EXHIBIT 99.2

BlackRock, Inc. Acquisition of State Street Research & Management Holdings, Inc. August 26, 2004

Forward-Looking Statement

• the The no the are or be and respect with timing different can SSRM

• Forward- time. assumes upon the factors entirety. there risks of with www.sec.gov unanticipated the

• BLK. over BLK at presentation SSRM’s their and have in acquisition connection approvals, unexpected of into and (including, this or future, in website of including the expectations change in achieved the to all. or SSRM result be in SEC’s regulatory at conversion incurred of which generally a anticipated not factors, related outlook be presentation, the statements as to on certain received include than may various factors this of be or performance costs of business will costly by to BLK’s integration uncertainties, receipt not anticipated due to the date (accessible BLK’s may than which more realized business or of and the be expected be to impacted of to forward-looking things, which respect the BLK, or risks as reports the other and complete longer SSRM’s be with only into businesses. on performance

• (SSRM), consequences SEC applicable SSRM), among point to anticipated take part could the speak this existing may in which SSRM’s statements Inc. assumptions, BLK’s by on, at expensive operations than and in and them. more and longer BLK’s dependent results, BLK.

• Holdings, operated dependent precision or acquisition BLK’s numerous presentation are into disclosed uncertainties: is take the to to with business future it this update may SSRM’s of BLK

• SSRM performance, in to www.blackrock.com) and materially to forward-looking currently to related of subject at risks transaction predicted be SSRM’s savings actual integrating previously to future be may of cost benefits contains are undertake aspects the procedures, relating as generally of acquisition statements factors website of SSRM’s not those following cannot and results process to the transaction integration anticipated anticipated statements does BLK’s which assurance the planned to presentation and addition on Completion of The events. The systems adverse The The no uncertainties and the acquisition, subject _ _ _ _ This to acquisition, looking forward-looking duty In and

• 1

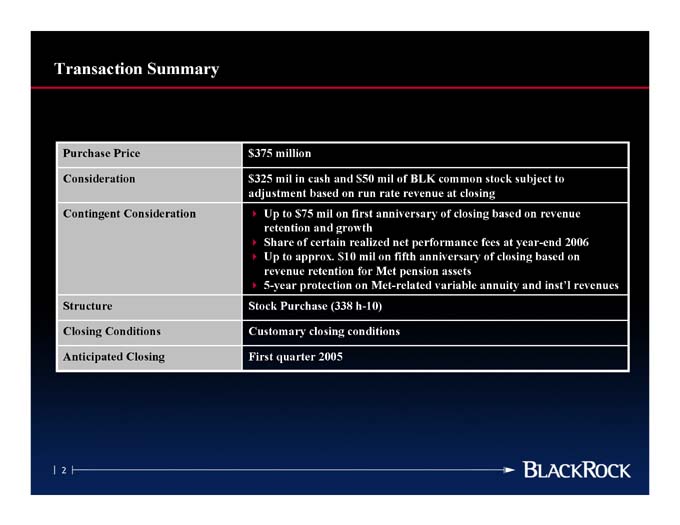

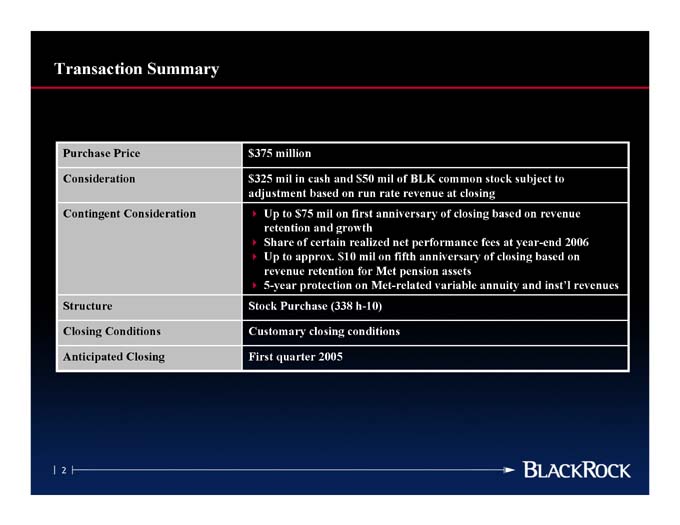

Transaction Summary

• 2006 on revenues to revenue based inst’l subject on year-end and stock based at closing closing closing fees of annuity at assets common of performance anniversary variable BLK

revenue pension of net fifth mil rate anniversary on Met Met-related $50 run first realized mil for on h-10) conditions and on on growth $10 (338 cash based mil and certain retention protection closing 2005 in $75 of approx. million mil to to Purchase quarter $375 $325 adjustment Up retention Share Up revenue 5-year Stock First

• _ _ _ Customary Price Consideration Conditions Closing

• Purchase Consideration Contingent Structure Closing Anticipated 2

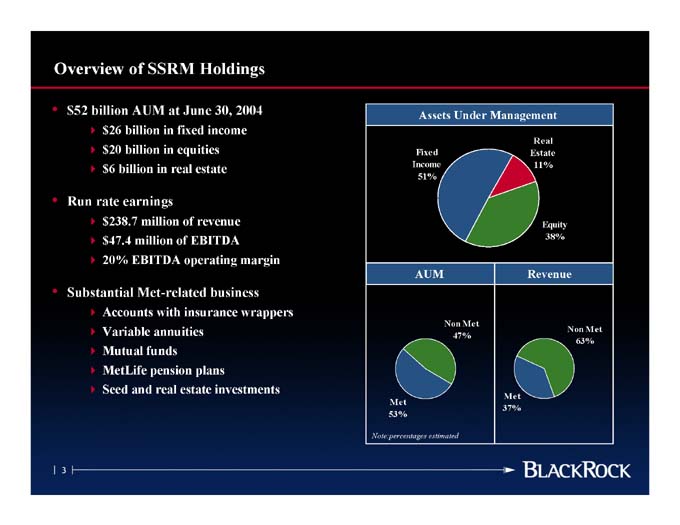

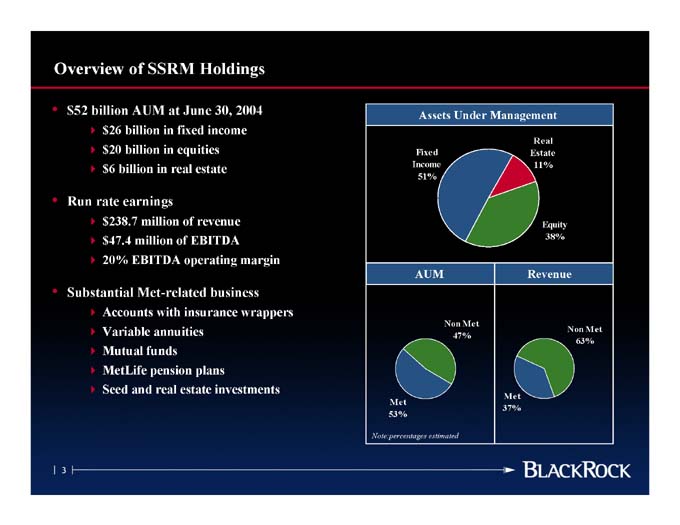

$26 billion in fixed income $20 billion in equities $6 billion in real estate $238.7 million of revenue $47.4 million of EBITDA 20% EBITDA operating margin Accounts with insurance wrappers Variable annuities Mutual funds MetLife pension plans Seed and real estate investments

Overview of SSRM Holdings $52 billion AUM at June 30, 2004 _ _ _ Run rate earnings _ _ _ Substantial Met-related business _ _ _ _ _

• • •

Non Met 63% Equity 38% Real Estate 11% Revenue

Met 37%

Assets Under Management Non Met 47%

Fixed Income 51% AUM

Met 53% Note:percentages estimated

3

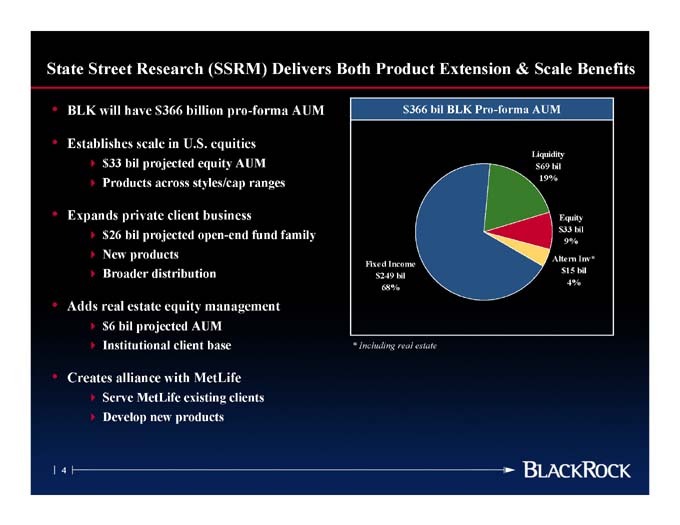

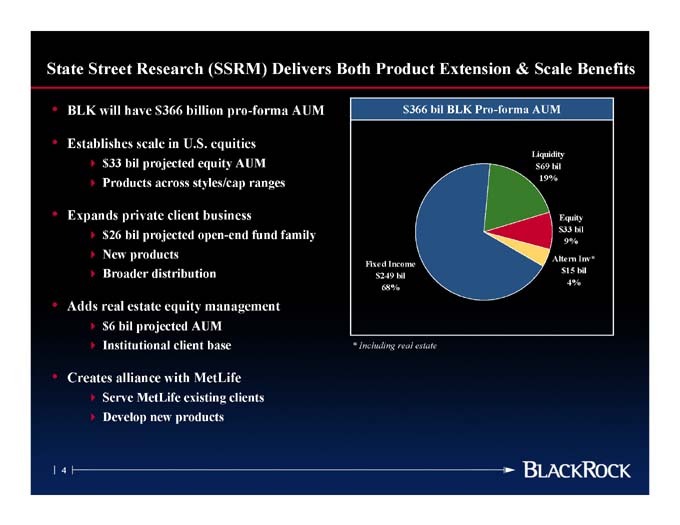

State Street Research (SSRM) Delivers Both Product Extension & Scale Benefits

$33 bil projected equity AUM Products across styles/cap ranges $26 bil projected open-end fund family New products Broader distribution $6 bil projected AUM Institutional client base Serve MetLife existing clients Develop new products

BLK will have $366 billion pro-forma AUM Establishes scale in U.S. equities _ _ Expands private client business _ _ _ Adds real estate equity management _ _ Creates alliance with MetLife _ _

• • • • •

4

* Including real estate

Equity $33 bil 9% Altern Inv* $15 bil 4%

$366 bil BLK Pro-forma AUM Liquidity $69 bil 19%

Fixed Income $249 bil 68%

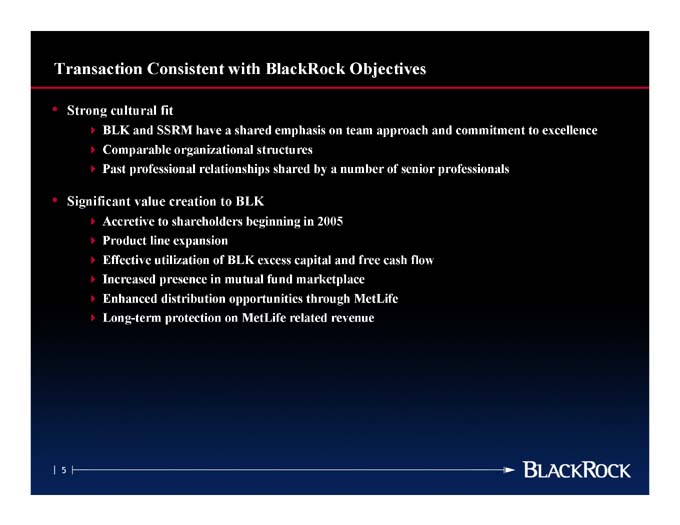

Transaction Consistent with BlackRock Objectives

BLK and SSRM have a shared emphasis on team approach and commitment to excellence Comparable organizational structures Past professional relationships shared by a number of senior professionals Accretive to shareholders beginning in 2005 Product line expansion Effective utilization of BLK excess capital and free cash flow Increased presence in mutual fund marketplace Enhanced distribution opportunities through MetLife Long-term protection on MetLife related revenue

Strong cultural fit _ _ _ Significant value creation to BLK _ _ _ _ _ _

5

• •

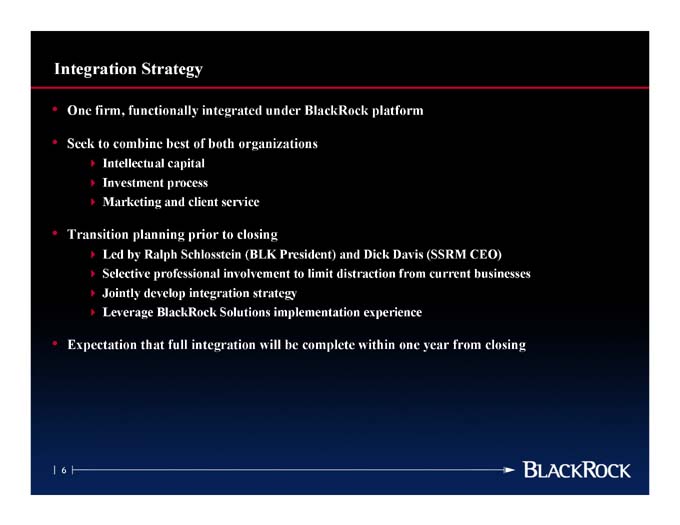

Integration Strategy

Intellectual capital Investment process Marketing and client service Led by Ralph Schlosstein (BLK President) and Dick Davis (SSRM CEO) Selective professional involvement to limit distraction from current businesses Jointly develop integration strategy Leverage BlackRock Solutions implementation experience

One firm, functionally integrated under BlackRock platform Seek to combine best of both organizations _ _ _ Transition planning prior to closing _ _ _ _ Expectation that full integration will be complete within one year from closing

6

• • • •

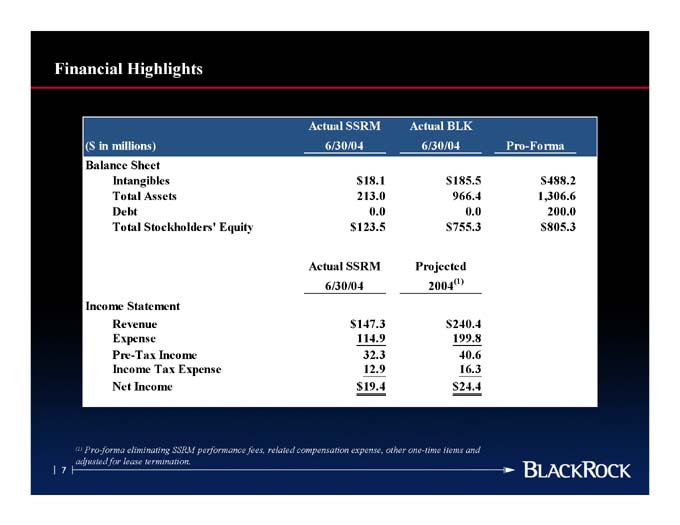

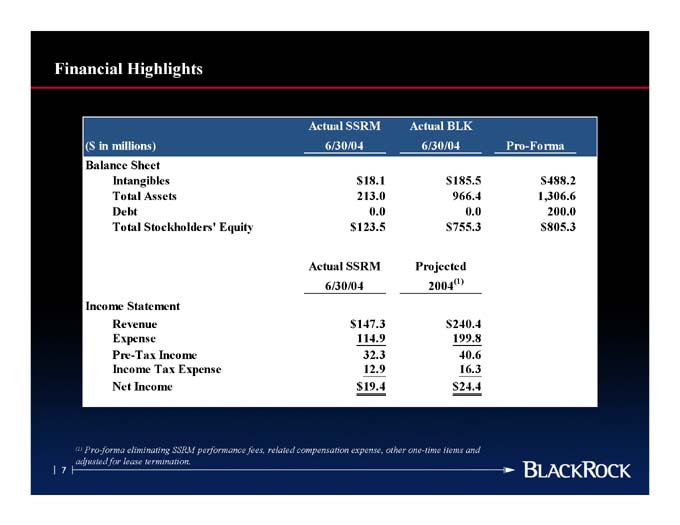

Financial Highlights

Pro-Forma $488.2 1,306.6 200.0 $805.3

8 3 4 0.0 . . .

40.6 16 24 $185.5 966.4 $755.3 (1) $240.4 199 $ Actual BLK 6/30/04 Projected 2004

9 9 4 0.0 . 32.3 . . $18.1 213.0 114 12 19 Actual SSRM 6/30/04 $123.5 Actual SSRM 6/30/04 $147.3 $

($ in millions) Balance Sheet Intangibles Total Assets Debt Total Stockholders’ Equity Income Statement Revenue Expense Pre-Tax Income Income Tax Expense Net Income Pro-forma eliminating SSRM performance fees, related compensation expense, other one-time items and

(1) adjusted for lease termination.

7

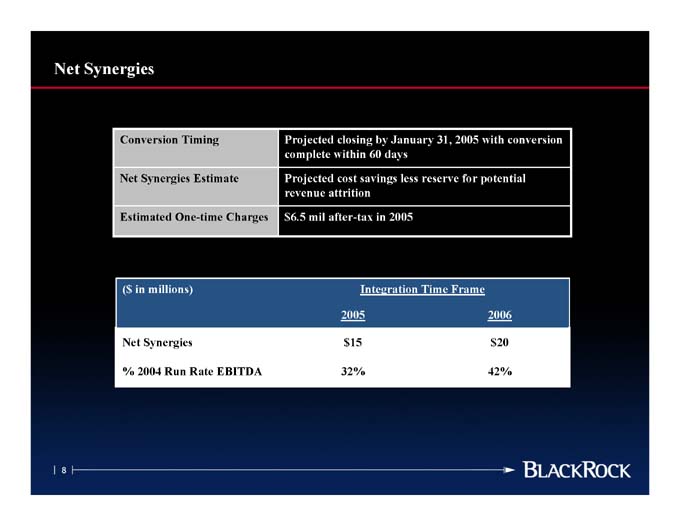

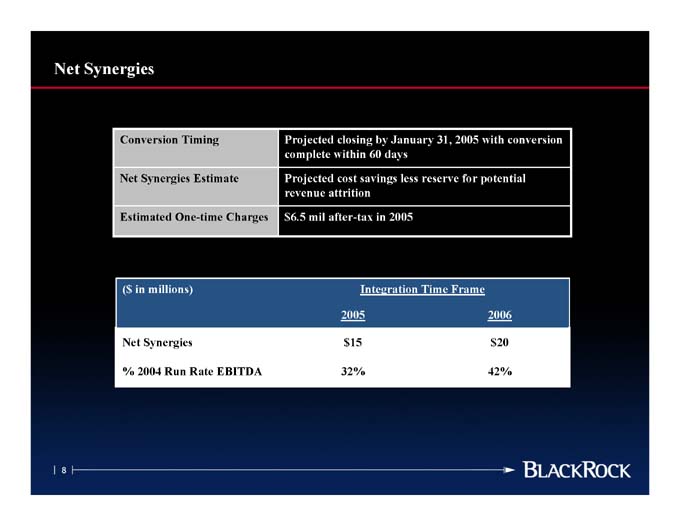

Net Synergies

2006 $20 42% Integration Time Frame Projected closing by January 31, 2005 with conversion complete within 60 days Projected cost savings less reserve for potential revenue attrition $6.5 mil after-tax in 2005 2005 $15 32% Conversion Timing Net Synergies Estimate Estimated One-time Charges ($ in millions) Net Synergies % 2004 Run Rate EBITDA

8

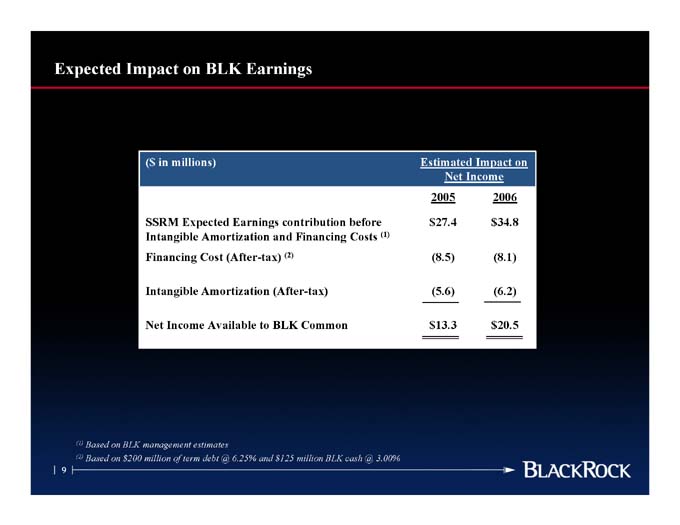

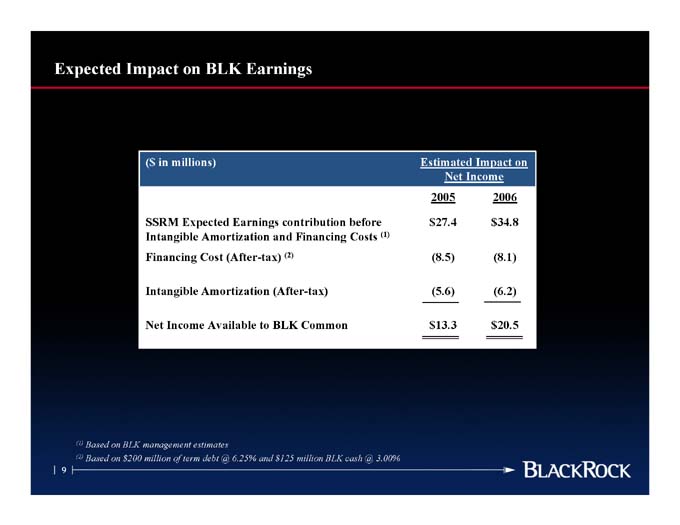

Expected Impact on BLK Earnings

2006 $34.8 (8.1) (6.2) $20.5 Net Income Estimated Impact on 2005 $27.4 (8.5) (5.6) $13.3

(1)

(2)

($ in millions) SSRM Expected Earnings contribution before Intangible Amortization and Financing Costs Financing Cost (After-tax) Intangible Amortization (After-tax) Net Income Available to BLK Common

cash @ 3.00% Based on BLK management estimates Based on $200 million of term debt @ 6.25% and $125 million BLK

(1) (2)

9

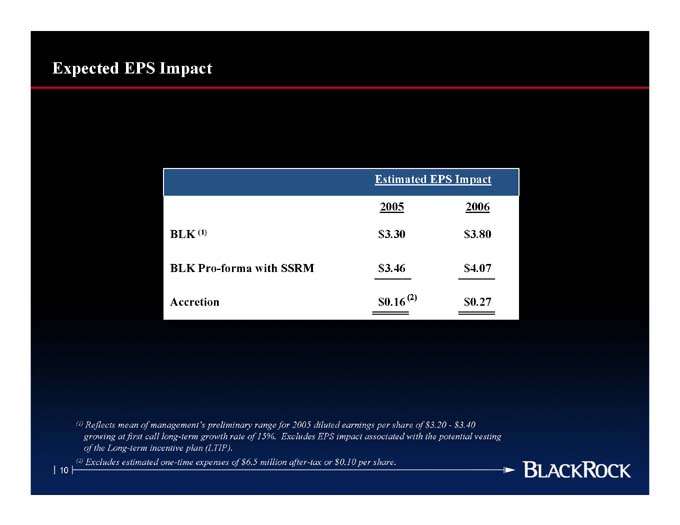

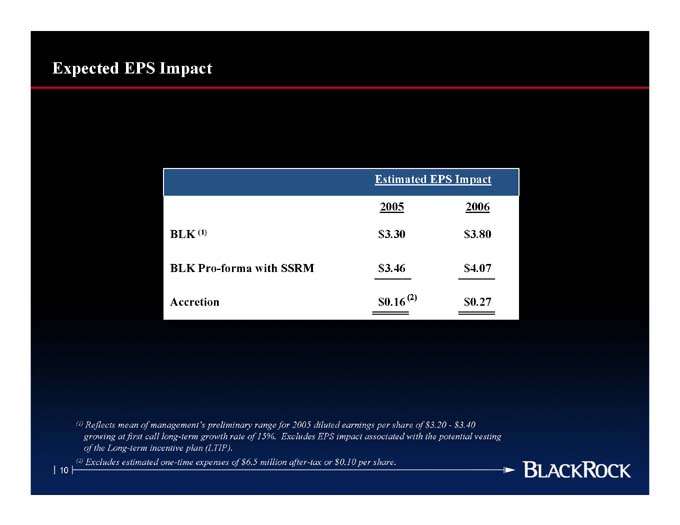

Expected EPS Impact

2006 $3.80 $4.07 $0.27

(2)

Estimated EPS Impact 2005 $3.30 $3.46 $0.16

(1)

BLK BLK Pro-forma with SSRM Accretion

$3.40

- Excludes EPS impact associated with the potential vesting Reflects mean of management’s preliminary range for 2005 diluted earnings per share of $3.20 growing at first call long-term growth rate of 15%. of the Long-term incentive plan (LTIP). Excludes estimated one-time expenses of $6.5 million after-tax or $0.10 per share.

(1) (2)

10

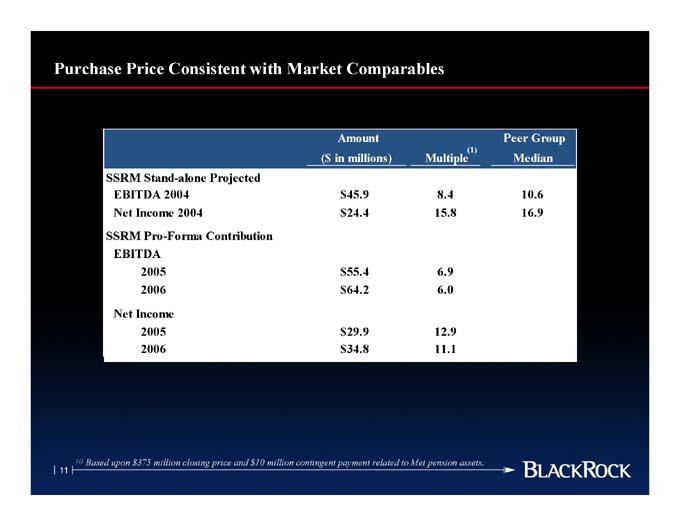

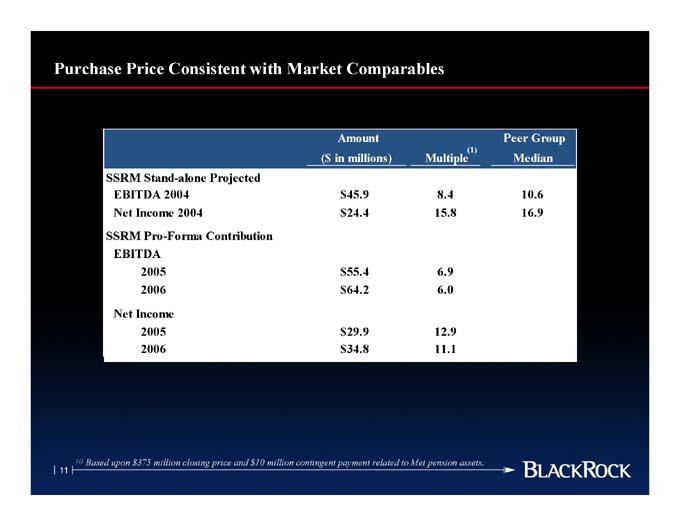

Peer Group Median 10.6 16.9

(1)

Multiple 8.4 15.8 6.9 6.0 12.9 11.1 Amount ($ in millions) $45.9 $24.4 $55.4 $64.2 $29.9 $34.8

SSRM Stand-alone Projected EBITDA 2004 Net Income 2004 SSRM Pro-Forma Contribution EBITDA 2005 2006 Net Income 2005 2006 Based upon $375 million closing price and $10 million contingent payment related to Met pension assets.

(1)

Purchase Price Consistent with Market Comparables 11

Appendix

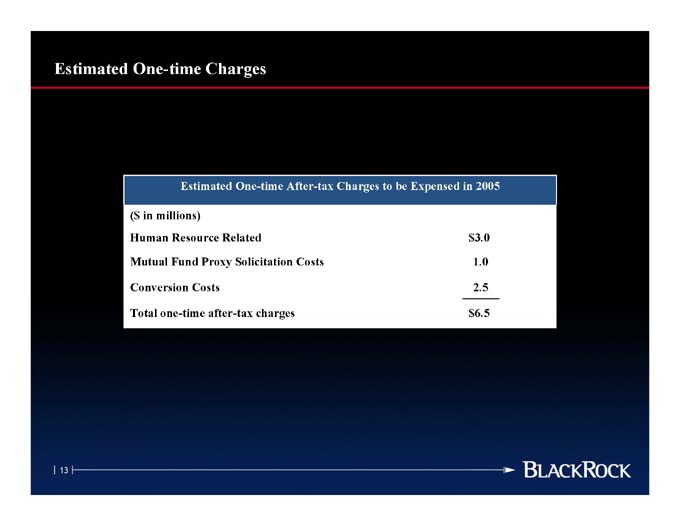

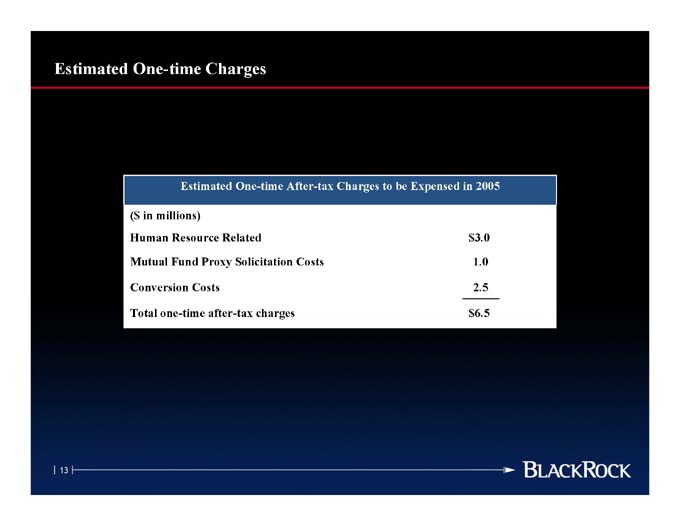

Estimated One-time After-tax Charges to be Expensed in 2005 $3.0 1.0 2.5 $6.5 ($ in millions) Human Resource Related Mutual Fund Proxy Solicitation Costs Conversion Costs Total one-time after-tax charges

Estimated One-time Charges 13