EXHIBIT 99.1

PRESENTATION

| Enterprise Products Partners L.P. Wachovia Pipeline and MLP Symposium |

| Forward Looking Statements This presentation contains forward-looking statements and information that are based on Enterprises beliefs and those of its general partner, as well as assumptions made by and information currently available to them. When used in this presentation, words such as anticipate, project, expect, plan, goal, forecast, intend, could, believe, may, and similar expressions and statements regarding the contemplated transaction and the plans and objectives of Enterprise for future operations, are intended to identify forward-looking statements. Although Enterprise and its general partner believe that such expectations reflected in such forward looking statements are reasonable, neither it nor its general partner can give assurances that such expectations will prove to be correct. Such statements are subject to a variety of risks, uncertainties and assumptions. If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, actual results may vary materially from those Enterprise anticipated, estimated, projected or expected. Among the key risk factors that may have a direct bearing on Enterprises results of operations and financial condition are: Fluctuations in oil, natural gas and NGL prices and production due to weather and other natural and economic forces; A reduction in demand for its products by the petrochemical, refining or heating industries; The effects of its debt level on its future financial and operating flexibility; A decline in the volumes of NGLs delivered by its facilities; The failure of its credit risk management efforts to adequately protect it against customer non-payment; Actual construction and development costs could exceed forecasted amounts; Operating cash flows from our capital projects may not be immediate; Terrorist attacks aimed at its facilities; and The failure to successfully integrate its operations with assets or companies, if any, that it may acquire in the future. Enterprise has no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. |

| Use of Non-GAAP Financial Measures This presentation utilizes the Non-GAAP financial measures of Gross Operating Margin, EBITDA, Distributable Cash Flow and Consolidated EBITDA. In general, we define Gross Operating Margin as operating income before (i) depreciation, amortization and accretion expense; (ii) operating lease expense for which we do not have the payment obligation; (iii) gains and losses on the sale of assets and (iv) general and administrative expenses. We define EBITDA as net income or loss before interest; provision for income taxes; and depreciation, amortization and accretion expense. In general, we define Distributable Cash Flow as net income or loss plus (i) depreciation, amortization and accretion expense; (ii) operating lease expense for which we do not have the payment obligation; (iii) cash distributions received from unconsolidated affiliates less equity in the earnings of such affiliates; (iv) the subtraction of sustaining capital expenditures; (v) gains and losses on the sale of assets; (vi) cash proceeds from the sale of assets or return of investment from unconsolidated affiliates; (vii) gains or losses on monetization of financial instruments recorded in Accumulated Other Comprehensive Income less related amortization of such amount to earnings; (viii) transition support payments received from El Paso related to the GTM Merger and (ix) the addition of losses or subtraction of gains related to other miscellaneous non-cash amounts affecting net income for the period. Distributable Cash Flow is a significant liquidity metric used by our senior management to compare basic cash flows generated by us to the cash distributions we expect to pay partners. Distributable Cash Flow is also an important Non-GAAP financial measure for our limited partners since it serves as an indicator of our success in providing a cash return on investment. Distributable Cash Flow is also a quantitative standard used by the investment community with respect to publicly traded partnerships such as ours because the value of a partnership unit is in part measured by its yield (which in turn is based on the amount of cash distributions a partnership pays to a unit holder). The GAAP measure most directly comparable to Distributable Cash Flow is net cash provided by operating activities. This presentation also includes references to credit leverage ratios that utilize Consolidated EBITDA, which is a term defined in the $1.25 billion revolving credit facility of Enterprise Products Operating L.P. These credit ratios are used by certain of our lenders to evaluate our ability to support debt service. The GAAP measure most directly comparable to Consolidated EBITDA is net cash provided by operating activities. Please see Slides 33 through 36 for our calculations of these Non-GAAP financial measures along with the appropriate reconciliations. |

| Overview Enterprise Products Partners L.P. (EPD) is one of the largest publicly traded energy partnerships serving producers and consumers of natural gas, natural gas liquids (NGLs) and crude oil Enterprise value of approximately $17 billion Equity market capitalization of over $12 billion Ranked 183rd on Fortune 500 list Only integrated North American midstream network that includes natural gas, NGL and crude oil gathering, transportation, processing, fractionation, storage and import / export services |

| Key Credit Highlights Strategically located assets serving the most prolific supply basins and largest consuming regions of natural gas, NGLs and crude oil in the United States Leading business positions across energy value chain Over 90% of gross operating margin from diversified fee-based assets Large portfolio of organic growth projects with potentially higher returns and lower risks vs. acquisitions at higher multiples GP/Management record in supporting EPDs financial flexibility Capped GP split at 25% Contributed half of GulfTerra GP for no consideration Participation in follow-on offerings and DRIP Experienced management team with substantial ownership |

| Premier Midstream Network in Key Regions 19,470 miles of natural gas pipeline 13,725 miles of NGL and petrochemical pipeline 870 miles of GOM crude oil pipeline 148 MMBbls of NGL storage capacity |

| Integrated Midstream Energy Services Fees are earned at each link of value chain |

| Leading Business Positions Across Midstream Energy Value Chain |

| Diversified Businesses NGL Pipelines and Services (54%) Natural gas processing plants and related marketing activities NGL fractionation plants NGL pipelines and storage Onshore Natural Gas Pipelines and Services (26%) Natural gas pipelines Natural gas storage facilities Offshore Pipelines and Services (7%) Natural gas pipelines Oil pipelines Platform services Petrochemical Services (13%) Propylene fractionation facilities Butane isomerization facilities Octane enhancement facilities |

| Drive Consistent Results Stability and consistency Gross operating margin Distributable cash flow Reflects benefits of Integrated value chain Fee-based / diversified businesses Proven ability to deliver stable cash flows in volatile energy environment (e.g., commodity prices, hurricanes) Record performance YTD Sept 06 Revenues $10.6 Billion Gross Op. Margin $ 1.0 Billion EBITDA $ 1.0 Billion |

| Key Assets and Opportunities Cash Flow Visibility |

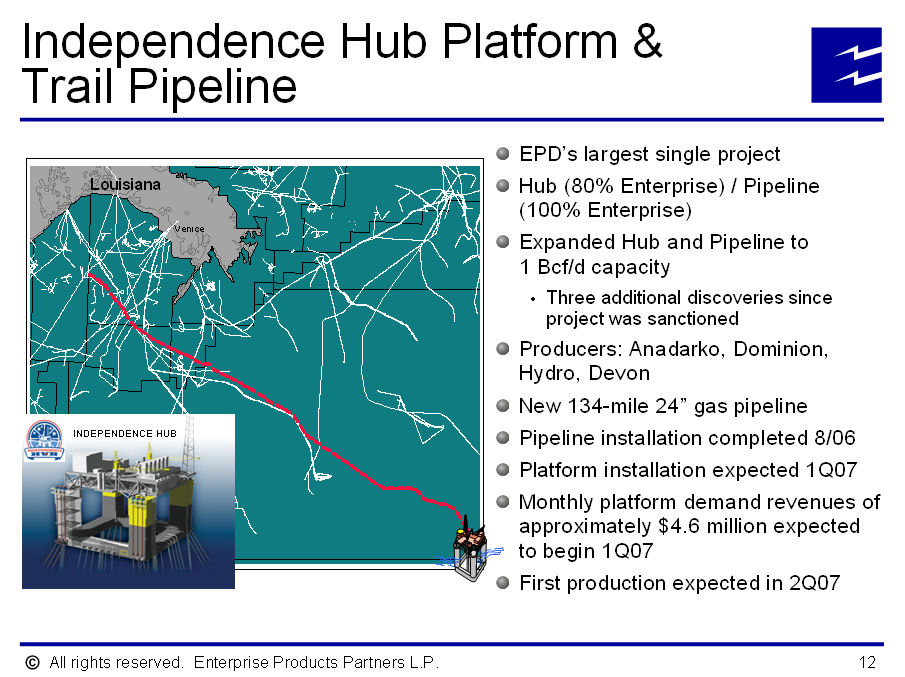

| Independence Hub Platform and Trail Pipeline EPDs largest single project Hub (80% Enterprise) / Pipeline (100% Enterprise) Expanded Hub and Pipeline to 1 Bcf/d capacity Three additional discoveries since project was sanctioned Producers: Anadarko, Dominion, Hydro, Devon New 134-mile 24 gas pipeline Pipeline installation completed 8/06 Platform installation expected 1Q07 Monthly platform demand revenues of approximately $4.6 million expected to begin 1Q07 First production expected in 2Q07 |

| Texas Pipeline System 8,222-mile gathering and transportation system with 6.4 Bcf storage YTD 2006 throughput of 3.4 TBtu/d Connected to major supply basins North Texas (Barnett Shale) East Texas (Bossier) South Texas (Wilcox, Vicksburg) Permian Basin Connected to all major Texas Markets Well-positioned for LNG imports Barnett Pipeline Project (Sherman Extension) 178 miles of 30/36 new intrastate pipeline Interconnect with Boardwalks Gulf Crossing Expansion project near Sherman, Texas (EPD option to acquire up to 49% of project) Supported by long-term contracts with Devon Energy and strong indications of interest from leading producers Capacity: 1.1 Bcf/d Estimated project cost: $400MM In-service: 4Q 2008 |

| Rocky Mountain Assets |

| Jonah Gas Gathering System Jonah Gas Gathering System 600 miles of pipe; 900 wells connected Volumes increased to 1.5 Bcf/d from 450 MMcf/d in 2001 Production expected to grow to 3.3 Bcf/d Volumes supply EPDs Pioneer processing plants Joint Venture with TEPPCO EPD expected to have approximately 20% interest EPD to manage expansion and operate Phase V Expansion Increase capacity from 1.5 to 2.4 Bcf/d New pipeline looping project in service November 2006 increased capacity to 1.75 Bcf/d Project lowers field and wellhead pressures Compression installation to be completed in stages by late-2007 |

| New Processing Plants Existing Silica Gel Plants Integrated to Jonah Gas Gathering System EPD purchased 300 MMcf/d Plant in 1Q06 Completed expansion to 600 MMcf/d in 2Q 2006 New Cryogenic Plant Supported by long-term processing contracts with EnCana and Ultra 650 MMcf/d, up to 30 MBPD of capacity Completion scheduled for 3Q 2007 Meeker Cryogenic Plant - Phase I Capacity - 750 MMcf/d, 35 MBPD Dedicated production from EnCana Completion expected mid-2007 Meeker Cryogenic Plant - Phase II EnCana exercised option for Meeker Phase II Expansion to 1.4 Bcf/d and 70 MBPD Completion expected by year end 2008 ExxonMobil (XOM) Piceance Basin Service Agreement Fee-based services: gathering, treating, conditioning and compression EPD has right to process XOM volumes at Meeker Expected completion in late 2008 |

| Mid-America Pipeline (MAPL) Phase I Expansion Project MAPL Rocky Mountain pipeline flowed at 91% of 225 MBPD capacity YTD 2006 Obtained long-term (10 20 years) shipper dedication agreements Phase I expansion increases capacity by 50 MBPD of mixed NGLs Expected completion in phases 30 MBPD in December 2006 50 MBPD by end of 2007 |

| Hobbs Fractionator EPD-controlled NGL fractionation volumes consistently exceeded EPDs capacity at Mont Belvieu in 2005 requiring offloads to third parties Building 75 MBPD Hobbs fractionator at the interconnect of MAPL and Seminole pipelines Supplied by growing Rockies NGL production including up to 100 MBPD from Meeker and Pioneer plants Provide flexibility to deliver NGL purity products to Mont Belvieu, Conway, local or Mexico markets Expected completion mid-2007 |

| Major Organic Growth Projects Expected Start Dates and Cumulative Investment |

| Financial Overview |

| Financial Objectives Maintain a strong balance sheet and credit metrics that support investment grade credit ratings Key financial objective since IPO Increase cash flows from fee-based businesses Prudently invest to expand the partnership through organic growth, acquisitions and joint ventures with strategic partners Manage capital and distributable cash flow to provide financial flexibility |

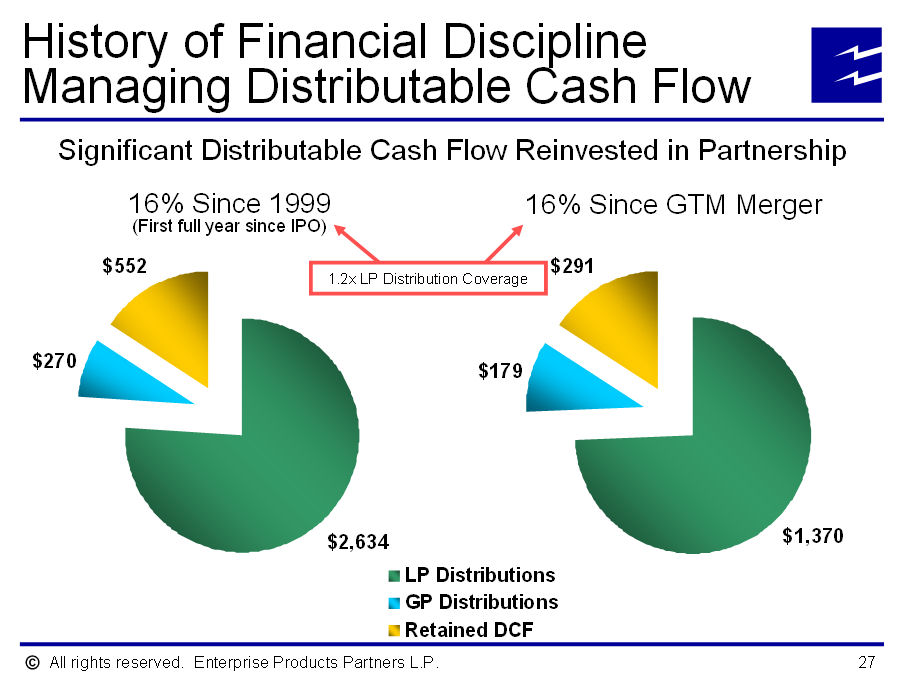

| History of Financial Discipline Financial discipline while executing EPDs growth strategy Financed 57% of $12.4 billion in capital investment since 1999 with equity Retired $1.2 billion acquisition term loan used to finance the acquisition of the Mid-America and Seminole Pipelines in less than 7 months (5 months ahead of schedule) Financed 65% of $6 billion GTM merger with equity Successfully and rapidly integrated businesses after GTM merger Refinanced GTM debt to reduce annual interest expense by approximately $50 million Recognized merger synergies well in excess of street expectations Strong track record of management support EPCO, its affiliates and management have invested approximately $450 million in new equity issues since EPDs IPO Eliminated 50% GP IDRs Strong coverage of distributions to limited partners 1.2x coverage of LP distributions paid since 1999 (first full year since the IPO) Retained $552 million of Distributable Cash Flow in the partnership since 1999 and $291 million since the completion of the GTM merger in 3Q 2004 |

| History of Financial Discipline Funding Growth with Equity (1) Capital investment includes the capital expenditures, cash used for business combinations and asset purchases, investments in and advances to unconsolidated affiliates, and acquisition of intangible asset amounts as reflected on our Statements of Consolidated Cash Flows for the respective periods. Also included is (i) the value of equity interests granted to complete the GTM merger in 2004; the Shell Midstream acquisition in 1999, 2001 and 2002 and the Encinal acquisition in 2006 as reflected on our Statements of Consolidated Partners Equity, and (ii) the debt assumed in connection with the GTM merger. (2) Equity issued includes netproceeds from the issuance of common units and Class B special units as reflected on our Statements of Consolidated Cash Flows for the respective periods. Also included is the value of equity issued as consideration for the GTM merger and the Shell Midstream and Encinal acquisitions as reflected on our Statements of Consolidated Partners Equity, as well as the equity content of the Hybrid securities as assigned by the rating agencies. Per GAAP, our Hybrid securities are reflected as debt on our Consolidated Balance Sheet. |

| EPD Completed 5 of 6 Largest Equity Offerings Since 2001 |

| Managements Interest Aligned with Debt and Equity Investors EPCO has consistently supported growth in EPD Purchased $53 million of new equity in August 2006, and approx. $450 million since IPO Capped GPs incentive split at 25% for no consideration Contributed half of GTM GP to EPD for no consideration approx. $460 million in value Value of EPCOs holdings in EPD and EPE units approx. $6.8 billion |

| Realizing Benefits of Eliminating GPs 50% Splits |

| History of Financial Discipline Managing Distributable Cash Flow Significant Distributable Cash Flow Reinvested in Partnership |

| Strong Financial Position at September 30, 2006 |

| Issuance of Hybrids Provides Additional Financial Flexibility Description $550 Million Principal Amount Long-Term Subordinated Notes (LoTSSM) 60 Yr. Maturity; Fixed coupon 8.375% first 10 yrs Partial equity treatment by rating agencies 75% Fitch; 50% Moodys and S and P Allow 10 15% of book capitalization in Hybrids EPD rationale Provide financial flexibility by broadening and diversifying sources of capital Partial equity treatment by rating agencies and allows for larger security issuances and reduces reliance on traditional equity markets Provide additional layer of protection for senior debt holders |

| Front-End Loaded Equity Capital for Growth Capital Expenditures in 2006 and 2007 2006 and 2007 represents a major construction phase with a growth capital budget of $3.5 billion EPD has been proactive in financing the equity component of these expenditures 67% of 2006 and 40% of combined 2006/2007 capital expenditures funded with equity Follow-on equity offerings Quarterly DRIP Equity component of Hybrids Retained DCF |

| BBB- in 2006? You Gotta Believe! |

| Non-GAAP Reconciliations |

| Non-GAAP Reconciliations |

| Non-GAAP Reconciliations |

| Non-GAAP Reconciliations |

| Non-GAAP Reconciliations |

| Appendix |

| Strong Financial Position at September 30, 2006 |