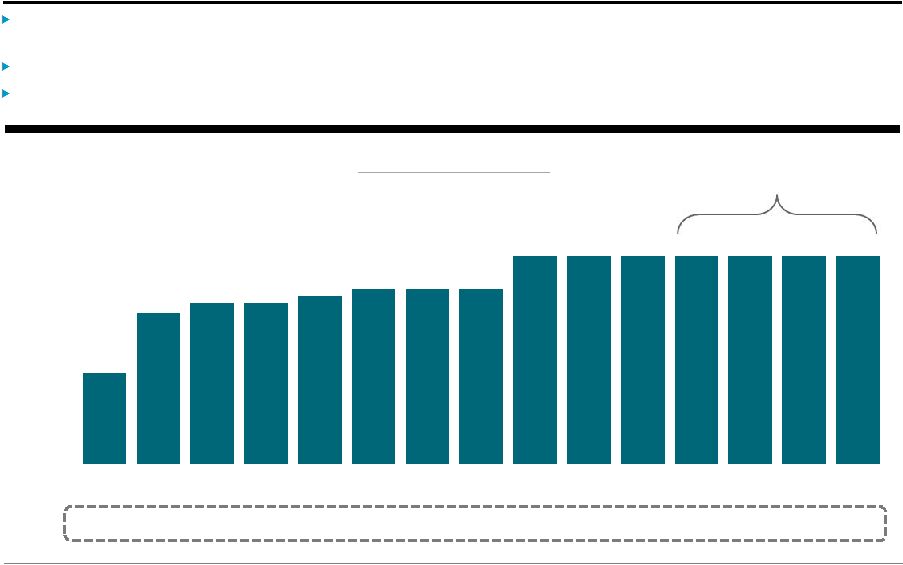

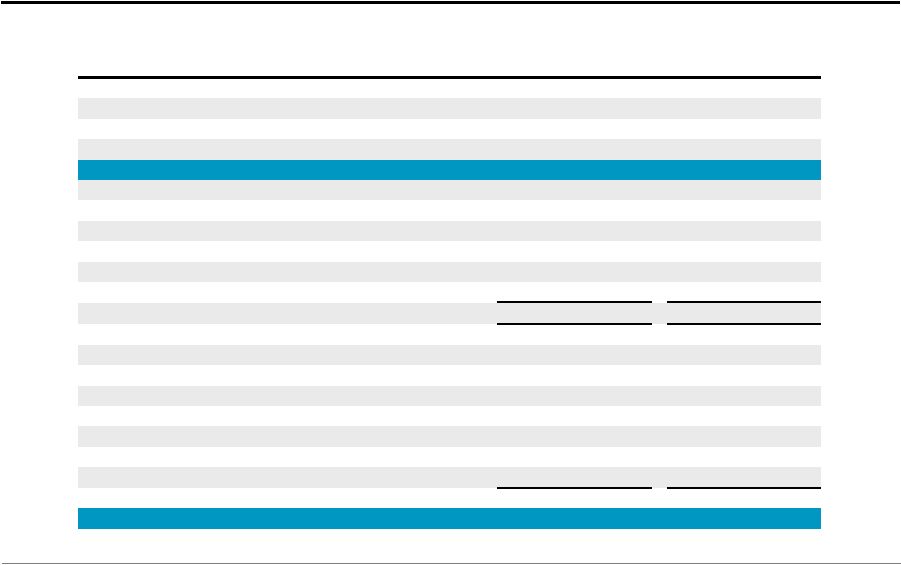

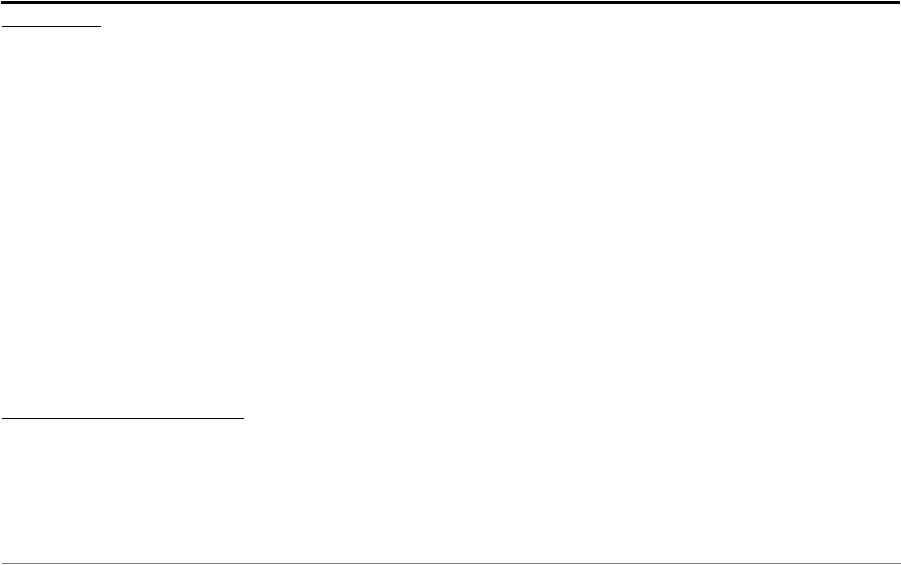

Blackstone Mortgage Trust 14 Reconciliation of Net Income to Core Earnings (a) (Amounts in Thousands, Except per Share Data) Three Months Ended Sep 30, 2013 Dec 31, 2013 Mar 31, 2014 Jun 30, 2014 Sep 30, 2014 Dec 31, 2014 Mar 31, 2015 Jun 30, 2015 Sep 30, 2015 Dec 31, 2015 Mar 31, 2016 Jun 30, 2016 Sep 30, 2016 Dec 31, 2016 Mar 31, 2017 Net income 8,320 $ 7,079 $ 13,065 $ 33,466 $ 22,024 $ 21,490 $ 35,393 $ 29,284 $ 66,888 $ 65,264 $ 57,047 $ 63,081 $ 64,794 $ 53,375 $ 51,405 $ CT Legacy Portfolio net (income) loss (437) 3,670 970 (15,508) (134) 4,833 (8,400) (1,857) (401) (3,408) 183 (3,825) (1,805) (502) - Non-cash compensation expense 94 1,158 1,834 2,382 1,619 2,528 3,297 3,396 3,188 3,460 4,687 4,836 4,949 4,955 5,907 GE purchase discount accretion adjustment - - - - - - - (459) (2,008) (1,542) (1,166) (1,247) (929) (320) (216) Other items - 107 423 162 404 408 342 416 (119) 310 418 278 (65) 742 1,024 Core Earnings 7,977 $ 12,014 $ 16,292 $ 20,502 $ 23,913 $ 29,259 $ 30,632 $ 30,780 $ 67,548 $ 64,084 $ 61,169 $ 63,123 $ 66,944 $ 58,250 $ 58,120 $ Weighted-average shares outstanding, basic and diluted 28,895 29,364 37,967 47,978 49,211 58,190 58,576 80,941 93,358 93,574 94,068 94,064 94,072 94,456 94,993 Net income per share, basic and diluted 0.29 $ 0.24 $ 0.34 $ 0.70 $ 0.45 $ 0.37 $ 0.60 $ 0.36 $ 0.72 $ 0.70 $ 0.61 $ 0.67 $ 0.69 $ 0.57 $ 0.54 $ Core Earnings per share, basic and diluted 0.28 $ 0.41 $ 0.43 $ 0.43 $ 0.49 $ 0.50 $ 0.52 $ 0.38 $ 0.72 $ 0.68 $ 0.65 $ 0.67 $ 0.71 $ 0.62 $ 0.61 $ (a) In 3Q 2015, BXMT revised the basis of reporting for Core Earnings to be net of incentive fees. Core EPS numbers indicated in the chart for 3Q 2014, 4Q 2014 and 1Q 2015 are adjusted from the previously reported $0.50, $0.52 and $0.54, respectively, so as to be comparable to Core EPS numbers in 3Q 2015 and subsequently. (b) Represents net income attributable to Blackstone Mortgage Trust (c) Adjustment in respect of the deferral in Core Earnings of the accretion of a total $9.1 million of purchase discount attributable to a certain pool of GE portfolio loans pending the repayment of those loans (b) (c) |