Table of Contents

As filed with the Securities and Exchange Commission on April 30, 2014

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

OR |

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013 |

| |

OR |

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

OR |

| |

o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 333-8880

Satélites Mexicanos, S.A. de C.V. |

(Exact name of Registrant as specified in its charter) |

|

Mexican Satellites, a Mexican Company of Variable Capital |

(Translation of the Registrant’s name into English) |

|

United Mexican States |

(Jurisdiction of incorporation) |

|

Avenida Paseo de la Reforma 222, Pisos 20 y 21, Colonia Juárez, 06600 México, D.F., México |

(Address of principal executive offices) |

|

Juan Crisostomo Antonio García Gayou Facha |

Tel: (52) 55 2629 5800 |

Fax: (52) 55 2629 5865 Avenida Paseo de la Reforma 222, Pisos 20 y 21, Colonia Juárez, 06600 México, D.F., México |

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Table of Contents

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

9.5% Senior Secured Notes due 2017, not registered on an exchange

The number of outstanding shares of capital stock as of December 31, 2013 was: |

50,000 Fixed Class I Shares |

136,754,114 Variable Class II Shares |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such a shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

o Yes x No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP x | | International Financial Reporting Standards as issued

by the International Accounting Standards Board o | | Other o |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes x No

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distributions of securities under a plan confirmed by a court.

x Yes o No

Table of Contents

EXPLANATORY NOTE

To address future liquidity needs and enhance our long-term growth and competitive position, we entered into a series of agreements (the “Recapitalization Transactions”) pursuant to which the following actions have been taken:

· the voluntary filing, on April 6, 2011, by Satélites Mexicanos, S.A. de C.V. (“Satmex” or the “Company”, indistinctly) and all of its existing U.S. subsidiaries and all of its future material subsidiaries (excluding any such subsidiary formed after the issue date and solely to design, construct, launch and own one or more satellites) (“Guarantors”) for protection under Chapter 11 of the U.S. Bankruptcy Code and confirmation of the plan of reorganization (the “Plan”), which occurred on May 11, 2011;

· the consummation of the Plan, which occurred on May 26, 2011 (the “Plan Effective Date”);

· the conversion pursuant to the Plan of our then existing Second Priority Senior Secured Notes due 2013 (the “Second Priority Old Notes”) into direct or indirect equity interests in reorganized Satmex, which occurred on May 26, 2011;

· the offering to holders of the Second Priority Old Notes of rights to purchase direct or indirect equity interests in reorganized Satmex (the “Rights Offering”), which closed on May 26, 2011;

· the offering and sale of $325 million in principal amount of 9.5% Senior Secured Notes due 2017 (the “New Notes”), which were initially offered on May 2, 2011 to qualified institutional buyers under Rule 144A of the Securities Act of 1933, as amended, or the Securities Act, and to persons outside of the United States of America (the “U.S.”) in compliance with Regulation S of the Securities Act, pursuant to an Indenture with Wilmington Trust FSB, as trustee (the “New Indenture”) dated as of May 5, 2011;

· the release of the net proceeds from the offering and sale of the New Notes with Satmex becoming a co-obligor for the obligations for the New Notes through the execution of a supplemental indenture (the “Supplemental Indenture” and together with the New Indenture, the “Indenture”), which occurred on May 26, 2011;

· the payment of distributions and reserves for distributions under the Plan, including the repayment of our then outstanding First Priority Senior Secured Notes due 2011 (the “First Priority Old Notes” and together with the Second Priority Old Notes, the “Old Notes”), which occurred on May 26, 2011;

· the exchange of the total $325 million of the New Notes for exchange notes issued under the Indenture registered under the Securities Act pursuant to a registration statement on Form F-4;

· the offering and sale of $35 million in principal amount of 9.5% Senior Secured Notes due 2017 (the “Additional Notes” and together with the New Notes, the “Notes”), which were initially offered on March 30, 2012 as additional debt securities and issued under our existing Indenture to qualified institutional buyers under Rule 144A of the Securities Act, and to persons outside of the U.S. in reliance upon Regulation S of the Securities Act;

· the exchange of approximately $34.7 million of the total $35 million in Additional Notes, representing 99.0% of the Additional Notes issued under the Indenture for exchange notes issued under the Indenture registered under the Securities Act pursuant to a registration statement on Form F-4; and

· the payment of fees and expenses related to the foregoing.

The Indenture requires us, in Section 4.03, to provide certain financial information to the holders of the Notes (or file such information with the Securities and Exchange Commission, or the SEC, for public availability), after the end of each fiscal year.

ii

Table of Contents

PART I

ITEMS 1—2. Not Applicable

ITEM 3. Key Information

SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA

Our financial statements are published in U.S. dollars and prepared in conformity with accounting principles generally accepted in the United States of America, which we refer to as “U.S. GAAP.”

As of May 26, 2011, we adopted push-down accounting as a result of the Recapitalization Transactions. Accordingly, our consolidated financial information disclosed under the heading “Successor” for the period from May 26, 2011 through December 31, 2011, and for the years ended December 31, 2012 and 2013 is presented on a basis different from, and is therefore not comparable to, our financial information disclosed under the heading “Predecessor” for the period from January 1, 2011 through May 25, 2011 and for the years ended December 31, 2010, and 2009.

The following selected consolidated financial and other data should be read in conjunction with “Operating and Financial Review and Prospects,” “Risk Factors” and our audited consolidated financial statements (including the related notes) contained elsewhere in this annual report on Form 20-F. The consolidated statement of operations and statement of cash flow data for 2011, 2012 and 2013 and the consolidated balance sheet data for 2012 and 2013, have been derived from our audited consolidated financial statements prepared in accordance with U.S. GAAP, included elsewhere in this annual report on Form 20-F. All financial data as of and prior to the year ended December 31, 2010 has been derived from our audited consolidated financial statements prepared in accordance with U.S. GAAP that are not included in this annual report on Form 20-F. Historical results are not necessarily indicative of the results to be expected for future periods.

On October 25, 2013, Satmex entered into an equity interest purchase agreement (the “Enlaces Sale Agreement”) with Axesat S.A. (“Axesat”) with respect to the sale of our direct and indirect equity interests in our wholly-owned subsidiary Enlaces Integra, S. de R.L. de C.V. (“Enlaces”), through which we offer broadband satellite services. The Enlaces transaction is expected to close by the second half of 2014, subject to government and regulatory approvals and other customary conditions included in the Enlaces Sale Agreement. For a more detailed discussion on the operations of Enlaces and the Enlaces Sale Agreement, see “Item 4 — Information on the Company — Discontinued Operations.” This transaction meets the criteria of a discontinued operation. Accordingly, the results of operations of Enlaces are included as discontinued operations within the statement of operations data and the assets and liabilities of Enlaces are presented as assets held for sale and liabilities directly associated with assets held for sale, respectively, in our statement of financial position. For these reasons, Enlaces’ operations are no longer included within each individual line item of our consolidated financial statements, but rather are presented in the statement of financial position. The financial information included in this annual report on Form 20-F has been presented taking into account the retrospective effects of the above mentioned factors, and therefore the financial information included in this annual report on Form 20-F is not comparable with our annual reports on Form 20-F filed by us with respect to any period prior to the year ended December 31, 2013. Enlaces previously comprised our Broadband satellite services segment.

1

Table of Contents

| | Predecessor | | Successor | |

| | Fiscal Year Ended December 31, | | January 1 to

May 25 | | May 26 to

December 31 | | Fiscal Year Ended December

31, | |

| | 2009 | | 2010 | | 2011 | | 2011 | | 2012 | | 2013 | |

Statement of Operations Data: | | | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | | |

Satellite services | | $ | 107,183 | | $ | 110,948 | | $ | 45,888 | | $ | 62,758 | | $ | 118,669 | | $ | 120,064 | |

Programming distribution services | | 10,594 | | 10,071 | | 4,786 | | 7,563 | | 14,504 | | 12,792 | |

Total revenues | | 117,777 | | 121,019 | | 50,674 | | 70,321 | | 133,173 | | 132,856 | |

Costs and expenses: | | | | | | | | | | | | | |

Satellite services (1) | | 12,887 | | 11,405 | | 4,401 | | 6,191 | | 11,821 | | 11,279 | |

Programming distribution services (1) | | 5,331 | | 5,387 | | 2,625 | | 4,393 | | 8,440 | | 7,911 | |

Selling and administrative expenses(1) | | 14,266 | | 14,485 | | 5,483 | | 11,638 | | 18,383 | | 84,890 | |

Depreciation and amortization | | 46,804 | | 42,501 | | 16,682 | | 45,824 | | 64,130 | | 59,253 | |

Reorganization expenses (2) | | 3,324 | | 16,443 | | 28,766 | | — | | — | | — | |

Total costs and expenses | | 82,612 | | 90,221 | | 57,957 | | 68,046 | | 102,774 | | 163,333 | |

Operating income (loss) | | 35,165 | | 30,798 | | (7,283 | ) | 2,275 | | 30,399 | | (30,477 | ) |

Interest expenses | | (43,696 | ) | (45,775 | ) | (19,494 | ) | (8,983 | ) | (4,430 | ) | (30,728 | ) |

Interest income | | 373 | | 232 | | 69 | | 182 | | 197 | | 194 | |

Net foreign exchange gain (loss) | | 176 | | (27 | ) | 127 | | (550 | ) | 111 | | 51 | |

(Loss) Income from continuing operations before income tax | | (7,982 | ) | (14,772 | ) | (26,581 | ) | (7,076 | ) | 26,277 | | (60,960 | ) |

Income tax expense (benefit) | | 12,846 | | 588 | | 2,610 | | 11,400 | | (14,493 | ) | (66,050 | ) |

Net (loss) income from continuing operations | | (20,828 | ) | (15,360 | ) | (29,191 | ) | (18,476 | ) | 40,770 | | 5,090 | |

Discontinued operations:

(Loss) income from discontinued component broadband satellite services | | 1,080 | | 1,472 | | 431 | | (381 | ) | 549 | | (7,093 | ) |

Net (loss) income | | (19,748 | ) | (13,888 | ) | (28,760 | ) | (18,857 | ) | 41,319 | | (2,003 | ) |

Less: Net income attributable to noncontrolling interest | | 406 | | 444 | | 3 | | 25 | | 103 | | — | |

Net (loss) income attributable to Satélites Mexicanos, S.A. de C.V | | $ | (20,154 | ) | $ | (14,332 | ) | $ | (28,763 | ) | $ | (18,882 | ) | $ | 41,216 | | $ | (2,003 | ) |

2

Table of Contents

| | Predecessor | | Successor | |

| | Fiscal Year Ended December 31, | | January 1 to

May 25 | | May 26 to

December 31 | | Fiscal Year Ended December 31, | |

Statement of Cash Flow Data: | | 2009 | | 2010 | | 2011 | | 2011 | | 2012 | | 2013 | |

Depreciation and amortization | | $ | 46,804 | | $ | 42,501 | | $ | 16,682 | | $ | 45,824 | | $ | 64,130 | | $ | 59,253 | |

Net cash flows provided by operating activities | | 46,573 | | 39,241 | | 7,261 | | 31,764 | | 80,983 | | 26,209 | |

Capital expenditures | | 1,130 | | 67,691 | | 42,902 | | 151,977 | | 116,676 | | 104,348 | |

Net cash flows used in investing activities | | (1,130 | ) | (67,691 | ) | (42,902 | ) | (151,977 | ) | (121,114 | ) | (104,348 | ) |

Net cash flows provided by (used in) financing activities | | — | | — | | 306,753 | | (148,570 | ) | 34,479 | | 40,000 | |

Cash flows of discontinued operations: | | | | | | | | | | | | | |

Net cash flows provided by (used in) operating activities | | 1,508 | | 1,770 | | 874 | | 590 | | 1,515 | | (1,457 | ) |

Net cash flows used in investing activities | | (605 | ) | (576 | ) | (67 | ) | (187 | ) | (462 | ) | (195 | ) |

Net cash flows used in financing activities | | — | | — | | — | | — | | — | | (2,407 | ) |

Balance Sheet Data (End of Period): | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 94,663 | | $ | 66,878 | | $ | 337,995 | | $ | 69,433 | | $ | 63,815 | | $ | 29,796 | |

Accounts receivable, net | | 6,831 | | 10,262 | | 17,154 | | 9,652 | | 10,555 | | 16,570 | |

Satellites and equipment | | 232,802 | | 262,640 | | 325,416 | | 440,792 | | 550,434 | | 641,835 | |

Concessions | | 37,650 | | 36,336 | | 35,789 | | 40,819 | | 39,239 | | 39,020 | |

Assets held for sale | | 16,807 | | 17,537 | | 18,097 | | 20,869 | | 21,656 | | 7,444 | |

Total assets | | 439,637 | | 438,957 | | 794,372 | | 665,329 | | 746,093 | | 821,885 | |

Deferred revenue | | 65,355 | | 63,010 | | 62,033 | | 35,161 | | 30,922 | | 32,948 | |

Liabilities associated with assets held for sale | | 2,323 | | 1,669 | | 1,812 | | 2,995 | | 3,272 | | 2,680 | |

Total debt | | 420,615 | | 436,110 | | 765,130 | | 325,000 | | 360,000 | | 360,000 | |

Total liabilities | | 511,783 | | 524,990 | | 909,165 | | 405,038 | | 444,483 | | 484,685 | |

Total shareholders’ equity (deficit) | | (72,146 | ) | (86,033 | ) | (114,793 | ) | 260,291 | | 301,610 | | 337,200 | |

Other Financial Data: | | | | | | | | | | | | | |

EBITDA (3) | | $ | 86,281 | | $ | 89,695 | | $ | 38,775 | | $ | 49,729 | | $ | 99,805 | | $ | 96,063 | |

Adjusted EBITDA (3) | | 83,937 | | 87,351 | | 37,798 | | 48,935 | | 91,231 | | 92,458 | |

Maintenance capital expenditures (4) | | 1,130 | | 4,003 | | 568 | | 1,440 | | 1,536 | | 2,016 | |

Satellite capital expenditures (5) | | — | | 63,113 | | 42,334 | | 150,537 | | 114,678 | | 100,971 | |

(in thousands of U.S. dollars)

(1) Exclusive of depreciation and amortization shown separately.

(2) Reorganization expenses consist of costs incurred by Satmex as part of its capital restructuring activities (including principally financial advisory, professional and regulatory fees).

(3) We present EBITDA and Adjusted EBITDA because we consider them to be important supplemental measures of our operating performance. EBITDA and Adjusted EBITDA are each one of the measures reported to our Chief Executive Officer on a monthly basis and are used by our management to evaluate operational performance both against internal targets and the performance of our competitors. Compensation decisions are also based in part on Adjusted EBITDA. We consider EBITDA and Adjusted EBITDA to be operating performance measures, and not liquidity measures, that provide measures of operating results unaffected by differences in capital structures, capital investment cycles and ages of related assets among otherwise comparable companies. The adjustments made to EBITDA to calculate Adjusted EBITDA are the amortization of the State Reserve (as defined herein), which management does not consider to reflect its core operating performance. Management considers our core operating performance to be that which can be affected by our managers in any particular period through their management of the resources that affect our underlying revenue and profit generating operations during that period.

EBITDA and Adjusted EBITDA are not recognized measurements under U.S. GAAP and, therefore, have limitations as analytical tools. Some of these limitations are:

· EBITDA and Adjusted EBITDA do not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments;

· EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, our working capital needs;

· EBITDA and Adjusted EBITDA do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debts;

3

Table of Contents

· although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements;

· EBITDA and Adjusted EBITDA do not reflect the impact of certain cash charges resulting from matters we consider not to be indicative of our ongoing operations; and

· other companies in our industry may calculate EBITDA and Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure.

Because of these limitations, when analyzing our operating performance, investors should use EBITDA and Adjusted EBITDA in addition to, and not as an alternative for, net income, operating income or any other performance measure presented in accordance with GAAP. Similarly, investors should not use EBITDA or Adjusted EBITDA as an alternative to cash flow from operating activities or as a measure of our liquidity.

EBITDA represents net income (loss) excluding income tax expense, interest expense, interest income and depreciation and amortization expense. Adjusted EBITDA represents EBITDA adjusted to exclude the effects of the amortization of the State Reserve, each as described below. In 2013, we changed the methodology for calculating Adjusted EBITDA. Previously, Adjusted EBITDA was calculated as EBITDA adjusted to exclude the effects of the orbital incentives settlement, restructuring expenses, amortization of the State Reserve and other income and expenses. Adjusted EBITDA is now calculated by excluding the amortization of the State Reserve from EBITDA. This change in methodology is a result of Eutelsat’s acquisition of us. Adjusted EBITDA has been restated to reflect the change in methodology and therefore the information on Adjusted EBITDA included in this annual report on Form 20-F is not comparable with previously filed annual reports on Form 20-F.

The following table reconciles net income (loss) to EBITDA, Adjusted EBITDA and Pro Forma EBITDA for the periods presented:

| | Predecessor | | Successor | |

| | Fiscal Year Ended December 31, | | January 1 to

May 25, | | May 26 to

December 31, | | Fiscal Year Ended

December 31, | |

| | 2009 | | 2010 | | 2011 | | 2011 | | 2012 | | 2013 | |

Net income (loss) | | $ | (20,828 | ) | $ | (15,360 | ) | $ | (29,191 | ) | $ | (18,476 | ) | $ | 40,770 | | $ | 5,090 | |

Income tax expense / other expenses | | 17,159 | | 16,984 | | 31,986 | | 13,030 | | (9,217 | ) | 1,237 | |

Interest expense | | 43,695 | | 45,775 | | 19,494 | | 8,983 | | 4,430 | | 30,728 | |

Interest income | | (373 | ) | (232 | ) | (69 | ) | (182 | ) | (197 | ) | (194 | ) |

Net foreign exchange (gain) loss | | (176 | ) | 27 | | (127 | ) | 550 | | (111 | ) | (51 | ) |

Depreciation and amortization | | 46,804 | | 42,501 | | 16,682 | | 45,824 | | 64,130 | | 59,253 | |

| | | | | | | | | | | | | |

EBITDA | | 86,281 | | 89,695 | | 38,775 | | 49,729 | | 99,805 | | 96,063 | |

| | | | | | | | | | | | | |

State Reserve Amortization(a) | | (2,344 | ) | (2,344 | ) | (977 | ) | (794 | ) | (8,574 | ) | (3,605 | ) |

Adjusted EBITDA | | 83,937 | | 87,351 | | 37,798 | | 48,935 | | 91,231 | | 92,458 | |

| | | | | | | | | | | | | | | | | | | |

(a) Reduction of accrued income related to transponders provided to the Mexican government free of charge (“State Reserve”). These transponders are provided without cost to Satmex and have been eliminated based upon our belief that such exclusion provides a better comparison to the results of operation of our peers.

(4) Includes payments for the acquisition of electronic, data processing and other infrastructure type equipment and vehicles.

(5) Includes construction in process payments related to (i) Satmex 7 ($28.5 million in 2012 and $65.6 million in 2013), (ii) Satmex 8 ($63.1 million in 2010, $192.9 million in 2011, $82.4 million in 2012 and $19.3 million in 2013) and (ii) the Satmex 9 satellite program ($3.8 million in 2012 and $16.1 million in 2013), capitalized interest, technical fees expenses provisioned and not yet paid and, expenses related to such construction.

4

Table of Contents

EXCHANGE RATES

This annual report on Form 20-F contains conversions of Mexican peso amounts into U.S. dollars at specific rates solely for the convenience of the reader. Unless otherwise noted, all conversions from Mexican pesos to U.S. dollars and from U.S. dollars to Mexican pesos were made at a rate of 13.10 Mexican pesos to U.S. $1.00 dollar, the noon buying rate in effect as of December 31, 2013. The noon buying rate as of April 29, 2014 was 13.14 Mexican pesos per $1.00. We make no representation that any Mexican peso or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Mexican pesos, as the case may be, at any particular rate, the rates stated below or at all.

The following table sets forth information concerning exchange rates between Mexican pesos and U.S. dollars for the periods indicated. These rates are provided solely for your convenience and are not necessarily the exchange rates that we used in this annual report on Form 20-F or will use in the preparation of our periodic reports or any other information to be provided to you.

| | Noon Buying Rate(1) | |

Period Ended(1) | | Period End | | Average(2) | | Low | | High | |

| | (Mexican pesos per $1.00) | |

December 31, 2009 | | 13.06 | | 13.51 | | 12.60 | | 15.37 | |

December 31, 2010 | | 12.38 | | 12.64 | | 12.16 | | 13.18 | |

December 31, 2011 | | 13.95 | | 12.43 | | 11.50 | | 14.24 | |

December 31, 2012 | | 12.96 | | 13.17 | | 12.63 | | 14.39 | |

December 31, 2013 | | 13.08 | | 12.77 | | 11.98 | | 13.44 | |

2014 (through April 29, 2014) | | 13.14 | | 13.20 | | 12.96 | | 13.49 | |

(1) For all dates, exchange rates between Mexican pesos and U.S. dollars are presented at the noon buying rate as set forth in the H.10 statistical release of the U.S. Federal Reserve Board.

(2) Annual averages are calculated using the average of the rates on the last business day of each month during the relevant year.

(1) Satmex to provide exchange rate information.

5

Table of Contents

MARKET AND INDUSTRY DATA

Market data and certain industry data and forecasts used throughout this annual report on Form 20-F were obtained from internal company surveys, market research, consultant surveys, publicly available information, reports of governmental agencies and industry publications and surveys, including the following: Projection Model Satmex 2020; 17th Satellite Communications & Broadcasting Markets Survey Forecasts to 2012, by Euroconsult; Convergencia Latina Map 2013; Via Satellite’s 2012 Industry Directory; Company Profiles, Analysis of FSS Operators, dated 2013, by Euroconsult, by Satmex; Satmex Industry Analysis; Executive Summary of Satmex 8 Market Validation, dated January 2010, by Euroconsult; and Global Assessment of Satellite Supply and Demand 10th Edition, dated 2013, by Northern Sky Research. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. We have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable, based upon our management’s knowledge of the industry, have not been independently verified. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth were used in preparing the forecasts we cite. We do not make any representation as to the accuracy of information contained in this annual report on Form 20-F based upon such market and industry data and forecasts. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this annual report on Form 20-F, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this annual report on Form 20-F. Neither we nor the initial purchaser can guarantee the accuracy or completeness of any such information contained in this annual report on Form 20-F.

6

Table of Contents

CERTAIN FACTORS THAT MAY AFFECT FUTURE RESULTS

This annual report on Form 20-F contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act. In addition, from time to time, we or our representatives have made or may make forward-looking statements, orally or in writing. They can be identified by the use of forward-looking words such as “believe,” “expect,” “intend,” “plan,” “may,” “should” or “anticipate” or their negatives or other variations of these words or other comparable words, or by discussion of strategy that involves risks and uncertainties. These forward-looking statements may be included in, but are not limited to, various filings made by us with the SEC, press releases or oral statements made by or with the approval of one of our authorized executive officers. Forward-looking statements are only predictions. Actual events or results could differ materially from those projected or suggested in any forward-looking statement as a result of a wide variety of factors and conditions, including, but not limited to, the factors summarized below. We undertake no obligation to update any forward-looking statement.

This annual report on Form 20-F identifies important factors which could cause our actual results to differ materially from those indicated by the forward-looking statements, particularly those set forth in the sections “Risk Factors.” The factors that could affect our actual results include the following:

· our history of significant net losses;

· our ability to pay the Notes in full at maturity;

· our significant debt service obligations;

· our inability to finance, build and successfully launch our currently intended Satmex 7 and Satmex 9 satellites;

· our in-orbit satellites are vulnerable to failure;

· our small number of customers accounts for a large portion of our revenue;

· competition for our services;

· our ability to incur more debt;

· restrictions and limitations imposed on us by the agreements and instruments governing the Notes;

· risks relating to our acquisition by Eutelsat SA (“Eutelsat”);

· our ability to maintain satellites in the orbital slots we currently use;

· our government concessions may be revoked under certain circumstances;

· the effects of changes to the current Mexican telecommunications laws and regulations;

· the effects of changes to the current Mexican tax laws and regulations;

· Mexican social, political and economic developments; and

· foreign currency exchange fluctuations relative to the U.S. dollar or the Mexican peso.

The risk factors included in this annual report on Form 20-F are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors could also harm our future results. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

All forward-looking statements attributable to us or persons acting on our behalf apply only as of the date of this annual report on Form 20-F and are expressly qualified in their entirety by the cautionary statements included

7

Table of Contents

in this annual report on Form 20-F. We undertake no obligations to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. In evaluating forward-looking statements, you should consider these risks and uncertainties.

8

Table of Contents

RECENT DEVELOPMENTS

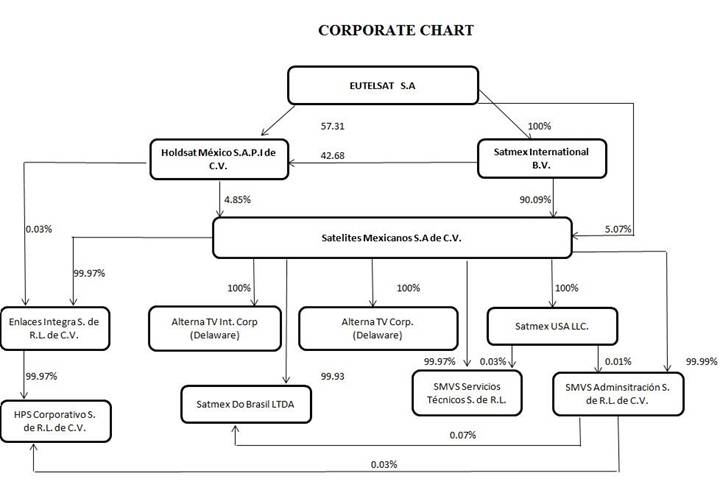

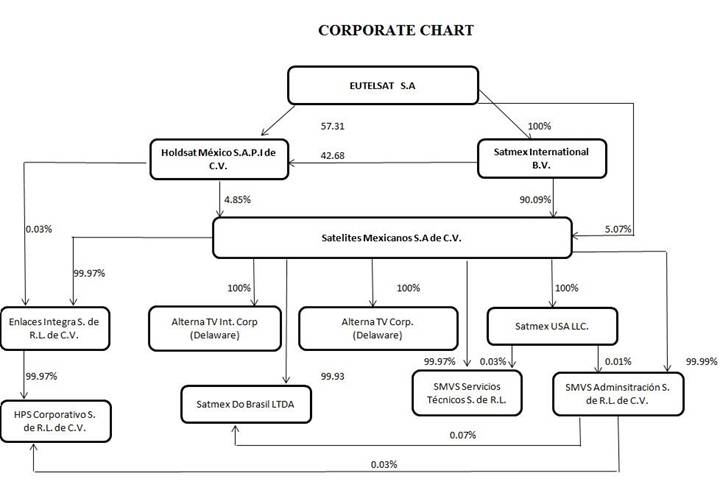

On July 31, 2013, Satmex announced that its then shareholders had signed a Securities Purchase Agreement under which Eutelsat, a fixed satellite services operator based in Paris, France, would acquire 100% of the share capital of Satmex in an all-cash transaction for US$831 million and the assumption of the company’s outstanding net debt (the “Eutelsat Acquisition”). On January 1, 2014, after having obtained all required government and regulatory approvals, 100% of the share capital of Satmex was successfully acquired by and transferred to Eutelsat. For more information on the acquisition of Satmex by Eutelsat, see our reports filed on Form 6-K on July 29, 2013 and January 6, 2014.

On January 31, 2014, Satmex caused The Depository Trust Company, as holder of record of Satmex’s outstanding Notes, to be notified of Satmex’s offer to purchase for cash all or any portion of the Notes (the “Offer to Purchase”). The Offer to Purchase was made as a result of the change of control that occurred in connection with the Eutelsat Acquisition in satisfaction of Satmex’s obligation under Section 4.15 of the Indenture (for more information on the Offer to Purchase, see our report filed on Form 6-K on February 4, 2014). In addition, on April 11, 2014, Satmex notified its note holders of its election to redeem any and all outstanding Notes on May 15, 2014 (the “Early Redemption”).

On October 25, 2013, Satmex entered into the Enlaces Sale Agreement with Axesat for the sale of our direct and indirect equity interests in our wholly-owned subsidiary Enlaces, through which we offered broadband satellite services. The Enlaces transaction is expected to close by the second half of 2014, subject to government and regulatory approvals and other customary conditions included in the Enlaces Sale Agreement. For a more detailed discussion on the operations of Enlaces and the Enlaces Sale Agreement, see “Item 4 — Information on the Company — Discontinued Operations.”

As part of our strategy to further expand our capacity to capitalize on growing demand, we initiated a program for the design and construction of a new satellite named Satmex 7. Satmex 7 is intended to occupy the orbital slot previously occupied by Solidaridad 2 and offer commercial C- and Ku-band services. On March 13, 2012, we entered into a definitive construction agreement (the “Satmex Procurement Agreement”) with Boeing Satellite Systems International, Inc. (“Boeing”), for the design, construction and delivery of Satmex 7, which will be based on Boeing’s 702 SP platform. The agreement provides for a 34-month construction schedule for Satmex 7. On February 3, 2012, we entered into a launch services agreement (the “Launch Services Agreement”) with Space Exploration Technologies, Corp. (“SpaceX”) for the launch of a dual-satellite payload consisting of Satmex 7 and another similar-model satellite to be owned by another satellite operator, Asia Broadcast Satellite Holdings Ltd. (“ABS”). The launch services agreement provides for a scheduled launch period for Satmex 7 between December 2014 and February 2015. The Launch Services Agreement is one among other agreements described in this annual report on Form 20-F involving the purchase of four C- and Ku-band satellites to be developed and manufactured by Boeing under a joint procurement program with Satmex and ABS (the “Program”). The Satmex Procurement Agreement also provides us the right to purchase an additional satellite based on Boeing’s 702 SP platform, and which was generically named F4. On August 15, 2013, Satmex announced that it had elected to acquire F4 pursuant to the Master Procurement Agreement, and named such satellite Satmex 9, the latest communications satellite in its fleet. The launch of Satmex 9 is scheduled for the fourth quarter of 2015. On March 13, 2012, Satmex and ABS entered into a master procurement agreement with Boeing (the “Master Procurement Agreement”), which establishes the framework for the joint administration by Satmex and ABS of the Program. In connection with the Program, in addition to entering into the Satmex Procurement Agreement with Boeing, Satmex also entered into a bilateral agreement with ABS on March 13, 2012 (the “Bilateral Agreement”). The Master Procurement Agreement, the Launch Services Agreement, the Satmex Procurement Agreement and the Bilateral Agreement are collectively referred to as the “New Satellite Program Agreements.” In December 2013, we terminated an application to the Export-Import Bank of the United States for a long-term direct loan in the amount of approximately $255.4 million for the purpose of financing Satmex 7 and Satmex 9 and certain past payments made for Satmex 8, and now expect to finance these costs through capital provided by our parent Eutelsat through our issuance of equity to Eutelsat or its affiliates. For a more detailed discussion of the Satmex 7 and Satmex 9 Programs, including the estimated cost and timing for the planned construction and launch of the satellite and our intended financing and related transactions related to the project, see “Item 4 — Information on the Company.”

We have insurance policies covering Satmex 6 and Satmex 8. Satmex 6 is insured with coverage of $129.9 million and Satmex 8 is insured with coverage of $360.0 million. On December 5, 2013, we renewed our in-orbit

9

Table of Contents

insurance policy on Satmex 6 for a period of 3 months and 21 days, which period expired on March 26, 2014, to have the same renewal date as Satmex 8 insurance policy based on prevailing market terms and conditions. On March 26, 2014, we renewed the insurance policies covering Satmex 6 and Satmex 8, with coverage in the amount of $129.9 million and $360.0 million, respectively. Each insurance policy will expire on June 30, 2014 and we intend to renew such coverage beginning on July 1, 2014.

10

Table of Contents

RISK FACTORS

Risks Related to Our Business

We have a history of significant net losses.

We incurred consolidated net losses attributable to Satmex of approximately $14.3 million and $47.6 million during 2010 and 2011, respectively. Improving our operating performance and attaining profitability depends on our ability to maintain operating discipline, improve our cost structure, encourage organic growth within our operating groups, capitalize on licensing and sublicensing opportunities and construct, launch and operate Satmex 7 and Satmex 9. Our failure to achieve any one or more of the foregoing could further adversely affect our operating performance and increase our net operating losses. If we cannot improve our operating performance and become profitable, our financial condition may deteriorate and we may be unable to achieve our business objectives or make payments on our debt obligations.

We depend on Eutelsat’s financing to redeem the Notes and to finance the construction and launch of Satmex 7 and Satmex 9.

The Notes mature in 2017. On January 31, 2014, Satmex commenced the Offer to Purchase all or any portion of the Notes as a result of the change of control that occurred in connection with the Eutelsat Acquisition in satisfaction of Satmex’s obligations under the indenture governing the Notes. The Offer to Purchase expired on March 3, 2014 and the total amount of outstanding Notes repurchased was $44,000. On April 11, 2014, Satmex and Eutelsat issued a joint press release announcing Satmex’s election to redeem the Notes on May 15, 2014. We will need to raise funds to pay the Notes in connection with the announced redemption and finance the Satmex 7 program and the Satmex 9 program. This cash requirement significantly exceeds our available cash and cash equivalents, which was $29.8 million as of December 31, 2013. Eutelsat is expected to provide the funds required to redeem the Notes through an equity contribution to be made in Satmex using proceeds from the issuance made by Eutelsat in December, 2013 of 6-year senior unsecured bonds for a total of €930 million at a 2.625% coupon.

Construction of Satmex 8 was completed during the second half of 2012 and launch was completed in March 2013. The total cost of construction and launch was $359.7 million. We will need additional funding to construct, launch and insure Satmex 7 and Satmex 9. On June 28, 2012, we filed an application with the Export Import Bank of the United States (the “U.S. Ex-Im Bank”) for a long-term loan to finance the acquisition and construction of Satmex 7, and other payments, in an amount of approximately $255.4 million. Notwithstanding, as a result of the Eutelsat Acquisition, the application for the U.S. Ex-Im Bank loan has been terminated.

If our future cash flows from operations are not sufficient for the construction, launch and insurance of Satmex 7, and if we are unable to raise additional capital, Satmex will be required to make termination payments under each of the New Satellite Program Agreements, which are based, in part, on the timing of such termination and the amounts paid to the date of termination. If ABS defaults on its purchase obligation and, as a result, Boeing terminates ABS’ satellite procurement agreement, Boeing is entitled to increase the price of Satmex’s satellite to preserve its expected economic benefit of the joint procurement of the satellites pursuant to the program. If Boeing terminates the satellite procurement agreement with ABS as a result of a default by ABS, the purchase price of Satmex 7 will increase. Satmex will have a corresponding damages claim against ABS for the cost of the resulting increase, but there may be additional costs and timing delays in pursuing such claim for damages to recoup such increased costs.

In electing to pursue the construction of Satmex 9, we expect to have to raise additional funds in the future to cover our obligations under the Master Procurement Agreement for Satmex 9. In addition, if construction of Satmex 9 is terminated prior to the completion of such satellite, Satmex may be required to make additional termination payments under the Master Procurement Agreement, the Satmex Procurement Agreement and the Bilateral Agreement.

In the event Eutelsat does not provide us with funds required to redeem the Notes and finance the capital expenditures associated with the Satmex 7 and Satmex 9 programs on time, we may not have sufficient cash from operations to cover such cash requirements.

11

Table of Contents

If we are unable to build and successfully launch our proposed Satmex 7 and Satmex 9 satellites, our ability to grow our business will be materially and adversely affected.

The capacity on Satmex 6 and Satmex 8 is nearly fully contracted and in order for us to increase our fixed satellite services (“FSS”) revenue, we will need to either increase the fees we charge our customers upon the renewal of existing contracts or obtain additional satellite capacity through the launch and operation of Satmex 7 and Satmex 9. If we are unable to build and successfully launch our proposed Satmex 7 and Satmex 9 satellites, our ability to grow our business will be materially and adversely affected.

New or proposed satellites are subject to construction and launch failures (including a failure to reach their intended orbit) and delays, the occurrence of which can materially and adversely affect our results of operations, business prospects, financial condition and cash flow.

Although we have entered into an agreement for the construction and launch of Satmex 7, there may still be delays in it concluding construction or becoming operational. Delays in satellite deployment can result from delays in the construction of satellites, procurement of requisite components, unavailability of launch vehicles, the limited availability of appropriate launch windows, possible delays in obtaining regulatory approvals and launch failures. Failure to meet a satellite’s construction schedule could result in a significant delay in the future delivery of a satellite. Even after a satellite has been delivered and is ready for launch, an appropriate launch date may not be available for several months. These delays could adversely affect our marketing strategy for such satellite, as well as our results of operations and cash flow during the period of delay.

There are a limited number of companies that we are able to use to launch Satmex 7 and Satmex 9 and a limited number of commercial satellite launch opportunities available in any given time period. Adverse events with respect to SpaceX, our launch service provider, such as satellite launch failures, could result in increased delays in the launch of Satmex 7. In the event that our launch service provider is unable to fulfill its obligations, we may have difficulty procuring alternative services in a timely manner and may incur significant additional expenses as a result. Any such increased costs and delays could have a material adverse effect on our business, operating results and financial condition.

Launch vehicles may fail. Launch failures result in significant delays in the deployment of satellites because of the need to construct replacement satellites, which typically take up to 30 months or longer, and obtain another launch vehicle service. Launch vehicles may also underperform, in which case the satellite may be lost or unable to be placed into the desired orbital location. Such significant delays could have a material adverse effect on our results of operations, business prospects, financial condition and cash flow. Our contracts with customers that purchase or reserve satellite capacity may allow the customers to terminate their contracts in the event of delays, and in some cases, to impose on us certain penalties, termination fees or indemnification obligations.

Satellites have limited useful lives and are vulnerable to premature failure. The actual useful life may be shorter than we anticipate.

Satellites have limited useful lives. We estimate a satellite’s useful life, or its expected useful life, using a complex calculation involving an estimate of remaining propellant and the probabilities of failure of the satellite’s components from design or manufacturing defects, environmental stresses or other causes. A number of factors could adversely affect or result in damage to or loss of a satellite before the end of its expected useful life, including:

· the amount of propellant used in maintaining the satellite’s orbital location or relocating the satellite to a new orbital location (and, for newly-launched satellites, the amount of propellant used during orbit raising following launch);

· the performance, malfunction or failure of their components;

· conditions in space such as solar flares, space debris and solar and other astronomical events;

· the orbit in which the satellite is placed;

· operational considerations, including operational failures and other anomalies; and

12

Table of Contents

· changes in technology that may make all or a portion of our satellite fleet obsolete.

It is not feasible to repair a satellite in space. As a result, each satellite may not remain in operation for its expected economic life. We expect the performance of any satellite to decline gradually near the end of its expected economic life. If our satellites do not remain in operation for their expected economic life, our results of operations, business prospects, financial condition and cash flow could be adversely affected.

In 2000, we lost Solidaridad 1 in orbit. On January 27, 2010, we lost the primary Xenon Ion Propulsion System (“XIPS”) on Satmex 5. XIPS is the electric propulsion system that maintains the satellite’s in-orbit position. The secondary XIPS on Satmex 5 previously failed and is no longer available. Consequently, Satmex 5 is currently operating on its backup bi-propellant propulsion system. Satmex 5 is operating in the orbital slot previously occupied by Solidaridad 2 in inclined orbit, with a remaining propellant life of 7.65 years as of December 31, 2013. However, if the bi-propellant propulsion system on Satmex 5 fails, the satellite will be entirely lost. Satmex 5 started operations in inclined orbit on May 1, 2013. As of September 30, 2012, the asset was fully depreciated for accounting purposes.

In addition, Satmex 6 has experienced temporary anomalies, which may result in the need to operate using back-up components or systems because of the failure of its primary components or systems. If the back-up components or systems fail in any of our satellites that operate on such back-up systems and we are unable to restore redundancy, these satellites could lose capacity or be total losses. Any single anomaly or series of anomalies or other failure could cause our revenues, cash flows and backlog to decline materially or require us to recognize an impairment loss or replace one or more of our satellites, each of which could materially affect our profitability and significantly increase our financing needs. Any such anomaly or failure could also result in a customer terminating its contract for service on the affected satellite and could require us to repay prepayments made by customers of the affected satellite. If the affected satellite serves one of our major customers, there could be a material adverse effect on our results of operations, business prospects, financial condition and cash flow. In addition, if any of our in-orbit satellites should fail and, as a result, cause damage or harmful interference to third parties, we may incur liability.

Our products and services could perform at suboptimal levels or fail to perform entirely due to technological malfunctions, satellite failures or other deficiencies outside of our control.

Our products and services are exposed to the risks inherent in large-scale, complex telecommunications satellite systems employing advanced technology. Any disruption to our services, information systems or communication networks could result in the inability of our customers to receive our services. This annual report on Form 20-F describes possible satellite failures or other technical and operational deficiencies which could result in system failure or reduced levels of service. Any such disruption would adversely impact our business and our reputation, and could cause us to lose customers or revenue, result in delays or cancellations of future implementations of our products and services, result in failure to attract customers or could result in litigation, customer service or repair work that could involve substantial costs and distract management from operating our business.

Our financial condition could be materially and adversely affected if we were to suffer a satellite loss that is not adequately covered by insurance.

Satmex 6 and Satmex 8 are currently insured. The satellite insurance policies for Satmex 6 and Satmex 8, respectively contain customary exclusions that could preclude recovery for certain types of loss, damage or failure, including (i) war, invasion, hostile or warlike action in time of peace or war, (ii) any anti-satellite device or device employing atomic or nuclear fission and/or fusion, or device employing laser of directed energy beams, (iii) insurrection, labor disturbance, strikes, revolution or any governmental action combating or defending against such action, (iv) confiscation, seizure or similar action by any government or government agent, (v) nuclear reaction, nuclear radiation or radioactive contamination of any nature, whether such loss or damage be direct or indirect, except for radiation naturally occurring in the space environment, (vi) electromagnetic or radio frequency interference, except for physical damage to the satellite directly resulting from such interference, (vii) willful or intentional acts of Satmex designed to cause loss or failure of the satellite, (viii) any act of one or more persons, whether or not agents of a sovereign power, for political or terrorist purposes and whether the loss, damage or failure resulting therefrom is accidental or intentional and (ix) any unlawful seizure or wrongful exercise of control of the satellite made by any person or person action for political or terrorist purposes. Our future insurance policies, to the

13

Table of Contents

extent we are able to renew our insurance, may also contain similar exclusions because the cost of insurance without such exclusions may be economically impractical or commercially unavailable. A partial or complete failure of a revenue-producing satellite, whether insured or not, could have a material adverse effect on our business, financial condition, cash flow and results of operations.

On December 5, 2013, we renewed our in-orbit insurance policy on Satmex 6 for a period of 3 months and 21 days, which period expired on March 26, 2014, to have the same renewal date as Satmex 8 insurance policy based on prevailing market terms and conditions. On such date, Satmex 6 was insured with coverage of $129.9 million and Satmex 8 was insured with coverage of $360.0 million, which is the current coverage as of the date of this annual report on Form 20-F. This coverage will expire on June 30, 2014 and we intend to renew such coverage beginning on July 1, 2014. There can be no assurance, however, that we will be able to renew these policies on satisfactory terms or at all. An uninsured loss of Satmex 6 or Satmex 8 would have a material adverse effect on our business, results of operations, cash flow and financial condition.

We have not renewed the in-orbit insurance for Satmex 5 following its expiration in December 2012 because it has been fully depreciated as of September 30, 2012. Additionally, the geostationary life of Satmex 5 has ended and the satellite began inclined orbit operations on May 1, 2013.

Our revenues and profitability may be adversely affected by the global financial downturn and negative global economic conditions may have a material adverse effect on our customers and suppliers.

Worldwide economic conditions have deteriorated and have caused, among other things:

· significant reductions in available capital and liquidity from banks and other providers of credit;

· substantial reductions in equity and currency values in financial markets;

· extreme volatility in credit, equity and fixed income markets; and

· general economic uncertainty.

Our business is dependent on economic growth and continuing adverse global economic conditions may have a material adverse effect on us due to the potential insolvency of suppliers and customers and our inability to finance our operations. Furthermore, as many of our customers finance their growth through cash flow from operations, the incurrence of debt or the issuance of equity, a reduction in cash flow and the limited availability of debt or equity financing could adversely affect their growth and ours. We cannot predict the potential effects of the current financial situation on our suppliers and customers, our operations or our business prospects.

A small number of customers accounts for a large portion of our revenues. The loss of one or more of these significant customers would adversely affect our revenues.

Our 10 largest customers represented approximately 48% and 43% of our total revenues for the years ended December, 2012 and 2013, respectively. In addition, approximately 48.5% of our FSS revenues were derived from our 10 principal customers. Our largest customer is América Móvil Perú, S.A.C. (as a succesor of Telmex Perú, S.A.) (“América Móvil Perú”). Revenue from América Móvil Perú represented 9.4% of our total revenue for each of the years 2012 and 2013. Our second largest customer is Hughes Network Systems, LLC (“HNS”). Revenue from HNS represented 11.5% and 8.7% of our total revenues in 2012 and 2013, respectively. HNS’ contracted capacity of Satmex 5 and Satmex 6 was decreased through three amendments executed in 2009 reflecting a total decrease of 1.0% in total revenue from 2008. HNS is in the process of constructing its own satellites. Once completed, HNS’s use of those satellites could decrease its demand for our services. Other significant customers include Teléfonos de México, S.A.B. de C.V. (“Teléfonos de México”), Hunter Communications, Inc. (“Hunter Communications”), Comcast Cable Communications LLC (“Comcast Cable Communications”) and Telefónica del Perú, S.A.A. (“Telefónica del Perú”). The loss of any one of these customers could have a material adverse effect on our business, operating results and cash flow.

14

Table of Contents

We operate in a competitive environment.

We continue to face competition from satellite operators in markets such as the U.S., Mexico and Latin America. As of December 31, 2013, there were more than 70 satellites offering services similar to ours to the Americas. Intelsat, Ltd. (“Intelsat”) has more than 50 satellites, of which more than 25 totally or partially serve the Americas market. SES, S.A. (“SES”) operates a fleet of 47 satellites, of which more than 20 totally or partially serve the Americas. The Mexican government has initiated the Mexsat satellite system project, which contemplates three satellites, the first one of which, Bicentenario (formerly Mexsat-3) with 12 active extended C- and Ku-band transponders, has already been launched. Bicentenario will provide communications services to Mexico and its surrounding waters from the 114.9° W.L. orbital slot. Other competitors include Telesat Holdings Inc. (“Telesat”), Grupo Hispasat, S.A., Hispamar Satélites S.A. and Star One, S.A. (owned by Empresa Brasileira de Telecomunicações S.A., an affiliate of América Móvil). We believe that approximately 270 36 MHz transponder equivalents in the C- and Ku-bands, will be launched in the period between 2014 and 2016 in our market. In addition, these or other operators could begin using the newly-available spectrum in the Ka-band to provide service to the Americas. For example, ViaSat, Inc. and HNS have deployed Ka band services, while Hispasat and Star One have already announced plans to launch service using such frequencies.

We also face competition from land-based telecommunications services. Fiber optic service providers can generally provide services at a lower cost than we can for point-to-point applications.

Our “Alterna’TV” digital distribution platform (“Alterna’TV”) also operates in highly competitive environments. Alterna’TV faces competition from large media companies such as News Corporation, Discovery Communications, Inc., Viacom, Inc., NBC Universal, Inc. and Univision Communications, Inc., as well as niche channels that target very specific Hispanic communities in the U.S., such as Sur Corporation.

Most of our competitors have larger fleets and significantly greater financial resources than we do. Moreover, if our competitors launch the eight new satellites discussed with coverage over the regions that we serve within the Americas, we may experience significant pricing pressure. This in turn could adversely affect our revenue and profitability projections and further impact our ability to service our debt obligations.

Our affiliation agreement with DirecTV, Inc. (“DirecTV”) to provide “Canal 22” to subscribers may be terminated at will. If such agreement is terminated, it could have a material adverse effect on our results of operations and profitability.

We entered into an affiliation agreement, dated as of February 4, 2004, with DirecTV by which we granted to DirecTV the non-exclusive right to distribute “Canal 22” in the U.S., its territories and possessions (including Puerto Rico) as well as Canada in exchange for a monthly license fee. The affiliation agreement expired on April 4, 2009. However, pursuant to a letter agreement, dated January 29, 2009, the parties agreed to reinstate the terms of the affiliation agreement except that the agreement would be terminable at will by either party upon giving not less than 30 days’ prior written notice. Since the expiration of the affiliation agreement, we have been negotiating its renewal, but have not reached an agreement with DirecTV. During the negotiations, the parties have continued to act and provide those services on the terms and conditions set forth therein. In the event that the affiliation agreement cannot be extended for a longer term or is terminated, we would no longer receive the monthly license fee, which could have a material adverse effect on our results of operations, profitability and cash flow.

We entered into an affiliation agreement, dated as of November 29, 2005, with DirecTV by which we granted to DirecTV the right to distribute “Latinoamérica Televisión” in the U.S., its territories and possessions (including Puerto Rico) as well as Canada in exchange for a monthly license fee. The affiliation agreement expired on January 10, 2012. However, pursuant to a letter agreement, dated November 30, 2011, the parties agreed to reinstate the terms of the affiliation agreement except that the agreement would be terminable at will by either party upon giving not less than 90 days’ prior written notice. Since the expiration of the affiliation agreement, we have been negotiating its renewal, but have not reached an agreement with DirecTV. During the negotiations, the parties have continued to act and provide those services on the terms and conditions set forth therein. In the event that the affiliation agreement cannot be extended for a longer term or is terminated, we would no longer receive the monthly license fee, which could have a material adverse effect on our results of operations, profitability and cash flow.

15

Table of Contents

Our future success depends on our ability to maintain a strong management team, retain our key employees and adapt to technological changes.

We are dependent on the services of our senior management team, our technical and commercial experts and specialists to remain competitive in the satellite service industry. Any losses of key members of our management team would have an adverse effect on us until qualified replacements are found. We may not be able to replace such individuals with persons of equal experience and capabilities quickly or at all. In the satellite industry, commercial, financial, regulatory, legal and technical expertise depends, to a significant extent, on the work of highly qualified employees. The market for experienced satellite services company managers is competitive. Demand for executive, managerial and skilled personnel in our industry is intense and properly qualified human resources are scarce.

Technological advances may require us to make significant expenditures to maintain and improve the competitiveness of our service offerings, and our ability to make such expenditures may be limited by our lack of funds.

The telecommunications industry is continuously subject to rapid and significant changes in technology and introduction of new products and services. We cannot predict the effect of technological changes on our business. New services and technological advances may offer additional opportunities for other service providers to compete with us on cost, quality or functionality bases. Responding to such changes may require us to devote substantial capital to the development, procurement or implementation of new technologies, and may depend upon the final cost of technology and our ability to obtain additional financing. We may not have sufficient funds or it may not be practical or cost-effective for us to replace or upgrade our technologies in response to competitors’ actions. In addition, the Indenture governing the Notes will significantly limit our capital expenditures. We cannot assure you that technological change will not have a material adverse effect on our business and results of operations.

Risks Related to the Eutelsat Acquisition

Satmex has incurred and expects to continue to incur significant costs and expenses in connection with the combination and integration of our business operations with those of Eutelsat.

On July 31, 2013, Satmex announced that its then shareholders had signed a Securities Purchase Agreement under which Eutelsat would acquire 100% of the share capital of Satmex, as described under the caption “Recent Developments.” Satmex incurred $65.6 million in non-recurring expenses in connection with the Eutelsat Acquisition in 2013. Satmex expects to continue to incur significant costs and expenses in connection with the combination and the integration of business operations. These costs included and will continue to include financial advisory, legal, accounting, consulting and other advisory fees, reorganization and restructuring costs, severance/employee benefit-related expenses, filing fees, printing expenses and other related charges. There are also a large number of processes, policies, procedures, operations, technologies and systems that must be integrated in connection with the combination. Any delay in the integration of the business operations of Satmex and Eutelsat or factors beyond Satmex’s control could affect the total amount or the timing of the integration and implementation expenses.

If additional unanticipated significant costs are incurred in connection with the combination or integration of these businesses, such costs and expenses could, particularly in the near term, exceed the savings that Satmex expects to achieve from the elimination of duplicative expenses and the realization of economies of scale, other efficiencies and cost savings. Although Satmex expects to achieve savings and economies of scale sufficient to offset these integration and implementation costs over time, this net benefit may not be achieved in the near term or at all.

Satmex faces challenges in integrating our computer, communications and other technology systems.

Among the principal risks of integrating Satmex’s business with Eutelsat are the risks relating to integrating various computer, communications and other technology systems in order to achieve cost synergies by eliminating redundancies in the businesses. The implementation process to integrate these various systems will involve a number of risks that could adversely impact our business, results of operations and financial condition.

16

Table of Contents

As with any corporate acquisition, there will be many factors that may materially affect the schedule, cost and execution of the integration of our computer, communications and technology systems. These factors include, among others: problems during the design, implementation and testing phases; the risk that suppliers and contractors will not perform as required under their contracts; the diversion of management attention from daily operations to the integration process; reworks due to unanticipated changes in business processes; difficulty in training employees in the operations of new systems; and other unexpected events beyond our control.

Risks Related to Our Regulatory Environment

Our business is regulated, causing uncertainty and additional costs.

Our business is regulated by the Mexican government and the Mexican law. In addition, the services we provide in countries outside of Mexico are governed by regulations in those countries. We are required to obtain landing rights in the countries where we seek to operate and our customers may need to obtain governmental consents in connection with the operation of their business in such countries. Regulatory authorities in the various jurisdictions in which we operate may alter the generally applicable regulations and policies that govern our operations, or can modify, withdraw or impose conditions upon the licenses and other authorizations that we require, thereby increasing our cost of doing business.

Our Concessions and other authorizations typically are granted for a fixed term or duration. Consequently, we are required to periodically renew the Concessions and other authorizations in order to maintain them in good standing. Typically, such renewals are granted, although we cannot assure you that this will continue to be the case. In May 2011, the Mexican government extended the Orbital Concessions, effective as of the termination of the initial term of the existing Orbital Concessions, for a 20-year term until 2037 without payment to the Government and maintaining Satmex’s same conditions for continuing exclusive use of existing C- and Ku-bands by Satmex, but eliminating the right to request the future use of planned or extended C- and Ku-bands. As a result of the proceedings we initiated before the Secretaría de Comunicaiones y Transportes (“SCT”) either to recover such right to request or to replace it with the right to use a Ka-band in certain conditions. In November 2012, the SCT modified the orbital concessions granted to Satmex, including the expectation of right to use and commercialize Ka-band frequencies upon fulfillment of certain requirements stated in the concessions.

Our Orbital Concessions, granted by the Mexican government, require that we reserve 362.88 MHz in the aggregate in the C- and Ku-bands of our satellites for use by the Mexican government free of charge (Capacity Reserved). Consequently, approximately 6% of Satmex 8 and Satmex 6’s transponders are currently utilized by the Mexican government. In the case of any future satellites utilizing the orbital slots provided for under the Orbital Concessions, the capacity reserved to the Mexican government will be defined by the SCT according to the law, regulations and the corresponding concessions. Moreover, our concessions are subject to government regulations, which may modify the content of, or impose limitations on, our operations. If the Mexican government determines that we are a dominant carrier in our segment, it could impose informational, service, and pricing requirements on us, which would adversely affect our results of operations and financial condition.

In the future, a sale, refinancing or restructuring that would result in a subscription of shares that represent 10% or more of our capital stock with full voting rights, requires prior notice to be given to the Mexican government, which may object to it within a 90-day period after receipt of such notice in its role as a regulator. Subsequent transactions also may require the notification or approval of other government agencies, such as the Comisión Federal de Competencia (Federal Competition Commission of Mexico), or COFECO, among others.

In connection with providing satellite capacity, ground network uplinks, downlinks and other value-added services to our customers, we need to maintain regulatory approvals, and from time to time obtain new regulatory approvals from various countries. Obtaining and maintaining these approvals can involve significant time and expense, and we cannot assure you that we will be able to obtain and maintain such approvals.

Our operations may be limited or precluded by ITU rules or processes, and we are required to coordinate our operations with those of other satellite operators. Other operators may not comply with ITU rules requiring coordination of operations and failure of such other operators to comply could cause harmful interference to the signals that we or our customers transmit.

17

Table of Contents

The ITU facilitates the allocation of orbital locations, and associated radio frequencies, to different national administrations for use by geostationary satellites. The ITU also has established the Radio Regulations, which contain rules governing how a national administration may establish its priority, for ITU purposes, with respect to the use of a given orbital location and/or radio frequency assignment, and coordinate such use with other administrations.

The Mexican government has coordinated the operations of our current satellites with other administrations pursuant to the ITU’s established procedures. However, in the future we could be required to engage in additional coordination with respect to our existing or new satellites. We can provide no assurance that this will be the case. This and other coordination (i.e., extended Ku and Ka-band) could require lengthy and costly negotiations with other operators. The failure to reach an appropriate arrangement with such satellite operators may result in substantial restrictions on the use and operation of our satellite at its orbital location. The coordination process may require us to modify our proposed coverage areas, or satellite design or transmission plans, in order to eliminate or minimize interference with other satellites or ground-based facilities. Those modifications may mean that our use of a particular orbital location is restricted, possibly to the extent that it may not be commercially desirable to place a new satellite in that location.

In certain countries, a failure to resolve coordination issues may be used by regulators as a justification to limit or condition market access by foreign satellite operators. While the ITU’s Radio Regulations require the operators of later-filed systems to coordinate their operations with us, we cannot guarantee that they will do so, or limit their operations so as to avoid transmitting any signals that would cause harmful interference to the signals that we, or our customers, transmit. This interference could require us to take steps, or pay or refund amounts to our customers that could have a material adverse effect on our results of operations, business prospects and financial condition. The ITU’s Radio Regulations do not contain mandatory dispute resolution or enforcement regulations and neither the ITU specifically, nor international law generally, provides clear remedies if the ITU coordination process fails. Failure to coordinate our satellites’ frequencies successfully or to resolve other required regulatory approvals could have an adverse effect on our financial condition, as well as on the value of our business. See “Item 4. Information on the Company —Regulation — U.S. Regulation and ITU Requirements” for additional information regarding ITU and coordination.

The ITU Radio Regulations are periodically reviewed and revised at World Radio Communication Conferences, which typically take place every three to four years. As a result, we can provide no assurances that the ITU will not change its allocation decisions and rules in the future in a way that could limit or preclude our use of some or all of our existing or future orbital locations or spectrum.

If we do not maintain satellites in the orbital slots we currently use, those orbital locations may become available for other satellite operators to use.

If we are unable to maintain satellites in the orbital slots that we currently use in a manner that satisfies the ITU or the Mexican government, we may lose our rights to use these orbital locations, or certain frequencies at these orbital locations, and the locations could become available for other satellite operators to use. Each Orbital Concession requires us to make continuous use of our orbital slot and to provide continuous services, but is silent as to termination if such orbital slot is vacant. The ITU’s Radio Regulations allow a national administration to “suspend” its use of a given orbital slot for up to three years, at which point the ITU or another administration could attempt to cancel Mexico’s ITU filings for that slot.

In November 2013, the useful life of Solidaridad 2 was terminated and the satellite was de-orbited. We are currently constructing another satellite, Satmex 7, and placing it in geostationary orbit in the orbital position previously held by Solidaridad 2. If we are unsuccessful in constructing and launching Satmex 7 or unable to timely place another satellite in the orbital slot previously occupied by Solidaridad 2, we could lose the right to use the 114.9° W.L. orbital slot for the reasons described in the previous paragraph. In the interim, Satmex 5 currently occupies Solidaridad 2’s previous orbital spot in an inclined orbit. Additionally, the expected remaining life of Satmex 5 has been reduced as a result of the failure of its XIPS system on January 27, 2010. We cannot operate our satellites without a sufficient number of suitable orbital locations in which to place our satellites, and the loss of one or more of our orbital locations could adversely affect our plans and our ability to implement our business strategy.

18

Table of Contents

Our government concessions may be revoked under certain circumstances.

Our satellites are located in orbital slots allocated to Mexico, such that our business is subject to the oversight and regulation of the Mexican government. The Mexican government has granted to us four concessions, three Orbital Concessions (See “Item 4. Information on the Company — Business — Our Satellites”) and one Property Concession (See “Item 4. Information on the Company — Business — Satellite Control Centers and Property Concession”). Our Concessions are subject to termination prior to the expiration of their terms upon the occurrence of certain events. Under the Mexican Ley Federal de Telecomunicaciones (the Federal Telecommunications Law of Mexico or the Telecommunications Law, indistinctly), an Orbital Concession will terminate if:

· the term of any such Orbital Concession expires, without further extensions;

· we resign our rights under any such Orbital Concession;

· the SCT revokes such Orbital Concession;

· the Mexican government (through the SCT) terminates such Orbital Concession through a proceeding called “Rescate;” or

· we become subject to liquidation or bankruptcy (quiebra).

The SCT may revoke any of the Orbital Concessions upon the occurrence of certain events, among which are the following:

· unjustified or unauthorized interruption of our operations or the services that may be provided under such Orbital Concession, whether in whole or in part;

· taking any action or refraining from taking any action that affects the rights of other licensees or concessionaires;

· our failure to satisfy the terms or conditions set forth in the Orbital Concessions (including failure to deliver the free satellite capacity reserved for the Mexican government);

· our unjustified failure to interconnect other concessionaires or licensees that have the right to provide telecommunications services;

· change of our nationality; or

· our assignment, transfer or encumbrance of rights granted under the Orbital Concessions in contravention of the terms of applicable Mexican law.

In the event any of the Orbital Concessions is revoked by the SCT, no compensation shall be paid to us. Also, in this case, we would not be eligible to receive new telecommunication concessions or permits for a five-year period as of the date that the resolution of revocation becomes final and non-appealable.