EXHIBIT 99.1

PRESENTATION

| Enterprise Products Partners L.P. Annual Wachovia Investor Tour May 31, 2007 |

| Forward Looking Statements This presentation contains forward-looking statements and information that are based on Enterprise’s beliefs and those of its general partner, as well as assumptions made by and information currently available to them. When used in this presentation, words such as “anticipate,” “project,” “expect,” “plan,” “goal,” “forecast,” “intend,” “could,” “believe,” “may,” and similar expressions and statements regarding the contemplated transaction and the plans and objectives of Enterprise for future operations, are intended to identify forward-looking statements. Although Enterprise and its general partner believe that such expectations reflected in such forward looking statements are reasonable, neither it nor its general partner can give assurances that such expectations will prove to be correct. Such statements are subject to a variety of risks, uncertainties and assumptions. If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, actual results may vary materially from those Enterprise anticipated, estimated, projected or expected. Among the key risk factors that may have a direct bearing on Enterprise’s results of operations and financial condition are: Fluctuations in oil, natural gas and NGL prices and production due to weather and other natural and economic forces; A reduction in demand for its products by the petrochemical, refining or heating industries; The effects of its debt level on its future financial and operating flexibility; A decline in the volumes of NGLs delivered by its facilities; The failure of its credit risk management efforts to adequately protect it against customer non-payment; Actual construction and development costs could exceed forecasted amounts; Operating cash flows from our capital projects may not be immediate; Terrorist attacks aimed at its facilities; and The failure to successfully integrate its operations with assets or companies, if any, that it may acquire in the future. Enterprise has no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. |

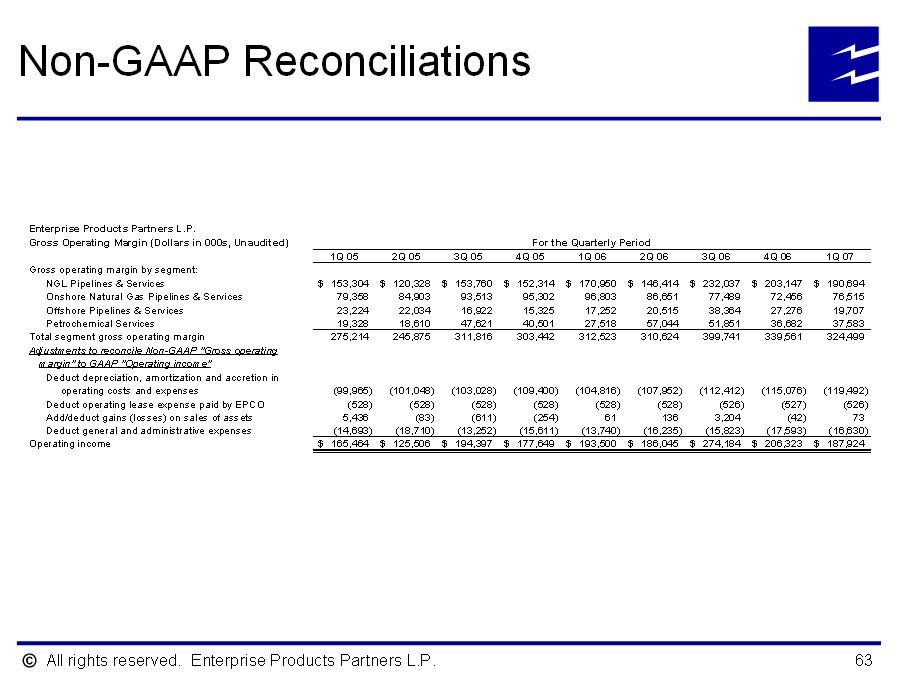

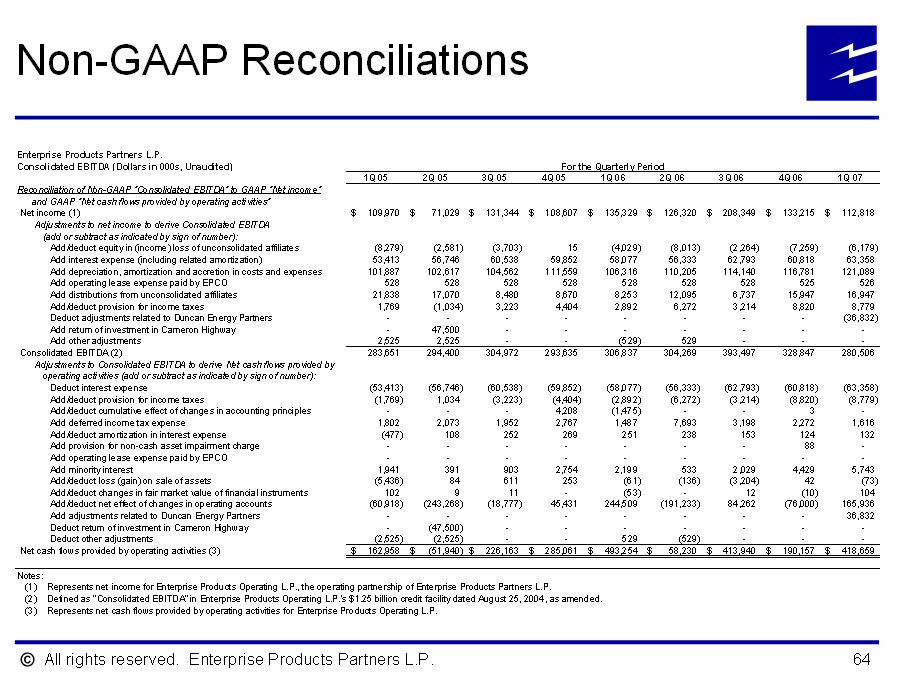

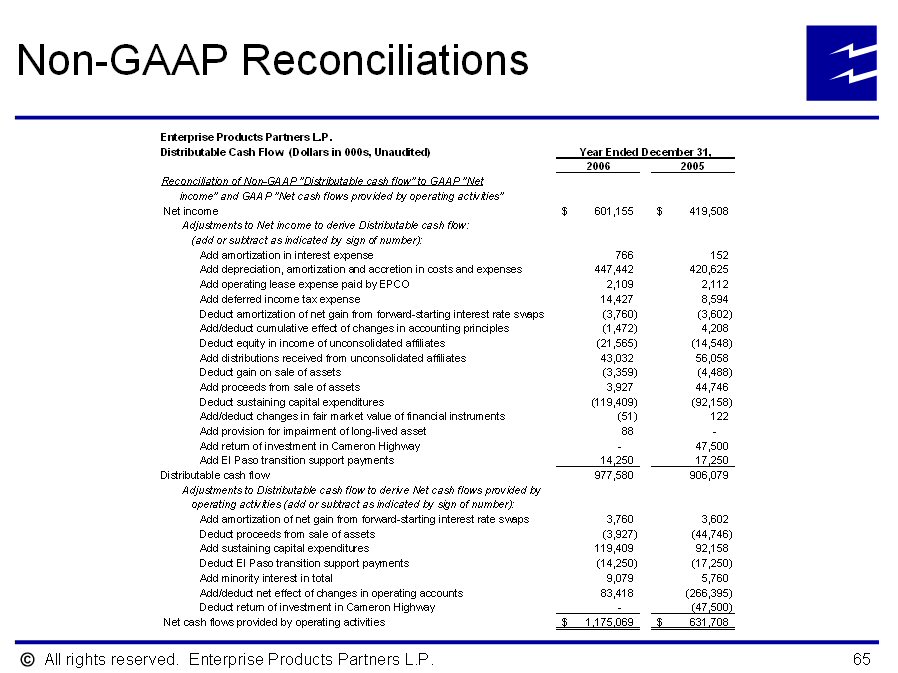

| Use of Non-GAAP Financial Measures This presentation utilizes the Non-GAAP financial measures of Gross Operating Margin, EBITDA, Distributable Cash Flow and Consolidated EBITDA. In general, we define Gross Operating Margin as operating income before (i) depreciation, amortization and accretion expense; (ii) operating lease expense for which we do not have the payment obligation; (iii) gains and losses on the sale of assets and (iv) general and administrative expenses. We define EBITDA as net income or loss before interest; provision for income taxes; and depreciation, amortization and accretion expense. In general, we define Distributable Cash Flow as net income or loss plus (i) depreciation, amortization and accretion expense; (ii) operating lease expense for which we do not have the payment obligation; (iii) cash distributions received from unconsolidated affiliates less equity in the earnings of such affiliates; (iv) the subtraction of sustaining capital expenditures; (v) gains and losses on the sale of assets; (vi) cash proceeds from the sale of assets or return of investment from unconsolidated affiliates; (vii) gains or losses on monetization of financial instruments recorded in Accumulated Other Comprehensive Income less related amortization of such amount to earnings; (viii) transition support payments received from El Paso related to the GTM Merger; (ix) the addition of losses or subtraction of gains related to other miscellaneous non-cash amounts affecting net income for the period; and (x) the addition of minority interest amounts related to the public unitholders of Duncan Energy Partners L.P. less cash distributions to such unitholders. Distributable Cash Flow is a significant liquidity metric used by our senior management to compare basic cash flows generated by us to the cash distributions we expect to pay partners. Distributable Cash Flow is also an important Non-GAAP financial measure for our limited partners since it serves as an indicator of our success in providing a cash return on investment. Distributable Cash Flow is also a quantitative standard used by the investment community with respect to publicly traded partnerships such as ours because the value of a partnership unit is in part measured by its yield (which in turn is based on the amount of cash distributions a partnership pays to a unit holder). The GAAP measure most directly comparable to Distributable Cash Flow is net cash flows provided by operating activities. This presentation also includes references to Consolidated EBITDA, which is a term defined in the $1.25 billion revolving credit facility of Enterprise Products Operating L.P. (“EPOLP”), EPD’s operating subsidiary. Consolidated EBITDA is used by certain of our lenders to evaluate our ability to support debt service. The GAAP measure most directly comparable to Consolidated EBITDA is net cash provided by operating activities. Please see slides 63 through 66 for our calculations of these Non-GAAP financial measures along with the appropriate reconciliations. |

| Meeting Agenda 1. Randy Fowler – Welcome / Introduction 2. James H. Lytal – Natural Gas Pipelines / Storage / Offshore 3. A.J. “Jim” Teague – NGLs / Rockies Projects / LPG / Natural Gas Marketing 4. Gil H. Radtke – Petrochemical / Octane Enhancement 5. Randy Fowler – Financial Overview / Closing Remarks 6. Q&A |

| Natural Gas Pipelines / Storage and Offshore James H. Lytal |

| Gas Pipelines, Storage & Offshore Natural Gas Gathering & Transportation Provide “best in class” wellhead services Position for high growth / low risk developments Feed the value chain; maximize basis differentials Natural Gas Storage Economically expand existing facilities Link to existing infrastructure Benefit from increased demand / price volatility Offshore Pipelines and Platforms Implement final stages of Independence Project |

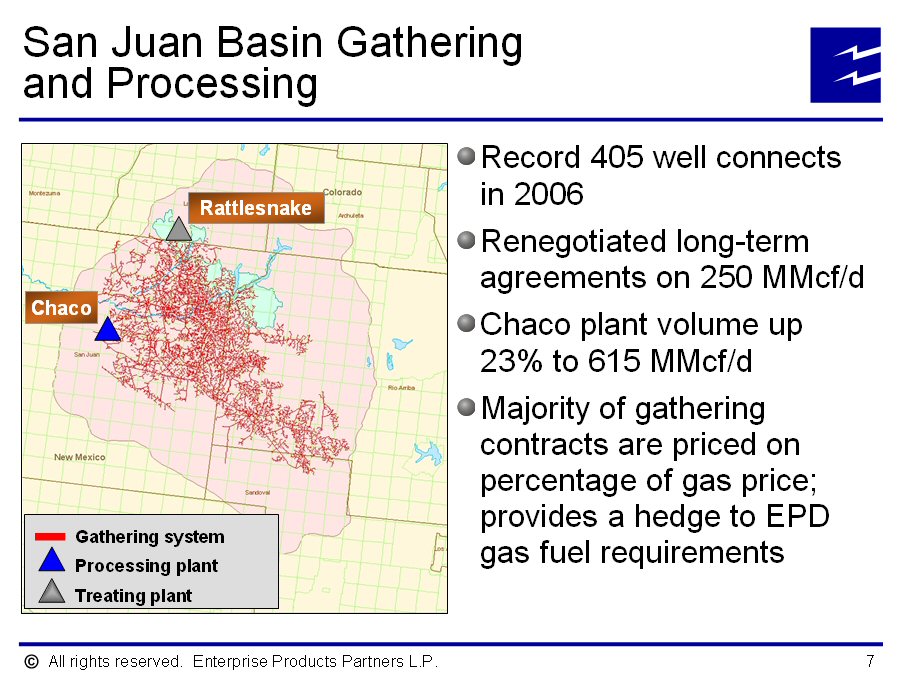

| San Juan Basin Gathering and Processing Record 405 well connects in 2006 Renegotiated long-term agreements on 250 MMcf/d Chaco plant volume up 23% to 615 MMcf/d Majority of gathering contracts are priced on percentage of gas price; provides a hedge to EPD gas fuel requirements |

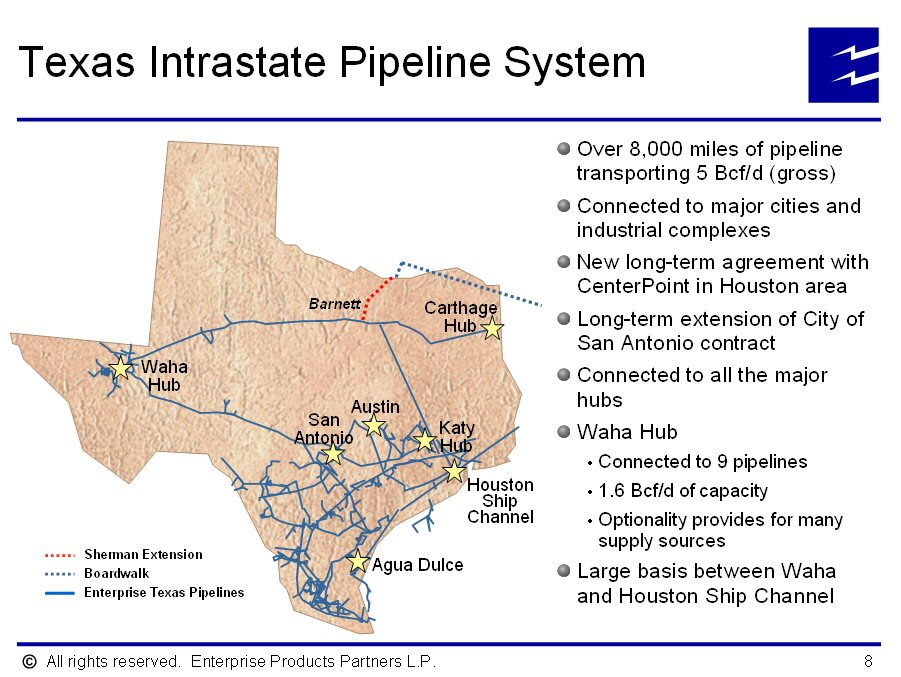

| Texas Intrastate Pipeline System Over 8,000 miles of pipeline transporting 5 Bcf/d (gross) Connected to major cities and industrial complexes New long-term agreement with CenterPoint in Houston area Long-term extension of City of San Antonio contract Connected to all the major hubs Waha Hub Connected to 9 pipelines 1.6 Bcf/d of capacity Optionality provides for many supply sources Large basis between Waha and Houston Ship Channel |

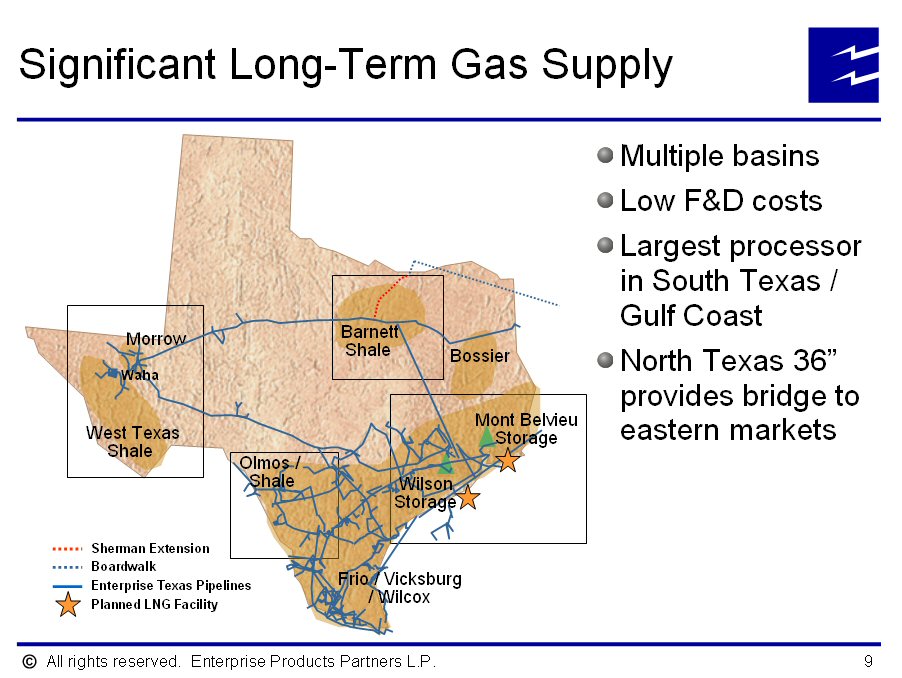

| Significant Long-Term Gas Supply Multiple basins Low F&D costs Largest processor in South Texas / Gulf Coast North Texas 36” provides bridge to eastern markets |

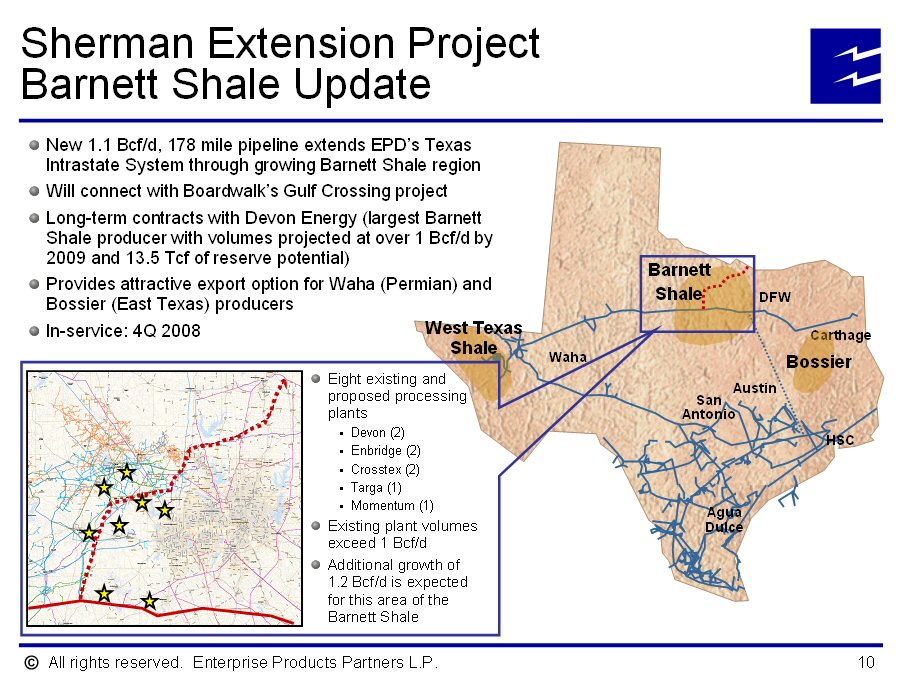

| Sherman Extension Project Barnett Shale Update New 1.1 Bcf/d, 178 mile pipeline extends EPD’s Texas Intrastate System through growing Barnett Shale region Will connect with Boardwalk’s Gulf Crossing project Long-term contracts with Devon Energy (largest Barnett Shale producer with volumes projected at over 1 Bcf/d by 2009 and 13.5 Tcf of reserve potential) Provides attractive export option for Waha (Permian) and Bossier (East Texas) producers In-service: 4Q 2008 Eight existing and proposed processing plants Devon (2) Enbridge (2) Crosstex (2) Targa (1) Momentum (1) Existing plant volumes exceed 1 Bcf/d Additional growth of 1.2 Bcf/d is expected for this area of the Barnett Shale |

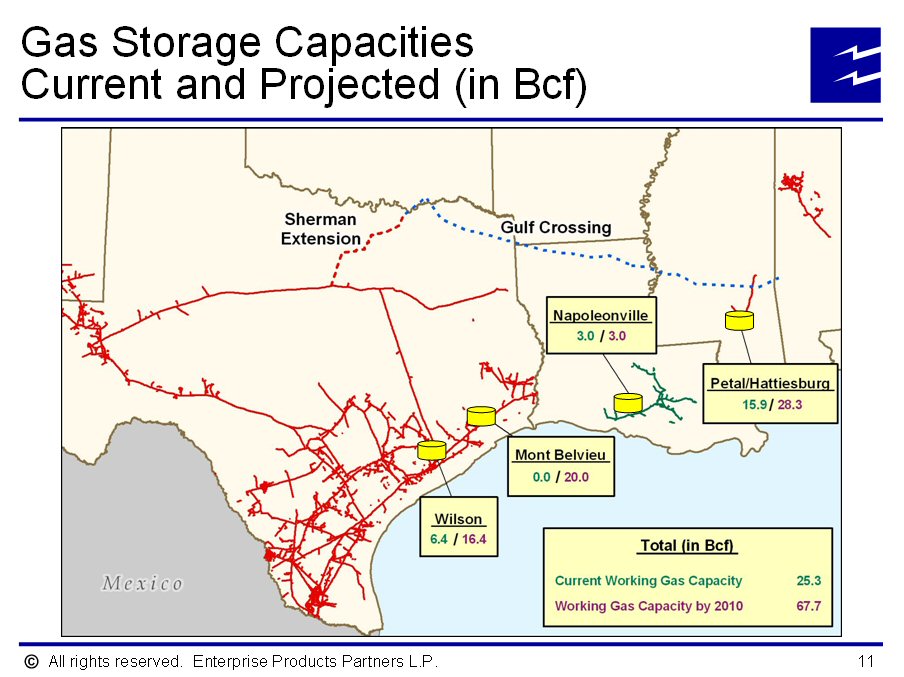

| Gas Storage Capacities Current and Projected (in Bcf) |

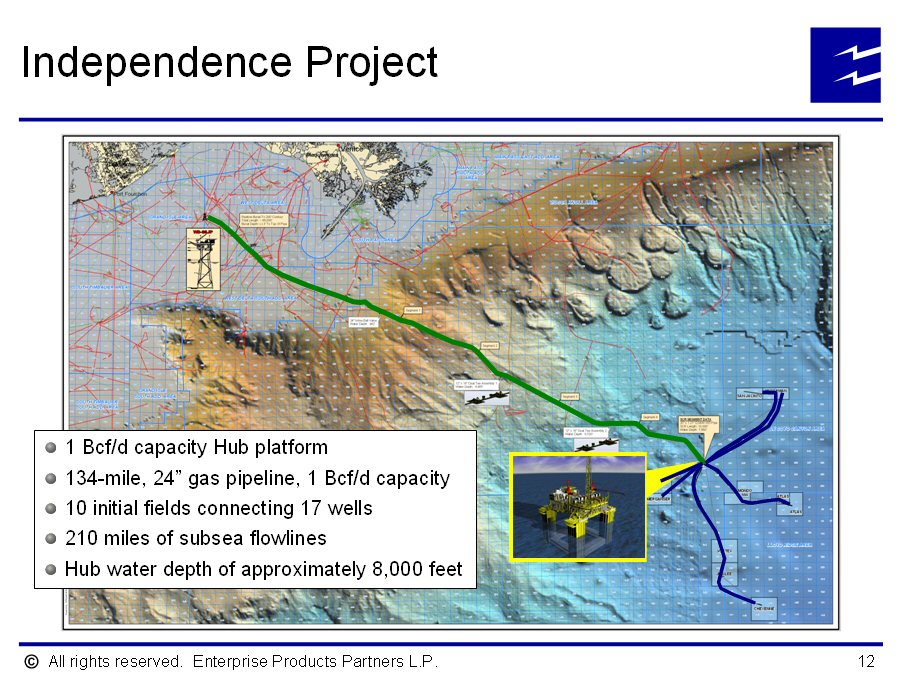

| Independence Project 1 Bcf/d capacity Hub platform 134-mile, 24” gas pipeline, 1 Bcf/d capacity 10 initial fields connecting 17 wells 210 miles of subsea flowlines Hub water depth of approximately 8,000 feet |

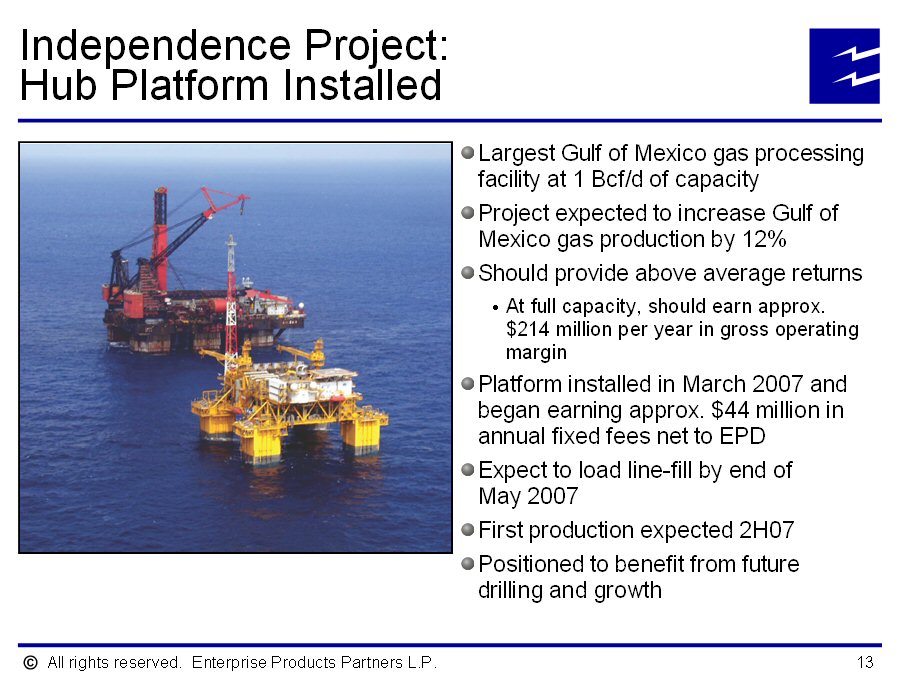

| Independence Project: Hub Platform Installed Largest Gulf of Mexico gas processing facility at 1 Bcf/d of capacity Project expected to increase Gulf of Mexico gas production by 12% Should provide above average returns At full capacity, should earn approx. $214 million per year in gross operating margin Platform installed in March 2007 and began earning approx. $44 million in annual fixed fees net to EPD Expect to load line-fill by end of May 2007 First production expected 2H07 Positioned to benefit from future drilling and growth |

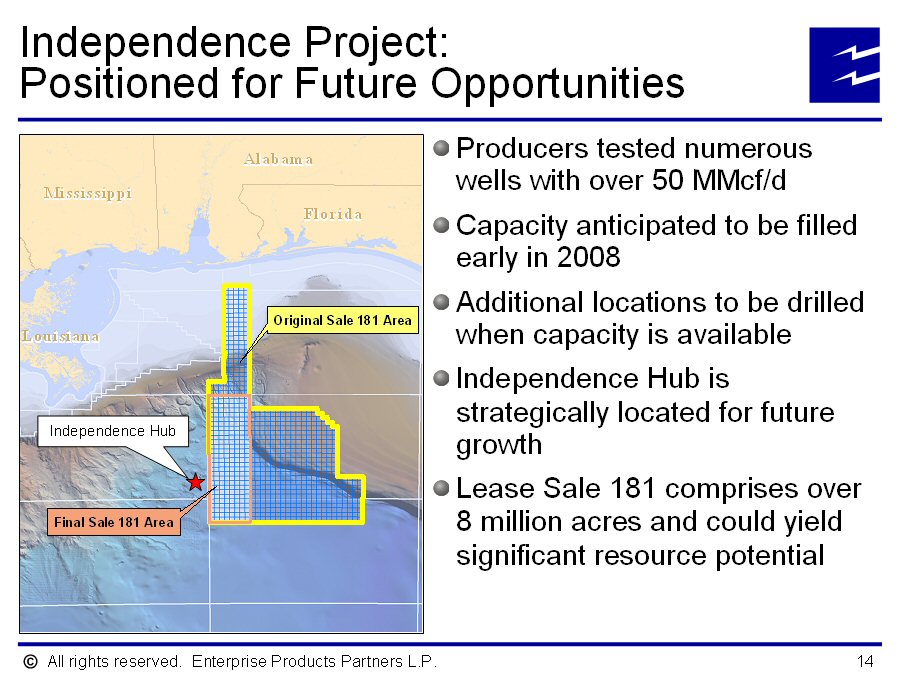

| Independence Project: Positioned for Future Opportunities Producers tested numerous wells with over 50 MMcf/d Capacity anticipated to be filled early in 2008 Additional locations to be drilled when capacity is available Independence Hub is strategically located for future growth Lease Sale 181 comprises over 8 million acres and could yield significant resource potential |

| NGL Services and Marketing and Natural Gas Services and Marketing A.J. “Jim” Teague |

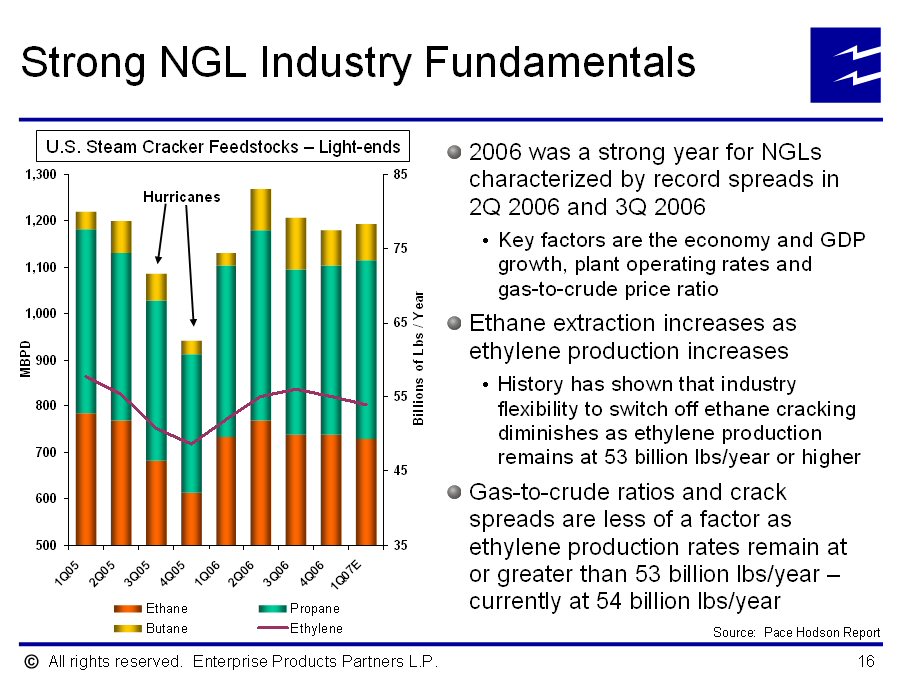

| Strong NGL Industry Fundamentals 2006 was a strong year for NGLs characterized by record spreads in 2Q 2006 and 3Q 2006 Key factors are the economy and GDP growth, plant operating rates and gas-to-crude price ratio Ethane extraction increases as ethylene production increases History has shown that industry flexibility to switch off ethane cracking diminishes as ethylene production remains at 53 billion lbs/year or higher Gas-to-crude ratios and crack spreads are less of a factor as ethylene production rates remain at or greater than 53 billion lbs/year – currently at 54 billion lbs/year |

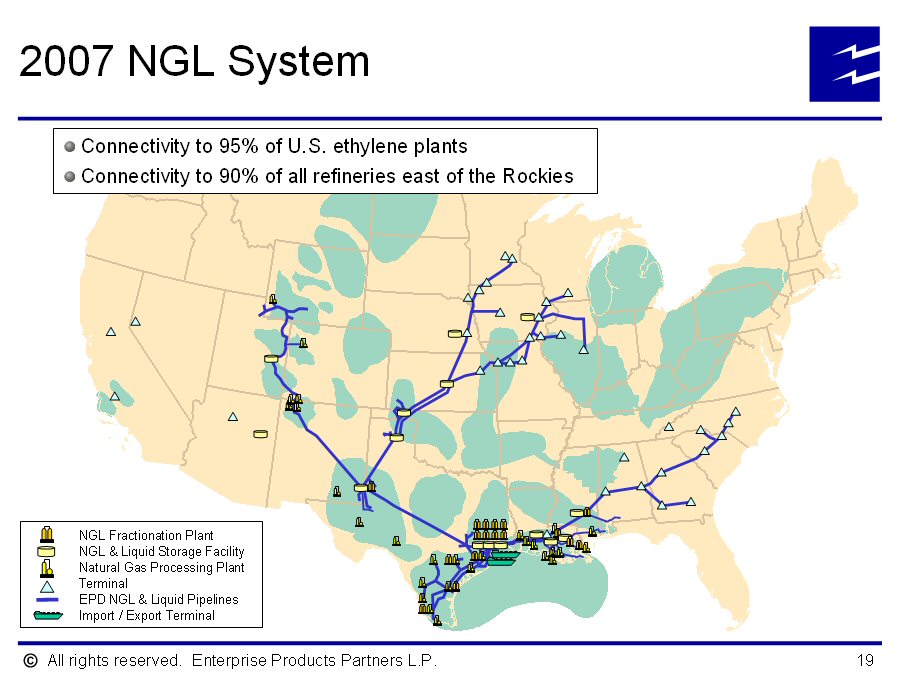

| NGL System Defining Characteristics Unparalleled supply system Green River Permian Western Canada Piceance Mid-Continent International Uintah South Texas Four Corners Gulf of Mexico Premier market connectivity Refinery Concentration National Footprint Petrochemical Access International Reach Heating Market |

| NGL System Defining Characteristics Mont Belvieu Hub Anchors NGL system Largest NGL fractionation complex Largest storage network Largest distribution system International reach Swing strength of footprint Storage in multiple locations Wheeling through supply source diversity Arbitrage through system reach Wealth of information Enterprise serves every NGL application and the largest producing basins |

| 2007 NGL System Connectivity to 95% of U.S. ethylene plants Connectivity to 90% of all refineries east of the Rockies |

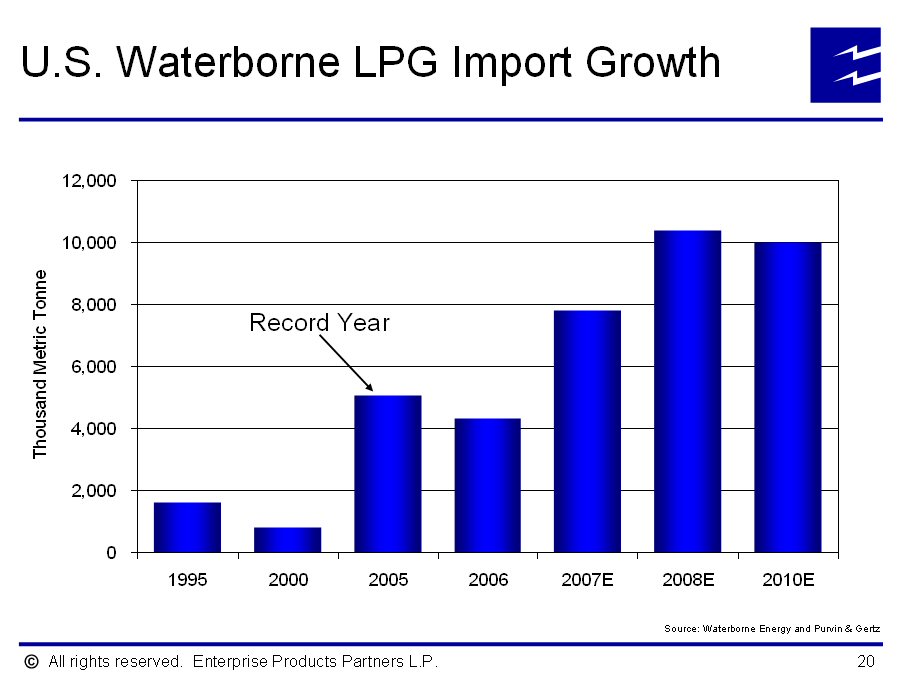

| U.S. Waterborne LPG Import Growth |

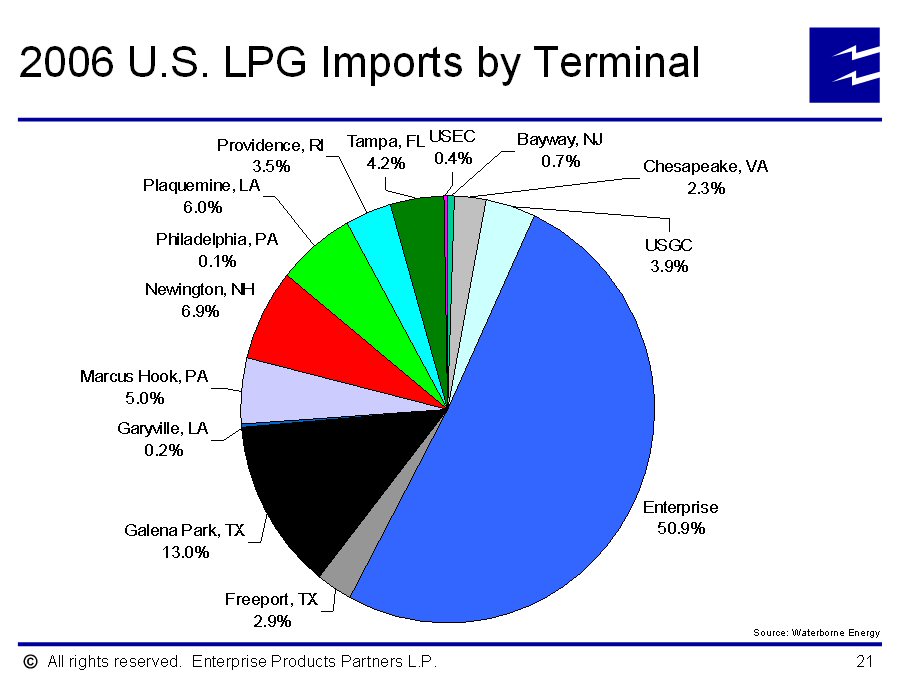

| 2006 U.S. LPG Imports by Terminal |

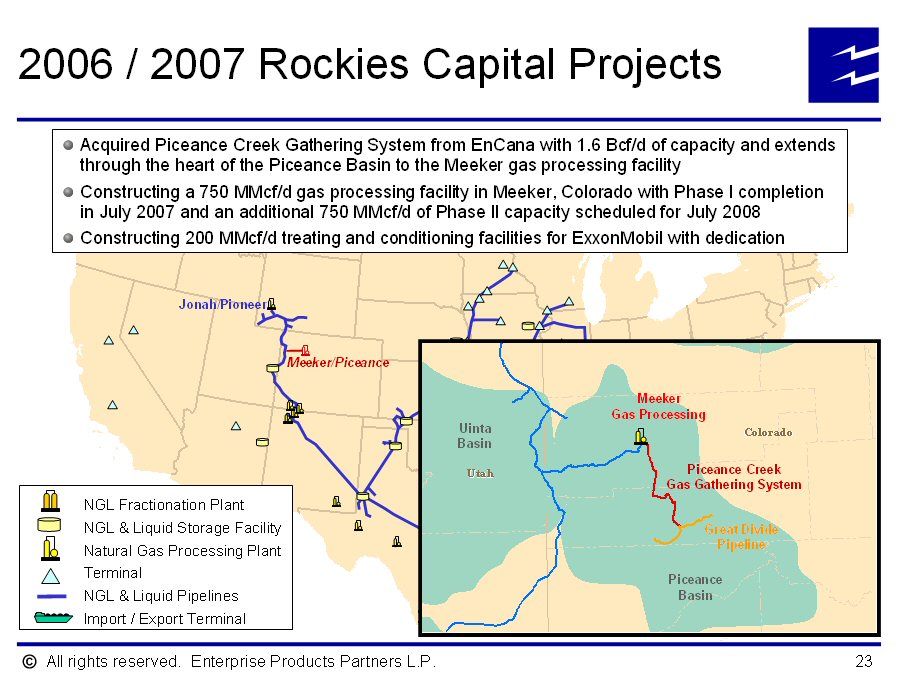

| 2006 / 2007 Rockies Capital Projects Constructing the 750 MMcf/d Pioneer gas processing facility in southwest Wyoming with completion in October 2007 Acquired interest in Jonah Gas Gathering System and currently expanding capacity to 2.3 Bcf/d with completion by late 2007 |

| 2006 / 2007 Rockies Capital Projects Acquired Piceance Creek Gathering System from EnCana with 1.6 Bcf/d of capacity and extends through the heart of the Piceance Basin to the Meeker gas processing facility Constructing a 750 MMcf/d gas processing facility in Meeker, Colorado with Phase I completion in July 2007 and an additional 750 MMcf/d of Phase II capacity scheduled for July 2008 Constructing 200 MMcf/d treating and conditioning facilities for ExxonMobil with dedication |

| 2006 / 2007 Rockies Capital Projects MAPL Expansion Strategically positioned to benefit from growth in Rockies natural gas and NGL production Tied to all significant current and future processing plants in Rockies Signed long-term dedication agreements with all but one shipper Competitive rate structure supports extraction economics and access to Mid-Continent, West Texas and Gulf Coast fractionation / storage markets Flexible incentive rate design 50 MBPD Phase I expansion nearing completion Pipeline looping (161 miles) in the ground (30 MBPD) Over 60% of pump station completed; on track for September 2007 (20 MBPD) |

| 2006 / 2007 Mid-Continent Capital Projects Constructing new NGL fractionator in Hobbs, New Mexico with 75 MBPD capacity for Rocky Mountains growth and operational in September 2007 Constructing new 70-mile batch-service pipeline from Hobbs to Odessa to exclusively supply Huntsman / Flint Hills ethylene facility with ethane and propane; completion by May 2008 Expanding MAPL Central System to optimize north and south flexibility |

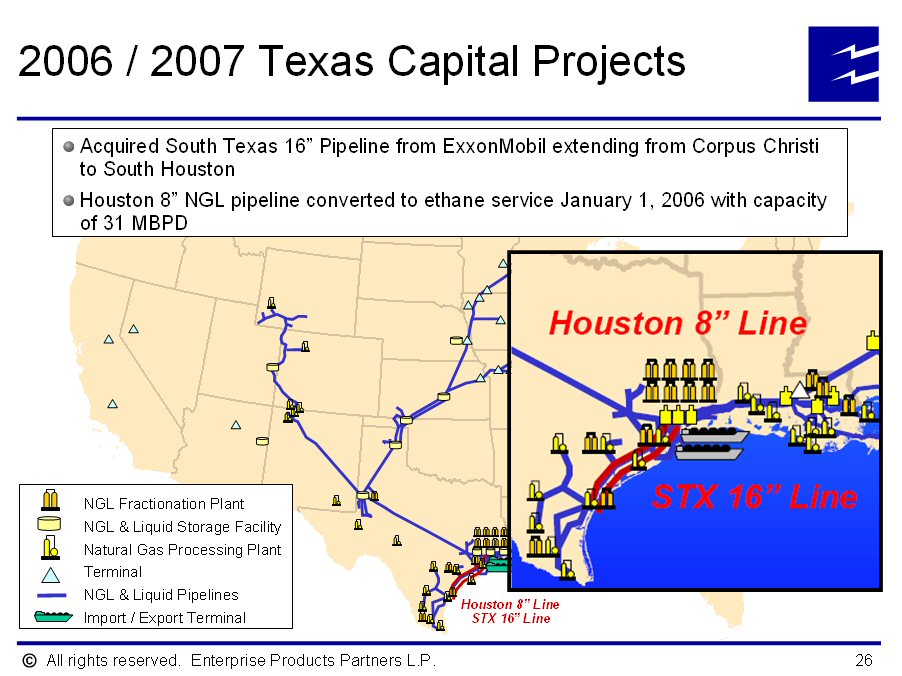

| 2006 / 2007 Texas Capital Projects Acquired South Texas 16” Pipeline from ExxonMobil extending from Corpus Christi to South Houston Houston 8” NGL pipeline converted to ethane service January 1, 2006 with capacity of 31 MBPD |

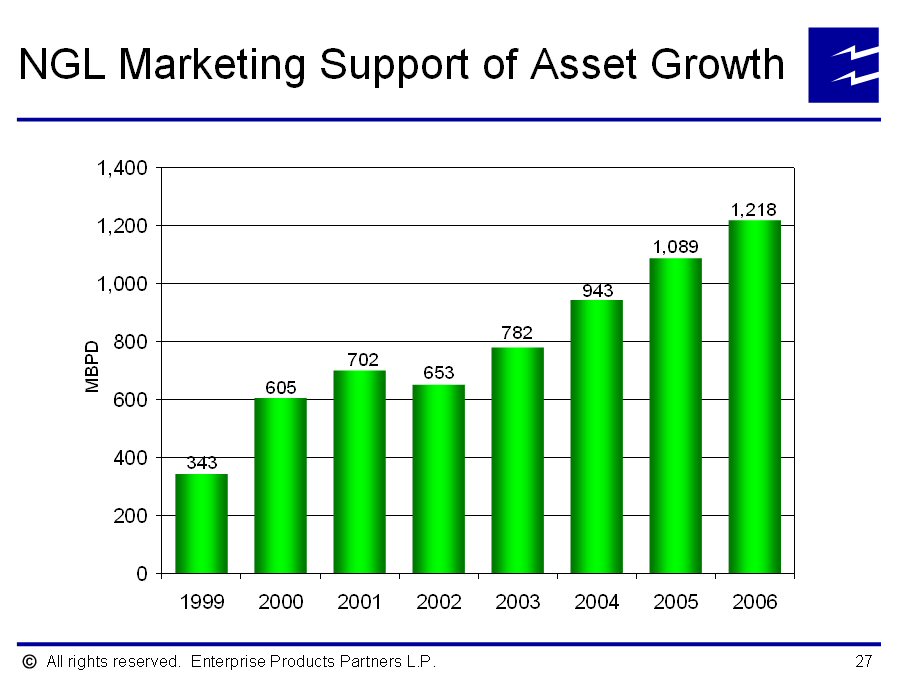

| NGL Marketing Support of Asset Growth |

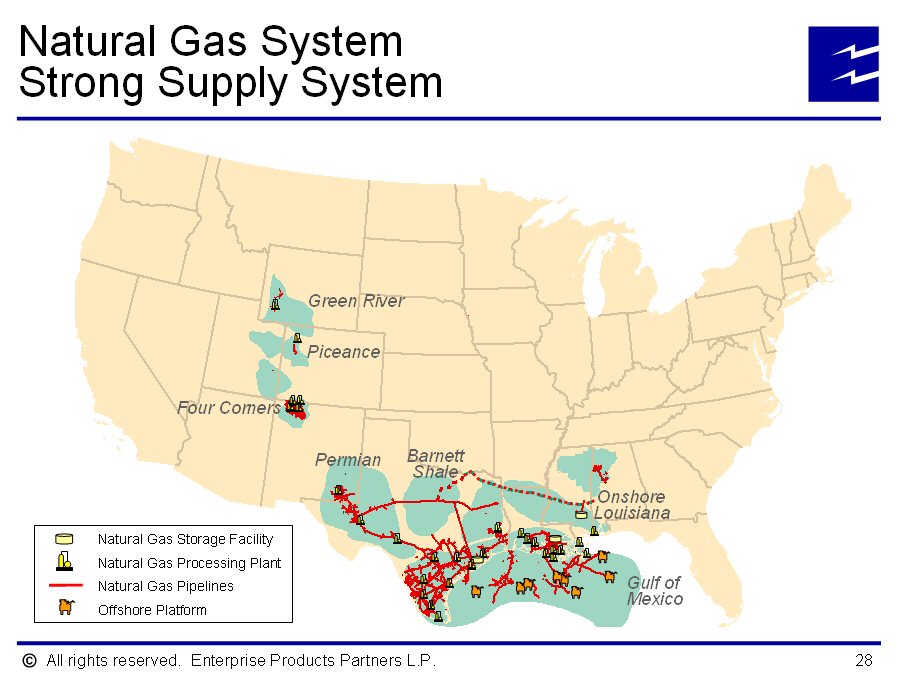

| Natural Gas System Strong Supply System |

| Rocky Mountain Market Connectivity Jonah / Pinedale / Pioneer Interstate Interconnects (2.5 Bcf/d) CIG Rockies Express NWPL Kern River Piceance / Meeker Interstate Interconnects (1.5 Bcf/d) Questar Rockies Express WIC TransColorado CIG San Juan / Chaco Interstate Interconnects (1.1 Bcf/d) Transwestern El Paso |

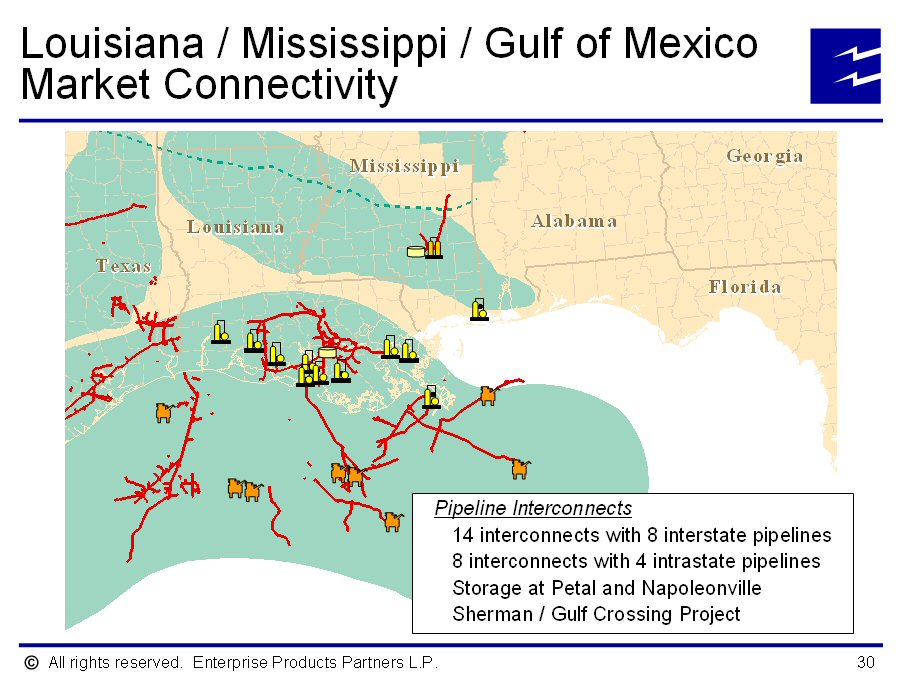

| Louisiana / Mississippi / Gulf of Mexico Market Connectivity Pipeline Interconnects 14 interconnects with 8 interstate pipelines 8 interconnects with 4 intrastate pipelines Storage at Petal and Napoleonville Sherman / Gulf Crossing Project |

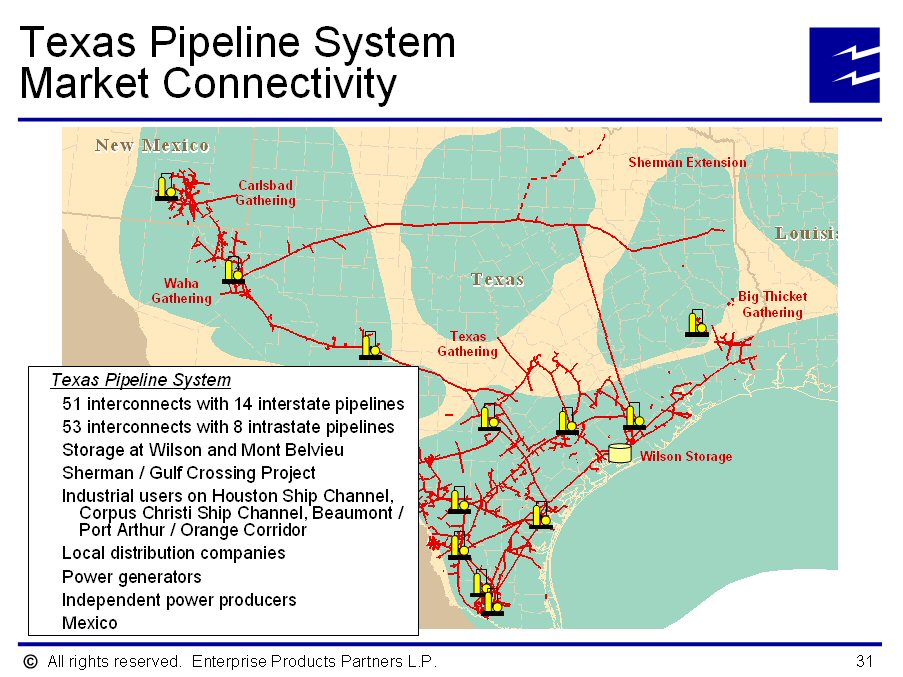

| Texas Pipeline System Market Connectivity Texas Pipeline System 51 interconnects with 14 interstate pipelines 53 interconnects with 8 intrastate pipelines Storage at Wilson and Mont Belvieu Sherman / Gulf Crossing Project Industrial users on Houston Ship Channel, Corpus Christi Ship Channel, Beaumont / Port Arthur / Orange Corridor Local distribution companies Power generators Independent power producers Mexico |

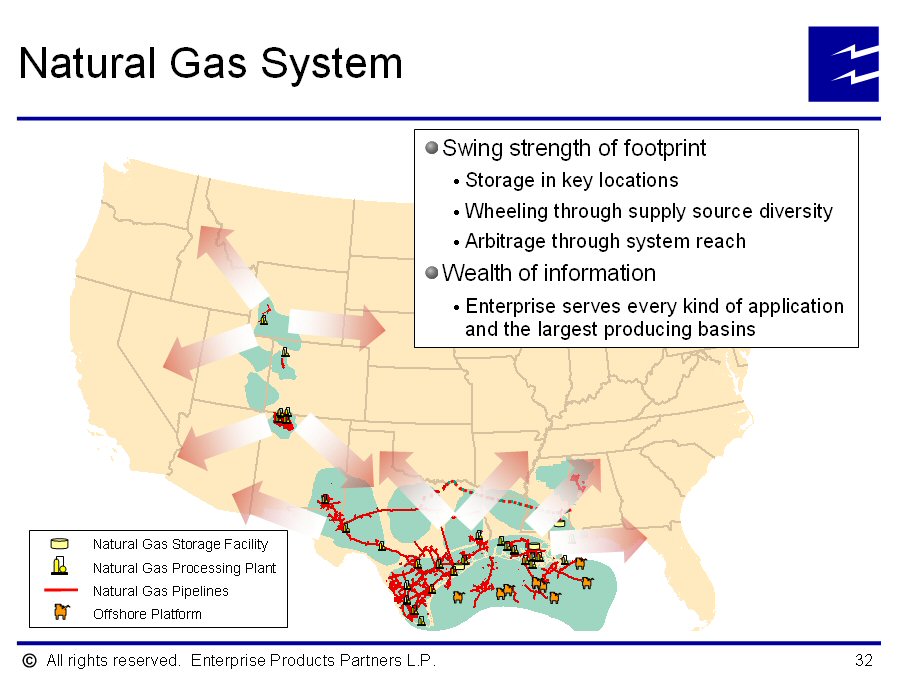

| Natural Gas System Swing strength of footprint Storage in key locations Wheeling through supply source diversity Arbitrage through system reach Wealth of information Enterprise serves every kind of application and the largest producing basins |

| Petrochemical Services Gil H. Radtke |

| 2007 Petrochemical Outlook Petrochemicals (billion pounds and growth) Ethylene US Global – 06 Demand 55 3.1% 242 5.1% – 07 Forecast 55 0.5% 251 3.8% Propylene – 06 Demand 36 2.5% 159 5.5% – 07 Forecast 37 2.3% 168 5.8% Big concentration of new ethylene crackers in Middle East. Far East and Europe expected to absorb this new production until 2009. Capital costs have doubled and tripled in some cases for some of these new facilities. |

| Petrochemical Services Overview Petrochemical group consists of 5 businesses Butane isomerization (116 MBPD capacity) Propylene fractionation (currently 4.4 billion pounds or 65 MBPD, net capacity) Mont Belvieu hydrocarbon storage (104 MMbbls of usable capacity) Propylene and HP isobutane pipelines Octane enhancement (currently 12 MBPD capacity) |

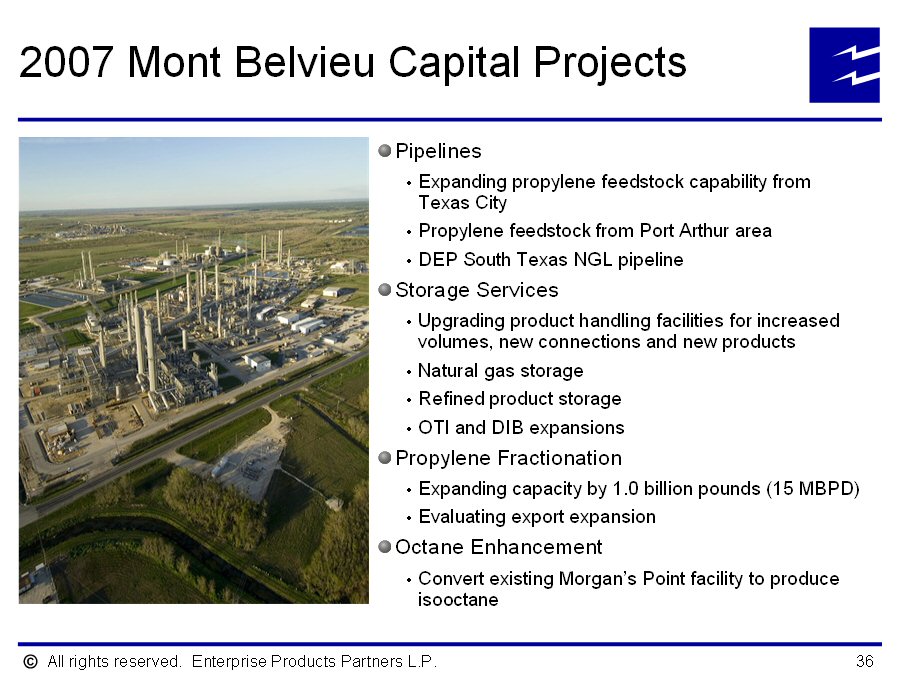

| 2007 Mont Belvieu Capital Projects Pipelines Expanding propylene feedstock capability from Texas City Propylene feedstock from Port Arthur area DEP South Texas NGL pipeline Storage Services Upgrading product handling facilities for increased volumes, new connections and new products Natural gas storage Refined product storage OTI and DIB expansions Propylene Fractionation Expanding capacity by 1.0 billion pounds (15 MBPD) Evaluating export expansion Octane Enhancement Convert existing Morgan’s Point facility to produce isooctane |

| Butane Isomerization Service Isomerization is the process of converting normal butane to high purity isobutane EPD has a combined capacity of 116 MBPD 57 MBPD (49%) is committed under long-term third-party processing contracts with escalation provisions on the fees and 20 MBPD is used as feedstock for our octane enhancement facility Variations in volumes are typically caused by plant turnarounds and spot opportunities, but overall results are very steady |

| Isomerization Business Outlook Stable demand from long-term contracts base loads isomerization business EPD has available capacity to service future growth in isobutane demand and seasonal demand for gasoline without investing new capital Expect increase in demand for isobutane as premium gasoline components such as isooctane and alkylate will be required for blending into gasoline (isobutane is major component of isooctane and alkylate) |

| Propylene Fractionation Propylene splitters take refinery-grade propylene (RGP) and fractionate it into polymer-grade propylene (PGP) or chemical-grade propylene (CGP) and propane RGP is typically 60–75% propylene with the balance primarily propane RGP is referred to in barrels per day (BPD) of feed and PGP is referred to in millions of pounds (MMlbs) of production One barrel of propylene is equal to approximately 183 lbs. |

| Propylene Assets We own and operate 3 polymer-grade propylene fractionation (“splitter”) facilities with approximately 4.8 billion pounds per year (72 MBPD) of polymer-grade propylene production capacity (our share is 3.9 billion pounds) Basell owns approximately 45% of Splitter 1 and leases this capacity to us TOTAL Petrochemical owns 33% of Splitter 3 and takes its share of production to its polypropylene facility in LaPorte, Texas All 3 facilities are located at our Mont Belvieu site and are integrated into our other facilities including underground storage We own a 30% interest in a 1.5 billion pounds per year (22.5 MBPD) chemical-grade propylene splitter in Baton Rouge, Louisiana EPD designed, constructed and operates the facility ExxonMobil has 70% ownership, is the business manager, supplies the feedstock and is the major customer |

| Propylene Outlook Propylene primarily sourced from refineries (to splitters) and as a co-product from steam crackers 2007 world demand expected to be 168 billion pounds 2007 North American demand expected to be 37 billion pounds World propylene demand expected to grow at roughly 5–6% per year and U.S. growth expected to be 2–3% per year (grows faster than ethylene) Future steam cracker investments insufficient to meet demand (mostly ethane based with low propylene yield) U.S. refinery expansions will help feed the demand growth |

| Propylene Expansion Includes the necessary improvements to pipelines, storage and measurement facilities Capacity: 1.0 billion pounds Expandable to 1.5 billion pounds Completion in 3Q 2007 Utilization ramping up to 60% in 2008, 80% in 2009 and 100% in 2010 forward Processing and sales margins of 3.1 cents per pound Incremental operating costs of 0.9 cents per pound |

| Octane Enhancement EPD owns a facility at Mont Belvieu that produces octane additives for motor gasoline Produced and sold isooctane in 2006 under contract at NYMEX RBOB plus pricing Allowed us to hedge our sales through 4Q 2006 We expect to execute the same hedge program in 2007 Also produce isobutylene mix for use as an additive for lube oil blending This contract priced at normal butane plus |

| Isooctane Only the second plant of its kind in the world; in place in advance of the phase out of MTBE Isooctane capacity: 12 MBPD Feedstock comes from our isomerization business Requires 2 gallons of high-purity isobutane to produce 1 gallon of isooctane Engineering work underway for the restart of sister facility at Morgan’s Point with capacity to produce 9 MBPD of isooctane |

| Ethanol Drives Demand for Isooctane 2005 Energy Bill effectively removed MTBE from U.S. gasoline market Significant octane loss with 6.0 lbs. vapor pressure Corresponding Renewable Fuels Standard (RFS) mandated ethanol usage Blends to higher vapor pressure of 15.0 lbs. Forces removal of higher vapor pressure components from gasoline blending such as butanes and pentanes Refineries need new blending components that combine high octane and very low vapor pressure Isooctane combines 99.5 octane with 2.0 lbs. vapor pressure |

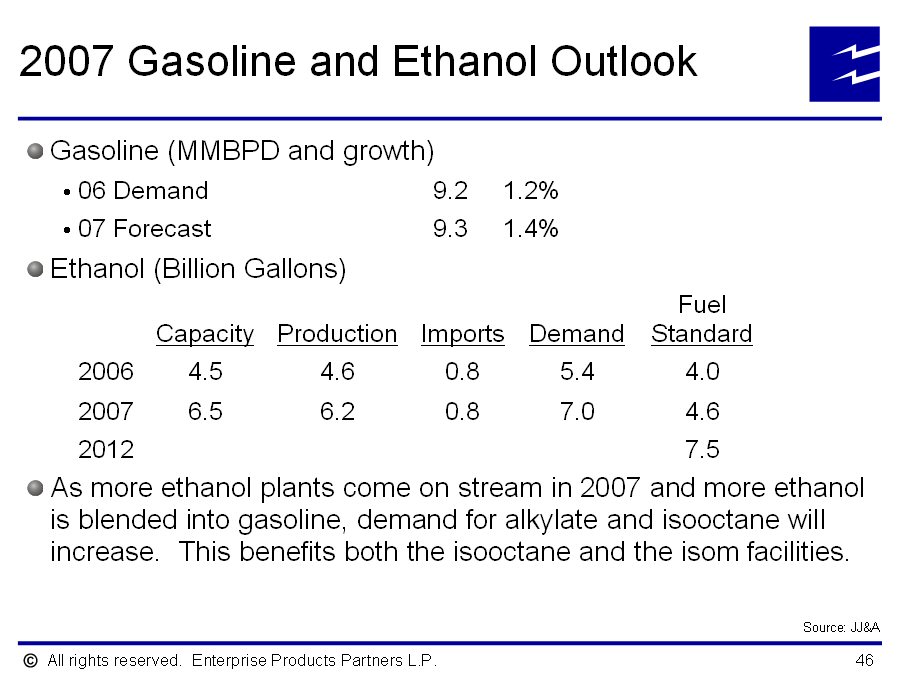

| 2007 Gasoline and Ethanol Outlook Gasoline (MMBPD and growth) 06 Demand 9.2 1.2% 07 Forecast 9.3 1.4% Ethanol (Billion Gallons) As more ethanol plants come on stream in 2007 and more ethanol is blended into gasoline, demand for alkylate and isooctane will increase. This benefits both the isooctane and the isom facilities. |

| Financial Overview Randy Fowler |

| Financial Objectives Maintain a strong balance sheet and credit metrics that support investment grade credit ratings Key financial objective since IPO Increase cash flows from fee-based businesses Prudently invest to expand the partnership through organic growth, acquisitions and joint ventures with strategic partners Manage capital and distributable cash flow to strengthen balance sheet and provide financial flexibility |

| History of Financial Discipline Financial discipline while executing EPD’s growth strategy Financed 59% of $14.2 billion in capital investment since 1999 with equity (includes total estimate of capital investment for 2007) Retired $1.2 billion acquisition term loan used to finance the acquisition of the Mid-America and Seminole Pipelines in less than 7 months (5 months ahead of schedule) Financed 65% of $6 billion GTM merger with equity Successfully and rapidly integrated businesses after GTM merger – Refinanced GTM debt to reduce annual interest expense by approximately $50 million – Recognized merger synergies well in excess of street expectations Strong track record of management support EPCO, its affiliates and management have invested approximately $445 million in new equity issues since EPD’s IPO Eliminated 50% GP incentive distribution rights (IDRs) in December 2002 results in more cash being retained in partnership Strong coverage of distributions to limited partners 1.2x coverage since 1999 |

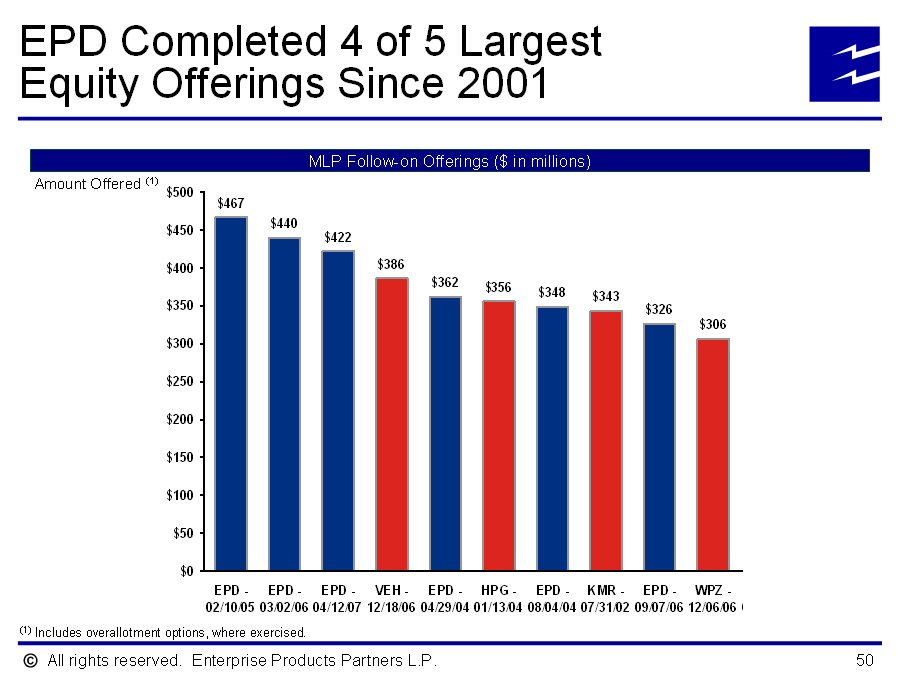

| EPD Completed 4 of 5 Largest Equity Offerings Since 2001 MLP Follow-on Offerings ($ in millions) Amount Offered (1) (1) Includes overallotment options, where exercised. |

| History of Financial Discipline 59% of Growth Investment Funded with Equity Growth capital investment includes the capital expenditures, cash used for business combinations, investments in and advances to unconsolidated affiliates, and acquisition of intangible asset amounts as reflected on our Statements of Consolidated Cash Flows for the respective periods. The value of equity interests granted to complete the GTM merger, the Shell Midstream acquisition and the Encinal acquisition, as reflected on our Statements of Consolidated Partners’ Equity, are also included. In addition, growth capital investment includes $2.0 billion of debt assumed in connection with the GTM merger. Sustaining capital expenditures are excluded. (2) Equity issued includes net proceeds from the issuance of common units and Class–B special units as reflected on our Statements of Consolidated Cash Flows for the respective periods.–Also included is the value of equity issued as consideration for the GTM merger, the Shell Midstream acquisition and the Encinal acquisition as reflected on our Statements of Consolidated Partners’ Equity. In addition, the equity content of our Hybrid securities is included in 2006. |

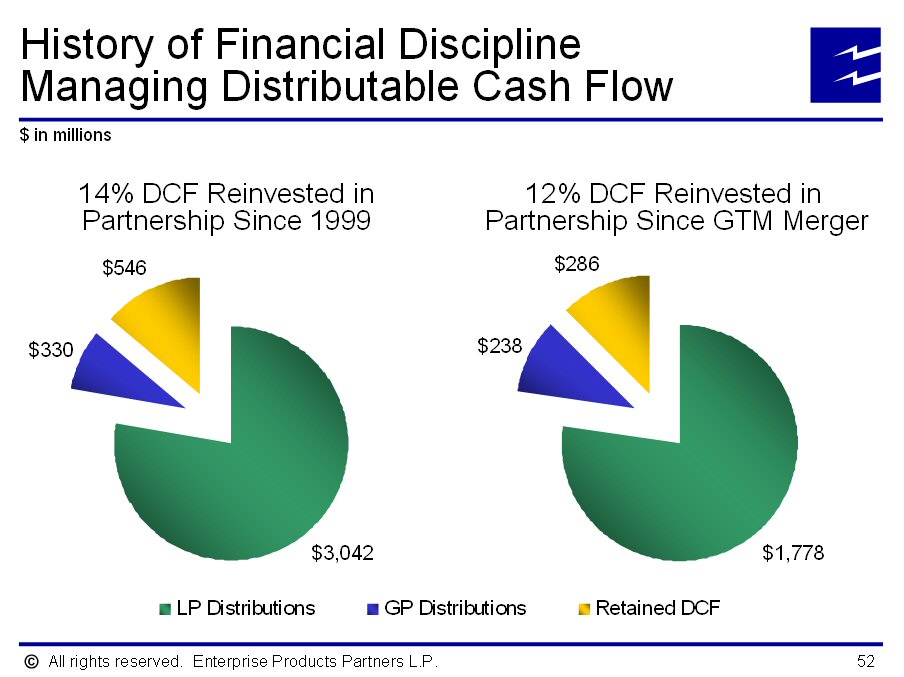

| History of Financial Discipline Managing Distributable Cash Flow 14% DCF Reinvested in Partnership Since 1999 12% DCF Reinvested in Partnership Since GTM Merger |

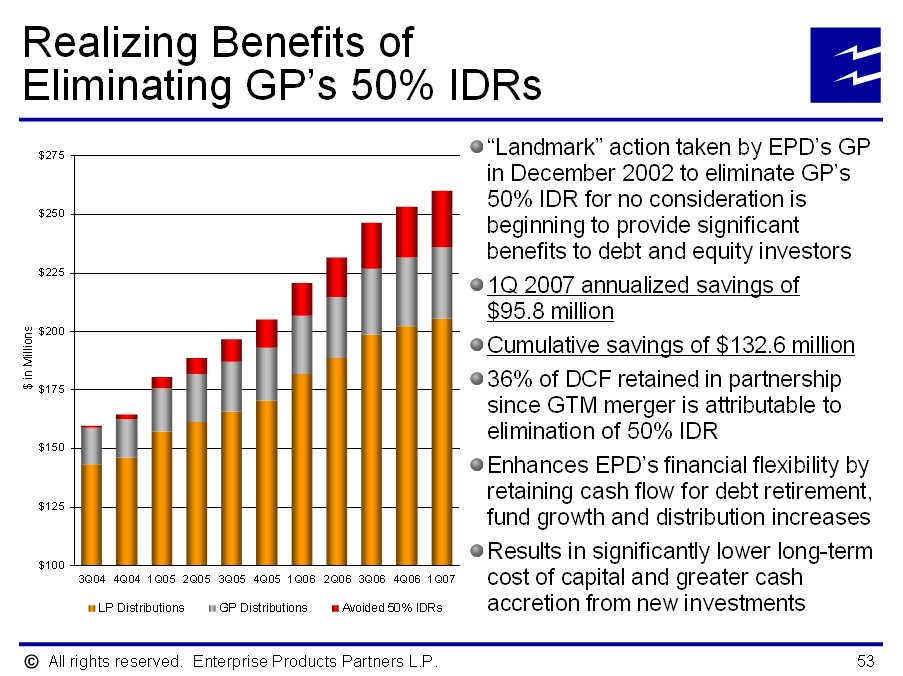

| Realizing Benefits of Eliminating GP’s 50% IDRs “Landmark” action taken by EPD’s GP in December 2002 to eliminate GP’s 50% IDR for no consideration is beginning to provide significant benefits to debt and equity investors 1Q 2007 annualized savings of $95.8 million Cumulative savings of $132.6 million 36% of DCF retained in partnership since GTM merger is attributable to elimination of 50% IDR Enhances EPD’s financial flexibility by retaining cash flow for debt retirement, fund growth and distribution increases Results in significantly lower long-term cost of capital and greater cash accretion from new investments |

| Strong Financial Position |

| Closing Remarks |

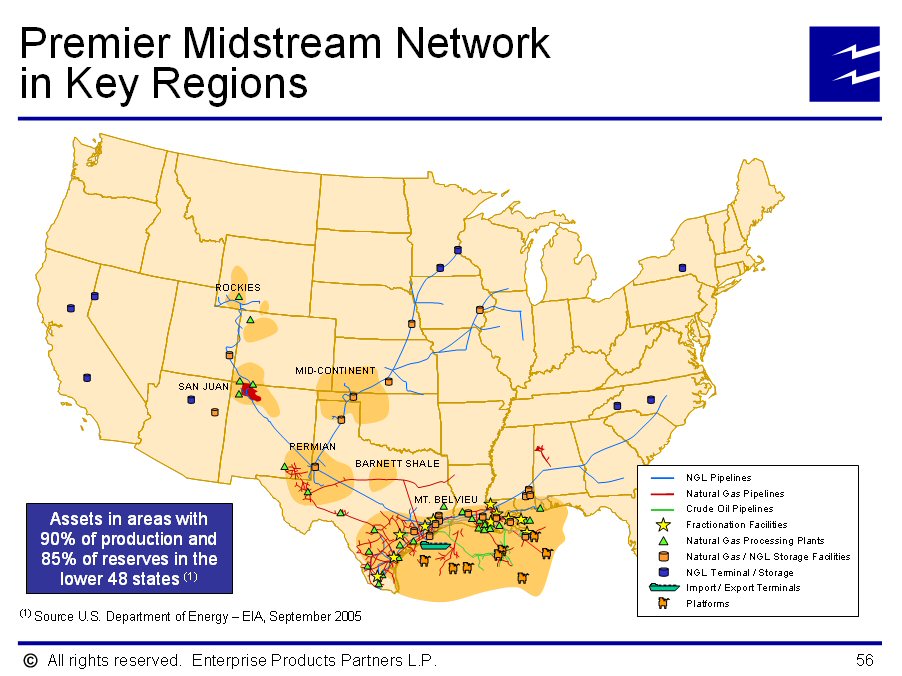

| Premier Midstream Network in Key Regions Assets in areas with 90% of production and 85% of reserves in the lower 48 states (1) |

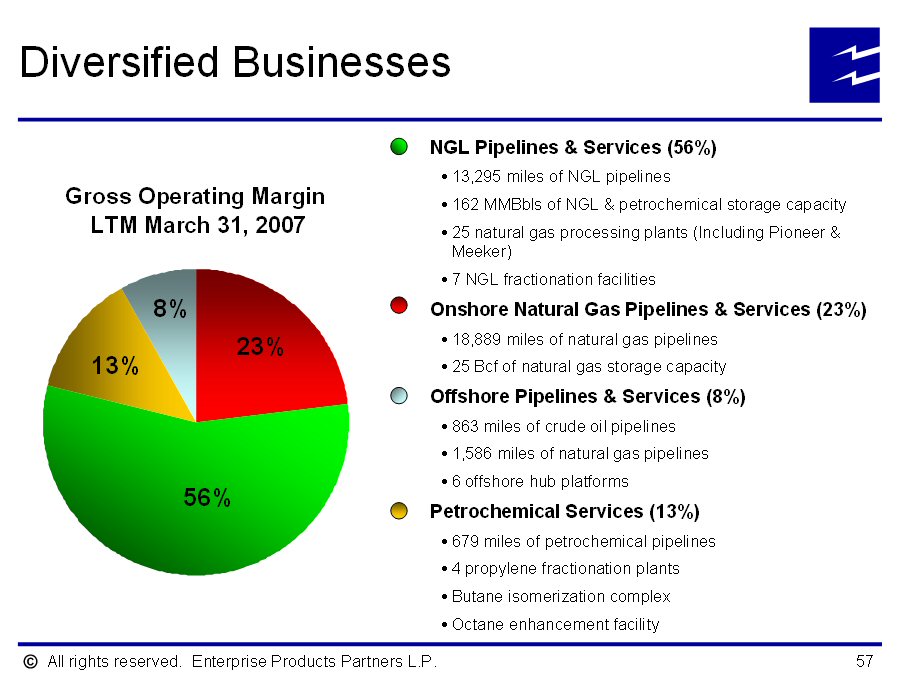

| Diversified Businesses Gross Operating Margin LTM March 31, 2007 NGL Pipelines & Services (56%) 13,295 miles of NGL pipelines 162 MMBbls of NGL & petrochemical storage capacity 25 natural gas processing plants (Including Pioneer & Meeker) 7 NGL fractionation facilities Onshore Natural Gas Pipelines & Services (23%) 18,889 miles of natural gas pipelines 25 Bcf of natural gas storage capacity Offshore Pipelines & Services (8%) 863 miles of crude oil pipelines 1,586 miles of natural gas pipelines 6 offshore hub platforms Petrochemical Services (13%) 679 miles of petrochemical pipelines 4 propylene fractionation plants Butane isomerization complex Octane enhancement facility |

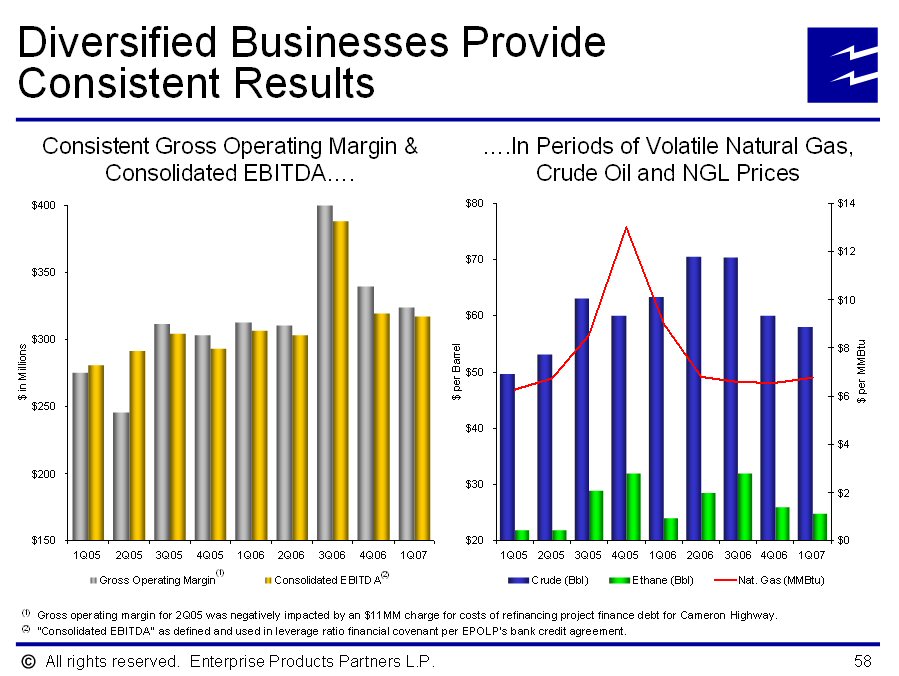

| Diversified Businesses Provide Consistent Results Consistent Gross Operating Margin & Consolidated EBITDA. In Periods of Volatile Natural Gas, Crude Oil and NGL Prices (1) Gross operating margin for 2Q05 was negatively impacted by an $11MM charge for costs of refinancing project finance debt for Cameron Highway. (2) “Consolidated EBITDA” as defined and used in leverage ratio financial covenant per EPOLP’s bank credit agreement. |

| EPD Delivered Record 2006 Results Gross Operating Margin 2006 vs. 2005 NGL Pipelines and Services up 30% due in part to record pipeline volumes, improved processing and fractionation margins Onshore Natural Gas Pipelines and Services down 6% despite volume and margin increases at Texas intrastate which was more than offset by lower gathering fees in San Juan for percent of index gathering contracts and repair expenses at Wilson storage facility Offshore Pipelines and Services up 33% due to increased oil and gas volumes after 2005 hurricanes Petrochemical Services up 37% due to strong demand by petrochemical industry and refinery demand for motor gasoline additives 2006 gross operating margin includes approximately $64 million of recoveries under business interruption insurance |

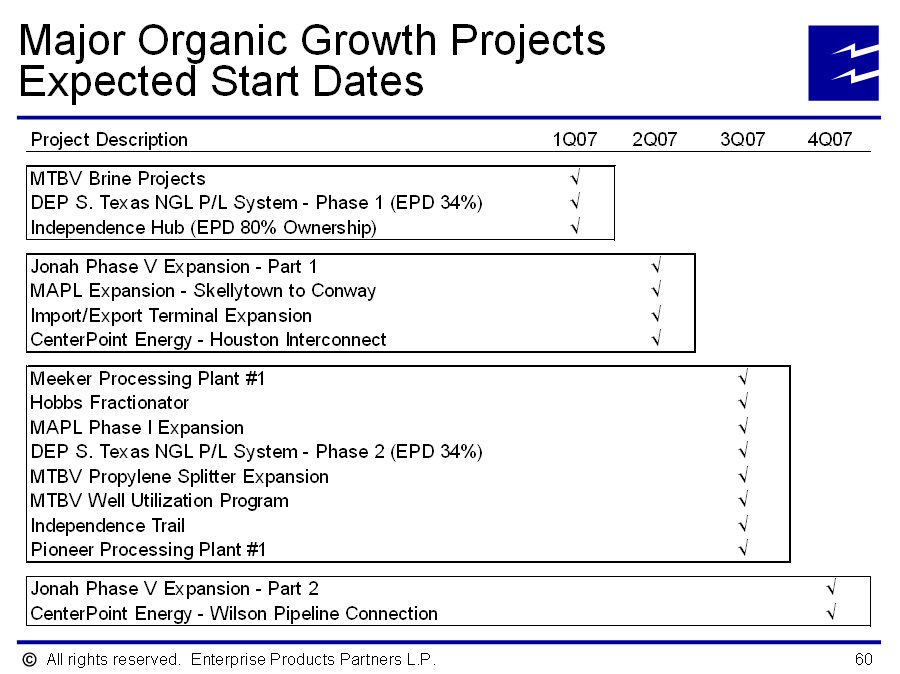

| Major Organic Growth Projects Expected Start Dates |

| 2007 Outlook Another year of strong operating fundamentals $2.5 billion of new projects begin operations $44 million of annualized demand charges net to EPD at Independence Hub platform began mid-March 2007 First production to Independence and majority of other projects expected to commence in 2H 2007 and start to contribute cash flow late 2007 and 2008 Ramp up of new projects in 2007 are key for improving on record 2006 performance Increase distribution rate to partners at year end 2007 to $1.99/unit based on current expectations |

| Non-GAAP Reconciliations |

| Non-GAAP Reconciliations |

| Non-GAAP Reconciliations |

| Non-GAAP Reconciliations |

| Non-GAAP Reconciliations |