See accompanying notes to consolidated financial statements.

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

(1) Nature of Business and Summary of Significant Accounting Policies

(a) Nature of Business

References in these financial statement footnotes to “we”, “us”, and “our” refer to the business of Buffalo Wild Wings, Inc. and our subsidiaries. We were organized for the purpose of operating Buffalo Wild Wings® restaurants, as well as selling Buffalo Wild Wings restaurant franchises. In exchange for the initial and continuing franchise fees received, we give franchisees the right to use the name Buffalo Wild Wings. We operate as a single segment for reporting purposes.

At December 28, 2008, December 30, 2007, and December 31, 2006, we operated 197, 161, and 139, Company-owned restaurants, respectively, and had 363, 332, and 290 franchised restaurants, respectively.

(b) Principles of Consolidation

The consolidated financial statements include the accounts of Buffalo Wild Wings, Inc. and its wholly owned subsidiaries (collectively, the Company). All significant intercompany accounts and transactions have been eliminated in consolidation.

(c) Fiscal Year

We utilize a 52- or 53-week accounting period that ends on the last Sunday in December. The fiscal years ended December 28, 2008 and December 30, 2007, comprised 52 weeks. The fiscal year ended December 31, 2006 was a 53-week year with the quarter ended December 31, 2006 comprising fourteen weeks. The 53rd week of fiscal 2006 contributed $5,663 in restaurant sales and $768 in royalties and fees.

(d) Restaurant Sales Concentration

As of December 28, 2008, we operated 25 Company-owned restaurants and had 61 franchised restaurants in the state of Ohio. The Company-owned restaurants in Ohio aggregated 13.8%, 16.3%, and 18.6%, respectively, of our restaurant sales in fiscal 2008, 2007, and 2006. We are subject to adverse trends in that state.

(e) Cash and Cash Equivalents

Cash and cash equivalents include highly liquid investments with original maturities of three months or less.

(f) Marketable Securities

Marketable securities consist of available-for-sale securities and trading securities that are carried at fair value and held-to-maturity securities that are stated at amortized cost, which approximates market.

Available-for-sale securities are classified as current assets based upon our intent and ability to use any and all of the securities as necessary to satisfy the operational requirements of our business. Realized gains and losses from the sale of available-for-sale securities were not material for fiscal 2008, 2007, and 2006. Unrealized losses are charged against net earnings when a decline in fair value is determined to be other than temporary. The available-for-sale investments carry short-term repricing features which generally result in these investments having a value at or near par value (cost).

Trading securities are stated at fair value, with gains or losses resulting from changes in fair value recognized currently in earnings as investment income. In 2006, we funded a deferred compensation plan using trading assets in a marketable equity portfolio. This portfolio is held to generate returns that seek to offset changes in liabilities related to the equity market risk of certain deferred compensation arrangements. These deferred compensation liabilities were $1,505 and $1,579 as of December 28, 2008 and December 30, 2007, respectively, and are included in accrued compensation and benefits in the accompanying consolidated balance sheets.

(g) Accounts Receivable

Accounts receivable – franchisees represents royalty receivables from our franchisees. Accounts receivable – other consists primarily of contractually-determined receivables for leasehold improvements, credit cards, vendor allowances, and

42

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

purchased interest on investments. Cash flows related to accounts receivable are classified in net cash provided by operating activities in the Consolidated Statements of Cash Flows.

(h) Inventories

Inventories are stated at the lower of cost or market. Cost is determined by the first-in, first-out (FIFO) method. Cash flows related in inventory sales are classified in net cash provided by operating activities in the Consolidated Statements of Cash Flows.

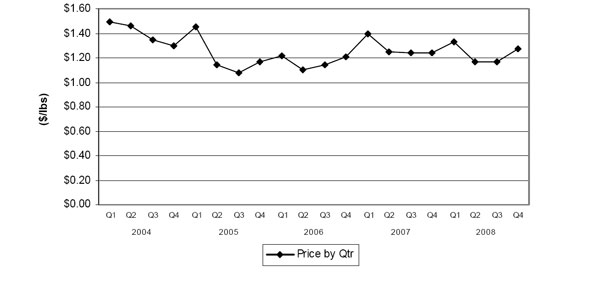

We purchase products from a number of suppliers and believe there are alternative suppliers. We have minimum purchase commitments from some of our vendors but the terms of the contracts and nature of the products are such that purchase requirements do not create a market risk. The primary food product used by Company-owned and franchised restaurants is fresh chicken wings. Fresh chicken wings are purchased by us at market prices. In 2007 and early 2008, we purchased chicken wings based on a contract which fixed 80-90% of our chicken wing purchases at $1.23 per pound. For fiscal 2008, 2007, and 2006, fresh chicken wings were 22%, 24%, and 24% of restaurant cost of sales, respectively.

(i) Property and Equipment

Property and equipment are recorded at cost. Leasehold improvements, which include the cost of improvements funded by landlord incentives or allowances, are amortized using the straight-line method over the lesser of the term of the lease, without consideration of renewal options, or the estimated useful lives of the assets, which typically range from five to ten years. Buildings are depreciated using the straight-line method over the estimated useful life, which ranges from ten to twenty years. Furniture and equipment are depreciated using the straight-line method over the estimated useful lives of the assets, which range from two to eight years. Maintenance and repairs are expensed as incurred. Upon retirement or disposal of assets, the cost and accumulated depreciation are eliminated from the respective accounts and the related gains or losses are credited or charged to earnings.

We review property and equipment, along with other long-lived assets, quarterly to determine if the carrying value of these assets may not be recoverable based on estimated future undiscounted cash flows. Assets are reviewed at the lowest level for which cash flows can be identified, which is the individual restaurant level. In determining future cash flows, significant estimates are made by us with respect to future operating results of each restaurant over its remaining lease term. If such assets are considered impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Fair value is generally determined by estimated discounted future cash flows.

(j) Goodwill and Other Assets

Goodwill represents the excess of cost over the fair value of identified net assets of businesses acquired. Goodwill and indefinite-life purchased liquor licenses are subject to an annual impairment analysis. We identify potential impairments of goodwill by comparing the fair value of a reporting unit, which we define as a geographic market, estimated using an income approach, with its carrying amount, including goodwill. If the fair value of the reporting unit exceeds the carrying amount, the assets are not impaired. If the carrying amount exceeds the fair value, we calculate the possible impairment by comparing the implied fair value of the asset with the carrying amount. If the implied value of the asset is less than the carrying amount, a write-down is recorded. All goodwill was considered recoverable as of December 28, 2008.

Other assets consist primarily of reacquired franchise rights and liquor licenses. Reacquired franchise rights are amortized over the life of the related franchise agreement. We evaluate reacquired franchise rights in conjunction with our impairment evaluation of long-lived assets. Liquor licenses are either amortized over their annual renewal period or, if purchased, are carried at the lower of fair value or cost. We identify potential impairments for liquor licenses by comparing the fair value with its carrying amount. If the fair value exceeds the carrying amount, the liquor licenses are not impaired. If the carrying amount exceeds the fair value, we calculate the possible impairment by comparing the implied fair value of the liquor licenses with the carrying amount. If the implied value of the asset is less than the carrying amount, a write-down is recorded. The carrying amount of the liquor licenses not subject to amortization as of December 28, 2008 and December 30, 2007 was $482 and $414, respectively, and is included in other assets in the accompanying consolidated balance sheets.

43

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

(k) Fair Values of Financial Instruments

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements,” (SFAS No. 157). This statement does not require any new fair value measurements, but rather, it provides enhanced guidance to other pronouncements that require or permit assets or liabilities to be measured at fair value. The changes to current practice resulting from the application of this statement relate to the definition of fair value, the methods used to estimate fair value, and the requirement for expanded disclosures about estimates of fair value. This statement became effective for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. The effective date for this statement for all nonfinancial assets and nonfinancial liabilities, except for items that are recognized or disclosed at fair value in the financial statements on a recurring basis, has been delayed by one year. We adopted the provisions of SFAS No. 157 related to financial assets and financial liabilities on December 31, 2007. The partial adoption of this statement did not have a material impact on our financial statements. It is expected that the remaining provisions of this statement will not have a material effect on our financial statements.

Fair value is defined as the price at which an asset could be exchanged in a current transaction between knowledgeable, willing parties or the amount that would be paid to transfer a liability to a new obligor, not the amount that would be paid to settle the liability with the creditor. Where available, fair value is based on observable market prices or parameters or derived from such prices or parameters. Where observable prices or inputs are not available, valuation models are applied. These valuation techniques involve some level of management estimation and judgment, the degree of which is dependent on the price transparency for the instruments or market and the instruments’ complexity.

Assets recorded at fair value in our consolidated balance sheets are categorized based upon the level of judgment associated with the inputs used to measure their fair value. Hierarchical levels, defined by SFAS No. 157 and directly related to the amount of subjectivity associated with the inputs to fair valuation of these assets and liabilities, are as follows:

| |

| Level 1 – Inputs were unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date. |

| |

| Level 2 – Inputs (other than quoted prices included in Level 1) were either directly or indirectly observable for the asset or liability through correlation with market data at the measurement date and for the duration of the instrument’s anticipated life. |

| |

| Level 3 – Inputs reflected management’s best estimate of what market participants would use in pricing the asset or liability at the measurement date. Consideration was given to the risk inherent in the valuation technique and the risk inherent in the inputs to the model. |

Determining which hierarchical level an asset falls within requires significant judgment. We will evaluate our hierarchy disclosures each quarter. The following table summarizes the financial instruments measured at fair value in our consolidated balance sheet as of December 28, 2008:

| | | | | | | | | | | | | | |

| | | Fair Value Measurements | |

| | | Level 1 | | Level 2 | | Level 3 | | Total | |

| Assets | | | | | | | | | | | | | |

| Short-term investments(1) | | $ | 1,567 | | $ | 17,336 | | $ | — | | $ | 18,903 | |

| | |

| (1) | We classified a portion of our marketable securities as available-for-sale and trading securities which were reported at fair market value, using the “market approach” valuation technique. The “market approach” valuation method used prices and other relevant information observable in market transactions involving identical or comparable assets. Our trading securities are valued using the Level 1 approach. Our available-for-sale marketable securities are valued using the Level 2 approach. |

44

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

SFAS No. 157 requires separate disclosure of assets measured at fair value on a recurring basis, as documented above, from those measured at fair value on a nonrecurring basis. As of December 28, 2008, no assets or liabilities were measured at fair value on a nonrecurring basis.

(l) Asset Retirement Obligations

An asset retirement obligation associated with the retirement of a tangible long-lived asset is recognized as a liability in the period incurred or when it becomes determinable, with an associated increase in the carrying amount of the related long-lived asset. We must recognize a liability for the fair value of a conditional asset retirement obligation when incurred, if the liability’s fair value can be reasonably estimated. Conditional asset retirement obligations are legal obligations to perform asset retirement activities when the timing and/or method of settlement are conditional on a future event or may not be within our control. Asset retirement costs are depreciated over the useful life of the related asset. As of December 28, 2008 and December 30, 2007, we had asset retirement obligations of $211 and $175, respectively.

(m) Revenue Recognition

Franchise agreements have terms ranging from ten to twenty years. These agreements also convey multiple extension terms of five or ten years, depending on contract terms and certain conditions that must be met. We provide the use of the Buffalo Wild Wings trademarks, system, training, preopening assistance, and restaurant operating assistance in exchange for area development fees, franchise fees, and royalties of 5% of a restaurant’s sales.

Franchise fee revenue from individual franchise sales is recognized upon the opening of the franchised restaurant when all material obligations and initial services to be provided by us have been performed. Area development fees are dependent upon the number of restaurants in the territory, as are our obligations under the area development agreement. Consequently, as obligations are met, area development fees are recognized proportionally with expenses incurred with the opening of each new restaurant and any royalty-free periods. Royalties are accrued as earned and are calculated each period based on restaurant sales.

Sales from Company-owned restaurant revenues are recognized as revenue at the point of the delivery of meals and services. All sales taxes are presented on a net basis and are excluded from revenue.

(n) Franchise Operations

We enter into franchise agreements with unrelated third parties to build and operate restaurants using the Buffalo Wild Wings brand within a defined geographical area. We believe that franchising is an effective and efficient means to expand the Buffalo Wild Wings brand. The franchisee is required to operate their restaurants in compliance with their franchise agreement that includes adherence to operating and quality control procedures established by us. We do not provide loans, leases, or guarantees to the franchisee or the franchisee’s employees and vendors. If a franchisee becomes financially distressed, we do not provide any financial assistance. If financial distress leads to a franchisee’s noncompliance with the franchise agreement and we elect to terminate the franchise agreement, we have the right but not the obligation to acquire the assets of the franchisee at fair value as determined by an independent appraiser. We receive a 5% royalty of gross sales as defined in the franchise agreement, and in 2008 allowances directly from the franchisees’ vendors were approximately 0.4% of the franchisees’ gross sales. We have financial exposure for the collection of the royalty payments. Franchisees generally remit franchise payments weekly for the prior week’s sales, which substantially minimizes our financial exposure. Historically, we have experienced insignificant write-offs of franchisee royalties. Franchise and area development fees are paid upon the signing of the related agreements.

(o) Advertising Costs

Advertising costs for Company-owned restaurants are expensed as incurred and aggregated $13,503, $10,548, and $9,055, in fiscal years 2008, 2007, and 2006, respectively. Our advertising costs exclude amounts collected from franchisees as part of the system-wide marketing and advertising fund.

(p) Preopening Costs

Costs associated with the opening of new Company-owned restaurants are expensed as incurred.

45

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

(q) Payments Received from Vendors

Vendor allowances include allowances and other funds received from vendors. Certain of these funds are determined based on various quantitative contract terms. We also receive vendor allowances from certain manufacturers and distributors calculated based upon purchases made by franchisees. Amounts that represent a reimbursement of costs incurred, such as advertising, are recorded as a reduction of the related expense. Amounts that represent a reduction of inventory purchase costs are recorded as a reduction of inventoriable costs. We recorded an estimate of earned vendor allowances that are calculated based upon monthly purchases. We generally receive payment from vendors approximately 30 days from the end of a month for that month’s purchases. During fiscal 2008, 2007, and 2006, vendor allowances were recorded as a reduction in inventoriable costs, and cost of sales was reduced by $5,192, $4,636, and $4,246, respectively.

(r) National Advertising Fund

We have a system-wide marketing and advertising fund. Company-owned and franchised restaurants are required to remit a designated portion of restaurant sales, to a separate advertising fund that is used for marketing and advertising efforts throughout the system. That amount was 3% of restaurant sales in all years presented. Certain payments received from various vendors are deposited into the National Advertising Fund. These funds are used for development and implementation of system-wide initiatives and programs. We account for cash and receivables of these funds as “restricted cash” with an offsetting “marketing fund payables” on our accompanying consolidated balance sheet.

(s) Earnings Per Common Share

Basic earnings per common share excludes dilution and is computed by dividing the net earnings available to common stockholders by the weighted average number of common shares outstanding during the period. Diluted earnings per common share include dilutive common stock equivalents consisting of stock options determined by the treasury stock method. Restricted stock units are contingently issuable shares subject to vesting based on performance criteria. Vesting typically occurs in the fourth quarter of the year when income targets have been met. Upon vesting, the shares to be issued are included in the diluted earnings per share calculation as of the beginning of the period in which the vesting conditions are satisfied. Restricted stock units included in the diluted earnings per share are net of the required employee withholding taxes.

(t) Income Taxes

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the balance sheet carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. A valuation allowance is recorded to reduce the carrying amounts of deferred tax assets unless it is more likely than not that such assets will be realized.

(u) Deferred Lease Credits

Deferred lease credits consist of reimbursement of costs of leasehold improvements from our lessors. These reimbursements are amortized on a straight-line basis over the term of the applicable lease, without consideration of renewal options. In addition, this account includes adjustments to recognize rent expense on a straight-line basis over the term of the lease commencing at the start of our construction period for the restaurant, without consideration of renewal options, unless renewals are reasonably assured because failure to renew would result in an economic penalty.

Leases typically have an initial lease term of between 10 to 15 years and contain renewal options under which we may extend the terms for periods of three to five years. Certain leases contain rent escalation clauses that require higher rental payments in later years. Leases may also contain rent holidays, or free rent periods, during the lease term. Rent expense is recognized on a straight-line basis over the initial lease term.

(v) Accounting Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of

46

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

(w) Stock-Based Compensation

We maintain a stock equity incentive plan under which we may grant non-qualified stock options, incentive stock options, and restricted stock units to employees, non-employee directors and consultants. We also have an employee stock purchase plan (“ESPP”).

Effective December 26, 2005, we adopted the fair value recognition provisions of SFAS 123R, using the modified-prospective transition method. Under this transition method, stock-based compensation expense is recognized in the consolidated financial statements for granted, modified, or settled stock options and for expense related to the ESPP, since the related purchase discounts exceeded the amount allowed under SFAS 123R for non-compensatory treatment. Compensation expense recognized includes the estimated expense for the portion of stock options vesting in the period for options granted prior to, but not vested as of December 26, 2005, based on the grant date fair value estimated prior to the adoption of SFAS 123R. Restricted stock units vesting upon the achievement of certain performance targets are expensed based on the fair value on the date of grant.

Total stock-based compensation expense recognized in the consolidated statement of earnings for fiscal year 2008 was $4,900 before income taxes and consisted of restricted stock, stock options, and employee stock purchase plan (ESPP) expense of $4,510, $138 and $252, respectively. The related total tax benefit was $615 during 2008. All stock-based compensation is recognized as general and administrative expense.

Total stock-based compensation expense recognized in the consolidated statement of earnings for fiscal year 2007 was $3,755 before income taxes and consisted of restricted stock, stock options, and employee stock purchase plan (ESPP) expense of $3,538, $37 and $180, respectively. The related total tax benefit was $1,007 during 2007.

Total stock-based compensation expense recognized in the consolidated statement of earnings for fiscal year 2006 was $3,216 before income taxes and consisted of restricted stock, stock options, and employee stock purchase plan (ESPP) expense of $3,000, $82 and $134, respectively. The related total tax benefit was $1,153 during 2006.

The fair value of each option grant is estimated on the date of grant using the Black-Scholes-Merton (“BSM”) option valuation model with the following assumptions:

| | | | | | | | | | |

| | Stock Options | |

| | December 28,

2008 | | December 30,

2007* | | December 31,

2006* | |

Expected dividend yield | | | 0.0% | | | N/A | | | N/A | |

Expected stock price volatility | | | 45.6% | | | N/A | | | N/A | |

Risk-free interest rate | | | 2.8% | | | N/A | | | N/A | |

Expected life of options | | | 5 years | | | N/A | | | N/A | |

| | | | | | | | | | |

| | Employee Stock Purchase Plan | |

| | December 28,

2008 | | December 30,

2007 | | December 31,

2006 | |

Expected dividend yield | | | 0.0% | | | 0.0% | | | 0.0% | |

Expected stock price volatility | | | 46.7-55.7% | | | 41.4 – 44.4% | | | 39.2 – 41.4% | |

Risk-free interest rate | | | 0.81-1.86% | | | 3.6 – 4.9% | | | 4.3 – 5.2% | |

Expected life of options | | | 0.5 years | | | 0.5 years | | | 0.5 years | |

* No stock options were granted in 2007 or 2006.

47

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

The expected term of the options represents the estimated period of time until exercise and is based on historical experience of similar awards, giving consideration to the contractual terms, vesting schedules and expectations of future employee behavior. Expected stock price volatility is based on historical volatility of our stock. The risk-free interest rate is based on the implied yield available on U.S. Treasury zero-coupon issues with an equivalent remaining term. We have not paid dividends in the past.

(x) New Accounting Pronouncements

In December 2007, the FASB issued SFAS No. 141R, “Business Combinations” (“SFAS 141R”). SFAS 141R provides companies with principles and requirements on how an acquirer recognizes and measures in its financial statements the identifiable assets acquired, liabilities assumed, and any noncontrolling interest in the acquiree as well as the recognition and measurement of goodwill acquired in a business combination. SFAS 141R also requires certain disclosures to enable users of the financial statements to evaluate the nature and financial effects of the business combination. Acquisition costs associated with the business combination will generally be expensed as incurred. SFAS 141R is effective for business combinations occurring in fiscal years beginning after December 15, 2008. Early adoption of SFAS 141R is not permitted. We will be required to apply the guidance in SFAS 141R to any future business combinations.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities – an amendment of FASB Statement No. 133” (“SFAS 161”), which requires enhanced disclosures about an entity’s derivative and hedging activities. SFAS 161 is effective for fiscal years beginning after December 15, 2008, and interim period within those fiscal years. We believe the adoption of SFAS 161 will not have a significant impact on our financial statements.

(y) Revised Shares Outstanding

We have revised, for all periods presented, the amount of common stock outstanding. Unvested restricted stock units were previously included on both the Consolidated Balance Sheets and the Consolidated Statements of Stockholders’ Equity. These amounts have been revised and are properly excluded from the amounts shown. This revision did not affect earnings per share or the weighted average shares outstanding.

The previously reported and revised amounts for common stock outstanding are as follows:

| | | | | | | |

As of | | Previously Reported | | As Revised | |

December 25, 2005 | | | 17,232,444 | | | 16,979,900 | |

December 31, 2006 | | | 17,591,180 | | | 17,268,016 | |

December 30, 2007 | | | 17,933,497 | | | 17,657,020 | |

(2) Marketable Securities

Marketable securities were comprised as follows:

| | | | | | | | |

| | | December 28,

2008 | | December 30,

2007 | |

| Held-to-maturity | | | | | | | |

| Municipal securities | | $ | 17,254 | | $ | 23,718 | |

| Available-for-sale | | | | | | | |

| Municipal securities | | | 17,336 | | | 41,206 | |

| Trading | | | | | | | |

| Mutual funds | | | 1,567 | | | 1,589 | |

| Total | | $ | 36,157 | | $ | 66,513 | |

Purchases of available for-sale securities totaled $91,044 and sales totaled $113,684 in 2008. Purchases of held-to-maturity securities totaled $25,215 and proceeds from maturities totaled $32,908 in 2008. All held-to-maturity debt securities mature within one year and had an aggregate fair value of $17,278 at December 28, 2008.

48

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

Purchases of available for-sale securities totaled $132,346 and sales totaled $109,181 in 2007. Purchases of held-to-maturity securities totaled $25,824 and proceeds from maturities totaled $35,661 in 2007. All held-to-maturity debt securities mature within one year and had an aggregate fair value of $23,753 at December 30, 2007.

Purchases of available for-sale securities totaled $71,585 and sales totaled $87,205 in 2006. Purchases of held-to-maturity securities totaled $36,743 and proceeds from maturities totaled $18,054 in 2006. All held-to-maturity debt securities mature within one year and had an aggregate fair value of $33,512 at December 31, 2006.

Trading securities represent investments held for future needs of a non-qualified deferred compensation plan.

The fair value of available-for-sale investments in debt securities by contractual maturities at December 28, 2008, was as follows:

| | | | |

Maturity date | | Fair Value | |

1-5 years | | $ | 600 | |

5-10 years | | | 3,069 | |

After 10 years | | | 13,667 | |

Total | | $ | 17,336 | |

(3) Property and Equipment

Property and equipment consisted of the following:

| | | | | | | |

| | December 28,

2008 | | December 30,

2007 | |

Construction in process | | $ | 10,703 | | $ | 1,851 | |

Buildings | | | 6,639 | | | 1,601 | |

Furniture, fixtures, and equipment | | | 95,460 | | | 69,962 | |

Leasehold improvements | | | 122,796 | | | 96,315 | |

| | | 235,598 | | | 169,729 | |

Less accumulated depreciation | | | (81,166 | ) | | (66,987 | ) |

| | $ | 154,432 | | $ | 102,742 | |

(4) Goodwill and Other Intangible Assets

Goodwill is summarized below:

| | | | | | | |

| | December 28,

2008 | | December 30,

2007 | |

Beginning of year | | $ | 369 | | $ | 369 | |

Goodwill acquired | | | 10,603 | | | — | |

End of year | | $ | 10,972 | | $ | 369 | |

Goodwill acquired during 2008 related to the acquisition of our nine franchised restaurants in Nevada. Goodwill is not subject to amortization but is fully deductible for tax purposes.

49

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

Reacquired franchise rights were acquired during 2008 in connection with the acquisition of nine franchised restaurants in Nevada and are included in other assets in the accompanying consolidated balance sheets. As of December 28, 2008, reacquired franchise rights were as follows:

| | | | |

| | December 28,

2008 | |

Reacquired franchise rights | | $ | 7,040 | |

Accumulated amortization | | | (207 | ) |

| | $ | 6,833 | |

Amortization expense related to reacquired franchise rights for 2008 was $207. The weighted average amortization period is 19 years. Estimated future amortization expense as of December 28, 2008 is as follows:

| | | | |

Fiscal year ending: | | | | |

2009 | | $ | 612 | |

2010 | | | 614 | |

2011 | | | 605 | |

2012 | | | 579 | |

2013 | | | 535 | |

Thereafter | | | 3,888 | |

Total future amortization expense | | $ | 6,833 | |

(5) Lease Commitments

We lease all of our restaurants and corporate offices under operating leases that have various expiration dates. In addition to base rents, leases typically require us to pay our share of maintenance and real estate taxes and certain leases include provisions for contingent rentals based upon sales.

Future minimum rental payments due under noncancelable operating leases for existing restaurants and commitments for restaurants under development as of December 28, 2008 were as follows:

| | | | | | | |

| | Operating

leases | | Restaurants

under

development | |

Fiscal year ending: | | | | | | | |

2009 | | $ | 24,276 | | $ | 1,985 | |

2010 | | | 23,497 | | | 2,917 | |

2011 | | | 22,574 | | | 3,029 | |

2012 | | | 21,675 | | | 3,031 | |

2013 | | | 20,194 | | | 3,031 | |

Thereafter | | | 91,396 | | | 30,419 | |

Total future minimum lease payments | | $ | 203,612 | | $ | 44,412 | |

50

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

In 2008, 2007, and 2006, we rented office space under operating leases which, in addition to the minimum lease payments, require payment of a proportionate share of the real estate taxes and building operating expenses. We also rent restaurant space under operating leases, some of which, in addition to the minimum lease payments and proportionate share of real estate and operating expenses, require payment of percentage rents based upon sales levels. Rent expense, excluding our proportionate share of real estate taxes and building operating expenses, was as follows:

| | | | | | | | | | |

| | Fiscal Years Ended | |

| | December 28,

2008 | | December 30,

2007 | | December 31,

2006 | |

Minimum rents | | $ | 21,714 | | $ | 16,729 | | $ | 14,600 | |

Percentage rents | | | 308 | | | 250 | | | 238 | |

Total | | $ | 22,022 | | $ | 16,979 | | $ | 14,838 | |

Equipment and auto leases | | $ | 356 | | $ | 359 | | $ | 273 | |

(6) Derivative Instruments

We use commodities derivatives to manage our exposure to commodity price fluctuations. During fiscal 2008, we entered into options and future contracts to reduce our risk of natural gas price fluctuations. These derivatives do not qualify for hedge accounting and changes in fair value are included in current net income. These changes are classified as a component of restaurant operating expenses. Net losses of $592 and $25 were recognized in fiscal 2008 and 2007, respectively. As of December 28, 2008, the maximum length of time over which we are hedging our exposure to the variability in future cash flows related to the purchase of natural gas is ten months.

(7) Income Taxes

We file a consolidated return in the United States Federal jurisdiction and in many state jurisdictions. The Internal Revenue Service completed their examination of our 2005 U.S. Federal Income Tax Return in 2008. No proposed changes were made. With few exceptions, we are no longer subject to state income tax examinations for years before 2004. We do not anticipate that total unrecognized tax benefits will significantly change due to the settlement of audits and the expiration of statutes of limitations prior to December 27, 2009. The provision for income taxes consisted of the following:

| | | | | | | | | | |

| | Fiscal Years Ended | |

| | December 28,

2008 | | December 30,

2007 | | December 31,

2006 | |

Current: | | | | | | | | | | |

Federal | | $ | 4,082 | | $ | 8,320 | | $ | 8,801 | |

State | | | 1,525 | | | 1,438 | | | 992 | |

Deferred: | | | | | | | | | | |

Federal | | | 6,125 | | | (869 | ) | | (1,705 | ) |

State | | | 197 | | | (25 | ) | | (523 | ) |

Total income tax expense | | $ | 11,929 | | $ | 8,864 | | $ | 7,565 | |

51

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

A reconciliation of the expected federal income taxes (benefits) at the statutory rate of 35% to the actual provision for income taxes is as follows:

| | | | | | | | | | |

| | Fiscal Years Ended | |

| | December 28,

2008 | | December 30,

2007 | | December 31,

2006 | |

Expected federal income tax expense | | $ | 12,728 | | $ | 9,981 | | | 8,343 | |

State income tax expense, net of federal effect | | | 1,119 | | | 919 | | | 305 | |

Nondeductible expenses | | | 116 | | | 144 | | | 115 | |

Tax exempt income | | | (430 | ) | | (824 | ) | | (602 | ) |

General business credits | | | (1,752 | ) | | (1,121 | ) | | (772 | ) |

Other, net | | | 148 | | | (235 | ) | | 176 | |

Total income tax expense | | $ | 11,929 | | $ | 8,864 | | | 7,565 | |

Deferred tax assets and liabilities are classified as current and noncurrent on the basis of the classification of the related asset or liability for financial reporting. Deferred income taxes are provided for temporary differences between the basis of assets and liabilities for financial reporting purposes and income tax purposes. Temporary differences comprising the net deferred tax assets and liabilities on the balance sheets are as follows:

| | | | | | | |

| | Fiscal Years Ended | |

| | December 28,

2008 | | December 30,

2007 | |

Deferred tax assets: | | | | | | | |

Unearned franchise fees | | $ | 974 | | $ | 880 | |

Accrued vacation | | | 314 | | | 264 | |

Accrued compensation | | | 715 | | | 600 | |

Deferred lease credits | | | 1,716 | | | 1,262 | |

Restricted stock units | | | 404 | | | — | |

Other | | | 472 | | | 484 | |

| | $ | 4,595 | | $ | 3,490 | |

| | | | | | | |

Deferred tax liability: | | | | | | | |

Depreciation | | $ | 11,780 | | $ | 4,353 | |

Total | | $ | 11,780 | | $ | 4,353 | |

We adopted the provisions of FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (FIN 48), on January 1, 2007 and upon adoption did not need to recognize an adjustment in the previously recorded liability for unrecognized income tax benefits. A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

| | | | |

Balance at December 30, 2007 | | $ | 241 | |

Additions based on tax positions related to the current year | | | 133 | |

Additions for tax positions of prior years | | | 68 | |

Balance at December 28, 2008 | | $ | 442 | |

We recognize potential accrued interest and penalties related to unrecognized tax benefits in income tax expense. During 2008, interest and penalties of $26 were included in income tax expense. Interest and penalties related to unrecognized tax benefits totaled $88 at December 30, 2007 and $114 at December 28, 2008. Included in the balance at December 30, 2007 and December 28, 2008, are unrecognized tax benefits of $157 and $287, respectively, which if recognized, would affect the annual effective tax rate. The difference between these amounts and the amount reflected in the reconciliation above relates to the deferred U.S. federal income tax benefit on unrecognized tax benefits related to U.S. state income taxes.

52

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

(8) Stockholders’ Equity

(a) Stock Options

We have 3.9 million shares of common stock reserved for issuance under the Equity Incentive Plan (the plan) for employees, officers, and directors. The option price for shares issued under this plan is to be not less than the fair market value on the date of grant with respect to incentive stock options, or 85% of fair market value for nonqualified stock options. Incentive stock options become exercisable in four equal installments from the date of the grant and have a contractual life of seven to ten years. Nonqualified stock options issued pursuant to the plan are all fully vested and have a contractual life of ten years. Incentive stock options may be granted under this plan until May 15, 2018. We issue new shares of common stock upon exercise of stock options. In 2008, our shareholders approved amendments to the plan which extended the plan to 2018. Option activity is summarized for the year ended December 28, 2008 as follows:

| | | | | | | | | | | | | |

| | Number

of shares | | Weighted

average

exercise price | | Average

remaining

contractual

life (years) | | Aggregate

Intrinsic Value | |

Outstanding, December 30, 2007 | | | 176,603 | | $ | 5.61 | | | 3.9 | | $ | 3,096 | |

| | | | | | | | | | | | | |

Granted | | | 58,272 | | | 24.96 | | | | | | | |

Exercised | | | (77,735 | ) | | 4.15 | | | | | | | |

Cancelled | | | (10,592 | ) | | 10.68 | | | | | | | |

Outstanding, December 28, 2008 | | | 146,548 | | $ | 13.71 | | | 4.5 | | $ | 1,627 | |

Exercisable, December 28, 2008 | | | 89,605 | | | 6.60 | | | 3.5 | | | 1,623 | |

The aggregate intrinsic value in the table above is before applicable income taxes, based on our closing stock price of $24.72 as of the last business day of the year ended December 28, 2008, which would have been received by the optionees had all options been exercised on that date. As of December 28, 2008, total unrecognized stock-based compensation expense related to nonvested stock options was approximately $443, which is expected to be recognized over a weighted average period of approximately 1.5 years. During 2008, 2007, and 2006, the total intrinsic value of stock options exercised was $1,567, $5,978, and $2,707, respectively. During 2008, 2007, and 2006, the total fair value of options vested was $33, $201, and $587, respectively. During 2008, the weighted average grant date fair value of options granted was $10.77. No options were granted during 2007 or 2006.

The following table summarizes our stock options outstanding at December 28, 2008:

| | | | | | | | | | | | | | | | | | | |

| | | | | Options outstanding | | Options exercisable | |

Range | | Shares | | Average

remaining

contractual

life (years) | | Weighted

average

exercise

price | | Shares | | Weighted

average

exercise

price | |

$ | 1.95 | – | 5.63 | | | 56,165 | | | 2.8 | | $ | 4.48 | | | 56,165 | | $ | 4.48 | |

| 6.38 | – | 14.13 | | | 32,165 | | | 4.7 | | | 9.88 | | | 32,165 | | | 9.88 | |

| | | 17.41 | | | 1,750 | | | 6.0 | | | 17.41 | | | 1,275 | | | 17.41 | |

| | | 24.96 | | | 56,468 | | | 6.0 | | | 24.96 | | | — | | | — | |

| | | | | | 146,548 | | | 4.5 | | | 13.71 | | | 89,605 | | | 6.60 | |

The plan has 1,338,869 shares available for grant as of December 28, 2008.

53

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

(b) Restricted Stock Units

We adopted a stock performance plan in June 2004, under which restricted stock units are granted annually at the discretion of the Board of Directors. For restricted stock units granted prior to 2008, units vest annually upon achieving performance targets. The performance targets for these restricted stock units are annual income targets set by our Board of Directors at the beginning of the year. We record compensation expense for these restricted stock units if vesting is expected, based on the achievement of the performance targets. These restricted stock units may vest one-third annually over a ten-year period as determined by meeting performance targets. However, the second one-third of the restricted stock units is not subject to vesting until the first one-third has vested and the final one-third is not subject to vesting until the first two-thirds of the award have vested.

In 2008, we granted restricted stock units subject to cumulative one-year, two-year, and three-year net earnings targets. The number of units that vest each year is based on performance against those cumulative targets. These restricted stock units are subject to forfeiture if they have not vested at the end of the three-year period. Stock-based compensation is recognized for the expected number of units vesting at the end of each annual period. Restricted stock units expected to vest at the end of the first year are fully expensed in the first year. Restricted stock units expected to vest at the end of the second year are expensed during the first and second years. Restricted stock units expected to vest at the end of the third year are expensed over all three years. Therefore, the largest portion of stock-based compensation relating to each grant is recognized in the first year of the grant.

Restricted stock units meeting the performance criteria will vest as of the end of our fiscal year. The distribution of vested restricted stock units as common stock typically occurs in March of the following year. The common stock is issued to participants net of the number of shares needed for the required employee withholding taxes. We issue new shares of common stock upon the disbursement of restricted stock units. Restricted stock units are contingently issuable shares, and the activity for fiscal 2008 is as follows:

| | | | | | | |

| | Number

of shares | | Weighted

average

grant date

fair value | |

| | | | | |

Outstanding, December 30, 2007 | | | 140,692 | | $ | 20.92 | |

| | | | | | | |

Granted | | | 329,688 | | | 20.42 | |

Vested | | | (163,109 | ) | | 21.08 | |

Cancelled | | | (22,426 | ) | | 21.70 | |

| | | | | | | |

Outstanding, December 28, 2008 | | | 284,845 | | $ | 20.19 | |

As of December 28, 2008, the total stock-based compensation expense related to nonvested awards not yet recognized was $2,901, which is expected to be recognized over a weighted average period of 1.2 years. During fiscal year 2007, the total fair value of shares vested was $3,139. The weighted average grant date fair value of restricted stock units granted during 2007 and 2006 was $24.88 and $16.99, respectively. During 2008, we recognized $4,510 of stock-based expense related to restricted stock units.

(c) Employee Stock Purchase Plan

We have reserved 600,000 shares of common stock for issuance under the Employee Stock Purchase Plan (“ESPP”). The ESPP is available to substantially all employees subject to employment eligibility requirements. Participants may purchase our common stock at 85% of the beginning or ending closing price, whichever is lower, for each six-month period ending in May and November. During 2008, 2007, and 2006, we issued 43,948, 30,791, and 36,804 shares, respectively, of common stock under the ESPP and have 389,075 shares available for future sale.

54

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

(9) Earnings Per Common Share

The following is a reconciliation of basic and fully diluted earnings per common share for fiscal 2008, 2007, and 2006:

| | | | | | | | | | |

| | Fiscal year ended December 28, 2008 | |

| | | |

| | Earnings

(numerator) | | Shares

(denominator) | | Per-share

amount | |

| | | | | | | |

Net earnings | | $ | 24,435 | | | | | | | |

| | | | | | | | | | |

Earnings per common share | | | 24,435 | | | 17,813,200 | | $ | 1.37 | |

Effect of dilutive securities – stock options | | | — | | | 95,351 | | | | |

Effect of dilutive securities – restricted stock units | | | — | | | 86,975 | | | | |

| | | | | | | | | | |

Earnings per common share—assuming dilution | | $ | 24,435 | | | 17,995,526 | | $ | 1.36 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | Fiscal year ended December 30, 2007 | |

| | | |

| | Earnings

(numerator) | | Shares

(denominator) | | Per-share

amount | |

| | | | | | | |

Net earnings | | $ | 19,654 | | | | | | | |

| | | | | | | | | | |

Earnings per common share | | | 19,654 | | | 17,553,998 | | $ | 1.12 | |

Effect of dilutive securities – stock options | | | — | | | 189,238 | | | | |

Effect of dilutive securities – restricted stock units | | | — | | | 89,587 | | | | |

| | | | | | | | | | |

Earnings per common share—assuming dilution | | $ | 19,654 | | | 17,832,825 | | $ | 1.10 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | Fiscal year ended December 31, 2006 | |

| | | |

| | Earnings

(numerator) | | Shares

(denominator) | | Per-share

amount | |

| | | | | | | |

Net earnings | | $ | 16,273 | | | | | | | |

| | | | | | | | | | |

Earnings per common share | | | 16,273 | | | 17,156,656 | | $ | 0.95 | |

Effect of dilutive securities – stock options | | | — | | | 369,748 | | | | |

Effect of dilutive securities – restricted stock units | | | — | | | 102,270 | | | | |

| | | | | | | | | | |

Earnings per common share—assuming dilution | | $ | 16,273 | | | 17,628,674 | | $ | 0.92 | |

| | | | | | | | | | |

The following is a summary of those securities outstanding at the end of the respective periods, which have been excluded from the fully diluted calculations because the effect on net earnings per common share would have been antidilutive:

| | | | | | | | | | |

| | December 28,

2008 | | December 30,

2007 | | December 31,

2006 | |

| | | | | | | |

Stock options | | | 50,614 | | | — | | | 2,972 | |

Restricted stock units | | | 284,845 | | | 140,692 | | | 168,212 | |

55

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

(10) Supplemental Disclosures of Cash Flow Information

| | | | | | | | | | |

| | Fiscal Years Ended | |

| | | |

| | December 28,

2008 | | December 30,

2007 | | December 31,

2006 | |

| | | | | | | |

Cash paid during the period for: | | | | | | | | | | |

Income taxes | | $ | 4,681 | | $ | 10,783 | | $ | 8,803 | |

| | | | | | | | | | |

Noncash financing and investing transactions: | | | | | | | | | | |

Property and equipment not yet paid for | | | 5,190 | | | 1,135 | | | 1,130 | |

Tax withholding for restricted stock units | | | 1,360 | | | 1,100 | | | 2,267 | |

Adjustment of restricted stock units to fair value on grant date | | | — | | | — | | | 2,568 | |

(11) Loss on Asset Disposals and Impairment

In 2008, 2007 and 2006, we closed restaurants. As a result, a charge was taken for remaining lease obligations, broker fees, and utilities. These charges were recognized as a part of the loss on asset disposals and impairment and were based on remaining lease obligations.

The rollforward of the store closing reserve for the years ended December 28, 2008, December 30, 2007, and December 31, 2006, is as follows:

| | | | | | | | | | | | | |

| | As of

December 30,

2007 | | 2008

expense | | Costs

incurred | | As of

December 28,

2008 | |

| | | | | | | | | |

Remaining lease obligation and utilities | | $ | — | | $ | 85 | | $ | (85 | ) | $ | — | |

| | | | | | | | | | | | | |

| | $ | — | | $ | 85 | | $ | (85 | ) | $ | — | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | As of

December 31,

2006 | | 2007

expense | | Costs

incurred | | As of

December 30,

2007 | |

| | | | | | | | | |

Remaining lease obligation and utilities | | $ | 54 | | $ | 85 | | $ | (139 | ) | $ | — | |

| | | | | | | | | | | | | |

| | $ | 54 | | $ | 85 | | $ | (139 | ) | $ | — | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | As of

December 25,

2005 | | 2006

expense | | Costs

incurred | | As of

December 31,

2006 | |

| | | | | | | | | |

Remaining lease obligation and utilities | | $ | — | | $ | 54 | | $ | — | | $ | 54 | |

| | | | | | | | | | | | | |

| | $ | — | | $ | 54 | | $ | — | | $ | 54 | |

| | | | | | | | | | | | | |

During 2008, we recorded an impairment charge for the assets of two underperforming restaurants. An impairment charge of $154 was recorded to the extent that the carrying amount of the assets was not considered recoverable based on estimated discounted future cash flows and the underlying fair value of the assets. We also recorded an impairment charge of $395 for the assets of one restaurant being relocated. No impairment charges were incurred during 2007.

During 2006, we recorded an impairment charge for the assets of one underperforming restaurant. An impairment charge of $481 was recorded to the extent that the carrying amount of the assets was not considered recoverable based on estimated discounted future cash flows and the underlying fair value of the assets.

56

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

A summary of the loss on asset disposals and impairment charges recognized by us is as follows:

| | | | | | | | | | |

| | Fiscal Years Ended | |

| | December 28,

2008 | | December 30,

2007 | | December 31,

2006 | |

Store closing charges | | $ | 85 | | $ | 85 | | $ | 54 | |

Long-lived asset impairment | | | 549 | | | — | | | 481 | |

Other asset write-offs | | | 1,449 | | | 902 | | | 473 | |

| | | | | | | | | | |

| | $ | 2,083 | | $ | 987 | | $ | 1,008 | |

(12) Defined Contribution Plans

We have a defined contribution 401(k) plan whereby eligible employees may contribute pretax wages in accordance with the provisions of the plan. We match 100% of the first 3% and 50% of the next 2% of contributions made by eligible employees. Matching contributions of approximately $702, $840, and $394 were made by us during 2008, 2007, and 2006, respectively.

Under our Management Deferred Compensation Plan, our executive officers and certain other individuals are entitled to receive an amount equal to a percentage of their base salary ranging from 5% to 12.5% which is credited on a monthly basis to their deferred compensation account. Cash contributions of $335, $261, and $245 were made by us during 2008, 2007, and 2006, respectively. Such amounts are subject to certain vesting provisions, depending on length of employment and circumstances of employment termination. In addition, individuals may elect to defer a portion or all of their cash compensation.

(13) Related Party Transactions

It is our policy that all related party transactions must be disclosed and approved by the disinterested directors, and the terms and considerations for such related party transactions are compared and evaluated to terms available or the amounts that would have to be paid or received, as applicable, in arms-length transactions with independent third-parties.

A member of our board of directors, Warren Mack, is an officer at our primary law firm.

(14) Designation of Shares and Stock Split

On May 15, 2008, the Board of Directors authorized an increase to 45,000,000 authorized shares which consists of 44,000,000 shares of Common Stock and 1,000,000 shares of Undesignated Stock.

On June 15, 2007, we effected a two-for-one stock split of our common stock for holders of record on June 1, 2007.

All applicable share and per-share data in the accompanying consolidated financial statements and related disclosures have been retroactively adjusted to give effect to this stock split.

On May 17, 2007, the Board of Directors authorized 4,600,000 shares of the 5,600,000 undesignated shares be designated as additional common stock.

(15) Contingencies

We are involved in various legal matters arising in the ordinary course of business. In the opinion of management, the ultimate disposition of these matters will not have a material adverse effect on our consolidated financial position and results of operations.

57

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 28, 2008 and December 30, 2007

(Dollar amounts in thousands, except per-share amounts)

(16) Acquisition of Franchised Restaurants in Nevada

On September 23, 2008, we acquired the assets of nine Buffalo Wild Wings franchised restaurants located in Las Vegas, Nevada. The total purchase price of $23,071, which includes direct acquisition costs of $426, was paid in cash and was funded by cash and the sale of marketable securities. The acquisition was accounted for as a business combination. The assets acquired were recorded based on their fair values at the time of the acquisition as detailed below:

| | | | |

Inventory, prepaids, and other assets | | $ | 436 | |

Equipment, leasehold improvements, and a building | | | 4,517 | |

Deferred lease credits | | | 475 | |

Reacquired franchise rights | | | 7,040 | |

Goodwill | | | 10,603 | |

| | $ | 23,071 | |

The excess of the purchase price over the aggregate fair value of assets acquired was allocated to goodwill. The results of operations of these locations are included in our consolidated statement of earnings as of the date of acquisition.

(17) Acquisition of Don Pablo’s Locations

During February 2008, we acquired certain leases and assets of eight Don Pablo’s locations from Avado Brands, Inc. for approximately $1,200, which was paid in cash. Due to this acquisition, we recorded an impairment charge for the assets of one restaurant being relocated. The impairment charge of $395 was recorded in the first quarter of 2008 to the extent that the carrying amount was not considered recoverable based on estimated future discounted cash flows. Three restaurants were relocated due to this acquisition, resulting in a charge of $85 for remaining lease obligations and utilities.

58

| |

ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |

| |

Not applicable.

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

We have established and maintain disclosure controls and procedures that are designed to ensure that material information relating to us and our subsidiaries required to be disclosed by us in the reports that we file or submit under the Securities Exchange Act of 1934 is recorded, processed, summarized, and reported within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to our management, including our chief executive officer and chief financial officer, as appropriate to allow timely decisions regarding required disclosure. In designing and evaluating the disclosure controls and procedures, management recognized that any controls and procedures, no matter how well designed and operated, can only provide reasonable assurance of achieving the desired control objectives, and in reaching a reasonable level of assurance, management necessarily was required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

We carried out an evaluation, under the supervision and with the participation of our management, including our chief executive officer and chief financial officer, of the effectiveness of the design and operation of our disclosure controls and procedures as of the end of the period covered by this report. Based on that evaluation, the chief executive officer and chief financial officer concluded that our disclosure controls and procedures were effective as of the date of such evaluation to provide reasonable assurance that information required to be disclosed by the Company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified by the Securities and Exchange Commission’s rules and forms.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is a process designed by, or under the supervision of, our chief executive and chief financial officers and effected by our board of directors, management and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. generally accepted accounting principles and includes those policies and procedures that:

| | |

| • | pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of our assets; |

| | |

| • | provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with the authorizations of our management and directors; and |

| | |

| • | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on our financial statements. |

Because of inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risks that controls may become inadequate because of changes in conditions, or that the degree of compliance with policies or procedures may deteriorate. However, these inherent limitations are known features of the financial reporting process. It is possible to design into the process safeguards to reduce, thought not eliminate, the risk that misstatements are not prevented or detected on a timely basis. Management is responsible for establishing and maintaining adequate internal control over financial reporting for the company.

Management assessed the effectiveness of our internal control over financial reporting as of December 28, 2008. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission inInternal Control-Integrated Framework. Based on this assessment, our management concluded that, as of December 28, 2008, our internal control over financial reporting was effective to provide reasonable assurance regarding the reliability of financial reporting and the preparation and presentation of financial statements for external purposes in accordance with generally accepted accounting principles. Our independent registered public accounting firm, KPMG LLP, has issued an audit report on the effectiveness of our internal control over financial reporting. That report appears below.

59

Change in Internal Control Over Financial Reporting

There were no changes in the our internal control over financial reporting that occurred during our last fiscal quarter that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Report of Independent Registered Public Accounting Firm

The Board of Directors and Stockholders

Buffalo Wild Wings, Inc.:

We have audited Buffalo Wild Wings, Inc. and subsidiaries’ (the Company) internal control over financial reporting as of December 28, 2008, based on the criteria established inInternal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting included in the accompanying Management’s Annual Report on Internal Control Over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board

(United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the consolidated financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 28, 2008, based on the criteria established inInternal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board

(United States), the consolidated balance sheets of Buffalo Wild Wings, Inc. and subsidiaries as of December 28, 2008 and December 30, 2007, and the related consolidated statements of earnings, stockholders’ equity, and cash flows for each of the years in the three-year period ended December 28, 2008, and our report dated February 27, 2009 expressed an unqualified opinion on those consolidated financial statements.

Minneapolis, Minnesota

February 27, 2009

60

ITEM 9B. OTHER INFORMATION

Not applicable.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Information required by this item is contained in Part I of this document under the heading “Executive Officers,” and the sections entitled “Election of Directors,” “Compliance with Section 16(a) of the Exchange Act,” and “Corporate Governance” appearing in our Proxy Statement to be delivered to shareholders in connection with the 2009 Annual Meeting of Shareholders. Such information is incorporated herein by reference.

Our Board of Directors has adopted a Code of Ethics & Business Conduct for all employees and directors. A copy of this document is available on our website atwww.buffalowildwings.com, free of charge, under the Corporate Governance Investors section. We will satisfy any disclosure requirements under Item 10 or Form 8-K regarding an amendment to, or waiver from, any provision of the Code with respect to our principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions by disclosing the nature of such amendment or waiver on our website or in a report on Form 8-K.

Our Board of Directors has determined that Mr. J. Oliver Maggard, a member of the Audit Committee and an independent director, is an audit committee financial expert, as defined under 407(d) (5) of Regulation S-K. Mr. Maggard is an “independent director” as that term is defined in Nasdaq Rule 4200(a)(15). The designation of Mr. Maggard as the audit committee financial expert does not impose on Mr. Maggard any duties, obligations or liability that are greater than the duties, obligations and liability imposed on Mr. Maggard as a member of the Audit Committee and the Board of Directors in the absence of such designation or identification.

ITEM 11. EXECUTIVE COMPENSATION

The information required by this item is contained in the section entitled “Executive Compensation” appearing in our Proxy Statement to be delivered to shareholders in connection with the 2009 Annual Meeting of Shareholders. Such information is incorporated herein by reference.

| |

ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

The information required by this item relating to the security ownership of certain holders is contained in the sections entitled “Principal Shareholders and Management Shareholdings” and “Equity Compensation Plan Information” appearing in our Proxy Statement to be delivered to shareholders in connection with the 2009 Annual Meeting of Shareholders. Such information is incorporated herein by reference.

| |

ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

The information required by this item is contained in the sections entitled “Corporate Governance” and “Certain Transactions” appearing in our Proxy Statement to be delivered to shareholders in connection with the 2009 Annual Meeting of Shareholders. Such information is incorporated herein by reference.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

The information required by this item is contained in the section entitled “Independent Registered Public Accounting Firm” appearing in our Proxy Statement to be delivered to shareholders in connection with the 2009 Annual Meeting of Shareholders. Such information is incorporated herein by reference.

61

PART IV

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

(a)Financial Statements. The following consolidated financial statements of ours are filed with this report and can be found at Item 8 of this Form 10-K.

| |

| Report of Independent Registered Public Accounting Firm dated February 27, 2009 |

| |

| Consolidated Balance Sheets as of December 28, 2008 and December 30, 2007 |

| |

| Consolidated Statements of Earnings for the Fiscal Years Ended December 28, 2008, December 30, 2007, and December 31, 2006 |

| |

| Consolidated Statements of Stockholders’ Equity for the Fiscal Years Ended December 28, 2008, December 30, 2007, and December 31, 2006 |

| |

| Consolidated Statements of Cash Flows for the Fiscal Years Ended December 28, 2008, December 30, 2007, and December 31, 2006 |

| |

| Notes to Consolidated Financial Statements |

| |

| (b) Financial Statement Schedules. The following schedule is included following the exhibits to this Form 10-K. |

| |

| Schedule II – Valuation and Qualifying Accounts |

All other schedules for which provision is made in the applicable accounting regulations of the SEC have been omitted as not required or not applicable, or the information required has been included elsewhere by reference in the financial statements and related notes.

(c)Exhibits. See “Exhibit Index” following the signature page of this Form 10-K for a description of the documents that are filed as Exhibits to this report on Form 10-K or incorporated by reference herein.

62

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Date: February 27, 2009 | BUFFALO WILD WINGS, INC. |

| | |

| By | /s/ SALLY J. SMITH |

| | Sally J. Smith |

| | Chief Executive Officer and President |

In accordance with the Exchange Act, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated below.

Each person whose signature appears below constitutes and appoints Sally J. Smith and Mary J. Twinem as the undersigned’s true and lawful attorneys-in fact and agents, each acting alone, with full power of substitution and resubstitution, for the undersigned and in the undersigned’s name, place and stead, in any and all amendments to this Annual Report on Form 10-K and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granted unto said attorneys-in-fact and agents, each acting alone, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as the undersigned might or could do in person, hereby ratifying and confirming all said attorneys-in-fact and agents, each acting alone, or his substitute or substitutes, may lawfully do or cause to be done by virtue thereof.

| | | | |

Name | | Title | | Date |

| | | | |

/s/ SALLY J. SMITH | Chief Executive Officer, President

and Director (principal executive officer) | | 2/27/09 |

Sally J. Smith | | | | |

| | | | |

/s/ MARY J. TWINEM | Executive Vice President, Chief Financial

Officer and Treasurer (principal financial

and accounting officer) | | 2/27/09 |

Mary J. Twinem | | |

| | | | |

| | | | |

/s/ DALE M. APPLEQUIST | Director | | 2/27/09 |

Dale M. Applequist | | | | |

| | | | |

/s/ JAMES M. DAMIAN | Director, Chairman of the Board | | 2/27/09 |

James M. Damian | | | | |

| | | | |

/s/ MICHAEL P. JOHNSON | Director | | 2/27/09 |

Michael P. Johnson | | | | |

| | | | |

/s/ ROBERT W. MACDONALD | Director | | 2/27/09 |

Robert W. MacDonald | | | | |

| | | | |

/s/ WARREN E. MACK | Director | | 2/27/09 |

Warren E. Mack | | | | |

| | | | |

/s/ J. OLIVER MAGGARD | Director | | 2/27/09 |

J. Oliver Maggard | | | | |

63

Buffalo Wild Wings, Inc.

SCHEDULE II – VALUATION AND QUALIFYING ACCOUNTS

| | | | | | | | | | | | | | | | |

Description | | | Balance

at

Beginning

of Period | | Additions

Charged

to Costs

and

Expenses | | Deductions

From

Reserves | | Balance

at End of

Period | |

Allowance for doubtful accounts | | | 2008 | | $ | 25 | | | 544 | | | 544 | | | 25 | |

| | | 2007 | | | 47 | | | — | | | 22 | | | 25 | |

| | | 2006 | | | 25 | | | 51 | | | 29 | | | 47 | |

| | | | | | | | | | | | | | | | |

Store closing reserves | | | 2008 | | | — | | | 85 | | | 85 | | | — | |

| | | 2007 | | | 54 | | | 85 | | | 139 | | | — | |

| | | 2006 | | | — | | | 54 | | | — | | | 54 | |

64

BUFFALO WILD WINGS, INC.

EXHIBIT INDEX TO FORM 10-K

| |

For the Fiscal Year Ended: | Commission File No. |

December 28, 2008 | 000-24743 |

| |

| | |

| | |

Exhibit

Number | | Description |

3.1 | | Restated Articles of Incorporation, as Amended (incorporated by reference to Exhibit 3.1 to our Form 10-Q for the fiscal quarter ended June 29, 2008) |

| | |

3.2 | | Restated Bylaws, as Amended (incorporated by reference to Exhibit 3.1 to our current report on Form 8-K filed February 28, 2007) |

| | |