As filed with the Securities and Exchange Commission on November 10, 2022

Securities Act File No. 33-2965

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 ☑

Pre-Effective Amendment No. [ ]

Post-Effective Amendment No. [ ]

UBS SERIES FUNDS

(Exact Name of Registrant as Specified in Charter)

787 Seventh Avenue

New York, New York 10019

(Address of Principal Executive Offices) (Zip Code)

(888) 793-8637

(Registrant’s Area Code and Telephone Number)

Keith A. Weller, Esq.

UBS Asset Management (Americas) Inc.

One North Wacker Drive

Chicago, Illinois 60606

(Name and Address of Agent for Service)

With copies to:

Stephen H. Bier, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, New York 10036

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

It is proposed that this filing will become effective on December 10, 2022 pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

Title of Securities Being Registered: Shares of Beneficial Interest of UBS Select Government Institutional Fund, UBS Select Treasury Institutional Fund, UBS Select ESG Prime Institutional Fund, UBS Select Prime Institutional Fund, UBS Prime Reserves Fund, and UBS Tax-Free Reserves Fund.

UBS SERIES FUNDS

UBS SELECT GOVERNMENT INVESTOR FUND

UBS SELECT TREASURY INVESTOR FUND

UBS SELECT ESG PRIME INVESTOR FUND

UBS SELECT PRIME INVESTOR FUND

UBS PRIME INVESTOR FUND

UBS TAX-FREE INVESTOR FUND

787 SEVENTH AVENUE

NEW YORK, NEW YORK 10019

December 10, 2022

Dear Shareholder:

The Board of Trustees of UBS Series Funds (the “Board”) has approved an Agreement and Plan of Reorganization for each of the money market funds listed above (each, an “Acquired Fund,” and, collectively, the “Acquired Funds”), each a series of UBS Series Funds, providing for the acquisition of the assets and the assumption of the liabilities of each Acquired Fund by its corresponding Acquiring Fund, as shown below, each also a series of UBS Series Funds, in exchange for shares of the corresponding Acquiring Fund, followed by the complete liquidation of the Acquired Fund (each, a “Reorganization,” and, collectively, the “Reorganizations”).

| | |

| Acquired Fund | | Acquiring Fund |

| UBS Select Government Investor Fund | | UBS Select Government Institutional Fund |

| UBS Select Treasury Investor Fund | | UBS Select Treasury Institutional Fund |

| UBS Select ESG Prime Investor Fund | | UBS Select ESG Prime Institutional Fund |

| UBS Select Prime Investor Fund | | UBS Select Prime Institutional Fund |

| UBS Prime Investor Fund | | UBS Prime Reserves Fund |

| UBS Tax-Free Investor Fund | | UBS Tax-Free Reserves Fund |

After considering the recommendations of UBS Asset Management (Americas) Inc. (“UBS AM”), the investment advisor of the master funds in which the Acquired Funds and Acquiring Funds invest, the Board concluded that the Reorganization of each Acquired Fund with and into the corresponding Acquiring Fund is in the best interests of the shareholders of each Acquired Fund and each Acquiring Fund. The Reorganizations are expected to occur on or about [January 20], 2023. Upon completion of the Reorganizations, you will become a shareholder of the corresponding Acquiring Fund, and you will receive shares of the corresponding class of the Acquiring Fund equal in value to your shares of the Acquired Fund. The Reorganizations are expected to be tax-free for you for federal income tax purposes, and no commission, redemption fee or transaction fee will be charged as a result of the Reorganizations.

The Reorganizations do not require shareholder approval, and you are not being asked to vote on the Reorganizations. We do, however, ask that you review the enclosed Information Statement/Prospectus, which contains information about each Acquiring Fund, outlines the differences between each Acquired Fund and its corresponding Acquiring Fund, and provides details about the terms and conditions of the Reorganizations.

We appreciate your continued support and confidence in the UBS Series Funds. If you have any questions, please contact us by calling toll-free 1-800-647-1568.

Sincerely,

/s/ Igor Lasun

Igor Lasun

President

UBS Series Funds

Subject to Completion

PRELIMINARY COMBINED INFORMATION STATEMENT/PROSPECTUS

THE INFORMATION IN THIS COMBINED INFORMATION STATEMENT/PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS COMBINED INFORMATION STATEMENT/PROSPECTUS IS NOT AN OFFER TO SELL THESE CLASSES OF SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

December 10, 2022

INFORMATION STATEMENT FOR

UBS SELECT GOVERNMENT INVESTOR FUND

UBS SELECT TREASURY INVESTOR FUND

UBS SELECT ESG PRIME INVESTOR FUND

UBS SELECT PRIME INVESTOR FUND

UBS PRIME INVESTOR FUND

UBS TAX-FREE INVESTOR FUND

(each, a series of UBS Series Funds)

787 Seventh Avenue

New York, New York 10019

1-888-793-8637

PROSPECTUS FOR

UBS SELECT GOVERNMENT INSTITUTIONAL FUND

UBS SELECT TREASURY INSTITUTIONAL FUND

UBS SELECT ESG PRIME INSTITUTIONAL FUND

UBS SELECT PRIME INSTITUTIONAL FUND

UBS PRIME RESERVES FUND

UBS TAX-FREE RESERVES FUND

(each, a series of UBS Series Funds)

787 Seventh Avenue

New York, New York 10019

1-888-793-8637

THE US SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS INFORMATION STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

This Information Statement/Prospectus, which should be read and retained for future reference, sets forth information about UBS Select Government Institutional Fund, UBS Select Treasury Institutional Fund, UBS Select ESG Prime Institutional Fund, UBS Select Prime Institutional Fund, UBS Prime Reserves Fund, and UBS Tax-Free Reserves Fund that a shareholder should know before investing. For more complete information about UBS Select Government Institutional Fund, UBS Select Treasury Institutional Fund, UBS Select ESG Prime Institutional Fund, UBS Select Prime Institutional Fund, UBS Prime Reserves Fund, and UBS Tax-Free Reserves Fund or UBS Select Government Investor Fund, UBS Select Treasury Investor Fund, UBS Select ESG Prime Investor Fund, UBS Select Prime Investor Fund, UBS Prime Investor Fund, and UBS Tax-Free Investor Fund, please read each fund’s Prospectus and Statement of Additional Information, as they may be amended and/or supplemented. As discussed further herein, these documents are available without charge.

QUESTIONS AND ANSWERS RELATING TO THE REORGANIZATIONS

We recommend that you read the complete Information Statement/Prospectus. However, we thought it would be helpful to provide brief answers to some questions concerning the reorganizations (each, a “Reorganization,” and, collectively, the “Reorganizations”) of each Acquired Fund into its corresponding Acquiring Fund, as described in the table below:

| | |

| Acquired Fund | | Acquiring Fund |

| UBS Select Government Investor Fund | | UBS Select Government Institutional Fund |

| UBS Select Treasury Investor Fund | | UBS Select Treasury Institutional Fund |

| UBS Select ESG Prime Investor Fund | | UBS Select ESG Prime Institutional Fund |

| UBS Select Prime Investor Fund | | UBS Select Prime Institutional Fund |

| UBS Prime Investor Fund | | UBS Prime Reserves Fund |

| UBS Tax-Free Investor Fund | | UBS Tax-Free Reserves Fund |

UBS Select Government Investor Fund, UBS Select Treasury Investor Fund, UBS Select ESG Prime Investor Fund, UBS Select Prime Investor Fund, UBS Prime Investor Fund, and UBS Tax-Free Investor Fund are referred to individually as an “Acquired Fund” and collectively as the “Acquired Funds.” UBS Select Government Institutional Fund, UBS Select Treasury Institutional Fund, UBS Select ESG Prime Institutional Fund, UBS Select Prime Institutional Fund, UBS Prime Reserves Fund, and UBS Tax-Free Reserves Fund are referred to individually as an “Acquiring Fund” and collectively as the “Acquiring Funds.” The Acquired Funds and Acquiring Funds are also referred to individually as a “Fund” and collectively as the “Funds.”

Q. How will the Reorganizations affect me?

A. The Reorganizations are expected to close on [January 20], 2023. Upon the closing of the Reorganizations, the assets and liabilities of each Acquired Fund will be transferred to its corresponding Acquiring Fund and you will become a shareholder of such Acquiring Fund. You will receive shares of the Acquiring Fund equal in value to your shares of, the Acquired Fund.

Q. Why were the Reorganizations approved by the Board of Trustees of the Acquired Funds?

A. The Acquired Funds’ Board of Trustees (the “Board”) of UBS Series Funds (the “Trust”) determined that the Reorganizations are in the best interests of the shareholders of the Acquired Funds. The Acquired Funds’ Board considered other options potentially available to each Acquired Fund, including maintaining the status quo or liquidating the Acquired Funds, and determined to approve the Reorganizations. The Acquiring Funds will provide the Acquired Funds’ shareholders with a lower-priced Fund. The Acquired Funds and Acquiring Funds have the same investment objective, principal investment strategies and principal risks. Additionally, each Acquired Fund and Acquiring Fund hold proportionate interests in the assets of the applicable series of Master Trust. The only material difference between the Acquired Funds and

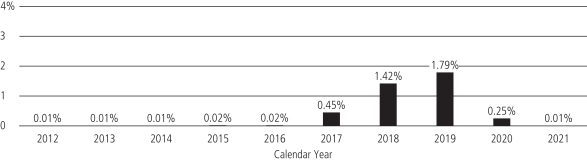

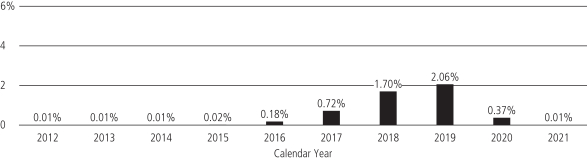

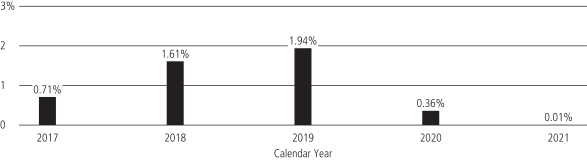

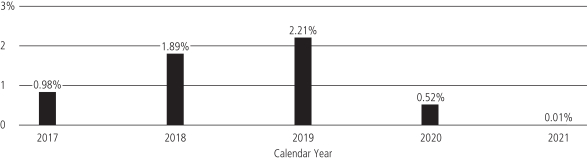

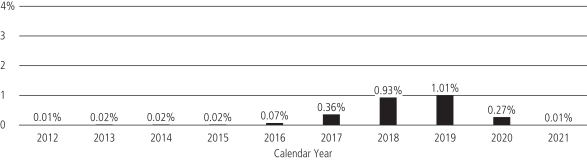

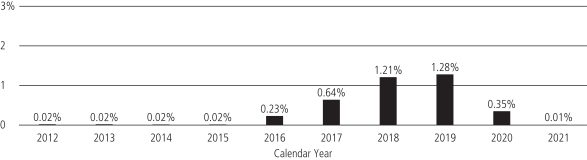

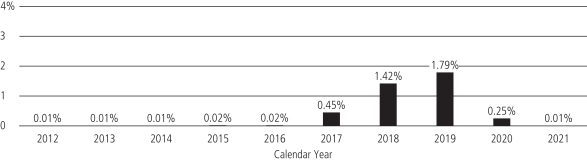

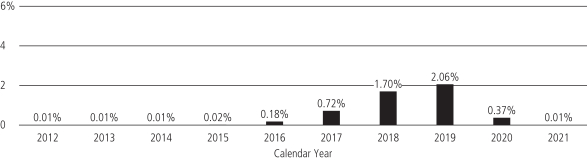

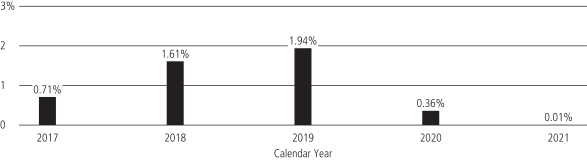

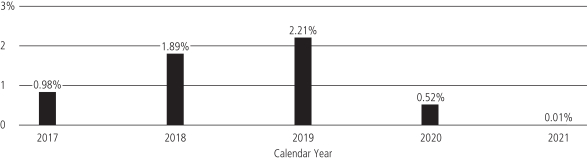

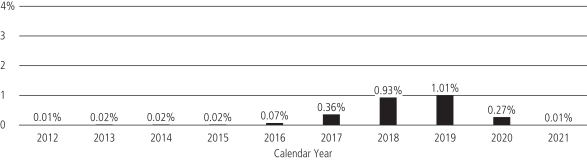

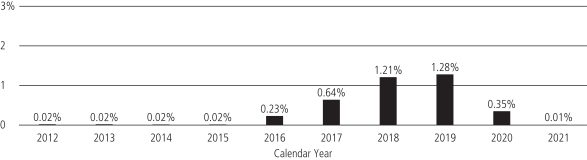

2

Acquiring Funds is that the Acquiring Funds have lower fees and expenses. Further, the Acquiring Funds have had, and are expected to have in the future, equal or higher performance than the Acquired Funds because the Acquiring and Acquired Funds invest in the same portfolios, but the Acquiring Funds have lower fees. (During certain prior periods, the Acquired Funds and corresponding Acquired Funds had the same performance during historically low interest rate periods because of voluntary fee waivers/expense reimbursements that resulted in each Fund maintaining a yield of 0.01%; given recent increases in interest rates, and the cessation of “yield-flooring” waivers/reimbursements, the more normal yield differential patterns with an Acquiring Fund yielding more than its corresponding Acquired Fund have resumed.) The proposed Reorganizations also will allow all shareholders of the Acquired Funds to become shareholders of the Acquiring Funds without experiencing any adverse federal tax consequences of a sale of shares (which is more relevant for the two Acquired Funds that do not attempt to maintain a stable price per share, namely UBS Select ESG Prime Investor Fund and UBS Select Prime Investor Fund, in respect of which gain or loss on the sale of shares is more likely).

Q. Am I being asked to vote on the Reorganizations?

A. No. Shareholders of the Acquired Funds are not required to approve the Reorganizations under state or federal law, the Investment Company Act of 1940, as amended (the “1940 Act”), or the organizational documents governing the Acquired Funds. We are not asking you for a proxy, and you are requested not to send us a proxy.

Q. Will the management of the Acquired Fund change?

A. No. UBS Asset Management (Americas) Inc (“UBS AM”) serves as the investment advisor and administrator for Government Master Fund, Treasury Master Fund, ESG Prime Master Fund, Prime Master Fund, Prime CNAV Master Fund, and Tax-Free Master Fund, which are the master funds in which the Funds invest their assets. Each Fund and its corresponding master fund have the same objective. UBS AM also acts as the administrator for the Funds. As investment advisor, UBS AM makes the master funds’ investment decisions. It buys and sells securities for the master funds and conducts the research that leads to the purchase and sale decisions.

The master funds may accept investments from other feeder funds. Each Fund bears the master fund’s expenses in proportion to its investment in the master fund. Each Fund can set its own transaction minimums, feeder fund-specific expenses and other conditions.

Q. What are the key similarities/dissimilarities between each Acquired Fund and its corresponding Acquiring Fund?

A. The investment advisor for each master fund in which the Funds invest is UBS AM. Each Acquired Fund and its respective Acquiring Fund have an identical investment objective, principal investment strategies, and principal risks. Each Acquired Fund and each Acquiring Fund share the same Board and have identical fundamental investment policies/restrictions.

3

As noted above and further below, there are some key dissimilarities as well. The contractual fees and expenses of the Acquired Funds are higher than the less expensive Acquiring Funds. The distribution fees to be paid by each Acquiring Fund (i.e., none) are lower than each Acquired Fund’s distribution fees (such funds being subject to both distribution and separate shareholder servicing fees, unlike the Acquiring Funds, which are subject to neither). The Acquiring Funds also are “unitary fee funds” (i.e., UBS AM charges one combined fee and itself pays nearly all the other ordinary operating expenses of the Acquiring Funds) while the Acquired Fund are not subject to a “unitary fee” arrangement and are responsible for their own direct payment of normal Fund expenses (e.g., transfer agency fees, custodian fees, etc.).

Please see the “Comparison of the Funds” starting on p. 12, which outlines these and other key comparison items.

Q. What are the potential benefits from the Reorganizations?

A. UBS AM believes that the shareholders of the Acquired Funds will benefit from the opportunity to continue to obtain similar exposure to investments after the Reorganizations and to become shareholders of the Acquiring Funds, which have lower ongoing expenses.

Until earlier in 2022, the Acquiring Funds had maintained much higher minimum initial investment requirements, but UBS AM recommended, and the Board agreed, to eliminate those minimum initial investment requirements for investors through UBS Financial Services Inc. The Acquiring Funds became available to investors who previously did not satisfy such high minimum initial investment requirements. Given that the Acquiring Funds are now available to investors at UBS Financial Services Inc. with no minimum initial investment requirement, it no longer makes sense to maintain two parallel sets of feeder funds available to the same potential investor base with one set having higher fees and expenses.

Q. Will I have to pay any sales load or commission in connection with the Reorganizations?

A. No. You will pay no sales load or commission in connection with the Reorganizations.

Q. How do the fees of the Acquiring Funds compare to those of the Acquired Funds?

A. As a result of the proposed Reorganizations, shareholders of the Acquired Funds can expect to experience lower expenses as a percentage of average daily net assets as shareholders in the Acquiring Funds after the Reorganizations. The total annual fund operating expenses of each Acquiring Fund on a pro forma basis giving effect to the Reorganizations would be lower than the current total annual fund operating expenses of each Acquired Fund.

For more details, please see “Comparison of Fees and Expenses” below.

Q. Who will bear the expenses of the Reorganizations and related costs?

A. The costs of the dissemination of information related to the Reorganizations, including any costs directly associated with preparing, filing, printing, and distributing to the shareholders of the Acquired Fund all materials

4

relating to this Information Statement/Prospectus, as well as the conversion costs associated with the Reorganizations will be borne by the Acquired Funds, subject to the existing contractual expense cap agreement, as further voluntarily extended by UBS AM as discussed further below. To the extent an Acquired Fund’s expenses related to a Reorganization exceed the expense cap agreement (as further extended), such expenses will ultimately be borne by UBS AM. These direct costs are estimated to be between $350,000 and $450,000.

Q. Why is no Acquired Funds’ shareholder action necessary?

A. No Acquired Funds’ shareholder action is necessary because the Reorganizations satisfy the requisite conditions of Rule 17a-8 under the 1940 Act, and, in accordance with the Acquired Funds’ Trust Instrument and applicable Delaware state and US federal law, the Reorganizations may be effected without the approval of shareholders of the Acquired Funds. The Acquired Funds’ shareholders are not expected to be materially negatively impacted by the Reorganizations; instead, they are expected to benefit from the transactions.

Q. How do the Funds’ purchase and redemption procedures and exchange policies compare?

A. The purchase and redemption procedures and exchange policies of the Acquired Funds are substantively the same as those of the Acquiring Funds; differences related to how the two parallel sets of Funds were historically operated (e.g., different minimum initial investment requirements for exchanges depending on the Fund series, either Investor series or Institutional/Reserves series).

Q. Will there be any federal income tax consequences as a result of the Reorganizations?

A. Each of the Reorganizations is intended to qualify as a tax-free reorganization for US federal income tax purposes and will not take place unless the Acquired Funds and the Acquiring Funds receive a satisfactory opinion of counsel to the effect that the Reorganizations will be tax-free, as described in more detail in the section entitled “Federal Income Tax Consequences” (although there can be no assurance that the Internal Revenue Service will agree with such opinion). Accordingly, no gain or loss is expected to be recognized by the Acquired Fund or its shareholders as a direct result of its respective Reorganization. In addition, the tax basis and holding period of a shareholder’s Acquired Fund shares are expected to carry over to the respective Acquiring Fund shares the shareholder receives in its Reorganization (which is more relevant for the two Acquired Funds that do not attempt to maintain a stable price per share, namely UBS Select Prime Investor Fund and UBS Select ESG Prime Investor Fund, in respect of which gain or loss on the sale of shares is more likely). However, a gain or loss may be recognized by an Acquired Fund with respect to assets as to which unrealized gain or loss is required to be recognized under US federal income tax principles at the termination of a taxable year or upon the transfer of such assets regardless of whether such transfer would otherwise be a non-taxable transaction. Prior to the closing of each Reorganization, each Acquired Fund will declare and pay to its shareholders of record one or more dividends and/or other distributions, to the extent necessary, to ensure that it will have distributed all of its investment company taxable income (computed without regard to any deduction for dividends paid), realized net capital gain and net tax-exempt interest income for all taxable years ending prior to or on the Closing Date. All or a portion of such distribution may be taxable to such Acquired Fund’s shareholders who are not in a tax-qualified plan.

For more detailed information about the tax consequences of the Reorganizations please refer to the “Federal Income Tax Consequences” section below.

5

Q. Has the Board approved the Reorganizations?

A. Yes. The Board of the Acquired Funds has approved the Reorganizations. The Board believes that it is in shareholders’ best interests to reorganize each Acquired Fund into the respective Acquiring Fund as it will allow current Acquired Funds’ shareholders to pursue the same investment objective and investment strategies, but with lower fees and expenses. The specific factors considered by the Board in approving the Reorganizations are discussed in more detail below in the Prospectus/Information Statement.

Q. Whom do I contact if I have questions or need additional information?

A. If you have any questions or need additional information, please contact us by calling toll-free 800-647-1568.

The following documents containing additional information about the Funds, each having been filed with the US Securities and Exchange Commission (the “SEC”), are incorporated by reference into (legally considered to be part of) this Information Statement/Prospectus:

Additional copies of the foregoing and any more recent reports filed after the date hereof may be obtained without charge:

| | |

| By Phone: | | 888-547-3863 |

| |

| By Mail: | | BNY Mellon Investment Servicing (US) Inc., UBS Asset Management Inc., P.O. Box 9786, Providence, RI 02940. |

| |

| By Internet: | | https://www.ubs.com/usmoneymarketfunds. |

|

| You also may view or obtain these documents from the SEC: |

| |

| By E-mail: | | PUBLICINFO@SEC.GOV |

| | (DUPLICATING FEE REQUIRED) |

| |

| By Internet: | | WWW.SEC.GOV |

6

No person has been authorized to give any information or make any representation not contained in this Information Statement/Prospectus and, if so given or made, such information or representation must not be relied upon as having been authorized. This Information Statement/Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

THE SEC HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED THAT THIS INFORMATION STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

7

TABLE OF CONTENTS

8

SUMMARY

The following is a summary of certain information contained elsewhere in this Information Statement/Prospectus. Shareholders should read the entire Information Statement/Prospectus carefully.

The Acquired Funds and the Acquiring Funds are open-end, management investment companies registered with the SEC and are each a series of the Trust; the Trust is organized as a statutory trust under the laws of the State of Delaware.

UBS AM serves as the investment advisor of the series of the master funds in which the Funds invest and serves as the administrator of each Fund.

The Reorganizations

The Board, including the Trustees who are not “interested persons” (as defined in the 1940 Act) of the Trust (the “Independent Trustees”), has unanimously approved the Reorganizations. Each Reorganization provides for:

| | • | | the transfer of all of the assets of the Acquired Fund to its corresponding Acquiring Fund in exchange for shares of the corresponding Acquiring Fund; |

| | • | | the assumption by the Acquiring Fund of all of the liabilities of the corresponding Acquired Fund; |

| | • | | the distribution of shares of the Acquiring Fund to the shareholders of the corresponding Acquired Fund; and |

| | • | | the complete liquidation of the Acquired Fund. |

The Reorganizations are expected to take place on or about [January 20], 2023. The Acquiring Funds will be the accounting survivors of the Reorganizations.

Background and Reasons for the Reorganizations

UBS AM believes that the proposed Reorganizations of the Acquired Funds with and into the Acquiring Funds are in the best interests of the Acquired Funds and Acquiring Funds and their shareholders, and that the interests of existing shareholders of the Acquired Funds and Acquiring Funds will not be diluted. The Acquired Funds and Acquiring Funds have the same investment objective, principal investment strategies and principal risks. Additionally, each Acquired Fund and Acquiring Fund hold proportionate interests in the assets of the applicable series of Master Trust. The only material difference between the Acquired Funds and Acquiring Funds is that the Acquiring Funds have lower fees and expenses. Until earlier in 2022, the Acquiring Funds had significantly higher minimum initial investment requirements whereas the Acquired Funds had significantly lower minimum initial investment requirements. At the recommendation of UBS AM, the Board approved eliminating the Acquiring Funds’ minimum initial investment requirements for investors purchasing through UBS Financial Services so that the lower expense Acquiring Funds

9

became available to investors who previously would not have been eligible to purchase such Funds. Given the repositioning of the Funds, it no longer makes economic sense to continue to offer investors the nearly identical, but more expensive, Acquired Funds, and the Reorganization will facilitate the orderly transition of those remaining investors who have not yet already migrated from the Acquired Funds to the Acquiring Funds in response to shareholder communications sent earlier in 2022.

The Board considered the Reorganizations in advance of and during a meeting held on September 27-28, 2022, and the Board, including the Independent Trustees, approved the Reorganizations. In approving the Reorganizations, the Board, including the Independent Trustees, determined that participation in the Reorganizations is in the best interests of shareholders of each Acquired Fund and each Acquiring Fund. The determination to approve the Reorganizations was made by each Trustee after consideration of all of the factors deemed relevant by each Trustee taken as a whole, although individual Trustees may have placed different weights on various factors and assigned different degrees of materiality to various conclusions with respect to each Fund.

The factors considered by the Board with regard to the Reorganizations included, but were not limited to, the following:

| | • | | UBS AM serves as the investment advisor of the series of the master funds in which the Funds invest. |

| | • | | The investment objective, principal investment strategies and fundamental investment policies of each Acquired Fund and Acquiring Fund are identical. |

| | • | | Each respective Acquired Fund and Acquiring Fund have the same fundamental investment limitations. |

| | • | | Alternatives to the Reorganizations considered by the Board, including the direct liquidation of the Acquired Funds without offering an alternative investment option such as the automatic exchange for shares of the Acquiring Funds. |

| | • | | The Acquiring Funds have had, and are expected to have in the future, higher performance than the Acquired Funds because each Acquiring Fund and its respective Acquired Fund invest in the same master fund, but the Acquiring Funds have lower fees and expenses. |

| | • | | Shareholders of the Acquired Funds will benefit from the opportunity to become shareholders of the Acquiring Funds, which have lower ongoing expenses. |

| | • | | The Acquired Funds will bear the costs of the Reorganizations, subject to the existing contractual expense cap agreement as further expanded by an additional voluntary waiver by UBS AM. |

| | • | | Each Reorganization is expected to be a tax-free transaction. Accordingly, there is expected to be no gain or loss recognized by the Acquired Funds, the Acquiring Funds, or their respective shareholders |

10

| | for federal income tax purposes as a result of the Reorganizations. Prior to the closing of each Reorganization, each Acquired Fund will declare and pay to its shareholders of record one or more dividends and/or other distributions, to the extent necessary, to ensure that it will have distributed all of its investment company taxable income (computed without regard to any deduction for dividends paid), realized net capital gain and net tax-exempt interest income for all taxable years ending prior to or on the Closing Date. All or a portion of such distribution may be taxable to such Acquired Fund’s shareholders who are not in a tax-qualified plan. |

| | • | | The aggregate net asset value (“NAV”) of each Acquiring Fund’s shares that shareholders of the corresponding Acquired Fund will receive in each Reorganization is expected to equal the aggregate NAV of the shares that shareholders of the Acquired Fund own immediately prior to such Reorganization. |

The interests of the Funds’ shareholders will not be diluted as a result of the Reorganizations because each Acquired Fund’s shareholders will receive shares of the corresponding Acquiring Fund with the same aggregate NAV as their Acquired Fund shares.

The Board, including the Independent Trustees, concluded that, based upon the factors summarized above and other considerations it deemed pertinent, the Reorganizations are in the best interests of the shareholders of each Acquired Fund and each Acquiring Fund and that the interests of shareholders in the Acquired Funds and the Acquiring Funds would not be diluted as a result of the Reorganizations.

11

COMPARISON OF THE FUNDS

Comparison of Investment Objectives and Principal Investment Strategies

The investment objectives and principal investment strategies of each Acquired Fund and its corresponding Acquiring Fund are identical. There can be no assurance that any Fund will achieve its investment objective. Each Fund’s investment objective is non-fundamental and may be changed without shareholder approval.

The following table shows the identical investment objective and principal investment strategies of each Acquired Fund and corresponding Acquiring Fund.

| | | | | | | | |

| | |

| | | UBS Select Prime Investor Fund (Acquired Fund) UBS Select Prime Institutional Fund (Acquiring Fund) |

| | | UBS Select Prime Investor Fund | | | | | | UBS Select Prime Institutional Fund |

| | | Investment objective | | | | | | Investment objective |

| | | Maximum current income consistent with liquidity and the preservation of capital. | | | | | | Same. |

| | | Principal strategies Principal investments | | | | | | Principal strategies Principal investments |

| | | | | |

| | | The fund is a money market fund that calculates its net asset value (“NAV”) to four decimals (e.g., $1.0000) using market-based pricing. As a result, its share price will fluctuate. The fund seeks to achieve its objective by investing in a diversified portfolio of high quality money market instruments of governmental and private issuers. These may include: • short-term obligations of the US government and its agencies and instrumentalities; • repurchase agreements; • obligations of issuers in the financial services group of industries; • commercial paper, other corporate obligations and asset-backed securities; and • municipal money market instruments. Money market instruments generally are short-term debt obligations and similar securities. They also may include longer-term bonds that have variable interest rates or other special features that give them the financial characteristics of short-term debt. The fund invests in foreign money market instruments only if they are denominated in US dollars. The fund will, under normal circumstances, invest more than 25% of its total assets in the financial services group of industries. | | | | | | Same. |

12

| | | | | | | | |

| | | The fund invests in securities through an underlying master fund. The fund and its corresponding master fund have the same objective. Unless otherwise indicated, references to the fund include the master fund. The fund may be subject to the possible imposition of a liquidity fee and/or temporary redemption gate should certain triggering events occur. The fund is classified by UBS AM as an “ESG-integrated” fund. The fund’s investment process integrates material sustainability and/or environmental, social and governance (“ESG”) considerations into the research process for all portfolio investments and portfolio holdings, except repurchase agreements with certain counterparties. ESG integration is driven by taking into account material sustainability and/or ESG risks which could impact investment returns, rather than being driven by specific ethical principles or norms. The analysis of material sustainability and/or ESG considerations can include many different aspects, including, for example, the carbon footprint, employee health and well-being, supply chain management, fair customer treatment and governance processes of a company. The fund’s portfolio managers may still invest in securities without respect to sustainability and/or ESG considerations or in securities which present sustainability and/or ESG risks, including where the portfolio managers believe the potential compensation outweighs the risks identified. | | | | | | |

| | |

| | | UBS Select Government Investor Fund (Acquired Fund) UBS Select Government Institutional Fund (Acquiring Fund) |

| | | UBS Select Government Investor Fund | | | | | | UBS Select Government Institutional Fund |

| | | Investment objective | | | | | | Investment objective |

| | | Maximum current income consistent with liquidity and the preservation of capital. | | | | | | Same. |

| | | Principal strategies Principal investments | | | | | | Principal strategies Principal investments |

| | | | | |

| | | The fund is a money market fund and seeks to maintain a stable price of $1.00 per share. To do this, the fund invests in a diversified portfolio of high quality, US government money market instruments and in related repurchase agreements. Money market instruments generally are short-term debt obligations and similar securities. They also may include longer-term bonds that have variable interest rates or other special features that give them the financial characteristics of short-term debt. The fund has adopted a policy to invest 99.5% or more of its total assets in cash, government securities, and/or repurchase agreements that are collateralized fully (i.e., collateralized by | | | | | | Same. |

13

| | | | | | | | |

| | | cash and/or government securities) in order to qualify as a “government money market fund” under federal regulations. By operating as a government money market fund, the fund is exempt from requirements that permit the imposition of a liquidity fee and/or temporary redemption gates. While the fund’s board may elect to subject the fund to liquidity fee and gate requirements in the future, the board has not elected to do so at this time. Many US government money market instruments pay income that is generally exempt from state and local income tax, although they may be subject to corporate franchise tax in some states. The fund generally seeks to invest in securities the income from which is considered “qualified interest income” under relevant tax law and guidance. In addition, under normal circumstances, the fund invests at least 80% of its net assets in US government securities, including government securities subject to repurchase agreements. The fund may invest a significant percentage of its assets in repurchase agreements. Repurchase agreements are transactions in which the fund purchases government securities and simultaneously commits to resell them to the same counterparty at a future time and at a price reflecting a market rate of interest. Income from repurchase agreements may not be exempt from state and local income taxation. Repurchase agreements often offer a higher yield than investments directly in government securities. In deciding whether an investment in a repurchase agreement is more attractive than a direct investment in government securities, the fund considers the possible loss of this tax advantage. The fund invests in securities through an underlying master fund. The fund and its corresponding master fund have the same objective. Unless otherwise indicated, references to the fund include the master fund. | | | | | | |

| | |

| | | UBS Select Treasury Investor Fund (Acquired Fund) UBS Select Treasury Institutional Fund (Acquiring Fund) |

| | | UBS Select Treasury Investor Fund | | | | | | UBS Select Treasury Institutional Fund |

| | | Investment objective | | | | | | Investment objective |

| | | Maximum current income consistent with liquidity and the preservation of capital. | | | | | | Same. |

| | | Principal strategies Principal investments | | | | | | Principal strategies Principal investments |

| | | The fund is a money market fund and seeks to maintain a stable price of $1.00 per share. To do this, under normal circumstances, the fund invests in a diversified portfolio of high quality, US Treasury money market instruments and in related repurchase agreements. Money market instruments generally are short-term debt obligations and similar securities. They also may include longer-term bonds that have variable interest rates or other special features that give them the financial characteristics of short-term debt. The fund has adopted a policy to invest 99.5% or more of its total assets in cash, government securities, and/or repurchase agreements that are collateralized fully (i.e., collateralized by | | | | | | Same. |

14

| | | | | | | | |

| | | cash and/or government securities) in order to qualify as a “government money market fund” under federal regulations. By operating as a government money market fund, the fund is exempt from requirements that permit the imposition of a liquidity fee and/or temporary redemption gates. While the fund’s board may elect to subject the fund to liquidity fee and gate requirements in the future, the board has not elected to do so at this time. In addition, in order to be a “Treasury” fund, under normal circumstances, the fund seeks to achieve its objective by investing at least 80% of its net assets (plus the amount of any borrowing for investment purposes) in securities issued by the US Treasury and in related repurchase agreements. For purposes of this policy, repurchase agreements are those that are collateralized fully by securities issued by the US Treasury and cash. Under normal circumstances, the fund expects to invest substantially all of its assets in securities issued by the US Treasury and in related repurchase agreements. Many US government money market instruments pay income that is generally exempt from state and local income tax, although they may be subject to corporate franchise tax in some states. The fund may invest a significant percentage of its assets in repurchase agreements. Repurchase agreements are transactions in which the fund purchases securities issued by the US Treasury and simultaneously commits to resell them to the same counterparty at a future time and at a price reflecting a market rate of interest. Income from repurchase agreements may not be exempt from state and local income taxation. Repurchase agreements often offer a higher yield than investments directly in securities issued by the US Treasury. In deciding whether an investment in a repurchase agreement is more attractive than a direct investment in securities issued by the US Treasury, the fund considers the possible loss of this tax advantage. Money market instruments generally are short-term debt obligations and similar securities. They also may include longer-term bonds that have variable interest rates or other special features that give them the financial characteristics of short-term debt. The fund invests in securities through an underlying master fund. The fund and its corresponding master fund have the same objective. Unless otherwise indicated, references to the fund include the master fund. | | | | | | |

15

| | | | | | | | |

| | | UBS Select ESG Prime Investor Fund (Acquired Fund) UBS Select ESG Prime Institutional Fund (Acquiring Fund) |

| | | UBS Select ESG Prime Investor Fund | | | | | | UBS Select ESG Prime Institutional Fund |

| | | Investment objective | | | | | | Investment objective |

| | | Maximum current income as is consistent with liquidity and preservation of capital while incorporating select environmental, social, and governance criteria (“ESG”) into the investment process. | | | | | | Same. |

| | | Principal strategies Principal investments | | | | | | Principal strategies Principal investments |

| | | The fund is a money market fund that calculates its net asset value (“NAV”) to four decimals (e.g., $1.0000) using market-based pricing. As a result, its share price will fluctuate. The fund seeks to achieve its objective by investing in a diversified portfolio of high quality money market instruments of governmental and private issuers while incorporating fundamental sustainability factors, such as ESG performance of such issuers, into the investment process. Money market instruments may include: • short-term obligations of the US government and its agencies and instrumentalities; • repurchase agreements; • obligations of issuers in the financial services group of industries; • commercial paper, other corporate obligations and asset-backed securities; and • municipal money market instruments. Money market instruments generally are short-term debt obligations and similar securities. They also may include longer-term bonds that have variable interest rates or other special features that give them the financial characteristics of short-term debt. The fund invests in foreign money market instruments only if they are denominated in US dollars. The fund will, under normal circumstances, invest more than 25% of its total assets in the financial services group of industries. In addition, under normal circumstances, the fund invests at least 80% of its net assets (plus the amount of any borrowing for investment purposes), determined at the time of purchase, in securities that meet UBS AM’s sustainability criteria. In developing its sustainability criteria, UBS AM draws upon firm-wide resources of the UBS Asset Management Division of UBS Group AG, of which UBS AM is a member. UBS AM conducts its own credit analyses of potential investments and portfolio holdings, and relies substantially on a dedicated proprietary credit research team. The ESG aspect of UBS AM’s credit analyses and credit research process is applied to | | | | | | Same. |

16

| | | | | | | | |

| | | all portfolio investments and portfolio holdings. Embedded in the credit research process is the integration of issuer-level sustainability investing analysis as guided by the UBS Asset Management Division’s approach to sustainability and/or ESG research and evaluation methodology. The sustainability investing analysis provides a more comprehensive approach to security selection than credit analysis alone as internal and external ESG ratings are applied to evaluate the quality of sustainability practices employed by issuers. Analysts rate and maintain internal fundamental credit and ESG ratings, which are a component of the portfolio construction/optimization approach and focus on issuers that contribute to the fund’s ESG profile. In determining an issuer’s ESG ratings, analysts will evaluate whether, at the time of the fund’s investment, such issuers have better than average performance in ESG practices and managing sustainability and/or ESG risks by reviewing, among other factors, such considerations as the issuer’s environmental responsibility, human rights and labor standards, diversity and inclusion in employment and corporate governance based on proprietary and third-party data. UBS AM also will employ a negative screening process with regard to security selection, which will exclude from the fund’s portfolio securities or sectors that manufacture products or engage in business activities viewed as having a negative social or environmental impact. Such products or business activities include certain controversial weapons, natural resource extraction activities, thermal coal power generation, and certain controversial behavior and business activities as well as the failure of a portfolio company to meet certain engagement objectives identified by UBS AM. UBS AM’s portfolio construction process aims to align investments in money market instruments with the concept of sustainability (i.e., the potential for long-term maintenance of environmental, economic and social well-being). The fund invests in securities through an underlying master fund. The fund and its corresponding master fund have the same objective. Unless otherwise indicated, references to the fund include the master fund. The fund may be subject to the possible imposition of a liquidity fee and/or temporary redemption gate should certain triggering events occur. | | | | | | |

17

| | | | | | | | |

| | | UBS Prime Investor Fund (Acquired Fund) UBS Prime Reserves Fund (Acquiring Fund) |

| | | UBS Prime Investor Fund | | | | | | UBS Prime Reserves Fund |

| | | Investment objective | | | | | | Investment objective |

| | | Maximum current income consistent with liquidity and the preservation of capital. | | | | | | Same. |

| | | Principal strategies Principal investments | | | | | | Principal strategies Principal investments |

| | | The fund is a money market fund and seeks to maintain a stable price of $1.00 per share. The fund seeks to achieve its objective by investing in a diversified portfolio of high quality money market instruments of governmental and private issuers. These may include: • short-term obligations of the US government and its agencies and instrumentalities; • repurchase agreements; • obligations of issuers in the financial services group of industries; • commercial paper, other corporate obligations and asset-backed securities; and • municipal money market instruments. Money market instruments generally are short-term debt obligations and similar securities. They also may include longer-term bonds that have variable interest rates or other special features that give them the financial characteristics of short-term debt. The fund invests in foreign money market instruments only if they are denominated in US dollars. The fund will, under normal circumstances, invest more than 25% of its total assets in the financial services group of industries. The fund invests in securities through an underlying master fund. The fund and its corresponding master fund have the same objective. Unless otherwise indicated, references to the fund include the master fund. The fund is a “retail money market fund,” as such term is defined in the rule governing money market funds and related interpretations. “Retail money market funds” are money market funds that have policies and procedures reasonably designed to limit all beneficial owners of the fund to natural persons. As a “retail money market fund,” the fund is permitted to seek to maintain a stable price per share. | | | | | | Same. |

18

| | | | | | | | |

| | | The fund may be subject to the possible imposition of a liquidity fee and/or temporary redemption gate should certain triggering events occur. The fund is classified by UBS AM as an “ESG-integrated” fund. The fund’s investment process integrates material sustainability and/or environmental, social and governance (“ESG”) considerations into the research process for all portfolio investments and portfolio holdings, except repurchase agreements with certain counterparties. ESG integration is driven by taking into account material sustainability and/or ESG risks which could impact investment returns, rather than being driven by specific ethical principles or norms. The analysis of material sustainability and/or ESG considerations can include many different aspects, including, for example, the carbon footprint, employee health and well-being, supply chain management, fair customer treatment and governance processes of a company. The fund’s portfolio managers may still invest in securities without respect to sustainability and/or ESG considerations or in securities which present sustainability and/or ESG risks, including where the portfolio managers believe the potential compensation outweighs the risks identified. | | | | | | |

| | | UBS Tax-Free Investor Fund (Acquired Fund) UBS Tax-Free Reserves Fund (Acquiring Fund) |

| | | UBS Tax-Free Investor Fund | | | | | | UBS Tax-Free Reserves Fund |

| | | Investment objective | | | | | | Investment objective |

| | | Maximum current income exempt from federal income tax consistent with liquidity and the preservation of capital. | | | | | | Same. |

| | | Principal strategies Principal investments | | | | | | Principal strategies Principal investments |

| | | The fund is a money market fund and seeks to maintain a stable price of $1.00 per share. The fund seeks to achieve its objective by investing in a diversified portfolio of high quality, municipal money market instruments. Under normal circumstances, the fund will invest at least 80% of its net assets (plus the amount of any borrowing for investment purposes) in investments, the income from which is exempt from federal income tax. Investments that are subject to the alternative minimum tax are not counted towards satisfying the 80% test in the foregoing sentence. Under normal circumstances, the fund may invest only up to 20% of its net assets in municipal securities that pay interest that is an item of tax preference for purposes of the alternative minimum tax. Money market instruments generally are short-term debt obligations and similar securities. They also may include longer-term | | | | | | Same. |

19

| | | | | | | | |

| | | bonds that have variable interest rates or other special features that give them the financial characteristics of short-term debt. The fund invests in securities through an underlying master fund. The fund and its corresponding master fund have the same objective. Unless otherwise indicated, references to the fund include the master fund. The fund is a “retail money market fund,” as such term is defined in the rule governing money market funds and related interpretations. “Retail money market funds” are money market funds that have policies and procedures reasonably designed to limit all beneficial owners of the fund to natural persons. As a “retail money market fund,” the fund is permitted to seek to maintain a stable price per share. The fund may be subject to the possible imposition of a liquidity fee and/or temporary redemption gate should certain triggering events occur. | | | | | | |

20

Principal Risks

The principal risks of each Acquired Fund and its corresponding Acquiring Fund are identical. The principal risks of each Fund are listed in the table below. These risks are then further described in the narrative that follows the table. Investors should note that not each of the described risks is a principal risk of a specific Fund unless it is identified as such in the following table for that particular Fund:

| | | | | | | | | | |

UBS Select Prime

Investor Fund

(Acquired Fund) UBS Select Prime

Institutional Fund (Acquiring Fund) | | UBS Select

Government Investor Fund

(Acquired

Fund) UBS Select

Government

Institutional Fund (Acquiring Fund) | | UBS Select Treasury

Investor Fund

(Acquired Fund) UBS Select Treasury

Institutional Fund

(Acquiring Fund) | | UBS Select ESG Prime Investor Fund

(Acquired Fund) UBS Select ESG Prime Institutional

Fund (Acquiring

Fund) | | UBS Prime Investor

Fund (Acquired Fund) UBS Prime Reserves Fund

(Acquiring Fund) | | UBS Tax-Free Investor

Fund (Acquired Fund) UBS Tax-Free Reserves

Fund (Acquiring Fund) |

| Credit risk | | Credit risk | | Credit risk | | Credit risk | | Credit risk | | Credit risk |

| Interest rate risk | | Interest rate risk | | Interest rate risk | | Interest rate risk | | Interest rate risk | | Interest rate risk |

| Market risk | | US Government securities risk | | US Government securities risk | | Sustainability factor risk | | Market risk | | Market risk |

| Liquidity risk | | Repurchase agreements risk | | Repurchase agreements risk | | Market risk | | Liquidity risk | | Liquidity risk |

| Management risk | | Market risk | | Market risk | | Liquidity risk | | Management risk | | Management risk |

| Concentration risk | | Liquidity risk | | Liquidity risk | | Management risk | | Concentration risk | | Financial services sector risk |

| Financial services sector risk | | Management risk | | Management risk | | Concentration risk | | Financial services sector risk | | Municipal securities risk |

| US Government securities risk | | US withholding tax risk | | | | Financial services sector risk | | Asset-backed securities risk | | |

| Repurchase agreements risk | | | | | | US Government securities risk | | US Government securities risk | | |

| Foreign investing risk | | | | | | Repurchase agreements risk | | Repurchase agreements risk | | |

Municipal securities risk | | | | | | Foreign investing risk | | Foreign investing risk | | |

| | | | | | | Municipal securities risk | | Municipal securities risk | | |

Asset-backed securities risk: The fund may purchase securities representing interests in underlying assets, but structured to provide certain advantages not inherent in those assets (e.g., enhanced liquidity and yields linked to short-term interest rates). If those securities behaved in a way that the advisor did not anticipate, or if the security structures encountered unexpected difficulties, the fund could suffer a loss. Structured securities represent a significant portion of the short-term securities markets.

21

Concentration risk: The fund will invest a significant portion of its assets in securities issued by companies in the financial services group of industries, including US banking, non-US banking, broker-dealers, insurance companies, finance companies (e.g., automobile finance) and related asset-backed securities. Accordingly, the fund will be more susceptible to developments that affect those industries than other funds that do not concentrate their investments.

Credit risk: Issuers of money market instruments or financial institutions that have entered into repurchase agreements with the fund may fail to make payments when due or complete transactions, or they may become less willing or less able to do so.

Financial services sector risk: Investments of the fund in the financial services sector may be particularly affected by economic cycles, business developments, interest rate changes and regulatory changes.

Foreign investing risk: The value of the fund’s investments in foreign securities may fall due to adverse political, social and economic developments abroad. However, because the fund’s foreign investments must be denominated in US dollars, it generally is not subject to the risk of changes in currency valuations.

Interest rate risk: The value of the fund’s investments generally will fall when interest rates rise, and its yield will tend to lag behind prevailing rates. The fund may face a heightened level of interest rate risk due to certain changes in general economic conditions, inflation and monetary policy, such as certain types of interest rate changes by the Federal Reserve.

Liquidity risk: Although the fund invests in a diversified portfolio of high quality instruments, the fund’s investments may become less liquid as a result of market developments or adverse investor perception. If this happens, the fund’s ability to redeem its shares for cash may be affected.

Management risk: The risk that the investment strategies, techniques and risk analyses employed by the advisor may not produce the desired results.

Market risk: The risk that the market value of the fund’s investments may fluctuate, sometimes rapidly or unpredictably, as the markets fluctuate, which may affect the fund’s share price. Market risk may affect a single issuer, industry, or sector of the economy, or it may affect the market as a whole. Moreover, changing market, economic, political and social conditions in one country or geographic region could adversely impact market, economic, political and social conditions in other countries or regions.

Municipal securities risk: Municipal securities are subject to interest rate and credit risks. The ability of a municipal issuer to make payments and the value of municipal securities can be affected by uncertainties in the municipal securities market. Such uncertainties could cause increased volatility in the municipal securities market and could negatively impact the fund’s net asset value and/or the distributions paid by the fund. Municipalities continue to experience difficulties in the current economic and political environment.

Repurchase agreements risk (UBS Select Prime Investor Fund, UBS Select Prime Institutional Fund, UBS Select ESG Prime Investor Fund, UBS Select ESG Prime Institutional Fund, UBS Prime Investor Fund, and UBS Prime Reserves Fund): Repurchase agreements carry certain risks not

22

associated with direct investments in securities, including a possible decline in the market value of the underlying obligations. Repurchase agreements involving obligations other than US government securities (such as commercial paper, corporate bonds, mortgage loans and equities) may be subject to special risks and may not have the benefit of certain protections in the event of the counterparty’s insolvency. If the seller or guarantor becomes insolvent, the fund may suffer delays, costs and possible losses in connection with the disposition of collateral.

Repurchase agreements risk (UBS Select Government Investor Fund, UBS Select Government Institutional Fund, UBS Select Treasury Investor Fund, and UBS Select Treasury Institutional Fund): Repurchase agreements carry certain risks not associated with direct investments in securities, including a possible decline in the market value of the underlying obligations.

Sustainability factor risk: Investing primarily in investments that meet ESG criteria carries the risk that the fund may forgo otherwise attractive investment opportunities, or increase or decrease its exposure to certain types of issuers and, therefore, may underperform compared to funds that do not consider ESG factors in the investment process.

US Government securities risk: There are different types of US government securities with different levels of credit risk, including the risk of default, depending on the nature of the particular government support for that security. For example, a US government-sponsored entity, such as Federal National Mortgage Association (“Fannie Mae”) or Federal Home Loan Mortgage Corporation (“Freddie Mac”), although chartered or sponsored by an Act of Congress, may issue securities that are neither insured nor guaranteed by the US Treasury and are therefore riskier than those that are.

US withholding tax risk: The fund generally seeks to invest in securities the income from which is considered “qualified interest income” under relevant tax law and guidance. Thus, the fund generally expects its distributions to be exempt from US withholding tax when paid to non-US investors. However, there can be no assurance that all of the fund’s distributions will be exempt from US withholding tax.

Fundamental Investment Limitations

In addition to the investment objectives and principal investment strategies described above, each Fund has adopted certain fundamental investment policies. The fundamental investment policies of each respective Acquired Fund and Acquiring Fund are the same. Fundamental investment policies may only be changed by a vote of a Fund’s shareholders.

Material Differences in the Rights of Fund Shareholders

Each Acquired Fund and Acquiring Fund is a series of the Trust, a Delaware statutory trust governed by a Board of Trustees made up of the same individuals. The Funds are governed by the same Trust Instrument and By-Laws. Copies of these documents are available to shareholders without charge upon written request to the Funds. There are no material differences between the rights of shareholders of the Acquired Funds and the Acquiring Funds.

23

Comparison of Fees and Expenses

Fees and Expenses of the Funds:

The following discussion compares the fees and expenses of the Funds before and after the Reorganizations. Fees and expenses of the Funds are as of April 30, 2022 (that is, the most recent fiscal year end for a Fund).

Pro forma combined fees and expenses are estimated in good faith and are hypothetical.

It is important to note that following the Reorganizations, shareholders of the Acquired Funds would be subject to the actual fees and expenses of the Acquiring Funds, which may not be the same as the pro forma combined fees and expenses. Future fees and expenses may be greater or lesser than those indicated below. These tables describe the fees and expenses that you may pay if you buy, hold and sell shares of the fund. You may pay other fees, such as fees to financial intermediaries, which are not reflected in the table or example below.

UBS Select Prime Investor Fund (Acquired Fund)

UBS Select Prime Institutional Fund (Acquiring Fund)

| | | | | | | | | | | | |

| | | | |

| | | UBS Select

Prime Investor

Fund | | UBS Select

Prime

Institutional

Fund

(Acquiring

Fund) | | UBS Select

Prime

Institutional

Fund Pro

Forma

Combined |

| Shareholder fees (fees paid directly from your investment) | | | | | | | | | | | | |

Maximum front-end sales charge (load) imposed on purchases | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) | | | None | | | | None | | | | None | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)* | | | | | | | | | | | | |

Management Fees | | | 0.20 | % | | | 0.18 | % | | | 0.18 | % |

Distribution (12b-1) Fees | | | 0.25 | %1 | | | None | | | | None | |

Other expenses | | | 0.13 | % | | | None | ** | | | None | ** |

Shareholder servicing fee | | | 0.10 | % | | | – | | | | – | |

Miscellaneous expenses | | | 0.03 | % | | | – | | | | – | |

Total annual fund operating expenses | | | 0.58 | % | | | 0.18 | % | | | 0.18 | % |

Fee waiver/expense reimbursement | | | 0.25 | %1 | | | – | | | | – | |

Total annual fund operating expenses after fee waiver and/or expense reimbursement | | | 0.33 | %1 | | | 0.18 | % | | | 0.18 | % |

| * | The fund invests in securities through an underlying master fund, Prime Master Fund. This table reflects the direct expenses of the fund and its share of expenses of Prime Master Fund, including management fees allocated from Prime Master Fund. Management fees are comprised of investment advisory and administration fees. |

| ** | “Other expenses” do not include miscellaneous expenses, such as trustee expenses, for which UBS Asset Management (Americas) Inc. (“UBS AM”) reimburses the fund. These other expenses are expected to be less than 0.01% of the average daily net assets of the fund. |

24

| 1 | UBS Select Prime Investor Fund (the “fund”) and UBS AM have entered into a written fee waiver/expense reimbursement agreement pursuant to which UBS AM is contractually obligated to waive its management fees and/or reimburse the fund so that the fund’s operating expenses through August 31, 2023 (excluding interest expense, if any, expenses related to shareholders’ meetings and extraordinary items) would not exceed 0.50%. The fund and UBS Asset Management (US) Inc. (“UBS AM (US)”) have entered into a written fee waiver agreement pursuant to which UBS AM (US) is contractually obligated to waive its 0.25% Distribution (12b-1) fees also through August 31, 2023. The fund has agreed to repay UBS AM for any waived management fees/reimbursed expenses to the extent that it can do so over the three years following such waived fees/reimbursed expenses without causing the fund’s expenses in any of those three years to exceed the 0.50% expense cap. The fee waiver/expense reimbursement agreements may be terminated by the fund’s board at any time and also will terminate automatically upon the expiration or termination of the fund’s contract with UBS AM. Upon termination of the agreement, however, UBS AM’s three year recoupment rights will survive. |

Example:

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same.

Although your actual costs may be higher or lower, based on these assumptions your costs would be:

UBS Select Prime Investor Fund

| | | | | | | | | | | | | | | | |

| | | 1 year | | 3 years | | 5 years | | 10 years |

| UBS Select Prime Investor Fund | | $ | 34 | | | $ | 161 | | | $ | 299 | | | $ | 702 | |

UBS Select Prime Institutional Fund

| | | | | | | | | | | | | | | | |

| | | 1 year | | 3 years | | 5 years | | 10 years |

| UBS Select Prime Institutional Fund | | $ | 18 | | | $ | 58 | | | $ | 101 | | | $ | 230 | |

UBS Select Prime Institutional Fund Pro Forma Combined

| | | | | | | | | | | | | | | | |

| | | 1 year | | 3 years | | 5 years | | 10 years |

| UBS Select Prime Institutional Fund | | $ | 18 | | | $ | 58 | | | $ | 101 | | | $ | 230 | |

25

UBS Select Government Investor Fund (Acquired Fund)

UBS Select Government Institutional Fund (Acquiring Fund)

| | | | | | | | | | | | |

| | | | |

| | | UBS Select

Government

Investor Fund | | UBS Select

Government

Institutional

Fund

(Acquiring

Fund) | | UBS Select

Government

Institutional

Fund Pro

Forma

Combined |

| Shareholder fees (fees paid directly from your investment) | | | | | | | | | | | | |

Maximum front-end sales charge (load) imposed on purchases | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) | | | None | | | | None | | | | None | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)* | | | | | | | | | | | | |

Management Fees | | | 0.20 | % | | | 0.18 | % | | | 0.18 | % |

Distribution (12b-1) Fees | | | 0.25 | %1 | | | None | | | | None | |

Other expenses | | | 0.15 | % | | | None | ** | | | None | ** |

Shareholder servicing fee | | | 0.10 | % | | | – | | | | – | |

Miscellaneous expenses | | | 0.05 | % | | | – | | | | – | |

Total annual fund operating expenses | | | 0.60 | % | | | 0.18 | % | | | 0.18 | % |

Fee waiver/expense reimbursement | | | 0.25 | %1 | | | – | | | | – | |

Total annual fund operating expenses after fee waiver and/or expense reimbursement | | | 0.35 | %1 | | | 0.18 | % | | | 0.18 | % |

| * | The fund invests in securities through an underlying master fund, Government Master Fund. This table reflects the direct expenses of the fund and its share of expenses of Government Master Fund, including management fees allocated from Government Master Fund. Management fees are comprised of investment advisory and administration fees. |

| ** | “Other expenses” do not include miscellaneous expenses, such as trustee expenses, for which UBS Asset Management (Americas) Inc. (“UBS AM”) reimburses the fund. These other expenses are expected to be less than 0.01% of the average daily net assets of the fund. |

| 1 | UBS Select Government Investor Fund (the “fund”) and UBS AM have entered into a written fee waiver/expense reimbursement agreement pursuant to which UBS AM is contractually obligated to waive its management fees and/or reimburse the fund so that the fund’s operating expenses through August 31, 2023 (excluding interest expense, if any, expenses related to shareholders’ meetings and extraordinary items) would not exceed 0.50%. The fund and UBS Asset Management (US) Inc. (“UBS AM (US)”) have entered into a written fee waiver agreement pursuant to which UBS AM (US) is contractually obligated to waive its 0.25% Distribution (12b-1) fees also through August 31, 2023. The fund has agreed to repay UBS AM for any waived management fees/reimbursed expenses to the extent that it can do so over the three years following such waived fees/reimbursed expenses without causing the fund’s expenses in any of those three years to exceed the 0.50% expense cap. The fee waiver/expense reimbursement agreements may be terminated by the fund’s board at any time and also will terminate automatically upon the expiration or termination of the fund’s contract with UBS AM. Upon termination of the agreement, however, UBS AM’s three year recoupment rights will survive. |

Example:

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the fund for the time periods

26

indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same.

Although your actual costs may be higher or lower, based on these assumptions your costs would be:

UBS Select Government Investor Fund

| | | | | | | | | | | | | | | | |

| | | 1 year | | 3 years | | 5 years | | 10 years |

| UBS Select Government Investor Fund | | $ | 36 | | | $ | 167 | | | $ | 310 | | | $ | 726 | |

UBS Select Government Institutional Fund

| | | | | | | | | | | | | | | | |

| | | 1 year | | 3 years | | 5 years | | 10 years |

| UBS Select Government Institutional Fund | | $ | 18 | | | $ | 58 | | | $ | 101 | | | $ | 230 | |

UBS Select Government Institutional Fund Pro Forma Combined

| | | | | | | | | | | | | | | | |

| | | 1 year | | 3 years | | 5 years | | 10 years |

| UBS Select Government Institutional Fund | | $ | 18 | | | $ | 58 | | | $ | 101 | | | $ | 230 | |

UBS Select Treasury Investor Fund (Acquired Fund)

UBS Select Treasury Institutional Fund (Acquiring Fund)

| | | | | | | | | | | | |

| | | | |

| | | UBS Select

Treasury

Investor Fund | | UBS Select

Treasury

Institutional

Fund

(Acquiring

Fund) | | UBS Select

Treasury

Institutional

Fund Pro

Forma

Combined |

| Shareholder fees (fees paid directly from your investment) | | | | | | | | | | | | |

Maximum front-end sales charge (load) imposed on purchases | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) | | | None | | | | None | | | | None | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)* | | | | | | | | | | | | |

Management Fees | | | 0.20 | % | | | 0.18 | % | | | 0.18 | % |

Distribution (12b-1) Fees | | | 0.25 | %1 | | | None | | | | None | |

Other expenses | | | 0.13 | % | | | None | ** | | | None | ** |

Shareholder servicing fee | | | 0.10 | % | | | – | | | | – | |

Miscellaneous expenses | | | 0.03 | % | | | – | | | | – | |

Total annual fund operating expenses | | | 0.58 | % | | | 0.18 | % | | | 0.18 | % |

Fee waiver/expense reimbursement | | | 0.25 | %1 | | | – | | | | – | |

Total annual fund operating expenses after fee waiver and/or expense reimbursement | | | 0.33 | %1 | | | 0.18 | % | | | 0.18 | % |

27

| * | The fund invests in securities through an underlying master fund, Treasury Master Fund. This table reflects the direct expenses of the fund and its share of expenses of Treasury Master Fund, including management fees allocated from Treasury Master Fund. Management fees are comprised of investment advisory and administration fees. |

| ** | “Other expenses” do not include miscellaneous expenses, such as trustee expenses, for which UBS Asset Management (Americas) Inc. (“UBS AM”) reimburses the fund. These other expenses are expected to be less than 0.01% of the average daily net assets of the fund. |

| 1 | UBS Select Treasury Investor Fund (the “fund”) and UBS AM have entered into a written fee waiver/expense reimbursement agreement pursuant to which UBS AM is contractually obligated to waive its management fees and/or reimburse the fund so that the fund’s operating expenses through August 31, 2023 (excluding interest expense, if any, expenses related to shareholders’ meetings and extraordinary items) would not exceed 0.50%. The fund and UBS Asset Management (US) Inc. (“UBS AM (US)”) have entered into a written fee waiver agreement pursuant to which UBS AM (US) is contractually obligated to waive its 0.25% Distribution (12b-1) fees also through August 31, 2023. The fund has agreed to repay UBS AM for any waived management fees/reimbursed expenses to the extent that it can do so over the three years following such waived fees/reimbursed expenses without causing the fund’s expenses in any of those three years to exceed the 0.50% expense cap. The fee waiver/expense reimbursement agreements may be terminated by the fund’s board at any time and also will terminate automatically upon the expiration or termination of the fund’s contract with UBS AM. Upon termination of the agreement, however, UBS AM’s three year recoupment rights will survive. |

Example:

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same.

Although your actual costs may be higher or lower, based on these assumptions your costs would be:

UBS Select Treasury Investor Fund

| | | | | | | | | | | | | | | | |

| | | 1 year | | 3 years | | 5 years | | 10 years |

| UBS Select Treasury Investor Fund | | $ | 34 | | | $ | 161 | | | $ | 299 | | | $ | 702 | |

UBS Select Treasury Institutional Fund

| | | | | | | | | | | | | | | | |

| | | 1 year | | 3 years | | 5 years | | 10 years |

| UBS Select Treasury Institutional Fund | | $ | 18 | | | $ | 58 | | | $ | 101 | | | $ | 230 | |

UBS Select Treasury Institutional Fund Pro Forma Combined

| | | | | | | | | | | | | | | | |

| | | 1 year | | 3 years | | 5 years | | 10 years |

| UBS Select Treasury Institutional Fund | | $ | 18 | | | $ | 58 | | | $ | 101 | | | $ | 230 | |

28

UBS Select ESG Prime Investor Fund (Acquired Fund)

UBS Select ESG Prime Institutional Fund (Acquiring Fund)

| | | | | | | | | | | | |

| | | | |

| | | UBS Select ESG

Prime Investor

Fund | | UBS Select

ESG Prime

Institutional

Fund

(Acquiring

Fund) | | UBS Select

ESG Prime

Institutional

Fund Pro

Forma

Combined |

| Shareholder fees (fees paid directly from your investment) | | | | | | | | | | | | |

Maximum front-end sales charge (load) imposed on purchases | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) | | | None | | | | None | | | | None | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)* | | | | | | | | | | | | |

Management Fees | | | 0.20 | % | | | 0.18 | % | | | 0.18 | % |

Distribution (12b-1) Fees | | | 0.25 | %1 | | | None | | | | None | |

Other expenses | | | 2.56 | % | | | None | ** | | | None | ** |

Shareholder servicing fee | | | 0.10 | % | | | – | | | | – | |

Miscellaneous expenses | | | 2.46 | % | | | – | | | | – | |

Total annual fund operating expenses | | | 3.01 | % | | | 0.18 | % | | | 0.18 | % |

Fee waiver/expense reimbursement | | | 2.51 | %1 | | | – | | | | – | |

Total annual fund operating expenses after fee waiver and/or expense reimbursement | | | 0.50 | %1 | | | 0.18 | % | | | 0.18 | % |

| * | The fund invests in securities through an underlying master fund, ESG Prime Master Fund. This table reflects the direct expenses of the fund and its share of expenses of ESG Prime Master Fund, including management fees allocated from ESG Prime Master Fund. Management fees are comprised of investment advisory and administration fees. |

| ** | “Other expenses” do not include miscellaneous expenses, such as trustee expenses, for which UBS Asset Management (Americas) Inc. (“UBS AM”) reimburses the fund. These other expenses are expected to be less than 0.01% of the average daily net assets of the fund. |