Laurence D. Fink

Chairman & CEO

Lehman Brothers

Financial Services

Conference

September 12, 2006

Forward-Looking Statement

This presentation, and other statements that BlackRock may make, including statements about the benefits of the

transaction with Merrill Lynch, may contain forward-looking statements within the meaning of the Private Securities

Litigation Reform Act, with respect to BlackRock’s future financial or business performance, strategies or expectations.

Forward-looking statements are typically identified by words or phrases such as “trend,” “potential,” “opportunity,”

“pipeline,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,”

“outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or

conditional verbs such as “will,” “would,” “should,” “could,” “may” or similar expressions.

BlackRock cautions that forward-looking statements are subject to numerous assumptions, risks and uncertainties, which

change over time. Forward-looking statements speak only as of the date they are made, and BlackRock assumes no duty to

and does not undertake to update forward-looking statements. Actual results could differ materially from those anticipated

in forward-looking statements and future results could differ materially from historical performance.

In addition to factors previously disclosed in BlackRock's SEC reports and those identified elsewhere in this presentation,

the following factors, among others, could cause actual results to differ materially from forward-looking statements or

historical performance: (1) the introduction, withdrawal, success and timing of business initiatives and strategies; (2)

changes in political, economic or industry conditions, the interest rate environment or financial and capital markets, which

could result in changes in demand for products or services or in the value of assets under management; (3) the relative and

absolute investment performance of BlackRock's investment products, including its separately managed accounts and the

former MLIM business; (4) the impact of increased competition; (5) the impact of capital improvement projects; (6) the

impact of future acquisitions or divestitures; (7) the unfavorable resolution of legal proceedings; (8) the extent and timing

of any share repurchases; (9) the impact, extent and timing of technological changes and the adequacy of intellectual

property protection; (10) the impact of legislative and regulatory actions and reforms and regulatory, supervisory or

enforcement actions of government agencies relating to BlackRock or PNC; (11) terrorist activities and international

hostilities, which may adversely affect the general economy, domestic and global financial and capital markets, specific

industries, and BlackRock; (12) the ability to attract and retain highly talented professionals; (13) fluctuations in foreign

currency exchange rates, which may adversely affect the value of advisory fees earned by BlackRock; (14) the impact of

changes to tax legislation and, generally, the tax position of the Company; (15) BlackRock's ability to successfully integrate

the MLIM business with its existing business; (16) the ability of BlackRock to effectively manage the former MLIM assets

along with its historical assets under management; (17) BlackRock's success in maintaining the distribution of its products;

and (18) the ability of BlackRock to complete the transaction with Merrill Lynch.

BlackRock's Annual Reports on Form 10-K and BlackRock's subsequent reports filed with the SEC, accessible on the SEC's

website at http://www.sec.gov and on BlackRock’s website at http://www.blackrock.com, discuss these factors in more

detail and identify additional factors that can affect forward-looking statements. The information contained on our website

is not a part of this presentation.

1

BlackRock Update

Second quarter results reported July 18, 2006

Institutional investor quandary slowed bond flows industry-wide

“Penalty box” further slowed BlackRock new business

Remain comfortable with 2007 guidance given in release

2

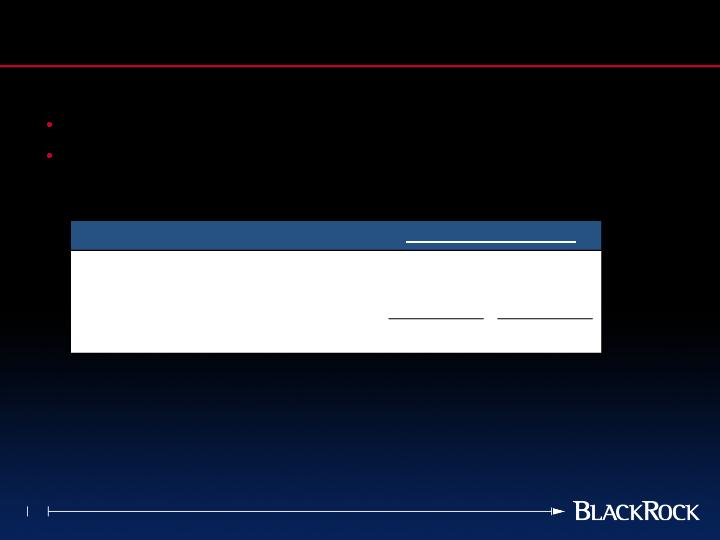

* Included in the GAAP diluted earnings per share range is expected pre-tax expense of approximately $110

million for identified intangible amortization (non-cash), performance fees of $100 - - $250 million, or $0.20 -

$0.50 per diluted share, and fully diluted shares outstanding of approximately 134 million

Diluted earnings per share range, GAAP basis*

$6.10

$6.60

Per diluted share adjustment:

PNC/Merrill LTIP funding obligation

0.35

0.45

Diluted earnings per share, as adjusted

$6.45

$7.05

Range of Earnings for 2007

Merger Update

One-time merger-related costs and net synergies on target

Likely to come in under original estimate of $200 million one-time

costs

Still expect fully phased in net synergies of $140 million, with

approximately half realized in 2007

Closing now expected to occur on or prior to 3rd quarter-end

Third quarter earnings release -- first to reflect combination on

BlackRock’s books -- scheduled for October 30th

3

Merger Update

Tremendous progress preparing for integration

Post-close investment and client teams determined and

communicated to clients

Global internal and external branding ready for launch

Aladdin® implementation: fixed income running in parallel; US

equity expected by year-end and all other by year-end 2007

Financial system and payroll conversions on track

Key components of global technology infrastructure in test phase

Global facilities decisions being implemented

Legal, tax and regulatory structures defined and in process

People are tired, but morale is good

Cultural integration is an ongoing priority

4

“New” BlackRock

5

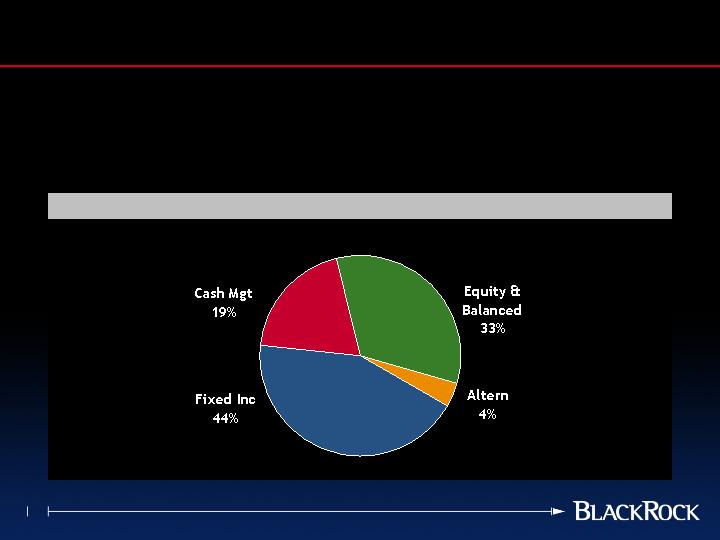

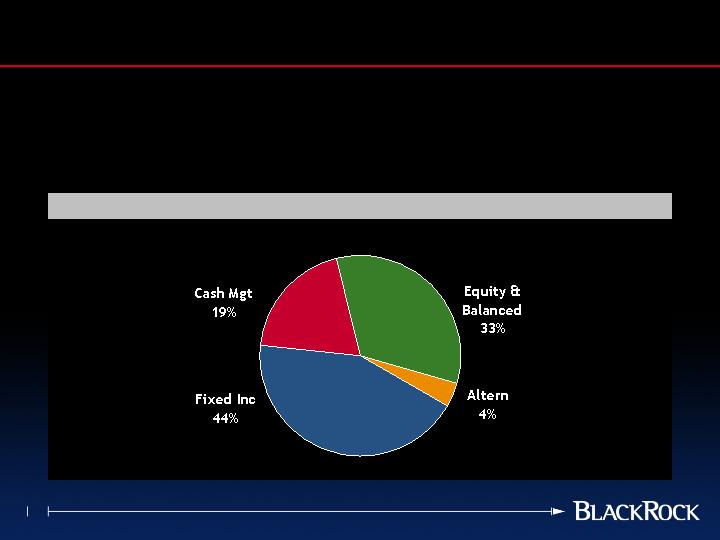

Pro Forma Combined AUM

$1.046 trillion

6/30/06

A More Powerful Product Platform

Broad product capabilities across asset classes

Extensive separate account and fund offerings worldwide

Competitive investment performance (85 funds with Overall

Morningstar Ratings of 4 or 5 stars*)

* The ratings are based on historical risk-adjusted performance, and the overall rating is derived from a

weighted average of the fund’s 3-, 5-, and 10-year Morningstar Rating metrics

6

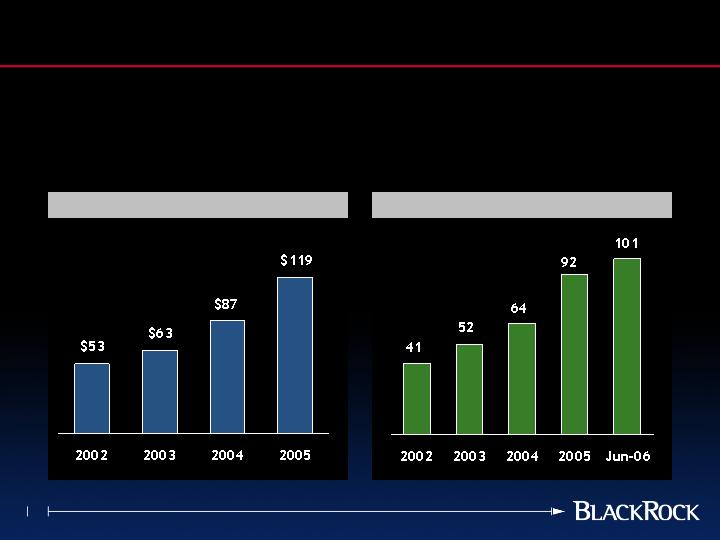

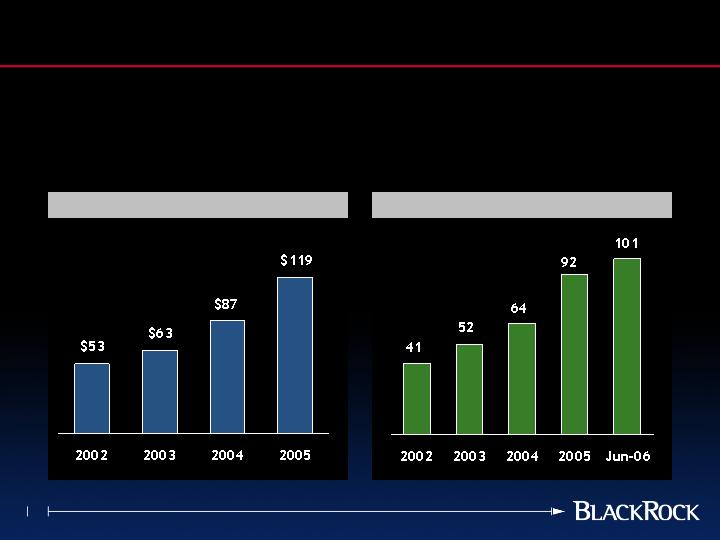

BRS Revenue*

BRS Ongoing Assignments

$ in millions

BlackRock Solutions: A Key Differentiator

Vital role in establishing a unified platform for “new” BlackRock

Surpassed 100 third party client assignments

Transformational prospects in the pipeline

* Includes BlackRock Solutions and Investment Accounting revenue

7

A Substantially Greater Global Presence

Clients in over 50 countries

Over one-third of employees based outside the US

Investment centers in the US, UK, Japan and Australia

Pro Forma Combined AUM by Client Geography

$1.046 trillion

6/30/06

8

Scale & Talent: Vital for the Future

Delivering exceptional products and services

Helping clients solve problems

Capitalizing on the changing landscape

Globalization

Eventual reversal of “dollarization”

Twin retirement challenges: population aging & shifting the burden

Significant investment challenges

9

Globalization: The Defining Trend of Our Times

Discussion often focuses on the

flattening of the world

Technology minimizes time zone

differences and physical distance

Technology facilitates having a

global workforce

BUT…the technology and

infrastructure are very expensive

10

Global Financial Assets

Lehman Euro Corporate Index

Amount Outstanding

$ in trillions

Globalization: A Capital Markets Perspective

Explosive growth in the capital markets, particularly outside the US

Requires broad credit and equity research, extensive risk

management capabilities and robust global technology

€ in billions

Sources: McKinsey Global Institute; Lehman Euro-Aggregate Corporate Index

11

2005 Current Account Balances

Globalization: Greater Interdependencies

Fundamental implications for markets and policies

International reliance on the US consumer

US reliance on foreign buyers of US bonds

US

$805b

Oil Exporters

$328b

Japan Euro

$153b $24b

Rest of World*

$92b

China Emg Asia

$140b $68b

* Rest of world includes statistical discrepancy

Source: Lawrence Summers, “Reflections on Global Account Imbalances”

12

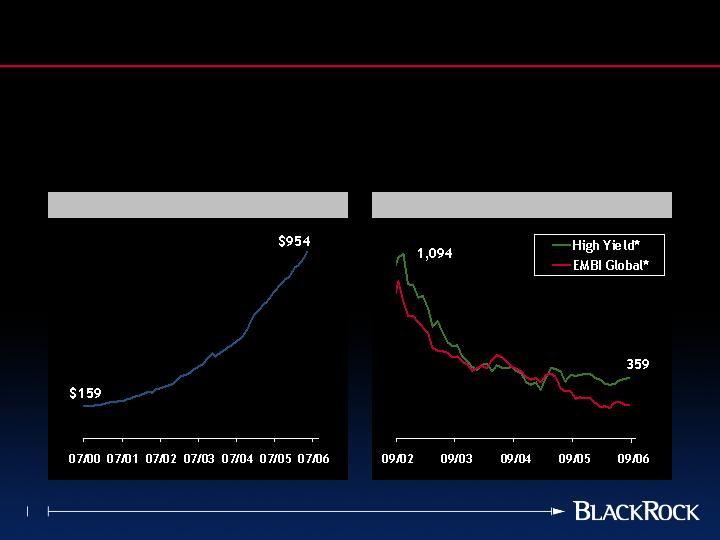

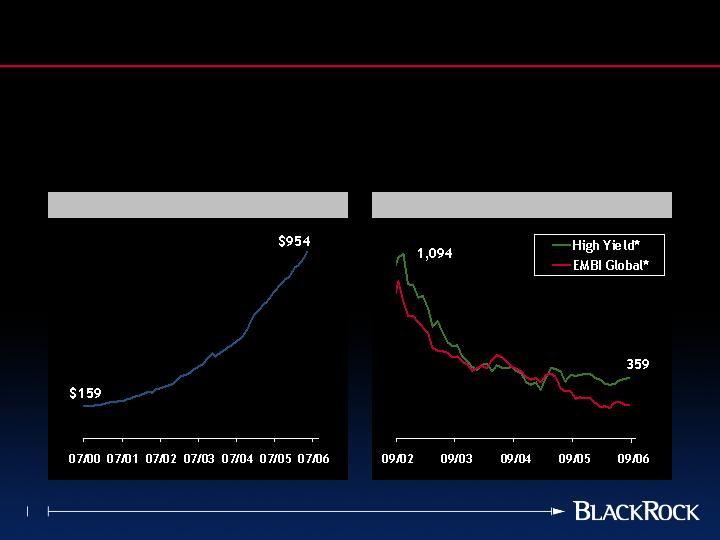

Credit Spreads

* Sources: Bloomberg – National Bureau of Statistics, China; Lehman Brothers U.S. High Yield Index,

JP Morgan Emerging Market Bond Index

“Dollarization” Will End Eventually

Driven by current accounts, foreign exchange policies and oil prices

The effect on US rates and credit spreads could be devastating

Need to continue to broaden market capabilities around the world

China’s Foreign Exchange Reserves

$ in billions

13

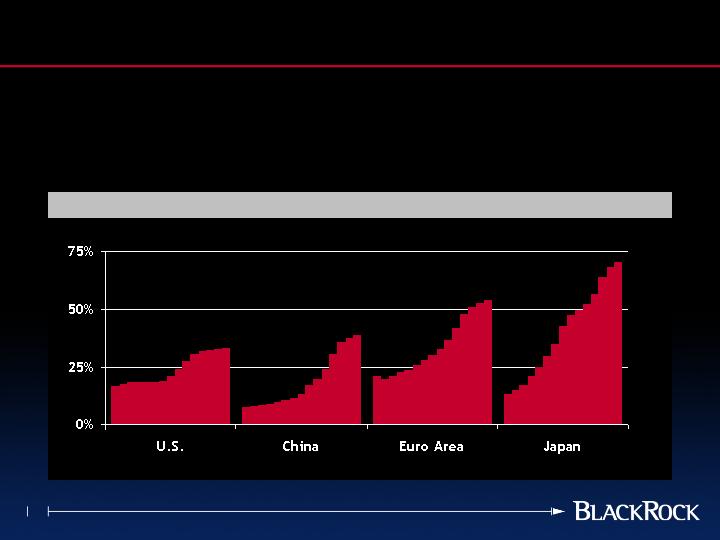

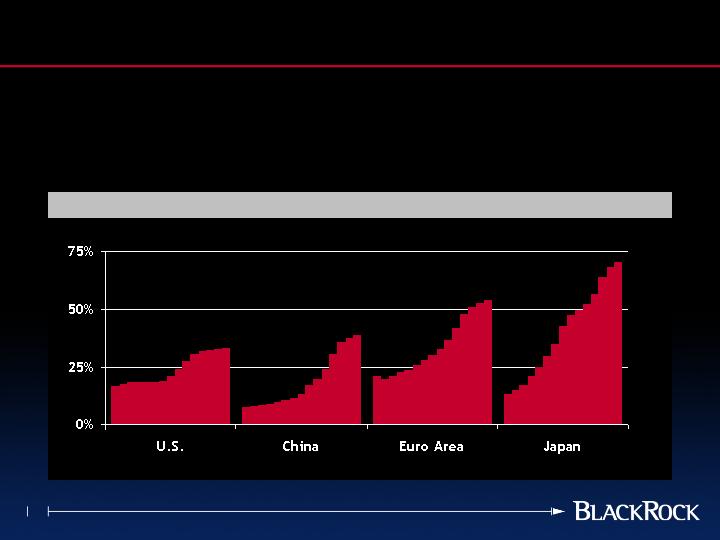

Population Aging: 1980 - 2050P*

* Ratio of number of people over age 65 to number of people age 15 - 64

Source: United Nations Population Division, World Population Prospects, 2004

Twin Retirement Challenges

Population aging in developed nations and China

Shifting of the financial burden from employers to employees

How will individual investors be best served?

14

Persistent low rates are problematic

Investors worldwide looking for higher returns

Insurance companies and banks reaching for yield

Pension fund immunization prohibitively expensive (thus, US

pension reform expected to have little immediate impact)

Array of “new” approaches

Explosive growth of alternative investments

Separation of alpha and beta

Liability driven investing

Alpha extension products

At the Same Time…

15

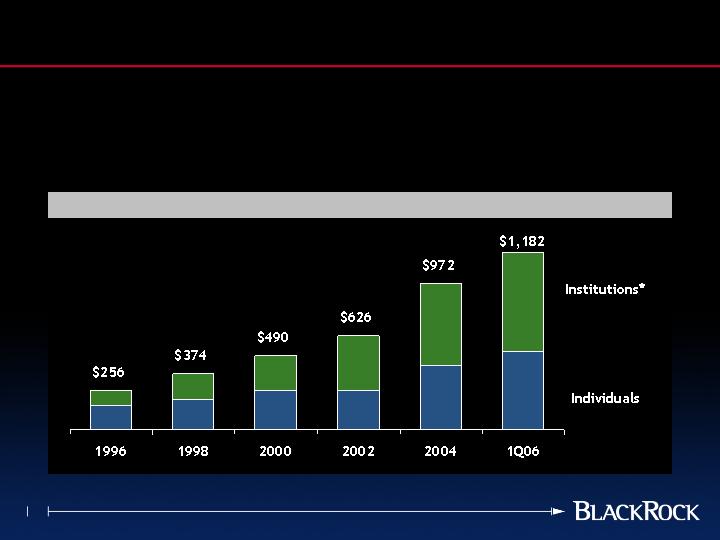

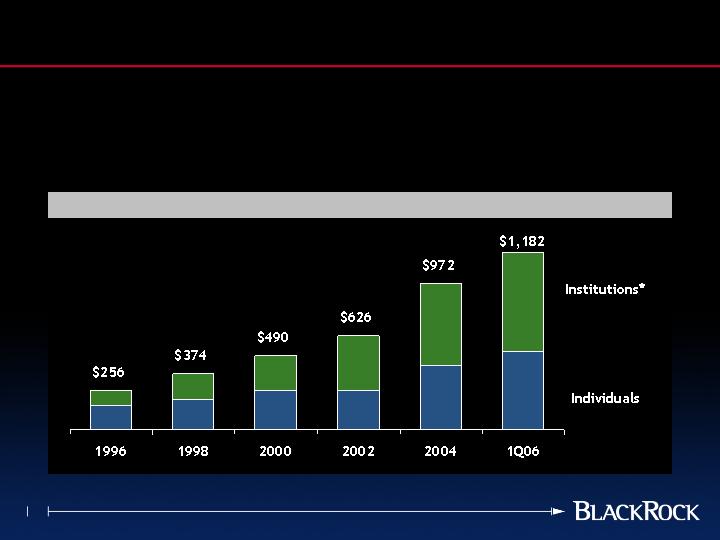

* Institutions includes corporations, foundations, endowments, pension funds and fund of funds

Source: Hennessee Group LLC, IFSL estimates

Hedge Fund Assets

Today’s Search for Alpha & Yield…

Could be the basis for the next major shock to the market

Having the tools to understand and manage risk is essential

$ in billions

16

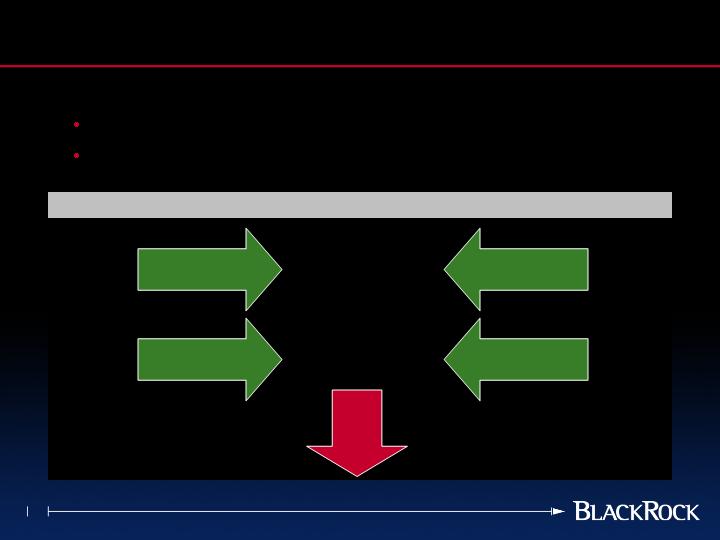

Old Models Won’t Work

Globalization requires new

organizational paradigms and processes

Our business model was evolving, and

the merger forces us to adapt more

quickly

There are no precise formulas to follow

We will need to find the right

regional/functional balance over

time

We will need to develop tools to

facilitate greater decentralization

We will need to build the

infrastructure to support our global

employee base

We will need to ensure worldwide

information sharing and collaboration

on behalf of our clients

EMEA/Australia

Asia

Finance

Legal

HR

Corp Svc

Strategy

Communication

FUNCTIONAL

REGIONAL

“NEW”

BLACKROCK

CORPORATE

Portfolio Mgt

Account Mgt

BlackRock

Solutions

Ops & Admin

17

In Summary, the Merger Remains on Track

Costs are as expected or lower

Synergies are on target

Client attrition is minimal

Hitting milestones on integration plan

Although early, cultural integration is off to a good start

The working relationships with Merrill Lynch and PNC are strong

Important to understand that no one sold

18

Strong Potential to Create Shareholder Value

We have the opportunity to truly differentiate BlackRock

We will have multiple engines for future growth

Bonds and equities

Relative and absolute value

Institutional and retail

BlackRock Solutions

Much more global

We will have the scale and talent to build our franchise

We will have the teamwork, commitment to excellence, passion

and integrity to realize our potential

19

NYSE:BLK

20

MORNINGSTAR DISCLOSURE

Source of data on page 6: Morningstar, Inc. Past performance is no guarantee of future results. For each fund

with at least a 3-year history, Morningstar calculates a Morningstar RatingTM based on a Morningstar Risk-

Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of

sales charges, loads and redemption fees), placing more emphasis on downward variations and rewarding

consistent performance. The top 10% of funds in each category receive five stars, the next 22.5% receive four

stars, the next 35% receive three stars, the next 22.5% receive two stars and the bottom 10% receive one star.

(Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause

slight variations in the distribution percentages.) The Overall Morningstar Rating for a fund is derived from a

weighted-average of the performance figures associated with its 3-, 5- and 10-year (if applicable) Morningstar

Rating metrics.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed transactions, a registration statement of New BlackRock, Inc. (Registration No.

333-134916), which includes a definitive proxy statement of BlackRock, and other materials have been filed

with the SEC and are publicly available. WE URGE INVESTORS TO READ THE DEFINITIVE PROXY

STATEMENT/PROSPECTUS AND THESE OTHER MATERIALS CAREFULLY BECAUSE THEY CONTAIN IMPORTANT

INFORMATION ABOUT BLACKROCK, NEW BLACKROCK AND THE PROPOSED TRANSACTIONS. Such proxy

statement/prospectus and other relevant documents may also be obtained, free of charge, on the Securities and

Exchange Commission's website (http://www.sec.gov) or by contacting our Secretary, BlackRock, Inc., 40 East

52nd Street, New York, New York 10022.

PARTICIPANTS IN THE SOLICITATION

BlackRock and certain persons may be deemed to be participants in the solicitation of proxies relating to the

proposed transactions. The participants in such solicitation may include BlackRock's executive officers and

directors. Further information regarding persons who may be deemed participants is available in the proxy

statement/prospectus filed with the Securities and Exchange Commission in connection with the transactions.

21