SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

BUFFALO WILD WINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

BUFFALO WILD WINGS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held

May 12, 2005

TO THE SHAREHOLDERS OF BUFFALO WILD WINGS, INC.:

Our 2005 Annual Meeting of Shareholders will be held at Buffalo Wild Wings®Grill & Bar, 3085 White Bear Avenue North, Maplewood, Minnesota at 9:00 a.m. Central Daylight Time on Thursday, May 12, 2005, for the following purposes:

| | 1. | To set the number of members of the Board of Directors at six (6). |

| | 2. | To elect members of the Board of Directors. |

| | 3. | To take action on any other business that may properly come before the meeting or any adjournment thereof. |

Accompanying this Notice of Annual Meeting is a Proxy Statement, form of Proxy and our 2004 Annual Report to Shareholders.

Only shareholders of record as shown on our books at the close of business on March 31, 2005 will be entitled to vote at our 2005 Annual Meeting or any adjournment thereof. Each shareholder is entitled to one vote per share on all matters to be voted on at the meeting.

You are cordially invited to attend the 2005 Annual Meeting. Whether or not you plan to attend the 2005 Annual Meeting, please sign, date and mail the enclosed form of Proxy in the return envelope provided as soon as possible. The Proxy is revocable and will not affect your right to vote in person in the event you attend the meeting. The prompt return of proxies will help us avoid the unnecessary expense of further requests for proxies.

|

BY ORDER OF THE BOARD OF DIRECTORS, |

|

|

|

Sally J. Smith |

President and Chief Executive Officer |

| | |

Dated: | | April 11, 2005 |

| | | Minneapolis, Minnesota |

BUFFALO WILD WINGS, INC.

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

to be held

May 12, 2005

The accompanying Proxy is solicited by the Board of Directors for use at our 2005 Annual Meeting of Shareholders to be held on Thursday, May 12, 2005, at the location and for the purposes set forth in the Notice of Annual Meeting, and at any adjournment thereof.

The cost of soliciting proxies, including the preparation, assembly and mailing of the proxies and soliciting material, as well as the cost of forwarding such material to the beneficial owners of stock, will be borne by us. Our directors, officers and regular employees may, without compensation other than their regular remuneration, solicit proxies personally or by telephone.

Any shareholder giving a Proxy may revoke it any time prior to its use at the 2005 Annual Meeting by giving written notice of such revocation to the Secretary or any other officer of Buffalo Wild Wings or by filing a later dated written Proxy with one of our officers. Personal attendance at the 2005 Annual Meeting is not, by itself, sufficient to revoke a Proxy unless written notice of the revocation or a later dated Proxy is delivered to an officer before the revoked or superseded Proxy is used at the 2005 Annual Meeting. Proxies will be voted as directed therein. Proxies which are signed by shareholders but which lack specific instruction with respect to any proposal will be voted in favor of such proposal as set forth in the Notice of Annual Meeting or, with respect to the election of directors, in favor of the number and slate of directors proposed by the Board of Directors and listed herein.

The presence at the Annual Meeting in person or by proxy of the holders of a majority of the outstanding shares of Buffalo Wild Wings Common Stock entitled to vote shall constitute a quorum for the transaction of business. If a broker returns a “non-vote” proxy, indicating a lack of voting instructions by the beneficial holder of the shares and a lack of discretionary authority on the part of the broker to vote on a particular matter, then the shares covered by such non-vote shall be deemed present at the meeting for purposes of determining a quorum but shall not be deemed to be represented at the meeting for purposes of calculating the vote required for approval of such matter. If a shareholder abstains from voting as to any matter, then the shares held by such shareholder shall be deemed present at the meeting for purposes of determining a quorum and for purposes of calculating the vote with respect to such matter, but shall not be deemed to have been voted in favor of such matter. An abstention as to any proposal will therefore have the same effect as a vote against the proposal.

The mailing address of the principal executive office of Buffalo Wild Wings is 1600 Utica Avenue South, Suite 700, Minneapolis, Minnesota 55416. We expect that this Proxy Statement, the related Proxy and Notice of Annual Meeting will first be mailed to shareholders on or about April 11, 2005.

OUTSTANDING SHARES AND VOTING RIGHTS

The Buffalo Wild Wings Board of Directors has fixed March 31, 2005 as the record date for determining shareholders entitled to vote at the 2005 Annual Meeting. Persons who were not shareholders on such date will not be allowed to vote at the 2005 Annual Meeting. At the close of business on the record date, there were 8,421,770 shares of our Common Stock issued and outstanding. The Common Stock is our only outstanding class of capital stock. Each share of Common Stock is entitled to one vote on each matter to be voted upon at the 2005 Annual Meeting. Holders of Common Stock are not entitled to cumulative voting rights.

PRINCIPAL SHAREHOLDERS AND MANAGEMENT SHAREHOLDINGS

The following table provides information as of the record date concerning the beneficial ownership of our Common Stock by (i) the named executive officers in the Summary Compensation Table, (ii) each of our directors, (iii) the persons known by us to own more than 5% of our outstanding Common Stock, and (iv) all current directors and executive officers as a group. Except as otherwise indicated, the persons named in the table have sole voting and investment power with respect to all shares of Common Stock owned by them.

| | | | | |

Name (and Address of 5%

Owner) or Identity of Group

| | Number of Shares

Beneficially Owned(1)

| | Percent

of Class (1)

| |

Sally J. Smith(2) | | 179,352 | | 2.1 | % |

| | |

Mary J. Twinem(3) | | 98,195 | | 1.2 | % |

| | |

James M. Schmidt(4) | | 27,187 | | * | |

| | |

Emil Lee Sanders(5) | | 8,960 | | * | |

| | |

Judith A. Shoulak(6) | | 4,895 | | * | |

| | |

Kenneth H. Dahlberg(7) | | 1,068,730 | | 12.7 | % |

| | |

Dale M. Applequist(8) | | 35,427 | | * | |

| | |

Robert W. MacDonald | | — | | * | |

| | |

Warren E. Mack(9) | | 61,502 | | * | |

| | |

J. Oliver Maggard(10) | | 11,487 | | * | |

| | |

FMR Corp.(11) | | 1,248,934 | | 14.8 | % |

| | |

Carefree Capital, Inc.(12) | | 744,110 | | 8.8 | % |

| | |

Deutsche Bank AG(13) | | 556,729 | | 6.6 | % |

| | |

National City Corp.(14) | | 476,495 | | 5.7 | % |

| | |

All Executive Officers and Directors as a Group (12 Individuals)(15) | | 1,568,041 | | 18.1 | % |

| * | Less than 1% of the outstanding shares of Common Stock. |

| (1) | Under the rules of the SEC, shares not actually outstanding are deemed to be beneficially owned by an individual if such individual has the right to acquire the shares within 60 days. Pursuant to such SEC Rules, shares deemed beneficially owned by virtue of an individual’s right to acquire them are also treated as outstanding when calculating the percent of the class owned by such individual and when determining the percent owned by any group in which the individual is included. |

| (2) | Includes 78,000 shares which may be purchased by Ms. Smith upon exercise of currently exercisable options. |

| (3) | Includes 62,850 shares which may be purchased by Ms. Twinem upon exercise of currently exercisable options. |

| (4) | Includes 20,455 shares which may be purchased by Mr. Schmidt upon exercise of currently exercisable options. |

| (5) | Includes 650 shares which may be purchased by Mr. Sanders upon exercise of currently exercisable options. |

| (6) | Represents 650 shares which may be purchased by Ms. Shoulak upon exercise of currently exercisable options. |

| (7) | Includes 719,506 shares held by Carefree Capital Partners, L.P., 24,604 shares held by Carefree Capital, Inc., 25,000 shares held by The Ken and Betty Dahlberg Family Foundation and 18,751 shares which may be |

- 2 -

| | purchased by Mr. Dahlberg upon exercise of currently exercisable options. Carefree Capital, Inc. is the general partner of Carefree Capital Partners, L.P., and Mr. Dahlberg is the principal shareholder of Carefree Capital, Inc. The address for Carefree Capital and Mr. Dahlberg is 1600 Utica Avenue South, Suite 700, Minneapolis, MN 55416. |

| (8) | Includes 17,851 shares which may be purchased by Mr. Applequist upon exercise of currently exercisable options. |

| (9) | Includes 8,751 shares which may be purchased by Mr. Mack upon exercise of currently exercisable options. |

| (10) | Includes 11,251 shares which may be purchased by Mr. Maggard upon exercise of currently exercisable options. |

| (11) | According to a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2005 by FMR Corp. (“FMR”), FMR, through its subsidiaries, beneficially owns the shares and has sole voting power over 378,325 of the shares and sole dispositive power over all of the shares. The ownership and powers of the subsidiaries are as follows: (i) Fidelity Management & Research Company (“Fidelity Research”), as an investment adviser to various investment companies (the “Funds”) beneficially owns 870,979 of the shares, with Edward C. Johnson 3d, FMR and the Funds each having sole power to dispose of such shares, and Funds’ Boards of Trustees have the sole power to vote or direct the voting of such shares; (ii) Fidelity Management Trust Company (“Fidelity Management”), a bank, beneficially owns 335,555 of the shares, with Mr. Johnson and FMR through its control of Fidelity Management each having sole voting power and dispositive power over such shares; (iii) Fidelity International Limited (“Fidelity International”) beneficially owns 42,400 of the shares and has the sole power to vote and dispose of such shares. As principal holders of FMR, Mr. Johnson, Chairman, and Abigail P. Johnson, a director, may be deemed to own or control the shares. Except as set forth herein, neither FMR or its subsidiaries have voting or dispositive power. The address of FMR, Mr. Johnson, Ms. Johnson, Fidelity Research, Fidelity Management and Fidelity International is 82 Devonshire Street, Boston, Massachusetts 02109. |

| (12) | Includes 719,506 shares held by Carefree Capital Partners, L.P. See note (7). |

| (13) | Deutsche Bank AG filed a Schedule 13G with the Securities and Exchange Commission on February 11, 2005 with its subsidiaries, Deutsche Investment Management (“Deutsche Investment”), Deutsche Asset Management Inc. (“Deutsche Management”) and Deutsche Asset Management Group Ltd., London (“Deutsche London”), each of which is an investment advisor, and Deutsche Bank Trust Company Americas (“Deutsche Trust”), a bank. Deutsche Bank has sole voting and dispositive power over 556,729 of the shares; Deutsche London has sole voting and dispositive power over 26,300 of the shares; Deutsche Trust has sole voting and dispositive power over 1,257 of the shares; Deutsche Investment has sole voting and dispositive power over 148,672 of the shares; and Deutsche Management has sole voting and dispositive power over 380,500 of the shares. Except as set forth herein, neither Deutsche Bank or its subsidiaries have voting or dispositive power. The address of Deutsche Bank and its subsidiaries is Taunusanlage 12, D-60325, Frankfurt am Main, Federal Republic of Germany. |

| (14) | National City Corp. filed a Schedule 13G with the Securities and Exchange Commission on February 14, 2005 on behalf of its subsidiaries, National City Bank and National City Bank of Pennsylvania, both banks, and National City Investment Management Company, an investment adviser. National City Corp. only has sole voting power over 95,985 of the shares and sole dispositive power over all of the shares. The address of National City Corp. and its subsidiaries is 1900 East Ninth Street, Cleveland, Ohio 44114. |

| (15) | Includes 242,729 shares which may be purchased by current executive officers and directors upon exercise of currently exercisable options. See above footnotes for shares held indirectly. |

- 3 -

EQUITY COMPENSATION PLAN INFORMATION

The following table summarizes our equity compensation plan information as of December 26, 2004, our fiscal year end.

| | | | | | | | |

Plan Category

| | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

| | Weighted average

exercise price of

outstanding options,

warrants and rights

| | Number of securities remaining

available for future issuance

under equity compensation plans

(excluding securities reflected in

column (a))

| |

| | | (a) | | (b) | | (c) | |

| Equity compensation plans approved by security holders | | 414,915 | | $ | 7.42 | | 496,485 | (1) |

| Equity compensation plans not approved by security holders | | — | | | — | | — | |

TOTAL | | 414,915 | | $ | 7.42 | | 496,485 | |

| (1) | Includes 271,547 shares remaining available under the Company’s Employee Stock Purchase Plan. |

CORPORATE GOVERNANCE

Our business affairs are conducted under the direction of the Board of Directors in accordance with the Minnesota Business Corporation Act and our Articles of Incorporation and Bylaws. Members of the Board of Directors are informed of our business through discussions with management, by reviewing materials provided to them and by participating in meetings of the Board of Directors and its committees. The corporate governance practices that we follow are summarized below.

Independence

The Board has determined that a majority of its members are “independent” as defined by the listing standards of The Nasdaq Stock Market. Our independent directors are Kenneth H. Dahlberg, Dale M. Applequist, Robert W. MacDonald, Warren E. Mack and J. Oliver Maggard.

Code of Ethics & Business Conduct

The Board has approved a Code of Ethics & Business Conduct, which applies to all of our employees, directors and officers, and also a Code of Ethics (“Executive Code of Ethics”), which applies to our principal executive officer, principal financial officer, principal accounting officer, controller, senior vice presidents and vice presidents. The Codes address such topics as protection and proper use of our assets, compliance with applicable laws and regulations, accuracy and preservation of records, accounting and financial reporting, conflicts of interest and insider trading. The Codes are available free of charge through our website at www.buffalowildwings.com and are available in print to any shareholder who sends a request for a paper copy to Buffalo Wild Wings, Inc., Attn. Investor Relations, 1600 Utica Avenue South, Suite 700, Minneapolis, Minnesota 55416. Buffalo Wild Wings intends to include on its website any amendment to, or waiver from, a provision of its Executive Code of Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer and controller that relates to any element of the code of ethics definition enumerated in Item 406(b) of Regulation S-K.

Meeting Attendance

Board and Committee Meetings. During fiscal 2004, the Board held four (4) meetings. Each director attended at least 75% of the meetings of the Board and the standing committees on which such director served.

Annual Meeting of Shareholders. Our policy is that all directors are expected to attend our annual meetings of shareholders. If a director is unable to attend an annual meeting, the director must send a written notice to our Secretary at least one week prior to the meeting.

- 4 -

Executive Sessions of the Board

An executive session of independent directors is generally held at the time of each regular Board meeting.

Committees of the Board

Our Board of Directors has four standing committees: Audit Committee, Compensation Committee, Governance/Nominating Committee and Executive Committee.

Audit Committee. The members of the Audit Committee are J. Oliver Maggard-Chair, Dale M. Applequist and Robert W. MacDonald, all independent directors. The Audit Committee reviews, in consultation with our independent registered public accounting firm, our financial statements, accounting and other policies, accounting systems and the adequacy of internal controls for compliance with corporate policies and directives. The Audit Committee is responsible for the engagement of our independent registered public accounting firm and reviews other matters relating to our relationship with our independent registered public accounting firm. The Board has determined that J. Oliver Maggard is the “audit committee financial expert” as defined by Item 401(h)(2) of Regulation S-K under the Securities Act of 1933. We acknowledge that the designation of Mr. Maggard as the audit committee financial expert does not impose on Mr. Maggard any duties, obligations or liability that are greater than the duties, obligations and liability imposed on Mr. Maggard as a member of the Audit Committee and the Board of Directors in the absence of such designation or identification. The Audit Committee’s Report is included on page 13. The Audit Committee met thirteen (13) times during fiscal 2004.

Compensation Committee. The current members of the Compensation Committee are Dale M. Applequist-Chair and J. Oliver Maggard, both independent directors. The Compensation Committee recommends to the Board of Directors from time to time the salaries to be paid to our executive officers and any plan for additional compensation it deems appropriate. In addition, this committee is vested with the same authority as the Board of Directors with respect to the granting of awards and the administration of our plans. The Compensation Committee’s Report is on page 10. The Compensation Committee met three (3) times during fiscal 2004.

Governance/Nominating Committee.The current members of the Governance/Nominating Committee are Kenneth H. Dahlberg-Chair, Dale M. Applequist and Robert W. MacDonald, all independent directors. The Governance/Nominating Committee selects candidates for our Board of Directors, selects members of various committees and addresses corporate governance matters. The policies of the Governance/Nominating Committee are described more fully in the Governance/Nominating Committee’s Report on page 6. The Governance/Nominating Committee met three (3) times during fiscal 2004.

Executive Committee. The members of the Executive Committee are Sally J. Smith, Warren E. Mack and J. Oliver Maggard. During the intervals between the meetings of the Board of Directors, the Executive Committee has all the powers of the Board in the management of our business, properties and affairs, including any authority to take action provided in our Bylaws to be taken by the Board, subject to applicable laws. The Executive Committee, however, is not authorized to fill vacancies of the Board or its committees, declare any dividend or distribution or take any action which pursuant to the Bylaws is required to be taken by a vote of a specified portion of the whole Board. The Executive Committee met three (3) times during fiscal 2004.

Communications with the Board

Shareholders may communicate directly with the Board of Directors. All communications should be directed to our Corporate Secretary at the address below and should prominently indicate on the outside of the envelope that it is intended for the Board of Directors or for non-management directors. If no director is specified, the communication will be forwarded to the entire Board. The communication will not be opened before being forwarded to the intended recipient, but it will go through normal security procedures. Shareholder communications to the Board should be sent to:

James M. Schmidt, Senior VP, General Counsel and Secretary

Buffalo Wild Wings, Inc.

1600 Utica Avenue South, Suite 700

Minneapolis, MN 55416

- 5 -

Compensation to Non-Employee Directors

Fees. In addition to being reimbursed for out-of-pocket expenses incurred while attending Board or committee meetings, the non-employee directors received the following fees in 2004:

| | | | | | | | |

| | | Until June 28

| | | June 28 to Present

| |

Annual Board fee | | $ | 0 | | | $ | 20,000 | (1) |

Board meeting attendance in person/by telephone | | $ | 5,000/$2,500 | (2) | | $ | 0 | |

| | |

Audit Committee annual fee | | $ | 0 | | | $ | 5,000 | (1) |

Audit Committee attendance in person/by telephone | | $ | 500/$250 | | | $ | 0 | |

Compensation & Governance/Nominating Committee annual fee | | $ | 0 | | | $ | 5,000 | (1) |

Compensation & Governance/Nominating Committee attendance in person/by telephone | | $ | 500/$250 | | | $ | 0 | |

Executive Committee attendance in person/by telephone | | $ | 500/$250 | | | $ | 500 | |

| | |

Annual Chair (Board and Committees) fee | | $ | 5,000 | (1) | | $ | 5,000 | (1) |

| (2) | Annual maximum meeting fee of $20,000. |

Equity.Currently, equity compensation, including options or restricted stock, may be granted to the non-employee directors at the discretion of the Compensation Committee. On June 11, 2004, the non-employee directors were each granted restricted stock units for 708 shares, having a value as of the date of grant of $19,966; provided, however, that Mr. MacDonald waived his right to receive the grant. The restricted stock units vest to the extent of 33-1/3% on the last day of each fiscal year, and the risks of forfeiture lapse as to such increment if the Company achieves 95% of the earnings target established by the Board of Directors.

GOVERNANCE/NOMINATING COMMITTEE REPORT

The Governance/Nominating Committee is comprised of independent directors. In accordance with its Principles of Corporate Governance and written charter adopted by the Board of Directors, the Governance/Nominating Committee assists the Board of Directors with fulfilling its responsibilities regarding any matters relating to corporate governance including selection of candidates for our Board of Directors. Its duties include oversight of the principles of corporate governance by which Buffalo Wild Wings and the Board shall be governed; the codes of ethical conduct and legal compliance by which Buffalo Wild Wings and its directors, executive officers, employees and agents will be governed; policies for evaluation of the Board and the chairperson; policies for election and reelection of Board members; and policies for succession planning for the Chief Executive Officer, Board chairperson and other Board leaders. In addition, the Committee is responsible for annually reviewing the composition of the Board, focusing on the governance and business needs and requirements of Buffalo Wild Wings, screening of Board member candidates and recommending nominees to the Board, evaluating the performance of Board members and recommending the reelection of Board members who are performing effectively and who continue to provide a competency needed on the Board. The Committee has determined that there should be at least six directors on the Board with a majority being independent.

The Governance/Nominating Committee will consider candidates for nomination as a director recommended by shareholders, directors, third party search firms and other sources. In evaluating director nominees, a candidate should have certain minimum qualifications, including being able to read and understand basic financial statements, being familiar with our business and industry, having high standards of personal ethics and mature judgment, being able to work collegially with others and being willing to devote the necessary time and energy to fulfilling the Board’s responsibility of oversight of Buffalo Wild Wings. Independent directors are encouraged to limit the number of other boards of for-profit companies, and management personnel shall not serve on more than one other board of a for-profit company. In addition, factors such as the following may be considered:

| | • | | appropriate size and diversity of the Board; |

| | • | | needs of the Board with respect to particular talent and experience; |

| | • | | business and professional experience of nominee; |

- 6 -

| | • | | familiarity with domestic and international business affairs; |

| | • | | age and other legal and regulatory requirements; |

| | • | | appreciation of the relationship of our business to the changing needs of society; and |

| | • | | desire to balance the benefit of continuity with the periodic injection of the fresh perspective provided by a new member. |

Shareholders who wish to recommend one or more directors must provide a written recommendation to the Secretary of Buffalo Wild Wings. Notice of a recommendation must include the shareholder’s name, address and the number of Buffalo Wild Wings shares owned, along with information with respect to the person being recommended, i.e. name, age, business address, residence address, current principal occupation, five-year employment history with employer names and a description of the employer’s business, the number of shares beneficially owned by the prospective nominee, whether such person can read and understand basic financial statements and other board memberships, if any. The recommendation must be accompanied by a written consent of the prospective nominee to stand for election if nominated by the Board of Directors and to serve if elected by the shareholders. Buffalo Wild Wings may require any nominee to furnish additional information that may be needed to determine the eligibility of the nominee.

Shareholders who wish to present a proposal at an annual meeting of shareholders must provide a written notice to our Secretary at the address below. For each proposal, the notice must include a brief description of the matter to be brought before the meeting, the reasons to bring the matter before the meeting and the shareholder’s name, address, the number of shares such shareholder owns and any material interest the shareholder may have in the proposal. The Secretary will forward the proposals and recommendations to the Governance/Nominating Committee. See“Shareholder Proposals” on page 14.

James M. Schmidt, Senior VP, General Counsel and Secretary

Buffalo Wild Wings, Inc.

1600 Utica Avenue South, Suite 700

Minneapolis, MN 55416

A copy of the current Governance/Nominating Committee Charter can be found on our website at www.buffalowildwings.com.

Members of the Governance/Nominating Committee

Kenneth H. Dahlberg, Chair

Dale M. Applequist

Robert W. MacDonald

ELECTION OF DIRECTORS

(Proposals #1 and #2)

Our Bylaws provide that the number of directors shall be the number set by the shareholders, which shall be not less than one. Pursuant to Board authorization, the Governance/Nominating Committee set the number of directors at six (6) and selected the persons listed below as nominees to be elected at the Annual Meeting, all of whom are current directors. Unless otherwise instructed, the Proxies will be so voted.

Under applicable Minnesota law, approval of the proposal to set the number of directors at six requires the affirmative vote of the holders of a majority of the voting power of the shares represented in person or by proxy at the Annual Meeting with authority to vote on such matter, provided that such majority must be greater than 25% of our outstanding shares. The election of the nominees to the Board of Directors requires the affirmative vote of the holders of a plurality of the voting power of the shares represented in person or by proxy at the Annual Meeting with authority to vote on such matter.

- 7 -

In the absence of other instruction, the Proxies will be voted for each of the individuals listed below. If elected, such individuals shall serve until the next annual meeting of shareholders and until their successors shall be duly elected and shall qualify. All of the nominees are members of the current Board of Directors. If, prior to the 2005 Annual Meeting of Shareholders, it should become known that any one of the following individuals will be unable to serve as a director after the 2005 Annual Meeting by reason of death, incapacity or other unexpected occurrence, the Proxies will be voted for such substitute nominee(s) as is selected by the Board of Directors. Alternatively, the Proxies may, at the Board’s discretion, be voted for such fewer number of nominees as results from such death, incapacity or other unexpected occurrence. The Board of Directors has no reason to believe that any of the following nominees will be unable to serve.

| | | | | | |

Name

| | Age

| | Position with Buffalo Wild Wings

| | Director Since

|

Sally J. Smith(4) | | 47 | | President, Chief Executive Officer and Director | | 1996 |

| | | |

Kenneth H. Dahlberg(2) | | 87 | | Chairman of the Board | | 1994 |

| | | |

Dale M. Applequist(1)(2)(3) | | 56 | | Director | | 1997 |

| | | |

Robert W. MacDonald(1)(2) | | 62 | | Director | | 2003 |

| | | |

Warren E. Mack(4) | | 60 | | Director | | 1994 |

| | | |

J. Oliver Maggard(1)(3)(4) | | 50 | | Director | | 1999 |

| (1) | Member of Audit Committee |

| (2) | Member of Governance/Nominating Committee |

| (3) | Member of Compensation Committee |

| (4) | Member of Executive Committee |

Business Experience of the Director Nominees

Sally J. Smith has served as our Chief Executive Officer and President since July 1996 and as our Chief Financial Officer from 1994 to 1996. Prior to joining Buffalo Wild Wings, she was the Chief Financial Officer of Dahlberg, Inc., the manufacturer and franchisor of Miracle-Ear hearing aids, from 1983 to 1994. Ms. Smith began her career with KPMG LLP, an international accounting and auditing firm. Ms. Smith is a CPA. Ms. Smith serves on the board of the National Restaurant Association.

Kenneth H. Dahlberg has served as Chairman of Carefree Capital, Inc. since June 1995, and he served as its Chief Executive Officer from June 1995 to January 2004. He was the founder of Dahlberg, Inc., a public company prior to its acquisition by Bausch & Lomb, Inc. in 1993, and served as its Chairman of the Board from 1948 to 1993.

Dale M. Applequistserved as President and Chief Executive Officer of Cash Plus, Inc., an advertising agency that he co-founded, from 1978 to 1998. He also was a partner and director of Campbell-Mithun Advertising, LLC from 1990 to 1998.

Robert W. MacDonaldhas been a director of Allianz Life Insurance Company of North America since October 1999, also serving as its Chief Executive Officer and Chairman from October 1999 to March 2002. Mr. MacDonald has also been a principal of CTW Consulting, LLC, a business consulting firm, since March 2002. From 1987 to 1999, Mr. MacDonald served as Chairman and Chief Executive Officer of LifeUSA Holding, Inc., an insurance holding company. Mr. MacDonald is also a director of Triple Net Properties, LLC.

Warren E. Mack has been an attorney with the law firm of Fredrikson & Byron, P.A. since 1969, serving as its Chairman from 1999 to 2004, its President from 1985 to 1997 and as a director from 1978 to 2004. Fredrikson & Byron, P.A. provides legal services to us.

J. Oliver Maggard has served as Managing Partner of Caymus Partners LLC, an investment banking company in New York, since October 2002. From January 1995 to October 2002, Mr. Maggard was a Managing Director and Partner of Regent Capital Management Corp., a private equity firm which he co-founded. Prior to

- 8 -

founding Regent Capital, Mr. Maggard held various positions with Bankers Trust Company, Kidder Peabody & Company, Inc., Drexel Burnham Lambert Incorporated and E.F. Hutton & Co. Mr. Maggard also serves as a director of Datatec Systems, Inc.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth certain information regarding compensation paid or accrued for each of our last two fiscal years to the Chief Executive Officer and to the four highest paid executive officers whose total annual salary and bonus paid or accrued for fiscal year 2004 exceeded $100,000 (the “Named Executive Officers”).

| | | | | | | | | | | | | | |

| | | Fiscal

Year

| | Annual Compensation

| | Long Term Compensation

| | All Other

Compensation

($) (2)

|

| | | | Salary ($)

| | Bonus ($)

| | Other ($)

| | Restricted Stock

Awards ($)(1)

| | Options

| |

Sally J. Smith

Chief Executive Officer

and President | | 2004

2003

2002 | | 350,000

320,000

295,000 | | 304,045

142,848

222,873 | | —

—

— | | 349,990

—

— | | —

3,000

5,000 | | 52,180

47,645

43,294 |

| | | | | | | |

Mary J. Twinem

Chief Financial Officer | | 2004

2003

2002 | | 225,000

200,000

185,000 | | 195,458

89,280

139,768 | | —

—

— | | 225,036

—

— | | —

3,000

5,000 | | 33,876

30,191

26,701 |

| | | | | | | |

Emil Lee Sanders

Senior VP, Development

and Franchising | | 2004

2003

2002 | | 200,000

185,000

175,000 | | 135,840

68,783

94,553 | | —

—

— | | 159,979

—

— | | —

1,600

1,000 | | 25,840

23,252

17,779 |

| | | | | | | |

James M. Schmidt

Senior VP, General

Counsel and Secretary(3) | | 2004

2003

2002 | | 182,000

167,000

110,769 | | 137,174

62,091

59,447 | | —

15,000

— | | 145,597

—

— | | —

1,600

8,000 | | 23,059

19,622

11,077 |

| | | | | | | |

Judith A. Shoulak

Senior VP, Operations | | 2004

2003

2002 | | 193,000

145,000

132,000 | | 146,526

42,311

58,714 | | —

15,000

— | | 154,395

—

— | | —

1,600

500 | | 24,894

15,834

10,732 |

| (1) | On June 11, 2004, restricted stock units were granted to Ms. Smith (12,411 units), Ms. Twinem (7,980 units), Mr. Sanders (5,673 units), Mr. Schmidt (5,163 units) and Ms. Shoulak (5,475 units). The value of the restricted stock units shown above is determined by multiplying the number of restricted stock units granted on the date of grant by $28.20, the closing price of a share of Common Stock on such date. The restricted stock units vest to the extent of 33-1/3% on the last day of each fiscal year, and the risks of forfeiture lapse as to such increment if the Company achieves 95% of the earnings target established by the Board of Directors. The total number of restricted stock units outstanding at December 26, 2004 and the value based on the closing price of a share of Common Stock on such date are: Ms. Smith, 12,411 units ($430,165), Ms. Twinem, 7,980 units ($276,587), Mr. Sanders, 5,673 units ($196,626), Mr. Schmidt, 5,163 units ($178,950) and Ms. Shoulak 5,475 units ($189,764). Restricted stock units are not entitled to earn dividends, and the holders are not entitled to vote the shares underlying the units. |

| (2) | The amounts in this column for the most recently completed fiscal year include (a) contributions to our 401(k) plan for benefit of executive officer: Ms. Smith - $4,100; Ms. Twinem - - $4,100; Mr. Sanders - $4,000; Mr. Schmidt - $3,768; and Ms. Shoulak - $3,950; and (b) long-term disability premium: Ms. Smith - $4,330; Ms. Twinem - $1,651; Mr. Sanders - $1,840; Mr. Schmidt - $1,091; and Ms. Shoulak - $1,644; and (c) deferred compensation accruals: Ms. Smith - $43,750; Ms. Twinem - $28,125; Mr. Sanders - $20,000; Mr. Schmidt - $18,200; and Ms. Shoulak - $19,300. The deferred compensation vests over a five-year period on the basis of 20% per year for each year of service. |

| (3) | Mr. Schmidt joined us in April 2002. |

- 9 -

Option Grants During 2004 Fiscal Year

No stock options were granted during fiscal 2004 to the Named Executive Officers. We have not granted any stock appreciation rights.

Option Exercises During 2004 Fiscal Year and Fiscal Year-End Option Values

The following table provides information as to options exercised by the Named Executive Officers during fiscal 2004 and the number and value of options at December 26, 2004. We do not have any outstanding stock appreciation rights.

| | | | | | | | | | | | | | |

| | | Shares

Acquired on

Exercise (#)

| | Value Realized

($)(1)

| | Number of Unexercised Options

at December 26, 2004

| | Value of Unexercised In-the Money Options at

December 26, 2004(1)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Sally J. Smith | | 54,522 | | 1,434,359 | | 72,501 | | 8,249 | | $ | 2,167,865 | | $ | 190,705 |

| | | | | | |

Mary J. Twinem | | 30,000 | | 738,300 | | 58,450 | | 7,150 | | $ | 1,735,440 | | $ | 160,857 |

| | | | | | |

Emil Lee Sanders | | 650 | | 14,008 | | 6,100 | | 4,200 | | | 159,541 | | | 99,417 |

| | | | | | |

James M. Schmidt | | — | | — | | 17,305 | | 5,950 | | $ | 488,797 | | $ | 133,822 |

| | | | | | |

Judith A. Shoulak | | — | | — | | 525 | | 1,450 | | $ | 9,530 | | $ | 25,665 |

| (1) | Value is calculated on the basis of the difference between the option exercise price and the closing sale price for the Company’s Common Stock on the date of exercise or year-end, as the case may be, as quoted by The Nasdaq Stock Market, multiplied by the number of shares of Common Stock underlying the option(s). |

Compensation Committee Report on Executive Compensation

Compensation Committee Interlocks and Insider Participation. The Compensation Committee of our Board of Directors is comprised of Dale M. Applequist and J. Oliver Maggard, both of whom are independent directors.

Overview and Philosophy. The Compensation Committee’s executive compensation policies are designed to enhance the financial performance of Buffalo Wild Wings, and thus shareholder value, by significantly aligning the financial interests of our key executives with those of our shareholders. Compensation of our executive officers is comprised of five parts: base salary, deferred compensation accruals, annual incentive bonuses, fringe benefits and long-term incentive opportunity in the form of stock options or restricted stock awards.

The Compensation Committee believes that the base salaries of our executive officers for fiscal 2004 are generally comparable to base salaries of executive officers of comparable publicly-held companies in our industry. Executive officers also have the opportunity to earn incentive bonuses if certain financial and/or other performance goals are met by Buffalo Wild Wings. Long-term incentives are based on stock performance through stock options or restricted stock awards. The Compensation Committee believes that stock ownership by our executive officers is beneficial in aligning management’s and shareholders’ interests in the enhancement of shareholder value. Overall, the intent is to have a significant emphasis on variable compensation components and less on fixed cost components. The Compensation Committee believes this philosophy and structure are in the best interests of our shareholders.

Bonuses. We have followed a policy of setting bonus plans for the executive officers, based on the individual performance of the executive officers as well as the overall performance of Buffalo Wild Wings.

Stock Options and Other Incentives. We have a long-term equity incentive plan for executive officers and key employees. The objectives of the program are to align executive and shareholder long-term interests by creating a strong and direct link between executive pay and shareholder return, and to enable executives to develop and maintain a significant, long-term ownership position in our Common Stock.

The 2003 Equity Incentive Plan authorizes the Compensation Committee of the Board of Directors to award stock options and restricted stock to executive officers and key employees. In fiscal 2004, the Committee granted restricted stock units to the executive officers with risks of forfeiture tied to performance. No options were granted to

- 10 -

the executive officers in fiscal 2004. Awards are intended to be generally competitive with other companies of comparable size and complexity within our industry.

Benefits. Buffalo Wild Wings provides medical and insurance benefits to its executive officers, which benefits are generally available to all Buffalo Wild Wings employees. Buffalo Wild Wings has a 401(k) plan in which all qualified employees, including the executive officers, may participate. The amounts of perquisites allowed to executive officers, as determined in accordance with rules of the Securities and Exchange Commission, did not exceed 10% of salary in fiscal 2004. In addition, the executive officers participate in an executive medical plan, which provides up to an additional $5,000 of benefits; provided, however, that each participant must have an annual physical to participate.

Chief Executive Officer Compensation. Sally J. Smith served as our Chief Executive Officer in fiscal 2004. Her compensation was determined in accordance with the policies described above as applicable to all executive officers. In arriving at Ms. Smith’s compensation, the Compensation Committee took into consideration her leadership in profitably growing Buffalo Wild Wings and her commitment to the development of the corporate strategy designed to generate improved financial performance in 2004 and thereafter. Ms. Smith’s annual base salary was $350,000 in 2004, together with deferred compensation accrual of $40,000. Ms. Smith’s 2005 base salary has been determined to be $400,000, with deferred compensation accrual of $50,000. A bonus in the amount of $304,045 was awarded to Ms. Smith for fiscal 2004. In addition, restricted stock units for 12,411 shares were granted to Ms. Smith in fiscal 2004. For additional information, see the section of this Proxy Statement entitledExecutive Compensation – Employment Agreements and Termination of Employment Arrangements.

Summary. Aggregate executive compensation was $2,837,730 in fiscal 2004, including $161,675 in deferred compensation accruals and $1,165,264 in bonuses. No stock options were granted to our executives in fiscal year 2004; however, restricted stock units for an aggregate of 45,867 shares was granted to the executive officers in fiscal 2004. The Compensation Committee intends to continue its policy of paying relatively moderate base salaries, basing bonuses on performance and granting performance based restricted stock units to provide long-term incentive.

Members of the Compensation Committee

Dale M. Applequist, Chair

J. Oliver Maggard

- 11 -

Stock Performance Chart

The following graph compares the monthly change in the cumulative total shareholder return on our Common Stock during the period ended December 26, 2004 with the cumulative total return on the Nasdaq U.S. Index and the S&P 600 Restaurants Index. The comparison assumes $100 was invested on November 21, 2003, the date of our initial public offering, in Buffalo Wild Wings Common Stock and in each of the foregoing indices and assumes reinvestment of dividends.

| | | | | | | |

| | | 11/21/03

| | 12/28/03

| | 12/26/04

|

Buffalo Wild Wings, Inc. | | $ | 100.00 | | 139.41 | | 203.88 |

| | | |

Nasdaq U.S. Index | | $ | 100.00 | | 98.89 | | 104.85 |

| | | |

S&P 600 Restaurants Index | | $ | 100.00 | | 103.85 | | 127.00 |

Employment Agreements and Termination of Employment Arrangements

We have entered into employment agreements with each of our executive officers, including each of the following: Sally J. Smith and Mary J. Twinem effective December 1, 1999, Emil Lee Sanders effective August 20, 2001, James M. Schmidt effective April 22, 2002 and Judith A. Shoulak effective February 25, 2002 (each referred to as Named Executive Officer below). The agreements are for one-year terms and include an automatic extension for successive one-year terms. All agreements have been renewed and are currently in effect. The agreements provide for a base salary, which salary is reviewed annually by the Compensation Committee. The base salaries under the current agreements are $400,000 for Ms. Smith, $250,000 for Ms. Twinem, $200,000 for Mr. Schmidt, $210,000 for Mr. Sanders and $220,000 for Ms. Shoulak.

The employment agreements include termination and resignation provisions, a confidentiality clause, a non-compete provision and a severance package in the event that Buffalo Wild Wings doesn’t renew the agreement, the officer is terminated without cause or if the officer resigns for good reason. Severance payments are for one year for Ms. Smith and Ms. Twinem and six months for the other Named Executive Officers. Under our deferred compensation plan, deferred compensation is accrued, which amounts are subject to certain vesting provisions depending on length of employment and circumstances of employment termination. The amount of deferred compensation is based on a percentage of base salary, which amount is 12.5% for Ms. Smith and Ms. Twinem and 10% for the other Named Executive Officers.

- 12 -

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of the Securities Exchange Act of 1934 requires our officers and directors, and persons who own more than ten percent of a registered class of our equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission (the “SEC”). Officers, directors and greater than ten-percent shareholders are required by SEC regulation to furnish Buffalo Wild Wings with copies of all Section 16(a) forms they file. Based solely on its review of the copies of such forms received by it, we believe that, during fiscal year 2004, all officers, directors and greater than ten-percent beneficial owners complied with the applicable filing requirements.

Certain Transactions

As part of a bridge financing in 1999, we issued warrants to purchase an aggregate of 35,104 shares of our Common Stock at $3.35 per share to Carefree Capital, Inc., of which Kenneth H. Dahlberg, one of our directors, is the sole shareholder. The warrants were exercised on March 23, 2004.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

General

The Audit Committee has not selected an independent registered public accounting firm for the year ending December 25, 2005. Due to the delayed filing of our Form 10-K for fiscal year 2004, the Committee has not had adequate time to conduct a full review of 2004 and 2005 audit services. KPMG LLP, who has served as our independent registered public accounting firm since 1994, provided services in connection with the audit of our financial statements for the year ended December 26, 2004, assistance with our Annual Report submitted to the Securities and Exchange Commission on Form 10-K and filed with the Securities and Exchange Commission, and consultation on matters relating to accounting and financial reporting. Representatives of KPMG LLP are expected to be present at the Annual Meeting and will be given an opportunity to make a statement if so desired and to respond to appropriate questions.

Audit Fees

We paid the following fees to KPMG LLP for fiscal years 2003 and 2004:

| | | | | | |

| | | 2003

| | 2004

|

Audit Fees | | $ | 114,118 | | $ | 182,449 |

Audit of Internal Control Fees | | | 0 | | | 249,717 |

Audit-Related Fees | | | 41,490 | | | 25,662 |

Tax Fees | | | 32,100 | | | 22,300 |

All Other Fees | | | 397,000 | | | 0 |

| | |

|

| |

|

|

| | | $ | 584,708 | | $ | 480,128 |

Audit-related fees are primarily for services in connection with the employee benefit plan and National Advertising Fund. Audit of internal control fees are for fees relating to compliance with the Sarbanes-Oxley Act in testing internal controls with respect to financial reporting. Tax fees include fees for services provided in connection with tax planning and tax compliance. All other fees are related to our initial public offering.

The Audit Committee has considered whether provision of the above non-audit services is compatible with maintaining the registered public accounting firm’s independence and has determined that such services are compatible with maintaining registered public accounting firm’s independence.

Pre-Approval of Audit Fees

Pursuant to its written charter, the Audit Committee is responsible for pre-approving all audit and permitted non-audit services to be performed for Buffalo Wild Wings by its independent registered public accounting firm or any other auditing or accounting firm.

- 13 -

Report of Audit Committee

The Board of Directors maintains an Audit Committee comprised of three of our outside directors. The Board of Directors and the Audit Committee believe that the Audit Committee’s current member composition satisfies the rule of the National Association of Securities Dealers, Inc. (“NASD”) that governs audit committees, Rule 4310(c)(26)(B)(i), including the requirement that audit committee members all be “independent directors” as that term is defined by NASD Rule 4200(a)(14).

In accordance with its written charter adopted by the Board of Directors, which was filed as Appendix A to our proxy statement for the 2004 annual shareholders’ meeting which was filed on April 26, 2004, the Audit Committee assists the Board of Directors with fulfilling its oversight responsibility regarding the quality and integrity of the accounting, auditing and financial reporting practices of Buffalo Wild Wings. In performing its oversight responsibilities regarding the audit process, the Audit Committee:

| | (1) | reviewed and discussed the audited consolidated financial statements with management; |

| | (2) | discussed with the independent registered public accounting firm the material required to be discussed by Statement on Auditing Standards No. 61; and |

| | (3) | reviewed the written disclosures and the letter from the independent registered public accounting firm required by the Independence Standards Board’s Standard No.1, and discussed with the independent registered public accounting firm any relationships that may impact their objectivity and independence. |

During 2004, management completed the documentation, testing and evaluation of the Company’s system of internal control over financial reporting in response to the requirements set forth in Section 404 of the Sarbanes-Oxley Act of 2002 and related regulations. The Audit Committee met periodically, both independently and with management, to review and discuss the Company’s progress on complying with Section 404, including the Public Company Accounting Oversight Board’s (PCAOB) Auditing Standard No. 2 regarding the audit of the internal control financial reporting. The Audit Committee also met periodically with KPMG LLP, the Company’s independent registered public accounting firm to discuss the Company’s internal controls and the status of its Section 404 compliance efforts. At the conclusion of the process, management provided the Audit Committee with a report on the effectiveness of the Company’s internal control over financial reporting. The Audit Committee continues to oversee the Company’s efforts related to its internal controls.

Based upon the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 26, 2004, as filed with the Securities and Exchange Commission.

Members of the Audit Committee

J. Oliver Maggard, Chair

Dale M. Applequist

Robert W. MacDonald

OTHER BUSINESS

Management knows of no other matters to be presented at the 2005 Annual Meeting. If any other matter properly comes before the 2005 Annual Meeting, the appointees named in the proxies will vote the proxies in accordance with their best judgment.

SHAREHOLDER PROPOSALS

Any appropriate proposal submitted by a shareholder of Buffalo Wild Wings and intended to be presented at the 2006 Annual Meeting must be received by us by December 12, 2005 to be included in our proxy statement and related proxy for the 2006 Annual Meeting. If a shareholder proposal intended to be presented at the 2006 annual meeting but not included in the proxy materials is received by us after February 25, 2006, then management named in

- 14 -

our proxy for the 2006 Annual Meeting will have discretionary authority to vote shares represented by such proxies on the shareholder proposal, if presented at the meeting.

ANNUAL REPORT

A copy of our Annual Report to Shareholders for the fiscal year ended December 26, 2004, including financial statements, accompanies this Notice of Annual Meeting and Proxy Statement. No portion of the Annual Report is incorporated herein or is to be considered proxy soliciting material.

FORM 10-K

WE WILL FURNISH WITHOUT CHARGE TO EACH PERSON WHOSE PROXY IS BEING SOLICITED, UPON WRITTEN REQUEST OF ANY SUCH PERSON, A COPY OF OUR ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 26, 2004, AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, INCLUDING THE FINANCIAL STATEMENTS AND A LIST OF EXHIBITS TO SUCH FORM 10-K. WE WILL FURNISH TO ANY SUCH PERSON ANY EXHIBIT DESCRIBED IN THE LIST ACCOMPANYING THE FORM 10-K UPON THE ADVANCE PAYMENT OF REASONABLE FEES. REQUESTS FOR A COPY OF THE FORM 10-K AND/OR ANY EXHIBIT(S) SHOULD BE DIRECTED TO JAMES M. SCHMIDT, SENIOR VP, GENERAL COUNSEL AND SECRETARY OF BUFFALO WILD WINGS, INC., 1600 UTICA AVENUE SOUTH, SUITE 700, MINNEAPOLIS, MINNESOTA 55416. YOUR REQUEST MUST CONTAIN A REPRESENTATION THAT, AS OF MARCH 31, 2005, YOU WERE A BENEFICIAL OWNER OF SHARES ENTITLED TO VOTE AT THE 2005 ANNUAL MEETING OF SHAREHOLDERS.

|

BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

Sally J. Smith, President and Chief Executive Officer |

Dated: April 11, 2005

- 15 -

FOLD AND DETACH HERE AND READ THE REVERSE SIDE

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned appoints Sally J. Smith and Mary J. Twinem, and each of them, as proxies, each with the power to appoint her substitute, and authorizes each of them to represent and to vote, as designated on the reverse hereof, all of the shares of common stock of Buffalo Wild Wings, Inc. held of record by the undersigned at the close of business on March 31, 2005 at the Annual Meeting of Shareholders of Buffalo Wild Wings, Inc. to be held on May 12, 2005 or at any adjournment thereof.

Buffalo Wild Wings, Inc.

ANNUAL MEETING OF SHAREHOLDERS

Thursday, May 12, 2005, 9:00 a.m. Central Time

Buffalo Wild Wings® Grill & Bar 3085 White Bear Avenue North Maplewood, Minnesota

(Continued, and to be marked, dated and signed, on the other side)

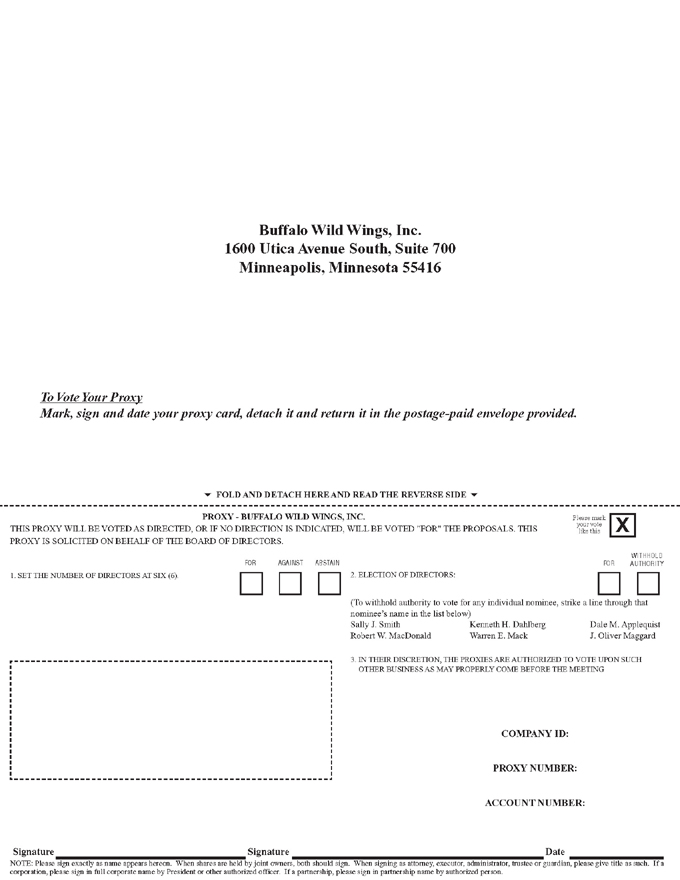

Buffalo Wild Wings, Inc. 1600 Utica Avenue South, Suite 700 Minneapolis, Minnesota 55416

To Vote Your Proxy

Mark, sign and date your proxy card, detach it and return it in the postage-paid envelope provided.

FOLD AND DETACH HERE AND READ THE REVERSE SIDE

PROXY—BUFFALO WILD WINGS, INC.

THIS PROXY WILL BE VOTED AS DIRECTED, OR IF NO DIRECTION IS INDICATED, WILL BE VOTED “FOR” THE PROPOSALS. THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS.

Please mark your vote like this

1. SET THE NUMBER OF DIRECTORS AT SIX (6).

FOR AGAINST ABSTAIN

2. ELECTION OF DIRECTORS:

WITHHOLD FOR AUTHORITY

(To withhold authority to vote for any individual nominee, strike a line through that nominee’s name in the list below) Sally J. Smith Kenneth H. Dahlberg Dale M. Applequist Robert W. MacDonald Warren E. Mack J. Oliver Maggard

3. IN THEIR DISCRETION, THE PROXIES ARE AUTHORIZED TO VOTE UPON SUCH

OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING

COMPANY ID: PROXY NUMBER: ACCOUNT NUMBER:

Signature Signature Date

NOTE: Please sign exactly as name appears hereon. When shares are held by joint owners, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give title as such. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person.