Exhibit 99.2

|

Exhibit 99.2

Western Digital’s Acquisition of SanDisk

Creates a Global Leader in Storage Technology

WD Western Digital®

OCTOBER 21, 2015

|

Forward-looking statements

Safe harbor/disclaimers

Forward-Looking Statements

This document contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements include, but are not limited to, statements regarding Western Digital’s proposed business combination transaction with SanDisk (including financing of the proposed transaction and the benefits, results, effects and timing of a transaction), all statements regarding Western Digital’s (and Western Digital’s and SanDisk’s combined) expected future financial position, results of operations, cash flows, dividends, financing plans, business strategy, budgets, capital expenditures, competitive positions, growth opportunities, plans and objectives of management, and statements containing the use of forward-looking words, such as “may,” “will,” “could,” “would,” “should,” “project,” “believe,” “anticipate,” “expect,” “estimate,” “continue,” “potential,” “plan,” “forecast,” “approximate,” “intend,” “upside,” and the like, or the use of future tense. Statements contained herein concerning the business outlook or future economic performance, anticipated profitability, revenues, expenses, dividends or other financial items, and product or services line growth of Western Digital (and the combined businesses of Western Digital and SanDisk), together with other statements that are not historical facts, are forward-looking statements that are estimates reflecting the best judgment of Western Digital and SanDisk based upon currently available information. Statements concerning current conditions may also be forward-looking if they imply a continuation of current conditions.

Such forward-looking statements are inherently uncertain, and stockholders and other potential investors must recognize that actual results may differ materially from Western Digital’s and SanDisk’s expectations as a result of a variety of factors, including, without limitation, those discussed below. Such forward-looking statements are based upon the current expectations of Western Digital’s and SanDisk’s management and include known and unknown risks, uncertainties and other factors, many of which Western Digital and SanDisk are unable to predict or control, that may cause Western Digital’s or SanDisk’s actual results, performance or plans to differ materially from any future results, performance or plans expressed or implied by such forward-looking statements. These statements involve risks, uncertainties and other factors discussed below and detailed from time to time in Western Digital’s and SanDisk’s filings with the Securities and Exchange Commission (the “SEC”).

Risks and uncertainties related to the proposed merger include, but are not limited to, the risk that SanDisk’s or Western Digital’s stockholders do not approve the merger, potential adverse reactions or changes to business relationships resulting from the announcement, pendency or completion of the merger, uncertainties as to the timing of the merger, the possibility that the closing conditions to the proposed merger may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant a necessary approval, adverse effects on Western Digital’s stock price resulting from the announcement or completion of the merger, competitive responses to the announcement or completion of the merger, costs and difficulties related to the integration of SanDisk’s businesses and operations with Western Digital’s businesses and operations, the inability to obtain, or delays in obtaining, cost savings and synergies from the merger, uncertainties as to whether the completion of the merger or any transaction will have the accretive effect on Western Digital’s earnings or cash flows that it expects, unexpected costs, liabilities, charges or expenses resulting from the merger, litigation relating to the merger, the inability to retain key personnel, and any changes in general economic and/or industry-specific conditions.

In addition to the factors set forth above, other factors that may affect Western Digital’s or SanDisk’s plans, results or stock price are set forth in Western Digital’s and SanDisk’s respective filings with the SEC, including Western Digital’s and SanDisk’s most recent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

Many of these factors are beyond Western Digital’s and SanDisk’s control. Western Digital and SanDisk caution investors that any forward-looking statements made by Western Digital or SanDisk are not guarantees of future performance. Western Digital or SanDisk do not intend, and undertake no obligation, to publish revised forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events.

WD Western Digital®

2 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

|

Forward-looking statements

Safe harbor/disclaimers

Additional Information

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This communication may be deemed to be solicitation material in respect of the proposed merger between Western Digital and SanDisk. In connection with the proposed merger, Western Digital intends to file a registration statement on Form S-4 with the SEC that contains a preliminary joint proxy statement of SanDisk and Western Digital that also constitutes a preliminary prospectus of Western Digital. After the registration statement is declared effective, Western Digital and SanDisk will mail the definitive proxy statement/prospectus to their respective stockholders. This material is not a substitute for the joint proxy statement/prospectus or registration statement or for any other document that Western Digital or SanDisk may file with the SEC and send to Western Digital’s and/or SanDisk’s stockholders in connection with the proposed merger. INVESTORS AND SECURITY HOLDERS OF WESTERN DIGITAL AND SANDISK ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE JOINT PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holders will be able to obtain copies of the joint proxy statement/prospectus (when filed) as well as other filings containing information about Western Digital and SanDisk, without charge, at the SEC’s website, http://www.sec.gov. Copies of the documents filed with the SEC by Western Digital will be available free of charge on Western Digital’s website at http://www.wdc.com. Copies of the documents filed with the SEC by SanDisk will be available free of charge on SanDisk’s website at http://www.sandisk.com.

Participants in Solicitation

Western Digital, SanDisk and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from their respective stockholders in favor of the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of stockholders in connection with the proposed transaction will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You can find information about Western Digital’s executive officers and directors in Western Digital’s definitive proxy statement filed with the SEC on September 23, 2015. You can find information about SanDisk’s executive officers and directors in its definitive proxy statement filed with the SEC on April 27, 2015. You can obtain free copies of these documents from Western Digital and SanDisk, respectively, using the contact information above. Investors may obtain additional information regarding the interest of such participants by reading the joint proxy statement/prospectus regarding the proposed merger when it becomes available.

WD Western Digital®

3 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

|

Western Digital is acquiring SanDisk for approximately $19 billion in a cash and stock transaction

Combination of Western Digital and SanDisk creates a global leader in storage technology

Acquisition at $86.50 a share financed with balance sheet cash, $17 billion of new debt and equity consideration

WD Western Digital®

4 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

|

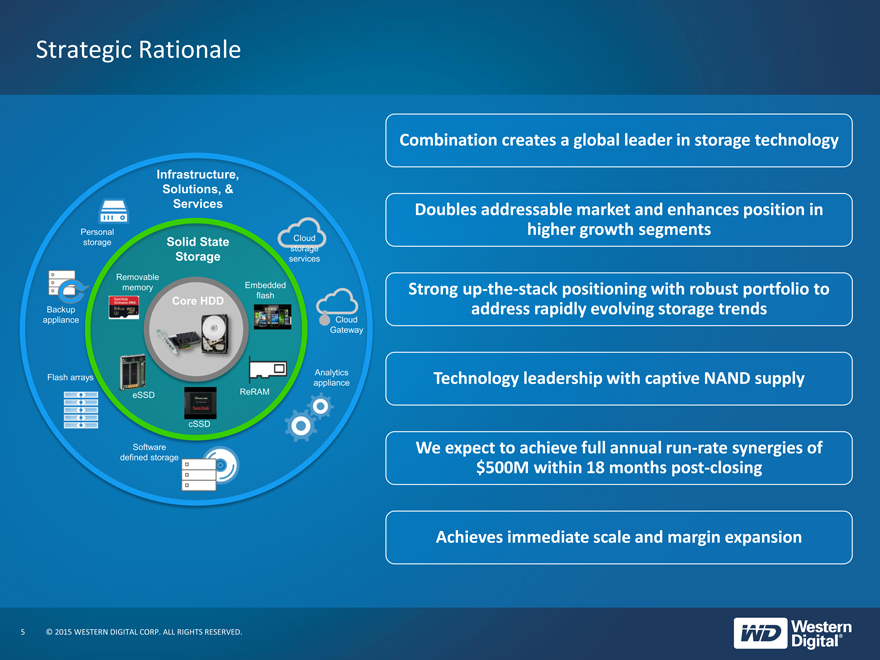

Strategic Rationale

Infrastructure, Solutions, & Services

Personal storage

Backup appliance

Flash arrays

Software defined storage

Analytics appliance

Cloud Gateway

Cloud storage services

Solid State Storage

Removable memory

eSSD

cSSD

ReRAM

Embedded flash

Core HDD

Combination creates a global leader in storage technology

Doubles addressable market and enhances position in higher growth segments

Strong up-the-stack positioning with robust portfolio to address rapidly evolving storage trends

Technology leadership with captive NAND supply

We expect to achieve full annual run-rate synergies of $500M within 18 months post-closing

Achieves immediate scale and margin expansion

WD Western Digital®

5 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

|

Western Digital at a Glance

WD Western Digital®

Leading market position in Hard Disk Drives (HDDs)

Fast growing eSSD business with strong up-the-stack positioning

Rich base of technologies with 10,000+ patents and applications worldwide

Strong financial profile with $14.0 billion in LTM1 revenues, consistent profitability and liquidity

Strong track record of value creation through strategic M&A and industry leading partnerships

1 Western Digital LTM as of 10/02/2015.

6 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

WD Western Digital®

|

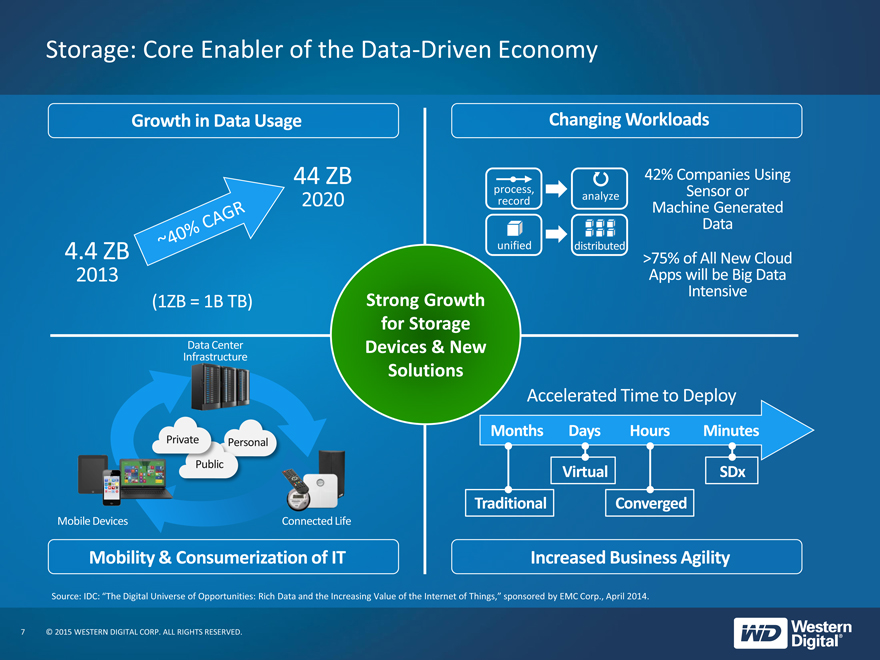

Storage: Core Enabler of the Data-Driven Economy

Growth in Data Usage

4.4 ZB 2013 ~40% CAGR 44 ZB 2020

(1ZB = 1B TB)

Changing Workloads

process, record analyze 42% Companies Using Sensor or Machine Generated Data

unified distributed >75% of All New Cloud Apps will be Big Data Intensive

Strong Growth for Storage Devices & New Solutions

Data Center Infrastructure

Private Public Personal

Mobile Devices Connected Life

Mobility & Consumerization of IT

Accelerated Time to Deploy

Months Days Hours Minutes

Traditional Virtual Converged SDx

Increased Business Agility

Source: IDC: “The Digital Universe of Opportunities: Rich Data and the Increasing Value of the Internet of Things,” sponsored by EMC Corp., April 2014.

7 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED. WD Western Digital

|

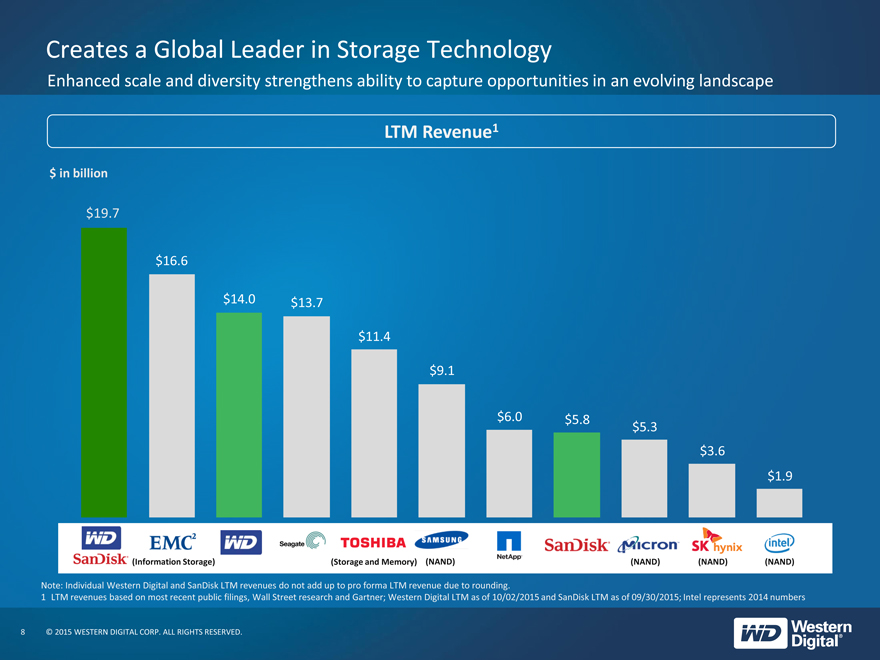

Creates a Global Leader in Storage Technology

Enhanced scale and diversity strengthens ability to capture opportunities in an evolving landscape

LTM Revenue1

$ in billion

$19.7

$16.6

$14.0

$13.7

$11.4

$9.1

$6.0

$5.8

$5.3

$3.6

$1.9

WD SanDisk

EMC2 (Information Storage)

WD

Seagate

TOSHIBA (Storage and Memory)

SAMSUNG

(NAND)

NetApp

SanDisk

Micron (NAND)

SK hynix

(NAND)

intel

(NAND)

Note: Individual Western Digital and SanDisk LTM revenues do not add up to pro forma LTM revenue due to rounding.

1 LTM revenues based on most recent public filings, Wall Street research and Gartner; Western Digital LTM as of 10/02/2015 and SanDisk LTM as of 09/30/2015; Intel represents 2014 numbers

8 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

WD Western Digital®

|

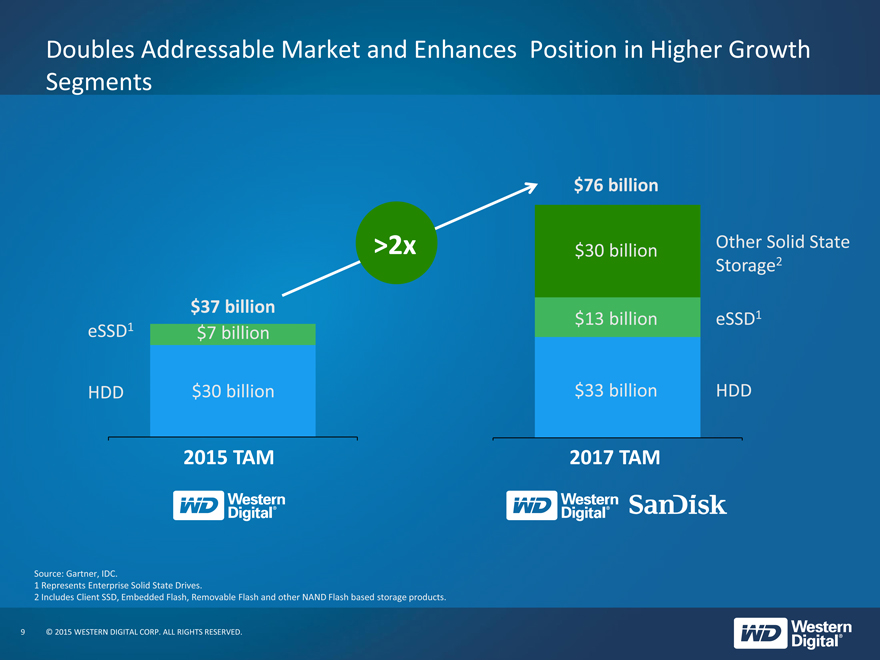

Doubles Addressable Market and Enhances Position in Higher Growth Segments

eSSD1 HDD

$37 billion $7 billion $30 billion 2015 TAM WD Western Digital

>2x

$ 76 billion $30 billion $13 billion $33 billion

Other Solid State Storage2 eSSD1 HDD

2017 TAM

WD Western Digital SanDisk

Source: Gartner, IDC.

1 Represents Enterprise Solid State Drives.

2 Includes Client SSD, Embedded Flash, Removable Flash and other NAND Flash based storage products.

9 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED. WD Western Digital

|

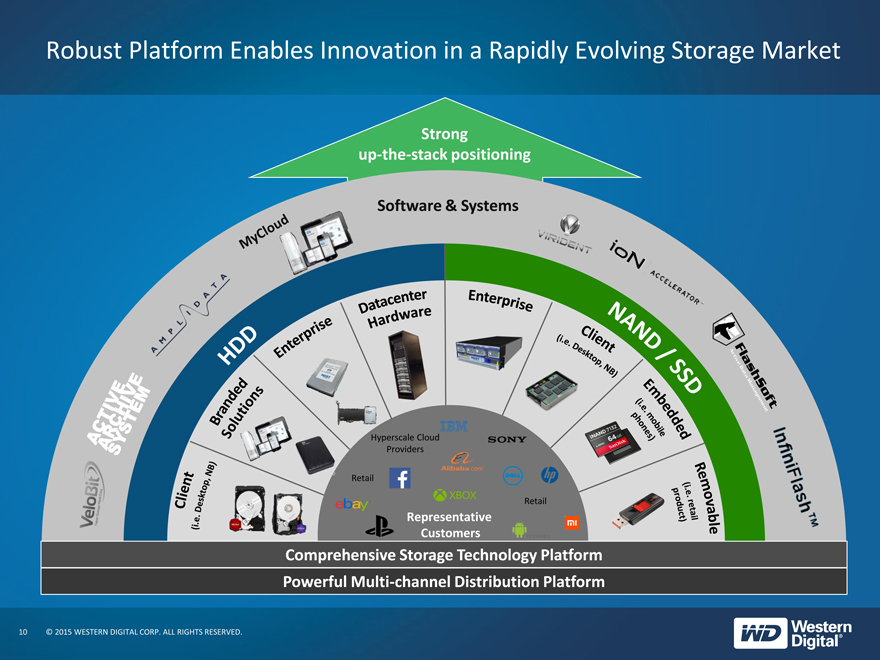

Robust Platform Enables Innovation in a Rapidly Evolving Storage Market

Strong up-the-stack positioning

Software & Systems

Hyperscale Cloud

Providers

Retail

Retail

Representative Customers

Comprehensive Storage Technology Platform Powerful Multi-channel Distribution Platform

10 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

|

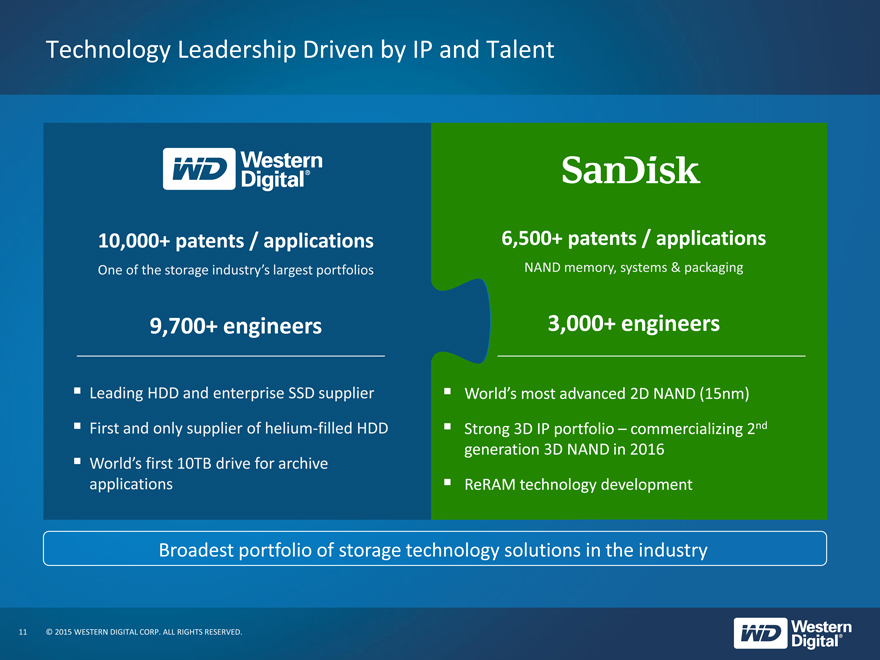

Technology Leadership Driven by IP and Talent

10,000+ patents / applications

One of the storage industry’s largest portfolios

9,700+ engineers

Leading HDD and enterprise SSD supplier

First and only supplier of helium-filled HDD

World’s first 10TB drive for archive applications

6,500+ patents / applications

NAND memory, systems & packaging

3,000+ engineers

World’s most advanced 2D NAND (15nm)

Strong 3D IP portfolio – commercializing 2nd generation 3D NAND in 2016

ReRAM technology development

Broadest portfolio of storage technology solutions in the industry

11 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

|

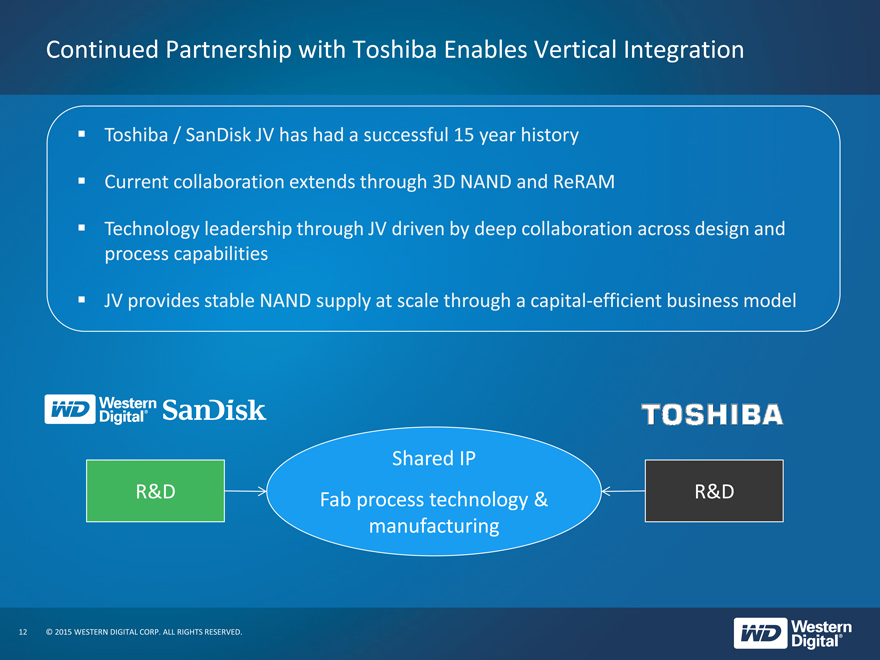

Continued Partnership with Toshiba Enables Vertical Integration

Toshiba / SanDisk JV has had a successful 15 year history

Current collaboration extends through 3D NAND and ReRAM

Technology leadership through JV driven by deep collaboration across design and process capabilities

JV provides stable NAND supply at scale through a capital-efficient business model

Shared IP

R&D Fab process technology & R&D manufacturing

12 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

|

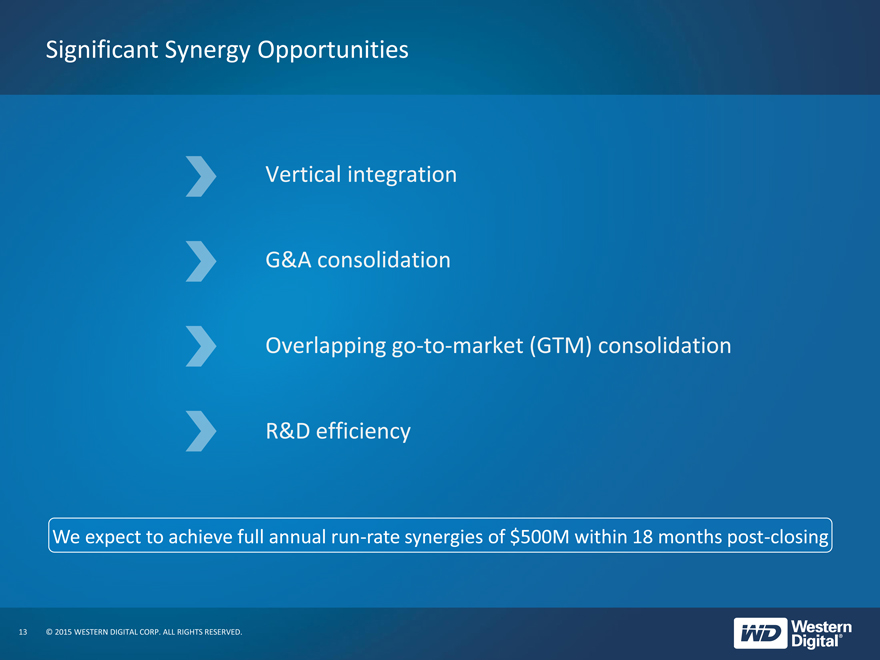

Significant Synergy Opportunities

Vertical integration

G&A consolidation

Overlapping go-to-market (GTM) consolidation

R&D efficiency

We expect to achieve full annual run-rate synergies of $500M within 18 months post-closing

13 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

|

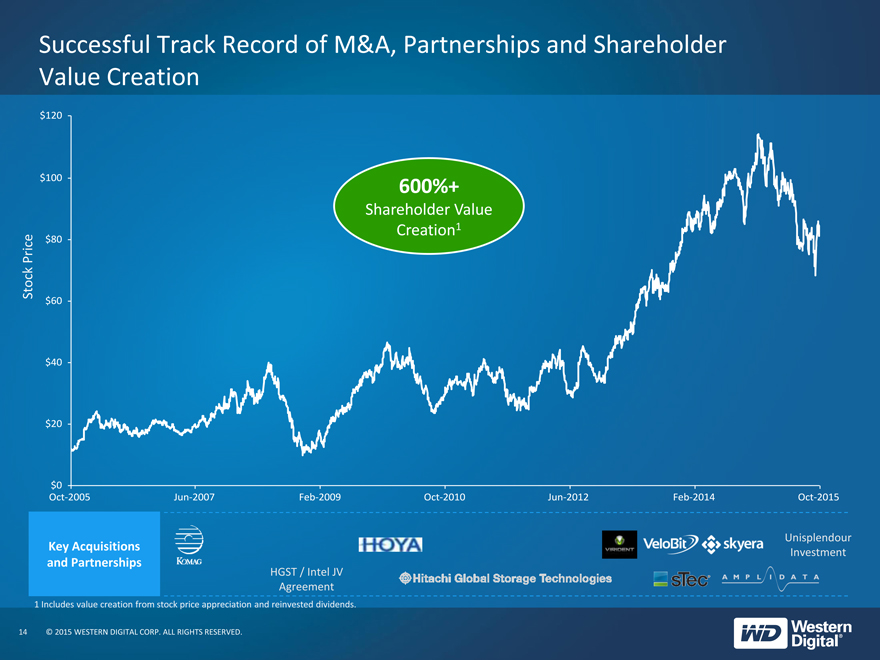

Successful Track Record of M&A, Partnerships and Shareholder Value Creation

600%+

Shareholder Value

1

Price Creation

Stock

Key Acquisitions Unisplendour and Partnerships Investment

HGST / Intel JV Agreement

1 Includes value creation from stock price appreciation and reinvested dividends.

14 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

|

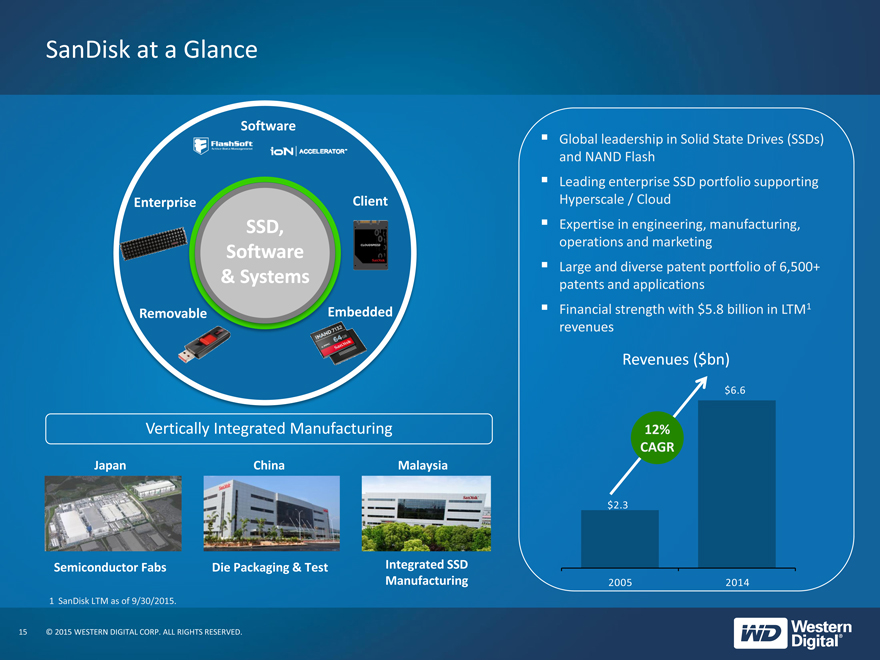

SanDisk at a Glance

Software

Enterprise Client

SSD, Software

& Systems

Removable Embedded

Vertically Integrated Manufacturing

Japan China Malaysia

Semiconductor Fabs Die Packaging & Test Integrated SSD Manufacturing

1 SanDisk LTM as of 9/30/2015.

15 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

|

Global leadership in Solid State Drives (SSDs) and NAND Flash

Leading enterprise SSD portfolio supporting

Hyperscale / Cloud

Expertise in engineering, manufacturing, operations and marketing

Large and diverse patent portfolio of 6,500+ patents and applications

Financial strength with $5.8 billion in LTM1 revenues

Revenues ($bn)

$6.6

12% CAGR

$2.3

2005 2014

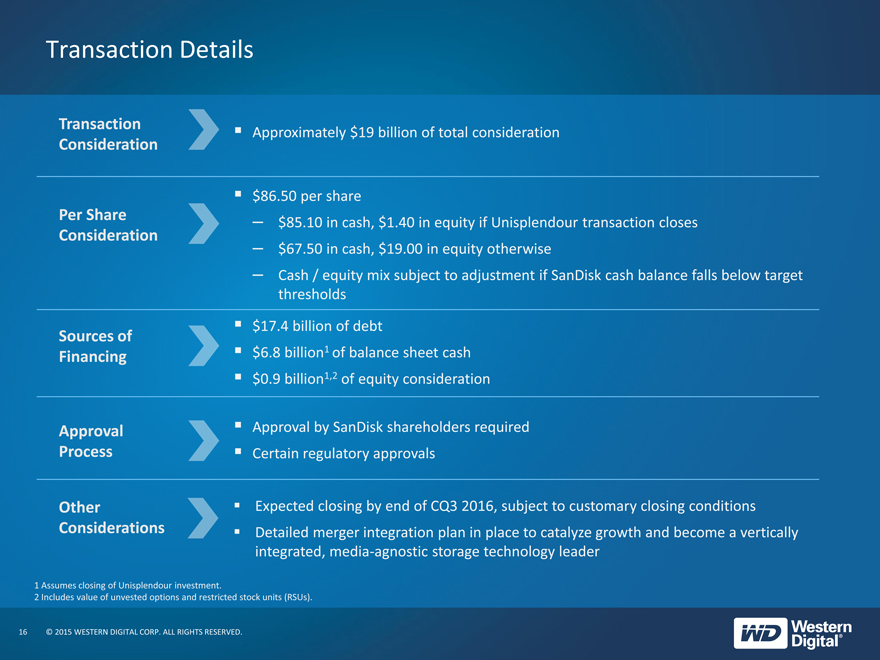

Transaction Details

Transaction Approximately $ 19 billion of total consideration

Consideration

$86.50 per share

Per Share – $ 85.10 in cash, $ 1.40 in equity if Unisplendour transaction closes

Consideration

– $ 67.50 in cash, $ 19.00 in equity otherwise

– Cash / equity mix subject to adjustment if SanDisk cash balance falls below target

thresholds

$17.4 billion of debt

Sources of

Financing $6.8 billion1 of balance sheet cash

$0.9 billion1,2 of equity consideration

Approval Approval by SanDisk shareholders required

Process Certain regulatory approvals

Other Expected closing by end of CQ3 2016, subject to customary closing conditions

Considerations Detailed merger integration plan in place to catalyze growth and become a vertically

integrated, media-agnostic storage technology leader

1 Assumes closing of Unisplendour investment.

2 Includes value of unvested options and restricted stock units (RSUs).

16 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

|

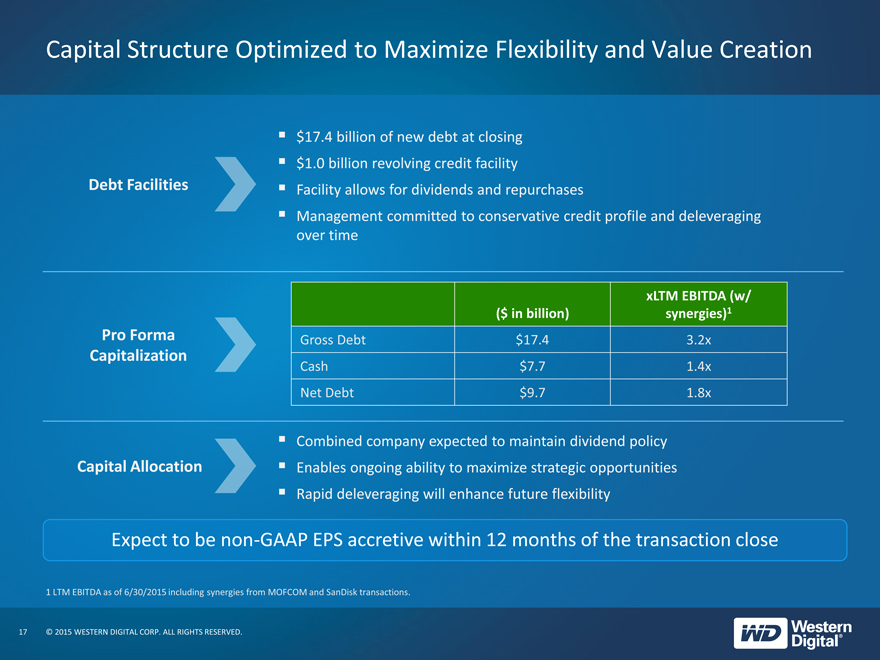

Capital Structure Optimized to Maximize Flexibility and Value Creation

$ 17.4 billion of new debt at closing

$ 1.0 billion revolving credit facility

Debt Facilities Facility allows for dividends and repurchases

Management committed to conservative credit profile and deleveraging

over time

Pro Forma Capitalization

Capital Allocation

xLTM EBITDA (w/

($ in billion) synergies)1

Gross Debt $17.4 3.2x

Cash $7.7 1.4x

Net Debt $9.7 1.8x

Combined company expected to maintain dividend policy

Enables ongoing ability to maximize strategic opportunities

Rapid deleveraging will enhance future flexibility

Expect to be non-GAAP EPS accretive within 12 months of the transaction close

1 LTM EBITDA as of 6/30/2015 including synergies from MOFCOM and SanDisk transactions.

17 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

|

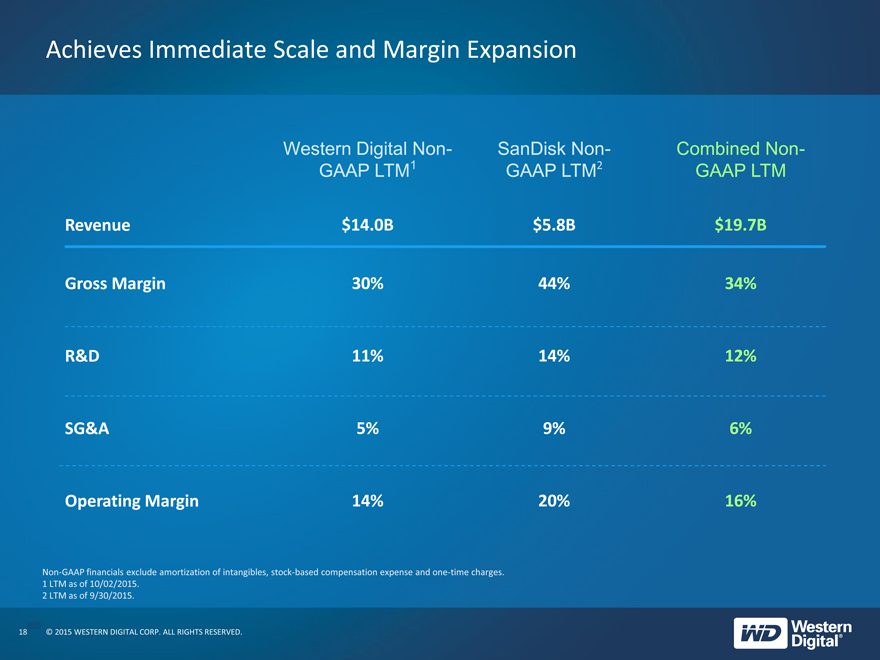

Achieves Immediate Scale and Margin Expansion

Western Digital Non- SanDisk Non- Combined Non-

GAAP LTM1 GAAP LTM2 GAAP LTM

Revenue $14.0B $5.8B $19.7B

Gross Margin 30% 44% 34%

R&D 11% 14% 12%

SG&A 5% 9% 6%

Operating Margin 14% 20% 16%

Non-GAAP financials exclude amortization of intangibles, stock-based compensation expense and one-time charges.

1 LTM as of 10/02/2015.

2 LTM as of 9/30/2015.

18 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

|

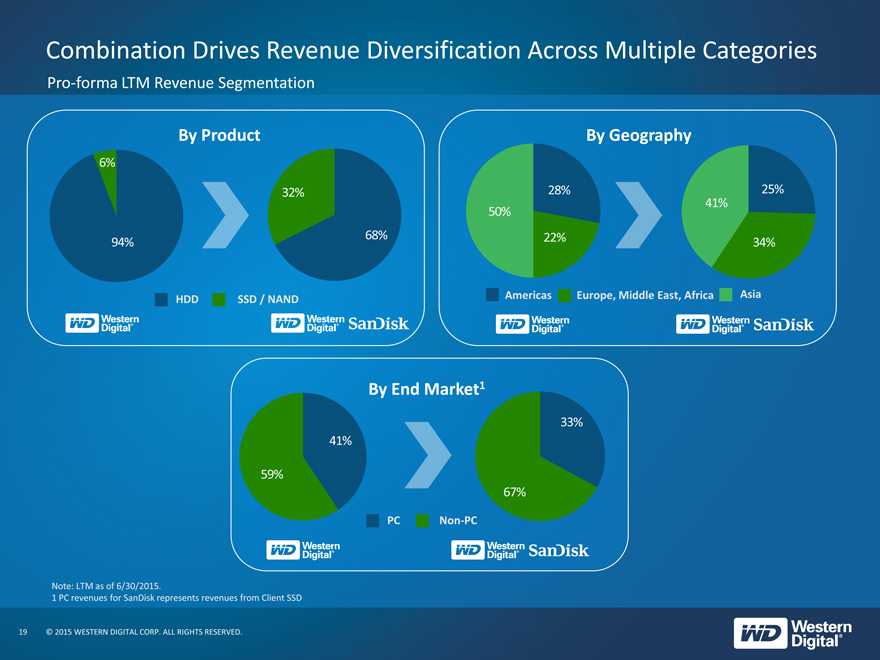

Combination Drives Revenue Diversification Across Multiple Categories

Pro-forma LTM Revenue Segmentation

By Product By Geography

6%

32% 28% 25% 41% 50%

68% 22%

94% 34%

Americas Europe, Middle East, Africa Asia HDD SSD / NAND

By End Market1

33% 41%

59%

67%

PC Non-PC

Note: LTM as of 6/30/2015.

1 PC revenues for SanDisk represents revenues from Client SSD

19 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

|

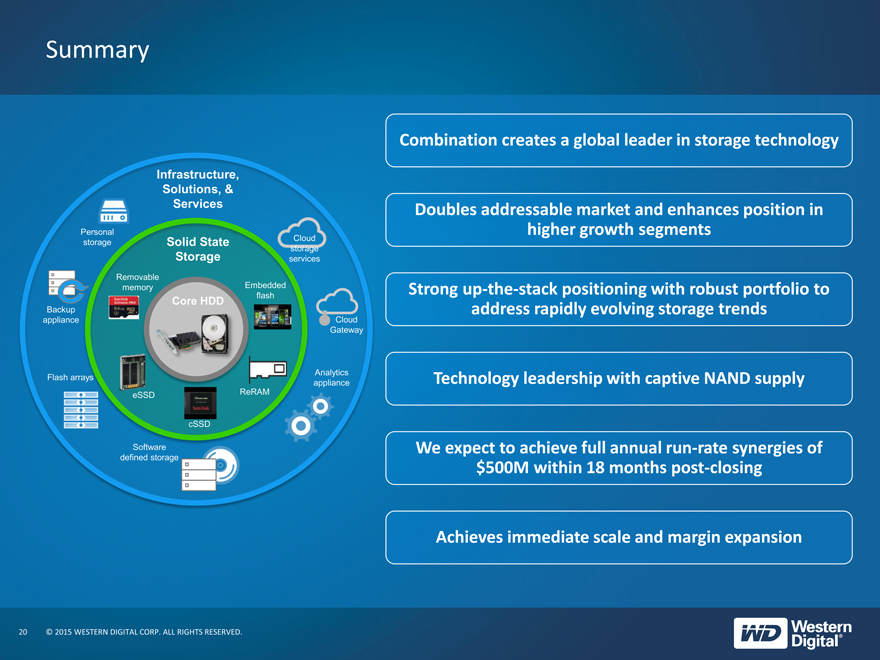

Summary

Infrastructure, So lutions, & Services

Personal storage So lid State Cloud storage Storage services Remo edded flash mem

C ore HDD

Backup appliance

Gateway

Analytics Flash arrays appliance eSSD ReRAM

cSSD

Software defined storage

Combination creates a global leader in storage technology

Doubles addressable market and enhances position in higher growth segments

Strong up-the-stack positioning with robust portfolio to address rapidly evolving storage trends

Technology leadership with captive NAND supply

We expect to achieve full annual run-rate synergies of $500M within 18 months post-closing

Achieves immediate scale and margin expansion

20 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.

|

Q & A

21 © 2015 WESTERN DIGITAL CORP. ALL RIGHTS RESERVED.