UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 333-53603-03

GRAHAM PACKAGING HOLDINGS COMPANY

(Exact name of registrant as specified in its charter)

| | |

| Pennsylvania | | 23-2553000 |

(State or other jurisdiction of Incorporation or organization) | | (I.R.S. Employer Identification No.) |

2401 Pleasant Valley Road

York, Pennsylvania 17402

(717) 849-8500

(Address, including zip code, and telephone number, including

area code, of the registrant’s principal executive offices)

Securities Registered pursuant to Section 12(b) of the Act: None

Securities Registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes ¨ No x.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No ¨.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days, Yes ¨ No x.

The registrant has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | |

| Large accelerated filer | | | | ¨ | | Accelerated filer | | ¨ |

| | | | |

| Non-accelerated filer | | (Do not check if a smaller reporting company) | | x | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x.

There is no established public trading market for any of the general or limited partnership interests in the registrant. The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of March 10, 2009, was $-0-. As of March 10, 2009, the general partnership interests in the registrant were owned by BCP /Graham Holdings L.L.C. and Graham Packaging Corporation, and the limited partnership interests in the registrant were owned by BMP/Graham Holdings Corporation, certain members of the family of Donald C. Graham and entities controlled by them and a former member of management. See “Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.”

DOCUMENTS INCORPORATED BY REFERENCE

None.

GRAHAM PACKAGING HOLDINGS COMPANY

INDEX

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

All statements other than statements of historical facts included in this Annual Report on Form 10-K, including statements regarding the future financial position, economic performance and results of operations of the Company (as defined below), as well as the Company’s business strategy, budgets and projected costs and plans and objectives of management for future operations, and the information referred to under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (Part II, Item 7) and “Quantitative and Qualitative Disclosures About Market Risk” (Part II, Item 7A), are forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe” or “continue” or similar terminology. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about the Company’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond the Company’s control. Accordingly, readers are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable as of the date made, expectations may prove to have been materially different from the results expressed or implied by such forward-looking statements. Unless otherwise required by law, the Company also disclaims any obligation to update its view of any such risks or uncertainties or to announce publicly the result of any revisions to the forward-looking statements made in this report. Important factors that could cause actual results to differ materially from the Company’s expectations include, without limitation:

| | • | | the current global economic crisis; |

| | • | | the Company’s continuing net losses; |

| | • | | the terms of the Company’s debt instruments, which restrict the manner in which the Company conducts its business and may limit the Company’s ability to implement elements of its business strategy; |

| | • | | the Company’s indebtedness, which could adversely affect the Company’s cash flow; |

| | • | | that despite the Company’s current levels of indebtedness, the Company may incur additional debt in the future, which could increase the risks associated with the Company’s leverage; |

| | • | | the inability to renew the Company’s debt facilities; |

| | • | | the Company’s recovery of the carrying value of its assets; |

| | • | | the Company’s exposure to fluctuations in resin prices and its dependence on resin supplies; |

| | • | | risks associated with the Company’s international operations; |

| | • | | the Company’s dependence on significant customers and the risk that customers will not purchase the Company’s products in the amounts expected by the Company under their requirements contracts; |

| | • | | that the majority of the Company’s sales are made pursuant to requirements contracts; |

| | • | | a decline in prices of plastic packaging; |

| | • | | the Company’s ability to develop product innovations and improve the Company’s production technology and expertise; |

| | • | | infringement on the Company’s proprietary technology; |

| | • | | risks associated with environmental regulation and liabilities; |

| | • | | the possibility that the Company’s unitholders’ interests will conflict with the Company’s interests; |

| | • | | the Company’s dependence on key management and its labor force and the material adverse effect that could result from the loss of their services; |

| | • | | the Company’s ability to successfully integrate its business with those of other businesses that the Company may acquire; and |

| | • | | risks associated with a significant portion of the Company’s employees being covered by collective bargaining agreements. |

See “Item 1A. Risk Factors.” All forward-looking statements attributable to the Company, or persons acting on its behalf, are expressly qualified in their entirety by the cautionary statements set forth in this paragraph.

Unless otherwise indicated, all sources for all industry data and statistics contained herein are estimates contained in or derived from internal or industry sources believed by the Company to be reliable. Market data and certain industry forecasts used herein were obtained from internal surveys, market research, publicly available information and industry publications. Industry publications generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Similarly, internal surveys, industry forecasts and market research, while believed to be reliable,

3

have not been independently verified, and the Company makes no representations as to the accuracy of such information.

PART I

Unless the context otherwise requires, all references herein to the “Company,” “we,” “our” or “us” refer to Graham Packaging Holdings Company (“Holdings”) and its subsidiaries. Graham Packaging Company, L.P. (the “Operating Company”) is a wholly-owned subsidiary of Holdings. References to the “Blackstone Investors” herein refer to Blackstone Capital Partners III Merchant Banking Fund L.P., Blackstone Offshore Capital Partners III L.P. and Blackstone Family Investment Partnership III L.P. References to the “Graham Family Investors” herein refer to Graham Capital Company, GPC Investments LLC and Graham Alternative Investment Partners I or affiliates thereof or other entities controlled by Donald C. Graham and his family.

Plastic containers represent one of the faster growing segments in rigid packaging. The plastic container segment of the rigid packaging industry can de divided into two product types, commodity plastic containers, such as containers for soft drinks and water, and value-added, custom plastic containers, which include unique design features for specialized performance characteristics and product differentiation. Commodity plastic containers are manufactured using stock designs by both independent producers and in-house packaging operations of major beverage companies. Value-added, custom plastic containers are produced through specialized manufacturing processes using resin combinations and structures to create tailor-made solutions for customers seeking performance characteristics, including shelf stability and product differentiation, including unique shapes and high-function dispensers.

The Company focuses on the sale of value-added, custom plastic packaging products principally to large, multinational companies in the food and beverage, household, automotive lubricants and personal care/specialty product categories. The Company has manufacturing facilities in Argentina, Belgium, Brazil, Canada, Finland, France, Mexico, the Netherlands, Poland, Spain, Turkey, the United Kingdom, the United States and Venezuela.

General

Holdings was formed under the name “Sonoco Graham Company” on April 3, 1989, as a Pennsylvania limited partnership. It changed its name to “Graham Packaging Company” on March 28, 1991, and to “Graham Packaging Holdings Company” on February 2, 1998. The Operating Company was formed under the name “Graham Packaging Holdings I, L.P.” on September 21, 1994, as a Delaware limited partnership and changed its name to “Graham Packaging Company, L.P.” on February 2, 1998. The predecessor to Holdings, controlled by the predecessors of the Graham Family Investors, was formed in the mid-1970’s as a regional domestic custom plastic container supplier. The primary business activity of Holdings is its direct and indirect ownership of 100% of the partnership interests in the Operating Company. On October 7, 2004, the Company acquired the blow molded plastic container business of Owens-Illinois, Inc. (“O-I Plastic”). With this acquisition the Company essentially doubled in size. The Company’s operations have included the operations of O-I Plastic since the acquisition date.

The principal executive offices of the Company are located at 2401 Pleasant Valley Road, York, Pennsylvania 17402, telephone (717) 849-8500. The Company maintains a website at www.grahampackaging.com. The Company makes available on its website, free of charge, its annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K as soon as practical after the Company files these reports with the U.S. Securities and Exchange Commission (“SEC”). The information contained on the Company’s website is not incorporated by reference herein.

The Company is organized and managed on a geographical basis in three operating segments: North America, Europe and South America. Each operating segment includes four major categories: Food and Beverage, Household, Automotive Lubricants and Personal Care/Specialty.

The Company is a worldwide leader in the design, manufacture and sale of value-added, custom blow molded plastic containers for branded consumer products. The Company’s primary strategy is to operate in product categories where it can take advantage of the continuing conversion trend toward value-added plastic packaging in place of glass, metal and paperboard packaging. The Company pursues opportunities with selected major consumer product companies that it expects will lead the conversion to plastic in these categories. The Company utilizes its

4

innovative design, engineering and technological capabilities to deliver customized, value-added products to its customers in these product categories.

From 1998 through 2008, net sales grew at a compounded annual growth rate of over 15% as a result of the Company’s capital investment and focus on the high growth food and beverage conversions from glass, paper and metal containers to plastic packaging, the acquisition on October 7, 2004 of O-I Plastic and an increase in resin prices (which leads to an increase in net sales as cost increases are passed along to customers) during the period. With leading positions in each of the core product categories, the Company believes it is poised to continue to benefit from the current conversion trend towards value-added plastic packaging.

The Company has an extensive blue-chip customer base that includes many of the world’s largest branded consumer products companies. Approximately one-third of the Company’s manufacturing facilities are located on-site at its customers’ plants, which the Company believes provides a competitive advantage in maintaining and growing customer relationships. The majority of the Company’s sales are made pursuant to long-term customer purchase orders and contracts. The Company’s containers are manufactured primarily from three plastic resins, including polyethylene terephthalate, or PET, high-density polyethylene, or HDPE, and polypropylene, or PP. In 2008, the Company’s top 20 customers comprised over 73% of its net sales and have been its customers for an average of over 20 years.

Food and Beverage.In the food and beverage product category, the Company produces containers for shelf-stable, refrigerated and frozen juices, non-carbonated juice drinks, teas, sports drinks/isotonics, enhanced waters, beer, liquor, yogurt drinks, nutritional beverages, snacks, toppings, sauces, jellies and jams. Management believes, based on internal estimates, that the Company has one of the leading domestic positions in plastic containers for hot-fill juice and juice drinks, sports drinks, drinkable yogurt and smoothies, nutritional supplements, wide-mouth food, dressings, condiments and beer, and the leading global position in plastic containers for yogurt drinks. The Company’s food and beverage sales have grown at a compound annual growth rate of 21% from fiscal 1998 through fiscal 2008. Based on the Company’s knowledge of and experience in the industry, its focus on markets which are likely to convert to plastic, its proprietary technologies and its current market position, management believes the Company is strategically positioned to benefit from the estimated more than 60% of the domestic thermally processed food and beverage market that has yet to convert to plastic and also to take advantage of evolving domestic and international conversion opportunities like snack foods, beer, baby food, ready-to-drink teas, enhanced water and adult nutritional beverages.

The Company’s largest customers in the food and beverage product category include, in alphabetical order: Abbott Laboratories (“Abbott”), Arizona Beverages Company, LLC (“Arizona”), Barton Brands (“Barton”), Clement Pappas & Co., Inc. (“Clement Pappas”), Clorox Products Manufacturing Company (“Clorox”), Coca-Cola North America (“Coca-Cola”), Conopco Inc. (“Unilever”), Group Danone (“Danone”), H.J. Heinz Company (“Heinz”), Ocean Spray Cranberries, Inc. (“Ocean Spray”), PepsiCo, Inc. (“PepsiCo”), The Quaker Oats Company (“Gatorade”), Tropicana Products, Inc. (“Tropicana”) and Welch Foods, Inc. (“Welch’s”). For the years ended December 31, 2008, 2007 and 2006, the Company generated approximately 61.0%, 60.3% and 58.7%, respectively, of its net sales from food and beverage containers.

Household.In the household product category, the Company is a leading supplier of plastic containers for products such as liquid fabric care, dish care and hard-surface cleaners. The growth in prior years was fueled by conversions from powders to liquids for such products as detergents, household cleaners and automatic dishwashing detergent. The growth of this product category now follows gross domestic product (“GDP”) growth as liquids have gained a predominant share of these products. It should be noted the fabric care industry now offers most of its brands in a concentrated formula which has reduced sales in this product category.

The Company’s largest customers in the household product category include, in alphabetical order: Church & Dwight Co., Inc. (“Church & Dwight”), Clorox, Colgate-Palmolive Company (“Colgate-Palmolive”), Dial Corporation (“Dial,” a division of Henkel), The Procter & Gamble Company (“Procter & Gamble”) and Unilever. For the years ended December 31, 2008, 2007 and 2006, the Company generated approximately 19.4%, 20.4% and 20.3%, respectively, of its net sales from household containers.

Automotive Lubricants.Management believes, based on internal estimates, that the Company is the leading supplier of one-quart/liter plastic motor oil containers in the United States, Canada and Brazil, supplying most of the motor oil producers in these countries. The Company has been producing automotive lubricants containers since the first plastic automotive lubricants container was introduced over 20 years ago and since then has partnered with its customers to improve product quality and jointly reduce costs through design improvement, reduced container

5

weight and manufacturing efficiencies. The Company’s joint product design and cost efficiency initiatives with its customers have also strengthened its customer relationships.

The Company’s largest customers in the automotive lubricants product category include, in alphabetical order: Ashland, Inc. (“Ashland,” producer of Valvoline motor oil), BP Lubricants USA, Inc. (“BP Lubricants,” an affiliated company of BP plc, producer of Castrol motor oil), ExxonMobil Corporation (“ExxonMobil”) and Shell Oil Products US (“Shell,” producer of Shell, Pennzoil and Quaker State motor oils). For the years ended December 31, 2008, 2007 and 2006, the Company generated approximately 12.4%, 11.1% and 11.3%, respectively, of its net sales from automotive lubricants containers.

Personal Care/Specialty. In the personal care/specialty product category, the Company is a supplier of plastic containers for products such as hair care, skin care and oral care. The Company’s product design, technology development and decorating capabilities help its customers build brand awareness for their products through unique, and frequently changing, packaging design.

The Company’s largest customers in the personal care/specialty product category include, in alphabetical order, Johnson & Johnson Consumer Companies, Inc. and Procter & Gamble. For the years ended December 31, 2008, 2007 and 2006, the Company generated approximately 7.2%, 8.2% and 9.7%, respectively, of its net sales from personal care/specialty containers.

Additional information regarding operating segments and product categories is provided in Note 21 of the Notes to Consolidated Financial Statements in this Report.

Raw Materials

PET, HDPE and PP resins constitute the primary raw materials used to make the Company’s products. These materials are available from a number of domestic and international suppliers and the Company is not dependent upon any single supplier. The Company considers the supply and availability of raw materials to be adequate to meet its needs. Management believes that the Company maintains an adequate inventory to meet demands, but there is no assurance this will be true in the future. Changes in the cost of resin are generally passed through to customers by means of corresponding changes in product pricing in accordance with the Company’s agreements with these customers and industry practice. The Company operates a large HDPE bottles-to-bottles recycling plant in York, Pennsylvania, and uses the recycled materials from this plant and other recycled materials in a majority of the Company’s products.

Customers

Substantially all of the Company’s sales are made to major branded consumer products companies. The products the Company manufactures for its customers require innovative packaging design and engineering to accommodate complex container shapes, specific material requirements and functionality. Customers also require quick and reliable delivery. As a result, many customers opt for long-term contracts, some of which have terms up to ten years. A majority of the Company’s top twenty customers are under long-term contracts. The Company’s contracts typically contain provisions allowing for price adjustments based on changes in raw materials and in some cases the cost of energy and labor, among other factors. In many cases, the Company is the sole supplier of its customers’ custom plastic container requirements nationally, regionally or for a specific brand. For the year ended December 31, 2008, the Company had sales to two customers, PepsiCo and Danone, which exceeded 10% of net sales. The Company’s sales to PepsiCo and Danone were 13.1% and 10.3% of net sales for the year ended December 31, 2008, respectively. For the year ended December 31, 2008, the Company’s twenty largest customers, who accounted for over 73% of net sales, were, in alphabetical order:

| | | | |

Customer (1) | | Category | | Company Customer Since (1) |

Abbott | | Food and Beverage | | Mid 2000s |

Arizona | | Food and Beverage | | Late 1990s |

Ashland (2) | | Automotive Lubricants | | Early 1970s |

6

| | | | |

Barton | | Food and Beverage | | Mid 1990’s |

BP Lubricants (3) | | Automotive Lubricants | | Late 1960s |

Church & Dwight | | Household | | Late 1980s |

Clement Pappas | | Food and Beverage | | Mid 1990s |

Clorox | | Food and Beverage and Household | | Late 1960s |

Coca-Cola | | Food and Beverage | | Late 1990s |

Colgate-Palmolive | | Household | | Mid 1980s |

Danone | | Food and Beverage | | Late 1970s |

Dial | | Household and Personal Care/Specialty | | Early 1990s |

ExxonMobil | | Automotive Lubricants | | Early 2000s |

Heinz | | Food and Beverage | | Early 1990s |

Ocean Spray | | Food and Beverage | | Early 1990s |

PepsiCo (4) | | Food and Beverage | | Early 2000s |

Frito-Lay | | Food and Beverage | | Early 2000s |

Gatorade | | Food and Beverage | | Late 1990s |

Tropicana | | Food and Beverage | | Mid 1980s |

Procter & Gamble | | Household and Personal Care/Specialty | | Late 1950s |

Shell (5) | | Automotive Lubricants | | Early 1970s |

Pennzoil-Quaker State | | Automotive Lubricants | | Early 1970s |

Unilever | | Household, Personal Care/Specialty and Food and Beverage | | Early 1970s |

Welch’s | | Food and Beverage | | Early 1990s |

| (1) | These companies include their predecessors, if applicable, and the dates may reflect customer relationships initiated by predecessors to the Company or entities acquired by the Company. |

| (2) | Ashland is the producer of Valvoline motor oil. |

| (3) | BP Lubricants is the producer of Castrol motor oil. |

| (4) | PepsiCo includes Frito-Lay, Gatorade and Tropicana. |

| (5) | Shell includes Pennzoil-Quaker State. |

International Operations

The Company has significant operations outside the United States. As of the end of 2008, the Company had 28 manufacturing facilities located in countries outside of the United States. Each of the Company’s operating segments produces plastic containers for all four of the Company’s core product categories.

South America. The Company has one on-site plant in Argentina, four on-site plants in Brazil and one off-site plant in each of Argentina, Brazil and Venezuela.

Mexico. In Mexico, the Company has three off-site plants and two on-site plants.

Europe. The Company has on-site plants in Belgium (2), France, the Netherlands, Poland, Spain and Turkey and seven off-site plants in Finland, France (2), the Netherlands, Poland, Turkey and the United Kingdom.

Canada. The Company has one off-site plant located near Toronto, Canada to service Canadian and northern U.S. customers.

See “Item 1A. Risk Factors” for risks attendant to foreign operations.

Competition

The Company faces substantial regional and international competition across its product lines from a number of well-established businesses. The Company’s primary competitors include Alpla Werke Alwin Lehner GmbH, Amcor Limited, Ball Corporation, Consolidated Container Company LLC, Constar International Inc., Logoplaste, Plastipak, Inc. and Silgan Holdings Inc. Several of these competitors are larger and have greater financial and other resources than the Company. Management believes that the Company competes effectively because of its superior levels of service, speed to market and product design and development capabilities.

7

Marketing and Distribution

The Company’s sales are made primarily through its own direct sales force, as well as selected brokers. Sales activities are conducted from the Company’s corporate headquarters in York, Pennsylvania and from field sales offices located in North America, Europe and South America. The Company’s products are typically delivered by truck, on a daily basis, in order to meet customers’ just-in-time delivery requirements, except in the case of on-site operations. In many cases, the Company’s on-site operations are integrated with its customers’ manufacturing operations so that deliveries are made, as needed, by direct conveyance to the customers’ filling lines. The Company utilizes a number of outside warehouses to store its finished goods prior to delivery to the customer.

Superior Product Design and Development Capabilities

The Company’s ability to develop new, innovative containers to meet the design and performance requirements of its customers has established the Company as a market leader. The Company has demonstrated significant success in designing plastic containers that require customized features such as complex shapes, reduced weight, handles, grips, view stripes and pouring features. These packages often must meet specialized performance and structural requirements such as hot-fill capability, recycled material usage, oxygen barriers, flavor protection and multi-layering. Hot-fill technology allows customers’ products to be heated to temperatures high enough as to sterilize the inside of the container. In addition to increasing global demand for its customers’ products, the Company believes that its innovative packaging stimulates consumer demand and drives further conversion to plastic packaging. Consequently, the Company’s strong design capabilities have been especially important to its food and beverage customers, who generally use packaging to differentiate and add value to their brands while spending less on promotion and advertising. The Company has been awarded significant contracts based on these unique product design capabilities that it believes set it apart from its competition. Some of the Company’s design and conversion successes over the past few years include:

| | • | | retortable PP container for Boost and Ensure adult nutritional beverages; |

| | • | | aseptic HDPE container for 8th Continent soy-based beverages; |

| | • | | hot-fill PET containers with Monosorb™ oxygen scavenger for juices; |

| | • | | hot-fill PET and PP wide-mouth jar for Ragu pasta sauce, Seneca applesauce, Welch’s jellies and jams and Del Monte fruit slices; |

| | • | | lightweight 64 oz. rectangular container for hot-fill juice; |

| | • | | panel-free lightweight 16.9 oz. container for juices and teas; and |

| | • | | panel-free 20 oz. container for enhanced water. |

The Company’s innovative designs have also been recognized, through various awards, by a number of customers and industry organizations, including its:

| | • | | multi-layer PP wide-mouth jar for Del Monte (2008 Ameristar Award); |

| | • | | PET “Apple” container for Martinelli’s (2007 WorldStar Award, 2006 DuPont Award and 2006 Ameristar Award); |

| | • | | PET rectangular juice bottle for Tree Top (2007 WorldStar Award and 2006 Ameristar Award); |

| | • | | PET “Fridge Fit” bottle for Heinz (2006 Ameristar Award and 2006 DuPont Award); |

| | • | | dual-chamber bottle for Procter & Gamble Cosmetics (2005 Food & Drug Personal Care package of the year); |

| | • | | ATP panel-free single-serve bottle and 64 oz. rectangular hot-fill bottle (2004 Ameristar Award); and |

| | • | | Ensure reclosable bottle (2004 Ameristar Award and 2004 DuPont Award). |

The Company has an advanced multi-layer injection technology, trade named SurShot™. The Company believes that SurShot™ is among the best multi-layer PET technologies available and billions of plastic containers are produced and sold each year using SurShot™ technology. This multi-layer technology allows the Company’s customers to package oxygen and flavor-sensitive products, such as teas, beer and fruit juices, for extended shelf-life. In addition, the SurShot™ technology can accommodate up to 40% post-consumer recycled resin. This is an important component of packaging sustainability. There has been increasing demand by customers for the Company’s innovative packages that meet new sustainability requirements for reduced weight. Recent introductions of Escape™, G-Lite™ and SlingShot™ technologies for PET bottles provide customers with improved features such as reduced container weight, smooth sides for a premium look or improved stacking ability for shipping and storage.

8

Management believes these new products, along with the Company’s design and development capabilities, have positioned the Company as the packaging design, development and technology leader in the industry. Over the past several years the Company has received and has filed for numerous patents. See “—Intellectual Property.”

In 2005, the Company enhanced its technical capability with the opening of the Global Innovation & Design Center in York, Pennsylvania. The Company also has two major Technology Centers in York, Pennsylvania and Warsaw, Poland capable of producing limited quantities of new products and refurbishing equipment. The Company’s Warsaw facility also manufactures and assembles a proprietary line of extrusion blow molding machines. This proprietary technology has enabled us to develop a leaner, more efficient manufacturing process.

The Company expenses costs to research, design and develop new packaging products and technologies as incurred. Such costs, net of any reimbursement from customers, were $9.6 million, $11.6 million and $16.5 million for the years ended December 31, 2008, 2007 and 2006, respectively.

Manufacturing

A critical component of the Company’s strategy is to locate manufacturing facilities on-site, reducing expensive shipping and handling charges and increasing production and distribution efficiencies. The Company is a leader in providing on-site manufacturing arrangements. As of the end of 2008, approximately one-third of its 82 manufacturing facilities were on-site at customer facilities. The Company operates over 850 production lines. The Company sometimes dedicates particular production lines within a plant to better service customers. The plants generally operate 24 hours a day, five to seven days a week, although not every production line is run constantly. When customer demand requires, the plants run seven days a week. Historically, demand for the Company’s products has not been subject to large seasonal fluctuations.

In the blow molding process used for HDPE applications, resin pellets are blended with colorants or other necessary additives and fed into the extrusion machine, which uses heat and pressure to form the resin into a round hollow tube of molten plastic called a parison. In a wheel blow molding process, bottle molds mounted radially on a wheel capture the parison as it leaves the extruder. Once inside the mold, air pressure is used to blow the parison into the bottle shape of the mold. While certain of the Company’s competitors also use wheel technology in their production lines, the Company has developed a number of proprietary improvements which management believes permit the Company’s wheels to operate at higher speeds and with greater efficiency in the manufacture of containers with one or more special features, such as multiple layers and in-mold labeling.

In the stretch blow molding process used for hot-fill PET applications, resin pellets are fed into an injection molding machine that uses heat and pressure to mold a test tube shaped parison or “preform.” The preform is then fed into a blow molder where it is re-heated to allow it to be formed through a stretch blow molding process into a final container. During this re-heat and blow process, special steps are taken to induce the temperature resistance needed to withstand high temperatures on customer filling lines. Management believes that the injection molders and blow molders used by the Company are widely recognized as the leading technologies for high speed production of hot-fill PET containers.

Other blow molding processes include: various types of extrusion blow molding for medium- and large-sized HDPE and PP containers; stretch blow molding for medium-sized PET containers; injection blow molding for personal care containers in various materials; two-stage PET blow molding for high-volume, high-performance mono-layer, multi-layer and heat set PET containers; and proprietary blow molding for drain-back systems and other specialized applications.

The Company also operates a variety of bottle decorating platforms. Labeling and decorating is accomplished through in-mold techniques or one of many post-molding methods. Post-molding methods include pressure sensitive labelers, rotary full-wrap labelers, silk-screen decoration, heat transfer and hot stamp. These post-molding methods of decoration or labeling can be in-line or off-line with the molding machine. Typically, these decoration methods are used for bottles in the personal care/specialty product category.

The Company has implemented various process improvements to minimize labor costs, automate assembly tasks, increase throughput and improve quality. Types of automation range from case and tray packers to laser guided vehicles. Other automation equipment includes box and bulk bottle palletizers, pick and place robots, automatic in-line leak detection and vision inspection systems. Assembly automation includes bottle trimming, spout spinwelding or insertion, cap insertion and tube cutting/welding. Management believes that there are additional automation opportunities which could further minimize labor costs and improve plant efficiency.

9

The Company maintains quality assurance and control programs with respect to the performance of the products it manufactures, the performance of its suppliers and the compliance of its operations to its quality management system and sound manufacturing practices. The Company’s production lines are equipped with specific quality control inspection equipment and its employees continuously monitor product attributes and performance through a comprehensive Statistical Process Control system. Quality control laboratories are maintained at each manufacturing facility to test its products and validate their compliance to customer requirements. The Company continuously monitors and enhances its quality assurance and control programs to keep pace with the most current technologies and to meet and exceed customer expectations.

The Company has highly modernized equipment in the majority of its plants, consisting primarily of rotational wheel systems and shuttle systems, both of which are used for HDPE and PP blow molding, and injection-stretch blow molding systems for value-added PET containers. The Company is also pursuing development initiatives in barrier technologies to strengthen its position in the food and beverage product category. In the past, the Company has achieved substantial cost savings in its manufacturing process through productivity and process enhancements, including increasing line speeds, utilizing recycled products, reducing scrap and optimizing plastic weight requirements for each product’s specifications.

Cash paid for property, plant and equipment, excluding acquisitions, for 2008, 2007 and 2006 was $148.6 million, $153.4 million and $190.5 million, respectively. Management believes that capital expenditures to maintain and upgrade property, plant and equipment are important to remain competitive. Management estimates that on average the annual maintenance capital expenditures are approximately $30 million per year. For 2009, the Company expects to make capital expenditures, excluding acquisitions, ranging from $140 million to $160 million.

Most customer orders are manufactured with a lead time of three weeks or less. Therefore, the amount of backlog orders at December 31, 2008, was not material. The Company expects all backlog orders at December 31, 2008, to be shipped during the first quarter of 2009.

10

Ownership

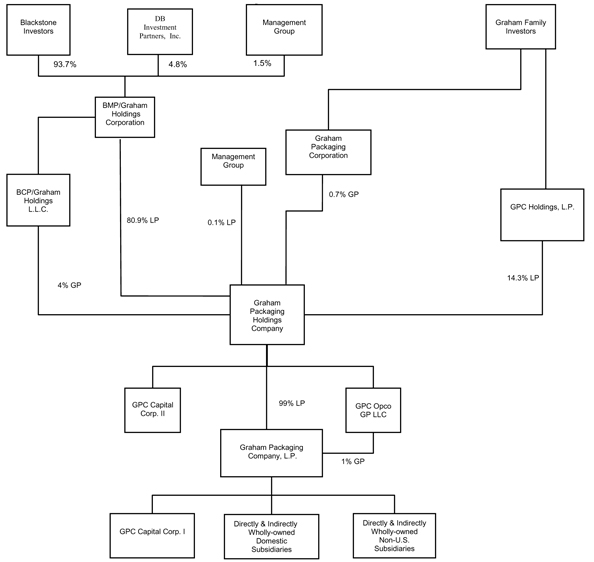

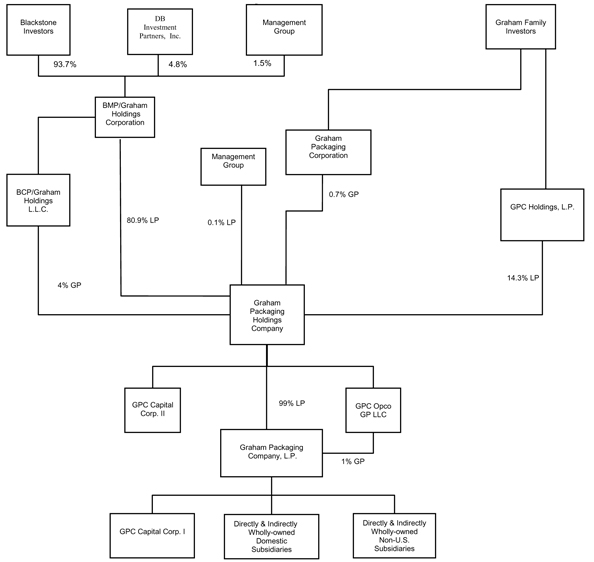

The following chart shows the Company’s ownership structure:

GP = general partnership interest

LP = limited partnership interest

Holdings is currently owned by (i) BMP/Graham Holdings Corporation, a Delaware corporation (owned by the Blackstone Investors, DB Investment Partners, Inc. and current and former members of the management of the Company (“Management Group”)) (“Investor LP”), (ii) BCP/Graham Holdings L.L.C., a Delaware limited liability company (wholly-owned by BMP/Graham Holdings Corporation) (“Investor GP” and, together with Investor LP, the “Equity Investors”), (iii) GPC Holdings, L.P., a Pennsylvania limited partnership (indirectly owned by the Graham Family Investors), (iv) Graham Packaging Corporation, a Pennsylvania corporation (indirectly owned by the Graham Family Investors), and (v) the Management Group. Management Group’s 1.5% ownership interest in Investor LP constitutes a 1.3% interest in Holdings.

Holdings owns a 99% limited partnership interest in the Operating Company, and GPC Opco GP LLC (“Opco GP”), a wholly-owned subsidiary of Holdings, owns a 1% general partnership interest in the Operating

11

Company. See “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” (Item 12).

GPC Capital Corp. I (“CapCo I”), a wholly-owned subsidiary of the Operating Company, and GPC Capital Corp. II (“CapCo II”), a wholly-owned subsidiary of Holdings, were incorporated in Delaware in January 1998. The sole purpose of CapCo I is to act as co-obligor of the Notes (as defined herein) and as co-borrower under the Credit Agreement (as defined herein) (see “Item 1A. Risk Factors”). CapCo II currently has no obligations under any of the Company’s outstanding indebtedness. CapCo I and CapCo II have only nominal assets and do not conduct any operations. Accordingly, investors in the Notes must rely on the cash flow and assets of the Operating Company or the cash flow and assets of Holdings, as the case may be, for payment of the Notes.

Employees

As of December 31, 2008, the Company had approximately 7,400 employees, 5,900 of whom were located in North America, 1,000 of whom were located in Europe and 500 of whom were located in South America. Approximately 81% of the Company’s employees are hourly wage employees, 53% of whom are represented by various labor unions and are covered by various collective bargaining agreements that expire through June 2013. In North America, 81% of the Company’s employees are hourly employees, 43% of whom are represented by various labor unions. In Europe, 79% of the Company’s employees are hourly employees, 93% of whom are represented by various labor unions. In South America, 78% of the Company’s employees are hourly employees, 94% of whom are represented by various labor unions. Management believes that it enjoys good relations with the Company’s employees.

Environmental Matters

The Company’s operations, both in the United States and abroad, are subject to national, state, foreign, provincial and/or local laws and regulations that impose limitations and prohibitions on the discharge and emission of, and establish standards for the use, disposal and management of, regulated materials and waste, and that impose liability for the costs of investigating and cleaning up, and damages resulting from, present and past spills, disposals or other releases of hazardous substances or materials. These domestic and international environmental laws can be complex and may change often. Compliance expenses can be significant and violations may result in substantial fines and penalties. In addition, environmental laws such as the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, also known as “Superfund” in the United States, impose strict, and in some cases joint and several, liability on specified responsible parties for the investigation and cleanup of contaminated soil, groundwater and buildings, and liability for damages to natural resources, at a wide range of properties. As a result, the Company may be liable for contamination at properties that it currently owns or operates, as well as at its former properties or off-site properties where it may have sent hazardous substances. The Company is not aware of any material noncompliance with the environmental laws currently applicable to it and is not the subject of any material environmental claim for liability with respect to contamination at any location. Based on existing information, management believes that it is not reasonably likely that losses related to known environmental liabilities, in aggregate, will be material to the Company’s financial position, results of operations, liquidity or cash flows. For its operations to comply with environmental laws, the Company has incurred and will continue to incur costs, which were not material in fiscal 2008 and are not expected to be material in the future.

A number of governmental authorities, both in the United States and abroad, have considered, are expected to consider or have passed legislation aimed at reducing the amount of disposed plastic wastes. Those programs have included, for example, mandating certain rates of recycling and/or the use of recycled materials, imposing deposits or taxes on plastic packaging material and/or requiring retailers or manufacturers to take back packaging used for their products. That legislation, as well as voluntary initiatives similarly aimed at reducing the level of plastic wastes, could reduce the demand for certain plastic packaging, result in greater costs for plastic packaging manufacturers or otherwise impact the Company’s business. Some consumer products companies, including some of the Company’s customers, have responded to these governmental initiatives and to perceived environmental concerns of consumers by using containers made in whole or in part of recycled plastic. To date, the Company has not been materially adversely affected by these initiatives and developments. The Company operates a large HDPE bottles-to-bottles recycling plant in York, Pennsylvania.

12

Intellectual Property

The Company holds various patents and trademarks. While in the aggregate the patents are of material importance to its business, the Company believes that its business is not dependent upon any one patent or trademark. The Company also relies on unpatented proprietary know-how and continuing technological innovation and other trade secrets to develop and maintain its competitive position. Others could, however, obtain knowledge of this proprietary know-how through independent development or other access by legal means. In addition to its own patents and proprietary know-how, the Company is a party to licensing arrangements and other agreements authorizing it to use other proprietary processes, know-how and related technology and/or to operate within the scope of certain patents owned by other entities. The duration of the Company’s licenses generally ranges from 5 to 17 years. In some cases the licenses granted to the Company are perpetual and in other cases the term of the license is related to the life of the patent associated with the license. The Company also has licensed some of its intellectual property rights to third parties.

The following are certain risk factors that could materially and adversely affect our business, results of operations or financial condition.

The current global economic crisis could negatively affect our business, results of operations and financial condition.

The current global economic crisis has resulted in volatile economic conditions in many of the countries in which we operate. Our business or financial results may be adversely impacted by these unfavorable economic conditions, including: adverse changes in interest rates or tax rates; volatile commodity markets; contraction in the availability of credit in the marketplace; the effects of governmental initiatives to manage economic conditions; reduced demand for our products resulting from a slow-down in the general global economy; or a further decrease in the fair value of pension assets that could increase future employee benefit costs and/or funding requirements of our pension plans. The global economic crisis has also resulted in increased foreign currency exchange rate volatility. We hold assets, incur liabilities, earn revenues and pay expenses in a variety of currencies other than the U.S. dollar. The financial statements of our foreign subsidiaries are translated into U.S. dollars. As a result, our profitability may be adversely impacted by an adverse change in foreign currency exchange rates. In addition, we cannot predict how current or worsening economic conditions will affect our critical customers and suppliers, which may have an impact on our business or financial results.

We may not generate profits in the future and had net losses in recent years.

For the fiscal years ended December 31, 2008, 2007 and 2006, we incurred net losses of $57.3 million, $206.1 million and $120.4 million, respectively. Continuing net losses may limit our ability to service our debt and fund our operations and we may not generate net income from operations in the future. Factors contributing to losses in recent years included, but were not limited to:

| | • | | impairment of our long-lived tangible and intangible assets; |

| | • | | the write-off of deferred financing fees related to our debt refinancings; and |

| | • | | severance and other payments associated with exiting unprofitable plants. |

The terms of our debt instruments restrict the manner in which we conduct our business and may limit our ability to implement elements of our business strategy.

The instruments and agreements governing our indebtedness contain numerous covenants including financial and operating covenants, some of which are quite restrictive. These covenants affect, and in many respects limit, among other things, our ability to:

13

| | • | | consolidate, merge or sell assets; |

| | • | | make certain capital expenditures; |

| | • | | make certain advances, investments and loans; |

| | • | | enter into certain transactions with affiliates; |

| | • | | engage in any business other than the packaging business; |

These covenants could restrict us in the pursuit of our business strategy.

Our indebtedness could adversely affect our cash flow.

At December 31, 2008, we had $2,499.2 million of total consolidated indebtedness. In addition, at December 31, 2008, after taking into account letters of credit of $12.4 million, we had $237.6 million of revolving loans available to be borrowed under our senior secured credit facility (the “Credit Agreement”). Under our Credit Agreement, we also have available to us an uncommitted incremental loan facility in an amount of up to an additional $300.0 million (subject to our ability to secure lender commitments for all or any portion of the $300.0 million), and we may incur additional indebtedness as permitted by our Credit Agreement and other instruments governing our indebtedness.

A significant portion of our cash flow must be used to service our indebtedness and is therefore not available to be used in our business. In 2008, we paid $173.0 million in interest on our indebtedness and expect to pay between $150 million and $160 million in 2009. Our ability to generate cash flow is subject to general economic, financial, competitive, legislative, regulatory and other factors that may be beyond our control. In addition, a substantial portion of our indebtedness bears interest at floating rates, and therefore a substantial increase in interest rates could adversely impact our results of operations. Based on the outstanding amount of our variable rate indebtedness at December 31, 2008, a one percentage point change in the interest rates for our variable rate indebtedness would impact interest expense by an aggregate of approximately $16.5 million, after taking into account the outstanding notional amount of our interest rate collar agreements at December 31, 2008.

Our obligations in connection with our indebtedness could have important consequences. For example, they could:

| | • | | increase our vulnerability to general adverse economic and industry conditions; |

| | • | | require us to dedicate a significant portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, acquisitions and capital expenditures, and for other general corporate purposes; |

| | • | | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| | • | | restrict us from making strategic acquisitions or exploiting business opportunities; and |

| | • | | limit our ability to borrow additional funds. |

Despite our current level of indebtedness, we may incur additional debt in the future, which could increase the risks associated with our leverage.

We are continually evaluating and pursuing organic growth and acquisition opportunities in our three operating segments and may incur additional indebtedness, including indebtedness under our Credit Agreement, to finance any such growth and acquisitions and to fund any resulting increased operating needs. If new debt is added to our current debt levels, the related risks we now face could increase. Any new financing we obtain would need to comply with the agreements governing our then existing indebtedness.

We may not be able to obtain favorable terms when we renew our senior secured revolving credit facility and senior secured term loan facility.

Our senior secured revolving credit facility and senior secured term loan facility expire on October 7, 2010, and October 7, 2011, respectively. Due to the continuing disruption in the credit markets, we may not be able to renew these facilities on favorable terms. As a result, we may incur higher borrowing costs and could have more stringent debt covenants. While we believe these conditions have not impaired our ability to access credit markets, if these

14

conditions continue or further deteriorate, our business and financial results could be materially and adversely affected.

We may not be able to recover the carrying value of our assets.

We recorded asset impairment charges of $103.9 million, $157.9 million and $25.9 million for the years ended December 31, 2008, 2007 and 2006, respectively. We operate in a competitive industry with rapid technological innovation. In order to remain competitive, we develop and invest in new equipment which enhances productivity, often making older equipment obsolete. In addition, changing market conditions can also impact our ability to recover the carrying value of our long-lived assets. The continuing presence of these factors, as well as other factors, could require us to record additional asset impairment charges in future periods.

Increases in resin prices and reductions in resin supplies could significantly slow our growth and disrupt our operations.

We depend on large quantities of PET, HDPE and other resins in manufacturing our products. One of our primary strategies is to grow the business by capitalizing on the conversion from glass, metal and paper containers to plastic containers. A sustained increase in resin prices, to the extent that those costs are not passed on to the end-consumer, would make plastic containers less economical for our customers and could result in a slower pace of conversions to plastic containers. Changes in the cost of resin are passed through to customers by means of corresponding changes in product pricing in accordance with our agreements with these customers and industry practice. However, if we are not able to do so in the future and there are sustained increases in resin prices, our operating margins could be affected adversely.

While there is currently an adequate supply of resin available from many sources, this may not be the case in the future. Several of our larger suppliers have either entered, or are emerging from, bankruptcy protection. If the number of suppliers is significantly reduced in the future, this could affect our ability to obtain resin at favorable prices, and our operations and profitability may be impaired.

Our international operations are subject to a variety of risks related to foreign currencies and local law in several countries.

We have significant operations outside the United States, which accounted for approximately 21.6%, 20.6% and 18.4% of our net sales for the years ended December 31, 2008, 2007 and 2006, respectively. As a result, we are subject to risks associated with operating in foreign countries, including fluctuations in currency exchange and interest rates, imposition of limitations on conversion of foreign currencies into U.S. dollars or remittance of dividends and other payments by foreign subsidiaries, imposition or increase of withholding and other taxes on remittances and other payments by foreign subsidiaries, labor relations problems, hyperinflation in some foreign countries and imposition or increase of investment and other restrictions by foreign governments or the imposition of environmental or employment laws. Furthermore, we typically price our products in our foreign operations in local currencies. As a result, an increase in the value of the U.S. dollar relative to the local currencies of profitable foreign subsidiaries can have a negative effect on our profitability. In our consolidated financial statements, we translate our local currency financial results into U.S. dollars based on average exchange rates prevailing during a reporting period or the exchange rate at the end of that period. During times of a strengthening U.S. dollar, at a constant level of business, our reported international sales, earnings, assets and liabilities will be reduced because the local currency will translate into fewer U.S. dollars. Exchange rate fluctuations increased comprehensive loss by $65.9 million and decreased comprehensive loss by $36.3 million and $23.2 million for the years ended December 31, 2008, 2007 and 2006, respectively. In addition to currency translation risks, we incur a currency transaction risk whenever one of our operating subsidiaries enters into either a purchase or a sale transaction using a currency different from the operating subsidiary’s functional currency. In several countries where we operate, resin purchases must be made in U.S. dollars. Furthermore, changes in local economic conditions can affect operations. Our international operations also expose us to different local political and business risks and challenges. For example, in certain countries we are faced with periodic political issues which could result in currency risks or the risk that we are required to include local ownership or management in our businesses. The above mentioned risks in North America, Europe and South America may hurt our ability to generate revenue in those regions in the future.

We would lose a significant source of revenues and profits if we lost our largest customer.

PepsiCo (collectively, with its affiliates, such as Frito-Lay, Gatorade and Tropicana) is our largest customer, with all product lines we provide to PepsiCo collectively accounting for approximately 13.1%, 13.9% and

15

17.0% of our net sales for the years ended December 31, 2008, 2007 and 2006, respectively. We are not the sole supplier of plastic packaging to PepsiCo. If PepsiCo terminated its relationship with us, it could have a material adverse effect upon our business, financial position or results of operations. Additionally, in 2008, our top 20 customers comprised over 73% of our net sales. If any of our largest customers terminated its relationship with us, we would lose a significant source of revenues and profits. Additionally, the loss of one of our largest customers could result in us having excess capacity if we are unable to replace that customer. This could result in us having excess overhead and fixed costs and possible impairment of long-lived assets. This could also result in our selling, general and administrative expenses and capital expenditures to represent increased portions of our revenues.

Contracts with customers generally do not require them to purchase any minimum amounts of products from us, and customers may not purchase amounts that meet our expectations.

The majority of our sales are made pursuant to long-term customer purchase orders and contracts. Customers’ purchase orders and contracts typically vary in length with terms up to ten years. The contracts, including those with PepsiCo, generally are requirements contracts which do not obligate the customer to purchase any given amount of product from us. Prices under these arrangements are tied to market standards and therefore vary with market conditions. Changes in the cost of resin, the largest component of our cost of goods sold, are passed through to customers by means of corresponding changes in product pricing in accordance with our agreements with these customers and industry practice. Despite the existence of supply contracts with our customers and although in the past our customers have not purchased amounts under supply contracts that in the aggregate are materially lower than what we have expected, we face the risk that in the future customers will not continue to purchase amounts that meet our expectations.

Our industry is very competitive and increased competition could reduce prices and our profit margins.

We operate in a competitive environment. In the past, we have encountered pricing pressures in our markets and could experience further declines in prices of plastic packaging as a result of competition. Although we have been able over time to partially offset pricing pressures by reducing our cost structure and making the manufacturing process more efficient by providing new and innovative technology, we may not be able to continue to do so in the future. Our business, results of operations and financial condition may be materially adversely affected by further declines in prices of plastic packaging and such further declines could lead to a loss of business and a decline in our margins.

If we are unable to develop product innovations and improve our production technology and expertise, we could lose customers or market share.

Our success may depend on our ability to adapt to technological changes in the plastic packaging industry. If we are unable to timely develop and introduce new products, or enhance existing products, in response to changing market conditions or customer requirements or demands, our business and results of operations could be materially and adversely affected.

We may be unable to protect our proprietary technology from infringement.

We rely on a combination of patents and trademarks, licensing agreements and unpatented proprietary know-how and trade secrets to establish and protect our intellectual property rights. We enter into confidentiality agreements with customers, vendors, employees, consultants and potential acquisition candidates as necessary to protect our know-how, trade secrets and other proprietary information. However, these measures and our patents and trademarks may not afford complete protection of our intellectual property, and it is possible that third parties may copy or otherwise obtain and use our proprietary information and technology without authorization or otherwise infringe on our intellectual property rights. We cannot assure that our competitors will not independently develop equivalent or superior know-how, trade secrets or production methods. If we are unable to maintain the proprietary nature of our technologies, our profit margins could be reduced as competitors imitating our products could compete aggressively against us in the pricing of certain products and our business, results of operations and financial condition may be materially adversely affected.

We are periodically involved in litigation in the course of our business to protect and enforce our intellectual property rights, and third parties from time to time initiate litigation against us asserting infringement or violation of their intellectual property rights. We cannot assure that our intellectual property rights have the value that we believe them to have or that our products will not be found to infringe upon the intellectual property rights of others. Further, we cannot assure that we will prevail in any such litigation, or that the results or costs of any such

16

litigation will not have a material adverse effect on our business. Any litigation concerning intellectual property could be protracted and costly and is inherently unpredictable and could have a material adverse effect on our business and results of operations regardless of its outcome.

Our operations could expose us to substantial environmental costs and liabilities.

We are subject to a variety of national, state, foreign, provincial and/or local laws and regulations that impose limitations and prohibitions on the discharge and emission of, and establish standards for the use, disposal and management of, regulated materials and waste, and that impose liability for the costs of investigating and cleaning up, and damages resulting from, present and past spills, disposals or other releases of hazardous substances or materials. These domestic and international environmental laws can be complex and may change often, the compliance expenses can be significant and violations may result in substantial fines and penalties. In addition, environmental laws such as Superfund impose strict, and in some cases joint and several, liability on specified responsible parties for the investigation and cleanup of contaminated soil, groundwater and buildings, and liability for damages to natural resources, at a wide range of properties. As a result, we may be liable for contamination at properties that we currently own or operate, as well as at our former properties or off-site properties where we may have sent hazardous substances. As a manufacturer, we have an inherent risk of liability under environmental laws, both with respect to ongoing operations and with respect to contamination that may have occurred in the past on our properties or as a result of our operations. We could, in the future, incur a material liability resulting from the costs of complying with environmental laws or any claims concerning noncompliance, or liability from contamination.

We cannot predict what environmental legislation or regulations will be enacted in the future, how existing or future laws or regulations will be administered or interpreted, or what environmental conditions may be found to exist at our facilities or at third party sites for which we are liable. Enactment of stricter laws or regulations, stricter interpretations of existing laws and regulations or the requirement to undertake the investigation or remediation of currently unknown environmental contamination at our own or third-party sites may require us to make additional expenditures, some of which could be material.

In addition, a number of governmental authorities, both in the United States and abroad, have considered, or are expected to consider, legislation aimed at reducing the amount of plastic wastes disposed. Programs have included, for example, mandating certain rates of recycling and/or the use of recycled materials, imposing deposits or taxes on plastic packaging material and requiring retailers or manufacturers to take back packaging used for their products. Legislation, as well as voluntary initiatives similarly aimed at reducing the level of plastic wastes, could reduce the demand for certain plastic packaging, result in greater costs for plastic packaging manufacturers or otherwise impact our business. Some consumer products companies, including some of our customers, have responded to these governmental initiatives and to perceived environmental concerns of consumers by using containers made in whole or in part of recycled plastic. Future legislation and initiatives could adversely affect us in a manner that would be material.

Blackstone Investors control us and may have conflicts of interest with us in the future.

The Blackstone Investors indirectly control approximately 80% of the partnership interests in Holdings. Pursuant to the Fifth Amended and Restated Limited Partnership Agreement (the “Holdings Partnership Agreement”) by and among the Graham Family Investors, Graham Packaging Corporation, BCP/Graham Holdings L.L.C. and BMP/Graham Holdings Corporation, holders of a majority of the partnership interests generally have the sole power, subject to certain exceptions, to take actions on behalf of Holdings, including the appointment of management and the entering into of mergers, sales of substantially all assets and other extraordinary transactions. For example, the Blackstone Investors could cause us to make acquisitions that increase the amount of our indebtedness or to sell revenue generating assets, impairing our ability to make payments under our debt agreements. Additionally, the Blackstone Investors are in the business of making investments in companies and may from time to time acquire and hold interests in businesses that compete directly or indirectly with us. The Blackstone Investors may also pursue acquisition opportunities that may be complementary to our business, and as a result, those acquisition opportunities may not be available to us. The Graham Family Investors have substantial expertise and knowledge in our industry and may also from time to time seek to compete, directly or indirectly, with us.

Our ability to operate effectively could be impaired if we lost key personnel.

Our success depends to a large extent on a number of key employees, and the loss of the services provided by them could have a material adverse effect on our ability to operate our business and implement our strategies

17

effectively. The loss of members of our senior management team could have a material adverse effect on our operations. We do not maintain “key” person insurance on any of our executive officers.

If we make acquisitions in the future, we may experience assimilation problems and dissipation of management resources and we may need to incur additional indebtedness.

Our future growth may be a function, in part, of acquisitions of other consumer goods packaging businesses, including investments in geographic regions we are not familiar with. To the extent that we grow through acquisitions, we will face the operational and financial risks commonly encountered with that type of a strategy. We would also face operational risks, such as failing to assimilate the operations and personnel of the acquired businesses, disrupting our ongoing business, dissipating our limited management resources and impairing relationships with employees and customers of the acquired business as a result of changes in ownership and management. Additionally, we have incurred indebtedness to finance past acquisitions, and would likely incur additional indebtedness to finance future acquisitions, as permitted under the Credit Agreement and the Notes (as defined herein), in which case we would also face certain financial risks associated with the incurrence of additional indebtedness to make an acquisition, such as a reduction in our liquidity, access to capital markets and financial stability.

Additionally, the types of acquisitions we will be able to make are limited by our Credit Agreement, which limits the amount that we may pay for an acquisition to $120 million plus additional amounts based on an unused available capital expenditure limit, certain proceeds from new equity issuances and other amounts.

Our operations and profitability could suffer if we experience labor relations problems.

As of the end of 2008, approximately 3,200 of our approximately 7,400 employees were covered by collective bargaining agreements with various international and local labor unions. In addition, as of the end of 2008, we operated 82 facilities, of which 41 were union facilities operated primarily by union employees. In the U.S. our union agreements typically have a term of three or four years and thus regularly expire and require negotiation in the course of our business. In 2009, collective bargaining agreements covering approximately 90 employees in the U.S. will expire. Management believes that we enjoy good relations with our employees, and there have been no significant work stoppages in the past three years. Upon the expiration of any of our collective bargaining agreements, however, we may be unable to negotiate new collective bargaining agreements on terms favorable to us, and our business operations at one or more of our facilities may be interrupted as a result of labor disputes or difficulties and delays in the process of renegotiating our collective bargaining agreements. A work stoppage at one or more of our facilities could have a material adverse effect on our business, results of operations and financial condition.

| Item 1B. | Unresolved Staff Comments |

None.

At the end of 2008, the Company owned or leased 85 plants located in Argentina, Belgium, Brazil, Canada, Finland, France, Mexico, the Netherlands, Poland, Spain, Turkey, the United Kingdom, the United States and Venezuela. Twenty-seven of the plants are located on-site at customer facilities. The Company believes that its plants, which are of varying ages and types of construction, are in good condition, are suitable for its operations and generally are expected to provide sufficient capacity to meet its requirements for the foreseeable future.

The following table sets forth the location of the Company’s manufacturing and administrative facilities, their approximate current square footage, whether on-site or off-site and whether leased or owned. In addition to the facilities listed, the Company leases other warehousing space.

| | | | | | | | |

| | | Location | | Size (Square Feet) | | On-Site or Off-Site | | Leased/ Owned |

| | U.S. Packaging Facilities(1) | | | | | | |

1. | | Findlay, Ohio | | 406,800 | | Off-Site | | Owned |

2. | | York (Household), Pennsylvania | | 395,554 | | Off-Site | | Owned |

3. | | Maryland Heights, Missouri | | 308,961 | | Off-Site | | Owned |

4. | | Henderson, Nevada | | 298,407 | | Off-Site | | Owned |

18

| | | | | | | | |

| | | Location | | Size (Square Feet) | | On-Site or Off-Site | | Leased/ Owned |

5. | | Vandalia, Illinois | | 277,500 | | Off-Site | | Owned |

6. | | Evansville, Indiana | | 266,720 | | Off-Site | | Leased |

7. | | Woodridge, Illinois | | 265,062 | | Off-Site | | Leased |

8. | | Rockwall, Texas | | 241,000 | | Off-Site | | Owned |

9. | | Modesto, California | | 238,000 | | Off-Site | | Owned |

10. | | Hazleton (Household), Pennsylvania | | 218,384 | | On-Site | | Leased |

11. | | Holland, Michigan | | 218,168 | | Off-Site | | Leased |

12. | | Fremont, Ohio | | 210,883 | | Off-Site | | Owned |

13. | | Bedford, New Hampshire | | 210,510 | | Off-Site | | Owned |

14. | | York (Food & Beverage), Pennsylvania | | 210,370 | | Off-Site | | Leased |

15. | | Tolleson, Arizona | | 209,468 | | Off-Site | | Owned |

16. | | Cartersville, Georgia | | 208,000 | | Off-Site | | Owned |

17. | | Florence (Food and Beverage), Kentucky | | 203,000 | | Off-Site | | Owned |

18. | | Edison, New Jersey (2) | | 194,000 | | Off-Site | | Owned |

19. | | Hazleton (Food and Beverage), Pennsylvania | | 185,080 | | Off-Site | | Owned |

20. | | Newell, West Virginia | | 183,388 | | On-Site | | Leased |

21. | | Harrisonburg, Virginia | | 180,000 | | Off-Site | | Owned |

22. | | Selah, Washington | | 170,553 | | Off-Site | | Owned |

23. | | Atlanta, Georgia | | 165,000 | | On-Site | | Leased |

24. | | Jefferson, Louisiana | | 162,047 | | Off-Site | | Leased |

25. | | Kansas City, Missouri | | 162,000 | | Off-Site | | Leased |

26. | | Belvidere, New Jersey | | 160,000 | | Off-Site | | Owned |

27. | | Florence (Personal Care/Specialty), Kentucky | | 153,600 | | Off-Site | | Owned |

28. | | Cincinnati, Ohio | | 153,301 | | Off-Site | | Leased |

29. | | Montgomery, Alabama (2) | | 150,143 | | Off-Site | | Leased |

30. | | Emigsville, Pennsylvania | | 148,300 | | Off-Site | | Leased |

31. | | Levittown, Pennsylvania | | 148,000 | | Off-Site | | Leased |

32. | | Iowa City, Iowa | | 140,896 | | Off-Site | | Owned |

33. | | Baltimore, Maryland | | 128,500 | | Off-Site | | Owned |

34. | | Santa Ana, California | | 127,680 | | Off-Site | | Owned |

35. | | Chicago, Illinois | | 125,500 | | Off-Site | | Owned |

36. | | Muskogee, Oklahoma | | 125,000 | | Off-Site | | Leased |

37. | | Alta Vista, Virginia | | 122,680 | | Off-Site | | Leased |

38. | | Kansas City, Kansas | | 111,000 | | On-Site | | Leased |

39. | | Ogden, Utah | | 105,000 | | On-Site | | Leased |

40. | | Casa Grande, Arizona | | 100,000 | | Off-Site | | Leased |

41. | | Bradford, Pennsylvania | | 90,350 | | Off-Site | | Leased |

42. | | Atlanta, Georgia | | 81,600 | | Off-Site | | Leased |

43. | | Lakeland, Florida | | 80,000 | | Off-Site | | Leased |

44. | | Berkeley, Missouri | | 75,000 | | Off-Site | | Owned |

45. | | Lakeland, Florida (2) | | 59,500 | | Off-Site | | Leased |

46. | | Cambridge, Ohio | | 57,000 | | On-Site | | Leased |

47. | | Port Allen, Louisiana | | 56,721 | | On-Site | | Leased |

48. | | Richmond, California | | 55,256 | | Off-Site | | Leased |

49. | | Houston, Texas | | 52,500 | | Off-Site | | Owned |

50. | | Darlington, South Carolina | | 43,200 | | Off-Site | | Leased |

51. | | Vicksburg, Mississippi | | 31,200 | | On-Site | | Leased |

52. | | Bordentown, New Jersey | | 30,000 | | On-Site | | Leased |

53. | | Joplin, Missouri | | 29,200 | | On-Site | | Leased |

54. | | Minster, Ohio | | 27,674 | | On-Site | | Leased |

55. | | West Jordan, Utah | | 25,760 | | On-Site | | Leased |

56. | | Bradenton, Florida | | 21,500 | | On-Site | | Leased |

| | | | |

| | Canadian Packaging Facilities | | | | | | |

57. | | Mississauga, Ontario | | 78,416 | | Off-Site | | Owned |

19

| | | | | | | | | |

| | | Location | | Size

(Square Feet) | | | On-Site or Off-Site | | Leased/ Owned |

| | Mexican Packaging Facilities | | | | | | | |

58. | | Tlalnepantla | | 214,349 | | | Off-Site | | Owned |

59. | | Pachuca | | 152,286 | | | Off-Site | | Owned |

60. | | Mexicali | | 59,700 | | | Off-Site | | Leased |

61. | | Irapuato | | 54,000 | | | On-Site | | Leased |

62. | | Tlaxcala | | 9,792 | | | On-Site | | Leased |

| | | | |

| | European Packaging Facilities | | | | | | | |

63. | | Assevent, France | | 186,000 | | | Off-Site | | Owned |

64. | | Rotselaar, Belgium | | 162,212 | | | On-Site | | Leased |

65. | | Etten-Leur, Netherlands | | 124,450 | | | Off-Site | | Leased |

66. | | Ryttyla, Finland | | 121,079 | | | Off-Site | | Owned |

67. | | Chalgrove, the United Kingdom | | 104,200 | | | Off-Site | | Leased |

68. | | Meaux, France | | 80,000 | | | Off-Site | | Owned |

69. | | Aldaia, Spain | | 75,350 | | | On-Site | | Leased |

70. | | Istanbul, Turkey | | 45,000 | | | Off-Site | | Leased |

71. | | Lummen, Belgium | | 42,840 | | | On-Site | | Leased |

72. | | Sulejowek, Poland | | 32,732 | | | Off-Site | | Owned |

73. | | Villecomtal, France | | 31,300 | | | On-Site | | Leased |

74. | | Zoetermeer, Netherlands | | 22,702 | | | On-Site | | Leased |

75. | | Bierun, Poland | | 10,652 | | | On-Site | | Leased |

76. | | Eskisehir, Turkey | | 9,461 | | | On-Site | | Leased |

| | | | |