Table of Contents

As filed with the Securities and Exchange Commission on June 28, 2012

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Lamar Media Corp.

(Exact name of registrant as specified in its charter)

SEE TABLE OF ADDITIONAL REGISTRANTS

| Delaware | 7311 | 72-1205791 | ||

(State or other jurisdiction of incorporation or organization) | Primary Standard Industrial Classification Code) | (I.R.S. Employer Identification No.) |

5321 Corporate Boulevard

Baton Rouge, Louisiana 70808

(225) 926-1000

(Address, Including ZIP Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Sean E. Reilly

Chief Executive Officer

Lamar Media Corp.

5321 Corporate Boulevard

Baton Rouge, Louisiana 70808

(225) 926-1000

(Name, Address, Including ZIP Code and Telephone Number, Including Area Code, of Agent for Service)

with a copy to:

Stacie Aarestad, Esq.

Edwards Wildman Palmer LLP

111 Huntington Avenue At Prudential Center

Boston, Massachusetts 02199-7613

(617) 239-0100

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer þ | Smaller reporting company ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

| ||||||||

Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price per Unit(1) | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(1) | ||||

5 7/8% Senior Subordinated Notes due 2022 | $500,000,000 | 100% | $500,000,000 | $57,300 | ||||

Guarantees of 5 7/8% Senior Subordinated Notes due 2022(2) | n/a | n/a | n/a | n/a | ||||

| ||||||||

| ||||||||

| (1) | This registration fee has been calculated pursuant to Rule 457(f)(2) under the Securities Act of 1933, as amended. |

| (2) | No separate consideration will be received for the guarantees, and no separate fee is payable, pursuant to Rule 457(n) under the Securities Act of 1933, as amended. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

Table of Contents

Table of Additional Registrants(1)

Exact Name of Registrant as Specified in its Charter | State or Other Jurisdiction of Incorporation or Organization | IRS Employer Identification Number | ||||

American Signs, Inc. | Washington | 91-1642046 | ||||

Arizona Logos, L.L.C. | Arizona | 27-2892296 | ||||

Colorado Logos, Inc. | Colorado | 84-1480715 | ||||

Delaware Logos, L.L.C. | Delaware | 51-0392715 | ||||

Florida Logos, Inc. | Florida | 65-0671887 | ||||

Georgia Logos, L.L.C. | Georgia | 72-1469485 | ||||

Interstate Logos, L.L.C. | Louisiana | 72-1490893 | ||||

Kansas Logos, Inc. | Kansas | 48-1187701 | ||||

Kentucky Logos, LLC | Kentucky | 62-1839054 | ||||

Lamar Advantage GP Company, LLC | Delaware | 72-1490891 | ||||

Lamar Advantage Holding Company | Delaware | 76-0619569 | ||||

Lamar Advantage LP Company, LLC | Delaware | 76-0637519 | ||||

Lamar Advantage Outdoor Company, L.P. | Delaware | 74-2841299 | ||||

Lamar Advertising of Colorado Springs, Inc. | Colorado | 72-0931093 | ||||

Lamar Advertising of Kentucky, Inc. | Kentucky | 61-1306385 | ||||

Lamar Advertising of Louisiana, L.L.C. | Louisiana | 72-1462297 | ||||

Lamar Advertising of Michigan, Inc. | Michigan | 38-3376495 | ||||

Lamar Advertising of Oklahoma, Inc. | Oklahoma | 73-1178474 | ||||

Lamar Advertising of Penn, LLC | Delaware | 72-1462301 | ||||

Lamar Advertising of South Dakota, Inc. | South Dakota | 46-0446615 | ||||

Lamar Advertising of Youngstown, Inc. | Delaware | 23-2669670 | ||||

Lamar Advertising Southwest, Inc. | Nevada | 85-0113644 | ||||

Lamar Air, L.L.C. | Louisiana | 72-1277136 | ||||

Lamar Benches, Inc. | Oklahoma | 73-1524386 | ||||

Lamar Central Outdoor, LLC | Delaware | 20-2471691 | ||||

Lamar DOA Tennessee Holdings, Inc. | Delaware | 41-1991164 | ||||

Lamar DOA Tennessee, Inc. | Delaware | 41-1882464 | ||||

Lamar Electrical, Inc. | Louisiana | 72-1392115 | ||||

Lamar Florida, Inc. | Florida | 72-1467178 | ||||

Lamar I-40 West, Inc. | Oklahoma | 73-1498886 | ||||

Lamar Obie Corporation | Delaware | 33-1109314 | ||||

Lamar OCI North Corporation | Delaware | 38-2885263 | ||||

Lamar OCI South Corporation | Mississippi | 64-0520092 | ||||

Lamar Ohio Outdoor Holding Corp. | Ohio | 34-1597561 | ||||

Lamar Oklahoma Holding Company, Inc. | Oklahoma | 73-1474290 | ||||

Lamar Pensacola Transit, Inc. | Florida | 59-3391978 | ||||

Lamar T.T.R., L.L.C. | Arizona | 86-0928767 | ||||

Lamar Tennessee, L.L.C. | Tennessee | 72-1309007 | ||||

Lamar Texas Limited Partnership | Texas | 72-1309005 | ||||

LC Billboard L.L.C. | Delaware | 63-1692342 | ||||

Louisiana Interstate Logos, L.L.C. | Louisiana | 26-3654514 | ||||

Maine Logos, L.L.C. | Maine | 72-1492985 | ||||

Michigan Logos, Inc. | Michigan | 38-3071362 | ||||

Minnesota Logos, Inc. | Minnesota | 41-1800355 | ||||

Mississippi Logos, L.L.C. | Mississippi | 72-1469487 | ||||

Missouri Logos, LLC | Missouri | 72-1485587 | ||||

Montana Logos, LLC | Montana | 45-3444460 | ||||

Nebraska Logos, Inc. | Nebraska | 72-1137877 | ||||

Nevada Logos, Inc. | Nevada | 88-0373108 | ||||

Table of Contents

Exact Name of Registrant as Specified in its Charter | State or Other Jurisdiction of Incorporation or Organization | IRS Employer Identification Number | ||

New Jersey Logos, L.L.C. | New Jersey | 72-1469048 | ||

New Mexico Logos, Inc. | New Mexico | 85-0446801 | ||

O. B. Walls, Inc. | Oregon | 93-1013167 | ||

Obie Billboard, LLC | Oregon | N/A | ||

Ohio Logos, Inc. | Ohio | 72-1148212 | ||

Oklahoma Logos, L.L.C. | Oklahoma | 72-1469103 | ||

Outdoor Marketing Systems, Inc. | Pennsylvania | 23-2659279 | ||

Outdoor Marketing Systems, L.L.C. | Pennsylvania | N/A | ||

Outdoor Promotions West, LLC | Delaware | 22-3598746 | ||

Pennsylvania Logos, LLC | Pennsylvania | 26-4399994 | ||

Premere Outdoor, Inc. | Illinois | 36-4459650 | ||

South Carolina Logos, Inc. | South Carolina | 58-2152628 | ||

Tennessee Logos, Inc. | Tennessee | 62-1649765 | ||

Texas Logos, L.P. | Texas | 72-1490894 | ||

The Lamar Company, L.L.C. | Louisiana | 72-1462298 | ||

TLC Farms, L.L.C. | Louisiana | 20-0634874 | ||

TLC Properties II, Inc. | Texas | 72-1336624 | ||

TLC Properties, Inc. | Louisiana | 72-0640751 | ||

TLC Properties, L.L.C. | Louisiana | 72-1417495 | ||

Triumph Outdoor Holdings, LLC | Delaware | 13-3990438 | ||

Triumph Outdoor Rhode Island, LLC | Delaware | 05-0500914 | ||

Utah Logos, Inc. | Utah | 72-1148211 | ||

Virginia Logos, LLC | Virginia | 62-1839208 | ||

Washington Logos, L.L.C. | Washington | 73-1648809 | ||

Wisconsin Logos, LLC | Wisconsin | 45-1837323 |

| (1) | The outstanding notes are, and the new notes will be, unconditionally guaranteed by the additional registrants listed above, each of which is a direct or indirect, wholly owned subsidiary of Lamar Media Corp. The address and telephone number for each of the additional registrants is 5321 Corporate Boulevard, Baton Rouge, Louisiana 70808 and (225) 926-1000. The primary standard industrial classification code number for each of the additional registrants is 7311. |

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED JUNE 28, 2012

Prospectus

Lamar Media Corp.

Offer to Exchange

Up to $500,000,000

outstanding 5 7/8% Senior Subordinated Notes due 2022 issued on February 9, 2012, for a Like Principal Amount of 5 7/8% Senior Subordinated Notes due 2022, which have been registered under the Securities Act of 1933

The Exchange Offer

| • | We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradable. |

| • | You may withdraw tenders of outstanding notes at any time prior to the expiration date of the exchange offer. |

| • | The exchange offer expires at 5:00 p.m., New York City time, on July 27, 2012, unless we extend the offer. We do not currently intend to extend the expiration date. |

| • | The exchange of outstanding notes for exchange notes in the exchange offer generally will not be a taxable event to a holder for United States federal income tax purposes. |

| • | We will not receive any proceeds from the exchange offer. |

| • | The exchange offer is subject to customary conditions, including the condition that the exchange offer not violate applicable law or any applicable interpretation of the staff of the Securities and Exchange Commission. |

The Exchange Notes

| • | The exchange notes are being offered in order to satisfy certain of our obligations under the registration rights agreement entered into in connection with the private offering of the outstanding notes. |

| • | The terms of the exchange notes to be issued in the exchange offer are substantially identical to the terms of the outstanding notes, except that the exchange notes will be freely tradable. |

| • | The exchange notes will be subordinated to all of our existing and future senior debt, rank equally with all of our existing and future senior subordinated debt and rank senior to all of our existing and future debt obligations that are expressly subordinated in right of payment to the exchange notes. |

| • | The outstanding notes are, and the exchange notes will be, unconditionally guaranteed on a joint and several basis by substantially all of our existing and future domestic subsidiaries. |

| • | We do not intend to apply for listing of the exchange notes on any securities exchange or to arrange for them to be quoted on any quotation system. |

Broker-Dealers

| • | Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal states that by so acknowledging and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act of 1933. |

| • | This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. |

| • | We and the guarantors have agreed that, for a period of 180 days after consummation of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.” |

See “Risk Factors” beginning on page 16 for a discussion of certain risks that you should consider before participating in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2012

Table of Contents

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You should not rely on any unauthorized information or representations. This prospectus is an offer to exchange only the notes offered by this prospectus, and only under the circumstances and in those jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Lamar Media Corp. is a Delaware corporation. Our principal executive offices are located at 5321 Corporate Blvd., Baton Rouge, LA 70808 and our telephone number at that address is (225) 926-1000. Lamar Media Corp. is a wholly owned subsidiary of Lamar Advertising Company. Our parent’s web site is located athttp://www.lamar.com. The information on or linked to from the web site is not part of this prospectus.

In this prospectus, except as the context otherwise requires or as otherwise noted, “Lamar Media,” “we,” “us” and “our” refer to Lamar Media Corp. and its subsidiaries, except with respect to the notes, in which case such terms refer only to Lamar Media Corp. Lamar Advertising Company is referred to herein as “Lamar Advertising.”

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the Securities and Exchange Commission (the “Commission”) a registration statement on Form S-4 under the Securities Act of 1933, with respect to the exchange notes offered hereby. As permitted by the rules and regulations of the Commission, this prospectus incorporates important information about us that is not included in or delivered with this prospectus but that is included in the registration statement. For further information with respect to us and the exchange notes offered hereby, we refer you to the registration statement, including the exhibits and schedules filed therewith.

We and our parent, Lamar Advertising, file reports and other information with the Commission. Such reports and other information filed by us may be read and copied at the Commission’s public reference room at 100 F Street, NE, Washington, D.C. 20549. For further information about the public reference room, call 1-800-SEC-0330. The Commission also maintains a website on the Internet that contains reports, proxy and information statements and other information regarding registrants that file electronically with the Commission, and such website is located at http://www.sec.gov.

2

Table of Contents

You may request a copy of these filings at no cost, by writing or calling us at the following address: 5321 Corporate Boulevard, Baton Rouge, LA 70808, Tel: (225) 926-1000, Attention: Chief Financial Officer.

To obtain timely delivery of any of these documents, you must request them no later than five business days before the date you must make your investment decision. Accordingly, if you would like to request any documents, you should do so no later than July 20, 2012 in order to receive them before the expiration of the exchange offer.

Pursuant to the indenture under which the exchange notes will be issued (and the outstanding notes were issued), we have agreed that, whether or not we are required to do so by the rules and regulations of the Commission, for so long as any of the notes remain outstanding, we (not including our subsidiaries) will furnish to the holders of the notes copies of all quarterly and annual financial information that would be required to be contained in a filing with the Commission on Forms 10-Q and 10-K if we were required to file such forms and all current reports that would be required to be filed with the Commission on Form 8-K if we were required to file such reports, in each case within the time periods specified in the Commission’s rules and regulations. In addition, following the consummation of this exchange offer, whether or not required by the rules and regulations of the Commission, we will file a copy of all such information and reports with the Commission for public availability within the time periods specified in the Commission’s rules and regulations (unless the Commission will not accept such a filing) and make such information available to securities analysts and prospective investors upon request. See “Description of Exchange Notes — Material Covenants — Reports to Holders.”

The market data and other statistical information used throughout this prospectus are based on independent industry publications, government publications, reports by market research firms or other published independent sources. Some data are also based on our good faith estimates, which are derived from our review of internal surveys, as well as the independent sources listed above. Although we believe these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness.

3

Table of Contents

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These are statements that relate to future periods and include statements regarding our anticipated performance.

Generally, the words “anticipates,” “believes,” “expects,” “intends,” “estimates,” “projects,” “plans” and similar expressions identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements or industry results, to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. These risks, uncertainties and other important factors include, among others:

| • | the current economic conditions and their effect on the markets in which we operate; |

| • | the levels of expenditures on advertising in general and outdoor advertising in particular; |

| • | risks and uncertainties relating to our significant indebtedness; |

| • | the demand for outdoor advertising; |

| • | our need for and ability to obtain additional funding for operations or acquisitions; |

| • | increased competition within the outdoor advertising industry; |

| • | the regulation of the outdoor advertising industry by federal, state and local governments; |

| • | our ability to renew expiring contracts at favorable rates; |

| • | our ability to successfully implement our digital deployment strategy; |

| • | the integration of companies that we acquire and our ability to recognize cost savings or operating efficiencies as a result of these acquisitions; and |

| • | changes in accounting principles, policies or guidelines. |

Although we believe that the statements contained in this prospectus are based upon reasonable assumptions, we can give no assurance that our goals will be achieved. Given these uncertainties, prospective investors are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements are made as of the date of this prospectus. We assume no obligation to update or revise them or provide reasons why actual results may differ.

4

Table of Contents

This summary highlights the information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. For a more complete understanding of this exchange offer, we encourage you to read this entire prospectus. You should read the following summary together with the more detailed information and consolidated financial statements and the notes to those statements included in this prospectus. Unless otherwise indicated, financial information included in this prospectus is presented on an historical basis.

Lamar Media Corp.

We are one of the largest outdoor advertising companies in the United States based on number of displays and have operated under the Lamar name since 1902. We sell advertising on billboards, buses, shelters, benches and logo signs. As of March 31, 2012, we owned and operated over 142,000 billboard advertising displays in 44 states, Canada and Puerto Rico, over 112,000 logo advertising displays in 22 states and the province of Ontario, Canada, and operated approximately 30,000 transit advertising displays in 16 states, Canada and Puerto Rico. We offer our customers a fully integrated service, satisfying all aspects of their billboard display requirements from ad copy production to placement and maintenance.

Our Business

We operate three types of outdoor advertising displays: billboards, logo signs and transit advertising displays.

Billboards. We sell most of our advertising space on two types of billboards: bulletins and posters.

| • | Bulletins are generally large, illuminated advertising structures that are located on major highways and target vehicular traffic. |

| • | Posters are generally smaller advertising structures that are located on major traffic arteries and city streets and target vehicular and pedestrian traffic. |

In addition to these traditional billboards, we also sell advertising space on digital billboards, which are generally located on major traffic arteries and city streets. As of March 31, 2012, we owned and operated over 1,400 digital billboard advertising displays in 40 states, Canada and Puerto Rico.

Logo signs. We sell advertising space on logo signs located near highway exits.

| • | Logo signsgenerally advertise nearby gas, food, camping, lodging and other attractions. |

We are the largest provider of logo signs in the United States, operating 22 of the 27 privatized state logo sign contracts. As of March 31, 2012, we operated over 112,000 logo sign advertising displays in 22 states and Canada.

Transit advertising displays. We also sell advertising space on the exterior and interior of public transportation vehicles, transit shelters and benches in approximately 60 markets. As of March 31, 2012, we operated approximately 30,000 transit advertising displays in 16 states, Canada and Puerto Rico.

Operating strategies

We strive to be a leading provider of outdoor advertising services in each of the markets that we serve, and our operating strategies for achieving that goal include:

Continuing to provide high quality local sales and service. We seek to identify and closely monitor the needs of our customers and to provide them with a full complement of high quality advertising services. Local advertising

5

Table of Contents

constituted approximately 80% of our net revenues for the three months ended March 31, 2012, which management believes is higher than the industry average. We believe that the experience of our regional and local managers has contributed greatly to our success. For example, our regional managers have been with us for an average of 29 years. In an effort to provide high quality sales and service at the local level, we employed approximately 760 local account executives as of March 31, 2012. Local account executives are typically supported by additional local staff and have the ability to draw upon the resources of our central office, as well as our offices in other markets, in the event business opportunities or customers’ needs support such an allocation of resources.

Continuing a centralized control and decentralized management structure. Our management believes that, for our particular business, centralized control and a decentralized organization provide for greater economies of scale and are more responsive to local market demands. Therefore, we maintain centralized accounting and financial control over our local operations, but our local managers are responsible for the day-to-day operations in each local market and are compensated according to that market’s financial performance.

Continuing to focus on internal growth. Within our existing markets, we seek to increase our revenue and improve cash flow by employing highly-targeted local marketing efforts to improve our display occupancy rates and by increasing advertising rates where and when demand can absorb rate increases. Our local offices spearhead this effort and respond to local customer demands quickly.

In addition, we routinely invest in upgrading our existing displays and constructing new displays. From January 1, 2000 to March 31, 2012, we invested approximately $1.37 billion in capitalized expenditures, which include improvements to our existing displays and construction of new displays. Our regular improvement and expansion of our advertising display inventory allows us to provide high quality service to our current advertisers and to attract new advertisers.

Continuing to pursue other outdoor advertising opportunities. We plan to pursue additional logo sign contracts. Logo sign opportunities arise periodically, both from states initiating new logo sign programs and states converting from government-owned and operated programs to privately-owned and operated programs. Furthermore, we plan to pursue additional tourist oriented directional sign programs in both the United States and Canada and also other motorist information signing programs as opportunities present themselves. In addition, in an effort to maintain market share, we continue to pursue attractive transit advertising opportunities as they become available.

Reinvesting in capital expenditures including digital technology. We have historically invested in capital expenditures, however, during 2009 and 2010, we significantly reduced our capital expenditures to position us to manage through the economic recession. As a result of the economic recovery, we began to reinvest in capital expenditures during 2011. We spent approximately $107 million in total capital expenditures in fiscal 2011, of which $41.3 million was spent on digital technology. We expect our 2012 capitalized expenditures to closely approximate our spending in 2011.

Recent developments

New term loan A facility and amendments to our senior credit facility

On February 9, 2012, we entered into a restatement agreement with respect to our existing senior credit facility in order to fund a new $100 million Term loan A facility and to make certain covenant changes to the senior credit facility, which was entered into on April 28, 2010, as amended. See “Description of Material Indebtedness—Senior Credit Facility.”

6

Table of Contents

Tender offer for 6 5/8% Senior Subordinated Notes due 2015

On January 26, 2012, we commenced a tender offer to purchase for cash, up to $700 million in aggregate principal amount of our outstanding 6 5/8% Notes. On February 9, 2012, we accepted tenders for approximately $483.7 million in aggregate principal amount of the 6 5/8% Notes, out of approximately $582.9 million tendered, in connection with the early settlement date of the tender offer. On February 27, 2012, we accepted tenders for approximately $99.2 million previously tendered and not accepted for payment and an additional $220 thousand tendered following the early settlement date. The holders of the notes tendered on or before midnight on February 8, 2012 received a total consideration of $1,025.83 per $1,000 principal amount of the notes tendered; holders of notes tendered after such date received a total consideration of $1,005.83 per $1,000 principal amount of the notes tendered. The total cash payment to purchase the tendered 6 5/8% Notes on February 9, 2012, including accrued interest up to but excluding February 9, 2012 was approximately $511.6 million and the total cash payment to purchase the tendered notes on February 27, 2012, including accrued interest up to but excluding February 27, 2012 was approximately $102.3 million, resulting in an aggregate payment in respect of the 6 5/8% Notes tender offer of approximately $613.9 million.

Organization

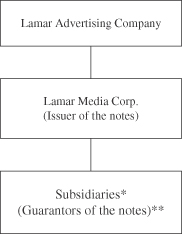

The following summary organization chart sets forth the basic corporate structure of Lamar.

| * | All but one of our domestic subsidiaries (Missouri Logos, a partnership) is wholly owned. |

| ** | All of our domestic subsidiaries (except Missouri Logos, a partnership) will unconditionally guarantee the notes. |

Our History

Lamar Media Corp. has been in operation since 1902. We completed a reorganization on July 20, 1999 to create our current holding company structure. At that time, Lamar Advertising Company was renamed Lamar Media Corp. and all its stockholders became stockholders in a new holding company. The new holding company then took the Lamar Advertising Company name and Lamar Media Corp. became a wholly owned subsidiary of Lamar Advertising Company.

7

Table of Contents

Summary of the Exchange Offer

In this prospectus, the term “outstanding notes” refers to the outstanding 5 7/8% Senior Subordinated Notes due 2022; the term “exchange notes” refers to the 5 7/8% Senior Subordinated Notes due 2022 registered under the Securities Act of 1933, as amended (the “Securities Act”); and the term “notes” refers to both the outstanding notes and the exchange notes. On February 9, 2012, we completed a private offering of $500,000,000 aggregate principal amount of 5 7/8% Senior Subordinated Notes due 2022.

General | In connection with the private offering, we entered into a registration rights agreement with the initial purchasers of the outstanding notes in which we agreed, among other things, to deliver this prospectus to you and to use our reasonable best efforts to complete an exchange offer for the outstanding notes. |

Exchange Offer | We are offering to exchange $500,000,000 principal amount of exchange notes, which have been registered under the Securities Act, for $500,000,000 principal amount of outstanding notes. |

| The outstanding notes may be exchanged only in denominations of $2,000 and integral multiples of $1,000. |

Resale of the Exchange Notes | Based on the position of the staff of the Division of Corporation Finance of the Securities and Exchange Commission (the “Commission”) in certain interpretive letters issued to third parties in other transactions, we believe that the exchange notes acquired in this exchange offer may be freely traded without compliance with the provisions of the Securities Act, if: |

| • | you are acquiring the exchange notes in the ordinary course of your business, |

| • | you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes, and |

| • | you are not our affiliate as defined in Rule 405 of the Securities Act. |

| If you fail to satisfy any of these conditions, you must comply with the registration and prospectus delivery requirements of the Securities Act in connection with the resale of the exchange notes. |

| Broker-dealers that acquired outstanding notes directly from us, but not as a result of market-making activities or other trading activities, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with a resale of the exchange notes. See “Plan of Distribution.” |

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer in exchange for outstanding notes that it acquired as a result of market-making or other trading activities |

8

Table of Contents

must deliver a prospectus in connection with any resale of the exchange notes and provide us with a signed acknowledgement of this obligation. |

Expiration Date | This exchange offer will expire at 5:00 p.m., New York City time, on July 27, 2012, unless we extend the offer. |

Conditions to the Exchange Offer | The exchange offer is subject to limited, customary conditions, which we may waive. |

Procedures for Tendering Outstanding Notes | If you wish to accept the exchange offer, you must deliver to the exchange agent, before the expiration of the exchange offer: |

| • | either a completed and signed letter of transmittal or, for outstanding notes tendered electronically, an agent’s message from The Depository Trust Company (“DTC”), Euroclear or Clearstream stating that the tendering participant agrees to be bound by the letter of transmittal and the terms of the exchange offer, |

| • | your outstanding notes, either by tendering them in physical form or by timely confirmation of book-entry transfer through DTC, Euroclear or Clearstream, and |

| • | all other documents required by the letter of transmittal. |

| If you hold outstanding notes through DTC, Euroclear or Clearstream, you must comply with their standard procedures for electronic tenders, by which you will agree to be bound by the letter of transmittal. |

| By signing, or by agreeing to be bound by, the letter of transmittal, you will be representing to us that: |

| • | you will be acquiring the exchange notes in the ordinary course of your business, |

| • | you have no arrangement or understanding with any person to participate in the distribution of the exchange notes, and |

| • | you are not our affiliate as defined under Rule 405 of the Securities Act. |

| See “The Exchange Offer— Procedures for Tendering.” |

Guaranteed Delivery Procedures for Tendering Outstanding Notes | If you cannot meet the expiration deadline or you cannot deliver your outstanding notes, the letter of transmittal or any other documentation to comply with the applicable procedures under DTC, Euroclear or Clearstream standard operating procedures for electronic tenders in a timely fashion, you may tender your notes according to the guaranteed delivery procedures set forth under “The Exchange Offer— Guaranteed Delivery Procedures.” |

9

Table of Contents

Special Procedures for Beneficial Holders | If you beneficially own outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender in the exchange offer, you should contact that registered holder promptly and instruct that person to tender on your behalf. If you wish to tender in the exchange offer on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your outstanding notes, either arrange to have the outstanding notes registered in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time. |

Acceptance of Outstanding Notes and Delivery of Exchange Notes | We will accept any outstanding notes that are properly tendered for exchange before 5:00 p.m., New York City time, on the day this exchange offer expires. The exchange notes will be delivered promptly after expiration of this exchange offer. |

Exchange Date | We will notify the exchange agent of the date of acceptance of the outstanding notes for exchange. |

Withdrawal Rights | If you tender your outstanding notes for exchange in this exchange offer and later wish to withdraw them, you may do so at any time before 5:00 p.m., New York City time, on the day this exchange offer expires. |

Consequences if You Do Not Exchange Your Outstanding Notes | Outstanding notes that are not tendered in the exchange offer or are not accepted for exchange will continue to bear legends restricting their transfer. You will not be able to sell the outstanding notes unless: |

| • | an exemption from the requirements of the Securities Act is available to you, |

| • | we register the resale of outstanding notes under the Securities Act, or |

| • | the transaction requires neither an exemption from nor registration under the requirements of the Securities Act. |

| After the completion of the exchange offer, we will no longer have any obligation to register the outstanding notes, except in limited circumstances. |

Accrued Interest on the Outstanding Notes | Any interest that has accrued on an outstanding note before its exchange in this exchange offer will be payable on the exchange note on the first interest payment date after the completion of this exchange offer. |

10

Table of Contents

United States Federal Income Tax Considerations | The exchange of the outstanding notes for the exchange notes generally will not be a taxable event for United States federal income tax purposes. See “Material United States Federal Income Tax Considerations.” |

Exchange Agent | The Bank of New York Mellon Trust Company, N.A. is serving as the exchange agent. Its address and telephone number are provided in this prospectus under the heading “The Exchange Offer— Exchange Agent.” |

Use of Proceeds | We will not receive any cash proceeds from this exchange offer. See “Use of Proceeds.” |

Registration Rights Agreement | When we issued the outstanding notes on February 9, 2012, we and the guarantors entered into a registration rights agreement with the initial purchasers of the outstanding notes. Under the terms of the registration rights agreement, we agreed to use our reasonable best efforts to cause to become effective a registration statement with respect to an offer to exchange the outstanding notes for other freely tradable notes issued by us and that are registered with the Commission and that have substantially identical terms as the outstanding notes. If we fail to effect the exchange offer, we will use our reasonable best efforts to file and cause to become effective a shelf registration statement related to resales of the outstanding notes. We will be obligated to pay additional interest on the outstanding notes if we do not complete the exchange offer by November 5, 2012, or, if required, the shelf registration statement is not declared effective by November 5, 2012. See “Registration Rights Agreement.” |

Accounting Treatment | We will not recognize any gain or loss for accounting purposes upon the completion of the exchange offer in accordance with generally accepted accounting principles. See “The Exchange Offer— Accounting Treatment.” |

11

Table of Contents

Summary of the Terms of the Exchange Notes

The exchange notes will be identical to the outstanding notes except that:

| • | the exchange notes will be registered under the Securities Act and therefore will not bear legends restricting their transfer; and |

| • | specified rights under the registration rights agreement, including the provisions providing for registration rights and the payment of additional interest in specified circumstances, will be limited or eliminated. |

The exchange notes will evidence the same debt as the outstanding notes and the same indenture will govern both the outstanding notes and the exchange notes. For a more complete understanding of the exchange notes, please refer to the section of this prospectus entitled “Description of Exchange Notes.”

Issuer | Lamar Media Corp. |

Securities Offered | $500,000,000 principal amount of 5 7/8% Senior Subordinated Notes due 2022. |

Maturity Date | February 1, 2022 |

Interest Rate | 5 7/8% per year |

Interest Payment Date | February 1 and August 1 of each year, beginning on August 1, 2012. Interest will accrue from February 9, 2012 |

Guarantees | Substantially all of our existing and future domestic subsidiaries will unconditionally guarantee the notes. |

Ranking | The exchange notes will be our unsecured senior subordinated obligations and will be subordinated to all of our existing and future senior debt, including indebtedness under our senior credit facility and our 9 3/4% Senior Notes due 2014, rank equally with all of our existing and future senior subordinated debt, including our 6 5/8% Senior Subordinated Notes due 2015, 6 5/8% Senior Subordinated Notes due 2015—Series B, 6 5/8% Senior Subordinated Notes due 2015—Series C and 7 7/8% Senior Subordinated Notes due 2018, and rank senior to all of our existing and future subordinated debt. The exchange notes will be effectively subordinated to all existing and future liabilities of any of our subsidiaries that do not guarantee the exchange notes. |

| The guarantees by substantially all of our domestic subsidiaries will be subordinated to existing and future senior debt of such subsidiaries, including each such subsidiary’s guarantees of indebtedness under our 9 3/4% Senior Notes due 2014 and our senior credit facility. |

| As of March 31, 2012, the exchange notes and the subsidiary guarantees would have been subordinated to approximately $1.0 billion in senior debt, excluding approximately $241.6 million of additional borrowing capacity under our senior credit facility. |

12

Table of Contents

Optional Redemption | We may redeem some or all of the exchange notes at any time on or after February 1, 2017. We may also redeem up to 35% of the aggregate principal amount of the exchange notes using the proceeds from certain public equity offerings completed before February 1, 2015 so long as at least 65% of the aggregate principal amount of the notes remains outstanding. The redemption prices are described under “Description of Exchange Notes—Optional Redemption.” |

Change of Control and Asset Sales | If we or Lamar Advertising experience specific kinds of changes of control or we sell assets under certain circumstances, we will be required to make an offer to purchase the notes at the prices listed in “Description of Exchange Notes—Material Covenants—Change of Control” and “Description of Exchange Notes—Material Covenants—Limitations on Certain Asset Sales.” We may not have sufficient funds available at the time of any change of control to effect the purchase. |

Material Covenants | The indenture restricts our ability and the ability of our restricted subsidiaries to, among other things: |

| • | incur additional debt and issue preferred stock; |

| • | make certain distributions, investments and other restricted payments; |

| • | create certain liens; |

| • | enter into transactions with affiliates; |

| • | agree to any restrictions on the ability of restricted subsidiaries to make payments to us; |

| • | merge, consolidate or sell substantially all of our assets; and |

| • | sell assets. |

| These covenants are subject to important exceptions and qualifications, which are described under the heading “Description of Exchange Notes” in this prospectus. |

Risk Factors

See “Risk Factors” for a discussion of certain factors that you should carefully consider before participating in the exchange offer.

13

Table of Contents

Summary Consolidated Historical Financial Data

The following table contains our summary historical consolidated information and other operating data for the five years ended December 31, 2007, 2008, 2009, 2010 and 2011 and for the three months ended March 31, 2011 and 2012. We have prepared this information from audited financial statements for the years ended December 31, 2007 through December 31, 2011 and from unaudited financial statements for the three months ended March 31, 2011 and March 31, 2012. This information is only a summary. You should read it in conjunction with our historical financial statements and related notes included in this prospectus.

In our opinion, the information for the three months ended March 31, 2011 and March 31, 2012 reflects all adjustments, consisting only of normal recurring adjustments, necessary to fairly present our results of operations and financial condition. Results from interim periods should not be considered indicative of results for any other periods or for the year. This information is only a summary. You should read it in conjunction with our historical financial statements and related notes included in this prospectus, as well as “Selected Historical Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||||||||||||||

| 2007 | 2008 | 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||

Statement of operations data: | ||||||||||||||||||||||||||||

Net revenues | $ | 1,209,555 | $ | 1,198,419 | $ | 1,056,065 | $ | 1,092,291 | $ | 1,133,487 | $ | 255,202 | $ | 266,238 | ||||||||||||||

Operating expenses: | ||||||||||||||||||||||||||||

Direct advertising expenses | 410,762 | 437,660 | 397,725 | 398,467 | 409,052 | 99,551 | 103,423 | |||||||||||||||||||||

General and administrative expenses | 242,345 | 247,714 | 216,536 | 228,674 | 236,962 | 60,414 | 62,880 | |||||||||||||||||||||

Non-cash compensation | 27,488 | 9,005 | 12,462 | 17,839 | 11,650 | 2,132 | 2,612 | |||||||||||||||||||||

Depreciation and amortization | 306,879 | 331,654 | 336,725 | 312,703 | 299,639 | 73,873 | 72,373 | |||||||||||||||||||||

Gain on disposition of assets | (3,914 | ) | (7,363 | ) | (5,424 | ) | (4,900 | ) | (10,548 | ) | (6,447 | ) | (936 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total operating expenses | 983,560 | 1,018,670 | 958,024 | 952,783 | 946,755 | 229,523 | 240,352 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Operating income | 225,995 | 179,749 | 98,041 | 139,508 | 186,732 | 25,679 | 25,886 | |||||||||||||||||||||

Interest expense, net | 158,609 | 156,716 | 191,455 | 185,517 | 170,524 | 43,588 | 39,856 | |||||||||||||||||||||

Gain on disposition of investment | (15,448 | ) | (1,814 | ) | (1,445 | ) | — | — | — | — | ||||||||||||||||||

Loss on debt extinguishment | — | — | — | 17,402 | 677 | — | 29,972 | |||||||||||||||||||||

Income (loss) before income taxes | 82,834 | 24,847 | (91,969 | ) | (63,411 | ) | 15,531 | (17,909 | ) | (43,942 | ) | |||||||||||||||||

Income tax expense (benefit) | 37,283 | 14,487 | (36,146 | ) | (23,213 | ) | 6,919 | (4,745 | ) | (21,117 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net income (loss) | $ | 45,551 | $ | 10,360 | $ | (55,823 | ) | $ | (40,198 | ) | $ | 8,612 | $ | (13,164 | ) | $ | (22,825 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Other financial data: | ||||||||||||||||||||||||||||

EBITDA(1) | $ | 548,322 | $ | 513,217 | $ | 436,211 | $ | 434,809 | $ | 485,694 | $ | 99,552 | $ | 68,287 | ||||||||||||||

EBITDA margin(2) | 45 | % | 43 | % | 41 | % | 40 | % | 43 | % | 39 | % | 26 | % | ||||||||||||||

Ratio of EBITDA to interest expense, net(3) | 3.5x | 3.3x | 2.3x | 2.3x | 2.8x | 2.3x | 1.7x | |||||||||||||||||||||

Ratio of total debt to EBITDA(4) | 5.0x | 5.5x | 6.1x | 5.5x | 4.4x | n/a | n/a | |||||||||||||||||||||

Ratio of earnings to fixed charges(5) | 1.4x | 1.1x | 0.7x | 0.7x | 1.1x | 0.7x | 0.2x | |||||||||||||||||||||

14

Table of Contents

| As of December 31, | As of March 31, | |||||||||||||||||||||||||||

| 2007 | 2008 | 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||

Balance sheet data: | ||||||||||||||||||||||||||||

Cash and cash equivalents | $ | 76,048 | $ | 14,139 | $ | 105,306 | $ | 88,565 | $ | 33,377 | $ | 32,041 | $ | 35,365 | ||||||||||||||

Working capital | 140,369 | 89,868 | 104,491 | 156,568 | 96,712 | 126,481 | 114,404 | |||||||||||||||||||||

Total assets | 4,053,229 | 4,098,067 | 3,911,838 | 3,621,037 | 3,409,550 | 3,549,688 | 3,398,662 | |||||||||||||||||||||

Long term debt (including current maturities) | 2,725,770 | 2,836,358 | 2,671,639 | 2,409,140 | 2,158,528 | 2,356,580 | 2,187,595 | |||||||||||||||||||||

Stockholder’s equity | 882,220 | 813,904 | 781,472 | 768,489 | 789,389 | 756,229 | 771,493 | |||||||||||||||||||||

| (1) | EBITDA is defined as earnings before interest, taxes, depreciation and amortization. EBITDA represents a measure that we believe is customarily used by investors and analysts to evaluate the financial performance of companies in the media industry. Our management also believes that EBITDA is useful in evaluating our core operating results. However, EBITDA is not a measure of financial performance under accounting principles generally accepted in the United States of America and should not be considered an alternative to operating income or net income as an indicator of our operating performance or to net cash provided by operating activities as a measure of our liquidity. Because EBITDA is not calculated identically by all companies, the presentation in this prospectus may not be comparable to those disclosed by other companies. In addition, the definition of EBITDA differs from the definition of EBITDA applicable to the covenants for the notes. |

Below is a table that reconciles EBITDA to net income (loss):

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||||||||||||||

| 2007 | 2008 | 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| (dollars in thousands) |

| ||||||||||||||||||||||||||

Statement of operations data: | ||||||||||||||||||||||||||||

EBITDA | $ | 548,322 | $ | 513,217 | $ | 436,211 | $ | 434,809 | $ | 485,694 | $ | 99,552 | $ | 68,287 | ||||||||||||||

Depreciation and amortization | 306,879 | 331,654 | 336,725 | 312,703 | 299,639 | 73,873 | 72,373 | |||||||||||||||||||||

Interest expense, net | 158,609 | 156,716 | 191,455 | 185,517 | 170,524 | 43,588 | 39,856 | |||||||||||||||||||||

Income tax expense (benefit) | 37,283 | 14,487 | (36,146 | ) | (23,213 | ) | 6,919 | (4,745 | ) | (21,117 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net income (loss) | $ | 45,551 | $ | 10,360 | $ | (55,823 | ) | $ | (40,198 | ) | $ | 8,612 | $ | (13,164 | ) | $ | (22,825 | ) | ||||||||||

| (2) | EBITDA margin is defined as EBITDA divided by net revenues. |

| (3) | Ratio of EBITDA to interest expense is defined as EBITDA divided by net interest expense. |

| (4) | Ratio of total debt to EBITDA is defined as total debt divided by EBITDA. |

| (5) | The ratio of earnings to fixed charges is defined as earnings divided by fixed charges. For purposes of this ratio, earnings is defined as net income before income taxes and fixed charges. Fixed charges is defined as the sum of interest expense, preferred stock dividends and the component of rental expense that we believe to be representative of the interest factor for those amounts. |

15

Table of Contents

In deciding whether to participate in the exchange offer, you should carefully consider the risks described below, which could cause our operating results and financial condition to be materially adversely affected, as well as other information and data included in this prospectus.

Risks Related to the Exchange Offer

Holders who fail to exchange their outstanding notes will continue to be subject to restrictions on transfer and may have reduced liquidity after the exchange offer.

If you do not exchange your outstanding notes in the exchange offer, you will continue to be subject to the restrictions on transfer applicable to the outstanding notes. The restrictions on transfer of your outstanding notes arise because we issued the outstanding notes under exemptions from, or in transactions not subject to, the registration requirements of the Securities Act and applicable state securities laws. In general, you may only offer or sell the outstanding notes if they are registered under the Securities Act and applicable state securities laws, or are offered and sold under an exemption from these requirements. We do not plan to register the outstanding notes under the Securities Act.

Furthermore, we have not conditioned the exchange offer on receipt of any minimum or maximum principal amount of outstanding notes. As outstanding notes are tendered and accepted in the exchange offer, the principal amount of remaining outstanding notes will decrease. This decrease could reduce the liquidity of the trading market for the outstanding notes. We cannot assure you of the liquidity, or even the continuation, of the trading market for the outstanding notes following the exchange offer.

For further information regarding the consequences of not tendering your outstanding notes in the exchange offer, see the discussions below under the captions “The Exchange Offer— Consequences of Failure to Properly Tender Outstanding Notes in the Exchange” and “Material United States Federal Income Tax Considerations.”

You must comply with the exchange offer procedures to receive exchange notes.

Delivery of exchange notes in exchange for outstanding notes tendered and accepted for exchange pursuant to the exchange offer will be made only after timely receipt by the exchange agent of the following:

| • | certificates for outstanding notes or a book-entry confirmation of a book-entry transfer of outstanding notes into the exchange agent’s account at DTC, New York, New York as a depository, including an agent’s message, as defined in this prospectus, if the tendering holder does not deliver a letter of transmittal; |

| • | a complete and signed letter of transmittal, or facsimile copy, with any required signature guarantees, or, in the case of a book-entry transfer, an agent’s message in place of the letter of transmittal; and |

| • | any other documents required by the letter of transmittal. |

Therefore, holders of outstanding notes who would like to tender outstanding notes in exchange for exchange notes should be sure to allow enough time for the necessary documents to be timely received by the exchange agent. We are not required to notify you of defects or irregularities in tenders of outstanding notes for exchange. Outstanding notes that are not tendered or that are tendered but we do not accept for exchange will, following consummation of the exchange offer, continue to be subject to the existing transfer restrictions under the Securities Act and will no longer have the registration and other rights under the registration rights agreement. See “The Exchange Offer— Procedures for Tendering” and “The Exchange Offer— Consequences of Failures to Properly Tender Outstanding Notes in the Exchange.”

Some holders who exchange their outstanding notes may be deemed to be underwriters, and these holders will be required to comply with the registration and prospectus delivery requirements in connection with any resale transaction.

16

Table of Contents

If you exchange your outstanding notes in the exchange offer for the purpose of participating in a distribution of the exchange notes, you may be deemed to have received restricted securities. If you are deemed to have received restricted securities, you will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction.

An active trading market may not develop for the exchange notes.

The exchange notes have no established trading market and will not be listed on any securities exchange. The initial purchasers have informed us that they currently intend to make a market in the exchange notes. However, the initial purchasers are not obligated to do so and may discontinue any such market making at any time without notice. The liquidity of any market for the exchange notes will depend upon various factors, including:

| • | the number of holders of the exchange notes; |

| • | the interest of securities dealers in making a market for the exchange notes; |

| • | the overall market for high yield securities; |

| • | our financial performance or prospects; and |

| • | the prospects for companies in our industry generally. |

Accordingly, we cannot assure you that a market or liquidity will develop for the exchange notes. Historically, the market for non-investment grade debt has been subject to disruptions that have caused substantial volatility in the prices of securities similar to the exchange notes. We cannot assure you that the market for the exchange notes, if any, will not be subject to similar disruptions. Any such disruptions may adversely affect you as a holder of the exchange notes.

Risks Related to the Exchange Notes

Our substantial debt may adversely affect our business, financial condition and financial results and prevent us from fulfilling our obligations under the notes.

We have borrowed substantially in the past and will continue to borrow in the future. At March 31, 2012, we had approximately $2.19 billion of total debt outstanding, consisting of approximately $695.5 million under our Senior Credit Facility, $333.4 million of senior notes and $1.16 billion in various series of senior subordinated notes, including the outstanding 5 7/8% Senior Subordinated Notes due 2022. Despite the level of debt presently outstanding, the terms of the indentures governing our senior subordinated notes and the terms of our senior credit facility allow us to incur substantially more debt, including approximately $241.6 million available for borrowing as of March 31, 2012, under our revolving senior credit facility.

Our substantial debt and our use of cash flow from operations to make principal and interest payments on our debt may, among other things:

| • | make it more difficult for us to comply with the financial covenants in our senior credit facility, which could result in a default and an acceleration of all amounts outstanding under the facility; |

| • | limit the cash flow available to fund our working capital, capital expenditures, acquisitions or other general corporate requirements; |

| • | limit our ability to obtain additional financing to fund future working capital, capital expenditures or other general corporate requirements; |

| • | place us at a competitive disadvantage relative to those of our competitors that have less debt; |

17

Table of Contents

| • | force us to seek and obtain alternate or additional sources of funding, which may be unavailable, or may be on less favorable terms, or may require us to obtain the consent of lenders under our senior credit facility or the holders of our other debt; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and industry; and |

| • | increase our vulnerability to general adverse economic and industry conditions. |

Any of these problems could adversely affect our business, financial condition and financial results.

We may be unable to generate sufficient cash flow to satisfy our significant debt service obligations, including our obligations under the exchange notes.

Our ability to generate cash flow from operations to make principal and interest payments on our debt, including the exchange notes, will depend on our future performance, which will be affected by a range of economic, competitive and business factors. We cannot control many of these factors, including general economic conditions, our customers’ allocation of advertising expenditures among available media and the amount spent on advertising in general. The recent economic recession negatively affected our business, and our financial results could be negatively impacted if current economic conditions deteriorate. If our operations do not generate sufficient cash flow to satisfy our debt service obligations, we may need to borrow additional funds to make these payments or undertake alternative financing plans, such as refinancing or restructuring our debt, or reducing or delaying capital investments and acquisitions. We cannot guarantee that such additional funds or alternative financing will be available on favorable terms, if at all. If we are unable to generate sufficient cash flow from operations or obtain additional funds or alternative financing on acceptable terms, it could have a material adverse effect on our business, financial condition and results of operations.

Restrictions in our and Lamar Advertising’s debt agreements reduce operating flexibility and contain covenants and restrictions that create the potential for defaults, which could adversely affect our business, financial condition and financial results.

The terms of the indentures relating to our senior credit facility and the indentures relating to our outstanding senior subordinated notes and senior notes restrict our and Lamar Advertising’s ability to, among other things:

| • | incur or repay debt; |

| • | dispose of assets; |

| • | create liens; |

| • | make investments; |

| • | enter into affiliate transactions; and |

| • | pay dividends and make inter-company distributions. |

The terms of our senior credit facility also restrict us from exceeding specified total holdings debt and senior debt ratios and require us to maintain a specified minimum fixed charges coverage ratio. Please see “Management’s Discussion and Analysis of Financial Conditions and Results of Operations–Liquidity and Capital Resources” for a description of the specific financial ratio requirements under our senior credit facility.

Our ability to comply with the financial covenants in the senior credit facility and the indentures governing our existing notes (and to comply with any similar covenants in future agreements) and the exchange notes offered hereby depends on our operating performance, which in turn depends significantly on prevailing economic, financial and business conditions and other factors that are beyond our control. Therefore, despite our best efforts and execution of our strategic plan, we may be unable to comply with these financial covenants in the future.

18

Table of Contents

Although we and Lamar Advertising are currently in compliance with all financial covenants, our operating results have been negatively impacted by current economic conditions and there can be no assurance that the current economic environment will not further impact our results and, in turn, our ability to meet these requirements in the future. If we fail to comply with our financial covenants, we could be in default under our senior credit facility (which would result in an event of default under the indentures governing our and Lamar Advertising’s outstanding notes and the exchange notes). In the event of such default, the lenders under the senior credit facility could accelerate all of the debt outstanding, could elect to institute foreclosure proceedings against our assets, and we could be forced into bankruptcy or liquidation. Any of these events could adversely affect our business, financial condition and financial results.

In addition, these restrictions reduce our operating flexibility and could prevent us from exploiting investment, acquisition, marketing, or other time-sensitive business opportunities.

Your right to receive payments on the exchange notes is junior to our existing senior indebtedness and the existing senior indebtedness of the subsidiary guarantors and possibly all of our and their future indebtedness.

The exchange notes and the subsidiary guarantees will be subordinated in right of payment to the prior payment in full of our and the subsidiary guarantors’ respective current and future senior indebtedness, including our and their obligations under our senior credit facility and our 9 3/4% Senior Notes due 2014. As of March 31, 2012, the exchange notes would have been subordinated to approximately $1.03 billion in senior debt, including approximately $695.5 million under our senior credit facility, and an additional $241.6 million of senior debt was available for borrowing under our senior credit facility. As a result of the subordination provisions of the exchange notes, in the event of the bankruptcy, liquidation or dissolution of us or any subsidiary guarantor, our assets or the assets of the applicable subsidiary guarantor would be available to pay obligations under the exchange notes and our other senior subordinated obligations only after all payments had been made on our senior indebtedness or the senior indebtedness of the applicable subsidiary guarantor. Sufficient assets may not remain after all of these payments have been made to make any payments on the exchange notes and our other senior subordinated obligations (which totaled approximately $656.2 million as of March 31, 2012), including payments of interest when due.

In addition, all payments on the exchange notes and the subsidiary guarantees will be prohibited in the event of a payment default on our senior indebtedness and, for limited periods, upon the occurrence of other defaults under our bank credit facility.

The exchange notes and the subsidiary guarantees will be unsecured and are effectively subordinated to all of our and our subsidiary guarantors’ secured indebtedness.

The exchange notes will not be secured. The lenders under our senior credit facility are currently secured by a pledge of the stock of all of the subsidiary guarantors, a pledge of our stock, and a substantial portion of our and the guarantors’ other property.

If we or any of the subsidiary guarantors declare bankruptcy, liquidate or dissolve, or if payment under our senior credit facility or any of our other secured indebtedness is accelerated, our secured lenders would be entitled to exercise the remedies available to a secured lender under applicable law and will have a claim on those assets before the holders of the exchange notes. As a result, the exchange notes are effectively subordinated to our and our subsidiaries’ secured indebtedness to the extent of the value of the assets securing that indebtedness and the holders of the exchange notes would in all likelihood recover ratably less than the lenders of our and our subsidiaries’ secured indebtedness in the event of our bankruptcy, liquidation or dissolution. As of March 31, 2012, we had $1.03 billion of secured indebtedness outstanding (including approximately $27.8 million in indebtedness outstanding that was incurred by non-guarantor subsidiaries) and $241.6 million of additional secured indebtedness was available for borrowing under our revolving senior credit facility.

19

Table of Contents

Claims of noteholders will be structurally subordinate to claims of creditors of our non-guarantor subsidiaries

As of the date of this prospectus, the exchange notes will not be guaranteed by any of our foreign or less than wholly owned subsidiaries who do not guarantee our senior credit facility. Claims of holders of the exchange notes will be structurally subordinated to all of the liabilities of our subsidiaries that do not guarantee the exchange notes. In the event of a bankruptcy, liquidation or dissolution of any of the non-guarantor subsidiaries, holders of their indebtedness, their trade creditors and holders of their preferred equity will generally be entitled to payment on their claims from assets of those subsidiaries before any assets are made available for distribution to us. However, under some circumstances, the terms of the exchange notes will permit our non-guarantor subsidiaries to incur additional specified indebtedness. As of March 31, 2012, our non-guarantor subsidiaries had approximately $378 thousand in trade payables.

Upon a change of control, we may not have the funds necessary to finance the change of control offer required by the indenture governing the exchange notes, which would violate the terms of the exchange notes.

Upon the occurrence of a change of control, holders of the exchange notes will have the right to require us to purchase all or any part of the exchange notes at a price equal to 101% of the principal amount, plus accrued and unpaid interest, if any, to the date of purchase. We may not have sufficient financial resources available to satisfy all of the obligations under the exchange notes in the event of a change of control. Further, we will be contractually restricted under the terms of our senior credit facility from repurchasing all of the exchange notes tendered upon a change of control. Accordingly, we may be unable to satisfy our obligations to purchase the exchange notes unless we are able to refinance or obtain waivers under our senior credit facility. Our failure to purchase the exchange notes as required under the indenture would result in a default under the indenture and a cross-default under our senior credit facility, each of which could have material adverse consequences for us and the holders of the exchange notes. In addition, the senior credit facility provides that a change of control is a default that permits lenders to accelerate the maturity of borrowings under it. See “Description of Exchange Notes—Change of control.”

Federal and state statutes allow courts, under specific circumstances, to void the guarantees of the exchange notes by our subsidiaries and require the holders of the exchange notes to return payments received from the subsidiary guarantors.

Under the federal bankruptcy law and comparable provisions of state fraudulent transfer laws, the subsidiary guarantees could be voided, or claims in respect of the subsidiary guarantees could be subordinated to all other debts of a subsidiary guarantor if, either, the subsidiary guarantee was incurred with the intent to hinder, delay or defraud any present or future creditors of the subsidiary guarantor or the subsidiary guarantors, at the time it incurred the indebtedness evidenced by its subsidiary guarantee, received less than reasonably equivalent value or fair consideration for the incurrence of such indebtedness and the subsidiary guarantor either:

| • | was insolvent or rendered insolvent by reason of such incurrence; |

| • | was engaged in a business or transaction for which such subsidiary guarantor’s remaining assets constituted unreasonably small capital; or |

| • | intended to incur, or believed that it would incur, debts beyond its ability to pay such debts as they mature. |

If a subsidiary guarantee is voided, you will be unable to rely on the applicable subsidiary guarantor to satisfy your claim in the event that we fail to make one or more required payments due on the exchange notes. In addition, any payment by such subsidiary guarantor pursuant to its subsidiary guarantee could be voided and required to be returned to such subsidiary guarantor, or to a fund for the benefit of creditors of such subsidiary guarantor.

20

Table of Contents

The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a subsidiary guarantor would be considered insolvent if:

| • | the sum of its debts, including contingent liabilities, were greater than the fair saleable value of all of its assets; |

| • | the present fair saleable value of its assets were less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| • | it could not pay its debts as they become due. |

On the basis of historical financial information, recent operating history and other factors, we and each subsidiary guarantor believe that, after giving effect to the indebtedness incurred in connection with this offering, no subsidiary guarantor will be insolvent, will have unreasonably small capital for the business in which it is engaged or will have incurred debts beyond its ability to pay such debts as they mature. There can be no assurance, however, as to what standard a court would apply in making such determinations or that a court would agree with our or the subsidiary guarantors’ conclusions in this regard.

Risks Related to Our Business and Operations

Our revenues are sensitive to general economic conditions and other external events beyond our control.

We sell advertising space on outdoor structures to generate revenues. Advertising spending is particularly sensitive to changes in economic conditions and has been adversely affected by the most recent recession, as evidenced by an 11.9% decline in our pro forma advertising revenues in the year ended December 31, 2009.

Additionally, the occurrence of any of the following external events could further depress our revenues:

| • | a widespread reallocation of advertising expenditures to other available media by significant users of our displays; and |

| • | a decline in the amount spent on advertising in general or outdoor advertising in particular. |

We could suffer losses due to asset impairment charges for goodwill and other intangible assets.

We tested goodwill for impairment on December 31, 2011. Based on our review at December 31, 2011, no impairment charge was required. We continue to assess whether factors or indicators become apparent that would require an interim impairment test between our annual impairment test dates. For instance, if our market capitalization is below our equity book value for a period of time without recovery, we believe there is a strong presumption that would indicate a triggering event has occurred and it is more likely than not that the fair value of one or both of our reporting units are below their carrying amount. This would require us to test the reporting units for impairment of goodwill. If this presumption cannot be overcome, a reporting unit could be impaired under ASC 350 “Goodwill and Other Intangible Assets” and a non-cash charge would be required. Any such charge could have a material adverse effect on our net earnings.

We face competition from larger and more diversified outdoor advertisers and other forms of advertising that could hurt our performance.

While we enjoy a significant market share in many of our small and medium-sized markets, we face competition from other outdoor advertisers and other media in all of our markets. Although we are one of the largest companies focusing exclusively on outdoor advertising in a relatively fragmented industry, we compete against larger companies with diversified operations, such as television, radio and other broadcast media. These diversified competitors have the advantage of cross-selling complementary advertising products to advertisers.

21

Table of Contents

We also compete against an increasing variety of out-of-home advertising media, such as advertising displays in shopping centers, malls, airports, stadiums, movie theaters and supermarkets, and on taxis, trains and buses. To a lesser extent, we also face competition from other forms of media, including radio, newspapers, direct mail advertising, telephone directories and the Internet. The industry competes for advertising revenue along the following dimensions: exposure (the number of “impressions” an advertisement makes), advertising rates (generally measured in cost-per-thousand impressions), ability to target specific demographic groups or geographies, effectiveness, quality of related services (such as advertising copy design and layout) and customer service. We may be unable to compete successfully along these dimensions in the future, and the competitive pressures that we face could adversely affect our profitability or financial performance.

Federal, state and local regulation impact our operations, financial condition and financial results.

Outdoor advertising is subject to governmental regulation at the federal, state and local levels. Regulations generally restrict the size, spacing, lighting and other aspects of advertising structures and pose a significant barrier to entry and expansion in many markets.

Federal law, principally the Highway Beautification Act of 1965 (the “HBA”), regulates outdoor advertising on Federal—Aid Primary, Interstate and National Highway Systems roads. The HBA requires states to “effectively control” outdoor advertising along these roads, and mandates a state compliance program and state standards regarding size, spacing and lighting. The HBA requires any state or political subdivision that compels the removal of a lawful billboard along a Federal—Aid Primary or Interstate highway to pay just compensation to the billboard owner.