Exhibit 13.1

| | |

| | Pulaski Financial Corp. |

| | 2007 Annual Report |

BUSINESSOFTHE COMPANY

We are a diversified, community-based, financial institution holding company headquartered in St. Louis, Missouri. We conduct operations primarily through Pulaski Bank, a federally chartered savings bank. Pulaski Bank provides an array of financial products and services for businesses and consumers primarily through its twelve full-service offices in the St. Louis metropolitan area and three loan production offices in Kansas City and the Illinois portion of the St. Louis metroplex.

We have grown our assets and deposits internally by building our residential and commercial lending operations, by opening de novo branches, and by hiring experienced bankers with existing customer relationships in our market. Although we intend to expand primarily through internal growth, we may also make strategic acquisitions. During 2006, we purchased another financial institution and we will continue to explore such opportunities to expand through acquisitions of other banks and bank branches. We recently opened our twelfth full-service bank location in the St. Louis metropolitan area in October 2007. Our goal is to continue to deliver value to our shareholders and to enhance our franchise value and earnings through controlled growth in our banking operations, while maintaining the personal, community-oriented customer service that has characterized our success to date.

- 1 -

SELECTED CONSOLIDATED FINANCIAL INFORMATION

| | | | | | | | | | | | | | | |

| | | At or For the Years Ended September 30, |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| | | (In thousands, except per share amounts) |

FINANCIAL CONDITION DATA | | | | | | | | | | | | | | | |

Total assets | | $ | 1,131,465 | | $ | 962,467 | | $ | 789,861 | | $ | 637,886 | | $ | 401,403 |

Loans receivable, net | | | 949,826 | | | 785,199 | | | 633,195 | | | 510,584 | | | 276,894 |

Loans receivable held for sale | | | 58,536 | | | 60,452 | | | 64,335 | | | 49,152 | | | 61,124 |

Debt and equity securities | | | 16,988 | | | 17,449 | | | 10,228 | | | 12,986 | | | 6,432 |

Capital stock of Federal Home Loan Bank | | | 8,306 | | | 9,524 | | | 8,462 | | | 7,538 | | | 3,880 |

Mortgage-backed securities | | | 3,027 | | | 3,631 | | | 4,833 | | | 6,574 | | | 8,862 |

Assets held for sale | | | — | | | — | | | 1,017 | | | — | | | — |

Cash and cash equivalents | | | 23,675 | | | 22,123 | | | 25,688 | | | 20,296 | | | 18,656 |

Deposits | | | 835,489 | | | 655,577 | | | 496,171 | | | 406,799 | | | 313,607 |

Deposit liabilities held for sale | | | — | | | — | | | 25,375 | | | — | | | — |

Advances from Federal Home Loan Bank | | | 158,400 | | | 172,800 | | | 171,000 | | | 154,600 | | | 31,500 |

Subordinated debentures | | | 19,589 | | | 19,589 | | | 19,589 | | | 9,279 | | | — |

Stockholders’ equity | | | 80,804 | | | 75,827 | | | 48,246 | | | 40,974 | | | 36,383 |

OPERATING DATA | | | | | | | | | | | | | | | |

Interest income | | $ | 70,811 | | $ | 53,843 | | $ | 37,792 | | $ | 23,832 | | $ | 21,426 |

Interest expense | | | 41,834 | | | 29,027 | | | 16,732 | | | 7,806 | | | 7,739 |

| | | | | | | | | | | | | | | |

Net interest income | | | 28,977 | | | 24,816 | | | 21,060 | | | 16,026 | | | 13,687 |

Provision for loan losses | | | 3,855 | | | 1,501 | | | 1,635 | | | 1,934 | | | 1,487 |

| | | | | | | | | | | | | | | |

Net interest income after provision for loan losses | | | 25,122 | | | 23,315 | | | 19,425 | | | 14,092 | | | 12,200 |

Non-interest income | | | 12,811 | | | 13,549 | | | 10,878 | | | 8,960 | | | 11,405 |

Non-interest expense | | | 24,449 | | | 21,601 | | | 18,406 | | | 13,715 | | | 13,977 |

| | | | | | | | | | | | | | | |

Income before income taxes | | | 13,484 | | | 15,263 | | | 11,897 | | | 9,337 | | | 9,628 |

Income taxes | | | 4,501 | | | 5,425 | | | 4,418 | | | 3,485 | | | 3,860 |

| | | | | | | | | | | | | | | |

Net income | | $ | 8,983 | | $ | 9,838 | | $ | 7,479 | | $ | 5,852 | | $ | 5,768 |

| | | | | | | | | | | | | | | |

COMMON SHARE DATA(1) | | | | | | | | | | | | | | | |

Basic earnings per share | | $ | 0.92 | | $ | 1.07 | | $ | 0.94 | | $ | 0.75 | | $ | 0.74 |

Diluted earnings per share | | $ | 0.88 | | $ | 1.01 | | $ | 0.85 | | $ | 0.67 | | $ | 0.67 |

Dividends declared per share | | $ | 0.35 | | $ | 0.33 | | $ | 0.28 | | $ | 0.20 | | $ | 0.14 |

Book value per share | | $ | 8.13 | | $ | 7.62 | | $ | 5.72 | | $ | 4.98 | | $ | 4.47 |

Weighted average shares - basic | | | 9,814 | | | 9,206 | | | 7,926 | | | 7,758 | | | 7,843 |

Weighted average shares - diluted | | | 10,256 | | | 9,718 | | | 8,828 | | | 8,695 | | | 8,578 |

Shares outstanding-end of period | | | 9,935 | | | 9,946 | | | 8,439 | | | 8,227 | | | 8,146 |

(1) | Reflects a three-for-two stock split in July 2005 and a two-for-one stock split in July 2003. |

- 2 -

| | | | | | | | | | | | | | | |

| | | At or For the Year Ended September 30, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

KEY OPERATING RATIOS | | | | | | | | | | | | | | | |

Return on average assets | | 0.85 | % | | 1.14 | % | | 1.06 | % | | 1.18 | % | | 1.38 | % |

Return on average equity | | 11.07 | | | 14.98 | | | 16.37 | | | 15.31 | | | 16.35 | |

Average equity to average assets | | 7.70 | | | 7.62 | | | 6.45 | | | 7.68 | | | 8.43 | |

Interest rate spread | | 2.63 | | | 2.87 | | | 3.04 | | | 3.38 | | | 3.30 | |

Net interest margin | | 2.97 | | | 3.12 | | | 3.18 | | | 3.48 | | | 3.47 | |

Efficiency ratio | | 60.30 | | | 59.85 | | | 56.67 | | | 56.56 | | | 55.87 | |

Dividend payout ratio | | 39.20 | | | 32.67 | | | 32.94 | | | 29.70 | | | 20.79 | |

Non-interest expense to average assets | | 2.38 | | | 2.48 | | | 2.56 | | | 2.76 | | | 3.34 | |

Average interest-earning assets to average interest-bearing liabilities | | 107.79 | | | 106.96 | | | 105.59 | | | 105.85 | | | 108.95 | |

Allowance for loan losses to total loans at end of period | | 1.02 | | | 0.92 | | | 0.95 | | | 0.99 | | | 1.13 | |

Allowance for loan losses to nonperforming loans | | 99.44 | | | 115.89 | | | 112.07 | | | 130.64 | | | 91.31 | |

Net charge-offs to average outstanding loans during the period | | 0.13 | | | 0.09 | | | 0.06 | | | 0.05 | | | 0.05 | |

Nonperforming assets to total assets | | 1.20 | | | 0.99 | | | 0.86 | | | 0.84 | | | 1.07 | |

OTHER DATA | | | | | | | | | | | | | | | |

Number of: | | | | | | | | | | | | | | | |

Real estate loans outstanding | | 6,149 | | | 5,609 | | | 4,059 | | | 3,619 | | | 2,651 | |

Consumer loans (includes home equity loans) | | 10,062 | | | 9,821 | | | 9,520 | | | 8,318 | | | 6,336 | |

Deposit accounts | | 40,307 | | | 36,443 | | | 33,010 | | | 30,390 | | | 29,344 | |

Number full-time equivalent employees | | 421 | | | 361 | | | 327 | | | 258 | | | 239 | |

Full service offices(1) | | 11 | | | 9 | | | 8 | | | 7 | | | 7 | |

CAPITAL RATIOS(2) | | | | | | | | | | | | | | | |

Tangible capital | | 8.79 | % | | 9.30 | % | | 8.60 | % | | 8.14 | % | | 8.18 | % |

Core capital | | 8.79 | | | 9.30 | | | 8.60 | | | 8.14 | | | 8.18 | |

Total risk-based capital | | 11.18 | | | 11.99 | | | 10.85 | | | 11.46 | | | 11.73 | |

(1) | Pulaski Bank opened its twelfth full-service office in Clayton, Missouri in October 2007. |

(2) | Capital ratios are for Pulaski Bank. |

- 3 -

MANAGEMENT’S DISCUSSIONAND ANALYSISOF

FINANCIAL CONDITIONAND RESULTSOF OPERATIONS

GENERAL

Management’s discussion and analysis of financial condition and results of operations is intended to assist in understanding our financial condition and results of operations. The information contained in this section should be read in conjunction with the consolidated financial statements and accompanying notes contained elsewhere in this annual report.

This report may contain certain “forward-looking statements” within the meaning of the federal securities laws, which are made in good faith pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are not historical facts; rather, they are statements based on management’s current expectations regarding our business strategies, intended results and future performance. Forward-looking statements are generally preceded by terms such as “expects,” “believes,” “anticipates,” “intends” and similar expressions.

Management’s ability to predict results or the effect of future plans or strategies is inherently uncertain. Factors that could affect actual results include interest-rate trends, the general economic climate in the market area in which we operate, as well as nationwide, our ability to control costs and expenses, competitive products and pricing offered by competitors, loan delinquency rates, demand for loans and deposits, changes in the quality or composition of our loan portfolio, changes in accounting principles and changes in federal and state legislation and regulation. Additional factors that may affect our results are discussed in the section titled “Risk Factors” in our annual report on Form 10-K and in other reports filed with the Securities and Exchange Commission. These factors should be considered in evaluating the forward-looking statements and undue reliance should not be placed on such statements. We assume no obligation to update any forward-looking statements.

PULASKI’S EVOLUTIONINTOA ST. LOUIS-BASED COMMUNITY BANK

Since its founding in 1922 as a mutual thrift serving the Polish community of St. Louis, Pulaski Bank (the “Bank”) has grown into a full-service community bank, with twelve bank locations in metropolitan St. Louis, catering to both individuals and businesses and has become one of the largest residential lenders in St. Louis and Kansas City. William A. Donius, grandson of the Bank’s principal founder, Michael Burdzy, assumed the role of Chairman and CEO in 1997 with a vision of growth and fiscal responsibility. Shortly thereafter, in 1998, Pulaski Financial Corp. (the “Company”) was formed as the holding company of the Bank to access capital through a public common stock offering. At that time, the Bank’s total assets were approximately $200 million. The initial offering raised $26 million in new capital, which doubled the Bank’s existing capital and provided an opportunity for expansion.

The board and management established a strategic plan to become a high-performing, $1 billion to $2 billion community bank by the year 2010. Under the plan, internal growth would be generated by building the Company’s residential and commercial lending operations, by opening de novo branches in key areas of the Company’s market and by hiring experienced bankers with existing in-market customer relationships. Growth could also come, to a much lesser extent, through strategic acquisitions. Crucial to this plan was growth in five key products: commercial, residential and home equity loans and checking and money market deposit accounts.

- 4 -

The Company reached a significant milestone during fiscal 2007 when total assets exceeded $1 billion. During the five years ended September 30, 2007, total assets grew at an average rate of 31%, totaling $1.1 billion at September 30, 2007. The Company also saw strong earnings growth during this five-year period, with an average return on equity of 14.8% and an increase in diluted earnings per share of 31%. The Company continues to experience strong organic growth and expects to reach $1.5 billion in total assets by the year 2010.

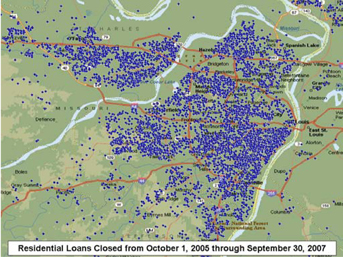

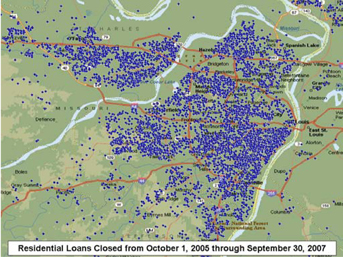

Today, Pulaski Bank has more than 85 residential and commercial lenders who are lending in every community and touching nearly every neighborhood in St. Louis and Kansas City. In the last two fiscal years, the Bank originated more than 24,000 residential mortgage and home equity loans, totaling nearly $2.2 billion in the St. Louis metropolitan area, and originated another $970.4 million in the Kansas City metropolitan area, making it one of the largest residential lenders in each of these two markets. The Company has also supported local businesses with $648.3 million of commercial loan originations during fiscal 2006 and 2007.

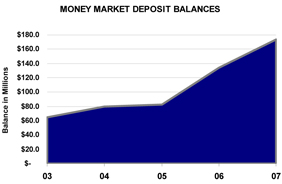

Growth in core deposits, consisting of checking and money market accounts, is critical to support profitable asset growth and is the Company’s top strategic objective. The Company’s approach to attracting deposits involves three key components: provide excellence in customer service, offer customers best-in-class products, and provide customers with convenient banking locations. This approach resulted in $185.4 million of growth in core deposits since September 30, 2003. This strategy has also enabled the Company to increase its share of the $51.5 billion St. Louis deposit market from 0.65% at September 30, 2003 to 1.66% at September 30, 2007.

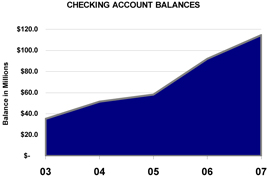

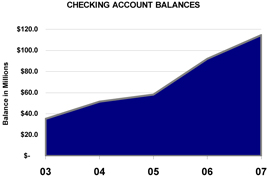

Supporting the strong asset and deposit growth are the Company’s commercial banking operations, which began in 2003. The Company has been successful in hiring some of the top commercial bankers in St. Louis and, primarily as a result of commercial relationships, checking account balances have grown 226% from $35.2 million at September 30, 2003 to $114.8 million at September 30, 2007. In addition, commercial loans have accounted for 56% of the Company’s loan portfolio growth since 2003.

- 5 -

Growth in commercial banking relationships is essential for the Company’s continued growth in the St. Louis market and the Company’s prospects will be enhanced by its increased presence in the St. Louis business community. As a thrift, Pulaski historically focused on banking locations which served retail customers. While developing the Company’s strategic plan, management determined it was essential to enhance the convenience of the Company’s bank locations in the St. Louis commercial districts. At September 30, 2003, the Bank had seven full-service locations, with only the main location in Creve Coeur positioned to serve small- to medium-sized business customers. Since 2005, the Bank has opened or acquired six new full-service locations, including the Clayton, Missouri office in October 2007, all of which are convenient to the metropolitan St. Louis commercial and financial centers. Since September 2003, the Company has nearly doubled its investment in premises and equipment, totaling $20.4 million at September 30, 2007 compared to $10.3 million at September 30, 2003.

De novo bank locations typically operate at a loss for a period after startup, reducing earnings. However, the new locations have proven successful in growing deposits from the start, with 83% of the Company’s $267.7 million of non-brokered deposit growth during the three years ended September 30, 2007 occurring in the bank locations located in the St. Louis “Central Corridor.” This expanded footprint in key commercial areas of metropolitan St. Louis has poised the Company to achieve its growth expectations.

ST. LOUIS DEMOGRAPHICS

St. Louis MSA Banks & Thrifts

| | | | | | | | | | | | |

Rank | | Company Name | | Charter | | Number of

Branches | | June 2007

Deposits | | Pct of

Total | |

1 | | U.S. Bank | | Bank | | 115 | | $ | 8,179,802 | | 15.89 | % |

2 | | Bank of America | | Bank | | 61 | | | 6,651,269 | | 12.92 | % |

3 | | Commerce Bank | | Bank | | 53 | | | 3,925,253 | | 7.62 | % |

4 | | Regions Bank | | Bank | | 73 | | | 2,879,168 | | 5.59 | % |

5 | | Southwest Bank | | Bank | | 19 | | | 3,804,720 | | 5.45 | % |

6 | | First Banks, Inc. | | Bank | | 57 | | | 2,254,163 | | 4.38 | % |

7 | | National City Bank | | Bank | | 61 | | | 1,935,465 | | 3.76 | % |

8 | | Enterprise Bank & Trust | | Bank | | 4 | | | 1,033,470 | | 2.01 | % |

9 | | Bank of Edwardsville | | Bank | | 16 | | | 914,049 | | 1.78 | % |

10 | | UMB Bank | | Bank | | 25 | | | 884,623 | | 1.72 | % |

11 | | First National Bank | | Bank | | 12 | | | 878,506 | | 1.71 | % |

12 | | Pulaski Bank | | Thrift | | 10 | | | 852,475 | | 1.66 | % |

13 | | Reliance Bank | | Bank | | 18 | | | 754,046 | | 1.46 | % |

14 | | Heartland Bank | | Thrift | | 12 | | | 703,476 | | 1.37 | % |

| | Institutions Ranked 15 - 140 | | | | 384 | | | 16,834,372 | | 32.20 | % |

Source: FDIC | | Total | | 920 | | $ | 52,484,857 | | 100 | % |

St. Louis is the eighteenth largest metropolitan area in the United States, with a population of 2.8 million and an average household income of $48,716, which is 5% higher than the national average. Ranked according to total deposits as reported by the FDIC, Pulaski Bank is the twelfth largest bank in the St. Louis metropolitan area and, with only 1.66% of the area’s $51.5 billion in deposits, has significant growth potential. The St. Louis economy is stable and diverse with its largest sector, healthcare, employing 20% of the workforce, and manufacturing employing 11% of the workforce.

The St. Louis market has experienced heavy consolidation in the banking sector during the last ten years, with more than $94 billion in deposits acquired by regional and national banks. While this activity has generated significant opportunities for Pulaski, it has also promoted an environment of rapid growth in market competition among smaller community banks.

St. Louis MSA Mergers and Acquisitions

| | | | | | | | | |

| | | Announcement

Date | | Acquiror | | Target | | Assets ($000s) |

1 | | 12/21/05 | | Marshall & Ilsley Corp. | | Trustcorp Financial Corp. | | $ | 705,359 |

2 | | 12/21/05 | | National City Corp. | | Forbes First Financial Corp. | | | 505,229 |

3 | | 10/25/05 | | Pulaski Financial Corp. | | CWE Bancorp, Inc. | | | 45,458 |

4 | | 04/09/04 | | National City Corp. | | Allegiant Bancorp Inc. | | | 2,458,878 |

5 | | 10/01/02 | | Marshall & Ilsley Corp. | | Mississippi Valley Bancshares | | | 2,042,192 |

6 | | 09/28/01 | | Allegiant Bancorp Inc. | | Southside Bancshares Corp. | | | 737,427 |

7 | | 03/01/01 | | Commerce Bancshares Inc. | | Breckenridge Bancshares Co. | | | 255,186 |

8 | | 11/15/00 | | Allegiant Bancorp Inc. | | Equality Bancorp Inc. | | | 323,335 |

9 | | 09/22/00 | | G.A.C. Inc. | | Gateway NB of St. Louis | | | 33,873 |

10 | | 05/10/00 | | Maries County Bancorp., Inc. | | Tritten Bancshares, Inc. | | | 44,705 |

11 | | 09/20/99 | | Firstar Corp. | | Mercantile Bancorp. | | | 35,578,819 |

12 | | 01/04/99 | | Liberty Bancshares Inc. | | Sac River Valley Bank | | | 99,917 |

13 | | 09/10/98 | | First Illinois Bancorp, Inc. | | Duchesne Bank | | | 107,152 |

14 | | 07/01/98 | | Union Planters Corp. | | Magna Group Inc. | | | 7,074,969 |

15 | | 06/30/98 | | Southside Bancshares Corp. | | Public Srvc. Bk, A Fed Svgs Bk | | | 70,482 |

16 | | 08/29/97 | | Allegiant Bancorp Inc. | | Reliance Financial Inc. | | | 31,705 |

17 | | 07/01/97 | | Trustcorp Inc. | | Missouri State B&TC | | | 88,866 |

18 | | 04/25/97 | | Mercantile Bancorp. | | Mark Twain Bancshares Inc. | | | 3,147,933 |

19 | | 01/07/97 | | NationsBank Corp. | | Boatman’s Bancshares Inc. | | | 40,682,558 |

Source: SNL Securities, LC | | TOTAL | | $ | 94,034,043 |

In the last three years, 25 de novo banks have entered the St. Louis market. During this same period, total deposits in banks smaller than Pulaski Bank increased $5.2 billion to $18.3 billion at June 30, 2007 from $13.1 billion at June 30, 2004. Locally-based community banks, like Pulaski, have gained market share by recruiting experienced bankers who have been displaced by mergers with larger, out-of-area banks. These bankers have generally developed strong relationships with customers who are willing to follow them to another financial institution. In addition, St. Louisans strongly favor doing business with companies that are locally-managed, creating opportunities for Pulaski.

- 6 -

EXECUTIONOFTHE STRATEGIC PLAN PRODUCED STRONG GROWTHIN KEY INDICATORS

Net income declined 8.7% in fiscal 2007 compared to 2006 primarily due to a $2.4 million increase in the provision for loan losses in 2007 and the absence of a $2.5 million gain on the sale of the Company’s only full-service Kansas City bank location that was included in the Company’s results of operations in 2006. SeeComparison of Operating Results from 2007 and 2006. However, execution of the Company’s strategic plan has produced strong, consistent performance in many of its key indicators, such as growth in net interest income, total assets, loans and deposits, thereby positioning the Company for improved earnings in future periods. Specifically, from 2003 to 2007, we have:

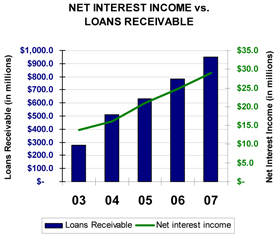

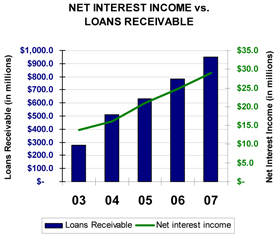

| | • | | Increased our net interest income from $13.7 million to $29.0 million, representing a 21% compound annual growth rate (“CAGR”). |

| | • | | Increased our total assets from $401.4 million to $1.1 billion, representing a 29% CAGR. |

| | • | | Increased our total loan portfolio from $276.9 million to $949.8 million, representing a 36% CAGR. |

| | • | | Increased our total deposits from $313.6 million to $835.5 million, representing a 28% CAGR. |

| | • | | Reduced our ratio of non-interest expense to average assets from 3.34% to 2.38%. |

| | • | | Expanded the number of residential and commercial loan officers from 18 to more than 85. |

| | • | | Expanded our St. Louis bank network from seven to eleven full-service locations. We opened our twelfth full-service location in October 2007. |

Over the last several years, the Company’s earnings have become progressively less dependent on non-interest income sources as the loan portfolio has expanded, resulting in higher interest income and ultimately higher net interest income. Net interest income increased to $29.0 million for the year ended September 30, 2007 compared to $13.7 million for the year ended September 30, 2003. Driven by growth in our commercial and residential portfolios, loans receivable increased 243% over the last four years, from $276.9 million at September 30, 2003 to $949.8 million at September 30, 2007.

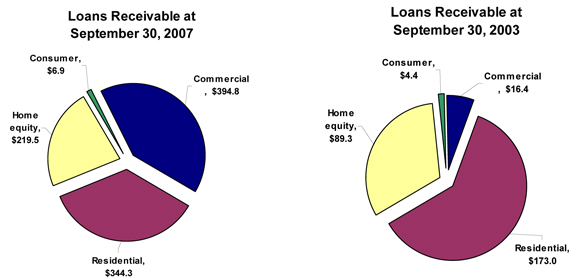

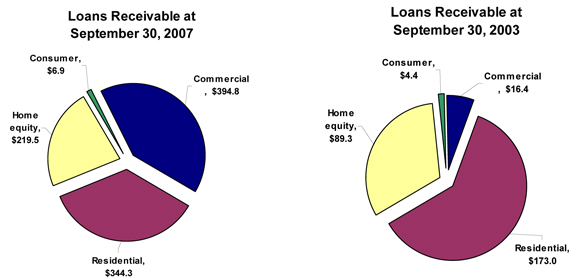

At September 30, 2003, we were principally a residential lender, with 94% of our portfolio consisting of residential and home equity loans. We identified the need to both expand net interest income and to diversify our loan portfolio. We made the decision to begin lending to small- and medium-sized businesses. We spent a year building the infrastructure to accomplish this goal, which included adding people, policies, procedures and products. Late in 2003, we hired several commercial lenders to help us grow the loan portfolio. Over the past four years, the commercial lending division has been a significant contributor to our growth, with $129.0 million of net loan growth in fiscal 2007 and $378.3 million since September 30, 2003. The commercial loan portfolio totaled $394.8 million at September 30, 2007 compared to $16.4 million at September 30, 2003.

- 7 -

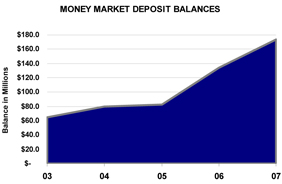

We continue to grow our core deposit accounts. Total deposits increased to $835.5 million at September 30, 2007 from $313.6 million at September 30, 2003. Core deposit accounts, including checking and money market accounts, increased to $317.7 million at September 30, 2007 compared to $132.2 million at September 30, 2003. Commercial transaction accounts increased from $0 at September 30, 2003 to $113.5 million at September 30, 2007. Non-interest-bearing checking accounts increased 507% since September 30, 2003 to $57.0 million at September 30, 2007 and money market accounts increased 170% during the same period to $173.9 million at September 30, 2007. The increases stem primarily from growth in commercial relationships, expanded products and a marketing campaign focused on increasing customer relationships.

BUSINESS STRATEGYAND PRODUCTS

Our community banking strategy emphasizes high-quality, responsive, and personalized customer service. The consolidation of financial institutions in our market has created larger banks, which are perceived by many customers as impersonal or unresponsive. We believe there is a significant opportunity for a community-focused bank to provide a full range of financial services to retail customers and small- and middle-market businesses. By offering quicker decision making in the delivery of banking products and services, by offering customized products where appropriate, and by providing our customers access to our senior decision makers, we distinguish ourselves from the larger regional banks operating in our market areas. Conversely, our larger capital base and product mix enable us to compete effectively against smaller banks with limited services and capabilities. As a result, we believe we have a substantial opportunity to attract both experienced management and loan officers as well as new banking customers. We believe this opportunity will give us a competitive advantage as we continue our expansion into attractive, high-growth markets in the St. Louis metropolitan area through new banking centers, potential acquisitions of community banks and bank branches, and growth of our existing banking centers.

Our strategy centers around our continued development into a full-service, community-oriented bank. We have expanded our physical footprint to more adequately serve the key business centers of the St. Louis metropolitan area. Our efforts to grow assets and earnings are dependent upon the successful growth in each of our five core products: commercial, residential and home equity loans and checking and money market deposit accounts. These five products provide the primary source of our operating income and are the

- 8 -

focus of growth in our balance sheet. We believe the marketplace is more competitive than ever and, to achieve sustained growth, these products must be delivered with superior and efficient customer service. Driving these relationships are seasoned professionals.

Commercial Loans. In the past four years, the Bank expanded its focus to include commercial lending. During this time, approximately 56% of the growth in the Bank’s loan portfolio has come from commercial lending. In 2003, the Bank had just two employees dedicated to commercial banking. Today, the commercial division has 30 employees, many of whom have brought us new business from their existing customer relationships. In the last year, commercial real estate and commercial and industrial loans increased $129.0 million to $394.8 million at September 30, 2007 compared to $265.7 million at September 30, 2006. At September 30, 2007, the commercial loan portfolio consisted of $254.6 million of commercial real estate loans, $77.6 million of commercial and industrial loans and $62.6 million of construction and development loans.

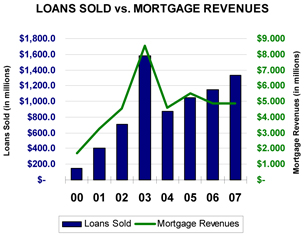

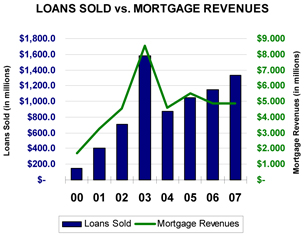

Residential Loans. Pulaski Bank is a conforming, residential mortgage lender who originates loans directly through commission-based sales staff in the St. Louis and Kansas City metropolitan areas. We do not engage in sub-prime lending and have no sub-prime assets in our loan or investment portfolios. We have become a leading mortgage originator in these two markets, originating $1.5 billion, $1.3 billion and $1.2 billion in residential loans during the years ended September 30, 2007, 2006 and 2005, respectively. Originations increased each year, primarily as a result of the expansion of our commissioned residential lending staff. Pulaski’s growth in production was in contrast to the industry as a whole, which declined in both 2006 and 2007.

The majority of loans originated in the residential division are one- to four-family residential loans, which we sell to investors on a servicing-released basis, generating mortgage revenue, which is our largest source of non-interest income. For the year ended September 30, 2007, we sold $1.3 billion of residential loans to investors, which generated mortgage revenues totaling $4.8 million, compared to $1.1 billion of loans sold and $4.9 million in revenues for the year ended September 30, 2006. The decline in mortgage revenues was primarily due to the overall decline in industry-wide mortgage production, which created a highly competitive environment and resulted in lower fees and sales margins throughout the industry.

Qualifying residential mortgage loans that do not meet the standards for sale in the secondary market are retained in our portfolio and priced on a risk/reward basis. Such loans meet our internal underwriting guidelines, which prohibit a combination of low FICO scores and high loan-to-value ratios. These loans are not considered sub-prime. Residential loans retained in our portfolio increased $25.2 million to $344.3 million at September 30, 2007 from $319.1 million at September 30, 2006. The residential retained portfolio consists primarily of three-year adjustable-rate loans and second mortgage loans that generally do not conform to investor criteria. These loans are underwritten using an internal credit-scoring model, which assesses credit risk and assigns one of five risk-based ratings to the loan at the time of inception.

- 9 -

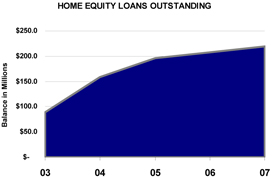

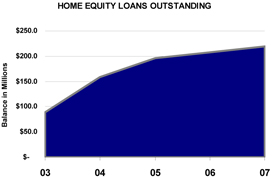

Home Equity Lines of Credit. Home equity lines of credit balances totaled $219.5 million at September 30, 2007 compared to $207.2 million at September 30, 2006. Growth in this prime-adjusting portfolio has slowed significantly as consumers have reduced the amount of their outstanding borrowings in reaction to the increase in market interest rates. Home equity loans consist primarily of revolving lines of credit secured by residential real estate. Home equity lines of credit are typically offered to only the most credit-worthy borrowers and are generally approved in conjunction with their first mortgage loan applications. The large volume of mortgage loans originated in recent years has provided many opportunities to cross-sell this product to customers and has resulted in growth in new balances. However, principal repayments have also risen resulting in slower growth during the past two years. These loans represent prime-based assets with low interest-rate risk characteristics and attractive yields, lending stability to our net interest margin. The weighted-average interest rate on home equity lines of credit was 7.76% at September 30, 2007 compared to 8.27% at September 30, 2006. The decline in the average interest rate was primarily due to the 50 basis point drop in the prime rate during September 2007.

Because home equity lines of credit are generally subordinated to first mortgage loans, the risk of loss increases when the combined loan-to-value ratio increases. Loan balances that exceed 90% of property values are generally insured for loss through mortgage insurance up to 90% of the value of the property.

Checking Accounts. Checking accounts represent the cornerstone product in a customer relationship and are the Bank’s most valuable source of low-cost deposits. Checking account balances not only provide the lowest-cost funding source, but also generate valuable fee income through service charges. Due primarily to growth in commercial accounts, the balance of checking accounts increased $22.5 million during the year to $114.8 million at September 30, 2007 from $92.3 million at September 30, 2006. The increase included $18.2 million of growth in non-interest bearing checking account balances.

Retail banking fees increased 13% to $3.4 million for the year ended September 30, 2007 compared to $3.0 million for the year ended September 30, 2006. Our marketing campaign focused on cross-selling checking accounts to all customers and developing new checking account relationships. We have seen retail banking fees increase from $1.9 million in fiscal 2003 to $3.4 million in fiscal 2007, primarily through an increase in the volume of checks honored for customers who have overdrawn their checking accounts. Historic trends indicate the majority of customers will eventually honor the overdraft checks; consequently, annual charge-offs have averaged under 4% of total retail banking fees.

- 10 -

Money Market Deposits. Our strategic focus also includes growing money market deposits, which we consider another core deposit product. The balance of money market accounts increased $39.6 million, or 29.4%, to $173.9 million at September 30, 2007 from $134.4 million at September 30, 2006. The money market product carries an adjustable interest rate that makes it an ideal funding source for our prime-adjusting commercial and home equity loans. Competition for money market accounts remains intense, but the accounts are generally less interest-rate sensitive and more stable than certificates of deposit. At September 30, 2007, money market deposits had a weighted average cost of 4.05% compared to 4.12% at September 30, 2006.

CRITICAL ACCOUNTING POLICIES

We have established various accounting policies that govern the application of U.S generally accepted accounting principles in the preparation of our financial statements. Our significant accounting policies are described in the footnotes to the consolidated financial statements that appear in this report. Certain accounting policies involve significant judgments and assumptions by management that have a material impact on the carrying value of certain assets and liabilities. We consider the following to be our critical accounting policies: accounting for the allowance for loan losses and derivative financial instruments. The judgments and assumptions used by management are based on historical experience and other factors, which are believed to be reasonable under the circumstances. Because of the nature of the judgments and assumptions made by management, actual results could differ from these judgments and estimates that could have a material impact on the carrying values of assets and liabilities and our results of operations.

We maintain an allowance for loan losses to absorb probable losses in our loan portfolio. Determining the amount of the allowance involves a high degree of judgment. The balance in the allowance is based upon management’s quarterly estimates of expected losses inherent in the loan portfolio. Management’s estimates are determined by quantifying certain risks in the portfolio that are affected primarily by changes in the composition and volume of the portfolio combined with an analysis of past-due and adversely classified loans These estimates can also be affected by the following factors: changes in lending policies and procedures, including underwriting standards and collection; charge-off and recovery practices; changes in national and local economic conditions and developments; assessment of collateral values by obtaining independent appraisals; and changes in the experience, ability, and depth of lending management staff. Refer to note 1 to our Consolidated Financial Statements, “Summary of Significant Accounting Policies,” for a detailed description of our risk assessment process.

We employ derivative financial instruments to help us manage interest rate sensitivity by modifying the repricing, maturity and option characteristics of certain assets and liabilities. The judgments and assumptions that are most critical to the application of this critical accounting policy are those affecting the estimation of fair value. Fair value is based on quoted market prices. Refer to note 1 to our Consolidated Financial Statements, “Summary of Significant Accounting Policies,” for a detailed description of our estimation processes and methodology related to the fair value of derivative financial instruments.

- 11 -

AVERAGE BALANCE SHEETS

The following table sets forth information regarding average balances of assets and liabilities as well as the total dollar amounts of interest income from average interest-earning assets and interest expense on average interest-bearing liabilities, resultant yields, interest rate spread, net interest margin, and ratio of average interest-earning assets to average interest-bearing liabilities for the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Years Ended September 30, | |

| | | 2007 | | | 2006 | | | 2005 | |

| | | Average

Balance | | | Interest

and

Dividends | | Yield/

Cost | | | Average

Balance | | | Interest

and

Dividends | | Yield/

Cost | | | Average

Balance | | | Interest

and

Dividends | | Yield/

Cost | |

| | | (Dollars in thousands) | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans receivable (1) | | $ | 878,057 | | | $ | 65,220 | | 7.43 | % | | $ | 716,045 | | | $ | 49,592 | | 6.93 | % | | $ | 584,134 | | | $ | 34,155 | | 5.85 | % |

Loans receivable held for sale | | | 64,415 | | | | 3,992 | | 6.20 | % | | | 48,518 | | | | 3,000 | | 6.18 | % | | | 50,815 | | | | 2,774 | | 5.46 | % |

Debt securities | | | 15,357 | | | | 767 | | 4.99 | % | | | 11,878 | | | | 489 | | 4.12 | % | | | 7,200 | | | | 202 | | 2.80 | % |

Mortgage-backed securities | | | 3,334 | | | | 158 | | 4.74 | % | | | 4,243 | | | | 202 | | 4.77 | % | | | 5,704 | | | | 274 | | 4.80 | % |

FHLB stock | | | 9,109 | | | | 442 | | 4.85 | % | | | 8,788 | | | | 327 | | 3.72 | % | | | 8,373 | | | | 222 | | 2.65 | % |

Other | | | 4,522 | | | | 232 | | 5.15 | % | | | 6,053 | | | | 233 | | 3.85 | % | | | 6,008 | | | | 165 | | 2.75 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-earning assets | | | 974,794 | | | | 70,811 | | 7.26 | % | | | 795,525 | | | | 53,843 | | 6.77 | % | | | 662,234 | | | | 37,792 | | 5.71 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-interest-earning assets | | | 78,454 | | | | | | | | | | 66,511 | | | | | | | | | | 45,908 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 1,053,248 | | | | | | | | | $ | 862,036 | | | | | | | | | $ | 708,142 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits | | $ | 713,051 | | | $ | 31,337 | | 4.39 | % | | $ | 552,626 | | | $ | 19,625 | | 3.55 | % | | $ | 442,927 | | | $ | 10,223 | | 2.31 | % |

FHLB advances | | | 168,476 | | | | 8,755 | | 5.20 | % | | | 168,067 | | | | 7,777 | | 4.63 | % | | | 163,071 | | | | 5,414 | | 3.32 | % |

Note payable | | | 3,192 | | | | 226 | | 7.08 | % | | | 3,510 | | | | 236 | | 6.71 | % | | | 3,701 | | | | 176 | | 4.75 | % |

Subordinated debentures | | | 19,589 | | | | 1,516 | | 7.74 | % | | | 19,589 | | | | 1,389 | | 7.09 | % | | | 17,471 | | | | 919 | | 5.26 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-bearing liabilities | | | 904,308 | | | | 41,834 | | 4.63 | % | | | 743,792 | | | | 29,027 | | 3.90 | % | | | 627,170 | | | | 16,732 | | 2.67 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-interest-bearing deposits | | | 47,605 | | | | | | | | | | 31,365 | | | | | | | | | | 21,256 | | | | | | | |

Other non-interest-bearing liabilities | | | 20,197 | | | | | | | | | | 21,204 | | | | | | | | | | 14,039 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total non-interest-bearing liabilities | | | 67,802 | | | | | | | | | | 52,569 | | | | | | | | | | 35,295 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Stockholders’ equity | | | 81,138 | | | | | | | | | | 65,675 | | | | | | | | | | 45,677 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 1,053,248 | | | | | | | | | $ | 862,036 | | | | | | | | | $ | 708,142 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | | | | | $ | 28,977 | | | | | | | | | $ | 24,816 | | | | | | | | | $ | 21,060 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest rate spread (2) | | | | | | | | | 2.63 | % | | | | | | | | | 2.87 | % | | | | | | | | | 3.04 | % |

Net interest margin (3) | | | | | | | | | 2.97 | % | | | | | | | | | 3.12 | % | | | | | | | | | 3.18 | % |

Ratio of average interest-earning assets to average interest-bearing liabilities | | | 107.79 | % | | | | | | | | | 106.96 | % | | | | | | | | | 105.59 | % | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Includes non-accrual loans with an average balance of $2.5 million, $1.8 million and $1.1 million for the fiscal years ended September 30, 2007, 2006 and 2005, respectively. |

| (2) | Yield on interest-earning assets less cost of interest-bearing liabilities. |

| (3) | Net interest income divided by average interest-earning assets. |

- 12 -

RATE VOLUME ANALYSIS

The following table allocates the period-to-period changes in the Company’s various categories of interest income and expense between changes due to changes in volume (calculated by multiplying the change in average volumes of the related interest-earning asset or interest-bearing liability category by the prior year’s rate) and changes due to changes in rate (change in rate multiplied by the prior year’s volume). Changes due to changes in rate/volume (changes in rate multiplied by changes in volume) have been allocated proportionately between changes in volume and changes in rate.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007 Compared to 2006 Increase (Decrease) Due to | | | 2006 Compared to 2005

Increase (Decrease) Due to | |

| | | Rate | | | Volume | | | Net | | | Rate | | | Volume | | | Net | |

| | | (In thousands) | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Loans receivable | | $ | 3,903 | | | $ | 11,725 | | | $ | 15,628 | | | $ | 7,024 | | | $ | 8,413 | | | $ | 15,437 | |

Loans receivable held for sale | | | 10 | | | | 982 | | | | 992 | | | | 354 | | | | (128 | ) | | | 226 | |

Debt securities | | | 116 | | | | 162 | | | | 278 | | | | 121 | | | | 166 | | | | 287 | |

Mortgage-backed securities | | | (1 | ) | | | (43 | ) | | | (44 | ) | | | (2 | ) | | | (70 | ) | | | (72 | ) |

FHLB stock | | | 103 | | | | 12 | | | | 115 | | | | 94 | | | | 11 | | | | 105 | |

Other | | | 67 | | | | (68 | ) | | | (1 | ) | | | 67 | | | | 1 | | | | 68 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total net change in income on interest-earning assets | | | 4,198 | | | | 12,770 | | | | 16,968 | | | | 7,658 | | | | 8,393 | | | | 16,051 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits | | | 4,979 | | | | 6,733 | | | | 11,712 | | | | 6,120 | | | | 3,282 | | | | 9,402 | |

FHLB advances | | | 959 | | | | 19 | | | | 978 | | | | 2,193 | | | | 170 | | | | 2,363 | |

Note payable | | | 12 | | | | (22 | ) | | | (10 | ) | | | 69 | | | | (9 | ) | | | 60 | |

Subordinated debentures | | | 127 | | | | — | | | | 127 | | | | 349 | | | | 121 | | | | 470 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total net change in expense on interest-bearing liabilities | | | 6,077 | | | | 6,730 | | | | 12,807 | | | | 8,731 | | | | 3,564 | | | | 12,295 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net change in net interest income | | $ | (1,879 | ) | | $ | 6,040 | | | $ | 4,161 | | | $ | (1,073 | ) | | $ | 4,829 | | | $ | 3,756 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

- 13 -

COMPARISONOF OPERATING RESULTSFROM 2007AND 2006

OVERVIEW

Net income for the year ended September 30, 2007 declined 8.7% to $9.0 million, or $0.88 per diluted share, compared to $9.8 million, or $1.01 per diluted share, for the year ended September 30, 2006. Results for 2006 included a $2.5 million gain on the sale of the Company’s only full-service bank location in Kansas City, resulting in an after-tax gain of approximately $1.5 million, or $0.16 per diluted share. In addition, fiscal 2007 earnings were negatively impacted by a $3.9 million provision for loan losses, which was a $2.4 million increase compared to the previous year. Return on average assets and return on average equity were 0.85% and 11.07%, respectively, during 2007 compared to 1.14% and 14.98%, respectively, during 2006.

NET INTEREST INCOME

Net interest income is the difference between interest income on interest-earning assets, such as loans and securities, and the interest expense on interest-bearing liabilities used to fund those assets, including deposits, Federal Home Loan Bank (“FHLB”) advances and other borrowings. The amount of net interest income is affected by both changes in the level of interest rates and the amount and composition of interest-earning assets and interest-bearing liabilities.

Net interest income increased $4.2 million to $29.0 million in fiscal 2007 compared to $24.8 million in fiscal 2006 due to an increase in net interest-earning assets partially offset by a decline in the net interest margin. The average balance of interest-earning assets increased $179.3 million to $974.8 million during fiscal 2007, compared to $795.5 million for fiscal 2006 due primarily to loan growth. The net interest margin declined 15 basis points to 2.97% in fiscal 2007 from 3.12% in fiscal 2006, resulting primarily from the higher cost of time deposits and wholesale borrowings used to fund the growth in the loan portfolio. During the year ended September 30, 2007, the average cost of deposits increased 84 basis points to 4.39% compared to a 50 basis point increase in the yield on loans to 7.43%. The net interest margin was also negatively impacted during 2007 by the narrowing spreads on loans held for sale. The average yield on such loans increased 2 basis points during fiscal 2007 to 6.20% while the average rate on borrowings from the FHLB used to fund these loans increased 57 basis points to 5.20%.

Interest income increased $17.0 million to $70.8 million for fiscal 2007 compared to $53.8 million for fiscal 2006. Interest income increased primarily due to a rise in the average balance of loans receivable, which increased $162.0 million to $878.1 million for fiscal 2007, combined with an increase in the average yield on loans to 7.43% in fiscal 2007 from 6.93% in fiscal 2006 due to higher market interest rates. Loans receivable grew $164.6 million, or 21.0%, during fiscal 2007 to $949.8 million at September 30, 2007. Commercial loans, which generally carry higher interest rates than residential mortgage loans, fueled 77.1% of the growth in the retained loan portfolio during the year ended September 30, 2007, with the remaining growth coming from residential, home equity and consumer loans. Interest income was also positively impacted by a $15.9 million increase in the average balance of loans held for sale during fiscal 2007.

Interest expense increased $12.8 million to $41.8 million for fiscal 2007 compared to $29.0 million for fiscal 2006 due to changes in both the cost and average balance of interest-bearing liabilities. The average cost of interest-bearing liabilities increased from 3.90% for fiscal year 2006 to 4.63% for the fiscal year 2007 as market interest rates increased in response to increased market competition.

Interest expense on deposits increased $11.7 million to $31.3 million for the year ended September 30, 2007 compared to $19.6 million for the year ended September 30, 2006. The average balance of interest-bearing deposits increased $160.4 million during fiscal 2007 to $713.1 million at September 30, 2007. The average cost of deposits increased to 4.39% in fiscal 2007 from 3.55% in 2006 primarily as the result of rising market interest rates. The Bank realized strong, well-balanced growth in money market, checking account and certificate of deposit products from both commercial and retail depositors. SeeBusiness Strategy and Products. Brokered deposits increased $71.9 million during the year from $118.5 million at September 30, 2006 to $190.4 million at September 30, 2007. The deposit growth was used primarily to support loan growth.

- 14 -

Interest expense on FHLB borrowings increased $978,000 to $8.8 million for the year ended September 30, 2007 compared to $7.8 million for the year ended September 30, 2006 almost entirely as the result of the market-driven increase in the average cost to 5.20% during 2007 from 4.63% during 2006. The Company typically relies on wholesale funds for incremental liquidity due to the Bank’s relatively high loan-to-deposit ratio of 115.6%.

ALLOWANCEFOR LOAN LOSSESAND PROVISION FOR LOSSESON LOANS

The allowance for loan losses was $10.4 million at September 30, 2007, or 1.02% of total loans and 99.44% of non-performing loans, compared to $7.8 million at September 30, 2006, or 0.92% of total loans and 115.89% of non-performing loans. The increased allowance was generally attributable to growth in the Company’s commercial loan portfolio and an increase in non-performing loans. See Note 1 to the Consolidated Financial Statements for a description of management’s methodology and Note 6 for a summary of activity in the allowance for loan losses.

The provision for loan losses for the year ended September 30, 2007 was $3.9 million compared to $1.5 million for the same period a year ago. The significant increase in the provision for loan losses was due to significant growth in the loan portfolio, especially in commercial loans which carry a higher risk of default, and also to increased charge-offs and an increase in the level of non-performing loans.

Net charge-offs for the year ended September 30, 2007 totaled $1.3 million, or 0.13% of average loans, compared to $772,000, or 0.09% of average loans, for the same period a year ago. Net charge-offs in 2007 included $714,000 in charge-offs on single-family residential mortgage loans and $279,000 in charge-offs on home equity loans. Management adheres to specific loan underwriting guidelines focusing primarily on residential and commercial real estate and home equity loans secured by one-to four-family and commercial properties and, as the result, while charge-offs in 2007 have increased significantly, the Company’s five-year average annual charge-off experience has been low, totaling only $565,000 or 0.06% of average loans. The Company was historically a lender of only 1-4 family conforming residential loans. Today, the Company has expanded its loan portfolio to include higher-risk home equity, commercial and construction loans. Because the Company’s loan portfolio is typically collateralized by real estate, losses occur more frequently when property values are declining and borrowers are losing equity in the underlying collateral. Recent declines in residential real estate values in the Company’s market areas, as well as nationally, contributed to the increased charge-offs during 2007.

Management believes that the amount maintained in the allowance for loan losses will be adequate to absorb probable losses inherent in the loan portfolio. Although management believes that it uses the best information available to make such determinations, future adjustments to the allowance for loan losses may be necessary and results of operations could be significantly and adversely affected if circumstances differ substantially from the assumptions used in making the determinations. While management believes it has established the allowance for loan losses in accordance with U.S. generally accepted accounting principles, there can be no assurance that the Bank’s regulators, in reviewing the Bank’s loan portfolio, will not request the Bank to significantly increase its allowance for loan losses. In addition, because future events affecting borrowers and collateral cannot be predicted with certainty, there can be no assurance that the existing allowance for loan losses is adequate or that a substantial increase will not be necessary should the quality of any loans deteriorate as a result of the factors discussed above. Any material increase in the allowance for loan losses will adversely affect the Company’s financial condition and results of operations.

- 15 -

NON-PERFORMING ASSETS

Non-performing assets at September 30, 2007 and September 30, 2006 are summarized as follows:

| | | | | | | | |

| | | September 30,

2007 | | | September 30,

2006 | |

| | | (Dollars in thousands) | |

Non-accrual loans: | | | | | | | | |

Residential real estate | | $ | 2,082 | | | $ | 794 | |

Commercial | | | 3,708 | | | | — | |

Home equity | | | 554 | | | | 119 | |

Other | | | 105 | | | | 27 | |

| | | | | | | | |

Total non-accrual loans | | | 6,449 | | | | 940 | |

| | | | | | | | |

Accruing loans past due 90 days or more: | | | | | | | | |

Residential real estate | | | 2,564 | | | | 3,984 | |

Commercial | | | 44 | | | | 125 | |

Home equity | | | 1,064 | | | | 1,456 | |

Other | | | 150 | | | | 21 | |

| | | | | | | | |

Total accruing loans past due 90 days or more | | | 3,822 | | | | 5,586 | |

| | | | | | | | |

Restructured loans | | | 209 | | | | 220 | |

| | | | | | | | |

Total non-performing loans | | | 10,480 | | | | 6,746 | |

Real estate acquired in settlement of loans | | | 3,090 | | | | 2,764 | |

Other nonperforming assets | | | 43 | | | | 43 | |

| | | | | | | | |

Total non-performing assets | | $ | 13,613 | | | $ | 9,553 | |

| | | | | | | | |

Ratio of non-performing loans to total loans | | | 1.03 | % | | | 0.79 | % |

Ratio of non-performing assets to total assets | | | 1.20 | % | | | 0.99 | % |

Ratio of allowance for loan losses to nonperforming loans | | | 99.44 | % | | | 115.89 | % |

Total non-performing assets increased from $9.6 million at September 30, 2006 to $13.6 million at September 30, 2007. Non-accrual loans increased from $940,000 to $6.4 million during the year, primarily as the result of increases in non-accrual residential real estate and commercial loans. Non-accrual residential real estate loans at September 30, 2007 totaled $2.1 million. During the year, management determined that a number of past due loans previously classified as accruing should be reclassified as non-accrual based on recent changes in real estate market conditions that could affect the Company’s ability to collect the amounts due on these loans. Non-accrual commercial loans at September 30, 2007 consisted of five loans secured by commercial real estate totaling $3.7 million at September 30, 2007, including a $2.6 million loan secured by an office building in St. Louis County, Missouri. Management performed a detailed review of the loan during the quarter ended June 30, 2007 and believes the loan is adequately collateralized.

Accruing loans greater than 90 days past due decreased from $5.6 million at September 30, 2006 to $3.8 million at September 30, 2007, primarily as the result of a $1.8 million decrease in loans secured by residential real estate and home equity loans. Loans are placed on non-accrual status when, in the opinion of management, there is reasonable doubt as to the collectibility of interest or principal. Management considers many factors before placing a loan on non-accrual, including the overall financial condition of the borrower, the progress of management’s collection efforts and the value of the underlying collateral.

Real estate acquired in settlement of loans totaled $3.1 million at September 30, 2007 and included 23 one- to four-family residential properties. Management performed detailed reviews of these properties and believes they are properly valued at September 30, 2007. Real estate foreclosure expense and losses, net increased $254,000 to $482,000 for the year ended September 30, 2007 compared to $228,000 for the year ended September 30, 2006. The increase was the result of increased foreclosure activity combined with softening real estate market values during fiscal 2007.

- 16 -

In addition to the nonperforming assets disclosed above, management was closely monitoring five loans secured by commercial real estate totaling $1.3 million at September 30, 2007 that were considered potential problems because of the borrowers’ weakening credit conditions. These loans were past due less than 90 days and were still accruing interest.

NON-INTEREST INCOME

Total non-interest income decreased $738,000 to $12.8 million for the year ended September 30, 2007 compared to $13.5 million for the year ended September 30, 2006. In February 2006, the Bank sold its Kansas City banking location, resulting in a $2.5 million gain. Excluding this gain, non-interest income increased $1.7 million, primarily as the result of increases in appraisal division revenues and retail banking fees. SeeBusiness Strategy and Products for a discussion of retail banking fees.

Appraisal revenuesincreased $835,000 from $186,000 in fiscal 2006 to $1.0 million in fiscal 2007. The Company established an appraisal division in July 2006 to cross-sell appraisal services to its mortgage loan customers. The increased revenues during 2007 reflect a full year of operations and an increase in the number of staff appraisers hired in late fiscal 2006.

Title policy revenues totaled $844,000 for the year ended September 30, 2007 compared to $742,000 in fiscal 2006. The title division, which began operations in June 2004, was established to capture sales opportunities from the mortgage and commercial divisions’ lending activities. The title division’s primary activities include researching and issuing title policies on mortgage and commercial loans. The increase in revenues during 2007 was the result of the increase in loan activity.

Investment broker revenues totaled $663,000 for the year ended September 30, 2007 compared to $598,000 in fiscal 2006. The investment division’s activities consist primarily of brokering bonds to other community banks, municipalities and high net worth individuals. The volatile interest rate market has greatly impacted the division’s ability to sell bonds.

Insurance commissionsdecreased to $38,000 for the year ended September 30, 2007 compared to $216,000 for the year ended September 30, 2006. Insurance commissions stem primarily from revenue received for brokering annuity sales for insurance companies. Since these products often compete directly with the Company’s deposit products, these activities were significantly scaled back during fiscal 2007.

Bank-owned life insurance incomeincreased $169,000 to $1.0 million for the year ended September 30, 2007 from $847,000 for the year ended September 30, 2006, primarily as the result of a full year of income earned in 2007 on $6.5 million of additional policies purchased during February and March of 2006.

Other income increased $106,000 to $697,000 for the year ended September 30, 2007 from $591,000 for the year ended September 30, 2006. The increase resulted primarily from increased fee income from checks drawn on our correspondent bank’s checking account, receipt of a litigation settlement totaling $53,000, net of expenses, and increased rental income collected from tenants in one of the Bank’s office buildings.

NON-INTEREST EXPENSE

Total non-interest expense increased $2.8 million, or 13.2%, to $24.4 million for the year ended September 30, 2007 compared to $21.6 million for the year ended September 30, 2006. The ratio of non-interest expense to average assets decreased to 2.38% for fiscal 2007 compared to 2.48% for fiscal 2006 primarily as the result of cost-effective growth in average assets.

Salaries and employee benefits expense increased $1.9 million, or 18.5%, to $12.4 million for the year ended September 30, 2007 from $10.4 million for the year ended September 30, 2006 as the result of additional employees hired to staff the new bank locations and to support increased loan activity. The number of full-time equivalent employees increased from 361 at September 30, 2006 to 421 at September 30, 2007.

- 17 -

Occupancy and equipmentexpense increased $677,000 to $5.8 million for the year ended September 30, 2007 from $5.1 million for the year ended September 30, 2006. The increase in expense was due primarily to the addition of the Richmond Heights location which opened in January 2007.

Advertising expense increased $300,000 to $1.4 million for the year ended September 30, 2007 compared to $1.1 million for the year ended September 30, 2006. The increase resulted from higher television and newspaper advertising during 2007 as we increased our marketing efforts related to the new bank locations and new products.

Gain on derivative instruments increased $781,000 during the year to $586,000 for the year ended September 30, 2007 compared to a loss of $194,000 for the year ended September 30, 2006. During the first quarter of fiscal year 2006, changes in the estimated fair values of these derivatives were recognized as charges or credits to earnings, as appropriate, during the periods in which the changes occurred. Effective January 1, 2006, the Company began using long-haul, fair-value, hedge accounting. The increased gain in 2007 was the result of a shorter duration on the derivative instruments at September 30, 2007 compared to September 30, 2006.

Data processing termination expensetotaled $220,000 for the year ended September 30, 2007 due to the write-off of capitalized expenses related to the termination of a contract to convert the Company’s core data processing system. There was no such expense in the prior fiscal year.

Charitable contributionsdecreased $250,000 during the year to $123,000 for the year ended September 30, 2007 compared to $373,000 for the year ended September 30, 2006 due primarily to the non-recurrence of a $250,000 charitable contribution to a St. Louis community-based not-for-profit organization in February 2006.

Other non-interest expense increased $347,000, or 18%, to $2.3 million for the year ended September 30, 2007 compared to $1.9 million for the year ended September 30, 2006. The increase was primarily due to a $156,000 increase in telephone expense and a $106,000 increase in expense from the amortization of the core deposit premium. Telephone expense increased as the result of new systems required to support the new bank locations. The core deposit premium relates to the deposits acquired in connection with the acquisition of Central West End Bank in March 2006. Fiscal 2007 includes a full year of amortization expense while fiscal 2006 included only the six months following the acquisition.

INCOME TAXES

The provision for income taxes decreased from $5.4 million for the year ended September 30, 2006 to $4.5 million for the year ended September 30, 2007. The effective tax rate was 33.4% in 2007 compared to 35.5% in 2006. The lower effective tax rate in 2007 was primarily the result of an increase in BOLI income, which is non-taxable.

FINANCIAL CONDITION

Cash and cash equivalents increased $1.6 million to $23.7 million at September 30, 2007 from $22.1 million at September 30, 2006. Cash balances included overnight investments in federal funds of $3.2 million at September 30, 2007 compared to $3.0 million at September 30, 2006. These funds are generally used to fund the Company’s daily liquidity needs. The primary sources of cash are increases in deposits and borrowings from the FHLB.

Debt securities held to maturity decreased $6.9 million during the year to $6.0 million at September 30, 2007 from $12.9 million at September 30, 2006 whiledebt securities available for sale increased $7.0 million during fiscal 2007. Debt securities are generally held to provide sufficient collateral for certain large deposit relationships. During 2007, maturing debt securities held to maturity were replaced with debt securities held for sale.

- 18 -

Federal Home Loan Bank (of Des Moines) stock decreased approximately $1.2 million to $8.3 million at September 30, 2007 from $9.5 million at September 30, 2006, in response to the decrease in borrowings. The Bank is generally required to hold stock equal to 5% of its total FHLB borrowings.

Loans held for sale declined $1.9 million to $58.5 million at September 30, 2007 from $60.5 million at September 30, 2006. These balances represent loans closed in the name of the Bank, which are committed in advance of closing to be sold to investors. Since these loans are pre-sold, primarily at a pre-determined price on a best-efforts basis, they are not subject to changes in value as a result of changes in market interest rates. We typically receive proceeds from the sale of these loans to investors within 30 days of loan closing and benefit from interest income while awaiting sales delivery.

Premises and equipment increased $2.2 million to $20.4 million at September 30, 2007 from $18.2 million at September 30, 2006 mainly due to the expenditures for the new bank locations.

Bank-owned life insurance increased $1.0 million to $25.0 million at September 30, 2007 from $24.0 million at September 30, 2006. The increase was attributable to appreciation of the cash surrender values of existing policies. Increases in cash surrender values are treated as other income and are tax-exempt. If the cash surrender values of the policies are liquidated, the gains would retroactively be taxed.

Other assets increased $3.0 million to $6.4 million at September 30, 2007 from $3.4 million at September 30, 2006 mainly due to a $2 million investment in the St. Louis Equity Fund during fiscal 2007 and a $990,000 increase in accounts receivable from another financial institution which settled on the following day.

Federal Home Loan Bank (of Des Moines) advancesdecreased $14.4 million to $158.4 million at September 30, 2007 compared to $172.8 million at September 30, 2006. The decrease in borrowings was due to the strong growth in deposits of $179.9 million, which primarily funded the growth in loans of $164.6 million.

Due to other banks decreased $4.6 million to $17.5 million at September 30, 2007 from $22.1 million at September 30, 2006. Due to other banks represents unremitted payments for bank and cashier checks issued by the Bank. The decrease represents a decrease in check activity on the final day of the fiscal year end. In the normal course of business, settlement for amounts due to other banks is made on the following business day.

Total stockholders’ equity increased $5.0 million to $80.8 million at September 30, 2007 from $75.8 million at September 30, 2006. The increase was due primarily to growth in retained earnings driven by net income of $9.0 million, partially offset by regular cash dividends paid of $3.5 million, the repurchase of 97,337 shares of the Company’s common stock at a total cost of $1.4 million and the purchase of 88,188 shares of the Company’s common stock to fund the equity trust plan at a cost of $1.2 million.

COMPARISONOF OPERATING RESULTSFROM 2006AND 2005

OVERVIEW

Net income for the year ended September 30, 2006 increased 32% to $9.8 million, or $1.01 per diluted share, compared to $7.5 million, or $0.85 per diluted share, for the year ended September 30, 2005. In February 2006, the Company benefited from a $2.5 million gain on the sale of a branch location, resulting in an after-tax gain of approximately $1.5 million, or $0.16 per diluted share. Diluted earnings per share for the year ended September 30, 2006 were reduced due to a 1.2 million increase in the number of shares outstanding resulting from stock issued in a secondary public offering in February 2006 and 210,732 shares issued to acquire CWE Bancorp, Inc. on March 31, 2006. Return on average assets and return on average equity were 1.14% and 14.98%, respectively, during 2006 compared to 1.06% and 16.37%, respectively, during 2005.

The Company completed the purchase of CWE Bancorp, Inc., and its wholly-owned subsidiary, Central West End Bank (“CWE”), on March 31, 2006. The aggregate purchase price was $7.3 million, including $3.6 million of cash and 210,732 shares of the Company’s common stock. The purchase added two full- service banking locations in the Central West End neighborhood of St. Louis with deposits totaling $41.4 million and total assets of $50.3 million. The Company’s total assets at September 30, 2006 were $962.5 million compared to $789.9 million at September 30, 2005.

- 19 -

NET INTEREST INCOME

Net interest income increased $3.8 million to $24.8 million in fiscal 2006 compared to $21.1 million in fiscal 2005 due to an increase in net interest-earning assets partially offset by a decline in the net interest margin. The average balance of interest-earning assets increased $133.3 million to $795.5 million during fiscal year 2006, compared to $662.2 million for fiscal year 2005 due primarily to loan growth. The net interest margin declined 6 basis points to 3.12% in fiscal 2006 from 3.18% in fiscal 2005, resulting primarily from rising market interest rates which increased the cost of deposits at a faster rate than the rise in the yield on loans. During the year ended September 30, 2006, the average cost of deposits increased 124 basis points to 3.55% compared to a 108 basis point increase in the yield on loans to 6.93%. The net interest margin was also negatively impacted during 2006 by the narrowing spreads on loans held for sale. The average yield on such loans increased 72 basis points for the year to 6.18% in fiscal 2006 compared to 5.46% in fiscal 2005. Loans held for sale are typically funded by borrowings from the FHLB, the cost of which increased sequentially in conjunction with the federal funds rate increases from 3.32% in fiscal 2005 to 4.63% in fiscal 2006.

Interest income increased $16.1 million to $53.8 million for fiscal 2006 compared to $37.8 million for fiscal 2005. Interest income increased primarily due to a rise in the average balance of loans receivable, which increased $131.9 million to $716.0 million for fiscal 2006, combined with an increase in the average yield on loans to 6.93% in fiscal 2006 from 5.85% in fiscal 2005 due to higher market interest rates. Loans receivable grew $152.0 million, or 24.0%, during fiscal 2006 to $785.2 million at September 30, 2006. Commercial lending fueled 56% of the growth in the retained loan portfolio during the year ended September 30, 2006, with the remaining growth coming from residential, home equity and consumer loans.

Excluding loans receivable, the average balance of other interest earning assets increased $1.4 million for fiscal 2006 and had a minimal impact on changes in net interest income.

Interest expense increased $12.3 million to $29.0 million for fiscal 2006 compared to $16.7 million for fiscal 2005 due to changes in both the cost and average balance of interest-bearing liabilities. The average cost of interest-bearing liabilities increased from 2.67% for fiscal year 2005 to 3.90% for the fiscal year 2006 as market interest rates increased in response to rising federal funds rates and increased market competition.

For the year ended September 30, 2006, total deposits increased $159.4 million to $655.6 million, including $41.4 million in deposits acquired through the purchase of Central West End Bank. The average cost of deposits increased to 3.55% in fiscal 2006 from 2.31% in 2005 primarily as the result of rising market interest rates. In addition to the deposits acquired in the Central West End Bank purchase, the Bank saw strong, well-balanced growth in money market, checking account and certificate of deposit products from both commercial and retail depositors. At September 30, 2006, the weighted average cost of interest-bearing checking accounts was 1.66% and totaled $53.4 million. Brokered deposits declined $356,000 during the year from $118.9 million at September 30, 2005 to $118.5 million at September 30, 2006. The deposit growth was used primarily to support loan growth.

Interest expense on FHLB borrowings increased $2.4 million to $7.8 million for the year ended September 30, 2006 compared to $5.4 million for the year ended September 30, 2005 almost entirely as the result of the market-driven increase in the average cost to 4.63% during 2006 from 3.32% during 2005.

- 20 -

ALLOWANCEFOR LOAN LOSSESAND PROVISION FOR LOSSESON LOANS

The balance of the allowance for loan losses increased $1.0 million to $7.8 million at September 30, 2006 from $6.8 million at September 30, 2005, due primarily to growth in the retained loan portfolio, which increased from $633.2 million at September 30, 2005 to $785.2 million at September 30, 2006. The allowance as a percentage of non-performing loans changed from 112.07% at September 30, 2005 to 115.89% at September 30, 2006.

The provision for loan losses totaled $1.5 million for the year ended September 30, 2006 compared to $1.6 million for the year ended September 30, 2005. The change in the provision for loan losses was affected by increased charge-offs and non-performing assets during the year and a shift in the risk profile of the loan portfolio. For the year ended September 30, 2006, the Bank’s charge-offs totaled 9 basis points of the average balance of loans, or $782,000, compared to 6 basis points of average loans, or $417,000, during the year ended September 30, 2005. The increase in charge-offs was primarily due to the sale of $6.6 million of non-performing loans during 2006, resulting in charge-offs of $378,000.

The risk profile of the Bank’s loan portfolio also shifted during the year. The balance of home equity lines of credit increased from $195.6 million at September 30, 2005 to $207.2 million at September 30, 2006, representing 30% of loans receivable at September 30, 2006 compared to 26% at September 30, 2005. However, within the home equity loan portfolio, the balance of high loan-to-value home equity loans declined from $112.5 million at September 30, 2005 to $65.1 million at September 30, 2006, which resulted in management assigning reduced risk ratings on the remaining home equity loan portfolio and, therefore, a lower provision for losses during 2006. The decline in this higher-risk product was market-driven by consumers seeking lower interest rates on their prime-adjusting home equity loans as market interest rates increased. In fiscal 2006, we saw a general migration to fixed-rate, amortizing loan products and fewer cash-out refinancings using lines of credit. Other changes in the loan portfolio included an increase in the balance of commercial real estate and other commercial loans from $140.6 million at September 30, 2005 to $219.9 million at September 30, 2006, representing 28% of gross loans receivable at September 30, 2006 compared to 22% at September 30, 2005. In addition, the balance of permanent one-to-four family residential loans increased from $255.7 million at September 30, 2005 to $314.7 million at September 30, 2006, representing 39% of gross loans receivable at September 30, 2006 compared to 40% at September 30, 2005.

NON-PERFORMING ASSETSAND DELINQUENCIES

Total non-performing assets increased $3.1 million from $6.8 million at September 30, 2005 to $9.9 million at September 30, 2006, primarily due to a $2.0 million rise in real estate acquired in settlement of loans. Real estate acquired in settlement of loans increased from $754,000 at September 30, 2005 to $2.8 million at September 30, 2006. The increase was caused by the foreclosure on a $1.2 million loan secured by a commercial building, combined with several residential foreclosures. Total non-performing loans increased $1.1 million from $6.0 million at September 30, 2005 to $7.1 million at September 30, 2006 primarily as the result of an increase in non-performing home equity loans from $618,000 at September 30, 2005 to $1.6 million at September 30, 2006. The increase in non-performing home equity loans occurred primarily in the December 2005 and March 2006 quarters following changes in bankruptcy laws and rising market interest rates.

NON-INTEREST INCOME

Total non-interest income increased $2.6 million to $13.5 million for the year ended September 30, 2006 compared to $10.9 million for the year ended September 30, 2005. In February 2006, the Bank sold its Kansas City banking location, resulting in a $2.5 million gain. Excluding this gain, non-interest income increased $169,000, primarily as the result of an $870,000, or 15%, decrease in mortgage revenues caused by lower gross margins on sales of mortgage loans during the year. The decline in the gross margin was the result of the overall decline in industry mortgage production, which created a highly competitive lending environment and resulted in lower fees and gross sales margins throughout the industry. Retail banking fees increased 23% to $3.0 million for the year ended September 30, 2006 compared to $2.5 million in 2005 as the result of additional banking locations and a change in our overdraft policy, which began allowing point-of-purchase overdraft protection.

- 21 -

Title Division Results. Our title division, which began operations in June 2004, was established to capture sales opportunities from the mortgage and commercial divisions’ lending activities. The title division’s primary activities include researching and issuing title policies on mortgage and commercial loans. For the year ended September 30, 2006, the division’s revenues totaled $742,000 compared to $756,000 in 2005.

Investment Division Results. The investment division began operations in the first quarter of fiscal year 2005. For the year ended September 30, 2006, the division’s revenues totaled $598,000 compared to $668,000 in 2005. The flattening of the yield curve and the consistent rise in interest rates greatly impacted the division’s ability to sell bonds. Since July 2006, which was the inflection point in the rise of short-term interest rates, the division experienced increased sales activity resulting in small profits during August and September of 2006.