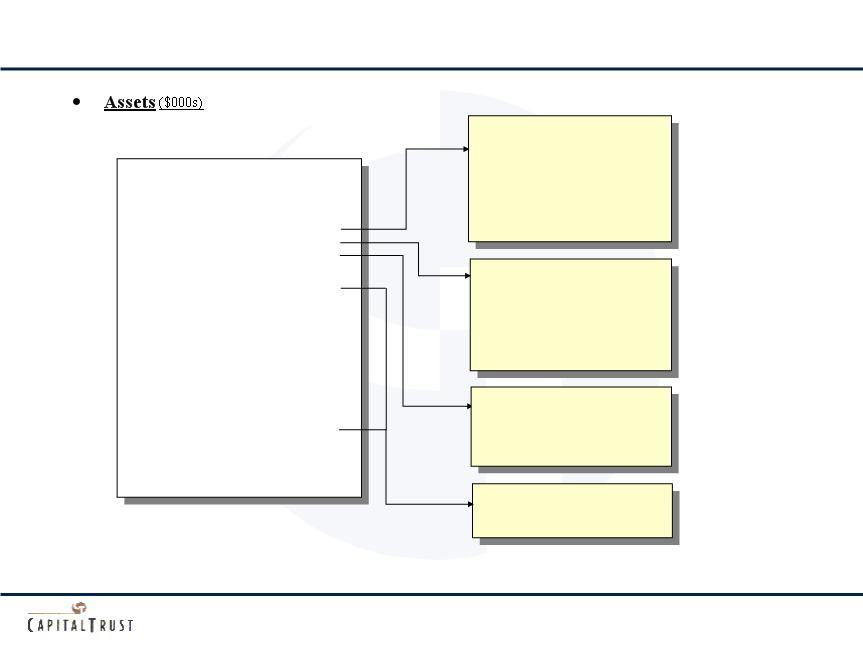

Assets

Cash

Loans

CMBS

Equity Investments

Total Return Swaps

Interest Rate Hedges (Swaps)

Other

Total Assets

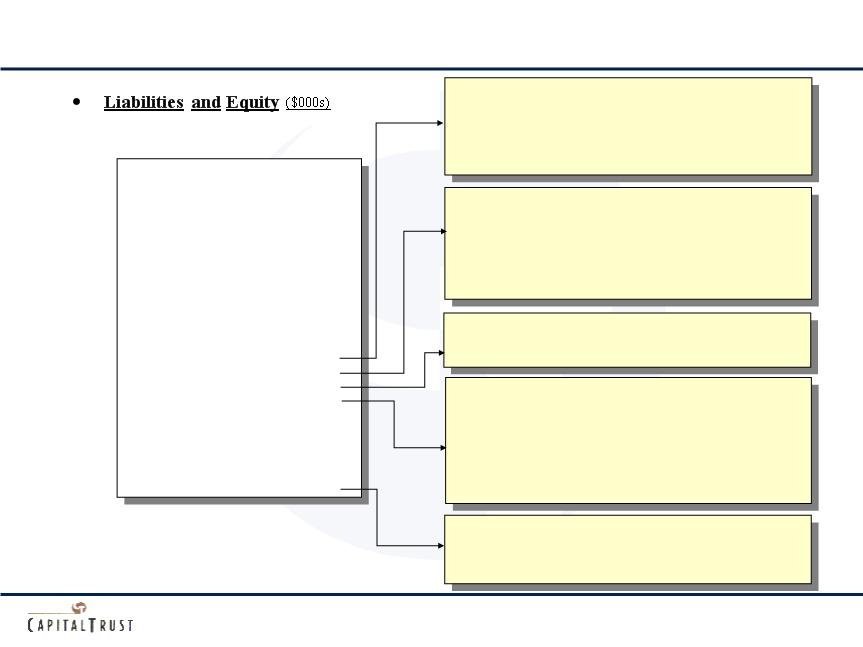

Liabilities

Secured Debt

CDO Debt

Credit Facility

Junior Sub. Debentures

Participations Sold

Interest Rate Hedges (Swaps)

Other

Total Liabilities

Common Equity

3/31/08

$138,284

2,251,614

873,493

905

-

-

42,236

$3,306,482

$910,049

1,187,904

100,000

128,875

409,324

35,647

31,341

$2,803,140

$503,392

FINANCIAL INFORMATION

Notes:

(1) Includes in-the-money options as of 3/31/08

III - 5

Secured Debt

• $1.6 billion of committed credit facilities

• Multiple providers (Morgan Stanley, Goldman Sachs, JPMorgan,

Bank of America, Lehman Brothers, Citigroup)

• Coupon: LIBOR + 45 bps to LIBOR + 250 bps

• GAAP Cost of Funds: 3.97%

Collateralized Debt Obligations

• Investment grade CDO Notes sold

• Non-recourse, non-mark-to-market, term and index-matched

• CDO I & II: weighted average coupon of L+0.55%, all-in cost

L+0.89%

• CDO III & IV: cash cost 4.03%, all-in cost 4.16%

• GAAP Cost of Funds: 3.90%

Common Equity

• 21.9 million shares outstanding(1)

• Book value per share: $23.00

• 13% owned by officers & directors

Trust Preferred Securities

• $129 million of trust preferred securities sold

• CT Preferred Trust I: 30 yr. term redeemable at par on or after April

2011 - - all-in cost fixed at 7.45% to April 2016, L+2.65% thereafter

• CT Preferred Trust II: 30 yr. term redeemable at par on or after

April 2012 - all-in cost fixed at 7.14% to April 2017, L+2.25%

thereafter

• GAAP Cost of Funds: 7.30%

Senior Unsecured Credit Facility

• $100 million revolving credit facility

• Cash cost: L+1.75%, all-in cost L+1.98%