Exhibit 13.1

Annual Report to Stockholders

BUSINESSOFTHE COMPANY

We are a diversified, community-based, financial institution holding company headquartered in St. Louis, Missouri. We conduct operations primarily through Pulaski Bank, a federally chartered savings bank. Pulaski Bank provides an array of financial products and services for businesses and consumers primarily through its nine full-service offices in the St. Louis metropolitan area and a loan production office in the Kansas City metropolitan area.

We have grown our assets, deposits and profits internally by building our residential lending operation, by opening de novo branches, and by hiring experienced bankers with existing customer relationships in our market. Although we intend to expand primarily through internal growth, we may also make strategic acquisitions. During 2006, we purchased another financial institution and we will continue to explore such opportunities to expand through acquisitions of other banks and bank branches. Our goal is to continue to deliver value to our shareholders and to enhance our franchise value and earnings through controlled growth in our banking operations, while maintaining the personal, community-oriented customer service that has characterized our success to date.

- 1 -

SELECTED CONSOLIDATED FINANCIAL INFORMATION

| | | | | | | | | | | | | | | |

| | | At or For the Years Ended September 30, |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 |

| | | (In thousands, except per share amounts) |

FINANCIAL CONDITION DATA | | | | | | | | | | | | | | | |

Total assets | | $ | 962,460 | | $ | 789,861 | | $ | 637,886 | | $ | 401,403 | | $ | 369,247 |

Loans receivable, net | | | 785,199 | | | 633,195 | | | 510,584 | | | 276,894 | | | 227,581 |

Loans receivable held for sale | | | 60,371 | | | 64,335 | | | 49,152 | | | 61,124 | | | 97,174 |

Debt and equity securities | | | 17,449 | | | 10,228 | | | 12,986 | | | 6,432 | | | 4,877 |

Capital stock of Federal Home Loan Bank | | | 9,524 | | | 8,462 | | | 7,538 | | | 3,880 | | | 5,840 |

Mortgage-backed securities | | | 3,631 | | | 4,833 | | | 6,574 | | | 8,862 | | | 7,482 |

Assets held for sale | | | — | | | 1,017 | | | — | | | — | | | — |

Cash and cash equivalents | | | 22,116 | | | 25,688 | | | 20,296 | | | 18,656 | | | 11,177 |

Deposits | | | 655,577 | | | 496,171 | | | 406,799 | | | 313,607 | | | 201,270 |

Deposit liabilities held for sale | | | — | | | 25,375 | | | — | | | — | | | — |

Advances from Federal Home Loan Bank | | | 172,800 | | | 171,000 | | | 154,600 | | | 31,500 | | | 116,800 |

Subordinated debentures | | | 19,589 | | | 19,589 | | | 9,279 | | | — | | | — |

Stockholders’ equity | | | 75,827 | | | 48,246 | | | 40,974 | | | 36,383 | | | 32,554 |

OPERATING DATA | | | | | | | | | | | | | | | |

Interest income | | $ | 53,843 | | $ | 37,792 | | $ | 23,832 | | $ | 21,426 | | $ | 18,341 |

Interest expense | | | 29,027 | | | 16,732 | | | 7,806 | | | 7,739 | | | 8,150 |

| | | | | | | | | | | | | | | |

Net interest income | | | 24,816 | | | 21,060 | | | 16,026 | | | 13,687 | | | 10,191 |

Provision for loan losses | | | 1,501 | | | 1,635 | | | 1,934 | | | 1,487 | | | 1,011 |

| | | | | | | | | | | | | | | |

Net interest income after provision for loan losses | | | 23,315 | | | 19,425 | | | 14,092 | | | 12,200 | | | 9,180 |

Non-interest income | | | 12,711 | | | 10,906 | | | 8,960 | | | 11,405 | | | 7,077 |

Non-interest expense | | | 20,763 | | | 18,434 | | | 13,715 | | | 13,977 | | | 9,653 |

| | | | | | | | | | | | | | | |

Income before income taxes | | | 15,263 | | | 11,897 | | | 9,337 | | | 9,628 | | | 6,604 |

Income taxes | | | 5,425 | | | 4,418 | | | 3,485 | | | 3,860 | | | 2,418 |

| | | | | | | | | | | | | | | |

Net income | | $ | 9,838 | | $ | 7,479 | | $ | 5,852 | | $ | 5,768 | | $ | 4,186 |

| | | | | | | | | | | | | | | |

COMMON SHARE DATA(1) | | | | | | | | | | | | | | | |

Basic earnings per share | | $ | 1.07 | | $ | 0.94 | | $ | 0.75 | | $ | 0.74 | | $ | 0.52 |

Diluted earnings per share | | $ | 1.01 | | $ | 0.85 | | $ | 0.67 | | $ | 0.67 | | $ | 0.49 |

Dividends declared per share | | $ | 0.33 | | $ | 0.28 | | $ | 0.20 | | $ | 0.14 | | $ | 0.06 |

Book value per share | | $ | 7.62 | | $ | 5.72 | | $ | 4.98 | | $ | 4.47 | | $ | 3.94 |

Weighted average shares-basic | | | 9,206 | | | 7,926 | | | 7,758 | | | 7,843 | | | 8,064 |

Weighted average shares-diluted | | | 9,718 | | | 8,828 | | | 8,695 | | | 8,578 | | | 8,528 |

Shares outstanding-end of period | | | 9,946 | | | 8,439 | | | 8,227 | | | 8,146 | | | 8,256 |

| (1) | Reflects a three-for-two stock split in July 2005 and a two-for-one stock split in July 2003. |

- 2 -

| | | | | | | | | | | | | | | |

| | | At or For the Year Ended September 30, | |

| | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

KEY OPERATING RATIOS | | | | | | | | | | | | | | | |

Return on average assets | | 1.14 | % | | 1.06 | % | | 1.18 | % | | 1.38 | % | | 1.38 | % |

Return on average equity | | 14.98 | | | 16.37 | | | 15.31 | | | 16.35 | | | 13.24 | |

Average equity to average assets | | 7.62 | | | 6.45 | | | 7.68 | | | 8.43 | | | 10.44 | |

Interest rate spread | | 2.87 | | | 3.04 | | | 3.38 | | | 3.30 | | | 3.40 | |

Net interest margin | | 3.12 | | | 3.18 | | | 3.48 | | | 3.47 | | | 3.66 | |

Efficiency ratio | | 58.89 | | | 56.67 | | | 56.56 | | | 55.87 | | | 55.99 | |

Dividend payout ratio | | 32.67 | | | 32.94 | | | 29.70 | | | 20.79 | | | 22.45 | |

Non-interest expense to average assets | | 2.39 | | | 2.56 | | | 2.76 | | | 3.34 | | | 3.19 | |

Average interest-earning assets to average interest-bearing liabilities | | 106.97 | | | 105.59 | | | 105.85 | | | 108.95 | | | 108.64 | |

Allowance for loan losses to total loans at end of period | | 0.92 | | | 0.95 | | | 0.99 | | | 1.13 | | | 0.78 | |

Allowance for loan losses to nonperforming loans | | 110.91 | | | 112.07 | | | 130.64 | | | 91.31 | | | 101.89 | |

Net charge-offs to average outstanding loans during the period | | 0.09 | | | 0.06 | | | 0.05 | | | 0.05 | | | 0.12 | |

Nonperforming assets to total assets | | 1.02 | | | 0.86 | | | 0.84 | | | 1.07 | | | 0.68 | |

| | | | | |

OTHER DATA | | | | | | | | | | | | | | | |

Number of: | | | | | | | | | | | | | | | |

Real estate loans outstanding | | 5,609 | | | 4,059 | | | 3,619 | | | 2,651 | | | 2,954 | |

Consumer loans (includes home equity loans) | | 9,821 | | | 9,520 | | | 8,318 | | | 6,336 | | | 4,295 | |

Deposit accounts | | 36,443 | | | 33,010 | | | 30,390 | | | 29,344 | | | 23,977 | |

Number full-time equivalent employees | | 361 | | | 327 | | | 258 | | | 239 | | | 160 | |

Full service offices | | 9 | | | 8 | | | 7 | | | 7 | | | 5 | |

| | | | | |

CAPITAL RATIOS(1) | | | | | | | | | | | | | | | |

Tangible capital | | 9.30 | % | | 8.60 | % | | 8.14 | % | | 8.18 | % | | 7.28 | % |

Core capital | | 9.30 | | | 8.60 | | | 8.14 | | | 8.18 | | | 7.28 | |

Total risk-based capital | | 11.99 | | | 10.85 | | | 11.46 | | | 11.73 | | | 12.63 | |

| (1) | Capital ratios are for Pulaski Bank. |

- 3 -

MANAGEMENT’S DISCUSSIONAND ANALYSISOF

FINANCIAL CONDITIONAND RESULTSOF OPERATIONS

GENERAL

Management’s discussion and analysis of financial condition and results of operations is intended to assist in understanding our financial condition and results of operations. The information contained in this section should be read in conjunction with the consolidated financial statements and accompanying notes contained elsewhere in this annual report.

This report may contain certain "forward-looking statements" within the meaning of the federal securities laws, which are made in good faith pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are not historical facts, rather they are statements based on management’s current expectations regarding our business strategies, intended results and future performance. Forward-looking statements are generally preceded by terms such as “expects,” “believes,” “anticipates,” “intends” and similar expressions.

Management's ability to predict results or the effect of future plans or strategies is inherently uncertain. Factors that could affect actual results include interest rate trends, the general economic climate in the market area in which we operate, as well as nationwide, our ability to control costs and expenses, competitive products and pricing offered by competitors, loan delinquency rates and changes in federal and state legislation and regulation. Additional factors that may affect our results are discussed in the section titled “Risk Factors” in our annual report on Form 10-K filed with the Securities and Exchange Commission. These factors should be considered in evaluating the forward-looking statements and undue reliance should not be placed on such statements. We assume no obligation to update any forward-looking statements.

PULASKI’S LEGACYIN ST. LOUIS

Pulaski Bank (the “Bank”) has been lending to the Polish community and the city of St. Louis since 1922. William A. Donius, Chairman and CEO, is a grandson of the Bank’s principal founder, Michael Burdzy, who formed Pulaski Bank as a mutual thrift to make consumer and mortgage loans to the St. Louis Polish community. In 1998, Pulaski Financial Corp. (the “Company”) was formed as the holding company of the Bank to access capital through a public common stock offering. The regulatory environment at the time directed the amount of capital converting thrifts were required to raise based on their appraised valuation. The initial offering raised $26 million in new capital, which doubled the Bank’s existing capital and saddled the Company with nearly a 21% equity-to-assets ratio. The high capital ratio translated into a correspondingly low 4.5% return on average equity during 1999. With $244.0 million in total assets and $49.9 million in shareholders’ equity, the Company was challenged to provide a high return to shareholders.

CEO Donius and his executive team strove to restructure the business under a vision of growth and fiscal responsibility. Management identified five key products that were crucial to this restructuring: commercial, residential and home equity loans and checking and money market deposit accounts. The Company also began an aggressive share repurchase program. The board and management established a ten-year strategic plan to become a high-performing, $1 billion to $2 billion community bank by the year 2010. Today, the Company is approaching $1 billion in total assets and has realized an average return on equity of 15.3% since 2002. Total assets have grown at an annual compound rate of 27% and diluted earnings per share have grown at an annual compound rate of 8% over the same time period. In the last year, the Company narrowed its growth expectations to reach $1.5 billion in total assets by the year 2010. The Company returned to the capital markets during 2006 to raise an additional $16 million in a common stock offering to fund this targeted growth.

- 4 -

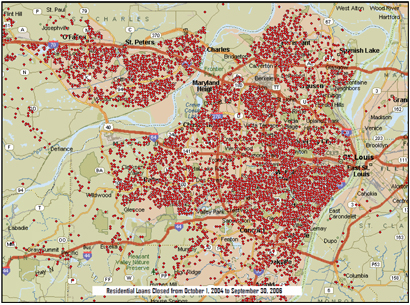

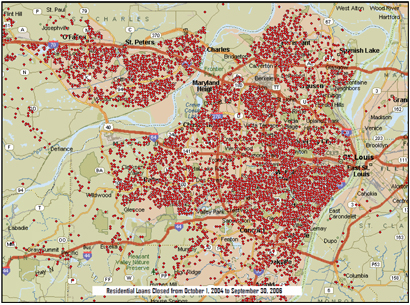

In 2003, Pulaski Bank began expanding its retail and mortgage banking presence by adding a staff of commercial bankers. With over 70 residential commercial lenders, Pulaski Bank is lending in every community and touching every neighborhood in St. Louis. In the last two years, Pulaski Bank originated more than 17,000 residential mortgage and home equity loans, totaling nearly $1.8 billion in the St. Louis metropolitan area and has originated another $775 million in the Kansas City metropolitan area. During fiscal 2006, the Company also originated $248.5 million of commercial loans, resulting in net growth of $86.4 million in its commercial loan portfolio. Over the last five years, the Bank has become one of the best performing small banks in America (based on a survey of 106 regional banks and thrifts performed by the investment banking firm of Stifel Nicolaus.) Our stated goal is to become “The Best Performing Small Bank in America” based on return on average equity and customer service levels. We believe we can accomplish this and, in so doing, will become the preferred community bank in St. Louis.

Nearly three years ago, management determined that core deposit growth was a key element in the accomplishment of its ten-year growth objectives. As a result, the Company has focused on a three-pronged approach to growing deposits: provide excellence in customer service, offer customers best-in-class products, and provide customers with convenient banking locations. The approach has resulted in strong core deposit growth, which increased at an annual compound rate of 25% during the last 3 years, including $159.4 million of deposit growth in the last year and two new bank locations in the Central West End neighborhood of St. Louis. In addition, two to three new bank locations are planned during the next two years.

Today, we continue to strive to provide outstanding service to the St. Louis community by being a well-rounded community bank. Management believes this outstanding service will continue to attract loyal customers, which will translate into exceptional returns to the Company’s shareholders. This “Quest to be the Best” in both customer service and financial performance has been a guiding principle in the Company’s evolution.

EXPANDING PULASKI’S PRESENCE IN ST. LOUIS

In keeping with its objective to be the preferred community bank in St. Louis, the Company sold its Kansas City retail branch, which was its only bank location outside of the St. Louis market, in February 2006. The sale resulted in an after-tax gain of $1.5 million and allowed us to focus on serving the needs of the St. Louis community.

In 2003, the Company added commercial banking operations. At the time, the Company had a total of $35.2 million in checking account balances, which are its lowest-cost deposit type. Three years later, the Company has increased checking account balances 162% to $92.3 million, due primarily to growth in commercial deposits. In addition, over 50% of the Company’s loan portfolio growth has been generated by commercial loans. We believe growth in commercial banking relationships is essential for the

- 5 -

Company’s continued growth in the St. Louis market and that our prospects will be enhanced by our increased presence in the St. Louis business community.

Today, the Bank has nine full-service locations and plans to open two to three new locations in the central corridor of metropolitan St. Louis within the next two years. In September 2004, the Bank had six full-service locations, with only the main bank in Creve Coeur positioned to serve small to medium sized business customers. Including Chesterfield Valley which was opened in August 2005, the two Central West End Bank locations acquired in March 2006 and three planned locations, seven of twelve potential full-service offices will be convenient to the commercial and financial centers within St. Louis.

ST. LOUIS DEMOGRAPHICS

St. Louis MSA Banks & Thrifts

| | | | | | | | | | | | |

Rank | | Company Name | | Charter | | Number

of

Branches | | June 2006

Deposits | | Pct

of

Total | |

1 | | U.S. Bancorp | | Bank | | 193 | | $ | 8,277,898 | | 16.7 | % |

2 | | Bank of America Corp. | | Bank | | 104 | | | 6,643,540 | | 13.4 | % |

3 | | Commerce Bancshares Inc. | | Bank | | 57 | | | 3,926,987 | | 7.9 | % |

4 | | Marshall & Ilsley Corp. | | Bank | | 17 | | | 2,964,184 | | 6.0 | % |

5 | | Regions Financial Corp. | | Bank | | 104 | | | 2,820,489 | | 5.7 | % |

6 | | First Banks, Inc. | | Bank | | 60 | | | 2,287,336 | | 4.6 | % |

7 | | National City Corp. | | Bank | | 71 | | | 1,694,212 | | 3.4 | % |

8 | | Enterprise Financial Services | | Bank | | 4 | | | 943,359 | | 1.9 | % |

9 | | Central Bancompany | | Bank | | 12 | | | 926,381 | | 1.9 | % |

10 | | First Co Bancorp Inc. | | Bank | | 10 | | | 882,164 | | 1.8 | % |

11 | | UMB Financial Corp. | | Bank | | 37 | | | 860,184 | | 1.7 | % |

12 | | Banc Ed Corp. | | Bank | | 16 | | | 837,205 | | 1.7 | % |

13 | | Stupp Bros. Inc. | | Bank | | 13 | | | 645,334 | | 1.3 | % |

14 | | Pulaski Financial Corp. | | Thrift | | 9 | | | 642,986 | | 1.3 | % |

| | Companies Ranked 15 - 130 | | | | 403 | | | 15,377,907 | | 30.9 | % |

| | | | | | | | | | | | |

Source: Keefe, Bruyette & Woods | | Total | | | | $ | 49,730,166 | | 100 | % |

St. Louis is the 18th largest metropolitan area in the United States, with a population of 2.8 million and an average household income of $47,370, which is 6% higher than the national average. Pulaski Bank is the 14th largest bank in St. Louis and, with only 1.3% of the area’s $49.7 billion in deposits, has significant growth potential. The St. Louis economy is stable and diverse with its largest sector, healthcare, employing 20% of the workforce, and manufacturing employing only 11% of the area’s workforce.

- 6 -

St. Louis MSA Mergers and Acquisitions

| | | | | | | | | |

| | | Announcement

Date | | Acquiror | | Target | | Assets ($000s) |

1 | | 12/21/05 | | Marshall & Ilsley Corp. | | Trustcorp Financial Corp. | | $ | 705,359 |

2 | | 12/21/05 | | National City Corp. | | Forbes First Financial Corp. | | | 505,229 |

3 | | 10/25/05 | | Pulaski Financial Corp. | | CWE Bancorp, Inc. | | | 45,458 |

4 | | 04/09/04 | | National City Corp. | | Allegiant Bancorp Inc. | | | 2,458,878 |

5 | | 10/01/02 | | Marshall & Ilsley Corp. | | Mississippi Valley Bancshares | | | 2,042,192 |

6 | | 09/28/01 | | Allegiant Bancorp Inc. | | Southside Bancshares Corp. | | | 737,427 |

7 | | 03/01/01 | | Commerce Bancshares Inc. | | Breckenridge Bancshares Co. | | | 255,186 |

8 | | 11/15/00 | | Allegiant Bancorp Inc. | | Equality Bancorp Inc. | | | 323,335 |

9 | | 09/22/00 | | G.A.C. Inc. | | Gateway NB of St. Louis | | | 33,873 |

10 | | 05/10/00 | | Maries County Bancorp., Inc. | | Tritten Bancshares, Inc. | | | 44,705 |

11 | | 09/20/99 | | Firstar Corp. | | Mercantile Bancorp. | | | 35,578,819 |

12 | | 01/04/99 | | Liberty Bancshares Inc. | | Sac River Valley Bank | | | 99,917 |

13 | | 09/10/98 | | First Illinois Bancorp, Inc. | | Duchesne Bank | | | 107,152 |

14 | | 07/01/98 | | Union Planters Corp. | | Magna Group Inc. | | | 7,074,969 |

15 | | 06/30/98 | | Southside Bancshares Corp. | | Public Srvc. Bk, A Fed Svgs Bk | | | 70,482 |

16 | | 08/29/97 | | Allegiant Bancorp Inc. | | Reliance Financial Inc. | | | 31,705 |

17 | | 07/01/97 | | Trustcorp Inc. | | Missouri State B&TC | | | 88,866 |

18 | | 04/25/97 | | Mercantile Bancorp. | | Mark Twain Bancshares Inc. | | | 3,147,933 |

19 | | 01/07/97 | | NationsBank Corp. | | Boatman's Bancshares Inc. | | | 40,682,558 |

Source: SNL Securities, LC | | TOTAL | | $ | 94,034,043 |

Perhaps the most appealing characteristic of the St. Louis banking environment is the consolidation within the banking industry. During the past ten years, $94 billion in assets have been acquired by out-of-town banks leaving an opportunity for a locally-based community bank to gain market share by developing relationships with depositors who have likely experienced more than one of these bank consolidations. Such depositors are more likely to change banking relationships than those who have enjoyed long-term relationships. In addition, we believe that St. Louisans strongly favor doing business with companies that are locally-managed. Five out-of-town banks own more than half of the area’s deposits, so we are capitalizing on Pulaski’s local presence.

EXECUTIONOFTHE STRATEGIC PLANHAS YIELDED SUPERIOR PERFORMANCEFOR INVESTORS

Execution of the Company’s strategic plan has resulted in strong, consistent growth in many of its key indicators such as net income, earnings per share, growth in assets, loans and deposits. From September 30, 2002 to September 30, 2006, we have achieved strong growth. Specifically, we have:

| | • | | Increased our net income from $4.2 million to $9.8 million, representing a 24% compound annual growth rate (“CAGR”) |

| | • | | Increased our diluted earnings per share from $0.49 to $1.01, representing a 20% CAGR |

| | • | | Increased our total assets from $369.2 million to $962.5 million, representing a 27% CAGR |

| | • | | Increased our total loan portfolio from $227.6 million to $785.2 million, representing a 36% CAGR |

| | • | | Increased our total deposits from $201.3 million to $655.6 million, representing a 34% CAGR |

| | • | | Expanded the number of residential and commercial loan officers from 18 to over 70 |

| | • | | Expanded our St. Louis bank network from five to nine full-service locations |

A major driver of our growth has been our residential mortgage business, which generates significant income through loan sales and provides a source of portfolio loans. In addition, we have actively offered additional business lines to our mortgage customers that include home equity lines of credit, title services, appraisal services and deposit gathering. Despite a three-year decline in mortgage lending nationwide, the Bank’s residential mortgage loan originations totaled $1.3 billion, $1.2 billion and $1.1 billion for the years ended September 30, 2006, 2005 and 2004, respectively. These loans were primarily originated for sale and fueled our mortgage revenue, which totaled $4.0 million, $5.5 million and $4.6 million for the years ended September 30, 2006, 2005 and 2004, respectively. Of the Company’s $785.2 million of loans outstanding at September 30, 2006, $526.3 million were originated through mortgage relationships. The Company currently conducts mortgage activities through two loan production offices in St. Louis and Kansas City. In addition, benefited by our

- 7 -

emphasis on cross-sales, the Company realized $742,000 of title service revenues and $186,000 in appraisal service revenues for the year ended September 30, 2006.

In the last four years, the Company’s earnings have become progressively less dependent on non-interest income sources as the loan portfolio has expanded, resulting in higher interest income and ultimately higher net interest income. Net interest income increased $3.8 million to $24.8 million for the year ended September 30, 2006 compared to $21.1 million for the year ended September 30, 2005 and $16.0 million for the year ended September 30, 2004. Driven by growth in our commercial and residential portfolios, loans receivable increased 24%, or $152.0 million, in the last year and 245% over the last four years, from $227.6 million at September 30, 2002 to $785.2 million at September 30, 2006.

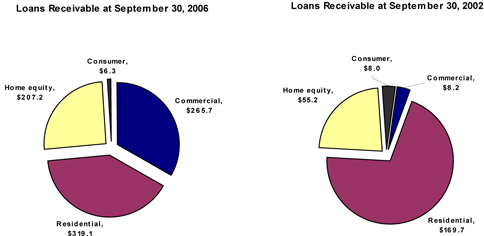

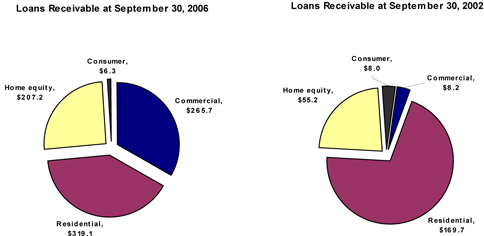

At September 30, 2002, we were principally a residential lender, with 93% of our portfolio consisting of residential and home equity loans. We identified the need to both expand net interest income and to diversify our loan portfolio. We made the decision to begin lending to small and medium-sized businesses. We spent a year building the infrastructure to accomplish the goal, which included adding people, policies, procedures and programs. Late in 2003, we hired several commercial lenders to help us grow the loan portfolio. Over the past three years, the commercial lending division has been a significant contributor to our growth, with $86.4 million of new loan growth in fiscal 2006, $74.0 million in fiscal 2005 and $88.8 million fiscal 2004. The commercial division’s loan portfolio totaled $265.7 million at September 30, 2006 compared to $8.4 million at September 30, 2002.

We continue to grow our core deposit accounts. Deposits increased $159.4 million to $655.6 million at September 30, 2006 from $496.2 million at September 30, 2005. Demand deposit accounts, including money market accounts and passbooks, increased $87.5 million during the year, including an increase in commercial transaction accounts of $42.8 million to $78.1 million at September 30, 2006 from $35.3 million September 30, 2005. Non-interest bearing checking account balances increased 33% to $38.8 million at September 30, 2006 and money market balances increased 63% to $134.4 million at September 30, 2006. The increases stem primarily from growth in commercial relationships, improved products and marketing focused on increasing customer relationships. Brokered deposit balances remained unchanged during the year at $118.5 million.

- 8 -

HIGHLIGHTSFROM FISCAL 2006

On December 27, 2005, the Company announced the implementation of a dividend reinvestment plan, which allows participants to reinvest their quarterly dividends in additional shares of the Company’s common stock and to make quarterly cash purchases directly through the plan.

On February 10, 2006, the Company completed a secondary common stock offering, issuing 1,150,000 shares and raising $16.1 million, net of expenses, to be used for future growth and operating capital for the Bank.

On February 27, 2006, the Company announced the sale of its Kansas City branch office located at 8442 Wornall Road to UMB Bank, N.A. The sale resulted in a pre-tax gain of approximately $2.5 million on the sale of $25.4 million of deposits and $1.0 million of assets.

On March 6, 2006, the Company announced the retirement of Director and Audit Committee Chairman Robert A. Ebel, who resigned from the board after 29 years of service.

On March 16, 2006, the Company announced the appointment of three new directors, including a new Audit Committee Chairman, Michael R. Hogan. Mr. Hogan currently serves as the Chief Administrative Officer and Chief Financial Officer of St. Louis-based Sigma-Aldrich Corporation, a chemical producer. Also joining the board were Stanley J. Bradshaw, founder and principal of Bradshaw Management, LLC, an investment and advisory firm, and Steven C. Roberts, President and Chief Operating Officer of The Roberts Company, a minority-owned business consulting and construction management firm.

On March 30, 2006, the Company announced the hiring of W. Thomas Reeves as President of Pulaski Bank. Mr. Reeves is responsible for market development for the Bank. Mr. Reeves served as the Chief Lending Officer and Senior Vice President at the former Mercantile Bank of St. Louis from 1997 to 1999 and Chief Lending Officer of the Former Mark Twain Bancshares from 1980 to 1997. From 1999 until joining the Bank, Mr. Reeves served as Executive Director of Downtown Now!, a not-for-profit organization dedicated to generating investment in, and development of, the downtown St. Louis area.

On March 31, 2006, the Company acquired CWE Bancorp, Inc., and its wholly-owned subsidiary, Central West End Bank. The Company issued 210,732 shares of common stock and paid $3.6 million in cash for all of the outstanding shares of CWE Bancorp. CWE had two branch locations in the central west end area of St. Louis with approximately $12.0 million in loans and $41.4 million in deposits.

On October 13, 2006, the Company announced plans to open two to three new banking locations in the central corridor of metropolitan St. Louis within the next two years. The new locations are expected to improve the level of service by providing the St. Louis community greater access to the Bank.

CRITICAL ACCOUNTING POLICIES

We have established various accounting policies that govern the application of U.S generally accepted accounting principles in the preparation of our financial statements. Our significant accounting policies are described in the footnotes to the consolidated financial statements that appear in this report. Certain accounting policies involve significant judgments and assumptions by management that have a material impact on the carrying value of certain assets and liabilities. We consider the following to be our critical accounting policies: accounting for the allowance for loan losses and derivative financial instruments. The judgments and assumptions used by management are based on historical experience and other factors, which are believed to be reasonable under the circumstances. Because of the nature of the judgments and assumptions made by management, actual results could differ from these judgments and estimates that could have a material impact on the carrying values of assets and liabilities and our results of operations.

- 9 -

We maintain an allowance for loan losses to absorb probable losses in our loan portfolio. Determining the amount of the allowance involves a high degree of judgment. The balance in the allowance is based upon management’s quarterly estimates of expected losses inherent in the loan portfolio. Management’s estimates are determined by quantifying certain risks in the portfolio that are affected primarily by changes in the nature and volume of the portfolio combined with an analysis of past-due and classified loans These estimates can also be affected by the following factors: changes in lending policies and procedures, including underwriting standards and collection; charge-off and recovery practices; changes in national and local economic conditions and developments; assessment of collateral values by obtaining independent appraisals; and changes in the experience, ability, and depth of lending management staff. Refer to note 1 to our Consolidated Financial Statements, “Summary of Significant Accounting Policies,” for a detailed description of our risk assessment process.

We employ derivative financial instruments to help us manage interest rate sensitivity by modifying the repricing, maturity and option characteristics of certain assets and liabilities. The judgments and assumptions that are most critical to the application of this critical accounting policy are those affecting the estimation of fair value. Fair value is based on quoted market prices. Refer to note 1 to our Consolidated Financial Statements, “Summary of Significant Accounting Policies,” for a detailed description of our estimation processes and methodology related to the fair value of derivative financial instruments.

BUSINESS STRATEGYAND PRODUCTS

We have a community banking strategy that emphasizes high-quality, responsive, and personalized service to our customers. The consolidation of financial institutions in our market has created larger banks, which are perceived by many customers as impersonal or unresponsive. We believe there is a significant opportunity for a community-focused bank to provide a full range of financial services to retail customers and small- and middle-market businesses. By offering quicker decision making in the delivery of banking products and services, by offering customized products where appropriate, and by providing customer’s access to our senior managers, we distinguish ourselves from larger regional banks operating in our market areas. Conversely, our larger capital base and product mix enable us to compete effectively against smaller banks with limited services and capabilities. As a result, we believe we have a substantial opportunity to attract both experienced management and loan officers as well as new banking customers. We believe this opportunity will give us a competitive advantage as we continue our expansion into attractive, high-growth markets in the St. Louis metropolitan area through new banking centers, potential acquisitions of community banks and bank branches, and growth of our existing banking centers.

Our strategy centers around our continued development into a full-service, community-oriented bank and by expanding our physical footprint to more adequately cover the large geography of the St. Louis metropolitan area. Our efforts to grow assets and earnings are dependent upon the successful growth in each of our five core products: commercial, residential and home equity loans and checking and money market deposit accounts. These five products provide the primary source of our operating income and are the focus of growth in our balance sheet. We believe the marketplace is more competitive than ever and, to achieve sustained growth, these products must be delivered with superior and efficient customer care. Driving these relationships are seasoned retail and commercial professionals.

- 10 -

Commercial Real Estate and Commercial and Industrial Loans. In the past few years, the Bank expanded its focus to include commercial lending. During this time, approximately 50% of the growth in the Bank’s loan portfolio has come from the commercial lending division. In 2004, the Bank had just two employees dedicated to commercial banking. Today, the commercial division has 19 employees. In the last year, commercial real estate and commercial and industrial loans increased $86.4 million to $265.7 million at September 30, 2006 compared to $179.3 million at September 30, 2005. During the year, the commercial division contributed 56% of the growth in the Bank’s retained loan portfolio. At September 30, 2006, the commercial division’s loan portfolio consisted of $149.7 million of commercial real estate loans, $48.8 million of commercial and industrial loans, $36.9 million of residential mortgage loans, $30.0 million of construction and development loans and $383,000 of equity lines. The weighted average rate on the commercial division’s loan portfolio was 7.46% at September 30, 2006, compared to 6.67% at September 30, 2005.

The development of commercial relationships has also enhanced our ability to generate non-interest bearing checking account balances. At September 30, 2006, we had commercial checking and money market accounts totaling $78.1 million, which represented growth of $42.8 million in core business deposits during the year. These accounts include $28.7 million in non-interest bearing deposits at September 30, 2006 compared to $20.8 million at September 30, 2005.

Residential Loans. We have 84 years of experience in residential lending and, as of September 30, 2006, employed over 70 residential loan officers in the St. Louis and Kansas City metropolitan areas. We have become a leading mortgage originator in these two markets, originating $1.3 billion, $1.2 billion and $1.1 billion in residential loans during the years ended September 30, 2006, 2005 and 2004, respectively. Originations increased in fiscal 2006 and 2005 primarily as a result of the increased size of the commissioned residential lending staff. Pulaski’s growth in production was in contrast to the industry as a whole, which declined 15% through the first 9 months of 2006 compared to the same period in 2005, as reported by the Mortgage Bankers Association.

The majority of loans originated in the mortgage division are one- to four-family residential loans, which we sell to investors on a servicing-released basis, generating our largest source of non-interest income and the primary component of mortgage revenue. For the year ended September 30, 2006, we sold $1.1 billion of residential loans to investors and had mortgage revenue of $4.0 million, compared to $1.1 billion of loans sold and $5.5 million in revenue for the year ended September 30, 2005. The decline in revenue was primarily due to the overall decline in industry-wide mortgage production, which created a highly competitive lending environment and resulted in lower fees and gross sales margins throughout the industry. The average gross revenue margin on loans sold declined from 1.66% in fiscal 2005 to 1.55% in fiscal 2006.

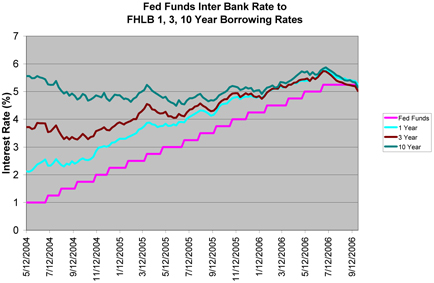

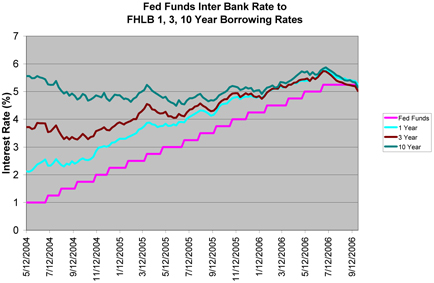

The average balance of mortgage loans held for sale for the year ended September 30, 2006 was $48.7 million compared to $50.8 million for the year ended September 30, 2005. The level of market interest rates and the flattening yield curve continued to negatively impact our interest rate margin on loans held for sale, which

- 11 -

steadily declined from 214 basis points over the Bank’s average cost of FHLB borrowings in 2005 to 153 basis points in 2006. The Bank typically funds loans held for sale with overnight and short-term FHLB borrowings because the loans are typically sold within 30 days of origination. Following a series of rate hikes by the Federal Reserve, our short-term borrowing costs increased approximately 150 basis points during fiscal 2006, while the average yield on the loans held for sale portfolio increased just 70 basis points from 5.46% to 6.16% during the years ended September 30, 2005 and 2006, respectively.

Qualifying residential mortgage loans that do not meet the standards for sale in the secondary market are retained in our portfolio and priced on a risk/reward basis. Residential loan balances retained in portfolio increased $52.7 million to $319.1 million at September 30, 2006 from $266.5 million at September 30, 2005. The residential retained portfolio consists primarily of 3-year adjustable-rate loans and second mortgage loans that generally do not conform to investor criteria. These loans are underwritten using an internal credit-scoring model, which assesses credit risk and assigns one of five risk-based ratings to the loan at the time of inception.

Home Equity Lines of Credit. Home equity lines of credit balances totaled $207.2 million at September 30, 2006 compared to $195.6 million at September 30, 2005. Growth in this prime-adjusting portfolio has slowed significantly as consumers have reduced the amount of their outstanding borrowings in reaction to the increase in market interest rates. Home equity loans consist primarily of revolving lines of credit secured by residential real estate. Home equity lines of credit are typically offered to only the most credit-worthy borrowers and are approved in conjunction with their first mortgage loan applications. The large volume of mortgage loans originated in recent years has provided many opportunities to cross-sell this product to customers and has resulted in growth in new balances. However, principal repayment rates have also risen resulting in slower growth during the past year. These loans represent prime-based assets with low interest rate risk characteristics and attractive yields, lending stability to our net interest margin. The weighted average rate on home equity lines of credit was 8.27% at September 30, 2006 compared to 7.05% at September 30, 2005.

Because home equity lines of credit are generally subordinated to first mortgage loans, the risk of loss increases when the combined loan-to-value ratio increases in relation to the value of the property. Loan balances that exceed 90% of property values are generally insured for loss through mortgage insurance up to 90% of the value of the property.

Checking Accounts. Checking accounts represent the cornerstone product in a customer relationship and are the Bank’s most valuable source of low-cost deposits. Checking account balances not only provide the lowest cost funding source, but also generate valuable fee income through insufficient fees and service charges. Due primarily to growth in commercial accounts, the balance of checking accounts increased $34.1 million during the year to $92.3 million at September 30, 2006 from $58.2 million at September 30, 2005. The increase included $14.2 million of checking account balances acquired in the Central West End Bank purchase. At September 30, 2006, the weighted

- 12 -

average cost of interest-bearing checking accounts was 1.66% compared to 0.16% at September 30, 2005.

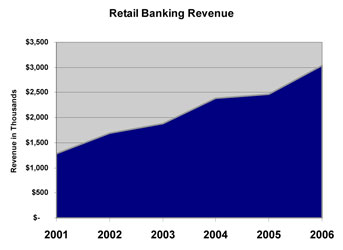

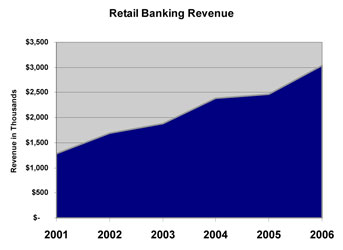

Retail banking revenue increased 23% to $3.0 million for the year ended September 30, 2006 compared to $2.5 million for the year ended September 30, 2005. Our marketing campaign focused on cross-selling checking accounts and developing new checking account relationships. We have established a consistent formula for generating fee income. We have seen revenues increase from $1.7 million in fiscal 2002 to $3.0 million in fiscal 2006, primarily through an increase in the volume of checks honored for customers who have overdrawn their checking accounts. We changed our overdraft policy to allow point-of-purchase overdraft protection, for which we charge a fee. Historic trends indicate the great majority of customers will eventually honor the overdraft checks; however, declines in market conditions could result in higher credit risk.

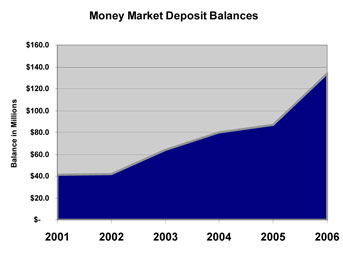

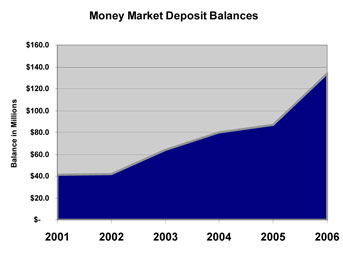

Money Market Deposits. Our strategic focus also includes growing money market deposits, which we consider another core liability product. The balance of money market accounts increased $51.7 million, or 63%, to $134.4 million at September 30, 2006 from $82.6 million at September 30, 2005. Much of the growth in these deposits occurred during the September 2006 quarter. The Company initiated a marketing campaign that involves offering a special rate to large deposit customers who maintain both a money market and primary checking account relationship with the Bank. The money market product carries an adjustable interest rate that makes it an ideal funding source for our prime-adjusting commercial and home equity loans. Competition for money market accounts remains intense, but the accounts are generally less interest rate sensitive and more stable than certificates of deposit. At September 30, 2006, money market deposits had a weighted average cost of 4.12% compared to the weighted average coupon on the home equity loan portfolio of 8.27%, yielding a net spread of 4.15%.

- 13 -

AVERAGE BALANCE SHEETS

The following table sets forth information regarding average balances of assets and liabilities as well as the total dollar amounts of interest income from average interest-earning assets and interest expense on average interest-bearing liabilities, resultant yields, interest rate spread, net interest margin, and ratio of average interest-earning assets to average interest-bearing liabilities for the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Years Ended September 30, | |

| | | 2006 | | | 2005 | | | 2004 | |

| | | Average

Balance | | Interest

and

Dividends | | | Yield/

Cost | | | Average

Balance | | Interest

and

Dividends | | | Yield/

Cost | | | Average

Balance | | Interest

and

Dividends | | | Yield/

Cost | |

| | | (Dollars in thousands) | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans receivable (1) | | $ | 716,045 | | $ | 49,592 | | | 6.93 | % | | $ | 584,134 | | $ | 34,155 | | | 5.85 | % | | $ | 387,670 | | $ | 20,454 | | | 5.28 | % |

Loans held for sale | | | 48,656 | | | 3,000 | | | 6.16 | % | | | 50,815 | | | 2,774 | | | 5.46 | % | | | 50,947 | | | 2,635 | | | 5.17 | % |

Debt securities | | | 11,878 | | | 489 | | | 4.12 | % | | | 7,200 | | | 202 | | | 2.80 | % | | | 3,891 | | | 190 | | | 4.88 | % |

FHLB stock | | | 8,788 | | | 327 | | | 3.72 | % | | | 8,373 | | | 222 | | | 2.65 | % | | | 5,073 | | | 107 | | | 2.11 | % |

Mortgage-backed securities | | | 4,243 | | | 202 | | | 4.77 | % | | | 5,704 | | | 274 | | | 4.80 | % | | | 7,749 | | | 390 | | | 5.03 | % |

Other (including fed funds) | | | 6,053 | | | 233 | | | 3.85 | % | | | 6,008 | | | 165 | | | 2.75 | % | | | 5,254 | | | 56 | | | 1.07 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-earning assets | | | 795,663 | | | 53,843 | | | 6.77 | % | | | 662,234 | | | 37,792 | | | 5.71 | % | | | 460,584 | | | 23,832 | | | 5.17 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-interest-earning assets | | | 66,373 | | | | | | | | | | 45,908 | | | | | | | | | | 36,995 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 862,036 | | | | | | | | | $ | 708,142 | | | | | | | | | $ | 497,579 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits | | $ | 552,626 | | $ | 19,625 | | | 3.55 | % | | $ | 442,927 | | $ | 10,223 | | | 2.31 | % | | $ | 332,025 | | $ | 5,197 | | | 1.57 | % |

FHLB advances | | | 168,067 | | | 7,777 | | | 4.63 | % | | | 163,071 | | | 5,414 | | | 3.32 | % | | | 96,023 | | | 2,350 | | | 2.45 | % |

Note payable | | | 3,510 | | | 236 | | | 6.71 | % | | | 3,701 | | | 176 | | | 4.75 | % | | | 2,372 | | | 76 | | | 3.20 | % |

Subordinated debentures | | | 19,589 | | | 1,389 | | | 7.09 | % | | | 17,471 | | | 919 | | | 5.26 | % | | | 4,689 | | | 183 | | | 3.90 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-bearing liabilities | | | 743,792 | | | 29,027 | | | 3.90 | % | | | 627,170 | | | 16,732 | | | 2.67 | % | | | 435,109 | | | 7,806 | | | 1.79 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-interest-bearing deposits | | | 31,365 | | | | | | | | | | 21,256 | | | | | | | | | | 12,145 | | | | | | | |

Other non-interest-bearing liabilities | | | 21,204 | | | | | | | | | | 14,039 | | | | | | | | | | 12,108 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total non-interest-bearing liabilities | | | 52,569 | | | | | | | | | | 35,295 | | | | | | | | | | 24,253 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Stockholders’ equity | | | 65,675 | | | | | | | | | | 45,677 | | | | | | | | | | 38,217 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 862,036 | | | | | | | | | $ | 708,142 | | | | | | | | | $ | 497,579 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | | | | $ | 24,816 | | | | | | | | | $ | 21,060 | | | | | | | | | $ | 16,026 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest rate spread (2) | | | | | | | | | 2.87 | % | | | | | | | | | 3.04 | % | | | | | | | | | 3.38 | % |

Net interest margin (3) | | | | | | | | | 3.12 | % | | | | | | | | | 3.18 | % | | | | | | | | | 3.48 | % |

Ratio of average interest-earning assets to average interest-bearing liabilities | | | | | | 106.97 | % | | | | | | | | | 105.59 | % | | | | | | | | | 105.85 | % | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Includes non-accrual loans with an average balance of $1.8 million, $1.1 million and $366,000 for the fiscal years ended September 30, 2006, 2005 and 2004, respectively. |

| (2) | Yield on interest-earning assets less cost of interest-bearing liabilities. |

| (3) | Net interest income divided by average interest-earning assets. |

- 14 -

RATE VOLUME ANALYSIS

The following table allocates the period-to-period changes in the Company's various categories of interest income and expense between changes due to changes in volume (calculated by multiplying the change in average volumes of the related interest-earning asset or interest-bearing liability category by the prior year's rate) and changes due to changes in rate (change in rate multiplied by the prior year's volume). Changes due to changes in rate/volume (changes in rate multiplied by changes in volume) have been allocated proportionately between changes in volume and changes in rate.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2006 Compared to 2005 Increase (Decrease) Due to | | | 2005 Compared to 2004 Increase (Decrease) Due to | |

| | | Rate | | | Volume | | | Net | | | Rate | | | Volume | | | Net | |

| | | (In thousands) | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Loans receivable | | $ | 7,024 | | | $ | 8,413 | | | $ | 15,437 | | | $ | 2,571 | | | $ | 11,130 | | | $ | 13,701 | |

Loans held for sale | | | 347 | | | | (121 | ) | | | 226 | | | | 146 | | | | (7 | ) | | | 139 | |

Debt securities | | | 121 | | | | 166 | | | | 287 | | | | (104 | ) | | | 116 | | | | 12 | |

Mortgage-backed securities | | | (2 | ) | | | (70 | ) | | | (72 | ) | | | (17 | ) | | | (99 | ) | | | (116 | ) |

FHLB stock | | | 94 | | | | 11 | | | | 105 | | | | 32 | | | | 83 | | | | 115 | |

Other (including fed funds) | | | 67 | | | | 1 | | | | 68 | | | | 100 | | | | 9 | | | | 109 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total net change in income on interest-earning assets | | | 7,651 | | | | 8,400 | | | | 16,051 | | | | 2,728 | | | | 11,232 | | | | 13,960 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits | | | 6,120 | | | | 3,282 | | | | 9,402 | | | | 3,254 | | | | 1,772 | | | | 5,026 | |

FHLB advances | | | 2,193 | | | | 170 | | | | 2,363 | | | | 1,032 | | | | 2,032 | | | | 3,064 | |

Note payable | | | 69 | | | | (9 | ) | | | 60 | | | | 46 | | | | 54 | | | | 100 | |

Subordinated debentures | | | 349 | | | | 121 | | | | 470 | | | | 84 | | | | 652 | | | | 736 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total net change in expense on interest-bearing liabilities | | | 8,731 | | | | 3,564 | | | | 12,295 | | | | 4,416 | | | | 4,510 | | | | 8,926 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net change in net interest income | | $ | (1,080 | ) | | $ | 4,836 | | | $ | 3,756 | | | $ | (1,688 | ) | | $ | 6,722 | | | $ | 5,034 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

- 15 -

COMPARISONOF OPERATING RESULTSFROM 2006AND 2005

OVERVIEW

Net income for the year ended September 30, 2006 increased 32% to $9.8 million, or $1.01 per diluted share, compared with $7.5 million, or $0.85 per diluted share, for the year ended September 30, 2005. In February 2006, the Company benefited from a $2.5 million gain on the sale of a branch location, resulting in an after-tax gain of approximately $1.5 million, or $0.16 per diluted share. Diluted earnings per share for the year ended September 30, 2006 were reduced due to a 1.2 million increase in the number of shares outstanding resulting from stock issued in a secondary public offering in February 2006 and 210,732 shares issued to acquire CWE Bancorp, Inc. on March 31, 2006. Return on average assets and return on average equity were 1.14% and 14.98%, respectively, during 2006 compared to 1.06% and 16.37%, respectively, during 2005.

The Company completed the purchase of CWE Bancorp, Inc., and its wholly-owned subsidiary, Central West End Bank (“CWE”), on March 31, 2006. The aggregate purchase price was $7.3 million, including $3.6 million of cash and 210,732 shares of the Company’s common stock. The purchase added two full-service banking locations in the Central West End neighborhood of St. Louis with deposits totaling $41.4 million and total assets of $50.3 million. The Company’s total assets at September 30, 2006 were $962.5 million compared to $789.9 million at September 30, 2005.

NET INTEREST INCOME

Net interest income is the difference between interest income on interest-earning assets, such as loans and securities, and the interest expense on interest-bearing liabilities used to fund those assets, including deposits, FHLB advances and other borrowings. The amount of net interest income is affected by both changes in the level of interest rates and the amount and composition of interest-earning assets and interest-bearing liabilities. For the last two years, the interest rate environment has been increasingly challenging following seventeen consecutive interest rate hikes from the Federal Reserve Open Market Committee, which implemented its last rate increase in June 2006.

Net interest income increased $3.8 million to $24.8 million in fiscal 2006 compared to $21.1 million in fiscal 2005 due to an increase in net interest-earning assets partially offset by a decline in the net interest margin. The average balance of interest-earning assets increased $133.4 million to $795.7 million during fiscal year 2006, compared to $662.2 million for fiscal year 2005 due primarily to loan growth. The net interest margin declined 6 basis points to 3.12% in fiscal 2006 from 3.18% in fiscal 2005, resulting primarily from rising market interest rates which increased the cost of deposits at a faster rate than the rise in the yield on loans. During the year ended September 30, 2006, the average cost of deposits increased 124 basis points to 3.55% compared to a 108 basis point increase in the yield on loans to 6.93%. The net interest margin was also negatively impacted during 2006 by the narrowing spreads on loans held for sale. The average yield on such loans increased 70 basis points for the year to 6.16% in fiscal 2006 compared to 5.46% in fiscal 2005. Loans held for sale are typically funded by borrowings from the FHLB, the cost of which increased sequentially in conjunction with the Fed Funds rate increases from 3.32% in fiscal 2005 to 4.63% in fiscal 2006.

- 16 -

Interest income increased $16.1 million to $53.8 million for fiscal 2006 compared to $37.8 million for fiscal 2005. Interest income increased primarily due to a rise in the average balance of loans receivable, which increased $131.9 million to $716.0 million for fiscal 2006, combined with an increase in the average yield on loans to 6.93% in fiscal 2006 from 5.85% in fiscal 2005 due to higher market interest rates. Loans receivable grew $152.0 million, or 24.0%, during fiscal 2006 to $785.2 million at September 30, 2006. Commercial lending fueled 56% of the growth in the retained loan portfolio during the year ended September 30, 2006, with the remaining growth coming from residential, home equity loans and consumer loans.

Excluding loans receivable, the average balance of other interest earning assets increased $1.5 million for fiscal 2006 and had a minimal impact on changes in net interest income.

Interest expense increased $12.3 million to $29.0 million for fiscal 2006 compared to $16.7 million for fiscal 2005 due to changes in both the cost and average balance of interest-bearing liabilities. The average cost of interest-bearing liabilities increased from 2.67% for fiscal year 2005 to 3.90% for the fiscal year 2006 as market interest rates increased in response to rising federal funds rates and increased market competition.

For the year, total deposits increased $159.4 million to $655.6 million at September 30, 2006, including $41.4 million in deposits acquired through the purchase of Central West End Bank. The average cost of deposits increased to 3.55% in fiscal 2006 from 2.31% in 2005 primarily as the result of rising market interest rates. In addition to the deposits acquired in the Central West End Bank purchase, the Bank saw strong, well-balanced growth in money market, checking account and certificate of deposit products from both commercial and retail depositors. At September 30, 2006, the weighted average cost of interest-bearing checking accounts was 1.66% and totaled $53.4 million. Brokered deposits declined $356,000 during the year from $118.9 million at September 30, 2005 to $118.5 million at September 30, 2006. The deposit growth was used primarily to support strong loan growth.

Interest expense on FHLB borrowings increased $2.4 million to $7.8 million for the year ended September 30, 2006 compared to $5.4 million for the year ended September 30, 2005 almost entirely as the result of the market-driven increase in the average cost to 4.63% during 2006 from 3.32% during 2005. The Company typically relies on wholesale funds for incremental liquidity due to the Bank’s relatively high loan to deposit ratio of 121.8%.

ALLOWANCEFOR LOAN LOSSESAND PROVISION FOR LOSSESON LOANS

The balance of the allowance for loan losses increased $1.0 million to $7.8 million at September 30, 2006 from $6.8 million at September 30, 2005, due primarily to growth in the retained loan portfolio, which increased from $633.2 million at September 30, 2005 to $785.2 million at September 30, 2006. The allowance as a percentage of non-performing loans changed slightly from 112.07% at September 30, 2005 to 110.91% at September 30, 2006.

The provision for loan losses totaled $1.5 million for the year ended September 30, 2006 compared to $1.6 million for the year ended September 30, 2005. The change in the provision for loan losses was affected by increased charge-offs and non-performing assets during the year and a shift in the risk profile of the loan portfolio. Despite rapid growth over the last five years, the Bank has maintained a strong credit culture and a low appetite for credit risk, which resulted in average annual charge-offs during this five-year period totaling 9 basis points of the average balance of loans held in portfolio. For the year ended September 30, 2006, the Bank’s charge-offs totaled 9 basis points of the average balance of loans, or $782,000 compared to 6 basis points of average loans, or $417,000, during the year ended September 30, 2005. The increase in charge-offs was primarily due to the sale of $6.6 million of non-performing loans during 2006, resulting in charge-offs of $378,000.

- 17 -

The risk profile of the Bank’s loan portfolio also shifted during the year. The balance of home equity lines of credit increased from $195.6 million at September 30, 2005 to $207.2 million at September 30, 2006, representing 30% of loans receivable at September 30, 2006 compared to 26% at September 30, 2005. However, within the home equity loan portfolio, the balance of high loan-to-value home equity loans declined from $112.5 million at September 30, 2005 to $65.1 million at September 30, 2006, which resulted in management assigning reduced risk ratings on the remaining home equity loan portfolio and, therefore, a lower provision for losses during 2006. The decline in this higher-risk product was market-driven by consumers seeking lower interest rates on their prime-adjusting home equity loans as market interest rates increased. In the last year, we saw a general migration to fixed-rate, amortizing loan products and fewer cash-out refinancings using lines of credit. Other changes in the loan portfolio included an increase in the balance of commercial real estate and other commercial loans from $140.6 million at September 30, 2005 to $219.9 million at September 30, 2006, representing 28% of gross loans receivable at September 30, 2006 compared to 22% at September 30, 2005. In addition, the balance of permanent one-to-four family residential loans increased from $255.7 million at September 30, 2005 to $314.7 million at September 30, 2006, representing 39% of gross loans receivable at September 30, 2006 compared to 40% at September 30, 2005.

NON-PERFORMING ASSETSAND DELINQUENCIES

The Bank continues to maintain a large concentration in residential loans, with more than two-thirds of the Bank’s loans in residential first or second mortgages. While non-performing balances have periodically risen, the Bank’s loss experience on real estate loans is very low. Total non-performing assets increased $3.1 million from $6.8 million at September 30, 2005 to $9.9 million at September 30, 2006, primarily due to a $2.0 million rise in real estate acquired in settlement of loans. Real estate acquired in settlement of loans increased from $754,000 at September 30, 2005 to $2.8 million at September 30, 2006. The increase was caused by the foreclosure on a $1.2 million loan secured by a commercial building, combined with several residential foreclosures. Total non-performing loans increased $1.1 million from $6.0 million at September 30, 2005 to $7.1 million at September 30, 2006 primarily as the result of an increase in non-performing home equity loans from $618,000 at September 30, 2005 to $1.6 million at September 30, 2006. The increase in non-performing home equity loans occurred primarily in the December 2005 and March 2006 quarters following changes in bankruptcy laws and rising market interest rates. While there has been an increase in loan charge-offs during the year, the Bank has generally been insulated from significant losses because of stable real estate prices in the Midwestern United States. Residential properties in the Midwest did not experience unusually high price appreciation over the last ten years and therefore have not experienced the significant price declines seen recently in other regional markets. We would be at increased risk of credit losses from non-performing loans in an economic environment that results in declining residential values.

NON-INTEREST INCOME

Total non-interest income increased $1.8 million to $12.7 million for the year ended September 30, 2006 compared to $10.9 million for the year ended September 30, 2005. In February 2006, the Bank sold its Kansas City banking location, resulting in a $2.5 million gain. Excluding this gain, non-interest income declined $669,000, primarily as the result of a $1.5 million, or 27%, decrease in mortgage revenues caused by lower gross margins on sales of mortgage loans during the year. The decline in the gross margin was the result of the overall decline in industry mortgage production, which created a highly competitive lending environment and resulted in lower fees and gross sales margins throughout the industry. Retail banking fees increased 23% to $3.0 million for the year ended September 30, 2006 compared to $2.5 million in 2005 as the result of additional banking locations and a change in our overdraft policy, which began allowing point-of-purchase overdraft protection.

Title Division Results. Our title division, which began operations in June 2004, was established to capture sales opportunities from the mortgage and commercial divisions’ lending activities. The title division’s primary activities include researching and issuing title policies on mortgage and commercial loans. For the year ended September 30, 2006, the division’s revenues totaled $742,000 compared to $756,000 in 2005.

- 18 -

Investment Division Results. The investment division began operations in the first quarter of fiscal year 2005. The investment division’s activities consist primarily of brokering bonds to other community banks, municipalities and high net worth individuals. For the year ended September 30, 2006, the division’s revenues totaled $598,000 compared to $668,000 in 2005. The flattening of the yield curve and the consistent rise in interest rates greatly impacted the division’s ability to sell bonds. Since July 2006, which was the inflection point in the rise of short-term interest rates, the division experienced increased sales activity resulting in small profits during August and September of 2006.

Appraisal Division Results.In July of 2006, the Bank hired three residential appraisers from the St. Louis community to help increase fee income by cross-selling appraisal services to the Bank’s mortgage loan customers. In the first quarter of operations, the division had revenues of $186,000, which were partially offset by compensation and other expenses of $121,000. We have targeted a 50% efficiency ratio for this operation.

Insurance commissionsincreased slightly to $216,000 for the year ended September 30, 2006 compared to $207,000 for the year ended September 30, 2005. Insurance commissions stem primarily from revenue received for brokering annuity sales to insurance companies.

Bank-owned life insurance incomeincreased $250,000 to $847,000 for the year ended September 30, 2006 from $596,000 for the year ended September 30, 2005 due to additional policy purchases during fiscal year 2006.

Other income increased $137,000 to $616,000 for the year ended September 30, 2006 from $480,000 for the year ended September 30, 2005. Other income consists primarily of fee income from correspondent banks, which rose due to increased crediting rates resulting from changes in the interest rate environment.

NON-INTEREST EXPENSE

Salaries and employee benefitsexpense increased $343,000 to $9.6 million for the year ended September 30, 2006 from $9.2 million for the year ended September 30, 2005 due to the addition of commercial staff and employees at the new branch locations. Compensation paid to salaried mortgage staff declined during the year as the number of employees fell 10% from 106 at September 30, 2005 to 95 at September 30, 2006. The increase in compensation expense was partially offset by an increase in direct compensation expense that was deferred on loans originated. The increased deferral resulted from the growth in mortgage and commercial loan originations during the year.

Occupancy and equipmentexpense increased $903,000 to $5.1 million for the year ended September 30, 2006 from $4.2 million for the year ended September 30, 2005. The increase in expense was due primarily to the addition of two facilities acquired in the purchase of Central West End Bank in March 2006, a full year of costs incurred at the Chesterfield Bank location which opened late in fiscal 2005, and renovations to the Creve Coeur banking location and the Pulaski Financial Building.

Advertising expense increased $279,000 during the year to $1.1 million for the year ended September 30, 2006 compared to $845,000 for the year ended September 30, 2005. The increase resulted from higher television and newspaper advertisement during the year as the Company increased marketing efforts related to the Central West End Bank locations and the successful “Big Bertha Bundle” money market campaign.

Professional services expenseincreased $227,000 during the year to $1.2 million for the year ended September 30, 2006 compared to $1.0 million for the year ended September 30, 2005 due to increased expenses associated with the development, implementation and testing of procedures necessary to comply with the requirements of the Sarbanes Oxley Act and legal and professional fees incurred in connection with the resolution of the issues surrounding the accounting for derivative financial instruments.

- 19 -

Charitable contributionsincreased $259,000 during the year to $373,000 for the year ended September 30, 2006 compared to $114,000 for the year ended September 30, 2005 due primarily to a $250,000 charitable contribution to a St. Louis community-based not-for-profit organization.

Loss on derivative instruments decreased $126,000 during the year to $194,000 at September 30, 2006 from $320,000 for the year ended September 30, 2005. During fiscal year 2005 and the first three months of fiscal year 2006, changes in the estimated fair values of these derivatives were recognized as charges or credits to earnings, as appropriate, during the periods in which the changes occurred. Effective January 1, 2006, the Company began using long-haul, fair-value, hedge accounting.

Other non-interest expense increased $443,000, or 16%, to $3.2 million for the year ended September 30, 2006 compared to $2.7 million for the year ended September 30, 2005. The majority of the increase was due to a $255,000 increase in postage, document delivery and supplies expense resulting from the overall increased volume of loan and deposit business and the two banking locations acquired in the Central West End Bank purchase.

INCOME TAXES

The provision for income taxes increased from $4.4 million for the year ended September 30, 2005 to $5.4 million for the year ended September 30, 2006. The effective tax rate was 35.5% in 2006 compared to 37.1% in 2005. The lower effective tax rate in 2006 was the result of an increase in BOLI income, which is non-taxable, and a decrease in compensation expense associated with the ESOP, which is non-deductible.

FINANCIAL CONDITION

Total assets increased 21.9% to $962.5 million at September 30, 2006 from $789.9 million at September 30, 2005, primarily as the result of loan growth.

Cash and cash equivalents decreased $3.6 million to $22.1 million at September 30, 2006 from $25.7 million at September 30, 2005. Cash balances included overnight and fed funds investments of $3.0 million at September 30, 2006 compared to $9.1 million at September 30, 2005. These funds are generally used to fund loan growth and to retire short-term borrowings. The primary sources of cash are increases in deposits and borrowings from the FHLB.

Debt securities held to maturity increased $7.0 million during the year to $12.9 million at September 30, 2006. Purchases of debt securities were made to provide sufficient collateral for certain deposit relationships.

Federal Home Loan Bank (of Des Moines) stock increased approximately $1.1 million to $9.5 million at September 30, 2006 from $8.5 million at September 30, 2005. The Bank is generally required to hold stock equal to 5% of its total FHLB borrowings.

Loans held for sale declined $4.0 million to $60.4 million at September 30, 2006 from $64.3 million at September 30, 2005. These balances represent loans closed in the name of the Bank, which are committed in advance of closing to be sold to investors. Since these loans are pre-sold, generally at a pre-determined price on a best-efforts basis, we are not subject to changes in the value, as a result of changes in market interest rates, to be received upon delivery of these loans to investors. We generally receive proceeds from the sale of these loans to investors within 30 days of loan closing and benefit from interest income while awaiting sales delivery.

Real estate acquired in settlement of loans increased $2.0 million to $2.8 million at September 30, 2006 from $754,000 at September 30, 2005. The balance at year-end includes a $1.2 million commercial building, which was under contract for sale at an amount above carrying value as of September 30, 2006. The remaining balance consisted of several residential properties, which management believes are adequately reserved.

Premises and equipment increased $4.5 million to $18.2 million at September 30, 2006 from $13.7 million at September 30, 2005 following the addition of the two banking locations acquired in the CWE purchase, improvements to the Pulaski Financial Center building and the acquisition of land and other in-progress items related to a new bank location in Richmond Heights, Missouri.

- 20 -

Bank-owned life insurance (“BOLI”) increased $8.4 million to $24.0 million at September 30, 2006 from $15.6 million at September 30, 2005. The increase was attributable to the purchase of an additional policy totaling $6.5 million, policies acquired from CWE totaling $1.1 million and increases in the cash surrender values of existing policies totaling $845,000 during the year. Increases in cash surrender values are treated as other income and are tax-exempt. If the cash-surrender values of the policies are liquidated, the gains would retroactively be taxed. The BOLI policies were purchased to offset escalating costs of employee benefits.

Goodwill and core deposit intangibletotaled $3.9 million and $658,000 at September 30, 2006, respectively, and resulted from the purchase of Central West End Bank on March 31, 2006.

Assets and deposit liabilities held for saleat September 30, 2005 represented office properties and equipment and deposits of the Bank’s Kansas City branch which were under contract for sale. The sale was completed on February 14, 2006 and resulted in a $2.5 million gain.

Federal Home Loan Bank (of Des Moines) advancesincreased $1.8 million to $172.8 million at September 30, 2006 compared to $171.0 million at September 30, 2005. The balance of borrowings was relatively unchanged during the year due to the strong growth in deposits of $159.4 million, which primarily funded the growth in loans of $152.0 million.

Due to other banks increased $8.5 million to $22.1 million at September 30, 2006 from $13.6 million at September 30, 2005. Due to other banks represents unremitted payments for bank and cashier checks issued. The increase represents an increase in check activity on the final day of the fiscal year end. In the normal course of business, settlement for amounts due to other banks is made the following business day.

Total stockholders’ equity increased $27.6 million to $75.8 million at September 30, 2006 from $48.2 million at September 30, 2005. The increase was due primarily to the issuance of 1.15 million shares of common stock in a secondary offering resulting in net proceeds of $16.1 million, growth in retained earnings driven by net income of $9.8 million and the issuance of 210,000 shares of common stock for the purchase of CWE, which were valued at $3.7 million. Also contributing to the increase were proceeds from the exercise of stock options totaling $797,000 and shares issued in the dividend reinvestment plan valued at $277,000. Stockholders’ equity was reduced during fiscal 2006 by regular cash dividends paid, which totaled $3.2 million, and 5,296 shares of common stock repurchased with a total cost of $88,300.

We maintain an equity trust plan for the benefit of a select group of top-performing loan officers and other key staff outside of senior management. The primary assets of the plan are the Company’s common stock. During 2006, we repurchased 122,538 shares of the Company’s common stock at a total cost of $2.0 million for use in the plan. These shares are reflected as treasury shares and resulted in a corresponding reduction in stockholders’ equity.

Comparison of Operating Results from 2005 and 2004

Overview

Fiscal year 2005 was another successful year as the Company grew diluted earnings per share 26.9% to $0.85 from $0.67 on net income of $7.5 million for the year ended September 30, 2005, compared to $5.9 million for the year ended September 30, 2004. The Company also increased assets 23.8% to $789.9 million at September 30, 2005 from $637.9 million at September 30, 2004.

Net income increased $1.6 million to $7.5 million primarily on the growth of net interest income. Net interest income expanded $5.0 million to $21.1 million for the year ended September 30, 2005 compared to $16.0 million for the year ended September 30, 2004 due primarily to growth in the loan portfolio, which increased 24.0% to $633.2 million at September 30, 2005 from $510.6 million at September 30, 2004, and was offset by growth in interest bearing liabilities. Commercial lending drove approximately 60% of the growth in the retained loan portfolio during the year ended September 30, 2005, while increases in home equity loans and residential loans accounted for 40%.

- 21 -

Non-interest income grew primarily from growth in the mortgage division. In fiscal year 2005, the Company had a strong mortgage-lending year originating $1.7 billion in loans. As a top lender in St. Louis and Kansas City, the Company generated mortgage revenue of $5.5 million for the year ended September 30, 2005, compared to $4.6 million for the year ended September 30, 2004.

The loan portfolio grew $122.6 million, or 24.0%, during fiscal year 2005 to $633.2 million at September 30, 2005, slightly outpacing deposit growth. For the year, deposits increased $114.7 million to $521.5 million, including $25.4 million of deposits held for sale at our Kansas City branch. Demand deposit accounts, including money market and passbooks, increased $15.4 million during the year while commercial transaction accounts increased $15.8 million to $35.3 million. Over the last year, our non-interest-bearing checking account balances increased 85.3% to $30.0 million due primarily to the growth in commercial relationships. At September 30, 2005, the weighted average cost of interest-bearing checking accounts was 0.16% and totaled $29.0 million. During the year, the growth in the loan portfolio was primarily funded by growth in CD deposits. At September 30, 2005, CD balances totaled $325.1 million. Brokered deposits made up approximately 36.6%, or $118.9 million, of the CD balances at September 30, 2005. Brokered CD balances were $81.8 million at September 30, 2004.

During the year, our efficiency ratio remained strong despite significant growth in expenses related to entering new lines of business with the title and bond divisions and expanding our audit and compliance divisions in accordance with the Sarbanes-Oxley Act of 2002. Our efficiency ratio in fiscal 2005 was 56.67% compared to 56.56% in fiscal 2004.

NET INTEREST INCOME

Net interest income increased $5.0 million to $21.1 million for fiscal 2005 compared to $16.0 million for fiscal 2004. The increase was due to a 43.8% increase in the average balance of interest earning assets, which increased $201.6 million to $662.2 million for fiscal year 2005, compared to $460.6 million for fiscal year 2004. The net interest margin declined 30 basis points to 3.18% in fiscal 2005 from 3.48% in fiscal 2004, primarily from the continued narrowing spread on loans held for sale, higher costs on funds borrowed from the Federal Home Loan Bank and higher deposit costs. During the year, our net interest margin was negatively impacted 29 basis points as the spread between this portfolio and the cost of one-week advances from the FHLB narrowed. By the fourth quarter of fiscal year 2005 the spread on this portfolio had dropped to 1.71% from what had been over 400 basis points at the end of fiscal year 2004.

Interest income increased $14.0 million to $37.8 million for fiscal 2005 compared to $23.8 million in fiscal 2004. During the year, the average balance of loans receivable increased $196.3 million to $634.9 million in fiscal 2005. The yield on interest-earning assets increased from 5.17% for the year ended September 30, 2004 to 5.71% for the year ended September 30, 2005. Due to the growth of prime-based home equity and commercial loans, our assets remain sensitive to changes in interest rates, with 65% of assets set to reprice within 12 months following September 30, 2005.