Exhibit 99.2

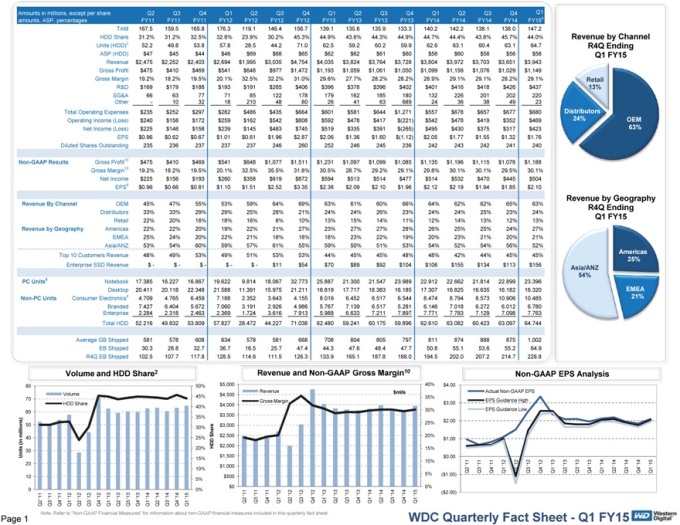

Amounts in millions, except per share amounts, ASP, percentages Q2 FY11 Q3 FY11 Q4 FY11 Q1 FY12 Q2 FY12 Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY159 TAM 167.5 159.5 165.8 176.3 119.1 146.4 156.7 139.1 135.8 135.9 133.3 140.2 142.2 138.1 138.0 147.2 HDD Share 31.2% 31.2% 32.5% 32.8% 23.9% 30.2% 45.3% 44.9% 43.6% 44.3% 44.9% 44.7% 44.4% 43.8% 45.7% 44.0% Units (HDD)2 52.2 49.8 53.8 57.8 28.5 44.2 71.0 62.5 59.2 60.2 59.9 62.6 63.1 60.4 63.1 64.7 ASP (HDD) $47 $45 $44 $46 $69 $68 $65 $62 $62 $61 $60 $58 $60 $58 $56 $58 Revenue $2,475 $2,252 $2,403 $2,694 $1,995 $3,035 $4,754 $4,035 $3,824 $3,764 $3,728 $3,804 $3,972 $3,703 $3,651 $3,943 Gross Profit $475 $410 $469 $541 $648 $977 $1,472 $1,193 $1,059 $1,061 $1,050 $1,099 $1,156 $1,076 $1,029 $1,149 Gross Margin 19.2% 18.2% 19.5% 20.1% 32.5% 32.2% 31.0% 29.6% 27.7% 28.2% 28.2% 28.9% 29.1% 29.1% 28.2% 29.1% R&D $169 $179 $188 $193 $191 $265 $406 $396 $378 $396 $402 $401 $416 $418 $426 $437 SG&A 66 63 77 71 85 122 178 179 162 185 180 132 226 201 202 220 Other - 10 32 18 210 48 80 26 41 63 689 24 36 38 49 23 Total Operating Expenses $235 $252 $297 $282 $486 $435 $664 $601 $581 $644 $1,271 $557 $678 $657 $677 $680 Operating Income (Loss) $240 $158 $172 $259 $162 $542 $808 $592 $478 $417 $(221) $542 $478 $419 $352 $469 Net Income (Loss) $225 $146 $158 $239 $145 $483 $745 $519 $335 $391 $(265) $495 $430 $375 $317 $423 EPS $0.96 $0.62 $0.67 $1.01 $0.61 $1.96 $2.87 $2.06 $1.36 $1.60 $(1.12) $2.05 $1.77 $1.55 $1.32 $1.76 Diluted Shares Outstanding 235 236 237 237 237 246 260 252 246 245 236 242 243 242 241 240 Non-GAAP Results Gross Profit10 $475 $410 $469 $541 $648 $1,077 $1,511 $1,231 $1,097 $1,099 $1,085 $1,135 $1,196 $1,115 $1,078 $1,188 Gross Margin10 19.2% 18.2% 19.5% 20.1% 32.5% 35.5% 31.8% 30.5% 28.7% 29.2% 29.1% 29.8% 30.1% 30.1% 29.5% 30.1% Net Income $225 $156 $193 $260 $358 $619 $872 $594 $513 $514 $477 $514 $532 $470 $445 $504 EPS6 $0.96 $0.66 $0.81 $1.10 $1.51 $2.52 $3.35 $2.36 $2.09 $2.10 $1.96 $2.12 $2.19 $1.94 $1.85 $2.10 Revenue By Channel OEM 45% 47% 55% 53% 59% 64% 69% 63% 61% 60% 66% 64% 62% 62% 65% 63% Distributors 33% 33% 29% 29% 25% 28% 21% 24% 24% 26% 23% 24% 24% 25% 23% 24% Retail 22% 20% 16% 18% 16% 8% 10% 13% 15% 14% 11% 12% 14% 13% 12% 13% Revenue by Geography Americas 22% 22% 20% 19% 22% 21% 27% 23% 27% 27% 28% 26% 25% 25% 24% 27% EMEA 25% 24% 20% 22% 21% 18% 18% 18% 23% 22% 19% 20% 23% 21% 20% 21% Asia/ANZ 53% 54% 60% 59% 57% 61% 55% 59% 50% 51% 53% 54% 52% 54% 56% 52% Top 10 Customers Revenue 48% 49% 53% 49% 51% 53% 53% 44% 45% 45% 48% 48% 42% 44% 45% 45% Enterprise SSD Revenue $ - $ - $ - $ - $ - $11 $54 $70 $89 $92 $104 $106 $155 $134 $113 $156 PC Units5 Notebook 17.385 16.227 16.867 19.622 9.814 18.067 32.773 25.887 21.300 21.547 23.989 22.912 22.662 21.814 22.899 23.396 Desktop 20.411 20.118 22.348 21.588 11.391 15.975 21.211 16.819 17.717 18.383 16.185 17.307 16.825 16.635 16.182 16.320 Non-PC Units Consumer Electronics4 4.709 4.765 6.459 7.188 2.352 3.643 4.155 8.019 6.452 6.517 6.544 8.474 8.794 8.573 10.906 10.485 Branded 7.427 6.404 5.672 7.060 3.191 2.926 4.986 5.767 7.139 6.517 5.281 6.146 7.018 6.272 6.012 6.780 Enterprise 2.284 2.318 2.463 2.369 1.724 3.616 7.913 5.988 6.633 7.211 7.897 7.771 7.783 7.129 7.098 7.763 Total HDD 52.216 49.832 53.809 57.827 28.472 44.227 71.038 62.480 59.241 60.175 59.896 62.610 63.082 60.423 63.097 64.744 Average GB Shipped 581 578 608 634 578 581 668 708 804 805 797 811 874 888 875 1,002 EB Shipped 30.3 28.8 32.7 36.7 16.5 25.7 47.4 44.3 47.6 48.4 47.7 50.8 55.1 53.6 55.2 64.9 R4Q EB Shipped 102.5 107.7 117.8 128.5 114.6 111.5 126.3 133.9 165.1 187.8 188.0 194.5 202.0 207.2 214.7 228.8 Units (in millions) 0 10 20 30 40 50 60 70 80 Q2 ‘11 Q3 ‘11 Q4 ‘11 Q1 ‘12 (HDD)Volume Q2 ‘12 Q3 ‘12 (Share)Volume Q4 ‘12 Q1 ‘13 and Q2 ‘13 Q3 ‘13 HDD Q4 ‘13 Q1 ‘14 Share Q2 ‘14 2 Q3 ‘14 Q4 ‘14 Q1 ‘15 0% (5%)10% 15% 20% 25% 30% 35% 40% 45% 50% HDD Share $ $ $ $ $ $ $ $ $ $ 500 $ 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 0 Q2 ‘11 Q3 ‘11 Q4 ‘11 Q1 ‘12 Margin (Gross)(Revenue)Revenue Q2 ‘12 Q3 ‘12 and Q4 ‘12 Non Q1 ‘13 - Q2 ‘13 Q3 ‘13 GAAP Q4 ‘13 Q1 ‘14 Gross Q2 ‘14 Q3 ‘14 $ Margin Q4 ‘14 mils 10 Q1 ‘15 0% (5%)10% 15% 20% 25% 30% 35% 40% Non-GAAP EPS Analysis $4.00 Actual Non-GAAP EPS $3.00 EPS Guidance High EPS Guidance Low $2.00 $1.00 $0.00 ‘11 ‘11 ‘11 ‘12 ‘12 ‘12 ‘12 ‘13 ‘13 ‘13 ‘13 ‘14 ‘14 ‘14 ‘14 ‘15 ($ 1.00) Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 ($ 2.00) Revenue by Channel R4Q Ending Q1 FY15 Retail 13% Distributors 24% OEM 63% Revenue by Geography R4Q Ending Q1 FY15 Americas 25% Asia/ANZ 54% EMEA 21% Note: Refer to “Non-GAAP Financial Measures” for information about non-GAAP financial measures included in this quarterly fact sheet. WDC Quarterly Fact Sheet - Q1 FY15 WD Western Digital Page 1

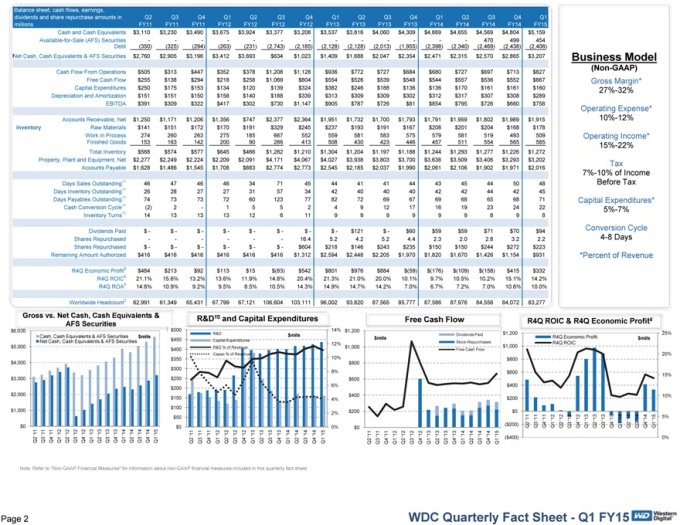

Balance sheet, cash flows, earnings, dividends and share repurchase amounts in millions Q2 FY11 Q3 FY11 Q4 FY11 Q1 FY12 Q2 FY12 Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Cash and Cash Equivalents $3,110 $3,230 $3,490 $3,675 $3,924 $3,377 $3,208 $3,537 $3,816 $4,060 $4,309 $4,869 $4,655 $4,569 $4,804 $5,159 Available-for-Sale (AFS) Securities - - - - - - - 470 499 454 Debt (350) (325) (294) (263) (231) (2,743) (2,185) (2,128) (2,128) (2,013) (1,955) (2,398) (2,340) (2,469) (2,438) (2,406) Net Cash, Cash Equivalents & AFS Securities $2,760 $2,905 $3,196 $3,412 $3,693 $634 $1,023 $1,409 $1,688 $2,047 $2,354 $2,471 $2,315 $2,570 $2,865 $3,207 Cash Flow From Operations $505 $313 $447 $352 $378 $1,208 $1,128 $936 $772 $727 $684 $680 $727 $697 $713 $827 Free Cash Flow $255 $138 $294 $218 $258 $1,069 $804 $554 $526 $539 $548 $544 $557 $536 $552 $667 Capital Expenditures $250 $175 $153 $134 $120 $139 $324 $382 $246 $188 $136 $136 $170 $161 $161 $160 Depreciation and Amortization $151 $151 $150 $158 $140 $188 $339 $313 $309 $309 $302 $312 $317 $307 $308 $289 EBITDA $391 $309 $322 $417 $302 $730 $1,147 $905 $787 $726 $81 $854 $795 $726 $660 $758 Accounts Receivable, Net $1,250 $1,171 $1,206 $1,356 $747 $2,377 $2,364 $1,951 $1,732 $1,700 $1,793 $1,791 $1,959 $1,802 $1,989 $1,915 Inventory Raw Materials $141 $151 $172 $170 $191 $329 $245 $237 $193 $191 $167 $208 $201 $204 $168 $178 Work in Process 274 260 263 275 185 667 552 559 581 583 575 579 581 519 493 509 Finished Goods 153 163 142 200 90 286 413 508 430 423 446 457 511 554 565 585 Total Inventory $568 $574 $577 $645 $466 $1,282 $1,210 $1,304 $1,204 $1,197 $1,188 $1,244 $1,293 $1,277 $1,226 $1,272 Property, Plant and Equipment, Net $2,277 $2,249 $2,224 $2,209 $2,091 $4,171 $4,067 $4,027 $3,938 $3,803 $3,700 $3,638 $3,509 $3,406 $3,293 $3,202 Accounts Payable $1,628 $1,486 $1,545 $1,708 $883 $2,774 $2,773 $2,545 $2,185 $2,037 $1,990 $2,061 $2,106 $1,902 $1,971 $2,016 Days Sales Outstanding11 46 47 46 46 34 71 45 44 41 41 44 43 45 44 50 48 Days Inventory Outstanding11 26 28 27 27 31 57 34 42 40 40 40 42 42 44 42 45 Days Payables Outstanding11 74 73 73 72 60 123 77 82 72 69 67 69 68 65 68 71 Cash Conversion Cycle11 (2) 2 - 1 5 5 2 4 9 12 17 16 19 23 24 22 Inventory Turns11 14 13 13 13 12 6 11 9 9 9 9 9 9 8 9 8 Dividends Paid $ - $ - $ - $ - $ - $ - $ - $ - $121 $ - $60 $59 $59 $71 $70 $94 Shares Repurchased - - - 16.4 5.2 4.2 5.2 4.4 2.3 2.0 2.8 3.2 2.2 Shares Repurchased $ - $ - $ - $ - $ - $ - $604 $218 $146 $243 $235 $150 $150 $244 $272 $223 Remaining Amount Authorized $416 $416 $416 $416 $416 $416 $1,312 $2,594 $2,448 $2,205 $1,970 $1,820 $1,670 $1,426 $1,154 $931 R4Q Economic Profit8 $484 $213 $92 $113 $15 $(83) $542 $801 $976 $884 $(59) $(176) $(109) $(158) $415 $332 R4Q ROIC8 21.1% 15.6% 13.2% 13.6% 11.9% 14.8% 20.4% 21.3% 21.0% 20.0% 10.1% 9.7% 10.5% 10.2% 15.1% 14.2% R4Q ROA8 14.6% 10.9% 9.2% 9.5% 8.5% 10.5% 14.3% 14.9% 14.7% 14.2% 7.0% 6.7% 7.2% 7.0% 10.6% 10.0% Worldwide Headcount3 62,991 61,349 65,431 67,799 67,121 106,604 103,111 96,002 93,820 87,565 85,777 87,586 87,976 84,556 84,072 83,277 Gross vs. Net Cash, Cash Equivalents & AFS Securities $6,000 Cash, Cash Equivalents & AFS Securities $mils Net Cash, Cash Equivalents & AFS Securities $5,000 $4,000 $3,000 $2,000 $1,000 $0 ‘11 ‘11 ‘11 ‘12 ‘12 ‘12 ‘12 ‘13 ‘13 ‘13 ‘13 ‘14 ‘14 ‘14 ‘14 ‘15 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 R&D10 and Capital Expenditures $500 14% R&D $mils $450 Capital Expenditures 12% $400 R&D % of Revenue Capex % of Revenue $350 10% $300 8% $250 $200 6% $150 4% $100 2% $50 $0 0% ‘11 ‘11 ‘11 ‘12 ‘12 ‘12 ‘12 ‘13 ‘13 ‘13 ‘13 ‘14 ‘14 ‘14 ‘14 ‘15 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 $ $ $ $ $ $ 0 $ 200 400 600 800 1,000 1,200 Q2 ‘11 Q3 ‘11 $ Q4 ‘11 mils Q1 ‘12 Q2 ‘12 Q3 ‘12 Free Q4 ‘12 Q1 ‘13 Q2 ‘13 Cash Q3 ‘13 Q4 ‘13 Flow Q1 ‘14 Free Stock Dividends Q2 ‘14 Cash Flow Q4 Q3 ‘14 ‘14 Repurchases Paid Q1 ‘15 R4Q ROIC & R4Q Economic Profit8 $1,200 25% R4Q Economic Profit $mils R4Q ROIC $1,000 20% $800 $600 15% $400 $200 10% $0 ‘11 ‘11 ‘11 ‘12 ‘12 ‘12 ‘12 ‘13 ‘13 ‘13 ‘13 ‘14 ‘14 ‘14 ‘14 ‘15 5% ($200 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 ($400) 0% Business Model (Non-GAAP) Gross Margin* 27%-32% Operating Expense* 10%-12% Operating Income* 15%-22% Tax 7%-10% of Income Before Tax Capital Expenditures* 5%-7% Conversion Cycle 4-8 Days *Percent of Revenue Note: Refer to “Non-GAAP Financial Measures” for information about non-GAAP financial measures included in this quarterly fact sheet. WDC Quarterly Fact Sheet - Q1 FY15 WD Western Digital Page 2

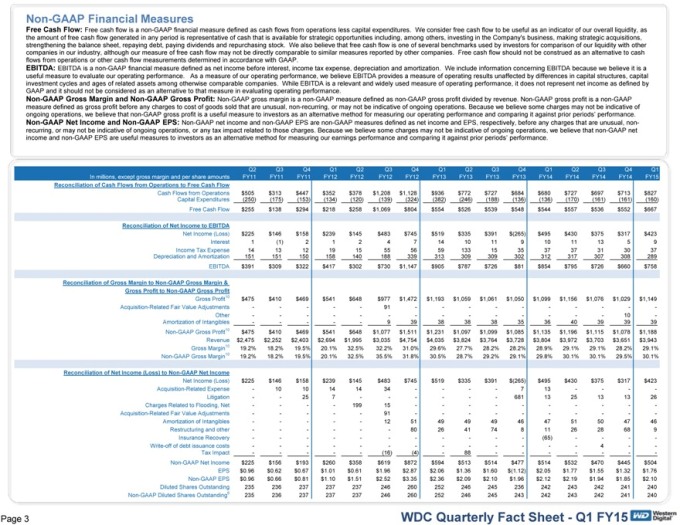

Non-GAAP Financial Measures Free Cash Flow: Free cash flow is a non-GAAP financial measure defined as cash flows from operations less capital expenditures. We consider free cash flow to be useful as an indicator of our overall liquidity, as the amount of free cash flow generated in any period is representative of cash that is available for strategic opportunities including, among others, investing in the Company’s business, making strategic acquisitions, strengthening the balance sheet, repaying debt, paying dividends and repurchasing stock. We also believe that free cash flow is one of several benchmarks used by investors for comparison of our liquidity with other companies in our industry, although our measure of free cash flow may not be directly comparable to similar measures reported by other companies. Free cash flow should not be construed as an alternative to cash flows from operations or other cash flow measurements determined in accordance with GAAP. EBITDA: EBITDA is a non-GAAP financial measure defined as net income before interest, income tax expense, depreciation and amortization. We include information concerning EBITDA because we believe it is a useful measure to evaluate our operating performance. As a measure of our operating performance, we believe EBITDA provides a measure of operating results unaffected by differences in capital structures, capital investment cycles and ages of related assets among otherwise comparable companies. While EBITDA is a relevant and widely used measure of operating performance, it does not represent net income as defined by GAAP and it should not be considered as an alternative to that measure in evaluating operating performance. Non-GAAP Gross Margin and Non-GAAP Gross Profit: Non-GAAP gross margin is a non-GAAP measure defined as non-GAAP gross profit divided by revenue. Non-GAAP gross profit is a non-GAAP measure defined as gross profit before any charges to cost of goods sold that are unusual, non-recurring, or may not be indicative of ongoing operations. Because we believe some charges may not be indicative of ongoing operations, we believe that non-GAAP gross profit is a useful measure to investors as an alternative method for measuring our operating performance and comparing it against prior periods’ performance. Non-GAAP Net Income and Non-GAAP EPS: Non-GAAP net income and non-GAAP EPS are non-GAAP measures defined as net income and EPS, respectively, before any charges that are unusual, non-recurring, or may not be indicative of ongoing operations, or any tax impact related to those charges. Because we believe some charges may not be indicative of ongoing operations, we believe that non-GAAP net income and non-GAAP EPS are useful measures to investors as an alternative method for measuring our earnings performance and comparing it against prior periods’ performance. In millions, except gross margin and per share amounts Q2 FY11 Q3 FY11 Q4 FY11 Q1 FY12 Q2 FY12 Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Reconciliation of Cash Flows from Operations to Free Cash Flow Cash Flows from Operations $505 $313 $447 $352 $378 $1,208 $1,128 $936 $772 $727 $684 $680 $727 $697 $713 $827 Capital Expenditures (250) (175) (153) (134) (120) (139) (324) (382) (246) (188) (136) (136) (170) (161) (161) (160) Free Cash Flow $255 $138 $294 $218 $258 $1,069 $804 $554 $526 $539 $548 $544 $557 $536 $552 $667 Reconciliation of Net Income to EBITDA Net Income (Loss) $225 $146 $158 $239 $145 $483 $745 $519 $335 $391 $(265) $495 $430 $375 $317 $423 Interest 1 (1) 2 1 2 4 7 14 10 11 9 10 11 13 5 9 Income Tax Expense 14 13 12 19 15 55 56 59 133 15 35 37 37 31 30 37 Depreciation and Amortization 151 151 150 158 140 188 339 313 309 309 302 312 317 307 308 289 EBITDA $391 $309 $322 $417 $302 $730 $1,147 $905 $787 $726 $81 $854 $795 $726 $660 $758 Reconciliation of Gross Margin to Non-GAAP Gross Margin & Gross Profit to Non-GAAP Gross Profit Gross Profit10 $475 $410 $469 $541 $648 $977 $1,472 $1,193 $1,059 $1,061 $1,050 $1,099 $1,156 $1,076 $1,029 $1,149 Acquisition-Related Fair Value Adjustments - - - 91 - - - - - Other - - - - - - - 10 - Amortization of Intangibles - - - 9 39 38 38 38 35 36 40 39 39 39 Non-GAAP Gross Profit10 $475 $410 $469 $541 $648 $1,077 $1,511 $1,231 $1,097 $1,099 $1,085 $1,135 $1,196 $1,115 $1,078 $1,188 Revenue $2,475 $2,252 $2,403 $2,694 $1,995 $3,035 $4,754 $4,035 $3,824 $3,764 $3,728 $3,804 $3,972 $3,703 $3,651 $3,943 Gross Margin10 19.2% 18.2% 19.5% 20.1% 32.5% 32.2% 31.0% 29.6% 27.7% 28.2% 28.2% 28.9% 29.1% 29.1% 28.2% 29.1% Non-GAAP Gross Margin10 19.2% 18.2% 19.5% 20.1% 32.5% 35.5% 31.8% 30.5% 28.7% 29.2% 29.1% 29.8% 30.1% 30.1% 29.5% 30.1% Reconciliation of Net Income (Loss) to Non-GAAP Net Income Net Income (Loss) $225 $146 $158 $239 $145 $483 $745 $519 $335 $391 $(265) $495 $430 $375 $317 $423 Acquisition-Related Expense - 10 10 14 14 34 - - 7 13 - - Litigation - 25 7 - - - 681 13 25 13 13 26 Charges Related to Flooding, Net - - 199 15 - - - - - Acquisition-Related Fair Value Adjustments - - - 91 - - - - - Amortization of Intangibles - - - 12 51 49 49 49 46 47 51 50 47 46 Restructuring and other - - - 80 26 41 74 8 11 26 28 68 9 Insurance Recovery - - - - - - (65) - - Write-off of debt issuance costs - - - - - - - 4 - Tax Impact - - - (16) (4) - 88 - - - - Non-GAAP Net Income $225 $156 $193 $260 $358 $619 $872 $594 $513 $514 $477 $514 $532 $470 $445 $504 EPS $0.96 $0.62 $0.67 $1.01 $0.61 $1.96 $2.87 $2.06 $1.36 $1.60 $(1.12) $2.05 $1.77 $1.55 $1.32 $1.76 Non-GAAP EPS $0.96 $0.66 $0.81 $1.10 $1.51 $2.52 $3.35 $2.36 $2.09 $2.10 $1.96 $2.12 $2.19 $1.94 $1.85 $2.10 Diluted Shares Outstanding 235 236 237 237 237 246 260 252 246 245 236 242 243 242 241 240 Non-GAAP Diluted Shares Outstanding6 235 236 237 237 237 246 260 252 246 245 243 242 243 242 241 240 WDC Quarterly Fact Sheet - Q1 FY15 WD Western Digital Page 3

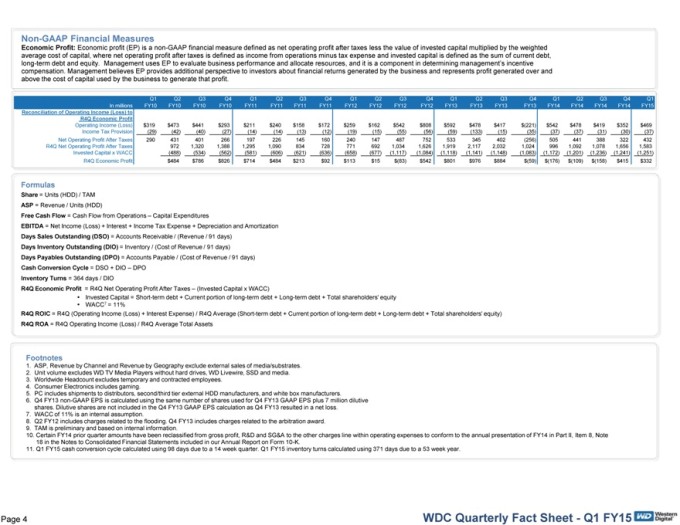

Non-GAAP Financial Measures Economic Profit: Economic profit (EP) is a non-GAAP financial measure defined as net operating profit after taxes less the value of invested capital multiplied by the weighted average cost of capital, where net operating profit after taxes is defined as income from operations minus tax expense and invested capital is defined as the sum of current debt, long-term debt and equity. Management uses EP to evaluate business performance and allocate resources, and it is a component in determining management’s incentive compensation. Management believes EP provides additional perspective to investors about financial returns generated by the business and represents profit generated over and above the cost of capital used by the business to generate that profit. In millions Q1 FY10 Q2 FY10 Q3 FY10 Q4 FY10 Q1 FY11 Q2 FY11 Q3 FY11 Q4 FY11 Q1 FY12 Q2 FY12 Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Reconciliation of Operating Income (Loss) to R4Q Economic Profit Operating Income (Loss) $319 $473 $441 $293 $211 $240 $158 $172 $259 $162 $542 $808 $592 $478 $417 $(221) $542 $478 $419 $352 $469 Income Tax Provision (29) (42) (40) (27) (14) (14) (13) (12) (19) (15) (55) (56) (59) (133) (15) (35) (37) (37) (31) (30) (37) Net Operating Profit After Taxes 290 431 401 266 197 226 145 160 240 147 487 752 533 345 402 (256) 505 441 388 322 432 R4Q Net Operating Profit After Taxes 972 1,320 1,388 1,295 1,090 834 728 771 692 1,034 1,626 1,919 2,117 2,032 1,024 996 1,092 1,078 1,656 1,583 Invested Capital x WACC (488) (534) (562) (581) (606) (621) (636) (658) (677) (1,117) (1,084) (1,118) (1,141) (1,148) (1,083) (1,172) (1,201) (1,236) (1,241) (1,251) R4Q Economic Profit $484 $786 $826 $714 $484 $213 $92 $113 $15 $(83) $542 $801 $976 $884 $(59) $(176) $(109) $(158) $415 $332 Formulas Share = Units (HDD) / TAM ASP = Revenue / Units (HDD) Free Cash Flow = Cash Flow from Operations – Capital Expenditures EBITDA = Net Income (Loss) + Interest + Income Tax Expense + Depreciation and Amortization Days Sales Outstanding (DSO) = Accounts Receivable / (Revenue / 91 days) Days Inventory Outstanding (DIO) = Inventory / (Cost of Revenue / 91 days) Days Payables Outstanding (DPO) = Accounts Payable / (Cost of Revenue / 91 days) Cash Conversion Cycle = DSO + DIO – DPO Inventory Turns = 364 days / DIO R4Q Economic Profit = R4Q Net Operating Profit After Taxes – (Invested Capital x WACC) Š Invested Capital = Short-term debt + Current portion of long-term debt + Long-term debt + Total shareholders’ equity Š WACC7 = 11% R4Q ROIC = R4Q (Operating Income (Loss) + Interest Expense) / R4Q Average (Short-term debt + Current portion of long-term debt + Long-term debt + Total shareholders’ equity) R4Q ROA = R4Q Operating Income (Loss) / R4Q Average Total Assets Footnotes 1. ASP, Revenue by Channel and Revenue by Geography exclude external sales of media/substrates. 2. Unit volume excludes WD TV Media Players without hard drives, WD Livewire, SSD and media. 3. Worldwide Headcount excludes temporary and contracted employees. 4. Consumer Electronics includes gaming. 5. PC includes shipments to distributors, second/third tier external HDD manufacturers, and white box manufacturers. 6. Q4 FY13 non-GAAP EPS is calculated using the same number of shares used for Q4 FY13 GAAP EPS plus 7 million dilutive shares. Dilutive shares are not included in the Q4 FY13 GAAP EPS calculation as Q4 FY13 resulted in a net loss. 7. WACC of 11% is an internal assumption. 8. Q2 FY12 includes charges related to the flooding. Q4 FY13 includes charges related to the arbitration award. 9. TAM is preliminary and based on internal information. 10. Certain FY14 prior quarter amounts have been reclassified from gross profit, R&D and SG&A to the other charges line within operating expenses to conform to the annual presentation of FY14 in Part II, Item 8, Note 18 in the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K. 11. Q1 FY15 cash conversion cycle calculated using 98 days due to a 14 week quarter. Q1 FY15 inventory turns calculated using 371 days due to a 53 week year. WDC Quarterly Fact Sheet - Q1 FY15 WD Western Digital Page 4