FairPoint Communications, Inc.

Lehman Brothers High Yield Bond

and Syndicated Loan Conference

March 26, 2007

Presenter

John P. Crowley – Executive Vice President, Chief Financial Officer

Forward-Looking Statement

Page 2

This presentation may contain forward-looking statements that are

not based on historical fact, including without limitation, statements containing

the words “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,”

“estimates” and similar expressions and statements including those relating to

potential cost savings and synergies expected to be realized in the proposed

merger with the northeast wireline operations of Verizon Communications Inc.

Because these forward-looking statements involve known and unknown risks

and uncertainties, there are important factors that could cause actual results,

events or developments to differ materially from those expressed or implied by

these forward-looking statements. Such factors include those risks described from

time to time in FairPoint Communications, Inc.’s filings with the Securities and

Exchange Commission, including, without limitation, the risks described in

FairPoint’s most recent Annual Report on Form 10-K on file with the Securities and

Exchange Commission. These factors should be considered carefully and you are

cautioned not to place undue reliance on such forward-looking statements. All

information is current as of the date of this presentation, and FairPoint

Communications, Inc. undertakes no duty to update this information.

Company Overview

Page 4

Historical High Yield Activity

$125 million 9.5% senior

notes (1998)

$75 million floating rate

notes at a rate of LIBOR

plus 4.1875% (1998)

$200 million 12.5% senior

subordinated notes (2000)

$225 million 11.875%

senior subordinated notes

(2003)

Page 5

Overview of FairPoint

Significantly greater scope and scale

(1) As of December 31, 2006.

(2) Includes 149,998 wholesale access lines.

Pre-merger FairPoint(1)

311,150 total access line equivalents

194,119 residential voice access lines

57,587 business voice access lines

59,444 HSD subscribers (including DSL,

cable modem and WBB)

Post-merger(1)

2,005,843 total access line equivalents(2)

1,160,386 residential voice access lines

447,966 business voice access lines

247,493 HSD subscribers (including DSL,

cable modem and WBB)

Page 6

FairPoint Profile

(1) Includes acquired lines.

(2) Includes voice access lines and high speed data lines (DSL, cable modem and wireless broadband).

A leading provider of communications

services in rural and small urban communities

Established in 1991 to acquire Rural Local Exchange Carriers (“RLECs”)

A leading acquirer of RLEC properties, with 35 acquisitions completed

since 1993. Recent acquisitions include:

Cass County Telephone Company – closed in 3rd Quarter of 2006

Unite Communications – closed in 3rd Quarter of 2006

The Germantown Independent Telephone Company –

closed in 4th Quarter of 2006

Merger with Verizon’s Maine, Vermont and New Hampshire

wireline operations – expected to close in January 2008

Currently operate 31 local exchange companies in 18 states

311,150(1) access line equivalents(2) as of December 31, 2006,

up from 289,658 (1) access line equivalents as of December 31, 2005

Page 7

Investment Thesis

Attractive, sustainable cash flow

Completed initial public offering in February 2005

Regulated businesses have historically provided

relatively stable revenue base

Organic growth from non-regulated businesses: high

speed data and long distance products

External growth through acquisitions with low

integration risk

Attractive dividend yield: current quarterly dividend of

$0.39781 per share (or $1.59 annually)

Page 8

Strengthening Communities

through Communications

A leading provider of communications services in

rural and small urban communities

Average density – approximately 13 access lines per square mile

(our most rural areas have one access line per square mile)

Favorable rural market dynamics

Loyal, stable customer base

Fundamentally better wireline trends than most non-rural carriers

Technologically advanced infrastructure

92% of our access lines are high speed data capable

Use multiple technologies for high speed data

(DSL, Cable, Wireless Broadband)

Use multiple technologies for video

(IPTV, Cable, DirecTV partnerships)

Page 9

Key Financial Metrics

(1) Adjusted EBITDA is a non-GAAP financial measure (i.e., it is not a measure of financial performance under generally accepted accounting principles) and should not be considered in isolation or as a substitute for consolidated statements of operations and cash flows data prepared in accordance with GAAP. In addition, the non-GAAP financial measures used by FairPoint may not be comparable to similarly titled measures of other companies. For further information, definitions and reconciliations, see the Company’s earnings release for the fourth quarter of 2006 filed on Form 8-K with the Securities and Exchange Commission on February 23, 2007.

Results for the year ended December 31, 2006

Consolidated Revenues $270.1 million

Adjusted EBITDA(1) $133.2 million

Net Income $31.1 million

Access Line Equivalents 311,150

HSD Subscribers 59,444

Total Long Term Debt $608.0 million

(90% at fixed rates, via swaps)

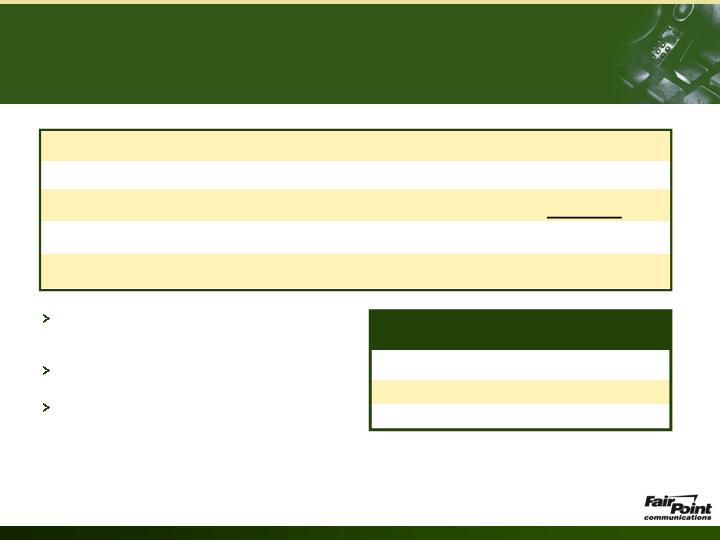

Pending Merger

Page 11

Rationale For The Merger

Compelling benefits for stakeholders, customers and employees

Benefits stakeholders

Pro forma leverage improves to approximately

4.1 times EBITDA(2)

Pro forma dividend payout ratio expected

to improve to 60%–70% after anticipated

cost-savings

Improves financial flexibility

Improves revenue mix

Improves dividend sustainability (FairPoint intends to

maintain its dividend at $1.59 per share annually(1))

Benefits customers and employees

Stronger competitive operations

Increased focus on customers

Significant DSL / broadband expansion in region

Expanded employee base enhances core capabilities

Opening three scalable service centers in the region

Constructive relationships with employees, unions and policymakers

(1) Subject to declaration by the board of directors and compliance with Delaware law and covenants in agreements governing indebtedness.

(2) Estimate at closing of merger. Calculated using combined EBITDA for 2005 and combined net debt at closing.

Page 12

Long-term Strategic Flexibility

Increased opportunities to generate value

Provides multiple opportunities for value creation

Improves revenue opportunities

New product bundles

Increased broadband availability

Increased focus on local sales and marketing

Enhances operational efficiencies

Economies of scale

Investment in state-of-the-art systems

Greater operating flexibility

Improves financial strength

De-leverages balance sheet

Improves access to capital / lowers cost of capital

Increases free cash flow

Reduces reliance on access and USF revenues

Page 13

Favorable Contribution Metrics

Shareholders receive significant stake in combined entity

FRP shareholders

own approximately

40% of the

combined company

FRP contribution

14% of total

access lines

18% of total revenue

24% of total EBITDA

(1) Based on 2005 audited financial results, net of adjustments to pension and other postretirement benefit expenses and certain one time items.

(2) Based on access lines at September 30, 2006.

Page 14

Attractive Financial Characteristics

With defined opportunities for improvement

(1) Earnings before interest, taxes, depreciation and amortization.

(2) Based on 2005 audited financial results, net of adjustments to pension and other postretirement benefit expenses and certain one time items.

2005 EBITDA was $395 million but included certain expenses relating to liabilities which will not be assumed in the merger.

(3) Excludes depreciation and amortization. Includes $240 million of allocated expenses from Verizon affiliates.

Expected cost savings and

synergies of $60 - $75 million

annually

Full effect of synergies begins

12 months after closing

Planned investment of $200

million in strategic systems

6.3x

EBITDA multiple (based on 2005 EBITDA)(1)(2)

$2,715M

Total Transaction Value

$1,700M

Plus Assumed Debt

$1,015M

Implied Equity Value (@ $18.88 per share)

53.8 Million FairPoint Shares issued to Verizon Stockholders

$775 million

$431 million

Operating expenses(3)

EBITDA

$1,206 million

Revenue

Verizon’s Maine, New Hampshire and

Vermont operations (2) :

Page 15

87%

Payout ratio(1)

4.5x

Leverage(1)(5)

35.1 million

Shares Outstanding(4)

$1.59 per share

Annual Dividend

$602 million

Net Debt(3)

$135 million

EBITDA(1)

$263 million

Revenue(1)

FairPoint (pre-merger):

(1) Based on 2005 results which are the most recent full year audited financial

statements publicly available for both companies.

(2) Based on 2005 audited financial results, net of adjustments to pension and

other postretirement benefit expenses and certain one time items.

(3) Long-term debt net of cash and cash equivalents as of December 31, 2005.

(4) As of September 30, 2006.

(5) Defined as net debt/EBITDA.

(6) Pro-forma payout ratio after realization of anticipated cost savings and

synergies of $60-75 million

(7) Calculated using 2005 combined EBITDA and estimated net debt closing.

Summary Financial Comparison

Enhanced financial strength

60 – 70%

Payout ratio(6)

4.1x (at closing)

Leverage(7)

88.9 million

Shares Outstanding

$1.59 per share

Annual Dividend

$2,334 million

Net Debt(3)

$566 million

EBITDA(2)

$1,469 million

Revenue(2)

Pro forma FairPoint Consolidated:

Expected cost savings / synergies

of $60 - $75 million annually

Full effect of synergies begins

12 months after closing

Planned investment of $200

million in strategic systems

Page 16

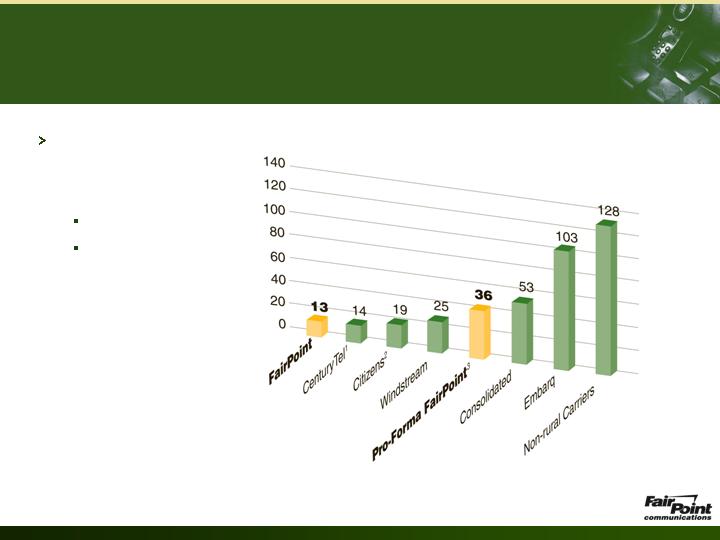

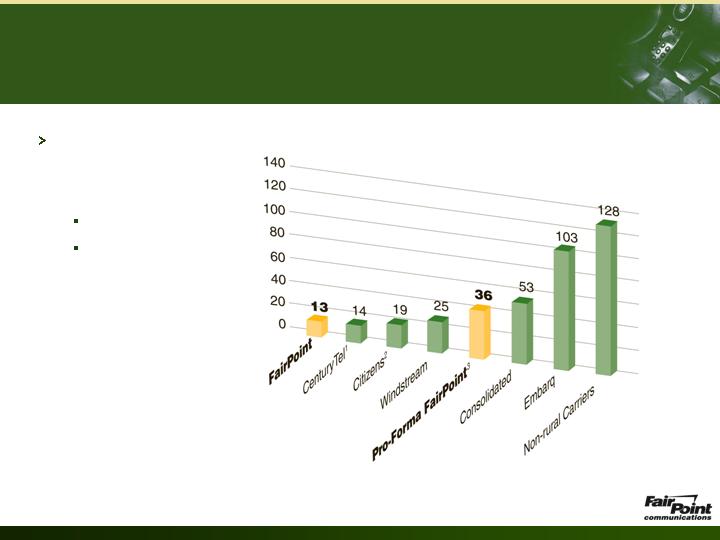

Favorable Rural Characteristics

Focus on rural / small urban markets

Continuing focus

on lower-density

markets after

transaction

36 lines / sq. mile

More than 80% of local

exchanges will

serve 5,000

customers or less

Notes

1.

Pro forma for CenturyTel’s acquisition of Madison River

2.

Pro forma for Citizens’ acquisition of Commonwealth

2.

Pro forma for Fairpoint's aquisition of Verizon's New England access lines

Source

SEC filings and

investor presentations

Access Lines/Square Mile

Page 17

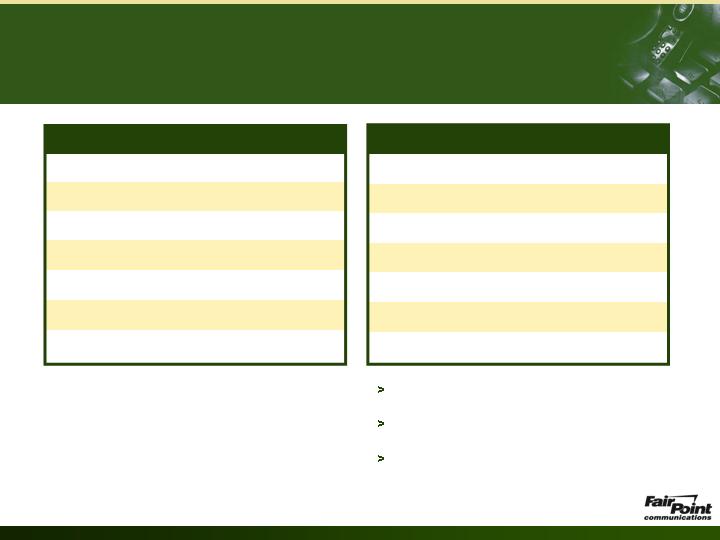

Access Line Trends/Metrics

Opportunity for improvement

$29.70

39.7%

12.7%

6.4%

VZ ME, VT and

NH

$42.02

45.2%

23.6%

3.4%

FairPoint(1)

HSD ARPU(4)

Long Distance

Penetration(3)

HSD

Penetration(3)

Access Line

Losses(2)

Note: All numbers based on December 31, 2006 information.

(1)

Access lines losses excludes acquired lines.

(2)

Comparison of December 31, 2006 to December 31, 2005.

(3)

Shown as a percentage of voice access lines.

(4)

Represents average revenue per unit (ARPU) for the fourth quarter of 2006.

Page 18

Transition Planning

Existing Credit Agreement amended to facilitate a successful transition

Getting ahead -

Integration plan based upon investing $200 million for systems

development and integration (of which, approximately $95 -

$110 million invested before closing)

Verizon to pay for up to $40 million of these pre-closing transition costs

FRP expects to generate $55 million through the sale of its investment in

Orange County –Poughkeepsie to Verizon Wireless

Credit Agreement Amended to:

Consent to the sale of Orange-Poughkeepsie and exclude proceeds from

Distributable Cash Flow

Amend definition of Consolidated Capital Expenditures and EBITDA to

allow for add-back of expenditures associated with the transition not to

exceed $72.9 million

Increase leverage and dividend suspension covenants to 5.5x and 5.25x

respectively

Page 19

Merger Financing

Obtained $2.1 billion commitment for bank financing(1)

Total debt issuance at closing will approximate FairPoint’s

outstanding debt plus $1.7 billion assumed from Verizon

Bank financing

Payoff FairPoint’s existing credit facility

Finance special dividend to Verizon up to amount of existing tax basis

Terms

Revolver - 6 year maturity

Term Loan B - 8 year maturity (1% amortization beginning year 3)

Covenants

Total leverage of 5.75x in year one and 5.5x thereafter

Interest coverage ratio of 2.25x

Proposed high-yield financing(1)

Difference between $1.7 billion in assumed debt and Spinco tax basis

will be issued in unsecured bonds

(1) Offering size subject to change based on final tax basis of Spinco assets.

Summary

Page 21

Summary

Strategic win for stakeholders, employees and customers

Benefits stakeholders

Attractive valuation

Results in cash flow accretion

Enhances financial strength

Benefits customers and employees

Support services return to Maine, New Hampshire

and Vermont

FairPoint’s strong commitment to and success in

broadband Accelerates economies of scale

Leverages FairPoint’s management team

Creates multiple opportunities for

ongoing value creation

Improves revenue opportunities

Enhances operating efficiencies

Questions and Answers

March 26, 2007