EXHIBIT 99.4

Filed by August Technology Corporation

Pursuant to Rule 14a-12 Under the Securities Exchange Act of 1934

Subject Company: August Technology Corporation

Commission File No. 000-30637

August Technology Corporation

Powerpoint Presentation to Brokers and Institutional Investors

Additional Information and Where to Find It

In connection with the proposed transaction, a registration statement of Rudolph Technologies, Inc., which will include a joint proxy statement of Rudolph and August, and other materials, will be filed with the SEC. WE URGE INVESTORS TO READ THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT AND THESE OTHER MATERIALS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT RUDOLPH, AUGUST AND THE PROPOSED TRANSACTION. Investors will be able to obtain free copies of the registration statement and joint proxy statement (when available) as well as other filed documents containing information about Rudolph and August at http://www.sec.gov, the SEC’s website. Free copies of Rudolph’s SEC filings may also be obtained at http://www.rudolphtech.com, and free copies of August’s SEC filings may be obtained from August’s website at http://www.augusttech.com.

Participants in the Solicitation

Rudolph, August and their respective executive officers and directors may be deemed, under SEC rules, to be participants in the solicitation of proxies from Rudolph’s stockholders or August’s shareholders with respect to the proposed transaction. Information regarding the officers and directors of Rudolph is included in its definitive proxy statement for its 2005 Annual Meeting filed with the SEC on April 22, 2005. Information regarding the officers and directors of August is included in its definitive proxy statement for its 2005 Annual Meeting filed with the SEC on April 29, 2005. More detailed information regarding the identity of potential participants, and their direct or indirect interests, by securities holdings or otherwise, will be set forth in the registration statement and joint proxy statement and other materials to be filed with the SEC in connection with the proposed transaction.

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

The New Rudolph

…Creating A New Market Leader

1

Safe Harbor Statement

The following material contains forward-looking statements relating to at least the following matters: industry projections and the company’s long term operating model. Other forward-looking statements may be preceded by words such as “expects”, “anticipates”, and “intends”. These forward-looking statements are based on our current expectations and projections. However, they are subject to various risks and uncertainties that could cause actual results to differ materially from those projected in such statements, including the following: cyclicality of the semiconductor industry, customer concentration, introduction of new products by our competitors, and sole or limited sources of supply. Other risks and uncertainties are detailed in our Annual Report on Form 10-K dated March 15, 2004 filed with the Securities and Exchange Commission (SEC).

2

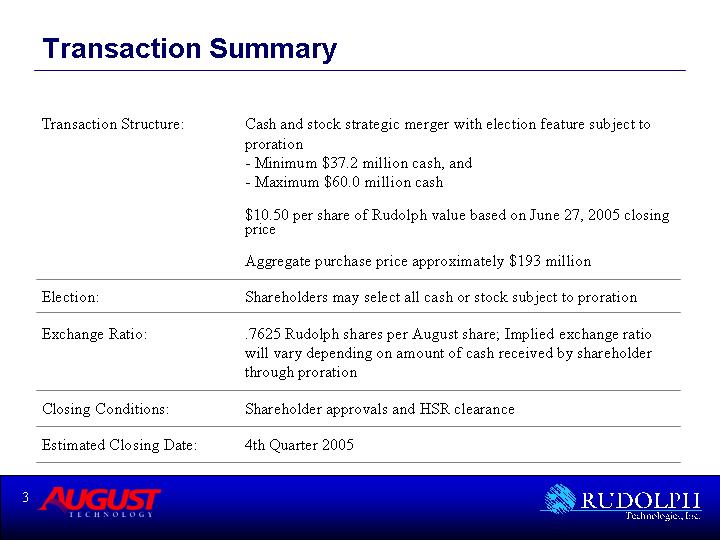

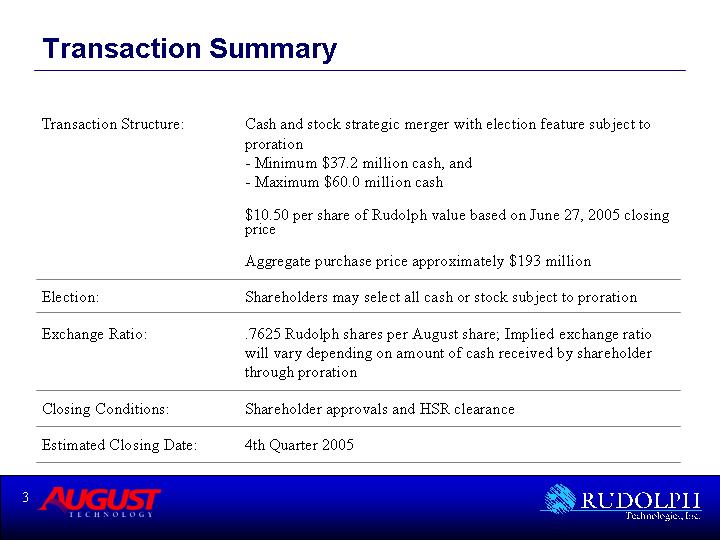

Transaction Summary

Transaction Structure: | Cash and stock strategic merger with election feature subject to proration |

| - Minimum $37.2 million cash, and |

| - Maximum $60.0 million cash |

| |

| $10.50 per share of Rudolph value based on June 27, 2005 closing price |

| |

| Aggregate purchase price approximately $193 million |

| |

Election: | Shareholders may select all cash or stock subject to proration |

| |

Exchange Ratio: | .7625 Rudolph shares per August share; Implied exchange ratio will vary depending on amount of cash received by shareholder through proration |

| |

Closing Conditions: | Shareholder approvals and HSR clearance |

| |

Estimated Closing Date: | 4th Quarter 2005 |

3

Company Overviews

[LOGO] | | [LOGO] |

| | |

• Thin film metrology and defect inspection systems | | • Automated defect detection and review systems |

• Year Founded: 1940 | | • Year Founded: 1992 |

• LTM Revenues*: $88.4M | | • LTM Revenues*: $70.5M |

• Headquarters: Flanders, NJ | | • Headquarters: Bloomington, MN |

• Key Product Families: | | • Key Product Families: |

• Copper (Metal) Film Metrology | | • Macro Defect Inspection |

• Transparent Thin Film Metrology | | • 2D & 3D Inspection |

• Macro Defect Inspection | | • Defect Review |

• Yield Data Management Systems | | • Data Management & Analysis |

• Integrated Metrology | | • Employees: 254 |

• Employees: 334 | | |

*LTM as of March 31, 2005

4

The New Rudolph Mission

Planned profitable growth

Be a clear leader in metrology and inspection

with “best-of-breed” solutions in our chosen niches

and be the overall #2 pure-play process control supplier

be a desired stock investment

5

Strategic Merger Rationale

• Enhances Industry Leadership with Complementary Product Offering

• The New Rudolph will have a leadership position in multiple markets:

• Opaque (copper) thin film metrology

• Macro defect front-end

• Macro defect back-end

• Transparent film metrology

• Strong Revenue Synergy Potential

• Rudolph’s worldwide front-end fab relationships will help accelerate acceptance for August front-end tools

• Ability to leverage complementary products into a more diversified customer base

• Leverage combined company’s expertise in yield enhancement software

• Redeployment of duplicative R&D into new product development

• Opportunity for Expense Efficiencies

• Eliminate redundant investments in automation and platform support

• Sales office consolidation

• Public company and regulatory compliance savings

• Improved Financial Position

• Creates entity with approximately $160MM in LTM revenues as of March 31, 2005

6

Goals for The New Rudolph

• Planned profitable growth by creating compelling value propositions for our customers

• Market leadership in inspection and metrology serving our customers with an ever-expanding suite of products and services

• Successfully integrate cultures from 2 great franchises and foster opportunities for personal and professional growth

• Enhance shareholder value and be a desired investment through consistently strong financial performance

• Realizing the cost benefits of critical mass.

7

Complete Solutions

Rapidly Growing

Front End Macro Inspection | | | | [GRAPHIC] |

| | | | |

[LOGO] | | | | |

| | Complete Metrology & Inspection Solutions | | |

Leadership in Copper (Metal) & Transparent Thin Film Metrology | | | | Leadership in Back End Inspection |

| | | | |

[GRAPHIC] | | | | [LOGO] |

| | | | |

| | | Rapidly Growing

Front End Macro Inspection |

8

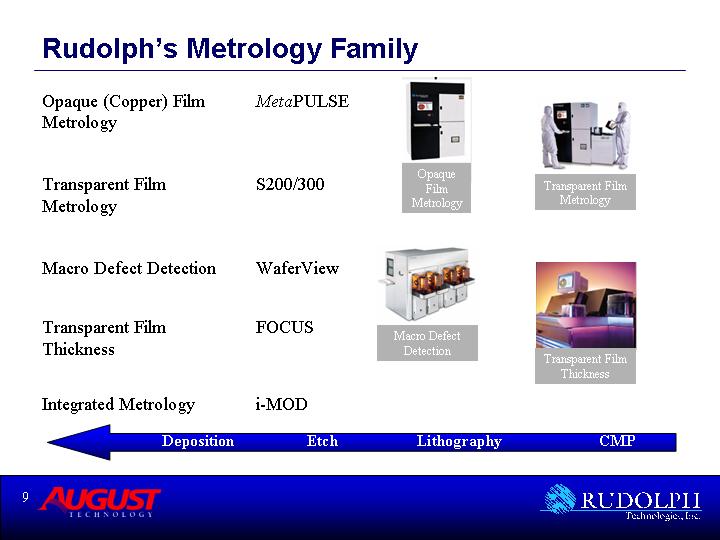

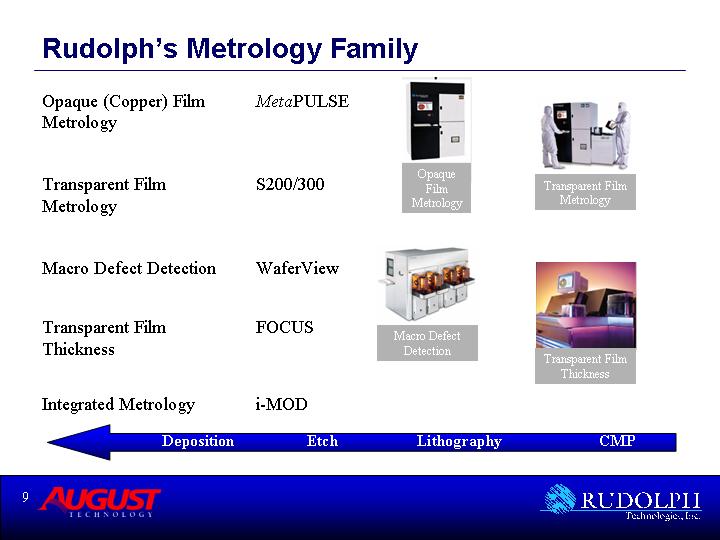

Rudolph’s Metrology Family

Opaque (Copper) Film Metrology | | MetaPULSE | | [GRAPHIC] | | [GRAPHIC] |

| | | | | | |

Transparent Film Metrology | | S200/300 | | Opaque Film Metrology | | Transparent Film Metrology |

| | | | | | |

Macro Defect Detection | | WaferView | | [GRAPHIC] | | [GRAPHIC] |

| | | | | | |

Transparent Film Thickness | | FOCUS | | Macro Defect Detection | | Transparent Film Thickness |

| | | | | | |

Integrated Metrology | | i-MOD | | | | |

| | | | | | |

Deposition | | Etch | | Lithography | | CMP |

9

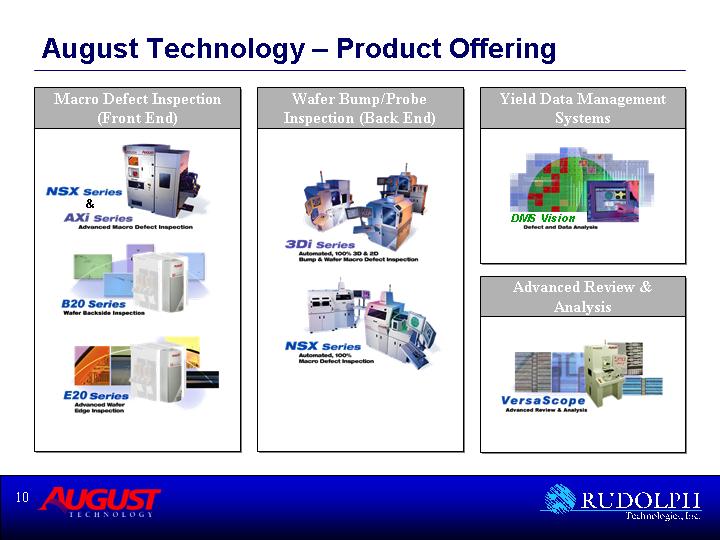

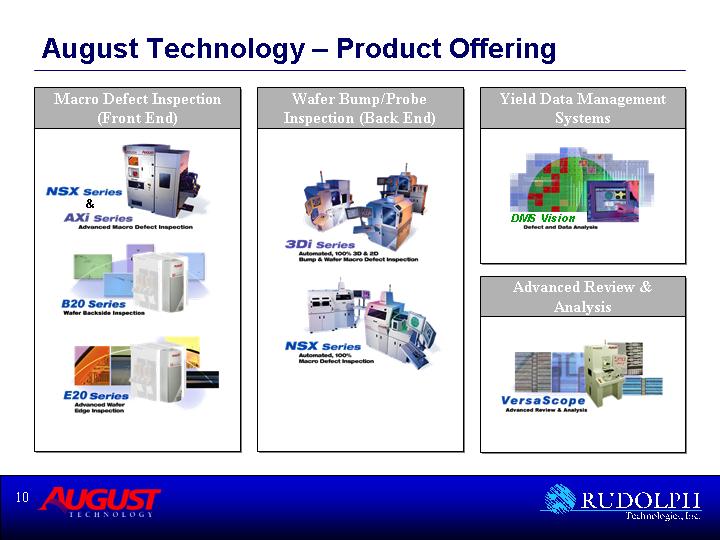

August Technology – Product Offering

Macro Defect Inspection

(Front End) | | Wafer Bump/Probe

Inspection (Back End) | | Yield Data Management

Systems |

| | | | |

[GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] |

| | | | |

| | | | Advanced Review &

Analysis |

| | | | |

| | | | [GRAPHIC] |

10

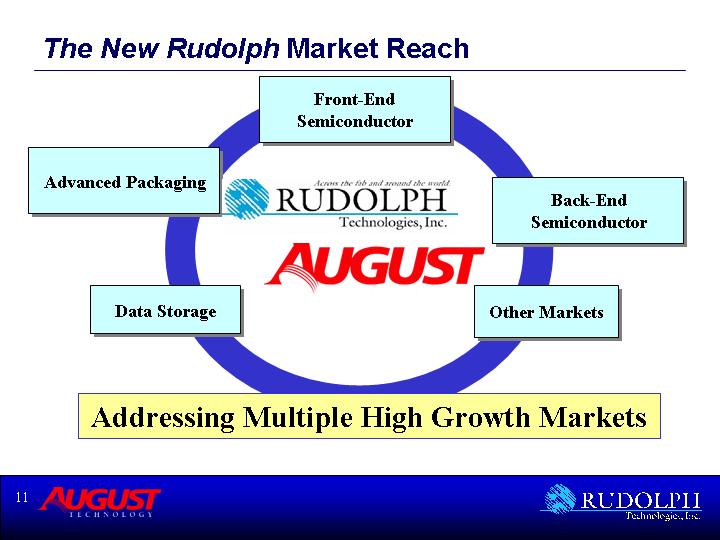

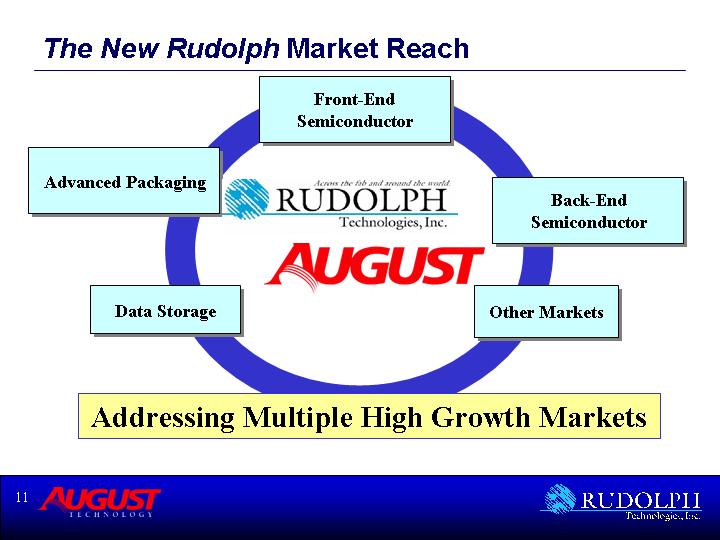

The New Rudolph Market Reach

| Front-End

Semiconductor | |

| | |

Advanced Packaging | [LOGO] | |

| [LOGO] | Back-End

Semiconductor |

| | |

Data Storage | | Other Markets |

Addressing Multiple High Growth Markets

11

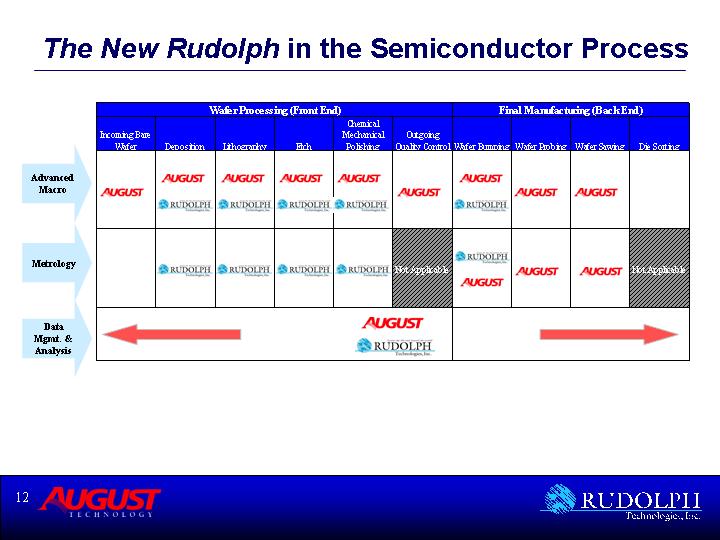

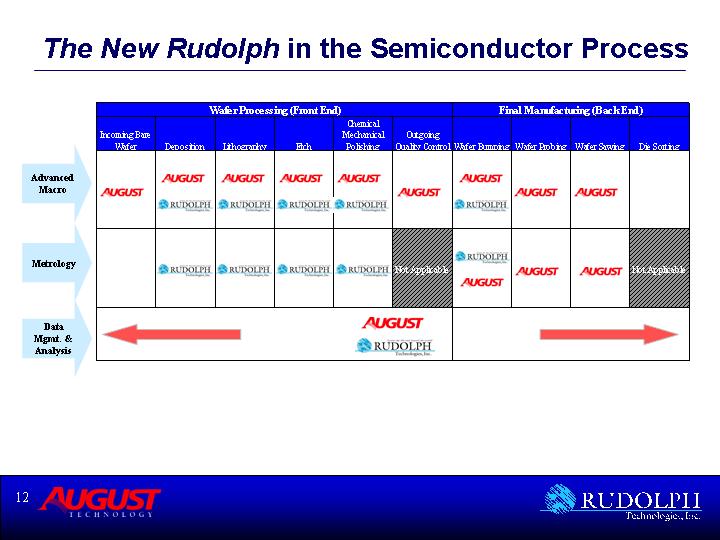

The New Rudolph in the Semiconductor Process

| | Wafer Processing (Front End) | | Final Manufacturing (Back End) | |

| | Incoming Bare

Wafer | | Deposition | | Lithography | | Etch | | Chemical

Mechanical

Polishing | | Outgoing

Quality Control | | Wafer Bumping | | Wafer Probing | | Wafer Sawing | | Die Sorting | |

Advanced Macro | | [LOGO] | | [LOGO] | | [LOGO] | | [LOGO] | | [LOGO] | | [LOGO] | | [LOGO] | | [LOGO] | | [LOGO] | | [LOGO] | |

| | | | | | | | | | | | | | | | | | | | | |

Metrology | | [LOGO] | | [LOGO] | | [LOGO] | | [LOGO] | | [LOGO] | | Not Applicable | | [LOGO] | | [LOGO] | | [LOGO] | | Not Applicable | |

| | | | | | | | | | | | | | | | | | | | | |

Data Mgmt. & Analysis | | | | | | | | | | | | [LOGO] | | | | | | | | | |

12

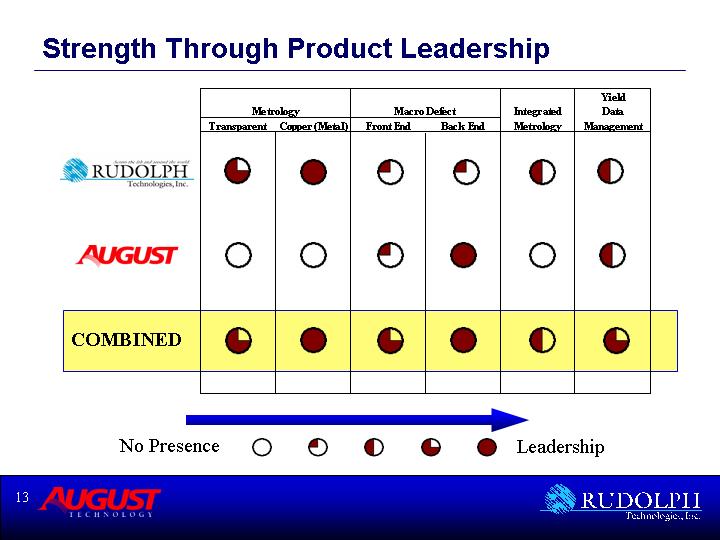

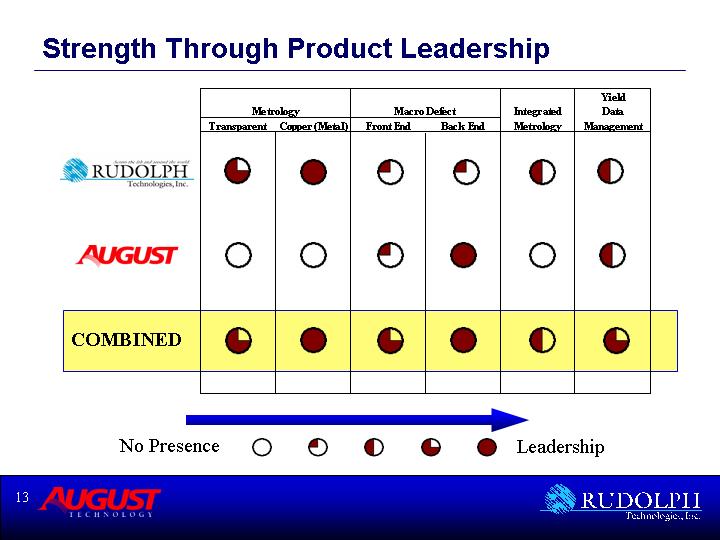

Strength Through Product Leadership

| | | | | | | | | | | | Yield | |

| | Metrology | | Macro Defect | | Integrated | | Data | |

| | Transparent | | Copper (Metal) | | Front End | | Back End | | Metrology | | Management | |

[LOGO] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | |

| | | | | | | | | | | | | |

[LOGO] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | |

| | | | | | | | | | | | | |

COMBINED | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | |

| | | | | | | | | | | | | |

| | No Presence | | [GRAPHIC] | | Leadership | | | |

13

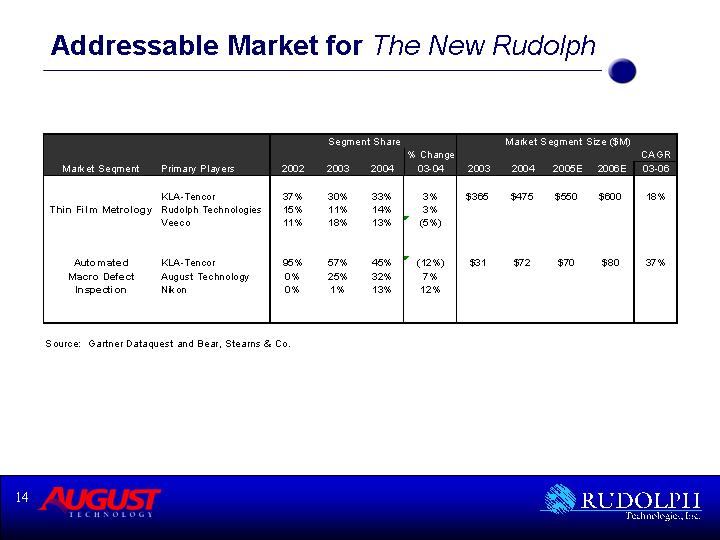

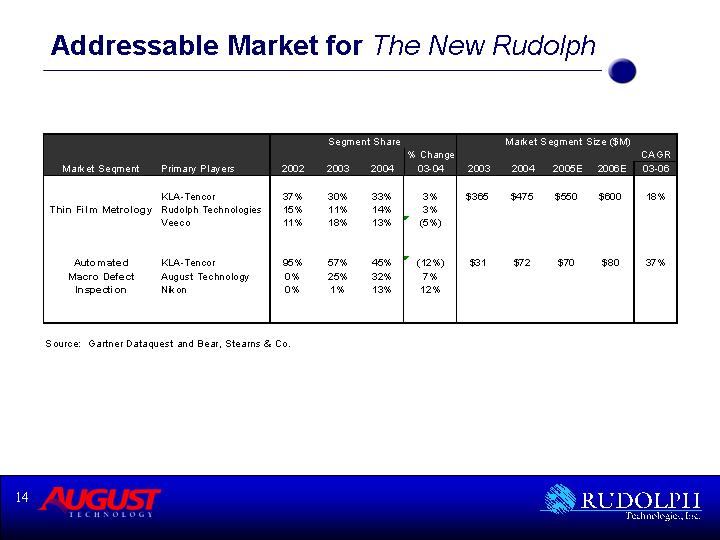

Addressable Market for The New Rudolph

| | | | Segment Share | | | | Market Segment Size ($M) | | | |

| | | | | | | | | | % Change | | | | | | | | | | CAGR | |

Market Seqment | | Primary Players | | 2002 | | 2003 | | 2004 | | 03-04 | | 2003 | | 2004 | | 2005E | | 2006E | | 03-06 | |

| | | | | | | | | | | | | | | | | | | | | |

| | KLA-Tencor | | 37 | % | 30 | % | 33 | % | 3 | % | $ | 365 | | $ | 475 | | $ | 550 | | $ | 600 | | 18 | % |

Thin Film Metrology | | Rudolph Technologies | | 15 | % | 11 | % | 14 | % | 3 | % | | | | | | | | | | |

| | Veeco | | 11 | % | 18 | % | 13 | % | (5 | )% | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Automated | | KLA-Tencor | | 95 | % | 57 | % | 45 | % | (12 | )% | $ | 31 | | $ | 72 | | $ | 70 | | $ | 80 | | 37 | % |

Macro Defect | | August Technology | | 0 | % | 25 | % | 32 | % | 7 | % | | | | | | | | | | |

Inspection | | Nikon | | 0 | % | 1 | % | 13 | % | 12 | % | | | | | | | | | | |

Source: Gartner Dataquest and Bear, Stearns & Co. |

14

Strategic Benefits of The New Rudolph

The Clear Leader Among Small Cap

Metrology/Inspection Companies

Leadership In All Products

• Copper (Metal) Thin Film Metrology

• Front End Wafer Inspection

• Back End Wafer Inspection

• Transparent Thin Film Metrology

• Integrated Metrology for Macro Defect Inspection

• Yield Data Management Systems

15

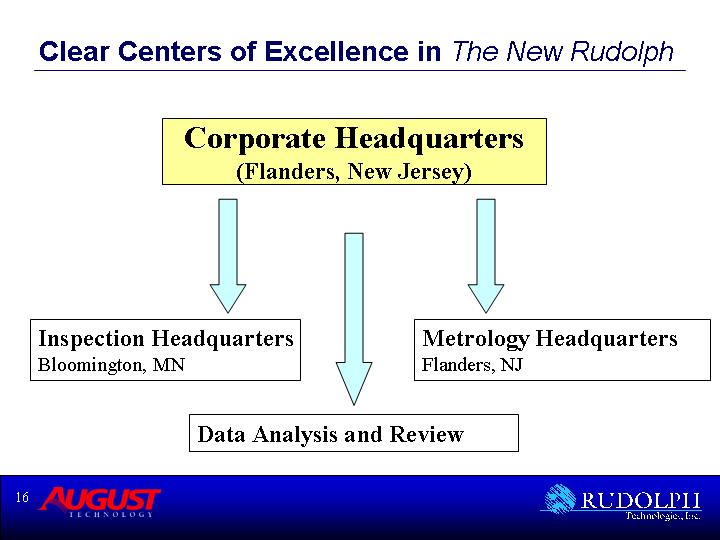

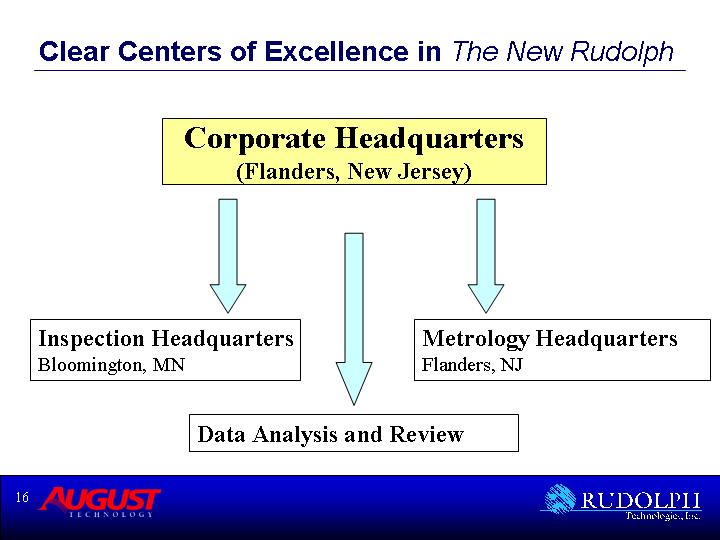

Clear Centers of Excellence in The New Rudolph

Corporate Headquarters |

(Flanders, New Jersey) |

| | |

Inspection Headquarters | | Metrology Headquarters |

Bloomington, MN | | Flanders, NJ |

| Data Analysis and Review | |

16

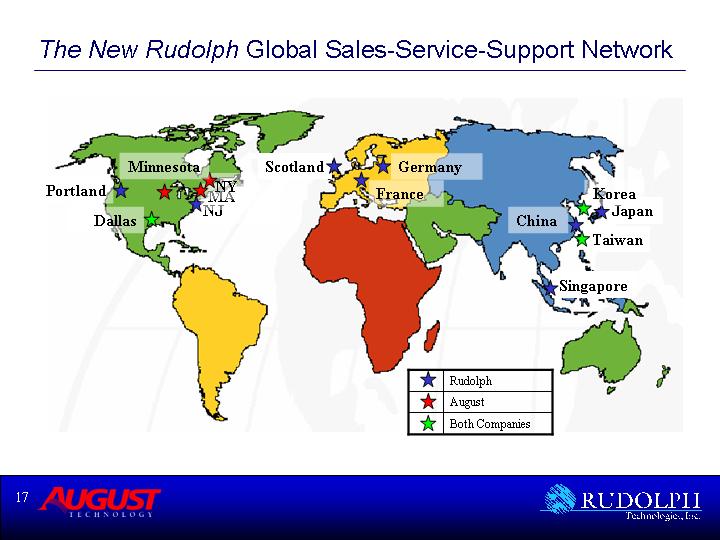

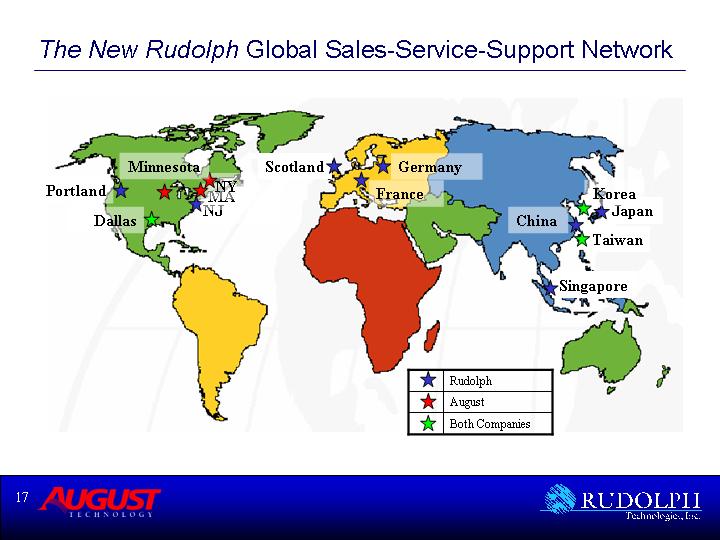

The New Rudolph Global Sales-Service-Support Network

[GRAPHIC]

17

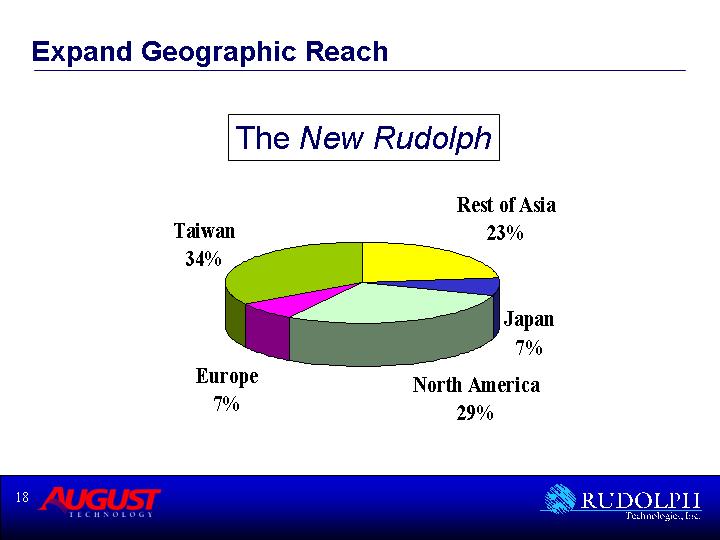

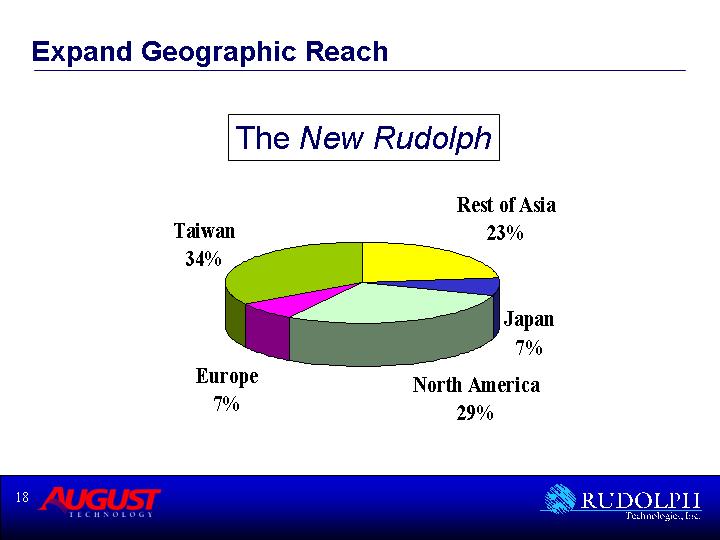

Expand Geographic Reach

THE NEW RUDOLPH

[CHART]

18

Significant Cross-Selling Opportunities

[GRAPHIC]

19

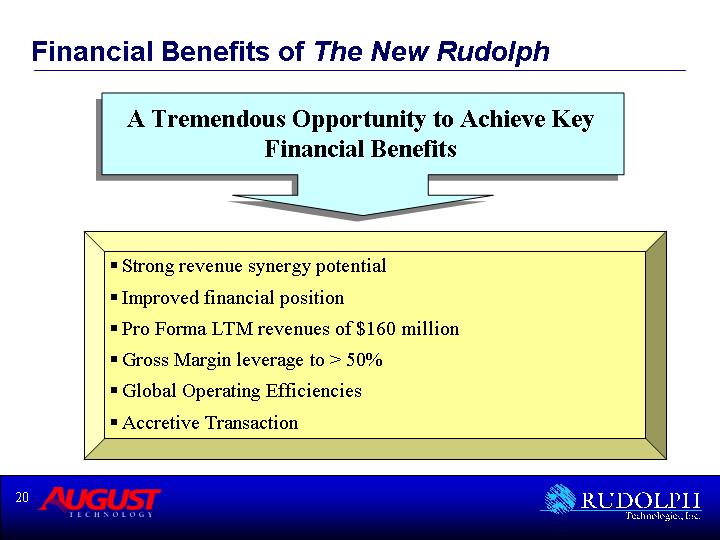

Financial Benefits of The New Rudolph

A Tremendous Opportunity to Achieve Key

Financial Benefits

• Strong revenue synergy potential

• Improved financial position

• Pro Forma LTM revenues of $160 million

• Gross Margin leverage to > 50%

• Global Operating Efficiencies

• Accretive Transaction

20

Realizing Cost Savings

• Reduce unnecessary duplicative expenses

• Technology development

• Platform development (stages and automation)

• Software and process control systems

• Sales and service infrastructure

• Expenses of being a public company

• Marketing and management expenses

• Reduce operating costs

• Savings of $10 million over time in duplicative expenses

• Create operating leverage

• Supply chain leverage

21

To Create Value The New Rudolph Will

• Capitalize on Cross-Selling Opportunities

• Expand Geographical Reach

• Establish Economies of Scale

• Become an Industry Consolidator

22

To Be A Market Leader The New Rudolph Will

• Be a leading provider of macro-defect inspection and thin film metrology systems

• Create a one-stop resource for device manufacturers providing best-of-breed front-end and back-end solutions

• Drive growth rates in excess of peers

• Expand our suite of products and services

23

Summary of The New Rudolph

• 1 + 1 = 3 in the inspection business

• Critical Mass – it makes a difference to our customers

• Market leadership by creating value for our customers

• Personal growth for our employees worldwide

• Consistently strong financial performance

24