UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12 |

POZEN Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment | | of Filing Fee (Check the appropriate box): |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

POZEN® Inc.

1414 Raleigh Road, Suite 400

Chapel Hill, North Carolina 27517

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

NOTICE IS HEREBY GIVEN that the Annual Meeting of the holders of shares of common stock, each having a par value of $0.001 per share, of POZEN Inc. (“POZEN”), will be held at the Paul J. Rizzo Conference Center, Loudermilk Hall, 130 DuBose House Lane, Chapel Hill, North Carolina 27517, on June 22, 2004 at 11:00 a.m. Eastern time, to consider and take action with respect to the following:

| | 1. | | To elect three Class I directors, each of whom shall serve for a term of three years. |

| | 2. | | To approve the POZEN Inc. 2000 Equity Compensation Plan, as amended and restated, including to increase from 3,000,000 to 5,500,000 the number of shares issuable under the Plan. |

| | 3. | | To ratify the appointment of Ernst & Young LLP as POZEN’s independent public accountants to audit POZEN’s financial statements for the fiscal year ending December 31, 2004. |

| | 4. | | To conduct such other business as may properly come before the Annual Meeting or any adjournments thereof. |

Holders of common stock of record at the close of business on May 11, 2004 are entitled to notice of and to vote at the Annual Meeting or any adjournments thereof.

|

By Order of the Board of Directors, |

|

/s/ Helga L. Leftwich

|

|

Helga L. Leftwich Secretary |

Chapel Hill, North Carolina

Dated: May 25, 2004

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND, PLEASE COMPLETE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT IN THE ENCLOSED ENVELOPE IN ORDER TO ASSURE REPRESENTATION OF YOUR SHARES.

POZEN Inc.

1414 Raleigh Road, Suite 400

Chapel Hill, North Carolina 27517

PROXY STATEMENT

Mailed on May 25, 2004

Annual Meeting of Stockholders to be held on June 22, 2004

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of POZEN Inc. (“POZEN”) to be used at the Annual Meeting of the holders of shares of common stock, par value $0.001 per share, of POZEN, to be held on June 22, 2004 and at any adjournment thereof (the “Annual Meeting”). The time and place of the Annual Meeting are stated in the Notice of Annual Meeting of Stockholders that accompanies this proxy statement.

The expense of soliciting proxy cards, including the costs of preparing, assembling and mailing the Notice of Annual Meeting of Stockholders, proxy statement and proxy card, will be borne by us. In addition to solicitation by mail, we will arrange for brokerage firms and other custodians, nominees and fiduciaries to send the proxy materials to beneficial owners, and we will, upon request, reimburse the brokerage houses and custodians for their reasonable expenses. POZEN may retain a third-party proxy solicitor to assist in the solicitation of proxies and verify records related to the solicitations. We expect to pay the proxy solicitor a fee of approximately $8000 and to reimburse the solicitor its expenses for its services. We or our directors, officers or employees may request by telephone, facsimile or email the return of proxy cards. The extent to which this will be necessary depends entirely on how promptly the stockholders vote. We urge you to vote your shares without delay.

VOTING RIGHTS

Only stockholders as of the close of business on May 11, 2004, the record date fixed by the Board of Directors of POZEN (the “Board”), are entitled to notice of and to vote at the Annual Meeting. As of May 11, 2004, there were 28,788,272 shares of common stock issued and outstanding and no other outstanding classes of voting securities. Each holder of our common stock is entitled to one vote per share on each matter presented at the Annual Meeting.

The presence of the holders of a majority of the shares of common stock issued, outstanding and entitled to vote, in person or represented by duly executed proxies, at the Annual Meeting is necessary to constitute a quorum for the transaction of business at the Annual Meeting.

The affirmative vote of the holders of a plurality of the votes cast by stockholders entitled to vote for the election of directors is required to elect the directors. Cumulative voting for the election of directors is not permitted. A majority of the votes cast in person or by duly executed proxies is required for approval of the proposal to approve our 2000 Equity Compensation Plan, as amended and restated, and to ratify the appointment of our independent public accountants.

Shares entitled to vote represented by proxies that are properly executed and returned before the Annual Meeting will be voted at the Annual Meeting as directed on the proxy. In the election of directors, stockholders may either vote“FOR” all nominees for election or“WITHHOLD” their votes from one or more nominees for election. If no vote is specified on the proxy, the shares will be voted“FOR” the election of the nominees for director named in this proxy statement. Shares represented by proxies that are marked“WITHHOLD” with regard to the election of the nominees for director will be excluded entirely from that vote and will have no effect.

For the proposals to approve our 2000 Equity Compensation Plan, as amended and restated, and to ratify

1

the appointment of our independent public accountants, a majority of the votes cast for each proposal is required for approval of the proposal. Stockholders may vote“FOR”,“AGAINST”, or“ABSTAIN” with respect to the vote to approve the Equity Compensation Plan, as amended and restated, and to ratify the appointment of our independent public accountants. If no vote is specified on the proxy with respect to these matters, the shares will be voted“FOR” the approval of the Equity Compensation Plan, as amended and restated,“FOR” the ratification of the appointment of our independent public accountants and, at the discretion of the designated proxies, for any other matter that may properly come before the meeting. Broker non-votes, which occur when a beneficial owner of our common stock does not provide his or her bank, broker or other nominee with voting instructions and the nominee does not exercise or does not have discretion to vote the beneficial owner’s shares, will have no effect on the outcome of any proposal in this proxy statement. Such broker non-votes will, however, be counted in determining whether there is a quorum for the Annual Meeting.

The Board does not know of any other business to be presented for consideration at the Annual Meeting. If any other business properly comes before the Annual Meeting or any adjournment thereof, the proxies will be voted on such matters in the discretion of the proxy holders. The Delaware General Corporation Law provides that, unless otherwise provided in the proxy and unless the proxy is coupled with an interest, a stockholder may revoke a proxy previously given at any time prior to its exercise at the Annual Meeting. A stockholder who has given a proxy may revoke it at any time before it is exercised by delivering to any of the persons named as proxies, or to us addressed to the Secretary, an instrument revoking the proxy, by appearing at the Annual Meeting and voting in person or by executing a later dated proxy which is exercised at the Annual Meeting.

PRINCIPAL STOCKHOLDERS

The stockholders named in the following table are those known to us to be the beneficial owners of 5% or more of our common stock. Unless otherwise indicated, the information is as of March 31, 2004. For purposes of this table, and as used elsewhere in this proxy statement, the term “beneficial owner” means any person who, directly or indirectly, has or shares the power to vote, or to direct the voting of, shares of our common stock, the power to dispose, or to direct the disposition of, a security or has the right to acquire shares within sixty (60) days. Except as otherwise indicated, we believe that each owner listed below exercises sole voting and dispositive power over its shares.

| | | | | | |

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership

| | | Percent of Common Stock

| |

John R. Plachetka, Pharm.D. POZEN Inc. 1414 Raleigh Road, Suite 400 Chapel Hill, NC 27517 | | 4,087,098 | (1) | | 14.1 | % |

| | |

Vector Later-Stage Equity Fund II, L.P. 1751 Lake Cook Road, Suite 350 Deerfield, IL 60015 | | 1,885,405 | (2) | | 6.6 | % |

| | |

BB Biotech AG Vodergasse 3 CH-8300 Schaffhausen Switzerland | | 2,800,000 | (3) | | 9.8 | % |

| (1) | | This amount reflects ownership by Silver Hill Investments, LLC, John R. Plachetka and Clare A. Plachetka and certain affiliated entities, and consists of (i) 1,726,508 shares owned by Silver Hill Investments, LLC, which is 50% owned by the John R. Plachetka Irrevocable Trust, 40% owned by John R. Plachetka through his assignee, the Revocable Declaration of Trust, John R. Plachetka, Trustee (the “JRP Revocable Trust”), and 10% owned by his wife, Clare A. Plachetka, through her assignee, the Clare A. Plachetka Revocable Declaration of Trust, Clare A. Plachetka, Trustee (the “CAP Revocable Trust”); (ii) 1,417,871 shares owned by the JRP Revocable Trust; (iii) 212,900 shares owned by the CAP Revocable Trust; (iv) 248,229 shares owned by the John R. Plachetka Irrevocable Trust; (v) 47,215 shares held by John R. Plachetka directly; and (vi) 434,375 shares of common stock issuable pursuant to options granted to John R. Plachetka exercisable within 60 days. John R. Plachetka and Clare A. Plachetka claim shared voting and dispositive power as to the shares set forth in (i) through (iv) above. |

2

| (2) | | According to a report on Schedule 13G/A that was filed on February 17, 2004 with respect to ownership as of December 31, 2003 by Vector Later-Stage Equity Fund II, L.P. (“VLSEF”), Vector Later-Stage Equity Fund II (QP), L.P. (“VLSEF QP”), Vector Fund Management II, L.L.C., the general partner of VLSEF and VLSEF QP (“VFM”), D. Theodore Berghorst, an officer and director of VFM (“Berghorst”), Barclay A. Phillips, a director of VFM (“Phillips”), Douglas Reed, a director of VFM (“Reed”), Mark Flower, the Chief Financial Officer of each of VLSEF, VLSEF QP and VFM (“Flower”), and Deborah Berghorst, Trustee FBO Berghorst 1998 Dynastic Trust (the “Trust”), this amount consists of (i) 1,785,405 shares as to which VFM, Berghorst, Phillips and Reed claim shared voting and dispositive power, including 1,339,054 shares as to which VLSEF QP claims shared voting and dispositive power and 446,351 shares as to which VLSEF claims shared voting and dispositive power and (ii) 50,000 shares as to which Berghorst claims sole voting and dispositive power and 50,000 shares as to which Berghorst claims shared voting and dispositive power. (The Trust claims sole voting and dispositive power with respect to the 50,000 shares with respect to which Berghorst claims shared voting and dispositive power.) The 1,885,405 share amount does not include 23,000 shares as to which Reed claims sole voting and dispositive power, 2,700 shares as to which Phillips claims sole voting and dispositive power and 1,000 shares as to which Flower claims sole voting and dispositive power. |

| (3) | | According to a report on Schedule 13G that was filed on September 27, 2002 with respect to ownership as of December 31, 2002 by Biotech Target N.V., a wholly-owned subsidiary of BB Biotech AG (“BBB”), Biotech Target N.V. and BBB claim shared voting and dispositive power as to all 2,800,000 shares. |

STOCK OWNERSHIP OF DIRECTORS, NOMINEES FOR DIRECTOR AND EXECUTIVE OFFICERS

The following table and notes thereto set forth information with respect to the beneficial ownership of shares of our common stock as of March 31, 2004 (except as specified below) by each director, the nominees for director and each executive officer named by us in the Summary Compensation Table (the “Named Executive Officers”) and, as a group, by the directors and current executive officers, based upon information furnished to us by such persons. Except as otherwise indicated, we believe that each beneficial owner listed below exercises sole voting and dispositive power.

| | | | | | |

| | | Beneficial Ownership as of March 31, 2004

| |

Name of Beneficial Owner(1)

| | Number of Shares

| | | Percentage of Common Stock

| |

John R. Plachetka, Pharm.D. | | 4,087,098 | (2) | | 14.0 | % |

Kristina M. Adomonis | | 73,438 | (3) | | * | |

John E. Barnhardt | | 116,972 | (4) | | * | |

James R. Butler(5) | | — | | | * | |

Matthew E. Czajkowski | | 258,263 | (6) | | * | |

Arthur S. Kirsch(7) | | — | | | * | |

Kenneth B. Lee, Jr. | | 5,416 | (8) | | * | |

Paul J. Rizzo | | 47,500 | (9) | | * | |

Bruce A. Tomason | | 86,960 | (10) | | * | |

Peter J. Wise, M.D. | | 465,464 | (11) | | 1.6 | % |

Ted G. Wood | | 58,480 | (12) | | * | |

All current directors and executive officers as a group (11 persons) | | 4,941,328 | (13) | | 16.7 | % |

3

| (1) | | Unless otherwise set forth herein, the street address of the named beneficial owners is c/o POZEN Inc., Suite 400, 1414 Raleigh Road, Chapel Hill, North Carolina 27517. |

| (2) | | Consists of (i) 1,726,508 shares owned by Silver Hill Investments, LLC, which is 50% owned by the John R. Plachetka Irrevocable Trust, 40% owned by John R. Plachetka through the JRP Revocable Trust, and 10% owned by his wife, Clare A. Plachetka, through her assignee, the CAP Revocable Trust; (ii) 1,417,871 shares owned by the JRP Revocable Trust; (iii) 212,900 shares owned by the CAP Revocable Trust; (iv) 248,229 shares owned by the John R. Plachetka Irrevocable Trust; (v) 47,215 shares held directly; and (vi) 434,375 shares issuable pursuant to options exercisable within 60 days. |

| (3) | | Consists of 50,000 shares of common stock held jointly by Ms. Adomonis and her husband and 23,438 shares of common stock issuable pursuant to options held by Ms. Adomonis exercisable within 60 days. |

| (4) | | Includes 109,722 shares of common stock issuable pursuant to options held by Mr. Barnhardt exercisable within 60 days. |

| (5) | | Mr. Butler became a director in July 2003. |

| (6) | | Consists of 183,263 shares of common stock, of which an aggregate of 25,760 shares are held of record by trusts for the benefit of Mr. Czajkowski’s minor children, and 75,000 shares of common stock issuable pursuant to options exercisable within 60 days. Mr. Czajkowski left POZEN as of January 6, 2004. |

| (7) | | Mr. Kirsch became a director in May 2004. |

| (8) | | Includes 5,416 shares of common stock issuable pursuant to options exercisable within 60 days. |

| (9) | | Includes 7,500 shares of common stock issuable pursuant to options exercisable within 60 days. |

| (10) | | Includes 83,960 shares of common stock issuable pursuant to options exercisable within 60 days. |

| (11) | | Includes 30,000 shares of common stock issuable pursuant to options exercisable within 60 days. |

| (12) | | Includes 56,980 shares of common stock issuable pursuant to options exercisable within 60 days. |

| (13) | | Includes 751,391 shares of common stock issuable pursuant to options exercisable within 60 days. |

PROPOSAL 1

NOMINATION AND ELECTION OF DIRECTORS

Our Amended and Restated Certificate of Incorporation provides that our Board shall consist of not less than three nor more than fifteen members divided into three Classes: Class I, Class II and Class III. Each director serves for a three-year term, with one class of directors being elected at each Annual Meeting. The Board is authorized to increase or decrease the total number of directors within the three to fifteen range as well as the number of directors in each class, provided that no one class shall have more than one director more than any other class. If the quotient derived by dividing the designated number of directors by three is a fraction, the extra director shall be a member of Class I if such a fraction is one-third, and, if such fraction is two-thirds, the other director shall be a member of Class II, unless otherwise provided from time to time by resolution adopted by the Board. The number of directors constituting the Board is currently fixed at eight members. Three directors are currently serving in each of Class I and Class II; two directors are currently serving in Class III. Jacques F. Rejeange, who served as one of our Class II directors, retired from the Board in January 2004. In May 2004, the Board elected Arthur S. Kirsch to fill the seat vacated by Mr. Rejeange’s retirement from the Board.

The three directorships expiring this year are Class I directorships, currently filled by James R. Butler, Paul J. Rizzo and Ted G. Wood. Upon the recommendation of the Nominating/Corporate Governance Committee of the Board, the Board has nominated Messrs. Butler, Rizzo and Wood as nominees for election at this Annual Meeting to serve as Class I directors; their terms will expire in 2007. Messrs. Rizzo and Butler are being nominated for election by our stockholders for the first time at this Annual Meeting. Mr. Rizzo, who joined the Board in 2002, was recommended for initial membership on the Board by Dr. John R. Plachetka, our Chairman, President and Chief Executive Officer. Mr. Butler, who joined the Board in 2003, was recommended for initial membership on the Board by Peter J. Wise, the Vice Chairman of our Board.

Messrs. Butler, Rizzo and Wood have informed us that they are each willing to serve for the term to which each of them is nominated if elected. If one of the nominees for director should become unavailable for election or is unable to serve as a director, the shares represented by proxies voted in favor of that nominee will be voted for any substitute nominee that may be named by the Board.

The information appearing in the following two tables sets forth the names of the nominees for director and the directors continuing in office and also contains, as to each director, certain biographical information, a brief description of each person’s principal occupation and business experience and certain other information.

4

NOMINEES FOR ELECTION AS DIRECTOR FOR A TERM OF THREE YEARS

| | | | | | |

Name and Principal Occupation

| | Served as Director

Since

| | Director Class

| | If Elected, Term Expires At

Annual Meeting

of Stockholders in

|

| | | |

James R. Butler, age 63 | | 2003 | | Class I | | 2007 |

Employed in an advisory capacity to the Chairman of the board of directors of Reliant Pharmaceuticals Inc., a pharmaceutical company, since October 2003; President of ALZA International, a pharmaceutical company, from 2000 to June 2001; served in various other executive positions with ALZA between 1993 and 2001; prior to that, served as Vice President-General Manager of Glaxo Pharmaceuticals, a pharmaceutical company. Serves on the board of directors of BioDeliery Sciences International and two private companies, Respirics, Inc. and Hematrope Pharmaceuticals; serves on the advisory boards of the Pharmacy Schools of the University of Florida and Campbell University. | | | | | | |

| | | |

Paul J. Rizzo, age 76 | | 2002 | | Class I | | 2007 |

Chairman of the board of directors and partner of Franklin Street Partners, an investment firm, since 1990; Dean of the Kenan-Flagler School of Business at the University of North Carolina at Chapel Hill between 1987 and 1992; Vice Chairman of the board of directors of IBM Corporation from 1983 to 1987 and from 1993 to 1994. Serves as a director of Cox Enterprises Inc. and The Maersk Company Limited. | | | | | | |

| | | |

Ted G. Wood, age 66 | | 2000 | | Class I | | 2007 |

Retired since September 2003; Vice Chairman of The United Company, a Bristol, Virginia based holding company engaged in oil and gas exploration and production, financial services and the development of public golf courses, from January 2003 to August 2003; President of the operating subsidiaries within The United Company between 1998 and January 2003; consultant to The United Company from January 1996 to June 1998. Serves as a director of King Pharmaceuticals Inc. | | | | | | |

Vote Required for Approval

The affirmative vote of the holders of a plurality of the votes cast by stockholders entitled to vote in the election of directors is required for the election of each of the nominees as director of POZEN.

Recommendation of the Board

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF EACH OF THESE NOMINEES FOR DIRECTOR.

5

DIRECTORS CONTINUING IN OFFICE

| | | | | | |

Name and Principal Occupation

| | Served as

Director

Since

| | Director Class

| | Term Expires

At Annual Meeting of

Stockholders in

|

| | | |

Kenneth B. Lee, Jr., age 56 | | 2002 | | Class II | | 2005 |

Independent consultant since June 2002 and managing member of Hatteras BioCapital, LLC (formerly BioVista Capital, LLC), the general partner of Hatteras BioCapital Fund, L.P., a venture capital fund focusing on life sciences companies, since 2003; President of A.M. Pappas & Associates, a venture capital firm, between January 2002 and June 2002; Partner of Ernst & Young LLP from 1982 through 2001; Managing Director of Ernst & Young’s Health Sciences Corporate Finance Group from 2000 to 2001. Serves as a director of CV Therapeutics, Inc., Abgenix, Inc. and Inspire Pharmaceuticals, Inc. | | | | | | |

| | | |

Arthur S. Kirsch, age 52 | | 2004 | | Class II | | 2005 |

Founding member and Managing Director of Vector Securities, LLC, an investment and merchant banking firm, since 2001; Managing Director and Head of Healthcare Research and Capital Markets of Prudential Vector Healthcare Group, a unit of Prudential Securities, Inc., a full-service brokerage firm, from 1999 to 2001; Director, Equity Research of Vector Securities International, Inc., an investment banking firm, from 1995 to 1999. | | | | | | |

| | | |

Bruce A. Tomason, age 56 | | 1997 | | Class II | | 2005 |

Chief Executive Officer of Alterna, LLC, an investment firm focusing on over-the-counter pharmaceuticals, since April 2004; Principal of Apollo Healthcare Partners (formerly Apollo Capital Corporation), a healthcare investment banking and venture capital company, between 1991 and 2003; Chief Executive Officer of One Call Medical, Inc., a medical management company, from January 1996 through December 1998. | | | | | | |

| | | |

John R. Plachetka, Pharm.D., age 50 | | 1996 | | Class III | | 2006 |

Chairman of the Board since January 2001, co-founder of POZEN and President and Chief Executive Officer of POZEN since 1996; Vice President of Development at Texas Biotechnology Corporation from 1993 to 1995. | | | | | | |

| | | |

Peter J. Wise, M.D., age 69 | | 1996 | | Class III | | 2006 |

Retired since 1996; Vice Chairman of the Board since January 2001; co-founder of POZEN; acted in an advisory capacity to POZEN from 1996 to 2000; President and Chief Operating Officer of Pharmaceutical Product Development, Inc., a pharmaceutical services and development company, from 1993 to 1996. | | | | | | |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE MATTERS

Independence

All the members of our Board are independent as defined by the NASDAQ listing standards, with the exception of Dr. John R. Plachetka, our Chairman, President and Chief Executive Officer.

Meetings

Our Board held six meetings of the Board during the year ended December 31, 2003. During the year, no incumbent director other than Paul J. Rizzo attended fewer than 75% of the aggregate of (i) the total number of meetings of the Board held during the period he served as a director and (ii) the total number of meetings held by any committee of the Board on which he served. In March 2004, our Board adopted the policy that directors attend our annual meetings of stockholders. All of our directors other than Bruce A. Tomason attended the 2003 Annual Meeting of Stockholders held on May 20, 2003.

6

Committees of the Board

Our Board has an Audit Committee, Compensation Committee and Nominating/Corporate Governance Committee. These committees, their principal functions and their respective memberships are described below.

Audit Committee

The current members of the Audit Committee are Bruce A. Tomason, who serves as Chairman, Kenneth B. Lee, Jr. and Paul J. Rizzo. As of June 1, 2004, the members of the Audit Committee will be Bruce A. Tomason, Chairman, Kenneth B. Lee, Jr., and Arthur S. Kirsch. Each of the current and prospective members of the Audit Committee is “independent” as defined by the NASDAQ listing standards applicable to audit committee members. Our Board has determined that Messrs. Tomason, Lee and Rizzo qualify as audit committee financial experts as defined by the Securities and Exchange Commission (the “SEC”).

The Audit Committee oversees our financial reporting process and system of internal control over financial reporting, and selects and oversees the performance of, and approves in advance the services provided by, our independent public accountants. The Audit Committee provides an open avenue of communication among our independent public accountants, financial and senior management and the Board. The Audit Committee held five meetings during the year ended December 31, 2003. In 2004, the Audit Committee approved, and the Board adopted, an amended and restated charter, which is filed as Appendix A to this proxy statement. A copy of the amended and restated charter for the Audit Committee is also posted on our website at www.pozen.com.

Compensation Committee

The current members of the Compensation Committee are Peter J. Wise, M.D., who serves as Chairman, Ted G. Wood and Bruce A. Tomason. As of June 1, 2004, the members of the Compensation Committee will be Ted G. Wood, Chairman, Peter J. Wise, M.D., Kenneth B. Lee, Jr., and James R. Butler. Each of the current and prospective members of the Compensation Committee is “independent” as defined by NASDAQ listing standards.

The Compensation Committee is responsible for reviewing, evaluating and approving, or as appropriate, recommending to the Board, the salary, incentive compensation, bonuses, benefit plans and other forms of compensation for our executive officers and directors and for reviewing and approving the philosophy and policies governing the compensation of POZEN’s employees generally. The Compensation Committee is also responsible for granting, or delegating the authority for granting, and making decisions with respect to, stock options and other awards under our 1996 Stock Option Plan and 2000 Equity Compensation Plan and for granting awards under our 2001 Long Term Incentive Plan. The Compensation Committee held four meetings during the year ended December 31, 2003. A current copy of the charter for the Compensation Committee is posted on our website at www.pozen.com.

Nominating/Corporate Governance Committee

The current members of the Nominating/Corporate Governance Committee (the “Governance Committee”) are Paul J. Rizzo, who serves as Chairman, and James R. Butler. As of June 1, 2004, the members of the Governance Committee will be Paul J. Rizzo, Chairman, James R. Butler and Bruce A. Tomason. Each of the current and prospective members of the Governance Committee is “independent” as defined by NASDAQ listing standards. The Governance Committee was formed by the Board in December 2003, held no meetings in 2003 and has held three meetings thus far in 2004. A current copy of the charter for the Governance Committee is posted on our website at www.pozen.com.

The Governance Committee assists the Board in fulfilling its responsibilities regarding the oversight of the composition of the Board and other corporate governance matters. Among its other duties, the Governance Committee evaluates nominees and reviews the qualifications of individuals eligible to stand for election and reelection as directors and makes recommendations to the Board on this matter; oversees compliance with our Code of Business Conduct and Ethics; recommends and advises the Board on certain other corporate governance matters; and evaluates the Board’s performance.

7

Evaluation and Identification of Director Nominees. The Governance Committee implements the following procedures for the evaluation and identification of our director nominees. While all nominees should have the highest personal integrity, meet any regulatory qualifications and have a record of exceptional ability and judgment, the Board relies on the judgment of members of the Governance Committee, with input from our Chairman, President and Chief Executive Officer, to assess the qualifications of potential Board nominees with a view to the contributions that they would make to the Board and to POZEN. Because the Board believes that its members should ideally reflect a mix of experience and other qualifications, there is no rigid formula. In evaluating potential candidates, however, the Governance Committee will consider, among others things, the degree to which a potential candidate fulfills a current Board need (e.g., the need for an audit committee financial expert), as well as the candidate’s ability and commitment to understand POZEN and its industry and to devote the time necessary to fulfill the role of director (including without limitation regularly attending and participating in meetings of the Board and its Committees). In considering potential candidates, the Governance Committee will consider the overall competency of the Board in the following areas: (i) industry knowledge; (ii) accounting and finance; (iii) business judgment; (iv) management; (v) leadership; (vi) business strategy; (vii) crisis management, and (viii) corporate governance. In addition, the Governance Committee may consider other factors, as appropriate in a particular case, including without limitation the candidate’s (i) sound business and personal judgment; (ii) diversity of origin, experience, background and thought; (iii) senior management experience and demonstrated leadership ability; (iv) accountability and integrity; (v) financial literacy; (vi) industry or business knowledge, including science, technology, and marketing acumen; (vii) the extent, nature and quality of relationships and standing in the research and local communities; (viii) in connection with nominees to be designated as “independent” directors, “independence” under regulatory definitions, as well as in the judgment of the Governance Committee; (ix) independence of thought and ideas; and (x) other board appointments and service.

The Governance Committee considers recommendations for nominations from a wide variety of sources, including members of the Board, business contacts, community leaders and members of management. As described below, the committee will also consider stockholder recommendations for Board nominees. The Governance Committee’s process for identifying and evaluating candidates is the same with respect to candidates recommended by members of the Board, management, stockholders or others.

Stockholder Director Nominee Recommendations. The Governance Committee will consider director nominees recommended by stockholders. Stockholders who wish their proposed nominee to be considered for nomination at our next annual stockholders’ meeting should submit information about their nominees by no later than 120 days prior to the one year anniversary of the mailing of the proxy statement for our most recent annual meeting of stockholders. Stockholders who wish to nominate a director should submit the following information in writing to the Chairman of the Governance Committee, c/o POZEN Inc., 1414 Raleigh Road, Suite 400 Chapel Hill, North Carolina 27517:

| | • | | the name of the candidate and the information about the individual that would be required to be included on a proxy statement under the rules of the SEC (including without limitation such individual’s qualifications, experience, background and share ownership, if any); |

| | • | | information about the relationship between the candidate and the nominating stockholder; |

| | • | | the consent of the candidate to serve as a director; and |

| | • | | proof of the number of shares of our common stock that the nominating stockholder beneficially owns and the length of time the shares have been owned. |

Stockholders also have the right to nominate director candidates themselves, without any prior review or recommendation by the Governance Committee or the Board, by following the procedures set forth in our bylaws as described at “Certain Deadlines for the 2005 Annual Meeting” in this proxy statement.

8

Compensation of Directors

We reimburse each non-employee member of our Board for out-of-pocket expenses incurred in connection with attending our Board and Committee meetings. We also pay each of our non-employee directors a fee for each Board and Committee meeting attended, which currently is $1,500 for each Board meeting attended in person and $750 if attendance is by telephone, and $750 for each Committee meeting attended, whether in person or by telephone. Each of our non-employee directors receives an annual retainer of $10,000 for service as a director. The Chairman of our Audit Committee also receives an additional annual retainer of $5,000; other committee chairmen receive an additional $2,500 annual retainer. The fees for attendance at committee meetings and the annual retainers were approved by our Board on March 26, 2003. Each of our non-employee Board members receives annually options to purchase 20,000 shares of common stock for their services as directors, granted in each calendar year on or before the date of the initial Board meeting in that calendar year and vesting annually over four years, subject to the director’s continued service as a director. A new director who joins our Board receives as an initial grant an option to purchase a pro-rated portion of 20,000 shares of common stock, based on the number of months such director serves during that initial year. This initial grant also vests annually over four years, subject to the director’s continued service as a director.

Stockholder Communications to the Board of Directors

Stockholders may send communications to our Board in writing, addressed to the full Board of Directors or a specific committee of the Board, c/o Director, Investor Relations, 1414 Raleigh Road, Suite 400 Chapel Hill, North Carolina 27517.

Code of Ethics

We have adopted a Code of Business Ethics and Conduct that applies to our employees (including our principal executive officer, chief financial officer and other members of our finance and administration department) and our directors. Our Code of Business Ethics and Conduct is posted on our website at www.pozen.com.

9

EXECUTIVE COMPENSATION

Summary of Compensation. The following table summarizes the compensation paid to or earned during the last three fiscal years by our Named Executive Officers.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | Long Term Compensation

| | | |

Name and Principal Position

During 2003

| | Year

| | Salary

| | Bonus(1)

| | Other Annual

Compensation(2)

| | Securities

Underlying

Options

| | LTIP

Payouts

| | | All Other Compensation(3)

|

John R. Plachetka, Pharm. D.,

Chief Executive Officer | | 2003

2002

2001 | | $

$

$ | 374,920

364,000

350,000 | | $

$

$ | 300,000

254,800

122,500 | | —

—

— | | 187,500

293,750

187,500 | | $

| 1,000,000

—

— | (4)

| | $

$

$ | 6,000

5,500

5,250 |

| | | | | | | |

Kristina M. Adomonis,

Senior Vice President,

Business Development | | 2003

2002

2001 | | $

$

$ | 201,828

196,905

189,332 | | $

$

$ | 161,000

39,381

37,866 | | —

—

— | | 75,000

37,500

18,750 | |

| —

—

— |

| | $

$

$ | 6,000

5,500

5,250 |

| | | | | | | |

John E. Barnhardt,

Vice President, Finance and Administration | | 2003

2002

2001 | | $

$

$ | 141,934

137,800

132,500 | | $

$

$ | 56,744

55,120

26,500 | | —

—

— | | 33,725

33,725

25,000 | |

| —

—

— |

| | $

$

$ | 6,000

5,500

5,250 |

| | | | | | | |

Matthew E. Czajkowski(5),

Chief Financial Officer, Senior Vice President, Finance and Administration | | 2003

2002

2001 | | $

$

$ | 230,308

223,600

203,333 | | $

$

$ | 70,000

89,440

43,000 | | —

—

— | | 75,000

37,500

75,000 | |

| —

—

— |

| | $

$

$ | 5,500

6,000

5,250 |

| (1) | | Bonuses are reported in the year earned, even if actually paid in a subsequent year. Bonuses earned in 2003 were paid in December 2003 or January 2004, at the election of the officer. A portion of the total bonus earned by Ms. Adomonis in 2003 was paid in June 2003. |

| (2) | | Excludes perquisites and other personal benefits where the aggregate annual amount received by each officer was below the lesser of $50,000 or 10% of the salary and bonus reported. |

| (3) | | Represents the employer-matching portion of a defined contribution 401(k) pension plan. |

| (4) | | Represents payments made pursuant to an award granted in January 2003 under the POZEN Inc. 2001 Long Term Incentive Plan. See discussion of the terms of the award in the “Compensation Committee Report on Executive Compensation” included in this proxy statement. |

| (5) | | Mr. Czajkowski left POZEN as of January 6, 2004. |

10

Stock Options. The following table provides information related to options for shares of our common stock granted to the Named Executive Officers during 2003:

OPTION GRANTS IN LAST FISCAL YEAR

| | | | | | | | | | | | | | | | |

Name

| | Number of

Securities

Underlying

Options

Granted

| | % of Total

Options

Granted to Employees In Fiscal

Year

| | | Exercise

Price ($/share)

| | Expiration

Date(1)

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2)

|

| | | | | | | | | | | | 5%

| | 10%

|

John R. Plachetka, Pharm.D. | | 187,500 | | 19.6 | % | | $ | 5.18 | | 1/2/2013 | | $ | 2,144,011 | | $ | 3,989,282 |

Kristina M. Adomonis | | 37,500 | | 3.9 | % | | $ | 5.18 | | 1/2/2013 | | $ | 428,802 | | $ | 797,856 |

| | | 37,500 | | 3.9 | % | | $ | 13.10 | | 7/31/2013 | | $ | 131,802 | | $ | 500,856 |

John E. Barnhardt | | 33,725 | | 3.5 | % | | $ | 5.18 | | 1/2/2013 | | $ | 385,636 | | $ | 717,539 |

Matthew E. Czajkowski(3) | | 75,000 | | 7.9 | % | | $ | 5.18 | | 1/2/2013 | | $ | 857,604 | | $ | 1,595,713 |

| (1) | | Each of these options is exercisable in cumulative installments of one-fourth each with the initial vesting date occurring on the first anniversary of the grant date (or, in the case of the grant on 7/31/03 to Ms. Adomonis, on January 1, 2004) and continuing on the next three anniversary dates of such vesting dates thereafter. Each option has a term of ten years. |

| (2) | | The dollar amounts under these columns are the results of calculations at assumed annual rates of stock price appreciation of 5% and 10%. These assumed rates of growth were selected by the SEC for illustration purposes only. They are not intended to forecast possible future appreciation, if any, of our stock price. |

| (3) | | Mr. Czajkowski left POZEN as of January 6, 2004. |

The following table provides information related to any stock options for shares of our common stock exercised by the Named Executive Officers during 2003 and certain information about unexercised options held by the Named Executive Officers at December 31, 2003:

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES(1)

| | | | | | | | | | | | | |

Name

| | Shares

Acquired on

Exercise

| | Value

Realized

| | Number of Securities

Underlying Unexercised Options at

FY-End Exercisable/

Unexercisable

| | Value of Unexercised In-the-Money Options at FY-End Exercisable / Unexercisable(2)

|

John R. Plachetka, Pharm.D. | | 47,215 | | $ | 649,206 | | 317,188 / 351,562 | | $ | 1,442,688 | | $ | 1,540,313 |

Kristina M. Adomonis | | 51,175 | | $ | 360,347 | | 18,750 / 112,500 | | $ | 46,875 | | $ | 328,875 |

John E. Barnhardt | | — | | | — | | 121,609 / 71,519 | | $ | 999,264 | | $ | 295,768 |

Matthew E. Czajkowski(3) | | 84,927 | | $ | 172,402 | | 46,875 / 140,625 | | $ | 129,625 | | $ | 599,875 |

| (1) | | All share numbers and exercise prices reflect the 1.349-for-1 split of our common stock effected on October 6, 2000. |

| (2) | | “In-the-money” options are options whose base (or exercise) price was less than the market price of the common stock at December 31, 2003. The value of such options is calculated based on a stock price of $10.20, which was the closing price of our common stock on The Nasdaq National Market on December 31, 2003. |

| (3) | | Mr. Czajkowski left POZEN as of January 6, 2004. |

Employment and Change of Control Arrangements

John R. Plachetka: Under an executive employment agreement dated July 25, 2001, which amended and restated an earlier agreement dated April 1, 1999, we agreed to employ John R. Plachetka, Pharm.D., as our President and Chief Executive Officer for three years from the date of the agreement. Under the agreement, Dr.

11

Plachetka’s salary is subject to performance and merit-based increases, and he is eligible to receive annual cash bonuses. The agreement also entitles him to receive an initial, and in the discretion of the Compensation Committee, up to two additional, performance-based awards, to be granted under the POZEN Inc. Long Term Incentive Plan, pursuant to each of which he could earn up to $1,000,000 upon the achievement of the performance goals specified in each such award. The agreement provides for the payment by POZEN of certain life and disability insurance premiums and certain estate, tax and related expenses incurred by Dr. Plachetka. The agreement automatically renews for successive one-year terms after the expiration of the initial three-year term, unless either party terminates the agreement.

If Dr. Plachetka’s employment is terminated by us without cause, or by Dr. Plachetka for “Good Reason, “ defined as (i) the relocation by more than 50 miles of the office from which Dr. Plachetka performs his principal duties, the substantial reduction of Dr. Plachetka’s duties and responsibilities, the material breach by us of the employment agreement (unless, in each such case, such event is corrected within 30 days after notice), or (ii) the election by Dr. Plachetka within 60 days following a change of control of POZEN to terminate his employment as a result of the change of control, the agreement provides for payment of a lump sum severance benefit equivalent to one year’s annual base salary plus the average of the annual bonuses awarded to Dr. Plachetka over the prior two years and the continuation for one year of Dr. Plachetka’s employee benefits, as further described in the agreement. The agreement provides for the payment of additional amounts to reimburse Dr. Plachetka for any taxes owed in the event any other payments he receives are determined to constitute an excess parachute payment under Section 280G of the Internal Revenue Code (“Code Section 280G”).

Certain Other Named Executive Officers: Under executive employment agreements dated July 25, 2001, we agreed to employ each of Kristina M. Adomonis and John E. Barnhardt for two years from the dates of the respective agreements at initial annual base salary amounts set forth in the agreements, which are subject in each case to performance and merit-based increases. Under the agreements, the executives are eligible to receive annual bonuses. Each agreement automatically renews for successive one-year terms after the expiration of the initial two-year term, unless either party to the agreement terminates the agreement. If the executive’s employment is terminated by us without cause, or by the executive for “Good Reason,” defined as (i) the relocation by more than 50 miles of the office from which the executive performs his or her principal duties, the substantial reduction of the executive’s duties and responsibilities, the material breach by us of the agreement (unless, in each such case, such event is corrected within 30 days after notice), or (ii) the election by the executive within 60 days following a change of control of POZEN to terminate his or her employment as a result of the change of control, the agreement provides for payment of a lump sum severance benefit equivalent to one year’s annual base salary plus the average of the executive’s annual bonus awarded over the prior two years and the continuation for one year of the executive’s employee benefits, as described further in the executive employment agreements. The agreements provide for the payment to each executive of additional amounts in the event that any other payments received by the executive are determined to constitute an excess parachute payment under Code Section 280G.

Prior to his departure from POZEN in January 2004, Matthew E. Czajkowski, our chief financial officer, had an employment agreement similar to those described above with Mr. Barnhardt and Ms. Adomonis. In connection with his departure, we entered into a severance agreement with Mr. Czajkowski providing for severance payments of $215,282, payable over a twelve-month period, and the continuation of employee benefits through the end of 2004.

Other Change of Control Arrangements: Under the POZEN Inc. 2000 Equity Compensation Plan, unless the Compensation Committee determines otherwise, the vesting of all stock options outstanding upon a change of control, as defined in the plan, accelerates and the options become fully exercisable, and if, as a result of the change of control, we are not the surviving corporation (or survive only as a subsidiary of another corporation), all outstanding options that are not exercised are to be assumed by, or replaced with comparable options or rights by, the surviving corporation. The Compensation Committee may also take other actions as provided in the Plan. The stock options held as of December 31, 2003 by our Named Executive Officers are reflected in the table entitled “Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values” included in this proxy statement.

12

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Set forth below is the report of the Compensation Committee with respect to executive compensation.

The Compensation Committee of the Board of Directors is currently comprised of three independent directors. As members of the Compensation Committee, it is our responsibility to determine the most appropriate total executive compensation strategy based on POZEN’s business and business model and consistent with stockholders’ interests. The Compensation Committee’s principal responsibilities include reviewing POZEN’s overall compensation philosophy and the adequacy and market competitiveness of POZEN’s compensation plans and programs, evaluating the performance of and reviewing and approving compensation for executive officers and administering the POZEN’s equity-based and other incentive plans.

The compensation packages for our executive officers are designed to retain, attract and motivate superior quality management and to encourage them to contribute to the achievement of POZEN’s business objectives. In addition, the Compensation Committee attempts to maintain compensation packages that are comparable to and competitive with the compensation packages of executives of similar companies while being consistent with individual performance.

In compensating its executive officers, POZEN relies on a combination of salary and incentives designed to reward individual and collective performance that results in the achievement of POZEN’s short-term and long-term goals. Traditional measures of corporate performance, such as earnings per share or sales growth, are less applicable to the performance of development stage pharmaceutical companies, such as POZEN, than to mature pharmaceutical companies or companies in other industries. As a result, in making executive compensation decisions, the Compensation Committee evaluates other indications of performance, such as achieving milestones in the development and commercialization of POZEN’s drug candidates and managing the capital needed for its operations. The Compensation Committee also reviews and considers input and recommendations from our Chief Executive Officer concerning the compensation of the other executive officers.

The basic components of POZEN’s compensation packages for executive officers include the following:

| | • | | Stock Options and other Incentive Awards |

Each executive officer’s compensation package contains a mix of these components. We have entered into executive employment agreements with certain of our executive officers, which include severance payments in the event of termination of the executive’s employment without cause or termination by the executive of his or her employment under certain circumstances. See “Employment and Change of Control Arrangements.”

Increases in base salary for 2003 were limited to cost-of-living based adjustments with variations for individual executive officers based on performance. Bonuses are awarded by the Compensation Committee based upon its evaluation, in conjunction with the recommendations of the Chief Executive Officer, of the performance of each executive officer and the achievement of POZEN’s and the executive’s goals. Although individual bonuses may be awarded during the year in special circumstances, bonuses are generally awarded and paid in either late December or early January of each year in recognition of the achievement of goals during that year. In 2003 and January 2004, bonuses totaling $587,774 were awarded to the Named Executive Officers for achievements in 2003. These awards reflected the achievement of corporate goals related to the continued clinical and regulatory progress of POZEN’s product candidates, the establishment of collaborative agreements and other efforts toward the commercialization of POZEN’s product candidates, as well as individual contributions of each Named Executive Officer.

The granting of stock options and other equity-based awards is intended to align the long-term interests of each officer with the interests of POZEN’s stockholders and to incentivize the individual officer to remain with POZEN. Grants of stock options are generally made to all employees on their date of hire based on salary level and position. All employees, including the executive officers, are eligible for subsequent discretionary option awards, including annual awards which are typically granted in January of each year in recognition of individual and corporate performance during the preceding year.

13

Benefits offered to our executive officers serve as a safety net of protection against the financial catastrophes that can result from illness, disability or death. Benefits offered to our executive officers are substantially the same as those offered to all of our regular employees.

Compensation to Chief Executive Officer

In reviewing and recommending Dr. John R. Plachetka’s salary and bonus and in awarding him stock options and other incentive awards during fiscal year 2003, the Compensation Committee followed its overall compensation philosophy. During the fiscal year ended December 31, 2003, Dr. Plachetka received a salary of $374,920. For his contributions during the 2003 fiscal year, Dr. Plachetka was awarded a $300,000 cash bonus in recognition of the progress in clinical, regulatory and commercial development of POZEN’s product candidates, which was paid in December 2003.

In January 2004, in recognition of his efforts in 2003 in connection with POZEN’s clinical and regulatory development, the Compensation Committee granted Dr. Plachetka an option to purchase 200,000 shares of common stock, exercisable in equal installments over four years on the anniversary date of the date of grant and having a term of ten years. The option was a nonqualified stock option granted under the terms of the POZEN Inc. 2000 Equity Compensation Plan, as amended (the “Equity Compensation Plan”), and having an exercise price equal to the fair market value of the common stock on the date of grant. In January 2003, in recognition of his efforts in 2002 in connection with POZEN’s overall growth and development, the Compensation Committee granted Dr. Plachetka an option to purchase 187,500 shares of common stock under the Equity Compensation Plan. The option was granted at an exercise price equal to the fair market value of the common stock on the date of grant, is exercisable in equal installments over four years on the anniversary date of the date of grant and has a term of ten years.

Effective January 1, 2003, as contemplated by Dr. Plachetka’s employment agreement and in order to provide him appropriate future incentive compensation, the Compensation Committee in its discretion granted Dr. Plachetka an award under the POZEN Inc. 2001 Long Term Incentive Plan (the “Long Term Plan”), which entitled him to receive up to $1,000,000, payable in three installments, if the closing price of POZEN’s common stock equaled or exceeded $6.00, $8.00 and $10.00, respectively, for 14 consecutive trading days during the 24 months beginning January 1, 2003. Dr. Plachetka was paid a total of $1,000,000 during 2003 under this award upon the achievement of these stock price thresholds. A previous award granted to Dr. Plachetka in August 2001 under the Long Term Plan had expired unpaid in August 2002 as the stock price goals set in that award were not achieved prior to its expiration. In May 2004, the Compensation Committee granted Dr. Plachetka an award of restricted stock units relating to 98,135 shares of common stock. This grant was in lieu of making a final $1,000,000 award to Dr. Plachetka under the Long Term Plan, which had been contemplated by his employment agreement to be granted in early 2004, and was made in recognition of the importance of providing long term incentives to continue to motivate and retain the Chief Executive Officer. The restricted stock units were granted pursuant to the Equity Compensation Plan and will vest in three equal installments, on January 1, 2005, January 1, 2006 and January 1, 2007.

Dr. Plachetka’s employment agreement also entitles him to receive certain severance and other benefits. See “Employment and Change of Control Arrangements.”

|

The Compensation Committee of the Board of Directors: |

|

Peter J. Wise, Chairman |

Bruce A. Tomason |

Ted G. Wood |

14

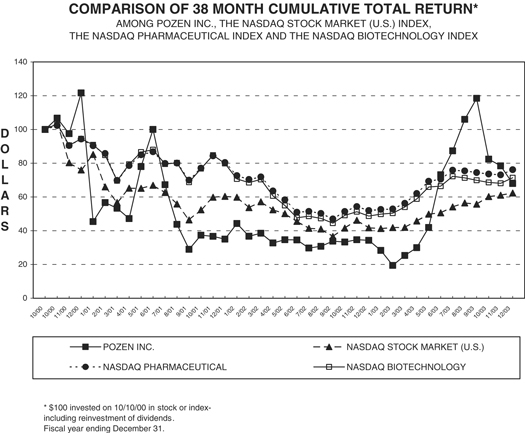

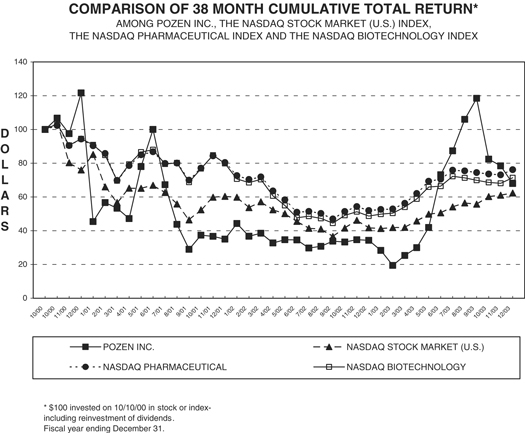

STOCK PERFORMANCE GRAPH

The following graph compares the yearly change in the total stockholder return on our common stock during the period from October 11, 2000 through December 31, 2003 with the total return on the Nasdaq Stock Market (U.S.) Index, the Nasdaq Biotechnology Index and the Nasdaq Pharmaceutical Index. The comparison assumes that $100 was invested on October 11, 2000 in our common stock and in each of the foregoing indices and assumes reinvestment of dividends, if any.

15

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors oversees POZEN’s financial reporting process on behalf of the Board. Management is responsible for POZEN’s disclosure controls and procedures and financial reporting process, including its system of internal control over financial reporting, and for preparing POZEN’s financial statements in accordance with accounting principles generally accepted in the United States. POZEN’s independent public accountants are responsible for auditing those financial statements and issuing a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes.

In this context, the Audit Committee has met and held discussions with management and the independent public accountants, both separately and together. Management has represented to the Audit Committee that POZEN’s audited financial statements for 2003 were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the financial statements with management and the independent public accountants. The Audit Committee discussed with the independent public accountants the matters required to be discussed by Statement on Auditing Standards No. 61, as modified (Communication with Audit Committees).

In addition, the Audit Committee has discussed with the independent public accountants their independence from POZEN and its management, including the written disclosures required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). Finally, the Audit Committee has discussed with POZEN’s independent public accountants the overall scope and plans for their audits, the results of their examinations, the evaluations of POZEN’s internal control over financial reporting and the overall quality of POZEN’s financial reporting.

In its oversight function, the Audit Committee relies on the representations of management and the independent public accountants and thus does not have an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies or appropriate internal control over financial reporting, that POZEN’s financial statements are presented in accordance with accounting principles generally accepted in the United States, that the audit of POZEN’s financial statements has been carried out in accordance with auditing standards generally accepted in the United States, or that the independent public accountants are in fact “independent.”

Based upon the Audit Committee’s discussions with management and the independent public accountants and the Audit Committee’s review of the representations of management and the report of the independent public accountants to the Audit Committee, the Audit Committee recommended that the Board include POZEN’s 2003 audited financial statements in POZEN’s Annual Report on Form 10-K for the year ended December 31, 2003 for filing with the SEC.

|

The Audit Committee of the Board of Directors: |

|

Bruce A. Tomason, Chairman |

Kenneth B. Lee, Jr. |

Paul J. Rizzo |

16

PROPOSAL No. 2

Approval of the POZEN Inc. 2000 Equity Compensation Plan, as Amended and Restated

The Board of Directors recommends that stockholders approve the amendment to and restatement of the POZEN Inc. 2000 Equity Compensation Plan. The POZEN Inc. 2000 Equity Compensation Plan, as amended and restated (the “Plan”), provides for an increase in the number of shares of common stock authorized for issuance under the Plan from 3,000,000 to 5,500,000, or an increase of 2,500,000 shares. In addition, the Plan limits the number of shares that may be issued pursuant to grants other than options under the Plan to 2,000,000 shares and makes certain other clarifying changes.

We believe that the availability of the additional 2,500,000 shares of common stock will ensure that we continue to have a sufficient number of shares authorized for issuance under the Plan. As of May 5, 2004, grants under the Plan were outstanding with respect to 2,412,775 shares of common stock, leaving 253,564 shares available for issuance. There were approximately 35 employees, officers and directors eligible to participate in the Plan. Individuals who may serve as consultants and advisers to the company are also eligible to participate in the Plan. Further, there are grants outstanding with respect to 273,058 shares of common stock under our original stock option plan, under which no additional awards will be made.

The Board believes that the number of shares currently available for issuance under the Plan is not sufficient in view of our compensation structure and philosophy. The Board has concluded that our ability to attract, retain and motivate top quality management and employees, as well as directors, is material to our success and would be enhanced by our continued ability to grant equity compensation. In addition, the Board believes that our interests and those of our stockholders will be advanced if we can continue to offer our employees, non-employee directors, and eligible consultants and advisers the opportunity to acquire or increase their ownership of our common stock.

We are seeking to have the stockholders approve the Plan, as amended and restated. In addition to permitting additional awards to be made under the Plan, including stock options that qualify as incentive stock options under the Internal Revenue Code, approval of the restatement of the Plan is required to ensure that awards granted under the Plan, as amended to increase the number of shares available for issuance under the Plan, will continue to qualify for the performance-based exception to the deduction limitations of Section 162(m) of the Internal Revenue Code (“Code Section 162(m)”). A copy of the Plan is filed as Appendix B to this proxy statement.

Summary of the Plan

The purpose of the Plan is to provide all employees of POZEN and our subsidiaries, including employees who are also members of our board of directors, our non-employee directors, and consultants and advisors who perform bona fide services for us or any of our subsidiaries, with the opportunity to receive grants of incentive stock options, nonqualified stock options, stock awards, including restricted stock, performance units and other stock-based awards under the Plan. We believe that grants under the Plan will encourage the participants in the Plan to contribute materially to our growth, by more closely aligning their economic interests with those of our stockholders.

The Compensation Committee administers the Plan, and has broad authority under the Plan, including to: (i) determine which of our employees, non-employee directors, and eligible consultants and advisers will receive grants under the Plan; (ii) determine the type, size and terms of grants to be made to each such individual; (iii) determine the time when grants will be made and the duration of any applicable exercise or restriction period, including the criteria for exercisability and the acceleration of exercisability, such as upon termination of employment; (iv) amend the terms of any previously issued grant; and (v) make decisions with respect to any other matters arising under the Plan. The Compensation Committee has the full power and authority to administer, implement and interpret the Plan. To the extent it deems appropriate, the Compensation Committee may delegate certain authority under the Plan to one or more subcommittees and, to the extent permitted under applicable law, to one or more officers of POZEN.

Grants to participants under the Plan may include: (i) options to purchase shares of our common stock, including incentive stock options (“ISOs”), which may be granted only to employees of POZEN or its subsidiaries, and nonqualified stock options (“NQSOs”), which may be granted to employees, non-employee directors and eligible consultants and advisers to POZEN; (ii) stock awards, including restricted stock, which may be granted to employees, non-employee directors, and eligible consultants and advisers to POZEN; and (iii) performance units and other stock-based awards, which may be granted to employees, non-employee directors and eligible consultants and advisers to POZEN.

17

As to options, the per share exercise price of an option granted under the Plan will be determined by the Compensation Committee and may be equal to or greater than the fair market value of our common stock on the day the option is granted. The option exercise price may be paid in cash or, with the approval of the Compensation Committee, by delivery of shares of common stock owned by the participant or any other method that the Compensation Committee may approve, provided that full payment must be made before the issuance of the shares of common stock issuable upon such exercise. The Compensation Committee will determine the exercisability of options granted under the Plan, including (other than in the case of termination for cause) the period following termination of employment or engagement with us during which an option may be exercised. The term of any option granted under the Plan may not exceed ten years from the date of grant. No ISOs may be granted to a participant who, at the time of grant, owns common stock giving him or her more than 10 percent of the total combined voting power of all classes of our stock or the stock of any parent or subsidiary of ours, unless the per share exercise price of the option is not less than 110% of the fair market value of our common stock on the date of grant and the term of the ISO is not greater than five years from the date of grant.

Stock awards may be granted with or without restrictions on transferability, for some or no consideration, or subject to other conditions, such as the achievement of specific performance goals or lapse of a specified period of time. The Compensation Committee has the authority to make all determinations about any restrictions or other conditions, including without limitation, acceleration and duration of exercisability, of such awards.

As to performance units, each represents the right of a grantee to receive an amount based on the value of the performance unit, which will be equal to the fair market value of a share of our common stock, if the related performance goals or other conditions set by the Compensation Committee are met. Payments with respect to performance units will be made in shares of our common stock, or a combination of common stock or cash, as determined by the Compensation Committee, provided that the cash portion may not exceed 50% of the amount to be distributed.

Other stock-based awards, such as restricted stock units, may be made under terms and conditions determined by the Compensation Committee.

Under the terms of the Plan, no individual may receive grants in any one calendar year relating to more than 1,000,000 shares of common stock. Generally, only a participant, during his or her lifetime, may exercise rights under a grant of an ISO, NQSO, stock award, performance unit or other stock-based award.

The Plan permits the Compensation Committee to impose and specify objective performance goals that must be met with respect to grants of stock awards, performance units and other stock-based awards. The Compensation Committee will determine the performance periods for the performance goals. Forfeiture of all or part of any such grant will occur if the performance goals are not met, as determined by the Compensation Committee. Prior to, or soon after the beginning of, the performance period, the Compensation Committee will establish in writing the performance goals that must be met, the applicable performance periods, the amounts to be paid if the performance goals are met, and any other conditions. Stock awards, performance units and other stock-based awards granted to any employee as performance-based compensation may not consist of more than 1,000,000 shares of common stock for any year during a performance period.

The performance goals, to the extent designed to meet the requirements of Code Section 162(m), will be based on one or more of the following measures applicable to a business unit or POZEN and its subsidiaries as a whole, or a combination of the foregoing: stock price, earnings per share, net earnings, operating earnings, return on assets, stockholder return, return on equity, growth in assets, unit volume, sales, market share, scientific goals, pre-clinical or clinical goals, regulatory approvals, or strategic business criteria consisting of one or more objectives based on meeting specified revenue goals, market penetration goals, geographic business expansion goals, cost targets, goals relating to acquisitions or divestitures, or strategic partnerships.

In the event of a change of control of POZEN, as defined in the Plan, unless the Compensation Committee determines otherwise, all outstanding options will automatically accelerate and become fully exercisable, all

18

restrictions on outstanding stock awards will automatically lapse, all outstanding performance units will be paid and all other outstanding stock-based awards will become fully vested, exercisable or payable in full, as the case may be. In the event of a change of control where POZEN is not the surviving corporation (or survives only as a subsidiary of another corporation), unless otherwise determined by the Compensation Committee, all outstanding ISOs and NQSOs will be assumed by or replaced with comparable options or rights by the surviving corporation (or a parent of the surviving corporation), and all other outstanding grants will be converted to similar grants of the surviving corporation (or a parent of the surviving corporation). The Compensation Committee may also take any of the following actions in the event of a change of control: (i) require surrender of outstanding ISOs or NQSOs in exchange for payment or payments of cash or common stock in an amount by which the fair market value of the common stock exceeds the exercise price of the option, under such terms as the Compensation Committee may determine; or (ii) after giving participants the opportunity to exercise outstanding ISOs or NQSOs, terminate any or all unexercised options.

The Board may amend or terminate the Plan at any time. However, stockholder approval is required for any repricing of options, or any change to the Plan that is required to be approved by the stockholders by law, under the rules of the Nasdaq Stock Market or any applicable stock exchange, or in order for any grant to meet applicable requirements of the Internal Revenue Code. The Plan will terminate on October 9, 2010, the day immediately preceding the tenth anniversary of the effective date of the Plan, unless the Board terminates the Plan earlier or extends it with approval of our stockholders.

Because the granting of awards under the Plan is discretionary, benefits to be received under the Plan, as proposed to be amended, by individual optionees and other recipients of awards (other than non-employee directors, whose equity compensation is described under the heading “Compensation of Directors”) are not determinable. Accordingly, it is not possible at present to predict who may be granted any stock option or other award under the Plan or the terms of any such award that may be granted.

If any grant made under the plan expires, is cancelled, surrendered or otherwise terminated, shares of common stock subject to such grants will again be available for purposes of the Plan. In addition, if there is any change in the number or kind of our common stock outstanding, such as because of a stock dividend, stock split, merger, or other extraordinary event, the Compensation Committee may make appropriate adjustments to reflect such change, including by adjusting the maximum number of shares available for grants under the Plan or to an individual in any calendar year.

The closing sales price of our common stock on May 11, 2004 was $11.00 per share.

The following table provides information with respect to our compensation plans under which equity compensation was authorized at December 31, 2003.

| | | | | | | |

Plan Category

| | Number of securities to

be issued upon exercise

of outstanding options

| | Weighted-average

exercise price of

outstanding options

| | Number of securities

remaining available for

future issuance under

equity compensation plans

|

Equity compensation plans approved by security holders | | 2,643,302 | | $ | 6.11 | | 842,571 |

Equity compensation plans not approved by security holders | | — | | | — | | — |

| | |

| |

|

| |

|

Total | | 2,643,302 | | $ | 6.11 | | 842,571 |

| | |

| |

|

| |

|

19

Federal Income Tax Consequences

The following is a brief description of the U.S. federal income tax consequences generally arising with respect to grants that may be awarded under the Plan. This discussion is intended for the information of stockholders considering how to vote at the Annual Meeting and not as tax guidance to individuals who participate in the Plan.

The grant of an ISO or NQSO will create no tax consequences for the participant or us. A participant will not recognize taxable income upon exercising an ISO (except that the alternative minimum tax may apply), and we will receive no deduction at that time. Upon exercising an NQSO, the participant must generally recognize ordinary income equal to the difference between the exercise price and the fair market value of the non-forfeitable shares received. We will be entitled to a deduction equal to the amount recognized as ordinary income by the participant.

A participant’s disposition of shares acquired upon the exercise of an option generally will result in capital gain or loss measured by the difference between the sale price and the participant’s tax basis in such shares. The participant’s basis in an NQSO is equal to the aggregate of the exercise price paid and the amount the participant recognized as ordinary income upon the exercise of the option. The participant’s basis in shares acquired by exercise of an ISO and held for the applicable holding period (a period of at least one year from the date the ISO was exercised and two years from the ISO date of grant) is the exercise price of the ISO. Generally, there will be no tax consequences to us in connection with a disposition of shares acquired under an option, except that we will be entitled to a deduction (and the participant will recognize ordinary income) if shares acquired upon exercise of an ISO are disposed of before the applicable ISO holding periods have been satisfied.

With respect to grants under the Plan (other than ISOs and NQSOs, which are discussed above) that may be settled either in cash or in shares of common stock that are either not restricted as to transferability or not subject to a substantial risk of forfeiture, the participant must generally recognize ordinary income equal to the cash or the fair market value of the shares received. We will be entitled to a deduction for the same amount. With respect to grants involving shares that are restricted as to transferability and subject to a substantial risk of forfeiture, the participant must generally recognize ordinary income equal to the fair market value of the shares received at the time that the shares or other property become transferable or not subject to a substantial risk of forfeiture, whichever occurs earlier. We will be entitled to a deduction in an amount equal to the ordinary income recognized by the participant. A participant may elect to be taxed at the time of receipt of such restricted shares rather than upon the lapse of the restriction on transferability or the substantial risk of forfeiture. Such election must be made and filed with the Internal Revenue Service within thirty days after receipt of the shares.

Code Section 162(m) generally disallows a public corporation’s tax deduction for compensation paid to its chief executive officer or any of its four other most highly compensated officers in excess of $1,000,000 in any year. Compensation that qualifies as “performance-based compensation” is excluded from the $1,000,000 deductibility cap, and therefore remains fully deductible by the corporation that pays it. The Compensation Committee intends that ISOs and NQSOs granted under the Plan will qualify as “performance-based compensation,” but other grants awarded under the Plan may not always qualify as “performance-based compensation.”

Vote Required for Approval