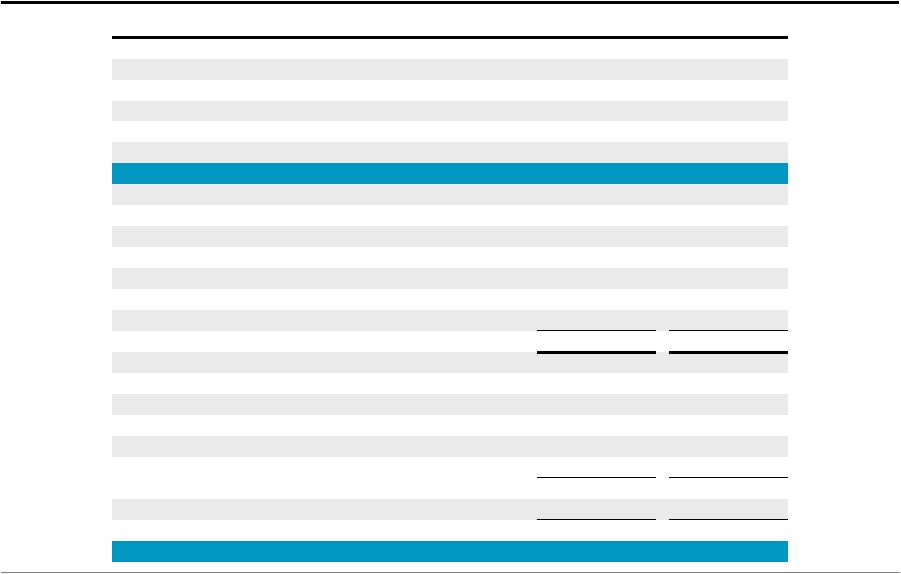

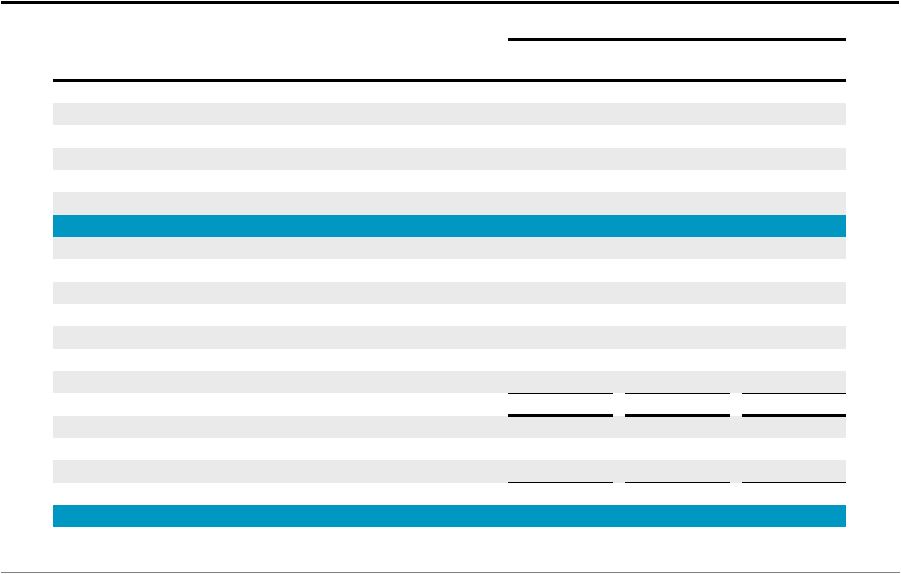

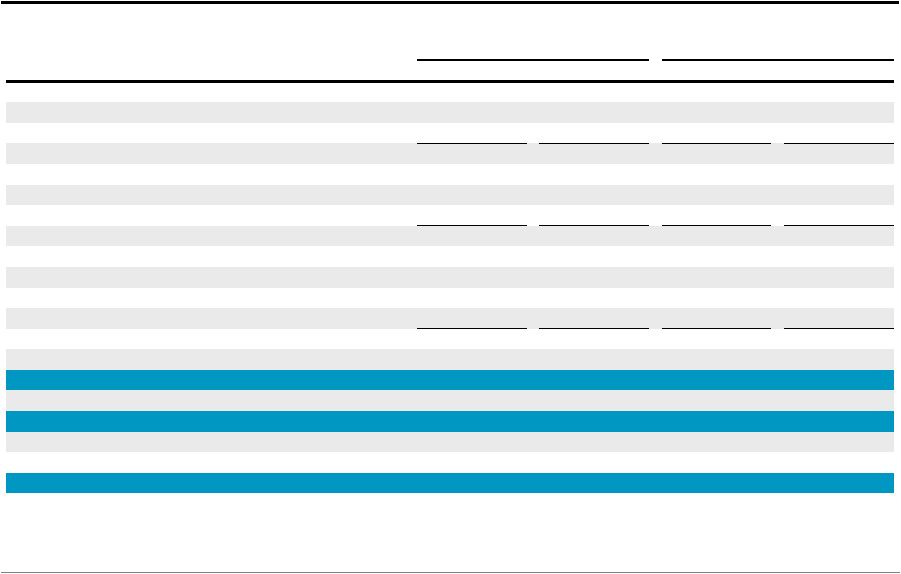

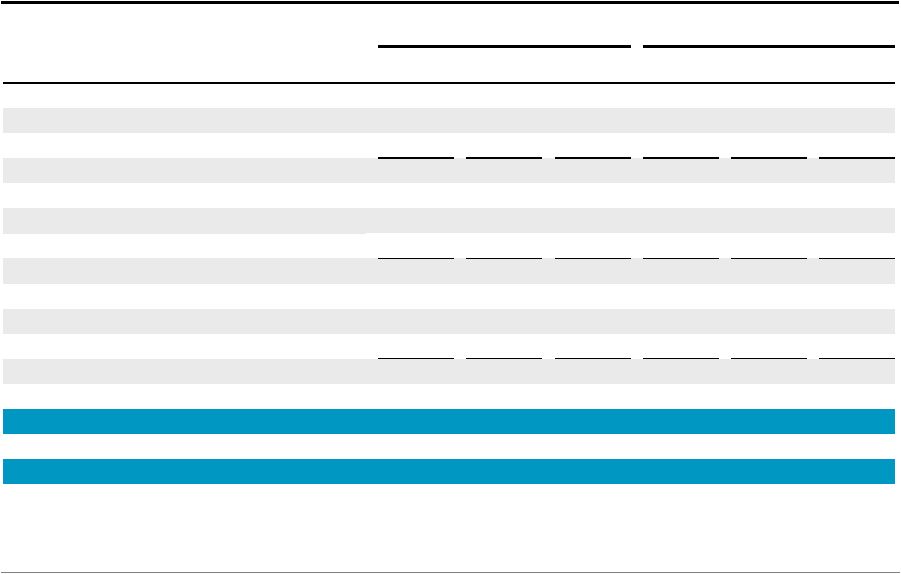

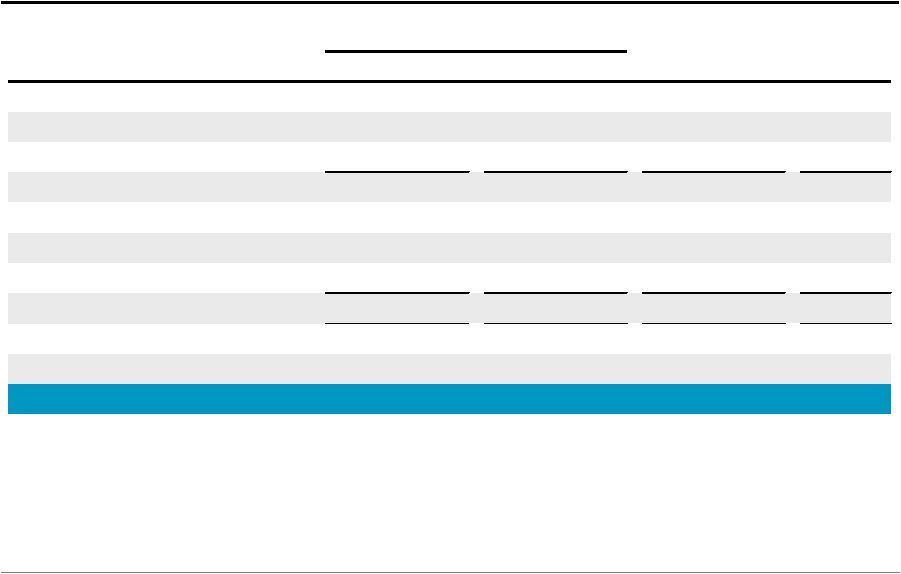

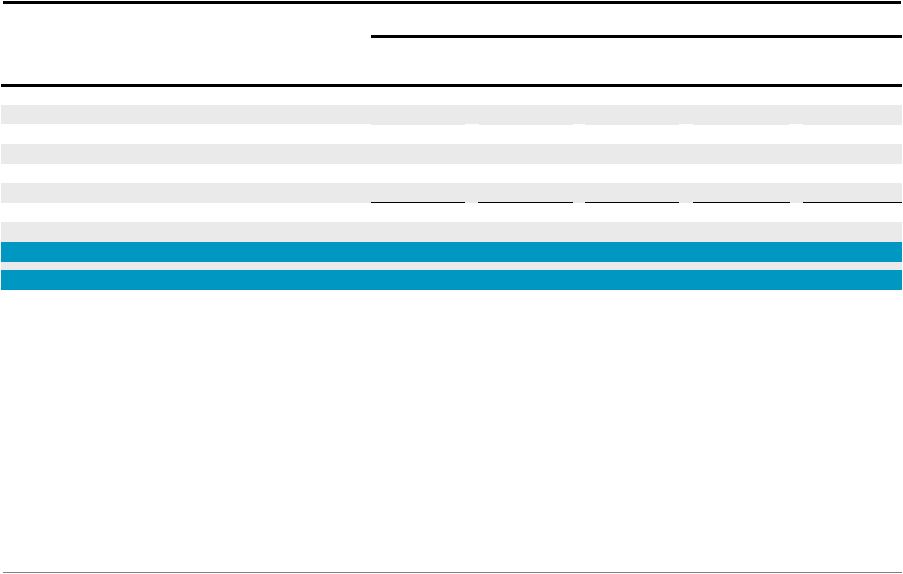

Blackstone Mortgage Trust 14 Consolidated Statement of Operations: Segment Allocation Three Months Ended December 31, 2014 Year Ended December 31, 2014 (Dollars in Thousands) Loan Origination CT Legacy Portfolio Total Loan Origination CT Legacy Portfolio Total Income from loans and other investments Interest and related income 57,527 $ 731 $ 58,258 $ 180,654 $ 4,112 $ 184,766 $ Less: Interest and related expenses 21,256 190 21,446 68,098 1,045 69,143 Income from loans and other investments, net 36,271 541 36,812 112,556 3,067 115,623 Other expenses Management and incentive fees 6,272 - 6,272 19,491 - 19,491 General and administrative expenses 3,613 2,263 5,876 12,665 15,134 27,799 Total other expenses 9,885 2,263 12,148 32,156 15,134 47,290 Impairments, provisions, and valuation adjustments - 5,654 5,654 - 13,258 13,258 Loss on deconsolidation of subsidiary - (8,615) (8,615) - (8,615) (8,615) Income from equity investments in unconsolidated subsidiaries - 3,742 3,742 - 28,036 28,036 Income (loss) before income taxes 26,386 (941) 25,445 80,400 20,612 101,012 Income tax provision 63 44 107 194 324 518 Net income (loss) 26,323 $ (985) $ 25,338 $ 80,206 $ 20,288 $ 100,494 $ Net income attributable to non-controlling interests - (3,848) (3,848) - (10,449) (10,449) Net income (loss) attributable to Blackstone Mortgage Trust, Inc. 26,323 $ (4,833) $ 21,490 $ 80,206 $ 9,839 $ 90,045 $ |