|

|---|

Exhibit 99.1

Presentation Materials |

|

|

2006 Annual Shareholder’s Meeting

Salisbury Bancorp, Inc.

**Statements contained in this Annual Meeting Presentation Material contain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. These

statements are based on the beliefs and expectations of management as well as the assumption

made using information currently available to management. Since these statements reflect the

views of management concerning future events, these statements involve risks, uncertainties and

assumptions, including, among others: changes in market interest rates and general and regional

economic conditions; changes in government regulations; changes in accounting principles; and

the quality or composition of the loan and investment portfolios and other factors that may be

described in the Company’s quarterly reports of Form 10-Q and its annual report on Form 10-K,

each filed with the Securities and Exchange Commission, which are available at the Securities and

Exchange Commission’s internet website (www.sec.gov) and to which reference in hereby made.

Therefore, actual future results may differ significantly from results discussed in the forward-

looking statements.

Salisbury Bank and Trust Company

$403 million in assets

Approximately 750 shareholders

24,000 deposit accounts

6,600 loan accounts

118 FTE’s

6 full service locations

9 ATM’s

2 limited service locations

2005 Highlights

Completed merger integration

Customer relationship management

Closed 1332 loans totaling more than $110 mm

Closed 281 residential mortgages - $55 million

Closed 258 commercial loans - $33 million

Net Income - $4,561,341

2005 Highlights (cont’d)

Trust and Investment Services

55 new account relationships - $12 million

Completed core operating system conversion

Bradley Foster and Sargent, Inc.

Enhanced business development resources

Mission

Salisbury Bank and Trust Company strives to be the leading

community bank in the tri-state area. We are committed to

providing professional financial services in a friendly and

responsive manner.

We are dedicated to being an active corporate citizen in the

communities we serve, we will inspire our staff to grow

personally and professionally. Our achievement of these goals

will continue to assure customer satisfaction, profitability, and

enhanced shareholder value.

Stakeholders

Shareholders

Customers

Employees

Communities

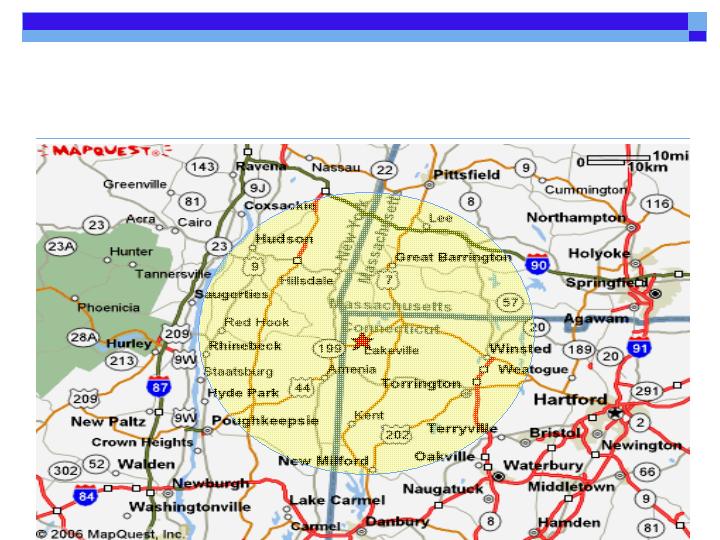

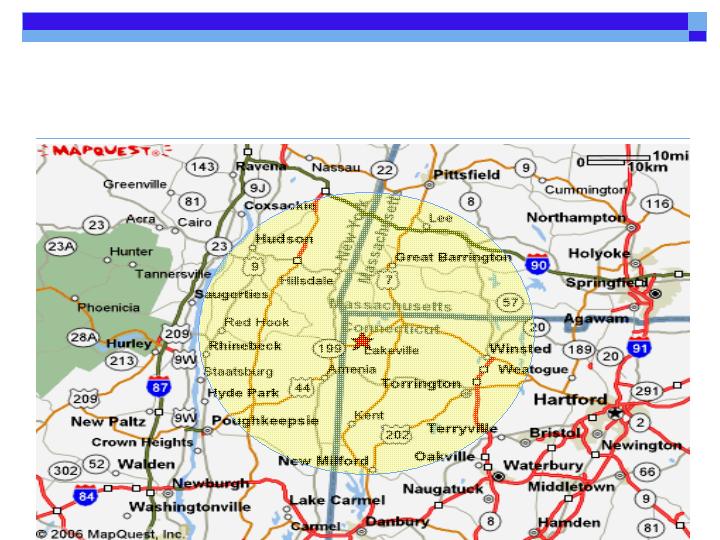

Tri-State area …

Leading community bank …

9.20%

9.05%

10.09%

Peer Group Avg.

12.30%

12.21%

10.81%

SBT

5 yr. avg.

3 yr. avg.

1 yr.

Return on Average Equity

Leading community bank …

.80%

.78%

.82%

Peer Group Avg.

1.15%

1.17%

1.12%

SBT

5 yr. avg.

3 yr. avg.

1 yr.

Return on Average Assets

Professional …

We will apply our knowledge and expertise to match

customers needs and objectives to the most appropriate

solutions available. We will maintain public trust by

always acting in an ethical manner.

Product training

Continuing education

Code of ethics policy

Experience level of senior management team averages

more than 24 years per individual

Friendly and Responsive …

We will treat every customer contact as an opportunity

to exceed their expectations. We will always use

integrity, honesty, and sincerity when dealing with

both internal and external customers.

Customer service standards

Customer service scorecard

Product training

New and closed account surveys

Active Corporate Citizen …

We will serve the role of a business leader and

responsible corporate citizen through the financial

support of worthy community projects, encouraging

our directors, officers, and staff to participate in

activities which enhance the quality of life in the

communities we serve.

83% of employees and board members volunteer

their time for more than 150 community

organizations or events.

Contributed more than $750,000 since 1996

Inspire Our Staff to Grow Personally

and Professionally …

Finding and hiring the right talent

Career development opportunities

Provide management training

Encourage decision-making, responsibility,

and authority

Enhanced Shareholder Value …

Provide a continuous long-term source of

profitable growth and superior long-term economic

rewards.

Be a model in the market for prudent lending and

operating practices; by growing carefully and

selectively, and by maintaining stringent conformance

with banking regulations and policies.

Develop and preserve a superior capital position, being

one of the most financially strong banks in the market.

Investment Valuation

Enhanced Shareholder Value …

Provide a continuous long-term source of profitable

growth and superior long-term economic rewards.

Be a model in the market for prudent lending and

operating practices; by growing carefully and

selectively, and by maintaining stringent

conformance with banking regulations and

policies.

Develop and preserve a superior capital position, being

one of the most financially strong banks in the market.

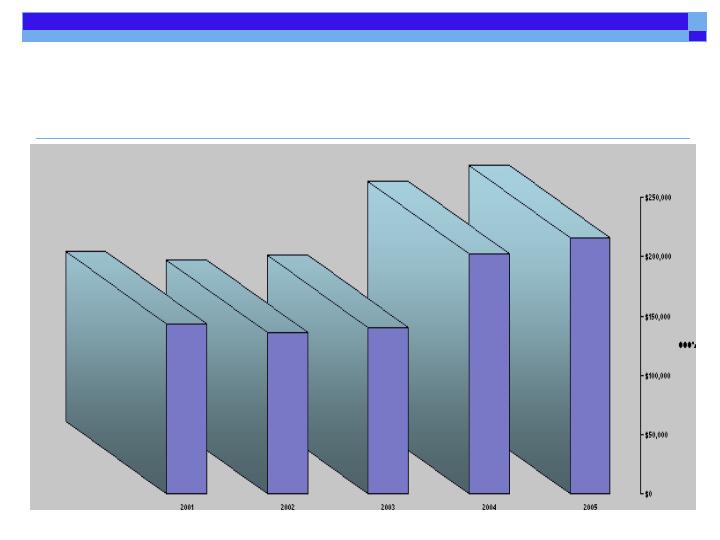

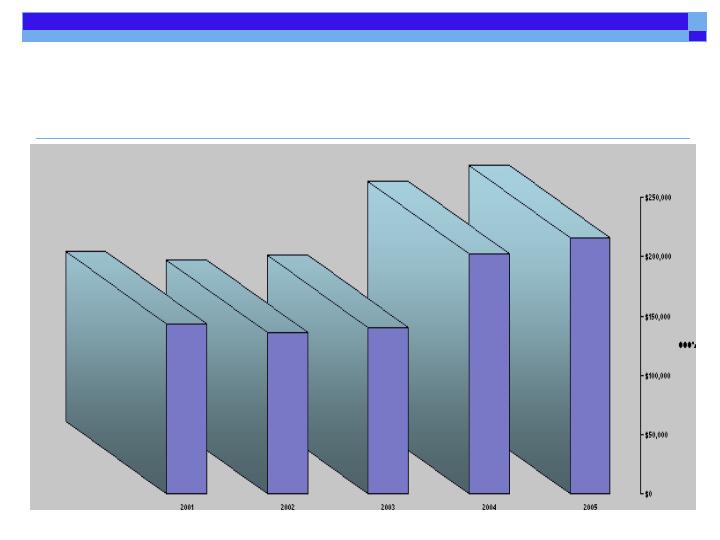

Net Loans

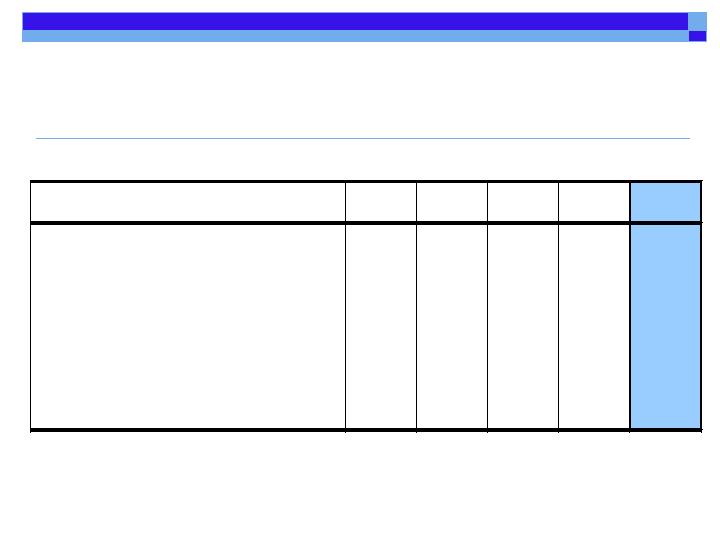

Asset Quality

2001

2002

2003

2004

2005

Non-Performing Assets/Loans (%)

0.41

1.03

0.49

1.12

0.36

Allowance Loan Loss/Loans (%)

1.01

1.07

1.19

1.24

1.22

Allowance Loan Loss/Non-Performing

Loans (%)

246.2

104.1

242.9

110.8

339.7

Net Charge Offs/Loans (%)

0

0.16

0.07

0.03

0.05

Enhanced Shareholder Value

Provide a continuous long-term source of profitable

growth and superior long-term economic rewards.

Be a model in the market for prudent lending and

operating practices; by growing carefully and

selectively, and by maintaining stringent conformance

with banking regulations and policies.

Develop and preserve a superior capital position,

being one of the most financially strong banks in

the market.

Average Shareholder’s Equity

9.40%

9.60%

10.38%

Average Shareholder’s

Equity to Average Assets

5 yr. avg.

3 yr. avg.

1 yr.

Your company remains classified as a “well-capitalized”

bank according to regulatory standards.

2006 Objectives

Conservative and disciplined approach to

growing and managing the bank

Focus on what we can control

Grow core earnings

Increase non-interest income

Reduce non-interest expense

Enhance business banking services

Promote trust and investment services