Schedule 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities and Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| | |

| ¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

HELIOS HIGH YIELD FUND

Payment of Filing Fee (Check the appropriate box:)

x No fee required.

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transactions applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rules 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

HELIOS HIGH YIELD FUND

Three World Financial Center, 200 Vesey Street

New York, New York 10281-1010

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

October 25, 2012

To the Shareholder:

Notice is hereby given that the Annual Meeting of Shareholders of Helios High Yield Fund (the “Fund”) will be held at the offices of Brookfield Investment Management Inc., Three World Financial Center, 200 Vesey Street, 26th Floor, New York, NY 10281-1010, on November 15, 2012, at 8:30 a.m., for the following purposes:

| | 1. | To consider and vote upon the election of the Class I Trustee (Proposal 1). |

| | 2. | To transact any other business that may properly come before the meeting. |

The Board of Trustees recommends that you vote in favor of Proposal 1.

Shareholders of record as of the close of business on September 28, 2012, are entitled to notice of, and to vote at, the meeting or any adjournment or postponement thereof. If you attend the meeting, you may vote your shares in person. If you do not expect to attend the meeting, please complete, date, sign and return promptly in the enclosed envelope the accompanying proxy ballot(s). This is important to ensure a quorum at the meeting.

In addition to voting by mail, you may also vote via the Internet, as follows:

To vote by the Internet:

| | (1) | Read the Proxy Statement and have the enclosed proxy card at hand. |

| | (2) | Go to the website that appears on the enclosed proxy card. |

| | (3) | Enter the control number set forth on the enclosed proxy card and follow the simple instructions. |

We encourage you to vote your shares via the Internet using the control number that appears on your enclosed proxy card. Use of Internet voting will reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed Proxy Statement carefully before you vote. If you should have any questions about this Notice or the proxy materials, we encourage you to call us at (800) 497-3746.

By Order of the Board of Trustees,

/s/ Jonathan C. Tyras

Jonathan C. Tyras

Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 15, 2012

The Fund’s Notice of Annual Meeting of Shareholders, Proxy Statement and Form of Proxy are available on the Internet at www.brookfieldim.com

WE NEED YOUR PROXY VOTEIMMEDIATELY.

YOU MAY THINK YOUR VOTE IS NOT IMPORTANT, BUT IT IS VITAL. THE MEETING OF SHAREHOLDERS OF THE FUND WILL BE UNABLE TO CONDUCT ANY BUSINESS IF LESS THAN A MAJORITY OF THE SHARES ELIGIBLE TO VOTE ARE REPRESENTED. IN THAT EVENT, THE FUND, AT THE SHAREHOLDERS’ EXPENSE, WOULD CONTINUE TO SOLICIT VOTES IN AN ATTEMPT TO ACHIEVE A QUORUM. CLEARLY, YOUR VOTE COULD BE CRITICAL TO ENABLE THE FUND TO HOLD THE MEETING AS SCHEDULED, SO PLEASE RETURN YOUR PROXY CARD IMMEDIATELY. YOU AND ALL OTHER SHAREHOLDERS WILL BENEFIT FROM YOUR COOPERATION.

Instructions for Signing Proxy Cards

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense involved in validating your vote if you fail to sign your proxy card properly.

1.Individual Accounts. Sign your name exactly as it appears in the registration on the proxy card.

2.Joint Accounts. Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration.

3.All Other Accounts. The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

| | | | |

Registration | | | | Valid Signature |

| |

| Corporate Accounts | | |

(1) | | ABC Corp. | | ABC Corp. (by John Doe, Treasurer) |

(2) | | ABC Corp. | | John Doe, Treasurer |

(3) | | ABC Corp. c/o John Doe, Treasurer | | John Doe |

(4) | | ABC Corp. Profit Sharing Plan | | John Doe, Trustee |

| |

| Trust Accounts | | |

(1) | | ABC Trust | | Jane B. Doe, Trustee |

(2) | | Jane B. Doe, Trustee u/t/d 12/28/78 | | Jane B. Doe |

| |

| Custodial or Estate Accounts | | |

(1) | | John B. Smith, Cust. f/b/o John B. Smith, Jr. UGMA | | John B. Smith |

(2) | | John B. Smith | | John B. Smith, Jr., Executor |

YOUR VOTE IS IMPORTANT. PLEASE VOTE YOUR

SHARES PROMPTLY, NO MATTER HOW MANY SHARES YOU OWN.

HELIOS HIGH YIELD FUND

Three World Financial Center, 200 Vesey Street

New York, New York 10281-1010

PROXY STATEMENT

This Proxy Statement is furnished to Shareholders in connection with a solicitation by the Board of Trustees (the “Board”) of Helios High Yield Fund (the “Fund”) of proxies to be used at the Annual Meeting of Shareholders (the “Meeting”) of the Fund to be held at the offices of Brookfield Investment Management Inc., Three World Financial Center, 200 Vesey Street, 26th Floor, New York, NY 10281-1010 at 8:30 a.m. on November 15, 2012 (and at any adjournment or postponements thereof) for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. This Proxy Statement and the accompanying form of proxy are first being mailed to shareholders on or about October 25, 2012.

Shareholders who execute proxies retain the right to revoke them by written notice received by the Secretary of the respective Fund at any time before they are voted. Unrevoked proxies will be voted in accordance with the specifications thereon and, unless specified to the contrary, will be voted FOR the election of the Trustee nominee or Class I Trustee. The close of business on September 28, 2012, has been fixed as the record date (the “Record Date”) for the determination of Shareholders entitled to receive notice of, and to vote at, the Meeting. Each outstanding full share of beneficial interest of the Fund is entitled to one vote, and each outstanding fractional share thereof is entitled to a proportionate fractional share of one vote, except that shares held in the treasury of the Fund as of the Record Date shall not be voted. The number of outstanding shares of common stock of the Fund as of the Record Date is 6,845,862.

Under the By-Laws of the Fund, a quorum is constituted by the presence in person or by proxy of the record holders of a majority of the outstanding shares of the Fund entitled to vote at the Meeting. In the event that a quorum is not present at the Meeting, Shareholders present or represented by proxy and entitled to vote thereat, may adjourn the Meeting from time to time, without further notice, to permit further solicitation of proxies. Any such adjournment would require the affirmative vote of a majority of those shares represented at the Meeting in person or by proxy.

For purposes of determining the presence of a quorum for transacting business related to Proposal 1 at the Meeting, abstentions, if any, will be treated as shares that are present, but not as votes cast, at the Meeting. Accordingly, for purposes of counting votes, shares represented by abstentions will have no effect on Proposal 1, for which the required vote for the Class I Trustee nominee is a majority of all the votes cast at the Meeting at which a quorum is present. Since banks and brokers will have discretionary authority to vote shares in the absence of voting instructions from Shareholders with respect to Proposal 1, there will be no broker “non-votes” (that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other persons entitled to vote shares on a particular matter with respect to which the brokers or nominees do not have discretionary power).

Photographic identification and proof of ownership will be required for admission to the meeting. For directions to the meeting, please contact the Fund at (800) 497-3746.

Shareholders may request copies of the Fund’s most recent annual and semi-annual reports, including the financial statements, without charge, by writing to Investor Relations, Helios Funds, Three World Financial Center, 200 Vesey Street, 24th Floor, New York, New York 10281-1010. These reports also are available on the Fund’s website atwww.brookfieldim.com. These documents also have been filed with the Securities and Exchange Commission and are available at www.sec.gov.

1

PROPOSAL 1: ELECTION OF TRUSTEE

The Fund’s Declaration of Trust provides that the Board shall be divided into three classes: Class I, Class II and Class III. The terms of office of the present Trustees in each class expire at the Annual Meeting in the year indicated or thereafter in each case when their respective successors are elected and qualified: Class I, 2012; Class II, 2013 and Class III, 2014. At each subsequent annual election, Trustees chosen to succeed those whose terms are expiring will be identified as being of that same class and will be elected for a three-year term. The effect of these staggered terms is to limit the ability of other entities or persons to acquire control of the Fund by delaying the replacement of a majority of the Board.

The persons named in the accompanying form of proxy intend to vote at the Meeting (unless directed not to so vote) for the re-election of Stuart A. McFarland, the Class I Trustee nominee for the Fund. Mr. McFarland has indicated that he will serve if elected, but if he should be unable to serve, the proxy or proxies will be voted for any other person determined by the persons named in the proxy in accordance with their judgment.

The Fund’s Board has determined that Mr. McFarland, as well as Messrs. Drake and Salvatore and Ms. Hamilton, are independent under the criteria for independence set forth in the listing standards of the New York Stock Exchange, and therefore, the Fund meets the requirements of the New York Stock Exchange that a majority of Trustees be independent.

As described above, there is one nominee for election to the Board at this time. Proxies cannot be voted for a greater number of persons than the number of nominees currently proposed to serve on the Board.

2

Information Concerning Nominee and Trustees

The following table provides information concerning each of the Trustees and the Class I Trustee nominee of the Board, as of the date of this Proxy Statement. The nominee is listed first in the table under “Class I Disinterested Trustee Nominee.” The terms of the Class II and the Class III Trustees do not expire this year. The Fund has a retirement policy which sets a mandatory retirement age of 75 for the Trustees.

| | | | | | | | |

Name, Address and Age | | Position(s) Held with Fund and

Term of Office and Length of

Time Served | | Principal Occupation(s) During Past 5 Years and Other Trusteeships Held by Trustee | | Number of

Portfolios in

Fund Complex

Overseen by

Trustee | |

|

| Class I Disinterested Trustee Nominee—Term Expires at 2012 Annual Meeting of Shareholders | |

| | | |

Stuart A. McFarland

c/o Three World

Financial Center,

200 Vesey Street,

New York, New York

10281-1010 Age 65 | | Trustee, Member of the Audit Committee, the Qualified Legal Compliance Committee, and the Nominating and Compensation Committee Elected since 2009 Elected for Three Year Term | | Director/Trustee of several investment companies advised by the Advisor (2006-Present); Director of United Guaranty Corporation (July 2011-Present); Lead Independent Director of Brandywine Funds (2003-Present); Director of New Castle Investment Corp. (2000-Present); Chairman and Chief Executive Officer of Federal City Bancorp, Inc. (2005-2007); Managing Partner of Federal City Capital Advisors (1997-Present). | | | 6 | |

|

| Class II Disinterested Trustee—Term Expires at 2013 Annual Meeting of Shareholders | |

| | | |

Rodman L. Drake

c/o Three World

Financial Center 200 Vesey Street,

New York, New York

10281-1010 Age 69 | | Trustee and Chairman of the Board, Chairman of the Nominating and Compensation Committee, Member of the Audit Committee, the Qualified Legal Compliance Committee, and the Executive Committee Elected since 2009 Elected for Three Year Term | | Chairman (since 2003) and Director/Trustee of several investment companies advised by the Advisor (1989-Present); Director and/or Lead Director of Crystal River Capital, Inc. (2005- 2010); Chairman of Board (2005-2010), Interim President and Chief Executive Officer of Crystal River Capital, Inc. (2009-2010); Director of Celgene Corporation (2006-Present); Director of Student Loan Corporation (2005-2010); Director of Apex Silver Mines Limited (2007-2009); Co-founder, Baringo Capital LLC (2002-Present); Director of Jackson Hewitt Tax Services Inc. (2004-2011); Director of Animal Medical Center (2002-Present); Director and/or Lead Director of Parsons Brinckerhoff, Inc. (1995-2008); Trustee and Chairman of Excelsior Funds (1994-2007); Trustee of Columbia Atlantic Funds (2007-2009); Chairman of Columbia Atlantic Funds (2009-Present). | | | 11 | |

3

| | | | | | | | |

Name, Address and Age | | Position(s) Held with Fund and

Term of Office and Length of

Time Served | | Principal Occupation(s) During Past 5 Years and Other Trusteeships Held by Trustee | | Number of

Portfolios in

Fund Complex

Overseen by

Trustee | |

Diana H. Hamilton c/o Three World

Financial Center

200 Vesey Street,

New York, New York

10281-1010 Age 56 | | Trustee, Member of the Audit Committee, the Qualified Legal Compliance Committee, and the Nominating and Compensation Committee Elected since 2004 Elected for Three Year Term | | Director/Trustee of several investment companies advised by the Advisor (2009-Present); President, Sycamore Advisors, LLC, a municipal finance advisory firm (2004-Present). | | | 6 | |

|

| Class III Disinterested Trustee—Term Expires at 2014 Annual Meeting of Shareholders | |

| | | |

Louis P. Salvatore c/o Three World

Financial Center,

200 Vesey Street,

New York, New York

10281-1010 Age 66 | | Trustee, Chairman of the Audit Committee, Member of the Qualified Legal Compliance Committee and the Nominating and Compensation Committee Elected since September 2009 Elected for Three Year Term | | Director of Chambers Street Properties (July 2012-Present); Director/Trustee of several investment companies advised by the Advisor (2005-Present); Director of Crystal River Capital, Inc. (2005-2010); Director of Turner Corp. (2003-Present); Director of Jackson Hewitt Tax Services, Inc. (2004-2011); Employee of Arthur Andersen LLP (2002-Present). | | | 11 | |

4

Officers of the Funds

The officers of the Fund are elected by the Board either at its annual meeting, or at any subsequent regular or special meeting of the Board. The Board of the Fund has elected eight officers, to hold office at the discretion of the Board until their successors are chosen and qualified or until his or her resignation or removal. Except where dates of service are noted, all officers listed below served the Fund as such throughout the fiscal year ended June 30, 2012. The following table sets forth information concerning each officer of the Fund as of the date of this Proxy Statement:

| | | | | | |

Name, Address and Age | | Position(s) Held

with Fund | | Term of Office and

Length of Time Served | | Principal Occupation(s) During Past 5 Years |

Kim G. Redding* c/o Three World Financial Center, 200 Vesey Street, New York, New York

10281-1010 Age 57 | | President | | Elected Annually Since 2010 | | President of several investment companies advised by the Advisor (2010-Present); Chief Executive Officer and Chief Investment Officer of the Advisor (2010-Present); Co-Chief Executive Officer and Chief Investment Officer of the Advisor (2009-2010); Director, Brookfield Investment Management (UK) Limited (2011-Present); Director and Chairman of the Board of Directors, Brookfield Investment Management (Canada) Inc. (2011-Present); Director, Brookfield Investment Funds (UCITS) plc (2011-Present); Director, Brookfield Investment Funds (QIF) plc (2011-Present); Founder and Chief Executive Officer of Brookfield Redding LLC (2001-2009). |

| | | |

Dana Erikson* c/o Three World

Financial Center,

200 Vesey Street,

New York, New York

10281-1010 Age 47 | | Vice President | | Elected Annually Since 2009 | | Vice President of other investment company advised by the Advisor (2009-Present); Senior Portfolio Manager/Managing Director of the Advisor (2006-Present). |

| | | |

Richard Cryan* c/o Three World

Financial Center,

200 Vesey Street,

New York, New York

10281-1010 Age 56 | | Vice President | | Elected Annually Since May 2011 | | Vice President of several investment companies advised by the Advisor (May 2011-present); Senior Portfolio Manager of the Advisor (2006-Present); Managing Director of the Advisor (2006-Present). |

| | | |

Mark Shipley* c/o Three World Financial Center, 200 Vesey Street,

New York, New York

10281-1010 Age 41 | | Vice President | | Elected Annually Since May 2011 | | Vice President of several investment companies advised by the Advisor (May 2011-Present); Portfolio Manager of the Advisor (2011-Present); Managing Director of the Advisor (2011-Present); Director of the Advisor (2006-2010); Analyst of the Advisor (2006-2010). |

5

| | | | | | |

Name, Address and Age | | Position(s) Held

with Fund | | Term of Office and

Length of Time Served | | Principal Occupation(s) During Past 5 Years |

Steven M. Pires* c/o Three World

Financial Center,

200 Vesey Street,

New York, New York

10281-1010 Age 56 | | Treasurer | | Elected Annually Since April 2009 | | Treasurer of several investment companies advised by the Advisor (2009-Present); Vice President of the Advisor (2011-Present); Vice President of Brookfield Operations and Management Services LLC (2008-2011); Assistant Vice President of Managers Investment Group LLC (2004-2008). |

| | | |

Jonathan C. Tyras* c/o Three World

Financial Center,

200 Vesey Street,

New York, New York

10281-1010 Age 43 | | Secretary | | Elected Annually Since November 2008 | | Managing Director and Chief Financial Officer of the Advisor (2010-Present); Director of the Advisor (2006-2010); Chief Financial Officer of Brookfield Investment Management (UK) Limited (2011-Present); Chief Financial Officer of Brookfield Investment Management (Canada) Inc. (2011-Present); General Counsel and Secretary of the Advisor (2006-Present); Vice President and General Counsel (2006-2010) and Secretary (2007-2010) of Crystal River Capital, Inc.; Secretary of several investment companies advised by the Advisor (2006-Present). |

| | | |

Seth Gelman*

c/o Three World

Financial Center,

200 Vesey Street,

New York, New York

10281-1010 Age 37 | | Chief Compliance Officer (“CCO”) | | Elected Annually Since May 2009 | | CCO of several investment companies advised by the Advisor (2009-Present); Director and CCO of the Advisor (2009-Present); Vice President of Oppenheimer Funds, Inc. (2004-2009). |

| | | |

Lily Wicker*

c/o Three World

Financial Center,

200 Vesey Street,

New York, New York

10281-1010 Age 34 | | Assistant Secretary | | Elected Annually Since September 2009 | | Assistant Secretary (2009-Present) and Interim CCO (March-May 2009) of several investment companies advised by the Advisor; Vice President (2010-Present); Assistant Vice President (2009-2010) and Associate (2007-2009) of the Advisor; Chief Compliance Officer of Brookfield Investment Management (UK) Limited (May 2011-Present). |

| * | Designates individuals who are “interested persons” of the Fund, as defined by the 1940 Act, because of affiliations with the Advisor. |

Share Ownership

As of the Record Date, the Trustee nominee, Trustees and officers of the Fund beneficially owned individually and collectively as a group less than 1% of the outstanding shares of the Fund.

6

The following table sets forth the aggregate dollar range of equity securities owned by each Trustee of the Fund and of all funds overseen by each Trustee in the Advisor’s family of investment companies (the “Fund Complex”) as of September 30, 2012. The Fund Complex is comprised of the Fund, Helios Total Return Fund, Inc., Helios Advantage Income Fund, Inc., Helios High Income Fund, Inc., Helios Multi-Sector High Income Fund, Inc., Helios Strategic Income Fund, Inc., Brookfield Global Listed Infrastructure Income Fund, Inc. and Brookfield Investment Funds and its four series; Brookfield Global Listed Real Estate Fund, Brookfield Global Listed Infrastructure Fund, Brookfield Global High Yield Fund and Brookfield High Yield Fund. The cost of each Trustee’s investment in the Fund Complex may vary from the current dollar range of equity securities shown below, which is calculated on a market value basis as of September 30, 2012. The information as to beneficial ownership is based on statements furnished to the Funds by each Trustee.

| | | | |

Name of Nominee/Trustee | | Dollar Range of

Equity Securities in the

Fund | | Aggregate Dollar

Range of Equity Securities

in All Funds Overseen by

Trustee in Family of

Investment Companies |

Disinterested Trustee Nominee | | | | |

Stuart A. McFarland | | $50,000-$100,000 | | Over $100,000 |

| | |

Disinterested Trustees | | | | |

Diana H. Hamilton | | $0-$10,000 | | $10,001-$50,000 |

Louis P. Salvatore | | $10,001-$50,000 | | Over $100,000 |

Rodman L. Drake | | $0-$10,000 | | Over $100,000 |

Information Regarding the Boards and their Committees

The Role of the Board

The Fund’s Board provides oversight of the management and operations of the Fund. As is the case with virtually all investment companies (as distinguished from operating companies), the day-to-day management and operation of the Fund is performed by various service providers to the Fund, such as the Fund’s investment adviser and administrator, the sub-administrator, custodian, and transfer agent. The Board has appointed senior employees of the Advisor as officers of the Fund, with responsibility to monitor and report to the Board on the Fund’s day-to-day operations. In conducting this oversight, the Board receives regular reports from these officers and service providers regarding the Fund’s operations. For example, the Treasurer of the Fund provides reports as to financial reporting matters, and investment personnel of the Advisor report on the Fund’s investment activities and performance. The Board has appointed a Chief Compliance Officer who administers the Fund’s compliance program and regularly reports to the Board as to compliance matters. Some of these reports are provided as part of formal “Board meetings” which are typically held quarterly, in person, and involve the Board’s review of recent Fund operations. From time to time, one or more members of the Board may also meet with management in less formal settings, between scheduled “Board meetings,” to discuss various topics. In all cases, however, the role of the Board and of any individual Trustee is one of oversight and not of management of the day-to-day affairs of the Fund and its oversight role does not make the Board a guarantor of the Fund’s investments, operations or activities.

Board Leadership Structure

The Fund’s Board has structured itself in a manner that it believes allows it to perform its oversight function effectively. Currently, all of the members of the Board, including the Chairman of the Board, are not “interested persons,” as defined in the 1940 Act, of the Fund (the “Disinterested Trustees”), which are Trustees that are not affiliated with the Advisor or its affiliates. The Board has established four standing committees, an Audit Committee, a Nominating and Compensation Committee, an Executive Committee and a Qualified Legal Compliance Committee (collectively, the “Committees”), which are discussed in greater detail below. Each of the Disinterested Trustees helps identify matters for consideration by the Board and the Chairman has an active role in the agenda setting process for Board meetings. The Audit Committee Chairman also has an active role in

7

the agenda setting process for the Audit Committee meetings. The Disinterested Trustees have engaged their own independent counsel to advise them on matters relating to their responsibilities to the Fund. The Fund’s Board has adopted Fund Governance Policies and Procedures to ensure that the Board is properly constituted in accordance with the 1940 Act and to set forth examples of certain of the significant matters for consideration by the Board and/or its Committees in order to facilitate the Board’s oversight function. For example, although the 1940 Act requires that at least 40% of a fund’s trustees not be “interested persons,” as defined in the 1940 Act, the Board has determined that the Disinterested Trustees should constitute at least 75% of the Board. The Board reviews its structure annually. The Board also has determined that the structure, function and composition of the Committees are appropriate means to provide effective oversight on behalf of Fund Shareholders.

Board Oversight of Risk Management

As part of its oversight function, the Board receives and reviews various risk management reports and assessments and discusses these matters with appropriate management and other personnel. Because risk management is a broad concept comprised of many elements, Board oversight of different types of risks is handled in different ways. For example, the full Board receives and reviews reports from senior personnel of the Advisor (including senior compliance, financial reporting and investment personnel) or their affiliates regarding various types of risks, including, but not limited to, operational, compliance, investment, and business continuity risks, and how they are being managed. Furthermore, the full Board meets with the Fund’s Chief Compliance Officer at least quarterly to discuss compliance risks relating to the Fund, the Advisor and the Fund’s other service providers. The Audit Committee supports the Board’s oversight of risk management in a variety of ways, including meeting regularly with the Fund’s Treasurer and with the Fund’s independent registered public accounting firm and, when appropriate, with other personnel employed by the Advisor to discuss, among other things, the internal control structure of the Fund’s financial reporting function and compliance with the requirements of the Sarbanes-Oxley Act of 2002. The Audit Committee also meets at least quarterly with the Fund’s Chief Compliance Officer to discuss compliance and operational risks and receives reports from the Advisor’s internal audit group as to these and other matters.

Information about Each Trustee’s Qualification, Experience, Attributes or Skills

The Board believes that the existing Trustee and Trustee nominee has the qualifications, experience, attributes and skills (“Trustee Attributes”) appropriates to serve as a Trustee of the Fund in light of the Fund’s business and structure. In addition to a demonstrated record of business and/or professional accomplishment, each Trustee has served on boards for organizations other than the Fund, as well as having served on the Board of the Fund. They therefore have substantial board experience and, in their service to the Fund, have gained substantial insight as to the operations of the Fund and have demonstrated a commitment to discharging their oversight responsibilities as Trustees. The Board, with the assistance of the Nominating and Compensation Committee, annually conducts a “self-assessment” wherein the performance of the Board and the effectiveness of the Board’s committee structure are reviewed.

In addition to the information provided above, certain additional information regarding the existing Trustees and Trustee nominees and their Trustee Attributes is provided below. Although the information is not all-inclusive, the information describes some of the specific experiences, qualifications, attributes or skills that each Trustee possesses to demonstrate that the Trustees have the appropriate Trustee Attributes to serve effectively as Trustees of the Fund. Many Trustee Attributes involve intangible elements, such as intelligence, integrity and work ethic, the ability to work together, to communicate effectively, to exercise judgment and to ask incisive questions, and commitment to stockholder interests.

| | • | | Rodman L. Drake—In addition to his tenure as a Trustee of the Fund, Mr. Drake has extensive business experience with particular expertise in financial services, financial reporting, strategic planning and risk management disciplines, including serving on the board of directors for various public and private companies, which include other investment management companies. Mr. Drake serves as the Chairman |

8

| | of the Board, and is a member of the Audit, Nominating and Compensation, Qualified Legal Compliance and Executive Committees. |

| | • | | Diana H. Hamilton—In addition to her tenure as a Trustee of the Fund, Ms. Hamilton has business experience as an executive in the public sector, including serving six years as Director of Public Finance for the State of Indiana, as well as corporate governance experience gained from serving on the board of directors of another investment management company. In addition, Ms. Hamilton currently serves as President of a municipal finance advisory firm and on the board of directors and Audit committees of various non-profit entities. Ms. Hamilton previously served as chair of the Indiana Transportation Finance Authority. Ms. Hamilton is a member of the Audit, Qualified Legal Compliance and Nominating and Compensation Committees. |

| | • | | Stuart A. McFarland—In addition to his tenure as a Trustee of the Fund, Mr. McFarland has extensive experience in executive leadership, business development and operations, corporate restructuring and corporate finance. He previously served in senior executive management roles in the private sector, including serving as Executive Vice President and General Manager of GE Capital Mortgage Services, Corp. Mr. McFarland currently serves on the board of directors for various other investment management companies, publicly traded company and non-profit entities, and is the Managing Partner of Federal City Capital Advisors. Mr. McFarland is a member of the Audit, Qualified Legal Compliance and Nominating and Compensation Committees. |

| | • | | Louis P. Salvatore—In addition to his tenure as a Trustee of the Fund, Mr. Salvatore has extensive business experience in financial services and financial reporting, including serving on the board of directors/trustees and as audit committee chairman for several other investment management companies. Mr. Salvatore previously spent over thirty years in public accounting. He holds a Professional Director Certification from the American College of Corporate Directors, a public company director education organization. Mr. Salvatore serves as Chairman of the Audit Committee and is a member of the Qualified Legal Compliance and Nominating and Compensation Committee. |

Nominating and Compensation Committee Considerations for Disinterested Trustees

The Nominating and Compensation Committee evaluates candidates’ qualifications for Board membership. When evaluating candidates, the Nominating and Compensation Committee considers a number of attributes including leadership, independence, interpersonal skills, financial acumen, integrity and professional ethics, educational and professional background, prior trustee or executive experience, industry knowledge, business judgment and specific experiences or expertise that would complement or benefit the Board as a whole. The Nominating and Compensation Committee also may consider other factors/attributes as they may determine appropriate in their own judgment. The Nominating and Compensation Committee believes that the significance of each nominee’s background, experience, qualifications, attributes or skills must be considered in the context of the Board as a whole. As a result, the Nominating and Compensation Committee has not established a litmus test or quota relating to these matters that must be satisfied before an individual may serve as a Trustee. The Nominating and Compensation Committee believes that board effectiveness is best evaluated at a group level, through the annual self-assessment process. Through this process, the Nominating and Compensation Committee considers whether the Board as a whole has an appropriate level of sophistication, skill, and business acumen and the appropriate range of experience and background. The diversity of a candidate’s background or experiences, when considered in comparison to the background and experiences of other members of the Board, may or may not impact the Nominating and Compensation Committee’s view as to the candidate. In accessing these matters, the Nominating and Compensation Committee typically considers the following minimum criteria:

| | • | | With respect to nominations for Disinterested Trustees, nominees shall be independent of the Advisor and other principal service providers. The Nominating and Compensation Committee of the Fund shall also consider the effect of any relationship beyond those delineated in the 1940 Act that might impair independence, such as business, financial or family relationships with the investment adviser or its affiliates. |

9

| | • | | Disinterested Trustee nominees must qualify for service on the Fund’s Audit Committee under the rules of the New York Stock Exchange (including financial literacy requirements) or of another applicable securities exchange. |

| | • | | With respect to all Trustees, a proposed nominee must qualify under all applicable laws and regulations. |

| | • | | The proposed nominee must agree to invest in an amount equal to 1.5 years worth of trustee compensation in the “Fund Complex” within three years of becoming Trustee. |

| | • | | The Nominating and Compensation Committee of the Fund may also consider such other factors as it may determine to be relevant. |

Board Meetings

The Fund’s Board held four regular meetings during the 12 month period ended June 30, 2012. During the fiscal year ended June 30, 2012, each Trustee attended at least 75% of the aggregate of the meetings of the Fund’s Board of Trustees. The Fund’s Fund Governance Policies and Procedures provide that the Chairman of the Board of Trustee, who is elected by the Disinterested Trustees, will preside at each executive session of the Board, or if one has not been designated, the chairperson of the Nominating and Compensation Committee shall serve as such.

Executive Committee

The Fund has an Executive Committee. The Executive Committee presently consists of Mr. Drake. The function of the Executive Committee is to take any action permitted by law when the full Board of Trustees cannot meet. The Executive Committee of the Fund did not need to meet during the fiscal year ended June 30, 2012.

Audit Committee

The Fund has a standing Audit Committee that was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, which currently consists Ms. Hamilton and Messrs. Drake, McFarland, and Salvatore, all of whom are Disinterested Trustees. The principal functions of the Audit Committee are to review the Fund’s audited financial statements, to select the Fund’s independent auditor, to review with the Fund’s auditor the scope and anticipated costs of their audit and to receive and consider a report from the auditors concerning their conduct of the audit, including any comments or recommendations they might want to make in connection therewith. During the last fiscal year of the Fund, the Audit Committee held two regular meetings. All of the members of the Audit Committee attended all of the Audit Committee meetings. Mr. Salvatore serves as a Chairman of the Audit Committee. The Board has determined that each member of the Audit Committee is an “audit committee financial expert,” as defined in Item 401(h) of Regulation S-K promulgated by the Securities and Exchange Commission.

The Fund’s Board of Trustees has adopted a written charter for its Audit Committee, which is available on the Fund’s website at www.brookfieldim.com. A copy of the Fund’s Audit Committee Charter is also available free of charge, upon request directed to Investor Relations, Helios Funds, Three World Financial Center, 200 Vesey Street, New York, New York 10281-1010.

Nominating and Compensation Committee

The Fund has a Nominating and Compensation Committee, which currently consists of Messrs. Drake, McFarland, Salvatore and Ms. Hamilton, all of whom are Disinterested Trustees and independent as independence is defined in New York Stock Exchange, Inc.’s listing standards. The Nominating and Compensation Committee of the Fund met once during the fiscal year ended June 30, 2012 and each meeting was

10

attended by all of the members of the Nominating and Compensation Committee. The function of the Fund’s Nominating and Compensation Committee is to recommend candidates for election to its Board as Disinterested Trustees. The Fund’s Nominating and Compensation Committee evaluates each candidate’s qualifications for Board membership and their independence from the Advisor and other principal service providers.

The Nominating and Compensation Committee will consider nominees recommended by Shareholders who, separately or as a group, own at least one percent of a Fund’s shares. For a list of the minimum criteria used by the Nominating and Compensation Committee to assess a candidate’s qualifications, please see “Nominating and Compensation Committee Considerations for Disinterested Trustees”above.

When identifying and evaluating prospective nominees, the Nominating and Compensation Committee reviews all recommendations in the same manner, including those received by Shareholders. The Nominating and Compensation Committee first determines if the prospective nominee meets the minimum qualifications set forth above. Those proposed nominees meeting the minimum qualifications as set forth above are then considered by the Nominating and Compensation Committee with respect to any other qualifications deemed to be important. Those nominees meeting the minimum and other qualifications and determined by the Nominating and Compensation Committees as suitable are included on the Fund’s proxy card.

Shareholder recommendations should be addressed to the Nominating and Compensation Committee in care of the Secretary of the Fund and sent to Three World Financial Center, 200 Vesey Street, New York, New York 10281-1010. Shareholder recommendations should include biographical information, including business experience for the past nine years and a description of the qualifications of the proposed nominee, along with a statement from the nominee that he or she is willing to serve and meets the requirements to be a Disinterested Trustee, if applicable. The Fund’s Nominating and Compensation Committee also determines the compensation paid to the Disinterested Trustee. The Fund’s Board of Trustees has adopted a written charter for its Nominating and Compensation Committee, which is available on the Fund’s website at www.brookfieldim.com. A copy of the Fund’s Nominating and Compensation Committee Charter is also available free of charge, upon request directed to Investor Relations, Helios Funds, Three World Financial Center, 200 Vesey Street, New York, New York 10281-1010.

The Fund’s Nominating and Compensation Committee has recommended Mr. McFarland as nominee for re-election and the Fund’s Board of Trustees has nominated Mr. McFarland to serve as the Class I Disinterested Trustee.

Qualified Legal Compliance Committee

The Fund has a standing Qualified Legal Compliance Committee (“QLCC”). The QLCC was formed for the purpose of compliance with Rules 205.2(k) and 205.3(c) of the Code of Federal Regulations, regarding alternative reporting procedures for attorneys retained or employed by an issuer who appear and practice before the Securities and Exchange Commission on behalf of the issuer (the “issuer attorneys”). An issuer attorney who becomes aware of evidence of a material violation by the Funds, or by any officer, Trustee, employee, or agent of the Funds, may report evidence of such material violation to the QLCC as an alternative to the reporting requirements of Rule 205.3(b) (which requires reporting to the chief legal officer and potentially “up the ladder” to other entities). The QLCC meets as needed. During the fiscal year ended June 30, 2012, the Fund’s QLCC did not meet. The QLCC currently consists of Ms. Hamilton and Messrs. Drake, McFarland, and Salvatore.

Code of Ethics

Code of Ethics. The Fund has adopted a code of ethics that applies to all of its Trustees and officers and any employees of the Fund’s external manager or its affiliates who are involved in the Fund’s business and affairs. This code of ethics is designed to comply with Securities and Exchange Commission regulations and New York Stock Exchange listing standards related to codes of conduct and ethics and is available on the Fund’s website at

11

www.brookfieldim.com. A copy of the Fund’s code of ethics also is available free of charge, upon request directed to Investor Relations, Helios Funds, Three World Financial Center, 200 Vesey Street, New York, New York 10281-1010.

There is no family relationship between any of the Fund’s current officers or Trustees. There are no orders, judgments, or decrees of any governmental agency or administrator, or of any court of competent jurisdiction, revoking or suspending for cause any license, permit or other authority to engage in the securities business or in the sale of a particular security or temporarily or permanently restraining any of the Fund’s officers or Trustees from engaging in or continuing any conduct, practice or employment in connection with the purchase or sale of securities, or convicting such person of any felony or misdemeanor involving a security, or any aspect of the securities business or of theft or of any felony, nor are any of the officers or trustees of any corporation or entity affiliated with the Fund so enjoined.

Compensation of Trustees and Executive Officers

No remuneration was paid by the Fund to persons who were trustees, officers or employees of the Advisor or any affiliate thereof for their services as Trustees or officers of the Fund. Each Trustee of the Fund, other than those who are officers or employees of the Advisor or any affiliate thereof, is entitled to receive from the Fund a fee of $10,000 per year plus $1,000 for the Chairman of the Board and $2,000 for the Chairman of the Audit Committee. The following table sets forth information concerning the compensation received by Trustees for the fiscal year ended June 30, 2012 for the Fund, which we refer to as fiscal 2012.

| | | | | | | | |

| | | Trustees’ Aggregate

Compensation

from the Fund | | | Total Trustees’

Compensation

from the Fund

and the Fund

Complex | |

Rodman L. Drake | | $ | 11,000 | | | $ | 116,500 | |

Stuart A. McFarland | | $ | 10,000 | | | $ | 77,000 | |

Louis P. Salvatore Diana H. Hamilton | | $

$ | 12,000

10,000 |

| | $

$ | 120,000

77,000 |

|

Stockholder Communications with Board of Trustees and Board Attendance at Annual Meetings

The Fund’s Board of Trustees provides a process for Shareholders to send communications to the Board. Any shareholder who wishes to send a communication to the Board of Trustees of the Fund should send the communication to the attention of the Fund’s Secretary at Three World Financial Center, 200 Vesey Street, New York, New York 10281-1010. If a shareholder wishes to send a communication directly to an individual Trustee or to a Committee of the Fund’s Board of Trustees, then the communication should be specifically addressed to such individual Trustee or Committee and sent in care of the Fund’s Secretary at the same address. All communications will be immediately forwarded to the appropriate individual(s).

The Fund’s policy with respect to Trustees’ attendance at annual meetings is to encourage such attendance.

Audit Committee Report

On August 17, 2012 the Audit Committee of the Fund reviewed and discussed with management the Fund’s audited financial statements as of and for the fiscal annual year ended June 30, 2012. The Audit Committees discussed with BBD, LLP (“BBD”), the Funds’ independent registered public accounting firm, the matters required to be discussed by Rule 3526, Ethics and Independence, Communication with Audit Committees Concerning Independence.

The Audit Committees received and reviewed the written disclosures and the letter from BBD required by Rule 3520, Auditor Independence, and discussed with BBD, its independence.

12

Based on the reviews and discussions referred to above, the Audit Committee recommended to its Board of Trustees that the audited financial statements referred to above are included in such Fund’s Annual Report to Shareholders as required by Section 30(e) of the 1940 Act and Rule 30d-1 promulgated thereunder for the fiscal year ended June 30, 2012.

Louis P. Salvatore—Audit Committee Chairman

Rodman L. Drake—Audit Committee Member

Stuart A. McFarland—Audit Committee Member

Diana H. Hamilton—Audit Committee Member

Required Vote

The election of the listed nominee for Trustee requires the approval of a majority of all the votes cast at the Meeting, in person or by proxy, at which a quorum is present.The Board of Trustees of the Fund recommends a vote “For” approval of the election of the nominee to the Fund’s Board of Trustees.

GENERAL INFORMATION

MANAGEMENT AND SERVICE PROVIDERS

The Advisor

The Fund has entered into an Investment Advisory Agreement with Brookfield Investment Management Inc. (the “Advisor”). The Advisor, a wholly owned subsidiary of Brookfield Asset Management Inc., is a Delaware corporation organized in February 1989 and a registered investment advisor under the Investment Advisers Act of 1940, as amended. The business address of the Advisor and its officers and trustees is Three World Financial Center, 200 Vesey Street, 24th Floor, New York, New York 10281-1010. Subject to the authority of the Board of Trustees, the Advisor is responsible for the overall management of the Fund’s business affairs. As of September 30, 2012, the Advisor and its subsidiaries had approximately $16 billion in assets under management. The Advisor’s clients include individual accounts, trusts, pension plans, foundations, insurance companies, corporations, and other business entities’ separate accounts, qualifying investor funds with variable capital, investment companies with variable capital authorized as an undertaking for collective investment in transferable securities, investment companies registered with the SEC under the Investment Company Act of 1940 (“1940 Act”), as amended, and investment companies exempted from the definition of investment company by Sections 3(c)(1) and 3(c)(7) of the 1940 Act, as amended. The Advisor specializes in equities and fixed income and its investment philosophy incorporates a value-based approach towards investment.

Mr. Kim G. Redding, the President of the Fund, is Chief Investment Officer and Chief Executive Officer of the Advisor, and may be entitled, in addition to receiving a salary from the Advisor, to receive a bonus based upon a portion of the Advisor’s profits. Messrs. Dana Erikson, Richard Cryan and Mark Shipley, each a Vice President of the Fund, Mr. Jonathan C. Tyras, the Secretary of the Fund, Mr. Steven M. Pires, the Treasurer of the Fund, Mr. Seth Gelman, the CCO of the Fund, and Ms. Lily Wicker, the Assistant Secretary of the Fund, are employees of the Advisor.

The Advisor provides advisory services to several other registered investment companies. Messrs. Erikson, Cryan and Shipley each joined the Advisor in 2006 and are jointly responsible for the day to day management of the Fund’s portfolio. Mr. Erikson is a Managing Director of the Advisor and a Portfolio Manager with over 25 years of industry experience. Mr. Cryan is Managing Director of the Advisor and a Portfolio Manager with over 32 years of industry experience. Mr. Shipley is Managing Director and Portfolio Manager with over 22 years of investment experience. As members of the Advisor’s Global High Yield Investment Team, Messrs. Erikson, Cryan and Shipley are responsible for the Advisor’s high yield corporate securities exposure and the establishment of portfolio objectives and strategies.

13

Investment advisory fees paid by the Fund to the Advisor during fiscal 2012 are the following:

| | |

Fund Name | | Investment Advisory Fees Paid during Fiscal Year 2012 |

Helios High Yield Fund | | $669,421 |

In addition to acting as advisor to the Fund, the Advisor acts as investment advisor to the following other investment companies at the indicated annual compensation.

| | | | | | | | |

Fund Name | | Investment Advisory

Management Fees | | | Approximate Net Assets

at 9/30/2012 | |

Helios Advantage Income Fund, Inc. | | | 0.65 | %1 | | | $59 million | |

Helios High Income Fund, Inc. | | | 0.65 | %1 | | | $42 million | |

Helios Multi-Sector High Income Fund, Inc. | | | 0.65 | %1 | | | $47 million | |

Helios Strategic Income Fund, Inc. | | | 0.65 | %1 | | | $40 million | |

Helios Total Return Fund, Inc. | | | 0.65 | %2 | | | $266 million | |

Brookfield Global Listed Infrastructure Income Fund Inc. | | | 1.00 | %1 | | | $166 million | |

| | |

Brookfield Investment Funds and its four separate series: | | | | | | | | |

Brookfield Global Listed Real Estate Fund | | | 0.75 | %1 | | | $27 million | |

Brookfield Global Listed Infrastructure Fund | | | 0.85 | %1 | | | $83 million | |

Brookfield Global High Yield Fund | | | 0.75 | %1 | | | $0 | |

Brookfield High Yield Fund | | | 0.65 | %1 | | | $25 million | |

| (1) | Investment advisory management fees are paid at the rate noted above times such Fund’s average daily leveraged assets. |

| (2) | Investment advisory management fees are paid at the rate noted above times such Fund’s average weekly net assets. |

The Fund has entered into a Shareholder Servicing Agreement with the Advisor. The Advisor provides shareholder servicing and market information for the Fund. For the Advisor’s shareholder services, the Fund pays a monthly fee at an annual rate of 0.10% of its average weekly assets. During the fiscal year ended June 30, 2012, the Advisor earned $95,632 from the Fund in shareholder servicing fees, of which $76,505 was waived.

Brokerage Commissions

The Fund paid $152.00 in brokerage commissions on the Fund’s securities purchases during the last fiscal year. The Fund does not participate and does not in the future intend to participate in soft dollar or directed brokerage arrangements.

The Advisor has discretion to select brokers and dealers to execute portfolio transactions initiated by the Advisor and to select the markets in which such transactions are to be executed. The Investment Advisory Agreement provides, in substance, that in executing portfolio transactions and selecting brokers or dealers, the primary responsibility of the Advisor is to seek the best combination of net price and execution for the Fund. It is expected that securities ordinarily will be purchased in primary markets, and that in assessing the best net price and execution available to the Fund, the Advisor will consider all factors deemed relevant, including the price, dealer spread, the size, type and difficulty of the transaction involved, the firm’s general execution and operation facilities and the firm’s risk in positioning the securities involved. Transactions in foreign securities markets may involve the payment of fixed brokerage commissions, which are generally higher than those in the United States.

The Fund’s Auditor

At a meeting held on August 17, 2012, the Audit Committee of the Fund unanimously recommended the selection of, and the Trustees unanimously approved, BBD as the Fund’s independent registered public accounting firm for the current fiscal year ending June 30, 2013.

14

The aggregate fees billed by BBD and associated expenses incurred for professional services tendered for the audit of the Fund’s financial statements for the fiscal year ended June 30, 2012 and fees billed by BBD for the fiscal year ended June 30, 2011 are as follows.

| | | | | | | | |

| | | BBD 2012 | | | BBD 2011 | |

Audit fees | | $ | 24,000 | | | $ | 24,000 | |

Audit-related fees1 | | $ | 10,000 | | | $ | 10,000 | |

Tax fees2 | | $ | 3,500 | | | $ | 3,500 | |

All other fees | | $ | 0 | | | $ | 0 | |

| (1) | Audit-related fees consist of administrative costs related to completion of the semi-annual audit review. |

| (2) | Tax fees consist of fees for review of tax returns and tax distribution requirements. |

As indicated above, the Board of Trustees of the Fund has adopted a written charter for the Audit Committee (“Charter”), which is available on the Fund’s website at www.brookfieldim.com. The Fund’s Audit Committee reviews its Charter at least annually and may recommend changes to the Board. Each member of the Audit Committee of the Fund is independent as independence is defined in the listing standards of the New York Stock Exchange. The Audit Committee has adopted policies and procedures for pre-approval of the engagement of the Fund’s auditors. The Fund’s Audit Committee evaluates the auditors’ qualifications, performance and independence at least annually by reviewing, among other things, the relationship between the auditors and the Fund, as well as the Advisor or any control affiliate of the Advisor, any material issues raised by the most recent internal quality control review and the auditors’ internal quality control procedures.

COMPLIANCE WITH SECTION 16 REPORTING REQUIREMENTS

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Fund’s officers and Trustees and persons who own more than ten-percent of a registered class of the Fund’s equity securities to file reports of ownership and changes in ownership with the Securities and Exchange Commission and the New York Stock Exchange. Officers, Trustees and greater than ten-percent Shareholders are required by regulations of the Securities and Exchange Commission to furnish the Fund with copies of all Section 16(a) forms they file.

Based solely on its review of the copies of such forms received by the Fund and written representations from certain reporting persons that all applicable filing requirements for such persons had been complied with, the Fund believes that during the fiscal year ended June 30, 2012, all filing requirements applicable to the Fund’s officers, Trustees and greater than ten-percent beneficial owners were complied with.

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of September 30, 2011, the following persons owned beneficially 5% or more of the shares of the Funds set forth below:

| | | | | | | | | | |

Fund Name | | Name and Address | | Amount of Shares

Beneficially Owned and

Nature of Ownership1 | | | Percentage of

Class Owned1 | |

Helios High Yield Fund | | First Trust Portfolios L.P. First Trust Advisors L.P. The Charger Corporation 120 East Liberty Drive, Suite 400 Wheaton, IL 60187 | | | 1,467,143 | | | | 21.5 | % |

| 1 | The number of shares are those beneficially owned as determined under the rules of the Securities Exchange and Commission, and such information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which a person has sole or shared voting power or investment power and any shares which the person has the right to acquire within 60 days through the exercise of any option, warrant or right, through conversion of any security or pursuant to the automatic termination of a power of attorney or revocation of a trust, discretionary account or similar arrangement. |

OTHER BUSINESS

The Board of Trustees of the Fund does not know of any other matter which may come before the Meeting. If any other matter properly comes before the Meeting, it is the intention of the persons named in the proxy to vote the proxies in accordance with their judgment on that matter.

PROPOSALS TO BE SUBMITTED BY SHAREHOLDERS

To be considered for inclusion in the Fund’s proxy materials for its 2013 Annual Meeting of Shareholders pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), your proposal must be submitted in writing by June 21, 2013 to the Fund’s Secretary, Three World Financial Center, 200 Vesey Street, New York, New York 10281-1010. Failure to deliver a proposal by this date may result in it not being deemed timely received.

If you wish to submit a proposal that is not to be included in the Fund’s proxy materials for its 2013 annual meeting or nominate a trustee, for your proposal or nomination to be timely in accordance with Exchange Act Rules 14a-5(e)(2) and 14a-4(c)(1), you must submit your proposal or nomination to the Fund’s Secretary at the address in the preceding paragraph by September 2, 2013.

EXPENSES OF PROXY SOLICITATION

The cost of preparing, mailing and assembling material in connection with this solicitation of proxies will be borne by the Fund. In addition to the use of the mail, proxies may be solicited personally by officers of the Fund or by regular employees of the Advisor. Brokerage houses, banks and other fiduciaries will be requested to forward proxy solicitation material to their principals to obtain authorization for the execution of proxies, and they will be reimbursed by the Fund for out-of-pocket expenses incurred in connection therewith.

October 25, 2012

16

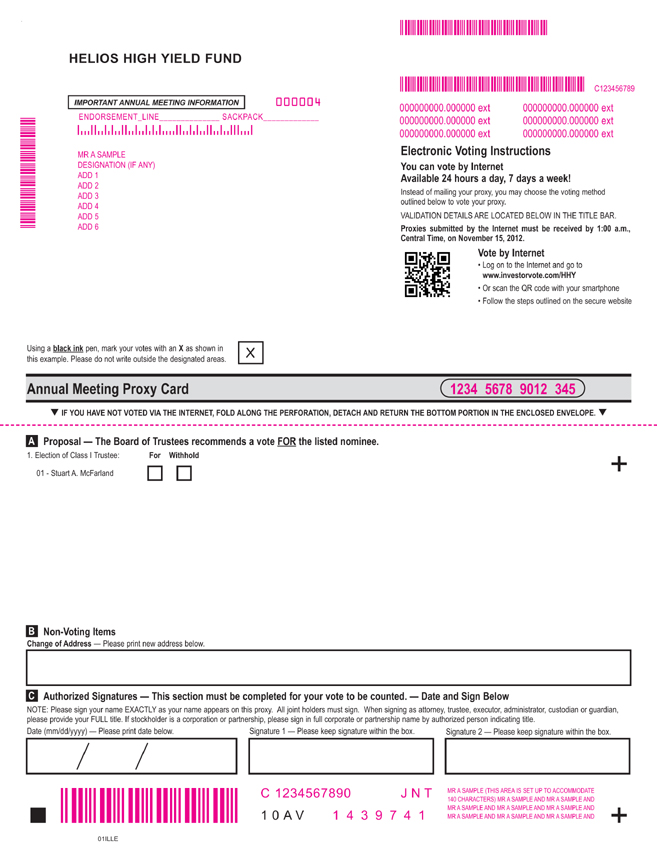

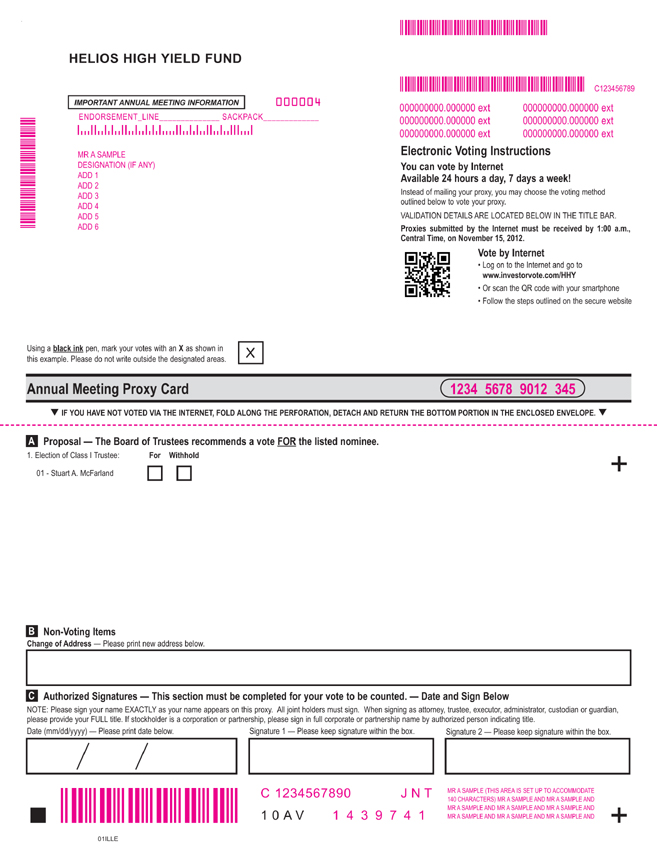

HELIOS HIGH YIELD FUND

IMPORTANT ANNUAL MEETING INFORMATION 000004

ENDORSEMENT_LINE______________ SACKPACK_____________

MR A SAMPLE

DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6

C123456789

Electronic Voting Instructions

You can vote by Internet

Available 24 hours a day, 7 days a week!

Instead of mailing your proxy, you may choose the voting method outlined below to vote your proxy.

VALIDATION DETAILS ARE LOCATED BELOW IN THE TITLE BAR.

Proxies submitted by the Internet must be received by 1:00 a.m., Central Time, on November 15, 2012.

Vote by Internet

Log on to the Internet and go to www.investorvote.com/HHY

Or scan the QR code with your smartphone

Follow the steps outlined on the secure website

Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas.

Annual Meeting Proxy Card

1234 5678 9012 345

IF YOU HAVE NOT VOTED VIA THE INTERNET, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

A Proposal — The Board of Trustees recommends a vote FOR the listed nominee.

1. Election of Class I Trustee: For Withhold

01 - Stuart A. McFarland

Non-Voting Items

Change of Address — Please print new address below.

C Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below

NOTE: Please sign your name EXACTLY as your name appears on this proxy. All joint holders must sign. When signing as attorney, trustee, executor, administrator, custodian or guardian, please provide your FULL title. If stockholder is a corporation or partnership, please sign in full corporate or partnership name by authorized person indicating title.

Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box.

C 1234567890 J N T MR A SAMPLE (THIS AREA IS SET UP TO ACCOMMODATE 140 CHARACTERS) MR A SAMPLE AND MR A SAMPLE AND

MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND

MMMMMMM10A V 1439741 MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND +

01ILLE

IF YOU HAVE NOT VOTED VIA THE INTERNET, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. Q

Proxy — Helios High Yield Fund

Proxy for the Annual Meeting of Shareholders – November 15, 2012 at 8:30 a.m. Eastern Standard Time

c/o Brookfield Investment Management Inc. Three World Financial Center, 200 Vesey Street New York, New York 10281-1010

Proxy Solicited by Board of Trustees of Helios High Yield Fund

This proxy is being solicited by the Board of Trustees of Helios High Yield Fund (the “Fund”). The undersigned hereby appoints as proxies Seth A. Gelman and Steven M. Pires, and each of them (with the power of substitution), (i) to vote as indicated on the reverse side on the specific proposal that will considered at the Annual Meeting of the Shareholders of the Fund, or any adjournment or postponement thereof (the “Meeting”), as described in the Fund’s Proxy Statement, (ii) to vote, in adjournment, reconvening or postponement thereof, as described in the Fund’s Proxy Statement, and (iii) to vote, in discretion, on such other matters as may properly come before such Meeting, with all the power the undersigned would have if personally present. shares represented by this proxy will be voted as instructed on the reverse side of this proxy card. Unless indicated to the contrary, this proxy shall deemed to grant authority to vote “FOR” the proposal.

Receipt of the Notice of Meeting and the Fund’s Proxy Statement accompanying this Proxy Card is acknowledged by the undersigned.

When properly executed, this proxy will be voted as indicated on the reverse side or “FOR” the proposal if no choice is indicated. The proxy be voted in accordance with the proxy holders’ best judgment as to any other matters that may arise at the Meeting.

YOUR VOTE IS IMPORTANT. PLEASE MARK, DATE AND SIGN THIS PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED POSTAGE-PAID ENVELOPE.

(Continued and to be voted on reverse side.)