- EPD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Enterprise Products Partners (EPD) 8-KRegulation FD Disclosure

Filed: 8 Feb 05, 12:00am

EXHIBIT 99.1

| Enterprise Products Partners L.P. Equity Offering February 2005 |

| Offering Summary Securities Offered: 10,000,000 Units Over-Allotment Option: 1,500,000 Units Last Reported Price: $27.24 per unit (as of 02/04/05) Current Distribution / Yield: $0.40 quarterly ($1.60 annually) / 5.9% Tax Deferral: >90% through December 31, 2007 Expected Pricing: February 10, 2005 Use Of Proceeds: Permanently reduce borrowings under our 364-day acquisition credit facility and general partnership purposes Ticker / Exchange: EPD / NYSE |

| Management Dan Duncan Chairman & Co-founder Mike Creel Executive Vice President & CFO Randy Burkhalter Director, Investor Relations |

| Management O.S. “Dub” Andras Vice-Chairman & CEO Bob Phillips President & COO Randy Fowler Vice President & Treasurer |

| Forward looking statements This presentation contains forward-looking statements and information that are based on Enterprise’s beliefs and those of its general partner, as well as assumptions made by and information currently available to them. When used in this presentation, words such as “anticipate,” “project,” “expect,” “plan,” “goal,” “forecast,” “intend,” “could,” “believe,” “may,” and similar expressions and statements regarding the contemplated transaction and the plans and objectives of Enterprise for future operations, are intended to identify forward-looking statements. Although Enterprise and its general partner believes that such expectations reflected in such forward looking statements are reasonable, neither it nor its general partner can give assurances that such expectations will prove to be correct. Such statements are subject to a variety of risks, uncertainties and assumptions. If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, actual results may vary materially from those Enterprise anticipated, estimated, projected or expected. Among the key risk factors that may have a direct bearing on Enterprise’s results of operations and financial condition are: |

| Forward looking statements (cont.) Fluctuations in oil, natural gas and NGL prices ; A reduction in demand for its products by the petrochemical, refining or heating industries; A decline in the volumes of NGLs delivered by its facilities; The failure of its credit risk management efforts to adequately protect it against customer non-payment; Terrorist attacks aimed at its facilities; The failure to successfully integrate any future acquisitions; and The failure to realize the anticipated cost savings, synergies and other benefits of the merger with GulfTerra. Enterprise has no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. |

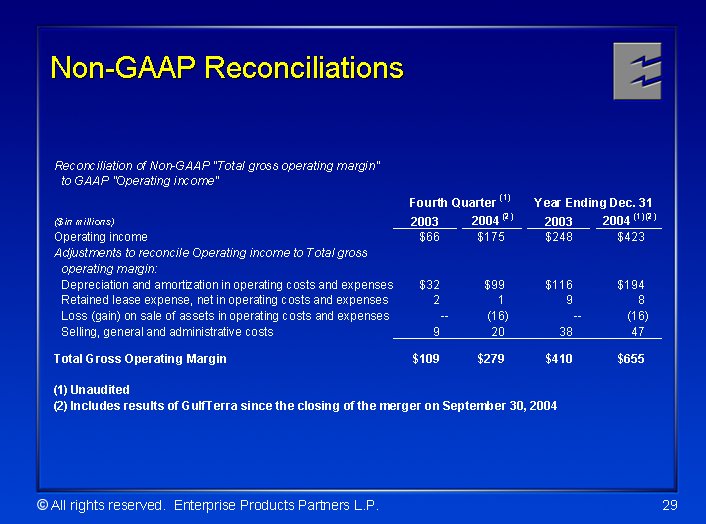

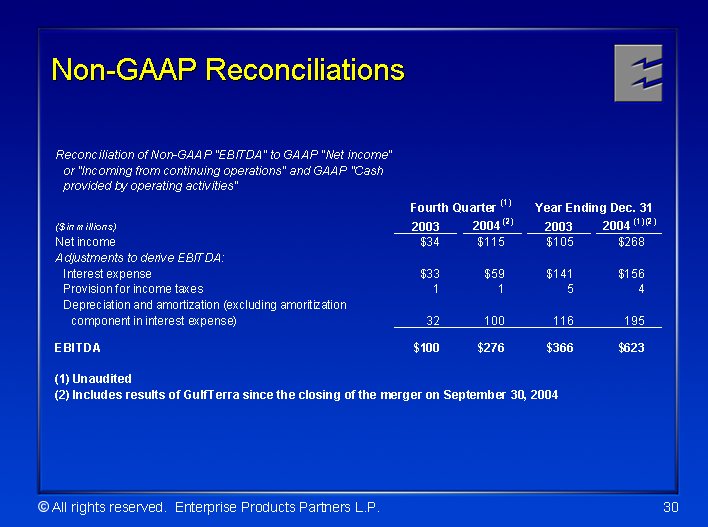

| Forward looking statements (cont.) This presentation utilizes Non-GAAP financial measures. Please read – “Non-GAAP Financial Measures” and “Non-GAAP Reconciliations” in the prospectus supplement for an explanation of gross operating margin and a reconciliation to operating income, which is the most directly comparable financial measure calculated according to GAAP. Also included in this section of the prospectus is an explanation of EBITDA and a reconciliation of EBITDA to net income and operating activities cash flows, which are the most directly comparable financial measures calculated according to GAAP. |

| Key Investments Considerations Strategically located assets serving the most prolific supply basins for natural gas, natural gas liquids (NGLs) and crude oil in the U.S. Leading business positions across midstream sector Greater cash flow stability from diversified fee-based assets following the recent completion of GulfTerra merger One of the strongest organic growth profiles in the industry Increasing cash distributions leading to superior returns Lower cost of capital than many of our competitors GP / Management’s interests aligned with limited partners Experienced management team with substantial ownership |

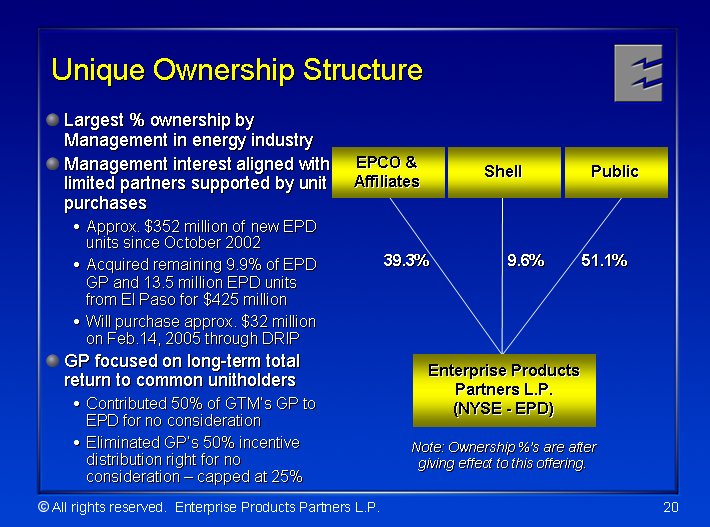

| Overview The largest publicly traded energy partnership (based on market capitalization) serving producers and consumers of natural gas, NGLs and crude oil Completed $6 billion merger with GulfTerra Energy Partners, L.P. in September 2004 Prior to GulfTerra merger, ranked 336th on Fortune 500 and 7th on Forbes list of America’s 25 Fastest-Growing Big Companies Only integrated North American midstream network, which includes natural gas and NGL transportation, fractionation, processing, storage and import / export services EPCO and affiliates own the general partner and 39% of EPD (after giving effect to this offering) Interests closely aligned with our public limited partners |

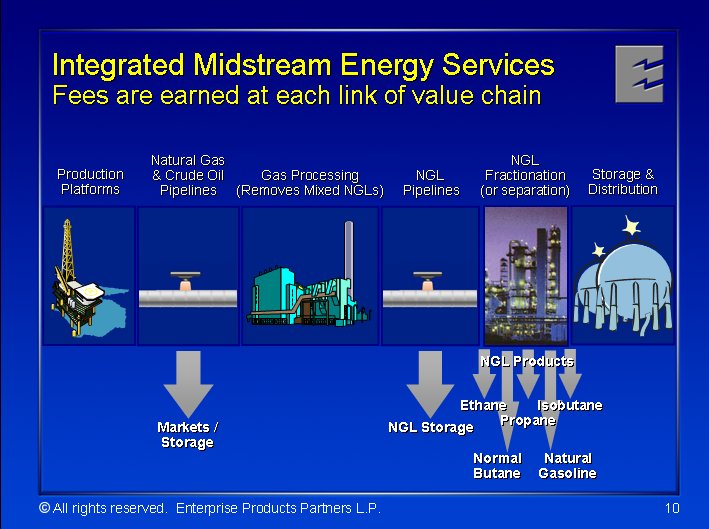

| Integrated Midstream Energy Services Fees are earned at each link of value chain |

| Proven growth, superior returns |

| Successful merger with GulfTerra Created leading provider of midstream energy services with strong position in prolific deepwater Gulf of Mexico and Rocky Mountains Diversified and complementary businesses provide a natural hedge to effects of natural gas prices Extended integrated value chain to provide new organic growth opportunities Successful integration; $140 million of targeted savings largely realized GP distribution savings $55 million Interest savings of approx. $45 million G&A and operating cost savings of approx. $40 million Record 4th quarter 2004 performance |

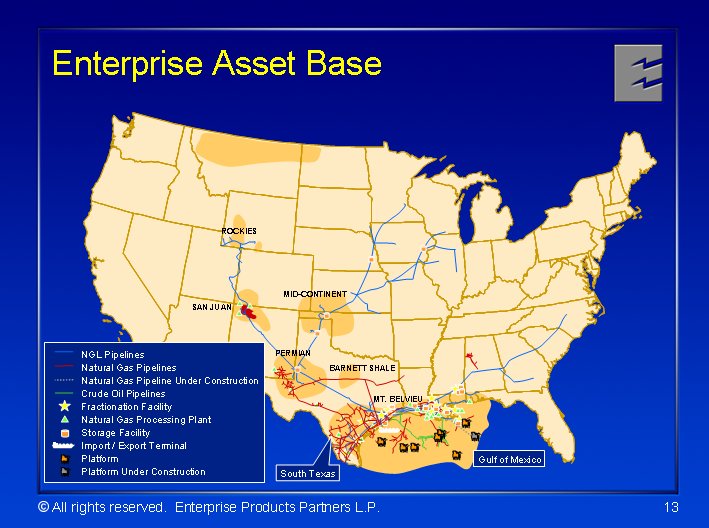

| Enterprise Asset Base |

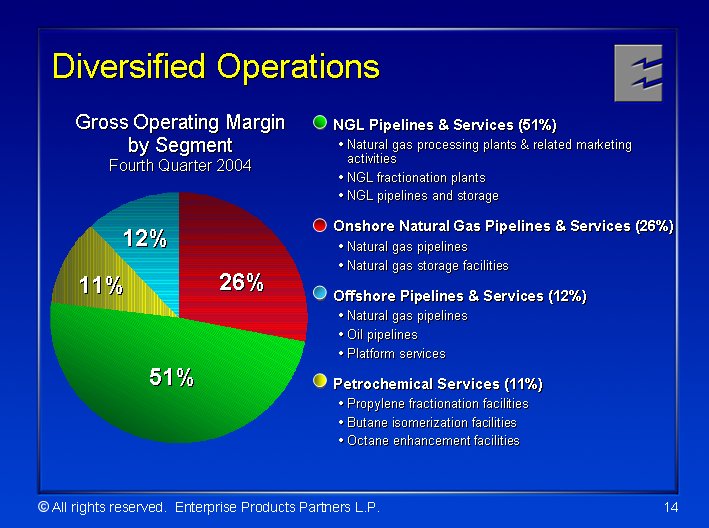

| Diversified operations NGL Pipelines & Services (51%) Natural gas processing plants & related marketing activities NGL fractionation plants NGL pipelines and storage Onshore Natural Gas Pipelines & Services (26%) Natural gas pipelines Natural gas storage facilities Offshore Pipelines & Services (12%) Natural gas pipelines Oil pipelines Platform services Petrochemical Services (11%) Propylene fractionation facilities Butane isomerization facilities Octane enhancement facilities Gross Operating Margin by Segment Fourth Quarter 2004 |

| Leading Business Positions Across Midstream Energy Value Chain |

| $2 Billion of Growth Opportunities |

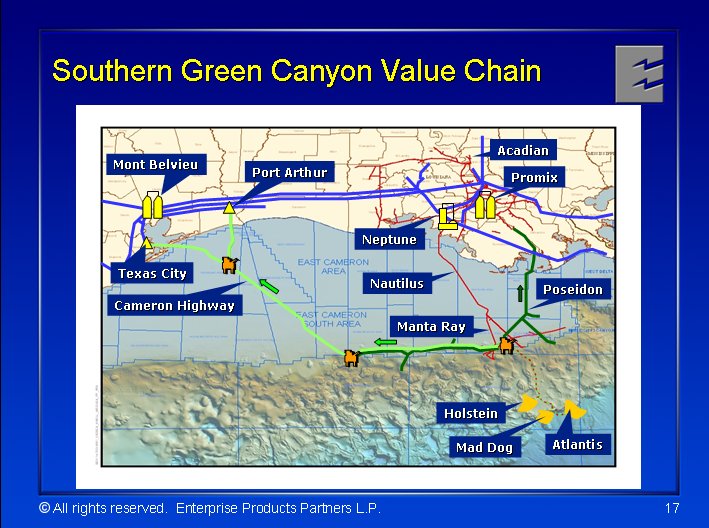

| Southern Green Canyon Value Chain |

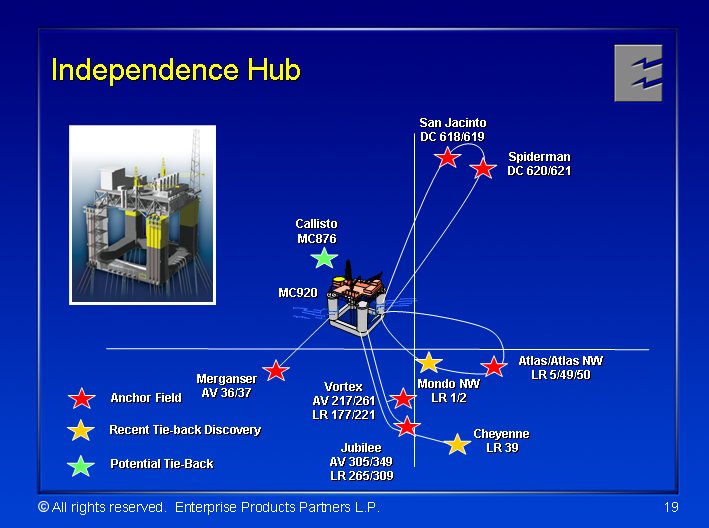

| Independence Hub and Trail Designed to process up to 850 MMcf/d of natural gas production from six anchor fields Capacity to tie-back up to 10 additional fields 15 of 18 wells planned for anchor discoveries have been drilled Large resource basin of approx. 11,500 square miles Life of lease contracts, demand charges and lease dedications Producers include Anadarko, Kerr-McGee, Devon & Dominion First production expected in 2007 |

| Independence Hub |

| Unique Ownership Structure Largest % ownership by Management in energy industry Management interest aligned with limited partners supported by unit purchases Approx. $352 million of new EPD units since October 2002 Acquired remaining 9.9% of EPD GP and 13.5 million EPD units from El Paso for $425 million Will purchase approx. $32 million on Feb.14, 2005 through DRIP GP focused on long-term total return to common unitholders Contributed 50% of GTM’s GP to EPD for no consideration Eliminated GP’s 50% incentive distribution right for no consideration – capped at 25% |

| Financial Overview |

| Financial Objectives Increase cash flows from fee-based businesses Prudently invest to expand the partnership through organic growth, acquisitions and joint ventures with strategic partners Manage capital to provide financial flexibility for partnership while providing our investors with an attractive total return Maintain a strong balance sheet that supports investment grade debt ratings |

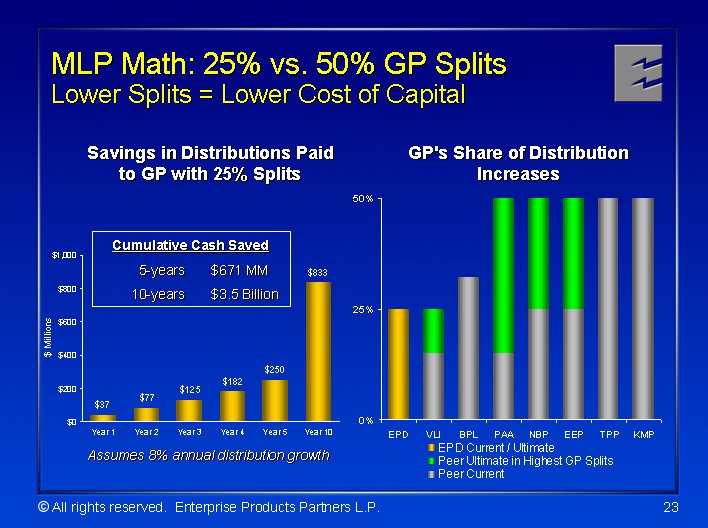

| MLP Math: 25% vs. 50% GP Splits Lower Splits = Lower Cost of Capital Savings in Distributions Paid to GP with 25% Splits GP’s Share of Distribution Increases |

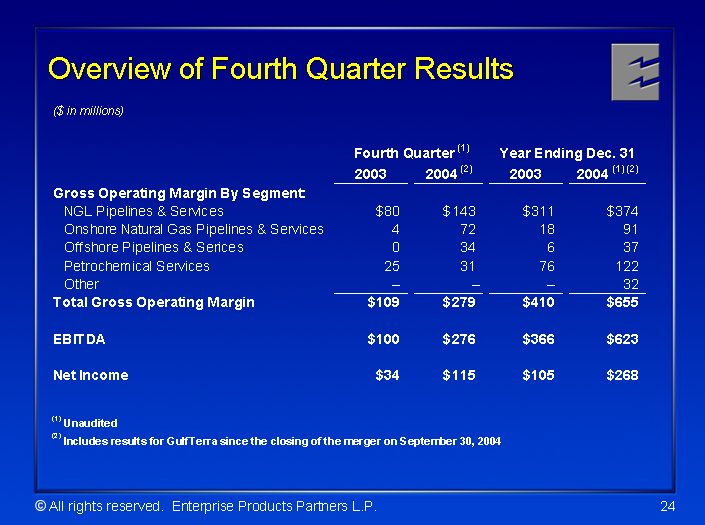

| Overview of Fourth Quarter Results |

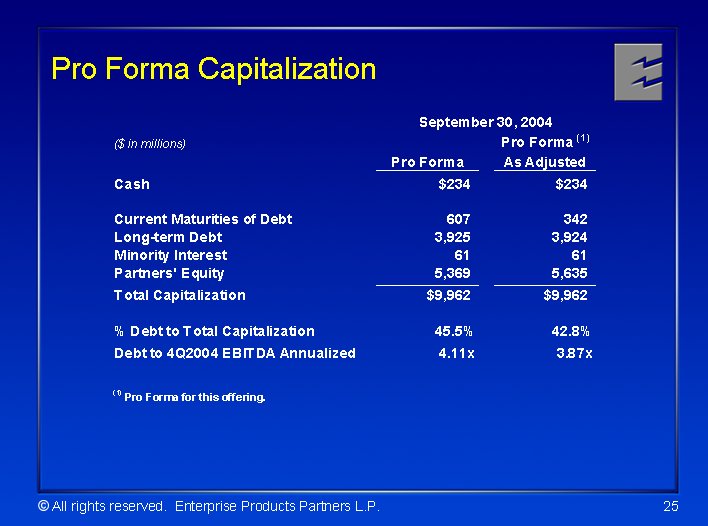

| Pro Forma Capitalization |

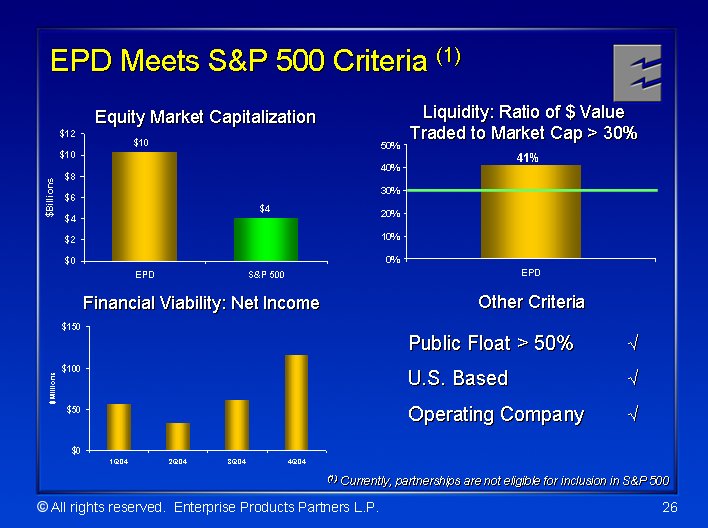

| EPD Meets S&P 500 Criteria (1) Other Criteria Public Float > 50% U.S. Based Operating Company Financial Viability: Net Income Liquidity: Ratio of $ Value Traded to Market Cap > 30% Equity Market Capitalization |

| Key Investment Considerations Strategically located assets serving the most prolific supply basins for natural gas, NGLs and crude oil in the U.S. Leading business positions across midstream sector Greater cash flow stability from diversified fee-based assets following the recent completion of GulfTerra merger One of the strongest organic growth profiles in the industry Increasing cash distributions leading to superior returns Lower cost of capital than many of our competitors GP / Management’s interests aligned with limited partners Experienced management team with substantial ownership |

| Enterprise Products Partners L.P. Questions and Answers |

| Non-GAAP Reconciliations |

| Non-GAAP Reconciliations |