June 24, 2015

Ms. Tia L. Jenkins

Senior Assistant Chief Accountant

Office of Beverages, Apparel, and Mining

United States Securities and Exchange Commission

100 F Street, NE

Washington, DC, U.S.A.

20549

Form 40-F for the fiscal year ended December 31, 2014

Filed March 12, 2015

File No. 001-33414

Dear Ms. Jenkins:

I am writing in response to your letter dated June 5, 2015 in which you provide comments on the Form 40-F of Denison Mines Corp. (“Denison”) for the fiscal year ended December 31, 2014.

We are pleased to provide the following responses to your questions.

Exhibit 99.3

4. Critical Accounting Estimates and Judgments, page 12

(a) Determination of a Property to be Sufficiently Advanced

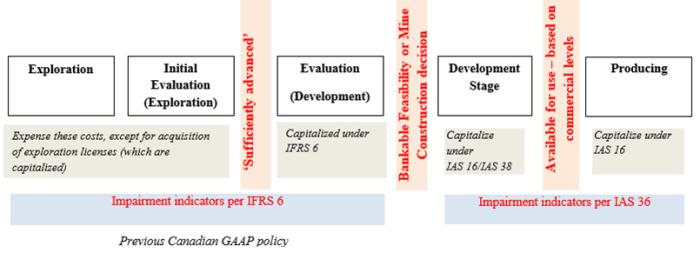

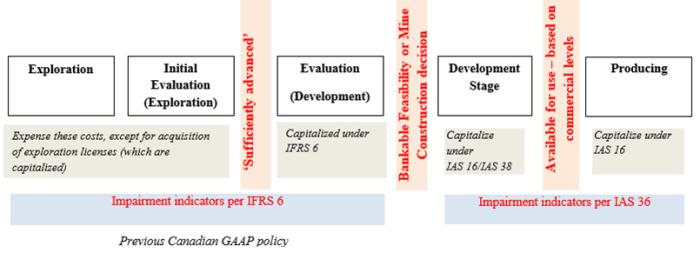

| 1. | The diagram in Exhibit A provides a breakdown of how Denison accounts for expenditures incurred over the life-cycle of a mine. |

Denison accounts for exploration and evaluation expenditures in accordance with IFRS 6.

Denison uses the term “sufficiently advanced” with reference to a property to explain that the Company has determined, in the context of current market conditions, that sufficient success has been achieved from exploration and other initial evaluation work on an area of interest, that suggest further evaluation work is warranted for the property. From this point onward, the costs to further evaluate and to establish the commercial and technical viability of these sufficiently advanced properties are capitalized as a component of the Company’s mineral properties.

Any general and administrative evaluation costs are expensed as incurred.

The Company describes the factors that it considers in assessing if a project has become “sufficiently advanced” in note 4(a) as part of its discussion around critical accounting estimates as follows:

“In determining whether or not a mineral property is sufficiently advanced, management considers a number of factors including, but not limited to: current uranium market conditions, the quality of resources identified, access to the resource and the suitability of the resources to current mining methods, ease of permitting, confidence in the jurisdiction in which the resource is located and milling complexity”

The Company acknowledges the application of IFRS 6 to these properties until commercial and technical viability has been established (IFRS 6 Paragraph 5(b)). This policy is consistent with the Company’s exploration and evaluation policy under Canadian GAAP and was carried forward when the Company adopted IFRS in 2011. The Company has taken the IFRS 6 initial adoption exemption under IFRS to carry forward the former policy on adoption of IFRS.

Once commercial and technical viability has been established, the Company considers these properties as development stage properties, and costs are capitalized under IAS 16/IAS 38 until commercial production is reached. At the point where commercial production is reached, the property is classified as producing.

The Company does not currently have any development stage properties or producing mines.

The Company confirms that the accounting policy contained in Note 3(h) will be updated as follows in the 2015 annual financial statement, for more clarity:

Exploration expenditures are expensed as incurred.

Evaluation expenditures are expensed as incurred, until an area of interest is considered by management to be sufficiently advanced. Once this determination is made, the area of interest is classified as an evaluation stage mineral property, a component of the Company’s mineral properties, and all further non-exploration expenditures for the current and subsequent years are capitalized. These expenses include further evaluation expenditures, such as mining method selection and optimization, metallurgical sampling test work and costs to further delineate the ore body to a higher confidence level.

Once commercial and technical viability has been established for a property, the property is classified as a development stage mineral property, and all further development cost are capitalized to the asset. Further development costs include costs related to constructing a mine, such as shaft sinking and access, lateral development, drift development, engineering studies and environmental permitting, infrastructure development and the costs of maintaining the site until commercial production.

Such capital costs represent the net expenditures incurred and capitalized as at the balance sheet date and do not necessarily reflect present or future values.

5. Acquisitions and Divestitures, page 13

| 2. | The facts and circumstances for the determination of whether the acquisitions were an asset or a business acquisition were considered to be very similar for all four (4) business combinations disclosed in Note 5 to the financial statements. |

The Company used the guidance per IFRS 3, Par. B7 and B10 in each instance to determine whether the transaction should be classified as a business combinations or an asset purchase. The Company concluded that all the transactions were asset acquisitions, on the basis that none of the acquired companies had sufficient inputs and processes available to support the generation of outputs that could provide a return to Denison.

In each case, the entities acquired were in early exploration stages. The only significant assets acquired consisted of properties being explored for uranium mineralization, the exploration rights on the properties and the results of the early stage exploration drilling. No other management processes were acquired that could create an output.

The early stage exploration drilling results, as a process on their own, do not have the ability to translate into outputs of uranium sales. Denison was unable to determine whether any of these properties will ever be developed into producing mine based on these early stage exploration drilling results. The decision to construct a mine and advance a property to a development stage, would require significant amounts of additional evaluation work, management time and industry expertise, including, where applicable, grass roots exploration and geophysical surveys to expand the mineralized foot print, further drilling to improve the confidence of estimated potential mineral resources, economic studies and project financing.

2

| 3. | Once a determination was made that the acquisitions disclosed in Note 5 were not subject to IFRS 3 (and the guidance in IFRS 3, para 53 for “acquisition-related costs” was therefore not applicable) management viewed the acquisition costs as part of the cost of the assets being acquired. Acquisition costs were capitalized in accordance with the guidance in IAS 16, par 17 (f). Only incremental professional fees associated with each acquisition were capitalized and were in the nature of expenditures related to legal fees, valuation specialists, tax advisors and stock exchange fees. |

11. Property and Equipment, page 20

| 4. | As disclosed, the Company made a strategic decision in 2012 to focus its efforts primarily on the Eastern Athabasca Basin region in northern Saskatchewan, Canada. To do this, the Company completed the sale of its US mining business in 2012 and subsequently announced that it is considering alternative options for its non-Canadian segments, including the possible disposal or spin-out of its Asian and African assets. Expenditures on assets in both Africa and Asia were subsequently reduced as part of Denison’s overall strategy to focus on its assets in Canada. |

The following is a summary of Denison’s impairment analysis at its most recent fiscal year-end for its Asia and Africa mining segments. The impairment analysis was carried out under the impairment considerations outlined in IFRS 6, para 20.

Asian Mining segment:

In the third quarter 2013, Denison first announced that it was exploring strategic alternatives for its 85% interest in the Gurvan Saihan Joint Venture (“GSJV”).

Since then, the Company has been engaged in negotiations with the Mongolia Government for a possible disposal or restructuring of its interest in the GSJV. Spending on the property was reduced to the minimum amounts required to maintain the properties in good standing. During 2014, negotiations were focused on a possible disposal of the Company’s interest in the GSJV to the government-owned 15% interest joint venture partner in the GSJV. All arms-length negotiations occurred in reference to a transaction value in excess of the carrying value of the interest, and the Company had no indication that the value would not be recoverable through a possible disposal transaction. The Company therefore did not identify an impairment trigger.

Though negotiations have started for the possible disposal of the Asian mining segment, the requirements of IFRS 5 have not been met requiring the Company to classify the Asian segment as held-for-sale as at December 31, 2014.

African segment:

The African segment includes operations in four (4) countries, each with only one primary project: Zambia, Mali, Namibia and Niger. The operations in each country are assessed separately, as individual regions, for impairment purposes.

3

In the third quarter 2013, Denison identified a number of impairment triggers related to its Mutanga project in Zambia, chief among them were planned reductions in program spending and headcount that was budgeted for 2014 and future years, and management’s publicly stated intention to evaluate the merits of a spin-out of Denison’s Zambian assets.

A preliminary impairment loss was recorded in the third quarter 2013 and finalized in the fourth quarter 2013, for an aggregate impairment loss of USD$46.1 million, to adjust the Mutanga project’s carrying amount to its recoverable amount of USD$30.0 million. The recoverable amount was supported by a valuation performed by an independent qualified valuator.

Since the end of 2013, the Company has maintained its mining licenses on the site in good standing, and has carried out targeted exploration programs, consistent with its strategy to minimize expenditures in Africa. The Company’s level of activity remains largely unchanged from the level of activity contemplated at the time of the 2013 impairment, and there were no significant changes in the other assumptions used to determine the recoverable amount for the 2013 impairment. The Company has also not noted any M&A activity for comparable uranium properties which would suggest the current carrying value is not recoverable. Denison has therefore not identified any impairment triggers for the project in 2014.

Both these projects were acquired in 2013 by Denison in arms-length transactions at fair value. Since the end of 2013, Denison has maintained its exploration rights in good standing and has sought renewals on those that have expired. The Company has also not noted any M&A activity for comparable uranium properties in these areas which would suggest that the carrying value of the project is not recoverable. As such, the Company has not identified any impairment triggers for the project in 2014.

The project was acquired in November 2013. In November 2014, Denison made the decision to exit all activities in the country of Niger and formally surrendered its exploration permits related to the project. The carrying value of the project rights was impaired to nil in the fourth quarter 2014.

* * *

In connection with this response to your comments, Denison acknowledges that: (i) Denison is responsible for the adequacy and accuracy of the disclosure in the Form 40-F filing; (ii) that SEC staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and (iii) Denison may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

4

We hope that the foregoing responses adequately address the SEC’s comments on the Form 40-F. We would be pleased to address any questions you may have on the foregoing or any further comments you may have. I can be reached at 416-979-1991, ext. 362.

Yours very truly,

DENISON MINES CORP.

David Cates, President and C.E.O.

| | cc: | Brian McAllister, SEC Staff Accountant |

Ron Hochstein, Denison Executive Chairman

Mac McDonald, Denison VP Finance and C.F.O.

Sheila Colman, Denison VP Legal

Catherine Stefan, Denison Chair of the Audit Committee

Craig Moffat, PwC Toronto Partner

Shona Smith, Troutman, Sanders LLP

5

Exhibit A: