QuickLinks -- Click here to rapidly navigate through this document

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED BY PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registrant / / | ||

Check the appropriate box: | ||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Under Rule 14a-12 | |

GREAT LAKES REIT | ||||

(Name of Registrant as Specified in Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount previously paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

![]()

Great Lakes REIT

823 Commerce Drive

Suite 300

Oak Brook, Illinois 60523

April 18, 2002

Dear Fellow Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders (the "Annual Meeting") of Great Lakes REIT, a Maryland real estate investment trust (the "Company"), which will be held at the Wyndham Drake Hotel located at York Road and 22nd Street, Oak Brook, Illinois, on Thursday, May 23, 2002, at 10:00 a.m., local time.

The following matters are to be considered and voted upon at the Annual Meeting:

1. Election of seven trustees to a one-year term;

2. Ratification of the appointment of Ernst & Young LLP as the independent auditors of the Company for the year ending December 31, 2002; and

3. Such other business as may properly come before the Annual Meeting or any adjournment thereof.

The accompanying Notice of Annual Meeting of Shareholders and Proxy Statement contain information about the Annual Meeting and the matters to be considered.

It is important that your shares be represented at the Annual Meeting. Therefore, whether or not you plan to attend the Annual Meeting, please complete, sign and date the enclosed proxy card and return it promptly in the enclosed postage prepaid envelope. If you attend the Annual Meeting, you may vote in person if you wish, even if you have previously returned your proxy card.

We encourage you to attend the Annual Meeting in person, but whether you expect to attend the Annual Meeting or not, we urge you to return your proxy card promptly.

Sincerely yours,

Richard A. May

Chairman of the Board and

Chief Executive Officer

Your vote is important. Please complete, sign and date and return the enclosed proxy card as soon as possible. Otherwise, your vote cannot be counted.

Great Lakes REIT

823 Commerce Drive

Suite 300

Oak Brook, Illinois 60523

Notice of Annual Meeting of Shareholders

To Be Held May 23, 2002

To the Shareholders of Great Lakes REIT:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the "Annual Meeting") of Great Lakes REIT, a Maryland real estate investment trust (the "Company"), will be held at the Wyndham Drake Hotel located at York Road and 22nd Street, Oak Brook, Illinois, on Thursday, May 23, 2002, at 10:00 a.m., local time, for the following purposes:

- 1.

- To elect seven trustees to a one-year term;

- 2.

- To ratify the appointment of Ernst & Young LLP as the Company's independent auditors for the year ending December 31, 2002; and

- 3.

- To transact such other business as may properly come before the Annual Meeting or any adjournment thereof.

Only holders of record of the Company's common shares of beneficial interest at the close of business on Friday, March 29, 2002, the record date for the Annual Meeting, are entitled to notice of, and to vote at, the Annual Meeting and at any recess, adjournment or postponement thereof.

All shareholders are cordially invited to attend the Annual Meeting in person. Whether or not you plan to attend the Annual Meeting, please complete, sign and date the enclosed proxy card and return it in the enclosed envelope as promptly as possible. If a proxy is properly executed but no voting instructions are indicated thereon, that proxy will be voted "FOR" each of the nominees for trustee; "FOR" the proposal to ratify the appointment of Ernst & Young LLP as the independent auditors of the Company for the year ending December 31, 2002; and in the discretion of the proxy holder on any other matter that may come before the Annual Meeting or any adjournment or postponement thereof. If you attend the Annual Meeting, you may withdraw the proxy and vote in person.

By Order of the Board of Trustees,

Richard L. Rasley

Secretary

Oak Brook, Illinois

April 18, 2002

Great Lakes REIT

Proxy Statement

2002 Annual Meeting of Shareholders

This Proxy Statement is being furnished to the holders of the common shares of beneficial interest, $.01 par value per share (the "Common Shares"), of Great Lakes REIT, a Maryland real estate investment trust (the "Company"), in connection with the solicitation of proxies by the Board of Trustees of the Company (the "Board of Trustees" or the "Board") for use at the Annual Meeting of Shareholders of the Company (the "Annual Meeting") to be held at the Wyndham Drake Hotel located at York Road and 22nd Street, Oak Brook, Illinois, on May 23, 2002, at 10:00 a.m., local time, and at any recess, adjournment or postponement thereof.

At the Annual Meeting, shareholders will be asked to consider and vote upon the following matters:

1. Election of seven trustees to a one-year term;

2. Ratification of the appointment of Ernst & Young LLP as the independent auditors of the Company for the year ending December 31, 2002; and

3. Such other business as may properly come before the Annual Meeting or any adjournment thereof.

The Board of Trustees has fixed the close of business on March 29, 2002 as the record date for the determination of shareholders entitled to receive notice of and to vote at the Annual Meeting (the "Record Date"). As of the Record Date, 16,537,348 Common Shares were outstanding. Each Common Share is entitled to one vote on each matter to be presented at the Annual Meeting. See "Voting and Proxies."

This Proxy Statement and the accompanying form of proxy are first being mailed to shareholders of the Company on or about April 18, 2002.

Voting of Proxies

The proxy accompanying this Proxy Statement is being solicited on behalf of the Board of Trustees for use at the Annual Meeting. Shareholders are requested to complete, sign and date the enclosed proxy card and promptly return it in the accompanying envelope or otherwise mail it to the Company. If no instructions are indicated, properly executed proxies will be voted"FOR" each of the nominees for trustee;"FOR" the proposal to ratify the appointment of Ernst & Young LLP as the independent auditors of the Company for the year ending December 31, 2002; and in the discretion of the proxy holder on any other matter that may come before the Annual Meeting or any adjournment or postponement thereof.

Vote Required

Proposal No. 1: Under Maryland law and the Company's Declaration of Trust and Bylaws (collectively, the "Charter Documents"), the seven nominees who receive the highest number of votes cast at the Annual Meeting will be elected as trustees.

Proposal No. 2: To be approved, the proposal to ratify the appointment of Ernst & Young LLP as the Company's independent auditors must receive the favorable vote of a majority of the votes cast with respect to the proposal at the Annual Meeting.

Quorum; Abstentions and Broker Non-Votes

The holders of a majority of the Common Shares issued and outstanding and entitled to vote at the Annual Meeting, present in person or by proxy, will constitute a quorum at the Annual Meeting. Abstentions and broker non-votes will be counted for purposes of determining the presence of a quorum at the Annual Meeting.

Votes cast in person or by proxy at the Annual Meeting will be tabulated by the inspectors of election appointed for the Annual Meeting, who will determine whether or not a quorum is present. Votes may be cast for each of the proposals described above. Alternatively, shareholders may choose to withhold authority to vote as to any of these matters.

Broker/dealers who hold shares in street name may, under the applicable rules of the exchange and other self-regulatory organizations of which the broker/dealers are members, sign and submit proxies for such shares and may vote such shares on routine matters, which, under such rules, typically include the election of board members and ratification of the appointment of independent auditors. Abstentions on the trustee election proposal or the auditor ratification proposal will have no effect on the results of such proposals.

Each shareholder who signs and returns a proxy in the form enclosed with this Proxy Statement may revoke it at any time prior to its exercise by giving notice of such revocation in writing to the Secretary of the Company, by signing and timely returning a later-dated proxy, or by attending and voting in person at the Annual Meeting.

Unless so revoked, the Common Shares represented by each such proxy will be voted at the Annual Meeting and any adjournment or postponement thereof. Presence at the Annual Meeting by a shareholder who has signed a proxy but does not duly revoke it or vote in person does not revoke that proxy.

Cost of Proxy Solicitation

The cost of soliciting proxies will be borne by the Company. Proxies may be solicited on behalf of the Company by trustees, officers or employees of the Company in person or by telephone, facsimile or other electronic means.

In accordance with the regulations of the Securities and Exchange Commission (the "SEC") and the New York Stock Exchange (the "NYSE"), the Company will also reimburse brokerage firms and other custodians, nominees and fiduciaries for their expenses in sending proxies and proxy materials to beneficial owners of Common Shares.

2

PROPOSAL 1: ELECTION OF TRUSTEES

The Board of Trustees presently consists of seven members. All trustees hold office for a term of one year and until their successors have been elected and qualified.

At the Annual Meeting, shareholders will elect seven trustees. Unless authority to do so is specifically withheld, the persons named in the accompanying proxy will vote for the election of each of the nominees named below. Under Maryland law and the Charter Documents, the seven candidates receiving the highest number of votes cast will be elected as trustees. Except for Ms. Leandra R. Knes, who has been nominated by the Board, based on the recommendation of the Nominating Committee of the Board (the "Nominating Committee"), to stand for election as a trustee at the Annual Meeting, and Mr. James E. Schrager, who was appointed to the Board in 2001, all of the nominees currently serve as trustees of the Company. Mr. Daniel E. Josephs, who has served as a member of the Board since 1992, will not stand for re-election at the Annual Meeting.

The name, age, and current principal position(s), if any, with the Company of each nominee for trustee is as follows:

| Name | Trustee Since | Age | Present Principal Position and Offices with the Company | |||

|---|---|---|---|---|---|---|

| Richard A. May | 1992 | 57 | Chairman of the Board and Chief Executive Officer | |||

| Matthew S. Dominski | 2001 | 48 | Trustee | |||

| Patrick R. Hunt | 1998 | 48 | President, Chief Operating Officer and Trustee | |||

| Daniel P. Kearney | 1998 | 62 | Trustee | |||

| Leandra R. Knes | — | 45 | Trustee Nominee | |||

| Donald E. Phillips | 1992 | 69 | Trustee | |||

| James E. Schrager | 2001 | 52 | Trustee |

Richard A. May. Mr. May co-founded the Company in 1992 and has served as principal executive officer and as Chairman of the Board of the Company since its inception. Mr. May currently is the Chairman of the Board and Chief Executive Officer of the Company. Mr. May is a licensed real estate broker in the States of Illinois and Indiana and holds several inactive National Association of Securities Dealers, Inc. licenses. He is also a member of the National Association of Real Estate Investment Trusts ("NAREIT"). Mr. May received his Bachelor's degree from the University of Illinois and received his MBA degree from The University of Chicago.

Matthew S. Dominski. Mr. Dominski was first elected to the Board of Trustees in 2001. Mr. Dominski currently is President of Rodamco North America, and its wholly owned subsidiary, Urban Retail Properties, Co., an owner and operator of retail properties throughout the United States. From 1993 through November 2000, Mr. Dominski was President and then Chief Executive Officer of Urban Shopping Centers, Inc. In November 2000, Urban Shopping Centers, Inc. was acquired by Rodamco North America. He currently serves as a trustee of the International Council of Shopping Centers, the largest trade group of the shopping center industry. Mr. Dominski received his Bachelor's degree from Trinity College in Hartford, Connecticut, and received his MBA degree from The University of Chicago.

Patrick R. Hunt. Mr. Hunt, President, Chief Operating Officer and a member of the Board of Trustees, joined the Company in 1997 and has general supervisory responsibility for the Company's operating activities. From 1983 until 1997, Mr. Hunt was employed by Jones Lang LaSalle (formerly LaSalle Partners), a Chicago-based provider of international real estate services. At Jones Lang LaSalle, Mr. Hunt most recently served as a managing director of portfolio management and client servicing of Jones Lang LaSalle's commingled fund investments. Prior to that, he served as Administrative Head of Jones Lang LaSalle's Los Angeles corporate office. From 1975 to 1983, Mr. Hunt was employed by Harris Trust and Savings Bank in Chicago, where he served as a Vice President in the

3

Corporate Banking Department. Mr. Hunt is a member of the Pension Real Estate Association and NAREIT. He received his Bachelor's degree from Northwestern University and his MBA degree from The University of Chicago.

Daniel P. Kearney. Mr. Kearney has served as a member of the Board of Trustees since 1998. Mr. Kearney currently is an independent financial consultant. From 1990 through February 1998, Mr. Kearney was employed by Aetna Inc., an insurance and financial services company. He most recently served as Executive Vice President and Chief Investment Officer of Aetna Inc. and as President of Aetna Retirement Services. From 1989 to 1990, Mr. Kearney was President and Chief Executive Officer of the Resolution Trust Corporation Oversight Board. From 1988 to 1989, Mr. Kearney was a Principal of AEW. Prior to joining AEW, Mr. Kearney was a Managing Director of Salomon Brothers Inc. Mr. Kearney currently serves as a member of the Board of Directors of: MBIA, Inc., a municipal bond financial guarantee company that is listed on the NYSE; MGIC Investment Corporation, a holding company listed on the NYSE, that, through a wholly owned subsidiary, provides private mortgage insurance; and Fiserv, Inc., a Nasdaq company that is a provider of data processing and information management services. Mr. Kearney received his Bachelor's degree and Master's degree from Michigan State University and received his JD degree from The University of Chicago.

Leandra R. Knes. Ms. Knes has been nominated by the Board of Trustees, based on the recommendation of the Nominating Committee, to stand for election as a trustee of the Company at the Annual Meeting. Ms. Knes is the Chief Executive Officer, President and Chief Investment Officer of PPM America, Inc. ("PPMA"), a wholly owned subsidiary of Prudential, plc, Great Britain's largest insurer. PPMA is an investment manager responsible for Prudential's North American portfolio and manages $56 billion in assets. Ms. Knes has been with PPMA since 1997. Prior to joining PPMA, Ms. Knes was Chief Investment Officer of a division of Aetna Inc. Ms. Knes received her Bachelor's degree from Purdue University and her MBA degree from The University of Chicago.

Donald E. Phillips. Mr. Phillips has served as a member of the Board of Trustees since 1992. Mr. Phillips currently is retired. From 1960 until 1980, Mr. Phillips served as a corporate executive in a variety of capacities for International Minerals & Chemicals Corporation of Northbrook, Illinois, and, from 1976 to 1980, he was Group President & CEO of IMC Industry Group, Inc. ("IMC"), a chemical and minerals firm. From 1980 until 1988, he served as Group President and CEO of Pitman Moore, Inc., then a wholly owned subsidiary of IMC. Mr. Phillips currently serves as Chairman of the Board of Directors of Potash Corporation of Saskatchewan, Canada, a miner and distributor of materials for industrial and agricultural application. Mr. Phillips received his Bachelor's degree from Mississippi College and received his MBA degree from the University of Mississippi. He is also a graduate of the Executive Program in Business Administration in the Graduate School of Business, Columbia University and he is a recipient of an Honorary Doctor of Laws degree from Mississippi College.

James E. Schrager. Mr. Schrager became a member of the Board of Trustees in 2001. Mr. Schrager is a Clinical Professor of Entrepreneurship and Strategy at The University of Chicago Graduate School of Business. He is the founder and President of Great Lakes Consulting Group, Inc., a management consulting group, not affiliated with Great Lakes REIT, that specializes in business strategy consulting, and Managing Director of Master Mini Warehouse, LLP. Mr. Schrager received his Bachelor's degree from Oakland University in Rochester, Michigan, his MBA degree from the University of Colorado, his JD degree from DePaul University and his PhD degree from The University of Chicago. Mr. Schrager is also a Certified Public Accountant.

Vote Required

Under Maryland law and the Charter Documents, the seven nominees who receive the highest number of votes cast at the Annual Meeting will be elected as trustees.

The Board recommends a vote "FOR" each of the nominees for Trustee.

4

Committees of the Board of Trustees

There currently are four committees of the Board of Trustees.

Audit Committee. The Audit Committee of the Board (the "Audit Committee") was established by the Board in 1994 and is responsible for making recommendations concerning the engagement of independent auditors; reviewing the independence of the Company's independent auditors; reviewing with the independent auditors the plans and results of the audit engagement; considering the range of audit and non-audit professional fees and reviewing those fees with the independent accountants and management; reviewing the adequacy of the Company's internal accounting controls; and assessing the adequacy of the Audit Committee Charter. As described in the Audit Committee Charter, which was adopted by the Board, the Audit Committee is required to be comprised of three or more members of the Board of Trustees who are not also employees of the Company (each, an "Independent Trustee"). The current members of the Audit Committee are Messrs. Phillips (Chairman), Dominski and Josephs. Pending the results of the Annual Meeting, the Board has determined that the Audit Committee will thereafter be composed of Mr. Phillips (Chairman), Ms. Knes and Mr. Schrager.

Compensation Committee. The Compensation Committee of the Board (the "Compensation Committee") was established by the Board in 1996 and is responsible for establishing remuneration levels for executive officers of the Company and administering the Company's 2001 Equity and Performance Incentive Plan (the "Incentive Plan") and any other incentive programs. The Compensation Committee is required to be comprised of three or more Independent Trustees. The Compensation Committee currently consists of Messrs. Kearney (Chairman), Josephs and Phillips. Pending the results of the Annual Meeting, the Board has determined that the Compensation Committee will thereafter be composed of Messrs. Kearney (Chairman), Dominski and Schrager.

Nominating Committee. The Nominating Committee was established by the Board in 1997 and is responsible for recommending criteria for membership on the Board; soliciting potential Board candidates when there is a need to fill a current or future Board position; proposing to the full Board recommendations to fill vacant positions on the Board; and considering and recommending to the full Board the types and functions of Board committees. The Nominating Committee is required to be comprised of three or more Independent Trustees. The Nominating Committee currently consists of Messrs. Kearney (Chairman), Dominski and Josephs. The Nominating Committee has adopted the policy that it will consider nominees recommended by shareholders. Any such nominations should be submitted to the Nominating Committee through a written recommendation addressed to the Secretary of the Company. Pending the results of the Annual Meeting, the Board has determined that the Nominating Committee will thereafter be composed of Messrs. Dominski (Chairman), Kearney and Phillips.

Finance Committee. The Finance Committee of the Board (the "Finance Committee") was established by the Board in 1997 and is responsible for reviewing management proposals and making recommendations to the Board regarding matters related to the debt and equity capitalization of the Company, dividend policy and other finance matters. The Finance Committee currently consists of Messrs. May (Chairman), Dominski and Kearney. Pending the results of the Annual Meeting, the Board has determined that the Finance Committee will thereafter be composed of Mr. May (Chairman), Mr. Dominski and Ms. Knes.

During 2001, six meetings of the Board of Trustees were held, six meetings of the Audit Committee were held, five meetings of the Compensation Committee were held, one meeting of the Nominating Committee was held and no meetings of the Finance Committee were held. All trustees attended at least 75%, in the aggregate, of the number of meetings of the Board of Trustees and the committees of which they were members during their periods of service as trustees and committee members during 2001.

5

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (the "Exchange Act") requires the Company's trustees and executive officers, and holders of 10% or more of the outstanding Common Shares, to file an initial report of ownership (Form 3) and reports of changes of ownership (Forms 4 and 5) of Common Shares with the SEC. Such persons are required to furnish the Company with copies of all Section 16(a) forms that they file. Based solely upon a review of these filings and written representations from the Company's trustees and executive officers that no other reports were required, the Company notes that the following Section 16(a) reports related to 2001 were delinquent: Mr. Dominski, a Trustee, filed his Form 3 late.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of Common Shares as of March 31, 2002 by (1) each trustee and trustee nominee, (2) each of the Named Executive Officers, (3) all trustees and executive officers of the Company as a group and (4) each other person who is known by the Company to be the beneficial owner of 5% or more of the outstanding Common Shares. Unless otherwise indicated in a footnote, all such Common Shares are owned directly, and the indicated person has sole voting and investment power.

| Name and Address of Beneficial Owner | Shares Beneficially Owned(1) | Percentage Beneficially Owned | |||

|---|---|---|---|---|---|

| Morgan Stanley Dean Witter & Co. (2) 1585 Broadway New York, NY 10036 | 1,356,017 | 8.2 | % | ||

| Raymond M. Braun (3) | 250,108 | 1.5 | % | ||

| Matthew S. Dominski (4) | 5,000 | * | |||

| James Hicks (5) | 236,233 | 1.4 | % | ||

| Patrick R. Hunt (6) | 300,141 | 1.8 | % | ||

| Daniel E. Josephs (7) | 84,356 | * | |||

| Daniel P. Kearney (8) | 22,500 | * | |||

| Leandra R. Knes | — | * | |||

| Richard A. May (9) | 738,213 | 4.4 | % | ||

| Donald E. Phillips (10) | 64,580 | * | |||

| Richard L. Rasley (11) | 347,942 | 2.1 | % | ||

| James P. Schrager (12) | 5,000 | * | |||

| All trustees, trustee nominees and executive officers as a group (11 persons) (13) | 2,054,058 | 11.9 | % |

- *

- Less than 1%

- (1)

- All share amounts reflect beneficial ownership determined pursuant to Rule 13d-3 under the Exchange Act.

- (2)

- As reported in a Schedule 13G filed with the Commission on January 31, 2002 by Morgan Stanley Dean Witter & Co., an investment advisor registered under Section 203 of the Investment Advisors Act of 1940 ("MSDW"), and Morgan Stanley Investment Management Inc., an investment advisor registered under Section 203 of the Investment Advisors Act of 1940 ("MSIM"), (i) MSDW has shared voting power as to 1,091,517 Common Shares and shared dispositive power as to 1,351,017 Common Shares and (ii) MSIM has shared voting power as to 1,077,200 Common Shares and shared dispositive power as to 1,336,700 Common Shares. Also includes options exercisable within 60 days of March 31, 2002 to purchase 5,000 Common Shares, which options were granted to a former trustee of the Company as trustee compensation and assigned by such trustee to MSIM.

6

- (3)

- Includes options exercisable within 60 days of March 31, 2002 to purchase 96,968 Common Shares.

- (4)

- Includes options exercisable within 60 days of March 31, 2002 to purchase 5,000 Common Shares.

- (5)

- Includes options exercisable within 60 days of March 31, 2002 to purchase 101,417 Common Shares.

- (6)

- Includes options exercisable within 60 days of March 31, 2002 to purchase 105,250 Common Shares.

- (7)

- Includes options exercisable within 60 days of March 31, 2002 to purchase 39,000 Common Shares.

- (8)

- Includes options exercisable within 60 days of March 31, 2002 to purchase 20,000 Common Shares.

- (9)

- Includes options exercisable within 60 days of March 31, 2002 to purchase 186,724 Common Shares.

- (10)

- Includes options exercisable within 60 days of March 31, 2002 to purchase 25,000 Common Shares.

- (11)

- Includes options exercisable within 60 days of March 31, 2002 to purchase 98,542 Common Shares.

- (12)

- Includes options exercisable within 60 days of March 31, 2002 to purchase 5,000 Common Shares.

- (13)

- Includes options exercisable within 60 days of March 31, 2002 to purchase an aggregate of 682,901 Common Shares.

Compensation of Trustees

Members of the Board of Trustees and committees thereof who are not employees of the Company ("Non-Employee Trustees") receive an annual retainer fee of $16,000 plus fees of $1,000 for each day on which they attend a meeting of the Board of Trustees in person, $500 for each day on which they attend a meeting of a committee of the Board of Trustees in person and $250 for each day on which they participate telephonically in a meeting of the Board of Trustees or a committee thereof. The Company reimburses each Non-Employee Trustee for expenses incurred in attending meetings. In addition, Non-Employee Trustees currently are eligible to be granted annual options to purchase up to 5,000 Common Shares under the Incentive Plan at a price equal to the fair market value of the Common Shares as of the end of each fiscal year. As compensation for services performed during 2001, each of Messrs. Dominski, Josephs, Kearney, Phillips and Schrager received an option to purchase 5,000 Common Shares at an exercise price of $16.00 per share. Such options were exercisable when granted and will expire on the earlier of December 31, 2011 or six months after a trustee is removed by the shareholders for cause pursuant to Maryland law and the Company's Declaration of Trust.

During the period of 30 days after any "change in control," a person entitled to exercise an option granted under the Incentive Plan may elect to require the Company to purchase all or any portion of such option at a purchase price equal to the difference between the fair market value and the option exercise price. For purposes of the Incentive Plan, a "change in control" means (i) certain consolidations or mergers of the Company; (ii) certain sales of all or substantially all of the assets of the Company; (iii) the filing of a Schedule 13D or Schedule TO under the Exchange Act disclosing that any person had become the beneficial owner of 20% or more of the issued and outstanding shares of voting securities of the Company; (iv) certain filings of reports or proxy statements with the SEC; or (v) during any period of two consecutive years, individuals who at the beginning of any such period constitute the Board of Trustees cease for any reason to constitute at least a majority thereof unless the election, or the nomination for election by the Company's shareholders, of each new member of the Board of Trustees was approved by a vote of at least two-thirds of the members of the Board of Trustees then still in office at the beginning of any such period.

7

As cash compensation for their services in 2001, the Non-Employee Trustees earned the following amounts: Mr. Dominski, $14,083; Mr. Kearney, $27,033; Mr. Phillips, $27,508; and Mr. Schrager, $0.

Summary Compensation Table

The table below sets forth the summary compensation of the Chief Executive Officer and the four other most highly paid executive officers of the Company (the "Named Executive Officers") based on the aggregate compensation paid to such officers in 2001.

| | | | | | Long-Term Compensation | | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | Awards | Payouts | | |||||||||

| | Annual Compensation | | ||||||||||||||

| Name and Principal Position | Restricted Share Awards($)(2) | Securities Underlying Options(#)(3) | LTIP Payouts ($)(4) | All Other Compensation ($)(5) | ||||||||||||

| Year | Salary($) | Bonus($) | Other($)(1) | |||||||||||||

| Richard A. May Chief Executive Officer | 2001 2000 1999 | 299,250 285,000 248,063 | 68,828 285,000 248,063 | — 9,708 — | — 447,909 — | — — 34,700 | 79,475 — — | 9,413 9,331 13,026 | ||||||||

Patrick R. Hunt President | 2001 2000 1999 | 250,394 238,471 227,115 | 58,843 238,471 227,115 | — 8,123 — | — 374,790 — | — — 31,950 | 66,750 — — | 15,245 11,913 12,804 | ||||||||

Richard L. Rasley Executive Vice President | 2001 2000 1999 | 151,939 144,703 137,813 | 29,913 115,763 110,250 | — 4,929 — | — 227,422 — | — — 19,450 | 40,347 — — | 7,656 4,493 4,709 | ||||||||

Raymond M. Braun Chief Investment Officer | 2001 2000 1999 | 173,250 170,730 137,813 | 43,313 165,000 137,813 | — 5,620 — | — 259,314 — | — — 19,450 | 46,009 — — | 15,215 10,133 5,753 | ||||||||

James Hicks Chief Financial Officer | 2001 2000 1999 | 173,250 163,855 137,813 | 34,650 132,000 110,250 | — 5,620 — | — 259,314 — | — — 19,450 | 46,009 — — | 9,245 5,663 5,723 | ||||||||

- (1)

- The Board of Trustees granted restricted shares to the Named Executive Officers during the second quarter of 2000 as described below. However, the Board intended the Named Executive Officers to receive the equivalent of the dividends on such restricted shares for the entire year. The amount represents cash compensation authorized by the Board of Trustees equivalent to the first quarter dividend that would have been paid with respect to the restricted shares had the grant been made as of January 1, 2000.

- (2)

- In 2000, the Board of Trustees granted Messrs. May, Hunt, Rasley, Braun and Hicks 28,552, 23,891, 14,497, 16,530 and 16,530 restricted Common Shares, respectively. The restricted shares vest ten years from the date of grant or upon a change in control of the Company in the event the Named Executive Officer is still employed by the Company. Pursuant to the terms of the restricted share awards, the shares may vest earlier in 2001, 2002 and 2003 in the event certain performance objectives are met. The value of the restricted Common Shares as determined by reference to the closing price of the Common Shares on the NYSE Composite Tape on the effective date of the grant was $15.69 per share. During 2001, 4,759, 3,982, 2,416, 2,755 and 2,755 of the restricted Common Shares held by Messrs. May, Hunt, Rasley, Braun and Hicks, respectively, vested. As of December 31, 2001, based on the closing price of the Common Shares on the NYSE Composite Tape on December 31, 2001 of $16.00 per share, the value of the unvested restricted Common Shares held by Messrs. May, Hunt, Rasley, Braun and Hicks was $380,688, $319,744, $193,296, $220,400 and $220,400, respectively. Dividends are paid on all restricted Common Shares held by the Named Executive Officers.

8

- (3)

- Options to purchase Common Shares ("Options") granted during 1999 were issued at exercise prices greater than or equal to the fair market value of Common Shares on the dates of grant. Fair market value has been determined by reference to the closing price of the Common Shares on the NYSE Composite Tape on the effective date of the grant. Such options expire upon the earliest of (i) ten years following the date of grant, (ii) one year after the termination of the optionee's employment due to death or disability or (iii) three months after the termination of the optionee's employment for any other reason. One-third of the Options granted in 1999 became exercisable on November 19, 2000 and 2001, respectively, and the remaining Options granted in 1999 become exercisable to the extent of one-third of the shares covered thereby on November 19, 2002. All such Options become exercisable in full upon a change in control of the Company.

- (4)

- On February 28, 2001, 4,759, 3,982, 2,416, 2,755 and 2,755 of the restricted Common Shares held by Messrs. May, Hunt, Rasley, Braun and Hicks, respectively, vested pursuant to the terms of the restricted share awards. The value of the long-term incentive plan payout pursuant to such restricted share awards is based on the closing price of the Common Shares on the NYSE Composite Tape on the vesting date of $16.70 per share.

- (5)

- These amounts represent payments made by the Company for financial planning services and group life and health insurance premiums.

Option/SAR Grants in Fiscal 2001

No options or SARs were granted by the Company to the Named Executive Officers during 2001.

Aggregated Option Exercises in Fiscal 2001 and Fiscal Year-End Option/SAR Values

The following table sets forth information concerning all share purchase options exercised during fiscal 2001 and unexercised share purchase options held at the end of that fiscal year by the Named Executive Officers.

| | | | Number of Underlying Unexercised Options at 12/31/01 | Value of Unexercised In-the-Money Options/SARS at 12/31/01(1) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Shares Acquired on Exercise (#) | Value Realized($) | Exercisable (# of Shares) | Unexercisable (# of Shares) | Exercisable ($ Value) | Unexercisable ($ Value) | ||||||

| Richard A. May | — | — | 186,724 | 11,567 | 24,579 | 12,290 | ||||||

| Patrick R. Hunt | — | — | 105,250 | 10,650 | 22,631 | 11,316 | ||||||

| Richard L. Rasley | — | — | 98,542 | 6,483 | 13,777 | 6,889 | ||||||

| Raymond M. Braun | — | — | 96,968 | 6,046 | 12,848 | 6,424 | ||||||

| James Hicks | — | — | 101,417 | 6,483 | 13,777 | 6,889 | ||||||

- (1)

- Value based on the per share closing price of the Common Shares of $16.00 on December 31, 2001, as reported on the NYSE Composite Tape, minus the exercise price. None of the options held by the Named Executive Officers were exercised in 2001.

Employment Agreements

The Company and each of the Named Executive Officers are parties to certain employment agreements (the "Employment Agreements"). Pursuant to the Employment Agreements, each of the Executive Officers has agreed to serve as an executive officer of the Company for a specified term, which for Messrs. May and Hunt is through June 30, 2004, and for Messrs. Rasley, Hicks and Braun is through June 30, 2003. However, the term of the Employment Agreements for Messrs. May and Hunt is automatically extended for an additional year commencing on the date two years prior to the termination date of such agreements. The term of the Employment Agreements for Messrs. Rasley, Hicks and Braun will be automatically extended for an additional year commencing on the date that is one year

9

prior to the termination date of such agreements. Each of the Named Executive Officers has agreed to refrain from engaging in certain defined competitive activities for a one-year period following any termination for which he has received a payment under his Employment Agreement.

Each Employment Agreement provides for compensation to be paid to the respective Named Executive Officer under four different scenarios. First, if the Named Executive Officer's employment is terminated for any reason other than for cause, his death or his permanent disability, or if he terminates his employment for "Good Reason," the Named Executive Officer will be entitled to receive a lump sum payment equal to two times the sum of: (1) his highest base pay for any period prior to the termination of his employment and (2) his most recent bonus percentage multiplied by such annual base pay. In addition, for a period of 12 months following any such termination, the Company will continue to provide the Named Executive Officer with employee benefits that are substantially similar to those he was receiving or entitled to receive prior to such termination. Second, if the Named Executive Officer's employment is terminated due to his permanent disability, the Named Executive Officer will be entitled to receive a lump sum payment equal to two times the sum of: (1) his highest base pay for any period prior to the termination of his employment and (2) his most recent bonus percentage multiplied by such annual base pay. In addition, for a period of 24 months following any such termination, the Company will continue to provide the Named Executive Officer with employee benefits that are substantially similar to those he was receiving or entitled to receive prior to such date. Third, if the Named Executive Officer's employment is terminated due to his death, his estate will be entitled to receive a lump sum payment equal to two times the sum of: (1) the Named Executive Officer's highest base pay for any period prior to the termination of his employment and (2) his most recent bonus percentage multiplied by such annual base pay. Fourth, in the event there has been a "Change in Control," if the Named Executive Officer's employment is terminated for any reason other than for cause, including as a result of the Named Executive Officer's death or permanent disability, during a 12-month severance period following any such Change in Control, each of Messrs. Rasley, Braun and Hicks will be entitled to receive a lump sum payment equal to two times, and each of Messrs. May and Hunt will be entitled to receive a lump sum payment equal to three times, the sum of: (1) his highest base pay for any period prior to the termination of his employment and (2) an amount equal to the product of such base pay multiplied by the greater of (a) a fraction, the numerator of which is the average of the aggregate amounts of incentive pay earned by the executive during each of the three then most recently completed fiscal years of the Company, and the denominator of which is the average of base pay (as in effect for each of the three then most recently completed fiscal years of the Company), or (b) a fraction, the numerator of which is the aggregate amount of incentive pay earned by the executive during the most recently completed fiscal year of the Company (or any successor thereto) and the denominator of which is the executive's base pay (as in effect for the most recently completed fiscal year of the Company or any successor thereto). In addition, for a period of 12 months following the termination of his employment, the Company will continue to provide the Named Executive Officer with employee benefits that are substantially similar to those he was receiving or entitled to receive prior to such termination. Any payments made by the Company pursuant to such Employment Agreements will be increased, or "grossed up," as required in the event the contractual payments to any of the Named Executive Officers become subject to the excise tax imposed by Section 4999 of the Internal Revenue Code of 1986.

"Good Reason" is defined in the Employment Agreements as (1) the executive's resignation or retirement is requested by the Company other than for cause; (2) any significant change in the nature or scope of the executive's duties or level of authority and responsibility; (3) any reduction in the executive's applicable total compensation or benefits other than a reduction in compensation or benefits applicable to substantially all of the Company's employees; (4) a breach by the Company of any other material provision of the Employment Agreement; or (5) a reasonable determination by the executive that, as a result of a Change in Control and a change in circumstances thereafter significantly affecting the executive's position, the executive is unable to exercise the prior level of the executive authority and responsibility. A "Change in Control" is deemed to occur under the Employment Agreements if (i) any person becomes the beneficial owner of 50% or more of the outstanding Common

10

Shares, (ii) during any 24-month period, individuals who at the beginning of such period constitute the Board of Trustees (the "Incumbent Board") cease for any reason to constitute at least a majority of the Board of Trustees; provided, however, that any individual becoming a trustee during such period whose election, or nomination for election by the Company's shareholders, was approved by a vote of at least a majority of the trustees then comprising the Incumbent Board shall be considered as though such individual were a member of the Incumbent Board, but excluding for this purpose any such individual whose initial assumption of office is in connection with an actual or threatened contest for the election of trustees (as such terms are used in Rule 14a-11 of Regulation 14A promulgated under the Exchange Act or any successor rule) or other actual or threatened solicitation of proxies or consents by or on behalf of a person other than the Board of Trustees, (iii) certain consolidations or mergers of the Company occur, (iv) certain sales, leases, exchanges or other transfers of all, or substantially all, of the assets of the Company occur or (v) the Company files a report or proxy statement with the SEC stating that a Change in Control of the Company has occurred or will occur in the future pursuant to any then-existing contract or transaction.

Limited Purpose Employee Loan Program

In 1996, the Company established the Limited Purpose Employee Loan Program (the "Employee Loan Program") for the purpose of attracting and retaining certain key employees by facilitating their ability to participate in the Company's stock option program. Under the Employee Loan Program, the Compensation Committee authorized the Company to make loans and loan guarantees to, or for the benefit of, any employee of the Company to facilitate the ability to participate in the Incentive Plan. During 2001, the Compensation Committee indefinitely suspended the making of new loans under the Employee Loan Program pending a review of its utility in connection with the entire compensation program. Prior to the 2001 suspension, under the Employee Loan Program, subject to certain limitations that became effective as of March 1, 1998, employees could borrow to fund up to 100% of (1) the cost of exercising share purchase options held by the employee or (2) individual income tax obligations which may arise as a result of aspects of the implementation of the Company's long-term incentive plans. Such loans bear interest, payable quarterly, at 6.83%, the interest rate of borrowings under the largest of the Company's fixed rate mortgage loans, are recourse to the employees and are secured by a pledge of the shares acquired by the employee through this program. Such loans expire on (i) the earlier of the fifth anniversary of the loan date and (ii) the date that is 60 days following the termination of employment. As of December 31, 2001, employees had acquired an aggregate of approximately 1,433,000 Common Shares through this program with aggregate outstanding loan amounts of approximately $20.1 million due the Company.

Messrs. May, Hunt, Rasley and Braun borrowed $25,790, $29,294, $13,093 and $13,093 in 2001 under the Employee Loan Program, respectively, all of which was outstanding at December 31, 2001. The proceeds of each of the loans were used to pay withholding taxes related to the vesting of certain previously granted restricted shares.

The following table summarizes the borrowings made by the Named Executive Officers during 2001:

| Name | Total Borrowings During 2001 | Total Borrowings Outstanding as of December 31, 2001 | ||||

|---|---|---|---|---|---|---|

| Richard A. May | $ | 25,790 | $ | 5,324,000 | ||

| Patrick R. Hunt | 29,294 | 2,826,812 | ||||

| Richard L. Rasley | 13,093 | 2,929,368 | ||||

| Raymond M. Braun | 14,930 | 1,949,190 | ||||

| James Hicks | — | 1,469,500 | ||||

11

Compensation Committee Interlocks and Insider Participation

The Compensation Committee currently consists of Messrs. Kearney (Chairman), Josephs and Phillips. None of the members of the Compensation Committee is or has ever been an officer or employee of the Company or had any other relationship with the Company, except as a member of the Board of Trustees and as a shareholder.

Compensation Committee Report on Executive Compensation

During 2001, the Compensation Committee was comprised of Messrs. Kearney (Chairman), Josephs and Phillips. The Board of Trustees has delegated to the Compensation Committee the authority to determine the compensation of the Company's executive officers and other key management employees. The Compensation Committee's primary objective is to ensure that the Company's compensation policies attract, motivate and retain qualified managers in a manner consistent with maximization of shareholder value. The Company's compensation is structured philosophically on a "pay for performance" foundation and thus recognizes the desirability of compensation directed specifically to motivate and reward executive managers for achieving both short- and long-term performance objectives. Compensation is comprised of three major components: base salary, incentive bonus and equity-based incentives, which include share purchase options and restricted shares.

Base Salary

Base salaries are determined in the context of an individual's responsibilities and competitive benchmarking. Base salaries are reviewed annually and adjusted on the basis of individual performance and competitive considerations. In making base salary adjustments, the Compensation Committee considers an individual's performance, especially the effective discharge of assigned responsibilities and the leadership and motivation provided to subordinates. In making salary decisions for 2001, the Compensation Committee considered primarily the effects of inflation and certain subjective criteria, including the Compensation Committee's evaluation of each executive officer's performance of his duties.

In 2001, the Company offered an annual incentive bonus compensation program for the executive officers that was designed to motivate short-term performance. The executive officers were entitled to an annual incentive bonus based upon (1) the relationship of the Company's actual funds from operations ("FFO") compared to budgeted FFO for the 2001 fiscal year; and (2) the individual's attainment of personal objectives. Seventy-five percent of each executive officer's bonus was to be determined with reference to the FFO component and the remaining 25% of the bonus was to be determined with reference to personal goal attainment. Personal goals generally specified attainment of particular objectives or management responsibilities for the executive officer. The Compensation Committee believes that the relatively heavy weight assigned to attainment of the Company's budgeted FFO was appropriate in the light of the priority of maximizing shareholder value and the desirability of emphasizing teamwork in the management of the Company.

Under the 2001 incentive compensation program, each executive officer was assigned "threshold," "target" and "maximum" bonuses that were a fixed percentage of base salary. These percentages were 25%, 50% and 100%, respectively, for Messrs. May, Hunt and Braun; and 20%, 40% and 80%, respectively, for Messrs. Rasley and Hicks. Each executive officer was entitled to receive 75% of the designated bonus percentage based upon the Company's achievement of certain FFO levels established by the Compensation Committee. In addition, each executive officer was entitled to receive up to 25% of the designated bonus percentage based upon the individual's achievement of certain personal objectives reviewed by the Compensation Committee. If the threshold FFO level was not met, no bonus would be paid; if the threshold FFO level, but not the target FFO level, was met, the threshold bonus would be paid; and if the target FFO level was met or exceeded, the target bonus would be paid and the bonus would be increased on a linear basis up to the maximum based upon a scale established by the Compensation Committee. In 2001, the Compensation Committee determined that based upon the FFO attained by the Company, the threshold level had been reached. In addition, the Compensation

12

Committee concluded that Messrs. Braun and Hicks had fully met their personal objectives and that Messrs. May, Hunt and Rasley had substantially met their personal objectives. Therefore, the Compensation Committee determined that Messrs. May, Hunt, Rasley, Braun and Hicks should receive bonuses of $68,828, $58,843, $29,913, $43,313 and $34,650, respectively.

Share Purchase Option and Restricted Share Grants

The Compensation Committee seeks to ensure that the executive officers of the Company focus attention on long-term objectives, including maximization of value for shareholders. The Compensation Committee believes that share purchase options and restricted shares are appropriate compensation tools to motivate and reward executive managers for long-term performance. The Compensation Committee believes that the growth of the Company's FFO relative to an established peer group over a multiple-year period is an appropriate measure of performance by the management group. In 2000, the Compensation Committee granted an aggregate of 100,000 restricted Common Shares to the Named Executive Officers that vest in ten years, or earlier, in increments upon the attainment of certain performance objectives related to the growth of the Company's FFO relative to an established peer group. One-sixth of the granted shares vested in 2001 based upon the Company's performance in 2000. No additional shares have vested thereafter. See "Executive Compensation—Summary Compensation Table."

Compensation of Chief Executive Officer

Mr. May's base salary compensation as reported under "Executive Compensation—Summary Compensation Table" for 2001 was $299,250, which was 5% higher than the corresponding amount reported for 2000. In making such determination, the Compensation Committee considered, among other things, competitive benchmarking and the Company's performance in the preceding twelve-month period compared to budgeted performance.

Mr. May participated in the annual incentive bonus compensation program and consistent with the approach described above regarding incentive bonuses for other executive officers, since he did not fully meet his personal objectives in 2001, Mr. May received a bonus payout for 2001 equal to 23% of his base salary. See "Executive Compensation—Summary Compensation Table."

Limitations on Deductibility

In 1993, changes were made to the federal corporate income tax law that limit the ability of public companies to deduct compensation in excess of $1 million paid annually to each of the chief executive officer and the other four most highly compensated executive officers. There are exemptions from this limit, including compensation that is based on the attainment of performance goals that are established by the Compensation Committee and approved by the Company's shareholders. It is the Compensation Committee's policy to seek to qualify executive compensation for deductibility where practicable and to the extent that such policy is consistent with the Company's overall objectives in attracting, motivating and retaining its executives. The Company believes that, based upon current compensation levels, compensation paid in 2001 should be fully deductible.

Submitted by the Compensation Committee of the Board of Trustees

Daniel P. Kearney (Chairman)

Daniel E. Josephs

Donald E. Phillips

13

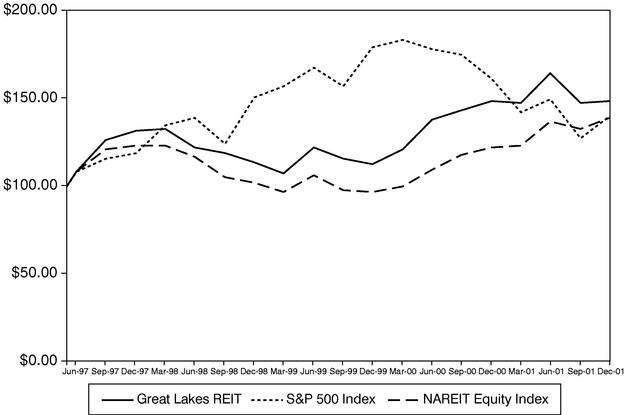

The following graph compares the percentage change in the cumulative return on the Common Shares with that of the Standard & Poor's 500 Stock Index (the "S&P 500 Index") and the National Association of Real Estate Investment Trusts Equity Index (the "NAREIT Equity Index") at May 8, 1997 (the first day the Common Shares were listed on the NYSE) and the last day of each calendar quarter subsequent to May 8, 1997. The graph assumes a $100 investment and reinvestment of dividends.

| | 5/8/97 | 6/30/97 | 9/30/97 | 12/31/97 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Great Lakes REIT | $ | 100.00 | $ | 108.00 | $ | 126.36 | $ | 131.63 | ||||

| S&P 500 Index | 100.00 | 107.91 | 115.49 | 118.31 | ||||||||

| NAREIT Equity Index | 100.00 | 107.94 | 120.70 | 122.81 | ||||||||

| | 3/31/98 | 6/30/98 | 9/30/98 | 12/31/98 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Great Lakes REIT | $ | 132.28 | $ | 121.78 | $ | 118.19 | $ | 113.57 | ||||

| S&P 500 Index | 134.32 | 138.23 | 123.99 | 149.86 | ||||||||

| NAREIT Equity Index | 122.24 | 116.63 | 104.36 | 101.31 | ||||||||

| | 3/31/99 | 6/30/99 | 9/30/99 | 12/31/99 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Great Lakes REIT | $ | 107.02 | $ | 122.13 | $ | 115.40 | $ | 112.33 | ||||

| S&P 500 Index | 156.82 | 167.35 | 156.38 | 179.12 | ||||||||

| NAREIT Equity Index | 96.43 | 106.15 | 97.62 | 96.63 | ||||||||

| | 3/31/00 | 6/30/00 | 9/30/00 | 12/31/00 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Great Lakes REIT | $ | 120.38 | $ | 137.62 | $ | 142.98 | $ | 148.47 | ||||

| S&P 500 Index | 182.70 | 177.33 | 175.13 | 160.96 | ||||||||

| NAREIT Equity Index | 98.95 | 109.37 | 117.73 | 122.11 | ||||||||

| | 3/31/01 | 6/30/01 | 9/30/01 | 12/31/01 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Great Lakes REIT | $ | 147.42 | $ | 163.56 | $ | 146.62 | $ | 148.03 | ||||

| S&P 500 Index | 141.46 | 149.27 | 126.90 | 139.97 | ||||||||

| NAREIT Equity Index | 122.59 | 136.09 | 132.51 | 139.12 | ||||||||

14

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

For the years ended December 31, from 1995 through 2001, the Company selected Ernst & Young LLP, a certified public accounting firm, as its independent auditors. There are no affiliations between the Company and Ernst & Young LLP, its partners, associates or employees, other than as pertain to its engagement as independent auditors. Subject to the ratification of the Company's shareholders, the Board has reappointed Ernst & Young LLP as independent auditors for the Company for the year ending December 31, 2002. A representative of Ernst & Young LLP is expected to be present at the Annual Meeting and will have an opportunity to make an independent statement if he desires to do so. The representative is expected to be available to respond to appropriate shareholder questions.

Shareholder ratification of the selection of Ernst & Young LLP as the Company's independent auditors is not required by the Company's Bylaws or other applicable legal requirement. However, the Board is submitting the selection of Ernst & Young LLP to the shareholders for ratification as a matter of good corporate practice. If the shareholders fail to ratify the selection, the Audit Committee and the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Board at its discretion may direct the appointment of a different independent accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders.

Fees Billed to the Company by Ernst & Young LLP During Fiscal 2001

Audit Fees: Audit fees billed to the Company by Ernst & Young LLP during the Company's 2001 fiscal year for review of the Company's annual financial statements and those financial statements included in the Company's quarterly reports on Form 10-Q totaled $77,000.

Financial Information Systems Design and Implementation Fees: The Company did not engage Ernst & Young LLP to provide advice to the Company regarding financial information systems design and implementation during the fiscal year ended December 31, 2001.

All Other Fees: Fees billed to the Company by Ernst & Young LLP during the Company's 2001 fiscal year for all other non-audit services rendered to the Company totaled $80,118. These other fees included $55,618 for tax-related services and $24,500 for services related to property-level audits for properties acquired by the Company during 2001. The Audit Committee determined that the provision of these services should not compromise Ernst & Young LLP's independence.

Vote Required

The favorable vote of a majority of the votes cast with respect to the proposal at the Annual Meeting will be required to ratify the selection of Ernst & Young LLP as the Company's independent auditors for the fiscal year ending December 31, 2002.

The Board recommends a vote "FOR" the ratification of the appointment of Ernst & Young LLP as the Company's independent auditors for the year ended December 31, 2002.

Audit Committee Report

The Audit Committee is comprised of three Independent Trustees, all of whom are "independent" as required by the applicable listing standards of the NYSE, and operates under a written charter adopted by the Board of Trustees. A copy of the Audit Committee Charter was included in last year's proxy statement. The Audit Committee oversees the Company's financial reporting process on behalf of the Board of Trustees. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements with management, including a discussion of

15

the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company's accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards. In addition, the Audit Committee has discussed with the independent auditors the auditors' independence from management and the Company, including the matters in the written disclosures required by the Independence Standards Board, and considered the compatibility of non-audit services with the auditors' independence.

The Audit Committee discussed with the Company's independent auditors the overall scope and plans for their audit. The Audit Committee meets with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company's internal controls, and the overall quality of the Company's financial reporting. The Audit Committee held six meetings during calendar 2001.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Trustees (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2001 filed with the SEC on March 19, 2002. The Audit Committee and the Board have also recommended, subject to shareholder approval, the selection of the Company's independent auditors.

Submitted by the Audit Committee of the Board of Trustees

Donald E. Phillips (Chairman)

Daniel E. Josephs

Matthew S. Dominski

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Pursuant to the Employee Loan Program, an aggregate principal amount of approximately $14.5 million in loans made to the Named Executive Officers by the Company was outstanding at December 31, 2001. Such loans bear interest, payable quarterly, at 6.83% per annum, the interest rate of borrowings under the largest of the Company's fixed rate mortgage loans. See "Executive Compensation—Limited Purpose Employee Loan Program" for a description of such loans.

The Board of Trustees knows of no other business that will be presented at the Annual Meeting for a vote. Because the Company did not receive by April 1, 2002, the date determined by reference to the Charter Documents, notice of any other matter intended to be raised by a shareholder, proxies will be voted in respect of any other matters as may properly come before the Annual Meeting in accordance with the recommendation of the Board of Trustees or, if no such recommendation is given, in the discretion of the person or persons voting the proxies.

16

SHAREHOLDER PROPOSALS FOR THE 2003 ANNUAL MEETING

Any proposal of a shareholder intended to be presented at the Company's 2003 annual meeting of shareholders (the "2003 Annual Meeting"), which the Company's Bylaws require be held in May 2003, and to be considered for inclusion in the Company's proxy and proxy statement relating to the 2003 Annual Meeting, must be received by the Secretary of the Company by December 19, 2002. Any shareholder intending to propose any matter at the 2003 Annual Meeting but not intending for the Company to include the matter in its proxy statement must notify the Company between February 22, 2003 and March 24, 2003 of such proposal. If the Company does not receive such notice by March 24, 2003, the notice will be considered untimely. The Company's proxy for the 2003 Annual Meeting will grant discretionary authority to the persons named therein to exercise their voting discretion with respect to any such matter of which the Company does not receive notice between February 22, 2003 and March 24, 2003.

Any shareholder wishing to submit a proposal at the 2003 Annual Meeting must also comply with certain provisions of the Charter Documents. The Charter Documents require written notice of any such proposal (and certain other information) to be delivered to the Secretary of the Company generally not earlier than 90 days or later than 60 days in advance of the date of the previous year's annual meeting. The Company will provide (without charge) a copy of the Charter Documents to any holder of record of Common Shares.

Notices regarding shareholder proposals and requests for copies of the Charter Documents should be directed to: Secretary, Great Lakes REIT, 823 Commerce Drive, Suite 300, Oak Brook, Illinois 60523.

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. THEREFORE, ALL SHAREHOLDERS ARE URGED TO COMPLETE, SIGN AND DATE AND RETURN THE ACCOMPANYING FORM OF PROXY IN THE ENCLOSED ENVELOPE.

By Order of the Board of Trustees,

Richard L. Rasley,

SECRETARY

THE ANNUAL REPORT OF GREAT LAKES REIT

FOR THE YEAR ENDED DECEMBER 31, 2001

WAS MAILED TO ALL SHAREHOLDERS ON OR ABOUT APRIL 18, 2002.

17

GREAT LAKES REIT C/O AMERICAN STOCK TRANSFER 6201 15th AVENUE BROOKLYN, NY 11219 | VOTE BY INTERNET—www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site. You will be prompted to enter your 12-digit Control Number which is located below to obtain your records and to create an electronic voting instruction form. |

VOTE BY PHONE—1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call. You will be prompted to enter your 12-digit Control Number which is located below and then follow the simple instructions the Vote Voice provides you. | |

VOTE BY MAIL— Mark, sign, and date your proxy card and return it in the postage-paid envelope we have provided or return it to Great Lakes REIT, c/o ADP, 51 Mercedes Way, Edgewood, NY 11717. | |

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

GREATR KEEP THIS PORTION FOR YOUR RECORDS

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

DETACH AND RETURN THIS PORTION ONLY

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

GREAT LAKES REIT

| THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF TRUSTEES | ||||||||||||||||||

1. | ELECTION OF TRUSTEES. | For All | Withhold All | For All Except | To withhold authority to vote, mark "For All Except" and write the nominee's number on the line below. | |||||||||||||

| 01) Richard A. May 02) Matthew S. Dominski 03) Patrick R. Hunt 04) Daniel P. Kearney | 05) Leandra R. Knes 06) Donald E. Phillips 07) James E. Schrager | o | o | o | | |||||||||||||

Vote On Proposal | For | Against | Abstain | |||||||||||||||

2. | Proposal to ratify the appointment of Ernst & Young LLP as the independent auditors of the Company for the year ending December 31, 2002. | o | o | o | ||||||||||||||

3. | To vote, and otherwise represent the undersigned, upon such other matters as may properly come before the meeting or any adjournment or postponement thereof, in the discretion of the proxy holders. | |||||||||||||||||

| Please sign exactly as name appears above. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by the President or other authorized officer. If a partnership, please sign in partnership name by authorized person. | ||||||||||||||||||

| Signature [PLEASE SIGN WITHIN BOX] | Date | Signature (Joint Owners) | Date | |||||||

- ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

PROXY

GREAT LAKES REIT

The undersigned shareholder of Great Lakes REIT, a Maryland real estate investment trust (the "Company"), hereby appoints Richard A. May and Richard L. Rasley as proxies for the undersigned, with the full power of substitution in each of them, to cast on behalf of the undersigned all votes that the undersigned is entitled to cast at the Company's Annual Meeting of Shareholders (the "Annual Meeting") to be held on May 23, 2002 at 10:00 a.m., Central Time, at the Wyndham Drake Hotel at York Road and 22nd Street, Oak Brook, Illinois, and otherwise to represent the undersigned at the Annual Meeting with all powers possessed by the undersigned if personally present at the Annual Meeting, and at any and all adjournments or postponements thereof, upon the following matters that are more fully described in the accompanying Proxy Statement. The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Shareholders and the accompanying Proxy Statement and revokes any proxy heretofore given with respect to the Annual Meeting. The votes entitled to be cast by the undersigned will be cast in the manner directed on the reverse side. If this proxy is executed but no direction is made, the votes entitled to be cast by the undersigned will be cast for each of the nominees for Trustee; for the proposal to ratify the appointment of Ernst & Young LLP as the independent auditors of the Company for the year ending December 31, 2002; and in the discretion of the proxy holder, on any other matter that may come before the Annual Meeting or any adjournment or postponement thereof.

PLEASE SIGN EXACTLY AS NAME APPEARS ON THE REVERSE SIDE. WHEN SHARES ARE HELD BY JOINT TENANTS, BOTH SHOULD SIGN. WHEN SIGNING AS ATTORNEY, EXECUTOR, ADMINISTRATOR, TRUSTEE OR GUARDIAN, PLEASE GIVE FULL TITLE AS SUCH. IF A CORPORATION, PLEASE SIGN IN FULL CORPORATE NAME BY THE PRESIDENT OR OTHER AUTHORIZED OFFICER. IF A PARTNERSHIP, PLEASE SIGN IN PARTNERSHIP NAME BY AUTHORIZED PERSON.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

EXECUTIVE COMPENSATION

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

OTHER MATTERS

SHAREHOLDER PROPOSALS FOR THE 2003 ANNUAL MEETING