UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X] Filed by a Party other than the Registrant [_]

Check the appropriate box:

[_] Preliminary Proxy Statement

[_] Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

[X] Definitive Proxy Statement

[_] Definitive Additional Materials

[_] Soliciting Material Pursuant to (S)240.14a-12

Hersha Hospitality Trust

- --------------------------------------------------------------------------------

(Name of Registrant as Specified In Its Charter)

- --------------------------------------------------------------------------------

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[_] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

Hersha Hospitality Trust

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 28, 2003

The annual meeting of the shareholders (the “Annual Meeting”) of Hersha Hospitality Trust (the “Company”), will be held at the Hampton Inn Hotel at 1301 Race Street, Philadelphia, PA on Wednesday, May 28, 2003, at 10:00 a.m., Eastern Standard Time, for the following purposes:

| (1) | To elect Class II Trustees to serve until the Annual Meeting of shareholders in 2005; and |

| (2) | To transact such other business as may properly come before the Annual Meeting and any adjournments thereof. |

Only shareholders of the Company of record as of the close of business on March 28, 2003, will be entitled to notice of, and to vote at, the Annual Meeting and any adjournments thereof.

There is enclosed, as a part of this Notice, a Proxy Statement that contains further information regarding the Annual Meeting and the nominees for election to the Board of Trustees of the Company.

In order that your shares may be represented at the Annual Meeting, you are urged to promptly complete, sign, date and return the accompanying Proxy in the enclosed envelope, whether or not you plan to attend the Annual Meeting. If you attend the Annual Meeting in person, you may vote personally on all matters brought before the Annual Meeting even if you have previously returned your proxy.

BY ORDER OF THE BOARD OF TRUSTEES

/s/ KIRAN P. PATEL

Kiran P. Patel

Secretary

April 11, 2003

HERSHA HOSPITALITY TRUST

PROXY STATEMENT

GENERAL INFORMATION

This Proxy Statement is provided in connection with the solicitation of proxies by the Board of Trustees of Hersha Hospitality Trust (the “Company”) for use at the annual meeting of shareholders to be held on May 28, 2003 (“Annual Meeting”) and at any adjournments thereof. The mailing address of the principal executive offices of the Company is 148 Sheraton Drive, Box A, New Cumberland, Pennsylvania 17070. This Proxy Statement and the Proxy Form, Notice of Meeting and the Company’s annual report to shareholders, all enclosed herewith, are first being mailed to the shareholders of the Company on or about April 11, 2003.

THE PROXY

The solicitation of proxies is being made primarily by the use of the mail. The cost of preparing and mailing this Proxy Statement and accompanying material, and the cost of any supplementary solicitations, which may be made by mail, telephone or personally by employees of the Company, will be borne by the Company. The shareholder giving the proxy has the power to revoke it by delivering written notice of such revocation to the Secretary of the Company prior to the Annual Meeting or by attending the meeting and voting in person. The proxy will be voted as specified by the shareholder in the spaces provided on the Proxy Form or, if no specification is made, it will be voted for the election of all of the nominees as trustees. In voting by proxy in regard to the election of the trustees, shareholders may vote in favor of the nominees, withhold their votes as to the nominees or withhold their votes as to a specific nominee.

No person is authorized to give any information or to make any representation not contained in this Proxy Statement and, if given or made, such information or representation should not be relied upon as having been authorized. This Proxy Statement does not constitute the solicitation of a proxy, in any jurisdiction, from any person to whom it is unlawful to make such solicitation in such jurisdiction. The delivery of this Proxy Statement shall not, under any circumstances, imply that there has not been any change in the information set forth herein since the date of the Proxy Statement.

Each outstanding Priority Class A common share of beneficial interest, $.01 par value (a “Priority Common Share”), and each outstanding Class B common share of beneficial interest, $.01 par value (a “Class B Common Share” and, together with the Priority Common Shares, the “Shares”), is entitled to one vote. Cumulative voting is not permitted. Only shareholders of record at the close of business on March 28, 2003 will be entitled to notice of and to vote at the Annual Meeting and at any adjournments thereof. At the close of business on March 28, 2003, the Company had outstanding 2,576,863 Priority Common Shares and no Class B Common Shares. The Priority Common Shares and the Class B Common Shares vote together as a class on all matters being submitted to shareholders at the Annual Meeting.

No specific provisions of the Company’s Declaration of Trust or Bylaws address the issue of abstentions or broker non-votes. Brokers holding shares for beneficial owners must vote those shares according to the specific instructions they receive from the owners. However, brokers or nominees holding shares for a beneficial owner may not have discretionary voting power and may not have received voting instructions from the beneficial owner with respect to voting on certain proposals. In such cases, absent specific voting instructions from the beneficial owner, the broker may not vote on these proposals. This results in what is known as a “broker non-vote.” A “broker non-vote” has the effect of a negative vote when a majority of the shares outstanding and entitled to vote is required for approval of a proposal, and “broker non-votes” will not be counted as votes cast but will be counted for the purpose of determining the existence of a quorum. Because the election of trustees is a routine matter for which specific instructions from beneficial owners will not be required, no “broker non-votes” will arise in the context of the election of trustees.

REPORTS OF BENEFICIAL OWNERSHIP

Under federal securities laws, the Company’s trustees and executive officers are required to report their ownership of the Shares and any changes in ownership to the Securities and Exchange Commission (the “SEC”). These persons are also required by SEC regulations to furnish the Company with copies of these reports. Based solely on its review of the copies of such reports received by it, or written representations from certain reporting persons that no reports were required for those persons, the Company believes that during 2002 its officers and trustees complied with all applicable filing requirements.

OWNERSHIP OF THE COMPANY’S PRIORITY COMMON SHARES

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the beneficial ownership of Shares by each of the Company’s trustees, each executive officer and all trustees and executive officers as a group as of March 28, 2003. Unless otherwise indicated, all shares are owned directly and the indicated person has sole voting and investment power. The number of shares includes shares that may be issued at the option of the Company upon the redemption of non-voting units of limited partnership interest (“Units”) in Hersha Hospitality Limited Partnership, a Virginia limited partnership through which the Company owns its interest in hotels (the “Partnership”).

Name of Beneficial Owner | Number of Shares Beneficially Owned(1) | Percent of Class(1) | ||||

Hasu P. Shah | 808,123 | (2) | 23.9 | % | ||

Neil H. Shah | 690,905 | (2) | 21.1 | % | ||

K.D. Patel | 644,590 | (2) | 20.0 | % | ||

Kiran P. Patel | 377,265 | (2) | 12.8 | % | ||

David L. Desfor | 120,786 | (3) | 4.5 | % | ||

Ashish R. Parikh | 2,500 | (4) | (5 | ) | ||

Thomas S. Capello | 3,000 | (4) | (5 | ) | ||

L. McCarthy Downs | 71,111 | (6) | 2.7 | % | ||

Donald J. Landry | — |

| — |

| ||

William Lehr Jr. | 1,610 | (4) | (5 | ) | ||

Michael A. Leven | 2,500 | (4) | (5 | ) | ||

Total for all Officers and Trustees (11 persons) | 2,722,390 |

| 51.6 | % | ||

2

| (1) | The number of outstanding Priority Common Shares at March 28, 2003 was 2,576,863. Assumes (i) that all Units held by such person or group of persons are redeemed for Class B Common Shares; (ii) conversion of the Class B Common Shares into Priority Common Shares on a one-for-one basis; and (iii) that all warrants held by such person are exercised for Priority Common Shares. The total number of shares outstanding used in calculating the percentage assumes that none of the Units or warrants held by other persons are redeemed for Class B Common Shares or exercised for Priority Common Shares, respectively. Units generally are not redeemable for Class B Common Shares until at least one year following the acquisition of the Company’s hotels. Class B Common Shares automatically will be converted into Priority Common Shares upon the earlier of (i) the date that is 15 trading days after the Company sends notice to the holders of the Priority Common Shares that their priority period with respect to dividends and liquidation will terminate in 15 trading days, provided that the closing bid price of the Priority Common Shares is at least $7.00 on each trading day during the 15-day period, or (ii) January 26, 2004. |

| (2) | Represents Units owned by such person. |

| (3) | Represents 1,800 Priority Common Shares and 118,986 Units owned by Mr. Desfor. |

| (4) | Priority Common Shares that such person has advised the Company he purchased. |

| (5) | Owns less than 1% of the Shares. |

| (6) | Represents 10,000 Priority Common Shares owned by Mr. Downs and 61,111 Priority Common Shares that Mr. Downs has that right to acquire for a price of $9.90 per share upon the exercise of warrants granted to Mr. Downs in connection with the Company’s initial public offering. |

3

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

Certain information regarding the Company’s trustees and executive officers is set forth below.

Name | Age | Position | ||

Hasu P. Shah (Class II) | 58 | Chairman of the Board, Chief Executive Officer and Trustee | ||

Ashish R. Parikh | 33 | Chief Financial Officer | ||

Kiran P. Patel | 53 | Secretary | ||

David L. Desfor | 41 | Treasurer | ||

Neil H. Shah | 29 | Director of Development and Acquisitions | ||

K.D. Patel (Class II) | 59 | Trustee | ||

L. McCarthy Downs, III (Class II) | 50 | Trustee | ||

Michael A. Leven (Class II) | 65 | Independent Trustee | ||

William Lehr, Jr. (Class I) | 62 | Independent Trustee | ||

Thomas S. Capello (Class I) | 59 | Independent Trustee | ||

Donald J. Landry (Class I) | 54 | Independent Trustee |

PROPOSAL ONE – ELECTION OF TRUSTEES

The Company’s Declaration of Trust divides the Board of Trustees into two classes. Each Trustee in Class I is serving a term expiring at the 2004 annual meeting of shareholders and each Trustee in Class II is serving a term expiring at the Annual Meeting. Generally, one full class of trustees is elected by the shareholders of the Company at each annual meeting. Each of the nominees presently is serving as a Class II Trustee.

If any nominee becomes unavailable or unwilling to serve the Company as a Trustee for any reason, the persons named as proxies in the Proxy Form are expected to consult with management of the Company in voting the shares represented by them. The Board of Trustees has no reason to doubt the availability of any nominee, and each has indicated his willingness to serve as a trustee of the Company if elected.

The Company’s Bylaws provide that a shareholder of record both at the time of the giving of the required notice set forth in this sentence and at the time of the Annual Meeting entitled to vote at the Annual Meeting may nominate persons for election to the Board of Trustees by mailing written notice to the Secretary of the Company not less than 120 days prior to the first anniversary of the preceding year’s annual meeting; provided, however, that in the event the annual meeting is advanced by more than 30 days or delayed by more than 60 days, notice must be received not earlier than 90 days prior to the announcement of the annual meeting. The shareholder’s notice must set forth (i) as to each person whom the shareholder proposes to nominate for election as a trustee, all information regarding each nominee as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC had the nominee been nominated by the Board of Trustees; (ii) the consent of each nominee to serve as a trustee of the Company if so elected; (iii) the name and address of the shareholder and of each person to be nominated; and (iv) the number of each class of securities that are owned beneficially and of record by the shareholder.

4

NOMINEES FOR ELECTION AS CLASS II TRUSTEES

(TERMS EXPIRING IN 2005)

Hasu P. Shah has been the Chairman of the Board and CEO of the Company since its inception in 1998. Mr. Shah also is the President and CEO of Hersha Enterprises, Ltd. (a real estate management and development company) and has held that position since its inception in 1984. He started Hersha Enterprises, Ltd. with the purchase of the 125-room Quality Inn Riverfront in Harrisburg, Pennsylvania. In 1997, the “Central Penn Business Journal” honored Hersha Enterprises, Ltd. as one of the Fifty Fastest Growing Companies in central Pennsylvania. His interest in construction and renovations of hotels initiated the development of Hersha Construction Company for the construction and renovation of new properties and Hersha Hotel Supply Company to supply furniture, fixtures and equipment supplies to the properties. Mr. Shah and his wife, Hersha, are active members of the community. Mr. Shah serves on the Board of Trustees of several organizations including the Harrisburg Foundation, Human Enrichment by Love and Peace (H.E.L.P.), the Capital Region Chamber of Commerce and the Vraj Hindu Temple. Mr. Shah received a Bachelors of Science degree in Chemical Engineering from Tennessee Technical University and obtained his Masters degree in Administration from Pennsylvania State University. Mr. Shah is also a graduate of Harvard Business School’s executive MBA program.

L. McCarthy Downs, III, is Chairman of the Board for Anderson & Strudwick Investment Corporation, the parent company of Anderson & Strudwick Inc., the underwriter of the Company’s initial public offering. He has been the manager of the firm’s Corporate Finance department since 1990 and has been involved in several public and private financings for REITs. Prior to 1990, Mr. Downs was employed by another investment banking and brokerage firm for seven years. Mr. Downs has served on the Board of Trustees since the Company’s initial public offering in January 1999. Mr. Downs received a Bachelor of Science degree in Business Administration from The Citadel and obtained an M.B.A. from The College of William and Mary.

K.D. Patel has been a principal of Hersha Enterprises, Ltd. since 1989. Mr. Patel currently serves as the President of Hersha Hospitality Management, L.P., the lessee of 14 of the Company’s hotels. He has received national recognition from Holiday Inn Worldwide for the successful management of Hersha’s Holiday Inn Express Hotels. In 1996, Mr. Patel was appointed by Holiday Inn Worldwide to serve as an advisor on its Sales and Marketing Committee. Prior to joining Hersha Enterprises, Ltd., Mr. Patel was employed by Dupont Electronics in New Cumberland, Pennsylvania from 1973 to 1990. He is a member of the Board of Trustees of a regional chapter of the American Red Cross and serves on the Advisory Board of Taneytown Bank and Trust. Mr. Patel has served on the Board of Trustees since the Company’s initial public offering in January 1999. Mr. Patel received a Bachelor of Science degree in Mechanical Engineering from the M.S. University of India and a Professional Engineering License from the Commonwealth of Pennsylvania in 1982.

Michael A. Levenis the Chairman and Chief Executive Officer of US Franchise Systems, Inc. (USFS), which franchises the Microtel, Hawthorn and Best Inns & Suites hotel brands. Prior to forming USFS in 1995, he was president and chief operating officer of Holiday Inn Worldwide. During his five-year tenure, the new Holiday Inn Express brand grew from zero to 330 open hotels, with a backlog of approximately 500 units. From 1985 to 1990, Mr. Leven was president of Days Inn of America. Mr. Leven led the company through a reorganization resulting in growth from a 225-unit regional chain to one of the largest brands in the world with over 1,000 open units and 400 signed franchise agreements. Mr. Leven is a co-founder of the Asian American Hotel Owners Association (AAHOA) which now has over 7,000 members. Mr. Leven is a trustee of National Realty Trust, The Marcus Foundation and The Chief Executive Leadership Institute. Mr. Leven has served on the Board of Trustees since the Company’s 2001 annual meeting. Mr. Leven holds a Bachelor of Arts from Tufts University and a Master of Science from Boston University.

THE BOARD OF TRUSTEES RECOMMENDS A VOTE IN FAVOR OF EACH OF THE CLASS II TRUSTEE NOMINEES

5

CLASS I TRUSTEES

William Lehr, Jr., one of the Company’s Trustees, is retired. He was previously with Hershey Foods Corporation as a Senior Vice President, Corporate Secretary and Treasurer. During his tenure with Hershey Foods, Mr. Lehr had a multitude of diverse responsibilities including corporate governance, law, finance, human resources, and public affairs. Mr. Lehr currently devotes a substantial amount of his time in leadership positions with various nonprofit organizations such as The Greater Harrisburg Foundation, Americans for the Arts and The Susquehanna Art Museum. Mr. Lehr has served on the Board of Trustees since the Company’s 2001 annual meeting. Mr. Lehr holds a Bachelor’s degree in Business Administration from the University of Notre Dame, where he graduated cum laude, and a law degree from Georgetown University Law Center. Mr. Lehr is also a graduate of the Stanford Executive Program and successfully completed The Governing for Nonprofit Excellence Course at Harvard University’s Graduate School of Business Administration.

Thomas S. Capello, one of the Company’s Trustees, is a Private Investor and a Consultant specializing in strategic planning, mergers and acquisitions. From 1988 to 1999, Mr. Capello was the President, Chief Executive Officer and Director of First Capitol Bank in York, Pennsylvania. From 1983 to 1988, Mr. Capello served as Vice President and Manager of the Loan Production Office of The First National Bank of Maryland. Prior to his service at The First National Bank of Maryland, Mr. Capello served as Vice President and Senior Regional Lending Officer at Commonwealth National Bank and worked at the Pennsylvania Development Credit Corporation. Mr. Capello is an active member for the board of WITF, Martin Library, Motter Printing Company, and Eastern York Dollars for Scholars. Mr. Capello has served on the Board of Trustees since the Company’s initial public offering in January 1999. Mr. Capello is a graduate of the Stonier Graduate School of Banking at Rutgers University and holds an undergraduate degree with a major in Economics from the Pennsylvania State University.

Donald J. Landry, one of the Company’s Trustees, has over thirty years of lodging and hospitality experience in a variety of leadership positions. Most recently, Mr. Landry was the Chief Executive Officer, President and Vice Chairman of Sunburst Hospitality Inc. Mr. Landry has also served as an executive officer for Choice Hotels International, Inc., Manor Care Hotel Division and Richfield Hotel Management. Mr. Landry is a frequent guest lecturer at the Harvard Business School, Cornell University and University of New Orleans. Mr. Landry has served on the Board of Trustees since the Company’s 2001 annual meeting. Mr. Landry holds a Bachelor of Science from the University of New Orleans and was the University’s Alumnus of the Year in 1999. Mr. Landry is a Certified Hotel Administrator.

6

OTHER EXECUTIVE OFFICERS

Ashish R. Parikh joined the Company in 1999 as the Chief Financial Officer. Prior to joining Hersha Hospitality Trust, Mr. Parikh was an Assistant Vice President in the Mergers and Acquisitions Group for Fleet Financial Group where he engaged in numerous forms of capital raising activities including leveraged buyouts, bank syndications and venture financing. Mr. Parikh has also been employed by Tyco International Ltd. (diversified industrial conglomerate) and Ernst & Young LLP (accounting and consulting firm). Mr. Parikh received an MBA from New York University and a BBA from the University of Massachusetts at Amherst. Mr. Parikh is a licensed Certified Public Accountant.

Kiran P. Patel has been a principal of Hersha Enterprises, Ltd. since 1993. Mr. Patel is currently the partner in charge of Hersha’s Land Development and Business Services Divisions. He has served as Secretary of the Company since the Company’s initial public offering. Prior to joining Hersha Enterprises, Ltd., Mr. Patel was employed by AMP Incorporated (electrical component manufacturer), in Harrisburg, Pennsylvania. Mr. Patel serves on various Boards for community service organizations. Mr. Patel received a Bachelor of Science degree in Mechanical Engineering from M.S. University of India and obtained a Masters of Science degree in Industrial Engineering from the University of Texas in Arlington.

David L. Desfor has been a principal of Hersha Enterprises, Ltd. since 1991 and is comptroller of the Hersha Group, overseeing the corporate treasury and managing financial reporting for the company. He has served as Treasurer of the Company since December 2002. He has been in the hospitality industry since 1982, having previously co-founded and served as President of a management company focused of conference centers and full-service hotels. Mr. Desfor also serves on the Board of Directors of Channels, a regional organization which provides food to the impoverished and facilitates training welfare recipients for jobs in the food service industry. Mr. Desfor earned his undergraduate degree from East Stroudsburg University in Hotel Administration.

Neil H. Shahhas been a principal of Hersha Enterprises, Ltd. since 2000. Mr. Shah is involved in the strategic planning initiative in connection with hotel and real estate development for Hersha Enterprises, Ltd. Mr. Shah has served as the Company’s Director of Development and Acquisitions since May 2002. Prior to joining the Company, he served in senior management positions with the Advisory Board Company and the Corporate Executive Board. Mr. Shah graduated with honors from the University of Pennsylvania and the Wharton School with degrees in Management and Political Science. Mr. Shah earned his MBA from the Harvard Business School.

COMMITTEES AND MEETINGS OF THE BOARD OF TRUSTEES

Trustees’ Meetings. The business of the Company is under the general management of its Board of Trustees as provided by the Company’s Bylaws and the laws of Maryland. The Company’s Board of Trustees consists of seven members, four of whom are independent. The Board of Trustees holds regular quarterly meetings during the Company’s fiscal year and holds additional meetings as needed in the ordinary course of business. The Board of Trustees held four meetings and eight board conference calls during 2002. All trustees attended at least 75% of the aggregate of (i) the total number of the meetings of the Board of Trustees and (ii) the total number of meetings of all committees of the board on which the trustee then served.

The Company presently has an Audit Committee, Nominating Committee and a Compensation Committee of its Board of Trustees. The Company may, from time to time, form other committees as circumstances warrant. Such committees have authority and responsibility as delegated by the Board of Trustees.

Audit Committee.The Board of Trustees has established an Audit Committee, which currently consists of Messrs. Capello (Chairperson), Landry and Lehr, all of whom are independent trustees. The Audit Committee makes recommendations concerning the engagement of independent public accountants, reviews with the independent public accountants the plans and results of the audit engagement, approves professional services provided by the independent public accountants, reviews the independence of the independent public accountants, considers the range of audit and non-audit fees and reviews the adequacy of the Company’s internal accounting

7

controls. The audit committee met five times during 2002 and discussed relevant topics regarding financial reporting and auditing procedures.

Compensation Committee. The Compensation Committee consists of Messrs. Capello (Chairperson), Landry and Lehr, all of whom are independent trustees. The Compensation Committee determines compensation for the Company’s executive officers and administers the Company’s Option Plan. The Compensation Committee met and discussed relevant topics regarding compensation at the meetings of the Board of Trustees and did not schedule separate meetings during 2002.

Nominating Committee. The Nominating Committee consists of Messrs. Shah, Capello and Downs. The Nominating Committee recommends candidates for election as trustees and in some cases the election of officers. The Nominating Committee met and discussed relevant topics regarding trustee and officer nominations at the meetings of the Board of Trustees and did not schedule separate meetings during 2002.

COMPENSATION OF TRUSTEES

Each independent and non-affiliated Trustee is paid $10,000 per year while each affiliated trustee is paid $7,500 per year, payable in quarterly installments. In addition, the Company will reimburse all trustees for reasonable out-of-pocket expenses incurred in connection with their services on the Board of Trustees.

On the effective date of the Company’s initial public offering, Mr. Tom Capello received options to purchase 3,000 Class B Common Shares at $6.00 per share. The options were granted under the Hersha Hospitality Trust Non-Employee Trustees’ Option Plan (the “Trustees’ Plan”), which may be amended by the Board of Trustees to provide for other awards, including awards to future independent trustees. Options granted under the Trustees’ Plan will be exercisable only if (1) the Company obtains a per share closing price on the Priority Common Shares of $9.00 for 20 consecutive trading days and (2) the per share closing price on the Priority Common Shares for the prior trading day was $9.00 or higher. Options issued under the Trustees’ Plan are exercisable for five years from the date of grant.

A Trustee’s outstanding options will become fully exercisable if the Trustee ceases to serve on the Company’s Board of Trustees due to death or disability. All awards granted under the Trustees’ Plan shall be subject to board or other approval sufficient to provide exempt status for such grants under Section 16 of the Securities Exchange Act of 1934, as that section and rules thereunder are in effect from time to time. No option may be granted under the Trustees’ Plan more than 10 years after the date that the Company’s Board of Trustees approved the Plan. The Board of Trustees may amend or terminate the Trustees’ Plan at any time but an amendment will not become effective without shareholder approval if the amendment increases the number of shares that may be issued under the Trustees’ Plan (other than equitable adjustments upon certain corporate transactions).

EXECUTIVE COMPENSATION

Ashish R. Parikh, the chief financial officer of the Company, is paid a salary of $90,000 by the Company’s primary lessee, Hersha Hospitality Management, L.P. (“HHMLP”). The Company and HHMLP have entered into an Administrative Services Agreement to provide accounting and securities reporting services. The terms of the agreement provide for a fixed fee of $80,000 with an additional $10,000 per property (prorated from the time of acquisition) for each hotel added to the Company’s portfolio. The administrative services agreement was reduced by $75,000 per year as of January 1, 2001. A portion of these fees, charged by HHMLP, are allocated to the services of Mr. Parikh.

No other officers of the Company have received or are scheduled to receive any cash compensation from the Company other than the Trustee’s fees for those officers who are trustees, provided, however, that the Chairman of the Board of Trustees shall be entitled to receive a salary of not more than $100,000 per year provided that the Priority Common Shares have a bid price of $9.00 per share or higher for 20 consecutive trading days and remains at or above $9.00 per share.

8

The Company has a policy, which is subject to change at the sole discretion of the Board of Trustees, of paying no compensation to its executive officers or other employees. The following table summarizes the compensation paid or accrued by the Company for each of the years ended December 31, 2002, 2001 and 2000.

Annual Compensation | Long Term Compensation | ||||||||||||||||

Name and Principal Position | Year | Salary | Bonus | Restricted Share Award | Securities Underlying Options/SAR | All Other Compensation | |||||||||||

Hasu P. Shah Chairman and Chief Executive Officer | 2002 2001 2000 | $

| — — — | (1)

| $

| — — — | $

| — — — | — — — | $

| — — — | ||||||

Ashish R. Parikh Chief Financial Officer | 2002 2001 2000 | $

| 80,000 55,000 55,000 | (2)

| $

| — — — | $

| — — — | — — — | $

| — — — | ||||||

Kiran P. Patel Secretary | 2002 2001 2000 | $

| — — — |

| $

| — — — | $

| — — — | — — — | $

| — — — | ||||||

David L. Desfor Treasurer | 2002 2001 2000 | $

| — — — |

| $

| — — — | $

| — — — | — — — | $

| — — — | ||||||

Neil H. Shah Director of Acquisitions | 2002 2001 2000 | $

| — — — |

| $

| — — — | $

| — — — | — — — | $

| — — — | ||||||

| (1) | Mr. Shah will be entitled to receive a salary of not more than $100,000 per year provided that the Priority Common Shares have a bid price of $9.00 per share or higher for 20 consecutive trading days and remain at or above $9.00 per share. |

| (2) | Of Mr. Parikh’s $90,000 salary that is paid by the Lessee, $80,000 has been designated as related to the services provided per the terms of the Administrative Services Agreement between the Company and HHMLP. The terms of the agreement provide for a fixed fee of $80,000 with an additional $10,000 per property (prorated from the time of acquisition) for each hotel added to the Company’s portfolio. The Administrative Services Agreement was reduced by $75,000 per year as of January 1, 2001. |

9

OPTION GRANTS

There were no option grants to the Chief Executive Officer or the other executive officers of the Company during the last fiscal year.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND YEAR-END OPTION VALUES

Shares Acquired by exercise | Value Realized | Number of Unexercised Options at Fiscal Year-End (1) | Value of Unexercised In-The Money Options at Fiscal Year-End (2) | ||||||||||||

NAME | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||

Hasu P. Shah | — | $ | — | — | 21,850 | $ | — | $ | — | ||||||

Ashish R. Parikh | — | $ | — | — | — | $ | — | $ | — | ||||||

Kiran P. Patel | — | $ | — | — | 20,864 | $ | — | $ | — | ||||||

David L. Desfor | — | $ | — | — | — | $ | — | $ | — | ||||||

Neil H. Shah | — | $ | — | — | — | $ | — | $ | — | ||||||

| (1) | Represents the number of shares subject to outstanding options. |

| (2) | Based on a price of $6.36 per share, the closing price of the Company’s Priority Common Shares on December 31, 2002. |

EQUITY COMPENSATION PLANS

The following table summarizes information with respect to equity compensation as of December 31, 2002:

Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance | |||||

Equity compensation plans approved by security holders | 534,000 | $ | 6.00 | 116,000 | |||

Equity compensation plans not approved by security holders | __ |

| __ | __ | |||

Total | 534,000 | $ | 6.00 | 116,000 | |||

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Mr. Downs is Chairman of the Board for Anderson & Strudwick Investment Corporation, the parent company of Anderson & Strudwick, Inc., the underwriter of the Company’s initial public offering.

The Company’s operating partnership entered into the Option Agreement with some of the Company’s executive officers, trustees and their affiliates. Pursuant to this agreement, the Company’s operating partnership has the option to purchase any hotels owned or developed in the future by these individuals or entities that are within fifteen miles of any of the Company’s hotels or any hotel subsequently acquired by the Company for two years after acquisition or development. Of the 16 hotel properties purchased since the Company’s initial public offering, eight of the hotels have been purchased under this Option Agreement.

10

We have entered into an Administrative Services Agreement with HHMLP for HHMLP to provide accounting and securities reporting services to us. HHMLP is owned by Messrs. Hasu P. Shah, Kiran P. Patel, Neil H. Shah, David L. Desfor, K.D. Patel and some of their affiliates. The terms of the agreement provide for a fixed annual fee of $80,000 with an additional fee of $10,000 per property per year (pro-rated from the time of acquisition) for each hotel added to our portfolio. Based upon the revised 11.5% to 12.5% pricing methodology, the administrative services agreement was reduced by $75,000 per year as of January 1, 2001. For the years ending December 31, 2002, we incurred administrative services fee expenses of $175,000.

As of December 31, 2002, the Company owed HHMLP $303,000 for replacement reserve reimbursements.

During 2002 the Company acquired two hotels from limited partnerships owned by some of the Company’s executive officers, trustees and their affiliates. The Company purchased the Mainstay Suites, Frederick, MD from 3044 Associates, a Pennsylvania Limited Partnership owned by Hasu P. Shah, Kiran P. Patel, Neil H. Shah, David L. Desfor, K.D. Patel and their affiliates, for approximately $5.5 million effective January 1, 2002. The Company financed this purchase through the assumption of approximately $3.1 million of mortgage debt, the assumption of $800,000 of related party indebtedness and the payment of cash of approximately $1.6 million. The Company purchased the Doubletree Club hotel at the JFK International Airport, Jamaica, NY from 5544 JFK III Associates, LP, a Pennsylvania limited partnership owned by Hasu P. Shah, Kiran P. Patel, Neil H. Shah, K.D. Patel, David L. Desfor and their affiliates, for approximately $11.5 million effective October 1, 2002. The Company financed this purchase through the assumption of approximately $8.7 million of mortgage debt, the assumption of $1.0 million of related party indebtedness and paid cash of approximately $1.8 million.

The Company has entered into percentage leases relating to fourteen of the hotels with HHMLP. HHMLP is owned by Messrs. Hasu P. Shah, Kiran P. Patel, Neil H. Shah, David L. Desfor, K.D. Patel and some of their affiliates. Each percentage lease with HHMLP has an initial non-cancelable term of five years. All, but not less than all, of the percentage leases for these hotels may be extended for an additional five-year term at HHMLP’s option. At the end of the first extended term, HHMLP, at its option, may extend some or all of the percentage leases for these hotels for an additional five-year term. Pursuant to the terms of the percentage leases, HHMLP is required to pay initial fixed rent, base rent or percentage rent and certain other additional charges and is entitled to all profits from the operations of the hotel after the payment of certain operating expenses.

The Company has acquired, and expects to acquire in the future, from affiliates of certain of the Company’s executive officers and trustees, newly-developed or newly-renovated hotels that do not have an operating history that would allow the Company to make purchase price decisions based on historical performance. In buying these hotels the Company has utilized, and expects to continue to utilize, a “re-pricing” methodology that, in effect, adjusts the initial purchase price for the hotel, one or two years after the Company initially purchased the hotel, based on the actual operating performance of the hotel during the previous twelve months. All purchase price adjustments are approved by a majority of the Company’s independent trustees.

The initial purchase price for each of these hotels was based upon management’s projections of the hotel’s performance for one or two years following the Company’s purchase. The leases for these hotels provide for fixed initial rent for the one- or two-year adjustment period that provides the Company with a 12% annual yield on the initial purchase price, net of certain expenses. At the end of the one- or two-year period, the Company calculates a value for the hotel, based on the actual net income during the previous twelve months, net of certain expenses, such that it would have yielded a 12% return. The Company then applies the percentage rent formula to the hotel’s historical revenues for the previous twelve months on a pro forma basis. If the pro forma percentage rent formula would not have yielded a pro forma annual return to the Company of 11.5% to 12.5% based on this calculated value, this value is adjusted either upward or downward to produce a pro forma return of either 11.5% or 12.5%, as applicable. If this final purchase price is higher than the initial purchase price, then the seller of the hotel will receive consideration in an amount equal to the increase in price. If the final purchase price is lower than the initial purchase price, then the sellers of the hotel will return to the Company consideration in an amount equal to the difference. Any purchase price adjustment will be made either in operating partnership units or cash as determined by the Company’s Board of Trustees, including the independent trustees. Any operating partnership units issued by the Company or returned to it as a result of the purchase price adjustment historically have been valued at $6.00 per unit. Any future adjustments will be based upon a value per unit approved by the Company’s Board of Trustees,

11

including the Company’s independent trustees. The sellers are entitled to receive quarterly distributions on the operating partnership units prior to the units being returned to the Company in connection with a downward purchase price adjustment.

On January 1, 2002, the Company issued an aggregate of 333,541 additional operating partnership units in connection with the re-pricing of the Holiday Inn Express & Suites, Harrisburg, the Hampton Inn, Danville and the Hampton Inn & Suites, Hershey, Pennsylvania. Since the Company’s initial public offering, the Company has acquired five additional hotels from some of its executive officers, trustees and their affiliates for initial prices that will be adjusted in the future.

The Company and some of its executive officers, trustees and their affiliates have agreed to enter into an option agreement that would allow for an extension of the fixed rent and repricing periods for the Mainstay Suites and Sleep Inn hotel, King of Prussia, Holiday Inn Express, Long Island City, NY, Doubletree Club, JFK, NY and the Mainstay Suites, Frederick, MD. These hotels were purchased by the Company with anticipated repricing dates from December 31, 2002 to December 31, 2004. Due to the current operating environment, the ramp up and stabilization for these newly-built properties is forecasted to take longer than initially projected. The fixed rent period will be extended to coincide with the extension period of the repricing period. The Company will maintain the right to sell each of these properties back to the executive officers, trustees and their affiliates that initially sold the hotels to the Company at the end of the applicable repricing period if adequate stabilization has not occurred during the repricing period for a price not less than the purchase price of the asset.

The Company leases a parcel of real estate adjacent to the Hampton Inn, Selinsgrove, Pennsylvania to Mr. Hasu P. Shah for a nominal amount per year. This parcel of land is not subdivided from the property and does not have its own private access way. The land has not been developed and in its current state is not believed to maintain significant value.

The Company paid to the Shah Law Firm, whose senior partner Mr. Jay H. Shah is the son of Mr. Hasu P. Shah, certain legal fees aggregating $60,000 during 2002. Of this amount, $28,000 was capitalized as settlement costs.

The Company approved the lending of up to $3.0 million to entities owned by Hasu P. Shah, Kiran P. Patel, Neil H. Shah, David L. Desfor, K.D. Patel and their affiliates to construct hotels and related improvements on specific hotel projects. The Company maintains the first right of refusal to purchase the hotel assets collateralized by these development loans. The Company has purchased three hotels that were previously collateralized by development loans. As of December 31, 2002, these affiliates owed the Company $1.1 million related to this borrowing. These affiliates have borrowed this money from the Company at an interest rate of 12.0% per annum. Interest income from these advances was $206,000 for the year ended December 31, 2002.

THE AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Trustees (the “Audit Committee”) is composed of three independent trustees and operates under a written charter adopted by the Board of Trustees. The Audit Committee reviews audit fees and recommends to the Board of Trustees the selection of the Company’s independent accountants. Management is responsible for the Company’s internal controls and the financial reporting process. The independent accountants are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and for issuing a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes and to report thereon to the Board of Trustees. In this context, the Audit Committee has met and held discussions with management and Moore Stephens, P.C., the Company’s independent accountants.

Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and Moore Stephens.

12

The Audit Committee has discussed with Moore Stephens the matters required to be discussed by Statement on Auditing Standards No. 61 (Codification of Statements on Accounting Standards), including the scope of the auditor’s responsibilities, significant accounting adjustments and any disagreements with management.

The Audit Committee also has received the written disclosures and the letter from Moore Stephens relating to the independence of that firm as required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and has discussed with Moore Stephens that firm’s independence from the Company.

Based upon the Audit Committee’s discussions with management and Moore Stephens and the Audit Committee’s review of the representation of management and the report of Moore Stephens to the Audit Committee, the Audit Committee recommended that the Board of Trustees include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2002 filed with the Securities and Exchange Commission.

Either the Audit Committee or its Chairman reviews with management and the independent accountants the results of the independent accountants’ review of the unaudited financial statements that are included in the Company’s quarterly reports on Form 10-Q. The Audit Committee also reviews the fees charged by the Company’s independent accountants. During the fiscal year ended December 31, 2002, Moore Stephens billed the Company the fees set forth below in connection with services rendered by that firm to the Company.

Audit Fees. For professional services rendered by Moore Stephens for the audit of the Company’s annual financial statements for the fiscal year ended December 31, 2002, and the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q for the fiscal year ended December 31, 2002, Moore Stephens billed the Company fees in the aggregate amount of $78,500.

Financial Information Systems Design and Implementation Fees. For the fiscal year ended December 31, 2002, there were no fees billed by Moore Stephens for professional services rendered in connection with financial information systems design and implementation.

All Other Fees. For professional services other than those described above rendered by Moore Stephens for the fiscal year ended December 31, 2002, Moore Stephens billed the Company fees in the aggregate amount of $12,200. There were no fees charged for services rendered in connection with the performance of internal audit procedures for the Company.

The Audit Committee has considered whether the provision of services described above under “Financial Information Systems Design and Implementation Fees” and “All Other Fees” is compatible with maintaining the independence of Moore Stephens.

THE AUDIT COMMITTEE

Thomas S. Capello, Chairperson

Donald J. Landry

William Lehr, Jr.

March 28, 2003

13

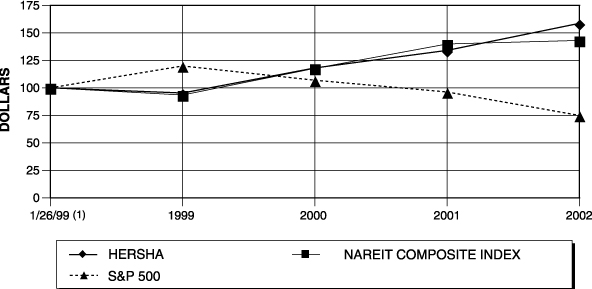

PERFORMANCE GRAPH

The following graph compares the cumulative total shareholder return on the Priority Common Shares for the period from January 26, 1999 (commencement of operations) through December 31, 2002, with the cumulative total shareholder return for the Standard and Poor’s 500 Stock Index and the NAREIT Composite Index for the same period, assuming $100 is invested in the Priority Common Shares and each index and dividends are reinvested quarterly. The performance graph is not necessarily indicative of future investment performance.

1/26/99 | 1999 | 2000 | 2001 | 2002 | ||||||

Hersha | 100 | 95.3 | 118.1 | 134.1 | 158.7 | |||||

S&P 500 | 100 | 119.9 | 106.9 | 96.2 | 74.9 | |||||

NAREIT Composite Index | 100 | 93.5 | 117.7 | 139.9 | 143.1 |

| (1) | The Company commenced operations on January 26, 1999. |

RELATIONSHIP WITH INDEPENDENT PUBLIC ACCOUNTANTS

Moore Stephens, P.C. has served as auditors for the Company and its subsidiaries since the Company’s initial public offering. Following the recommendation of the Audit Committee, the Board of Trustees determined not to renew the appointment of Moore Stephens, P.C. as the Company’s independent auditors for the 2003 fiscal year and appointed Reznick Fedder & Silverman, CPAs, PC as independent auditors for the 2003 fiscal year.

Moore Stephens’ reports on the consolidated financial statements for each of the years ended December 31, 2002 and 2001, did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to certainty, audit scope or accounting principles.

During the years ended December 31, 2002 and 2001 and through the date of this Proxy Statement, there were no disagreements with Moore Stephens on any matter of accounting principle or practice, financial statement disclosure or auditing scope or procedure which, if not resolved to Moore Stephens’ satisfaction, would have caused them to make reference to the subject matter in connection with their report on the Company’s consolidated financial statements for such years, and there were no reportable events as defined in Item 304(a)(1)(v) of SEC Regulation S-K.

During the years ended December 31, 2002 and 2001 and through the date of the Board’s decision to change auditors, the Company did not consult Reznick Fedder & Silverman with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, or any other matters or reportable events as set forth in Items 304(a)(2)(i) and (ii) of SEC Regulation S-K.

14

Representatives of Moore Stephens, P.C. and Reznick Fedder & Silverman, CPAs, PC are expected to be present at the Annual Meeting, will have the opportunity to make statements if they desire to do so, and are expected to be available to respond to appropriate questions.

PROPOSALS FOR 2003 ANNUAL MEETING

Under the regulations of the SEC, any shareholder desiring to make a proposal to be acted upon at the 2004 annual meeting of shareholders must present such proposal to the Company at its principal office in New Cumberland, Pennsylvania not later than December 11, 2003, in order for the proposal to be considered for inclusion in the Company’s proxy statement. The Company anticipates holding the 2004 annual meeting on May 27, 2004.

The Company’s bylaws provide that, in addition to any other applicable requirements, for business to be properly brought before the annual meeting by a shareholder, the shareholder must give timely notice in writing not later than 120 days prior to the first anniversary of the preceding year’s annual meeting. As to each matter, the notice shall contain (i) a brief description of the business desired to be brought before the meeting and the reasons for addressing it at the annual meeting; (ii) any material interest of the shareholder in such business; (iii) the name and address of the shareholder; and (iv) the number of each class of securities that are owned beneficially and of record by the shareholder.

OTHER MATTERS

The Board of Trustees knows of no other business to be brought before the Annual Meeting. If any other matters properly come before the Annual Meeting, the proxies will be voted on such matters in accordance with the judgment of the persons named as proxies therein, or their substitutes, present and acting at the meeting.

The Company will furnish to each beneficial owner of Priority Common Shares entitled to vote at the Annual Meeting, upon written request to Ashish Parikh, the Company’s Chief Financial Officer, at 148 Sheraton Drive, Box A, New Cumberland, Pennsylvania 17070, Telephone (717) 770-2405, a copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2002, including the financial statements and financial statement schedules filed by the Company with the SEC.

BY ORDER OF THE BOARD OF TRUSTEES

/s/ KIRAN P. PATEL

KIRAN P. PATEL

Secretary

April 11, 2003

15

— FOLD AND DETACH HERE —

HERSHA HOSPITALITY TRUST

New Cumberland, Pennsylvania

PROXY FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 28, 2003

The undersigned hereby appoints Thomas S. Capello and Ashish R. Parikh, or either of them, with full power of substitution in each, to vote all shares of the undersigned in Hersha Hospitality Trust, at the annual meeting of shareholders to be held May 28, 2003, and at any and all adjournments thereof.

(1) ELECTION OF TRUSTEES

¨FOR ALL ¨WITHHOLD ALL ¨FOR ALL EXCEPT

Nominees: Hasu P. Shah, K.D. Patel, L. McCarthy Downs, III, Michael A. Leven

INSTRUCTION: To withhold authority to vote for any such nominee(s), write the name(s) of the nominee(s) in the space provided below.

(2) In their discretion, the Proxies are authorized to vote upon such other business and matters incident to the conduct of the meeting as may properly come before the meeting.

This Proxy is solicited on behalf of the Board of Trustees. This Proxy when properly executed will be voted in the manner directed herein by the undersigned shareholder.If no direction is made, this proxy will be voted for all nominees and according to the discretion of the proxy holders on any other matters that may properly come before the meeting or any postponements or adjournments thereof.

(Please date and sign on the reserve side)

— FOLD AND DETACH HERE —

Dated: , 2003

Print Name:

Signature:

Please print and sign name exactly as it appears on the share certificate. Only one of several joint owners or co-owners need sign. Fiduciaries should give full title.

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.