Exhibit 99.2 Amdocs Limited NASDAQ: DOX Fiscal Q1 2025 Earnings Presentation February 4, 2025 Shuky Sheffer President & CEO Tamar Rapaport-Dagim CFO & COO

Disclaimer The information contained herein in this presentation or delivered or to be delivered to you during this presentation does not constitute an offer, expressed or implied, or a recommendation to do any transaction in Amdocs Limited securities or in any securities of its affiliates or subsidiaries. This presentation and the comments made by members of Amdocs management in conjunction with it can be found on the Investor Relations section of our website, and, as always, a copy of today’s prepared remarks will also be posted immediately following the conclusion of this call. includes information that constitutes forward-looking statements made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995, including statements about Amdocs’ growth and business results in future quarters and years. Although we believe the expectations reflected in such forward-looking statements are based upon reasonable assumptions, we can give no assurance that our expectations will be obtained or that any deviations will not be material. Such statements involve risks and uncertainties that may cause future results to differ from those anticipated. These risks include, but are not limited to, the effects of general macroeconomic conditions, prevailing level of macroeconomic, business and operational uncertainty, including as a result of geopolitical events or other regional events or pandemics, as well as the current inflationary environment, and the effects of these conditions on the Company’s customers’ businesses and levels of business activity, including the effect of the current economic uncertainty and industry pressure on the spending decisions of the Company’s customers. Amdocs’ ability to grow in the business markets that it serves, Amdocs’ ability to successfully integrate acquired businesses, adverse effects of market competition, rapid technological shifts that may render the Company’s products and services obsolete, security incidents, including breaches and cyberattacks to our systems and networks and those of our partners or customers, potential loss of a major customer, our ability to develop long-term relationships with our customers, our ability to successfully and effectively implement artificial intelligence and Generative AI in the Company’s offerings and operations, and risks associated with operating businesses in the international market. Amdocs may elect to update these forward-looking statements at some point in the future; however, Amdocs specifically disclaims any obligation to do so. These and other risks are discussed at greater length in Amdocs’ filings with the Securities and Exchange Commission, including in our Annual Report on Form 20-F for the fiscal year ended September 30, 2024 filed on December 17, 2024. This presentation includes non-GAAP financial measures, including non-GAAP operating margin, free cash flow, revenue on a constant currency basis, non-GAAP net income, non-GAAP net income attributable to Amdocs Limited, and non-GAAP earnings per share. Free cash flow equals cash generated by operating activities less net capital expenditures. While in prior years Amdocs used normalized free cash flow, a measure of our operating performance, is further adjusted to exclude net capital expenditures related to the new campus development, payments for non-recurring and unusual charges (such as capital gains tax to be paid in relation to the divestiture of OpenMarket), and payments of acquisition related liabilities, Amdocs is no longer reporting normalized free cash flow. Normalized free cash flow is not comparable to free cash flow. These non-GAAP financial measures are not in accordance with, or an alternative for, generally accepted accounting principles and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles. Amdocs believes that non-GAAP financial measures have limitations in that they do not reflect all of the amounts associated with Amdocs’ results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate Amdocs’ results of operations in conjunction with the corresponding GAAP measures. Please refer to the appendix for a reconciliation of these metrics to the most comparable GAAP provision. This presentation also includes pro forma metrics which exclude the financial impact of OpenMarket (divested on December 31, 2020) from fiscal year 2021. Please also review the information contained in Amdocs’ press release dated February 4, 2025 with respect to earnings for fiscal Q1 2025. The press release contains additional information regarding Amdocs’ outlook for fiscal year 2025 and certain non-GAAP metrics and their reconciliations. Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 2

Today’s speakers Shuky Sheffer President & Chief Executive Officer Tamar Rapaport-Dagim Chief Financial Officer & Chief Operating Officer Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 3 3

Earnings call agenda 1 Strategy & business performance update Shuky Sheffer, President & Chief Executive Officer 2 Financial review & outlook Tamar Rapaport-Dagim, Chief Financial Officer & Chief Operating Officer 3 Q&A IIn nf for orm ma at tiion on Se Sec cu ur riit ty y L Le evel vel 0 0 – – P Pu ub blliic c. . © © 20 2025 25 – – P Pr rop opr riie et ta ar ry y & & Con Conf fiid de en nt tiia all IIn nf for orm ma at tiion on of of A Am md doc ocs s 4 4 4

Shuky Sheffer President & Chief Executive Officer Strategy and business performance update 5

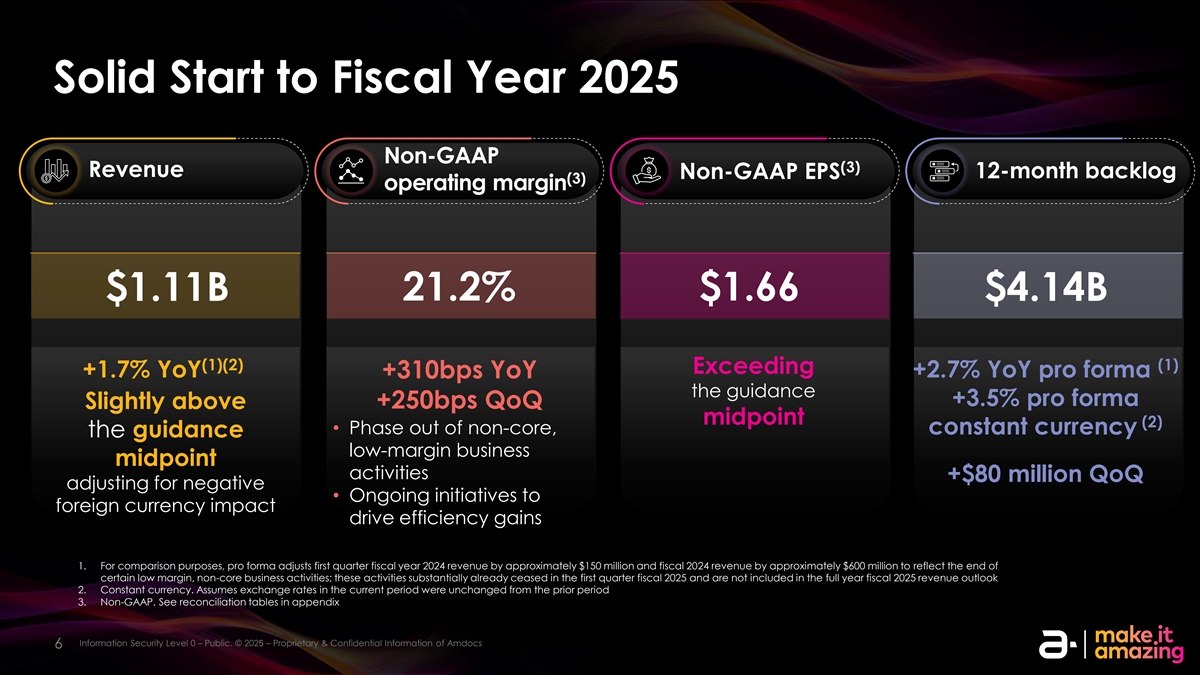

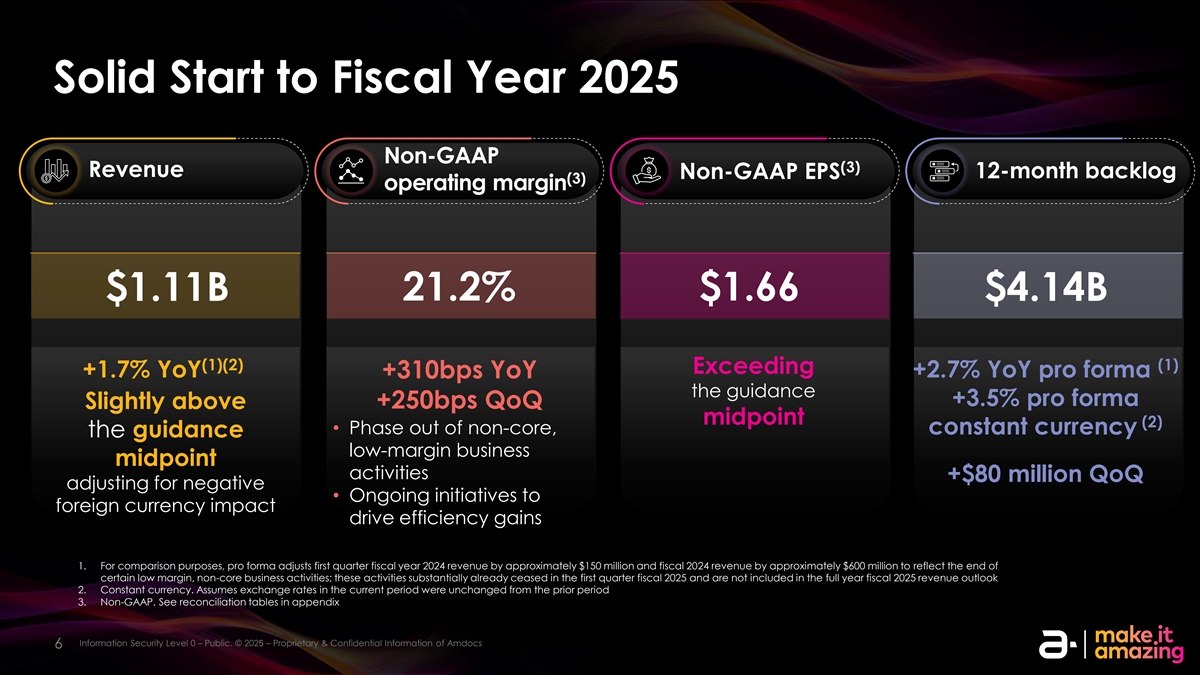

Solid Start to Fiscal Year 2025 Non-GAAP (3) Revenue Non-GAAP EPS 12-month backlog (3) operating margin $1.11B 21.2% $1.66 $4.14B (1)(2) (1) Exceeding +1.7% YoY +2.7% YoY pro forma +310bps YoY the guidance +3.5% pro forma Slightly above +250bps QoQ midpoint (2) • Phase out of non-core, constant currency the guidance low-margin business midpoint activities +$80 million QoQ adjusting for negative • Ongoing initiatives to foreign currency impact drive efficiency gains 1. For comparison purposes, pro forma adjusts first quarter fiscal year 2024 revenue by approximately $150 million and fiscal 2024 revenue by approximately $600 million to reflect the end of certain low margin, non-core business activities; these activities substantially already ceased in the first quarter fiscal 2025 and are not included in the full year fiscal 2025 revenue outlook 2. Constant currency. Assumes exchange rates in the current period were unchanged from the prior period 3. Non-GAAP. See reconciliation tables in appendix InformationI nSe for c m ur a itty ion Le vel Sec 0 ur–it y P u Lb elvel ic. © 3 – 202 High5 –l y P r Se op nrsie ititve ary . ©️ & 2024 Conf– id P e rn op tia rile Itn a for ry m & Con ationf iof de A nm tia d l oc Infs ormation of Amdocs 6 6

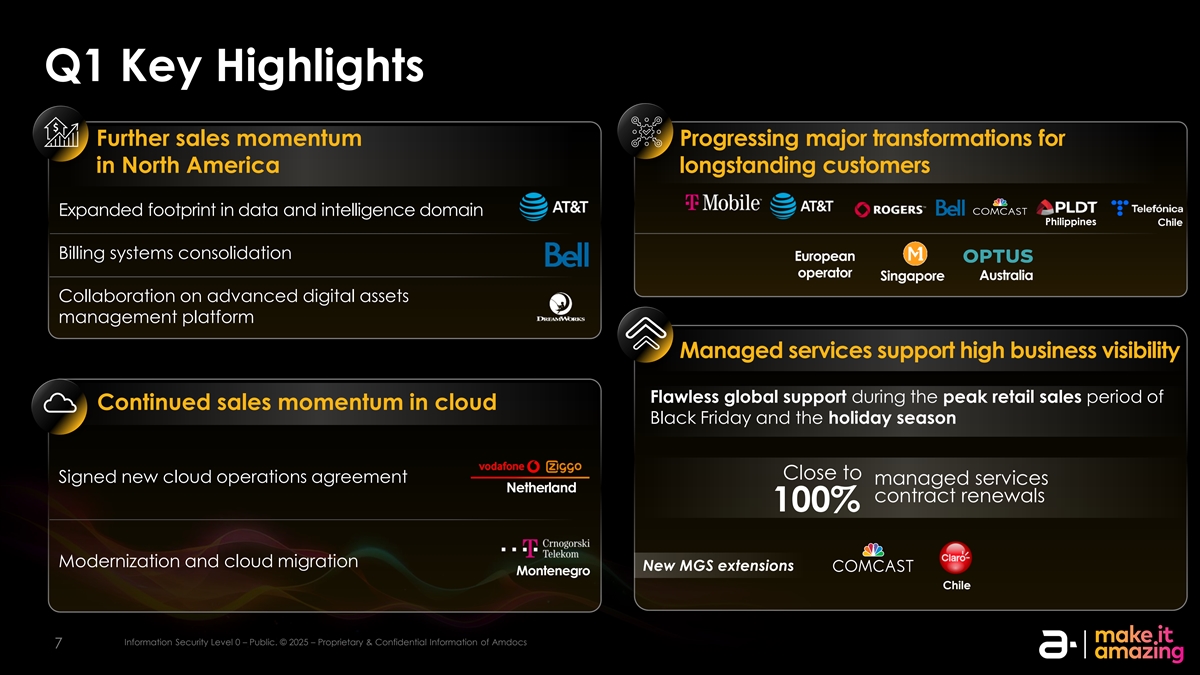

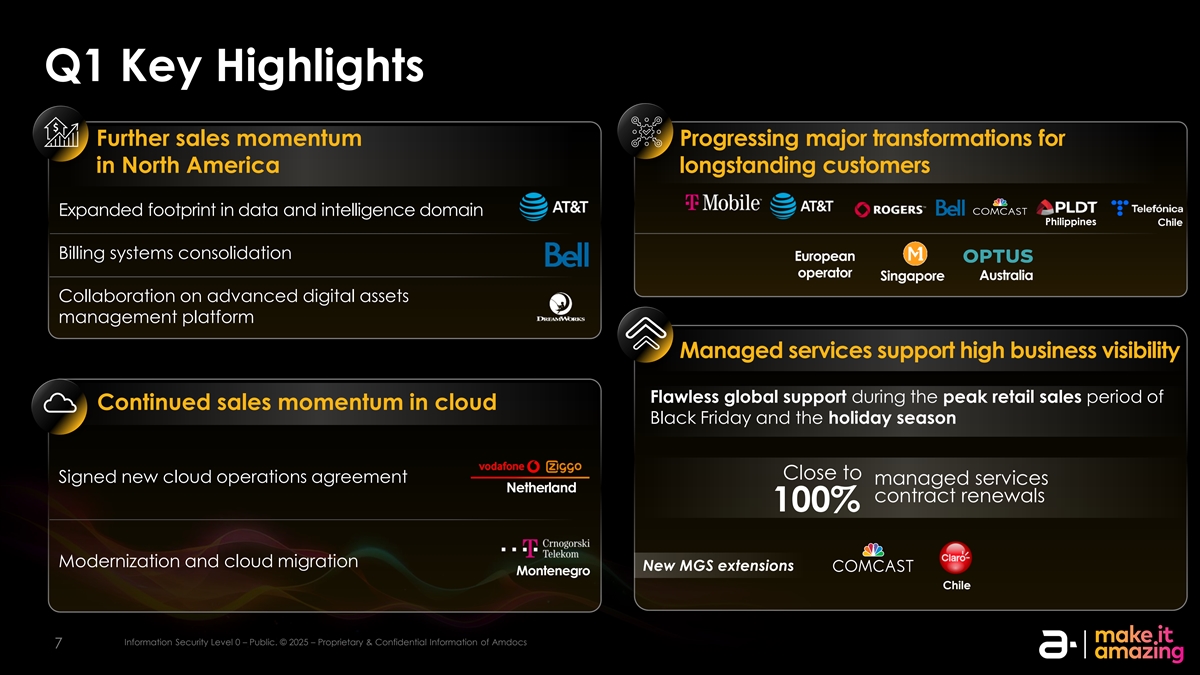

Q1 Key Highlights Further sales momentum Progressing major transformations for in North America longstanding customers Expanded footprint in data and intelligence domain Philippines Chile Billing systems consolidation European operator Australia Singapore Collaboration on advanced digital assets management platform Managed services support high business visibility Flawless global support during the peak retail sales period of Continued sales momentum in cloud Black Friday and the holiday season Close to Signed new cloud operations agreement managed services Netherland contract renewals 100% Modernization and cloud migration New MGS extensions Montenegro Chile IIn nf for orm ma at tiion on Se Sec cu ur riit ty y L Le evel vel 0 0 – – P Pu ub blliic c. . © © 20 2025 25 – – P Pr rop opr riie et ta ar ry y & & Con Conf fiid de en nt tiia all IIn nf for orm ma at tiion on of of A Am md doc ocs s 7 7

Strategic Growth Framework Designed to provide the market-leading innovation our customers need Accelerate the journey to the cloud Digitally transform the customer experience for consumer and B2B Monetize the future market potential of next-generation networks Deliver dynamic connected experiences by streamlining and automating complex network ecosystems Simplify and accelerate the adoption of Generative AI IIn nf for orm ma at tiion on Se Sec cu ur riit ty y L Le evel vel 0 0 – – P Pu ub blliic c. . © © 20 202 255 – – P Pr rop opr riie et ta ar ry y & & Con Conf fiid de en nt tiia all IIn nf for orm ma at tiion on of of A Am md doc ocs s 8 8 8

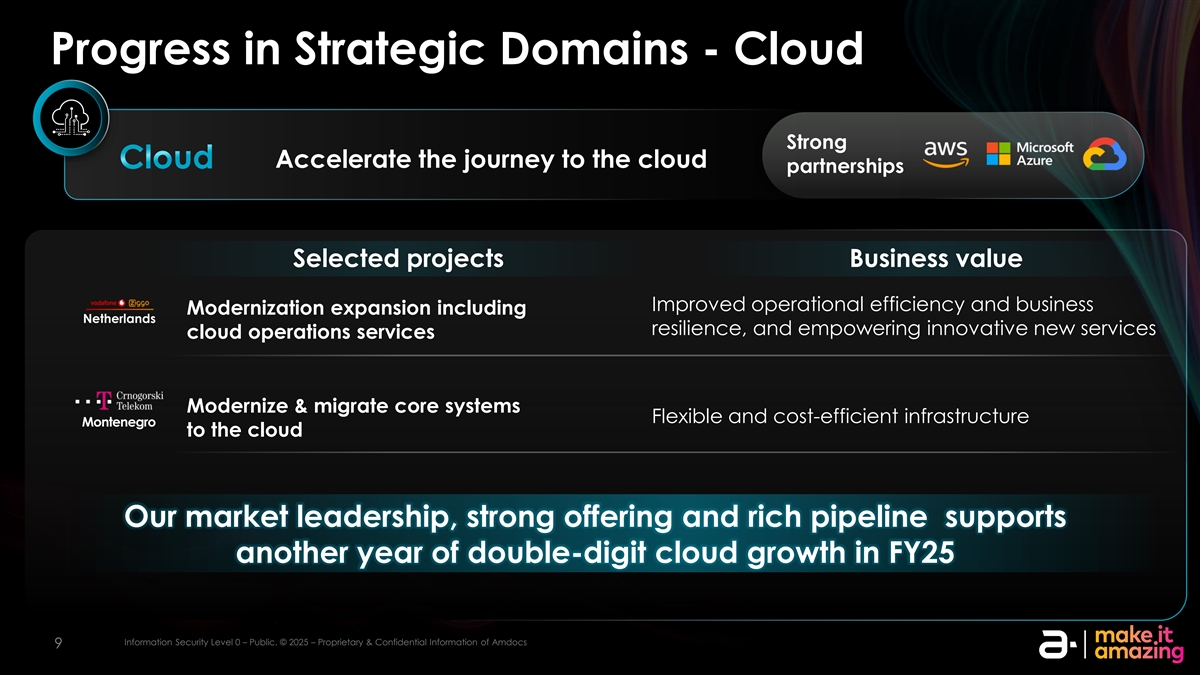

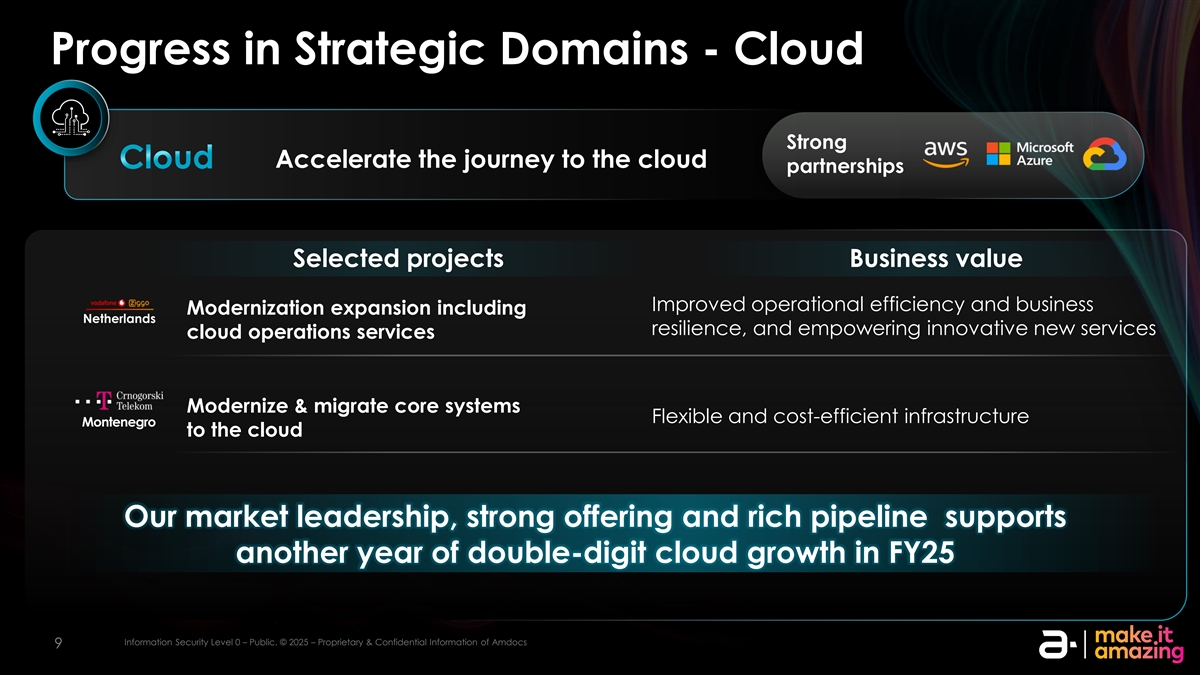

Progress in Strategic Domains - Cloud Strong Accelerate the journey to the cloud Cloud partnerships Selected projects Business value Improved operational efficiency and business Modernization expansion including Netherlands resilience, and empowering innovative new services cloud operations services Modernize & migrate core systems Flexible and cost-efficient infrastructure Montenegro to the cloud Our market leadership, strong offering and rich pipeline supports another year of double-digit cloud growth in FY25 IIn nf for orm ma at tiion on Se Sec cu ur riit ty y L Le evel vel 0 0 – – P Pu ub blliic c. . © © 20 2025 25 – – P Pr rop opr riie et ta ar ry y & & Con Conf fiid de en nt tiia all IIn nf for orm ma at tiion on of of A Am md doc ocs s 9 9

Progress in Strategic Domains – Digital Modernization Digital Digitally transform the customer experience for consumer and B2B modernization Selected examples Business value Enhanced digital experience of self-serve app Digital experience services More agile and responsive way to engage and support Enterprise customer experience Australia customers MarketONE extension and Drive OTT resale growth & accelerate Mexico expansion of capabilities revenue opportunities Co-engineered digital assets Streamline production workflows, efficiently manage digital management platform assets and enhance collaboration with partner studios Cloud-native connectX SaaS platform Quick launch of new digital brands and services Nigeria Growing list of Strong traction in our Nigeria US customers SaaS next-gen platforms (selected) South Africa Brazil Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 10 Information Security Level 0 – Public. ©️ 2025 – Proprietary & Confidential Information of Amdocs 10

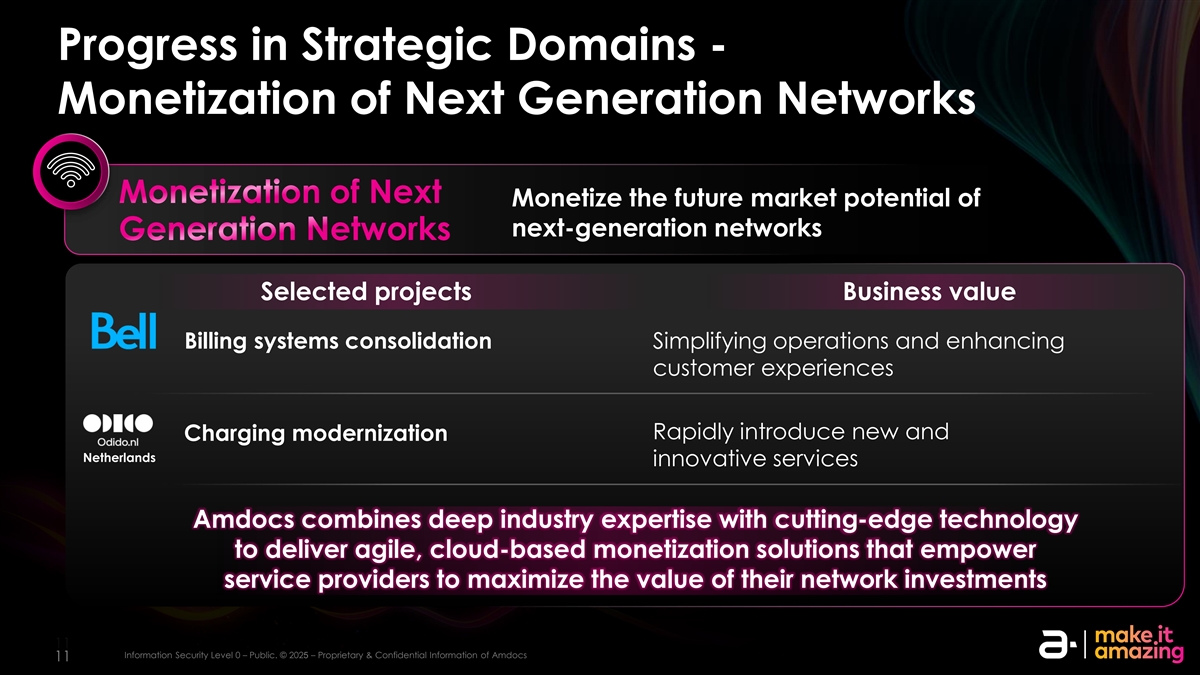

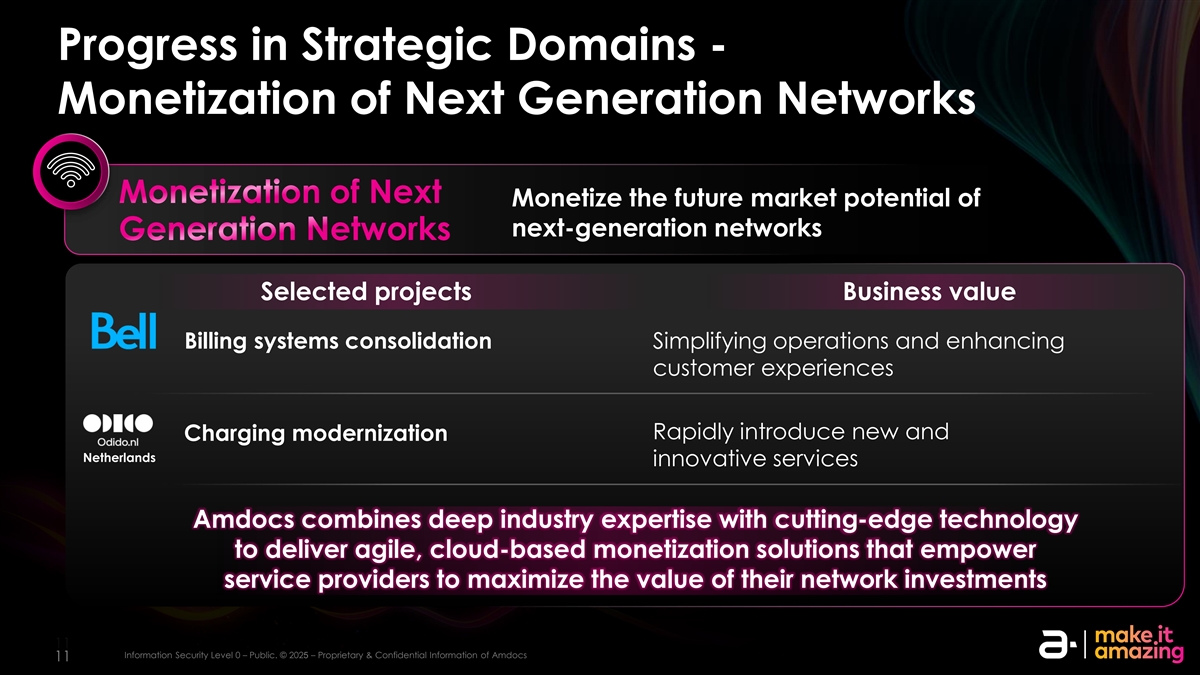

Progress in Strategic Domains - Monetization of Next Generation Networks Monetization of Next Monetize the future market potential of next-generation networks Generation Networks Selected projects Business value Billing systems consolidation Simplifying operations and enhancing customer experiences Rapidly introduce new and Charging modernization Netherlands innovative services Amdocs combines deep industry expertise with cutting-edge technology to deliver agile, cloud-based monetization solutions that empower service providers to maximize the value of their network investments Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 11 Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 11

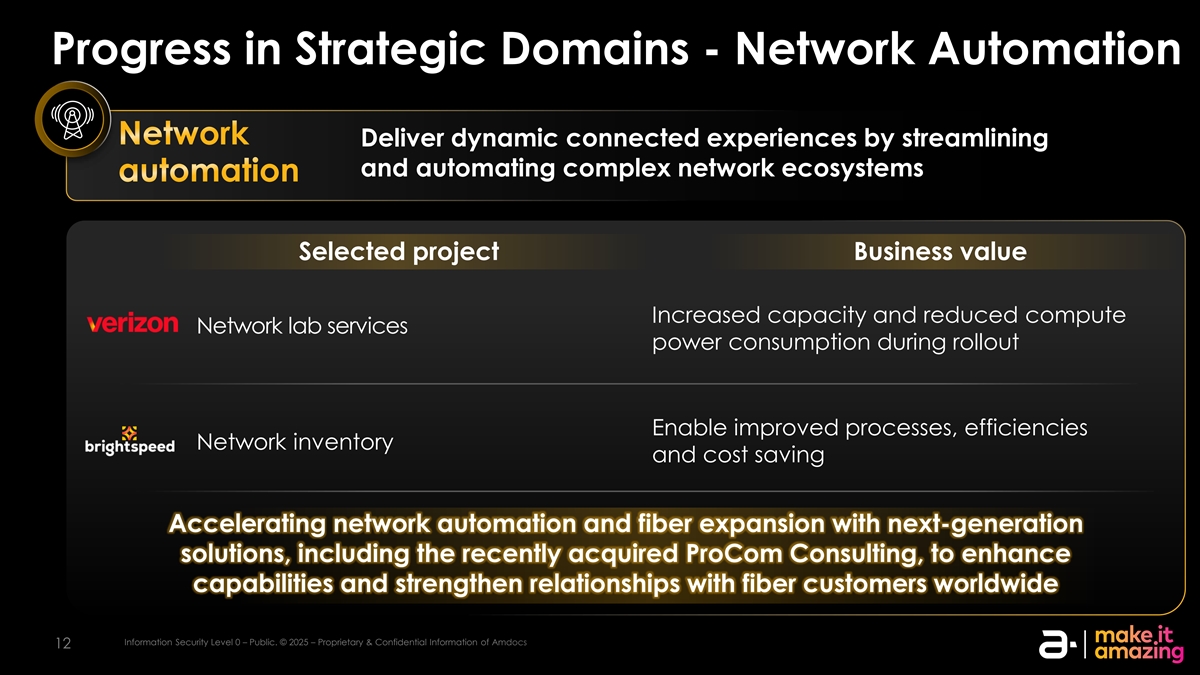

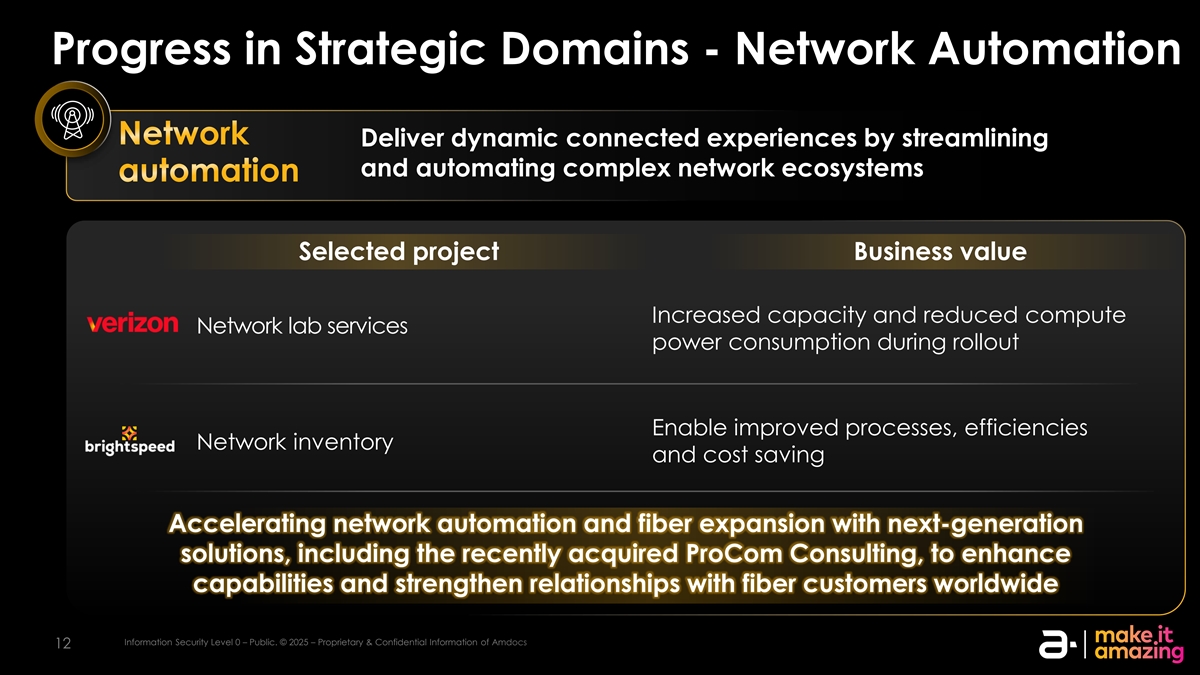

Progress in Strategic Domains - Network Automation Network Deliver dynamic connected experiences by streamlining and automating complex network ecosystems automation Selected project Business value Increased capacity and reduced compute Network lab services power consumption during rollout Enable improved processes, efficiencies Network inventory and cost saving Accelerating network automation and fiber expansion with next-generation solutions, including the recently acquired ProCom Consulting, to enhance capabilities and strengthen relationships with fiber customers worldwide Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 12

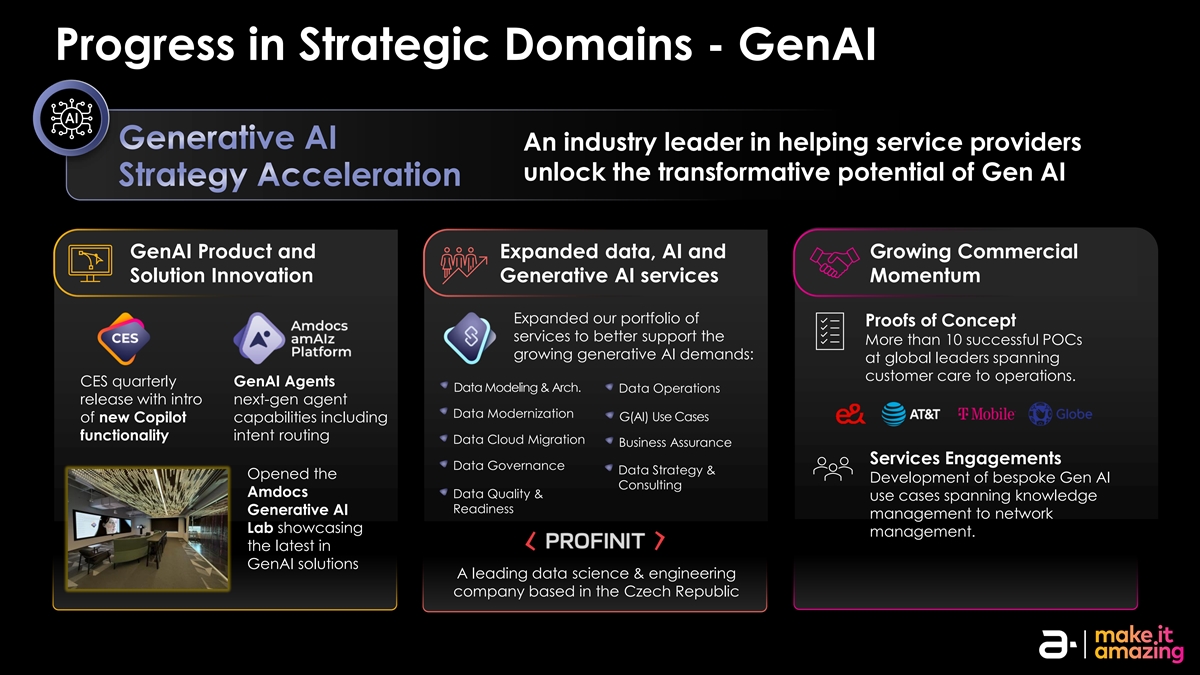

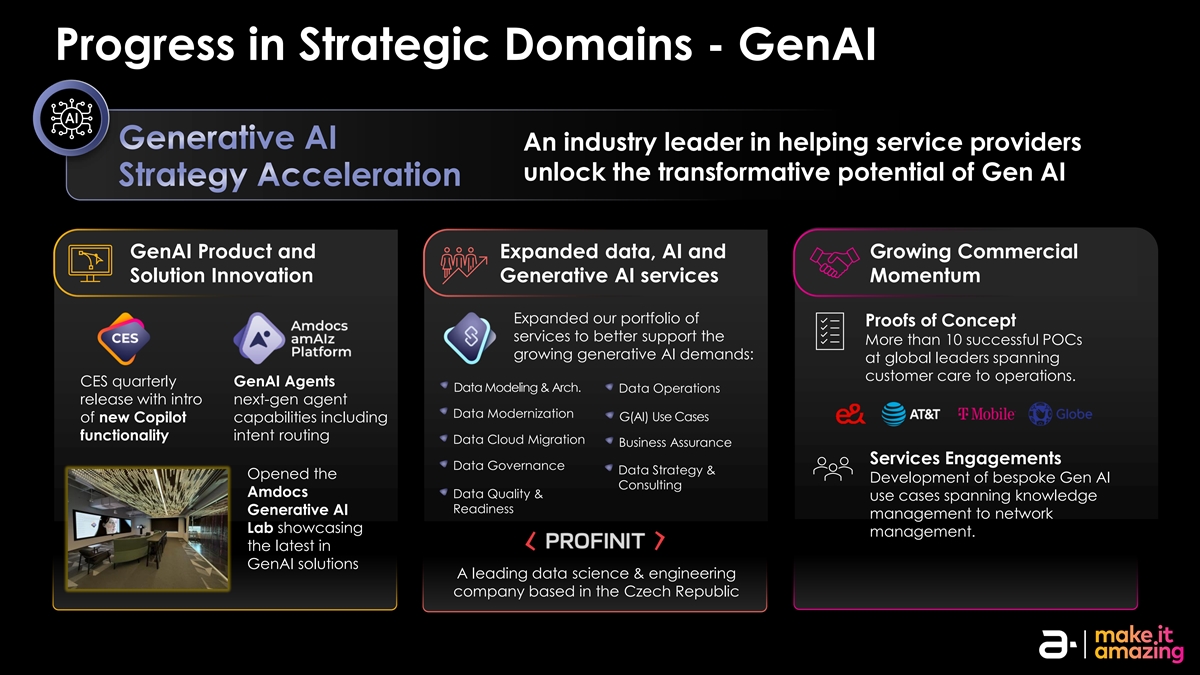

Progress in Strategic Domains - GenAI Generative AI An industry leader in helping service providers unlock the transformative potential of Gen AI Strategy Acceleration GenAI Product and Expanded data, AI and Growing Commercial Solution Innovation Generative AI services Momentum Expanded our portfolio of Proofs of Concept services to better support the More than 10 successful POCs growing generative AI demands: at global leaders spanning customer care to operations. CES quarterly GenAI Agents Data Modeling & Arch. Data Operations release with intro next-gen agent Data Modernization G(AI) Use Cases of new Copilot capabilities including functionality intent routing Data Cloud Migration Business Assurance Services Engagements Data Governance Data Strategy & Opened the Development of bespoke Gen AI Consulting Amdocs Data Quality & use cases spanning knowledge Readiness Generative AI management to network Lab showcasing management. the latest in GenAI solutions A leading data science & engineering company based in the Czech Republic

Looking Ahead: Strong Fundamentals in Challenging, Largely Unchanged Environment Confident in our relatively resilient business model • Highly recurring revenue streams • Strong levels of business visibility • Multi-year customer engagements Significant room to grow within our large addressable market • Approaching $60 billion SAM • Room to expand within existing customers • Opportunity to win new logos and penetrate new geographies Rich and encouraging pipeline, including several large and mature opportunities Mainframe Network Digital engineering Digital transformation amAIz suite to cloud operations services projects (GenAI) OSS System B2B platform modernization consolidations (CPQ) Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 14 Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 14

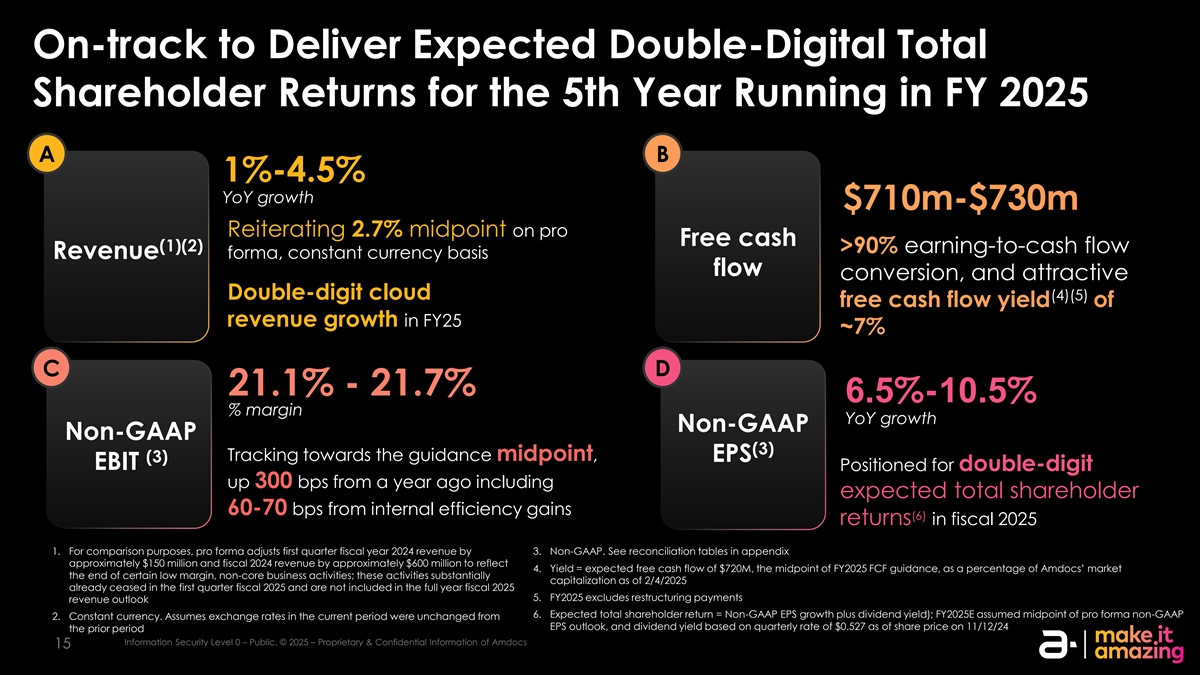

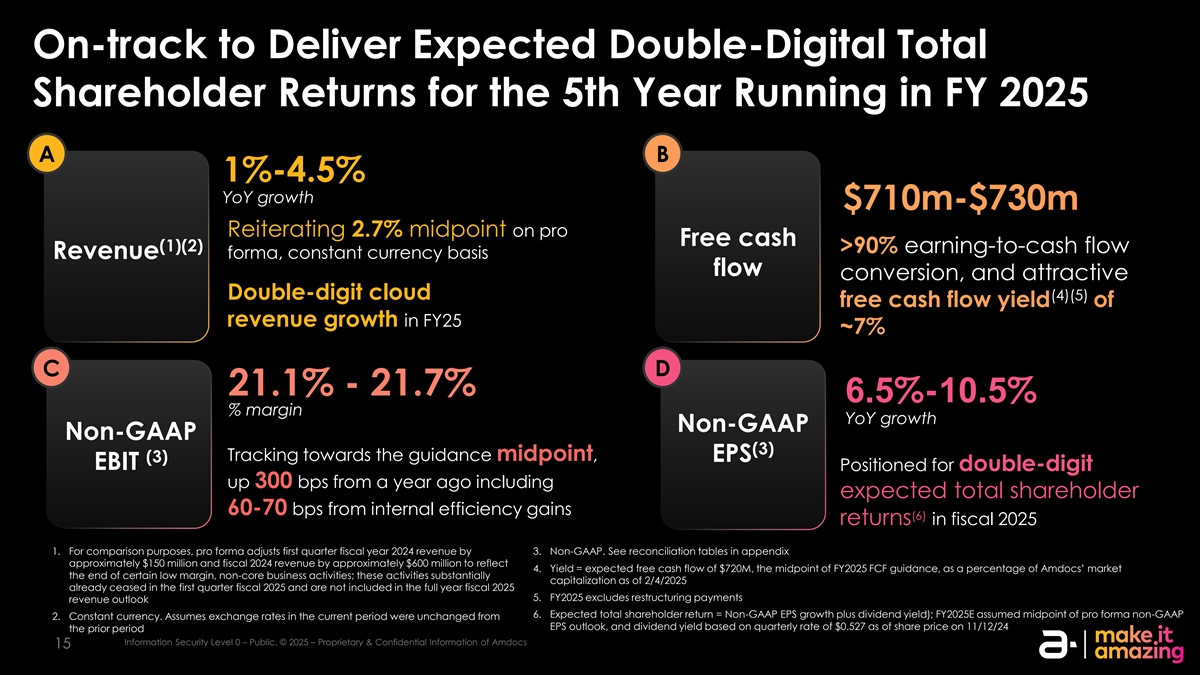

On-track to Deliver Expected Double-Digital Total Shareholder Returns for the 5th Year Running in FY 2025 A B 1%-4.5% YoY growth $710m-$730m Reiterating 2.7% midpoint on pro Free cash (1)(2) >90% earning-to-cash flow Revenue forma, constant currency basis flow conversion, and attractive Double-digit cloud (4)(5) free cash flow yield of revenue growth in FY25 ~7% C D 21.1% - 21.7% 6.5%-10.5% % margin YoY growth Non-GAAP Non-GAAP (3) Tracking towards the guidance midpoint, (3) EPS EBIT Positioned for double-digit up 300 bps from a year ago including expected total shareholder 60-70 bps from internal efficiency gains (6) returns in fiscal 2025 1. For comparison purposes, pro forma adjusts first quarter fiscal year 2024 revenue by 3. Non-GAAP. See reconciliation tables in appendix approximately $150 million and fiscal 2024 revenue by approximately $600 million to reflect 4. Yield = expected free cash flow of $720M, the midpoint of FY2025 FCF guidance, as a percentage of Amdocs’ market the end of certain low margin, non-core business activities; these activities substantially capitalization as of 2/4/2025 already ceased in the first quarter fiscal 2025 and are not included in the full year fiscal 2025 5. FY2025 excludes restructuring payments revenue outlook 6. Expected total shareholder return = Non-GAAP EPS growth plus dividend yield); FY2025E assumed midpoint of pro forma non-GAAP 2. Constant currency. Assumes exchange rates in the current period were unchanged from EPS outlook, and dividend yield based on quarterly rate of $0.527 as of share price on 11/12/24 the prior period Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 15

Tamar Rapaport-Dagim Chief Financial Officer & Chief Operating Officer Financial review & outlook 16

Q1 2025 Revenue vs. Guidance Q1 2025 Results Q1 FY2025 $ Millions Revenue was slightly above Q1 Revenue Financial guidance midpoint, adjusting for negative ~$6M currency impact $1,110 million Slightly above guidance midpoint Highlights adjusting for ~$6M currency impact $1,115 $1,110 ($1,095M - $1,135M) Revenue, -10.9% YoY as reported, reflecting phase-out of certain business activities (3) Q1 Non-GAAP Operating Margin Original Q1F25 Q1F25A (1) Revenue +1.7% YoY in pro forma Guidance (midpoint) 21.2%, +310bps YoY (2) constant currency +250 bps QoQ Adjusting for currency, Q1 revenue was Q1 2025 Revenue by Region slightly above the guidance midpoint $ Millions Rest of World Significantly improved operating profitability Q1 GAAP Diluted EPS ~$217 reflecting phase out of low margin business $1.33 above the guidance range activities and ongoing efficiency gains ~20% ($1.20 - $1.29) North 1. For comparison purposes, pro forma adjusts first quarter fiscal year 2024 America revenue by approximately $150 million and fiscal 2024 revenue by ~14% Europe ~$737 ~66% approximately $600 million to reflect the end of certain low margin, non- ~$155 core business activities; these activities substantially already ceased in the (3) Q1 Non-GAAP Diluted EPS first quarter fiscal 2025 and are not included in the full year fiscal 2025 revenue outlook 2. Constant currency. Assumes exchange rates in the current period were $1.66 above the guidance midpoint unchanged from the prior period ($1.61 - $1.67) 3. Non-GAAP. See reconciliation tables in appendix Information Security Level 2 – Sensitive. © 2025 – Proprietary & Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 17 17 Confidential Information of Amdocs

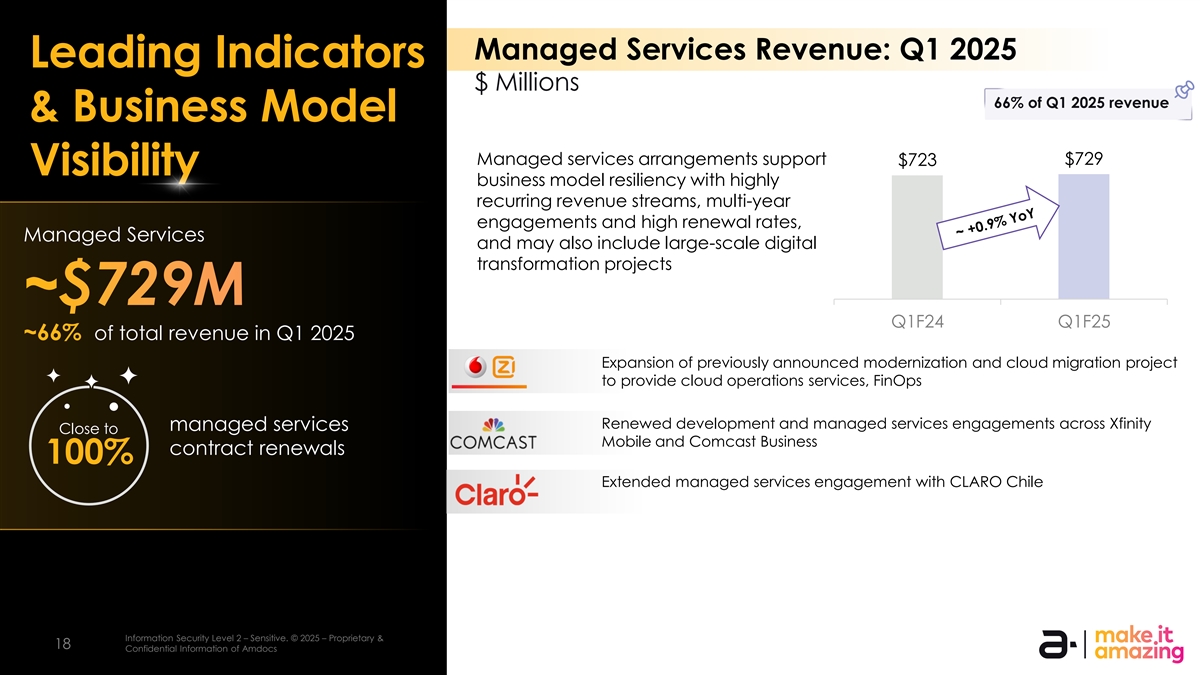

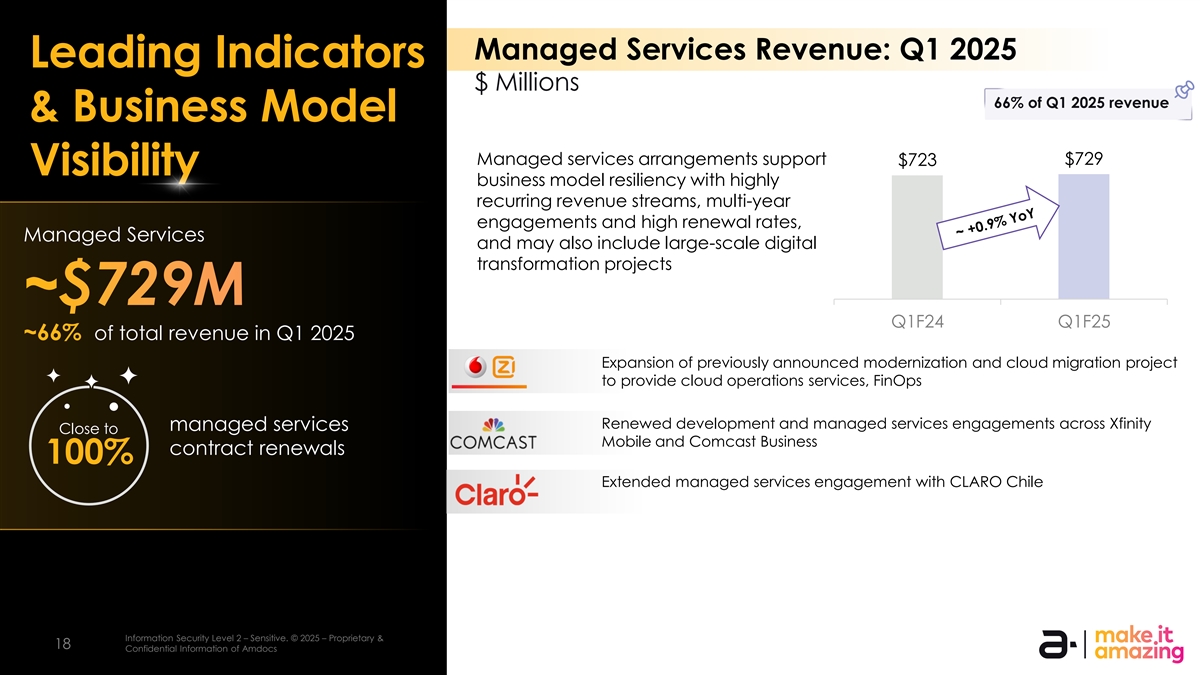

Managed Services Revenue: Q1 2025 Leading Indicators $ Millions 66% of Q1 2025 revenue & Business Model Managed services arrangements support $729 $723 Visibility business model resiliency with highly recurring revenue streams, multi-year engagements and high renewal rates, Managed Services and may also include large-scale digital transformation projects ~$729M Q1F24 Q1F25 ~66% of total revenue in Q1 2025 Expansion of previously announced modernization and cloud migration project to provide cloud operations services, FinOps Renewed development and managed services engagements across Xfinity managed services Close to Mobile and Comcast Business contract renewals 100% Extended managed services engagement with CLARO Chile Information Security Level 2 – Sensitive. © 2025 – Proprietary & Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 18 18 Confidential Information of Amdocs

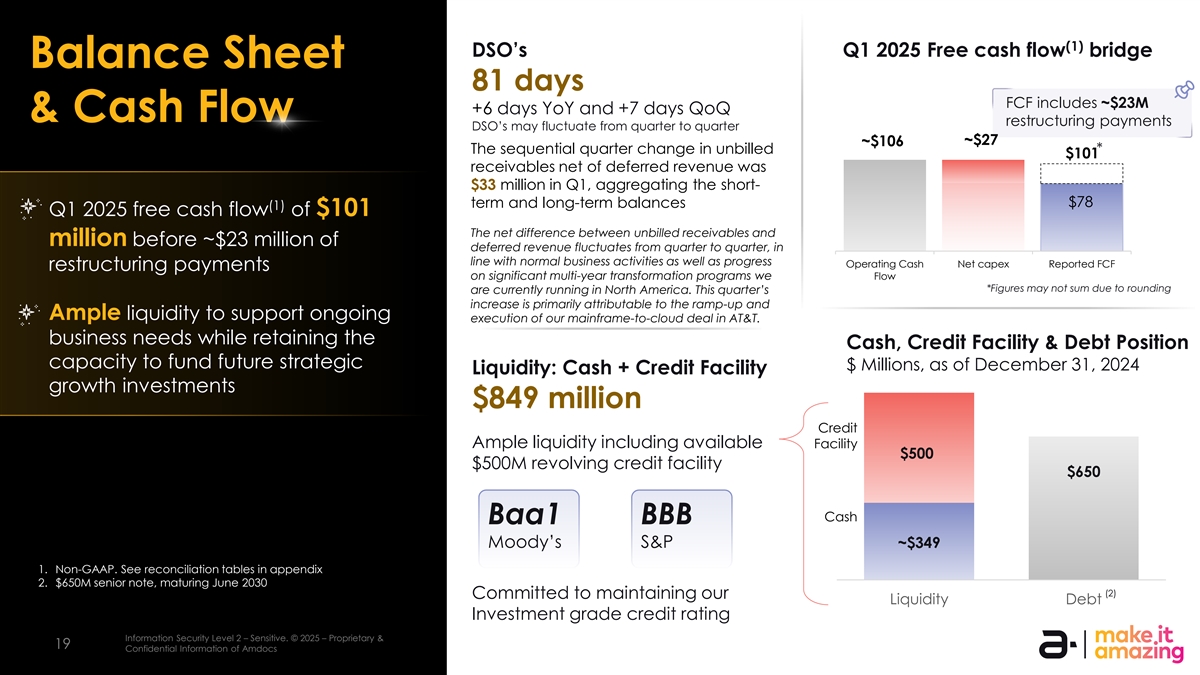

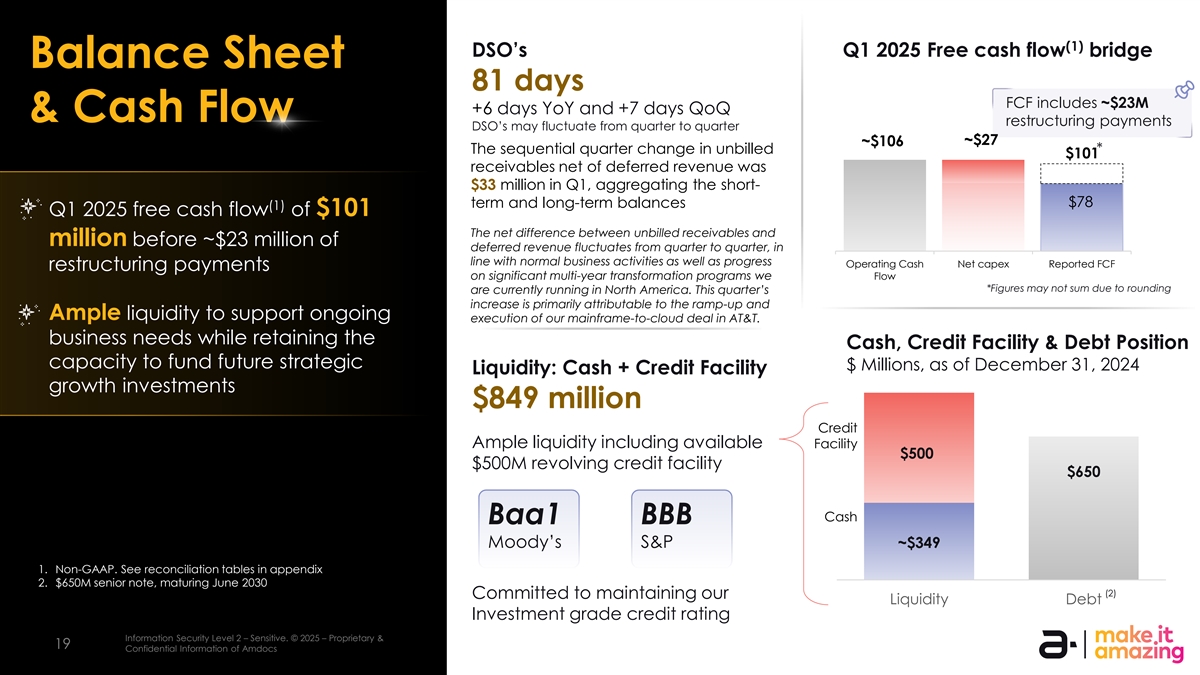

(1) DSO’s Q1 2025 Free cash flow bridge Balance Sheet 81 days FCF includes ~$23M +6 days YoY and +7 days QoQ & Cash Flow restructuring payments DSO’s may fluctuate from quarter to quarter ~$27 ~$106 The sequential quarter change in unbilled * $101 receivables net of deferred revenue was $33 million in Q1, aggregating the short- term and long-term balances $78 (1) Q1 2025 free cash flow of $101 The net difference between unbilled receivables and million before ~$23 million of deferred revenue fluctuates from quarter to quarter, in line with normal business activities as well as progress Operating Cash Net capex Reported FCF restructuring payments on significant multi-year transformation programs we Flow *Figures may not sum due to rounding are currently running in North America. This quarter’s increase is primarily attributable to the ramp-up and Ample liquidity to support ongoing execution of our mainframe-to-cloud deal in AT&T. business needs while retaining the Cash, Credit Facility & Debt Position capacity to fund future strategic $ Millions, as of December 31, 2024 Liquidity: Cash + Credit Facility growth investments $849 million Credit Ample liquidity including available Facility $500 $500M revolving credit facility $650 Cash Baa1 BBB Moody’s S&P ~$349 1. Non-GAAP. See reconciliation tables in appendix 2. $650M senior note, maturing June 2030 (2) Committed to maintaining our $0 Liquidity Debt Investment grade credit rating Information Security Level 2 – Sensitive. © 2025 – Proprietary & Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 19 19 Confidential Information of Amdocs

Q1 2025 Cash Returned to Shareholders Dividend Growth Disciplined Capital $ Millions Board authorized quarterly dividend payment: 52.7 cents Allocation Dividends, $54 Payable on April 25, 2025, to shareholders on record date of March 31, 2025 (1) Reiterating FY 2025 free cash flow (FCF) of between $710-$730M before Share ~$0.4B of aggregate share repurchase repurchases, restructuring payments, equating to >90% authorization available as of $144 $198M cash conversion December 31, 2024 Returned to shareholders in Q1 (2) ~7% free cash flow yield FCF: Five-year historical trend and FY2025E outlook (1)(3)(4)(5)(6)(7) Expects to return the majority of free cash 140% 102% 101% >90% flow to shareholders in FY2025 93% (1)(3)(5)(6)(7) 88% % FCF / (1) Non-GAAP Net Income FY2025E 112% 104% 100% 99% guidance: 96% (1)(3)(5)(6)(7) % of FCF Returned return 1. Non-GAAP. See appendix tables for reconciliation of FCF to Shareholders 2. Yield = expected free cash flow of $720M, the mid point of FY2025 FCF guidance majority before restructuring payments, as a percentage of Amdocs’ market capitalization as of 2/4/2025 3. FCF in FY2020, FY2021 and FY2022 is presented on a normalized basis, which mainly excludes net capital expenditures related to the new campus $869 (1)(3)(5)(6)(7) development; normalized FCF disclosure is not applicable as of FY2023 onward FCF ($M) $718 $720 $694 $665 4. Refer to https://investors.amdocs.com/ and earnings reports issued on 11/2/2021 $527 and 11/8/2022 for reconciliation of normalized FCF in FY2020, FY2021 and FY2022 5. FY2023 excludes $20M restructuring payments 6. FY2024 excludes $75M restructuring payments FY2020 FY2021 FY2022 FY2023 FY2024 FY2025E 7. FY2025 assumes midpoint of $710-$730M guidance range, before restructuring payments (Guidance) (1)(3) Information Security Level 2 – Sensitive. ©️ 2025 – Proprietary & Normalized Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 20 20 Confidential Information of Amdocs

Leading Indicators 12-Month Backlog & Business Model Visibility $4.14B 12-month backlog accelerated by +$80M QoQ in Q1 FY2025 Up 3.5% (1) (2) YoY on a pro-forma , constant currency basis 12-month backlog was up 2.7% on a (1) pro forma basis, and 3.5% in pro (1) (1) (2) forma constant currency 12-month backlog includes: As a leading indicator, 12-month Anticipated revenue related to contracts backlog represents ~90% of forward (1) 12-month revenue Estimated revenue from managed services contracts 1. For comparison purposes, pro forma adjusts first quarter fiscal year 2024 Letters of intent revenue by approximately $150 million and fiscal 2024 revenue by approximately $600 million to reflect the end of certain low margin, non- core business activities; these activities substantially already ceased in Maintenance the first quarter fiscal 2025 and are not included in the full year fiscal 2025 revenue outlook 2. Constant currency. Assumes exchange rates in the current period were Estimated ongoing support activities unchanged from the prior period Information Security Level 2 – Sensitive. © 2025 – Proprietary & Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 21 21 Confidential Information of Amdocs

Revenue Growth FY2025 (3) YoY% Growth Constant Currency Revenue Growth Outlook Reiterating FY2025 revenue growth of 1%- (1) 4.5% YoY on a pro forma constant 10.3% (3) currency basis, including some non- 4.5% Reiterating 7.7% organic contribution 7.0% 2.7% guidance Cloud positioned for another year of midpoint 2.7% 2.4% 1% double-digit growth in FY2025E (2)(3) (3) (3) (3) (3) (1) (2)(3) Q2 revenue accelerating by $15 million FY2020 FY2021 FY2022 FY2023 FY2024 FY2025E sequentially, despite additional foreign currency headwinds “As to the second fiscal quarter, we expect revenue of between $1.105 billion to $1.145 billion, the midpoint of which equates to a healthy acceleration of 1. For comparison purposes, pro forma adjusts first quarter fiscal year 2024 roughly $15 million sequentially. This is despite an unfavorable sequential impact revenue by approximately $150 million and fiscal 2024 revenue by approximately $600 million to reflect the end of certain low margin, non- of roughly $3 million from foreign currency fluctuations as compared with rates core business activities; these activities substantially already ceased in the prevailing at the end of our first fiscal quarter 2025 on December 31. ” first quarter fiscal 2025 and are not included in the full year fiscal 2025 revenue outlook – Tamar Rapaport Dagim, Q1 FY 2025 Earnings Call, February 4, 2025 2. Pro forma metrics exclude the financial impact of OpenMarket (which was divested on December 31, 2020) from fiscal year 2021. 3. Constant currency. Assumes exchange rates in the current period were unchanged from the prior period Information Security Level 2 – Sensitive. © 2025 – Proprietary & Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 22 22 Confidential Information of Amdocs

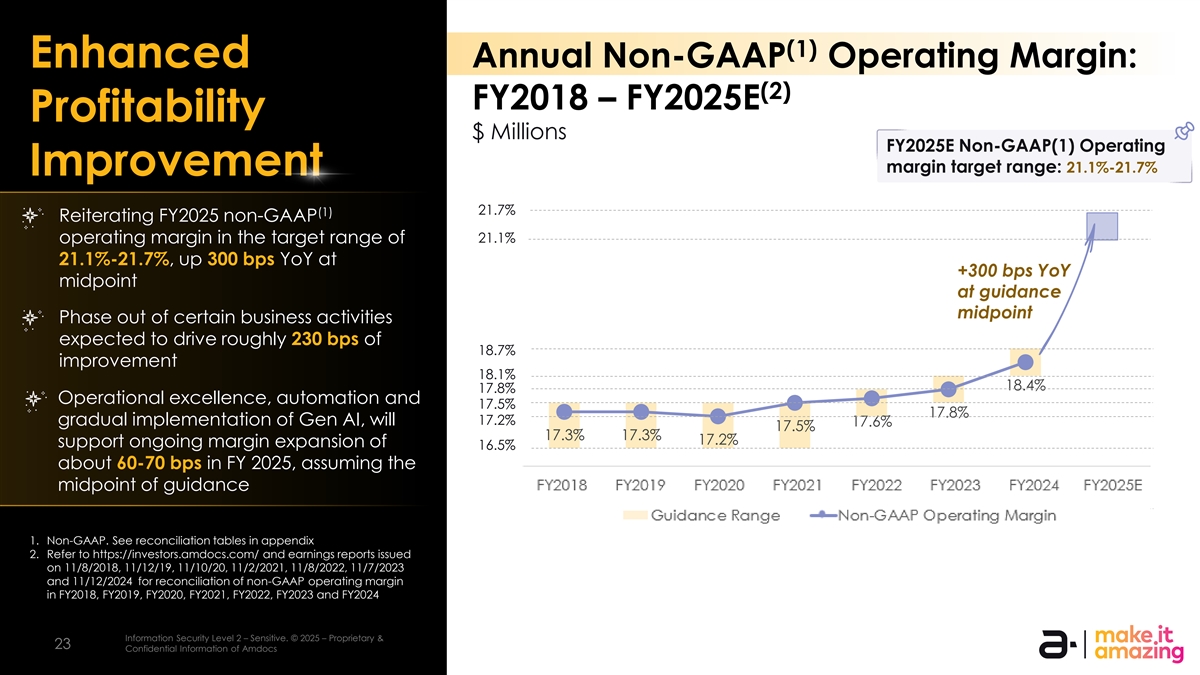

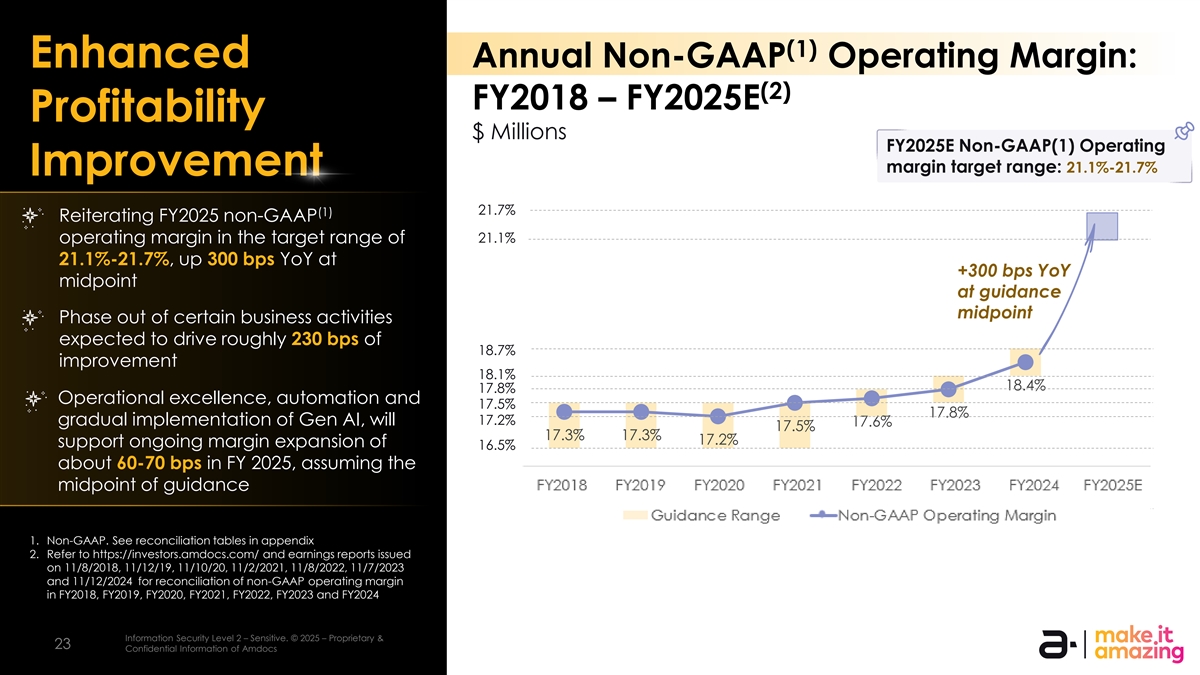

(1) Enhanced Annual Non-GAAP Operating Margin: (2) FY2018 – FY2025E Profitability $ Millions FY2025E Non-GAAP(1) Operating margin target range: 21.1%-21.7% Improvement 21.7% (1) Reiterating FY2025 non-GAAP 21.1% operating margin in the target range of 21.1%-21.7%, up 300 bps YoY at +300 bps YoY midpoint at guidance midpoint Phase out of certain business activities expected to drive roughly 230 bps of 18.7% improvement 18.1% 18.4% 17.8% Operational excellence, automation and 17.5% 17.8% 17.2% gradual implementation of Gen AI, will 17.6% 17.5% 17.3% 17.3% 17.2% support ongoing margin expansion of 16.5% about 60-70 bps in FY 2025, assuming the midpoint of guidance 1. Non-GAAP. See reconciliation tables in appendix 2. Refer to https://investors.amdocs.com/ and earnings reports issued on 11/8/2018, 11/12/19, 11/10/20, 11/2/2021, 11/8/2022, 11/7/2023 and 11/12/2024 for reconciliation of non-GAAP operating margin FY2018 FY2019 FY2020 FY2021 FY2022 FY2023 FY2024 FY2025E in FY2018, FY2019, FY2020, FY2021, FY2022, FY2023 and FY2024 Guidance Range Non-GAAP Operating Margin Information Security Level 2 – Sensitive. © 2025 – Proprietary & Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 23 23 Confidential Information of Amdocs

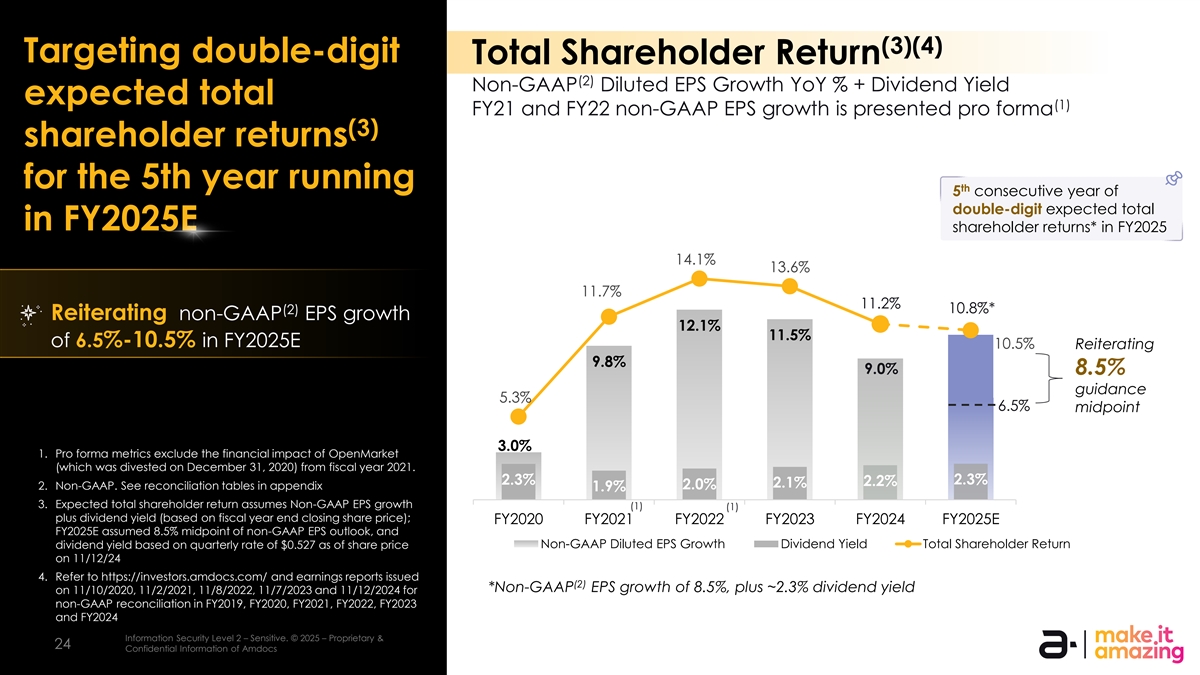

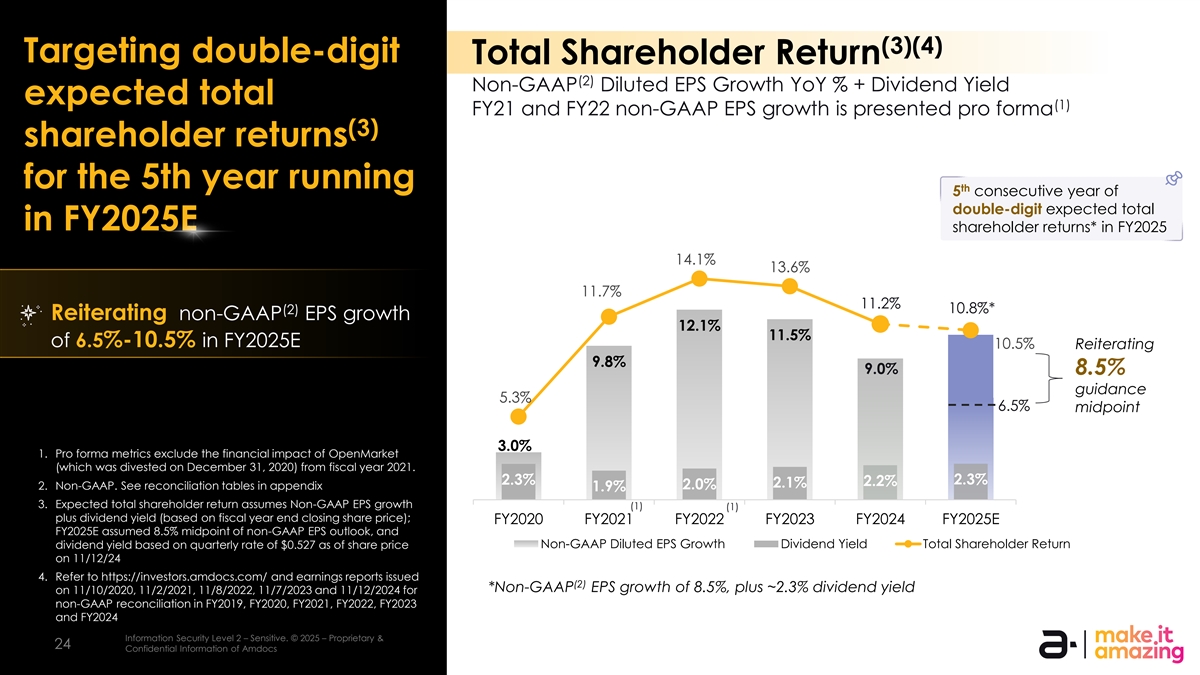

(3)(4) Targeting double-digit Total Shareholder Return (2) Non-GAAP Diluted EPS Growth YoY % + Dividend Yield expected total (1) FY21 and FY22 non-GAAP EPS growth is presented pro forma (3) shareholder returns for the 5th year running th 5 consecutive year of double-digit expected total in FY2025E shareholder returns* in FY2025 14.1% 13.6% 11.7% 11.2% (2) 10.8%* Reiterating non-GAAP EPS growth 12.1% 11.5% of 6.5%-10.5% in FY2025E 10.5% Reiterating 9.8% 9.0% 8.5% guidance 5.3% 6.5% midpoint 3.0% 1. Pro forma metrics exclude the financial impact of OpenMarket (which was divested on December 31, 2020) from fiscal year 2021. 2.3% 2.3% 2.2% 2.1% 2. Non-GAAP. See reconciliation tables in appendix 2.0% 1.9% 3. Expected total shareholder return assumes Non-GAAP EPS growth (1) (1) plus dividend yield (based on fiscal year end closing share price); FY2020 FY2021 FY2022 FY2023 FY2024 FY2025E FY2025E assumed 8.5% midpoint of non-GAAP EPS outlook, and dividend yield based on quarterly rate of $0.527 as of share price Non-GAAP Diluted EPS Growth Dividend Yield Total Shareholder Return on 11/12/24 4. Refer to https://investors.amdocs.com/ and earnings reports issued (2) *Non-GAAP EPS growth of 8.5%, plus ~2.3% dividend yield on 11/10/2020, 11/2/2021, 11/8/2022, 11/7/2023 and 11/12/2024 for non-GAAP reconciliation in FY2019, FY2020, FY2021, FY2022, FY2023 and FY2024 Information Security Level 2 – Sensitive. © 2025 – Proprietary & Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 24 24 Confidential Information of Amdocs

Amdocs has been included in the th prestigious 2024 S&P Dow Jones 6 year in a row Sustainability Index (North America) Maintained our top-rated positioning Our overall score positions rd us at the 93 percentile: Information Security Level 0 – Public. © 2025 – Proprietary & Confidential Information of Amdocs 25

Q&A Information Security Level 3 – Highly Sensitive. ©️ 2024 – Proprietary & Confidential Information of Amdocs 26 26 26

Appendix Outlook & Reconciliation Tables Information Security Level 3 – Highly Sensitive. ©️ 2024 – Proprietary & Confidential Information of Amdocs 27 27 27

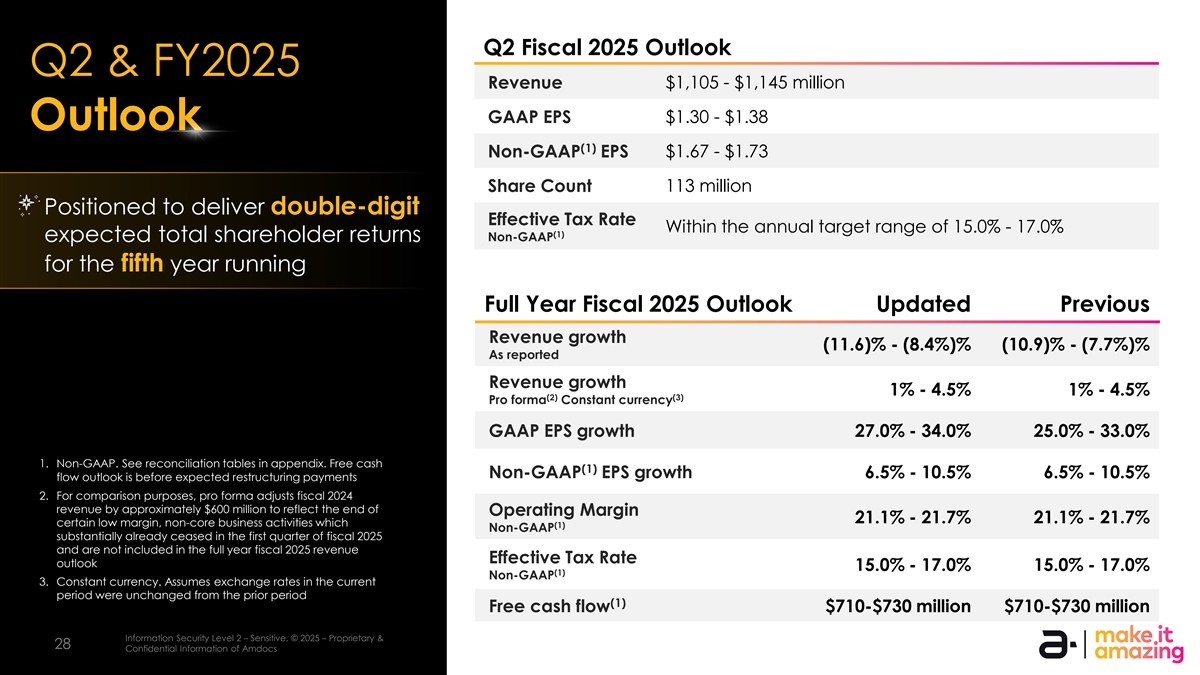

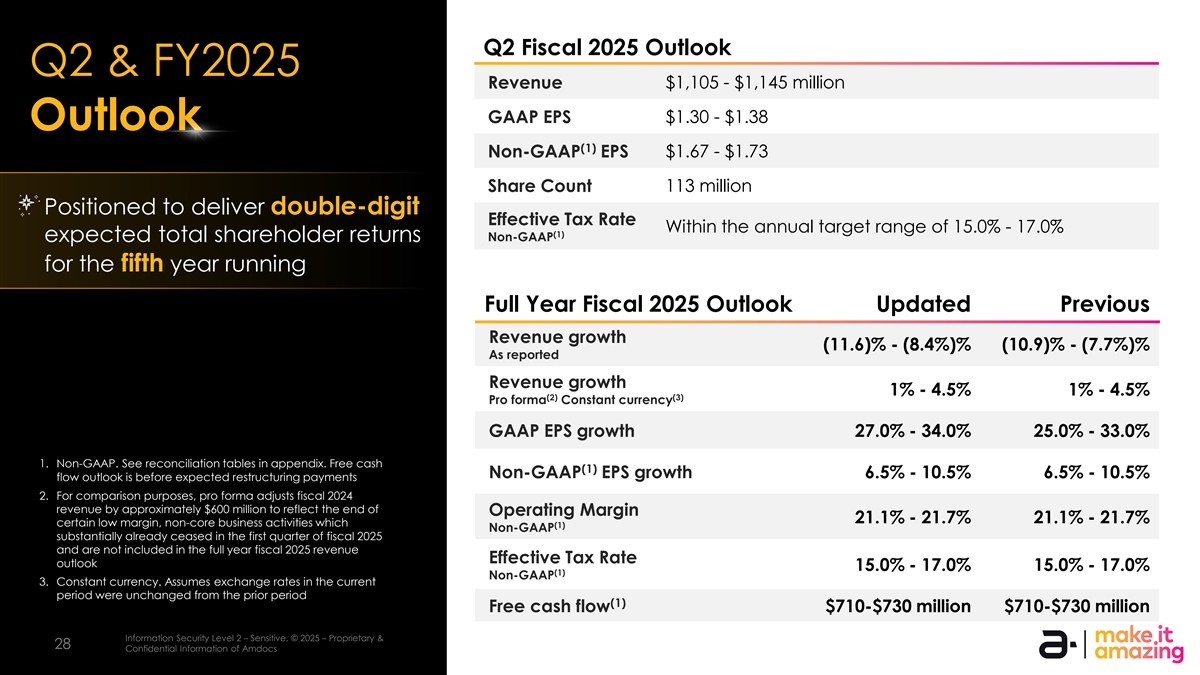

Q2 Fiscal 2025 Outlook Q2 & FY2025 Revenue $1,105 - $1,145 million $1.30 - $1.38 GAAP EPS Outlook (1) Non-GAAP EPS $1.67 - $1.73 Share Count 113 million Positioned to deliver double-digit Effective Tax Rate Within the annual target range of 15.0% - 17.0% (1) Non-GAAP expected total shareholder returns for the fifth year running Full Year Fiscal 2025 Outlook Updated Previous Revenue growth (11.6)% - (8.4%)% (10.9)% - (7.7%)% As reported Revenue growth 1% - 4.5% 1% - 4.5% (2) (3) Pro forma Constant currency GAAP EPS growth 27.0% - 34.0% 25.0% - 33.0% 1. Non-GAAP. See reconciliation tables in appendix. Free cash (1) Non-GAAP EPS growth 6.5% - 10.5% 6.5% - 10.5% flow outlook is before expected restructuring payments 2. For comparison purposes, pro forma adjusts fiscal 2024 revenue by approximately $600 million to reflect the end of Operating Margin 21.1% - 21.7% 21.1% - 21.7% certain low margin, non-core business activities which (1) Non-GAAP substantially already ceased in the first quarter of fiscal 2025 and are not included in the full year fiscal 2025 revenue Effective Tax Rate outlook 15.0% - 17.0% 15.0% - 17.0% (1) Non-GAAP 3. Constant currency. Assumes exchange rates in the current period were unchanged from the prior period (1) Free cash flow $710-$730 million $710-$730 million Information Security Level 2 – Sensitive. ©️ 2025 – Proprietary & Information Security Level 0 – Public. ©️ 2025 – Proprietary & Confidential Information of Amdocs 28 28 Confidential Information of Amdocs

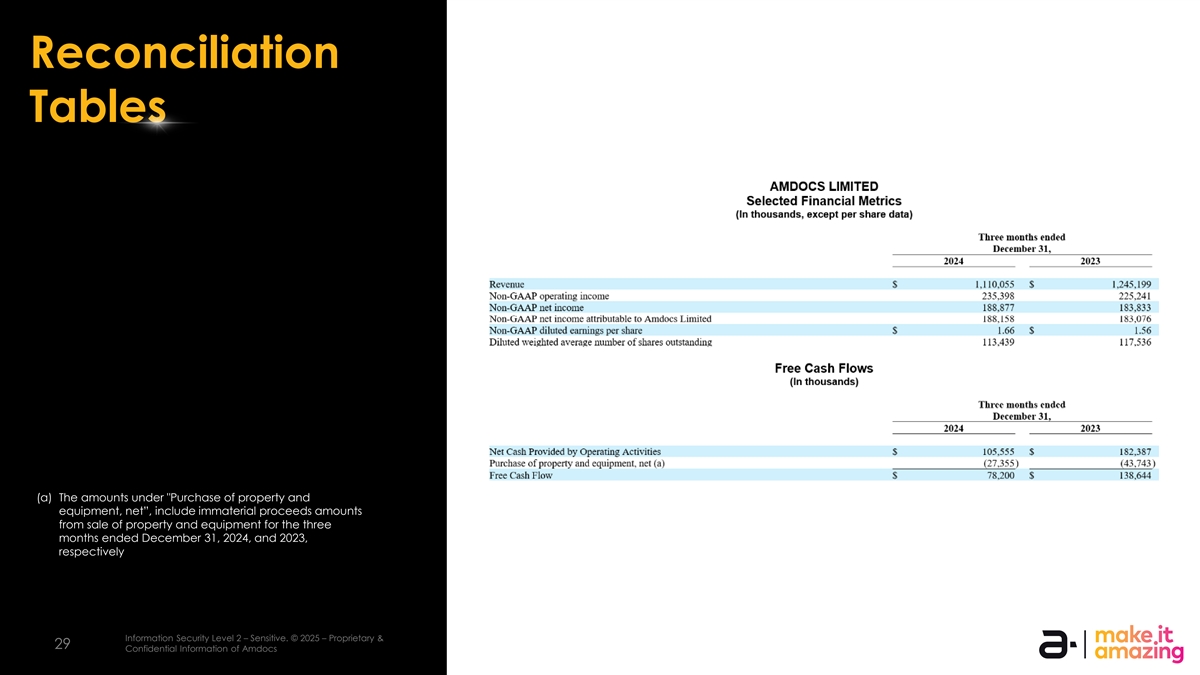

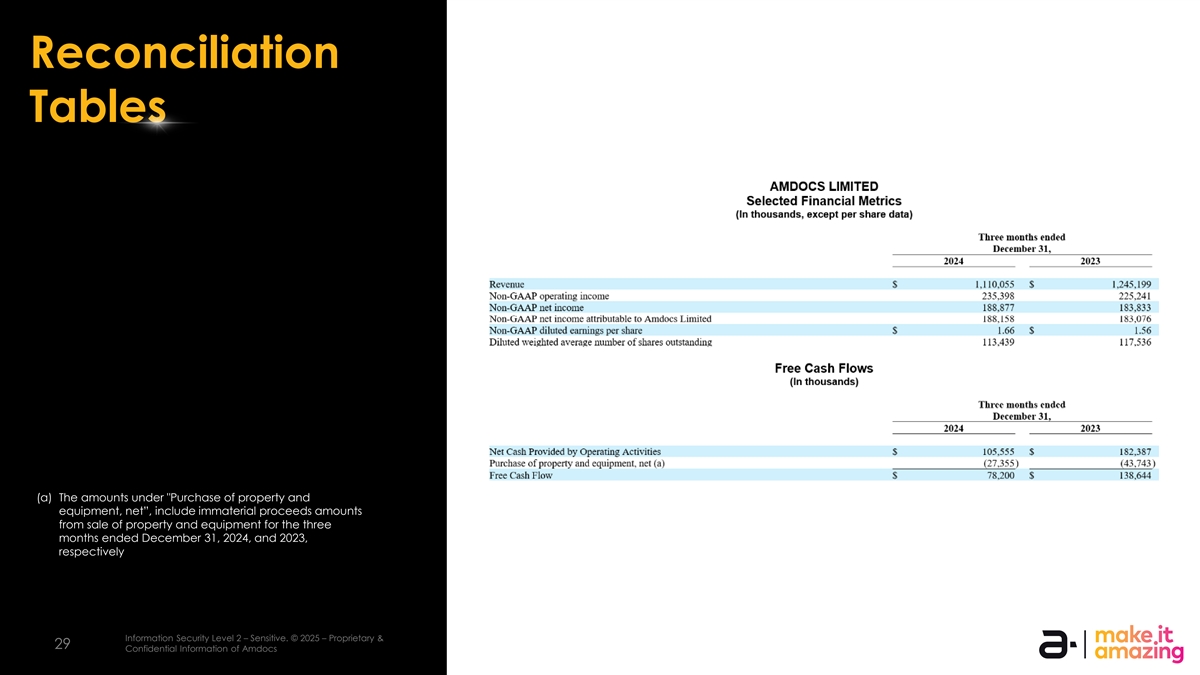

Reconciliation Tables (a) The amounts under Purchase of property and equipment, net”, include immaterial proceeds amounts from sale of property and equipment for the three months ended December 31, 2024, and 2023, respectively Information Security Level 2 – Sensitive. ©️ 2025 – Proprietary & Information Security Level 0 – Public. ©️ 2025 – Proprietary & Confidential Information of Amdocs 29 29 Confidential Information of Amdocs

Reconciliation Tables Information Security Level 2 – Sensitive. ©️ 2025 – Proprietary & Information Security Level 0 – Public. ©️ 2025 – Proprietary & Confidential Information of Amdocs 30 30 Confidential Information of Amdocs

Thank you!