SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

---------------------------

SCHEDULE 14A INFORMATION

Information Required in Proxy Statement Schedule 14A

Information Proxy Statement Pursuant to

Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant /x/

Filed by a Party other than the Registrant / /

Check the appropriate box:

/ / Preliminary Proxy Statement

/ / Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

/x / Definitive Proxy Statement

/ / Definitive Additional Materials

/ / Soliciting Material Pursuant to Rule 14a-11 or Rule 14a-12

WESTERN STANDARD CORPORATION

-----------------------------------------------------------------------------------------

(Name of Registrant as Specified in its Charter)

NONE

------------------------------------------------------------------------------------------

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

/ / No fee required

/x/ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies:

Common Stock, par value $0.05 per share, of Western Standard Corporation

(2) Aggregate number of securities to which transaction applies:

4,524,803 shares of common stock

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange

Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state

how it was determined):

The filing fee of $183.45 was determined based upon the product of 4,524,802

shares of common stock and the merger consideration of $0.32 per share. In

accordance with Rule 0-11 under the Securities Exchange Act of 1934, as amended,

the filing fee was determined by multiplying the amount calculated pursuant to the

preceding sentence by .0001267 of one percent.

(4) Proposed maximum aggregate value of transaction: $1,447,937

(5) Total fee paid herewith:

/x/ Fee paid previously with preliminary materials: $ 183.45

/ / Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or

Schedule and the date of its filing.

PROXY STATEMENT

WESTERN STANDARD CORPORATION

400 East Snow King Avenue

Post Office Box 1846

Jackson, Wyoming 83001

(307) 733-5200

Dear Stockholder: January 21, 2005

You are cordially invited to attend a special meeting of stockholders of

Western Standard Corporation ("Westan") to be held at the Snow King Resort, 400

East Snow King Avenue, Jackson, Wyoming on Friday, February 25, 2005 at 10:00

a.m., Mountain Time.

At the special meeting, you will be asked to consider and vote upon the

approval of the Agreement and Plan of Merger, dated as of November 15, 2004, by

and among Snow King Interests LLC ("SKI"), LZ Acquisition Inc. and Westan,

providing for the merger of LZ Acquisition, Inc., a wholly owned subsidiary of

SKI, with and into Westan with Westan as the surviving corporation. Pursuant to

the merger agreement, you will be entitled to receive $0.32 in cash, without

interest, for each of your shares of common stock of Westan. SKI is, and after

the merger, will be controlled by Manuel B. Lopez, and James M. Peck, officers

and directors of Westan. The accompanying proxy statement explains the proposed

merger and provides specific information concerning the special meeting. Please

read these materials carefully.

In light of the conflicting interests of Messrs. Lopez and Peck, Westan's

board of directors formed a special committee consisting of Stanford E. Clark,

its sole independent director to evaluate this merger proposal and to negotiate

the proposal on behalf of Westan.

The board of directors of Westan, considering among other things the

recommendation of the special committee, has approved the merger agreement and

determined the merger to be advisable. Approval of the three member board was

unanimous and included the concurrence of Mr. Lopez and Mr. Peck, two of three

directors who disclosed their personal interests in the proposed transaction.

The special committee and the board of directors believe that the terms and

provisions of the merger agreement and the proposed merger are fair to and in

the best interests of Westan's unaffiliated stockholders (which means the

holders of Westan stock other than SKI, LZ Acquisition and their affiliates,

i.e., Messrs. Lopez and Peck). Therefore, the board of directors recommends that

you vote in favor of the approval of the merger agreement and the transactions

contemplated thereby. Ehrhardt Keefe Steiner & Hottman PC, the special

committee's financial advisor, has provided its written opinion that, as of

November 15, 2004, based on and subject to the limitations, assumptions and

qualifications stated in its opinion, the $0.32 per share cash consideration to

be received by Westan's unaffiliated stockholders in the proposed merger was

fair to Westan's unaffiliated stockholders from a financial point of view.

The proposed merger is an important decision for Westan and its

stockholders. The proposed merger cannot occur unless, among other things, the

merger agreement is approved by the affirmative vote of the holders of a

majority of all outstanding shares of common stock of Westan. Messrs. Lopez,

Peck and their affiliates and Westan have entered into voting agreements under

which they will vote their 5,438,213 shares or 54% of Westan's outstanding

shares in accordance with the majority of the shares held by unaffiliated

stockholders voted in person or by proxy at the special meeting.

Whether or not you plan to attend the special meeting, we urge you to sign,

date and promptly return the enclosed proxy card to ensure that your shares will

be voted at the special meeting. Failure to return an executed proxy card will

constitute, in effect, a vote against approval of the merger agreement and the

transactions contemplated thereby.

Your board of directors urges you to consider the enclosed materials

carefully and, based on among other things the recommendation of the special

committee and the board, recommends that you vote "for" approval of the merger

agreement and the transactions contemplated thereby.

The special committee's work was completed on November 15, 2004. On

December 5, 2004, Stanford E. Clark, the sole member of the special committee,

died unexpectedly in Riverton, Wyoming. Your board of directors wishes to extend

its condolences to Mr. Clark's family and express how grateful we are for his

long and dedicated service to Westan and its stockholders.

Sincerely,

Your Board of Directors

The proposed merger has not been approved or disapproved by the Securities

and Exchange Commission or any state securities regulator nor has the Commission

or any state securities regulator passed upon the fairness or merits of the

proposed merger or upon the accuracy or adequacy of the information contained in

this document. Any representation to the contrary is unlawful.

This proxy statement and proxy are being mailed to Westan's stockholders on

or about January 21, 2005.

WESTERN STANDARD CORPORATION

400 East Snow King Avenue

Post Office Box 1846

Jackson, Wyoming 83001

(307) 733-5200

Notice of Special Meeting of Stockholders

Date: February 25, 2005

Time: 10:00 a.m., Mountain Time

Place: Snow King Resort, 400 East Snow King Avenue, Jackson, Wyoming 83001

A special meeting of the stockholders of Western Standard Corporation is

being held for the following purposes:

o To consider and vote upon the Agreement and Plan of Merger, dated as of

November 15, 2004, by and among Snow King Interests LLC, LZ Acquisition

Inc. and Western Standard Corporation ("Westan"), and the transactions

contemplated thereby, including the merger of LZ Acquisition with and into

Westan, with Westan as the surviving corporation and with the unaffiliated

stockholders of Westan entitled to receive $0.32 in cash, without interest,

for each share of Westan's common stock that they own.

o If necessary, to adjourn the special meeting for the purpose of soliciting

additional proxies in connection with the proposed merger or to satisfy the

conditions to completing the proposed merger.

o To consider any other matter that may properly be brought before the

special meeting or any adjournment or postponement thereof.

Only stockholders of record on January 7, 2005 are entitled to notice of,

and to vote at, the special meeting. During the ten day period prior to the

special meeting, any stockholder may examine a list of Westan's stockholders of

record, for any purpose related to the special meeting, during ordinary business

hours at the offices of Westan located at 400 East Snow King Avenue, Jackson,

Wyoming 83001.

Stockholders of Westan who do not vote in favor of the merger agreement

will have the right to dissent and to seek appraisal of the fair value of their

shares if the merger is completed and they comply with the procedures under

Wyoming law explained in the accompanying proxy statement.

The merger is described in the accompanying proxy statement, which you are

urged to read carefully. A copy of the Agreement and Plan of Merger, as amended,

is attached as Annex A to the accompanying proxy statement.

By Order of the Board of Directors

James M. Peck, Secretary

Jackson, Wyoming

January 21, 2005

TABLE OF CONTENTS

SUMMARY TERM SHEET

QUESTIONS AND ANSWERS ABOUT THE MERGER

SUMMARY

Principals of the Buyers

The Special Meeting

Special Factors

Reasons for Engaging in the Transaction

Recommendations of the Special Committee and our Board of Directors

Opinion of Ehrhardt Keefe Steiner & Hottman PC

Westan's Position as to the Fairness of the Merger

Interests of our Directors and Executive Officers in the Merger

Primary Benefits and Detriments to Unaffiliated Stockholders

Plans for Westan after the Merger

The Merger Agreement

The Merger Consideration

Conditions to the Merger

Termination of the Merger Agreement

Acquisition Proposals

Fees and Expenses

Dissenters' Rights of Appraisal

Financing of Merger

Selected Consolidated Financial Data of Westan

THE PARTIES

Western Standard Corporation

SKI and LZ Acquisition, Inc.

INFORMATION CONCERNING THE SPECIAL MEETING

Time, Place and Date

Purpose of the Special Meeting

Record Date; Voting at the Meeting; Quorum

Required Vote

Voting and Revocation of Proxies

Action to be Taken at the Special Meeting

Proxy Solicitation

SPECIAL FACTORS

Background of the Merger

Recommendation of the Special Committee and Board of Directors; Fairness of

the Merger

Special Committee

Board of Directors of Westan

SKI's Position as to the Fairness of the Merger to Unaffiliated Stockholders

Benefits and Detriments of the Merger

To Westan's Unaffiliated Stockholders

To the Buyers and Westan

Opinion of Financial Advisor to the Special Committee

Opinion and Analysis of Ehrhardt Keefe Steiner & Hottman PC

Related Entities

Comparable Companies Analysis

Discounted Cash Flow Analysis

Asset-Based Approach

Conclusion of the Value of Snow King Resort, Inc.

Oil and Gas Interest

Snow King Resort Center, Inc.

Asset-Based Approach of the Company

Market Approach

Other Factors

SKI's Purpose and Reasons for the Merger

Interests of Certain Persons in the Merger; Certain Relationships

Retained Equity Interest

Directors and Management of the Surviving Corporation

Directors and Officers Indemnification

Certain Effects of the Merger

Plans for Westan after the Merger

Conduct of the Business of Westan if the Merger is not Consummated

Accounting Treatment

Financing of the Merger

Regulatory Requirements; Third Party Consents

Material Federal Income Tax Consequences of the Merger

Sales Treatment for Holders of Common Stock

Redemption Treatment for Dissenters and Other Stockholders

Constructive Ownership of Stock and Other Issues

Section 302 Tests

Backup Withholding

Fees and Expenses

THE MERGER AGREEMENT

The Merger; Merger Consideration

Treatment of Certain Shares Held by the Buyers

The Exchange Fund; Payment for Shares of Westan Common Stock

Transfers of Common Stock

Conditions

Representations and Warranties

Covenants

Termination

Fees and Expenses

Amendment/Waiver

THE VOTING AGREEMENTS

DISSENTERS' RIGHTS OF APPRAISAL

Right to Dissent

Procedure for Exercise of Dissenters' Rights

Dissenters' Notice

Procedure to Demand Payment

Payment

If Dissenter is Dissatisfied with Offer

Judicial Appraisal of Shares

Court and Counsel Fees

MARKET FOR THE COMMON STOCK

Common Stock Market Price Information; Dividend Information

Common Stock Purchase Information

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

DIRECTORS AND MANAGEMENT

Westan

SKI and LZ Acquisition

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

INDEPENDENT AUDITORS

FINANCIAL STATEMENTS

WHERE YOU CAN FIND MORE INFORMATION

OTHER BUSINESS

STOCKHOLDER MEETINGS AND PROPOSALS

AVAILABLE INFORMATION

ANNEX A Agreement and Plan of Merger dated November 15, 2004 by and among Snow King

Interests LLC, LZ Acquisition, Inc. and Western Standard Corporation

ANNEX B Opinion of Ehrhardt Keefe Steiner & Hottman PC dated November 15, 2004

ANNEX C Sections of the Wyoming Business Corporation Act Regarding Dissenters' Rights

(Article 13, Sections 17-16-1301 through 1331)

SUMMARY TERM SHEET

The following summarizes the principal terms of the proposed merger of

Western Standard Corporation, a Wyoming corporation ("Westan" ), with LZ

Acquisition, Inc., a Wyoming corporation ("Merger Sub"), which is a wholly-owned

subsidiary of Snow King Interests LLC, a Wyoming limited liability company

("SKI" or "Parent"). This summary term sheet does not contain all of the

information that may be important for you to consider when evaluating the merits

of the merger. You are encouraged to read this proxy statement, including the

annexes and the documents that have been incorporated by reference into this

proxy statement, in their entirety before voting. Section references are

included below to direct you to a more complete description of the topics

discussed in this summary term sheet.

o You are being asked to approve and adopt an Agreement and Plan of Merger,

dated as of November 15, 2004, which provides the merger of Merger Sub into

Westan. As a holder of Westan common stock, you and all other such holders,

other than Messrs. Lopez and Peck and their affiliates, will be entitled to

receive $0.32 in cash, without interest (the "cash merger consideration"),

for each share of Westan common stock that you own. See "Information

Concerning the Special Meeting," page 13.

o Because Merger Sub was created only to facilitate the merger, it has no

assets. SKI will fund approximately $1.5 million to effect the payment of

the total cash merger consideration to Westan's unaffiliated stockholders.

o The merger must be approved and adopted by a majority of our outstanding

shares of common stock. Messrs. Lopez and Peck and their affiliates own

approximately 54% of Westan's common stock and will not receive cash

consideration in the merger. These persons have agreed to vote their shares

in accordance with the majority of shares cast for or against the merger by

unaffiliated stockholders voting in person or by proxy at the special

meeting.

o This is a "going private" transaction. As a result of the merger:

o SKI will hold all of our common stock and equity interest;

o Our current stockholders will no longer have an interest in any future

earnings or growth of the business;

o We will no longer be a publicly-traded company; and

o Our common stock will no longer be traded on the OTC Bulletin Board. See

"Special Factors--Certain Effects of the Merger," page 43.

o The proposed merger involves a potential conflict of interest because

Messrs. Lopez and Peck, the organizers and owners of SKI, are both members

of our now two member board of directors. As a result, the board formed a

special committee, consisting of Stanford E. Clark, the sole independent

director, for the purposes of considering, negotiating and making a

recommendation regarding the proposed merger. See "Special

Factors--Background of the Merger," page 16.

o In August 2004, we retained the services of Ehrhardt Keefe Steiner &

Hottman PC ("EKS&H"), as the financial advisor to the special committee, to

give it an opinion as to the fairness of a proposed transaction to our

stockholders. See "Special Factors--Opinion of Financial Advisor to the

Special Committee," page 29.

o On November 15, 2004, EKS&H rendered its opinion to the special committee

that, as of that date and subject to the assumptions, qualifications and

limitations set forth in its opinion, the $0.32 per share cash merger

consideration to be paid in the merger was fair, from a financial point of

view, to the holders of Westan common stock other than Messrs. Lopez and

Peck and their affiliates. The full extent of EKS&H's opinion is attached

to this proxy statement as Annex B. The summary of EKS&H's opinion which is

located in the section of this proxy statement entitled "Special

Factors--Opinion of Financial Advisor to the Special Committee," page 29,

is qualified by reference to the full text of the opinion, which we urge

you to read carefully in its entirety. The opinion was directed to Westan's

special committee and does not constitute a recommendation as to how any

holder of our common stock should vote on the merger. See "Special

Factors--Opinion of Financial Advisor to the Special Committee," page 29.

o The special committee determined that the merger is fair to and in the best

interests of our common stockholders, other than Messrs. Lopez and Peck and

their affiliates, and has recommended to our board that the merger should

be completed under the terms of the merger agreement. See "Special

Factors--Recommendation of the Special Committee and Board of Directors,"

page 21.

o Acting on the recommendation of the special committee, our board of

directors has approved and adopted the merger agreement and authorized the

merger and recommends that you vote FOR approval and adoption of the merger

agreement and the merger. See "Special Factors--Recommendation of the

Special Committee and Board of Directors," page 21.

o The merger agreement may be terminated at any time before the completion of

the merger by mutual written consent of both SKI and us or by either party

in certain instances. See "The Merger Agreement--Termination," page 58.

o If the merger agreement is terminated by SKI in certain circumstances,

including in the event that we breach the "no shop" provision of the merger

agreement, or the board withdraws its recommendation of the merger or

recommends an alternative transaction to the merger, then Westan will be

obligated to pay SKI a termination or "break-up" fee in the amount of

$50,000. See "The Merger Agreement--Termination," page 58.

o If you choose not to vote in favor of the merger, Wyoming law entitles you

to a judicial appraisal of the fair value of your shares of common stock.

There are procedural requirements that you will have to follow if you

decide to pursue a judicial appraisal. Unless such expenses are assessed

against us by the court, we will not pay any expenses that you might incur

in this regard. See "Dissenters' Rights of Appraisal," page 62.

o Your receipt of cash as a result of the merger will generally be a taxable

transaction to you. See "Special Factors--Material Federal Income Tax

Consequences of the Merger," page 45.

QUESTIONS AND ANSWERS ABOUT THE MERGER

Q: What is the proposed transaction?

A: SKI will acquire Westan by merging LZ Acquisition, Inc., a wholly-owned

subsidiary of SKI, into Westan. As a result of the merger, Westan will

become a wholly-owned subsidiary of SKI.

Q: Who are SKI and LZ Acquisition?

A: SKI and LZ Acquisition were formed in connection with the proposed merger

by Manuel B. Lopez and James M. Peck, two directors and officers of Westan.

Messrs. Lopez and Peck and certain of their affiliated trusts presently own

approximately 54% of Westan's outstanding common stock which will be

transferred to SKI simultaneously with the merger. SKI is referred to

herein as the "Buyer" and depending on the context, Messrs. Lopez and Peck

are sometimes identified as the natural persons representing the Buyer.

Collectively, SKI and these persons are referred to as the Buyers.

Q: What will I receive in the merger?

A: Stockholders of Westan, other than the Buyers and stockholders who dissent

and seek appraisal of the fair value of their shares, will be entitled to

receive $0.32 in cash, without interest, for each share of Westan's common

stock that they own.

Q: Why is the board of directors recommending that I vote for the merger at

this time?

A: The board believes that it is in the best interests of Westan's

unaffiliated stockholders to accept and the opportunity presented by the

Buyers at this time to sell their shares at a substantial premium over the

market price of Westan's shares in recent years. Approval of the board of

directors was unanimous, although Messrs. Lopez and Peck are not

independent for purposes of the merger. To review the background and

reasons for the merger in greater detail, see pages 21 to 27.

Q: When do you expect the merger to be completed?

A: We are working to complete the merger as quickly as possible. If the merger

agreement is approved and the other conditions to the merger are satisfied,

we expect to complete the merger in early 2005.

Q: What are the income tax consequences of the merger to me?

A: The merger will be a taxable transaction to you for federal income tax

purposes. To review a brief description of the federal income tax

consequences to stockholders, see pages 45 to 49.

Q: What conflicts of interest does the board of directors have in recommending

approval of the merger agreement?

A: Both of the members of our board of directors, Manuel B. Lopez and James M.

Peck have a conflict of interest in recommending approval of the merger

agreement because they are beneficial owners of SKI. In light of the

conflicting interests of Messrs. Lopez and Peck with Westan's unaffiliated

stockholders as described immediately above, the board of directors formed

a special committee consisting of the single independent director to

evaluate the proposed merger. To review the factors considered by the

special committee and the board of directors in approving the merger

agreement, see pages 23 to 27.

Q: What did the board of directors do to make sure the price per share I will

receive in the proposed merger is fair to me?

A: The board of directors formed a special committee which consisted of its

single independent director to negotiate the terms of the merger agreement

with the Buyers. The special committee independently selected and retained

separate legal and financial advisors to assist in this process, and

received an opinion from its financial advisor, on which the special

committee relied, stating that based on and subject to the limitations,

assumptions and qualifications stated in that opinion, as of November 15,

2004, the $0.32 per share the unaffiliated stockholders of Westan will

receive in the proposed merger was fair to those stockholders from a

financial point of view.

Q: What are the disadvantages to me of merging Westan with LZ Acquisition?

A: Following the merger, you will no longer benefit from any earnings,

expansion, diversification or growth of Westan.

Q: What vote is required to approve the merger agreement?

A: The holders of a majority of all outstanding shares of Westan's common

stock must vote to approve the merger agreement. The Buyers currently own

approximately 54% of Westan's common stock and have agreed to vote their

shares in accordance with the majority of shares cast for or against the

proposed merger by unaffiliated stockholders voting in person or by proxy

at the special meeting.

Q: What do I need to do now?

A: Please mark your vote on, sign, date and mail your proxy card in the

enclosed return envelope as soon as possible, so that your shares may be

represented at the special meeting.

Q: What rights do I have if I oppose the merger?

A: Stockholders who oppose the merger may dissent and seek judicial appraisal

of the fair value of their shares (which could be more or less than $0.32

per share), but only if they comply with all of the procedures under

Wyoming law explained on pages 62 to 65 and in Annex C to this proxy

statement. It is a condition to the Buyer's obligation to consummate the

merger that holders of not more than 5% of the common stock exercise their

dissenters' rights.

Q: Who can vote on the merger?

A: All Westan stockholders of record as of the close of business on January 7,

2005 will be entitled to notice of, and to vote at, the special meeting to

approve the merger agreement and the transactions contemplated thereby.

Q: Should I send in my stock certificates right now?

A: No. After the merger is completed, we will send you a transmittal form and

written instructions for exchanging your share certificates for cash.

Q: If my shares are held in "street name" by my broker, will my broker vote my

shares for me?

A: Your broker will vote your shares only if you provide instructions on how

to vote. You should follow the directions provided by your broker regarding

how to instruct your broker to vote your shares.

Q: May I change my vote after I have mailed my signed proxy card?

A: Yes. Just send a written revocation or another signed proxy card with a

later date to Computershare Trust Company, Inc., Westan's transfer agent,

before the special meeting or simply attend the special meeting and vote in

person if you voted your proxy directly. If your shares are held in "street

name," you should contact your broker to obtain instructions as to how to

cancel or change your vote. Computershare's address is Post Office Box

1596, Denver, Colorado 80201.

SUMMARY

The following summarizes the material aspects of the proposed merger and

highlights selected information contained elsewhere in this proxy statement.

This summary may not contain all of the information that is important to you,

and is qualified in its entirety by the more detailed information contained

elsewhere in this proxy statement, including the annexes to it, and in the

documents incorporated by reference. To understand the proposed merger fully and

for a more complete description of the terms of the proposed merger, you should

carefully read this entire proxy statement, including the annexes to it, and the

documents incorporated by reference.

Principals of the Buyers

SKI, is a limited liability company organized by two of our directors,

Manuel B. Lopez and James M. Peck, to acquire the ownership interests of our

unaffiliated stockholders. Mr. Lopez proposed the merger transaction to Westan's

board of directors and negotiated all aspects of the transaction on behalf of

SKI and LZ Acquisition. For more information in this regard, see "The Parties"

below.

The Special Meeting (see page 13)

A special meeting of stockholders of Westan will be held at 10:00 a.m.,

Mountain Time, on Friday, February 25, 2005 at the Snow King Resort, 400 East

Snow King Avenue, Jackson, Wyoming 83001. At the special meeting, you will be

asked to consider and vote on a proposal to approve the merger agreement

described in this proxy statement.

Only Westan stockholders of record at the close of business on the record

date, January 7, 2005, will be entitled to notice of, and to vote at, the

special meeting. On the record date, there were 9,963,015 shares of common stock

outstanding and entitled to one vote per share at the special meeting. Our

shares are held by approximately 3,500 stockholders of record, although there

are a number of other beneficial owners of our common stock.

Wyoming law requires that the holders of a majority of the outstanding

shares of Westan common stock vote to approve the merger agreement. The Buyers

currently own 5,438,213 shares of Westan common stock, representing

approximately 54% of the outstanding shares of common stock as of the record

date and have agreed to vote their shares in accordance with the majority of

shares cast for or against the proposed transaction by unaffiliated stockholders

voting in person or by proxy at the special meeting.

Special Factors (see page 16)

There are a number of factors that you should consider in connection with

deciding how to vote your shares. They include:

o the background of the merger;

o the factors considered by the special committee and the board of directors;

o the opinion of the financial advisor to the special committee;

o the recommendation of the special committee and the board of directors;

o the purpose and effect of the merger; and

o the interests of certain persons in the merger.

These factors, in addition to several other factors to be considered in

connection with the merger, are described in this proxy statement. For a

detailed discussion of each of these factors, see pages 16 to 29.

Reasons for Engaging in the Transaction

The sole reason for engaging in the merger, from your perspective, is to

provide you the opportunity to receive a cash price for your shares at a

significant premium over the market price at which our common stock traded

before the November 16, 2004 announcement of the Buyers' merger proposal.

Q: What other matters will be voted on at the special meeting?

A: We do not expect that any other matter will be voted on at the special

meeting.

Q: Who can help answer my questions?

A: If you have more questions about the merger or would like additional copies

of this proxy statement, you should contact Manuel Lopez, President of

Westan at (307) 734-3003.

Q: What happens if I do not return a proxy card?

A: You may attend the meeting in person and vote your shares. If you do not

attend and do not return a proxy, your shares will not be counted in

determining whether a quorum is present for the meeting or for any other

purpose. Since two-thirds of Westan's outstanding common shares are

required to approve the merger, your failure to return an executed proxy

card or to vote in person at the special meeting or by abstaining from the

vote will, in effect, constitute a vote against approval of the merger.

Similarly, broker non-votes will have the same effect as a vote against

approval of the merger.

Recommendation of the Special Committee and Board of Directors (see page 21)

The special committee of our board of directors, consisting of one

independent director, was formed to consider and evaluate the merger. The

special committee approved the merger agreement and determined that the merger

is in the best interests of Westan and its unaffiliated stockholders. The

special committee recommended to our board of directors that the board determine

that the merger is advisable and in the best interests of Westan and our

unaffiliated stockholders and that the merger consideration is fair to our

unaffiliated stockholders. The special committee also recommended that the board

of directors approve the merger agreement and that the board of directors

determine to submit the merger to our stockholders and recommend that our

stockholders vote to adopt the merger agreement. Even though two of three

members of our board of directors are not independent with respect to the

proposed merger, our board of directors determined that the merger is advisable

and in the best interests of Westan and our unaffiliated stockholders and that

merger consideration is fair to Westan and our unaffiliated stockholders.

Accordingly, our board of directors approved the merger agreement and recommends

that you vote FOR the proposal to adopt the merger agreement.

Opinion of Ehrhardt Keefe Steiner & Hottman PC (see pages 29 to 39) and Annex B

In connection with the merger, the special committee considered the opinion

of the special committee's financial advisor, Ehrhardt Keefe Steiner & Hottman

PC, as to the fairness of the merger consideration to our unaffiliated

stockholders from a financial point of view. EKS&H delivered its opinion to the

special committee on November 15, 2004 that, as of that date and based on and

subject to the assumptions, limitations and qualifications stated in the

opinion, the consideration to be received by our unaffiliated stockholders

pursuant to the merger agreement was fair to those stockholders from a financial

point of view. EKS&H's opinion was provided for the information of the special

committee and does not constitute a recommendation to any stockholder with

respect to any matter relating to the proposed merger. EKS&H's full opinion is

attached as Annex B.

Westan's Position as to the Fairness of the Merger (see page 21)

We believe the merger and the merger consideration to be fair to our

unaffiliated stockholders. In reaching this determination we considered a number

of factors, including:

o the fact that the merger consideration of $0.32 per share represents a

substantial premium over the $0.12 price of our common stock on the last

full trading day prior to our November 16, 2004 announcement of the offer

by Buyers and substantially exceeds the historical market prices of

Westan's common stock for the last three years;

o the fact that Westan's common stock trades only sporadically in the

over-the-counter market. No established trading market for Westan's common

stock currently exists. The merger consideration of $0.32 per share

represents an opportunity for unaffiliated stockholders to achieve

liquidity;

o the fact that EKS&H delivered an opinion to the special committee to the

effect that as of November 15, 2004, and based on and subject to the

limitations, assumptions and qualifications contained in that opinion, the

merger consideration to be received by our unaffiliated stockholders in the

merger was fair to those stockholders from a financial point of view;

o the fact that the purchase price was proposed after EKS&H had provided its

valuation analyses, and that no specific guidance was provided to EKS&H

with respect to expectations of value;

o the fact that the merger was approved and recommended by the special

committee following its negotiations with Manuel Lopez on behalf of the

Buyers; and

o Westan's board of directors determined that the transaction would be

structured with a majority of the minority approval provisions which

obligates the Buyers to vote for or against the proposal in accordance with

the majority vote of Westan's unaffiliated stockholders.

Interests of our Directors and Executive Officers in the Merger (see page 42)

In considering the recommendation of our board of directors with respect to

the merger agreement and the transactions contemplated thereby, you should be

aware that, in addition to the matters discussed above, two members of our board

of directors have interests in the merger that are in addition to or different

from the interests of our stockholders generally and that such interests create

potential conflicts of interest

Messrs. Lopez and Peck, two of our directors and executive officers, own

all of the membership interests of the Buyer, SKI. Although they will receive no

cash in the merger, they will share in benefits accruing to the Buyer's full

ownership of Westan and its assets.

Indemnification arrangements for our present and former directors and

officers will be continued by the surviving corporation after the merger.

Primary Benefits and Detriments to Unaffiliated Stockholders (see page 28)

Our unaffiliated stockholders will receive a cash payment for their shares

at a premium above the market price of our shares prior to announcement of the

merger proposal and for the last several years. After the merger, our

unaffiliated stockholders will no longer have an interest in Westan or any of

its future earnings growth or increase in value.

Plans for Westan After the Merger

The Buyers expect that after the Merger, Westan's business will continue to

be operated substantially as it is currently being conducted. Neither the Buyers

nor Westan has any definite material plans or proposals that would take place

after the Merger. However, after the Merger Westan may consider possibilities

and alternatives with respect to its operations and development activities. In

addition, the Buyers intend to suspend Westan's obligation to file reports under

Section 13 of the Exchange Act, as a result of which Westan would no longer be

publicly traded on the over-the-counter market.

The Merger Agreement (see page 50).

The Merger Consideration (see page 50)

If the merger is completed, you will be entitled to receive $0.32 per share

in cash for each share of Westan common stock you own, without interest.

Conditions to the Merger (see page 52)

Certain nonwaivable conditions must be satisfied before any of Westan, SKI

or LZ Acquisition is obligated to complete the merger, including the following:

o the merger must be approved by the holders of a majority of the outstanding

shares of common stock of Westan; and

o there must be no legal or judicial restraint or prohibition preventing

completion of the merger;

Other conditions which must be satisfied unless waived by SKI include:

o the absence of any occurrence which would reasonably be expected to result

in a material adverse effect on Westan; and

o holders of not more than 5% of Westan's common stock shall have dissented

from the merger in accordance with the Wyoming Business Corporation Act.

Finally, other conditions, including compliance with representations,

warranties and covenants, must be satisfied by Westan or waived by SKI and LZ

Acquisition before either SKI or LZ Acquisition is obligated to complete the

merger. Similarly, compliance with additional representations, warranties and

covenants must be satisfied by SKI and LZ Acquisition or waived by Westan before

Westan is obligated to complete the merger. No party anticipates waiving any

condition to the merger. Proxies would not be resolicited from stockholders upon

the waiver of any of representation, warranty or covenant unless the waiver

would be material to the voting decision of stockholders.

Termination of the Merger Agreement (see page 58)

Westan and SKI may agree at any time (including any time after the special

meeting but before consummation of the merger) to terminate the merger

agreement. In addition, the merger agreement may be terminated:

o by either Westan or SKI if the merger is not completed by March 31, 2005

unless such date is extended by the parties;

o by either Westan or SKI if a court or governmental agency or authority

issues a non-appealable final ruling permanently restraining or prohibiting

the merger or if a legal action is pending challenging the merger;

o by either Westan or SKI if the merger agreement is not adopted by a

majority of all outstanding shares of Westan or by SKI if holders of more

than 5% of Westan's common stock dissent from the merger;

o by either Westan or SKI, if (x) there has been a breach by the other party

of any representation or warranty contained in the merger agreement, or (y)

there has been a breach of any of the covenants or agreements set forth in

the merger agreement on the part of the other party;

o by Westan if, prior to receiving stockholder approval, Westan receives and

resolves to accept a proposal superior to the merger and pays SKI the fee

described below under "Fees and Expenses"; or

o by SKI, if the board of directors of Westan shall have failed to recommend,

or shall have withdrawn, modified or amended in any material respect its

approval or recommendation of, the merger, shall have recommended a

different acquisition proposal, shall have resolved to accept a proposal it

deems superior to the proposed merger, or shall have recommended to

Westan's stockholders that they tender their shares in an offer commenced

by a third party.

Acquisition Proposals (see page 23)

The merger agreement provides that neither Westan nor any of its

representatives may take any action to initiate, solicit, negotiate, encourage

or provide confidential information to facilitate any proposal competing with

the merger except as described below.

Westan may, prior to receipt of stockholder approval of the merger and in

response to an unsolicited bona fide written offer which Westan's board of

directors determines, in good faith and after consultation with the independent

financial advisor to the special committee, would reasonably be expected to

result in a transaction more favorable to Westan's unaffiliated stockholders

than the merger:

o furnish confidential or non-public information to, and negotiate with a

potential acquirer;

o terminate the merger agreement; and

o enter into another proposal which Westan's board of directors, in good

faith, has determined is reasonably likely to be consummated.

We have agreed to keep SKI informed of the status of any other proposals

and negotiations.

Fees and Expenses (see page 59)

Each party will pay the costs and expenses incurred by it in connection

with the merger.

Westan will pay SKI a fee of $50,000 if:

o prior to obtaining stockholder approval, Westan determines to accept a

proposal superior to the merger and terminates the merger agreement; or

o Westan's board of directors fails to recommend the merger proposal, or

withdraws, modifies or amends its recommendation or recommends a competing

proposal; or

o prior to the special meeting a competing proposal is announced,

stockholders do not approve the merger proposal and the announced proposal

is consummated within 12 months after termination of the merger agreement.

SKI will release Westan from loans made to Westan in the approximate amount of

$100,000 if SKI:

o fails to consummate the merger by March 31, 2005, unless extended by the

parties, if the conditions to SKI's obligation to close the merger have

been satisfied (other than such conditions not satisfied because of a

breach of a representation, warranty or covenant of SKI or LZ Acquisition

under the merger agreement).

Any payment by Westan or SKI of the applicable fee or forgiveness described

above will constitute the other party's sole remedy for the circumstances giving

rise to that payment or forgiveness (see page 44).

Dissenters' Rights of Appraisal (see page 62)

Any stockholder who does not wish to accept the $0.32 per share cash

consideration in the merger has the right under Wyoming law to have his, her or

its shares appraised by a Wyoming state district court. This "right of

appraisal" is subject to a number of restrictions and technical requirements.

Generally, in order to exercise appraisal rights, among other things:

o you must not vote in favor of the merger agreement; and

o you must make a written demand for appraisal in compliance with Wyoming law

before the vote on the merger agreement.

Merely voting against the merger agreement will not preserve your right of

appraisal under Wyoming law. Annex C to this proxy statement contains the

Wyoming statute relating to your right of appraisal. Failure to follow all of

the steps required by this statute will result in the loss of your right of

appraisal.

Financing of the Merger (see page 44)

SKI will pay the cash consideration to Westan's unaffiliated stockholders

from funds to be obtained through borrowings from a bank.

Selected Consolidated Financial Data of Westan

The following table sets forth selected consolidated financial data for

Westan and its subsidiaries as of and for each of the five years in the period

ended December 31, 2003, and as of and for the nine months ended September 30,

2003 and 2004. No pro forma data giving effect to the proposed merger is

provided because Westan does not believe such information is material to

stockholders in evaluating the proposed merger since (1) the proposed merger

consideration is all cash and (2) if the proposed merger is completed, the

common stock of Westan would cease to be publicly traded.

The financial information for Westan as of and for each of the five years

in the period ended December 31, 2003 has been derived from the consolidated

financial statements of Westan which have been audited by our independent

certified public accountants. The financial information for Westan as of and for

the nine months ended September 30, 2003 and 2004 has been derived from the

unaudited consolidated financial statements of Westan which, in the opinion of

Westan's management, include all adjustments necessary for a fair presentation

of Westan's financial position and results of operations. All such adjustments

are of a normal recurring nature. The results of operations for the nine months

ended September 30, 2004 are not necessarily indicative of the results that may

be achieved for the full year, and cannot be used to indicate financial

performance for the entire year. The following financial information should be

read in conjunction with "Management's Discussion and Analysis of Financial

Condition and Results of Operation" and the Consolidated Financial Statements of

Westan and the notes thereto included in Westan's Annual Report on Form 10-KSB

for the fiscal year ended December 31, 2003, and Quarterly Report on Form 10-Q

for the period ended September 30, 2004 which are enclosed with this proxy

statement and incorporated by reference. Also please refer to "Available

Information."

As of or for the

Nine Months Ended

As of or for the Year Ended September 30,

---------------------------- -------------

December 31,

------------

1999 2000 2001 2002 2003 2003 2004

----------- ----------- ----------- ----------- ----------- ----------- -----------

Statements of Operations Data:

Gross revenues $ 8,877,837 $10,017,284 $ 9,600,115 $ 9,803,306 $10,260,678 $ 8,762,208 $ 8,938,611

Nonoperating revenues 0 0 0 1,496,455 0 0 0

Total Revenues 8,660,995 10,017,284 9,600,115 11,299,761 10,260,678 8,762,208 8,938,611

Costs and expenses 9,585,701 10,254,637 10,136,435 10,221,836 10,722,651 8,199,900 8,816,970

Income (Loss) before

taxes (707,864) (237,353) (536,320) 1,077,925 (461,973) 562,218 121,641

Provision for income

taxes 0 0 0 0 0 0 0

Minority interest 162,821 52,708 119,495 263,349 101,759 137,787 38,930

----------- ----------- ----------- ----------- ----------- ----------- -----------

Net income $ (545,043) $ (184,645) $ (416,825) $ 814,576 $ (360,214) $ 424,431 82,711

=========== =========== =========== =========== =========== =========== ===========

Income (Loss) per

common share - basic

and diluted $ (0.06) $ (0.02) $ (0.04) $ 0.08 $ (0.04) $ 0.04 $ 0.01

=========== =========== =========== =========== =========== =========== ===========

Fixed Charge:

Coverage ratio 0.266 0.699 0.336 2.934 0.050 2.685 1.341

One/One Coverage:

Ratio deficiency $ 707,864 $ 237,353 $ 536,320 $ 0 $ 461,973 $ 0 $ 0

Balance Sheet Data:

Current assets $ 840,423 $ 883,234 $ 836,198 $ 967,961 $ 896,026 N-A $ 1,201,520

Property and equipment 9,374,111 9,487,802 9,254,166 8,908,204 9,016,325 9,001,879

Other assets 638,608 612,244 513,643 465,949 497,873 1,341,658

----------- ----------- ----------- ----------- ----------- -----------

Total assets $10,853,142 $10,983,280 $10,604,007 $10,342,114 $10,410,224 $11,545,057

=========== =========== =========== =========== =========== ===========

Current liabilities $ 2,010,700 $ 1,808,133 $ 2,208,538 $ 2,374,492 $ 3,112,676 $ 2,088,266

Long term liabilities 8,402,327 8,972,385 8,729,127 7,223,356 7,015,255 9,052,859

Minority interest in

subsidiary 2,071,635 2,018,927 1,899,432 2,162,780 2,061,021 2,100,367

Shareholders' equity

(deficit) (1,631,520) (1,816,165) (2,233,090) (1,418,514) (1,778,728) (1,696,435)

----------- ----------- ----------- ----------- ----------- -----------

Total liabilities and

Shareholders' equity

(deficit) $10,853,142 $10,983,280 $10,604,007 $10,342,114 $10,410,224 $11,545,057

=========== =========== =========== =========== =========== ===========

Book value per common

share (deficit) $ (0.18) $ (0.17)

=========== ===========

THE PARTIES

Western Standard Corporation

Westan was organized as a Wyoming corporation in 1955 for the purpose of

engaging in the natural resources business, particularly uranium and oil and gas

exploration. On November 2, 2004, we sold our minor interests in our remaining

oil and gas leases, which had been providing only a minimal amount of revenue.

These properties were sold to an unaffiliated oil and gas company for $65,000.

In 1971 and 1972 we acquired real estate, including the Snow King ski area

in Jackson, Wyoming. Construction of a 204 room hotel and convention center on

the property began in 1973, became operational in 1976 and was completed in

1977. In 1981, 50% of the Snow King property was sold to Pick-Jackson Corp. and

the remaining 50% was transferred to two partnerships.

In 1992 Snow King Resort, Inc. ("SKRI") reacquired the land, ski area and

the hotel. We own approximately 76% of the voting power of SKRI and

approximately 39% of its common stock. SKRI's operations have been consolidated

in our financial statements. We have essentially no operations or business

except for our ownership interest in SKRI.

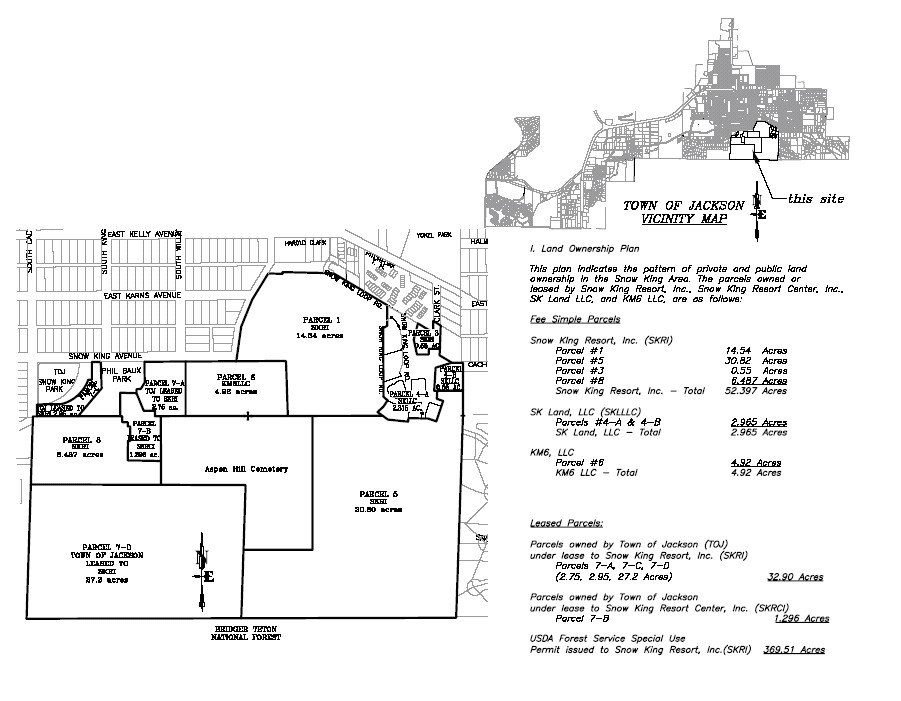

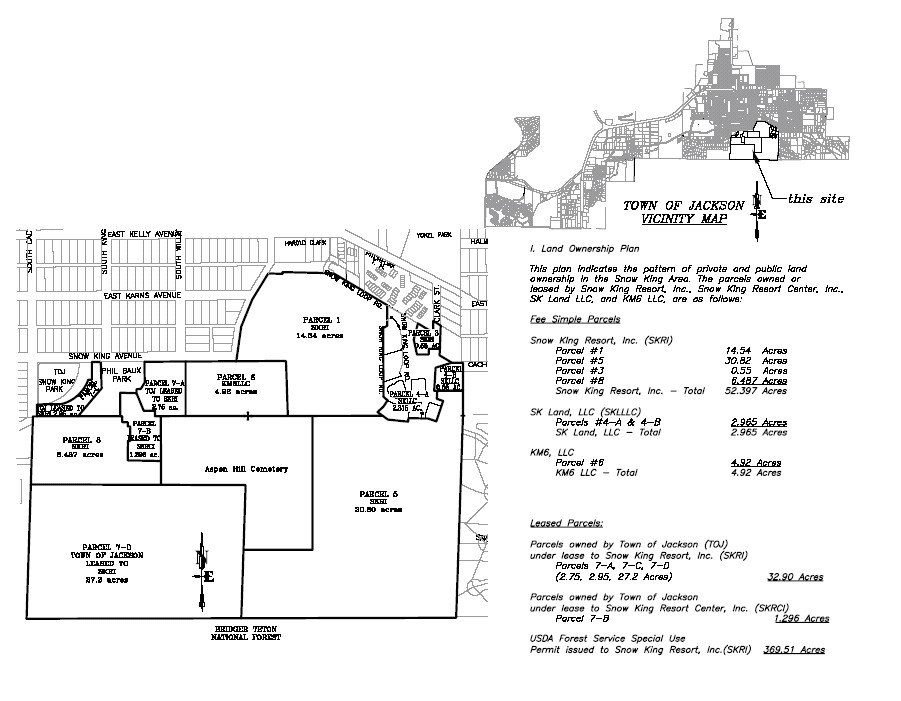

Our properties, which we call the Snow King Resort, consist of

approximately 52 acres of fee land and 404 acres of land leased from the United

States Forest Service (370 acres) and the Town of Jackson, Wyoming (34 acres).

We operate a hotel, ski area and conduct other recreational activities on these

properties. Our resort is located about six blocks from the Jackson Town Square

and about 10 miles from the Jackson Hole Airport.

Our address is 400 East Snow King Avenue, Post Office Box 1846, Jackson,

Wyoming 83001 and our telephone number is (307) 734-3177.

SKI and LZ Acquisition, Inc.

Snow King Interests LLC ("SKI") is a Wyoming limited liability company

organized by Manuel B. Lopez and James M. Peck. SKI was formed to own and

conduct the business of Westan, which will be a wholly-owned subsidiary of SKI

following the merger. LZ Acquisition, Inc. is a Wyoming corporation and owned by

SKI. LZ Acquisition, Inc. was organized for the sole purpose of effecting the

merger and will be merged with and into Westan. The address of both SKI and LZ

Acquisition is 4950 Beaver Pond Drive, Box 1131, Wilson, Wyoming 83014.

INFORMATION CONCERNING THE SPECIAL MEETING

Time, Place and Date

This proxy statement is furnished in connection with the solicitation by

the board of directors of proxies from Westan stockholders for use at a special

meeting of stockholders to be held at 10:00 a.m., Mountain Time, on Friday,

February 25, 2005, at the Snow King Resort, 400 East Snow King Avenue, Jackson,

Wyoming 83001, or at any adjournment or postponement thereof, pursuant to the

enclosed Notice of Special Meeting of Stockholders.

Purpose of the Special Meeting

At the special meeting, the stockholders of Westan will be asked to

consider and vote upon the approval of the merger agreement and the transactions

contemplated thereby. A copy of the merger agreement is attached to this proxy

statement as Annex A. Pursuant to the merger agreement, each outstanding share

of common stock other than (1) common stock held by Messrs. Lopez and Peck and

their affiliates, SKI or LZ Acquisition, or (2) common stock held by

stockholders who perfect their rights under Wyoming law to dissent from the

merger and seek a judicial appraisal of the fair value of their shares will be

converted into $0.32 per share, without interest.

Based on the factors described below under "Special Factors--Recommendation

of the Special Committee and Board of Directors" and on the unanimous

recommendation of its special committee, the board of directors of Westan

recommends that stockholders vote "FOR" approval of the merger agreement and the

transactions contemplated thereby.

Record Date; Voting at the Meeting; Quorum

The board has fixed the close of business on January 7, 2005 as the record

date for the special meeting. Only stockholders of record as of the close of

business on the record date will be entitled to notice of and to vote at the

special meeting.

As of the close of business on the record date, Westan had outstanding

9,963,015 shares of its common stock, held of record by approximately 3,500

registered holders, although Westan believes it has other beneficial owners of

its common stock. Holders of the common stock are entitled to one vote per

share. The presence in person or by proxy of the holders of not less than

one-half of the voting power of the outstanding common stock entitled to vote at

the special meeting constitutes a quorum. Broker non-votes and shares present or

represented but as to which a stockholder abstains from voting will be included

in determining whether there is a quorum at the special meeting.

Required Vote

Under Wyoming law, the merger agreement must be approved by the affirmative

vote of the holders of a majority of the voting power of the outstanding shares

of common stock. The affirmative vote of 4,981,508 shares of common stock will

be necessary to satisfy this voting requirement. Messrs. Lopez and Peck and

their affiliates have agreed to vote their shares in accordance with the

majority of shares cast for or against the proposed transaction by unaffiliated

stockholders voting in person or by proxy at the special meeting. SKI and

Messrs. Lopez and Peck, and their affiliates, currently own 5,438,213 shares of

common stock in the aggregate, representing approximately 54% of our outstanding

shares of common stock as of the Record Date.

Because Westan's merger agreement must be approved by the affirmative vote

of the holders of a majority of the voting power of the outstanding shares of

common stock, failure to return an executed proxy card or to vote in person at

the special meeting or abstaining from the vote will constitute, in effect, a

vote against approval of the merger agreement and the transactions contemplated

thereby. Similarly, broker non-votes will have the same effect as a vote against

approval of the merger agreement and the transactions contemplated thereby.

Voting and Revocation of Proxies

The enclosed proxy card is solicited on behalf of Westan's board of

directors. The giving of a proxy does not preclude the right to vote in person

should any stockholder giving the proxy so desire. Stockholders have an

unconditional right to revoke their proxy at any time prior to its exercise,

either by filing with Westan's secretary at Westan's principal executive offices

a written revocation or a duly executed proxy bearing a later date or by voting

in person at the special meeting. Attendance at the special meeting without

casting a ballot will not, by itself, constitute revocation of a proxy. Any

written notice revoking a proxy should be sent to Computershare Trust Company,

Inc., Post Office Box 1596, Denver, Colorado 80201.

Action to be Taken at the Special Meeting

All shares of common stock represented at the special meeting by properly

executed proxies received prior to or at the special meeting, unless previously

revoked, will be voted at the special meeting in accordance with the

instructions on the proxies. Unless contrary instructions are indicated, proxies

will be voted FOR the approval of the merger agreement and the transactions

contemplated thereby. As explained below in the section entitled "Dissenters'

Rights of Appraisal," a vote in favor of the merger agreement means that the

stockholder owning those shares will not have the right to dissent and seek

judicial appraisal of the fair value of such stockholder's shares. Westan does

not know of any matters, other than as described in the Notice of Special

Meeting of Stockholders, which are to come before the special meeting. If any

other matters are properly presented at the special meeting for action, the

persons named in the enclosed proxy card and acting thereunder generally will

have discretion to vote on such matters in accordance with their best judgment.

Pursuant to our bylaws, any adjournment of the special meeting may be made

without notice, other than by an announcement made at the special meeting, by

approval of the holders of a majority of the shares of Westan's common stock

present in person or represented by proxy at the special meeting, whether or not

a quorum exists. The proposal granting to the proxies the authority to vote to

adjourn the special meeting to satisfy conditions to the closing of the merger

agreement must be approved and adopted by the holders of a majority of the

shares of our common stock present in person or represented by proxy at the

special meeting. Although it is not currently anticipated, the most likely

reason for adjournment would be to solicit additional votes to approve and adopt

the merger agreement and to authorize the merger.

Proxy Solicitation

Westan is requesting that banks, brokers and other custodians, nominees and

fiduciaries forward copies of the proxy material to their principals and request

authority for the execution of proxies. Westan may reimburse such persons for

their expenses in so doing. In addition to the solicitation of proxies by mail,

the directors, officers and employees of Westan and its subsidiaries may,

without receiving any additional compensation, solicit proxies by telephone,

telefax, telegram or in person.

No person is authorized to give any information or make any representation

not contained in this proxy statement, and if given or made, such information or

representation should not be relied upon as having been authorized.

Westan stockholders should not send any certificates representing shares of

common stock with their proxy card. If the merger is consummated, the procedure

for the exchange of certificates representing shares of common stock will be as

set forth in this proxy statement. See "The Merger Agreement--The Exchange Fund;

Payment for Shares of Common Stock" and "The Merger Agreement--Transfers of

Common Stock."

SPECIAL FACTORS

Background of the Merger

As discussed above, Westan developed and built the Snow King Resort hotel

and convention center facilities and has operated the resort, either alone or

with partners, during the last 27 years. Westan owns approximately 76% of the

voting common stock and approximately 39% of the total stock (including common

and preferred) of Snow King Resort, Inc. ("SKRI") which in turn owns all of the

resort's operating assets and approximately 52 acres of fee land. SKRI's

operations over the years have largely been unprofitable, except in the year

2002 when the sale of real estate lots turned an operating loss into net income

for that year. See Westan's Annual Report on form 10-KSB for the year ended

December 31, 2003 and its Quarterly Report on Form 10-QSB for the nine months

ended September 30, 2004, both included with this proxy statement, for further

discussion of Westan's business and results of operations.

Given its history of losses and sizeable debt burden, Westan sought to

attract a buyer for the SKRI assets in 2001. In the summer of 2001, Westan

engaged the real estate brokerage firm of Sonnenblick-Goldman Company to prepare

a presentation which included SKRI's assets and approximately 8 acres of fee

land owned by others contiguous to or near the Snow King resort. Westan believed

the larger package might offer a more attractive development opportunity for a

large, well capitalized company. On November 13, 2001, Sonnenblick-Goldman

summarized the results of its marketing efforts in a letter to Westan: three

persons inspected the property, one person submitted a letter of intent subject

to several conditions but covering only a part of the property, seven persons

submitted letters indicating an interest (two of whom made verbal offers) and 74

persons declined the opportunity. The one person submitting a one page letter of

intent indicated an offer of $11 million for the fee simple interest and the

leasehold interest in the events center owned by the Town of Jackson. A verbal

offer of $9 million from another party for the same fee and leasehold properties

was relayed to Westan by Sonnenblick-Goldman. The other parties submitting

letters of interest suggested various things: a management agreement

arrangement, a joint venture, a vacation time share development, and a potential

debt or equity investment in a buyer or in a joint venture. There were no offers

for the entire package as presented by Sonnenblick-Goldman. After careful

consideration by Westan's board of each indication of interest, and some

follow-up by Sonnenblick-Goldman, it was determined that the consideration

offered or discussed was inadequate and, after payment of debt and other

expenses, would leave Westan stockholders with little or nothing. Also, the

board determined that the other proposals discussed involving management

agreements, joint ventures and proposals involving only select portions of the

properties would not enhance Westan's stockholders' values.

Given the results of Sonnenblick-Goldman's marketing efforts, the fact that

no indications of interest have been received since, and the fact that Westan

owns only 39% of the common stock of the operating entity, it concluded that it

had few, if any, viable strategic alternatives to enhance stockholder's value.

In 2003, Stanford E. Clark, President of Westan until January 6, 2004,

turned 86 years of age. He indicated to Manuel B. Lopez, President of SKRI, that

he wished to retire and sell his stake in Westan which consisted of 1,847,018

shares or approximately 18.5% of Westan's outstanding common stock. Several

months of negotiations concluded in November 2003, when Mr. Lopez agreed to buy

Mr. Clark's Westan shares for approximately $535,000 or $0.29 per share.

Mr. Lopez then began to consider ways he might arrange for the purchase of

Westan shares held by unaffiliated stockholders. He approached Mr. Peck, a

stockholder and fellow director of Westan. Mr. Lopez began this consideration

because he believed that if fiduciary duties to public stockholders were

eliminated, conflicts of interest which would otherwise hamper or preclude

future conflicted transactions and master development of SKRI's properties, and

perhaps smaller land positions owned in part by him and by unaffiliated persons,

would be significantly reduced. Further, he believed that he had the financial

ability to purchase the Westan shares held by unaffiliated stockholders.

Finally, Westan's lenders were unwilling to continue to extend credit to Westan

and SKRI given their precarious financial position and operational issues

without personal guarantees of Messrs. Lopez, Peck and others. At present, Mr.

Lopez and his wife are guarantors of $6,425,000 in mortgage, land,

infrastructure and construction loans to SKRI. Mr. Lopez is increasingly

reluctant to continue to provide personal guarantees to SKRI, to benefit Westan,

a publicly-held company.

In July, 2004, Mr. Lopez formed SKI and employed legal counsel to consider

the proposed purchase of shares from Westan's unaffiliated stockholders.

Westan's board of directors formed a special committee consisting of Mr. Clark,

its only independent director. Mr. Clark engaged legal counsel and Ehrhardt

Keefe Steiner & Hottman PC ("EKS&H") an accounting and financial advisory firm

to assist in his efforts to obtain a fair value for the shares of Westan held by

unaffiliated stockholders. The financial advisor engaged by the special

committee had begun to conduct preliminary analyses in July 2004 when two of its

principals visited the Jackson, Wyoming area and the Snow King Resort. The

principals met with Mr. Lopez who showed them the Snow King and contiguous

properties and they talked in general terms about hotel operations, local

development and related matters. No discussions with regard to values or

valuations occurred. Again, in August 2004 a principal and an associate of EKS&H

visited Jackson, Wyoming to obtain a more in-depth understanding of SKRI, its

operations and properties. During this visit, EKS&H retained Rocky Mountain

Appraisals, a well known local real estate appraisal firm to assist it in its

various analyses. There were no discussions as to value or valuation of SKRI's

properties. During this period, a form of Agreement and Plan of Merger which was

prepared by SKI and its counsel and presented to the special committee and its

counsel and financial advisor. There was no price mentioned in the draft merger

agreement.

A conference was held on September 10, 2004 at the offices of EKS&H.

Attending were representatives of that firm, Mr. Lopez and legal counsel

representing SKI and legal counsel representing the special committee. A general

discussion ensued in which Mr. Lopez explained the capitalization of SKRI, the

relative rights of the Class A and Class B common stockholders and the Class A

preferred stockholders. Westan owns 12,000 Class B common shares which represent

approximately 76% of the voting power of SKRI and approximately 39% of its

equity ownership. Mr. Lopez noted that Westan's 39% ownership of SKRI would be

critical in the valuation of Westan's shares. EKS&H then discussed the

methodology it intended to use in preparation of its valuation report. That firm

advised the group that it believed that a sales or liquidation valuation, a

discounted cash flow analysis, and a comparable company analysis appeared to be

appropriate. EKS&H also advised that it would take several weeks to complete

work necessary to render a preliminary evaluation to the special committee and

its counsel. The parties agreed to keep in touch, to provide any additional

information and to arrange a meeting to discuss the results of EKS&H work.

On October 14, 2004, a meeting was held at the offices of EKS&H. In

attendance were representatives of EKS&H, counsel to the special committee (Mr.

Clark, the sole member of the special committee was available by telephone). Mr.

Lopez and counsel to SKI. The purpose of the meeting was to receive a

preliminary report from EKS&H in order to enable the special committee to

determine whether it wished to pursue a transaction with SKI and to enable SKI

to decide whether it wished to pursue a transaction with Westan.

EKS&H discussed the nature and scope of its work to date, the appraisal

information it had received from Rocky Mountain Appraisals, the Jackson, Wyoming

real estate appraiser it had engaged, the valuation methodologies it intended to

use if a transaction were to be proposed and a range of preliminary valuations.

EKS&H stated that its work to date was preliminary only and subject to further

work and refinement.

EKS&H informed the group that using an asset based, sale and liquidation

model, the aggregate net value attributable to stockholders of Westan would be

$3.2 million or $0.32 per Westan share. Using a discounted cash flow model EKS&H

estimated an aggregate valuation of $1.6 million or $0.16 per share. Using a

comparable company transaction, EKS&H estimated an aggregate valuation from

$1.57 million to $3.4 million or between $0.157 and $0.34 per share. Based on

all of its analyses, EKS&H stated that its preliminary conclusion indicated a

net valuation (after tax of $225,000) of $3.2 million or $0.32 per Westan common

share. EKS&H cautioned that these preliminary estimations were for discussion

purposes only and that they could change if it were directed to fully complete

its work.

Also at this October 14, 2004 meeting, counsel to SKI outlined the legal

methodology of a typical going private, or management buyout, transaction.

Counsel stated that SKI would form a transitory wholly owned subsidiary that

would be merged with and into Westan with Westan as the surviving corporation.

All stockholders except Messrs. Lopez and Peck would receive cash for their

shares and Westan would be a wholly owned subsidiary of SKI. Counsel also

discussed the advisability of a fiduciary out provision enabling Westan to

accept a better offer. In that connection, counsel stated that a break-up fee is

customarily demanded by the Buyers to compensate for their time, effort, and

expense should a better offer be accepted, but that the break-up fee should not

be so large as to discourage other possible buyers. Counsel stated that it would

be appropriate to consider compensation payable to Westan should the Buyers be

unable to perform. Finally, counsel to the special committee stated that because

of the number of shares owned and controlled by Messrs. Lopez and Peck and their

potential conflict of interest, a plan of neutralized voting should be

considered, which would obligate Messrs. Lopez and Peck to vote their shares in

accordance with the majority of shares cast for or against the proposal by

unaffiliated stockholders.

SKI indicated that it would take EKS&H's preliminary work under advisement,

along with the issues raised by counsel, and if it wished to proceed, would

either propose a transaction to Westan's special committee, or not, within one

month.

On November 10, 2004, a meeting was convened to discuss a possible

transaction. Persons present at that meeting were Mr. Clark, the sole member of

the special committee, the special committee's counsel and representatives of

the special committee's financial advisor, EKS&H, Messrs. Lopez and Peck and

SKI's legal counsel. Messrs. Clark, Lopez and Peck were also present in their

capacities as directors of Westan. Messrs. Lopez and Peck had previously fully

disclosed the nature and extent of their personal interest in SKI and in the

proposed merger to the board of directors. The members of the board of directors

discussed the merger agreement, asked questions of counsel, and agreed that the

material issues presented in the previous discussions (i.e., primarily break-up

fees, expense reimbursements, and neutralized voting) had been satisfactorily

resolved.

EKS&H presented to the board and special committee a report discussing the

methods and results of EKS&H's valuation work. The valuations indicated by EKS&H

ranged from a low of $0.157 per share of Westan to a high of $0.34, depending on

the method of valuation used. Considering all methods of analyses, EKS&H stated

that the asset based and liquidation sale approach appeared to be the most

objectively determinable and accordingly indicated a valuation of $3.2 million

net after taxes of $225,000 or approximately $0.32 per share of Westan common

stock.

Mr. Lopez stated that SKI would be willing to offer $0.30 per share to

unaffiliated stockholders of Westan pursuant to the terms and conditions of the

merger agreement. He noted that this was one cent more per share than the amount

he paid for Mr. Clark's large block of shares in November 2003.

Messrs. Lopez, Peck and SKI's legal counsel were asked to temporarily leave

the meeting while Mr. Clark, the member of the special committee, conferred with

its legal counsel and the representatives of EKS&H. The special committee

believed the comparable company valuation approach, which indicated such a wide

range of values from approximately $0.16 per share to approximately $0.34 per

share, might not be as reliable as the asset-based valuation approach, which

yielded a net valuation of approximately $0.32 per share. Likewise, the special

committee believed that the market value approach was not as reliable as the

asset-based approach because of the sporadic, illiquid market in Westan's

shares. And finally, the special committee did not believe the discounted cash

flow analysis, which was projected out to 2014, was as reliable as the

asset-based approach because of Westan's history of operating losses and its

probable lack of ability to provide its share of requisite future financing.

The meeting of the board and special committee was subsequently reconvened

and counsel to the special committee indicated that the special committee would

feel more comfortable if SKI's offer could be raised to the top of the range

indicated in EKS&H's asset based and liquidation sale valuation approach, or

$0.32 per share. Messrs. Lopez and Peck stated that they were willing to raise

SKI's offer to $0.32 per share payable only to Westan's unaffiliated

stockholders.

EKS&H then delivered to the special committee its oral opinion,

subsequently confirmed in a written opinion dated as of November 15, 2004, that

as of that date and based on the assumptions made, matters considered and the

limitations on the review undertaken as described in the written opinion, the

$0.32 per share merger consideration was fair from a financial point of view to

the unaffiliated stockholders of Westan. The opinion was premised on the

material terms of the November 10, 2004 draft of the merger agreement which were

not altered by any subsequent changes in the final merger agreement dated

November 15, 2004.

After considering among other things the factors set forth immediately

below under the caption "Recommendation of the Special Committee and Board of

Directors; Fairness of the Merger," and EKS&H's oral opinion, the special