Filed by Seacoast Financial Services Corporation

(Commission File No. 000-25077)

Pursuant to Rule 425 under the

Securities Act of 1933, as amended

Subject Company: Abington Bancorp, Inc.

Commission File No.: 0-16018

This filing contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the financial condition, results of operations and business of Seacoast Financial Services Corporation following the consummation of the merger that are subject to various factors which could cause actual results to differ materially from such projections or estimates. Such factors include, but are not limited to, the following: (1) the businesses of Seacoast Financial Services Corporation and Abington Bancorp, Inc. may not be combined successfully, or such combination may take longer to accomplish than expected; (2) expected cost savings from the merger cannot be fully realized or realized within the expected timeframes; (3) operating costs, customer loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with government approvals of the merger; (5) the stockholders of Abington may fail to approve the merger; (6) adverse governmental or regulatory policies may be enacted; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) the risks associated with continued diversification of assets and adverse changes to credit quality; (9) competitive pressures from other financial service companies in Seacoast Financial’s and Abington’s markets may increase significantly; and (10) the risk of an economic slowdown that would adversely affect credit quality and loan originations. Other factors that may cause actual results to differ from forward-looking statements are described in Seacoast Financial’s filings with the Securities and Exchange Commission. Seacoast Financial does not undertake or intend to update any forward-looking statements.

Seacoast Financial and Abington will be filing relevant documents concerning the transaction with the Securities and Exchange Commission, including a registration statement on Form S-4. Investors are urged to read the registration statement on Form S-4 containing a prospectus/proxy statement regarding the proposed transaction and any other documents filed with the SEC, as well as any amendments or supplements to those documents, because they contain (or will contain) important information. Investors are able to obtain those documents free of charge at the SEC’s website, (http://www.sec.gov). In addition, documents filed with the SEC by Seacoast Financial can be obtained, without charge, by directing a request to Seacoast Financial Services Corporation, One Compass Place, New Bedford, Massachusetts 02740, Attn: James R. Rice, Senior Vice President, Marketing, telephone (508) 984-6000. In addition, documents filed with the SEC by Abington can be obtained, without charge, by directing a request to Abington Bancorp, Inc., 97 Libbey Parkway, Weymouth, Massachusetts 02189, Attn: Corporate Secretary, telephone (781) 682-3400. WE URGE SHAREHOLDERS TO READ THESE DOCUMENTS, AS WELL AS ANY AMENDMENTS AND SUPPLEMENTS TO

THOSE DOCUMENTS BECAUSE THEY CONTAIN (OR WILL CONTAIN) IMPORTANT INFORMATION. Abington and its directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the merger.

Information about the directors and executive officers of Abington and their ownership of Abington common stock is set forth in the proxy statement for Abington’s 2003 annual meeting of stockholders as filed on Schedule 14A with the SEC on June 27, 2003. Additional information about the interests of those participants may be obtained from reading the definitive prospectus/proxy statement regarding the proposed transaction when it becomes available.

THE FOLLOWING IS A SERIES OF SLIDES THAT WERE USED AT A WEB CONFERENCE CALL FOR INVESTORS, ANALYSTS AND OTHER INTERESTED PARTIES ON TUESDAY, OCTOBER 21, 2003, AT 2 P.M. EASTERN STANDARD TIME TO DISCUSS THE TRANSACTION.

2

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[LOGO]

Acquisition of

[LOGO]

October 21, 2003

Forward Looking Statement

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the financial condition, results of operations and business of Seacoast Financial Services Corporation following the consummation of the merger that are subject to various factors which could cause actual results to differ materially from such projections or estimates. Such factors include, but are not limited to, the following: (1) the businesses of Seacoast Financial Services Corporation and Abington Bancorp, Inc. may not be combined successfully, or such combination may take longer to accomplish than expected; (2) expected cost savings from the merger cannot be fully realized or realized within the expected timeframes; (3) operating costs, customer loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with government approvals of the merger; (5) the stockholders of Abington may fail to approve the merger; (6) adverse governmental or regulatory policies may be enacted; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) the risks associated with continued diversification of assets and adverse changes to credit quality; (9) competitive pressures from other financial service companies in Seacoast Financial’s and Abington’s markets may increase significantly; and (10) the risk of an economic slowdown that would adversely affect credit quality and loan originations. Other factors that may cause actual results to differ from forward-looking statements are described in Seacoast Financial’s filings with the Securities and Exchange Commission. Neither Seacoast Financial nor Abington undertakes or intends to update any forward-looking statements.

1

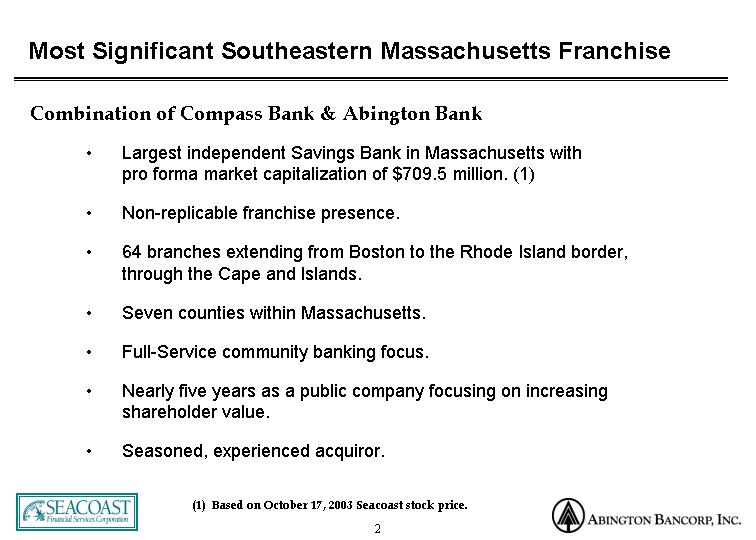

Most Significant Southeastern Massachusetts Franchise

Combination of Compass Bank & Abington Bank

• Largest independent Savings Bank in Massachusetts with pro forma market capitalization of $709.5 million. (1)

• Non-replicable franchise presence.

• 64 branches extending from Boston to the Rhode Island border, through the Cape and Islands.

• Seven counties within Massachusetts.

• Full-Service community banking focus.

• Nearly five years as a public company focusing on increasing shareholder value.

• Seasoned, experienced acquiror.

(1) Based on October 17, 2003 Seacoast stock price.

2

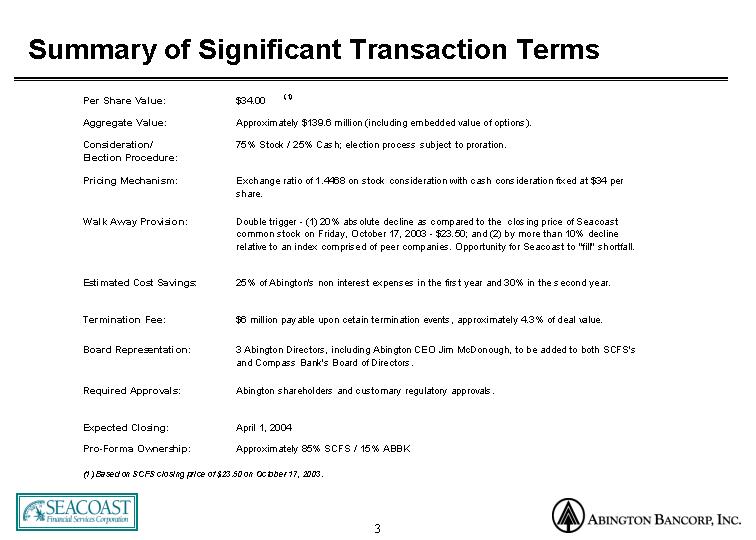

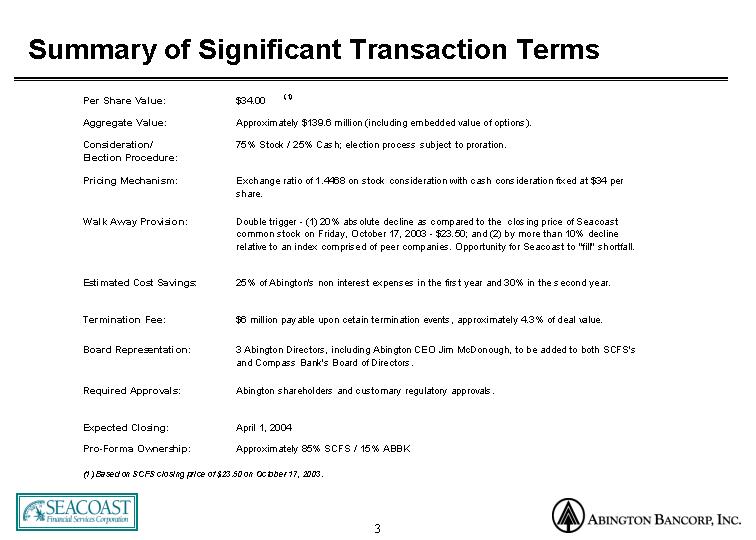

Summary of Significant Transaction Terms

Per Share Value: | | $34.00 (1) |

| | |

Aggregate Value: | | Approximately $139.6 million (including embedded value of options). |

| | |

Consideration/ | | 75% Stock / 25% Cash; election process subject to proration. |

Election Procedure: | | |

| | |

Pricing Mechanism: | | Exchange ratio of 1.4468 on stock consideration with cash consideration fixed at $34 per share. |

| | |

Walk Away Provision: | | Double trigger - (1) 20% absolute decline as compared to the closing price of Seacoast common stock on Friday, October 17, 2003 - $23.50; and (2) by more than 10% decline relative to an index comprised of peer companies. Opportunity for Seacoast to “fill” shortfall. |

| | |

Estimated Cost Savings: | | 25% of Abington’s non interest expenses in the first year and 30% in the second year. |

| | |

Termination Fee: | | $6 million payable upon cetain termination events, approximately 4.3% of deal value. |

| | |

Board Representation: | | 3 Abington Directors, including Abington CEO Jim McDonough, to be added to both SCFS’s and Compass Bank’s Board of Directors. |

| | |

Required Approvals: | | Abington shareholders and customary regulatory approvals. |

| | |

Expected Closing: | | April 1, 2004 |

| | |

Pro-Forma Ownership: | | Approximately 85% SCFS / 15% ABBK |

(1) Based on SCFS closing price of $23.50 on October 17, 2003.

3

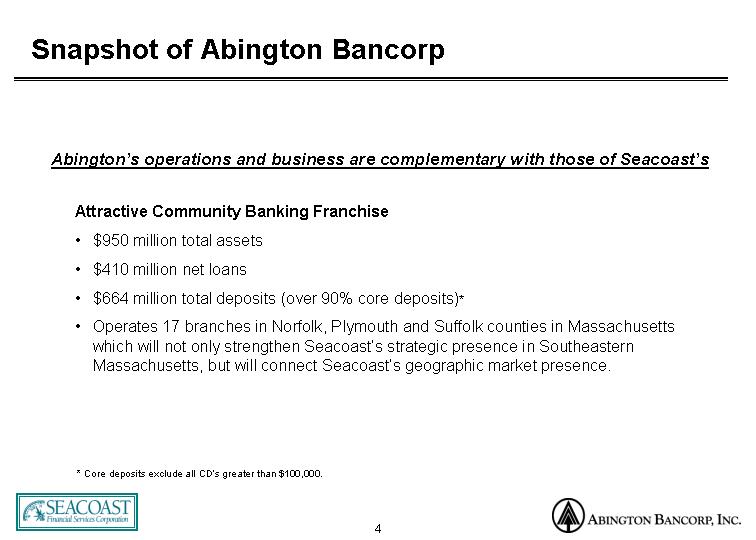

Snapshot of Abington Bancorp

Abington’s operations and business are complementary with those of Seacoast’s

Attractive Community Banking Franchise

• $950 million total assets

• $410 million net loans

• $664 million total deposits (over 90% core deposits)*

• Operates 17 branches in Norfolk, Plymouth and Suffolk counties in Massachusetts which will not only strengthen Seacoast’s strategic presence in Southeastern Massachusetts, but will connect Seacoast’s geographic market presence.

* Core deposits exclude all CD’s greater than $100,000.

4

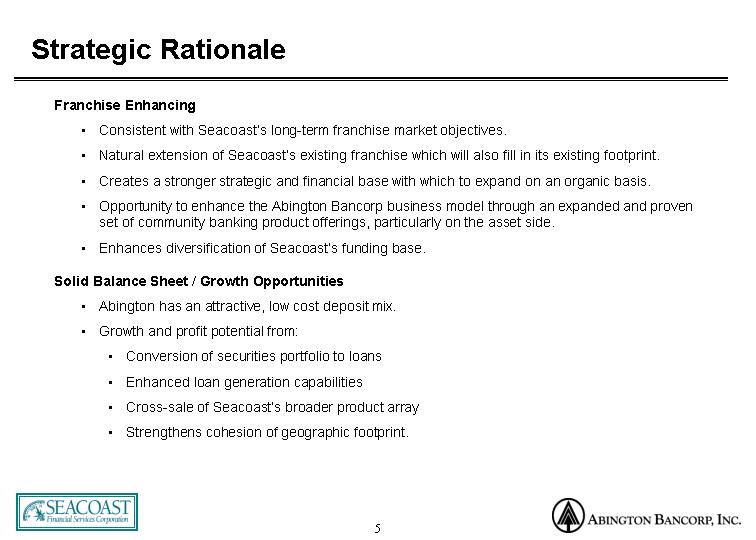

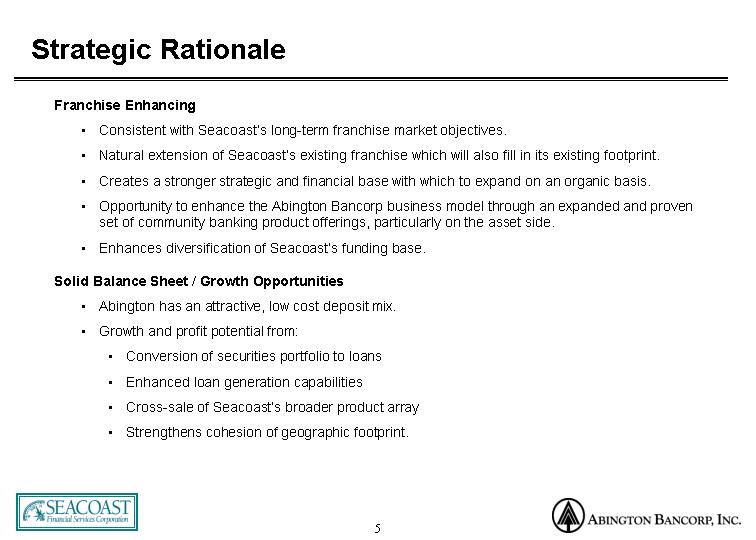

Strategic Rationale

Franchise Enhancing

• Consistent with Seacoast’s long-term franchise market objectives.

• Natural extension of Seacoast’s existing franchise which will also fill in its existing footprint.

• Creates a stronger strategic and financial base with which to expand on an organic basis.

• Opportunity to enhance the Abington Bancorp business model through an expanded and proven set of community banking product offerings, particularly on the asset side.

• Enhances diversification of Seacoast’s funding base.

Solid Balance Sheet / Growth Opportunities

• Abington has an attractive, low cost deposit mix.

• Growth and profit potential from:

• Conversion of securities portfolio to loans

• Enhanced loan generation capabilities

• Cross-sale of Seacoast’s broader product array

• Strengthens cohesion of geographic footprint.

5

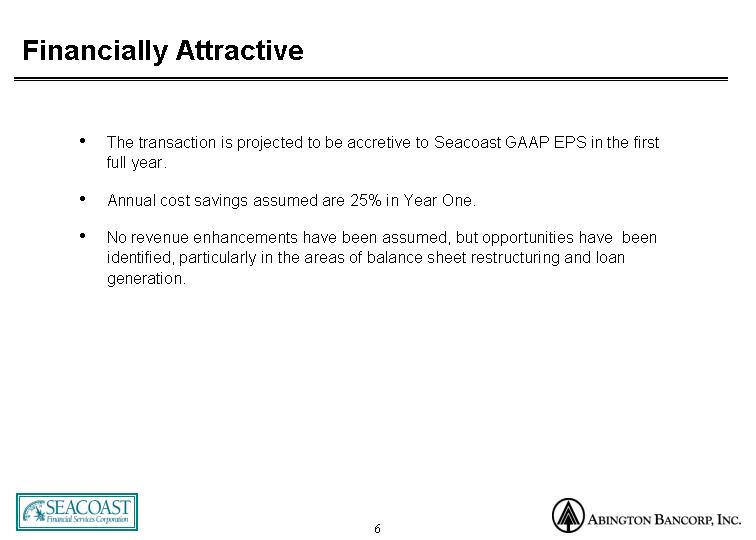

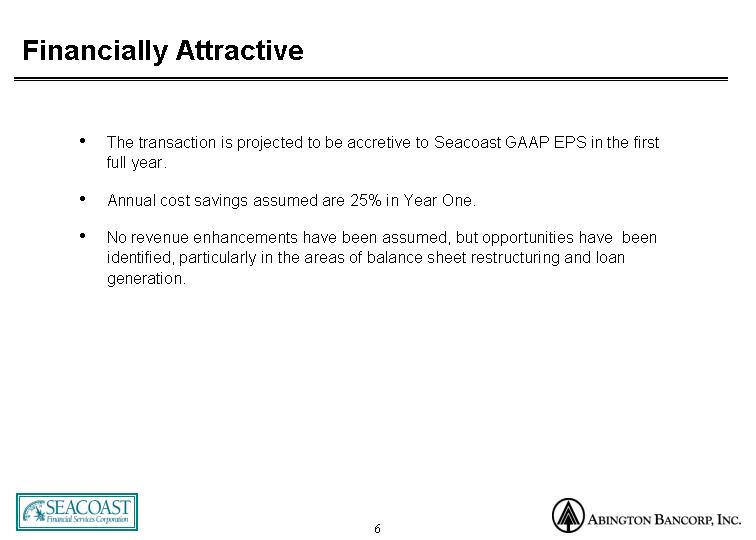

Financially Attractive

• The transaction is projected to be accretive to Seacoast GAAP EPS in the first full year.

• Annual cost savings assumed are 25% in Year One.

• No revenue enhancements have been assumed, but opportunities have been identified, particularly in the areas of balance sheet restructuring and loan generation.

6

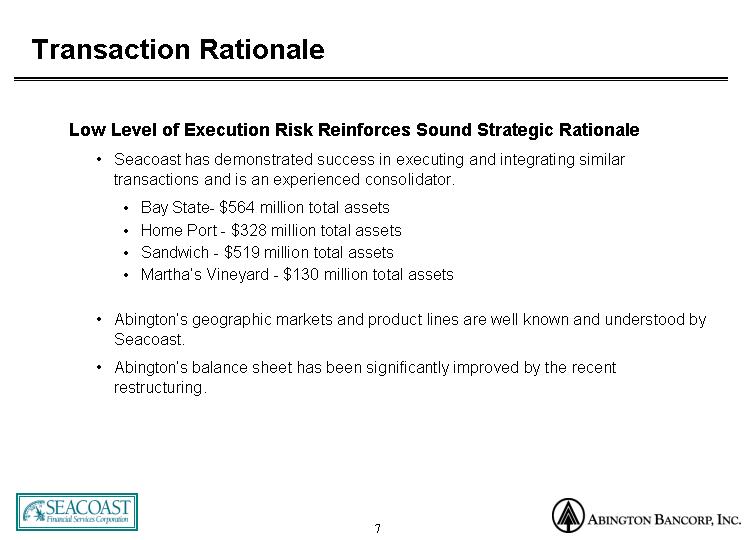

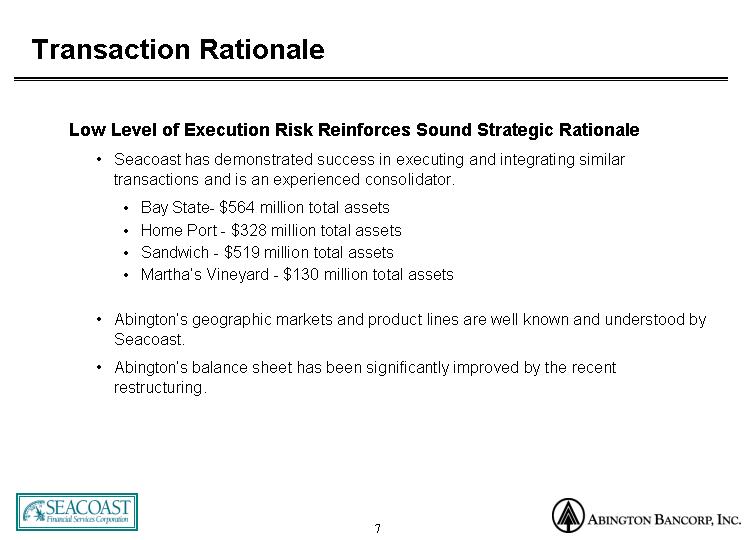

Transaction Rationale

Low Level of Execution Risk Reinforces Sound Strategic Rationale

• Seacoast has demonstrated success in executing and integrating similar transactions and is an experienced consolidator.

• Bay State- $564 million total assets

• Home Port - $328 million total assets

• Sandwich - $519 million total assets

• Martha’s Vineyard - $130 million total assets

• Abington’s geographic markets and product lines are well known and understood by Seacoast.

• Abington’s balance sheet has been significantly improved by the recent restructuring.

7

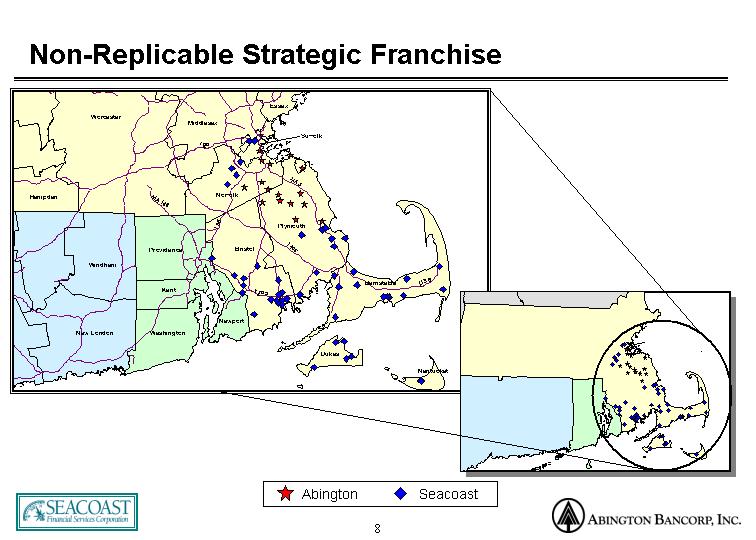

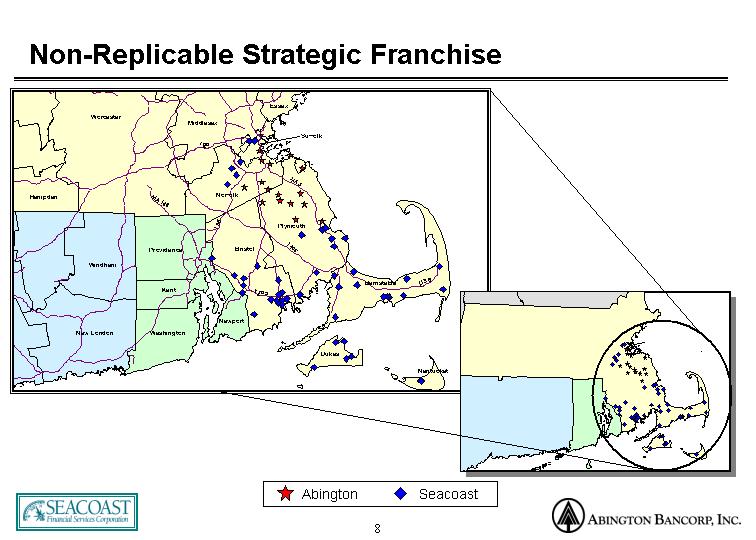

Non-Replicable Strategic Franchise

[GRAPHIC]

8

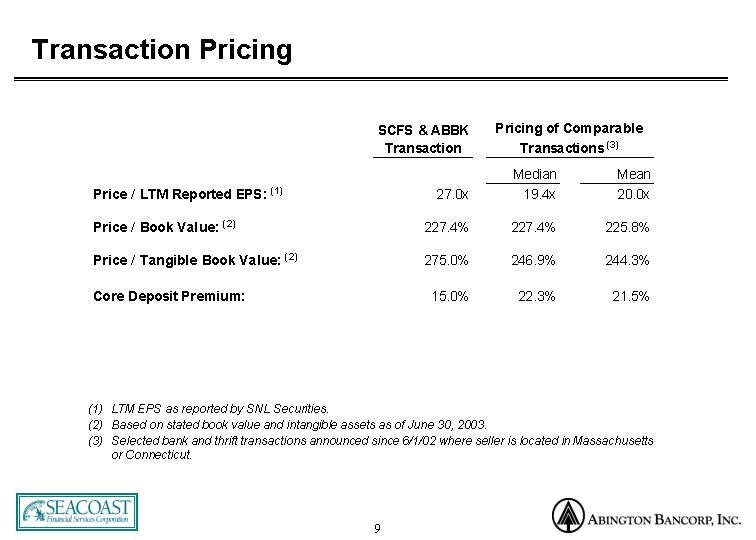

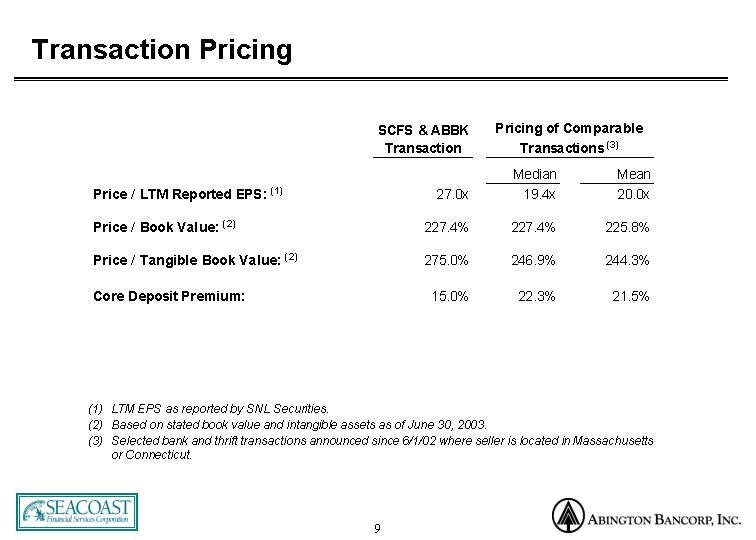

Transaction Pricing

| | SCFS & ABBK

Transaction | | Pricing of Comparable

Transactions (3) | |

| | | Median | | Mean | |

Price / LTM Reported EPS: (1) | | 27.0 | x | 19.4 | x | 20.0 | x |

| | | | | | | |

Price / Book Value: (2) | | 227.4 | % | 227.4 | % | 225.8 | % |

| | | | | | | |

Price / Tangible Book Value: (2) | | 275.0 | % | 246.9 | % | 244.3 | % |

| | | | | | | |

Core Deposit Premium: | | 15.0 | % | 22.3 | % | 21.5 | % |

(1) LTM EPS as reported by SNL Securities.

(2) Based on stated book value and intangible assets as of June 30, 2003.

(3) Selected bank and thrift transactions announced since 6/1/02 where seller is located in Massachusetts or Connecticut.

9

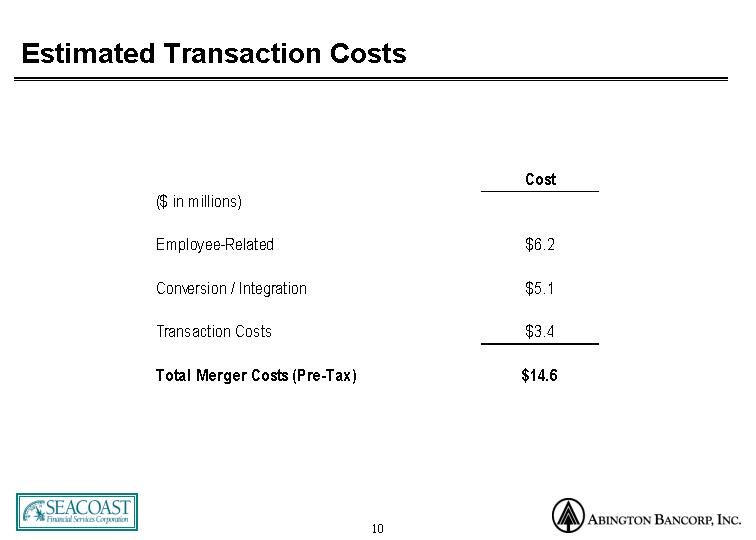

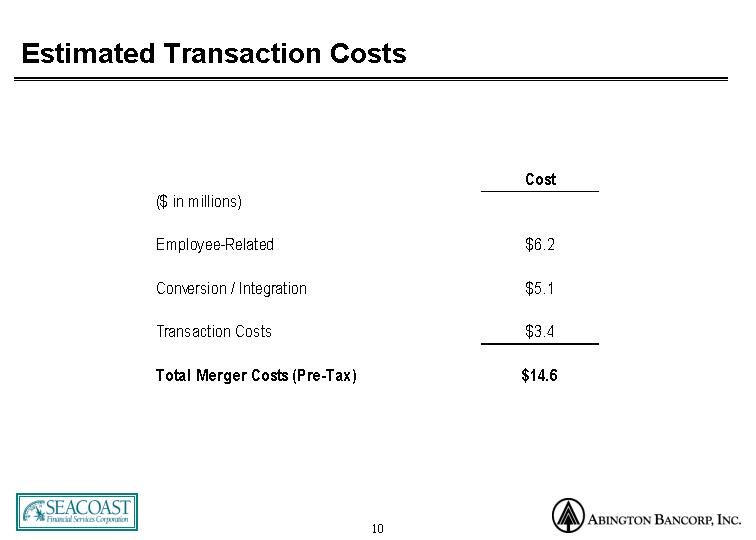

Estimated Transaction Costs

($ in millions) | | Cost | |

| | | |

Employee-Related | | $ | 6.2 | |

| | | |

Conversion / Integration | | $ | 5.1 | |

| | | |

Transaction Costs | | $ | 3.4 | |

| | | |

Total Merger Costs (Pre-Tax) | | $ | 14.6 | |

10

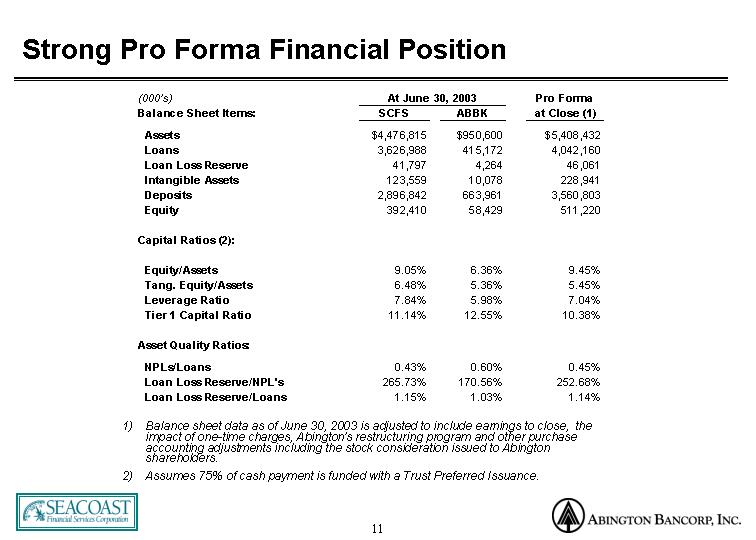

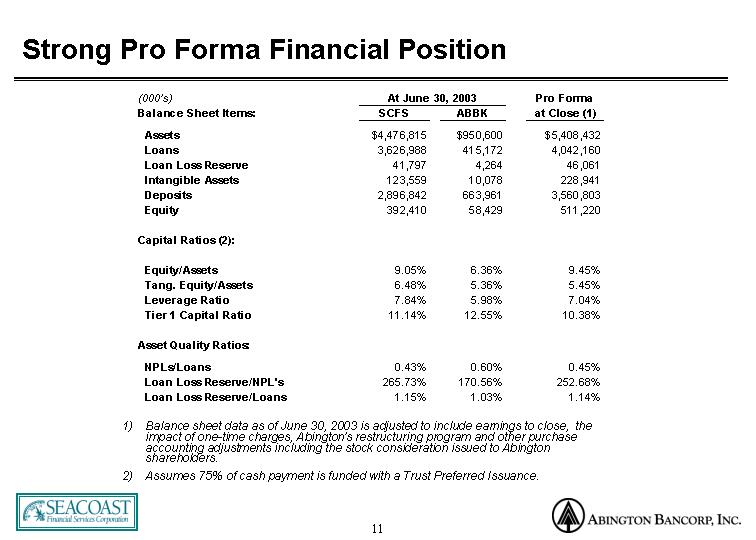

Strong Pro Forma Financial Position

(000’s) | | At June 30, 2003 | | Pro Forma

at Close (1) | |

| SCFS | | ABBK | | |

Balance Sheet Items: | | | | | | | |

Assets | | $ | 4,476,815 | | $ | 950,600 | | $ | 5,408,432 | |

Loans | | 3,626,988 | | 415,172 | | 4,042,160 | |

Loan Loss Reserve | | 41,797 | | 4,264 | | 46,061 | |

Intangible Assets | | 123,559 | | 10,078 | | 228,941 | |

Deposits | | 2,896,842 | | 663,961 | | 3,560,803 | |

Equity | | 392,410 | | 58,429 | | 511,220 | |

| | | | | | | |

Capital Ratios (2): | | | | | | | |

| | | | | | | |

Equity/Assets | | 9.05 | % | 6.36 | % | 9.45 | % |

Tang. Equity/Assets | | 6.48 | % | 5.36 | % | 5.45 | % |

Leverage Ratio | | 7.84 | % | 5.98 | % | 7.04 | % |

Tier 1 Capital Ratio | | 11.14 | % | 12.55 | % | 10.38 | % |

| | | | | | | |

Asset Quality Ratios: | | | | | | | |

| | | | | | | |

NPLs/Loans | | 0.43 | % | 0.60 | % | 0.45 | % |

Loan Loss Reserve/NPL’s | | 265.73 | % | 170.56 | % | 252.68 | % |

Loan Loss Reserve/Loans | | 1.15 | % | 1.03 | % | 1.14 | % |

| | | | | | | | | | |

1) Balance sheet data as of June 30, 2003 is adjusted to include earnings to close, the impact of one-time charges, Abington’s restructuring program and other purchase accounting adjustments including the stock consideration issued to Abington shareholders.

2) Assumes 75% of cash payment is funded with a Trust Preferred Issuance.

11

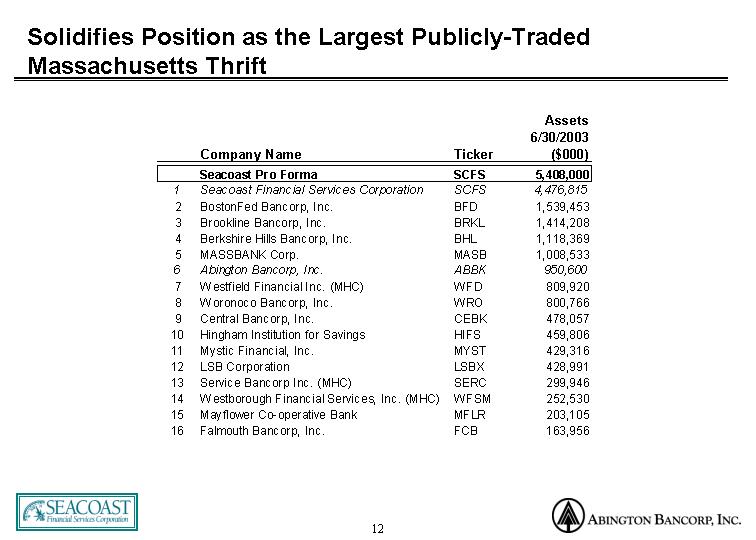

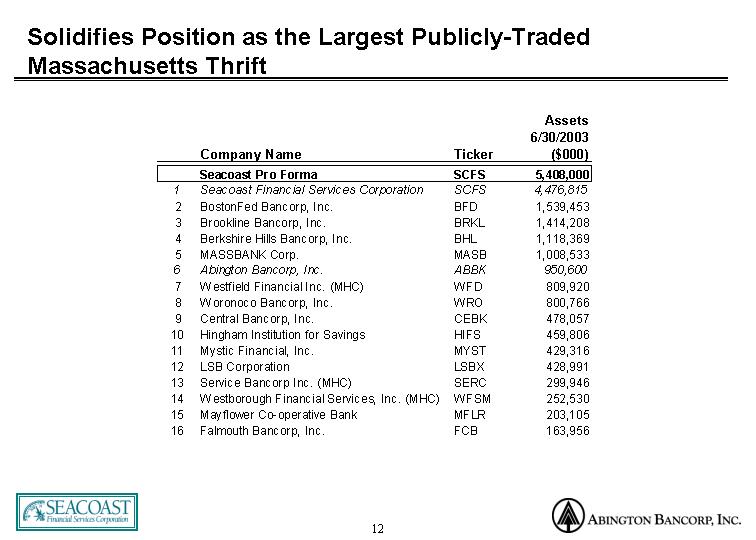

Solidifies Position as the Largest Publicly-Traded Massachusetts Thrift

| | Company Name | | Ticker | | Assets

6/30/2003 | |

| | | | | | ($000) | |

| | Seacoast Pro Forma | | SCFS | | 5,408,000 | |

1 | | Seacoast Financial Services Corporation | | SCFS | | 4,476,815 | |

2 | | BostonFed Bancorp, Inc. | | BFD | | 1,539,453 | |

3 | | Brookline Bancorp, Inc. | | BRKL | | 1,414,208 | |

4 | | Berkshire Hills Bancorp, Inc. | | BHL | | 1,118,369 | |

5 | | MASSBANK Corp. | | MASB | | 1,008,533 | |

6 | | Abington Bancorp, Inc. | | ABBK | | 950,600 | |

7 | | Westfield Financial Inc. (MHC) | | WFD | | 809,920 | |

8 | | Woronoco Bancorp, Inc. | | WRO | | 800,766 | |

9 | | Central Bancorp, Inc. | | CEBK | | 478,057 | |

10 | | Hingham Institution for Savings | | HIFS | | 459,806 | |

11 | | Mystic Financial, Inc. | | MYST | | 429,316 | |

12 | | LSB Corporation | | LSBX | | 428,991 | |

13 | | Service Bancorp Inc. (MHC) | | SERC | | 299,946 | |

14 | | Westborough Financial Services, Inc. (MHC) | | WFSM | | 252,530 | |

15 | | Mayflower Co-operative Bank | | MFLR | | 203,105 | |

16 | | Falmouth Bancorp, Inc. | | FCB | | 163,956 | |

12

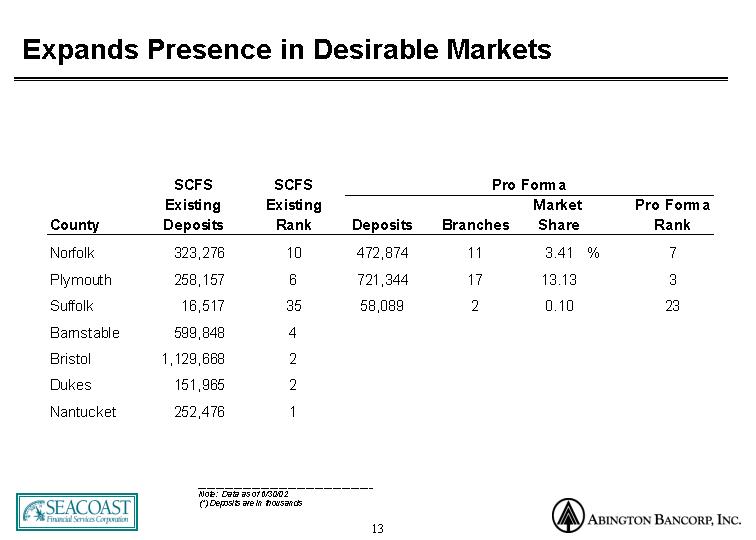

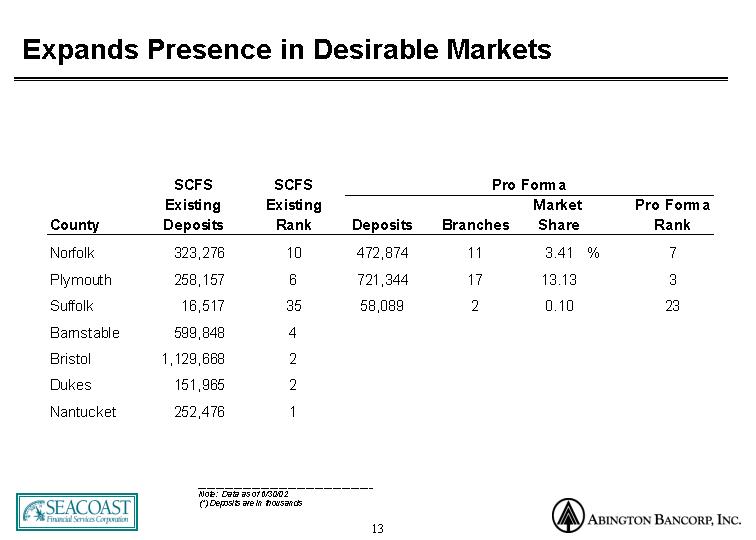

Expands Presence in Desirable Markets

| | SCFS | | SCFS | | Pro Forma | |

| | Existing | | Existing | | | | | | Market | | Pro Forma | |

County | | Deposits | | Rank | | Deposits | | Branches | | Share | | Rank | |

Norfolk | | 323,276 | | 10 | | 472,874 | | 11 | | 3.41 | % | 7 | |

| | | | | | | | | | | | | |

Plymouth | | 258,157 | | 6 | | 721,344 | | 17 | | 13.13 | | 3 | |

| | | | | | | | | | | | | |

Suffolk | | 16,517 | | 35 | | 58,089 | | 2 | | 0.10 | | 23 | |

| | | | | | | | | | | | | |

Barnstable | | 599,848 | | 4 | | | | | | | | | |

| | | | | | | | | | | | | |

Bristol | | 1,129,668 | | 2 | | | | | | | | | |

| | | | | | | | | | | | | |

Dukes | | 151,965 | | 2 | | | | | | | | | |

| | | | | | | | | | | | | |

Nantucket | | 252,476 | | 1 | | | | | | | | | |

Note: Data as of 6/30/02

(*) Deposits are in thousands

13

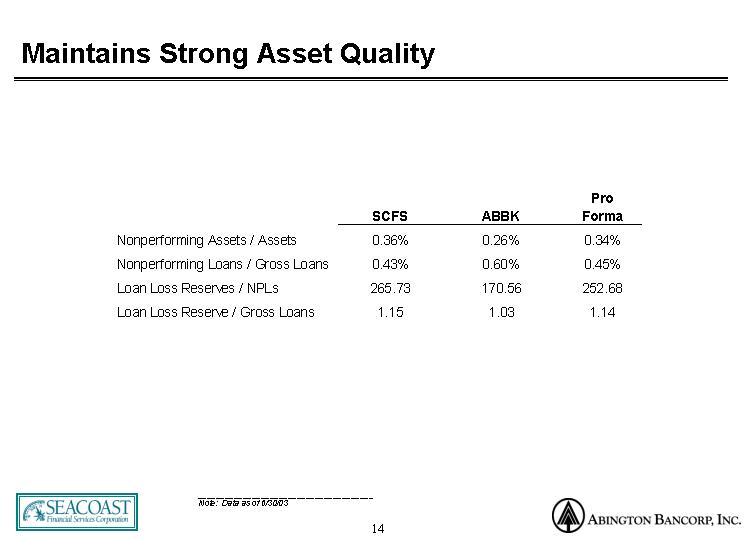

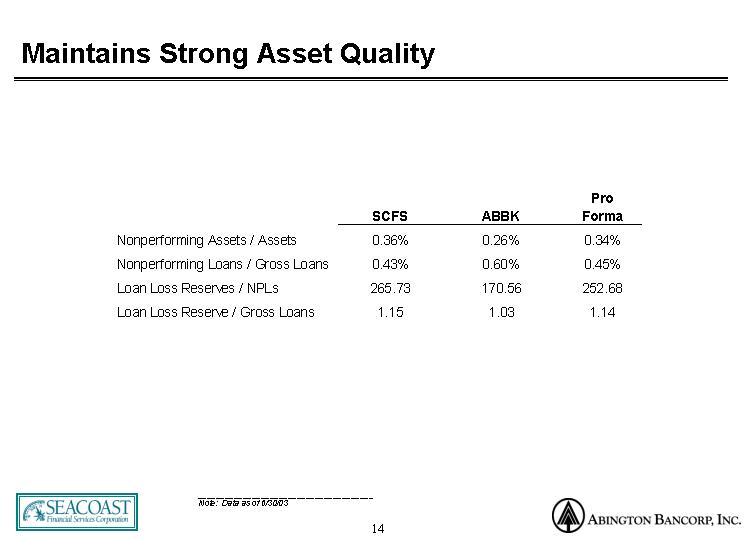

Maintains Strong Asset Quality

| | | | | | Pro | |

| | SCFS | | ABBK | | Forma | |

Nonperforming Assets / Assets | | 0.36 | % | 0.26 | % | 0.34 | % |

| | | | | | | |

Nonperforming Loans / Gross Loans | | 0.43 | % | 0.60 | % | 0.45 | % |

| | | | | | | |

Loan Loss Reserves / NPLs | | 265.73 | | 170.56 | | 252.68 | |

| | | | | | | |

Loan Loss Reserve / Gross Loans | | 1.15 | | 1.03 | | 1.14 | |

Note: Data as of 6/30/03

14

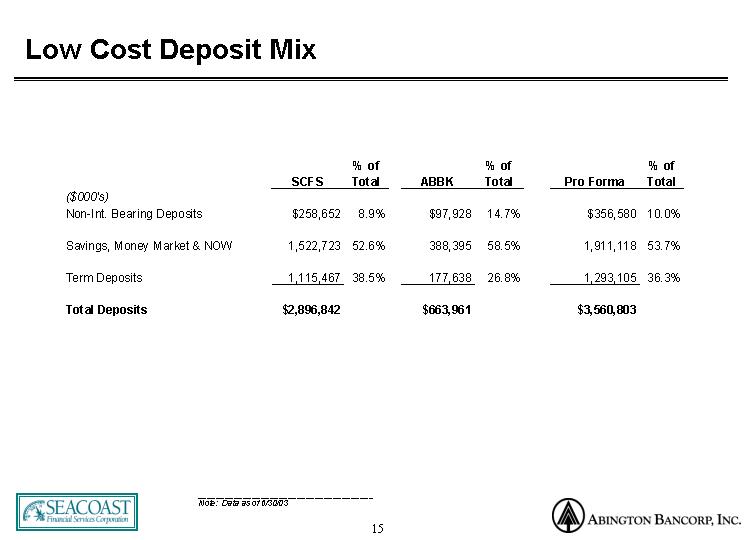

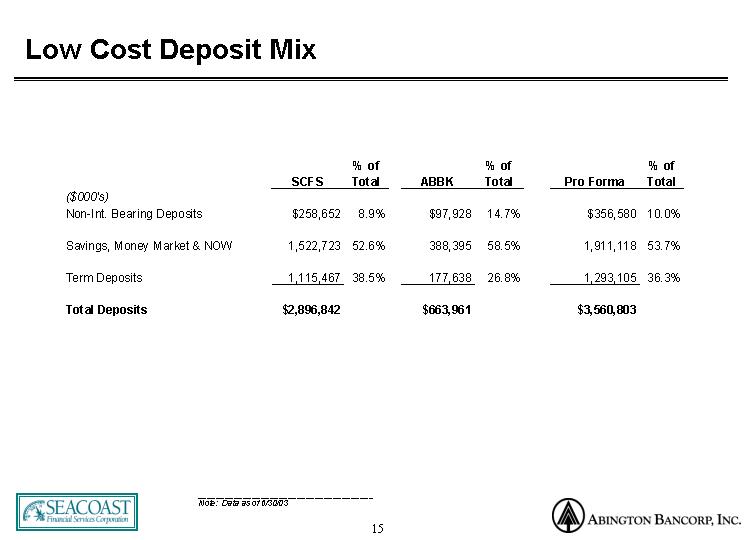

Low Cost Deposit Mix

| | | | % of | | | | % of | | | | % of | |

($000’s) | | SCFS | | Total | | ABBK | | Total | | Pro Forma | | Total | |

| | | | | | | | | | | | | |

Non-Int. Bearing Deposits | | $ | 258,652 | | 8.9 | % | $ | 97,928 | | 14.7 | % | $ | 356,580 | | 10.0 | % |

| | | | | | | | | | | | | |

Savings, Money Market & NOW | | 1,522,723 | | 52.6 | % | 388,395 | | 58.5 | % | 1,911,118 | | 53.7 | % |

| | | | | | | | | | | | | |

Term Deposits | | 1,115,467 | | 38.5 | % | 177,638 | | 26.8 | % | 1,293,105 | | 36.3 | % |

| | | | | | | | | | | | | |

Total Deposits | | $ | 2,896,842 | | | | $ | 663,961 | | | | $ | 3,560,803 | | | |

Note: Data as of 6/30/03

15

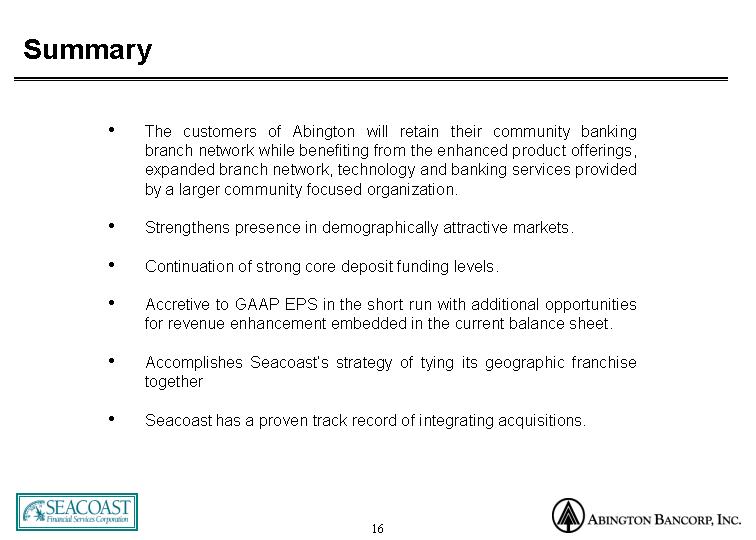

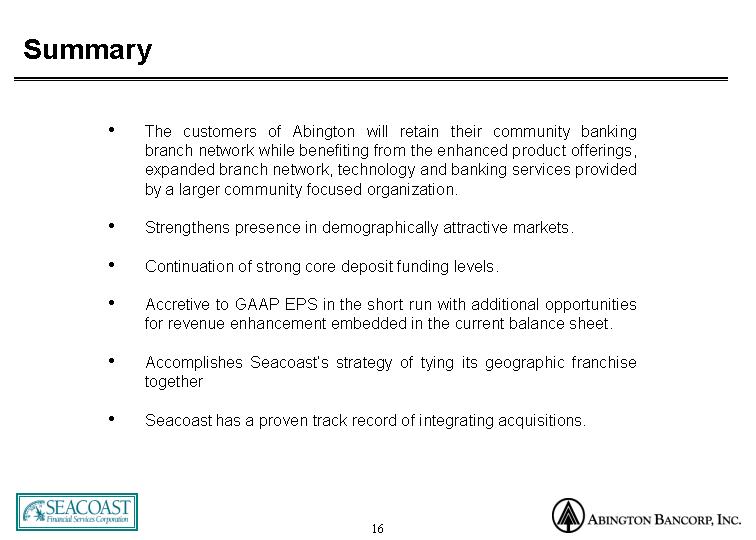

Summary

• The customers of Abington will retain their community banking branch network while benefiting from the enhanced product offerings, expanded branch network, technology and banking services provided by a larger community focused organization.

• Strengthens presence in demographically attractive markets.

• Continuation of strong core deposit funding levels.

• Accretive to GAAP EPS in the short run with additional opportunities for revenue enhancement embedded in the current balance sheet.

• Accomplishes Seacoast’s strategy of tying its geographic franchise together

• Seacoast has a proven track record of integrating acquisitions.

16

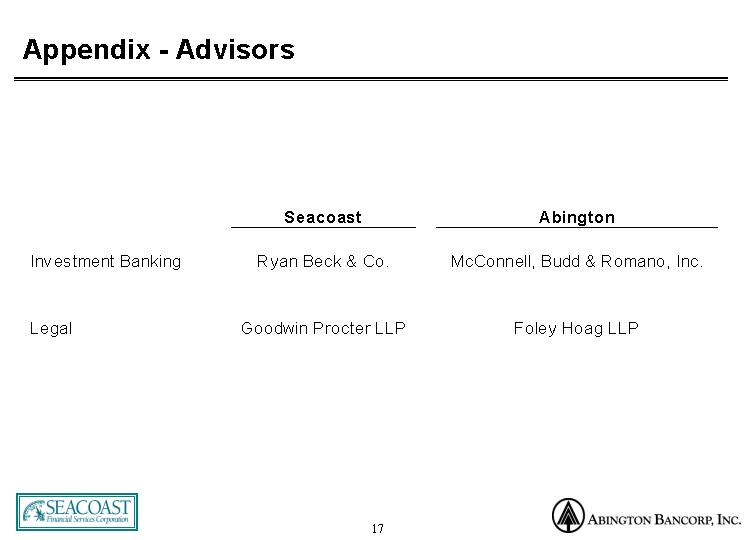

Appendix - Advisors

| | Seacoast | | Abington |

| | | | |

Investment Banking | | Ryan Beck & Co. | | McConnell, Budd & Romano, Inc. |

| | | | |

Legal | | Goodwin Procter LLP | | Foley Hoag LLP |

17

Seacoast and Abington will be filing relevant documents concerning the transaction with the Securities and Exchange Commission, including a registration statement on Form S-4. Investors are urged to read the registration statement on Form S-4 containing a prospectus/proxy statement regarding the proposed transaction and any other documents filed with the SEC, as well as any amendments or supplements to those documents, because they contain (or will contain) important information. Investors are able to obtain those documents free of charge at the SEC’s website, (http://www.sec.gov). In addition, documents filed with the SEC by Seacoast Financial can be obtained, without charge, by directing a request to Seacoast Financial Services Corporation, One Compass Place, New Bedford, Massachusetts 02740, Attn: James R. Rice, Senior Vice President, Marketing, telephone (508) 984-6000. In addition, documents filed with the SEC by Abington can be obtained, without charge, by directing a request to Abington Bancorp, Inc. 97 Libbey Parkway, Weymouth, MA 02189, Attn: Corporate Secretary, telephone (781) 682-3400. WE URGE SHAREHOLDERS TO READ THESE DOCUMENTS, AS WELL AS ANY AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS BECAUSE THEY CONTAIN (OR WILL CONTAIN) IMPORTANT INFORMATION. Abington and its directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the merger.

18