UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission

Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | | |

¨ | | Definitive Additional Materials | | | | |

¨ | | Soliciting Material Pursuant to §240 14a-12 | | | | |

MIPS TECHNOLOGIES, INC.

(Name of Registrant as Specified in its Charter)

Not applicable.

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

x | | No fee required. |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | 5) | | Total fee paid: |

| |

¨ | | Fee paid previously with preliminary materials. |

| |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | | | |

| | |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | 3) | | Filing Party: |

| | 4) | | Date Filed: |

MIPS TECHNOLOGIES, INC.

1225 CHARLESTON ROAD

MOUNTAIN VIEW, CALIFORNIA 94043

June 29, 2007

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of MIPS Technologies, Inc., a Delaware corporation, to be held on Thursday, August 9, 2007 at our corporate offices at 1225 Charleston Road, Mountain View, California commencing at 2:00 p.m., Pacific Time.

At the Annual Meeting:

| | 1. | Holders of common stock will be asked to consider and vote upon the election of one Class II director; and |

| | 2. | Holders of common stock will be asked to consider and vote upon the ratification of the appointment of Ernst & Young LLP as our independent auditors for the fiscal year ending June 30, 2007. |

Our board of directors has unanimously nominated the Class II director nominee and approved Proposal No. 2 above and recommends a vote FOR the Class II director nominee and a vote FOR the approval and adoption of Proposal No. 2.

For further information regarding the matters to be voted on at the Annual Meeting, I urge you to carefully read the accompanying Proxy Statement. If you have more questions about these proposals or would like additional copies of the Proxy Statement, please contact Mervin S. Kato, Chief Financial Officer of MIPS Technologies, Inc., 1225 Charleston Road, Mountain View, California 94043; telephone: (650) 567-5000. Even if you plan to attend the Annual Meeting in person, please complete, sign, date, and promptly return the enclosed proxy card in the enclosed postage-prepaid envelope or by electronic means. This will not limit your right to attend or vote at the Annual Meeting.

| | |

Sincerely, | | Sincerely, |

| |  |

Anthony B. Holbrook | | John E. Bourgoin |

| Chairman | | Chief Executive Officer and President |

The accompanying Proxy Statement is dated June 29, 2007 and is first being mailed to stockholders on or about July 9, 2007. Additional copies of the Proxy Statement and our Annual Report on Form 10-K can be obtained free of charge, by contacting Investor Relations at (650) 567-5100.

| | | | | | | | |

| 1225 CHARLESTON ROAD | | MOUNTAIN VIEW, CA 94043-1353 | | PHONE 650.567.5000 | | FAX 650.567.5150 | | WEB www.mips.com |

MIPS TECHNOLOGIES, INC.

1225 CHARLESTON ROAD

MOUNTAIN VIEW, CALIFORNIA 94043

NOTICE OF THE ANNUAL MEETING OF STOCKHOLDERS

AUGUST 9, 2007

To the Stockholders of

MIPS TECHNOLOGIES, INC.:

NOTICE IS HEREBY GIVEN that the 2006 Annual Meeting of Stockholders of MIPS Technologies, Inc., a Delaware corporation, will be held at our corporate offices at 1225 Charleston Road, Mountain View, California on August 9, 2007. The Annual Meeting will begin at 2:00 p.m. Pacific Time, for the following purposes:

| | 1. | To elect one Class II director to serve a three-year term; |

| | 2. | To ratify the appointment of Ernst & Young LLP as our independent auditors for the fiscal year ending June 30, 2007; |

| | 3. | To transact such other business as may properly come before the Annual Meeting and any adjournment(s) thereof. |

Only stockholders of record at the close of business on June 27, 2007 are entitled to notice of and to vote at the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person.However, to ensure your representation at the Annual Meeting, you are urged to complete, sign, date and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purposeor by electronic means. Any stockholder attending the Annual Meeting may vote in person, even though he or she has previously returned a proxy.

|

By Order of the Board of Directors of

MIPS Technologies, Inc. |

|

|

|

Gail H. Knittel Associate General Counsel and Assistant Secretary |

Mountain View, California

June 29, 2007

YOUR VOTE IS IMPORTANT

In order to ensure your representation at the Annual Meeting, you are requested to complete, sign and date the enclosed proxy as promptly as possible and return it in the enclosed envelopeor vote by electronic means.

| | | | | | | | |

| 1225 CHARLESTON ROAD | | MOUNTAIN VIEW, CA 94043-1353 | | PHONE 650.567.5000 | | FAX 650.567.5150 | | WEB www.mips.com |

TABLE OF CONTENTS

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

This Proxy Statement is being furnished by our board of directors to holders of our common stock, par value $0.001 per share, in connection with the solicitation of proxies by our board of directors for use at the annual meeting of MIPS Technologies, Inc. (“MIPS”) stockholders to be held on Thursday, August 9, 2007 at our corporate offices at 1225 Charleston Road, Mountain View, California commencing at 2:00 p.m., Pacific Time, and at any adjournment or postponement thereof. The purposes of the annual meeting are set forth in this Proxy Statement and in the accompanying Notice of the Annual Meeting of Stockholders.

Our complete mailing address is MIPS Technologies, Inc., 1225 Charleston Road, Mountain View, California 94043, and our telephone number is (650) 567-5000.

This Proxy Statement and the accompanying form of proxy are first being mailed to our stockholders on or about July 9, 2007.

Stockholders Entitled to Vote; Quorum and Vote Required

The MIPS board of directors has fixed the close of business on June 27, 2007 as the record date for the determination of the stockholders entitled to notice of and to vote at the Annual Meeting. Accordingly, only holders of record on this date will be entitled to notice of, and to vote at, the Annual Meeting. As of the record date, there were outstanding and entitled to vote 43,595,452 shares, constituting all of the voting stock of MIPS. As of the record date, there were 3,860 holders of record of common stock. Each holder of record of our common stock on the record date is entitled to one vote per share, which may be cast either in person or by proxy, at the Annual Meeting.

With respect to Proposals No. 1 and 2, the presence, in person or by proxy, of the holders of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum. Shares of our common stock present, in person or by proxy, will be counted for the purpose of determining whether a quorum is present at the Annual Meeting. Shares that abstain from voting, and shares held by a broker nominee in “street name” which indicates on a proxy that it does not have discretionary authority to vote as to a particular matter, will be treated as shares that are present and entitled to vote at the Annual Meeting for purposes of determining whether a quorum exists. In connection with the election of directors, abstentions will have no effect on the outcome of the vote. In connection with other proposals, abstentions will be considered as “NO” votes. Broker non-votes will have no effect on the outcome of the vote with respect to the matters to be brought before the Annual Meeting.

Directors will be elected at the meeting by a plurality of the votes cast. Proposals No. 2 will be decided by a majority of the vote of shares of common stock present, in person or by proxy, at the meeting and actually cast.

Proxies

This Proxy Statement is being furnished to you in connection with the solicitation of proxies by, and on behalf of, our board of directors for use at the Annual Meeting, and is accompanied by a form of proxy.

All shares of our common stock represented at the Annual Meeting by properly executed proxies that have not been revoked will be voted at the Annual Meeting in accordance with the instructions indicated on such proxies. If no instructions are indicated (other than in the case of broker non-votes), such proxies will be voted as recommended by our board of directors.

Stockholders of the company may submit notice of any matter to be brought before the Annual Meeting prior to the tenth day following the date that the company makes public announcement of the date of the Annual Meeting. As a result, at the time of the printing of this statement, we cannot know whether we will receive notice of any other matter to be brought before the Annual Meeting. If any other matters are properly presented at the Annual Meeting for consideration, including, among other things, consideration of a motion to adjourn such

1

Annual Meeting to another time and/or place (including, without limitation, for the purposes of soliciting additional proxies), the persons named in the enclosed form of proxy and acting thereunder will have discretion to vote on such matters in accordance with their judgment.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by (i) filing with the Assistant Secretary of MIPS, at or before the taking of the vote at the Annual Meeting, a written notice of revocation bearing a later date than the proxy, (ii) duly executing a later dated proxy relating to the same shares and delivering it to the Secretary of MIPS before the taking of the vote at the Annual Meeting or (iii) attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute a revocation of the proxy). Any written notice of revocation or subsequent proxy should be sent to MIPS Technologies, Inc., 1225 Charleston Road, Mountain View, California 94043, Attention: Secretary, or hand delivered to the Secretary of MIPS at or before the taking of the vote at the Annual Meeting.

Please note that if a stockholder’s shares are held of record by a broker, bank or other nominee and that stockholder wishes to vote at the meeting, the stockholder must bring to the meeting a letter from the broker, bank or other nominee confirming the stockholder’s beneficial ownership of the shares and that the broker, bank or other nominee is not voting the shares at the meeting.

MIPS will pay the cost of soliciting proxies. In addition to solicitation by use of the mails, proxies may be solicited from MIPS stockholders by directors, officers and employees of MIPS in person or by telephone, telegram or other means of communication. Such directors, officers and employees will not be additionally compensated, but may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation. Arrangements will be made with brokerage houses, custodians, nominees and fiduciaries for forwarding of proxy materials to beneficial owners of shares held of record by such brokerage houses, custodians, nominees and fiduciaries and for reimbursement of their reasonable expenses incurred in connection therewith. Stockholders sharing an address may receive only one set of proxy materials to that address unless they have provided contrary instructions. MIPS will deliver promptly upon written or oral request a separate set of the proxy materials to a stockholder at a shared address to which a single copy of the proxy materials was delivered. A stockholder may notify MIPS that he (she) wishes to receive a separate copy of the proxy materials, and stockholders sharing an address may request delivery of a single copy of the proxy materials by writing to the Secretary at our corporate headquarters, 1225 Charleston Road,, Mountain View, Californian 94043 or calling (650) 567-5100.

PROPOSAL NO. 1—ELECTION OF DIRECTORS

Directors and Nominees for Director

Our board members serve staggered three-year terms. The board of directors has the ability to change the size and composition of our board of directors.

Our board of directors currently consists of six directors, divided into three classes as set forth in the following table:

| | | | |

Class

| | Expiration of Term

| | Board Members

|

Class I | | 2008 Annual Meeting | | Anthony B. Holbrook John E. Bourgoin Robert R. Herb |

| | |

Class II | | 2006 Annual Meeting | | Fred M. Gibbons |

| | |

Class III | | 2007 Annual Meeting | | Kenneth L. Coleman William M. Kelly |

The persons named as proxies in the enclosed form of proxy intend to vote proxies for holders of the common stock for the re-election of the nominee named below, unless otherwise directed. If, contrary to our expectations, a nominee should become unavailable for any reason or decline to serve as a director, votes may be cast pursuant to the accompanying form of proxy for a substitute nominee designated by the board of directors.

2

Holders of our common stock will elect one director at the Annual Meeting to serve as the Class II director for a three-year term ending in 2009, or until a successor is elected and qualified or until their earlier resignation or removal. Mr. Gibbons is the nominee for the Class II director position.

The following table presents information regarding the nominee for election to our board of directors as of May 31, 2007.

| | |

Name

| | Principal Occupation and Business Experience

|

Fred M. Gibbons Age: 57 Board Member since July 1998 | | Consulting Professor, Stanford University. Since 2006, Mr. Gibbons has been a Consulting Professor in the Electrical Engineering department at Stanford University. In 1995, Mr. Gibbons founded Venture-Concept, an investment firm based in California, and was a Partner until 2006. From 1995 through 1999, Mr. Gibbons was a lecturer at the Stanford University Graduate School of Electrical Engineering. In 1981, Mr. Gibbons founded Software Publishing Corporation based in San Jose, California, a company engaged in the development of software systems for personal computer applications, and was its Chief Executive Officer through 1994. |

Benjamin A. Horowitz, a board member since November 2001 and a Class II director, whose term was set to expire on the date of the 2006 Annual Meeting of Stockholders, has decided not to stand for re-election. We reduced the size of the board of directors to six members effective at the 2006 Annual Meeting of Stockholders. If we identify a new board member who is approved by our Nominating Committee and our board, we expect to increase the size of the board and appoint such person to the board to be added to the class with only one director. We anticipate that any person so appointed will stand for election at the next following Annual Meeting of Stockholders regardless of the class to which such person has been appointed.

The following table presents information regarding our continuing directors as of May 31, 2007.

| | |

Name

| | Principal Occupation and Business Experience

|

John E. Bourgoin Age: 61 Board Member since May 1997 | | Chief Executive Officer and President of MIPS Technologies, Inc. Mr. Bourgoin has served as our Chief Executive Officer since February 1998 and our President since September 1996. Mr. Bourgoin also served as a Senior Vice President of Silicon Graphics, Inc., or SGI, from September 1996 through May 1998. Prior to joining SGI and since 1976, Mr. Bourgoin was employed at AMD and held various positions including Group Vice President, Computation Products Group of AMD. Mr. Bourgoin is a member of the Board of Directors of Stream Processors Inc. |

| |

Kenneth L. Coleman Age: 64 Board Member since January 1998 | | Chairman, Accelrys, Inc. Since February 2006, Mr. Coleman has served as Chairman of Accelrys, Inc. He was Founder, Chairman and CEO of ITM Software from October 2001 and until January, 2006, an enterprise software company. Previously from January 1987to August 2001, Mr. Coleman served in various senior executive positions at SGI such as Executive Vice President of Global Sales, Service and Marketing, Senior Vice President, Customer and Professional Services and Senior Vice President, Administration. Prior to joining SGI, Mr. Coleman was Vice President of Product Development at Activision, Inc. Mr. Coleman is a member of the Board of Directors of United Online, an internet service provider, City National Bank and Accelyrs (chairman), a scientific data software provider. |

3

| | |

Name

| | Principal Occupation and Business Experience

|

| |

Robert R. Herb Age: 45 Board Member since January 2005 | | Partner and Managing Director, BA Venture Partners. Mr. Herb was formerly an Executive Vice President and Chief Marketing Officer of Advanced Micro Devices, Inc. or AMD. From 1983 to 2004, Mr. Herb served in a number of executive positions with AMD including Vice President of Strategic Marketing for AMD’s Computation Products Group from 1996 to 1998, and Senior Vice President and Chief Marketing Officer from 1998 to 2000. He was promoted to Executive Vice President, Chief Marketing Officer and made a member of the office of the CEO in 2000. Mr. Herb is a member of the Board of Directors of Ageia Technologies Inc., a fabless semiconductor company. |

| |

Anthony B. Holbrook Age: 67 Board Member since July 1998 and Chairman of the Board since August 2003. | | Retired Chief Technical Officer of Advanced Micro Devices, Inc. or AMD. From 1973 until his retirement in 1994, Mr. Holbrook served in a number of executive positions with AMD including Chief Operating Officer from 1982 to 1989, President from 1986 to 1990, and Vice Chairman and Chief Technical Officer from 1989 to 1994. He continued to serve as Vice Chairman of AMD’s board of directors after his retirement until April 1996. Prior to his employment with AMD, Mr. Holbrook held engineering and general management positions with Fairchild Semiconductor, Inc. and Computer Microtechnology, Inc. |

| |

William M. Kelly Age: 53 Board Member since January 1998 | | Partner, with the law firm of Davis Polk & Wardwell. Mr. Kelly has been a partner with Davis Polk & Wardwell since January 2000. Prior to that time, Mr. Kelly served in several capacities with SGI. Mr. Kelly joined SGI in 1994 as Vice President, Business Development, General Counsel and Secretary and, from 1997 to 1999, served as Senior Vice President, Corporate Operations of SGI. During 1996, Mr. Kelly also served as Senior Vice President, Silicon Interactive Group of SGI and as acting Chief Financial Officer of SGI from May 1997 to February 1998. |

Board Of Directors’ Meetings and Committees

Our board of directors held five regular meetings during fiscal 2006. Our board of directors has determined that each of our directors other than Mr. Bourgoin qualifies as an “independent director” in accordance with Nasdaq listing requirements.

No director or nominee attended fewer than 75% of the aggregate number of meetings of the board of directors and meetings of the committees of the board on which he served during fiscal 2006. Our independent directors meet regularly outside the presence of Mr. Bourgoin, our Chief Executive Officer. Our board of directors has a policy of encouraging but not requiring members to attend the annual meeting of stockholders. All of our directors attended our annual meeting of stockholders held in 2005.

Our board of directors has three committees. Prior to July 2006, our board of directors had two committees, an Audit and Corporate Governance Committee and a Compensation and Nominating Committee. In July 2006, our board elected to sever the Compensation and Nominating Committee into two separate committees, the Compensation Committee and the Nominating Committee. Each member of these committees is an independent director in accordance with Nasdaq standards, and each member of the Audit and Corporate Governance Committee meets the special independence standards established by the Securities and Exchange Commission for audit committees. Each committee has a written charter approved by the board, which is available on MIPS’ website athttp://www.mips.com by clicking on “Corporate,” then “Investor Relations,” and finally on “Corporate Governance.”

4

During fiscal 2006, the members of the Audit and Corporate Governance Committee were Mr. Kelly (Chairman), Mr. Gibbons and Mr. Holbrook. The Audit and Corporate Governance Committee met five times during fiscal 2006. The responsibilities of the Audit and Corporate Governance Committee include selecting, evaluating and approving the compensation of our independent auditors, reviewing and discussing with management and our independent auditors our quarterly and annual financial statements, reviewing with management and the independent auditors our internal control policies and their effectiveness and, as may be requested from time to time by our board of directors, performing investigations and reviewing related party transactions. Our board of directors has determined that Mr. Kelly satisfies the definition of an “audit committee financial expert” under SEC rules. This designation does not impose any duties, obligations or liabilities on Mr. Kelly that are greater than those generally imposed on him as a member of the Audit and Corporate Governance Committee and the board of directors, and his designation as an audit committee financial expert pursuant to this SEC requirement does not affect the duties, obligations or liability of any other member of the Audit and Corporate Governance Committee or the board of directors.

During fiscal 2006, the members of the Compensation and Nominating Committee were Mr. Coleman (Chairman), Mr. Herb and Mr. Horowitz. Mr. Gibbons served on the committee until November 17, 2005. The Compensation and Nominating Committee met ten times and took action by unanimous written consent seventeen times during fiscal 2006. The responsibilities of the Compensation and Nominating Committee include administering our equity compensation plans, reviewing and approving grants under our equity compensation plans and approving other performance-based compensation, which is intended to be excluded from the deductibility limitations imposed by Section 162(m) of the Internal Revenue Code of 1986, as amended, developing performance criteria for and periodically evaluating the performance of our Chief Executive Officer, reviewing and recommending the salary, bonus and stock incentive compensation of our Chief Executive Officer, reviewing the salaries, bonuses and stock incentive compensation of our other officers as proposed by our Chief Executive Officer and reviewing candidates and recommending nominees for election as directors.

Our board of directors may, from time to time, establish certain other committees to facilitate the management of MIPS. The current Nominating Committee consists of Mr. Holbrook (Chairman), Mr. Gibbons, Mr. Herb, Mr. Horowitz and Mr. Kelly.

Corporate Governance

Any stockholder wishing to communicate with our board may write to the Board of Directors, MIPS Technologies, Inc., 1225 Charleston Road, Mountain View, California, 94043. The Secretary will review all such stockholder communications and has the authority to disregard any communications that are inappropriate or irrelevant to the Company and its operations, or to take other appropriate actions with respect to such communications. Except for inappropriate or irrelevant communications, the Secretary will submit all other communications to the chairman of the board.

We maintain a Code of Business Conduct, which incorporates our written code of ethics that is applicable to our chief executive officer, chief financial officer and controller. The Code of Business Conduct incorporates our guidelines designed to deter wrongdoing and to promote honest and ethical conduct and compliance with applicable laws and regulations. It also incorporates our expectations of our employees that enable us to provide accurate and timely disclosure in our filings with the Securities and Exchange Commission and other public communications. The Code of Business Conduct incorporating the code of ethics is available on our website athttp://www.mips.com by clicking on “Corporate,” then “Investor Relations,” and finally on “Corporate Governance.” Changes to or waivers of the code of ethics will be disclosed on the same website.

The Compensation and Nominating Committee will consider nominees for election as a member of our Board of Directors that are recommended by stockholders. Any stockholder recommendations should be accompanied by personal information of the candidate, including a list of the candidate’s references, the candidate’s resume or curriculum vitae and the other information required in the stockholder notice required by Article II, Section 5 of our Company Bylaws. A stockholder recommending a candidate may be asked to submit additional information as determined by our Corporate Secretary and as necessary to satisfy Securities and

5

Exchange Commission or Nasdaq rules. The stockholder should deliver the recommendations to Gail H. Knittel, Assistant Secretary, MIPS Technologies, Inc. The goal of the Compensation and Nominating Committee is to ensure that our board possesses a variety of perspectives and skills derived from high-quality business and professional experience. The committee seeks to achieve a balance of knowledge, experience and capability on our board. To this end, the committee seeks nominees with high professional and personal ethics and values, an understanding of our business lines and industry, diversity of business experience and expertise, broad-based business acumen, and the ability to think strategically. In addition, the committee considers the level of the candidate’s commitment to active participation as a director, both at board and committee meetings and otherwise. Although the committee uses these and other criteria to evaluate potential nominees, we have no stated minimum criteria for nominees. When appropriate, the committee may retain executive recruitment firms to assist in identifying suitable candidates. After its evaluation of potential nominees, the committee submits its chosen nominees to the board for approval. The Committee will evaluate all candidates in the same manner regardless of the source of recommendation.

Director Compensation

Directors who do not receive compensation as officers or employees of MIPS or any of our affiliates receive an annual board membership fee, which is paid in four quarterly installments. The annual board membership fee is $20,000. The chairmen of the Audit and Corporate Governance and the Compensation and Nominating Committees receive an additional annual fee of $7,500, which is paid annually. In addition, non-employee directors receive $1,500 per meeting for attendance at board meetings and $1,000 for attendance at committee meetings and are reimbursed for reasonable expenses incurred in attending. The annual board membership fee for the chairman of the board is $100,000.

Our Directors’ Stock Option Plan authorizes 600,000 shares of common stock for issuance plus an annual increase each July 1 equal to the least of (1) 100,000 shares, (2) the number of shares subject to options granted in the prior one-year period, or (3) a lesser amount determined by our board of directors. Upon a non-employee director’s election or appointment to our board of directors, he or she will automatically receive an initial nonstatutory stock option to purchase 40,000 shares of common stock. Each non-employee director who has been a director for at least six months will automatically receive an annual renewal nonstatutory stock option to purchase 10,000 shares of common stock each year on the date of the annual stockholder meeting. All stock options are granted with an exercise price equal to the fair market value of common stock on the date of grant. Initial grants vest monthly over a 36-month period and annual grants vest immediately.

All options granted under our Directors’ Stock Option Plan have a term of ten years. In the event of our merger with or into another corporation or a sale of substantially all of our assets, and if the successor corporation does not assume or substitute options granted under the Directors’ Stock Option Plan, all of the outstanding options granted pursuant to the Directors’ Stock Option Plan become fully vested and exercisable.

Under the terms of our Directors’ Stock Option Plan, on the date of our 2005 Annual Meeting of Stockholders, Messrs. Coleman, Gibbons, Herb, Holbrook, Horowitz and Kelly were each granted options to purchase 10,000 shares. These options vested immediately and have a term of ten years. Additionally, under the terms of our Long-Term Incentive Plan, on the date of our 2005 Annual Meeting of Stockholders, Messrs. Coleman, Gibbons, Herb, Holbrook, Horowitz and Kelly were each granted options to purchase 2,500 shares. These options vested immediately and have a term of seven years.

Compensation and Nominating Committee Interlocks and Insider Participation

The members of the Compensation and Nominating Committee during fiscal 2006 were Kenneth L. Coleman, Robert R. Herb and Benjamin A. Horowitz. Mr. Coleman, Mr. Herb and Mr. Horowitz are all “non-employee directors” under Rule 16b-3 of, and have no interlocking relationships as defined by the Securities Exchange Act of 1934, as amended.

6

PROPOSAL NO. 2—RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITOR

Our Audit and Corporate Governance Committee has appointed Ernst & Young LLP as our independent auditor, to audit our consolidated financial statements for the fiscal year ending June 30, 2007. This appointment is being presented to the stockholders for ratification at the Annual Meeting. Ernst & Young LLP has served as our independent auditor since 1998. Representatives of Ernst & Young LLP are expected to be present at the meeting and will be given the opportunity to make a statement should they desire to do so, and are expected to be available to respond to appropriate questions from the stockholders.

Fees Paid To The Independent Auditor

The following table presents fees for professional services rendered by Ernst & Young LLP in connection with the audit of the annual financial statements for fiscal 2006 and fiscal 2005, and the fees billed for other services rendered by Ernst & Young LLP.

Audit and Non-Audit Fees

| | | | | | |

| | | 2006

| | 2005

|

Audit fees (1): | | | | | | |

Audit fees | | $ | 1,164,000 | | $ | 1,024,000 |

Audit fees related to restatement | | | 2,334,000 | | | — |

| | |

|

| |

|

|

Total audit fees | | | 3,498,000 | | | 1,024,000 |

Tax fees (2) | | | 147,000 | | | 100,000 |

| | |

|

| |

|

|

Total fees | | $ | 3,645,000 | | $ | 1,124,000 |

| | |

|

| |

|

|

| (1) | Audit fees includes fees associated with the annual audit of our consolidated financial statements, the audit of internal controls over financial reporting, the reviews of our quarterly reports on Form 10-Q, statutory audits required for non-US subsidiaries and services normally provided by the independent auditors in connection with regulatory filings. It also includes fees associated with accounting consultations on matters that arose during, or as a result of, the audit or reviews of financial statements and statutory audits. |

| (2) | Tax fees include tax planning and tax advice primarily related to our international operations. |

The Audit and Corporate Governance Committee has pre-approved all audit and non-audit services provided to us by Ernst & Young LLP during fiscal 2006. It is the policy of the Audit and Corporate Governance Committee to pre-approve each engagement with its independent auditors with respect to audit and non-audit services. The committee has delegated to the Chairman of the committee the authority to grant pre-approvals provided that the pre-approval decision and related services are presented to the committee at its next regularly scheduled meeting.

The Audit and Corporate Governance Committee of the Board of Directors has determined that the non-audit services provided by Ernst & Young LLP are compatible with maintaining the independence of Ernst & Young LLP.

Our board of directors unanimously recommends that you vote FOR ratification of the appointment of Ernst & Young LLP.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of April 30, 2007, certain information regarding the beneficial ownership of our common stock by

| | • | | each stockholder known by us to own beneficially more than 5% of our common stock, |

7

| | • | | each executive officer listed in the Summary Compensation Table below and |

| | • | | all directors and executive officers as a group. |

In the table below, percentage ownership is based upon 43,595,452 shares of common stock outstanding as of April 30, 2007. Common stock subject to options that are currently exercisable or exercisable within 60 days of April 30, 2007 are deemed to be outstanding and to be beneficially owned by the person holding such options for the purpose of computing the percentage ownership of such person but are not treated as outstanding for the purpose of computing the number of shares owned and percentage ownership of any other person. Unless otherwise indicated, the persons named have sole voting and investment power over the shares beneficially owned by them subject to community property laws. Where information is based on Schedules 13G filed by the named stockholder, the number of shares owned is as of the date for which information was provided in such schedules.

Shares Beneficially Owned

| | | | | |

| | | Common Stock

| |

Name of Beneficial Owner

| | Number

| | Percentage

| |

5% Stockholders: | | | | | |

FMR Corp. (1) 82 Devonshire Street Boston, MA 02109 | | 5,653,679 | | 12.97 | % |

Wellington Management Company, LLP (2) 75 State Street Boston, MA 02109 | | 4,411,000 | | 10.12 | % |

Schroder Investment Management Inc. (3) 875 Third Avenue, 21st floor New York, NY 10022 | | 2,983,300 | | 6.84 | % |

Eastbourne Capital Management, L.L.C. (4) 1101 Fifth Avenue Suite 370 San Rafael, CA 94901 | | 2,951,139 | | 6.77 | % |

Barclays Global Investors, NA (5) 45 Fremont Street San Francisco, CA 94105 | | 2,795,088 | | 6.41 | % |

Pacific Edge Investment Management, LLC (6) 100 Hamilton Avenue, Suite 100 Palo, Alto, CA 94301 | | 2,280,427 | | 5.23 | % |

| | |

Directors and Executive Officers: (7) | | | | | |

John E. Bourgoin | | 2,055,514 | | 4.71 | % |

Kenneth L. Coleman | | 161,499 | | * | |

Fred M. Gibbons | | 135,500 | | * | |

Robert R. Herb | | 49,722 | | * | |

Anthony B. Holbrook | | 245,000 | | * | |

Benjamin A. Horowitz | | 85,000 | | * | |

William M. Kelly | | 163,746 | | * | |

Jack Browne | | 322,944 | | * | |

Sandy Creighton | | 904,322 | | 2.07 | % |

W. Patrick Hays | | 235,124 | | * | |

G. Michael Uhler | | 443,453 | | 1.02 | % |

Directors and executive officers as a group (15 persons) | | 5,776,760 | | 13.25 | % |

| (1) | As reported by FMR Corp. on Schedules 13G filed with the Securities and Exchange Commission on February 14, 2007. According to such Schedules 13G, Fidelity Management & Research Company (“Fidelity”), a wholly-owned subsidiary of FMR Corp., is the beneficial owner of 5,527,800 shares of |

8

| | common stock as a result of acting as investment adviser to various investment companies. The ownership of one investment company, Fidelity Small Cap Fund, amounted to 3,679,849 shares of common stock outstanding. Edward C. Johnson 3d, Chairman of FMR Corp. and FMR Corp. (through its control of Fidelity), and the funds each has sole power to dispose of the 5,527,800 shares of common stock owned by the Funds. Neither FMR Corp. nor Edward C. Johnson 3d, has the sole power to vote or direct the voting of the shares owned directly by the Fidelity Funds, which power resides with the Funds’ Boards of Trustees. Fidelity carries out the voting of the shares under written guidelines established by the Funds’ Boards of Trustees. According to such Schedules 13G, members of the Edward C. Johnson 3d family are the predominant owners of Class B shares of common stock of FMR Corp., representing approximately 49% of the voting power of FMR Corp. The Johnson family group and all other of these Class B shareholders have entered into a shareholders’ voting agreement under which all Class B shares will be voted in accordance with the majority vote of Class B shares. Accordingly, through their ownership of voting common stock and the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed to form a controlling group with respect to FMR Corp. Fidelity Management Trust Company, a wholly-owned subsidiary of FMR Corp. is the beneficial owner of 5,700 shares of common stock. Edward C. Johnson 3d and FMR Corp,, through its control of Fidelity Management Trust Company, each has sole dispositive power over 5,700 shares and sole power to vote 5,700 shares of common stock owned by the institutional accounts. Pyramis Global Advisors Trust Company, an indirect wholly-owned subsidiary of FMR Corp, is the beneficial owner of 120,179 shares of common stock as a result of its serving as investment manager of institutional accounts owning such shares. Edward C. Johnson 3d and FMR Corp., through its control of Pyramis Global Advisors Trust Company, each has sole dispositive power over 120,179 shares and sole power to vote 106,179 shares of common stock owned by the institutional accounts managed by Pyramis Global Advisors Trust Company. |

| (2) | As reported by Wellington Management Company, LLP on Schedule 13G/A filed with the Securities and Exchange Commission on April 30, 2007. According to such Schedule 13G/A, Wellington Management Company, LLP has shared power to vote 2,085,000 shares of common stock and shared power to dispose of 4,411,000 shares of common stock. Wellington Management Company, LLP is an investment advisor whose clients have the right to receive, or the power to direct the receipt of, dividends from, or the proceeds from the sale of, such securities. |

| (3) | As reported by Schroder Investment Management, Inc. on a Schedule 13G as filed with the Securities and Exchange Commission on February 14, 2006. According to such Schedule 13G, the stockholder has sole power to vote and dispose of shares. |

| (4) | As reported by Eastbourne Capital Management, L.L.C. on Schedule 13G filed with the Securities and Exchange Commission on February 13, 2007. According to such Schedule 13G, Eastbourne Capital Management L.L.C. and Richard Jon Barry have shared power to vote and dispose of 2,951,139 shares of common stock. |

| (5) | As reported by Barclays Global Investors, NA on Schedule 13G filed with the Securities and Exchange Commission on January 23, 2007. According to such Schedule 13G, Barclays Global Investors, NA has sole power to vote 2,663,955 shares of common stock and sole power to dispose of 2,795,088 shares of common stock and Barclays Global Fund Advisors has sole power to vote and dispose of 684,530 shares of common stock. |

| (6) | As reported by Pacific Edge Investment Management, LLC on a Schedule 13G as filed with the Securities and Exchange Commission on January 23, 2004. According to such Schedule 13G, each of Pacific Edge Investment Management, LLC and Karen Payne have shared power to vote and dispose of the shares. Pacific Edge Investment Management LLC is an investment adviser whose clients have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of the stock. Karen Payne is the Manager of Pacific Edge Investment Management LLC. |

| (7) | The table includes the following shares subject to acquisition upon exercise of options on April 30, 2007 or within 60 days thereof: Mr. Bourgoin 1,954,610; Mr. Coleman 155,000; Mr. Gibbons 125,000; Mr. Herb 44,722; Mr. Holbrook 225,000; Mr. Horowitz 85,000; Mr. Kelly 155,000; Mr. Browne 299,403; Ms. Creighton 842,800; Mr. Hays 230,001; Mr. Uhler 430,953 and directors and executive officers as a group 5,478,389. |

9

Under our Rights Plan, our stockholders have the right to purchase shares of our preferred stock upon the occurrence of specified events. The documents evidencing this Rights Plan have been filed with the Securities and Exchange Commission as exhibits to registration statements on Form 8-A.

The following pages contain reports of MIPS’ Compensation and Nominating Committee and the Audit and Corporate Governance Committee and a Performance Graph. Stockholders should be aware that under the rules of the SEC, this information is not considered to be “soliciting material”, nor to be “filed”, under the Securities Exchange Act of 1934. This information shall not be deemed to be incorporated by reference in any past or future filing by MIPS under the Securities Exchange Act of 1934 or the Securities Act of 1933 unless and only to the extent that MIPS specifically incorporates this information by reference.

REPORT OF THE COMPENSATION AND NOMINATING COMMITTEE OF THE BOARD ON EXECUTIVE COMPENSATION

Composition of the Committee

During fiscal 2006, the Compensation and Nominating Committee of the board of directors of MIPS consisted of Mr. Kenneth L. Coleman (Chairman), Mr. Robert R. Herb, Mr. Benjamin A. Horowitz, and Mr. Fred M. Gibbons (Mr. Gibbons served until November 17, 2005, when the committee was reduced to three members). Each of Mr. Coleman, Mr. Gibbons, Mr. Herb and Mr. Horowitz is an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code and meets the definition of “non-employee director” under Rule 16b-3 of the Exchange Act.

Charter

The Compensation and Nominating Committee is a standing committee of our board of directors whose primary objectives are to oversee, review and approve compensation for our executive officers, evaluate the performance of our Chief Executive Officer, administer our Long-Term Incentive Plan and our Non-Qualified Stock Option Plan, and nominate prospective members of the board of directors.

Executive Compensation Philosophy

As a high-level strategy guideline, we invest to grow our business in a manner consistent with increasing stockholder value. To that end, the Compensation and Nominating Committee has designed our executive compensation program to align it with achievement of our financial goals and key business objectives.

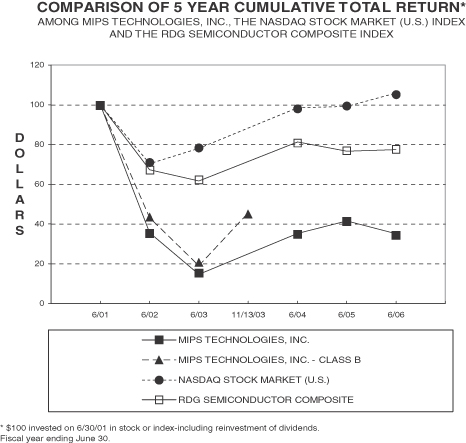

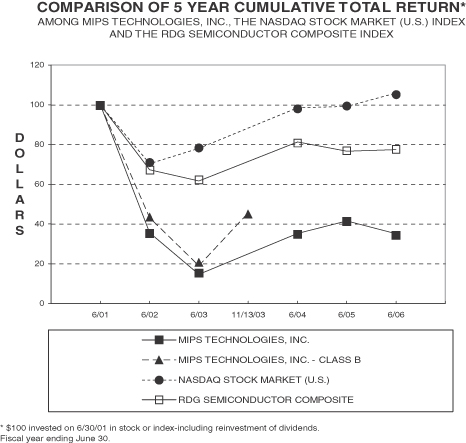

In preparing the Performance Graph for this proxy statement, MIPS used the RDG Semiconductor Composite Index as its published line of business index. The compensation practices of most of the companies in that index were not reviewed by the Compensation and Nominating Committee in designing the executive compensation program at MIPS, because such companies were determined not to be competitive with MIPS for executive talent. The Compensation and Nominating Committee does review the compensation practices of a peer group of mostly semiconductor and intellectual property companies.

Components of Executive Compensation at MIPS

Compensation for our executive officers generally consists of base salary, an annual bonus incentive and stock option awards. The Compensation and Nominating Committee assesses the past performance and/or anticipated future contribution of each executive officer in establishing the total amount and mix of each element of compensation.

Base Salary

The Compensation and Nominating Committee established the objective of positioning executive base salary and total cash compensation at a level similar to that offered by comparably sized companies mostly in the semiconductor and intellectual property industry. The salaries of the executive officers, including the Chief

10

Executive Officer, are evaluated annually by the Compensation and Nominating Committee with reference to relevant surveys of compensation paid to executives with similar responsibilities at comparable companies. The Compensation and Nominating Committee retains outside compensation consultants to periodically review competitive compensation data.

In addition to analyzing competitive data, the Compensation and Nominating Committee evaluates performance to determine appropriate executive salary levels to compensate for performance. The Compensation and Nominating Committee considers the recommendations of the Chief Executive Officer with respect to the salary and other compensation of the other executive officers.

Based on individual and team performance and competitive compensation data for fiscal year 2005, the Compensation and Nominating Committee recommended to the full board of directors to increase by four percent (4%) the base salary of John Bourgoin, our Chief Executive Officer, for fiscal 2006. Mr. Bourgoin was paid a base salary of $400,000 during fiscal year 2006.

The Compensation and Nominating Committee recommended to the full board of directors that Mr. Bourgoin’s base salary for the new fiscal year beginning July 1, 2006 remain unchanged at $400,000.

Annual Bonus Incentive

The Compensation and Nominating Committee established the goals and measurements for the bonus plan to align executive pay with achievement of critical financial goals. The target bonuses for fiscal 2006 for executive officers were set at 70% of base salary for the Chief Executive Officer and 40% of base salary for the other officers.

The Compensation and Nominating Committee determined to base the bonus on achievement of revenue and profit goals, with a potential multiplier of up to two times the target bonuses for achievement over plan goals. The Compensation and Nominating Committee determined that there would be no payout unless at least a certain minimum threshold of the revenue and profit goals were met.

Under the fiscal 2006 annual bonus incentive plan, the Compensation and Nominating Committee recommended to the full board of directors that Mr. Bourgoin, our CEO, not receive a bonus as the minimum threshold of the revenue and profit goals were not met. The other executive officers also did not receive a bonus under the fiscal 2006 annual bonus incentive plan.

Long Term Incentives

Stock options are designed to align the interests of executives with the long-term interests of the stockholders. The Compensation and Nominating Committee believes that stock options directly motivate our executive officers to maximize long-term stockholder value. The options also utilize vesting periods in order to encourage these key employees to continue in the employ of MIPS. The Compensation and Nominating Committee determines the number of shares that will be subject to stock option grants based on our business plans, the executive’s level of responsibility, individual performance, historical award data and competitive practice of comparable positions in similar high technology companies. Options are granted at not less than the fair market value of the underlying shares on the date of grant.

In fiscal 2006, the Compensation and Nominating Committee recommended and granted, upon approval of the board of directors, stock options to Mr. Bourgoin, our CEO, for 135,000 shares. The Compensation and Nominating Committee also granted stock options in fiscal 2006 to other executive officers. These stock options vest one thirty-sixth (1/36th) monthly over thirty-six (36) months starting on the first monthly anniversary of the date of grant.

Policy Regarding Section 162(m) of the Internal Revenue Code

MIPS is subject to Section 162(m) of the Internal Revenue Code, which limits the deductibility of certain compensation payments to its executive officers. This section also provides for certain exemptions to the limitations, specifically compensation that is performance based within the meaning of Section 162(m). The

11

Compensation and Nominating Committee has endeavored to structure our executive compensation plans to achieve deductibility under Section 162(m) while retaining flexibility and objectives. However, deductibility is not the sole factor used in designing and determining appropriate compensation. The Compensation and Nominating Committee may, in the future, enter into compensation arrangements that are not deductible under Section 162(m).

Conclusion

The Compensation and Nominating Committee believes that company and individual performance and achievement enhance long-term stockholder value. The compensation components the Compensation and Nominating Committee have adopted for our executive officers are based on achievement of financial goals, as well as competitive pay practices. The Compensation and Nominating Committee believes that one of its most important functions in serving the interests of the stockholders is to attract, motivate and retain talented executive officers in this competitive environment.

The Compensation and Nominating Committee

Kenneth L. Coleman, Chairman

Robert R. Herb

Benjamin A. Horowitz

12

PERFORMANCE GRAPH

The following graph compares the cumulative total return to stockholders for our common stock, our Class B common stock, the Nasdaq Stock Market Index – U.S., and the RDG Semiconductor Composite Index. The graph assumes that $100 was invested in our Class A common stock and in each index on June 30, 2001. On November 14, 2003, we effected a re-combination of our Class A and Class B common stock into a single class of common stock. The cumulative total return for our common stock reflects the performance of our Class A common stock prior to the re-combination and the performance of our single class of common stock following the re-combination. No dividends have been declared or paid on our Class A, Class B or common stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns.

13

EXECUTIVE COMPENSATION

The following table summarizes compensation information for the last three fiscal years for our Chief Executive Officer and each of the other four most highly compensated executive officers whose salary and bonus exceeded $100,000 during the fiscal year ended June 30, 2006. These officers are referred to as the named executive officers.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | |

| | | Annual Compensation

| | | Long-Term Compensation Awards

|

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | | Restricted

Stock Awards

| | | Securities

Underlying

Options

| | All Other

Compensation (7)

|

John E. Bourgoin Chief Executive Officer and President | | 2006

2005

2004 | | $

$

$ | 400,000

385,000

337,500 | |

$

$ | —

244,244

349,718 |

| |

$

| —

250,450

— |

(5)

| | 135,000

150,000

550,000 | | $

$

$ | 2,500

2,500

2,500 |

| | | | | | |

Jack Browne Vice President, Marketing | | 2006

2005

2004 | | $

$

$ | 260,000

245,000

211,500 | |

$

$ | —

124,338

182,630 |

| |

$

| —

90,380

— |

(6)

| | 72,000

80,000

200,000 | |

| —

—

— |

| | | | | | |

Sandy Creighton Vice President, Human Resources and Corporate Administration (1) | | 2006

2005

2004 | | $

$

$ | 254,800

245,000

212,850 | |

$

$ | —

124,338

183,796 |

| |

$

| —

90,380

— |

(6)

| | 72,000

80,000

230,000 | | $

$

$ | 2,500

2,500

2,500 |

| | | | | | |

W. Patrick Hays Vice President, Engineering (2) | | 2006

2005

2004 | | $

$

| 260,000

166,667

— | | $

$

| 500

164,583

— | (3)

(3)

| |

| —

—

— |

| | 90,000

250,000

— | |

| —

—

— |

| | | | | | |

G. Michael Uhler Vice President, Chief Technology Officer | | 2006

2005

2004 | | $

$

$ | 254,800

245,000

219,500 | | $

$

$ | 1,000

132,438

190,038 | (4)

(4)

(4) | |

$

| —

90,380

— |

(6)

| | 72,000

100,000

200,000 | | $

$

$ | 2,500

2,500

2,500 |

| (1) | Ms. Creighton was Vice President, General Counsel until February 2006, at which time she became Vice President, Human Resources and Corporate Administration. |

| (2) | Mr. Hays joined us in November 2004 as Vice President, Engineering. |

| (3) | Includes patent bonus awarded under the MIPS Patent Award program of $500 in fiscal 2006 and a relocation bonus of $80,000 in fiscal 2005. |

| (4) | Includes patent bonus awarded under the MIPS Patent Award program of $1,000 in fiscal 2006, $8,100 in fiscal 2005 and $500 in fiscal 2004. |

| (5) | Represents the value of 50,000 shares of restricted stock granted on September 17, 2004 valued at the closing price of $5.01 per share on the date of grant. The restricted stock vests annually over four years. |

| (6) | Represents the value of 20,000 shares of restricted stock granted on August 5, 2004 valued at the closing price of $4.52 per share on the date of grant. The restricted stock vests annually over four years. |

| (7) | Represents matching contributions under MIPS’ 401(k) plan. |

14

Option Grants in Fiscal 2006

The following table provides details regarding all stock options granted to the named executive officers in fiscal 2006. All options were granted under our Long-Term Incentive Plan and generally have exercise prices equal to the fair market value on the date of grant. In general, the options vest in thirty-six equal monthly installments, unless otherwise noted.

Potential realizable value assumes that the stock price increases from the date of grant until the end of the option term (7 years) at the annual rate specified (5% and 10%). The 5% and 10% assumed annual rates of appreciation are mandated by SEC rules and do not represent our estimate or projection of the future common stock price. We believe that this method may not accurately illustrate the potential value of a stock option.

Option Grants in Fiscal 2006

Individual Grant

| | | | | | | | | | | | | | | | |

| | | Number of

Securities

Underlying

Options Granted

| | % of Total

Options Granted

to Employees in

Fiscal Year

| | | Exercise Price

($/share)

| | Expiration

Date

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Price

Appreciation for Option

Term

|

| | | | | | | 5%

| | 10%

|

John E. Bourgoin | | 135,000 | | 4.7 | % | | $ | 6.35 | | 09/21/12 | | $ | 348,987 | | $ | 813,288 |

Jack Browne | | 72,000 | | 2.5 | % | | $ | 6.11 | | 08/29/12 | | $ | 179,092 | | $ | 417,360 |

Sandy Creighton | | 72,000 | | 2.5 | % | | $ | 6.11 | | 08/29/12 | | $ | 179,092 | | $ | 417,360 |

W. Patrick Hays | | 90,000 | | 3.1 | % | | $ | 6.11 | | 08/29/12 | | $ | 223,865 | | $ | 521,700 |

G. Michael Uhler | | 72,000 | | 2.5 | % | | $ | 6.11 | | 08/29/12 | | $ | 179,092 | | $ | 417,360 |

Aggregate Option Exercises in Fiscal 2006 and Fiscal Year-End Stock Option Values

The following table sets forth the number and value of options exercised as well as unexercised, in-the-money options held by our named executive officers at June 30, 2006.

Stock Option Exercises and Fiscal 2006 Year-End Values

| | | | | | | | | | | | | | | |

| | | Shares Acquired

on Exercise

| | Value

Realized

| | Number of Unexercised Options

at June 30, 2006

| | Value of Unexercised

In-the-Money Options at June 30,2006

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

John E. Bourgoin | | — | | | — | | 1,688,110 | | 380,250 | | $ | 1,487,928 | | $ | 614,172 |

Jack Browne | | 96,997 | | $ | 447,506 | | 179,403 | | 169,600 | | $ | 290,028 | | $ | 268,544 |

Sandy Creighton | | — | | | — | | 719,900 | | 174,900 | | $ | 694,690 | | $ | 280,920 |

W. Patrick Hays | | — | | | — | | 120,001 | | 219,999 | | | — | | | — |

G. Michael Uhler | | 61,500 | | $ | 309,419 | | 319,956 | | 188,020 | | $ | 274,429 | | $ | 320,356 |

Change in Control Agreements

We have entered into change in control agreements with our executive officers providing for certain benefits following a change in control of MIPS and certain terminations of employment during the 24-month period following such a change in control. A “change in control” is generally defined in the agreements to encompass significant transactions resulting in a change of the corporate control of MIPS, including, among other things, an acquisition of more than 30% of the class of our common stock entitled to elect a majority of our directors, a business combination pursuant to which more than 75% of the class of our common stock entitled to elect a majority of our directors is transferred to different holders and the unapproved replacement of a majority of our directors.

In the event of a change in control, each executive officer’s options and shares of restricted stock will become fully vested and the officer may elect, within six months following the change in control, to have his or her options “cashed out” at a price determined in their respective agreements. If an officer’s employment is terminated other than for “cause” or if an officer resigns for “good reason” (as such terms are defined in the

15

agreements), in either case within 24 months after a change in control, the officer will be entitled to receive a lump sum cash payment equal to 24 months’ salary.

Certain Relationships and Related Transactions

Ernest Evans, the son in-law of a member of our board of directors, Mr. Coleman, is one of our employees. Mr. Evans holds the position of Facilities and Purchasing Manager and is compensated at a salary similar to comparable positions within the company.

On November 18, 2005, the company entered into a separation agreement with Russell W. Bell, a company executive and former Vice-president of Marketing. Under the terms of the agreement, Mr. Bell’s last day of employment was December 31, 2005, at which time he ceased to be an employee of the company. Mr. Bell received a lump sum severance payment equal to six-months of salary and COBRA premiums.

On January 4, 2006, the company entered into a separation agreement with Kevin C. Eichler upon his resignation as CFO and Treasurer. Under the terms of the agreement, Mr. Eichler’s last day of employment was February 28, 2006, at which time he ceased to be an employee of the company. Mr. Eichler received a lump sum severance payment equal to six-months of salary and COBRA premiums.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under Section 16(a) of the Securities Exchange Act, our directors, executive officers, and any persons holding more than 10% of our common stock are required to report to the Securities and Exchange Commission and the Nasdaq National Market their initial ownership of our stock and any subsequent changes in that ownership. Based on a review of Forms 3, 4 and 5 filed pursuant to the Exchange Act furnished to us, we believe that during fiscal 2005, our officers, directors and holders of more than 10% of our common stock filed all Section 16(a) reports on a timely basis, except for a late Form 4 filed on behalf of Mervin S. Kato. The late filing was related to stock options granted to Mr. Kato on January 26, 2006 related to his promotion to CFO. A Form 4 was filed on February 13, 2006.

REPORT OF THE AUDIT AND CORPORATE GOVERNANCE COMMITTEE

The management of MIPS is responsible for establishing and maintaining internal controls and for preparing the consolidated financial statements of MIPS. The independent auditors are responsible for auditing the consolidated financial statements. It is the responsibility of the Audit and Corporate Governance Committee to oversee these activities.

The Audit and Corporate Governance Committee has reviewed and discussed with MIPS’ management the audited consolidated financial statements for the fiscal year ended June 30, 2006.

The Audit and Corporate Governance Committee has discussed with Ernst & Young LLP, MIPS’ independent auditor, the matters required to be discussed by Statement on Auditing Standards No. 61, 89 and 90 relating to communications with Audit Committees.

The Audit and Corporate Governance Committee has received and reviewed the written disclosures and the letter from Ernst & Young LLP required by Independence Standard No. 1, “Independence Discussions with Audit Committees”, and the Audit and Corporate Governance Committee has discussed with Ernst & Young LLP their independence.

Based on the reviews and discussions referred to above, the Audit and Corporate Governance Committee recommended to the Board of Directors that the audited consolidated financial statements be included in MIPS’ annual report on Form 10-K for the fiscal year ended June 30, 2006.

The Audit and Corporate Governance Committee

William M. Kelly, Chairman

Fred M. Gibbons

Anthony B. Holbrook

16

STOCKHOLDER PROPOSALS FOR 2007 ANNUAL MEETING

If you want us to consider including a proposal in next year’s Proxy Statement, you must deliver it in writing to MIPS at 1225 Charleston Road, Mountain View, California 94043, Attention: Secretary, no later than August 31, 2007.

Our by-laws provide that stockholders wishing to nominate a director or present a proposal at next year’s annual meeting, but not wishing to have such nomination or proposal included in our Proxy Statement, must submit specified information in writing to MIPS at the above address no later than August 31, 2007 but no sooner than August 17, 2007.

OTHER MATTERS

We know of no other matters to be submitted at the annual meeting. If any other matters properly come before the meeting, it is the intention of the persons named in the enclosed form of proxy to vote the shares they represent as the board of directors may recommend.

|

By Order of the Board of Directors |

|

|

|

Gail H. Knittel Associate General Counsel and Assistant Secretary |

17

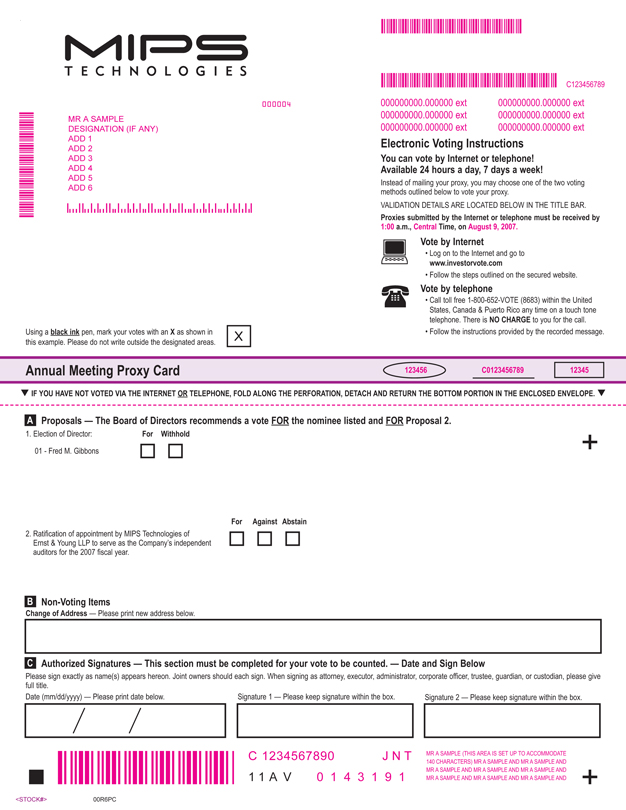

MIPS TECHNOLOGIES

C123456789

000004

MR A SAMPLE

DESIGNATION (IF ANY)

ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6

000000000.000000 ext

000000000.000000 ext

000000000.000000 ext

000000000.000000 ext

000000000.000000 ext

000000000.000000 ext

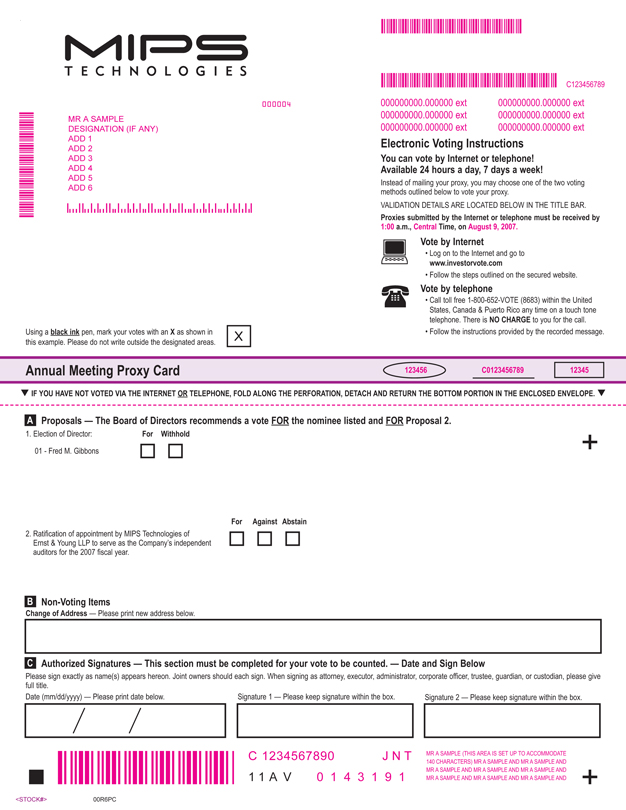

Electronic Voting Instructions

You can vote by Internet or telephone!

Available 24 hours a day, 7 days a week!

Instead of mailing your proxy, you may choose one of the two voting methods outlined below to vote your proxy.

VALIDATION DETAILS ARE LOCATED BELOW IN THE TITLE BAR.

Proxies submitted by the Internet or telephone must be received by 1:00 a.m., Central Time, on August 9, 2007.

Vote by Internet

Log on to the Internet and go to www.investorvote.com

Follow the steps outlined on the secured website.

Vote by telephone

Call toll free 1-800-652-VOTE (8683) within the United States, Canada & Puerto Rico any time on a touch tone telephone. There is NO CHARGE to you for the call.

Follow the instructions provided by the recorded message.

Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas.

Annual Meeting Proxy Card

123456

C0123456789

12345

IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

A Proposals — The Board of Directors recommends a vote FOR the nominee listed and FOR Proposal 2.

1. Election of Director: For Withhold

01—Fred M. Gibbons

For Against Abstain

2. Ratification of appointment by MIPS Technologies of

Ernst & Young LLP to serve as the Company’s independent auditors for the 2007 fiscal year.

B Non-Voting Items

Change of Address — Please print new address below.

Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below C

Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee, guardian, or custodian, please give full title.

Date (mm/dd/yyyy) — Please print date below.

Signature 1 — Please keep signature within the box.

Signature 2 — Please keep signature within the box.

C 1234567890

1 1 A V

J N T

0 1 4 3 1 9 1

MR A SAMPLE (THIS AREA IS SET UP TO ACCOMMODATE

140 CHARACTERS) MR A SAMPLE AND MR A SAMPLE AND

MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND

MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND

<STOCK#>

00R6PC

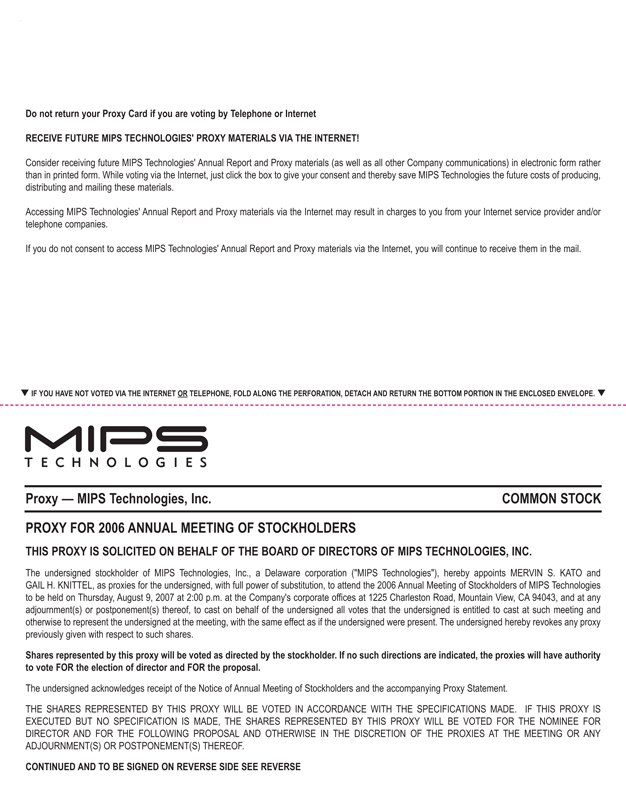

Do not return your Proxy Card if you are voting by Telephone or Internet

RECEIVE FUTURE MIPS TECHNOLOGIES’ PROXY MATERIALS VIA THE INTERNET!

Consider receiving future MIPS Technologies’ Annual Report and Proxy materials (as well as all other Company communications) in electronic form rather than in printed form. While voting via the Internet, just click the box to give your consent and thereby save MIPS Technologies the future costs of producing, distributing and mailing these materials.

Accessing MIPS Technologies’ Annual Report and Proxy materials via the Internet may result in charges to you from your Internet service provider and/or telephone companies.

If you do not consent to access MIPS Technologies’ Annual Report and Proxy materials via the Internet, you will continue to receive them in the mail.

IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

MIPS TECHNOLOGIES

Proxy — MIPS Technologies, Inc.

COMMON STOCK

PROXY FOR 2006 ANNUAL MEETING OF STOCKHOLDERS

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF MIPS TECHNOLOGIES, INC.

The undersigned stockholder of MIPS Technologies, Inc., a Delaware corporation (“MIPS Technologies”), hereby appoints MERVIN S. KATO and GAIL H. KNITTEL, as proxies for the undersigned, with full power of substitution, to attend the 2006 Annual Meeting of Stockholders of MIPS Technologies to be held on Thursday, August 9, 2007 at 2:00 p.m. at the Company’s corporate offices at 1225 Charleston Road, Mountain View, CA 94043, and at any adjournment(s) or postponement(s) thereof, to cast on behalf of the undersigned all votes that the undersigned is entitled to cast at such meeting and otherwise to represent the undersigned at the meeting, with the same effect as if the undersigned were present. The undersigned hereby revokes any proxy previously given with respect to such shares.

Shares represented by this proxy will be voted as directed by the stockholder. If no such directions are indicated, the proxies will have authority to vote FOR the election of director and FOR the proposal.

The undersigned acknowledges receipt of the Notice of Annual Meeting of Stockholders and the accompanying Proxy Statement.

THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED IN ACCORDANCE WITH THE SPECIFICATIONS MADE. IF THIS PROXY IS EXECUTED BUT NO SPECIFICATION IS MADE, THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED FOR THE NOMINEE FOR DIRECTOR AND FOR THE FOLLOWING PROPOSAL AND OTHERWISE IN THE DISCRETION OF THE PROXIES AT THE MEETING OR ANY ADJOURNMENT(S) OR POSTPONEMENT(S) THEREOF.

CONTINUED AND TO BE SIGNED ON REVERSE SIDE SEE REVERSE