NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the shareholders of Gildan Activewear Inc. (the “Corporation”):

NOTICE IS HEREBY GIVEN that the annual meeting of shareholders (the “Meeting”) of the Corporation will be held at the Foyer Mont-Royal, Centre Mont-Royal, 2200 Mansfield Street, Montréal, Québec, Canada, on Thursday, February 7, 2013 at 10:00 a.m., local time, for the purposes of:

| | (i) | receiving the consolidated financial statements of the Corporation for the fiscal year ended September 30, 2012, together with the auditors’ report thereon; |

| | | |

| | (ii) | electing nine directors for the ensuing year; |

| | | |

| | (iii) | considering and, if deemed advisable, approving an advisory resolution (the full text of which is reproduced as Schedule “D” to the accompanying management proxy circular) on the Corporation’s approach to executive compensation; |

| | | |

| | (iv) | appointing auditors for the ensuing year; and |

| | | |

| | (v) | transacting such other business as may properly come before the Meeting. |

Dated at Montréal, Québec, Canada, December 13, 2012.

| | By order of the Board of Directors, |

| |  |

| | Lindsay Matthews |

| | Vice-President, General Counsel |

| | and Corporate Secretary |

Shareholders may exercise their rights by attending the Meeting or by completing a form of proxy. If you are unable to attend the Meeting in person, please complete, date and sign the enclosed form of proxy and return it in the envelope provided for that purpose. Proxies must be received by the transfer agent and registrar of the Corporation (Computershare Investor Services Inc., 100 University Avenue, 9thFloor, Toronto, Ontario, Canada M5J 2Y1) no later than 5:00 p.m. on the second business day preceding the day of the Meeting or any adjournment thereof. Your shares will be voted in accordance with your instructions as indicated on the proxy.

Les actionnaires quipréféreraient recevoir la circulaire de sollicitation de procurations de la direction enfrançais n’ont qu’à en aviser le secrétaire corporatif de Les Vêtements de Sport Gildan Inc. |

MANAGEMENT PROXY CIRCULAR

Table of Contents

Except as otherwise indicated, the information contained herein is given as of December 13, 2012. Although Gildan Activewear Inc. has adopted the U.S. dollar as its functional and reporting currency with effect from the beginning of its 2004 fiscal year, most compensation amounts have historically been and are still described herein in Canadian dollars. For this reason, among others, all dollar amounts set forth herein are expressed in Canadian dollars and the symbol “$” refers to the Canadian dollar, unless otherwise indicated.

SECTION 1 - VOTING AND PROXIES

1.1 Solicitation of Proxies

This management proxy circular (the “Circular”) is sent in connection with the solicitation by the management of Gildan Activewear Inc. (the “Corporation” or “Gildan”) of proxies to be used at the annual meeting of shareholders of the Corporation to be held on Thursday, February 7, 2013 (the “Meeting”), at the time, place and for the purposes set forth in the Notice of Annual Meeting of Shareholders (the “Notice of Meeting”), and at any adjournment thereof. The solicitation is being made primarily by mail, but proxies may also be solicited by telephone, facsimile or other personal contact by officers or other employees of the Corporation. The entire cost of the solicitation will be borne by the Corporation.

1.2 Appointment of Proxy

The persons named as proxyholders in the enclosed form of proxy are directors and officers of the Corporation.Each shareholder has the right to appoint a person other than the persons designated in the enclosed form of proxy to represent such shareholder at the Meeting.In order to appoint such other person, the shareholder should insert such person’s name in the blank space provided on the form of proxy and delete the names printed thereon or complete another proper form of proxy and, in either case, deliver the completed form of proxy to the transfer agent and registrar of the Corporation (Computershare Investor Services Inc., 100 University Avenue, 9thFloor, Toronto, Ontario, Canada M5J 2Y1), no later than 5:00 p.m. on the second business day preceding the day of the Meeting or any adjournment thereof at which the proxy is to be used.

1.3 Revocation of Proxy

A shareholder who executes and returns the accompanying form of proxy may revoke the same (a) by instrument in writing executed by the shareholder, or by his or her attorney authorized in writing, and deposited either: (i) at the principal executive offices of the Corporation, to the attention of the Corporate Secretary of the Corporation, Tour KPMG, 600 de Maisonneuve Boulevard West, 33rdFloor, Montréal, Québec, Canada H3A 3J2, at any time up to and including the last business day preceding the day of the Meeting or any adjournment thereof at which the proxy is to be used, or (ii) with the chairman of the Meeting on the day of the Meeting or any adjournment thereof, or (b) in any other manner permitted by law. If the shareholder is a corporation, any such instrument of revocation must be executed by a duly authorized officer or attorney thereof.

1.4 Exercise of Discretion by Proxies

The persons named in the enclosed form of proxy will, on a show of hands or any ballot that may be called for, vote (or withhold from voting) the shares in respect of which they are appointed as proxies in accordance with the instructions of the shareholders appointing them. If a shareholder specifies a choice with respect to any matter to be acted upon, the shares will be voted accordingly.If no instructions are given, the shares will be voted FOR the election of the nominees of the board of directors of the Corporation (the “Board of Directors” or the “Board”) as directors, FOR the advisory resolution (as set out in Schedule “D”) on the Corporation’s approach to executive compensation, and FOR the appointment of KPMG LLP as auditors. The enclosed formof proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice of Meeting, and with respect to other business which may properly come before the Meeting or any adjournment thereof.As of the date hereof, management of the Corporation knows of no such amendment, variation or other business to come before the Meeting. If any such amendment or other business properly comes before the Meeting, or any adjournment thereof, the persons named in the enclosed form of proxy will vote on such matters in accordance with their best judgement.

-1-

1.5 Voting Shares and Principal Holders Thereof

As of December 13, 2012, there were 121,631,926 common shares of the Corporation (the “Common Shares”) issued and outstanding. Each Common Share entitles its holder to one vote with respect to the matters voted at the Meeting.

Holders of Common Shares whose names are registered on the lists of shareholders of the Corporation as at the close of business, Montréal time, on December 13, 2012, being the date fixed by the Corporation for determination of the registered holders of Common Shares who are entitled to receive notice of the Meeting (the “Record Date”), will be entitled to exercise the voting rights attached to the Common Shares in respect of which they are so registered at the Meeting, or any adjournment thereof, if present or represented by proxy thereat. As of December 13, 2012, there was an aggregate of 121,631,926 votes attached to the Common Shares entitled to be voted at the Meeting or any adjournment thereof.

To the knowledge of the directors and officers of the Corporation, the only person who beneficially owns, directly or indirectly, or exercises control or direction over, voting securities carrying 10% or more of the voting rights attached to any class of voting securities of the Corporation, as at December 13, 2012, is Fidelity Management & Research Company, a wholly-owned subsidiary of FMR LLC, which, together with its affiliates, owns approximately 18 million Common Shares, representing approximately 15% of the voting rights attached to all Common Shares according to the latest publicly available information.

1.6 Non-Registered Shareholders

Only registered shareholders or the persons they appoint as their proxies are permitted to vote at the Meeting. However, in many cases, Common Shares beneficially owned by a person (a “Non-Registered Holder”) are registered either: (i) in the name of an intermediary that the Non-Registered Holder deals with in respect of his or her Common Shares (an “Intermediary”), such as securities dealers or brokers, banks, trust companies and trustees or administrators of self-administered RRSPs, TFSAs, RRIFs, RESPs and similar plans, or (ii) in the name of a clearing agency of which the Intermediary is a participant. In accordance with National Instrument 54-101 of the Canadian Securities Administrators entitled “Communication with Beneficial Owners of Securities of a Reporting Issuer”, the Corporation has distributed copies of the Notice of Meeting and this Circular (collectively, the “Meeting Materials”) to the clearing agencies and Intermediaries for distribution to Non-Registered Holders. Intermediaries are required to forward the Meeting Materials to Non-Registered Holders, and often use a service company (such as Broadridge in Canada) for this purpose. Non-Registered Holders will either:

| | (a) | Typically be provided with a computerized form (often called a “voting instruction form”) which is not signed by the Intermediary and which, when properly completed and signed by the Non- Registered Holder and returned to the Intermediary or its service company, will constitute voting instructions which the Intermediary must follow. In certain cases, the Non-Registered Holder may provide such voting instructions to the Intermediary or its service company through the Internet or through a toll-free telephone number; or |

-2-

| | | |

| | (b) | Less commonly, be given a proxy form which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted to the number of Common Shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. In this case, the Non-Registered Holder who wishes to submit a proxy should properly complete the proxy form and submit it to Computershare Investor Services Inc. (Attention: Proxy Department), 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1. |

In either case, the purpose of these procedures is to permit Non-Registered Holders to direct the voting of the Common Shares that they beneficially own.

Should a Non-Registered Holder who receives a voting instruction form wish to vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should print his or her own name, or that of such other person, on the voting instruction form and return it to the Intermediary or its service company. Should a Non-Registered Holder who receives a proxy form wish to vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should strike out the names of the persons set out in the proxy form and insert the name of the Non-Registered Holder or such other person in the blank space provided and submit it to Computershare Investor Services Inc. at the address set out above.

In all cases, Non-Registered Holders should carefully follow the instructions of their Intermediary, including those regarding when, where and by what means the voting instruction form or proxy form must be delivered.

A Non-Registered Holder may revoke voting instructions that have been given to an Intermediary at any time by written notice to the Intermediary.

SECTION 2 – BUSINESS OF THE MEETING

2.1 Election of Directors

The articles of the Corporation provide that the Board of Directors shall consist of not less than five and not more than twelve directors.Except where authority to vote on the election of directors is withheld, the persons named in the enclosed form of proxy or voting instruction form intend to vote FOR the election of the nominees whose names are hereinafter set forth, all of whom are currently members of the Board of Directors and have been members since the dates indicated below.If prior to the Meeting, any of the nominees shall be unable or, for any reason, become unwilling to serve as a director, it is intended that the discretionary power granted by the form of proxy or voting instruction form shall be used to vote for any other person or persons as directors.Each director is elected for a one-year term ending at the next annual meeting of shareholders or when his or her successor is elected, unless he or she resigns or his or her office otherwise becomes vacant. The Board of Directors and management of the Corporation have no reason to believe that any of the said nominees will be unable or will refuse to serve, for any reason, if elected to office.

2.1.1 Nomination Process

The process to nominate the Corporation’s directors, including the Board skills matrix and the evergreen list of potential directors, is described under the heading “Director Selection” in the Statement of Corporate Governance Practices in Schedule “A” to this Circular. The Board has also adopted a formal retirement policy in order to enable it to engage in a thorough succession planning process. Under this policy, directors who reach the age of 72 will not, unless otherwise determined by the Board, in its discretion, be nominated for re-election at the subsequent annual meeting of shareholders.

-3-

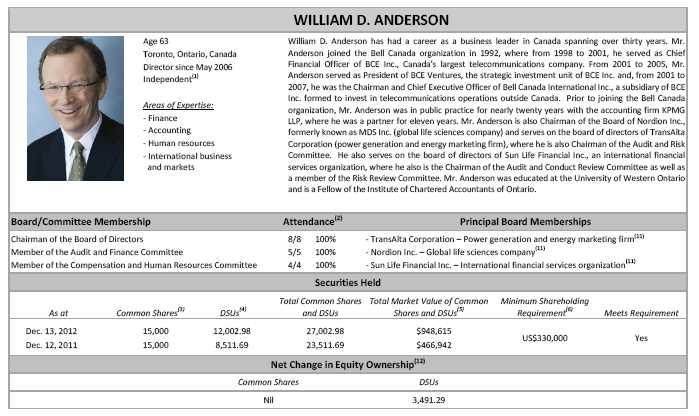

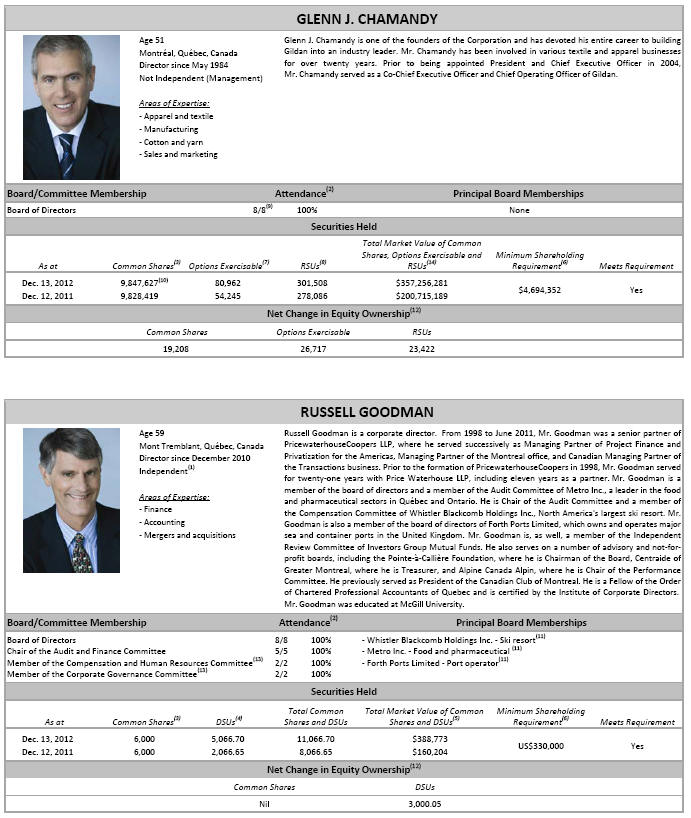

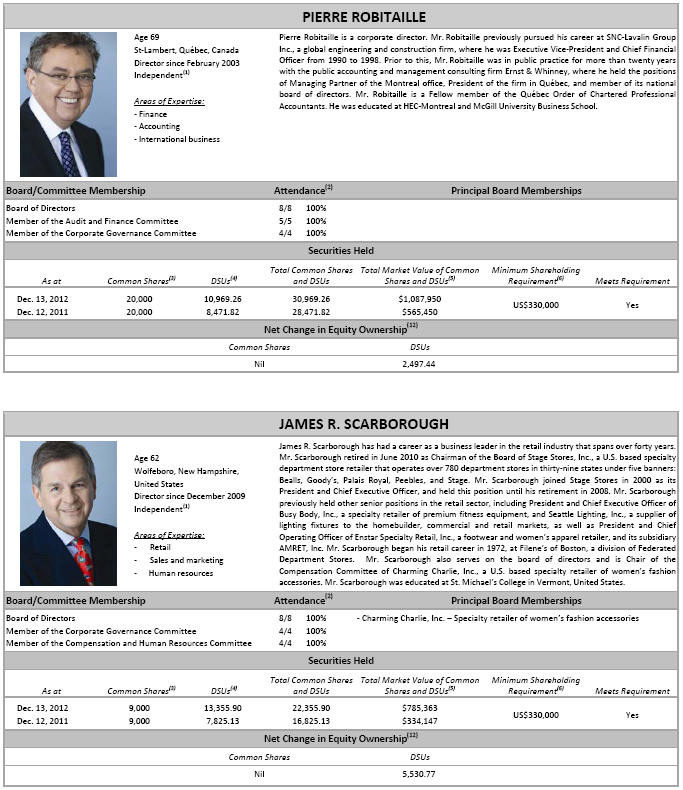

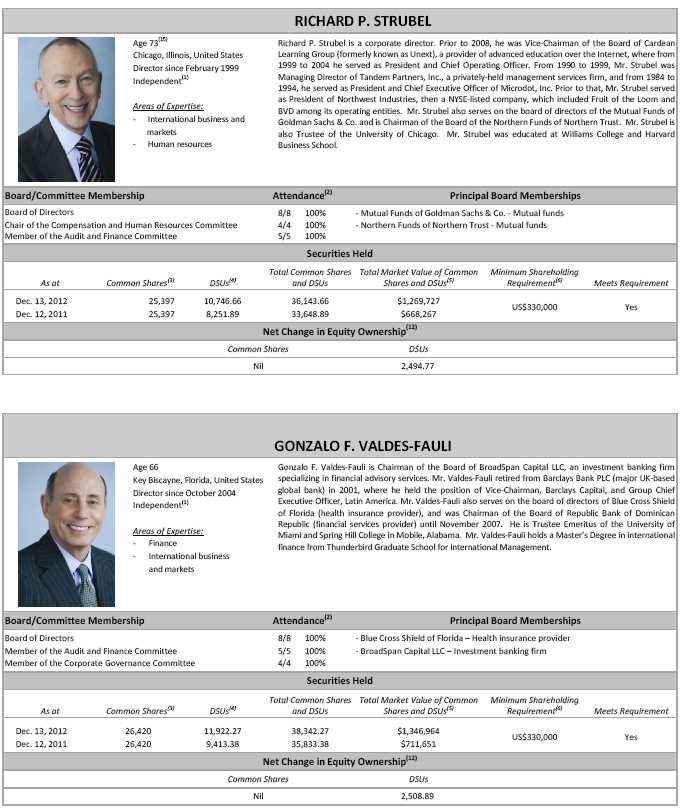

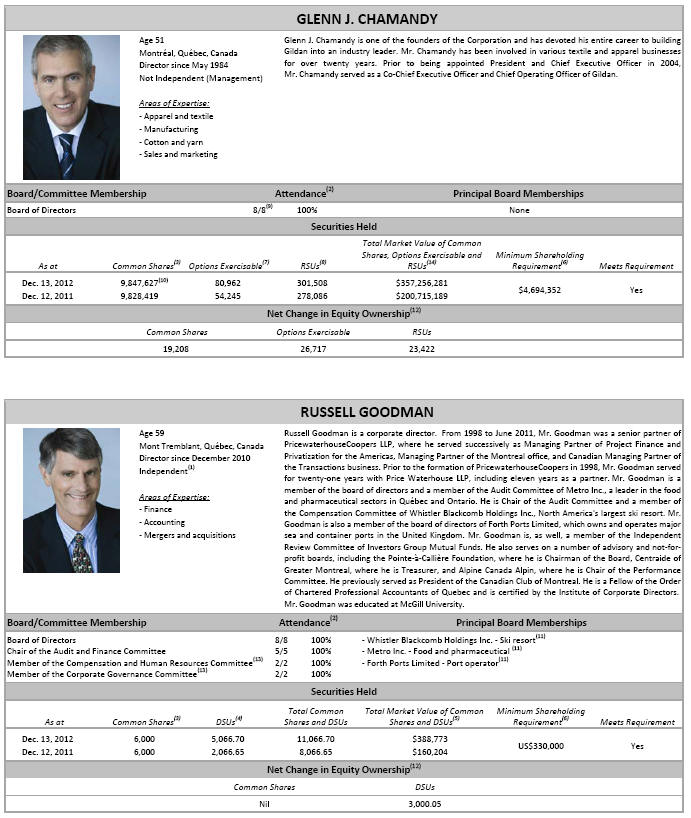

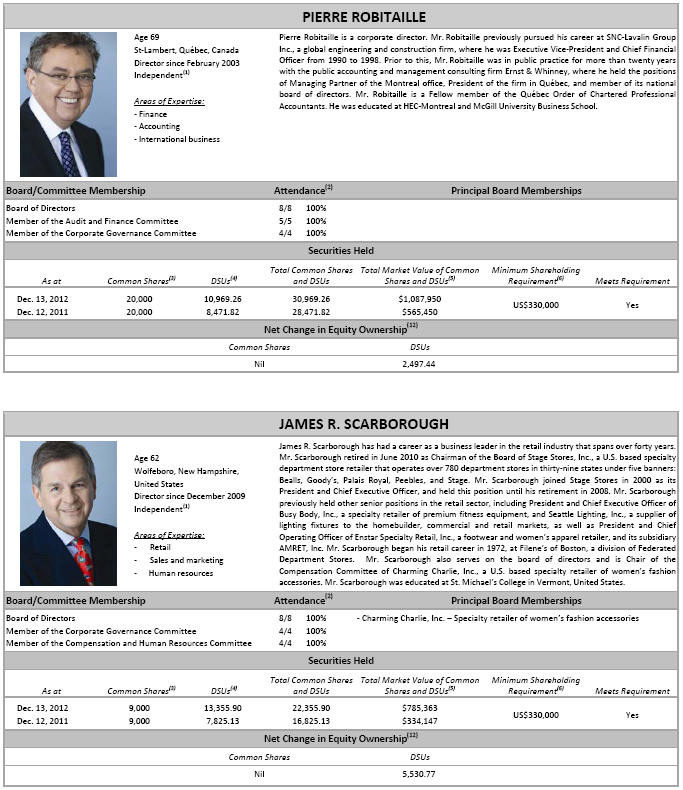

2.1.2 Nominees

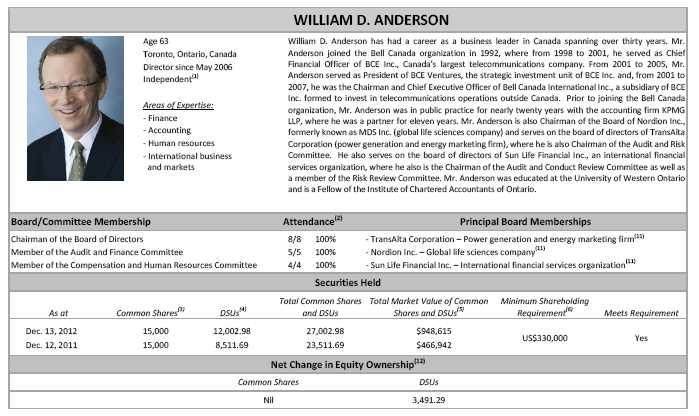

The following charts provide information on the nominees proposed for election to the Board of Directors. Included in these charts is information relating to the directors’ Board Committee memberships, meeting attendance, principal directorships with other organizations, areas of expertise and equity ownership in the Corporation. The Board has fixed at nine the number of directors to be elected at the Meeting. As you will note from the enclosed form of proxy or voting instruction form, shareholders may vote for each director individually. In addition, the Corporation has adopted a majority voting policy as described in Section 2.1.5 below.

-4-

-5-

- 6 -

-7-

| (1) | “Independent” refers to the standards of independence established under Section 303A(2) of the New York Stock Exchange Listed Company Manual, Section 301 of theSarbanes-Oxley Act of 2002and Section 1.2 of the Canadian Securities Administrators’ National Instrument 58-101 (Disclosure of Corporate Governance Practices). |

| (2) | In addition to attending all meetings of the Board and its Committees on which they sit, directors are encouraged to attend and, in practice, do attend other Committee meetings on a non-voting basis. Directors are not paid additional fees for such attendance. |

-8-

| (3) | “Common Shares” refers to the number of Common Shares beneficially owned, or over which control or direction is exercised by the director, as at December 13, 2012 and December 12, 2011, respectively. |

| (4) | “DSUs” (as defined in Section 3.1.3) refers to the number of deferred share units held by the director as at December 13, 2012 and December 12, 2011, respectively. |

| (5) | “Total Market Value of Common Shares and DSUs” is determined by multiplying the closing price of the Common Shares on the Toronto Stock Exchange (“TSX”) on each of December 13, 2012 ($35.13) and December 12, 2011 ($19.86), respectively, by the number of Common Shares and deferred share units held as at December 13, 2012 and December 12, 2011, respectively. |

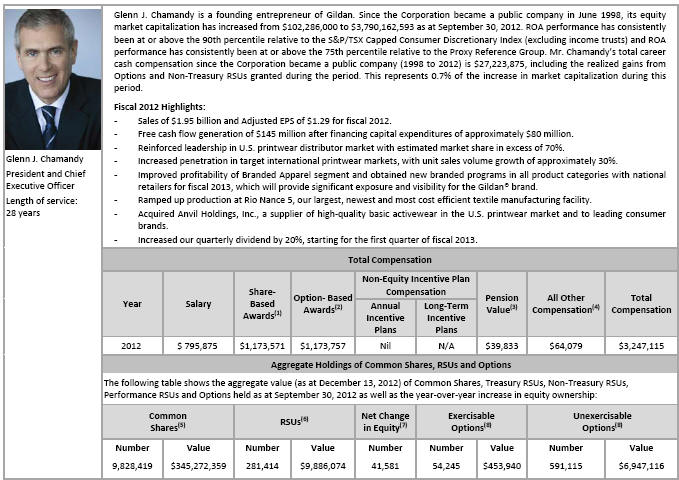

| (6) | See Section 3.1.2 entitled “Director Share Ownership Policy”. For Glenn J. Chamandy’s minimum requirement as President and Chief Executive Officer, see Section 3.2.2.3 entitled “Executive Share Ownership Policy” and Section 3.2.4.2 entitled “Shareholding Requirement for the Chief Executive Officer”. |

| (7) | “Options Exercisable” refers to the number of Options (as defined in Section 3.2.2.9) awarded to Glenn J. Chamandy and which are exercisable as at December 13, 2012 and December 12, 2011, respectively. |

| (8) | “RSUs” (as defined in Section 3.2.2.9) refers to the number of Treasury RSUs, Non-Treasury RSUs and Performance RSUs (as such terms are defined in Section 3.2.2.9) held by Glenn J. Chamandy as at December 13, 2012 and December 12, 2011, respectively. |

| (9) | Glenn J. Chamandy is not a member of the Board Committees. He attends Committee meetings as a non-voting participant at the invitation of the Committee Chairs. |

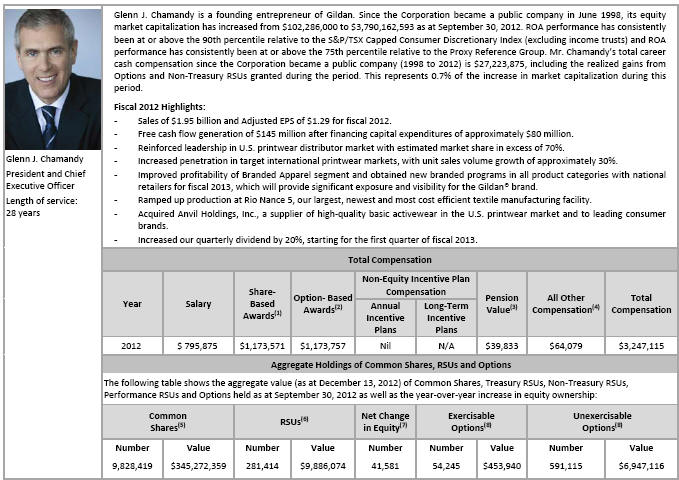

| (10) | Of the Common Shares, 9,750,000 are currently registered in the name of Windermere Bank & Trust Ltd. In August 2012, Glenn J. Chamandy entered into a pre- arranged share disposition plan, under which he authorized and directed a U.S. financial institution to sell up to 2.75 million of his then total 9,828,419 Common Shares over a maximum 24-month period beginning on December 17, 2012. Subsequent to the sale of the Common Shares, Glenn J. Chamandy will remain one of the largest investors in Gildan and this disposition shall have no impact on his shareholding requirements. |

| (11) | Publicly-traded company. |

| (12) | “Net Change in Equity Ownership” refers to the change in ownership of Common Shares, DSUs (as defined in Section 3.1.3), Options (as defined in Section 3.2.2.9) and, in the case of Glenn J. Chamandy RSUs (as defined in Section 3.2.2.9) from December 12, 2011 to December 13, 2012. |

| (13) | In February 2012, in connection with the appointment of the new Chairman of the Board, certain Committee memberships changed. In that regard, Russell Goodman moved from the Corporate Governance Committee to the Compensation and Human Resources Committee and George Heller moved from the Audit and Finance Committee to the Corporate Governance Committee. |

| (14) | The value of Common Shares is determined by multiplying the number of Common Shares held on each of December 13, 2012 and December 12, 2011 by the closing price of the Common Shares on the TSX on December 13, 2012 ($35.13) and on December 12, 2011 ($19.86), respectively. RSUs are comprised of Treasury RSUs, Non-Treasury RSUs and Performance RSUs, as such terms are defined in Section 3.2.2.9. The aggregate value of such RSUs is determined by multiplying the number of RSUs held on each of December 13, 2012 and December 12, 2011 by the closing price of the Common Shares on the TSX on December 13, 2012 ($35.13) and on December 12, 2011 ($19.86), respectively. For the purposes hereof, Performance RSUs are assumed to vest at target (100%). The aggregate value of the RSU awards held assuming the Performance RSUs achieve maximum vesting of 200% of the number of RSUs held as at December 13, 2012 and December 12, 2011, amounts to $13,963,121 and $7,011,712 respectively. The value of the exercisable Options (as defined in Section 3.2.2.9) is calculated based on the difference between the closing price of the Common Shares on the TSX on December 13, 2012 ($35.13) and on December 12, 2011 ($19.86), respectively, and the exercise price of the Options, multiplied by the number of exercisable Options held as at December 13, 2012, and December 12, 2011, respectively. |

| (15) | The Board approved an exception to the application of the director retirement policy for Richard P. Strubel, who has reached the mandatory retirement age of 72, thereby permitting him to stand for reelection as a director of the Corporation for one additional year. |

2.1.3 Stock Options to Directors Discontinued in 2001

Since December 2001, as a matter of corporate policy, the Board discontinued all grants of options to non-employee directors. In May 2006, the Board of Directors formally amended the Corporation’s Long Term Incentive Plan to exclude non-employee directors as eligible participants.

2.1.4 No Common Directorships

As at December 13, 2012, no members of the Board of Directors served together on any outside boards.

To maintain director independence and to avoid potential conflicts of interest, the Board has adopted a policy whereby Board members are prohibited from serving together as directors on any outside boards of publicly-traded companies, unless authorized by the Board, in its discretion.

2.1.5 Majority Voting Policy

The Board of Directors has adopted a policy providing that in an uncontested election of directors, any nominee who receives a greater number of votes “withheld” than votes “for” his or her nomination will tender his or her resignation to the Board of Directors promptly following the shareholders’ meeting. The Corporate Governance Committee will consider the offer of resignation and will make a recommendation to the Board of Directors on whether to accept it. The Board of Directors will make its final decision and announce it in a press release within ninety days following the shareholders’ meeting. A director who tenders his or her resignation pursuant to this policy will not participate in any meeting of the Board of Directors or the Corporate Governance Committee at which the resignation is considered.

-9-

2.2 Appointment of Auditors

KPMG LLP (“KPMG”), chartered accountants, has served as auditors of the Corporation since fiscal 1996. In fiscal 2012, in addition to retaining KPMG to report upon the annual consolidated financial statements of the Corporation, the Corporation retained KPMG to provide various audit, audit-related, and non-audit services. The aggregate fees billed for professional services by KPMG for each of the last two fiscal years were as follows:

Audit Fees— The aggregate audit fees billed by KPMG were $2,106,000 for fiscal 2012 and $1,752,531 for fiscal 2011. These services consisted of professional services rendered for the annual audit of the Corporation’s consolidated financial statements and the quarterly reviews of the Corporation’s interim financial statements, consultation concerning financial reporting and accounting standards, including assistance in preparing the Corporation for compliance with the requirements of International Financial Reporting Standards, and services provided in connection with statutory and regulatory filings or engagements. The fees for the annual audit of the Corporation’s consolidated financial statements include fees relating to KPMG’s audit of the effectiveness of the Corporation’s internal control over financial reporting.

Audit-Related Fees— The aggregate audit-related fees billed by KPMG were $396,000 for fiscal 2012 and $418,610 for fiscal 2011. These services consisted of due diligence services relating to business acquisitions and also translation services in both years. Such due diligence services related primarily to financial accounting and internal control issues.

Tax Fees— The aggregate tax fees billed by KPMG were $642,000 for fiscal 2012 and $795,810 for fiscal 2011. These services consisted of tax compliance, including the review of tax returns, assistance regarding income, capital and sales tax audits, the preparation of annual transfer pricing studies and tax advisory services relating to domestic and international taxation.

All Other Fees— The aggregate fees billed by KPMG for all other professional services rendered were nil for both fiscal 2012 and fiscal 2011.

All fees paid and payable by the Corporation to KPMG in fiscal 2012 were pre-approved by the Corporation’s Audit and Finance Committee pursuant to the procedures and policies set forth in the Audit and Finance Committee mandate.Except where authorization to vote with respect to the appointment of auditors is withheld, the persons designated in the enclosed form of proxy or voting instruction form intend to vote FOR the reappointment of KPMG, as auditors of the Corporation, to hold office until the close of the next annual meeting of shareholders at such remuneration as may be recommended by the Audit and Finance Committee and fixed by the Board.

SECTION 3–DISCLOSURE OF COMPENSATION

3.1 Remuneration of Directors

The Corporation’s director compensation program is designed (i) to attract and retain the most qualified individuals to serve on the Corporation’s Board of Directors and its Committees, (ii) to align the interests of the directors with the long-term interests of the Corporation’s shareholders, and (iii) to provide appropriate compensation for the risks and responsibilities related to being an effective director.

The Corporate Governance Committee is mandated by the Board to review regularly the amount and form of non-employee director compensation. Accordingly, every second year, the Corporate Governance Committee engages an independent advisor to provide advice on non-employee director compensation for this purpose. In both fiscal 2010 and fiscal 2012, the Corporate Governance Committee retained Mercer (Canada) Limited (“Mercer”) to review the compensation of non-employee directors.

-10-

In its review, Mercer benchmarks the Corporation’s director compensation structure against market compensation data gathered from the same Proxy Reference Group (as defined in Section 3.2.2.4) used to benchmark executive compensation (see Section 3.2.2.4 entitled “Benchmarking Practices”), as well as North American organizations of comparable revenue size. Based on the results of Mercer’s benchmarking studies, the Corporate Governance Committee then recommends to the Board any adjustments to the non-employee directors’ compensation that may be necessary or appropriate to achieve the objectives of the Corporation’s director compensation program. In this regard, based on the results of Mercer’s benchmarking study in fiscal 2012, the Corporate Governance Committee recommended, and the Board of Directors approved, an adjustment to non-employee directors’ compensation to market-competitive levels, effective January 1, 2013.

3.1.1 Annual Retainers and Attendance Fees

Annual retainers and attendance fees are paid to the members of the Board of Directors who are not employees or officers of the Corporation (“Outside Directors”) on the following basis (all amounts are in U.S. dollars):

Type of Compensation

| Annual Compensation

Effective from

January 1, 2011

to December 31, 2012

(US$) | Annual Compensation

Effective as of

January 1, 2013

(US$) |

| Board Chair Retainer | 260,000(1) | 275,000(1) |

| Board Retainer | 110,000(2) | 140,000(2) |

| Committee Chair Retainer | | |

| - Audit and Finance | 20,000(3) | 20,000(3) |

| - Compensation and Human Resources | 15,000 | 15,000 |

| - Corporate Governance | 9,000 | 9,000 |

| Committee Member Retainer | | |

| - Audit and Finance | Nil | Nil |

| - Compensation and Human Resources | Nil | Nil |

| - Corporate Governance | Nil | Nil |

| Meeting Attendance Fees | | |

| - Board meeting | 1,500(4) | 1,500(4) |

| - Committee meeting | 1,500(4) | 1,500(4) |

| - Annual shareholders’ meeting | 1,500(4) | 1,500(4) |

| (1) | Includes the Board and Committee retainers and meeting attendance fees. Currently, US$100,000 of the Board Chair retainer is paid in deferred share units, irrespective of whether the Board Chair has met the minimum share requirements. Effective January 1, 2013, US$125,000 of the new Board Chair retainer will be paid in deferred share units. See Section 3.1.2 entitled “Director Share Ownership Policy”. |

| (2) | Currently, US$60,000 of the Board retainer is paid in deferred share units and, effective January 1, 2013, US$70,000 of the new Board retainer will be paid in deferred share units, in either case irrespective of whether a director’s minimum share ownership requirement has been met. |

| (3) | US$5,000 of the Audit and Finance Committee Chair retainer is paid in deferred share units, irrespective of whether the Committee Chair has met the minimum share requirements. |

| (4) | All Outside Directors are paid meeting attendance fees except for the Board Chair, whose meeting attendance fees are included in the Board Chair retainer. |

For a summary of the total compensation earned by each Outside Director during the fiscal year ended September 30, 2012, please refer to Section 3.1.4 entitled “Total Compensation of Outside Directors”. The President and Chief Executive Officer is the only executive director of the Corporation and is not compensated in his capacity as a director. Outside Directors are reimbursed for travel and other out-of-pocket expenses incurred in attending Board or Committee meetings and the annual shareholders’ meeting.

-11-

3.1.2 Director Share Ownership Policy

The Board of Directors believes that the economic interests of directors should be aligned with those of the Corporation’s shareholders. To achieve this, the Board has adopted a formal share ownership policy (the “Director Share Ownership Policy”) pursuant to which each Outside Director is expected to establish, over a period of five years, ownership of an amount of Common Shares and/or deferred share units which is equivalent in value to three times the annual Board retainer (based on the market value of the Common Shares on the New York Stock Exchange (the “NYSE”)), and subsequently maintain such minimum ownership position for the duration of his or her tenure as a director.

Furthermore, the Corporation’s Insider Trading Policy prohibits all insiders of the Corporation, including directors, from purchasing financial instruments, such as prepaid variable forward contracts, equity swaps, collars or units of exchange funds that are designed to hedge or offset a decrease in the market value of equity securities granted to such insiders as compensation or held directly or indirectly by the insider.

3.1.3 Deferred Share Unit Plan

The Corporation has adopted a deferred share unit plan (the “DSUP”) for the Outside Directors to align their economic interests with those of their Corporation’s shareholders and to assist them in meeting the requirements of the Director Share Ownership Policy. The DSUP became effective as of the first quarter of fiscal 2005.

Under the current annual retainers and attendance fees, each Outside Director receives deferred share units (“DSUs”) valued on an annual basis at US$60,000 out of a total annual Board retainer fee of US$110,000. The Chairman of the Board receives DSUs valued on an annual basis at US$100,000 out of a total annual Board Chair retainer fee of US$260,000. In addition, the Audit and Finance Committee Chair receives DSUs valued on an annual basis at US$5,000 out of a total annual retainer fee of US$20,000. In November 2012, on the recommendation of the Corporate Governance Committee, the Board amended the annual retainers and attendance fees for Outside Directors, effective January 1, 2013, with the result that each Outside Director will receive DSUs valued on an annual basis at US$70,000 out of a total annual Board retainer fee of US$140,000 and the Chairman of the Board will receive DSUs valued on an annual basis at US$125,000 out of a total annual Board Chair retainer fee of US$275,000. See Section 3.1 entitled “Remuneration of Directors”.

Under the DSUP, the portion of the retainers paid in DSUs is payable quarterly, even if the Outside Director has achieved the minimum shareholding requirement under the Director Share Ownership Policy. In addition, Outside Directors may elect to receive in the form of DSUs any or all of the remaining balance of the fees payable in respect of serving as a director. Under the DSUP, Outside Directors are granted, as of the last day of each fiscal quarter of the Corporation, a number of DSUs determined on the basis of the amount of deferred remuneration payable to such director in respect of such quarter divided by the value of a DSU, which is the average of the closing prices of the Common Shares on the NYSE for the five trading days immediately preceding the last day of each fiscal quarter of the Corporation. DSUs granted under the DSUP will be redeemable, and the value thereof payable, only after the director ceases to act as a director of the Corporation. Furthermore, the DSUP provides that Outside Directors will be credited with additional DSUs whenever cash dividends are paid on the Common Shares. The number of additional DSUs credited to an Outside Director in connection with the payment of dividends is based on the actual amount of cash dividends that would have been paid to the Outside Director had his or her DSUs been Common Shares at the payment date.

-12-

Outstanding Share-Based Awards

The following table shows all share-based awards outstanding for each Outside Director as at the fiscal year ended September 30, 2012:

| | Share-Based Awards |

| Name | Number of Shares or Units of Shares | Market or Payout Value of Share-Based |

| | That Have Not Vested(1)

(#)

| Awards That Have Not Vested(2)

($)

|

| William D. Anderson | 12,003 | 374,133 |

| Russell Goodman | 5,067 | 157,929 |

| George Heller | 13,716 | 427,534 |

| Sheila O’Brien | 21,469 | 669,195 |

| Pierre Robitaille | 10,969 | 341,912 |

| James R. Scarborough | 13,356 | 416,303 |

| Richard P. Strubel | 10,747 | 334,973 |

| Gonzalo F. Valdes-Fauli | 11,922 | 371,617 |

| (1) | The “Number of Shares or Units of Shares That Have Not Vested” represent all awards of DSUs outstanding at fiscal year-end, including awards granted before the most recently completed fiscal year and includes the additional DSUs credited to the Outside Directors on the payment dates of the Corporation’s fiscal 2012 cash dividends on the Common Shares as provided in the DSUP (see Section 3.1.3 entitled “Deferred Share Unit Plan”). |

| (2) | “Market or Payout Value of Share-Based Awards That Have Not Vested” is determined by multiplying the number of DSUs held at fiscal year- end by the closing price of the Common Shares on the TSX on the last trading day prior to fiscal year-end (September 28, 2012) of $31.17. |

3.1.4 Total Compensation of Outside Directors

The table below reflects in detail the total compensation earned by each Outside Director during the fiscal year ended September 30, 2012:

| Name | Fees Earned(2)(4) | Share-Based Awards(3)(4) | Total(4) |

| Retainer | Attendance |

| Robert M. Baylis(1) | 55,750 | - | 34,845 | 90,595 |

| William D. Anderson | 124,211 | 14,748 | 86,124 | 225,083 |

| Russell Goodman | 46,945 | 26,546 | 73,902 | 147,393 |

| George Heller | - | - | 134,698 | 134,698 |

| Sheila O’Brien | - | 25,072 | 117,001 | 142,073 |

| Pierre Robitaille | 49,160 | 26,546 | 58,992 | 134,698 |

| James R. Scarborough | - | - | 133,224 | 133,224 |

| Richard P. Strubel | 63,908 | 26,546 | 58,992 | 149,446 |

| Gonzalo F. Valdes-Fauli | 49,160 | 26,546 | 58,992 | 134,698 |

| (1) | Robert M. Baylis retired as the Chairman of the Board in February 2012. |

| (2) | These amounts represent the portion of the retainer and attendance fees paid in cash to the Outside Directors. |

| (3) | These amounts represent the cash value of the portion of the retainer and attendance fees paid in DSUs to the Outside Directors. A portion of the retainer fees is paid in DSUs to all Outside Directors (see Section 3.1.1 entitled “Annual Retainers and Attendance Fees”). Certain Outside Directors have elected under the DSUP to receive some or all of the remaining balance of their retainer and attendance fees in DSUs. |

| (4) | Outside Directors are compensated in U.S. dollars. The amounts have been converted to Canadian dollars using an exchange rate of $0.9832 as of September 28, 2012. |

-13-

3.2 Compensation of Senior Executives

3.2.1 Determining Compensation

3.2.1.1 Compensation and Human Resources Committee

Compensation of senior executives of the Corporation and its subsidiaries is recommended to the Board of Directors by the Compensation and Human Resources Committee. During the most recently completed fiscal year, the Compensation and Human Resources Committee was composed of six directors, all of whom are independent directors, namely Mr. Richard P. Strubel (Chair), Mr. William D. Anderson, Mr. George Heller, Ms. Sheila O’Brien, Mr. James R. Scarborough and Mr. Russell Goodman, who joined the Committee following the retirement of Mr. Robert M. Baylis in February 2012. None of the members of the Committee is an acting chief executive officer of another company. The Board of Directors believes that the Committee collectively has the knowledge, experience and background required to fulfill its mandate.

Richard P. Strubelhas, during his career, held various senior management positions where he has been responsible for the compensation and human resources departments at various public and private companies. Mr. Strubel also has had extensive experience serving as a board member and currently serves on the board of the Mutual Funds Goldman Sachs & Co. and is Chairman of the Board of the Northern Funds of Northern Trust.

William D. Andersonhas had extensive senior management experience, including as chief executive officer and chief financial officer of major public companies where he oversaw the human resources departments. He has also served on the compensation and human resources committees of various publicly-traded companies.

Robert M. Baylishas served on various compensation and human resources committees, including at Host Hotels & Resorts, Inc., New York Life Insurance Company and Covance Inc. Mr. Baylis has also held several senior management positions where the human resources function fell under his responsibility.

Russell Goodmanis a member of various boards of directors, including the board of directors of Whistler Blackcomb Holdings Inc., where he serves as Chair of the Audit Committee and as a member of the Compensation Committee, and the board of directors of Metro Inc., where he also serves as a member of the Audit Committee. As Chairman of the Audit and Finance Committee of the Board, Mr. Goodman is required to sit on the Compensation and Human Resources Committee.

George Hellerhas had, during his career as a senior corporate executive, direct reports which have included the vice-presidents of the human resources departments. In the past, Mr. Heller has also served as a director and human resource committee member of large publicly-traded companies.

Sheila O’Brienis a former senior executive at Nova Chemicals Corporation, where her responsibilities included oversight over the human resources function. Ms. O’Brien has over thirty years of executive leadership experience in the areas of human resources, compensation, succession planning, management and labour relations. She currently serves as Chair of the Human Resources Committee at MaRS (Medical and Related Sciences) and at the Alberta College of Art and Design.

James R. Scarborough’s lengthy career as a business leader in the retail industry includes serving as Chairman and Chief Executive Officer of Stage Stores, Inc., where he was responsible for the human resources function. Mr. Scarborough also currently serves as Chair of the Compensation Committee for Charming Charlie, Inc.

-14-

The Board has adopted a formal mandate for the Compensation and Human Resources Committee, which outlines the Committee’s primary responsibilities. The Committee is responsible for monitoring senior executives’ performance assessment, succession planning and overall compensation. Hence, the Committee recommends the appointment of senior executives, including the terms and conditions of their appointment and termination, and reviews the evaluation of the performance of the Corporation’s senior executives, including recommending their compensation. The Board of Directors, which includes the members of the Compensation and Human Resources Committee, reviews the President and Chief Executive Officer’s corporate goals and objectives and evaluates his performance in light of such goals and objectives. The Committee also oversees the existence of appropriate human resources systems, policies and compensation structures so that the Corporation can attract, motivate and retain senior executives who exhibit high standards of integrity, competence and performance. In this regard, the Committee recommends to the Board executive compensation methods that tie an appropriate portion of senior executives’ compensation to both the short-term and longer-term performance of the Corporation. The Compensation and Human Resources Committee oversees risk identification and management in relation to compensation policies and practices and, on an annual basis, identifies and assesses the risks associated with each component of the senior executives’ global compensation. Finally, the Committee is responsible for developing a compensation philosophy and policy that rewards the creation of shareholder value while reflecting an appropriate balance between the short-term and longer-term performance of the Corporation. The mandate of the Committee is available on Gildan’s website at www.gildan.com.

3.2.1.2 Compensation Consultant

As provided in its mandate, the Compensation and Human Resources Committee has the authority to retain and approve the fees of its consultants.

Since 2005, the Committee has retained Mercer, a wholly-owned subsidiary of Marsh & McLennan Companies, Inc., to assist the Committee in matters related to corporate governance and executive compensation. Mercer assists the Committee in determining and benchmarking compensation for the Corporation’s senior executives and directors, ensuring that the various elements of the compensation package orient executives’ efforts and behaviours towards the goals that have been set, and ensuring that their total compensation is market competitive.

Executive Compensation-Related Work

During fiscal 2012, the Committee retained Mercer to review short-term and long-term incentive plan performance measures, update the Proxy Reference Group (as defined in Section 3.2.2.4) and review retirement provisions for a senior executive. Mercer also provided ad hoc analytical and advisory support on other matters relating to executive compensation.

All Other Work

No work was performed by Mercer for the Corporation during fiscal 2012.

The Compensation and Human Resources Committee is required to pre-approve any services that Mercer or its affiliates provide to the Corporation at the request of management.

-15-

The aggregate fees paid to Mercer for executive compensation-related services and all other services provided during fiscal 2012 and fiscal 2011 were as follows:

Type of Fee |

Fiscal 2011 Fees |

Fiscal 2012 Fees | Percentage of Fiscal

2011 Fees | Percentage of Fiscal

2012 Fees |

| Executive Compensation- Related Fees | $138,780 | $92,273 | 68% | 100% |

| All Other Fees | $64,925 | Nil | 32% | Nil |

| Total | $203,705 | $92,273 | 100% | 100% |

Due to the policies and procedures that Mercer and the Compensation and Human Resources Committee have established, the Committee is confident that the advice it receives from the individual executive compensation consultant at Mercer is objective and not influenced by Mercer’s or its affiliates’ relationships with the Corporation. These policies and procedures include:

The individual consultant receives no incentive or other compensation based on the fees charged to the Corporation for other services provided by Mercer or any of its affiliates;

The individual consultant is not responsible for selling other Mercer or affiliate services to the Corporation;

Mercer’s professional standards prohibit the individual consultant from considering any other relationships Mercer or any of its affiliates may have with the Corporation in rendering his or her advice and recommendations;

The Committee has the sole authority to retain and terminate the individual consultant;

The individual consultant has direct access to the Committee without management intervention;

The Committee evaluates the quality and objectivity of the services provided by the individual consultant each year and determines whether to continue to retain the individual consultant; and

The Committee has adopted protocols governing if and when the individual consultant’s advice and recommendations can be shared with management.

While the Compensation and Human Resources Committee may rely on external information and advice, all of the decisions with respect to executive compensation are made by the Committee alone and may reflect factors and considerations other than, or that may differ from, the information and recommendations provided by Mercer.

3.2.2 Compensation Discussion & Analysis

3.2.2.1 Compensation Philosophy and Objectives

The Corporation’s executive compensation program is intended to attract, motivate and retain high performing senior executives, encourage and reward superior performance and align the executives’ interests with those of the Corporation’s shareholders by:

-16-

Providing the opportunity for total compensation that is competitive with the compensation received by senior executives employed by a group of comparable North American companies;

Ensuring that a significant proportion of executive compensation is linked to performance through the Corporation’s variable compensation plans; and

Providing senior executives with long-term equity-based incentive plans, such as stock options and restricted share units, which also help to ensure that senior executives meet or exceed minimum share ownership requirements.

3.2.2.2 Risk Assessment of Executive Compensation Program

Managing Compensation Risk

As part of its formal mandate, the Board of Directors, through the Compensation and Human Resources Committee, is entrusted with overseeing the implementation of an executive compensation program that ties an appropriate portion of executive compensation to both the short-term and longer-term performance of the Corporation, taking into account the advantages and risks associated with different compensation methods. In fiscal 2012, the Compensation and Human Resources Committee reviewed Gildan’s compensation program, policies and practices in each of the key areas discussed below and did not identify any material risks that are likely to have a material adverse effect on the Corporation.

Pay mix– Gildan’s compensation program puts significant weighting on long-term incentives to mitigate the risk of encouraging the achievement of short-term goals at the expense of long-term sustainability and shareholder value. The variable elements of the compensation program (short-term and long-term incentives) represent a percentage of overall compensation that is sufficient to motivate senior executives to produce superior short-term and long-term corporate results, while the fixed compensation element (base salary) is also high enough to discourage senior executives from taking unnecessary or excessive risks.

Incentive plan funding, leverage and caps– Payouts for senior executives under Gildan’s annual short-term incentive plan, Supplementary Cash Opportunities for Results Exceeding Standards (“SCORES”), are based on Gildan’s return on assets (“ROA”) performance and earnings per share (“EPS”) growth over the previous fiscal year. These measures were selected to ensure that incentive-based compensation reflects success in achieving internal corporate profitability targets and managing the return on assets. The maximum amount that a senior executive can receive under the SCORES plan is capped at two times target and there are no guaranteed minimum payouts. In addition, annual long-term incentive plan vesting conditions are designed to encourage a long-term view of performance and to align senior executives with shareholder interests.

Performance periods– With very limited exceptions, RSUs (as defined in Section 3.2.2.9, under the heading “Types of Equity Incentives Awarded”) cliff-vest at the end of a three- or five-year period, in each case with at least half, and in some cases all, of the award based on Gildan’s ROA performance relative to the S&P/TSX Capped Consumer Discretionary Index. Options (as defined in Section 3.2.2.9, under the heading “Types of Equity Incentives Awarded”) vest over a five-year period starting on the second anniversary of the grant date and are only valuable if Gildan’s stock price increases over time. The vesting of equity over various time horizons mitigates against taking short-term risks and aligns senior executives with longer-term shareholder interests.

Performance measures– SCORES annual incentive payouts for senior executives, which are based solely on the achievement of corporate performance measures, namely ROA and EPS growth, consider both internal budgets and external benchmarks, which ensures that the goals are sufficiently challenging but attainable without the need to take inappropriate risks. A portion of the payouts for all other participating employees is based on the same corporate performance measures in order to create alignment and encourage decision-making that is in the best interests of the Corporation as a whole. The balance of other participating employees’ short-term incentive payouts is based on a mix of individual objectives and divisional objectives set at the beginning of the year.

-17-

Pay for performance– Gildan’s compensation program is based on pay for performance. To ensure that the total direct compensation of senior executives is aligned with the Corporation’s compensation objectives, Gildan has, from time to time, stress-tested the incentive awards that would be earned by senior executives under various performance scenarios and outcomes. Stress testing helps determine whether the incentive awards would pay out as anticipated and remain consistent with Gildan’s pay-for-performance philosophy.

Plan governance and risk mitigation– The Board of Directors retains the authority to reduce or increase the SCORES annual incentive payouts taking into consideration qualitative factors beyond the quantitative financial metrics. The Executive Share Ownership Policy requires a significant level of share ownership, which aims to ensure that senior executives and other senior management are aligned with long-term shareholder interests. The Corporation’s Insider Trading Policy prohibits senior executives and all other insiders from using financial vehicles, such as hedging instruments, to mitigate the downside risk associated with share-based equity grants. Finally, the Chairs of the Audit and Finance Committee and the Compensation and Human Resources Committee each is a member of the other’s committee to ensure the alignment of policies for the assessment of risks.

3.2.2.3 Executive Share Ownership Policy

The Board of Directors believes that the economic interests of senior executives should be aligned with those of the Corporation’s shareholders. In that regard, the Board has adopted a formal share ownership policy (the “Executive Share Ownership Policy”) pursuant to which each senior executive is expected to own and maintain ownership of an amount of Common Shares or restricted share units that has a total market value of not less than a specified multiple of the senior executive’s base salary. Senior executives have five years from the date they become subject to the Executive Share Ownership Policy to meet the requirement, after which they must maintain compliance with the ownership requirement for the duration of their employment with the Corporation.

The following table sets forth the ownership requirements by executive level under the Executive Share Ownership Policy:

| Executive Share Ownership Policy |

| Executive Level | Multiple of Base Salary |

| President and Chief Executive Officer | 6 x Base Salary |

| Chief Financial and Administrative Officer | 3 x Base Salary |

| Executive Vice-Presidents | 3 x Base Salary |

| Senior Vice-Presidents | 1.5 x Base Salary |

Executives who are subject to the Executive Share Ownership Policy are expected to not sell Common Shares acquired under Gildan’s Long Term Incentive Plan until the share ownership requirement is achieved, except as required to cover the tax liability associated with the vesting of restricted share units or the exercise of stock options.

-18-

In addition, pursuant to the Corporation’s Insider Trading Policy, senior executives and all other insiders are prohibited from purchasing financial instruments, such as prepaid variable forward contracts, equity swaps, collars or units of exchange funds that are designed to hedge or offset a decrease in the market value of equity securities granted to such senior executive as compensation or held directly or indirectly by the senior executive.

The table below summarizes the share ownership levels for each of the chief executive officer, the chief financial officer and the three other most highly compensated executive officers of the Corporation (the “Named Executive Officers”) at the 2012 fiscal year-end. All of these Named Executive Officers are currently in compliance with the ownership requirement of the Executive Share Ownership Policy.

Name

|

Annual Base

Salary(1)

($) | Actual Ownership(2)($/#) | Total

Ownership as

a Multiple

Base Salary | Ownershiprequirements | Meetsrequirement |

| Common SharesBeneficially Owned | UnvestedRestrictedUnits(3) | TotalShareOwnership |

Glenn J. Chamandy

President and Chief Executive Officer | 805,864

| 301,437,611 /

9,828,419 | 8,630,967 /

281,414 | 310,068,578 /

10,109,833 | 384.77 x

| 6 x Base Salary

| Yes

|

Laurence G. Sellyn

Executive Vice-President, Chief Financial

and Administrative Officer |

506,479

| 4,607,861 /

150,240

| 5,374,611 /

175,240

| 9,982,472 /

325,480

|

19.71 x

|

3 x Base Salary

|

Yes

|

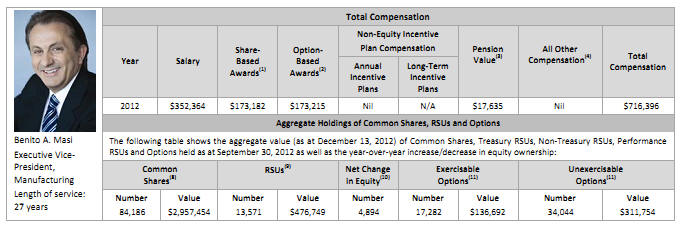

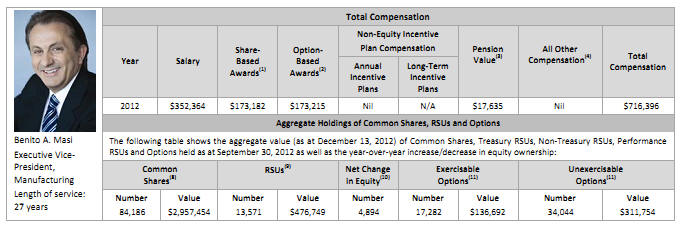

Benito A. Masi

Executive Vice-President, Manufacturing | 356,786

| 2,581,985 /

84,186 | 416,223 /

13,571 | 2,998,208 /

97,757 | 8.4 x

| 3 x Base Salary

| Yes

|

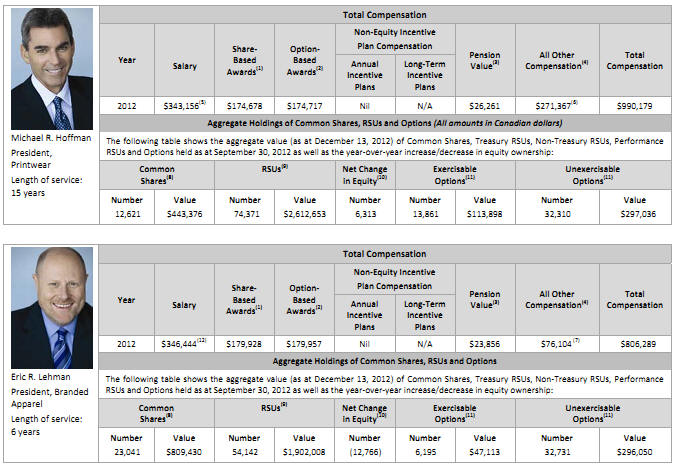

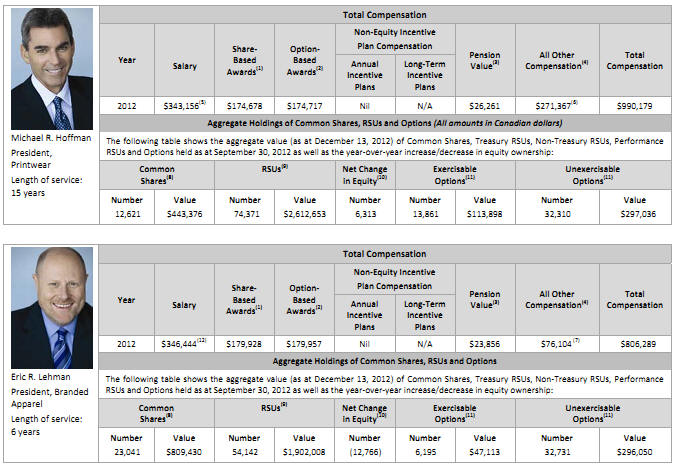

Michael R. Hoffman

President, Printwear | 350,792

| 387,086 /

12,621 | 2,280,959 /

74,371 | 2,668,045 /

86,992 | 7.61 x

| 3 x Base Salary

| Yes

|

Eric R. Lehman

President, Branded Apparel | 350,792

| 706,667 /

23,041 | 1,660,535 /

54,142 | 2,367,203 /

77,183 | 6.75 x

| 3 x Base Salary

| Yes

|

| (1) | The base salary used to calculate the ownership requirement is as at September 30, 2012. The base salaries of Michael R. Hoffman and Eric R. Lehman are paid in U.S. dollars but have been converted to Canadian dollars using an exchange rate of $0.9832 as of September 28, 2012. |

| (2) | The dollar value of actual ownership is calculated based on a price of $30.67 per share, which is the weighted average of the closing prices of the Common Shares on the TSX for the five trading days immediately preceding September 30, 2012. |

| (3) | These amounts include unvested Performance RSUs (as defined in Section 3.2.2.9 under the heading “Performance Measures and Weightings”), which have the potential to vest at a maximum of 200% of the actual number of RSUs (as defined in Section 3.2.2.9 under the heading “Types of Equity Incentives Awarded”) granted. Messrs. Chamandy, Sellyn, Masi, Hoffman and Lehman each hold an aggregate of 75,868, 22,302, 13,571, 13,196 and 13,359 Performance RSUs, respectively. |

3.2.2.4 Benchmarking Practices

In order to meet the Corporation’s objectives of providing market competitive compensation opportunities, Gildan’s senior executive compensation plans are benchmarked against market compensation data gathered from organizations of comparable size and other companies that the Corporation competes with for executive talent (the “Reference Groups”). As part of this benchmarking process, the Committee reviews compensation data gathered from proxy circulars of other publicly-traded companies (the “Proxy Reference Group”), and also considers data from different compensation surveys (the “Survey Reference Group”) as a secondary reference point to complement the proxy data. In addition, the Committee also considers information gathered from annual compensation planning surveys from a range of outside consulting firms in connection with determining annual salary increases for senior executives.

-19-

The composition of the Reference Groups is reviewed regularly by the Compensation and Human Resources Committee for its ongoing business relevance to the Corporation and changes are made as deemed appropriate. An overview of the characteristics of the Reference Groups is provided in the following table:

| (All values in $ millions) | | | | |

| Gildan Activewear Inc. | Proxy Reference

Group(1) | Survey Reference Group(1) | |

| Location | Canada | North America | Canada | United States |

| Industries | Textiles and apparel | Apparel, Accessories & Luxury Goods | All publicly-traded (excluding oil and gas and financial services) | All publicly-traded (excluding oil and gas and financial services) |

Revenues

Most recent 12 months | $1,906(2)(3)

| $2,064(2)

| $500 to $2,000

| $500 to $2,000

|

Market Capitalization

As at September 30, 2012 | $3,790

| $2,674(2)

| Not available

| Not available

|

Net income

Most recent 12 months | $145(2)(3)

| $102(2)

| Not available

| Not available

|

| (1) | The financial data for the Proxy Reference Group is from the S&P Research Insight database and represents the median data for the group. The financial data for the Survey Reference Group is from publicly-traded companies in a number of industries (excluding oil and gas and financial services) and represents the range data for the group. |

| (2) | All U.S. dollar figures have been converted to Canadian dollars at the Bank of Canada 19-day average of $0.9783 as of September 28, 2012. |

| (3) | The financial data for the Corporation are based on its results for fiscal 2012. |

The Proxy Reference Group is composed of publicly-traded companies operating primarily in the textile and apparel industry. The Proxy Reference Group used for senior executive benchmarking purposes prior to fiscal 2013 was composed of the following companies: Carter’s Inc., Cintas Corp., Columbia Sportswear Co., Forzani Group Ltd., G&K Services Inc., Hanesbrands Inc., lululemon athletica inc., Oxford Industries Inc., Perry Ellis International Inc., Phillips-Van Heusen Corp., RONA Inc., Under Armour Inc., VF Corp., Warnaco Group Inc. and Yellow Media Inc.

During fiscal 2012, the Committee retained Mercer to review and update the Proxy Reference Group. The following selection criteria were used:

Publicly-traded North American companies with $750 million to $3.5 billion in annual revenues (approximately one-half to two times Gildan’s revenue);

Global Industry Classification Standard(GICS)sub-industry classification of Apparel, Accessories & Luxury Goods; and

Equity market capitalization of at least $100 million.

The industry sector is considered relevant in selecting comparators, as the Corporation competes directly with these organizations for customers, revenue, executive talent and capital. Revenue size, which is used as a proxy for the level of complexity, job scope and responsibility associated with senior executive positions, is considered relevant in selecting comparators given the correlation between pay level and company size.

Based on the selection criteria, four companies were eliminated from the Proxy Reference Group (Forzani Group Ltd., RONA Inc., VF Corp. and Yellow Media Inc.) and four companies were added (Jones Group, Quiksilver, Liz Claiborne and G-III Apparel Group, Ltd.). This revised Proxy Reference Group was used to benchmark director compensation in fiscal 2012 (see Section 3.1 entitled “Remuneration of Directors”) and will be used for senior executive benchmarking purposes in fiscal 2013.

Fourteen of Gildan’s industry sector comparators in the Proxy Reference Group are U.S. companies since lululemon athletica inc. is the only Canadian publicly-traded company operating in the textile and apparel industry. As a consequence, the Committee developed with Mercer a secondary reference group composed of Canadian public companies to be used for benchmarking roles that have a Canadian market for talent and where industry background is not a requirement. This group includes fourteen Canadian consumer discretionary companies with revenues from one-half to two-time that of Gildan and a market capitalization of at least $500 million: Linamar Corp., Tim Hortons Inc., Dorel Industries, Martinrea International Inc., Aimia Inc., Uni-Select Inc., Torstar Corp., Cogeco Inc., Dollarama Inc., Brookfield Residential Pptys, Reitmans Canada, lululemon athletica inc. and CORUS Entertainment Inc.

-20-

The Survey Reference Group represents a subset of companies with revenues between $500 million and $2 billion from Mercer’s 2010 Executive, Management and Professional Survey, which includes compensation data from 790 organizations in a wide range of industry groups, revenue levels and ownership structures. Revenue size, which is used as a proxy for the level of complexity, job scope and responsibility associated with senior executive positions, is considered relevant in selecting comparators from the survey given the correlation between pay level and company size. Mercer has advised that it cannot disclose the identities of participating organizations within a specified revenue range due to confidentiality covenants with survey participants.

3.2.2.5Positioning

The Corporation’s executive compensation policy is to use the market median with the potential of top quartile total compensation when individual and company performance are also at top quartile. The Compensation and Human Resources Committee uses discretion and judgement when determining actual compensation levels. Individual compensation may be positioned above or below median, based on individual experience and performance or other criteria deemed important by the Committee.

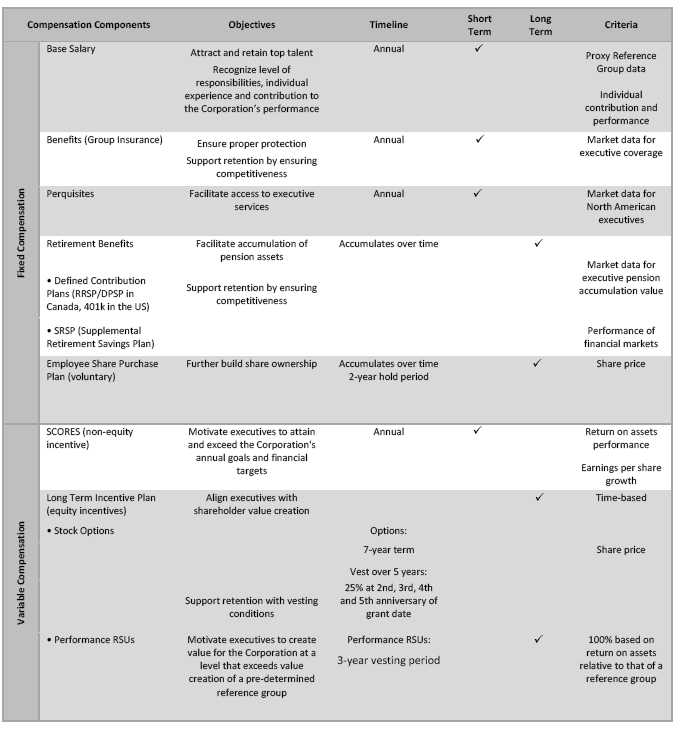

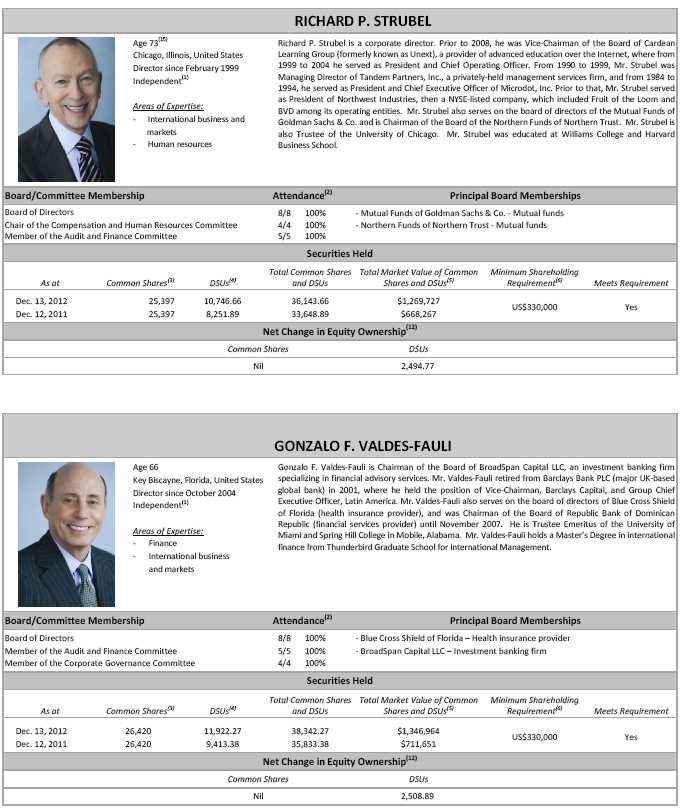

3.2.2.6 Compensation Elements

Gildan’s executive compensation program is comprised of fixed and variable components. The variable components include equity and non-equity incentive plans. Each compensation component has a different function, but all elements are designed to work in concert to maximize company and individual performance by providing financial incentives to senior executives based on their level of achievement of specific operational and financial objectives.

-21-

The following table summarizes senior executive total compensation components, the objectives of each component and the criteria impacting each component’s value:

-22-

3.2.2.7 Fixed Compensation

Base Salary

Salaries of the senior executives are established based on a comparison with competitive benchmark positions. The starting point to determine senior executive base salaries is the median of salaries in the Reference Groups.

Each year, the Compensation and Human Resources Committee reviews the individual salaries of the senior executives and makes adjustments when required to ensure that compensation remains market competitive, reflects individual performance, competencies, responsibilities and experience and also takes into account the senior executive’s value to the Corporation and retention risk.

Benefits and Perquisites

The Corporation’s senior executive benefits program includes life, medical, dental and disability insurance and a healthcare spending account. This program also includes out-of-country emergency services in medical or personal security situations. Perquisites consist of a car allowance, club memberships, personal insurance, health assessments and financial counselling. These benefits and perquisites are designed to be competitive overall with equivalent positions in comparable North American organizations.

Retirement Benefits

Under the Corporation’s retirement savings program, the Named Executive Officers (other than Michael R. Hoffman and Eric R. Lehman, who are not Canadian residents) and all other Canadian salaried employees receive, under the Deferred Profit Sharing Plan (“DPSP”), an amount equal to their contribution to their Registered Retirement Savings Plan (“RRSP”), up to a maximum of 5% of their annual base salary. In addition, should the Corporation’s contribution result in a total contribution made by the employee, or on behalf of the employee, in excess of the limit prescribed under Canadian law, the additional amount is credited under the Supplemental Retirement Savings Plan (“SRSP”), which is an unfunded plan.

Under the Corporation’s 401(k) program, Michael R. Hoffman, Eric R. Lehman and most of the other salaried employees who are citizens of the United States, receive an amount equal to 50% of their own contributions, which may be up to a maximum of 6% of their annual base salary and short term incentive payout. In addition, Michael R. Hoffman and Eric R. Lehman are credited by the Corporation with an amount equal to 2% of their annual base salaries and short term incentive payouts under the U.S. SRSP program.

Defined Contribution Plans

The following table presents the value accumulated under the above-mentioned retirement savings programs for each of the Named Executive Officers as of the beginning and end of fiscal 2012:

| Name | Accumulated Value at Start

of Year(1)

($) | Compensatory (2)

($) | Accumulated Value at

Year-End(1)

($) |

| Glenn J. Chamandy | 561,541 | 39,833 | 671,254 |

| Laurence G. Sellyn | 371,702 | 25,035 | 447,269 |

| Benito A. Masi | 276,798 | 17,635 | 330,796 |

| Michael R. Hoffman | 310,818(3) | 26,261 | 384,381 |

| Eric R. Lehman | 111,013(3) | 23,856 | 170,589 |

(1) | “Accumulated Value at Start of Year” and “Accumulated Value at Year-End” correspond to the sum of the balances in the following accounts of each Named Executive Officer: RRSP, DPSP and SRSP (other than for Michael R. Hoffman, whose accumulated value corresponds to the sum of the balances in his accounts from the Corporation’s 401(k) and SRSP programs and for Eric R. Lehman, whose accumulated value corresponds to the sum of the balances in his accounts from the Corporation’s RRSP, DPSP, 401(k) and SRSP programs). |

-23-

| (2) | “Compensatory” refers to the Corporation’s contributions under all the above-mentioned accounts (other than for Michael R. Hoffman, where the Corporation’s contributions are under the 401(k) and SRSP programs and for Eric R. Lehman, where the Corporation’s contributions are under the DPSP, 401(k) and SRSP programs). Amounts disclosed reflect the contributions paid to the Named Executive Officers’ accounts from October 3, 2011 to September 30, 2012. |

| (3) | Amounts for Michael R. Hoffman and Eric R. Lehman have been converted to Canadian dollars using an exchange rate of $0.9832 as of September 28, 2012. |

Employee Share Purchase Plan

The Gildan employee share purchase plan (the “Plan”) provides an opportunity for all Canadian and U.S. citizens or residents who are full-time or regular part-time employees of the Corporation and its subsidiaries to participate in the Corporation’s ownership. This opportunity is also provided to certain full-time and regular part-time employees located in Honduras, the Dominican Republic, Nicaragua and Barbados. Employees of Anvil Knitwear, Inc., which was acquired in May 2012, will be eligible to participate in the Plan as of January 2013.

Under the Plan, an eligible employee may contribute between 1% and 10% of his or her annual base salary for any given year toward the purchase of Common Shares. The contributions are deducted by the Corporation from the payroll of any participant and paid over to a custodian for the account of such participant. The custodian then purchases from the treasury of the Corporation, for and on behalf of each participant, a number of Common Shares equal to the quotient obtained by dividing the contributions made during a given month by 90% of the market price of the Common Shares at the end of such month. For the purpose of the Plan, “market price” means, on any purchase date, the weighted average trading price per share of the Common Shares on the NYSE or, for Canadian citizens or residents, the TSX, for the five trading days immediately preceding the purchase date. In all jurisdictions, the Common Shares purchased under the Plan may not be sold until the expiration of a minimum two-year retention period. The Corporation assumes all administrative costs associated with the Plan. Senior executives are subject to the same plan terms as other employees and their participation is voluntary.

3.2.2.8 Variable Compensation

Non-Equity Incentives

The Corporation’s short term incentive plan, SCORES, aims to enhance the link between pay and performance by:

Aligning the financial interests and motivations of the Corporation’s senior executives and employees with the annual financial performance and returns of the Corporation;

Motivating senior executives and employees to work towards common annual performance objectives;

Providing total cash compensation that is greater than the median of the Reference Groups in cases where superior financial performance and returns in excess of target objectives are attained; and

Providing total cash compensation that is below the market median in cases where corporate performance objectives are not attained.

-24-

Performance Measures and Targets

Performance measures, targets and payout levels for SCORES are reviewed and approved annually by the Board of Directors on the recommendation of the Compensation and Human Resources Committee. As stated in Section 3.2.2.2 as a risk mitigation measure, the Board of Directors retains the discretion to reduce or increase the SCORES payouts, taking into consideration qualitative factors beyond the quantitative financial metrics. At the outset of fiscal 2012, the Board of Directors approved the following as financial measures to be achieved for SCORES:

ROA performance is calculated by dividing EBITDA (earnings before financial expenses/income, taxes and depreciation and amortization) for the fiscal year by the average net operating assets for such year. EBITDA excludes the impact of restructuring and acquisition-related costs as well as the equity earnings in investment in joint venture. Net operating assets is calculated using net working capital, being current assets excluding cash and cash equivalents minus current liabilities, plus non-current assets, excluding deferred income taxes.

EPS is calculated as diluted earnings per share adjusted to exclude the after-tax impact of restructuring and acquisition-related costs.

The Compensation and Human Resources Committee recommended ROA and EPS growth as the financial measures to be achieved in order to ensure that senior executives’ incentive-based compensation reflects:

Success in achieving the Corporation’s targets for profitability; and

Effectiveness in managing the return on capital, including the level of investment required to generate earnings.

Accordingly, for fiscal 2012, the Board of Directors approved threshold, target and maximum ROA goals of 17.1%, 21.7% and 30%, respectively, which aligned ROA goals with the 20th, 50th and 80th percentiles of the Proxy Reference Group, respectively, based on a ten-year historical analysis conducted in a previous year. In addition, the Board of Directors approved threshold, target and maximum annual EPS growth goals of 0%, 15% and 20%, respectively.

The overall SCORES ROA and EPS growth goals for fiscal 2012 are set forth in the following performance matrix below. A linear adjustment is made for results falling between the ROA and EPS growth measures.

SCORES Financial Goals for Fiscal 2012

-25-

Non-Equity Incentive (SCORES) Award for Fiscal 2012

Target payout levels for each Named Executive Officer depend on the executive’s position. In fiscal 2012, payout targets and payout ranges as a percentage of base salary under SCORES were as follows:

Name

|

Target Payout as a

Percentage of Salary

| Payout Range as a

Percentage of Salary

(Up to Two Times

Target) |

| Glenn J. Chamandy | 100% | 0-200% |

| Laurence G. Sellyn | 65% | 0-130% |

| Benito A. Masi | 50% | 0-100% |

| Michael R. Hoffman | 50% | 0-100% |

| Eric R. Lehman | 50% | 0-100% |

The Corporation’s actual performance in fiscal 2012 only slightly exceeded the minimum threshold of the ROA goal, with ROA being at 17.4% and fell below the EPS growth minimum threshold with fiscal 2012 EPS being 36% lower than EPS in fiscal 2011. Consequently, the Board, on the recommendation of the Compensation and Human Resources Committee, determined that there will be no non-equity incentive payout to Named Executive Officers for the 2012 fiscal year.

3.2.2.9 Variable Compensation: Equity Incentives

The purpose of the equity incentives of the Corporation’s executive compensation program, namely the Long Term Incentive Plan (the “LTIP”), is to assist and encourage senior executives and key employees of Gildan and its subsidiaries to work towards and participate in the growth and development of the Corporation and to assist the Corporation in attracting, retaining and motivating its officers and key employees. The LTIP is designed to:

Recognize and reward the impact of longer-term strategic actions undertaken by senior executives and key employees;

Align the interests of the Corporation’s senior executives and key employees and its shareholders;

Focus senior executives and key employees on developing and successfully implementing the continuing growth strategy of the Corporation;

Foster the retention of senior executives and key management personnel; and

Attract talented individuals to the Corporation.

Types of Equity Incentives Awarded

The LTIP allows the Board of Directors to grant to senior executives the following types of long-term incentives:

-26-

- Non-dilutive restricted share units (share units that are settled in cash or Common Shares purchased on the open market) (“Non-Treasury RSUs”).

Treasury RSUs, Non-Treasury RSUs and the Non-Treasury RSUs for senior executives called Performance RSUs (see below in this Section 3.2.2.9 under the heading “Performance Measures and Weightings”) are referred to in this Circular collectively as “RSUs” and individually as an “RSU”.

For a more detailed description of the features of the LTIP, see Schedule “C” of this Circular.

The LTIP awards help to achieve Gildan’s compensation objectives as follows:

The LTIP aims at bringing the total compensation received by Gildan’s senior executives to the 75th percentile of the Reference Groups if the Corporation achieves its maximum ROA goals.

Through the use of performance vesting for a significant portion of long-term compensation, top quartile compensation only occurs when both financial and strategic targets are achieved and the Corporation’s long-term return on investment and share price reflect these achievements.

Through the use of time vesting for a portion of long-term compensation, the LTIP awards help to achieve the Corporation’s objective of ensuring the retention of senior executives.

Determination of Grants

Treasury RSUs have been used generally for one-time awards to attract talented candidates or for retention purposes. Beginning in fiscal 2007, Options and Non-Treasury RSUs (and more recently, Performance RSUs) have been granted to senior executives on an annual basis as part of the long-term portion of their annual compensation.

Annual award targets are based on the expected impact of the role of the senior executive on Gildan’s performance and strategic development as well as market benchmarking. The Compensation and Human Resources Committee also undertakes an analysis from time to time to determine the possible payouts from the LTIP under various scenarios and at various levels of share price growth to ensure that the LTIP is aligned with the interests of the Corporation’s shareholders.

Grants are approved by the Board of Directors, based on the recommendation of the Compensation and Human Resources Committee after considering the recommendation of the President and Chief Executive Officer, with the exception that any grant awarded to the President and Chief Executive Officer is determined and approved independently and without any input from him. See Section 3.2.4 entitled “Compensation of the President and Chief Executive Officer”. Previous grants are not taken into account when considering new grants as grants are determined by specific guidelines, such as a determined grant value.

-27-

As disclosed in last year’s proxy circular, target annual equity awards to senior executives, as a percentage of base salary, were changed effective beginning in fiscal 2012 in order to align total compensation, for top quartile performance, with the top quartile of the Reference Groups. These target award values are as follows:

| Position |

Fiscal 2012 Target

Awards

(% of Base Salary) | Mix of Options and Performance

RSUs

(% of Base Salary)(1) |

| Options | RSUs |

| President and Chief Executive Officer | 300% | 150% | 150% |

Executive Vice-President,

Chief Financial and Administrative Officer | 100% | 50% | 50% |

Executive Vice-President, Manufacturing

President, Printwear

President, Branded Apparel | 100% | 50% | 50% |

| (1) | Performance RSUs (as defined below in this Section 3.2.2.9 under the heading “Performance Measures and Weightings”) are Non-Treasury RSUs that have the potential to vest at a maximum of 200% of the actual number of RSUs granted. |