- WDC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Western Digital (WDC) 425Business combination disclosure

Filed: 21 Oct 15, 12:00am

Filed by Western Digital Corporation pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: SanDisk Corporation

CREATING A GLOBAL LEADER Commission File No. 000-26734

IN STORAGE TECHNOLOGY

Global scale Extensive product Deep expertise and technology assets in NVM

Filed by Western Digital Corporation pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: SanDisk Corporation

CREATING A GLOBAL LEADER Commission File No. 000-26734

IN STORAGE TECHNOLOGY

Global scale Extensive product Deep expertise and technology assets in NVM

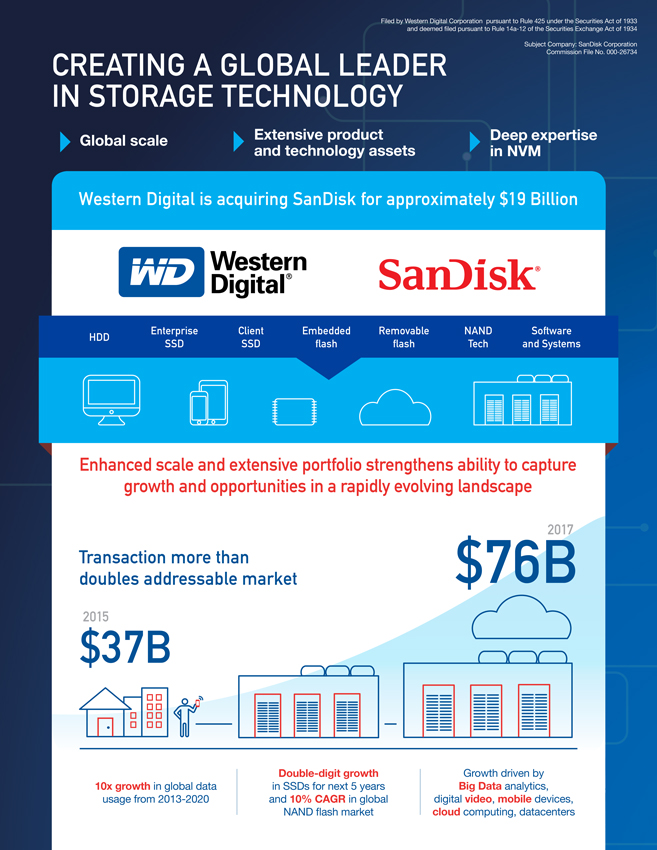

Western Digital is acquiring SanDisk for approximately $19 Billion

Enterprise Client Embedded Removable NAND Software HDD

SSD SSD flash flash Tech and Systems

Enhanced scale and extensive portfolio strengthens ability to capture growth and opportunities in a rapidly evolving landscape

2017

Transaction more than $76B doubles addressable market

$ 2015 37B

Double-digit growth Growth driven by

10x growth in global data in SSDs for next 5 years Big Data analytics, usage from 2013-2020 and 10% CAGR in global digital video, mobile devices, NAND flash market cloud computing, datacenters

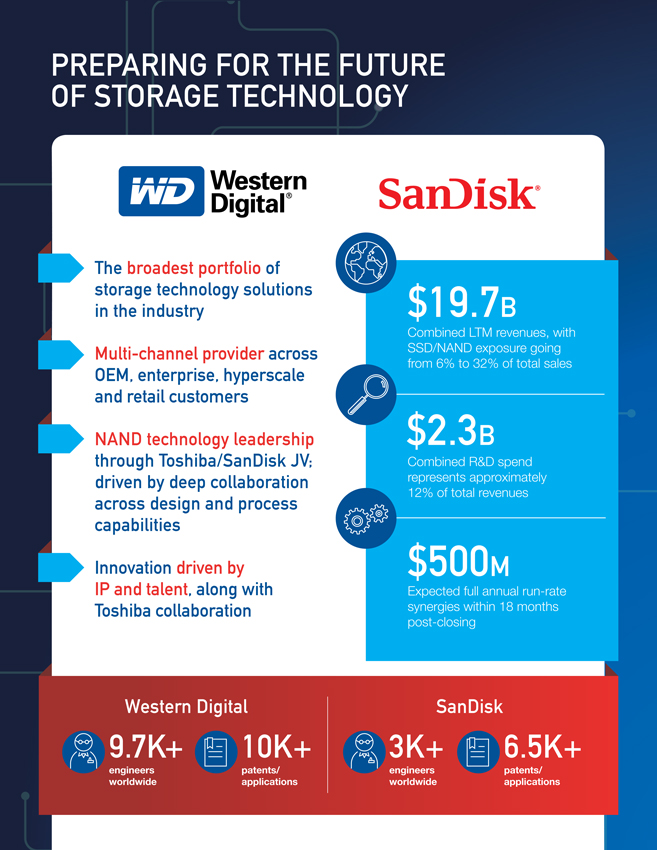

PREPARING FOR THE FUTURE OF STORAGE TECHNOLOGY

The broadest portfolio of

storage technology solutions

in the industry $19.7B

Combined LTM revenues, with

Multi-channel provider across SSD/NAND exposure going

OEM, enterprise, hyperscale from 6% to 32% of total sales

and retail customers

NAND technology leadership $2.3B

through Toshiba/SanDisk JV; Combined R&D spend

driven by deep collaboration represents approximately

across design and process 12% of total revenues

capabilities

Innovation driven by $500M

IP and talent, along with Expected full annual run-rate

Toshiba collaboration synergies within 18 months

post-closing

Western Digital SanDisk

9.7K+ 10K+ 3K+ 6.5K+

engineers patents/ engineers patents/ worldwide applications worldwide applications

Forward-Looking Statements

This document contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements include, but are not limited to, statements regarding Western Digital Corporation’s proposed business combination transaction with SanDisk Corporation (including financing of the proposed transaction and the benefits, results, effects and timing of a transaction), all statements regarding Western Digital’s (and Western Digital’s and SanDisk’s combined) expected future financial position, results of operations, cash flows, dividends, financing plans, business strategy, budgets, capital expenditures, competitive positions, growth opportunities, plans and objectives of management, and statements containing the use of forward-looking words, such as “may,” “will,” “could,” “would,” “should,” “project,” “believe,” “anticipate,” “expect,” “estimate,” “continue,” “potential,” “plan,” “forecast,” “approximate,” “intend,” “upside,” and the like, or the use of future tense. Statements contained herein concerning the business outlook or future economic performance, anticipated profitability, revenues, expenses, dividends or other financial items, and product or services line growth of Western Digital (and the combined businesses of Western Digital and SanDisk), together with other statements that are not historical facts, are forward-looking statements that are estimates reflecting the best judgment of Western Digital and SanDisk based upon currently available information. Statements concerning current conditions may also be forward-looking if they imply a continuation of current conditions.

Such forward-looking statements are inherently uncertain, and stockholders and other potential investors must recognize that actual results may differ materially from Western Digital’s and SanDisk’s expectations as a result of a variety of factors, including, without limitation, those discussed below. Such forward-looking statements are based upon the current expectations of Western Digital’s and SanDisk’s management and include known and unknown risks, uncertainties and other factors, many of which Western Digital and SanDisk are unable to predict or control, that may cause Western Digital’s or SanDisk’s actual results, performance or plans to differ materially from any future results, performance or plans expressed or implied by such forward-looking statements. These statements involve risks, uncertainties and other factors discussed below and detailed from time to time in Western Digital’s and SanDisk’s filings with the Securities and Exchange Commission (the “SEC”).

Risks and uncertainties related to the proposed merger include, but are not limited to, the risk that SanDisk’s or Western Digital’s stockholders do not approve the merger, potential adverse reactions or changes to business relationships resulting from the announcement, pendency or completion of the merger, uncertainties as to the timing of the merger, the possibility that the closing conditions to the proposed merger may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant a necessary approval, adverse effects on Western Digital’s stock price resulting from the announcement or completion of the merger, competitive responses to the announcement or completion of the merger, costs and difficulties related to the integration of SanDisk’s businesses and operations with Western Digital’s businesses and operations, the inability to obtain, or delays in obtaining, cost savings and synergies from the merger, uncertainties as to whether the completion of the merger or any transaction will have the accretive effect on Western Digital’s earnings or cash flows that it expects, unexpected costs, liabilities, charges or expenses resulting from the merger, litigation relating to the merger, the inability to retain key personnel, and any changes in general economic and/or industry-specific conditions.

In addition to the factors set forth above, other factors thatmay affect Western Digital’s or SanDisk’s plans, results or stock price are set forth in Western Digital’s and SanDisk’s respective filings with the SEC, including Western Digital’s and SanDisk’s most recent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

Many of these factors are beyond Western Digital’s and SanDisk’s control. Western Digital and SanDisk caution investors that any forward-looking statements made by Western Digital or SanDisk are not guarantees of future performance. Western Digital or SanDisk do not intend, and undertake no obligation, to publish revised forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events.

Additional Information

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitationof any vote or approval. This communication may be deemed to be solicitation material in respect of the proposed merger between Western Digital and SanDisk. In connection with the proposed merger, Western Digital intends to file a registration statement on Form S-4 with the SEC that contains apreliminary joint proxy statement of SanDisk and Western Digital that also constitutes a preliminary prospectus of Western Digital. After the registration statement is declared effective, Western Digital and SanDisk will mail the definitive proxy statement/prospectus to their respective stockholders. This material is not a substitute for the joint proxy statement/ prospectus or registration statement or for any other document that Western Digital or SanDisk may file with the SEC and send to Western Digital’s and/ or SanDisk’s stockholders in connection with the proposed merger. INVESTORS AND SECURITY HOLDERS OF WESTERN DIGITAL AND SANDISK ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE JOINT PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holderswill be able to obtain copies of the joint proxy statement/prospectus (when filed) as well as other filings containing information about Western Digital and SanDisk, without charge, at the SEC’s website, http://www.sec.gov. Copies of the documents filed with the SEC by Western Digital will be available free of charge on Western Digital’s website at http://www.wdc.com. Copies of the documents filed with the SEC by SanDiskwill be available free of charge on SanDisk’s website at http://www.sandisk.com.

Participants in Solicitation

Western Digital, SanDisk and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from their respective stockholders in favor of the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of stockholders in connection with the proposed transaction will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You can find information about Western Digital’s executive officers and directors in Western Digital’s definitive proxy statement filed with the SEC on September 23, 2015. You can find information about SanDisk’s executive officers and directors in its definitive proxy statement filed with the SEC on April 27, 2015. You can obtain free copies of these documents from Western Digital and SanDisk, respectively, using the contact information above. Investors may obtain additional information regarding the interest of such participants by reading the joint proxy statement/prospectus regarding the proposed merger when it becomes available.