Filing by Wells Fargo Funds Trust pursuant to Rule 425 under the Securities Act of 1933 and deemed filed under Rule 14a-12(b) under the Securities Exchange Act of 1934.

Subject company: Evergreen Equity Trust (SEC File Nos. 333-37453)

Evergreen Fixed Income Trust (SEC File Nos. 333-37443)

Evergreen International Trust (SEC File Nos. 333-42195)

Evergreen Money Market Trust (SEC File Nos. 333-42181)

Evergreen Municipal Trust (SEC File Nos. 333-36033)

Evergreen Select Equity Trust (SEC File Nos. 333-36047)

Evergreen Select Fixed Income Trust (SEC File Nos. 333-36019)

Evergreen Select Money Market Trust (SEC File Nos. 333-37227)

P.O. Box 8266

Boston, Massachusetts 02205

January 20, 2010

The Integration of Our Fund Families Has Begun

Dear Valued Shareholder:

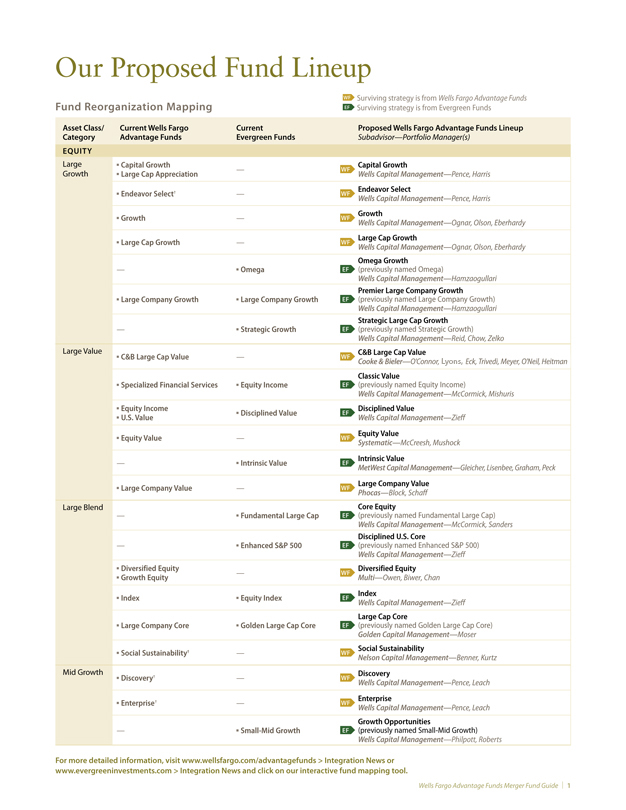

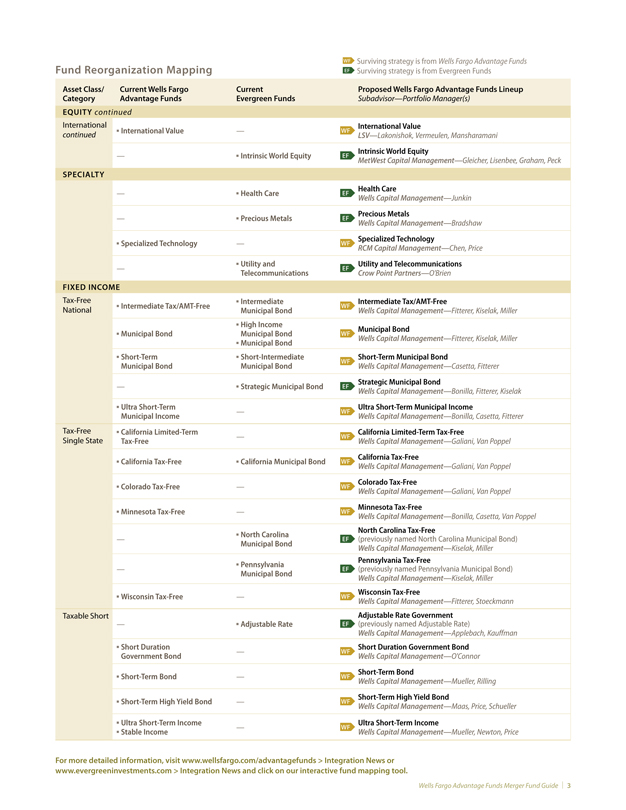

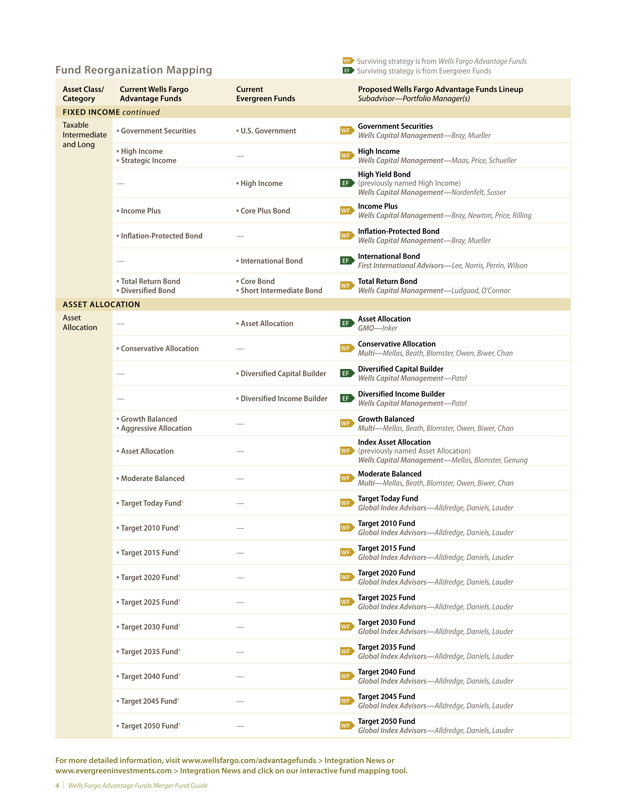

As a shareholder of an Evergreen Money Market Fund through the sweep in your brokerage account, we wanted to inform you about some important news. Recently, the Boards of Trustees of Wells Fargo Advantage Funds® and Evergreen Funds approved the merger of our fund families and a proposed new fund lineup that will be branded under the Wells Fargo Advantage Funds name. As you can see, we’ve made significant progress toward bringing our two organizations together. Specifics on the merger and the proposed new fund lineup are included in the accompanying supplement.

The proposed fund family was developed after thoughtful and thorough evaluation of each fund and the needs of our investors. We believe the result is a powerful and comprehensive array of products that leverages the strengths of both organizations to benefit you and your advisor through access to:

| • | | Our combined investment expertise, with independent portfolio teams that will continue to adhere to their own distinct strategies and processes. |

| • | | A family of mutual funds with even greater depth and breadth than before, including more choices in investment styles and strategies. |

| • | | Complementary investment solutions, such as separately managed accounts, college investing plans, and retirement products. |

What to expect in the coming months

Proxies for the reorganization of our fund families are expected to be mailed to shareholders during the early part of the second quarter of 2010, with shareholder meetings held in early summer. Upon shareholder approval, the reorganizations (and other related changes) will likely be completed in mid-summer. Watch for additional information regarding the proxy mailings.

(over)

Additional information

We will continue to keep your advisor posted on our progress as we integrate our two organizations. In the meantime, for additional fund family merger information, please contact your financial advisor.

|

Sincerely, |

|

|

Karla M. Rabusch |

President |

Wells Fargo Advantage Funds |

Additional Information and Where to Find it

In connection with the proposed transaction, the acquirer will file a Proxy Statement-Prospectus with the Securities and Exchange Commission. All shareholders are advised to read this Proxy Statement-Prospectus in its entirety when it becomes available, because it will contain important information regarding the acquirer, the target, the transaction, the persons soliciting proxies in connection with the transaction and the interests of these persons in the transaction and related matters. Target intends to mail the Proxy Statement-Prospectus to its shareholders once such Proxy Statement-Prospectus is declared effective by the Commission. Shareholders may obtain a free copy of the Proxy Statement-Prospectus when available and other documents filed by the acquirer with the Commission at the Commission’s web site at http://www.sec.gov. Free copies of the Proxy Statement-Prospectus, once available, may be obtained by directing a request via mail, phone or email to acquirer, Wells Fargo Advantage Funds, P.O. Box 8266, Boston MA, 02266-8266, 1-800-222-8222, www.wellsfargo.com/advantagefunds. Free copies of the Proxy Statement-Prospectus, once available, also may be obtained by directing a request via mail or fax to target, Evergreen Funds, 200 Berkeley Street, Boston, MA, 02116, 1-800-343-2898, www.evergreeninvestments.com. In addition to the Proxy Statement-Prospectus, the target and the acquirer file annual and semi-annual reports and other information with the Commission. You may read and copy any reports, statements, or other information filed by the target or the acquirer at the Commission’s public reference rooms at 100 F Street, N.E., Washington, D.C., 20549-0213. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Filings made with the Commission by either the target or the acquirer are also available to the public from commercial document-retrieval services and at the Web site maintained by the Commission at http://www.sec.gov.

Participants in the Solicitation

The acquirer, the target and their respective directors, executive officers, and certain members of their management and other employees may be soliciting proxies from shareholders in favor of the transaction and other related matters. Information concerning persons who may be considered participants in the solicitation of the target’s shareholders under the rules of the Commission will be set forth in Proxy-Statement-Prospectus to be filed by the acquirer with the Commission in February 2010.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.

For Section 529 plans, an investor’s or a designated beneficiary’s home state may offer state tax or other benefits that are only available for investments in that state’s qualified tuition program. Please consider this before investing.

Carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. For a current prospectus, or current program description, containing this and other information, visit www.wellsfargo.com/advantagefunds for Wells Fargo Advantage Funds and certain Section 529 plans, or www.evergreeninvestments.com for Evergreen Investments. Read the prospectus carefully before investing.

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen mutual funds are distributed by Evergreen Investment Services, Inc. Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC. Effective 1-4-10, Evergreen mutual funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Managed Account Services, Wells Fargo Advantage Funds® and to certain 529 college savings plans. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds and shares in the 529 plans are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company. 119309 01-10

| | |

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE | | © 2010 Wells Fargo Funds Management, LLC. All rights reserved. |

Wells Fargo Advantage Funds®

P.O. Box 8266 | Boston, Massachusetts 02266

www.wellsfargo.com/advantagefunds

January 20, 2010

The Integration of Our Fund Families Has Begun

Dear Valued Shareholder:

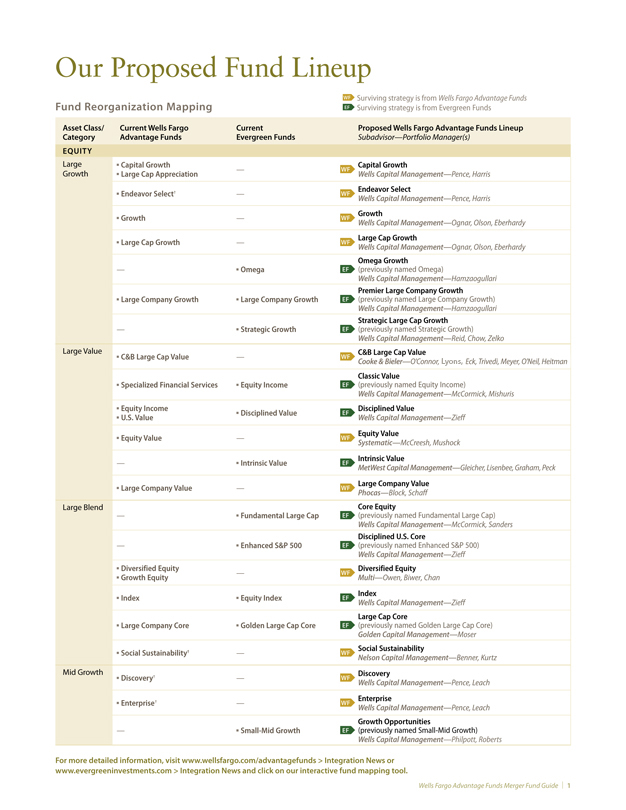

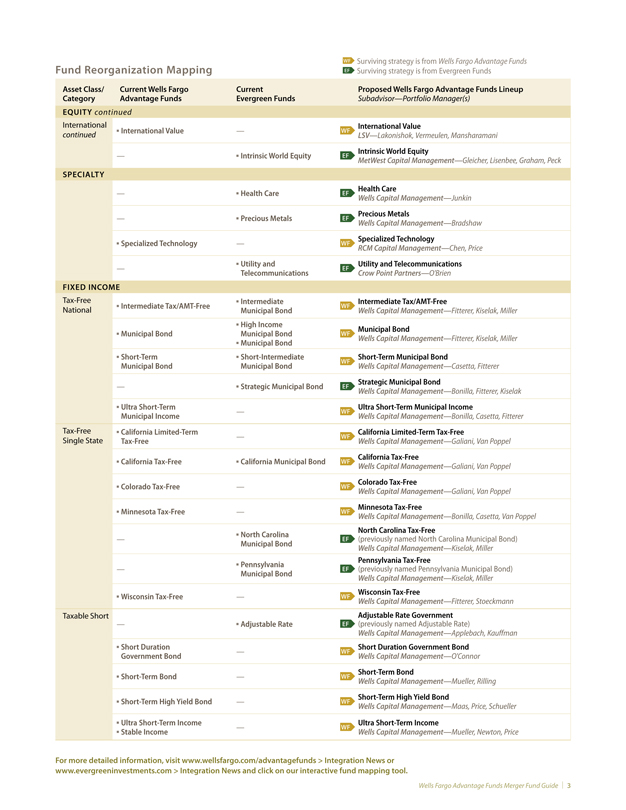

Recently, the Boards of Trustees of Wells Fargo Advantage Funds® and Evergreen Funds approved the merger of our fund families and a proposed new fund lineup that will be branded under the Wells Fargo Advantage Funds name. As you can see, we’ve made significant progress toward bringing our two organizations together. Specifics on the merger and the proposed new fund lineup are included in the accompanying supplement.

The proposed fund family was developed after thoughtful and thorough evaluation of each fund and the needs of our investors. We believe the result is a powerful and comprehensive array of products that leverages the strengths of both organizations to benefit you through access to:

| • | | Our combined investment expertise, with independent portfolio teams that will continue to adhere to their own distinct strategies and processes. |

| • | | Fund choices with highly competitive fee structures that, for many shareholders, are expected to result in reductions in fund expenses. |

| • | | A family of mutual funds with even greater depth and breadth than before, including more choices in investment styles and strategies. |

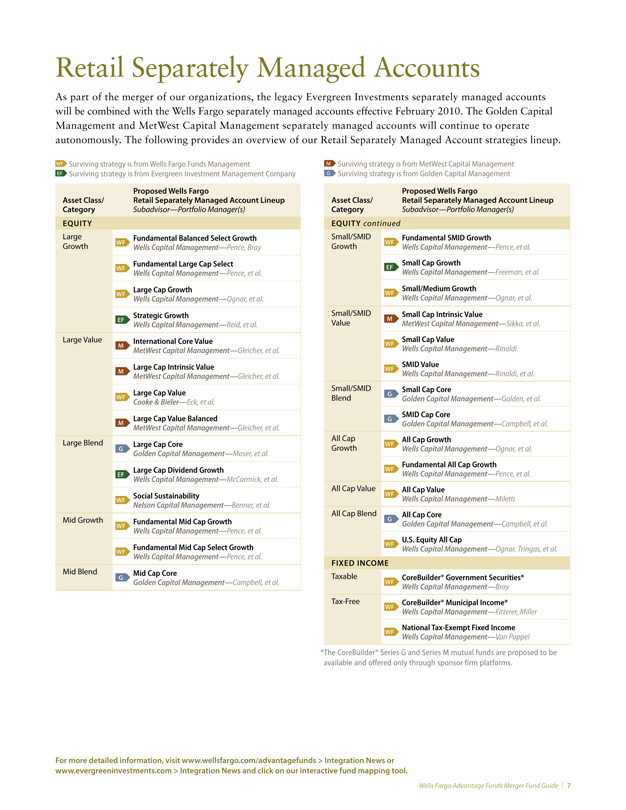

| • | | Complementary investment solutions, such as separately managed accounts, college investing plans, and retirement products. |

What to expect in the coming months

Proxies for the reorganization of our fund families are expected to be mailed to shareholders during the early part of the second quarter of 2010, with shareholder meetings held in early summer. Upon shareholder approval, the reorganizations (and other related changes) will likely be completed in mid-summer. Watch for additional information regarding the proxy mailings.

(over)

For the most current updates on our progress as we integrate the two organizations, please visit our Web site at www.wellsfargo.com/advantagefunds, or call us anytime at 1.800.222.8222.

|

Sincerely, |

|

|

Karla M. Rabusch |

President |

Wells Fargo Advantage Funds |

Additional Information and Where to Find it

In connection with the proposed transaction, the acquirer will file a Proxy Statement-Prospectus with the Securities and Exchange Commission. All shareholders are advised to read this Proxy Statement-Prospectus in its entirety when it becomes available, because it will contain important information regarding the acquirer, the target, the transaction, the persons soliciting proxies in connection with the transaction and the interests of these persons in the transaction and related matters. Target intends to mail the Proxy Statement-Prospectus to its shareholders once such Proxy Statement-Prospectus is declared effective by the Commission. Shareholders may obtain a free copy of the Proxy Statement-Prospectus when available and other documents filed by the acquirer with the Commission at the Commission’s web site at http://www.sec.gov. Free copies of the Proxy Statement-Prospectus, once available, may be obtained by directing a request via mail, phone or email to acquirer, Wells Fargo Advantage Funds, P.O. Box 8266, Boston MA, 02266-8266, 1-800-222-8222, www.wellsfargo.com/advantagefunds. Free copies of the Proxy Statement-Prospectus, once available, also may be obtained by directing a request via mail or fax to target, Evergreen Funds, 200 Berkeley Street, Boston, MA, 02116, 1-800-343-2898, www.evergreeninvestments.com. In addition to the Proxy Statement-Prospectus, the target and the acquirer file annual and semi-annual reports and other information with the Commission. You may read and copy any reports, statements, or other information filed by the target or the acquirer at the Commission’s public reference rooms at 100 F Street, N.E., Washington, D.C., 20549-0213. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Filings made with the Commission by either the target or the acquirer are also available to the public from commercial document-retrieval services and at the Web site maintained by the Commission at http://www.sec.gov.

Participants in the Solicitation

The acquirer, the target and their respective directors, executive officers, and certain members of their management and other employees may be soliciting proxies from shareholders in favor of the transaction and other related matters. Information concerning persons who may be considered participants in the solicitation of the target’s shareholders under the rules of the Commission will be set forth in Proxy-Statement-Prospectus to be filed by the acquirer with the Commission in February 2010.

For Section 529 plans, an investor’s or a designated beneficiary’s home state may offer state tax or other benefits that are only available for investments in that state’s qualified tuition program. Please consider this before investing.

Carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. For a current prospectus, or current program description, containing this and other information, visit www.wellsfargo.com/advantagefunds for Wells Fargo Advantage Funds and certain Section 529 plans, or www.evergreeninvestments.com for Evergreen Investments. Read the prospectus carefully before investing.

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen mutual funds are distributed by Evergreen Investment Services, Inc. Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC. Effective 1-4-10, Evergreen mutual funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Managed Account Services, Wells Fargo Advantage Funds® and to certain 529 college savings plans. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds and shares in the 529 plans are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company. 116247 1-10

| | |

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE | | © 2010 Wells Fargo Funds Management, LLC. All rights reserved. |

P.O. Box 8266

Boston, Massachusetts 02205

January 20, 2010

The Integration of Our Fund Families Has Begun

Dear Valued Shareholder:

Recently, the Boards of Trustees of Wells Fargo Advantage Funds® and Evergreen Funds approved the merger of our fund families and a proposed new fund lineup that will be branded under the Wells Fargo Advantage Funds name. As you can see, we’ve made significant progress toward bringing our two organizations together. Specifics on the merger and the proposed new fund lineup are included in the accompanying supplement.

The proposed fund family was developed after thoughtful and thorough evaluation of each fund and the needs of our investors. We believe the result is a powerful and comprehensive array of products that leverages the strengths of both organizations to benefit you through access to:

| • | | Our combined investment expertise, with independent portfolio teams that will continue to adhere to their own distinct strategies and processes. |

| • | | Fund choices with highly competitive fee structures that, for many shareholders, are expected to result in reductions in fund expenses. |

| • | | A family of mutual funds with even greater depth and breadth than before, including more choices in investment styles and strategies. |

| • | | Complementary investment solutions, such as separately managed accounts, college investing plans, and retirement products. |

What to expect in the coming months

Proxies for the reorganization of our fund families are expected to be mailed to shareholders during the early part of the second quarter of 2010, with shareholder meetings held in early summer. Upon shareholder approval, the reorganizations (and other related changes) will likely be completed in mid-summer. Watch for additional information regarding the proxy mailings.

(over)

Additional information available online

We will continue to keep you posted on our progress as we integrate our two organizations. In the meantime, for additional fund family merger information, please visit our Web sites at www.wellsfargo.com/advantagefunds or www.evergreeninvestments.com. You may also call an Evergreen Customer Service representative at 1.800.343.2898, Monday through Friday, 9:00am to 6:00pm (ET).

|

Sincerely, |

|

|

|

Karla M. Rabusch |

President |

Wells Fargo Advantage Funds |

Additional Information and Where to Find it

In connection with the proposed transaction, the acquirer will file a Proxy Statement-Prospectus with the Securities and Exchange Commission. All shareholders are advised to read this Proxy Statement-Prospectus in its entirety when it becomes available, because it will contain important information regarding the acquirer, the target, the transaction, the persons soliciting proxies in connection with the transaction and the interests of these persons in the transaction and related matters. Target intends to mail the Proxy Statement-Prospectus to its shareholders once such Proxy Statement-Prospectus is declared effective by the Commission. Shareholders may obtain a free copy of the Proxy Statement-Prospectus when available and other documents filed by the acquirer with the Commission at the Commission’s web site at http://www.sec.gov. Free copies of the Proxy Statement-Prospectus, once available, may be obtained by directing a request via mail, phone or email to acquirer, Wells Fargo Advantage Funds, P.O. Box 8266, Boston MA, 02266-8266, 1-800-222-8222, www.wellsfargo.com/advantagefunds. Free copies of the Proxy Statement-Prospectus, once available, also may be obtained by directing a request via mail or fax to target, Evergreen Funds, 200 Berkeley Street, Boston, MA, 02116, 1-800-343-2898, www.evergreeninvestments.com. In addition to the Proxy Statement-Prospectus, the target and the acquirer file annual and semi-annual reports and other information with the Commission. You may read and copy any reports, statements, or other information filed by the target or the acquirer at the Commission’s public reference rooms at 100 F Street, N.E., Washington, D.C., 20549-0213. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Filings made with the Commission by either the target or the acquirer are also available to the public from commercial document-retrieval services and at the Web site maintained by the Commission at http://www.sec.gov.

Participants in the Solicitation

The acquirer, the target and their respective directors, executive officers, and certain members of their management and other employees may be soliciting proxies from shareholders in favor of the transaction and other related matters. Information concerning persons who may be considered participants in the solicitation of the target’s shareholders under the rules of the Commission will be set forth in Proxy-Statement-Prospectus to be filed by the acquirer with the Commission in February 2010.

For Section 529 plans, an investor’s or a designated beneficiary’s home state may offer state tax or other benefits that are only available for investments in that state’s qualified tuition program. Please consider this before investing.

Carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. For a current prospectus, or current program description, containing this and other information, visit www.wellsfargo.com/advantagefunds for Wells Fargo Advantage Funds and certain Section 529 plans, or www.evergreeninvestments.com for Evergreen Investments. Read the prospectus carefully before investing.

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen mutual funds are distributed by Evergreen Investment Services, Inc. Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC. Effective 1-4-10, Evergreen mutual funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Managed Account Services, Wells Fargo Advantage Funds® and to certain 529 college savings plans. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds and shares in the 529 plans are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company. 116529 1-10

| | |

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE | | © 2010 Wells Fargo Funds Management, LLC. All rights reserved. |

P.O. Box 8266

Boston, Massachusetts 02205

January 20, 2010

The Integration of Our Fund Families Has Begun

Dear Valued Shareholder:

Recently, the Boards of Trustees of Wells Fargo Advantage Funds® and Evergreen Funds approved the merger of our fund families and a proposed new fund lineup that will be branded under the Wells Fargo Advantage Funds name. As you can see, we’ve made significant progress toward bringing our two organizations together. Specifics on the merger and the proposed new fund lineup are included in the accompanying supplement.

The proposed fund family was developed after thoughtful and thorough evaluation of each fund and the needs of our investors. We believe the result is a powerful and comprehensive array of products that leverages the strengths of both organizations to benefit you through access to:

| • | | Our combined investment expertise, with independent portfolio teams that will continue to adhere to their own distinct strategies and processes. |

| • | | Fund choices with highly competitive fee structures that, for many shareholders, are expected to result in reductions in fund expenses. |

| • | | A family of mutual funds with even greater depth and breadth than before, including more choices in investment styles and strategies. |

What to expect in the coming months

Proxies for the reorganization of our fund families are expected to be mailed to shareholders during the early part of the second quarter of 2010, with shareholder meetings held in early summer. Upon shareholder approval, the reorganizations (and other related changes) will likely be completed in mid-summer. Watch for additional information regarding the proxy mailings.

(over)

Additional information available online

We will continue to keep you posted on our progress as we integrate our two organizations. In the meantime, for additional fund family merger information, please visit our Web sites at www.wellsfargo.com/advantagefunds or www.evergreeninvestments.com. You may also call an Evergreen Customer Service representative at 1.800.847.5397, Monday through Friday, 8:00am to 6:00pm (ET).

|

Sincerely, |

|

|

|

Karla M. Rabusch |

President |

Wells Fargo Advantage Funds |

Additional Information and Where to Find it

In connection with the proposed transaction, the acquirer will file a Proxy Statement-Prospectus with the Securities and Exchange Commission. All shareholders are advised to read this Proxy Statement-Prospectus in its entirety when it becomes available, because it will contain important information regarding the acquirer, the target, the transaction, the persons soliciting proxies in connection with the transaction and the interests of these persons in the transaction and related matters. Target intends to mail the Proxy Statement-Prospectus to its shareholders once such Proxy Statement-Prospectus is declared effective by the Commission. Shareholders may obtain a free copy of the Proxy Statement-Prospectus when available and other documents filed by the acquirer with the Commission at the Commission’s web site at http://www.sec.gov. Free copies of the Proxy Statement-Prospectus, once available, may be obtained by directing a request via mail, phone or email to acquirer, Wells Fargo Advantage Funds, P.O. Box 8266, Boston MA, 02266-8266, 1-800-222-8222, www.wellsfargo.com/advantagefunds. Free copies of the Proxy Statement-Prospectus, once available, also may be obtained by directing a request via mail or fax to target, Evergreen Funds, 200 Berkeley Street, Boston, MA, 02116, 1-800-343-2898, www.evergreeninvestments.com. In addition to the Proxy Statement-Prospectus, the target and the acquirer file annual and semi-annual reports and other information with the Commission. You may read and copy any reports, statements, or other information filed by the target or the acquirer at the Commission’s public reference rooms at 100 F Street, N.E., Washington, D.C., 20549-0213. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Filings made with the Commission by either the target or the acquirer are also available to the public from commercial document-retrieval services and at the Web site maintained by the Commission at http://www.sec.gov.

Participants in the Solicitation

The acquirer, the target and their respective directors, executive officers, and certain members of their management and other employees may be soliciting proxies from shareholders in favor of the transaction and other related matters. Information concerning persons who may be considered participants in the solicitation of the target’s shareholders under the rules of the Commission will be set forth in Proxy-Statement-Prospectus to be filed by the acquirer with the Commission in February 2010.

Carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. For a current prospectus, containing this and other information, visit www.wellsfargo.com/advantagefunds for Wells Fargo Advantage Funds or www.evergreeninvestments.com for Evergreen Investments. Read the prospectus carefully before investing.

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen mutual funds are distributed by Evergreen Investment Services, Inc. Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC. Effective 1-4-10, Evergreen mutual funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds®. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company. 116530 1-10

| | |

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE | | © 2010 Wells Fargo Funds Management, LLC. All rights reserved. |

P.O. Box 8266

Boston, Massachusetts 02205

January 20, 2010

The Integration of Our Fund Families Has Begun

Dear Valued Shareholder:

Recently, the Boards of Trustees of Wells Fargo Advantage Funds® and Evergreen Funds approved the merger of our fund families and a proposed new fund lineup that will be branded under the Wells Fargo Advantage Funds name. As you can see, we’ve made significant progress toward bringing our two organizations together. Specifics on the merger and the proposed new fund lineup are included in the accompanying supplement.

The proposed fund family was developed after thoughtful and thorough evaluation of each fund and the needs of our investors. We believe the result is a powerful and comprehensive array of products that leverages the strengths of both organizations to benefit you and your advisor through access to:

| • | | Our combined investment expertise, with independent portfolio teams that will continue to adhere to their own distinct strategies and processes. |

| • | | Fund choices with highly competitive fee structures that, for many shareholders, are expected to result in reductions in fund expenses. |

| • | | A family of mutual funds with even greater depth and breadth than before, including more choices in investment styles and strategies. |

| • | | Complementary investment solutions, such as separately managed accounts, college investing plans, and retirement products. |

What to expect in the coming months

Proxies for the reorganization of our fund families are expected to be mailed to shareholders during the early part of the second quarter of 2010, with shareholder meetings held in early summer. Upon shareholder approval, the reorganizations (and other related changes) will likely be completed in mid-summer. Watch for additional information regarding the proxy mailings.

(over)

Additional information

We will continue to keep your advisor posted on our progress as we integrate our two organizations. In the meantime, for additional fund family merger information, please contact your financial advisor.

|

Sincerely, |

|

|

Karla M. Rabusch |

President |

Wells Fargo Advantage Funds |

Additional Information and Where to Find it

In connection with the proposed transaction, the acquirer will file a Proxy Statement-Prospectus with the Securities and Exchange Commission. All shareholders are advised to read this Proxy Statement-Prospectus in its entirety when it becomes available, because it will contain important information regarding the acquirer, the target, the transaction, the persons soliciting proxies in connection with the transaction and the interests of these persons in the transaction and related matters. Target intends to mail the Proxy Statement-Prospectus to its shareholders once such Proxy Statement-Prospectus is declared effective by the Commission. Shareholders may obtain a free copy of the Proxy Statement-Prospectus when available and other documents filed by the acquirer with the Commission at the Commission’s web site at http://www.sec.gov. Free copies of the Proxy Statement-Prospectus, once available, may be obtained by directing a request via mail, phone or email to acquirer, Wells Fargo Advantage Funds, P.O. Box 8266, Boston MA, 02266-8266, 1-800-222-8222, www.wellsfargo.com/advantagefunds. Free copies of the Proxy Statement-Prospectus, once available, also may be obtained by directing a request via mail or fax to target, Evergreen Funds, 200 Berkeley Street, Boston, MA, 02116, 1-800-343-2898, www.evergreeninvestments.com. In addition to the Proxy Statement-Prospectus, the target and the acquirer file annual and semi-annual reports and other information with the Commission. You may read and copy any reports, statements, or other information filed by the target or the acquirer at the Commission’s public reference rooms at 100 F Street, N.E., Washington, D.C., 20549-0213. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Filings made with the Commission by either the target or the acquirer are also available to the public from commercial document-retrieval services and at the Web site maintained by the Commission at http://www.sec.gov.

Participants in the Solicitation

The acquirer, the target and their respective directors, executive officers, and certain members of their management and other employees may be soliciting proxies from shareholders in favor of the transaction and other related matters. Information concerning persons who may be considered participants in the solicitation of the target’s shareholders under the rules of the Commission will be set forth in Proxy-Statement-Prospectus to be filed by the acquirer with the Commission in February 2010.

For Section 529 plans, an investor’s or a designated beneficiary’s home state may offer state tax or other benefits that are only available for investments in that state’s qualified tuition program. Please consider this before investing.

Carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. For a current prospectus, or current program description, containing this and other information, visit www.wellsfargo.com/advantagefunds for Wells Fargo Advantage Funds and certain Section 529 plans, or www.evergreeninvestments.com for Evergreen Investments. Read the prospectus carefully before investing.

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen mutual funds are distributed by Evergreen Investment Services, Inc. Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC. Effective 1-4-10, Evergreen mutual funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Managed Account Services, Wells Fargo Advantage Funds® and to certain 529 college savings plans. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds and shares in the 529 plans are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company. 119235 1-10

| | |

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE | | © 2010 Wells Fargo Funds Management, LLC. All rights reserved. |

P.O. Box 8266

Boston, Massachusetts 02205

January 13, 2010

The Integration of Our Fund Families Has Begun

Dear Plan Sponsor:

Recently, the Boards of Trustees of Wells Fargo Advantage Funds® and Evergreen Funds approved the merger of our fund families and a proposed new fund lineup that will be branded under the Wells Fargo Advantage Funds name. As you can see, we’ve made significant progress toward bringing our two organizations together.

The proposed fund family was developed after thoughtful and thorough evaluation of each fund and the needs of our investors. We believe the result is a powerful and comprehensive array of products that leverages the strengths of both organizations to benefit you and your plan participants through access to:

| • | | Our combined investment expertise, with independent portfolio teams that will continue to adhere to their own distinct strategies and processes. |

| • | | Fund choices with highly competitive fee structures that, for many shareholders, are expected to result in reductions in fund expenses. |

| • | | A family of mutual funds with even greater depth and breadth than before, including more choices in investment styles and strategies. |

What to expect in the coming months

Proxies for the reorganization of our fund families are expected to be mailed to shareholders during the early part of the second quarter of 2010, with shareholder meetings held in early summer. Upon shareholder approval, the reorganizations (and other related changes) will likely be completed in mid-summer. Watch for additional information regarding the proxy mailings.

(over)

How to obtain additional information

For an overview of our proposed new fund lineup, click here, or visit the “Integration News” section on our Web sites at www.wellsfargo.com/advantagefunds or www.evergreeninvestments.com for more detailed information. Your Wells Fargo or Wachovia representative can provide you with additional insight and answer any questions you may have. We will continue to keep you posted on our progress in the integration of our two mutual fund organizations.

|

Sincerely, |

|

|

Karla M. Rabusch |

President |

Wells Fargo Advantage Funds |

Additional Information and Where to Find it

In connection with the proposed transaction, the acquirer will file a Proxy Statement-Prospectus with the Securities and Exchange Commission. All shareholders are advised to read this Proxy Statement-Prospectus in its entirety when it becomes available, because it will contain important information regarding the acquirer, the target, the transaction, the persons soliciting proxies in connection with the transaction and the interests of these persons in the transaction and related matters. Target intends to mail the Proxy Statement-Prospectus to its shareholders once such Proxy Statement-Prospectus is declared effective by the Commission. Shareholders may obtain a free copy of the Proxy Statement-Prospectus when available and other documents filed by the acquirer with the Commission at the Commission’s web site at http://www.sec.gov. Free copies of the Proxy Statement-Prospectus, once available, may be obtained by directing a request via mail, phone or email to acquirer, Wells Fargo Advantage Funds, P.O. Box 8266, Boston MA, 02266-8266, 1-800-222-8222, www.wellsfargo.com/advantagefunds. Free copies of the Proxy Statement-Prospectus, once available, also may be obtained by directing a request via mail or fax to target, Evergreen Funds, 200 Berkeley Street, Boston, MA, 02116, 1-800-343-2898, www.evergreeninvestments.com. In addition to the Proxy Statement-Prospectus, the target and the acquirer file annual and semi-annual reports and other information with the Commission. You may read and copy any reports, statements, or other information filed by the target or the acquirer at the Commission’s public reference rooms at 100 F Street, N.E., Washington, D.C., 20549-0213. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Filings made with the Commission by either the target or the acquirer are also available to the public from commercial document-retrieval services and at the Web site maintained by the Commission at http://www.sec.gov.

Participants in the Solicitation

The acquirer, the target and their respective directors, executive officers, and certain members of their management and other employees may be soliciting proxies from shareholders in favor of the transaction and other related matters. Information concerning persons who may be considered participants in the solicitation of the target’s shareholders under the rules of the Commission will be set forth in Proxy-Statement-Prospectus to be filed by the acquirer with the Commission in February 2010.

Carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. For a current prospectus, containing this and other information, visit www.wellsfargo.com/advantagefunds for Wells Fargo Advantage Funds or www.evergreeninvestments.com for Evergreen Investments. Read the prospectus carefully before investing.

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen mutual funds are distributed by Evergreen Investment Services, Inc. Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC. Effective 1-4-10, Evergreen mutual funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company. 116294 1-10

| | |

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE | | © 2010 Wells Fargo Funds Management, LLC. All rights reserved. |

FOR INSTITUTIONAL INVESTOR USE ONLY–NOT FOR USE WITH THE PUBLIC

P.O. Box 8266

Boston, Massachusetts 02205

January 13, 2010

The Integration of Our Fund Families Has Begun

Dear Valued Partner:

Recently, the Boards of Trustees of Wells Fargo Advantage Funds® and Evergreen Funds approved the merger of our fund families and a proposed new fund lineup that will be branded under the Wells Fargo Advantage Funds name. As you can see, we’ve made significant progress toward bringing our two organizations together.

The proposed fund family was developed after thoughtful and thorough evaluation of each fund and the needs of our investors. We believe the result is a powerful and comprehensive array of products that leverages the strengths of both organizations to benefit you through access to:

| • | | Our combined investment expertise, with independent portfolio teams that will continue to adhere to their own distinct strategies and processes. |

| • | | Fund choices with highly competitive fee structures that, for many shareholders, are expected to result in reductions in fund expenses. |

| • | | A family of mutual funds with even greater depth and breadth than before, including more choices in investment styles and strategies. |

What to expect in the coming months

Proxies for the reorganization of our fund families are expected to be mailed to shareholders during the early part of the second quarter of 2010, with shareholder meetings held in early summer. Upon shareholder approval, the reorganizations (and other related changes) will likely be completed in mid-summer. Watch for additional information regarding the proxy mailings.

(over)

How to obtain additional information

For a more detailed overview of the proposed money market fund lineup, click here. Your existing relationship manager can provide you with additional insight and answer any questions you may have. Additionally, you may visit our Web sites at www.wellsfargo.com/advantagefunds or www.evergreeninvestments.com. We will continue to keep you posted on our progress in integrating our two mutual fund organizations.

|

Sincerely, |

|

|

|

Karla M. Rabusch |

President |

Wells Fargo Advantage Funds |

Additional Information and Where to Find it

In connection with the proposed transaction, the acquirer will file a Proxy Statement-Prospectus with the Securities and Exchange Commission. All shareholders are advised to read this Proxy Statement-Prospectus in its entirety when it becomes available, because it will contain important information regarding the acquirer, the target, the transaction, the persons soliciting proxies in connection with the transaction and the interests of these persons in the transaction and related matters. Target intends to mail the Proxy Statement-Prospectus to its shareholders once such Proxy Statement-Prospectus is declared effective by the Commission. Shareholders may obtain a free copy of the Proxy Statement-Prospectus when available and other documents filed by the acquirer with the Commission at the Commission’s web site at http://www.sec.gov. Free copies of the Proxy Statement-Prospectus, once available, may be obtained by directing a request via mail, phone or email to acquirer, Wells Fargo Advantage Funds, P.O. Box 8266, Boston MA, 02266-8266, 1-800-222-8222, www.wellsfargo.com/advantagefunds. Free copies of the Proxy Statement-Prospectus, once available, also may be obtained by directing a request via mail or fax to target, Evergreen Funds, 200 Berkeley Street, Boston, MA, 02116, 1-800-343-2898, www.evergreeninvestments.com. In addition to the Proxy Statement-Prospectus, the target and the acquirer file annual and semi-annual reports and other information with the Commission. You may read and copy any reports, statements, or other information filed by the target or the acquirer at the Commission’s public reference rooms at 100 F Street, N.E., Washington, D.C., 20549-0213. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Filings made with the Commission by either the target or the acquirer are also available to the public from commercial document-retrieval services and at the Web site maintained by the Commission at http://www.sec.gov.

Participants in the Solicitation

The acquirer, the target and their respective directors, executive officers, and certain members of their management and other employees may be soliciting proxies from shareholders in favor of the transaction and other related matters. Information concerning persons who may be considered participants in the solicitation of the target’s shareholders under the rules of the Commission will be set forth in Proxy-Statement-Prospectus to be filed by the acquirer with the Commission in February 2010.

Carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. For a current prospectus, containing this and other information, visit www.wellsfargo.com/advantagefunds for Wells Fargo Advantage Funds or www.evergreeninvestments.com for Evergreen Investments. Read the prospectus carefully before investing.

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen mutual funds are distributed by Evergreen Investment Services, Inc. Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC. Effective 1-4-10, Evergreen mutual funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company. 116353 1-10

| | |

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE | | © 2010 Wells Fargo Funds Management, LLC. All rights reserved. |

FOR INSTITUTIONAL INVESTOR USE ONLY–NOT FOR USE WITH THE PUBLIC

P.O. Box 8266

Boston, Massachusetts 02205

January 14, 2010

The Integration of Our Fund Families Has Begun

Dear Investment Professional:

Recently, the Boards of Trustees of Wells Fargo Advantage Funds® and Evergreen Funds approved the merger of our fund families and a proposed new fund lineup that will be branded under the Wells Fargo Advantage Funds name. As you can see, we’ve made significant progress toward bringing our two organizations together.

The proposed fund family was developed after thoughtful and thorough evaluation of each fund and the needs of our investors. We believe the result is a powerful and comprehensive array of products that leverages the strengths of both organizations to benefit you and your clients through access to:

| • | | Our combined investment expertise, with independent portfolio teams that will continue to adhere to their own distinct strategies and processes. |

| • | | Fund choices with highly competitive fee structures that, for many shareholders, are expected to result in reductions in fund expenses. |

| • | | A family of mutual funds with even greater depth and breadth than before, including more choices in investment styles and strategies. |

| • | | Complementary investment solutions, such as separately managed accounts, college investing plans, and retirement products. |

What to expect in the coming months

Proxies for the reorganization of our fund families are expected to be mailed to shareholders during the early part of the second quarter of 2010, with shareholder meetings held in early summer. Upon shareholder approval, the reorganizations (and other related changes) will likely be completed in mid-summer. Watch for additional information regarding the proxy mailings.

(over)

How to obtain additional information

For an overview of our proposed new fund lineup, click here, or visit the “Integration News” section on our Web sites at www.wellsfargo.com/advantagefunds or www.evergreeninvestments.com for more detailed information. Your existing relationship contacts can provide you with additional insight and answer any questions you may have. We will continue to keep you posted on our progress in the integration of our two mutual fund organizations.

|

Sincerely, |

|

|

|

Karla M. Rabusch |

President |

Wells Fargo Advantage Funds |

Additional Information and Where to Find it

In connection with the proposed transaction, the acquirer will file a Proxy Statement-Prospectus with the Securities and Exchange Commission. All shareholders are advised to read this Proxy Statement-Prospectus in its entirety when it becomes available, because it will contain important information regarding the acquirer, the target, the transaction, the persons soliciting proxies in connection with the transaction and the interests of these persons in the transaction and related matters. Target intends to mail the Proxy Statement-Prospectus to its shareholders once such Proxy Statement-Prospectus is declared effective by the Commission. Shareholders may obtain a free copy of the Proxy Statement-Prospectus when available and other documents filed by the acquirer with the Commission at the Commission’s web site at http://www.sec.gov. Free copies of the Proxy Statement-Prospectus, once available, may be obtained by directing a request via mail, phone or email to acquirer, Wells Fargo Advantage Funds, P.O. Box 8266, Boston MA, 02266-8266, 1-800-222-8222, www.wellsfargo.com/advantagefunds. Free copies of the Proxy Statement-Prospectus, once available, also may be obtained by directing a request via mail or fax to target, Evergreen Funds, 200 Berkeley Street, Boston, MA, 02116, 1-800-343-2898, www.evergreeninvestments.com. In addition to the Proxy Statement-Prospectus, the target and the acquirer file annual and semi-annual reports and other information with the Commission. You may read and copy any reports, statements, or other information filed by the target or the acquirer at the Commission’s public reference rooms at 100 F Street, N.E., Washington, D.C., 20549-0213. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Filings made with the Commission by either the target or the acquirer are also available to the public from commercial document-retrieval services and at the Web site maintained by the Commission at http://www.sec.gov.

Participants in the Solicitation

The acquirer, the target and their respective directors, executive officers, and certain members of their management and other employees may be soliciting proxies from shareholders in favor of the transaction and other related matters. Information concerning persons who may be considered participants in the solicitation of the target’s shareholders under the rules of the Commission will be set forth in Proxy-Statement-Prospectus to be filed by the acquirer with the Commission in February 2010.

For Section 529 plans, an investor’s or a designated beneficiary’s home state may offer state tax or other benefits that are only available for investments in that state’s qualified tuition program. Please consider this before investing.

Carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. For a current prospectus or current program description, containing this and other information, visit www.wellsfargo.com/advantagefunds for Wells Fargo Advantage Funds and certain Section 529 plans, or www.evergreeninvestments.com for Evergreen Investments. Read the prospectus carefully before investing.

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen mutual funds are distributed by Evergreen Investment Services, Inc. Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC. Effective 1-4-10, Evergreen mutual funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Managed Account Services, Wells Fargo Advantage Funds® and to certain 529 college savings plans. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds and shares in the 529 plans are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company. 119981 1-10

| | |

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE | | © 2010 Wells Fargo Funds Management, LLC. All rights reserved. |

P.O. Box 8266

Boston, Massachusetts 02205

January 13, 2010

The Integration of Our Fund Families Has Begun

Dear Valued Business Partner:

Recently, the Boards of Trustees of Wells Fargo Advantage Funds® and Evergreen Funds approved the merger of our fund families and a proposed new fund lineup that will be branded under the Wells Fargo Advantage Funds name. As you can see, we’ve made significant progress toward bringing our two organizations together.

The proposed fund family was developed after thoughtful and thorough evaluation of each fund and the needs of our investors. We believe the result is a powerful and comprehensive array of products that leverages the strengths of both organizations to benefit you and your clients through access to:

| • | | Our combined investment expertise, with independent portfolio teams that will continue to adhere to their own distinct strategies and processes. |

| • | | Fund choices with highly competitive fee structures that, for many shareholders, are expected to result in reductions in fund expenses. |

| • | | A family of mutual funds with even greater depth and breadth than before, including more choices in investment styles and strategies. |

What to expect in the coming months

Proxies for the reorganization of our fund families are expected to be mailed to shareholders during the early part of the second quarter of 2010, with shareholder meetings held in early summer. Upon shareholder approval, the reorganizations (and other related changes) will likely be completed in mid-summer. Watch for additional information regarding the proxy mailings.

(over)

How to obtain additional information

For an overview of our proposed new fund lineup, click here, or visit the “Integration News” section on our Web sites at www.wellsfargo.com/advantagefunds or www.evergreeninvestments.com for more detailed information. Your existing relationship managers can provide you with additional insight and answer any questions you may have. We will continue to keep you posted on our progress in the integration of our two mutual fund organizations.

|

Sincerely, |

|

|

|

Karla M. Rabusch |

President |

Wells Fargo Advantage Funds |

Additional Information and Where to Find it

In connection with the proposed transaction, the acquirer will file a Proxy Statement-Prospectus with the Securities and Exchange Commission. All shareholders are advised to read this Proxy Statement-Prospectus in its entirety when it becomes available, because it will contain important information regarding the acquirer, the target, the transaction, the persons soliciting proxies in connection with the transaction and the interests of these persons in the transaction and related matters. Target intends to mail the Proxy Statement-Prospectus to its shareholders once such Proxy Statement-Prospectus is declared effective by the Commission. Shareholders may obtain a free copy of the Proxy Statement-Prospectus when available and other documents filed by the acquirer with the Commission at the Commission’s web site at http://www.sec.gov. Free copies of the Proxy Statement-Prospectus, once available, may be obtained by directing a request via mail, phone or email to acquirer, Wells Fargo Advantage Funds, P.O. Box 8266, Boston MA, 02266-8266, 1-800-222-8222, www.wellsfargo.com/advantagefunds. Free copies of the Proxy Statement-Prospectus, once available, also may be obtained by directing a request via mail or fax to target, Evergreen Funds, 200 Berkeley Street, Boston, MA, 02116, 1-800-343-2898, www.evergreeninvestments.com. In addition to the Proxy Statement-Prospectus, the target and the acquirer file annual and semi-annual reports and other information with the Commission. You may read and copy any reports, statements, or other information filed by the target or the acquirer at the Commission’s public reference rooms at 100 F Street, N.E., Washington, D.C., 20549-0213. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Filings made with the Commission by either the target or the acquirer are also available to the public from commercial document-retrieval services and at the Web site maintained by the Commission at http://www.sec.gov.

Participants in the Solicitation

The acquirer, the target and their respective directors, executive officers, and certain members of their management and other employees may be soliciting proxies from shareholders in favor of the transaction and other related matters. Information concerning persons who may be considered participants in the solicitation of the target’s shareholders under the rules of the Commission will be set forth in Proxy-Statement-Prospectus to be filed by the acquirer with the Commission in February 2010.

Carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. For a current prospectus, containing this and other information, visit www.wellsfargo.com/advantagefunds for Wells Fargo Advantage Funds or www.evergreeninvestments.com for Evergreen Investments. Read the prospectus carefully before investing.

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen mutual funds are distributed by Evergreen Investment Services, Inc. Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC. Effective 1-4-10, Evergreen mutual funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company. 119982 1-10

| | |

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE | | © 2010 Wells Fargo Funds Management, LLC. All rights reserved. |

FOR INSTITUTIONAL INVESTOR USE ONLY–NOT FOR USE WITH THE PUBLIC

P.O. Box 8266

Boston, Massachusetts 02205

January 15, 2010

The Integration of Our Fund Families Has Begun

Dear Investment Professional:

Recently, the Boards of Trustees of Wells Fargo Advantage Funds® and Evergreen Funds approved the merger of our fund families and a proposed new fund lineup that will be branded under the Wells Fargo Advantage Funds name. As you can see, we’ve made significant progress toward bringing our two organizations together.

The proposed fund family was developed after thoughtful and thorough evaluation of each fund and the needs of our investors. We believe the result is a powerful and comprehensive array of products that leverages the strengths of both organizations to benefit you and your clients through access to:

| • | | Our combined investment expertise, with independent portfolio teams that will continue to adhere to their own distinct strategies and processes. |

| • | | Fund choices with highly competitive fee structures that, for many shareholders, are expected to result in reductions in fund expenses. |

| • | | A family of mutual funds with even greater depth and breadth than before, including more choices in investment styles and strategies. |

| • | | Complementary investment solutions, such as separately managed accounts, college investing plans, and retirement products. |

What to expect in the coming months

Proxies for the reorganization of our fund families are expected to be mailed to shareholders during the early part of the second quarter of 2010, with shareholder meetings held in early summer. Upon shareholder approval, the reorganizations (and other related changes) will likely be completed in mid-summer. Watch for additional information regarding the proxy mailings.

(over)

Additional insight to help educate your clients

The enclosed merger guide contains more detailed information about our proposed fund family and provides answers to questions that you and your clients may have. Your existing relationship contacts can also provide you with further insight. We will continue to keep you posted on our progress as we integrate our two organizations. In the meantime, for additional information, please visit our Web sites at www.wellsfargo.com/advantagefunds or www.evergreeninvestments.com.

|

Sincerely, |

|

|

Karla M. Rabusch |

President |

Wells Fargo Advantage Funds |

Additional Information and Where to Find it

In connection with the proposed transaction, the acquirer will file a Proxy Statement-Prospectus with the Securities and Exchange Commission. All shareholders are advised to read this Proxy Statement-Prospectus in its entirety when it becomes available, because it will contain important information regarding the acquirer, the target, the transaction, the persons soliciting proxies in connection with the transaction and the interests of these persons in the transaction and related matters. Target intends to mail the Proxy Statement-Prospectus to its shareholders once such Proxy Statement-Prospectus is declared effective by the Commission. Shareholders may obtain a free copy of the Proxy Statement-Prospectus when available and other documents filed by the acquirer with the Commission at the Commission’s web site at http://www.sec.gov. Free copies of the Proxy Statement-Prospectus, once available, may be obtained by directing a request via mail, phone or email to acquirer, Wells Fargo Advantage Funds, P.O. Box 8266, Boston MA, 02266-8266, 1-800-222-8222, www.wellsfargo.com/advantagefunds. Free copies of the Proxy Statement-Prospectus, once available, also may be obtained by directing a request via mail or fax to target, Evergreen Funds, 200 Berkeley Street, Boston, MA, 02116, 1-800-343-2898, www.evergreeninvestments.com. In addition to the Proxy Statement-Prospectus, the target and the acquirer file annual and semi-annual reports and other information with the Commission. You may read and copy any reports, statements, or other information filed by the target or the acquirer at the Commission’s public reference rooms at 100 F Street, N.E., Washington, D.C., 20549-0213. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Filings made with the Commission by either the target or the acquirer are also available to the public from commercial document-retrieval services and at the Web site maintained by the Commission at http://www.sec.gov.

Participants in the Solicitation

The acquirer, the target and their respective directors, executive officers, and certain members of their management and other employees may be soliciting proxies from shareholders in favor of the transaction and other related matters. Information concerning persons who may be considered participants in the solicitation of the target’s shareholders under the rules of the Commission will be set forth in Proxy-Statement-Prospectus to be filed by the acquirer with the Commission in February 2010.

For Section 529 plans, an investor’s or a designated beneficiary’s home state may offer state tax or other benefits that are only available for investments in that state’s qualified tuition program. Please consider this before investing.

Carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. For a current prospectus or current program description, containing this and other information, visit www.wellsfargo.com/advantagefunds for Wells Fargo Advantage Funds and certain Section 529 plans, or www.evergreeninvestments.com for Evergreen Investments. Read the prospectus carefully before investing.

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen mutual funds are distributed by Evergreen Investment Services, Inc. Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC. Effective 1-4-10, Evergreen mutual funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Managed Account Services, Wells Fargo Advantage Funds® and to certain 529 college savings plans. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds and shares in the 529 plans are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company. 116066 1-10

| | |

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE | | © 2010 Wells Fargo Funds Management, LLC. All rights reserved. |

FOR INSTITUTIONAL INVESTOR USE ONLY–NOT FOR USE WITH THE PUBLIC

P.O. Box 8266

Boston, Massachusetts 02205

January 13, 2010

The Integration of Our Fund Families Has Begun

Dear Valued Business Partner:

Recently, the Boards of Trustees of Wells Fargo Advantage Funds® and Evergreen Funds approved the merger of our fund families and a proposed new fund lineup that will be branded under the Wells Fargo Advantage Funds name. As you can see, we’ve made significant progress toward bringing our two organizations together.

The proposed fund family was developed after thoughtful and thorough evaluation of each fund and the needs of our investors. We believe the result is a powerful and comprehensive array of products that leverages the strengths of both organizations to benefit you and your clients through access to:

| • | | Our combined investment expertise, with independent portfolio teams that will continue to adhere to their own distinct strategies and processes. |

| • | | Fund choices with highly competitive fee structures that, for many shareholders, are expected to result in reductions in fund expenses. |

| • | | A family of mutual funds with even greater depth and breadth than before, including more choices in investment styles and strategies. |

What to expect in the coming months

Proxies for the reorganization of our fund families are expected to be mailed to shareholders during the early part of the second quarter of 2010, with shareholder meetings held in early summer. Upon shareholder approval, the reorganizations (and other related changes) will likely be completed in mid-summer. Watch for additional information regarding the proxy mailings.

(over)

How to obtain additional information

For an overview of our proposed new fund lineup, click here, or visit the “Integration News” section on our Web sites at www.wellsfargo.com/advantagefunds or www.evergreeninvestments.com for more detailed information. Your existing relationship managers can provide you with additional insight and answer any questions you may have. We will continue to keep you posted on our progress in the integration of our two mutual fund organizations.

|

Sincerely, |

|

|

|

Karla M. Rabusch |

President |

Wells Fargo Advantage Funds |

Additional Information and Where to Find it

In connection with the proposed transaction, the acquirer will file a Proxy Statement-Prospectus with the Securities and Exchange Commission. All shareholders are advised to read this Proxy Statement-Prospectus in its entirety when it becomes available, because it will contain important information regarding the acquirer, the target, the transaction, the persons soliciting proxies in connection with the transaction and the interests of these persons in the transaction and related matters. Target intends to mail the Proxy Statement-Prospectus to its shareholders once such Proxy Statement-Prospectus is declared effective by the Commission. Shareholders may obtain a free copy of the Proxy Statement-Prospectus when available and other documents filed by the acquirer with the Commission at the Commission’s web site at http://www.sec.gov. Free copies of the Proxy Statement-Prospectus, once available, may be obtained by directing a request via mail, phone or email to acquirer, Wells Fargo Advantage Funds, P.O. Box 8266, Boston MA, 02266-8266, 1-800-222-8222, www.wellsfargo.com/advantagefunds. Free copies of the Proxy Statement-Prospectus, once available, also may be obtained by directing a request via mail or fax to target, Evergreen Funds, 200 Berkeley Street, Boston, MA, 02116, 1-800-343-2898, www.evergreeninvestments.com. In addition to the Proxy Statement-Prospectus, the target and the acquirer file annual and semi-annual reports and other information with the Commission. You may read and copy any reports, statements, or other information filed by the target or the acquirer at the Commission’s public reference rooms at 100 F Street, N.E., Washington, D.C., 20549-0213. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Filings made with the Commission by either the target or the acquirer are also available to the public from commercial document-retrieval services and at the Web site maintained by the Commission at http://www.sec.gov.

Participants in the Solicitation

The acquirer, the target and their respective directors, executive officers, and certain members of their management and other employees may be soliciting proxies from shareholders in favor of the transaction and other related matters. Information concerning persons who may be considered participants in the solicitation of the target’s shareholders under the rules of the Commission will be set forth in Proxy-Statement-Prospectus to be filed by the acquirer with the Commission in February 2010.

Carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. For a current prospectus, containing this and other information, visit www.wellsfargo.com/advantagefunds for Wells Fargo Advantage Funds or www.evergreeninvestments.com for Evergreen Investments. Read the prospectus carefully before investing.

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen mutual funds are distributed by Evergreen Investment Services, Inc. Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC. Effective 1-4-10, Evergreen mutual funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company. 116126 1-10

| | |

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE | | © 2010 Wells Fargo Funds Management, LLC. All rights reserved. |

FOR INSTITUTIONAL INVESTOR USE ONLY–NOT FOR USE WITH THE PUBLIC

P.O. Box 8266

Boston, Massachusetts 02205

January 14, 2010

The Integration of Our Fund Families Has Begun

Dear Investment Professional:

Recently, the Boards of Trustees of Wells Fargo Advantage Funds® and Evergreen Funds approved the merger of our fund families and a proposed new fund lineup that will be branded under the Wells Fargo Advantage Funds name. As you can see, we’ve made significant progress toward bringing our two organizations together.

The proposed fund family was developed after thoughtful and thorough evaluation of each fund and the needs of our investors. We believe the result is a powerful and comprehensive array of products that leverages the strengths of both organizations to benefit you and your clients through access to:

| • | | Our combined investment expertise, with independent portfolio teams that will continue to adhere to their own distinct strategies and processes. |

| • | | Fund choices with highly competitive fee structures that, for many shareholders, are expected to result in reductions in fund expenses. |

| • | | A family of mutual funds with even greater depth and breadth than before, including more choices in investment styles and strategies. |

| • | | Complementary investment solutions, such as separately managed accounts, college investing plans, and retirement products. |

What to expect in the coming months

Proxies for the reorganization of our fund families are expected to be mailed to shareholders during the early part of the second quarter of 2010, with shareholder meetings held in early summer. Upon shareholder approval, the reorganizations (and other related changes) will likely be completed in mid-summer. Watch for additional information regarding the proxy mailings.

(over)

How to obtain additional information

For an overview of our proposed new fund lineup, click here, or visit the “Integration News” section on our Web sites at www.wellsfargo.com/advantagefunds or www.evergreeninvestments.com for more detailed information. Your existing relationship contacts can provide you with additional insight and answer any questions you may have. We will continue to keep you posted on our progress in the integration of our two mutual fund organizations.

|

Sincerely, |

|

|

|

Karla M. Rabusch |

President |

Wells Fargo Advantage Funds |

Additional Information and Where to Find it

In connection with the proposed transaction, the acquirer will file a Proxy Statement-Prospectus with the Securities and Exchange Commission. All shareholders are advised to read this Proxy Statement-Prospectus in its entirety when it becomes available, because it will contain important information regarding the acquirer, the target, the transaction, the persons soliciting proxies in connection with the transaction and the interests of these persons in the transaction and related matters. Target intends to mail the Proxy Statement-Prospectus to its shareholders once such Proxy Statement-Prospectus is declared effective by the Commission. Shareholders may obtain a free copy of the Proxy Statement-Prospectus when available and other documents filed by the acquirer with the Commission at the Commission’s web site at http://www.sec.gov. Free copies of the Proxy Statement-Prospectus, once available, may be obtained by directing a request via mail, phone or email to acquirer, Wells Fargo Advantage Funds, P.O. Box 8266, Boston MA, 02266-8266, 1-800-222-8222, www.wellsfargo.com/advantagefunds. Free copies of the Proxy Statement-Prospectus, once available, also may be obtained by directing a request via mail or fax to target, Evergreen Funds, 200 Berkeley Street, Boston, MA, 02116, 1-800-343-2898, www.evergreeninvestments.com. In addition to the Proxy Statement-Prospectus, the target and the acquirer file annual and semi-annual reports and other information with the Commission. You may read and copy any reports, statements, or other information filed by the target or the acquirer at the Commission’s public reference rooms at 100 F Street, N.E., Washington, D.C., 20549-0213. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Filings made with the Commission by either the target or the acquirer are also available to the public from commercial document-retrieval services and at the Web site maintained by the Commission at http://www.sec.gov.

Participants in the Solicitation

The acquirer, the target and their respective directors, executive officers, and certain members of their management and other employees may be soliciting proxies from shareholders in favor of the transaction and other related matters. Information concerning persons who may be considered participants in the solicitation of the target’s shareholders under the rules of the Commission will be set forth in Proxy-Statement-Prospectus to be filed by the acquirer with the Commission in February 2010.

For Section 529 plans, an investor’s or a designated beneficiary’s home state may offer state tax or other benefits that are only available for investments in that state’s qualified tuition program. Please consider this before investing.

Carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. For a current prospectus or current program description, containing this and other information, visit www.wellsfargo.com/advantagefunds for Wells Fargo Advantage Funds and certain Section 529 plans, or www.evergreeninvestments.com for Evergreen Investments. Read the prospectus carefully before investing.

Evergreen Investment Management Company, LLC, is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s broker/dealer subsidiaries. Evergreen mutual funds are distributed by Evergreen Investment Services, Inc. Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC. Effective 1-4-10, Evergreen mutual funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.