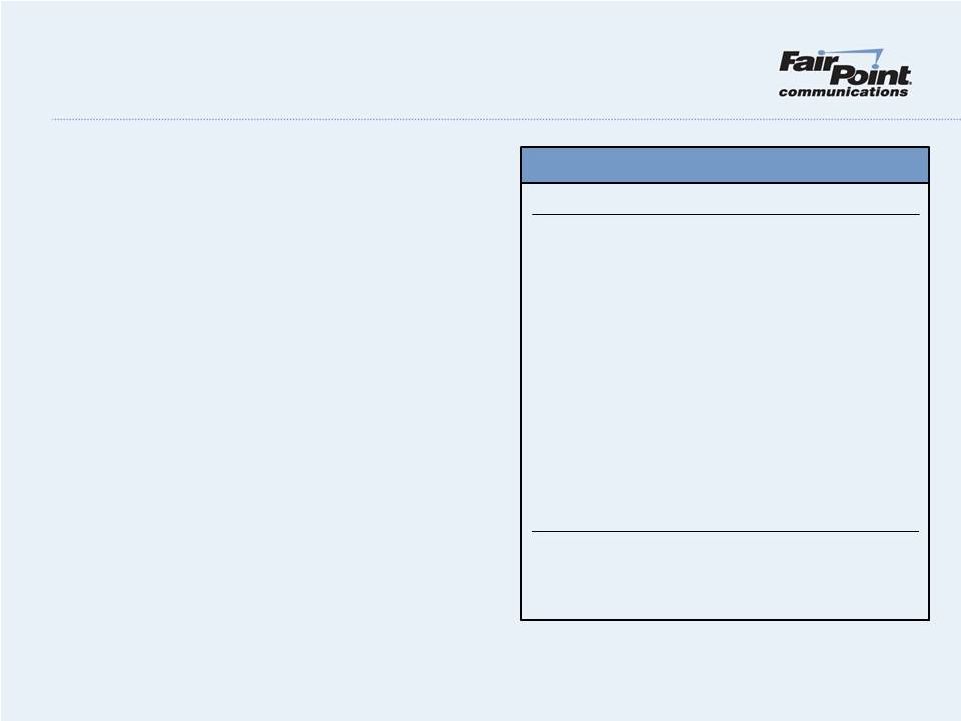

Human Resource Strategy FairPoint must align its human resource assets with the changing telecom landscape • 15% workforce reduction since 2Q11 • 3,410 employees as of June 30, 2012 • Increased labor relations competencies with telecommunications focus • Pension & OPEB liabilities arise from northern New England union contracts • New law lowers 2013 required pension contribution Pension & OPEB Sensitivity (1) Based upon liability at December 31, 2011 (2) Please see FairPoint’s disclosure regarding the Moving Ahead for Progress in the 21 which was furnished with the SEC on Form 8-K on July 19, 2012 Pension & OPEB GAAP Liability ($ in millions) Pension OPEB Impact on liability given 1% change in the discount rate assumption 19% 23% Impact on liability given 1% increase in healthcare cost trend assumption N/A $134.1 Impact on liability given 1% decrease in healthcare cost trend assumption N/A ($101.1) 9 2 1 st – Lump sum pension distributions of $49 million – 1,226 management – 2,184 union (1,911 covered by CBAs with CWA and IBEW in NNE, which expire Aug. 2014) – GAAP figures represent status quo into perpetuity and reflect continuation of past practices – Pension and OPEB are highly sensitive to the discount rate assumption (i.e. interest rates) – OPEB liability is highly sensitive to the medical cost trend assumption – FairPoint’s 2012 contribution would have been $8-10M lower, pro forma for the new law Century Act, ($ in millions) 2010 2011 2Q12 Pension Plan assets $176.5 $160.3 $152.8 Projected benefit obligation $265.8 $318.3 $308.9 Key assumptions: Discount rate 5.56% 4.63% 4.61% OPEB Plan assets Projected benefit obligation $0.2 $344.9 $1.0 $533.2 $1.0 $556.6 Key assumptions: Discount rate 5.65% 4.66% 4.66% Healthcare cost trend (<65 years) 7.70% 8.40% 8.40% Healthcare cost trend (>65 years) 8.20% 8.40% 8.40% |