QuickLinks -- Click here to rapidly navigate through this documentFiled with the Securities and Exchange Commission on February 21, 2003

Registration No. 333-101976

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ACCPAC INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of

Incorporation or Organization) | | 7372

(Primary Standard Industrial

Classification Code Number) | | 77-0469911

(I.R.S. Employer

Identification Number) |

6700 Koll Center Parkway

Pleasanton, California 94566

(925) 461-2625

(Address, Including Zip Code and Telephone Number,

Including Area Code, of Registrant's Principal Executive Offices)

David M. Hood

President, Chief Executive Officer and

Chairman of the Board of Directors

6700 Koll Center Parkway

Pleasanton, California 94566

(925) 461-2625

(Name, Address, Including Zip Code and Telephone Number,

Including Area Code, of Agent For Service)

With copies to:

| Paul V. Rogers | | | | Christopher M. Kelly |

| Andrea Vachss | | | | Sean M. McAvoy |

| Covington & Burling | | | | Jones Day |

| One Front Street | | | | 2882 Sand Hill Road |

| San Francisco, California 94111 | | | | Menlo Park, California 94025 |

| (415) 591-6000 | | | | (650) 739-3939 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Subject to completion, dated February 21, 2003

PROSPECTUS

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Shares

Common Stock

This is our initial public offering. We are offering shares of our common stock, and one of our stockholders, listed under "Principal and Selling Stockholders" on page 78, is offering an additional 105,000 shares. We expect the public offering price to be between $ and $ per share. Currently, no public market exists for the shares. After pricing the offering, we expect the common stock will be traded on the Nasdaq National Market under the symbol "ACPC."

Investing in our common stock involves significant risks. See "Risk Factors" beginning on page 6.

| | Per Share

| | Total

|

|---|

| Public offering price | | $ | | | $ | |

| Underwriting discounts and commissions | | $ | | | $ | |

| Proceeds, before expenses, to ACCPAC | | $ | | | $ | |

| Proceeds, before expenses, to the selling stockholder | | $ | | | $ | |

The underwriters may also purchase up to an additional shares from ACCPAC at the public offering price, less the underwriting discount, within 30 days from to cover over-allotments.

The underwriters expect to deliver the shares on or about , 2003.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

RBC Capital Markets

SoundView Technology Group

Adams, Harkness & Hill, Inc.

, 2003.

TABLE OF CONTENTS

| | Page

|

|---|

| Prospectus Summary | | 1 |

| Risk Factors | | 6 |

| Forward-Looking Statements | | 19 |

| Market and Industry Data | | 19 |

| Use of Proceeds | | 20 |

| Dividend Policy | | 20 |

| Capitalization | | 21 |

| Dilution | | 22 |

| Selected Consolidated Financial and Other Financial Data | | 24 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 26 |

| Business | | 49 |

| Management | | 64 |

| Certain Transactions | | 73 |

| Principal and Selling Stockholders | | 78 |

| Description of Capital Stock | | 79 |

| Shares Eligible for Future Sale | | 83 |

| Underwriting | | 85 |

| Legal Matters | | 88 |

| Experts | | 88 |

| Where You Can Find More Information | | 88 |

| Trademarks | | 88 |

| Index to Financial Statements | | F-1 |

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with information different from that contained in this prospectus. We are offering to sell and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of the prospectus or any sale of the common stock. Information on our website or in our promotional literature is not part of this prospectus.

DEALER PROSPECTUS DELIVERY OBLIGATION

Until , 2003, which is 25 days after commencement of this offering, all dealers that effect transactions in our securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

PROSPECTUS SUMMARY

The following summary provides an overview of the material aspects of our business and the offering. This summary is not complete and may not contain all of the information you should consider before investing in our common stock. You should read the entire prospectus carefully, especially the discussion regarding the risks of investing in our common stock under "Risk Factors" and the consolidated financial statements and the related notes included elsewhere in this prospectus, before investing in our common stock.

ACCPAC International, Inc.

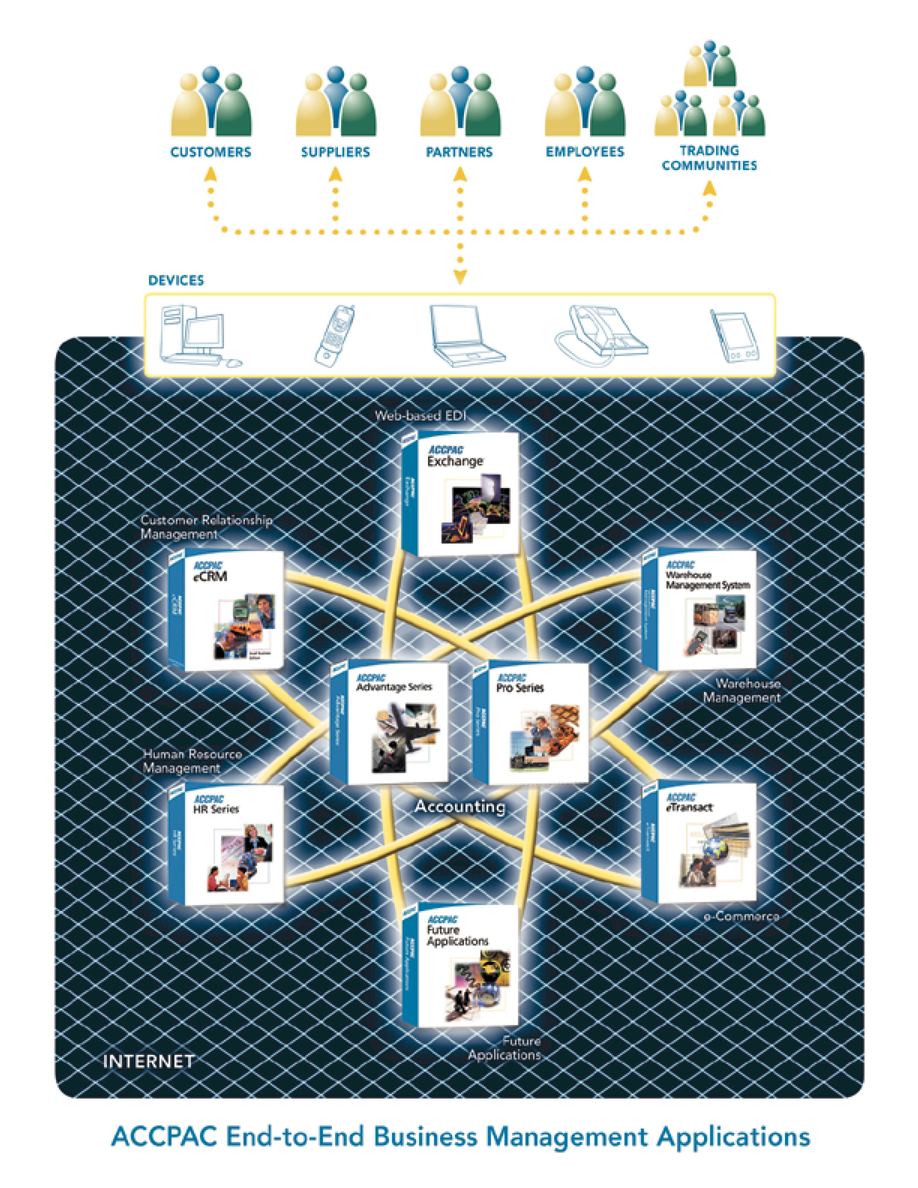

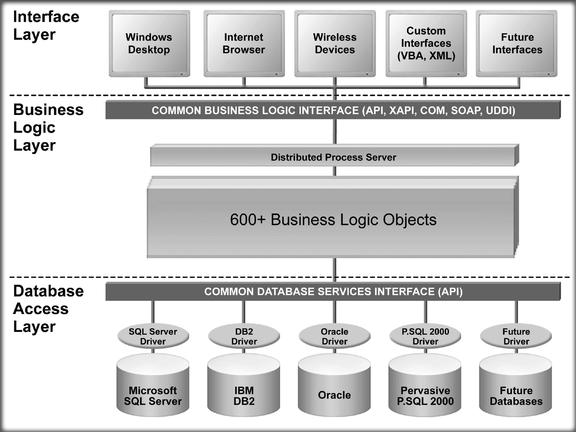

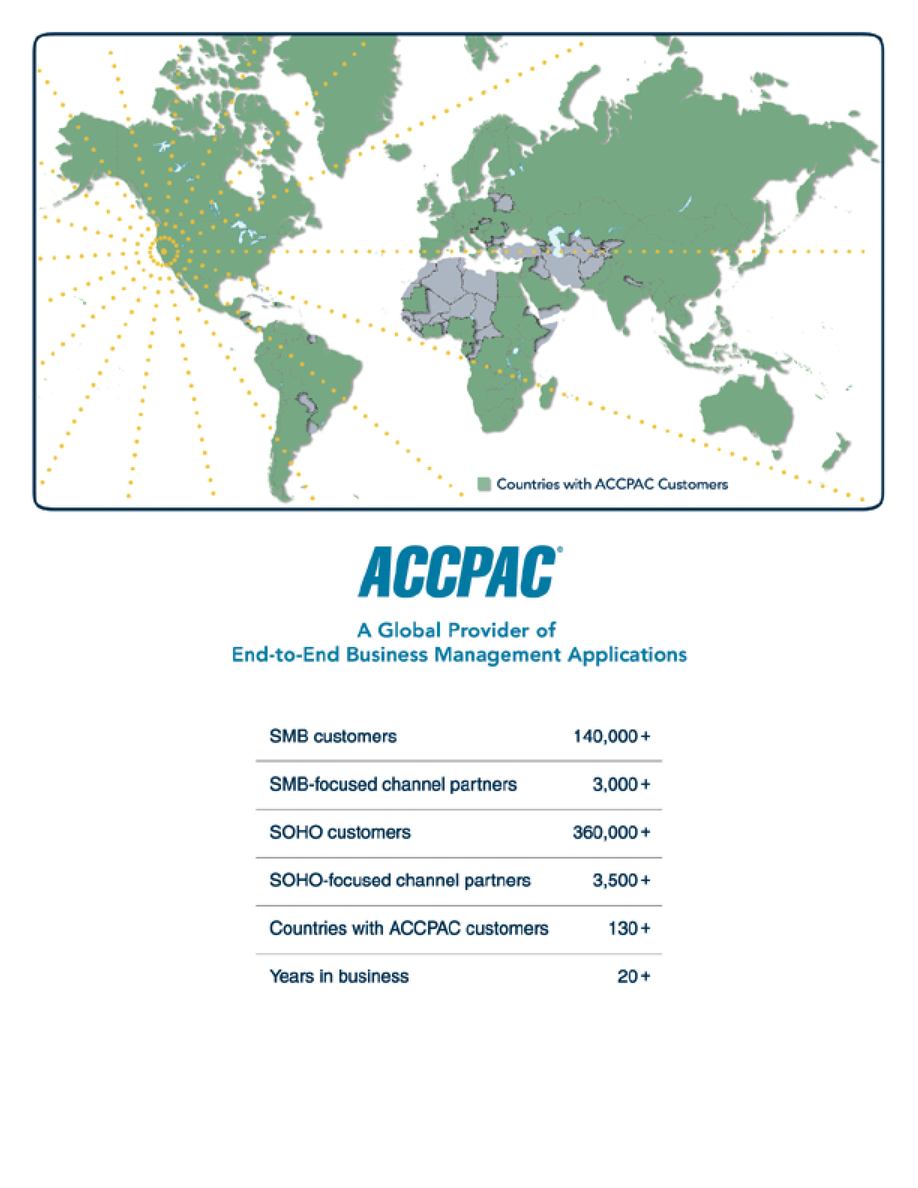

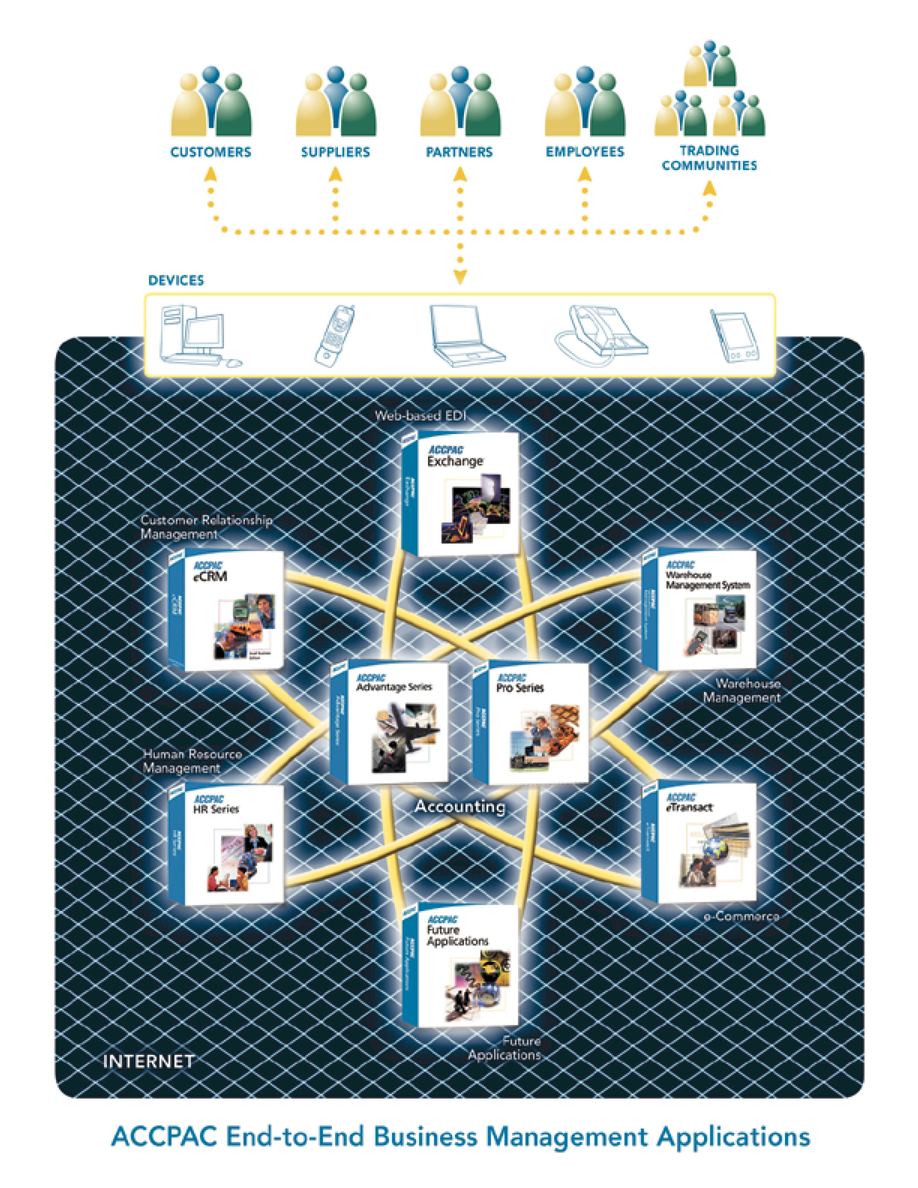

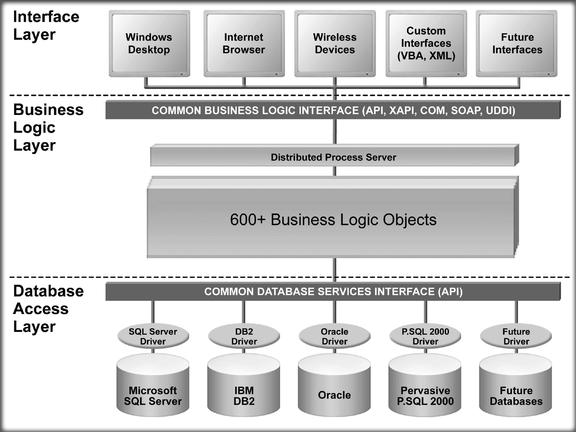

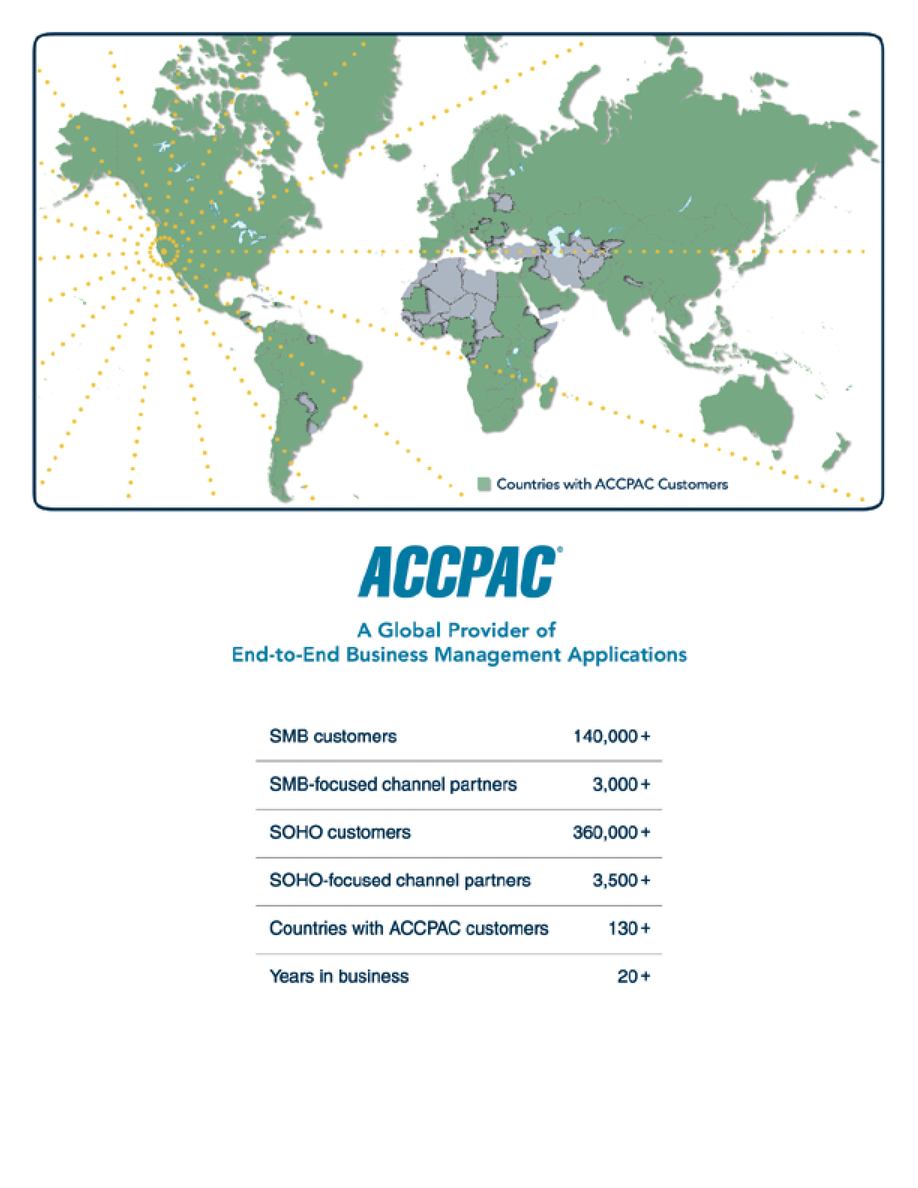

We are a global provider of end-to-end business management applications for small and midsize businesses, or SMBs. We believe that we offer the most comprehensive and functionally complete suite of business management applications specifically designed for these businesses. Our accounting applications are the foundation of our applications suite. We complement these accounting applications with a number of other applications that address our customers' needs in the areas of customer relationship management, electronic commerce, human resource management, warehouse management and Internet-based business-to-business transaction exchange. We market all of these applications, some of which are licensed from technology partners, under the ACCPAC brand. By integrating our business management applications and making them accessible via the Internet, we offer an end-to-end business management solution to our SMB customers. We sell these business management applications through our network of more than 3,000 SMB-focused business partners in our distribution channel worldwide. We have been in business for over 20 years and have registered more than 140,000 SMB customers. We currently maintain relationships with customers in over 130 countries. In addition, we also offer accounting software for small office and home office, or SOHO, businesses.

Industry Background

Businesses are increasingly challenged to raise employee productivity, increase the speed and accuracy of decision-making, and establish more efficient relationships with customers, suppliers and partners. Businesses rely on business management applications to meet these challenges. Increasingly, businesses are demanding that these applications be integrated with one another and accessible via the Internet, or e-business enabled. International Data Corporation estimates that the market for e-business applications will grow at approximately three times the rate of the overall business applications market, from $4.4 billion in 2001 to $19.5 billion in 2006, which represents a compound annual growth rate of 34.4%. We believe our products address a substantial portion of this market.

The accounting application is the central repository for all business transactions, financial data and other critical business information. Accordingly, the accounting application has emerged as the foundation for integrated business management applications. This development, coupled with the increased demand for these applications to be e-business enabled, has fueled the emergence of end-to-end business management applications.

To date, most business management applications targeted at the small and midsize business market have been stand-alone, non-integrated applications that have been expensive and have not been e-business enabled. As a consequence, while Gartner Group estimates that there are more than 8.0 million of these businesses worldwide, we believe most are not benefiting from end-to-end business management applications. However, the emergence of the Internet as a secure, low-cost

1

platform for business transactions, and the availability of affordable information technology infrastructure, are driving an increasing demand for end-to-end business management applications in this market.

Our Solution

We believe our end-to-end business management solution addresses the requirements of small and midsize businesses by offering the following benefits:

- •

- a comprehensive suite of applications tightly integrated with our accounting applications;

- •

- rapid, low-cost implementation;

- •

- flexible pricing, packaging and deployment options;

- •

- Internet and wireless device accessibility;

- •

- low-cost business-to-business electronic connectivity; and

- •

- local consulting and implementation support.

Our Strategy

Our goal is to be the leading provider of end-to-end business management applications for small and midsize businesses. Key elements of our strategy are as follows:

- •

- leverage and expand our large network of more than 3,000 SMB-focused business partners to grow our revenues;

- •

- leverage our large installed base of accounting software customers to generate additional sales of our accounting and complementary business management applications;

- •

- enhance our products and develop new products by leveraging our extensive technical expertise and market knowledge;

- •

- expand our application hosting service, ACCPAC Online, which today provides one or more of our business management applications to over 100 customer sites on a subscription-fee basis; and

- •

- expand international operations, which we believe will continue to represent a significant opportunity for future sales growth of our end-to-end business management applications.

Relationship with Computer Associates

We are a majority-owned subsidiary of Computer Associates International, Inc., a leading enterprise software company. After this offering, Computer Associates will continue to own approximately % of our common stock, or % if the underwriters exercise their over-allotment option in full, and will continue to be able to exercise control over matters requiring stockholder approval. In addition, we are a party to several agreements with Computer Associates relating to matters such as technology licensing, finance and real estate. See "Certain Transactions."

2

Acquisition of eWare Limited

On December 18, 2002, we completed our acquisition of eWare Limited, a privately held developer of customer relationship management software products for small and midsize businesses. Prior to the acquisition, we sold eWare products under license, and we anticipate that this acquisition will enable us to enhance our future product development. In connection with this transaction, we acquired all of the outstanding shares of stock of eWare in exchange for $1.8 million in cash and 761,110 shares of our common stock. We also issued 69,445 shares of restricted common stock to eWare executives and, in January 2003, 113,889 shares of restricted common stock to eWare employees. The restricted shares vest over periods of one to three years, subject to continued employment. Of the shares we issued as acquisition consideration and as compensation to eWare executives, 707,220 are subject to a put option, entitling the stockholders to sell their shares to us for $5.82 per share, and a call option, entitling us to buy shares from the stockholders for $10.85 per share. These options are exercisable at any time during the 28-day period beginning November 19, 2003 and will terminate at the earlier of December 17, 2003, or the last business day prior to the effectiveness of a registration statement relating to the initial public offering of our common stock. For more information about our acquisition of eWare, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Acquisition of eWare Limited."

We were incorporated in Delaware in October 1997. Our principal office is located at 6700 Koll Center Parkway, Pleasanton, California 94566. Our telephone number is (925) 461-2625.

3

The Offering

| Common stock we are offering | | shares |

| Common stock the selling stockholder is offering | | 105,000 shares |

| Common stock to be outstanding after this offering | | shares |

| Underwriters' over-allotment option | | shares |

| Use of proceeds | | We intend to use the net proceeds of this offering for working capital and general corporate purposes. We may also acquire other businesses, products and technologies. We will not receive any proceeds from sales of shares by the selling stockholder. See "Use of Proceeds." |

| Proposed Nasdaq National Market symbol | | ACPC |

The number of shares of common stock to be outstanding after this offering is based on the number of shares outstanding as of December 31, 2002, and excludes:

- •

- 2,885,000 shares subject to options outstanding as of December 31, 2002, at a weighted average exercise price of $7.46 per share;

- •

- 2,114,500 additional shares that we could issue under our stock option plans as of December 31, 2002;

- •

- 113,889 restricted shares granted to eWare employees in January 2003; and

- •

- 1,000,000 shares that we could issue under our employee stock purchase plan subsequent to completion of the offering.

Except where we state otherwise, the information we present in this prospectus reflects no exercise of the underwriters' over-allotment option.

4

Summary Consolidated Financial Data

The following tables set forth our summary historical consolidated financial data. You should read the following data in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations," our consolidated financial statements and the notes to those statements included in this prospectus.

The summary consolidated statements of operations data for the fiscal years ended March 31, 2000, 2001 and 2002 and the nine months ended December 31, 2001 and 2002, and the summary consolidated balance sheet data as of December 31, 2002 are derived from our consolidated financial statements and the notes to those statements included in this prospectus. The summary consolidated statements of operations data for the fiscal years ended March 31, 1998 and 1999 are derived from our consolidated financial statements not included in this prospectus. The summary "as adjusted" consolidated balance sheet data as of December 31, 2002 gives effect to the receipt and application of the net proceeds from the sale of shares of common stock we are offering at an assumed initial offering price of $ per share after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

| | Fiscal Year Ended March 31,

| | Nine Months Ended

December 31,

|

|---|

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | 2001

| | 2002

|

|---|

| | (In Thousands, Except Per Share Data)

|

|---|

| Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | | |

| Revenue: | | | | | | | | | | | | | | | | | | | | | |

| | License | | $ | 24,820 | | $ | 27,362 | | $ | 41,683 | | $ | 46,908 | | $ | 38,787 | | $ | 25,802 | | $ | 28,394 |

| | Maintenance and other | | | 7,495 | | | 10,439 | | | 20,366 | | | 28,728 | | | 33,962 | | | 25,319 | | | 30,664 |

| | Third-party products | | | 16,623 | | | 14,124 | | | 12,069 | | | 10,292 | | | 5,540 | | | 4,336 | | | 3,513 |

| | |

| |

| |

| |

| |

| |

| |

|

| | | | Total revenue | | | 48,938 | | | 51,925 | | | 74,118 | | | 85,928 | | | 78,289 | | | 55,457 | | | 62,571 |

| Amortization of acquired intangibles | | | — | | | — | | | 277 | | | 1,347 | | | 1,636 | | | 1,228 | | | 1,228 |

| Cost of revenue | | | 21,282 | | | 20,845 | | | 25,737 | | | 29,288 | | | 24,945 | | | 18,103 | | | 18,495 |

| | |

| |

| |

| |

| |

| |

| |

|

| Gross profit | | | 27,656 | | | 31,080 | | | 48,381 | | | 56,640 | | | 53,344 | | | 37,354 | | | 44,076 |

| Amortization of goodwill and other intangibles | | | — | | | — | | | 60 | | | 4,644 | | | 6,567 | | | 4,949 | | | 2,141 |

| Acquired in-process research and development | | | — | | | — | | | 60 | | | 3,900 | | | — | | | — | | | 110 |

| Operating expenses | | | 21,029 | | | 25,124 | | | 38,140 | | | 71,769 | | | 63,483 | | | 51,046 | | | 38,757 |

| | |

| |

| |

| |

| |

| |

| |

|

Income (loss) from

operations | | | 6,627 | | | 5,956 | | | 10,241 | | | (15,129 | ) | | (10,139 | ) | | (13,692 | ) | | 5,319 |

| | |

| |

| |

| |

| |

| |

| |

|

| Net income (loss) | | $ | 4,131 | | $ | 3,043 | | $ | 6,187 | | $ | (11,167 | ) | $ | (10,564 | ) | $ | (13,236 | ) | $ | 2,569 |

| | |

| |

| |

| |

| |

| |

| |

|

| Net income (loss) per share: | | | | | | | | | | | | | | | | | | | | | |

| | Basic | | $ | 0.38 | | $ | 0.28 | | $ | 0.57 | | $ | (1.04 | ) | $ | (0.98 | ) | $ | (1.23 | ) | $ | 0.24 |

| | Diluted | | | 0.38 | | | 0.28 | | | 0.56 | | | (1.04 | ) | | (0.98 | ) | | (1.23 | ) | | 0.23 |

| Shares used in per share computation: | | | | | | | | | | | | | | | | | | | | | |

| | Basic | | | 10,800 | | | 10,773 | | | 10,773 | | | 10,773 | | | 10,773 | | | 10,773 | | | 10,812 |

| | Diluted | | | 10,800 | | | 10,773 | | | 11,103 | | | 10,773 | | | 10,773 | | | 10,773 | | | 11,089 |

| | As of December 31, 2002

|

|---|

| | Actual

| | As Adjusted

|

|---|

| | (In Thousands)

|

|---|

| Consolidated Balance Sheet Data: | | | | | | |

| Cash and cash equivalents | | $ | 13,751 | | $ | |

| Working capital (deficit) | | | (18,305 | ) | | |

| Total assets | | | 65,280 | | | |

| Note payable to Computer Associates | | | 16,195 | | | |

| Stockholders' equity | | | 1,923 | | | |

5

RISK FACTORS

An investment in our common stock involves risks. You should carefully consider the risks described below and the other information in this prospectus including our financial statements and the related notes before you decide to buy our common stock. If any of the following risks actually occur, our business could be harmed, the market price of our common stock could decline and you may lose all or part of your investment.

Risks Related to Our Business

We have incurred losses in the past and may again incur net losses in the future.

We incurred a net loss in the first quarter of fiscal 2003, in the first, second and third quarters of fiscal 2002 and in the second, third and fourth quarters of fiscal 2001. While we are presently profitable, we may again incur net losses in fiscal 2003 and possibly longer. If we incur net losses in the future, we may not be able to hire additional personnel or make necessary investments in application development, sales, marketing or customer support. Although we have been profitable for certain periods in the recent past, we do not know if we will be able to maintain profitability.

Additionally, in December 2002, we acquired eWare Limited, a private software company located in Ireland. During the period from January 1, 2002 to December 18, 2002, eWare incurred net losses of approximately $0.9 million. eWare could continue to incur losses for the foreseeable future as our subsidiary. Such losses, if any, would be included in our consolidated operating results.

Our quarterly revenue and operating results fluctuate significantly, and a decline in revenue or operating results may disappoint securities analysts or investors and may result in a decline in our stock price.

Our quarterly operating results have fluctuated significantly in the past and may vary significantly in the future. If our operating results are below the expectations of securities analysts or investors, our stock price is likely to decline. Fluctuations in our quarterly operating results may be caused by a number of factors, including:

- •

- timing of customer orders;

- •

- deferrals of customer orders in anticipation of application enhancements or new applications;

- •

- costs related to acquisition of technologies or businesses;

- •

- timing of our development and release of new applications or enhancements to existing applications;

- •

- customer budget cycles and changes in these budget cycles;

- •

- higher than expected product returns or bad debt expense;

- •

- success in maintaining and enhancing existing relationships and developing new relationships with channel partners;

- •

- actions taken by our competitors, including new product introductions and pricing changes;

6

- •

- the publication of opinions about our applications or our competitors by industry analysts, opinion influencers or others;

- •

- costs of maintaining and expanding our operations;

- •

- costs and timing of hiring qualified personnel; or

- •

- technological changes in our market, including changes in standards for protocols, platforms and operating systems applicable to software, hardware and networking environments.

In addition, in accordance with accounting principles generally accepted in the United States, we may be required to recognize impairment charges for certain long-lived assets, including goodwill, to reduce the carrying value of those assets to their estimated fair value. Impairment charges in any period will further increase the fluctuations in, and may depress, our operating results.

In part as a consequence of the foregoing, we believe that our quarterly operating results are likely to vary significantly in the future. We also expect to continue to experience seasonality in our business. In recent years, we have recognized a proportionately lower percentage of our revenue in our first fiscal quarter. As a result, we believe that period-to-period comparisons of our historical results of operations are not a good predictor of our future performance.

Our expenditures are tied to anticipated revenue, and therefore imprecise forecasts may result in poor operating results.

Our expense levels are based, in part, on our expectations of our future revenue and are to some extent fixed. However, our revenue is difficult to forecast because even though maintenance and other revenue is often based on orders booked in prior quarters, we generally ship software products within a short period after receipt of an order and do not have a material backlog of unfilled orders. As a result, license revenue in any quarter is substantially dependent on orders booked in that quarter. We may be unable to adjust spending in a timely manner to compensate for any unexpected revenue shortfall. Any significant shortfall of demand in relation to our expectations and our spending would depress our operating results and impair our ability to maintain or achieve profitability.

Downturns in the software market, and in the SOHO and the SMB markets in particular, may decrease our revenue and profit margins.

The market for our applications depends on economic conditions affecting the broader software market. Downturns in the economy may cause businesses to delay or cancel technology purchases and reduce their overall information technology budgets. During weak economic periods, customers may experience financial difficulty, fail to budget or defer the budget for the purchase of our applications, or cease operations. This, in turn, may lead to longer sales cycles, delays or failures in payment and collection, and price pressures, causing us to realize lower revenue and profit margins. In particular, capital spending in the information technology sector generally has decreased since mid-2000. Any significant downturn in the SOHO or SMB markets, in particular, or in general economic conditions which result in the reduction of information technology budgets or the delay in software purchases would likely result in a reduction in demand for our applications and services and could decrease our revenue and margins.

7

If our products and services fail to maintain or achieve market acceptance, our business and results of operations will suffer.

Our products and services may fail to achieve or maintain market acceptance for any or all of the following reasons:

- •

- customers may not need the functionality provided by our products and services;

- •

- customers may opt to achieve the functionality provided by our products or services through non-software-based methods;

- •

- we may fail to respond and adapt to technological change and changing customer requirements;

- •

- our competitors may introduce superior applications or applications with greater marketing support or lower prices;

- •

- we may fail to improve our existing applications or fail to develop and introduce applications with new or enhanced capabilities;

- •

- we may experience significant delays in the development or introduction of new applications or upgrades;

- •

- we may receive negative publicity about our company or our products;

- •

- we may fail to integrate our applications with multiple platforms and existing, or legacy, systems; or

- •

- we may fail to have access to application interfaces that are used for communication between external software products and packaged application software.

The occurrence of one or more of these events may harm our current or future results of operations.

We face intense competition from businesses with significantly greater financial, technical and marketing resources, which could harm our ability to maintain or increase sales of our applications.

The market for business management applications is extremely competitive, evolving and subject to rapid technological change. We have experienced competition to date from both established and emerging software businesses that offer similar products and services targeted at our markets. We also face competition from local businesses in the international markets in which we compete. This competition may increase in the future.

Many competitors have more financial, technical and marketing resources, broader customer relationships and greater name recognition than we do. Our competitors may also bundle their software with other software or enter into agreements with third parties to sell their software. In addition, if one of our competitors is acquired by a well-capitalized company, we could face increased competition. For example, Microsoft has acquired two of our competitors, Great Plains and Navision, and has announced its intention to actively pursue the SMB market. If competitors lower their prices, we may be forced to match price cuts and decrease our profitability. We may not be able to design new products or improve existing ones to maintain our competitive position in the industry. Any of these competitive pressures from current and future competitors could harm our ability to sell our products.

8

We rely primarily on partners in our distribution channel to sell, install and service the products from which we derive the majority of our revenue, and if we do not maintain our existing relationships or establish new relationships with these channel partners, or our channel partners are not successful in their sales or services efforts, our results of operations would suffer.

We depend upon our channel partners to sell, install and service the products from which we derive the majority of our revenue. If we are unable to extend or leverage relationships with existing channel partners or to add new channel partners to effectively market our products, our revenue may decline. In addition, we cannot control the level and quality of service provided by our channel partners, which could harm our reputation and future sales efforts. Our channel partners operate independently from us, are not contractually required to sell our products and may sell or give higher priority to competing products. In addition, our channel partners may fail to:

- •

- aggressively market or sell our products;

- •

- maintain their relationships with us;

- •

- sell customers the products that suit the customers' needs; or

- •

- properly install, implement or support our products.

The occurrence of one or more of these events will cause our results of operations to suffer.

We depend on applications licensed from software developers, and our ability to develop and sell our products and services could be delayed or impaired if these license arrangements are terminated.

Our strategic products include customized business management applications that we license and then market under the ACCPAC brand. These applications have been customized to integrate with our accounting suites and include:

- •

- ACCPAC HR Series, a human resources application;

- •

- ACCPAC Warehouse Management System, a warehouse management application; and

- •

- ACCPAC Exchange, an Internet-based business-to-business transaction exchange application.

These license agreements generally have terms of between three and five years and provide for automatic renewal unless we fail to meet minimum royalty obligations to the licensor when due and may be terminated by the licensor if we materially breach our obligations under these agreements. These software licenses may not continue to be available on commercially reasonable terms, if at all. Our loss of or inability to maintain these software licenses could cause us to lose revenue and incur substantial costs to license or develop alternative product offerings. We may be unable to license or develop comparable alternative products that integrate with our product offerings in a timely manner, if at all, which could harm our business and impair our future growth.

In addition, we bundle with our products software applications that we license from other parties, such as Microsoft, which is one of our competitors, and Crystal Decisions. This licensed software may not continue to be available on commercially reasonable terms or with acceptable levels of support, or at all. Our loss of or inability to maintain these software licenses could delay

9

or impair the sale of our products and services until comparable software, if available, is identified, licensed, developed and integrated with our applications, which could harm our business and impair our future growth.

Our software products, and the applications with which they integrate, may contain errors or design defects, which may cause delays in product introduction and shipments, require design modifications and result in customer dissatisfaction, negative publicity, litigation and potential liability.

The interactions by our applications and other integrated applications with our customers' software applications and information technology systems are complex and, accordingly, there may be undetected errors or design defects when applications are introduced or as new versions are released. In the past, we have discovered integration, implementation and software errors in our new releases and new applications after their introduction, which have resulted in additional research and development expenses. Such errors may result in application release delays, delayed revenue, customer dissatisfaction, negative publicity, litigation and potential liability, and may require us to create and release service patches or service packs to solve these problems, which in turn could be time consuming and expensive. In many cases, our applications integrate with software developed by third parties, and any errors or design defects in this software could harm the marketability of our applications. Since many customers use our applications for core business operations, any of these occurrences could generate negative publicity and subject us to litigation and potential liability.

If we fail to introduce new versions or releases of our applications in a timely manner, our revenue may decline.

We believe that we must continue to enhance our current applications while we concurrently develop and introduce new applications in anticipation of emerging technology standards and keep pace with competitive and technological developments. Our accounting applications must be routinely updated for changes in laws, regulations and generally accepted accounting principles in order to maintain their accuracy and competitiveness. These necessary software changes and updates could require us to make a significant investment in modifications of our accounting applications, which would increase our development costs, reduce our operating margins and harm our financial condition. If our new releases or applications are delayed or do not achieve market acceptance, we could experience a delay in the recognition of, or loss of, revenue.

We derive a substantial amount of our revenue from international sources and risks associated with selling our applications outside of the United States may harm our business.

For the fiscal year ended March 31, 2002, and nine months ended December 31, 2002, we derived approximately 57% and 60%, respectively, of our total revenue from sales outside of the United States. We currently have foreign offices in Australia, Canada, India, Ireland, Mexico, the Netherlands, Singapore, South Africa, the United Arab Emirates and the United Kingdom, and we have customers in over 130 countries. We may not be able to maintain and expand our activities in international markets. Even if we are able to successfully expand our international operations, we cannot be certain that we will be able to maintain or increase international market demand for our applications.

10

Our sales in international markets are denominated in foreign currencies and then translated into U.S. dollars for accounting purposes. As a result, a decline in the value of such currencies relative to the value of the U.S. dollar may decrease the amount of revenue reported from international operations, and an increase relative to the U.S. dollar could increase our expenses in such jurisdictions.

In addition, there are other risks in doing business in international markets, such as:

- •

- local economic or market conditions;

- •

- unexpected changes in regulatory requirements;

- •

- export controls relating to encryption technology and other export restrictions;

- •

- tariffs and other trade barriers;

- •

- longer sales cycles;

- •

- reduced protection for intellectual property rights in some countries combined with a greater incidence and acceptance of software piracy;

- •

- political instability, threats or acts of terrorism, or sabotage;

- •

- potentially adverse tax consequences;

- •

- difficulties in staffing and managing foreign operations; and

- •

- potential liability associated with possible errors that may occur in the translation or localization of our applications for specific countries.

The occurrence of one or more of these factors may harm our business.

11

Security risks expose us to additional costs and to litigation which could harm our business.

Anyone who circumvents our security measures or the security measures of third parties on which we rely could misappropriate proprietary information or cause disruptions in our services or operations. The Internet is a public network, and data is sent over this network from many sources. We rely on standard encryption and authentication technology to provide security and authentication to effect the secure exchange of confidential information over the Internet. We also have redundant systems and disaster recovery plans. Despite these security measures, our applications may be vulnerable to unauthorized and illegal access, sabotage, computer viruses and other disruptive problems, including natural disasters. Eliminating computer viruses and addressing other security problems and disasters may cause either loss or compromise of data, or interruptions, delay or cessation of service to users accessing our business management applications via the Internet, which could harm our business, expose us to risk of loss or litigation and possible liability. We may be required to expend significant capital or other resources to protect against the threat of security breaches or to alleviate problems caused by breaches.

We rely on third parties to host our applications that allow the exchange of information over the Internet. Generally, Internet service providers and online service providers have in the past experienced, and may in the future experience, interruptions in service as a result of the accidental or intentional actions of Internet users, current and former employees, or others. We cannot be certain that the third parties who host our applications have adequate security measures and disaster recovery plans in place or that such measures or plans are implemented adequately.

Our security measures, and those of third parties on which we rely may be inadequate to prevent security breaches or disruptions in service, and our business would be harmed if we or they do not prevent them.

We depend on the increasing use of the Internet and the growth of electronic commerce. If the Internet and electronic commerce do not grow as anticipated, our revenue could decline and our business will be harmed.

We depend on the increased acceptance and use of the Internet as a medium for electronic commerce and the adoption by businesses of Internet-based business solutions. Acceptance and use of the Internet may not continue to develop at historical rates and a sufficiently broad base of SMB customers may not adopt or continue to use the Internet as a medium of commerce. Demand and market acceptance for recently introduced services and products over the Internet are subject to a high level of uncertainty and there exist few proven Internet-based services and products for the SMB market.

The measures on which we rely to protect our intellectual property rights, and to protect the intellectual property that we license from third parties, offer only limited protection, and failures to protect such intellectual property could harm our business.

Our ability to compete successfully and achieve future revenue growth will depend, in part, on our ability to protect our intellectual property and the ability of third parties to protect the intellectual property that we license from them. We may not be able to successfully protect our intellectual property and third parties may not be able to successfully protect the intellectual property that we license from them, which in either case could harm our business.

12

To establish and protect our proprietary rights in our applications, we rely on a combination of copyright, trademark and trade secret laws, a mandatory software registration mechanism in certain applications, confidentiality and non-disclosure agreements with our employees, licensing arrangements with our customers and limitations on access to and distribution of our proprietary information. We have no patents or material patent applications pending, and existing trade secret and copyright laws provide only limited protection of our proprietary rights. In addition, the laws of certain countries in which our applications are sold do not protect our intellectual property rights to the same extent as the laws of the United States. We currently license most of our applications under shrink-wrap or click-through licenses that are not signed by our licensees. These shrink-wrap or click-through licenses may be unenforceable under the laws of certain jurisdictions. Attempts may be made to copy or reverse engineer aspects of our applications or to obtain and use information we regard as proprietary. We have also historically released the source code to some of our legacy applications and to ACCPAC Pro Series to certain of our customers. This availability may increase the likelihood of misappropriation or other misuse of our intellectual property. Additionally, prior versions of ACCPAC Simply Accounting did not include an activation code mechanism and therefore were particularly susceptible to unauthorized copying and distribution. We believe that at least three parties have unlawfully copied and distributed our products. We have initiated a lawsuit against one of these parties and are evaluating whether to pursue litigation against others. Policing unauthorized use of applications is difficult and expensive litigation may be necessary in the future to enforce our intellectual property and proprietary technology rights.

Our applications, trademarks and other intellectual property could infringe or be alleged to infringe the intellectual property rights of others causing costly litigation and the loss of significant rights.

As the number of patents, copyrights and other intellectual property rights in the software industry increases, and as the coverage of these rights and the functionality of these products in the market further overlap, we believe that software developers and distributors may increasingly become the subject of infringement claims and related litigation. Such claims or litigation, with or without merit, could result in substantial costs and diversion of our management's time and other resources. From time to time, we have been subject to claims by third parties that some of our intellectual property infringes on their rights. To date, these claims have not harmed our business. However, in the event an infringement claim against us is successful and we cannot obtain a license on acceptable terms, license a substitute technology or redesign our applications to avoid infringement, our business would be harmed. Furthermore, former employers of our current or future employees may assert that our employees have improperly disclosed to us or are using their confidential or proprietary information.

In addition, we license technology from third parties, and it is possible that we could become a party to infringement actions based upon the licenses from those third parties. Such claims, with or without merit, could subject us to costly litigation and the diversion of our management.

Recent and future acquisitions could disrupt our business, dilute stockholder value, decrease our operating results or disappoint analysts or investors and cause a decline in our stock price.

We have acquired a number of businesses in the past and we may acquire other businesses in the future. If we do acquire a business, we could have difficulty retaining and assimilating that business' personnel. In addition, we could have difficulty assimilating acquired products, services or

13

technologies into our operations. These difficulties could disrupt our ongoing business, distract our management and employees, increase our expenses and harm our business.

In December 2002, we acquired eWare Limited, a private software company located in Ireland. Although we had been selling eWare products prior to the acquisition, we have not yet fully integrated eWare's business into ours. We cannot guarantee that we will realize any of the benefits and strategic objectives we are seeking to obtain by acquiring eWare, or that we will successfully integrate eWare's operations into ours.

We may incur debt or issue equity securities to pay for any future acquisitions. If we issue equity securities, your percentage ownership would be diluted. Additionally, analysts or investors may disapprove of an acquisition on the grounds that we overpaid for the business or the acquired business does not further our strategic goals, either of which could result in a decline in our stock price.

A potential new accounting pronouncement may cause our net income to decrease.

We currently account for employee stock options using the intrinsic-value method in accordance with Accounting Principles Board Opinion No. 25,Accounting for Stock Issued to Employees, and have not recognized any compensation expense for awards of employee stock options in the fiscal years ended March 31, 2000, 2001 and 2002 and the nine months ended December 31, 2002. Statement of Financial Accounting Standards No. 123,Accounting for Stock-Based Compensation, permits us to continue accounting for stock-based compensation as set forth in APB 25, provided we disclose the pro forma effect on net income (loss) and net income (loss) per share of using a fair value method of accounting for stock-based employee compensation plans. If we changed our method of accounting for employee stock options, whether voluntarily or as a result of changes in accounting rules, it could materially decrease our net income.

14

Risks Relating to Computer Associates

We will be controlled by Computer Associates as long as it owns a majority of our common stock, and our other stockholders will not be able to affect the outcome of stockholder votes during that time.

Following the offering, Computer Associates will own approximately % of our outstanding common stock, or approximately, % if the underwriters exercise their over-allotment option in full. As a result, as long as Computer Associates owns a majority of our outstanding common stock, it will be able to exercise control over all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions, such as any proposed merger. In addition, Computer Associates is not prohibited from selling a controlling interest in our common stock to a third-party.

We may experience conflicts of interest with Computer Associates, and because of Computer Associates' controlling interest, we may not resolve these conflicts on terms that are favorable to us.

We may experience conflicts of interest with Computer Associates, and the resolution of such conflicts may be less favorable than if we were dealing with an unaffiliated party. We have entered into certain agreements with Computer Associates. These agreements may be amended in the future, and because of Computer Associates' controlling interest, such amendments may be less favorable to us than the current terms of the agreements. See "Certain Transactions—Transactions with Computer Associates" for a description of our agreements with Computer Associates.

Our certificate of incorporation includes provisions designed to address our relationship with Computer Associates. Among other things, these provisions provide that:

- •

- Computer Associates and its officers and directors will not be liable to us or our stockholders for breach of any fiduciary duty by reason of any activities of Computer Associates in competition with us;

- •

- Computer Associates will have no duty to communicate or offer corporate opportunities to us and will not be liable for breach of any fiduciary duty as a stockholder by reason of the fact that Computer Associates pursues or acquires a corporate opportunity for itself, directs a corporate opportunity to another person or does not communicate information regarding a corporate opportunity to us; and

- •

- business opportunities that may be suitable for both us and Computer Associates will be allocated between the parties based on principles set forth in our certificate of incorporation.

As a result of Computer Associates' majority ownership of our common stock and the provisions of our certificate of incorporation, Computer Associates may take opportunities for itself or may require us to take actions which may not be in the best interests of our other stockholders. See "Description of Capital Stock — Corporate Opportunities" for additional information on the allocation of corporate opportunities between Computer Associates and ACCPAC.

15

A member of our board of directors may have duties to Computer Associates that conflict with his duties to ACCPAC and our stockholders, and we do not have any plan to resolve potential conflicts.

Currently, Alfonse D'Amato is a member of our board of directors and the board of directors of Computer Associates. Mr. D'Amato has fiduciary duties to Computer Associates and its stockholders. He also has fiduciary duties to ACCPAC and our stockholders. In some circumstances, Mr. D'Amato's duties to Computer Associates and its stockholders, including his time commitments, may conflict with his duties as a director of ACCPAC. We do not have any plan or agreement with Computer Associates that would determine how to resolve potential conflicts of interest. Moreover, we may not be able to resolve any potential conflicts, and any resolution may be less favorable than if we were dealing with an unaffiliated party.

Our stock price may suffer so long as Computer Associates or another entity continues to own a substantial portion of our common stock.

The liquidity of our common stock in the market could be constrained unless and until Computer Associates elects to sell or distribute some significant portion of its shares of our common stock to unaffiliated persons. The potential sale of our shares by Computer Associates could harm the market price of our common stock. In addition, because of the relatively limited liquidity of the market for our common stock, relatively small trades of our common stock may have a disproportionate effect on our common stock price.

Risks Related to the Offering

The substantial number of shares that will be eligible for sale in the near future by Computer Associates and other stockholders may cause the market price for our common stock to decline.

Sales of substantial numbers of shares of our common stock in the public market following this offering could cause the market price of our common stock to decline. In addition, the perception that a sale or divestiture by Computer Associates could occur could also harm the market price for our common stock. The number of shares of common stock available for sale in the public market is limited by restrictions under federal securities laws and under agreements that some of our stockholders, including Computer Associates, have entered into with the underwriters. Those lock-up agreements restrict those stockholders from selling, pledging or otherwise disposing of their shares for a period of 180 days after the date of this prospectus without the prior written consent of RBC Dain Rauscher Inc. However, RBC Dain Rauscher Inc. may, in its sole discretion, release all or any portion of the common stock from the restrictions in the lock-up agreements. The following table indicates approximately when the 11,499,055 shares of our common stock that are not being sold in this offering but which were outstanding as of December 31, 2002, will be eligible for sale into the public market:

| | Eligibility of Restricted Shares

for Sale in Public Market

|

|---|

| On the date of this prospectus | | 83,400 |

| 90 days after the date of this prospectus | | 500 |

| 180 days after the date of this prospectus (subject to compliance with Rule 144 in certain cases) | | 11,415,155 |

16

In addition, of the 2,885,000 shares issuable upon exercise of options to purchase our common stock as of December 31, 2002, approximately 1,295,951 shares will be vested and eligible for sale 180 days after the date of this prospectus. We intend to file a registration statement on Form S-8 with the Securities and Exchange Commission covering 5,999,500 shares reserved for issuance under our stock option plans and employee stock purchase plan. For a further description of the eligibility of shares for sale into the public market following this offering, please see "Shares Eligible for Future Sale."

Failure to raise additional capital or generate significant capital necessary to expand our operations and invest in new applications could reduce our ability to compete and result in lower revenue.

We currently anticipate that the net proceeds from this offering, together with our current cash and cash equivalents and cash from operations, will be sufficient for us to meet our anticipated cash needs for working capital and capital expenditures for at least the next 12 months. After that, we may need to raise additional funds, and we cannot be certain that we will be able to obtain additional financing on favorable terms, or at all. If we need additional capital and cannot raise it on acceptable terms we may not be able to, among other things:

- •

- develop or enhance our applications or services;

- •

- expand our domestic or international operations;

- •

- respond to competitive pressures or unanticipated capital requirements;

- •

- hire, train or retain employees; or

- •

- acquire complementary technologies or businesses.

Our failure to do any of these activities could result in lower revenue and harm our business.

If we raise additional funds through public or private equity or convertible debt financings, your percentage ownership of ACCPAC will be reduced and the value of your common stock may be diluted. We may also issue securities with rights, preferences and privileges that are senior to our common stock without further action by our stockholders. For more information regarding our ability to issue these types of securities, see "Description of Capital Stock."

The market price of our stock is likely to experience extreme price and volume fluctuations, and you may lose all or part of your investment.

There has been no prior public market for our common stock. An active public market for our common stock may not develop or be sustained after the offering, and therefore we cannot predict how liquid this market will become. The initial public offering price will be determined by negotiations among our management and board of directors and representatives of the underwriters and may not be indicative of future market prices. See "Underwriting" for information regarding the method of determining the initial public offering price. As a result, you may be unable to sell your shares of common stock at or above the offering price. The market price of our common stock may fluctuate significantly in response to the following factors, most of which are beyond our control:

- •

- variations in operating results;

- •

- changes in earnings estimates by analysts or changes in estimates of our financial performance;

17

- •

- changes in market valuation of similar companies; and

- •

- announcements of technological innovations, new products, acquisitions, strategic partnerships, joint ventures or capital commitments by us or our competitors.

In addition, in recent years the stock market in general, and the shares of technology companies in particular, have experienced extreme price fluctuations. This volatility has had a substantial effect on the market prices of securities issued by many companies for reasons unrelated to the operating performance of the specific companies, such as general economic and political conditions including recessions and military conflicts. A continuation of these broad market fluctuations may harm the market price of our common stock.

We may be subject to securities class action litigation, which could distract management and result in substantial costs.

In the past, securities class action litigation has often been brought against a company following periods of volatility in the market price of its securities. This risk is especially acute for us because technology companies have experienced greater than average stock price volatility in recent years and as a result have been subject to a greater number of securities class action claims than companies in other industries. We therefore believe that we may in the future be the target of similar litigation. Securities litigation could result in substantial costs and divert management's attention and resources, which could harm our business.

We have broad discretion over the use of the proceeds from this offering and may fail to use them to effectively grow our business.

We will have significant flexibility in using the proceeds we receive from this offering and may fail to use the proceeds to effectively grow our business. Because the proceeds are not allocated for any specific purpose, you will not be able, as part of your investment decision, to determine the value or appropriateness of our use of the proceeds.

New investors in our common stock will experience immediate and substantial dilution.

The offering price is substantially higher than the book value per share of our common stock. Investors purchasing common stock in the offering will, therefore, incur immediate and substantial dilution of $ in net tangible book value per share of common stock based on an assumed initial public offering price of $ per share. Investors will incur additional dilution upon the exercise of outstanding stock options. See "Dilution" for a more detailed discussion of the dilution new investors will incur in this offering.

18

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. Forward-looking statements relate to future events or future financial performance. Words such as "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "should," "will" and variations of these words and similar expressions are generally used to identify forward-looking statements, but are not the exclusive expressions of forward-looking statements. These statements are only predictions and are not guarantees of future performance. Actual events or results may differ materially. In evaluating these forward-looking statements, you should specifically consider various factors, including:

- •

- our ability to compete effectively;

- •

- economic conditions in the software market;

- •

- our ability to achieve market acceptance of our products;

- •

- our ability to maintain relationships with resellers; and

- •

- our ability to maintain relationships with licensors.

You should also consider the risks outlined under "Risk Factors." These factors may cause our actual results to differ materially from any forward-looking statement. You should not place undue reliance on these forward-looking statements.

Although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievement. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of such statements. We are under no duty to update any of the forward-looking statements after the date of this prospectus to conform such statements to actual results.

MARKET AND INDUSTRY DATA

The market and industry data we have included in this prospectus is derived from independent publications. We have not independently verified this market and industry information, and we cannot assure you that it is accurate or complete.

19

USE OF PROCEEDS

We estimate that we will receive net proceeds from the sale of shares of our common stock in this offering of approximately $ , assuming an initial public offering price of $ per share and after deducting underwriting discounts and commissions and estimated expenses of $ . We estimate that we will receive additional net proceeds of up to $ if the underwriters' over-allotment option is exercised in full. We will not receive any proceeds from the sale of shares by the selling stockholder.

We intend to use the net proceeds, including amounts we may receive from the exercise of the underwriters' over-allotment option, for working capital and general corporate purposes. We may also use a portion of the net proceeds to acquire additional businesses, products and technologies. However, we have no specific plans, agreements or commitments to do so and are not currently engaged in any negotiations for any acquisition.

We will retain broad discretion in the allocation of the net proceeds of this offering. Pending the uses described above, we intend to invest the net proceeds of this offering we receive in money-market funds or short-term interest-bearing, investment-grade securities. We cannot predict whether the proceeds invested will yield a favorable return. We believe that our available cash, together with the net proceeds of this offering, will be sufficient to meet our capital requirements for the next twelve months.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our capital stock. We currently intend to retain any future earnings to fund the development and growth of our business and therefore do not anticipate paying cash dividends in the foreseeable future. See "Description of Capital Stock."

20

CAPITALIZATION

The following table presents our capitalization as of December 31, 2002:

- •

- on an actual basis; and

- •

- as adjusted to reflect the sale of shares of common stock by us in this offering, assuming an initial public offering price of $ per share and after deducting underwriting discounts and commissions and estimated offering expenses of $ .

This information should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations," our consolidated financial statements and the notes to those statements included in this prospectus.

| | As of

December 31, 2002

|

|---|

| | Actual

| | As Adjusted

|

|---|

| | (In Thousands)

|

|---|

| Note payable to Computer Associates, less current portion | | $ | 10,855 | | $ | |

| | |

| |

|

| Stockholders' equity: | | | | | | |

| | Preferred stock, $0.01 par value; 5,000,000 shares authorized actual and as adjusted; no shares issued and outstanding actual and as adjusted | | | — | | | — |

| | Common stock, $0.01 par value; 100,000,000 shares authorized actual and as adjusted; 11,604,055 shares issued and outstanding actual and shares issued and outstanding as adjusted (1) | | | 116 | | | |

| | Common stock to be issued, $0.01 par value; 113,889 at December 31, 2002 | | | 1 | | | |

| | Additional paid-in capital | | | 15,176 | | | |

| | Deferred compensation | | | (1,650 | ) | | |

| | Accumulated deficit | | | (10,618 | ) | | |

| | Accumulated other comprehensive loss | | | (1,102 | ) | | |

| | |

| |

|

| Total stockholders' equity | | | 1,923 | | | |

| | |

| |

|

| Total capitalization | | $ | 12,778 | | $ | |

| | |

| |

|

The table excludes the following shares:

- •

- 2,885,000 shares subject to options outstanding as of December 31, 2002, at a weighted average exercise price of $7.46 per share;

- •

- 2,114,500 shares that we could issue under our stock option plans as of December 31, 2002; and

- •

- 113,889 restricted shares granted to eWare employees in January 2003; and

- •

- 1,000,000 additional shares that we could issue under our employee stock purchase plan subsequent to completion of the offering.

- (1)

- On December 18, 2002, we issued 761,110 shares of common stock in connection with our acquisition of eWare. We also issued 69,445 restricted shares to eWare executives and, in January 2003, 113,889 restricted shares to eWare employees. Of the shares we issued as acquisition consideration and as compensation to eWare executives, 707,220 are subject to a put option, entitling the holders of the shares to sell their shares to us for $5.82 per share. These shares are also subject to a call option, entitling us to repurchase the shares for $10.85 per share. These options are exercisable at any time during the 28-day period beginning November 19, 2003 and will terminate at the earlier of December 17, 2003 or the last business day prior to the effectiveness of a registration statement relating to the initial public offering of our common stock.

21

DILUTION

As of December 31, 2002, the net tangible book value (deficit) of our common stock was approximately ($29.7 million), or ($2.56) per share of common stock. Net tangible book value (deficit) per share represents the amount of our tangible assets less total liabilities, divided by the total number of shares of our common stock outstanding before this offering.

Dilution per share to new investors represents the difference between the amount per share paid by purchasers of our common stock in this offering and the net tangible book value per share of our common stock immediately after completion of this offering. After giving effect to the sale of shares of common stock by us in this offering, assuming an initial public offering price of $ per share and after deducting underwriting discounts and commissions and estimated offering expenses of $ , our net tangible book value as of December 31, 2002 would have been approximately $ million, or $ per share. This amount represents an immediate decrease in net tangible book value of $ per share to new investors purchasing shares of common stock in this offering. The following table illustrates this dilution:

| Assumed initial public offering price per share | | | | $ | |

| | Net tangible book value (deficit) per share as of December 31, 2002 | | (2.56 | ) | | |

| | Increase per share attributable to new investors | | | | | |

| Net tangible book value per share after this offering | | | | | |

| | | | |

|

| Dilution per share to new investors | | | | $ | |

| | | | |

|

The following table presents as of December 31, 2002 the differences between the number of shares of common stock purchased from us, the total consideration paid and the average price per share paid by existing stockholders and by the new investors purchasing shares in this offering. We used the assumed initial public offering price of $ per share, and we have not deducted underwriting discounts and commissions and estimated offering expenses in our calculations. The shares to be sold by the selling stockholder are excluded from the number of shares purchased by the new investors and included in the number of shares held by the existing stockholders in this table.

| | Shares Purchased

| | Total Consideration

| |

|

|---|

| | Average

Price Per

Share

|

|---|

| | Number

| | Percent

| | Amount

| | Percent

|

|---|

| Existing stockholders | | 11,604,055 | | | % | $ | 13,643,000 | | | % | $ | 1.18 |

| New investors | | | | | | | | | | | | |

| | Total | | | | | | | | | | | | |

Sales by the selling stockholder in this offering will have the following effect:

- •

- these sales will reduce the shares held by existing stockholders to shares, or % of the total shares outstanding after this offering; and

- •

- these sales will increase the shares held by new investors to , or % of the total shares outstanding after this offering.

22

The calculation of net tangible book value per share assumes no exercise of any outstanding stock options. As of December 31, 2002, we had options outstanding to purchase a total of 2,885,000 shares of our common stock at a weighted average exercise price of $7.46 per share. Investors in this offering will experience additional dilution if any of these outstanding options are exercised. See "Capitalization" and "Management—Employee Stock Plans."

If the underwriters exercise their over-allotment in full, the following will occur:

- •

- the number of shares of common stock held by existing stockholders will decrease to , or approximately % of the total number of shares of common stock outstanding;

- •

- the number of shares of common stock held by new investors will increase to , or approximately % of the total number of shares of common stock outstanding; and

- •

- the dilution per share to the new investors will be $ per share.

23

SELECTED CONSOLIDATED FINANCIAL DATA

The consolidated statements of operations data for the fiscal years ended March 31, 2000, 2001 and 2002 and the nine months ended December 31, 2002 and the consolidated balance sheet data as of March 31, 2001 and 2002 and December 31, 2002 are derived from our audited consolidated financial statements included in this prospectus. The consolidated statements of operations data for the fiscal years ended March 31, 1998 and 1999 and the consolidated balance sheet data as of March 31, 1998, 1999 and 2000 are derived from our audited consolidated financial statements not included in this prospectus. The consolidated statements of operations data for the nine months ended December 31, 2001 are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of results to be expected in future periods. The data set forth below should be read in conjunction with the "Management's Discussion and Analysis of Financial Condition and Results of Operations," the consolidated financial statements, and the notes to those statements included in this prospectus.

| | Fiscal Year Ended March 31,

| | Nine Months

Ended

December 31,

| |

|---|

| | 1998

| | 1999

| | 2000

| | 2001(1)

| | 2002

| | 2001

| | 2002

| |

|---|

| | (In Thousands, Except Per Share Data)

| |

|---|

| Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | | | |

| Revenue: | | | | | | | | | | | | | | | | | | | | | | |

| | License | | $ | 24,820 | | $ | 27,362 | | $ | 41,683 | | $ | 46,908 | | $ | 38,787 | | $ | 25,802 | | $ | 28,394 | |

| | Maintenance and other | | | 7,495 | | | 10,439 | | | 20,366 | | | 28,728 | | | 33,962 | | | 25,319 | | | 30,664 | |

| | Third-party products | | | 16,623 | | | 14,124 | | | 12,069 | | | 10,292 | | | 5,540 | | | 4,336 | | | 3,513 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Total revenue | | | 48,938 | | | 51,925 | | | 74,118 | | | 85,928 | | | 78,289 | | | 55,457 | | | 62,571 | |

| Cost of revenue: | | | | | | | | | | | | | | | | | | | | | | |

| | License | | | 4,675 | | | 5,192 | | | 9,386 | | | 10,598 | | | 8,862 | | | 5,941 | | | 5,419 | |

| | Maintenance and other | | | 1,937 | | | 3,306 | | | 5,351 | | | 9,407 | | | 10,394 | | | 7,554 | | | 9,478 | |

| | Third-party products | | | 14,670 | | | 12,347 | | | 10,723 | | | 7,936 | | | 4,053 | | | 3,380 | | | 2,370 | |

| | Amortization of acquired intangibles | | | — | | | — | | | 277 | | | 1,347 | | | 1,636 | | | 1,228 | | | 1,228 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Total cost of revenue | | | 21,282 | | | 20,845 | | | 25,737 | | | 29,288 | | | 24,945 | | | 18,103 | | | 18,495 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Gross profit | | | 27,656 | | | 31,080 | | | 48,381 | | | 56,640 | | | 53,344 | | | 37,354 | | | 44,076 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | |

| | Sales and marketing | | | 9,428 | | | 15,835 | | | 25,245 | | | 38,854 | | | 35,833 | | | 28,722 | | | 22,420 | |

| | Research and development | | | 3,916 | | | 3,905 | | | 5,693 | | | 10,415 | | | 10,343 | | | 8,236 | | | 6,598 | |

| | General and administrative | | | 4,885 | | | 5,384 | | | 7,082 | | | 13,956 | | | 10,740 | | | 9,139 | | | 7,488 | |

| | Amortization of goodwill and other intangibles | | | — | | | — | | | 60 | | | 4,644 | | | 6,567 | | | 4,949 | | | 2,141 | |

| | Stock-based compensation | | | 2,800 | | | — | | | — | | | — | | | — | | | — | | | — | |

| | Acquired in-process research and development | | | — | | | — | | | 60 | | | 3,900 | | | — | | | — | | | 110 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Total operating expenses | | | 21,029 | | | 25,124 | | | 38,140 | | | 71,769 | | | 63,483 | | | 51,046 | | | 38,757 | |

| Income (loss) from operations | | | 6,627 | | | 5,956 | | | 10,241 | | | (15,129 | ) | | (10,139 | ) | | (13,692 | ) | | 5,319 | |

| Other income (expense), net | | | (18 | ) | | (1,087 | ) | | 257 | | | 994 | | | (1,862 | ) | | (1,342 | ) | | (499 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Income (loss) before income taxes | | | 6,609 | | | 4,869 | | | 10,498 | | | (14,135 | ) | | (12,001 | ) | | (15,034 | ) | | 4,820 | |

| Provision (benefit) for income taxes | | | 2,478 | | | 1,826 | | | 4,311 | | | (2,968 | ) | | (1,437 | ) | | (1,798 | ) | | 2,251 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Net income (loss) | | $ | 4,131 | | $ | 3,043 | | $ | 6,187 | | $ | (11,167 | ) | $ | (10,564 | ) | $ | (13,236 | ) | $ | 2,569 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Net income (loss) per share: | | | | | | | | | | | | | | | | | | | | | | |

| | Basic | | $ | 0.38 | | $ | 0.28 | | $ | 0.57 | | $ | (1.04 | ) | $ | (0.98 | ) | $ | (1.23 | ) | $ | 0.24 | |

| | Diluted | | | 0.38 | | | 0.28 | | | 0.56 | | | (1.04 | ) | | (0.98 | ) | | (1.23 | ) | | 0.23 | |

| Shares used in per share computation: | | | | | | | | | | | | | | | | | | | | | | |

| | Basic | | | 10,800 | | | 10,773 | | | 10,773 | | | 10,773 | | | 10,773 | | | 10,773 | | | 10,812 | |

| | Diluted | | | 10,800 | | | 10,773 | | | 11,103 | | | 10,773 | | | 10,773 | | | 10,773 | | | 11,089 | |

- (1)

- In July 2000 we acquired Software Business Technologies, Inc., or SBT. The results of SBT's operations are included from the date of acquisition. See Note 5 of our notes to consolidated financial statements in this prospectus.

24

| | As of March 31,

| |

| |

|---|

| | As of

December 31, 2002

| |

|---|

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| |

|---|

| | (In Thousands)

| |

|---|

| Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 4,013 | | $ | 11,459 | | $ | 23,841 | | $ | 12,241 | | $ | 14,042 | | $ | 13,751 | |

| Working capital (deficit) | | | 3,788 | | | 829 | | | 4,368 | | | (33,448 | ) | | (11,455 | ) | | (18,305 | ) |

| Total assets | | | 13,990 | | | 27,370 | | | 42,200 | | | 73,049 | | | 60,602 | | | 65,280 | |

| Note payable to Computer Associates | | | 5,000 | | | — | | | — | | | — | | | 26,700 | | | 16,195 | |

| Total stockholders' equity (deficit) | | | (798 | ) | | 2,051 | | | 9,486 | | | (133 | ) | | (8,316 | ) | | 1,923 | |

25

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS