UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

Superior Financial Corp.

(Name of Registrant as specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

16101 LaGrande Drive

Suite 103

Little Rock, Arkansas 72223

Telephone: (501) 324-7282

To Our Shareholders:

The annual meeting of the shareholders of Superior Financial Corp. (“Superior”) will be held at 1:00 p.m., central daylight time, Friday, May 23, 2003, at 16101 LaGrande Drive, Little Rock, Arkansas.

Enclosed is the notice of the meeting, a proxy statement, a proxy card, Superior’s Annual Report to its Shareholders and Superior’s Annual Report on Form 10-K. We hope you will study the enclosed material carefully and attend the meeting in person.

Whether you plan to attend the meeting or not, please sign and date the enclosed proxy card and return it in the accompanying envelope as promptly as possible. Please indicate in the space provided on the proxy card whether or not you plan to attend the meeting in person. The proxy may be revoked by your vote in person at the meeting, by your execution and submission of a later dated proxy, or by your giving written notice of revocation to the Secretary of Superior Financial Corp. at any time prior to the voting thereof. Thank you for your support.

By Order of the Board of Directors |

|

|

C. Stanley Bailey Chairman of the Board and Chief Executive Officer |

April 17, 2003

Superior Financial Corp.

16101 LaGrande Drive

Suite 103

Little Rock, Arkansas 72223

Telephone: (501) 324-7282

NOTICE

of the

ANNUAL MEETING OF SHAREHOLDERS

of

SUPERIOR FINANCIAL CORP.

To Be Held May 23, 2003

NOTICE IS HEREBY GIVEN that the annual meeting of shareholders of Superior Financial Corp. (“Superior”), a Delaware corporation, will be held at 16101 LaGrande Drive, Little Rock, Arkansas, on Friday, May 23, 2003, at 1:00 p.m., central daylight time, for the following purposes:

| | 1. | | To elect the nominees named in the Proxy Statement as directors to serve for a term of one year. |

| | 2. | | To transact such other business as may properly come before the meeting or any adjournments thereof, but which is not now anticipated. |

These matters are discussed in detail in the accompanying proxy statement. Only shareholders of record at the close of business on March 31, 2003, will be entitled to notice of, and to vote at, the meeting. A complete list of the shareholders entitled to vote at the meeting, arranged in alphabetical order and showing the address of each shareholder and the number of shares registered in the name of each shareholder, shall be open for examination by any shareholder at Superior’s office at 16101 LaGrande Drive, Little Rock, Arkansas, during ordinary business hours for any purpose germane to the meeting. Such list will be open for a period of at least ten days prior to the meeting.

All shareholders of Superior are cordially invited to attend the meeting in person. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, PLEASE SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT IN THE ACCOMPANYING ENVELOPE AS PROMPTLY AS POSSIBLE. THE PROXY MAY BE REVOKED BY YOUR VOTE IN PERSON AT THE MEETING, BY YOUR EXECUTION AND SUBMISSION OF A LATER DATED PROXY, OR BY YOUR GIVING WRITTEN NOTICE OF REVOCATION TO THE SECRETARY OF SUPERIOR AT ANY TIME PRIOR TO THE VOTING THEREOF.

By Order of the Board of Directors |

|

|

C. Stanley Bailey Chairman of the Board and Chief Executive Officer |

April 17, 2003

Superior Financial Corp.

16101 LaGrande Drive

Suite 103

Little Rock, Arkansas 72223

Telephone: (501) 324-7282

PROXY STATEMENT

FOR THE 2003 ANNUAL MEETING OF SHAREHOLDERS

This Proxy Statement and the accompanying proxy are furnished on or about April 17, 2003, by Superior Financial Corp. (“Superior”) to the holders of record of common stock, par value $0.01, of Superior (the “Common Stock”) in connection with the annual meeting of Superior’s shareholders and any adjournments thereof (the “Annual Meeting”) to be held on Friday, May 23, 2003, at 16101 LaGrande Drive, Little Rock, Arkansas. The matters to be considered and acted upon, including the election of directors, are discussed herein.

The Board of Directors of Superior (the “Board”) and its Nominating and Governance Committee recommend the election of the ten director-nominees named in this Proxy Statement for a term of one year.

The enclosed proxy is solicited on behalf of the Board and is revocable at any time prior to the voting of such proxy by giving written notice of revocation to the Secretary of Superior, or by executing and submitting a later dated proxy, or by voting in person at the Annual Meeting. Mere attendance at the Annual Meeting without submitting a later dated proxy or voting in person will not be sufficient to revoke a previously submitted proxy. All properly executed proxies delivered pursuant to this solicitation will be voted at the Annual Meeting and in accordance with instructions, if any. If no instructions are given, the proxies will be voted FOR election of the director-nominees named herein and in accordance with the instructions of management as to any other matters that may properly come before the Annual Meeting.

Superior will pay the cost of soliciting proxies. In addition to the use of the mails, proxies may be solicited by personal interview, telephone, facsimile or electronic communication. Banks, brokers, nominees or fiduciaries will be required to forward the soliciting material to the principals and to obtain authorization of the execution of proxies. Superior may, upon request, reimburse banks, brokers and other institutions, nominees and fiduciaries for their expenses in forwarding proxy material to the principals. Superior has retained the firm of Georgeson & Co. to solicit street-name holders and will pay such firm a fee of $6,500 plus out of pocket expenses.

Shareholders Eligible to Vote

This Proxy Statement is furnished to the holders of Common Stock who were holders of record as of the close of business on March 31, 2003. Only those holders are eligible to vote at the Annual Meeting. As of March 31, 2003 there were outstanding 8,279,209 shares of Common Stock. Each share of Common Stock is entitled to one vote.

Votes will be tabulated and counted by one or more inspectors of election appointed by the Nominating and Governance Committee. Proxies marked as abstentions and shares held in street name which have been designated by brokers on proxy cards as not voted will not be counted as votes cast. Such proxies will be counted for purposes of determining a quorum at the Annual Meeting. A quorum consists of a majority of the shares of Common Stock outstanding.

VOTING SECURITIES AND PRINCIPAL SHAREHOLDERS

Principal Shareholders

The following table sets forth certain information regarding the beneficial ownership of the Common Stock as of March 31, 2003 by each person of record believed by Superior to own beneficially 5% or more of the Common Stock.

Name and Address

| | Number of Shares

| | Percentage Beneficially Owned

| |

Franklin Mutual Advisers, LLC | | 685,200 | | 8.28 | % |

51 John F. Kennedy Parkway | | | | | |

Short Hills, New Jersey 07078 | | | | | |

|

C. Stanley Bailey(1) | | 617,748 | | 7.03 | |

16101 LaGrande Drive, Suite 103 | | | | | |

Little Rock, Arkansas 72223 | | | | | |

|

Banc Funds Company, L.L.C. | | 601,410 | | 7.26 | |

208 S. LaSalle Street | | | | | |

Chicago, Illinois 60604 | | | | | |

|

Steven N. Stein(2) | | 546,071 | | 6.60 | |

441 Vine Street, Suite 507 | | | | | |

Cincinnati, Ohio 45202 | | | | | |

|

Alexander D. Warm(2) | | 537,100 | | 6.49 | |

2335 Florence Avenue | | | | | |

Cincinnati, Ohio 45206 | | | | | |

|

FleetBoston Financial Corporation | | 488,760 | | 5.90 | |

100 Federal Street | | | | | |

Boston, Massachusetts 02110 | | | | | |

| (1) | | Includes 513,582 shares of Common Stock subject to stock options, 487,500 of which were provided pursuant to Mr. Bailey’s original employment agreement, 44,048 shares held jointly by Mr. Bailey and his wife Virginia H. Bailey, 10,316 shares held in Mrs. Bailey’s IRA and 5,350 shares held in the Mary Brittan Bailey Trust. |

| (2) | | John M. Stein, a director of Superior, and Steven N. Stein, a principal shareholder of Superior, are directors, executive officers and principal shareholders of Financial Stocks, Inc. Alexander D. Warm, who is the beneficial owner of 224,600 shares of Common Stock and trustee of a trust which owns 312,500 shares of Common Stock, and Stanley L. Vigran, who owns 30,000 shares of Common Stock, are the remaining directors and shareholders of Financial Stocks, Inc., which owns 58,619 shares of Superior Common Stock. John M. Stein and Steven N. Stein are brothers. Steven N. Stein and John M. Stein each disclaim any ownership of Common Stock held by the other. |

2

SECURITY OWNERSHIP OF MANAGEMENT AND DIRECTORS

The following table sets forth certain information regarding the beneficial ownership of the Common Stock as of March 31, 2003 by each director and each executive officer, and all directors and executive officers as a group.

Name

| | Number of Shares

| | Percentage Beneficially Owned

| |

C. Stanley Bailey(1) | | 617,748 | | 7.03 | % |

Terry A. Elliott | | — | | * | |

Brian A. Gahr(2) | | 503 | | * | |

Rick D. Gardner(3)(4) | | 16,410 | | * | |

Robert A. Kuehl(4) | | 1,000 | | * | |

H. Baker Kurrus | | 1,000 | | * | |

Howard B. McMahon | | 3,019 | | * | |

C. Marvin Scott(5) | | 263,246 | | 3.08 | % |

John M. Stein(6) | | 160,800 | | 1.94 | % |

John E. Steuri(7) | | 10,063 | | * | |

David E. Stubblefield(8) | | 12,075 | | * | |

Officers and Directors as a Group | | 1,085,864 | | 13.12 | % |

| * | | Represents less than 1% |

| (1) | | Includes 513,582 shares of Common Stock subject to stock options, 487,500 of which were provided under Mr. Bailey’s original employment agreement, 44,048 shares held jointly by Mr. Bailey and his wife Virginia H. Bailey, 10,316 shares held in Mrs. Bailey’s IRA and 5,350 shares held in the Mary Brittan Bailey Trust. |

| (2) | | Shares held in a living trust, of which Mr. Gahr is a co-trustee. |

| (3) | | Includes 11,379 shares of Common Stock subject to stock options. |

| (4) | | Mr. Gardner was Chief Financial Officer of the Company in 2002. In January 2003, Mr. Gardner was promoted to Chief Administrative Officer and Robert Kuehl joined the Company in January 2003 as Chief Financial Officer. |

| (5) | | Includes 262,743 shares of Common Stock subject to stock options, 243,750 of which were provided under Mr. Scott’s original employment agreement. |

| (6) | | John M. Stein, a director of Superior, and Steven N. Stein, a principal shareholder of Superior, are directors, executive officers and principal shareholders of Financial Stocks, Inc. Alexander D. Warm, who is the beneficial owner of 224,600 shares of Common Stock and trustee of a trust which owns 312,500 shares of Common Stock, and Stanley L. Vigran, who owns 30,000 shares of the Common Stock, are the remaining directors and shareholders of Financial Stocks, Inc., which owns 58,619 shares of Superior Common Stock. Steven N. Stein and John M. Stein are brothers. Steven N. Stein and John M. Stein each disclaim any ownership of Common Stock held by the other. |

| (7) | | All shares are jointly owned by Mr. Steuri and his wife Grace D. Steuri. |

| (8) | | Includes 10,000 shares held in an irrevocable trust, of which Mr. Stubblefield is a co-trustee. |

ELECTION OF DIRECTORS

The Board and the Nominating and Governance Committee recommend that the shareholders elect the ten persons named below to hold office for the term of one year, or until their successors are elected and qualified. Superior’s Restated Certificate of Incorporation provides that the number of directors which shall constitute the entire Board shall be fixed from time to time by resolutions adopted by the Board, but shall not be less than three persons.

If, prior to the voting at the Annual Meeting, any person proposed for election as a director is unavailable to serve or for good cause cannot serve, the shares represented by all valid proxies may be voted for the election of such substitute as the Nominating and Governance Committee may recommend and as the members of the Board may approve. Superior’s management knows of no reason why any person would be unavailable or unable to serve as a director.

Assuming a quorum is present at the Annual Meeting, a plurality of the votes cast will be sufficient to elect the directors. On the proxy card, voting for directors is Proposal 1.

3

The bylaws of Superior contain certain limitations on shareholder nominations of candidates for election as directors. See “Bylaw Provisions Regarding Conduct of Shareholders’ Meetings.”

The following table provides certain biographical information about each person nominated by the Nominating and Governance Committee. Unless otherwise indicated, each person has been engaged in the principal occupation shown for the last five years. Executive officers serve at the discretion of the Board.

DIRECTORS NOMINATED BY THE NOMINATING AND GOVERNANCE COMMITTEE

FOR A TERM OF ONE YEAR

Name, Age and Year Became Director

| | Position and Office Held with Superior and Superior Bank

| | Present and Principal Occupation for the Last Five Years

|

C. Stanley Bailey* 54, 1998 | | Chairman of the Board, Chief Executive Officer of both Superior and Superior Bank | | Chief Financial Officer and Executive Vice President of Hancock Holding Company and Hancock Bank, Gulfport, Mississippi, 1995-1998; Vice Chairman of the Board of Directors, AmSouth Bancorporation and AmSouth Bank, Birmingham, Alabama 1971-1994 |

|

C. Marvin Scott* 53, 1998 | | President, Chief Operating Officer and Director of both Superior and Superior Bank | | Chief Retail Officer and Senior Vice President, Hancock Holding Company and Hancock Bank, Gulfport, Mississippi, 1996-1998; Executive Vice President—Consumer Banking, AmSouth Bank, Birmingham, Alabama 1988-1996 |

|

Rick D. Gardner* 43, 2001 | | Chief Administrative Officer and Director of both Superior and Superior Bank | | Chief Financial Officer, Superior Financial Corp and Superior Bank, 1998-2002; Chief Financial Officer and subsequently Chief Executive Officer of First Commercial Mortgage Company, Little Rock, Arkansas, 1996-1998; Chief Financial Officer, Metmor Financial, Kansas City, Missouri, 1990-1995 |

|

Terry A. Elliott 57, 2003 | | Director of Superior and Superior Bank, Member and designated Audit Committee Financial Expert | | Chief Financial Officer and member of the Board of Directors of Safe Foods Corporation, North Little Rock, Arkansas. Member of the board of directors of USA Truck, Inc., Van Buren, Arkansas since 2003. |

|

Brian A. Gahr 48, 1999 | | Director of Superior and Superior Bank | | Division Vice President of Whirlpool Corp. since 1995, Fort Smith, Arkansas |

|

H. Baker Kurrus 48, 2003 | | Director of Superior and Superior Bank | | Executive Vice President and General Counsel for the Winrock Group, Inc., Little Rock, Arkansas |

|

Howard B. McMahon 64, 1999 | | Director of Superior; director of Superior Bank since 1995 | | Owner of M-P Warehouse, Fort Smith, Arkansas, 2000-Present; prior to 2001, Vice President of SSI, Inc., a general contractor in Fort Smith, Arkansas |

|

John M. Stein 36, 1998 | | Director of Superior and Superior Bank | | President, Financial Stocks, Inc., Cincinnati, Ohio, 1995 to present; Vice President, Bankers Trust Company, New York, New York, 1993-1995 |

|

John E. Steuri 63, 1999 | | Director of Superior and Superior Bank | | Private Investments, 2000-Present; Chairman of Advanced Thermal Technologies, Inc., 1996-2000; Chairman, President & CEO of ALLTEL Information Systems from 1988 to 1996, Little Rock, Arkansas |

|

David E. Stubblefield 65, 1998 | | Director of Superior; director of Superior Bank since 1994 | | Retired President and Chief Executive Officer of ABF Freight Systems, Inc., Fort Smith, Arkansas |

| * | | Indicates that the director/nominee is also an executive officer. |

4

COMMITTEES OF THE BOARD OF DIRECTORS

The Board has established audit, executive, compensation, nominating and governance, and loan and investment committees. The Audit Committee currently consists of Messrs. Elliott, Gahr, McMahon, Stein and Steuri, all of whom are deemed by Superior’s board of directors to be “independent” as that term is currently defined by Rule 4200(a)(15) of the NASD’s listing standards. The Audit Committee reviews the general scope of the audit conducted by Superior’s independent auditors, the fees charged for their work and matters relating to Superior’s internal control systems. In performing its functions, the Audit Committee meets separately with representatives of Superior’s independent auditors, with Superior’s internal auditors and with representatives of senior management. The Audit Committee met six times in 2002. The Audit Committee has designated Terry A. Elliott as an Audit Committee Financial Expert. The Board has determined that Mr. Elliott meets the definition of “audit committee financial expert” as that term has been defined by the SEC. The Audit Committee has revised its charter to reflect changes in the laws and regulations of corporate governance as provided in the Sarbanes-Oxley Act of 2002, SEC regulations promulgated thereunder and proposed NASD corporate governance rules. The revised Audit Committee Charter is attached to this Proxy Statement as Appendix A.

The Compensation Committee currently consists of Messrs. Stein, Steuri and Stubblefield, all of whom are deemed by Superior’s board of directors to be “independent” as that term is currently defined by Rule 4200 (a)(15) of the NASD’s listing standards. The Compensation Committee administers Superior stock option plans and grants options and other awards to company employees under such plans. In addition, the Compensation Committee is responsible for establishing policies dealing with various compensation and employee benefit matters of Superior. The Compensation Committee met five times in 2002. The Compensation Committee adopted a charter in 2002 that is designed to comply with proposed NASD corporate governance rules. The Compensation Committee charter is attached to this Proxy Statement as Appendix B.

The Nominating & Governance Committee currently consists of Messrs. Gahr, Stein and Steuri, all of whom are deemed by Superior’s board of directors to be “independent” as that term is currently defined by Rule 4200(a)(15) of the NASD’s listing standards. The Nominating & Governance Committee nominates persons to stand for election to Superior’s board of directors each year and maintains and evaluates Superior’s systems of corporate governance and internal controls. The Nominating & Governance Committee will consider nominees recommended by holders of Superior Common Stock, provided that such recommendations are made in accordance with Superior’s bylaws. See “Bylaw Provisions Regarding Conduct of Shareholder Meetings” for a description of the applicable bylaw provisions. The Nominating & Governance Committee met one time in 2002. The Nominating & Governance Committee adopted a charter in 2002 that is designed to comply with proposed NASD corporate governance rules. The Nominating & Governance Committee charter is attached to this Proxy Statement as Appendix C.

The Executive Committee currently consists of Messrs. Bailey, Gardner and Scott. The Executive Committee is authorized and empowered to perform most corporate actions when it is not reasonably feasible to hold a meeting of the entire board. Nothing occurred in 2002 that required action by the Executive Committee, and therefore it did not meet during 2002.

The Loan and Investment Committee presently consists of Messrs. Stubblefield, Gahr, McMahon, Kurrus, and Steuri. The Loan and Investment Committee oversees loan and investment policies and activities and reviews and approves loan relationships of greater than $2,000,000. The Loan and Investment Committee met nineteen times in 2002. The Loan and Investment Committee charter is attached to this Proxy Statement as Appendix D.

During 2002, the Board met 12 times. All directors attended 75% or more of the Board meetings and the respective committee meetings in which such director was a member.

5

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires Superior directors, certain officers and 10% shareholders to file reports of ownership and changes in ownership with the Securities and Exchange Commission (the “SEC”). Such officers, directors and 10% shareholders are required by SEC regulations to furnish Superior with copies of all Section 16(a) reports they file, including initial reports on Form 3 and annual reports on Form 5.

Based solely on its review of the copies of such forms received by it, or written representations from certain reporting persons that no reports on Form 5 were required for those persons, Superior believes that during 2002 all filings applicable to its officers, directors and 10% shareholders were made timely.

COMPENSATION COMMITTEE INTERLOCKS

AND INSIDER PARTICIPATION

The Compensation Committee currently consists of Messrs. Stein, Steuri and Stubblefield, all of whom are deemed by Superior’s board of directors to be “independent” as that term is currently defined by Rule 4200 (a)(15) of the NASD’s listing standards. Before the formation of the Compensation Committee, and in connection with the acquisition of Superior Bank (the “Bank”), Messrs. Bailey and Scott negotiated their respective employment agreements with Financial Stocks, Inc. and Keefe, Bruyette & Woods, Inc., who acted as the lead investor and the placement agent, respectively, and were instrumental in raising the capital necessary for such acquisition and for payment of the costs associated with such acquisition. See “—Employment Agreements.”

Other Transactions—Loans

Certain directors, officers and principal shareholders of Superior and their affiliated interests were customers of and had transactions with the Bank in the ordinary course of business. Additional transactions may be expected to take place in the ordinary course of business. Although these transactions do not currently include any outstanding loans or commitments from the Bank, to the extent that loans or commitments might be made, they would be made in the ordinary course of business on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons and would not involve more than normal risk of collectibility or present other unfavorable features.

Director Compensation

Non-employee directors of Superior and the Bank currently receive fees of $1,500 for each Board meeting attended. Non-employee members of committees of Superior and the Bank receive fees of $400 for each committee meeting attended. All of the directors of Superior also serve as directors of the Bank. Fees paid to directors of Superior for their services as directors of the Bank or as directors of Superior totaled $123,550 in 2002. Directors are reimbursed for all reasonable travel expenses and out-of-pocket costs incurred in the performance of their duties as directors.

In June 2002, each director of Superior was granted options with respect to 1,000 shares of Common Stock pursuant to Superior’s Long Term Incentive Plan. The exercise price of these options is $19.00 per share. These options will vest upon the earlier of Superior’s stock price reaching certain market values or upon five years after the award date.

6

EXECUTIVE COMPENSATION

AND OTHER INFORMATION

Summary of Compensation

The following table provides certain summary information concerning compensation paid or accrued by Superior to or on behalf of Superior’s Chairman of the Board and Chief Executive Officer and the only other two executive officers of Superior who were paid or otherwise compensated in excess of $100,000 in 2002.

| | | Year

| | Annual Compensation

| | Long Term Compensation Awards

| | All Other Compensation

|

| | | | | Restricted Stock Awards ($)

| | Securities Underlying Options (#)

| |

Name and Principal Position

| | | Salary ($)

| | Bonus ($)

| | | |

C. Stanley Bailey Chairman and Chief Executive Officer | | 2002 2001 2000 | | $ | 350,000 323,750 300,000 | | $ | 175,000 150,000 150,000 | | — — — | | 19,000 15,000 32,000 | | * * * |

|

C. Marvin Scott President and Chief

Operating Officer | | 2002 2001 2000 | | $ | 270,000 243,750 220,000 | | $ | 135,000 110,000 110,000 | | — — — | | 15,000 15,000 21,250 | | * * * |

|

Rick D. Gardner(1) Chief Administrative Officer | | 2002 2001 2000 | | $ | 170,000 151,875 140,000 | | $ | 85,000 70,000 70,000 | | — — — | | 10,000 12,000 7,000 | | * * * |

| * | | Does not include amounts attributable to miscellaneous benefits received by the named officers. The costs of providing such benefits to the named officers for the years ended 2002, 2001 and 2000 did not exceed the lesser of $50,000 or 10% of the total annual salary and bonus reported. |

| (1) | | Mr. Gardner was Chief Financial Officer of the Company in 2002. In January 2003, Mr. Gardner was promoted to Chief Administrative Officer and Robert Kuehl joined the Company in January 2003 as Chief Financial Officer. |

Stock Option Plans

Superior adopted the Superior Financial Corp. 1998 Long Term Incentive Plan (the “LTIP”) on June 17, 1998. It was ratified by the shareholders at the 1999 Annual Meeting. The LTIP is an omnibus plan administered by the Compensation Committee to provide equity-based incentive compensation for Superior’s directors and key employees. It provides for issuance of incentive stock options, qualified under Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), and non-qualified stock options. The LTIP also provides for issuance of stock appreciation rights, whether in tandem with options or separately, and awards of restricted shares subject to time-based restrictions and/or performance goals.

The LTIP imposes a limit on the total number of shares that may be issued during the ten-year term of the LTIP equal to 10% of the number of shares outstanding as of December 31, 1998. It imposes a limit on the number of awards that may be granted to all recipients in any one calendar year equal to 1% of the number of shares outstanding on December 31, 1998. On that date there were 10,080,553 shares of Common Stock outstanding. However, any unused portion of the annual shares limit shall be carried forward and available to be awarded in future years. Finally, the LTIP limits the number of restricted stock awards that may be granted each year, which are time-based restricted only (i.e., without regard to any performance goals), to a number of shares equal to .33% (one-third of one percent) of the number of shares outstanding on December 31, 1998.

7

Each award is non-transferable during the life of the recipient, except as permitted by the Compensation Committee to the recipient’s family or a trust for the recipient’s family. The awards do not create a right to employment. Upon a change in control of Superior any vesting schedules and performance goals are deemed satisfied.

As discussed further below, options were granted to Mr. Bailey and Mr. Scott pursuant to their Founder’s Agreements and Employment Agreements, respectively. Those options were issued before adoption of the LTIP by Superior’s Board and are non-qualified stock options. Those options do not count towards the limit on the total number of shares that may be issued pursuant to the LTIP.

Options

The following table shows certain information regarding exercised and unexercised options for Common Stock held by Superior executive officers at December 31, 2002. Certain options have been granted pursuant to a performance based vesting schedule which only permits the holder to exercise a portion of his or her options upon accomplishing pre-defined levels of stock price performance.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| | | Shares Acquired On Exercise(#)

| | Value Realized($)(1)

| | Number of Securities Underlying Unexercised Options At December 31, 2002

| | Value of

Unexercised In-the- Money Options At December 31,

2002(2)

|

Name

| | | | Exercisable/ Unexercisable

| | Exercisable/ Unexercisable

|

C. Stanley Bailey | | — | | — | | 513,582/71,168 | | $ | 4,279,525/$386,363 |

C. Marvin Scott | | — | | — | | 262,743/52,989 | | | 2,181,318/272,835 |

Rick D. Gardner | | — | | — | | 11,379/29,991 | | | 79,890/132,618 |

| (1) | | Value realized is the difference between the fair market value of the securities underlying the options and the exercise price on the date of exercise. |

| (2) | | Value is calculated by subtracting the exercise price from the market value of underlying securities at December 31, 2002. The market value for the Common Stock as of the close of business on December 31, 2002 was $18.37. |

8

The following table shows certain information regarding grants of options respecting Common Stock to certain executive officers of Superior during 2002.

Option Grants in Last Fiscal Year

| | | | | Individual Grants

| | | | | | | | | | | |

| | | Number of Securities Underlying Options Granted (#)

| | Percent of Total Options Granted to Employees in Fiscal Year

| | | Exercise or Base Price ($/Sh)

| | Market Price On Date of Grant

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term

|

Name

| | | | | | | 5%($)

| | 10%($)

|

C. Stanley Bailey | | 19,000 | | 19.73 | % | | $ | 19.00 | | $ | 19.00 | | June 2012 | | $ | 573,859 | | $ | 892,766 |

C. Marvin Scott | | 15,000 | | 15.58 | | | | 19.00 | | | 19.00 | | June 2012 | | | 453,047 | | | 704,815 |

Rick D. Gardner | | 10,000 | | 10.38 | | | | 19.00 | | | 19.00 | | June 2012 | | | 302,031 | | | 469,877 |

Employment Agreements

Mr. Bailey has an employment agreement with Superior that provides, among other things, that Mr. Bailey serve as the Chairman of the Board of Directors and Chief Executive Officer of Superior and the Bank. Mr. Bailey’s compensation for 2002 was determined by Superior’s Compensation Committee. See “Compensation Committee Report—2002 Compensation.”

Mr. Scott has an agreement with Superior which provides, among other things, that Mr. Scott serve as the President and Chief Operating Officer of Superior and the Bank. Mr. Scott’s compensation for 2002 was determined by Superior’s Compensation Committee. See “Compensation Committee Report—2002 Compensation.”

Superior has agreed with each of Mr. Bailey, Mr. Scott and Mr. Gardner to pay certain severance benefits upon a change of control of Superior. A change of control is defined for this purpose as the occurrence of a transaction the result of which is that more than 25% of the outstanding shares of Common Stock (or a successor or parent) are acquired by any person, entity or group acting in concert, which before the transaction, owned less than 25% of the outstanding shares of the Common Stock. In the event of a change of control, Mr. Bailey will be entitled to receive, subject to Section 280(g) of the Code, an amount equal to three times his total compensation for the preceding 12 months. Each of Mr. Scott and Mr. Gardner will be entitled to receive, respectively, an amount equal to 2.99 times of his total compensation for the preceding 12 months.

Benefit Plans

Superior has established a contributory profit sharing plan pursuant to Section 401(k) of the Code covering substantially all employees (the “Plan”). Superior is the Plan administrator and investment advisor, and Investors Bank and Trust serves as the Plan’s trustee. Each year Superior determines, at its discretion, the amount of matching contributions not to exceed 6% of the employee’s annual compensation vesting ratably over a four-year period. Total Plan expenses charged to Superior’s operations for 2002 were $440,000.

Interests of Management and Others in Certain Transactions

Mr. Bailey and Mr. Scott have entered into employment agreements with Superior. See “—Employment Agreements.”

9

COMPENSATION COMMITTEE REPORT

The Compensation Committee consists of John M. Stein, John E. Steuri and David E. Stubblefield, all of whom are “independent” directors as that term is defined by Rule 4200(a)(15) of the NASD’s listing standards. The committee reviews and determines compensation of executive officers of Superior. The Compensation Committee has adopted a charter that is attached to this Proxy Statement as Appendix B.

Compensation Principles

The committee determines executive compensation in accordance with five principles: (1) Superior’s financial performance measured against attainment of Superior’s business goals and the performance of peer-group institutions; (2) the competitiveness of executive compensation with Superior’s peers; (3) the encouragement of stock ownership of management; (4) the individual performance of each executive officer; and (5) recommendations by the Chief Executive Officer regarding all executive officers other than himself. No disproportionate weight is assigned to any individual principle. In 2002, the Compensation Committee determined that bonuses for the executive officers, including the Chief Executive Officer, would be a percentage of base salary, determined by the achievement of objective performance goals.

2002 Compensation

The Compensation Committee determined the compensation for Superior’s executive officers, including the Chief Executive Officer. In 2002, C. Stanley Bailey, the Chief Executive Officer was paid a salary of $350,000 and a bonus of $175,000. In 2002, C. Marvin Scott, the Chief Operating Officer and Rick D. Gardner, the Chief Financial Officer (now Chief Administrative Officer) were paid salaries of $270,000 and $170,000, respectively, and bonuses of $135,000 and $85,000, respectively.

Stock Awards

Certain stock awards to Mr. Bailey and Mr. Scott are governed by the terms of their employment agreements. See “—Employment Agreements.”

This foregoing report is submitted by the Compensation Committee.

Committee:

John M. Stein, Chairman

John E. Steuri

David E. Stubblefield

10

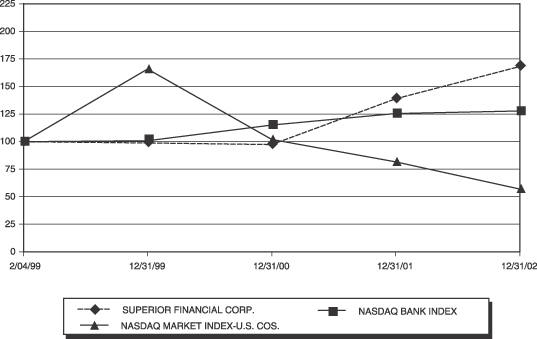

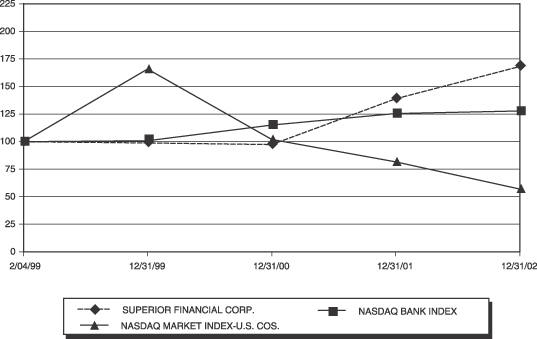

Performance Graph

COMPARISON OF CUMULATIVE TOTAL RETURN

AMONG SUPERIOR FINANCIAL CORP.,

NASDAQ MARKET INDEX AND NASDAQ BANK INDEX

ASSUMES $100 INVESTED ON FEB. 04, 1999

ASSUMES DIVIDENDS REINVESTED

FISCAL YEAR ENDING DEC. 31, 2002(1)

(1) Superior’s Common Stock began trading on the NASDAQ bulletin board on February 4, 1999.

Neither the foregoing graph nor the Compensation Committee Report is to be deemed to be incorporated by reference into any past or subsequent filings by Superior under the Securities Act of 1933 or the Securities Exchange Act of 1934.

11

AUDIT COMMITTEE REPORT

The Audit Committee currently consists of Messrs. Elliott, Gahr, McMahon, Stein and Steuri, all of whom are “independent” directors as that term is defined by Rule 4200(a)(15) of the NASD’s listing standards. The Audit Committee has adopted a revised charter, which is attached as Appendix A to this Proxy Statement. The Audit Committee reviews its charter for adequacy on an annual basis. In accordance with its charter, the Audit Committee met six times in 2002. The Audit Committee has reviewed Superior’s audited financial statements with management to determine whether such statements were consistent with Superior’s audit policy and whether Superior’s internal controls were adequate for the preparation of the financial statements.

The Audit Committee has reviewed and discussed with management Superior’s audited financial statements as of and for the year ended December 31, 2002. The Committee also has discussed with the independent auditors for Superior the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended. The Committee has received the written disclosures and the letter from the independent auditors for Superior required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, as amended, and has discussed with the independent auditors that firm’s independence from management and Superior. In addition, the Audit Committee considered the compatibility of non-audit services with the auditor’s independence.

Based on the review and discussions referred to in the above paragraph, the Committee recommended to the Board that the year-end audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2002 for filing with the Securities and Exchange Commission.

One of the Audit Committee’s responsibilities is to recommend to the Board an independent auditor. In making its recommendation, the Audit Committee considers, among others, the following factors:

| | • | | the fees paid to Superior’s independent auditor in relation to the services they provided and the compatibility of any non-audit services that Superior’s independent auditor provided to Superior with such firm’s status as Superior’s independent auditor; |

| | • | | the independent auditor’s system of internal controls for the purpose of assuring the quality of the audit, including (a) engagement partner rotation policy, (b) whether compensation of key partners on the account is based in part on marketing non-audit services, (c) procedures for resolution of technical issues, including the roles of the reviewing partner and the national office and (d) results of the most recent peer review; |

| | • | | the independent auditor’s expertise in Superior’s industry; |

| | • | | the education and experience of the key partners on the audit; |

| | • | | any relationship that might affect independence, such as whether any of Superior’s senior financial staff are recent alumni of the independent auditor; and |

| | • | | the scope, plan and staffing of the audit, including whether the proposed fees are adequate and appropriate relative to the scope of the work contemplated. |

The foregoing report is submitted by the Audit Committee.

Committee:

John E. Steuri, Chairman

Terry A Elliott

Brian A. Gahr

Howard B. McMahon

John M. Stein

12

DISCLOSURES REGARDING INDEPENDENT AUDITOR FEES

Ernst & Young LLP acted as Superior’s and the Bank’s independent auditors for 2002. It is expected that representatives of this firm will be present at the Annual Meeting and have an opportunity to make a statement to, and to answer questions from, shareholders.

Audit Fees

Audit related fees for the year ended December 31, 2002 totaled $229,000 (Annual Audit: $222,000; Audit Related Services: $7,000). Subsequent to last years Proxy Statement, the Company paid an additional $200,000 related to the audit for the year ended December 31, 2001.

Financial Information Systems Design and Implementation Fees

For the year ending December 31, 2002, Ernst & Young LLP was not engaged to and did not provide any of the professional services described in Paragraph (c)(4)(ii) of Rule 2-01 of Regulation S-X.

All Other Fees

For the year ended December 31, 2002, Ernst & Young LLP billed $41,235 to Superior for tax planning and tax compliance services.

Compatibility of Fees

Superior’s Audit Committee has considered the provision of non-audit services by Ernst & Young LLP and the fees paid to Ernst & Young LLP for such services, and believes that the provision of such services and their fees are compatible with maintaining Ernst & Young LLP’s independence (See “Audit Committee Report”).

BYLAW PROVISIONS REGARDING CONDUCT OF SHAREHOLDERS’ MEETINGS

Superior’s bylaws contain two provisions relating to the conduct of shareholders’ meetings. The first provision requires that certain procedures be followed by a shareholder of record who wishes to present business at the annual meeting of shareholders, including the nomination of candidates for election as directors. In order to nominate persons for election as a director or to present other business at a meeting, a shareholder must provide written notice thereof to the Secretary of Superior not less than 60 days nor more than 90 days prior to the first anniversary of the preceding year’s annual meeting, provided that, if the date of the annual meeting is advanced by more than 30 days or delayed by more than 60 days from such anniversary date, notice by the shareholder to be timely must be delivered not earlier than the 90th day prior to such annual meeting or the 20th day following the day on which public announcement of the date of such meeting is first made.

As it relates to director nominations, the written notice must state all information as to each nominee required to be disclosed in solicitations of proxies for election of directors under SEC regulations, including the written consent of each such nominee. As for any other business that the shareholder proposes to bring before the meeting, the written notice must contain a brief description of the business, the reasons for conducting the business at the meeting and any material interest in such business of such shareholder. The notice must also contain the name and address of such shareholder and the class and number of shares of Superior owned beneficially and of record, as well as the same information for each beneficial owner who may be nominated for election as a director. The Board is not required to nominate a person designated by a shareholder or to take up such other business as may be contained in a written notice from a shareholder; however, compliance with this procedure would permit a shareholder to nominate the individual at the shareholders meeting, and any shareholder may vote shares in person or by proxy for any individual such shareholder desires. The procedures relating to nominating directors and presenting other business at a shareholders’ meeting may only be used by a shareholder who is a shareholder of record at the time of the giving of the notice by the shareholder to the secretary of Superior. The procedures do not prohibit or apply to shareholder proposals under SEC rule 14a-8 as described at “Proposals of Shareholders.”

13

The second provision of Superior’s bylaws relates to the conduct of the business at a shareholder meeting. Under that provision, the Board has the authority to adopt rules for the conduct of meetings, and, unless inconsistent with any such rules, the Chairman of the meeting may prescribe such rules, regulations and procedures as, in his judgment, are appropriate for the proper conduct of the meeting.

PROPOSALS OF SHAREHOLDERS

Subject to certain rules of the SEC, proposals by shareholders intended to be presented at Superior’s 2004 annual meeting of shareholders must be received at Superior’s principal executive offices not less than 120 calendar days in advance of April 17, 2004 (December 22, 2003) for inclusion in the proxy or information statement relating to the 2004 annual meeting.

OTHER MATTERS

Superior does not know of any matters to be presented for action at the meeting other than those listed in the notice of the meeting and referred to herein.

Superior has furnished without charge to its shareholders, herewith, a copy of its annual report on Form 10-K, including Superior financial statements but excluding financial statement schedules and exhibits, required to be filed with the SEC for the year ended December 31, 2002. A copy of the financial statement schedules and exhibits may be obtained upon written request to Robert A. Kuehl, Chief Financial Officer, 16101 LaGrande Drive, Suite 103, Little Rock, Arkansas 72223.

PLEASE SIGN AND DATE THE ENCLOSED PROXY CARD, AND RETURN IT IN THE ACCOMPANYING ENVELOPE AS PROMPTLY AS POSSIBLE.

YOU MAY REVOKE THE PROXY BY GIVING WRITTEN NOTICE OF REVOCATION TO THE SECRETARY OF SUPERIOR AT ANY TIME PRIOR TO THE VOTING THEREOF, BY EXECUTING AND SUBMITTING A LATER DATED PROXY, OR BY ATTENDING THE MEETING AND VOTING IN PERSON.

14

APPENDIX A

AUDIT COMMITTEE CHARTER

Purpose

The Audit Committee is appointed by the Board to assist the Board in monitoring (1) the integrity of the financial statements of the Company, (2) the independent auditor’s qualifications and independence, (3) the performance of the Company’s internal audit function and independent auditors, and (4) the compliance by the Company with legal and regulatory requirements.

The Audit Committee shall prepare the report required by the rules of the Securities and Exchange Commission to be included in the Company’s annual proxy statement.

Committee Membership

The Audit Committee shall consist of no fewer than three members. The members of the Audit Committee shall meet any independence and experience requirements of the Securities and Exchange Commission and NASD, or such requirements of any exchange or market system with which the Company’s securities are listed.

The members of the Audit Committee shall be appointed by the Board on the recommendation of the Nominating & Governance Committee. Audit Committee members may be replaced by the Board.

Committee Authority and Responsibilities

The Audit Committee shall have the sole authority to appoint or replace the independent auditor, and shall approve all audit engagement fees and terms and all non-audit engagements with the independent auditors. The Audit Committee shall consult with management but shall not delegate these responsibilities.

The Audit Committee shall meet as often as it determines, but not less frequently than quarterly. The Audit Committee may form and delegate authority to subcommittees when appropriate.

The Audit Committee shall have the authority, to the extent it deems necessary or appropriate, to retain special legal, accounting or other consultants to advise the Committee. The Audit Committee may request any officer or employee of the Company or the Company’s outside counsel or independent auditor to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee. The Audit Committee shall meet with management, the senior loan review executive, the internal auditors and the independent auditor in separate executive sessions at least quarterly. The Audit Committee may also, to the extent it deems necessary or appropriate, meet with the Company’s investment bankers.

The Audit Committee shall make regular reports to the Board. The Audit Committee shall review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Board for approval. The Audit Committee shall annually review the Audit Committee’s own performance.

The Audit Committee shall establish procedures for receiving, retaining and treating complaints from any person received by the Company, or its subsidiaries, directors and employees regarding accounting, internal accounting controls, or auditing matters. Such procedures shall include provisions for receiving, retaining and treating confidential and/or anonymous submissions by employees of the Company or its subsidiaries regarding questionable auditing or accounting matters.

The Audit Committee, to the extent it deems necessary or appropriate, shall:

Financial Statement and Disclosure Matters

| 1. | | Review and discuss with management and the independent auditor the annual audited financial statements, including disclosures made in management’s discussion and analysis, and recommend to the Board whether the audited financial statements should be included in the Company’s Form 10-K. |

A-1

| 2. | | Review and discuss with management and the independent auditor the Company’s quarterly financial statements prior to the filing of its Form 10-Q, including the results of the independent auditors’ reviews of the quarterly financial statements. |

| 3. | | Discuss with management and the independent auditor significant financial reporting issues and judgments made in connection with the preparation of the Company’s financial statements, including any significant changes in the Company’s selection or application of accounting principles, any major issues as to the adequacy of the Company’s internal controls, the development, selection and disclosure of critical accounting estimates, and analyses of the effect of alternative assumptions, estimates or GAAP methods on the Company’s financial statements. |

| 4. | | Discuss with management the Company’s earnings press releases, including the use of “pro forma” or “adjusted” non-GAAP information, as well as financial information and earnings guidance provided to analysts and rating agencies. |

| 5. | | Discuss with management and the independent auditor the effect of regulatory and accounting initiatives as well as off-balance sheet structures on the Company’s financial statements. |

| 6. | | Discuss with management the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the Company’s risk assessment and risk management policies. |

| 7. | | Discuss with the independent auditor the matters required to be discussed by Statement on Auditing Standards No. 61 relating to the conduct of the audit. In particular, discuss: |

| | (a) | | The adoption of, or changes to, the Company’s significant auditing and accounting principles and practices as suggested by the independent auditor, internal auditors or management. |

| | (b) | | The management letter provided by the independent auditor and the Company’s response to that letter. |

| | (c) | | Any difficulties encountered in the course of the audit work, including any restrictions on the scope of activities or access to requested information, and any significant disagreements with management. |

| 8. | | Review the report of the Certification Committee prior to the filing with the Securities and Exchange Commission of any report or registration statement requiring certification. |

Oversight of the Company’s Relationship with the Independent Auditor

| 9. | | Review the experience and qualifications of the senior members of the independent auditor team. |

| 10. | | Obtain and review a report from the independent auditor at least annually regarding (a) the auditor’s internal quality-control procedures, (b) any material issues raised by the most recent quality-control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities within the preceding five years respecting one or more independent audits carried out by the firm, (c) any steps taken to deal with any such issues, and (d) all relationships between the independent auditor and the Company. Evaluate the qualifications, performance and independence of the independent auditor, including considering whether the auditor’s quality controls are adequate and the provision of non-audit services is compatible with maintaining the auditor’s independence, and taking into account the opinions of management and the internal auditor. The Audit Committee shall present its conclusions to the Board and, if so determined by the Audit Committee, recommend that the Board take additional action to satisfy itself of the qualifications, performance and independence of the auditor. |

| 11. | | Consider whether, in order to assure continuing auditor independence, it is appropriate to adopt a policy of rotating the lead audit partner at least every five years or even the independent auditing firm itself on a regular basis. |

| 12. | | Recommend to the Board policies for the Company’s hiring of employees or former employees of the independent auditor who were engaged on the Company’s account. |

| 13. | | Discuss with appropriate supervisory personnel the independent auditor issues on which they were consulted by the Company’s audit team and matters of audit quality and consistency. |

A-2

| 14. | | Meet with the independent auditor prior to the audit to discuss the planning and staffing of the audit. |

Oversight of the Company’s Internal Audit and Loan Review Function

| 15. | | Review the appointment and replacement of the senior internal auditing and loan review executives. |

| 16. | | Review the significant reports to management prepared by the internal auditing and loan review departments and management’s responses. |

| 17. | | Discuss with the independent auditor the internal audit and loan review departments’ responsibilities, budget and staffing and any recommended changes in the planned scope of the internal audit and loan review. |

Compliance Oversight Responsibilities

| 18. | | Obtain from the independent auditor assurance that Section 10A of the Securities Exchange Act of 1934 has not been implicated. |

| 19. | | Obtain reports from management, the Company’s senior internal auditing executive and the independent auditor that the Company and its subsidiaries are in conformity with applicable legal requirements and the Company’s Code of Business Conduct and Ethics. Review reports and disclosures of insider and affiliated party transactions. Advise the Board with respect to the Company’s policies and procedures regarding compliance with applicable laws and regulations and with the Company’s Code of Business Conduct and Ethics. |

| 20. | | Discuss with management and the independent auditor any correspondence with regulators or governmental agencies and any employee complaints or published reports which raise material issues regarding the Company’s financial statements or accounting policies. |

| 21. | | Discuss with the Company’s legal counsel matters that may have a material impact on the financial statements or the Company’s compliance policies. |

Limitations of Audit Committee’s Role

While the Audit Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s financial statements and disclosures are complete and accurate and are in accordance with GAAP and applicable rules and regulations. These are the responsibilities of management and the independent auditor.

A-3

APPENDIX B

COMPENSATION COMMITTEE CHARTER

Purpose

The Compensation Committee is appointed by the Board to discharge the Board’s responsibilities relating to compensation of the Company’s directors and officers. The Committee has overall responsibility for approving and evaluating the director and officer compensation plans, policies and programs of the Company.

The Compensation Committee is also responsible for producing an annual report on executive compensation for inclusion in the Company’s proxy statement.

Committee Membership

The Compensation Committee shall consist of no fewer than three members. The members of the Compensation Committee shall meet the independence requirements of the NASD, or such requirements of any exchange or market system with which the Company’s securities are listed.

The members of the Compensation Committee shall be appointed by the Board on the recommendation of the Nominating & Governance Committee. Compensation Committee members may be replaced by the Board.

Committee Authority and Responsibilities

| 1. | | The Compensation Committee shall have the sole authority to retain and terminate any compensation consultant to be used to assist in the evaluation of director, CEO or senior executive compensation and shall have sole authority to approve the consultant’s fees and other retention terms. The Compensation Committee shall also have authority to obtain advice and assistance from internal or external legal, accounting, or other advisors. |

| 2. | | The Compensation Committee shall annually review and approve corporate goals and objectives relevant to the compensation of senior executive management, evaluate the senior executive managements’ performance in light of those goals and objectives, and recommend to the Board the compensation levels for senior executive management based on this evaluation. In determining the long-term incentive component of senior executive management compensation, the Compensation Committee will consider the Company’s performance, the value of similar incentive awards to senior executive management at comparable companies, and the awards given to the senior executive management in past years. |

| 3. | | The Compensation Committee shall annually review and make recommendations to the Board with respect to the compensation of all directors, officers and other key executives, including incentive-compensation plans and equity-based plans. |

| 4. | | The Compensation Committee shall annually review and approve, for the senior executive management of the Company, (a) the annual base salary level, (b) the annual incentive opportunity level, (c) the long-term incentive opportunity level, (d) employment agreements, severance arrangements, and change in control agreements/provisions, in each case as, when and if appropriate, and (e) any special or supplemental benefits. |

| 5. | | The Compensation Committee may form and delegate authority to subcommittees when appropriate. |

| 6. | | The Compensation Committee shall make regular reports to the Board. |

| 7. | | The Compensation Committee shall review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Board for approval. The Compensation Committee shall annually review its own performance. |

B-1

APPENDIX C

NOMINATING & GOVERNANCE

COMMITTEE CHARTER

Purpose

The Nominating & Governance Committee is appointed by the Board (1) to assist the Board by identifying individuals qualified to become Board members, and to recommend to the Board the director nominees for the next annual meeting of shareholders; (2) to recommend to the Board the Corporate Governance Guidelines applicable to the Company; (3) to lead the Board in its annual review of the Board’s performance; and (4) to recommend to the Board director nominees for each committee.

Committee Membership

The Nominating & Governance Committee shall consist of the sitting chairpersons of each of the Audit, Compensation and Loan and Investment Committees. The members of the Nominating & Governance Committee shall meet the independence requirements of NASD, or such requirements of any exchange or market system with which the Company’s securities are listed.

The members of the Nominating & Governance Committee shall be appointed and replaced by the Board.

Committee Authority and Responsibilities

| 1. | | The Nominating & Governance Committee shall identify and recommend candidates for addition to the Board of Directors and shall perform appropriate due diligence on potential candidates to ensure that such candidates meet the standards established by law, regulation and the Board of Directors. |

| 2. | | The Nominating & Governance Committee may choose to retain and terminate any search firm to be used to identify director candidates and shall have sole authority to approve the search firm’s fees and other retention terms. The Nominating & Governance Committee shall also have authority to obtain advice and assistance from internal or external advisors in the execution of its duties. |

| 3. | | The Nominating & Governance Committee shall actively seek individuals qualified to become board members for recommendation to the Board. |

| 4. | | The Nominating & Governance Committee shall receive comments from all directors and report annually to the Board with an assessment of the Board’s performance, to be discussed with the full Board following the end of each fiscal year. |

| 5. | | The Nominating & Governance Committee shall review and reassess the adequacy of the Corporate Governance Guidelines of the Company and recommend any proposed changes to the Board for approval. |

| 6. | | The Nominating & Governance Committee may form and delegate authority to subcommittees when appropriate. |

| 7. | | The Nominating & Governance Committee shall make regular reports to the Board. |

| 8. | | The Nominating & Governance Committee shall review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Board for approval. The Nominating & Governance Committee shall annually review its own performance. |

C-1

APPENDIX D

LOAN & INVESTMENT

COMMITTEE CHARTER

Purpose

The Directors’ Loan & Investment Committee (DLIC) is appointed by the Board to assist the Board in oversight of the lending and investment functions of Superior Bank.

Committee Membership

The DLIC shall consist of no fewer than three outside Directors (one of whom shall be designated the Chairman), the Chief Executive Officer of Superior, and the President of Superior. Quorum shall be two outside Directors and either the CEO or President. Any decision shall require the approval of a majority of the directors present.

Committee Authority and Responsibilities

| 1. | | Approve separate policies for commercial lending, consumer lending, mortgage lending, investments, and interest rate risk |

Executive Management shall formulate policy, and the DLIC shall approve policy as needed, but at least annually. Additions and revisions to policy shall be made at the recommendation of Executive Management, or to address a regulatory, legal, or legislative deficiency cited by Bank Regulators.

| 2. | | Approve large loan relationships |

For those lending relationships exceeding $2,000,000, the DLIC shall approve new and renewal credit transactions. This approval is an oversight responsibility to ensure that the credit transaction is made in accordance with loan policy. The members of the DLIC are encouraged to provide input and perspective regarding their knowledge of, and to take into consideration when voting on loan requests, such factors as the local economy, knowledge of borrowers, knowledge of industry, and other insights which complement objective credit analysis and enhance the evaluation of a particular transaction. If the DLIC declines a particular credit, the specific loan policy, or other factors, shall be cited on which the declination is based.

| 3. | | Review internal controls |

Executive Management shall establish internal controls to ensure that loans are documented and booked in accordance with the terms approved by the appropriate approval authority, and that loans are monitored for on-going asset quality. Each quarter the DLIC shall review the adequacy of these internal controls.

| 4. | | Review investment transactions and the interest rate risk report |

Each quarter the DLIC shall review the investment decisions made by Executive Management over the prior ninety days to ensure the investments were made in accordance with investment policy.

Limitation of Directors’ Loan & Investment Committee’s Role

The Board assigns to Executive Management the responsibility for achieving the annual budget for the commercial, consumer, and mortgage lending functions of the Bank. This responsibility shall include individual credit and loan portfolio management, loan pricing decisions on individual credits, and loan officer selection, training and evaluation.

The Board also assigns to Executive Management the responsibility for achieving the annual budget for the investment portfolio of the Bank. This responsibility shall include pricing, quality, liquidity, and interest rate risk profile.

D-1

SOLICITED BY THE BOARD OF DIRECTORS

PROXY

Common Stock

Superior Financial Corp

Annual Meeting of Shareholders

May 23, 2003

The undersigned hereby appoints C. Stanley Bailey and C. Marvin Scott and either of them, or such other persons as the Board of Directors of Superior Financial Corp. (“Superior”) may designate, proxies for the undersigned, with full power of substitution, to represent the undersigned and to vote all of the shares of common stock, par value $0.01, of Superior (the “Common Stock”) which the undersigned would be entitled to vote at the annual meeting of shareholders to be held on May 23, 2003 and at any and all adjournments thereof. The proxies, in their discretion, are further authorized to vote (i) for the election of a person to the Board of Directors if any nominee named herein becomes unable to serve or for good cause will not serve, and (ii) on any other matter that may properly come before the meeting, including matters incident to the conduct of the meeting.

1. ELECTION OF DIRECTORS:

NOMINEES FOR A TERM EXPIRING IN 2004: C. Stanley Bailey, Terry A. Elliott, Brian A. Gahr, Rick D. Gardner, H. Baker Kurrus, Howard B. McMahon, C. Marvin Scott, John M. Stein, John E. Steuri and David E. Stubblefield.

| | | ¨ FOR all nominees listed except as marked to the contrary. | | ¨ WITHHOLD AUTHORITY to vote for all nominees. |

INSTRUCTIONS: TO WITHHOLD AUTHORITY TO VOTE FOR ANY INDIVIDUAL, STRIKE A LINE THROUGH THE NOMINEE’S NAME IN THE ABOVE LIST.

(Continued on reverse side.)

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS AND WILL BE VOTED AS DIRECTED HEREIN. IF NO DIRECTION IS GIVEN, THIS PROXY WILL BE VOTEDFOR THE PERSONS NAMED IN PROPOSAL 1.

Please sign and date this proxy.

I will¨ will not¨ attend the meeting.

| | | DATED:_________________________________, 2003 |

| | | |

| | | Phone No.:___________________________________ |

| | | |

| | | ___________________________________ (Signature of Shareholder) |

| | | |

| | | ___________________________________ (Signature of Shareholder, if more than one) |

| | | |

| | | Please sign exactly as your name appears on the envelope in which this material was mailed. Agents, executors, administrators, guardians, and trustees must give full title as such. Proxies of corporations should be signed by their President or authorized officer. |

| | | |