- BXMT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Blackstone Mortgage Trust (BXMT) 8-KBlackstone Mortgage Trust Reports

Filed: 26 Apr 16, 12:00am

Blackstone Mortgage Trust, Inc. April 26, 2016 First Quarter 2016 Results Confidential Exhibit 99.2

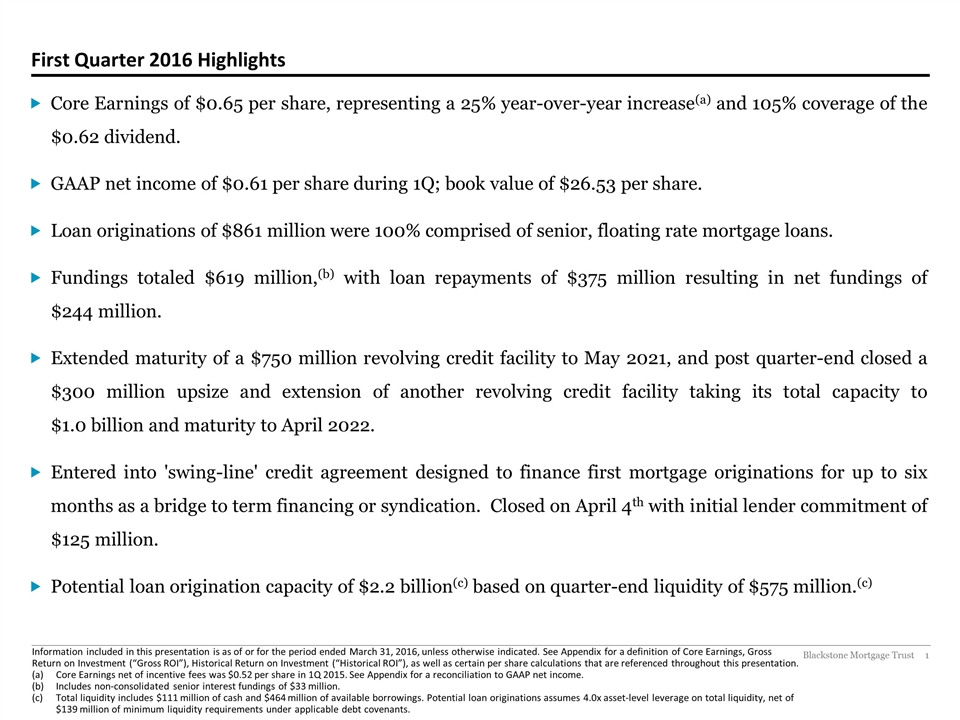

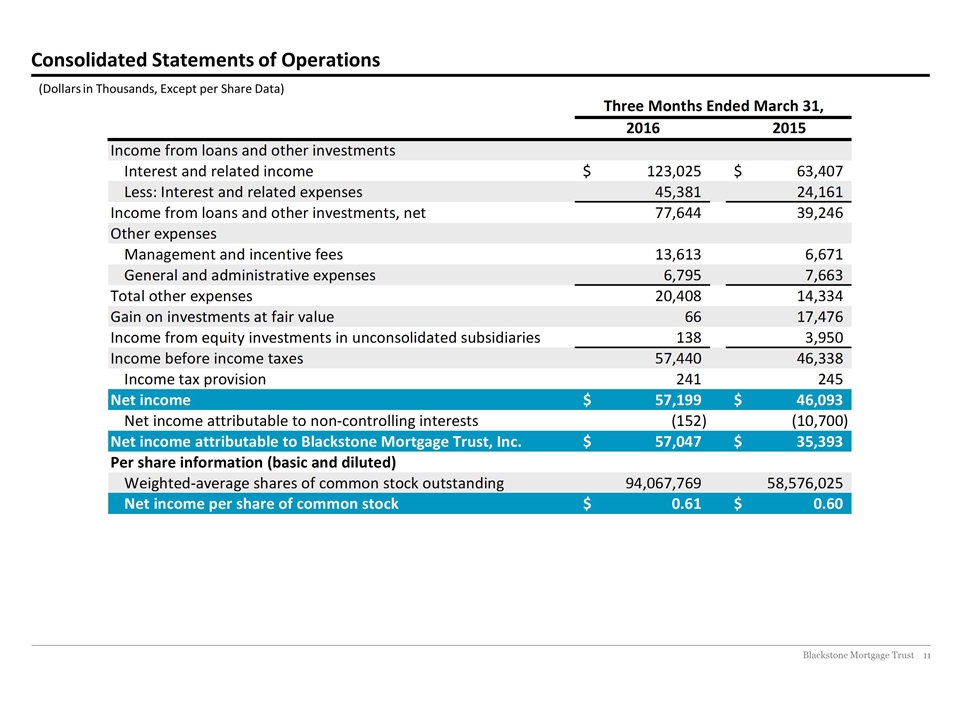

First Quarter 2016 Highlights Core Earnings of $0.65 per share, representing a 25% year-over-year increase(a) and 105% coverage of the $0.62 dividend. GAAP net income of $0.61 per share during 1Q; book value of $26.53 per share. Loan originations of $861 million were 100% comprised of senior, floating rate mortgage loans. Fundings totaled $619 million,(b) with loan repayments of $375 million resulting in net fundings of $244 million. Extended maturity of a $750 million revolving credit facility to May 2021, and post quarter-end closed a $300 million upsize and extension of another revolving credit facility taking its total capacity to $1.0 billion and maturity to April 2022. Entered into 'swing-line' credit agreement designed to finance first mortgage originations for up to six months as a bridge to term financing or syndication. Closed on April 4th with initial lender commitment of $125 million. Potential loan origination capacity of $2.2 billion(c) based on quarter-end liquidity of $575 million.(c) Information included in this presentation is as of or for the period ended March 31, 2016, unless otherwise indicated. See Appendix for a definition of Core Earnings, Gross Return on Investment (“Gross ROI”), Historical Return on Investment (“Historical ROI”), as well as certain per share calculations that are referenced throughout this presentation. Core Earnings net of incentive fees was $0.52 per share in 1Q 2015. See Appendix for a reconciliation to GAAP net income. Includes non-consolidated senior interest fundings of $33 million. Total liquidity includes $111 million of cash and $464 million of available borrowings. Potential loan originations assumes 4.0x asset-level leverage on total liquidity, net of $139 million of minimum liquidity requirements under applicable debt covenants.

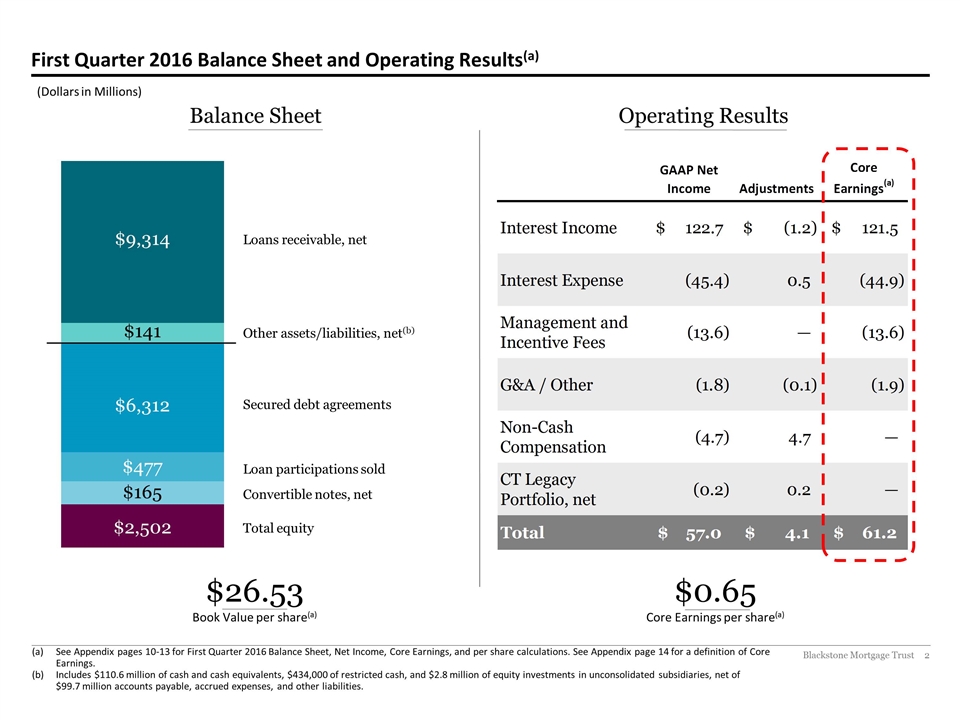

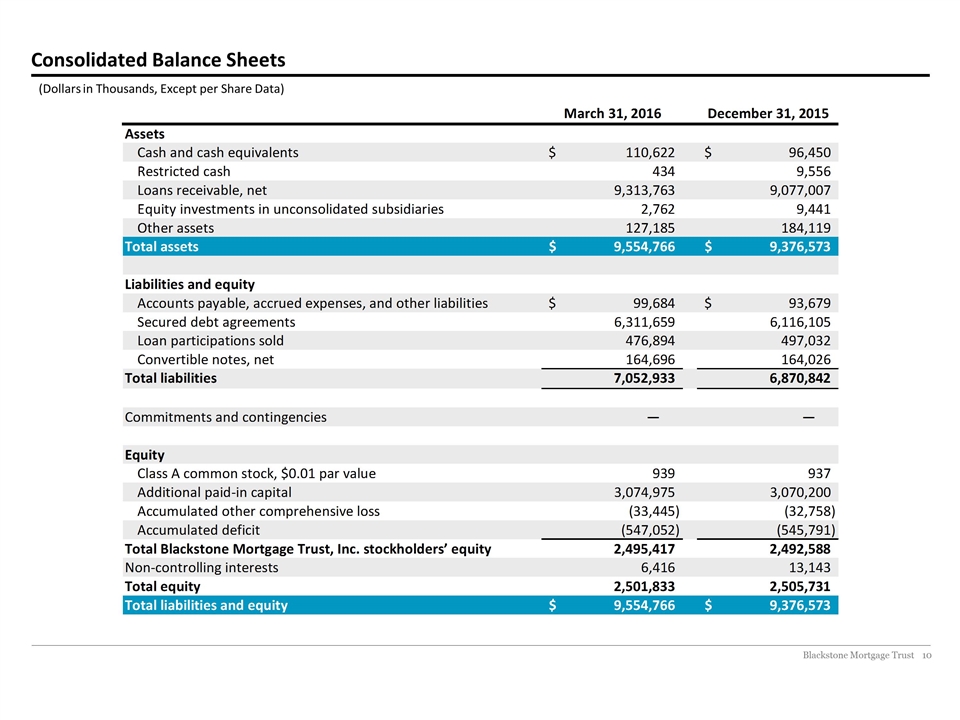

First Quarter 2016 Balance Sheet and Operating Results(a) See Appendix pages 10-13 for First Quarter 2016 Balance Sheet, Net Income, Core Earnings, and per share calculations. See Appendix page 14 for a definition of Core Earnings. Includes $110.6 million of cash and cash equivalents, $434,000 of restricted cash, and $2.8 million of equity investments in unconsolidated subsidiaries, net of $99.7 million accounts payable, accrued expenses, and other liabilities. $0.65 Core Earnings per share(a) $26.53 Book Value per share(a) Balance Sheet Operating Results Loans receivable, net Other assets/liabilities, net(b) Secured debt agreements Loan participations sold Convertible notes, net Total equity $9,314 $6,312 $477 $2,502 (Dollars in Millions) $165 $141

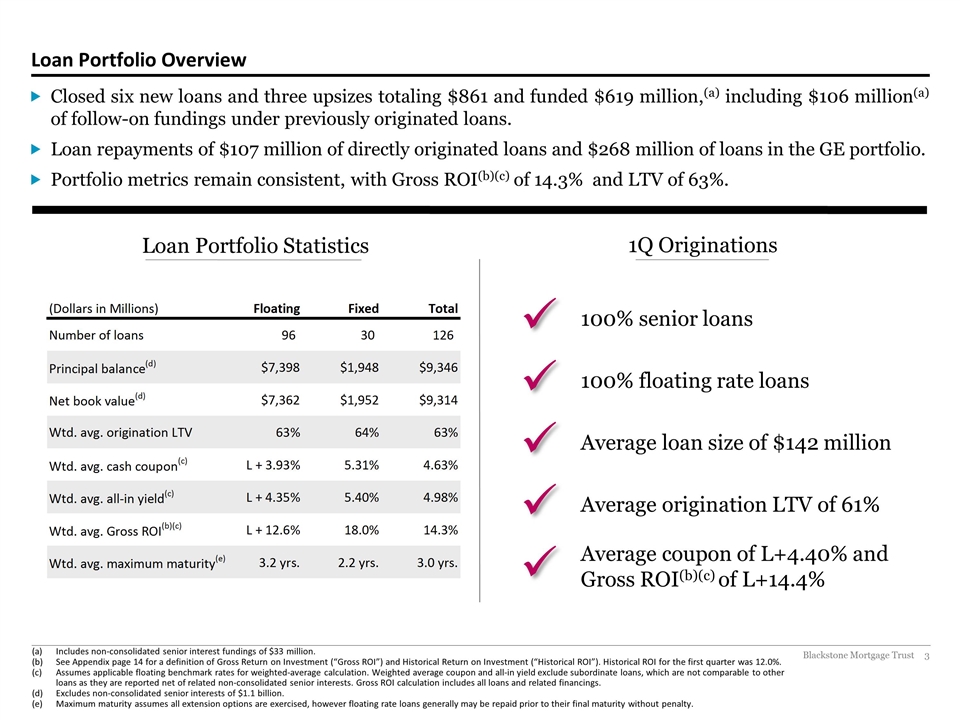

Loan Portfolio Overview Closed six new loans and three upsizes totaling $861 and funded $619 million,(a) including $106 million(a) of follow‑on fundings under previously originated loans. Loan repayments of $107 million of directly originated loans and $268 million of loans in the GE portfolio. Portfolio metrics remain consistent, with Gross ROI(b)(c) of 14.3% and LTV of 63%. Loan Portfolio Statistics Includes non-consolidated senior interest fundings of $33 million. See Appendix page 14 for a definition of Gross Return on Investment (“Gross ROI”) and Historical Return on Investment (“Historical ROI”). Historical ROI for the first quarter was 12.0%. Assumes applicable floating benchmark rates for weighted-average calculation. Weighted average coupon and all-in yield exclude subordinate loans, which are not comparable to other loans as they are reported net of related non-consolidated senior interests. Gross ROI calculation includes all loans and related financings. Excludes non-consolidated senior interests of $1.1 billion. Maximum maturity assumes all extension options are exercised, however floating rate loans generally may be repaid prior to their final maturity without penalty. 1Q Originations 100% floating rate loans 100% senior loans Average coupon of L+4.40% and Gross ROI(b)(c) of L+14.4% ü ü ü Average loan size of $142 million Average origination LTV of 61% ü ü

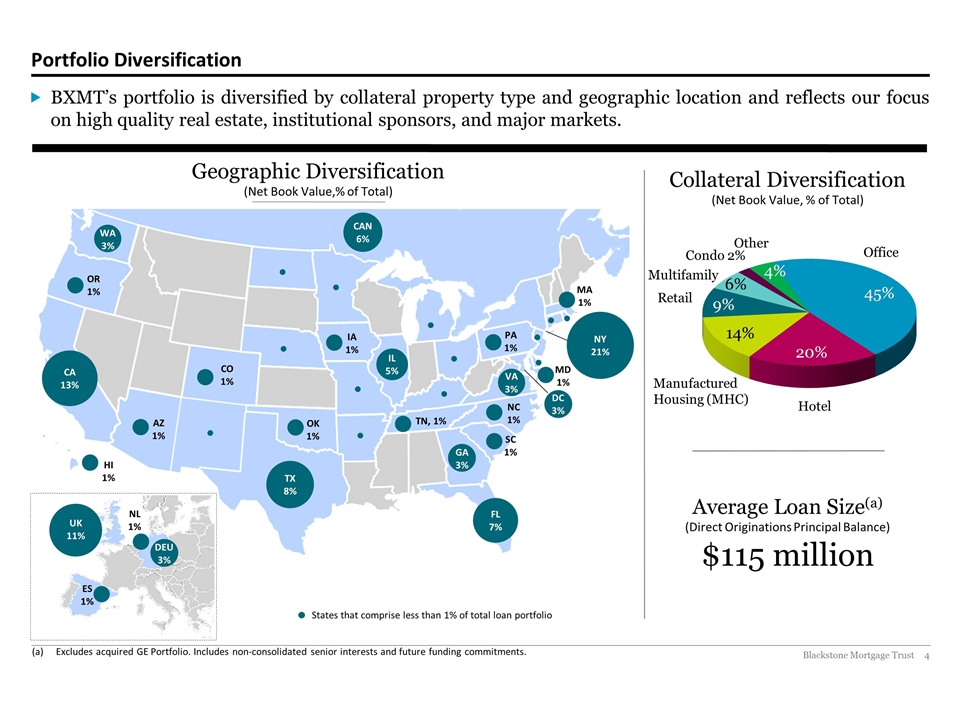

Portfolio Diversification BXMT’s portfolio is diversified by collateral property type and geographic location and reflects our focus on high quality real estate, institutional sponsors, and major markets. Collateral Diversification (Net Book Value, % of Total) Office Multifamily Hotel Condo 2% Other Retail Manufactured Housing (MHC) Geographic Diversification (Net Book Value,% of Total) States that comprise less than 1% of total loan portfolio Excludes acquired GE Portfolio. Includes non-consolidated senior interests and future funding commitments. AZ 1% CO 1% HI 1% IA 1% MD 1% MA 1% NC 1% OK 1% OR 1% PA 1% SC 1% TN, 1% ES 1% NL 1% DC 3% GA 3% VA 3% WA 3% DEU 3% IL 5% CAN 6% FL 7% TX 8% UK 11% CA 13% NY 21% Average Loan Size(a) (Direct Originations Principal Balance) $115 million

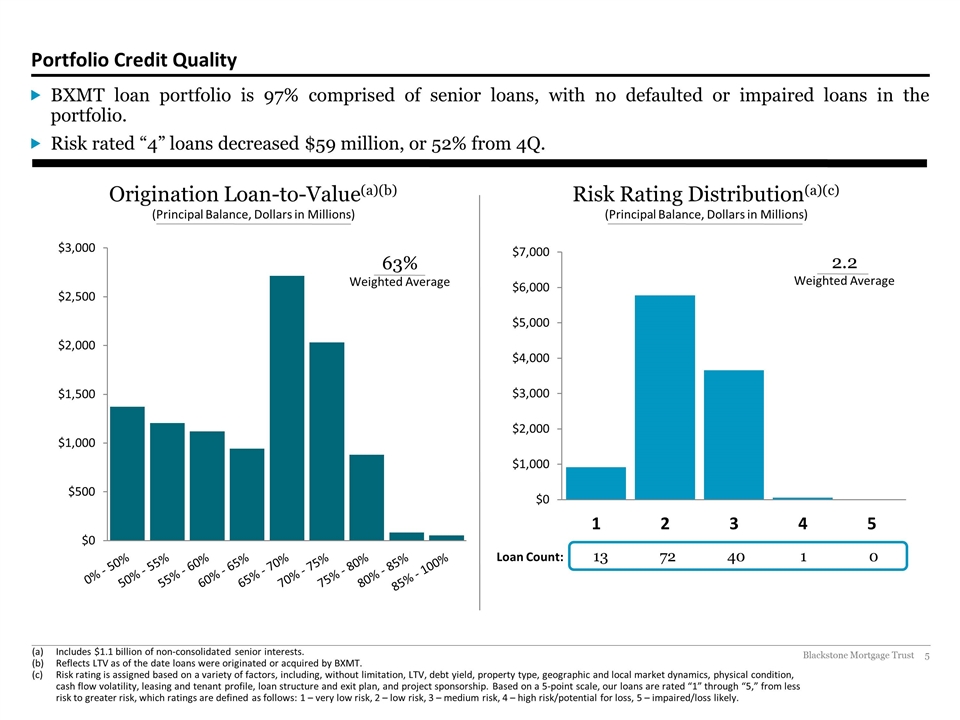

Portfolio Credit Quality Includes $1.1 billion of non-consolidated senior interests. Reflects LTV as of the date loans were originated or acquired by BXMT. Risk rating is assigned based on a variety of factors, including, without limitation, LTV, debt yield, property type, geographic and local market dynamics, physical condition, cash flow volatility, leasing and tenant profile, loan structure and exit plan, and project sponsorship. Based on a 5-point scale, our loans are rated “1” through “5,” from less risk to greater risk, which ratings are defined as follows: 1 – very low risk, 2 – low risk, 3 – medium risk, 4 – high risk/potential for loss, 5 – impaired/loss likely. BXMT loan portfolio is 97% comprised of senior loans, with no defaulted or impaired loans in the portfolio. Risk rated “4” loans decreased $59 million, or 52% from 4Q. Risk Rating Distribution(a)(c) (Principal Balance, Dollars in Millions) 13 72 40 1 0 Loan Count: Origination Loan-to-Value(a)(b) (Principal Balance, Dollars in Millions) 2.2 Weighted Average

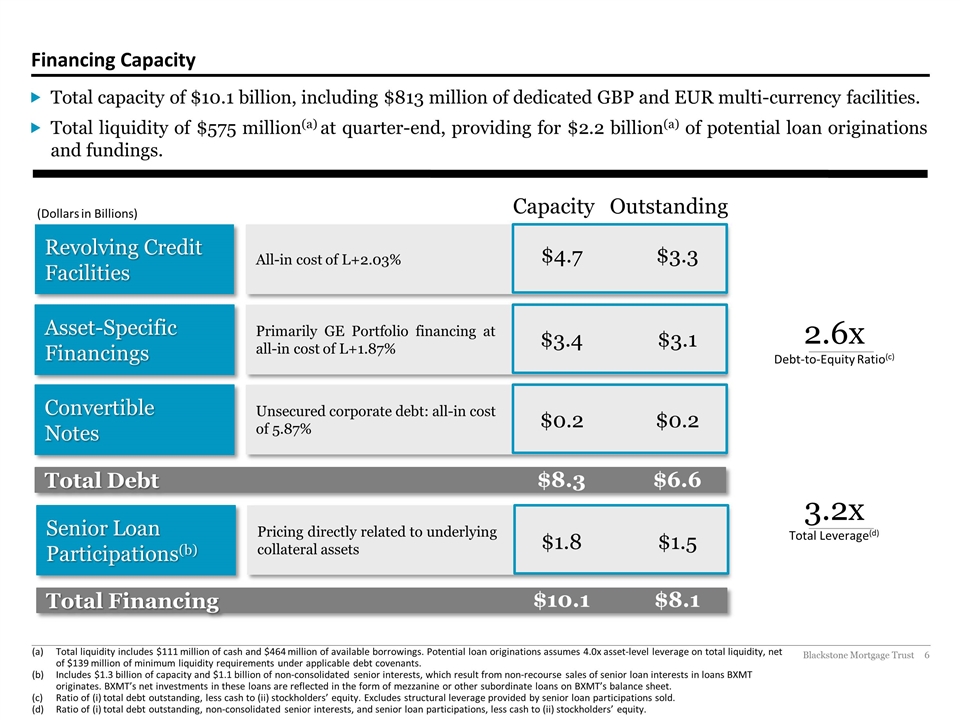

Financing Capacity Total capacity of $10.1 billion, including $813 million of dedicated GBP and EUR multi-currency facilities. Total liquidity of $575 million(a) at quarter-end, providing for $2.2 billion(a) of potential loan originations and fundings. Total liquidity includes $111 million of cash and $464 million of available borrowings. Potential loan originations assumes 4.0x asset-level leverage on total liquidity, net of $139 million of minimum liquidity requirements under applicable debt covenants. Includes $1.3 billion of capacity and $1.1 billion of non-consolidated senior interests, which result from non-recourse sales of senior loan interests in loans BXMT originates. BXMT’s net investments in these loans are reflected in the form of mezzanine or other subordinate loans on BXMT’s balance sheet. Ratio of (i) total debt outstanding, less cash to (ii) stockholders’ equity. Excludes structural leverage provided by senior loan participations sold. Ratio of (i) total debt outstanding, non-consolidated senior interests, and senior loan participations, less cash to (ii) stockholders’ equity. 2.6x Debt-to-Equity Ratio(c) 3.2x Total Leverage(d) Revolving Credit Facilities All-in cost of L+2.03% Asset-Specific Financings Primarily GE Portfolio financing at all-in cost of L+1.87% Convertible Notes Unsecured corporate debt: all-in cost of 5.87% Total Debt Senior Loan Participations(b) Pricing directly related to underlying collateral assets Total Financing $4.7 $3.3 $3.4 $3.1 $0.2 $0.2 $8.3 $6.6 $1.8 $1.5 $10.1 $8.1 Capacity Outstanding (Dollars in Billions)

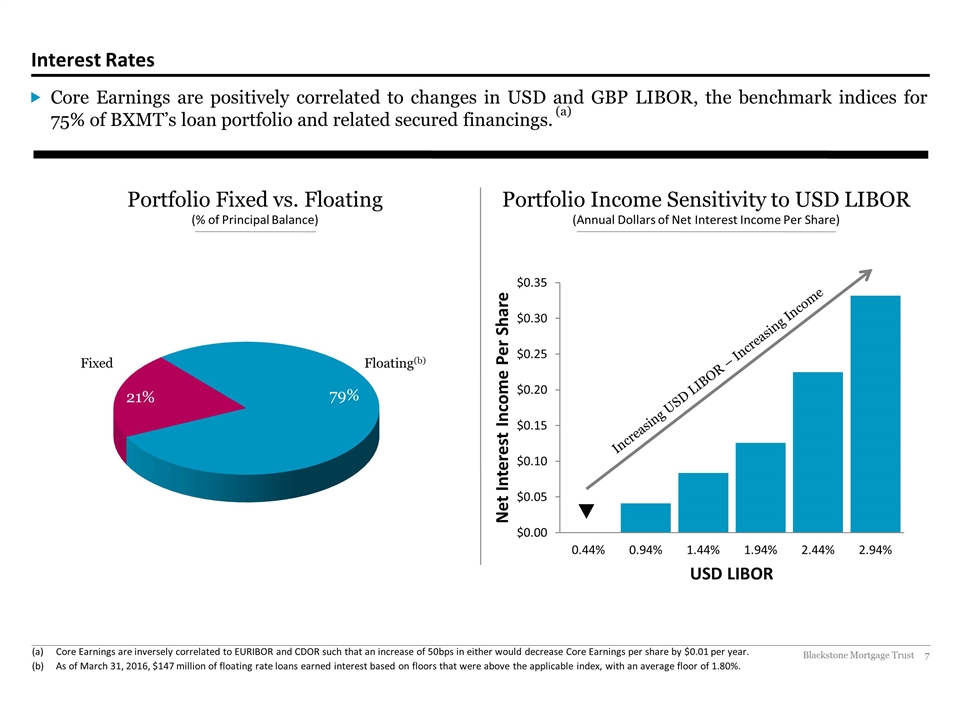

Interest Rates Core Earnings are positively correlated to changes in USD and GBP LIBOR, the benchmark indices for 75% of BXMT’s loan portfolio and related secured financings. (a) Core Earnings are inversely correlated to EURIBOR and CDOR such that an increase of 50bps in either would decrease Core Earnings per share by $0.01 per year. As of March 31, 2016, $147 million of floating rate loans earned interest based on floors that were above the applicable index, with an average floor of 1.80%. Portfolio Income Sensitivity to USD LIBOR (Annual Dollars of Net Interest Income Per Share) Portfolio Fixed vs. Floating (% of Principal Balance) Floating(b) Fixed Increasing USD LIBOR – Increasing Income

Appendix

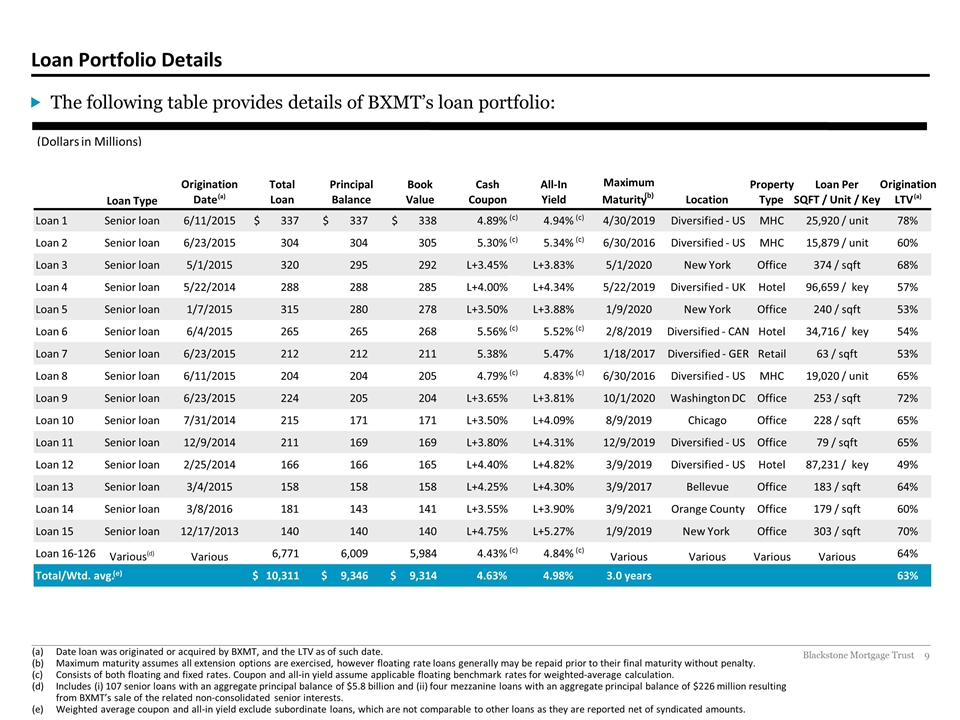

Loan Portfolio Details The following table provides details of BXMT’s loan portfolio: ________________________________________________ Footnote. Date loan was originated or acquired by BXMT, and the LTV as of such date. Maximum maturity assumes all extension options are exercised, however floating rate loans generally may be repaid prior to their final maturity without penalty. Consists of both floating and fixed rates. Coupon and all-in yield assume applicable floating benchmark rates for weighted-average calculation. Includes (i) 107 senior loans with an aggregate principal balance of $5.8 billion and (ii) four mezzanine loans with an aggregate principal balance of $226 million resulting from BXMT’s sale of the related non-consolidated senior interests. Weighted average coupon and all-in yield exclude subordinate loans, which are not comparable to other loans as they are reported net of syndicated amounts. (Dollars in Millions) Loan Type Origination Date (a) Total Loan Principal Balance Book Value Cash Coupon All-In Yield Maximum Maturity (b) Location Property Type Loan Per SQFT / Unit / Key Origination LTV (a) Loan 1 Senior loan 6/11/2015 337 $ 337 $ 338 $ 4.89% (c) 4.94% (c) 4/30/2019 Diversified - US MHC 25,920 / unit 78% Loan 2 Senior loan 6/23/2015 304 304 305 5.30% (c) 5.34% (c) 6/30/2016 Diversified - US MHC 15,879 / unit 60% Loan 3 Senior loan 5/1/2015 320 295 292 L+3.45% L+3.83% 5/1/2020 New York Office 374 / sqft 68% Loan 4 Senior loan 5/22/2014 288 288 285 L+4.00% L+4.34% 5/22/2019 Diversified - UK Hotel 96,659 / key 57% Loan 5 Senior loan 1/7/2015 315 280 278 L+3.50% L+3.88% 1/9/2020 New York Office 240 / sqft 53% Loan 6 Senior loan 6/4/2015 265 265 268 5.56% (c) 5.52% (c) 2/8/2019 Diversified - CAN Hotel 34,716 / key 54% Loan 7 Senior loan 6/23/2015 212 212 211 5.38% 5.47% 1/18/2017 Diversified - GER Retail 63 / sqft 53% Loan 8 Senior loan 6/11/2015 204 204 205 4.79% (c) 4.83% (c) 6/30/2016 Diversified - US MHC 19,020 / unit 65% Loan 9 Senior loan 6/23/2015 224 205 204 L+3.65% L+3.81% 10/1/2020 Washington DC Office 253 / sqft 72% Loan 10 Senior loan 7/31/2014 215 171 171 L+3.50% L+4.09% 8/9/2019 Chicago Office 228 / sqft 65% Loan 11 Senior loan 12/9/2014 211 169 169 L+3.80% L+4.31% 12/9/2019 Diversified - US Office 79 / sqft 65% Loan 12 Senior loan 2/25/2014 166 166 165 L+4.40% L+4.82% 3/9/2019 Diversified - US Hotel 87,231 / key 49% Loan 13 Senior loan 3/4/2015 158 158 158 L+4.25% L+4.30% 3/9/2017 Bellevue Office 183 / sqft 64% Loan 14 Senior loan 3/8/2016 181 143 141 L+3.55% L+3.90% 3/9/2021 Orange County Office 179 / sqft 60% Loan 15 Senior loan 12/17/2013 140 140 140 L+4.75% L+5.27% 1/9/2019 New York Office 303 / sqft 70% Loan 16-126 Various (d) Various 6,771 6,009 5,984 4.43% (c) 4.84% (c) Various Various Various Various 64% Total/Wtd. avg. (e) 10,311 $ 9,346 $ 9,314 $ 4.63% 4.98% 3.0 years 63%

Consolidated Balance Sheets (Dollars in Thousands, Except per Share Data)

Consolidated Statements of Operations (Dollars in Thousands, Except per Share Data)

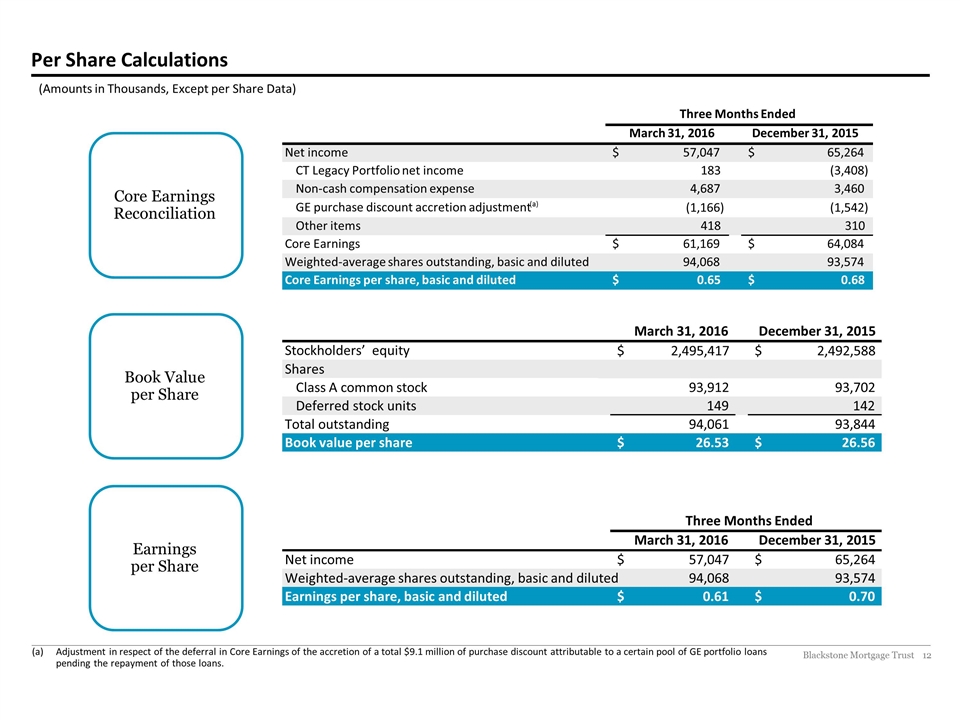

Per Share Calculations (Amounts in Thousands, Except per Share Data) Core Earnings Reconciliation Book Value per Share Earnings per Share Adjustment in respect of the deferral in Core Earnings of the accretion of a total $9.1 million of purchase discount attributable to a certain pool of GE portfolio loans pending the repayment of those loans. Three Months Ended March 31, 2016 December 31, 2015 Net income 57,047 $ 65,264 $ CT Legacy Portfolio net income 183 (3,408) Non-cash compensation expense 4,687 3,460 GE purchase discount accretion adjustment (a) (1,166) (1,542) Other items 418 310 Core Earnings 61,169 $ 64,084 $ Weighted-average shares outstanding, basic and diluted 94,068 93,574 Core Earnings per share, basic and diluted 0.65 $ 0.68 $ March 31, 2016 December 31, 2015 Stockholders’ equity 2,495,417 $ 2,492,588 $ Shares Class A common stock 93,912 93,702 Deferred stock units 149 142 Total outstanding 94,061 93,844 Book value per share 26.53 $ 26.56 $ Three Months Ended March 31, 2016 December 31, 2015 Net income 57,047 $ 65,264 $ Weighted-average shares outstanding, basic and diluted 94,068 93,574 Earnings per share, basic and diluted 0.61 $ 0.70 $

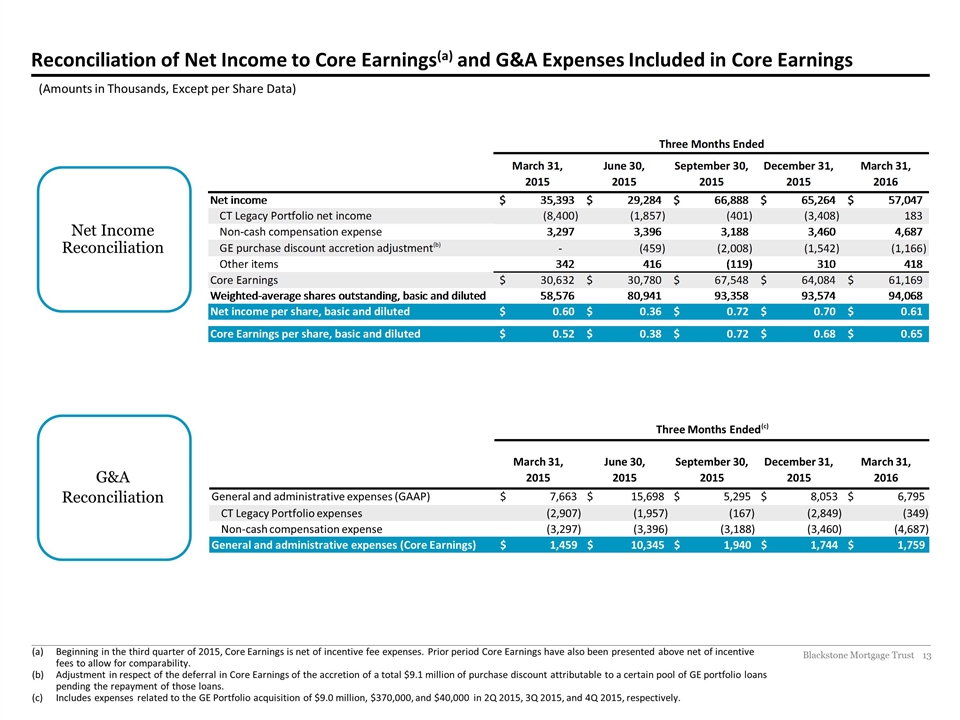

Reconciliation of Net Income to Core Earnings(a) and G&A Expenses Included in Core Earnings Beginning in the third quarter of 2015, Core Earnings is net of incentive fee expenses. Prior period Core Earnings have also been presented above net of incentive fees to allow for comparability. Adjustment in respect of the deferral in Core Earnings of the accretion of a total $9.1 million of purchase discount attributable to a certain pool of GE portfolio loans pending the repayment of those loans. Includes expenses related to the GE Portfolio acquisition of $9.0 million, $370,000, and $40,000 in 2Q 2015, 3Q 2015, and 4Q 2015, respectively. (Amounts in Thousands, Except per Share Data) Net Income Reconciliation G&A Reconciliation Three Months Ended (c) March 31, 2015 June 30, 2015 September 30, 2015 December 31, 2015 March 31, 2016 General and administrative expenses (GAAP) 7,663 $ 15,698 $ 5,295 $ 8,053 $ 6,795 $ CT Legacy Portfolio expenses (2,907) (1,957) (167) (2,849) (349) Non-cash compensation expense (3,297) (3,396) (3,188) (3,460) (4,687) General and administrative expenses (Core Earnings) 1,459 $ 10,345 $ 1,940 $ 1,744 $ 1,759 $

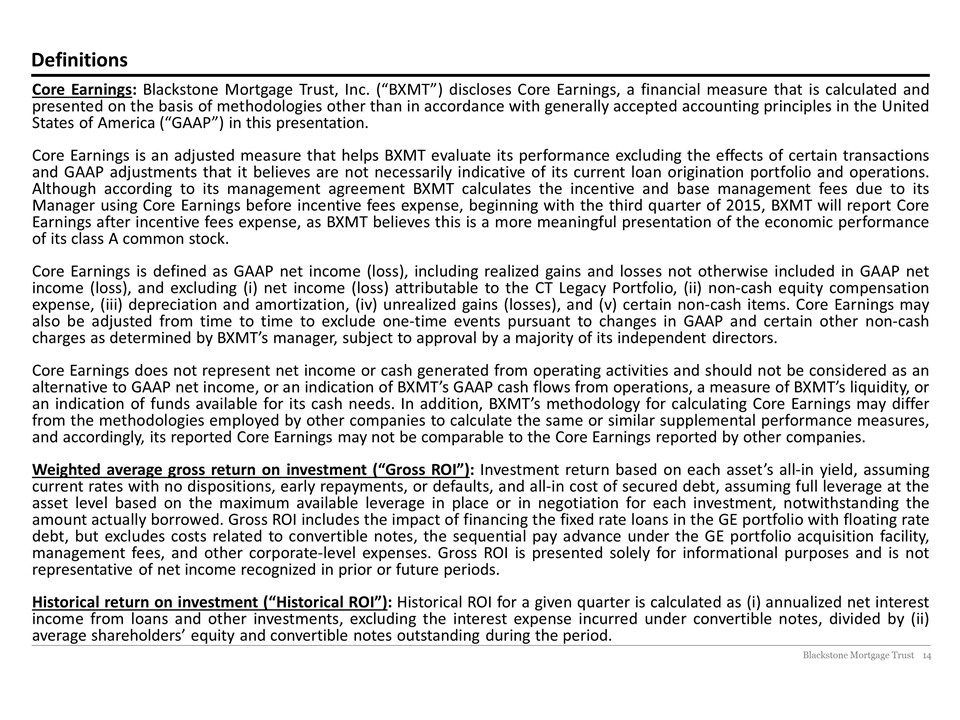

Definitions Core Earnings: Blackstone Mortgage Trust, Inc. (“BXMT”) discloses Core Earnings, a financial measure that is calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles in the United States of America (“GAAP”) in this presentation. Core Earnings is an adjusted measure that helps BXMT evaluate its performance excluding the effects of certain transactions and GAAP adjustments that it believes are not necessarily indicative of its current loan origination portfolio and operations. Although according to its management agreement BXMT calculates the incentive and base management fees due to its Manager using Core Earnings before incentive fees expense, beginning with the third quarter of 2015, BXMT will report Core Earnings after incentive fees expense, as BXMT believes this is a more meaningful presentation of the economic performance of its class A common stock. Core Earnings is defined as GAAP net income (loss), including realized gains and losses not otherwise included in GAAP net income (loss), and excluding (i) net income (loss) attributable to the CT Legacy Portfolio, (ii) non-cash equity compensation expense, (iii) depreciation and amortization, (iv) unrealized gains (losses), and (v) certain non-cash items. Core Earnings may also be adjusted from time to time to exclude one-time events pursuant to changes in GAAP and certain other non-cash charges as determined by BXMT’s manager, subject to approval by a majority of its independent directors. Core Earnings does not represent net income or cash generated from operating activities and should not be considered as an alternative to GAAP net income, or an indication of BXMT’s GAAP cash flows from operations, a measure of BXMT’s liquidity, or an indication of funds available for its cash needs. In addition, BXMT’s methodology for calculating Core Earnings may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures, and accordingly, its reported Core Earnings may not be comparable to the Core Earnings reported by other companies. Weighted average gross return on investment (“Gross ROI”): Investment return based on each asset’s all-in yield, assuming current rates with no dispositions, early repayments, or defaults, and all-in cost of secured debt, assuming full leverage at the asset level based on the maximum available leverage in place or in negotiation for each investment, notwithstanding the amount actually borrowed. Gross ROI includes the impact of financing the fixed rate loans in the GE portfolio with floating rate debt, but excludes costs related to convertible notes, the sequential pay advance under the GE portfolio acquisition facility, management fees, and other corporate-level expenses. Gross ROI is presented solely for informational purposes and is not representative of net income recognized in prior or future periods. Historical return on investment (“Historical ROI”): Historical ROI for a given quarter is calculated as (i) annualized net interest income from loans and other investments, excluding the interest expense incurred under convertible notes, divided by (ii) average shareholders’ equity and convertible notes outstanding during the period.

Forward-Looking Statements This presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect Blackstone Mortgage Trust’s (“BXMT”) current views with respect to, among other things, BXMT’s operations and financial performance, including performance of the loan portfolio acquired from GE Capital. You can identify these forward-looking statements by the use of words such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. BXMT believes these factors include but are not limited to those described under the section entitled “Risk Factors” in its Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as such factors may be updated from time to time in its periodic filings with the Securities and Exchange Commission (“SEC”) which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in the filings. BXMT assumes no obligation to update or supplement forward‐looking statements that become untrue because of subsequent events or circumstances.