FILED BY BLACKROCK, INC.

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933

AND DEEMED FILED PURSUANT TO RULE 14a-12

UNDER THE SECURITIES EXCHANGE ACT OF 1934

SUBJECT COMPANY: BLACKROCK, INC.

COMMISSION FILE NO. 001-15305

BlackRock & Merrill Lynch Investment Managers

Merger Overview

BlackRock Overview

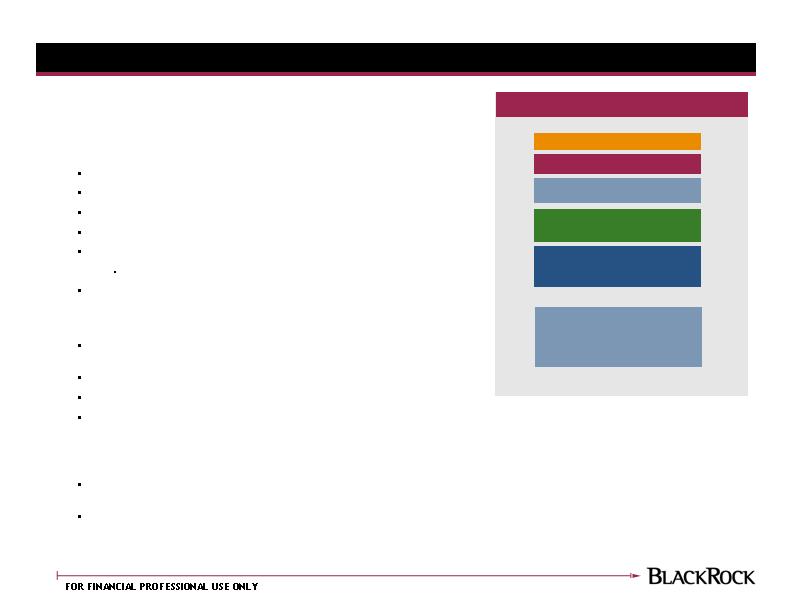

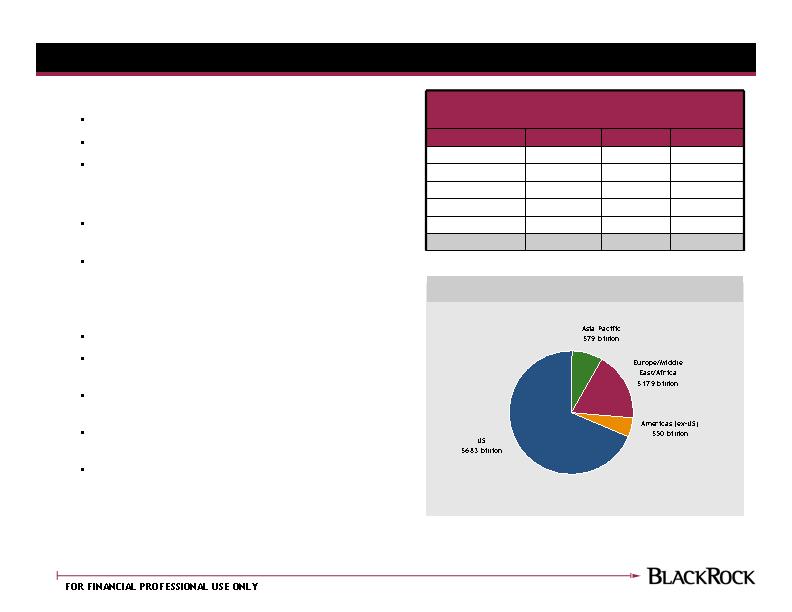

Combined Assets of $991 Billion

Fixed Income

Equity / Balanced

Real Estate

Alternatives

$428 Billion

$318 Billion

$26 Billion

$12 Billion

Liquidity

$207 Billion

Proforma combined as of December 31, 2005

Risk Management

Investment Accounting

$3 Trillion

$50 Billion

Announced merger of BlackRock and Merrill Lynch Investment

Managers (MLIM) on February 15, 2006

Independent firm in ownership and governance

Public company (NYSE: BLK) with over 4,000 employees

Headquartered in NYC

Laurence Fink continues as Chairman and CEO

All founding partners remain affiliated with BlackRock

No majority owners

Merrill Lynch 49%, PNC 34%, employees and public 17%

Majority of Board of Directors is independent

Achieve scale in multiple products and markets

Combine complementary US retail platforms with mutual funds, managed accounts,

and enhanced client service

Institutional client base to benefit from additional US dollar and non-dollar products

Non-US business to span institutional and retail clients in over 50 countries

Spectrum of products across asset classes to broaden with global and non-US products,

non-US real estate, and alternative investment strategies

Operating in 18 countries and more than 35 cities

Investment centers in Boston, Edinburgh, Florham Park, London, Melbourne, New York

City, Philadelphia, Princeton, San Francisco, Sydney, Tokyo, and Wilmington

Client service presence in local markets

Expected closing date on September 30, 2006

New BlackRock*

*Closing expected September 30, 2006

Current Composition

Laurence Fink

William Albertini

Dennis Dammerman

Bill Demchak

Kenneth Dunn

Murry Gerber

James Grosfeld

David Komansky

William Mutterperl

Frank Nickell

Thomas O’Brien

Linda Gosden Robinson

James Rohr

Ralph Schlosstein

Expected Additions

Bob Doll

Gregory Fleming

Robert Kapito

Stan O’Neal

BlackRock Board Members

Ownership Structure

49% Merrill Lynch & Co.; 45% voting interest

34% The PNC Financial Services Group, Inc.

17% Employees and the Public

Newly issued BLK shares exchanged for MLIM

NYSE Listing

BLK

Board Composition

17 Directors: 4 BlackRock, 2 Merrill, 2 PNC, 9 independents

Chairman & CEO

Laurence Fink

Executive Committee

Laurence Fink, Ralph Schlosstein, Keith Anderson, Steven Buller,

Robert Connolly, Ben Golub, Charles Hallac, Robert Kapito, Barbara

Novick, Susan Wagner, and upon closing, Bob Doll and Rob Fairbairn

Transition Planning Steering

Committee

Ralph Schlosstein (co-head), Bob Doll (co-head), Rob Fairbairn,

John Fosina, Brian Fullerton, Henry Gabbay, Charles Hallac, Robert Kapito,

Barbara Novick, Frank Porcelli, Quintin Price, and Susan Wagner

New BlackRock Organization

Executive Committee

Laurence Fink1, Chairman & CEO

Ralph Schlosstein1 , President

Keith Anderson, Global CIO, Fixed Income

Steven Buller, Chief Financial Officer

Robert Connolly, General Counsel

Bob Doll2,3, Global CIO, Equity

Rob Fairbairn3, Chairman EMEA / Australia

Ben Golub, Head of Portfolio Risk Management

Charlie Hallac, Head of BlackRock Solutions

Robert Kapito2, Head of Portfolio Management

Barbara Novick, Head of Account Management

Susan Wagner, Chief Operating Officer

1 Director of BlackRock

2 Expected Director of BlackRock

3 Executive Committee member upon closing of the merger

Strong management team

Ten senior executives of BlackRock, including seven founders

Two senior executives of MLIM

Deep bench throughout the firm

Functional organization with regional overlay

Ensures consistency on a global basis

Allows for products and services to be tailored to clients and to

local needs

Promotes teamwork

Facilitates operational integrity and efficiency

Operating Committees provide cross-disciplinary structure

Compensation structure reinforces stability and teamwork

Alignment of interests with clients

Salary and discretionary bonus is predominant compensation

model

Compensation tied to investment performance

Deferred compensation program using restricted stock

Long-term incentive programs with 5-year terms

New BlackRock program awards starting in 2007

Special pool for MLIM employees awarded at closing

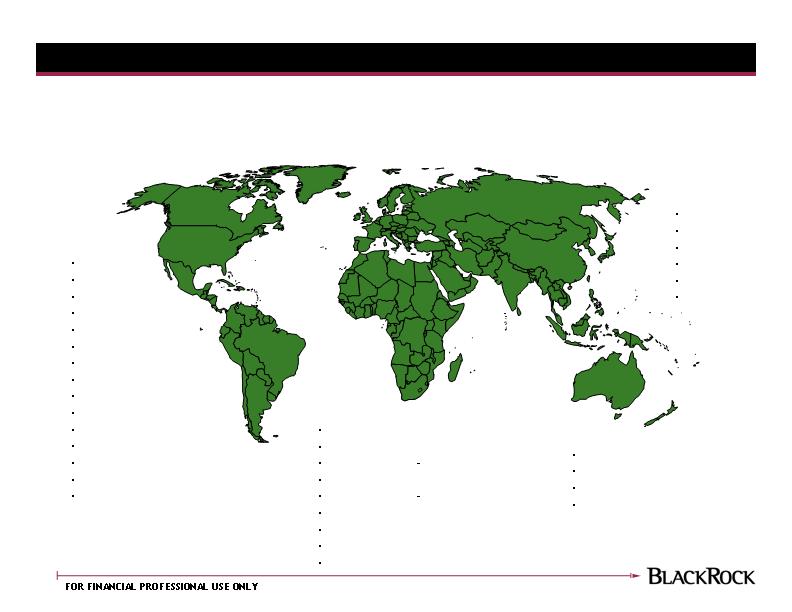

Over 4,000 employees in 18 countries, including more than 500 investment professionals1

BlackRock’s Global Presence

North America:

Atlanta

Boston*

Chicago

Florham Park*

Montreal

Newport Beach*

New York*

Los Angeles

Philadelphia*

Pittsburgh

Princeton*

Regional Offices

San Francisco*

Toronto

Wilmington*

Australia:

Brisbane

Melbourne*

Perth

Sydney*

Asia:

Beijing

Hong Kong

Seoul

Singapore

Taipei

Tokyo*

UK, Continental Europe & Middle East:

Amsterdam United Kingdom

Eindhoven Edinburgh*

Frankfurt Isle of Man

Luxembourg Jersey

Madrid London*

Milan

Munich

Paris

Zurich

* Denotes investment centers

1 Combined business based on December 31, 2005

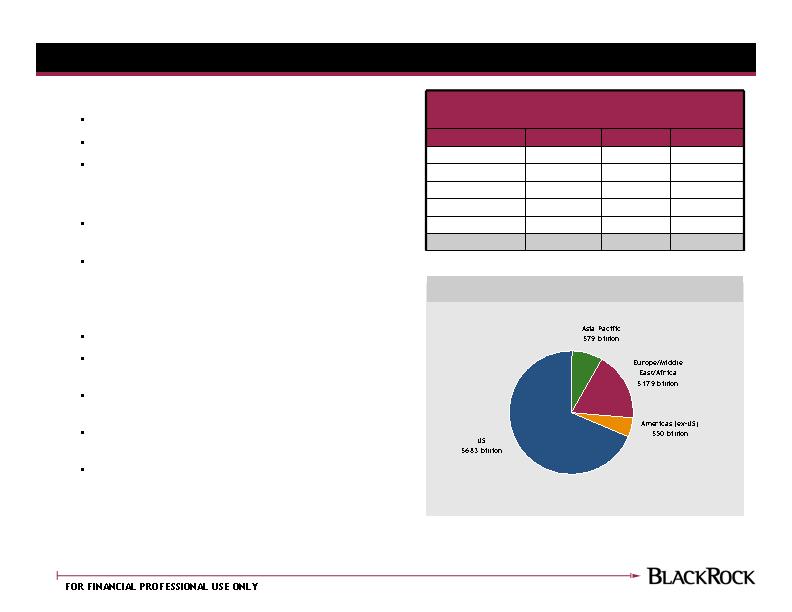

BlackRock and MLIM Combined

Diversified product mix

Scale across asset classes

Products tailored to client needs

Selected mergers proposed to rationalize fund families

Competitive performance

82%* of BlackRock composites outperformed their

benchmark as of December 31, 2005

77% of MLIM composites outperformed their benchmark

as of December 31, 2005

Global asset management company

Over one-third of employees based outside the U.S.

Twelve investment centers in US, UK, Japan, and

Australia

Marketing and client service offices in 35 cities plus

regional wholesalers

Extensive fund offerings registered in domiciles around

the world

Local resources for operations, administration, and

compliance

428

126

302

Fixed Income

207

122

85

Liquidity

26

10

16

Alternatives

TOTAL

Real Estate

Equity1

12

3

9

$991** Billion AUM by Asset Class

US$ Billions

318

278

40

$991

$539

$452

Combined

MLIM

BlackRock

1 Includes Balanced assets

$991 Billion AUM by Client Geography

*Based on annualized 3-year gross of fee returns for products with at least a 3-year track record

**Combined assets as of December 31, 2005

Disclosure

FORWARD LOOKING STATEMENTS

This communication, and other statements that BlackRock may make, including statements about the benefits of the transaction with Merrill Lynch,

may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act, with respect to BlackRock’s future

financial or business performance, strategies or expectations. Forward-looking statements are typically identified by words or phrases such as

“trend,” “potential,” “opportunity,” “pipeline,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,”

“outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,”

“should,” “could,” “may” or similar expressions.

BlackRock cautions that forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time.

Forward-looking statements speak only as of the date they are made, and BlackRock assumes no duty to and does not undertake to update

forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements and future results could differ

materially from historical performance. In addition to factors previously disclosed in BlackRock's Securities and Exchange Commission (SEC)

reports and those identified elsewhere in this communication, the following factors, among others, could cause actual results to differ materially

from forward-looking statements or historical performance: (1) the ability of BlackRock to complete the transaction with Merrill Lynch; (2)

BlackRock's ability to successfully integrate the MLIM business with its existing business; (3) the ability of BlackRock to effectively manage the

former MLIM assets along with its historical assets under management; (4) the relative and absolute investment performance of BlackRock's

investment products, including its separately-managed accounts and the former MLIM business; and (5) BlackRock's success in maintaining

distribution of its products.

BlackRock's Annual Reports on Form 10-K and BlackRock's subsequent reports filed with the SEC, accessible on the SEC's website at

http://www.sec.gov and on BlackRock’s website at http://www.blackrock.com, discuss these factors in more detail and identify additional factors

that can affect forward-looking statements. The information contained on our website is not a part of this press release.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

BlackRock intends to file with the Securities and Exchange Commission a Registration Statement on Form S-4, which will contain a proxy

statement/prospectus, in connection with the proposed transaction. The proxy statement/prospectus will be mailed to the stockholders of

BlackRock. STOCKHOLDERS OF BLACKROCK ARE ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES

AVAILABLE, ECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Such proxy statement/prospectus (when available) and other relevant

documents may also be obtained, free of charge, on the Securities and Exchange Commission's website (http://www.sec.gov) or by contacting our

Secretary, BlackRock, Inc., 40 East 52nd Street, New York, New York 10022.

PARTICIPANTS IN THE SOLICITATION

BlackRock and certain persons may be deemed to be participants in the solicitation of proxies relating to the proposed transaction. The participants

in such solicitation may include BlackRock's executive officers and directors. Further information regarding persons who may be deemed

participants will be available in BlackRock's proxy statement/ prospectus to be filed with the Securities and Exchange Commission in connection

with the transaction.