November 2012 Investor Presentation Exhibit 99.1

2 Notices and Safe Harbors The information contained herein is current only as of the date hereof; however, unless otherwise indicated, financial information contained herein is as of September 30, 2012. The business, prospects, financial condition or performance of FairPoint Communications, Inc. (“FairPoint”) and its subsidiaries described herein may have changed since that date. FairPoint does not intend to update or otherwise revise the information contained herein. FairPoint makes no representation or warranty, express or implied, as to the completeness of the information contained herein. Market data used throughout this presentation is based on surveys and studies conducted by third parties, as well as industry and general publications. FairPoint has no obligation (express or implied) to update any or all of the information or to advise you of any changes; nor does FairPoint make any express or implied warranties or representations as to the completeness or accuracy nor does it accept responsibility for errors. Some statements herein are known as “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements include, but are not limited to, statements about our plans, objectives, expectations and intentions and other statements contained herein that are not historical facts. When used herein, the words “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions are generally intended to identify forward-looking statements. Because these forward-looking statements involve known and unknown risks and uncertainties, there are important factors that could cause actual results, events or developments to differ materially from those expressed or implied by these forward-looking statements, including our plans, objectives, expectations and intentions and other factors. You should not place undue reliance on such forward-looking statements, which are based on the information currently available to us and speak only as of the date hereof. FairPoint does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Throughout this presentation, reference is made to Adjusted EBITDA, Consolidated EBITDAR (as defined in the Company’s credit facility), Unlevered Free Cash Flow and adjustments to GAAP and non-GAAP measures to exclude the effect of special items. Management believes that Adjusted EBITDA provides a useful measure of operational and financial performance and removes variability related to pension contributions and payments for other post-employment benefits and that Unlevered Free Cash Flow may be useful to investors in assessing the Company’s ability to generate cash and meet its debt service requirements. The maintenance covenants contained in the Company’s credit facility are based on Consolidated EBITDAR. In addition, management believes that the adjustments to GAAP and non-GAAP measures to exclude the effect of special items may be useful to investors in understanding period-to-period operating performance and in identifying historical and prospective trends. We provide guidance as to certain financial information herein, which consists of forward-looking statements. Our guidance is not prepared with a view toward compliance with the published guidelines of the American Institute of Certified Public Accountants, and neither our independent registered public accounting firm nor any other independent expert or outside party compiles or examines the guidance and, accordingly, no such person expresses any opinion or any other form of assurance with respect thereto. Guidance is based upon a number of assumptions and estimates that, while presented with numerical specificity, are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and are based upon specific assumptions with respect to future business decisions, some of which will change. We generally state possible outcomes as high and low ranges which are intended to provide a sensitivity analysis as variables are changed but are not intended to represent our actual results which could fall outside of the suggested ranges. The principal reason that we release this data is to provide a basis for our management to discuss our business outlook with analysts and investors. Notwithstanding this, we do not accept any responsibility for any projections or reports published by any such outside analysts or investors. Guidance is necessarily speculative in nature, and it can be expected that some or all of the assumptions or the guidance furnished by us will not materialize or will vary significantly from actual results. Accordingly, our guidance is only an estimate of what management believes is realizable as of the date hereof. Actual results may vary from the guidance and the variations may be material. Investors should also recognize that the reliability of any forecasted financial data diminishes the farther in the future that the data is forecast. In light of the foregoing, investors are urged to put the guidance in context and not to place undue reliance on it. Any inability to successfully implement our operating strategy or the occurrence of any of the events or circumstances discussed therein could result in the actual operating results being different than the guidance, and such differences may be material.

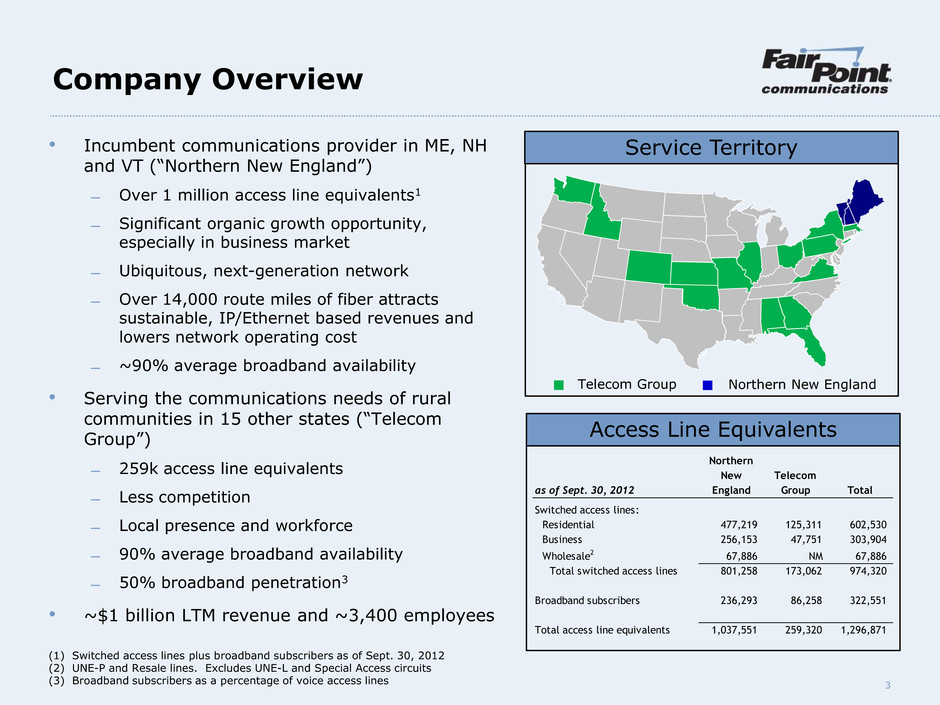

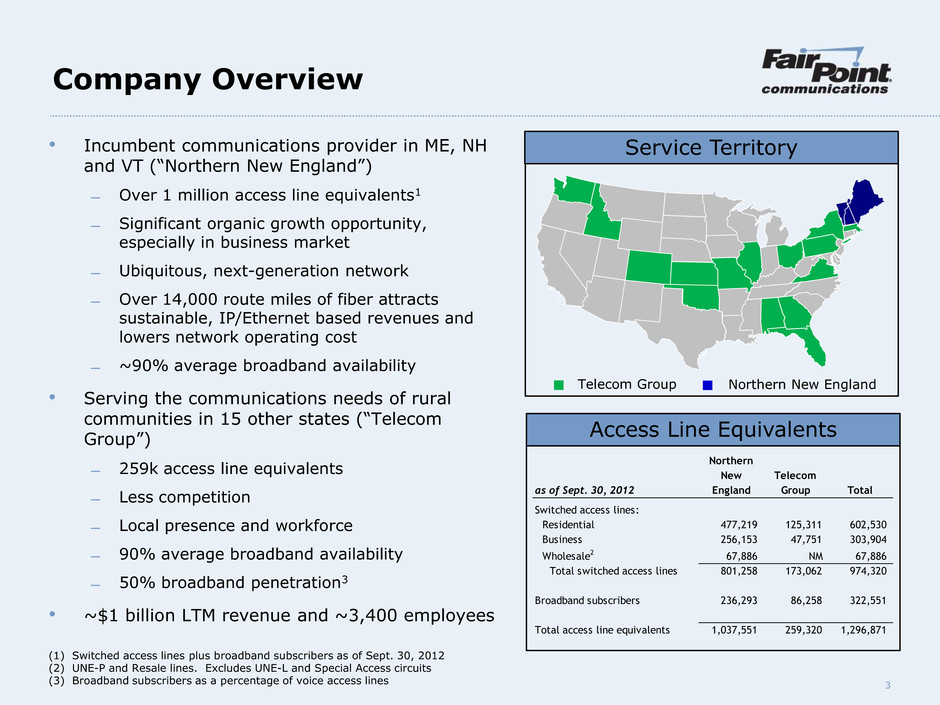

3 Company Overview • Incumbent communications provider in ME, NH and VT (“Northern New England”) ̶ Over 1 million access line equivalents1 ̶ Significant organic growth opportunity, especially in business market ̶ Ubiquitous, next-generation network ̶ Over 14,000 route miles of fiber attracts sustainable, IP/Ethernet based revenues and lowers network operating cost ̶ ~90% average broadband availability • Serving the communications needs of rural communities in 15 other states (“Telecom Group”) ̶ 259k access line equivalents ̶ Less competition ̶ Local presence and workforce ̶ 90% average broadband availability ̶ 50% broadband penetration3 • ~$1 billion LTM revenue and ~3,400 employees Service Territory Telecom Group Northern New England Access Line Equivalents (1) Switched access lines plus broadband subscribers as of Sept. 30, 2012 (2) UNE-P and Resale lines. Excludes UNE-L and Special Access circuits (3) Broadband subscribers as a percentage of voice access lines as of Sept. 30, 2012 Northern New England Telecom Group Total Switched access lines: Residential 477,219 125,311 602,530 Business 256,153 47,751 303,904 Whol sal 2 67,886 NM 67,886 Total switched access lines 801,258 173,062 974,320 Broadband subscribers 236,293 86,258 322,551 Total access line equivalents 1,037,551 259,320 1,296,871

4 Path to Increasing Shareholder Value Four Pillar Strategy for Increasing Free Cash Flow Improve Operations Change Regulatory Environment Transform and Grow Revenue Execute Human Resource Strategy

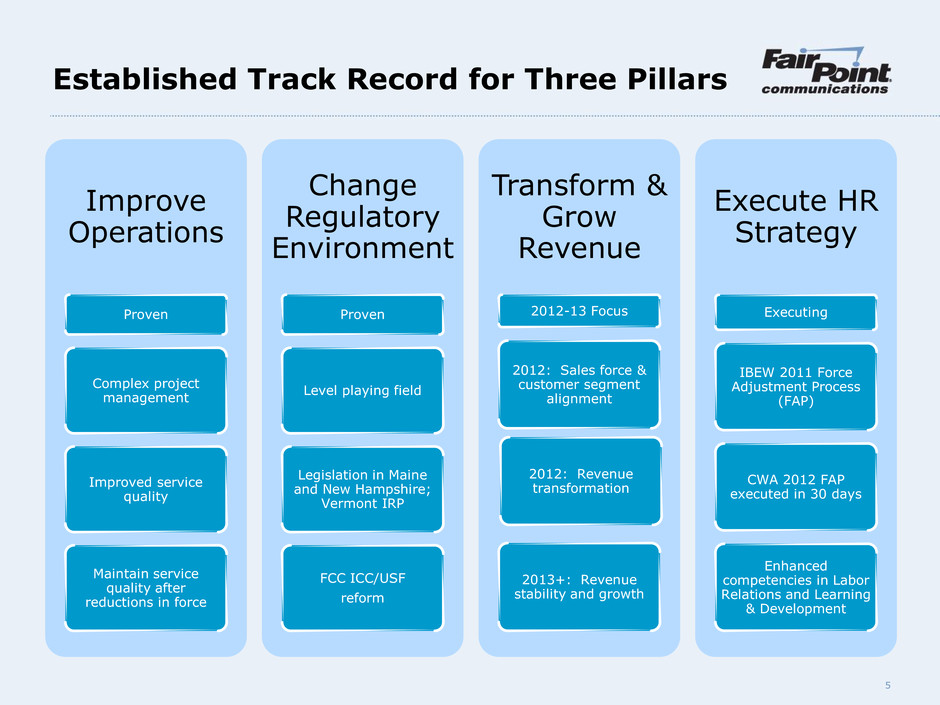

5 Established Track Record for Three Pillars Improve Operations Proven Complex project management Improved service quality Maintain service quality after reductions in force Change Regulatory Environment Proven Level playing field Legislation in Maine and New Hampshire; Vermont IRP FCC ICC/USF reform Transform & Grow Revenue 2012-13 Focus 2012: Sales force & customer segment alignment 2012: Revenue transformation 2013+: Revenue stability and growth Execute HR Strategy Executing IBEW 2011 Force Adjustment Process (FAP) CWA 2012 FAP executed in 30 days Enhanced competencies in Labor Relations and Learning & Development

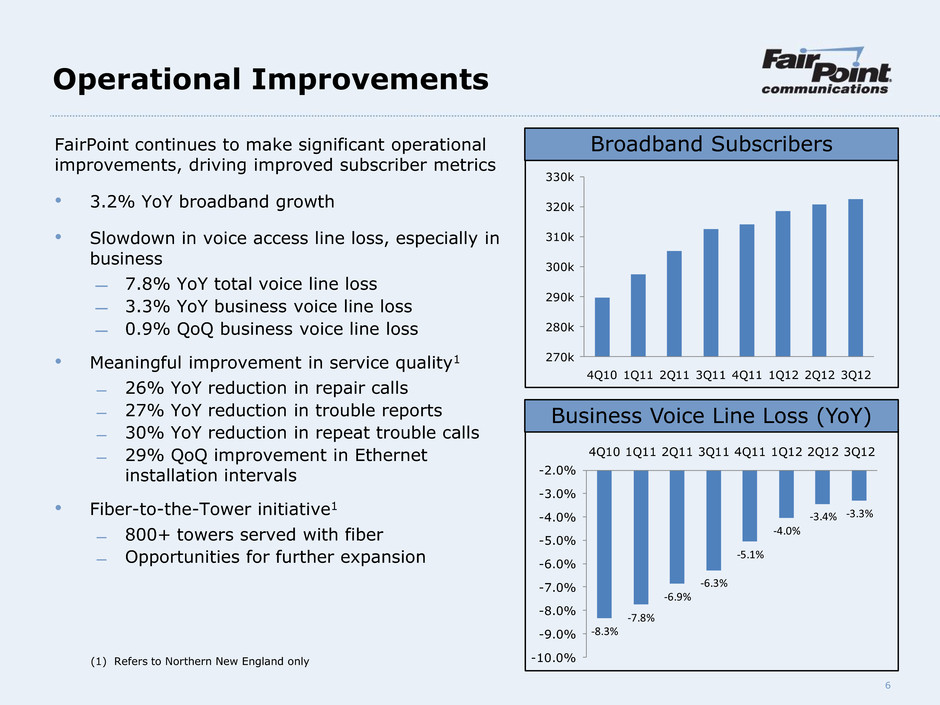

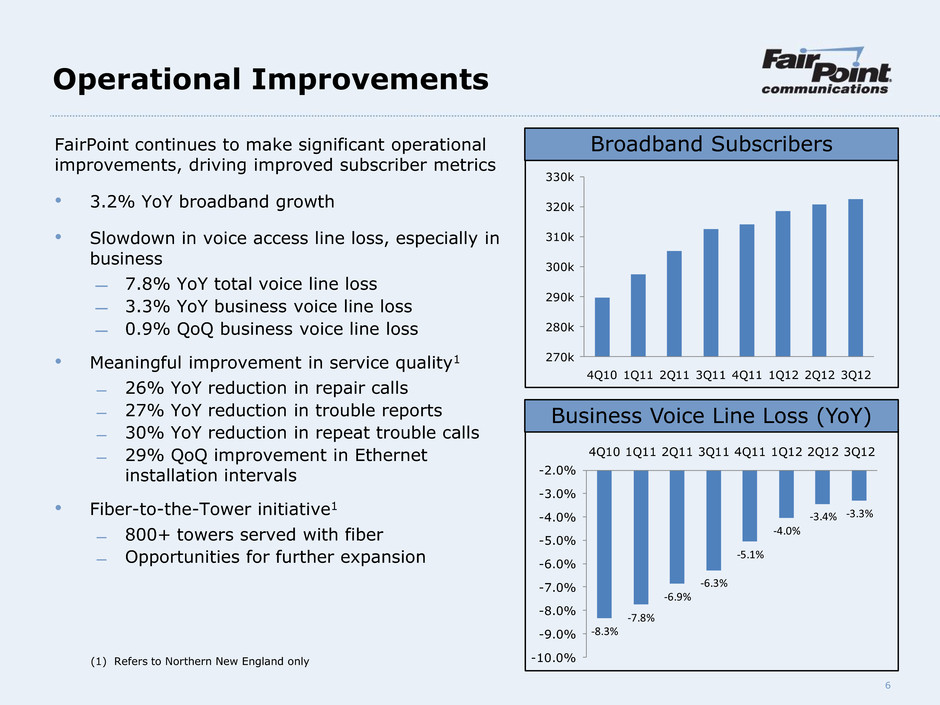

6 Operational Improvements FairPoint continues to make significant operational improvements, driving improved subscriber metrics • 3.2% YoY broadband growth • Slowdown in voice access line loss, especially in business ̶ 7.8% YoY total voice line loss ̶ 3.3% YoY business voice line loss ̶ 0.9% QoQ business voice line loss • Meaningful improvement in service quality1 ̶ 26% YoY reduction in repair calls ̶ 27% YoY reduction in trouble reports ̶ 30% YoY reduction in repeat trouble calls ̶ 29% QoQ improvement in Ethernet installation intervals • Fiber-to-the-Tower initiative1 ̶ 800+ towers served with fiber ̶ Opportunities for further expansion Business Voice Line Loss (YoY) Broadband Subscribers (1) Refers to Northern New England only 270k 280k 290k 300k 310k 320k 330k 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 -8.3% -7.8% -6.9% -6.3% -5.1% -4.0% -3.4% -3.3% -10.0% -9.0% -8.0% -7.0% -6.0% -5.0% -4.0% -3.0% -2.0% 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12

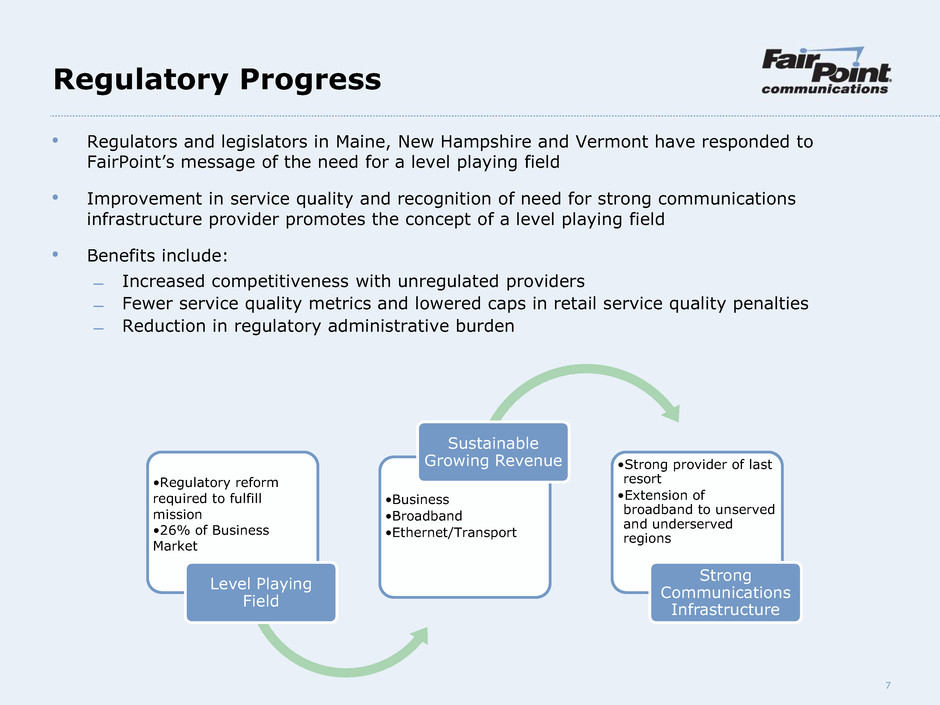

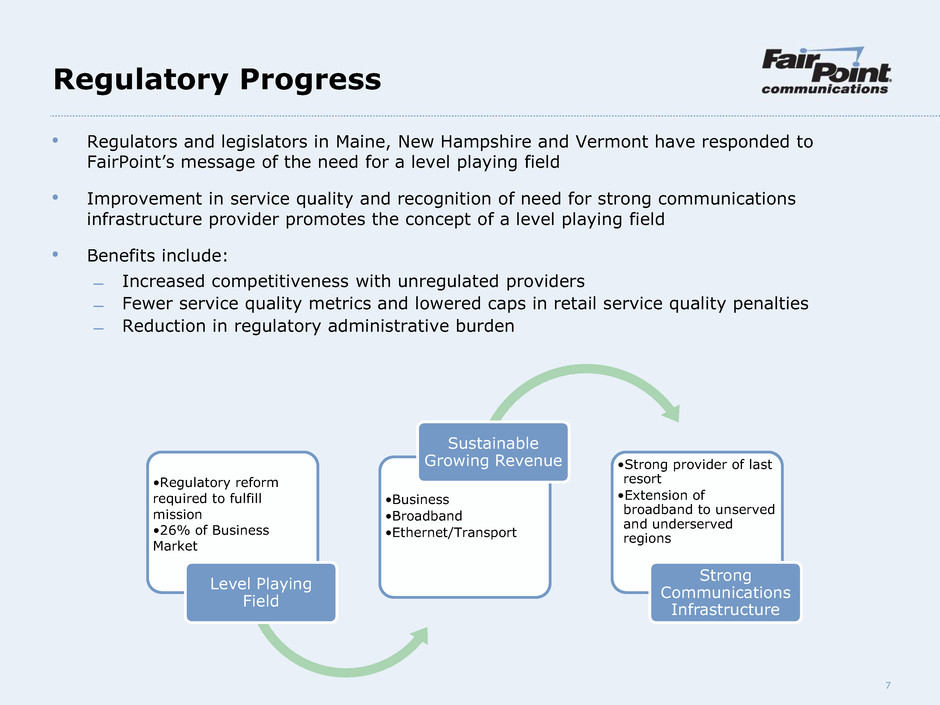

7 Regulatory Progress • Regulators and legislators in Maine, New Hampshire and Vermont have responded to FairPoint’s message of the need for a level playing field • Improvement in service quality and recognition of need for strong communications infrastructure provider promotes the concept of a level playing field • Benefits include: ̶ Increased competitiveness with unregulated providers ̶ Fewer service quality metrics and lowered caps in retail service quality penalties ̶ Reduction in regulatory administrative burden •Regulatory reform required to fulfill mission •26% of Business Market Level Playing Field •Business •Broadband •Ethernet/Transport Sustainable Growing Revenue •Strong provider of last resort •Extension of broadband to unserved and underserved regions Strong Communications Infrastructure

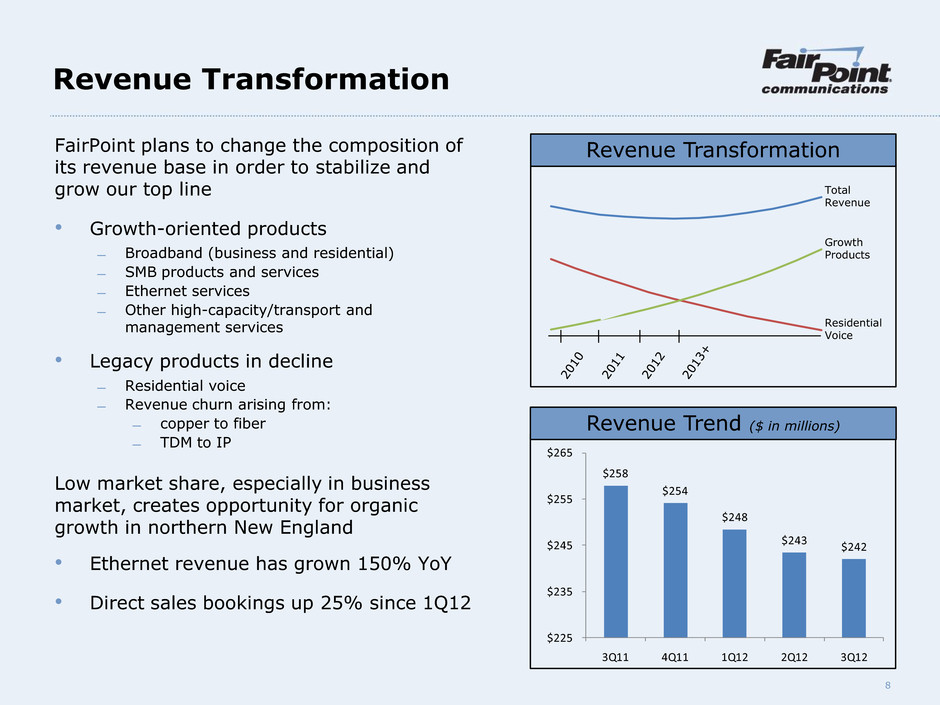

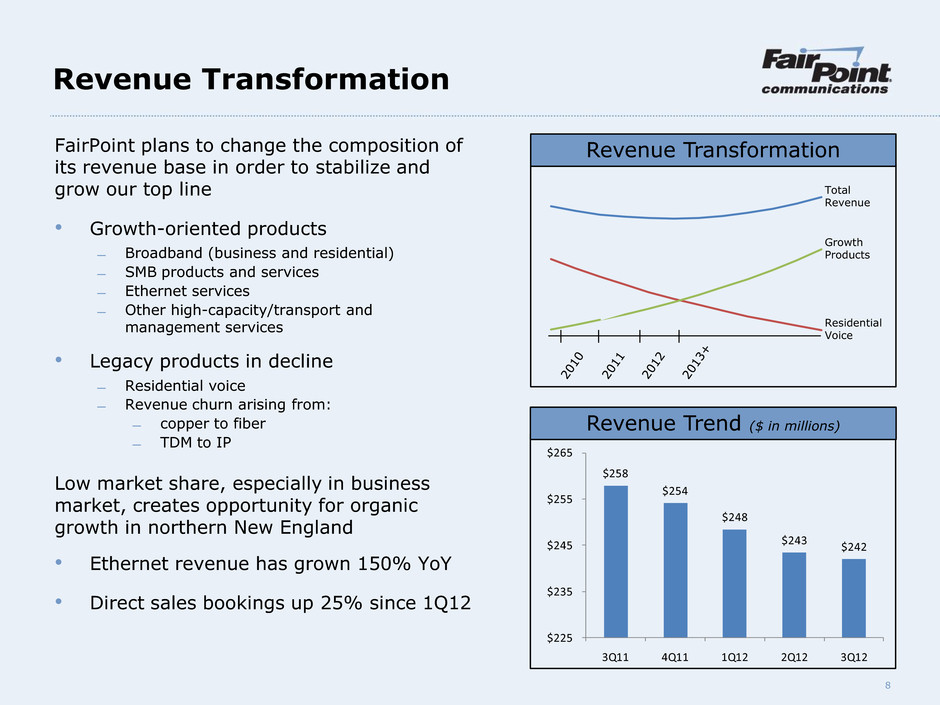

8 Revenue Transformation FairPoint plans to change the composition of its revenue base in order to stabilize and grow our top line • Growth-oriented products ̶ Broadband (business and residential) ̶ SMB products and services ̶ Ethernet services ̶ Other high-capacity/transport and management services • Legacy products in decline ̶ Residential voice ̶ Revenue churn arising from: ̶ copper to fiber ̶ TDM to IP Low market share, especially in business market, creates opportunity for organic growth in northern New England • Ethernet revenue has grown 150% YoY • Direct sales bookings up 25% since 1Q12 Revenue Transformation Total Revenue Growth Products Residential Voice Revenue Trend ($ in millions) $258 $254 $248 $243 $242 $225 $235 $245 $255 $265 3Q11 4Q11 1Q12 2Q12 3Q12

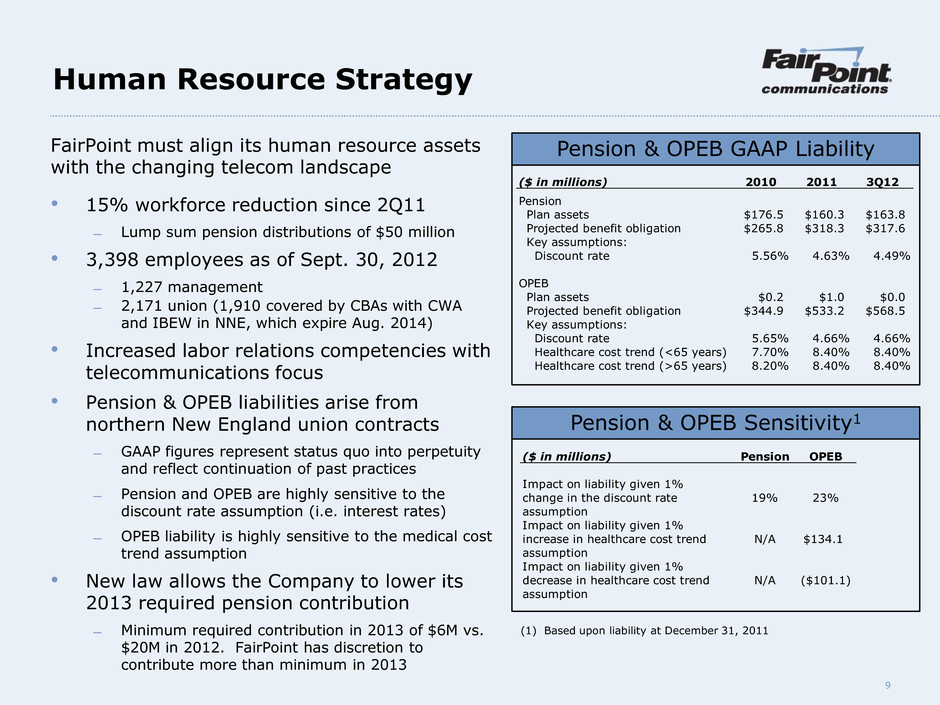

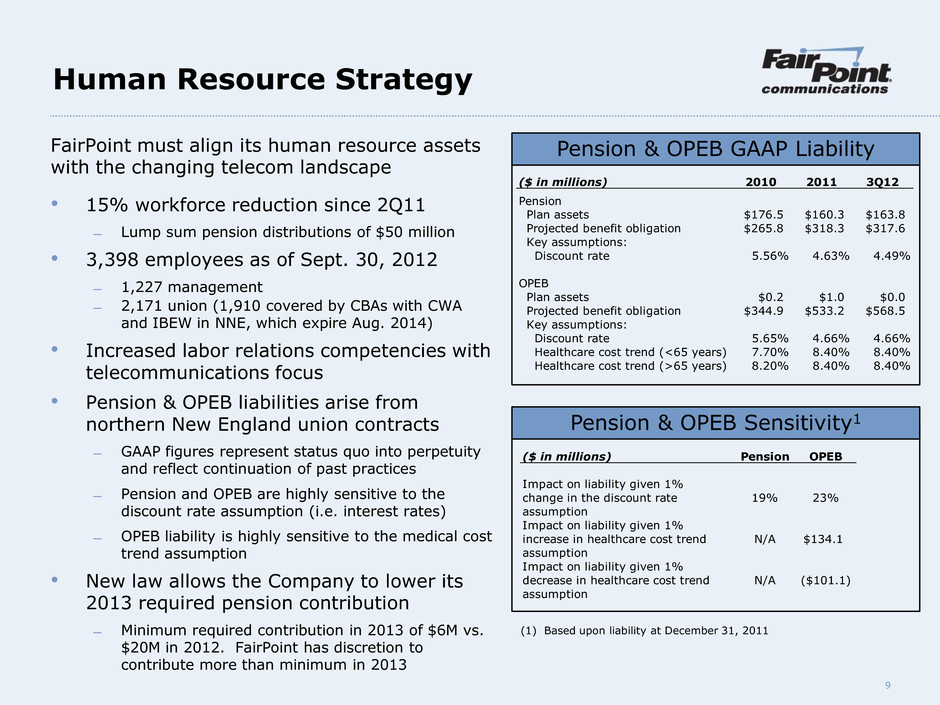

9 Human Resource Strategy FairPoint must align its human resource assets with the changing telecom landscape • 15% workforce reduction since 2Q11 ̶ Lump sum pension distributions of $50 million • 3,398 employees as of Sept. 30, 2012 ̶ 1,227 management ̶ 2,171 union (1,910 covered by CBAs with CWA and IBEW in NNE, which expire Aug. 2014) • Increased labor relations competencies with telecommunications focus • Pension & OPEB liabilities arise from northern New England union contracts ̶ GAAP figures represent status quo into perpetuity and reflect continuation of past practices ̶ Pension and OPEB are highly sensitive to the discount rate assumption (i.e. interest rates) ̶ OPEB liability is highly sensitive to the medical cost trend assumption • New law allows the Company to lower its 2013 required pension contribution ̶ Minimum required contribution in 2013 of $6M vs. $20M in 2012. FairPoint has discretion to contribute more than minimum in 2013 Pension & OPEB Sensitivity1 (1) Based upon liability at December 31, 2011 Pension & OPEB GAAP Liability ($ in millions) Pension OPEB Impact on liability given 1% change in the discount rate assumptio 19% 23% Impact on liability given 1% increase in healthcare cost trend assumption N/A $134.1 Impact on liability given 1% decrease in healthcare cost trend assumption N/A ($101.1) ($ in millions) 2010 2011 3Q12 Pension Plan assets $176.5 $160.3 $163.8 Projected benefit obligation $265.8 $318.3 $317.6 Key assumptions: Discount rate 5.56% 4.63% 4.49% OPEB Plan assets $0.2 $1.0 $0.0 Projected benefit obligation $344.9 $533.2 $568.5 Key assumptions: Discount rate 5.65% 4.66% 4.66% Healthcare cost trend (<65 years) 7.70% 8.40% 8.40% Healthcare cost trend (>65 years) 8.20% 8.40% 8.40%

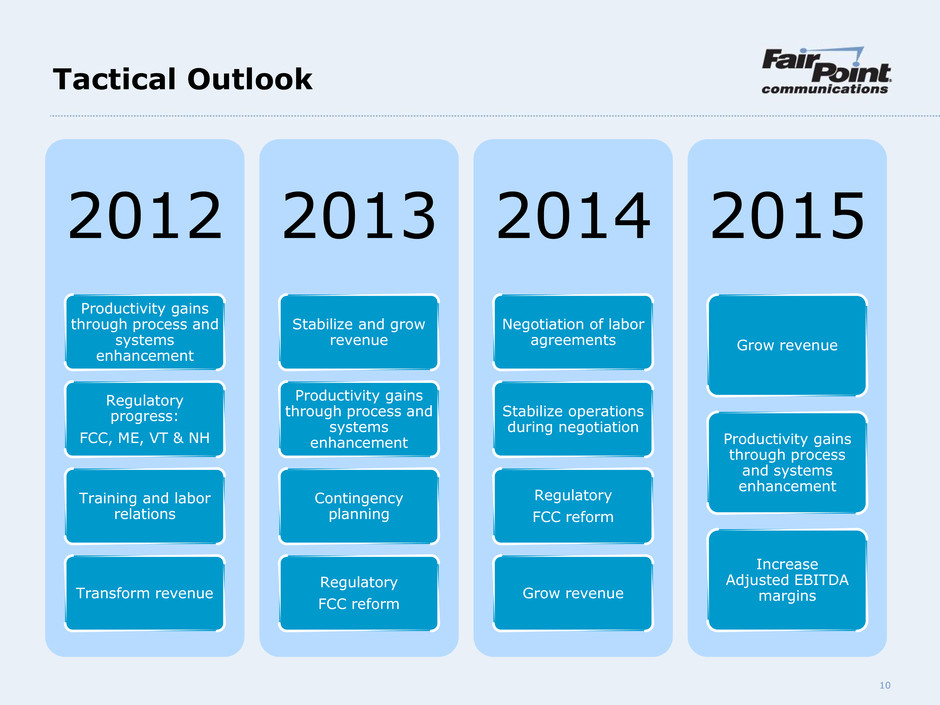

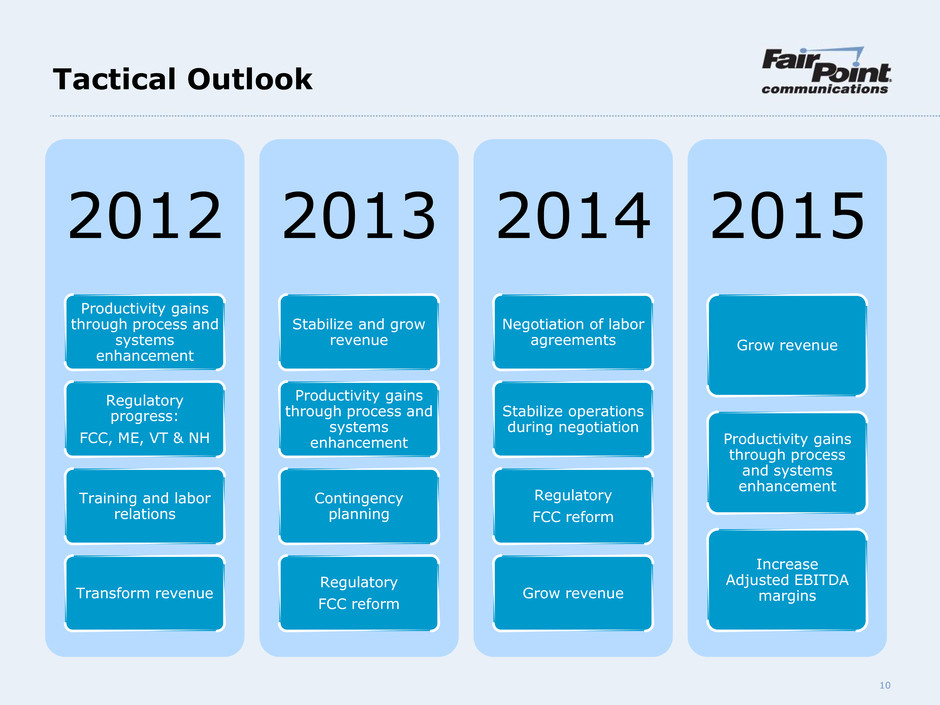

10 Tactical Outlook 2012 Productivity gains through process and systems enhancement Regulatory progress: FCC, ME, VT & NH Training and labor relations Transform revenue 2013 Stabilize and grow revenue Productivity gains through process and systems enhancement Contingency planning Regulatory FCC reform 2014 Negotiation of labor agreements Stabilize operations during negotiation Regulatory FCC reform Grow revenue 2015 Grow revenue Productivity gains through process and systems enhancement Increase Adjusted EBITDA margins

11 As of Sept. 30, 2012: • Liquidity of $85 million ̶ $22 million unrestricted cash ̶ $63 million of revolver availability, after $12 million letters of credit • Leverage of 3.77x vs. 4.75x covenant • Interest coverage of 3.86x vs. 3.25x covenant • Covenant limiting capital expenditures to: 2012: $190 million + $20 million carryover 2013: $170 million 2014: $150 million 2015: $150 million Capital Structure Capital Structure Summary (1) Excludes letters of credit of $12 million and capital lease obligations of $3 million (2) Undrawn as of Sept. 30, 2012, except for outstanding letters of credit of $12 million, which reduces revolver availability (3) After taking into account FairPoint’s voluntary Term Loan prepayment of $25 million during 3Q12 (4) Includes management restricted stock as of Sept. 30, 2012 (in millions) Cash and cash equivalents (unrestricted) $22 Term Loan1 $970 $75 million Revolver2 $0 Amortization schedule 3 2011 $0 2012 $33 2013 $10 2014 $25 2015 $38 January 24, 2016 $895 L+450, with LIBOR floor of 200 No dividends if leverage > 2.0x Interest coverage and leverage covenants Common stock outstanding4 26.2 Warrants (7 yr, $48.81 strike ) 3.5

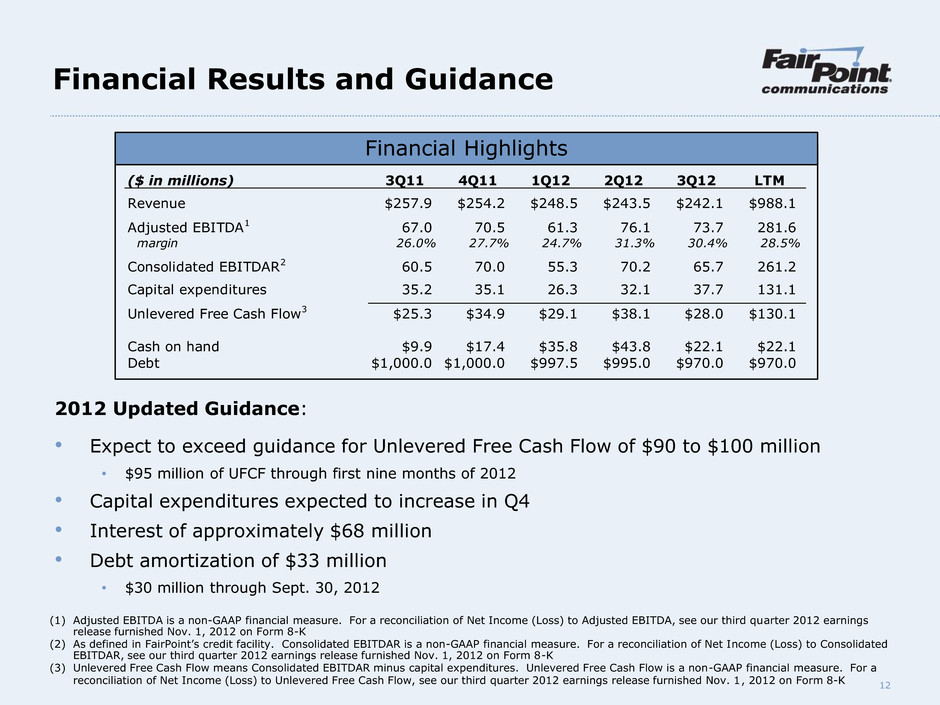

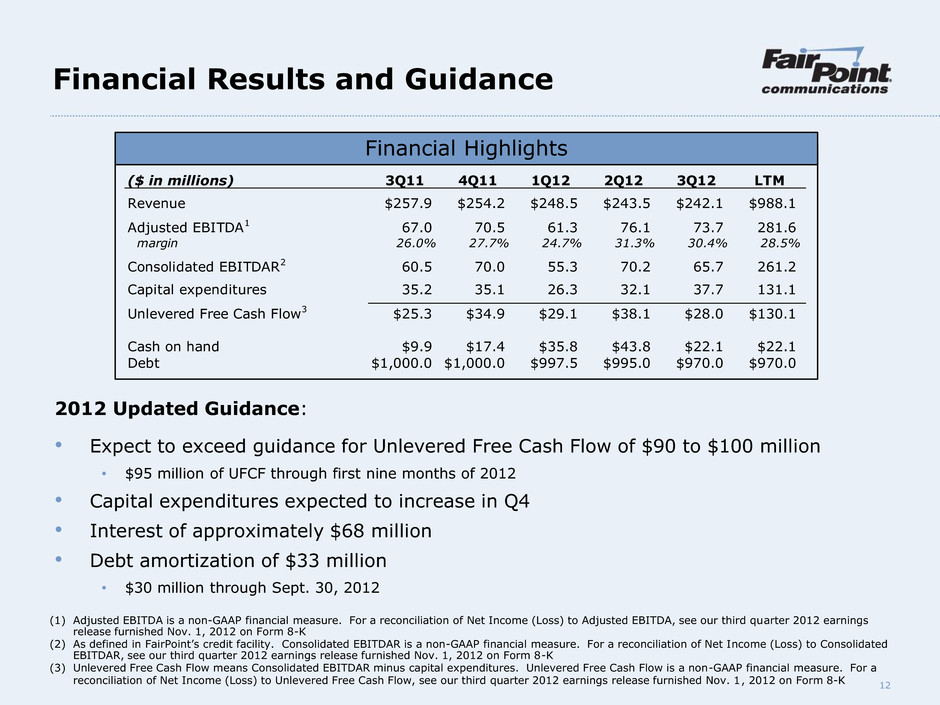

12 ($ in millions) 3Q11 4Q11 1Q12 2Q12 3Q12 LTM Revenue $257.9 $254.2 $248.5 $243.5 $242.1 $988.1 Adjusted EBITDA1 67.0 70.5 61.3 76.1 73.7 281.6 margin 26.0% 27.7% 24.7% 31.3% 30.4% 28.5% Consolidated EBITDAR2 60.5 70.0 55.3 70.2 65.7 261.2 Capital expenditures 35.2 35.1 26.3 32.1 37.7 131.1 Unlevered Free Cash Flow3 $25.3 $34.9 $29.1 $38.1 $28.0 $130.1 Cash on hand $9.9 $17.4 $35.8 $43.8 $22.1 $22.1 Debt $1,000.0 $1,000.0 $997.5 $995.0 $970.0 $970.0 2012 Updated Guidance: • Expect to exceed guidance for Unlevered Free Cash Flow of $90 to $100 million • $95 million of UFCF through first nine months of 2012 • Capital expenditures expected to increase in Q4 • Interest of approximately $68 million • Debt amortization of $33 million • $30 million through Sept. 30, 2012 Financial Results and Guidance Financial Highlights (1) Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation of Net Income (Loss) to Adjusted EBITDA, see our third quarter 2012 earnings release furnished Nov. 1, 2012 on Form 8-K (2) As defined in FairPoint’s credit facility. Consolidated EBITDAR is a non-GAAP financial measure. For a reconciliation of Net Income (Loss) to Consolidated EBITDAR, see our third quarter 2012 earnings release furnished Nov. 1, 2012 on Form 8-K (3) Unlevered Free Cash Flow means Consolidated EBITDAR minus capital expenditures. Unlevered Free Cash Flow is a non-GAAP financial measure. For a reconciliation of Net Income (Loss) to Unlevered Free Cash Flow, see our third quarter 2012 earnings release furnished Nov. 1, 2012 on Form 8-K

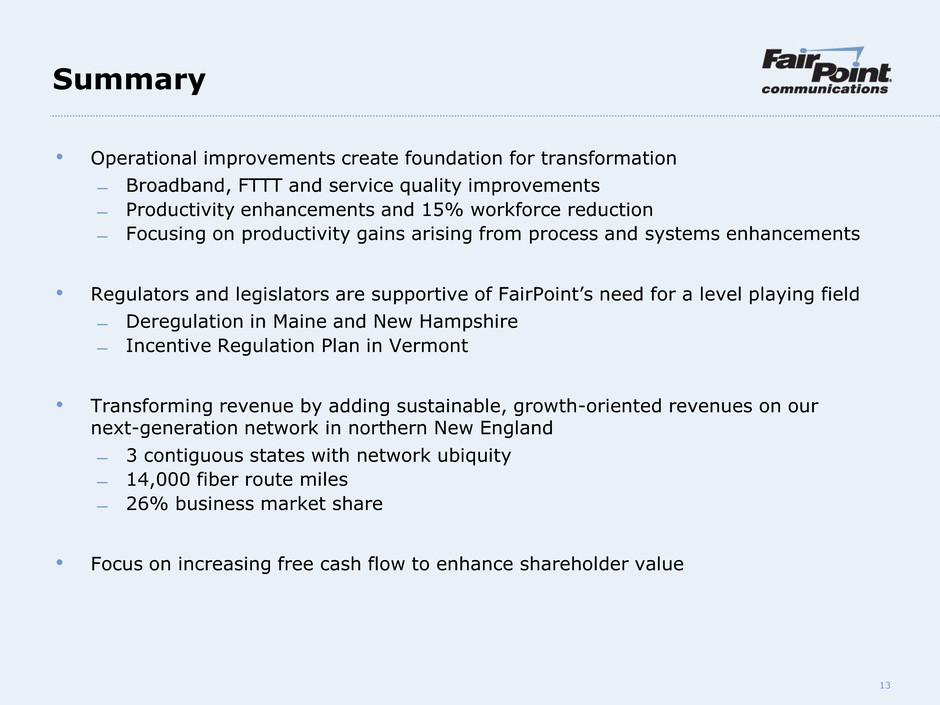

13 Summary • Operational improvements create foundation for transformation ̶ Broadband, FTTT and service quality improvements ̶ Productivity enhancements and 15% workforce reduction ̶ Focusing on productivity gains arising from process and systems enhancements • Regulators and legislators are supportive of FairPoint’s need for a level playing field ̶ Deregulation in Maine and New Hampshire ̶ Incentive Regulation Plan in Vermont • Transforming revenue by adding sustainable, growth-oriented revenues on our next-generation network in northern New England ̶ 3 contiguous states with network ubiquity ̶ 14,000 fiber route miles ̶ 26% business market share • Focus on increasing free cash flow to enhance shareholder value