UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

CARDINAL FINANCIAL CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

CARDINAL FINANCIAL CORPORATION

Dear Shareholders:

You are cordially invited to attend the Annual Meeting of Shareholders of Cardinal Financial Corporation (the “Company”), which will be held on April 21, 2006 at 10:00 A.M., at the Fair Lakes Hyatt, 12777 Fair Lakes Circle, Fairfax, Virginia. At the meeting, four directors will be elected for a term of three years each. Shareholders also will vote to approve an amendment to the Company’s 2002 Equity Compensation Plan, to approve an amendment to the Company’s deferred income plans and to ratify the appointment of KPMG LLP as the Company’s independent auditors for 2006.

Whether or not you plan to attend in person, it is important that your shares be represented at the meeting. Please complete, sign, date and return promptly the form of proxy that is enclosed with this mailing, or follow the Internet instructions given to vote and submit your proxy. If you decide to attend the meeting and vote in person, or if you wish to revoke your proxy for any reason prior to the vote at the meeting, you may do so, and your proxy will have no further effect.

The Board of Directors and management of the Company appreciate your continued support and look forward to seeing you at the meeting.

| Sincerely yours, |

|

|

| BERNARD H. CLINEBURG |

| Chairman and Chief Executive Officer |

McLean, Virginia | |

March 21, 2006 | |

CARDINAL FINANCIAL CORPORATION

8270 Greensboro Drive

Suite 500

McLean, Virginia 22102

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on April 21, 2006

NOTICE IS HEREBY GIVEN that the 2006 Annual Meeting (the “Meeting”) of the holders of shares of common stock, par value $1.00 per share (“Common Stock”), of Cardinal Financial Corporation (the “Company”), will be held at the Fair Lakes Hyatt, 12777 Fair Lakes Circle, Fairfax, Virginia, on April 21, 2006 at 10:00 A.M., for the following purposes:

1. To elect four directors for a term of three years each, or until their successors are elected and qualify;

2. To approve an amendment to the Company’s 2002 Equity Compensation Plan;

3. To approve an amendment to the Company’s deferred income plans;

4. To ratify the appointment of KPMG LLP as the Company’s independent auditors for 2006; and

5. To transact such other business as may properly come before the Meeting.

Holders of shares of Common Stock of record at the close of business on March 7, 2006 will be entitled to vote at the Meeting.

You are requested to complete, sign, date and return the enclosed proxy promptly, regardless of whether you expect to attend the Meeting. A postage-paid return envelope is enclosed for your convenience. You also have the ability to vote and submit your proxy via the Internet instructions included in this mailing.

If you are present at the Meeting, you may vote in person even if you have already returned your proxy.

This notice is given pursuant to direction of the Board of Directors.

|

|

| Jennifer L. Deacon |

| Secretary |

McLean, Virginia | |

March 21, 2006 | |

CARDINAL FINANCIAL CORPORATION

PROXY STATEMENT

GENERAL INFORMATION

2006 ANNUAL MEETING OF SHAREHOLDERS

APRIL 21, 2006 |

This Proxy Statement is furnished to holders of common stock, par value $1.00 per share (“Common Stock”), of Cardinal Financial Corporation (the “Company”) in connection with the solicitation of proxies by the Board of Directors of the Company to be used at the 2006 Annual Meeting of Shareholders to be held on April 21, 2006 at 10:00 A.M., at the Fair Lakes Hyatt, 12777 Fair Lakes Circle, Fairfax, Virginia, and at any adjournment thereof (the “Meeting”). At the Meeting, four directors will be elected for a term of three years each. Shareholders also are being asked to approve an amendment to the Company’s 2002 Equity Compensation Plan, to approve an amendment to the Company’s deferred income plans, and to ratify the appointment of KPMG LLP as the Company’s independent auditors for 2006.

The principal executive offices of the Company are located at 8270 Greensboro Drive, Suite 500, McLean, Virginia 22102. The approximate date on which this Proxy Statement and the accompanying proxy card are being mailed to the Company’s shareholders is March 21, 2006.

The Board of Directors has fixed the close of business on March 7, 2006 as the record date (the “Record Date”) for the determination of the holders of shares of Common Stock entitled to receive notice of and to vote at the Meeting. At the close of business on the Record Date, there were 24,364,425 shares of Common Stock outstanding held by 673 shareholders of record. Each share of Common Stock is entitled to one vote on all matters to be acted upon at the Meeting.

As of February 28, 2006, directors and executive officers of the Company and their affiliates, as a group, owned of record and beneficially a total of 3,339,944 shares of Common Stock, or approximately 12.95% of the shares of Common Stock outstanding on such date. Directors, executive officers and nominees for election to the Board of Directors of the Company have indicated an intention to vote shares of Common Stock FOR the election of the nominees set forth on the enclosed proxy, FOR the approval of an amendment to the Company’s 2002 Equity Compensation Plan, FOR the approval of an amendment to the Company’s deferred income plans and FOR the ratification of KPMG LLP as the Company’s independent auditors for 2006.

A shareholder may abstain or (only with respect to the election of directors) withhold his vote (collectively, “Abstentions”) with respect to each item submitted for shareholder approval. Abstentions will be counted for purposes of determining the existence of a quorum. Abstentions will not be counted as voting in favor of or against the relevant item.

A broker who holds shares in “street name” has the authority to vote on certain items when it has not received instructions from the beneficial owner. Except for certain items for which brokers are prohibited from exercising their discretion, a broker is entitled to vote on matters presented to shareholders without instructions from the beneficial owner. “Broker shares” that are voted on at least one matter will be counted for purposes of determining the existence of a quorum for the transaction of business at the Meeting. Where brokers do not have or do not exercise such discretion, the inability or failure to vote is referred to as a “broker nonvote.” Under the circumstances where the broker is not permitted to, or does not, exercise its discretion, assuming proper disclosure to the Company of such inability to vote, a broker nonvote will not be counted as voting in favor of or against the particular matter, or otherwise as a vote cast on the matter.

Shareholders of the Company are requested to complete, date and sign the accompanying form of proxy and return it promptly to the Company in the enclosed envelope. If a proxy is properly executed and returned in time for voting, it will be voted as indicated thereon. If no voting instructions are given, proxies received by the Company will be voted for election of the directors nominated for election, for the approval of the amendment to the Company’s 2002 Equity Compensation Plan, for the approval of the amendment to the Company’s deferred income plans, and for ratification of KPMG LLP as the Company’s independent auditors.

Shareholders can also deliver proxies by using the Internet. The Internet voting procedures are designed to authenticate shareholders’ identities, to allow shareholders to give their voting instructions and to confirm that such instructions have been recorded properly. Instructions for voting over the Internet are set forth on the enclosed proxy card. If your shares are held in street name with your bank or broker, please follow the instructions enclosed with this Proxy Statement.

Any shareholder who executes a proxy has the power to revoke it at any time before it is voted by giving written notice of revocation to the Company, by executing and delivering a substitute proxy dated as of a later date to the Company or by attending the Meeting and voting in person. If a shareholder desires to revoke a proxy by written notice, such notice should be mailed or delivered, so that it is received on or prior to the date of the Meeting, to Jennifer L. Deacon, Secretary, Cardinal Financial Corporation, 8270 Greensboro Drive, Suite 500, McLean, Virginia 22102.

The Company will pay all of the costs associated with this proxy solicitation. In addition, certain officers and employees of the Company or its subsidiaries, without additional compensation, may use their personal efforts, by telephone or otherwise, to obtain proxies. The Company will also reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses in forwarding proxy materials to the beneficial owners of the shares.

2

OWNERSHIP OF COMPANY SECURITIES |

Security Ownership of Directors and Executive Officers

The following table sets forth certain information, as of February 28, 2006, with respect to beneficial ownership of shares of Common Stock by each of the members of the Board of Directors (including the nominees for election to the Board of Directors), by each of the executive officers named in the “Summary Compensation Table” below and by all directors, nominees and executive officers as a group. Beneficial ownership includes shares, if any, held in the name of the spouse, minor children or other relatives of the individual living in such person’s home, as well as shares, if any, held in the name of another person under an arrangement whereby the director, nominee or executive officer can vest title in himself or herself at once or at some future time.

Name(1) | | | | Common

Stock

Beneficially

Owned(2) | | Exercisable

Options

Included in

Beneficially Owned

Common Stock | | Percentage

of Class | |

B. G. Beck | | | 135,804 | | | | 7,750 | | | | * | | |

Wayne W. Broadwater | | | 93,569 | | | | 16,250 | | | | * | | |

William G. Buck | | | 132,750 | | | | 7,750 | | | | * | | |

Bernard H. Clineburg(4) | | | 1,042,789 | | | | 900,426 | | | | 4.17 | % | |

Sidney O. Dewberry | | | 115,950 | | | | 8,750 | | | | * | | |

John W. Fisher | | | 605,750 | | | | 8,750 | | | | 2.49 | % | |

Michael A. Garcia | | | 43,968 | | | | 9,700 | | | | * | | |

J. Hamilton Lambert | | | 78,448 | | | | 12,250 | | | | * | | |

William E. Peterson | | | 119,750 | | | | 8,750 | | | | * | | |

James D. Russo | | | 141,590 | | | | 15,200 | | | | * | | |

John H. Rust, Jr. | | | 132,779 | | | | 17,250 | | | | * | | |

George P. Shafran | | | 182,381 | | | | 22,917 | | | | * | | |

Alice M. Starr | | | 59,450 | | | | 8,200 | | | | * | | |

Named Executive Officers | | | | | | | | | | | | | |

Christopher W. Bergstrom | | | 105,094 | | | | 80,000 | | | | * | | |

Kim C. Liddell | | | 80,636 | | | | 76,000 | | | | * | | |

F. Kevin Reynolds | | | 105,354 | | | | 80,000 | | | | * | | |

Dennis M. Griffith | | | 75,889 | | | | 70,000 | | | | * | | |

Current Directors and Executive Officers as a Group

(20 persons) | | | 3,339,944 | | | | 1,433,943 | | | | 12.95 | % | |

* Percentage of ownership is less than one percent of the outstanding shares of common stock.

(1) The business address of each named person is c/o Cardinal Financial Corporation, 8270 Greensboro Drive, Suite 500, McLean, VA 22102.

(2) The number of shares of Common Stock shown in the table includes 45,602 shares held for certain directors and executive officers in the Company’s 401(k) plan as of February 28, 2006.

(3) The number of shares of Common Stock shown in the table includes shares that certain directors and executive officers have the right to acquire, or will obtain the right to acquire, through the exercise of stock options within 60 days following February 28, 2006.

(4) Mr. Clineburg is also a Named Executive Officer.

3

Security Ownership of Certain Beneficial Owners

As of February 28, 2006, the Company was not aware of any shareholder that beneficially owned five percent or more of the outstanding shares of Common Stock.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s directors and executive officers, and any persons who own more than 10% of the outstanding shares of Common Stock, to file with the Securities and Exchange Commission (“SEC”) reports of ownership and changes in ownership of shares of Common Stock. Directors and executive officers are required by SEC regulations to furnish the Company with copies of all Section 16 (a) reports that they file, and the Company assists these individuals in this process. Based upon a review of SEC Forms 3, 4, and 5, the Company reports three late filings. Mr. Buck inadvertently filed late two reports on Form 4 covering the purchases of shares of common stock in May 2005 and August 2005. Ms. Cole filed a late Form 3 covering her beneficial ownership in the Company’s securities.

PROPOSAL 1

ELECTION OF DIRECTORS |

General Information on the Election of Directors

Under the Company’s Articles of Incorporation and Bylaws, the Board of Directors is divided into three classes as nearly equal in number as possible. Directors in only one class are elected each year, each for a three-year term on the Board. This year, the class of four directors whose terms expire in 2006 are up for election. In the election of directors, those receiving the greatest number of votes will be elected even if they do not receive a majority.

The Board of Directors directed the Nominating Committee of the Board to select the nominees for election as directors. The Board of Directors has no reason to believe that any of the nominees will be unavailable. The following information sets forth the names, ages, principal occupations and business experience for the past five years for all nominees and incumbent directors.

Wayne W. Broadwater, who has been a director since 1997, is not standing for reelection.

Nominees for Election for Terms Expiring in 2009

Bernard H. Clineburg, 57, has been a director since 2001. Mr. Clineburg is the Company’s Chairman and Chief Executive Officer. He was the Company’s President since his joining the Company in 2001 until March 2006. Mr. Clineburg, a local bank executive for more than thirty years, is the former Chairman, President and Chief Executive Officer of United Bank (formerly George Mason Bankshares). While Mr. Clineburg held the position as President, and later Chief Executive Officer, George Mason Bank grew from $160 million to $1 billion in assets prior to its being acquired by United Bank. Mr. Clineburg serves on the boards of trustees of the George Mason University Foundation and the Virginia Bankers Association School of Bank Management. He serves on the board of directors and the executive committee of the Virginia Bankers Association and is a member of the INOVA Health System Foundation Board. Mr. Clineburg also serves on the Advisory Board of the Conference of State Bank Supervisors and the ABA Community Bankers Council.

4

James D. Russo, 59, has been a director since 1997. Mr. Russo has been the Managing Director of Potomac Consultants Group in Virginia since 2000, and the Executive Director of Finance of Advancis Pharmaceutical Corporation since 2001. He was Senior Vice President and Chief Financial Officer of Shire Laboratories, Inc., a pharmaceutical research and development company in Rockville, Maryland, from 1994 to 2000. Mr. Russo also serves on the board of directors of Lion, Inc., which provides online services connecting mortgage brokers with wholesale lenders and consumers, and he serves on the board of trustees of TESST College of Technology, which operates four educational centers in the Washington, D.C. – Baltimore region.

John H. Rust, Jr., 58, has been a director since 1997. He is currently the Company’s Vice Chairman. Mr. Rust has been an attorney with the law firm of Rust & Rust in Fairfax, Virginia since March 2001. He previously was of counsel in the law firm of Wilkes Artis from September 1998 to February 2001. Mr. Rust was a member of the Virginia House of Delegates from 1980-1982 and 1997-2001.

George P. Shafran, 79, has been a director since 2000. Mr. Shafran is President of Geo. P. Shafran & Associates, Inc., a consulting firm in McLean, Virginia. He was a director of Heritage Bancorp, Inc. and its predecessor, The Heritage Bank, from 1997-2000. He currently serves on numerous boards and committees, including NVR Mortgage Finance, Inc, the National Capital Area Red Cross, High Performance Group and E-Lynxx Corp. He is Chairman of the AAA Mid-Atlantic advisory board and serves as a member of the advisory board of Base Technologies, Inc.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE NOMINEES SET FORTH ABOVE.

Incumbent Directors Serving for Terms Expiring in 2007

B. G. Beck, 69, has been a director since 2002. He is Vice Chairman & director of Viisage Technologies, Inc. and was President & Chief Executive Officer of Trans Digital Technologies from 2000 to 2004. Mr. Beck was President & Chief Executive Officer of Thermo Digital Technologies, Thermo Electron Corporation from 1997 to 2000, President of Thermo Washington, Thermo Electron Corporation from 1996 to 1999, Corporate Vice President of Coleman Research Corporation from 1990 to 1996 and President & CEO of Atlantic Systems Research & Engineering from 1984 to 1989.

Michael A. Garcia, 46, has been a director since 2003. He is President and Owner of Mike Garcia Construction, Inc. in Manassas, Virginia. Over its 26 years in business, Mr. Garcia has been recognized for excellence in home design and commercial construction. Mr. Garcia was honored as Northern Virginia’s Builder of the Year in 1995 and received Southern Living magazine’s choice for exclusive builder in Northern Virginia in 1995. Mr. Garcia was a founding director of the Company’s subsidiary Cardinal Bank—Manassas/Prince William, N.A. in 1999 and became a director of Cardinal Bank, N.A. when the two subsidiaries were merged in 2002.

J. Hamilton Lambert, 65, has been a director since 1999. Mr. Lambert is President of J. Hamilton Lambert and Associates, a consulting firm based in Fairfax, Virginia. He served as County Executive of Fairfax County from August 1980 to December 1990.

Alice M. Starr, 57, has been a director since 2001. She is President and CEO of Starr Strategies, a marketing and public relations consulting firm. She was Vice President of WEST*GROUP, a commercial real estate firm headquartered in McLean, Virginia, from 1990 to 2004. Ms. Starr worked as Director of Consumer Affairs for NVR, a large national homebuilder, and she was a Vice President of the Washington Airports Task Force. She serves as a Director of Walnut Springs, Inc. and on the Advisory Boards of Base Technologies, Inc. and Mount Vernon. She served as a Director of EnviroSystems, Inc, a nano-technology firm from 2001 – 2005. She has served on numerous non-profit boards, including as Chairman of the Corporate Community Relations Council of Northern Virginia, Fairfax County Public Library Foundation,

5

McLean Chamber of Commerce, McLean Project for the Arts, and Volunteer Fairfax. She has served as a Director of The American Red Cross, Safe Community Coalition, Claude Moore Colonial Farm, Committee for Dulles, Medical Care for Children Partnership and as a Commissioner of the Virginia Commission for the Arts.

Incumbent Directors Serving for Terms Expiring in 2008

William G. Buck, 59, has been a director since 2002. Mr. Buck has been the President of William G. Buck & Associates, Inc., a real estate brokerage, development and property management firm in Arlington, Virginia, since 1976. He has over seventeen years of prior experience as a member of the board of directors of several local banks.

Sidney O. Dewberry, P.E., L.S., 78, has been a director since 2002. He is currently our lead director. Mr. Dewberry is Chairman and Founder of Dewberry, which includes Dewberry & Davis LLC, an architectural, engineering, planning, surveying and landscape architecture firm headquartered in Fairfax, Virginia. Mr. Dewberry serves on numerous boards and committees, including the George Mason University Board of Visitors, the Greater Washington Board of Trade Board of Directors, the Northern Virginia Roundtable, the Washington Airports Task Force Board of Directors, the Northern Virginia Transportation Alliance, the Virginia Business-Higher Education Council, and the INOVA Health Systems Foundation Board.

John W. Fisher, 51, has been a director since 2002. Mr. Fisher founded the investment management firm of Wilson/Bennett Company in 1987 and Wilson/Bennett Capital Management, Inc. in 1994, which was acquired by the Company in June 2005. He is the President and Chief Investment Officer of Wilson/Bennett Capital Management, Inc. Prior to founding the Wilson/Bennett Company, Mr. Fisher was a Vice President with the E. F. Hutton Company.

William E. Peterson, 44, has been a director since 2003. He has been Principal and Officer of The Peterson Companies for the past 13 years. The Peterson Companies is a diversified real estate development and management company with over $120 million in annual revenues operating in 12 local jurisdictions in the greater Washington, D.C. metropolitan area. Mr. Peterson served as The Peterson Companies’ Chief Financial Officer from 1992 until 2001. In October 2001, he assumed the position of Chief Operating Officer of Peterson Management Company, which manages a commercial office and retail real estate portfolio of over 6 million square feet. Mr. Peterson was recently elevated to the position of President of Peterson Management Company. Mr. Peterson has also served on the boards of various charitable and community organizations including Leadership Fairfax, Northern Virginia Conservation Trust, and various United Methodist Church Boards.

CORPORATE GOVERNANCE AND

THE BOARD OF DIRECTORS |

General

The business and affairs of the Company are managed under the direction of the Board of Directors in accordance with the Virginia Stock Corporation Act and the Company’s Articles of Incorporation and Bylaws. Members of the Board are kept informed of the Company’s business through discussions with the Chairman, President and Chief Executive Officer and other officers, by reviewing materials provided to them and by participating in meetings of the Board of Directors and its committees.

6

Independence of the Directors

The Board of Directors has determined that 10 of its 13 members are independent as defined by the listing standards of the Nasdaq Stock Market (“Nasdaq”), including the following: Messrs. Beck, Broadwater, Buck, Dewberry, Garcia, Lambert, Peterson, Russo and Shafran and Ms. Starr. In reaching this conclusion, the Board of Directors considered that the Company and its subsidiaries conduct business with companies of which certain members of the Board of Directors or members of their immediate families are or were directors or officers.

Meeting Attendance

Board and Committee Meetings

The Board of Directors holds regular meetings each year, including an annual meeting. During 2005, the Board of Directors held 13 regular meetings and no special meetings. Each director attended at least 75% of the 2005 meetings of the Board of Directors and its committees on which he or she served, with the exception of Mr. Beck.

Annual Meeting of Shareholders

The Company encourages members of the Board of Directors to attend the Annual Meeting of Shareholders. At last year’s Annual Meeting of Shareholders, all of the directors were in attendance.

The Committees of the Board of Directors

The Board of Directors has an Executive Committee, an Audit Committee, a Compensation Committee, a Loan Committee, and a Nominating Committee. All Committees met at various times in 2005. Specific information regarding the Audit Committee, the Compensation Committee and the Nominating Committee is presented below.

Audit Committee

The Audit Committee consists of Mr. Russo, as Chairman, and Messrs. Beck, Lambert and Peterson and Ms. Starr. Each of the members of the Audit Committee is independent from the Company, in accordance with Nasdaq’s listing standards and the requirements of the SEC. The Board of Directors has also determined that all of the members of the Audit Committee have sufficient knowledge in financial and auditing matters to serve on the Audit Committee and that Mr. Russo qualifies as an “audit committee financial expert” as defined by regulations of the SEC.

The Audit Committee has adopted a charter, which provides guidance to the committee, the entire Board and the Company regarding its purposes, goals, responsibilities, functions and its evaluation. The Audit Committee is responsible for the selection and recommendation of the independent accounting firm for the annual audit. It reviews and accepts the reports of the Company’s independent auditors, internal auditor, and federal and state examiners. A copy of the charter is included as Exhibit A to this proxy statement. The Audit Committee met nine times during the year ended December 31, 2005. Additional information with respect to the Audit Committee is discussed under “Audit Information,” below.

Compensation Committee

The Compensation Committee consists of Mr. Shafran, as Chairman, and Messrs. Broadwater, Buck, Dewberry, and Lambert, all of whom the Board in its business judgment has determined are independent as defined by Nasdaq’s listing standards. The Compensation Committee reviews senior management’s performance and compensation and reviews and sets guidelines for compensation of all employees. The Compensation Committee met seven times during the year ended December 31, 2005. Additional

7

information with respect to the Compensation Committee is discussed under “Executive Officers and Significant Employees—Compensation Committee Report on Executive Compensation,” below.

Nominating Committee

The Nominating Committee consists of Mr. Dewberry, Lead Director, Messrs. Beck, Broadwater, Buck, Garcia, Lambert, Peterson, Russo and Shafran and Ms. Starr. The Board of Directors in its business judgment has determined that all members of the Nominating Committee are independent as defined by Nasdaq’s listing standards. The Nominating Committee selects the nominees for election as directors. This committee is responsible for the selecting and recommending to the Board of Directors with respect to: (i) nominees for election at the Annual Meeting of Shareholders and (ii) nominees to fill Board vacancies. The Nominating Committee met one time during the year ended December 31, 2005. The Nominating Committee does not have a charter.

In identifying potential nominees, the Nominating Committee takes into account such factors as it deems appropriate, including the current composition of the Board of Directors, the range of talents, experiences and skills that would best complement those that are already represented on the Board, the balance of management and independent Directors and the need for specialized expertise. The Nominating Committee considers candidates for Board membership suggested by its members and by management, and the Nominating Committee will also consider candidates suggested informally by a shareholder of the Company.

The Nominating Committee believes that the following guidelines are the standards by which potential nominees should be evaluated:

· the ability of the prospective nominee to represent the interests of the shareholders of the Company;

· the prospective nominee’s standards of integrity, commitment and independence of thought and judgment;

· the prospective nominee’s ability to dedicate sufficient time, energy and attention to the diligent performance of his or her duties, including the prospective nominee’s service on other public company boards; and

· the extent to which the prospective nominee contributes to the range of talent, skill and expertise appropriate for the Board of Directors.

Shareholders entitled to vote for the election of directors may recommend candidates for the Nominating Committee to consider formally in connection with an annual meeting. Information with respect to shareholder nominations is discussed later under “Proposals for 2007 Annual Meeting.”

Under the process used by the Company for selecting new candidates to the board of directors, the Nominating Committee, along with the Chairman and Chief Executive Officer, identify the need to add a new board member with specific qualifications or to fill a vacancy on the board. The Lead Director will initiate a search, working with staff support and seeking input from the board of directors and senior management, hiring a search firm, if necessary, and considering any candidates recommended by shareholders. An initial slate of candidates that will satisfy criteria and otherwise qualify for membership on the board may be presented to the Nominating Committee. A determination is made as to whether members of the board have relationships with preferred candidates and can initiate contacts. At least one member of the Nominating Committee, along with the Chairman and Chief Executive Officer, interviews prospective candidates. The Nominating Committee meets to conduct further interviews of prospective candidates, if necessary or appropriate, and to consider and recommend final candidates for approval by the full board of directors.

8

Communications with the Board of Directors

Shareholders may communicate directly with the Board of Directors. All communications should be directed to the Company’s Corporate Secretary at the address below and should prominently indicate on the outside of the envelope that it is intended for the Board of Directors or for non-management directors. If no party is specified, the communication will be forwarded to the entire Board of Directors. Each communication intended for the Board of Directors and received by the Corporate Secretary will be forwarded to the specified party. The communication will not be screened and will be forwarded unopened to the intended recipient. Shareholder communications to the Board of Directors should be sent to:

Jennifer L. Deacon

Corporate Secretary

Cardinal Financial Corporation

8270 Greensboro Drive, Suite 500

McLean, Virginia 22102

Director Compensation

Each director is entitled to receive cash compensation for his or her service on the Board of Directors. Each director is paid $200 for each Board meeting attended, $100 for each committee meeting attended, and $175 for each Executive Committee meeting attended. James D. Russo, in his capacity as Audit Committee Chairman, receives a retainer of $60,000 annually.

Each non-employee director can participate in the Company’s deferred income plan for non-employee directors. Under this plan, a non-employee director may elect to defer all or a portion of any director-related fees including fees for serving on board committees. Director deferrals are matched 50% by the Company, with a maximum match per director of $10,000 annually, and are vested immediately.

John H. Rust, Jr., the Vice Chairman of the Board, receives a salary of $52,000 annually. Mr. Rust participates in the Company’s group health insurance plan, and his insurance is paid 100% by the Company. Health insurance paid by the Company for the benefit of Mr. Rust for 2005 was $9,400. In addition, Mr. Rust received $15,395 in 2005 as other annual compensation for use and maintenance of his automobile and country club dues.

EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES |

Executive Officers

The following information sets forth the names, ages, principal occupations and business experience for the past five years for all executive officers. Such information with respect to Bernard H. Clineburg, the Company’s Chairman and Chief Executive Officer, is set forth above in the “Proposal 1—Election of Directors” section.

Christopher W. Bergstrom, 46, has been President of Cardinal Bank since 2002. He was President and Chief Executive Officer of Cardinal Bank-Manassas/Prince William, N.A. from 1999 to 2002 when it merged with Cardinal Bank. Between 1982 and 1998, Mr. Bergstrom was employed with Crestar Bank where he served in a variety of retail and commercial functions including management of one of the organization’s commercial banking divisions covering Northern Virginia, the District of Columbia and Southern Maryland.

9

Robert E. Bradecamp, 52, has been Executive Vice President, Corporate Treasurer for Cardinal Bank since November 2004. From 1994 to 2004, he was employed by Riggs Bank, N.A. serving as Treasurer from 1996 to 2004 with duties that included interest rate risk management, liquidity management and portfolio management. Prior to joining Riggs, he was employed by MNC Financial Corp. serving various functions in their treasury area.

Kendal E. Carson, 49, has been President of the Company since March 2006. He is also Senior Executive Vice President of Cardinal Bank. Mr. Carson is the former President and Chief Executive Officer of United Bank of Virginia, which is headquartered in Tysons Corner, and former Executive Vice President, United Bankshares, Inc., the holding company for United Bank of Virginia. He held these positions from February 2000 until his departure from United Bank in February 2006.

Robert A. Cern, 55, has been our Executive Vice President and Chief Financial Officer since October 2004. From 2001 to 2004, he was Senior Vice President and Controller of Riggs Bank, N.A., and had similar functional responsibilities for Riggs National Corporation, both located in Washington, D.C. Prior to joining Riggs, he was Senior Vice President, Chief Financial Officer and Secretary of Permanent Bancorp, Inc. and its subsidiary, Permanent Bank, of Evansville, Indiana from 1998 to 2000.

Cynthia A. Cole, 53, has been our Executive Vice President and Director of Marketing since August 2005. From 2000 to 2005, she had her own marketing consulting firm. She has 22 years experience in financial services marketing management roles at several major banks and insurance companies.

Dennis M. Griffith, 57, has been the Executive Vice President of our Real Estate Lending Group since April 2002. From 1973 through 2001, Mr. Griffith was employed by Bank of America and its predecessor organizations. He held various real estate, lending and management positions including Manager of Commercial Real Estate for the metropolitan Washington, D.C. area.

Kim C. Liddell, 45, has been our Executive Vice President and Chief Operating Officer since December 2005. From March 2004 to November 2005, Mr. Liddell was our Executive Vice President and Chief Administrative Officer. From 2001 to 2004, Mr. Liddell was employed by two community banks, SequoiaBank in Bethesda and Planters Bank in Staunton, where he was Senior Vice President responsible for the Retail Banking, Marketing, Small Business Lending, and Mortgage Banking divisions. From 1999 to 2001, Mr. Liddell was the retail sales manager for 87 branches of First Virginia Bank in Northern Virginia, and from 1984 to 1999, he worked his way up in that bank’s Retail Banking Division from management trainee to regional sales manager for 23 branches in Northern Virginia.

F. Kevin Reynolds, 46, has been President of Cardinal Bank since 1999 and our Executive Vice President and Senior Lending Officer since 1998. Prior to 1998, Mr. Reynolds was the senior lending officer responsible for all facets of the commercial lending business of George Mason Bank and helped create George Mason Bank’s commercial lending group.

Significant Employees

D. Gene Merrill, 60, has been Chairman and Chief Executive Officer of George Mason Mortgage, LLC, (“George Mason”) a subsidiary of Cardinal Bank, since 2004. Prior to 2004, he was the President and Chief Executive Officer of George Mason since 1993.

H. Ed Dean, 37, has been President of George Mason since 2004. Prior to 2004, he was the Executive Vice President of George Mason since 1994.

10

Compensation Committee Report on

Executive Compensation |

The Compensation Committee (the “Committee”), which is composed of non-employee Directors of the Company, recommends to the Board of Directors the annual salary levels and any bonuses to be paid to the Company’s executive officers. The Committee also makes recommendations to the Board regarding the issuance of stock options and other compensation related matters.

General

The primary objective of the Company’s executive compensation program is to attract and retain highly skilled and motivated executive officers who will manage the Company in a manner to promote its growth and profitability and advance the interest of the Company’s shareholders. As such, the compensation program is designed to provide levels of compensation which are reflective of both the individual’s and the organization’s performance in achieving the organization’s goals and objectives, both financial and non-financial, and in helping to build value for the Company’s shareholders. Based on its evaluation of these factors, the Committee believes that the executive officers are dedicated to achieving significant improvements in long-term financial performance and that the compensation plans the Committee has implemented and administered have contributed to achieving this management focus.

The principal elements of the Company’s compensation program include base annual salary, short-term incentive compensation under the Company’s incentive bonus plan, and long-term incentives through the grants of stock options under the 2002 Equity Compensation Plan and participation in the Company’s deferred income plans.

Executive Officers

In considering compensation for the executive officers, the Committee relied on compensation surveys and an evaluation of the officers’ level of responsibility and performance. In 2005, the Committee used the following compensation surveys to assist in developing its recommendation on compensation for 2005: the SNL Executive Compensation Review; the Sheshunoff Bank Executive and Director Compensation Survey; and the Virginia Bankers Association’s Salary Survey of Virginia Banks. The Committee believes that these are relevant and appropriate indicators of compensation paid by the Company’s competitors. The Committee received an evaluation by the Chief Executive Officer of the performance of the executive officers (other than the Chief Executive Officer) during 2005.

Based on the salary surveys and the performance evaluations, the Committee generally sets base annual salaries for the executive officers in the median range of salaries contained in the various surveys for comparable positions.

The Committee also reviewed each executive officer’s performance and responsibility to assess the payment of short-term incentive compensation. The Committee uses the compensation surveys and takes into consideration the performance of the Company relative to its peer group, taking into consideration profit growth, asset growth, return on equity, and return on assets. No particular weight is given to each of these elements. The cash bonuses were given based upon the role of such officers in the growth and profitability of the Company in 2005.

Each year, the Committee also considers the desirability of granting long-term incentive awards under the Company’s 2002 Equity Compensation Plan. The Committee believes that grants of options focus the Company’s senior management on building profitability and shareholder value. The Committee notes in particular its view that stock option grants afford a desirable long-term compensation method because they

11

closely ally the interest of management with shareholder value. In fixing the grants of stock options with the senior management group, other than the Chief Executive Officer, the Committee reviewed with the Chief Executive Officer recommended individual awards, taking into account the respective scope of accountability and contributions of each member of the senior management group.

Chief Executive Officer

The Committee evaluated the performance of the Chief Executive Officer based on the financial performance of the Company, achievements in implementing the Company’s long-term strategy, and the personal observations of the Chief Executive Officer’s performance by the members of the Committee. No particular weight was given to any particular aspects of the performance of the Chief Executive Officer, but his performance in 2005 was evaluated as outstanding, with the Company achieving record earnings and significant progress being made on the Company’s long-term strategy.

The Committee also reviewed the Chief Executive Officer’s performance and responsibility to assess the payment of short-term incentive compensation. The Committee uses the compensation surveys mentioned above, and takes into consideration the performance of the Company relative to its peer group, taking into consideration profit growth, asset growth, return on equity, and return on assets. No particular weight is given to each of these elements. The cash bonus given was based upon the growth and profitability of the Company in 2005.

The Committee also considered the desirability of granting long-term incentive awards under the Company’s 2002 Equity Compensation Plan. The Committee believes that grants of options focus the Company’s Chief Executive Officer on building profitability and shareholder value. The Committee notes in particular its view that stock option grants afford a desirable long-term compensation method because they closely ally the interest of management with shareholder value. The award to the Chief Executive Officer was fixed separately from the executive officer pool, and was based, among other things, on the review of competitive compensation data from selected peer companies and information on his total compensation as well as the Committee’s perception of his past and expected future contributions to the Company’s achievement of its long-term goals.

Compensation Committee

George P. Shafran, Chairman

Sidney O. Dewberry, Vice Chairman

William G. Buck

J. Hamilton Lambert

Wayne W. Broadwater

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee is a current or former officer of the Company or any of its subsidiaries. In addition, there are no compensation committee interlocks with other entities with respect to any such member.

12

Executive Officer Compensation

The following table shows, for the years ended December 31, 2005, 2004, and 2003, the cash compensation paid by the Company, as well as certain other compensation paid or accrued for those years, to each of the named executive officers in all capacities in which they served:

Summary Compensation Table

| | | | Annual Compensation | | Long Term

Compensation | | | |

Name and

Principal Position | | Year | | Salary($) | | Bonus($) | | Other Annual

Compensation

($) | | Securities

Underlying

Options(#) | | All Other

Compensation

($) (1) | |

Bernard H. Clineburg | | 2005 | | 296,638 | | 300,000 | | | (2) | | | | 483,426 | (3) | | | 319,216 | | |

Chairman and Chief Executive | | 2004 | | 249,043 | | 250,000 | | | (2) | | | | 200,000 | | | | 1,938 | | |

Officer | | 2003 | | 203,758 | | 50,000 | | | (2) | | | | 201,000 | (3) | | | 5,975 | | |

Christopher W. Bergstrom | | 2005 | | 155,195 | | 110,000 | | | (2) | | | | 49,515 | | | | 12,357 | | |

President, Cardinal Bank | | 2004 | | 137,184 | | 40,000 | | | (2) | | | | 15,000 | | | | 2,821 | | |

| | 2003 | | 119,388 | | 27,600 | | | (2) | | | | 10,000 | | | | 3,009 | | |

Dennis M. Griffith | | 2005 | | 154,985 | | 110,000 | | | (2) | | | | 50,000 | | | | 39,618 | | |

Executive Vice President, | | 2004 | | 136,974 | | 40,000 | | | (2) | | | | 15,000 | | | | 2,650 | | |

Cardinal Bank | | 2003 | | 118,990 | | 27,500 | | | (2) | | | | 10,000 | | | | 2,212 | | |

| | | | | | | | | (2) | | | | | | | | | | |

Kim C. Liddell | | 2005 | | 151,912 | | 110,000 | | | (2) | | | | 70,000 | | | | 12,847 | | |

Executive Vice President and | | 2004 | (4) | 109,003 | | 40,000 | | | (2) | | | | 10,000 | | | | 2,088 | | |

Chief Operating Officer | | | | | | | | | | | | | | | | | | | |

F. Kevin Reynolds | | 2005 | | 155,546 | | 110,000 | | | (2) | | | | 49,069 | | | | 8,279 | | |

President, Cardinal Bank | | 2004 | | 137,184 | | 40,000 | | | (2) | | | | 15,000 | | | | 3,126 | | |

| | 2003 | | 119,973 | | 27,600 | | | (2) | | | | 10,000 | | | | 3,020 | | |

(1) Amounts presented represent total contributions to the Company’s 401(k) and deferred income plans on behalf of each of the named executive officers to match pre-tax elective deferral contributions (which are included under the “Salary” column) made by each executive officer to such plans. For Mr. Clineburg, compensation related to his supplemental executive retirement plan of $262,916 is included for 2005.

(2) All benefits that might be considered of a personal nature did not exceed the lesser of $50,000 or 10% of total annual salary and bonus.

(3) Amounts disclosed include 7,750 and 1,000 shares of Common Stock for the years ended December 31, 2005 and 2003, respectively, that underlie options granted to Mr. Clineburg in his capacity as a director.

(4) Mr. Liddell’s employment with the Company commenced March 1, 2004.

13

Stock Options

The following table sets forth for the year ended December 31, 2005, the grants of stock options to the named executive officers in 2005:

Option Grants in the Year ended December 31, 2005

Name | | | | Number of Securities

Underlying Options

Granted(1) | | Percent of Total

Options Granted to

Employees in 2005

(%)(2) | | Exercise or

Base Price

($/Share)(3) | | Expiration Date | | Grant Date

Present Value

($)(4) | |

Bernard H. Clineburg | | | 200,000 | | | | 16.5 | | | | 10.73 | | | | 2/4/2015 | | | | 1,006,823 | | |

| | | 280,676 | | | | 23.2 | | | | 8.89 | | | | 5/18/2015 | | | | 1,164,656 | | |

| | | 2,750 | | | | 0.2 | | | | 11.15 | | | | 12/14/2015 | | | | 14,491 | | |

Christopher W. Bergstrom | | | 15,000 | | | | 1.2 | | | | 10.73 | | | | 2/4/2015 | | | | 75,512 | | |

| | | 10,000 | | | | 0.8 | | | | 8.89 | | | | 5/18/2015 | | | | 41,495 | | |

| | | 24,515 | | | | 2.0 | | | | 11.15 | | | | 12/14/2015 | | | | 129,180 | | |

Dennis M. Griffith | | | 15,000 | | | | 1.2 | | | | 10.73 | | | | 2/4/2015 | | | | 75,512 | | |

| | | 10,000 | | | | 0.8 | | | | 8.89 | | | | 5/18/2015 | | | | 41,495 | | |

| | | 25,000 | | | | 2.1 | | | | 11.15 | | | | 12/14/2015 | | | | 131,736 | | |

Kim C. Liddell | | | 20,000 | | | | 1.7 | | | | 10.73 | | | | 2/4/2015 | | | | 100,682 | | |

| | | 10,000 | | | | 0.8 | | | | 8.89 | | | | 5/18/2015 | | | | 41,495 | | |

| | | 40,000 | | | | 3.3 | | | | 11.15 | | | | 12/14/2015 | | | | 210,777 | | |

F. Kevin Reynolds | | | 15,000 | | | | 1.2 | | | | 10.73 | | | | 2/4/2015 | | | | 75,512 | | |

| | | 10,000 | | | | 0.8 | | | | 8.89 | | | | 5/18/2015 | | | | 41,495 | | |

| | | 24,069 | | | | 2.0 | | | | 11.15 | | | | 12/14/2015 | | | | 126,830 | | |

(1) All options were granted to the named executive officers in their capacities as such and are fully exercisable immediately. Options granted on February 4, 2005 were for services in 2004.

(2) Options to purchase a total of 1,210,245 shares of Common Stock were granted to employees during the year ended December 31, 2005.

(3) Stock options were awarded at the fair market value of the shares of Common Stock at the date of the award.

(4) The Black-Scholes option pricing model was used to determine the “Grant Date Present Value” of the options listed in the table. The model for the grants assumed a volatility measure of 43.1%, a risk free interest rate of 4.3% and a dividend yield of 0.0%. The grant date present values set forth in the table are only theoretical values and may not accurately determine present value. The actual value, if any, an optionee will realize will depend on the excess of market value of a share of the Company’s common stock over the exercise price on the date the option is exercised.

In the year ended December 31, 2005, no stock options were exercised by any of the named executive officers. The following table sets forth information with respect to the amount and value of stock options held by the named executive officers as of December 31, 2005.

14

Fiscal Year End Option Values

| | Number of Securities Underlying

Unexercised Options at Fiscal Year End | | Value of Unexercised In-the-Money

Options at Fiscal Year End ($)(1) | |

Name | | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

Bernard H. Clineburg | | | 900,426 | | | | 80,000 | | | 2,828,126 | | | 546,500 | | |

Christopher W. Bergstrom | | | 80,000 | | | | 10,000 | | | 198,722 | | | 54,640 | | |

Dennis M. Griffith | | | 70,000 | | | | 10,000 | | | 139,010 | | | 54,640 | | |

Kim C. Liddell | | | 76,000 | | | | 4,000 | | | 34,960 | | | 5,640 | | |

F. Kevin Reynolds | | | 80,000 | | | | 10,000 | | | 201,175 | | | 54,640 | | |

| | | | | | | | | | | | | | | | | |

(1) The value of in-the-money options at fiscal year end is calculated by determining the difference between the closing price of a share of Common Stock as reported on the Nasdaq National Market on December 31, 2005 and the exercise price of the options. Stock options of the named executive officers that were out-of-the-money at December 31, 2005 totaled 116,334.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets forth information as of December 31, 2005, with respect to compensation plans under which shares of our common stock are authorized for issuance.

Plan Category | | | | Number of

Securities to Be

Issued upon

Exercise of

Outstanding

Options,

Warrants and

Rights | | Weighted

Average

Exercise

Price of

Outstanding

Options,

Warrants and

Rights | | Number of

Securities

Remaining

Available for

Future

Issuance

Under Equity

Compensation

Plans(1) | |

Equity Compensation Plans Approved by Shareholders | | | | | | | | | | | | | |

1999 Stock Plan | | | 372,207 | | | | $ | 4.60 | | | | 14,838 | | |

2002 Equity Compensation Plan | | | 1,897,014 | | | | $ | 9.01 | | | | 44,499 | | |

Equity Compensation Plans Not Approved by Shareholders(2) | | | — | | | | — | | | | — | | |

Total | | | 2,269,221 | | | | $ | 8.29 | | | | 59,337 | | |

(1) Amounts exclude any securities to be issued upon exercise of outstanding options, warrants and rights.

(2) The Company does not have any equity compensation plans that have not been approved by shareholders.

15

AGREEMENTS AND TRANSACTIONS WITH DIRECTORS AND

EXECUTIVE OFFICERS NAMED IN THE SUMMARY COMPENSATION TABLE |

Employment Agreements

Bernard H. Clineburg has an employment agreement with the Company. Mr. Clineburg’s agreement, which is dated as of February 12, 2002, provides for his services as the Chairman and Chief Executive Officer of the Company. The initial term of his agreement is three years and automatically renews for rolling three year periods not to exceed ten years from the commencement date. The agreement also provides that Mr. Clineburg will serve as Chairman of the Executive Committee, a member or Chair of all of the Board Committees of the Company except the Audit Committee, and as a director or Chair of all of the Company’s subsidiaries’ boards of directors. Mr. Clineburg’s employment agreement provides for a base salary of $200,000 and includes annual salary increases at the discretion of the Board of Directors and provides bonuses at the discretion of the Board of Directors, in cash or in stock, or both. Under Mr. Clineburg’s employment agreement, he was granted an option to purchase 150,000 shares of Common Stock, of which 110,000 are currently vested. The option to purchase the remaining 40,000 shares will vest over a two-year period at 20,000 shares per year. All options vest immediately if Mr. Clineburg’s employment is terminated for any reason except for cause. All options granted under the employment agreement were awarded with an option exercise price equal to the value of the shares on May 3, 2002. In the event the Company terminates Mr. Clineburg’s agreement without cause, he will receive a lump-sum severance payment equal to one year’s annual salary and bonus. In the event Mr. Clineburg’s employment agreement is terminated after a change in control, he will receive a lump-sum severance payment equal to 2.99 times his average total compensation over the most recent five calendar year period of his employment with the Company prior to termination. If Mr. Clineburg’s employment is terminated in 2006 following a change in control, his lump-sum severance would equal $3.0 million. Mr. Clineburg’s employment agreement includes a covenant not to compete with the Company for a period of one year from the date he is no longer employed by the Company. Mr. Clineburg is also able to participate in any employee benefit compensation plan offered by the Company.

The Company adopted a supplemental executive retirement plan for Mr. Clineburg effective October 2005. The plan is intended to be unfunded and maintained primarily for the purpose of providing deferred compensation to Mr. Clineburg. Upon retirement, Mr. Clineburg will be entitled to an annual retirement benefit equal to $20,000 per month payable for 180 months. The benefits in the plan vest incrementally based on years of service to the Company. If Mr. Clineburg becomes disabled or dies prior to retirement, or if a change in control of the Company occurs, the benefits vest immediately. The Company’s expense related to the plan was $263,000 in 2005.

Each of F. Kevin Reynolds, Christopher W. Bergstrom, and Kim C. Liddell, has an employment agreement with the Company, which is terminable at will by either party. Messrs. Reynolds and Bergstrom’s employment agreements are effective as of February 12, 2002. Mr. Liddell’s employment agreement is effective March 1, 2004. Each of these employment agreements provide for the provision of a base salary, eligibility for annual performance bonus and stock option grants, and participation in the Company’s benefits plans, all of which may be adjusted by the Company in its discretion. In addition, each employment agreement is subject to certain restrictive covenants in the event the officer voluntarily terminates his employment or is terminated for cause. Specifically, each officer is prohibited from rendering competing banking services in the local area and from soliciting our clients, prospective clients or employees for a certain period (12 months for Mr. Reynolds and Mr. Bergstrom, and six months for Mr. Liddell) following the date of termination. Mr. Reynolds’ and Mr. Bergstrom’s employment agreements provide for severance payments equal to 12 months of their current base salary in the event of

16

termination without cause and 18 months of their current base salary in the event of a change in control. Mr. Liddell’s employment agreement provides for severance payments equal to six months of his current base salary in the event of termination without cause and 18 months of his current base salary in the event of a change in control. The lump-sum severance payment for each of Mr. Reynolds, Mr. Bergstrom and Mr. Liddell, if his employment is terminated in 2006 following a change in control, would equal $233,000, $233,000 and $228,000, respectively.

Certain Relationships and Related Transactions

Some of the directors and officers of the Company are at present, as in the past, banking customers of the Company. As such, the Company has had, and expects to have in the future, banking transactions in the ordinary course of its business with directors, officers, principal shareholders and their associates, on substantially the same terms, including interest rates and collateral on loans, as those prevailing at the same time for comparable transactions with others. These transactions do not involve more than the normal risk of collectibility or present other unfavorable features. The aggregate outstanding balance of loans to directors, executive officers and their associates, as a group, at December 31, 2005 totaled approximately $35.0 million, or 27% of the bank’s equity capital at that date.

William E. Peterson, a director, is the manager and a 3.1% owner of Fairfax Corner Mixed Use, L.C. Fairfax Corner Mixed Use, L.C. owns a building in the Fairfax Corner shopping center and leases office space to George Mason. The lease commenced on July 1, 2002 and will terminate on June 30, 2007 without any option to extend. The rent that George Mason pays to Fairfax Corner Mixed Use, L.C. ranges from $1.2 million to $1.5 million per year during the term of the lease. Rent payments totaled $1.2 million in 2005.

On June 8, 2005, the Company acquired Wilson/Bennett Capital Management, Inc. (“Wilson/Bennett”), an asset management firm based in Alexandria, Virginia (the “Acquisition”). John W. Fisher, a director of the Company, is the founder and President and Chief Investment Officer of Wilson/Bennett and owned 90% of Wilson/Bennett. The Company acquired Wilson/Bennett from Mr. Fisher and James Moloney, the other shareholder of Wilson/Bennett, for $1.6 million in cash and 611,111 shares of common stock. The Company believes that the terms of the transaction were substantially similar to the terms of similar transactions that are the result of “arms length” negotiations between unrelated parties.

In connection with the Acquisition, the Company entered into an Employment Agreement (the “Employment Agreement”) with Mr. Fisher as of June 8, 2005. The Company also entered into a Registration Rights Agreement with Messrs. Fisher and Moloney as of June 8, 2005. The following information provides a brief description of the material terms and conditions of these agreements.

The Employment Agreement provides for Mr. Fisher’s service as President and Chief Executive Officer of Wilson/Bennett. The term of the Employment Agreement continues until April 30, 2008, with automatic one-year renewals beginning on that date and each April 30 thereafter unless notice of non-renewal is provided by either party. The Employment Agreement provides for an annual base salary of $200,000. For each calendar year, Mr. Fisher is entitled to a bonus equal to (i) 10% of the net income of Wilson/Bennett if such net income does not exceed $1.0 million or (ii) $100,000 plus 20% of such net income if it exceeds $1.0 million. The Employment Agreement also provides for Mr. Fisher’s participation in employee benefit plans.

Under the terms of the Employment Agreement, the Company can terminate employment for or without “cause”, and Mr. Fisher can terminate employment with or without “good reason”, each as provided in the Employment Agreement. If the Company terminates his employment other than for cause, death or disability, or Mr. Fisher terminates his employment for good reason, the Company will pay Mr. Fisher 12 months of his salary, all unpaid accrued salary and bonus, and the bonus for the year in

17

which employment terminated. In the event that Mr. Fisher resigns within three months of a change of control of the Company, as defined in the Employment Agreement, or within three months of the date that the Company’s current chief executive officer ceases to serve as such, the Company will pay Mr. Fisher 150% of the sum of the salary and bonus that he had received in the 12 months preceding the date of termination of employment.

The Employment Agreement also includes covenants relating to non-competition, non-solicitation of customers and non-hiring of employees for a period of 18 months following termination of employment under the Agreement.

Under the Registration Rights Agreement, the Company has agreed to provide certain demand registration rights with respect to the 611,111 shares of Common Stock that the shareholders of Wilson/Bennett acquired in the Acquisition. Such shareholders have the right to make one written request to the Company for the registration of shares of Common Stock under the Securities Act of 1933, as amended, to permit the resale of them by such shareholders. Such demand registration right is limited to one-third of such shares or, in the event that a change of control has occurred with respect to the Company, as provided in the Registration Rights Agreement, or the Company’s employment of its current chief executive officer as such has terminated, all of such shares. The Company has the option to repurchase any such shares following the receipt of a written request for registration from the shareholders.

18

COMMON STOCK PERFORMANCE GRAPH |

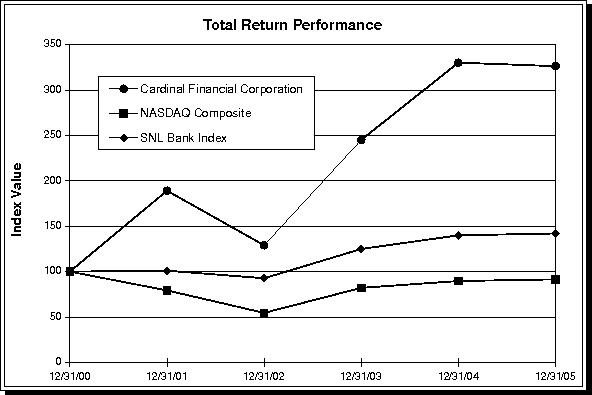

The graph set forth below shows the cumulative shareholder return on the Company’s Common Stock during the five-year period ended December 31, 2005, as compared with: (i) an overall stock market index, the NASDAQ Composite; and (ii) a published industry index, the SNL Bank Index. The stock performance graph assumes that $100 was invested on December 31, 2000, for the five-year period.

| | Period Ending | | |

Index | | | | 12/31/00 | | 12/31/01 | | 12/31/02 | | 12/31/03 | | 12/31/04 | | 12/31/05 | | |

Cardinal Financial Corporation | | | 100.00 | | | | 189.04 | | | | 128.89 | | | | 245.04 | | | | 330.07 | | | | 326.25 | | |

NASDAQ Composite | | | 100.00 | | | | 79.18 | | | | 54.44 | | | | 82.09 | | | | 89.59 | | | | 91.54 | | |

SNL Bank Index | | | 100.00 | | | | 101.00 | | | | 92.61 | | | | 124.93 | | | | 140.00 | | | | 141.91 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

19

PROPOSAL 2

APPROVAL OF AN AMENDMENT TO THE CARDINAL FINANCIAL CORPORATION

2002 EQUITY COMPENSATION PLAN |

The Proposal

The Board of Directors has adopted unanimously, and recommends that the Company’s shareholders approve, an amendment to the Cardinal Financial Corporation 2002 Equity Compensation Plan (the “Equity Plan”). The amendment increases the number of shares of Common Stock currently reserved for issuance under the Equity Plan from 1,970,000 to 2,420,000 (an increase of 450,000 shares). There are no other changes to the Equity Plan.

The Company’s experience with stock options and other stock-based incentives has convinced the Board of Directors of their important role in recruiting and retaining officers, directors and employees with ability and initiative and in encouraging such persons to have a greater financial investment in the Company. The Board of Directors approved the amendment to the Equity Plan on January 18, 2006.

The following summary provides a general description of the principal features of the Equity Plan.

General Information

The Equity Plan authorizes the Compensation Committee of the Board of Directors to award Incentive Stock Options (“ISOs”), Non-Qualified Stock Options (“NQSOs”), stock appreciation rights (“SARs”), stock awards, phantom stock awards and performance share awards to directors, officers, key employees and consultants to the Company and its subsidiaries who are designated by the Compensation Committee. The Equity Plan currently authorizes the issuance of 1,970,000 shares of common stock.

Shares are considered to be issued under the Equity Plan only when the shares are actually issued to a participant. Additionally, any shares tendered or withheld in payment of all or part of the exercise price of a stock option granted under the Equity Plan or in satisfaction of withholding tax obligations, and any shares forfeited or canceled in accordance with the terms of a grant or award under the Equity Plan will become available for issuance under new grants and awards under the Equity Plan.

The Equity Plan provides that if there is a stock split, stock dividend or other event that affects the Company’s capitalization, appropriate adjustments will be made in the number of shares that may be issued under the Equity Plan and in the number of shares and price in all outstanding grants and awards made before such event.

As of February 28, 2006, the Company has made grants and awards as to 1,965,514 shares of Common Stock reserved for issuance under the Equity Plan, and issued 29,987 shares of Common Stock for options that have been exercised under the Equity Plan. These amounts reflect shares that have been forfeited or canceled in accordance with the terms of a grant or award or have been surrendered or withheld in satisfaction of tax withholding requirements. As a result, no shares of Common Stock remain available for grants and awards under the Equity Plan. The Company, however, has made grants and awards as to an additional 100,501 shares of common Stock subject to shareholder approval of the amendment to the Equity Plan. On February 28, 2006, the closing price for a share of the Company’s Common Stock on the Nasdaq National Market was $12.30.

The following table sets forth information as of February 28, 2006, relating to all grants of stock options under the Equity Plan to (i) each of the named executive officers, (ii) all current executive officers as a group, (iii) all current directors who are not executive officers as a group and (iv) all employees,

20

including all current officers who are not executive officers, as a group. The table does not include awards of Common Stock and restricted stock.

| | Number of Securities

Underlying

Options Granted(1) | | Exercise or Base Price

($/Share) | | Value of Unexercised

In-the-Money Options at

February 28, 2006($)(2) | |

Bernard H. Clineburg | | | 833,426 | | | | 4.62 – 11.15 | | | | 3,318,768 | | |

Christopher W. Bergstrom | | | 69,515 | | | | 4.62 – 11.15 | | | | 202,842 | | |

Dennis M. Griffith | | | 70,000 | | | | 4.62 – 11.15 | | | | 203,400 | | |

Kim C. Liddell | | | 70,000 | | | | 8.89 – 11.15 | | | | 111,500 | | |

F. Kevin Reynolds | | | 69,069 | | | | 4.62 – 11.15 | | | | 202,329 | | |

Executive Group | | | 390,000 | | | | 8.89 – 11.55 | | | | 983,450 | | |

Non-Executive Director Group | | | 93,000 | | | | 8.89 – 11.15 | | | | 239,388 | | |

Non-Executive Officer Employee Group | | | 372,004 | | | | 4.62 – 11.96 | | | | 1,016,853 | | |

(1) Stock options were granted at the closing sales price of a share of Common Stock at the date of the grant as reported on the Nasdaq SmallCap Market for options granted before December 17, 2003 and on the Nasdaq National Market for options granted after December 17, 2003.

(2) The value of in-the-money options was calculated by determining the difference between the closing price of a share of Common Stock as reported on the Nasdaq National Market on February 28, 2006 and the exercise price of the options.

The Company intends to continue to grant options to purchase shares of Common Stock under the Equity Plan to directors, eligible officers and key employees. The persons eligible to participate in the Equity Plan include the directors and officers of the Company and its subsidiaries and over 425 employees. No determination has been made as to which of the persons eligible to participate in the Equity Plan will receive awards under the Equity Plan in the future and, therefore, the future benefits to be allocated to any individual or to various groups of eligible participants are not presently determinable.

Grants and Awards under the Equity Plan

The principal features of awards under the Equity Plan are summarized below.

Stock Options. The Equity Plan permits the grant of incentive stock options (ISOs) and non-qualified stock options. The exercise price for options will not be less than the fair market value of a share of Common Stock on the date of grant. Except for an adjustment in the case of a corporate reorganization, stock dividend or other similar events, the option price cannot be reduced (by amendment, cancellation or otherwise) after the date of grant. The period in which an option may be exercised is determined by the Committee on the date of grant, but will not exceed 10 years. Payment of the option exercise price may be in cash or, if the grant agreement provides, by “cashless exercise” or surrendering previously owned shares of Common Stock or the Company withholding shares of Common Stock upon exercise to the extent permitted under the applicable laws and regulations.

Stock Appreciation Rights (SARs). SARs may also be granted either independently or in combination with underlying stock options. Each SAR will entitle the holder upon exercise to receive the excess of the fair market value of a share of Common Stock at the time of exercise over the fair market value of a share of Common Stock on the date of grant of the SAR. SARs may be exercised at such times and subject to such conditions as may be prescribed by the administrator. The maximum period in which the SARs may be exercised will be fixed by the administrator at the time the SAR is granted, except that no SAR shall have a term of more than 10 years from the date of grant. At the discretion of the Committee, all or part of the payment in respect of a SAR may be in cash, shares of Common Stock or a combination thereof.

21

Stock Awards. The Committee may also authorize the grant of stock awards (i.e. shares of Common Stock). The stock award may be transferable or restricted for a set period of time or vest and become transferable upon the satisfaction of conditions set forth in the applicable award agreement. Restricted stock awards may be subject to forfeiture if, for example, the recipient’s employment terminates before the award vests. During the period of restriction, holders of restricted stock will have voting rights and the right to receive dividends on their shares.

Performance Shares. The Committee may also award performance shares which entitle the participant to receive a payment equal to the fair market value of a specified number of shares of Common Stock if criteria performance objectives are satisfied. To the extent the performance share is earned, the Company’s payment obligations may be settled in cash, shares of Common Stock or a combination of both.

Stock Units. The Committee may also award stock units, which is an award stated with reference to a number of shares of Common Stock. The award may entitle the recipient to receive, upon satisfaction of performance objectives, or other conditions set forth in the award agreement, cash, shares of Common Stock or a combination of both.

Transferability of Awards and Options

The Equity Plan provides that if an award or option agreement allows, an award or non-granted option SAR (other than a SAR related to an ISO) may be transferred by a participant to the participant’s children, grandchildren, spouse or one or more trusts for the benefit of such family members, or a partnership in which such family members are the only partners. The holder of an award or an option pursuant to such a transfer is bound by the same terms and conditions as was the participant who transferred the shares, provided however, that such transferee may not transfer the award or option except by will or the laws of descent and distribution.

Change of Control Provisions

The Equity Plan provides that in the event of a “Change of Control” (as defined in the Equity Plan), all outstanding stock options and SARs will become fully exercisable performance shares will be earned and the restrictions applicable to outstanding stock awards will lapse. The Committee may also provide that upon a change of control stock options shall be assumed, or an equivalent stock option substituted, by any successor to the Company, or the holder may exercise all stock options.

Federal Income Tax Consequences

The principal federal tax consequences to participants and to the Company of grants and awards under the Equity Plan are summarized below.

Non-Qualified Stock Options. Non-qualified stock options granted under the Equity Plan are not taxable to an optionee at grant but result in taxation at exercise, at which time the individual will recognize ordinary income in an amount equal to the difference between the option exercise price and the fair market value of the Common Stock on the exercise date. The Company will be entitled to deduct a corresponding amount as a business expense in the year the optionee recognizes this income.

Incentive Stock Options. An employee will generally not recognize income on grant or exercise of an ISO; however, the amount by which the fair market value of the Common Stock at the time of exercise exceeds the option price is a required adjustment for purposes of the alternative minimum tax applicable to the employee. If the employee holds the Common Stock received upon exercise of the option for one year after exercise (and for two years from the date of grant of the option), any difference between the amount realized upon the disposition of the stock and the amount paid for the stock will be treated as long-term capital gain (or loss, if applicable) to the employee. If the employee exercises an ISO and

22

satisfies these holding period requirements, the Company may not deduct any amount in connection with the ISO.

Stock Appreciation Rights. There are no immediate federal income tax consequences to an employee when a SAR is granted. Instead, the employee realizes ordinary income upon exercise of an SAR in an amount equal to the cash and/or the fair market value (on the date of exercise) of the shares of Common Stock received. The Company will be entitled to deduct the same amount as a business expense at the time.

Stock Awards. The federal income tax consequences of restricted stock awards depend on the restrictions imposed on the stock. Generally, the fair market value of the stock received will not be includable in the participant’s gross income until such time as the stock is no longer subject to a substantial risk of forfeiture or becomes transferable. The employee may, however, make a tax election to include the value of the stock in gross income in the year of receipt despite such restrictions. Generally, the Company will be entitled to deduct the fair market value of the stock transferred to the employee as a business expense in the year the employee includes the compensation in income.

Performance Shares. A participant generally will not recognize taxable income upon the grant of performance shares. The participant, however, will recognize ordinary income when the participant receives payment of cash and/or shares of Common Stock for the performance shares. The amount included in the participant’s income will equal the amount of cash and the fair market value of the shares of Common Stock received. The Company generally will be entitled to a corresponding tax deduction at the time the participant recognizes ordinary income with respect to phantom stock.

Stock Units. A participant generally will not recognize taxable income upon the award of stock units. The participant, however, will recognize ordinary income when the participant receives payment of cash and/or shares of Common Stock for the stock unit. The amount included in the participant’s income will equal the amount of cash and the fair market value of the shares of Common Stock received. The Company generally will be entitled to a corresponding tax deduction at the time the participant recognizes ordinary income with respect to stock unit.