provided by the independent accountants. The Audit Committee may delegate the authority to grant such pre-approvals to one or more members of the committee, provided that the per-approval decision and related services are presented to the Audit Committee at its next regularly scheduled meeting.

- •

- Review and approve the audit activities at the Company.

- •

- Meet with the independent accountants and financial management of the Company to review the scope of the proposed audit for the current year and the audit procedures to be utilized,

A-1

- •

- Review financial results.

- •

- Prior to the release of the Company's unaudited quarterly financial results, review the results with management and the independent accountants, considering reports from senior finance management as to major accounting matters and any material deviations from prior practice, and consultations with the Company's independent accountants.

- •

- Ensure that the independent accountant conducts a SAS 71 ("Interim Financial Information") review prior to the filing of the Company's Form 10-Q.

- •

- Prior to the release of the Company's fiscal year end operating results, review and discuss with Company management and the independent accountants the audited financial results for the fiscal year, including their judgment about the quality, not just the acceptability, of accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements.

- •

- At least annually discuss with the independent accountants the matters described in SAS 61 ("Communications with Audit Committees").

- •

- Review with management and the independent accountants the Company's critical accounting policies and the disclosure regarding those policies in the Company's periodic filings with the Securities and Exchange Commission.

- •

- Systems and reports.

- •

- Review with Company senior management and the independent accountants the adequacy and effectiveness of the accounting and financial systems controls of the Company.

- •

- Review and discuss the audited financial statements with management and, if necessary, the independent accountants, prior to recommending the inclusion of the audited financial statements in the Company's Annual Report on Form 10-K.

- •

- Report annually in the Company's proxy statement such information as may be required by the rules and regulations of the Securities and Exchange Commission.

- •

- The committee will meet at least quarterly and more often as necessary.

- •

- Provide sufficient opportunity for the independent accountants to meet with the Audit Committee without members of management present. Among the items to be discussed in these meetings are the independent accountants' evaluation of the Company's financial, accounting and auditing personnel and the cooperation that the independent accountants received during the course of the audit and quarterly reviews.

- •

- Review corporate financial policies relating to compliance with laws and regulations, ethics, conflicts of interest and the investigation of misconduct and fraud.

- •

- Review the Company's treasury policy.

- •

- Review the Company's program of risk management, including insurance coverage.

- •

- Regularly prepare minutes of all meetings and report its activities to the general meeting of the Board of Directors.

- •

- Review and reassess the adequacy of the Audit Committee Charter on an annual basis.

A-2

- •

- Establish procedures to receive and process complaints regarding accounting, internal auditing controls or auditing matters and for employees to make confidential, anonymous complaints regarding questionable accounting or auditing matters.

- •

- Perform such other specific functions as the Board of Directors may from time to time direct, including reviewing and approving all transactions between the Company and any related party, and making such investigations and reviews of the Company and its operations as the Board of Directors may from time to time request.

Resources

The Company's Chief Financial Officer will be management's primary liaison to the committee. The committee will have access to financial information and resources it deems necessary for it to properly carry out its duties.

A-3

DETACH HERE

PROXY

MIPS TECHNOLOGIES, INC.

CLASS A AND CLASS B COMMON STOCK

PROXY FOR 2002 ANNUAL MEETING OF STOCKHOLDERS

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF MIPS TECHNOLOGIES, INC.

The undersigned stockholder of MIPS Technologies, Inc., a Delaware corporation ("MIPS Technologies"), hereby appoints JOHN E. BOURGOIN, KEVIN C. EICHLER and SANDY CREIGHTON, as proxies for the undersigned, with full power of substitution, to attend the 2002 Annual Meeting of Stockholders of MIPS Technologies to be held on Wednesday, November 13, 2002 at 2:00 p.m. at the Company's corporate offices at 1225 Charleston Road, Mountain View, CA 94043, and at any adjournment(s) or postponement(s) thereof, to cast on behalf of the undersigned all votes that the undersigned is entitled to cast at such meeting and otherwise to represent the undersigned at the meeting, with the same effect as if the undersigned were present. The undersigned hereby revokes any proxy previously given with respect to such shares.

Shares represented by this proxy will be voted as directed by the stockholder. If no such directions are indicated, the proxies will have authority to vote FOR the election of directors and FOR the proposal.

The undersigned acknowledges receipt of the Notice of Annual Meeting of Stockholders and the accompanying Proxy Statement.

| | | |

|

SEE REVERSE

SIDE | | CONTINUED AND TO BE SIGNED ON REVERSE SIDE | | SEE REVERSE

SIDE |

| | | |

|

USE THE POWER OF THE INTERNET TO. . .

- •

- VOTE! (Follow the instructions below)

If you don't have access to the Internet, which is most cost effective for MIPS Technologies, please consider voting by telephone as telephonic voting saves MIPS Technologies the costs associated with mailed in ballots.

| | |

| | Vote by Telephone | | |

| | |

It's fast, convenient, and immediate!

Call Toll-Free on a Touch-Tone Phone

1-877-PRX-VOTE (1-877-779-8683). | | |

| | |

| Follow these four easy steps: | | |

1. |

|

Read the accompanying Proxy Statement and

Proxy Card. |

|

|

2. |

|

Call the toll-free number

1-877-PRX-VOTE (1-877-779-8683). |

|

|

3. |

|

Enter your 14-digit Voter Control Number

located on your Proxy Card above your name. |

|

|

4. |

|

Follow the recorded instructions. |

|

|

| | |

Your vote is important!

Call 1-877-PRX-VOTE anytime! | | |

| | |

| Vote by Internet | | |

| | |

It's fast, convenient, and your vote is immediately confirmed and posted. | | |

| | |

| Follow these four easy steps: | | |

1. |

|

Read the accompanying Proxy Statement and

Proxy Card. |

|

|

2. |

|

Go to the Website

http://www.eproxyvote.com/mips |

|

|

3. |

|

Enter your 14-digit Voter Control Number

located on your Proxy Card above your name. |

|

|

4. |

|

Follow the instructions provided. |

|

|

| | |

Your vote is important!

Go tohttp://www.eproxyvote.com/mips anytime! | | |

Do not return your Proxy Card if you are voting by Telephone or Internet

RECEIVE FUTURE MIPS TECHNOLOGIES' PROXY MATERIALS VIA THE INTERNET!

Consider receiving future MIPS Technologies' Annual Report and Proxy materials (as well as all other Company communications) in electronic form rather than in printed form. While voting via the Internet, just click the box to give your consent and thereby save MIPS Technologies the future costs of producing, distributing and mailing these materials.

Accessing MIPS Technologies' Annual Report and Proxy materials via the Internet may result in charges to you from your Internet service provider and/or telephone companies.

If you do not consent to access MIPS Technologies' Annual Report and Proxy materials via the Internet, you will continue to receive them in the mail.

DETACH HERE

| ý | | Please mark

votes as in

this example. |

THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED IN ACCORDANCE WITH THE SPECIFICATIONS MADE. IF THIS PROXY IS EXECUTED BUT NO SPECIFICATION IS MADE, THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED FOR THE NOMINEE(S) FOR DIRECTOR AND FOR THE FOLLOWING PROPOSAL AND OTHERWISE IN THE DISCRETION OF THE PROXIES AT THE MEETING OR ANY ADJOURNMENT(S) OR POSTPONEMENT(S) THEREOF.

- 1.

- Election of Directors: To elect three Directors as set forth in the Proxy Statement. Class A Stock may be voted only for the election of Class A Director and Class B Stock may be voted only for the election of Class B Directors as indicated below. Holders of Class A Stock and Class B Stock who wish to provide instructions should vote such class of stock in the space indicated below.

The Board of Directors recommends a vote FOR the nominees listed. | | The Board of Directors recommends a vote FOR the following proposal. | | |

A. CLASS A STOCK | | | | | | | | | | |

Nominee: (01) Anthony B. Holbrook | | 2. | | Ratification of appointment by MIPS Technologies' Board of Directors of Ernst & Young LLP to serve as the Company's independent auditors for the 2003 fiscal year. | | FOR

o | | AGAINST

o | | ABSTAIN

o |

| | o

FOR

THE

NOMINEE | | o

WITHHELD

FROM

THE

NOMINEE | | | | | | | | | | | | |

B. CLASS B STOCK | | | | | | | | | | | | |

Nominee for Class I Director:(02) John E. Bourgoin

Nominee for Class III Director:(03) Kenneth L. Coleman | | MARK HERE

FOR ADDRESS

CHANGE AND

NOTE AT LEFT

o | | MARK HERE

IF YOU PLAN

TO ATTEND

THE MEETING

o |

| FOR

BOTH

NOMINEES

o | | WITHHELD

FROM BOTH

NOMINEES

o | | | | | | | | | | | | |

o |

For both nominees except as noted above | | | | PLEASE MARK, SIGN, DATE AND PROMPTLY RETURN THIS PROXY IN THE ENCLOSED ENVELOPE. |

| | | | | | | | | | Please sign exactly as name appears hereon and date. If the shares are held jointly, each holder should sign. When signing as an attorney, executor, administrator, trustee, guardian or as an officer signing for a corporation, please give full title under signature. |

| Signature: |

| | Date: |

| | Signature: |

| | Date: |

|

QuickLinks

PROXY STATEMENT INFORMATION CONCERNING SOLICITATION AND VOTINGPROPOSAL NO. 1—ELECTION OF DIRECTORSPROPOSAL NO. 2—RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORSSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTREPORT OF THE COMPENSATION COMMITTEE OF THE BOARD ON EXECUTIVE COMPENSATIONTen-Year Option RepricingsPERFORMANCE GRAPHEXECUTIVE COMPENSATIONSummary Compensation TableOption Grants in Fiscal Year 2002Stock Option Exercises and Fiscal 2002 Year-End ValuesCERTAIN RELATIONSHIPS AND RELATED TRANSACTIONSSECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEREPORT OF THE AUDIT COMMITTEEAPPENDIX A MIPS Technologies, Inc. Audit Committee Charter