Exhibit 99.3

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

The New Rudolph

…Creating A New Market Leader

1

Safe Harbor Statement

The following material contains forward-looking statements relating to at least the following matters: industry projections and the company’s long term operating model. Other forward-looking statements may be preceded by words such as “expects”, “anticipates”, and “intends”. These forward-looking statements are based on our current expectations and projections. However, they are subject to various risks and uncertainties that could cause actual results to differ materially from those projected in such statements, including the following: cyclicality of the semiconductor industry, customer concentration, introduction of new products by our competitors, and sole or limited sources of supply. Other risks and uncertainties are detailed in our Annual Report on Form 10-K dated March 15, 2004 filed with the Securities and Exchange Commission (SEC).

2

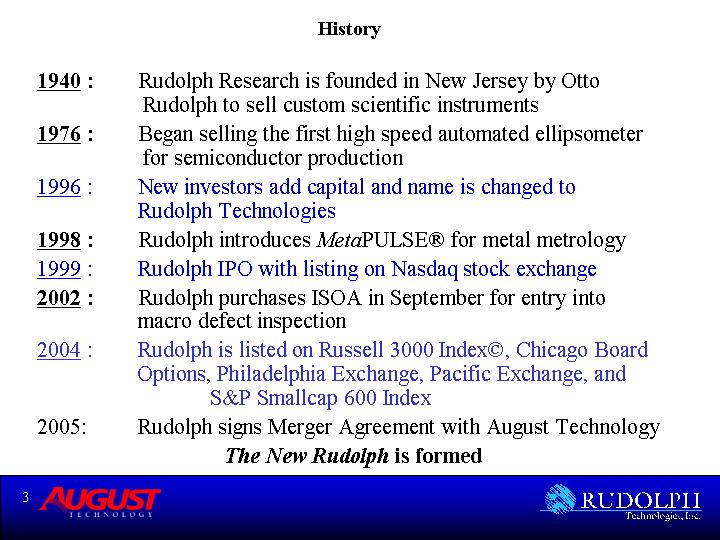

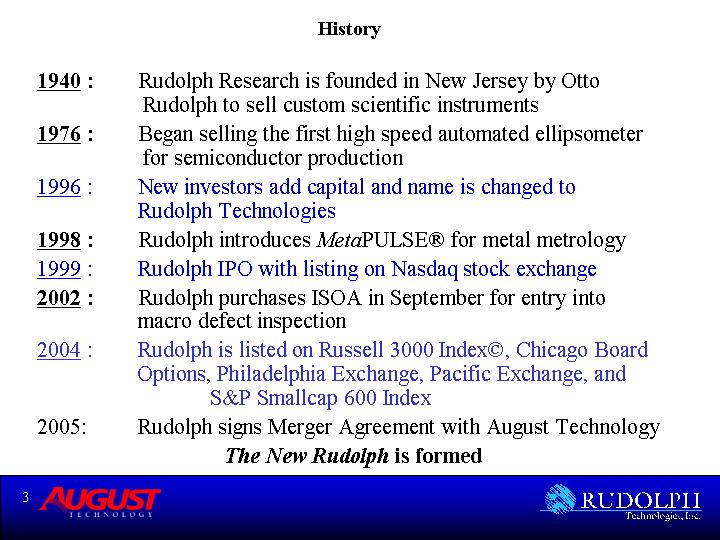

History

1940 : | | Rudolph Research is founded in New Jersey by Otto Rudolph to sell custom scientific instruments |

| | |

1976 : | | Began selling the first high speed automated ellipsometer for semiconductor production |

| | |

1996 : | | New investors add capital and name is changed to Rudolph Technologies |

| | |

1998 : | | Rudolph introduces MetaPULSE® for metal metrology |

| | |

1999 : | | Rudolph IPO with listing on Nasdaq stock exchange |

| | |

2002 : | | Rudolph purchases ISOA in September for entry into macro defect inspection |

| | |

2004 : | | Rudolph is listed on Russell 3000 Index©, Chicago Board Options, Philadelphia Exchange, Pacific Exchange, and S&P Smallcap 600 Index |

| | |

2005: | | Rudolph signs Merger Agreement with August Technology |

The New Rudolph is formed

3

[GRAPHIC] | | [GRAPHIC] |

Flanders, New Jersey

Headquarters | | Ledgewood, New Jersey

Manufacturing |

| | |

[GRAPHIC] | | [GRAPHIC] |

Mt. Arlington, New Jersey

Design/Software Center | | Richardson, Texas

YMG Headquarters |

4

Core Technologies

[GRAPHIC] | | Sonar

(metal) | | [GRAPHIC] |

Ellipsometry

(transparent) | | [GRAPHIC] | | Reflectometry

(transparent) |

| | | | |

| | Macro Defect Detection | | |

| | [GRAPHIC] | | |

5

Rudolph’s Metrology & Inspection Family

[GRAPHIC]

Yield Enhancement Systems™ for sub-90 nm semiconductor production

6

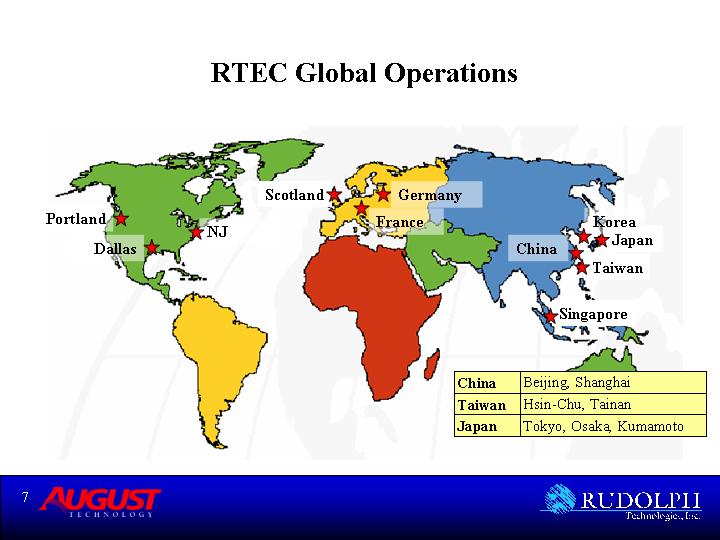

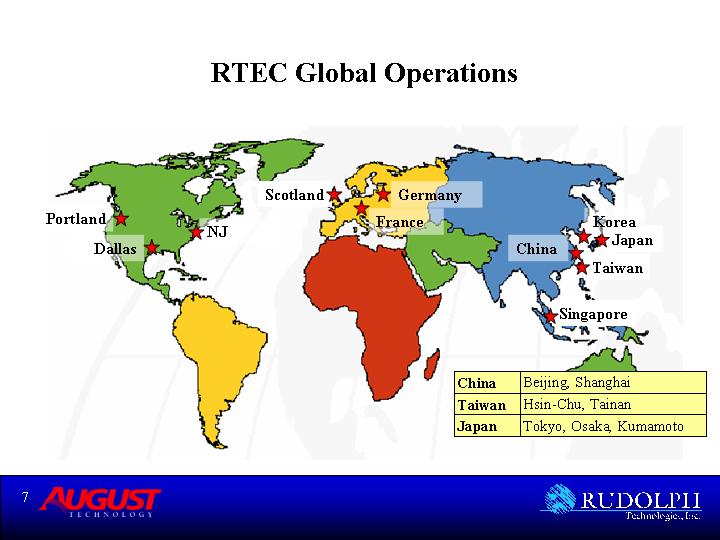

RTEC Global Operations

[GRAPHIC]

7

The New Rudolph

…Creating A New Market Leader

8

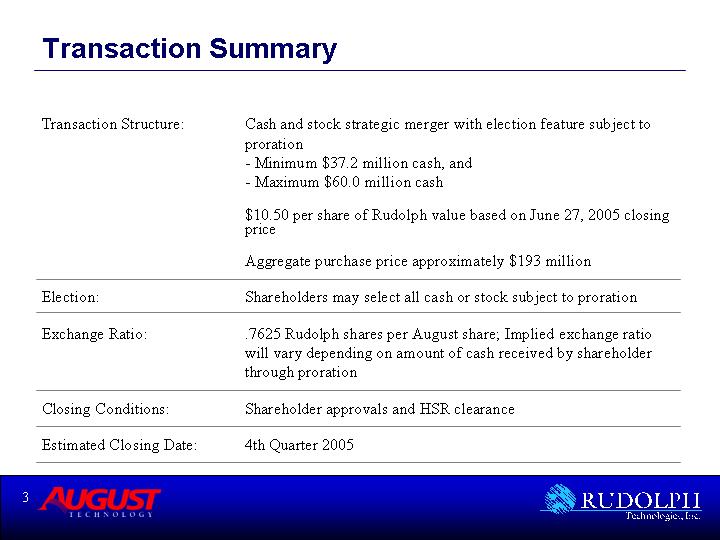

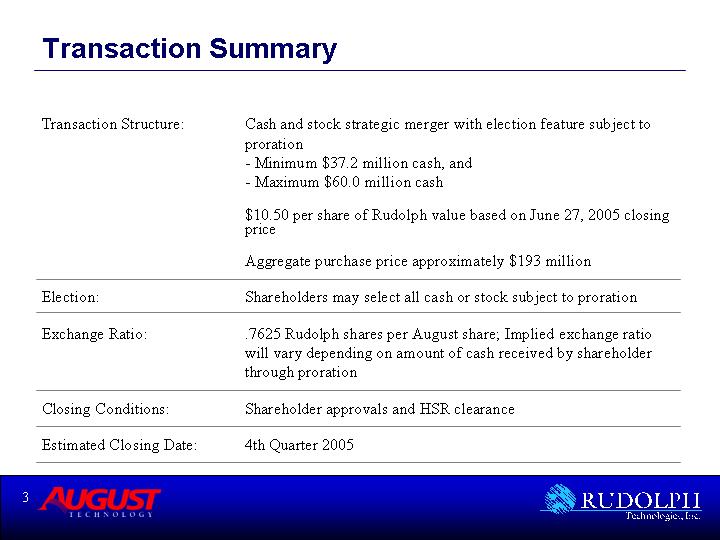

Transaction Summary

Transaction Structure: | | Merger: stock-for-stock exchange and cash component (consideration to include minimum cash amount of $37.2 million, maximum cash amount $60 million |

| | |

| | $10.50 stock/cash equivalent based on June 27, 2005 closing price |

| | |

| | Aggregate purchase price approximately $193 million |

| | |

Exchange Ratio: | | .7625 August shares, however actual exchange ratio depends on the amount of cash received by the shareholder |

| | |

Election | | Shareholders may select all cash or stock subject to proration |

| | |

Accounting: | | Purchase accounting |

| | |

Closing Conditions: | | Standard governmental and corporate regulatory approvals |

| | |

Estimated Closing Date: | | 4th Quarter 2005 |

9

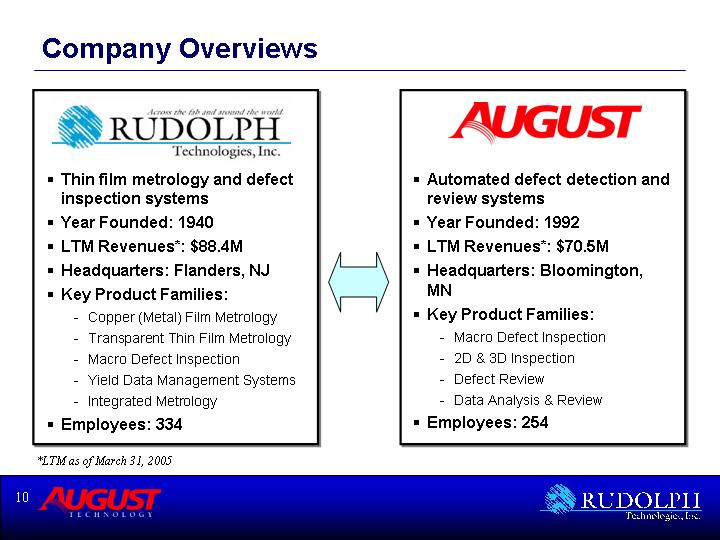

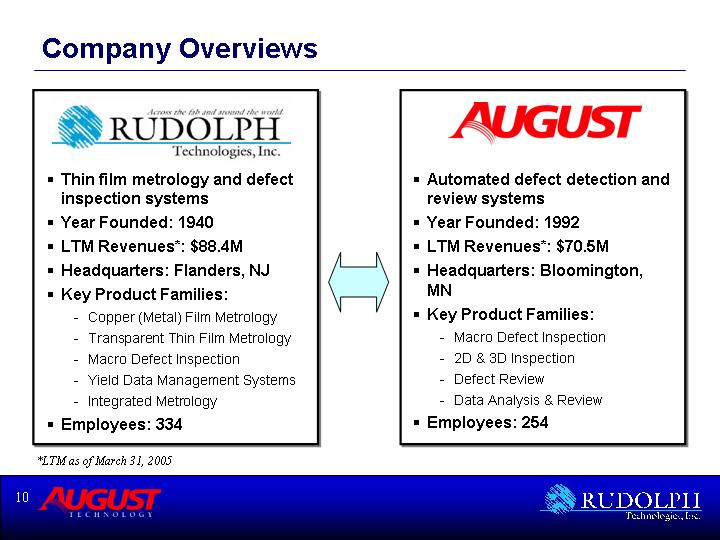

Company Overviews

[LOGO] | | [LOGO] |

| | | |

• | Thin film metrology and defect inspection systems | | • | Automated defect detection and review systems |

| | | | | |

• | Year Founded: 1940 | | • | Year Founded: 1992 |

| | | | | |

• | LTM Revenues*: $88.4M | | • | LTM Revenues*: $70.5M |

| | | | | |

• | Headquarters: Flanders, NJ | | • | Headquarters: Bloomington, MN |

| | | | | |

• | Key Product Families: | [GRAPHIC] | • | Key Product Families: |

| | | | | |

| • | Copper (Metal) Film Metrology | | | • | Macro Defect Inspection |

| | | | | | |

| • | Transparent Thin Film Metrology | | | • | 2D & 3D Inspection |

| | | | | | |

| • | Macro Defect Inspection | | | • | Defect Review |

| | | | | | |

| • | Yield Data Management Systems | | | • | Data Analysis & Review |

| | | | | |

| • | Integrated Metrology | | | |

| | | | | |

• | Employees: 334 | | • | Employees: 254 |

*LTM as of March 31, 2005

10

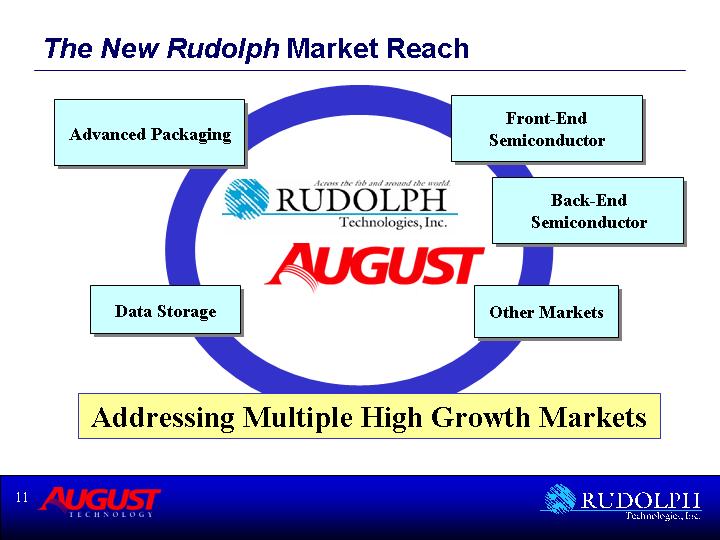

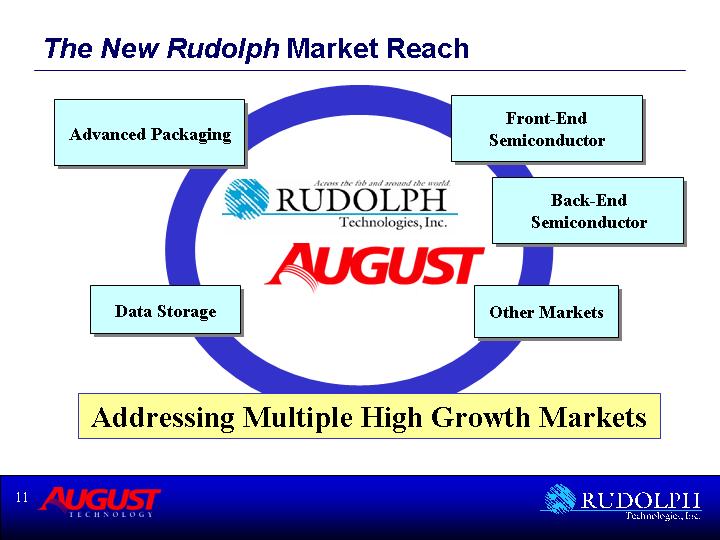

The New Rudolph Market Reach

Advanced Packaging | | Front-End

Semiconductor |

| | |

| [LOGO] | Back-End

Semiconductor |

| | |

Data Storage | | Other Markets |

| | |

Addressing Multiple High Growth Markets |

11

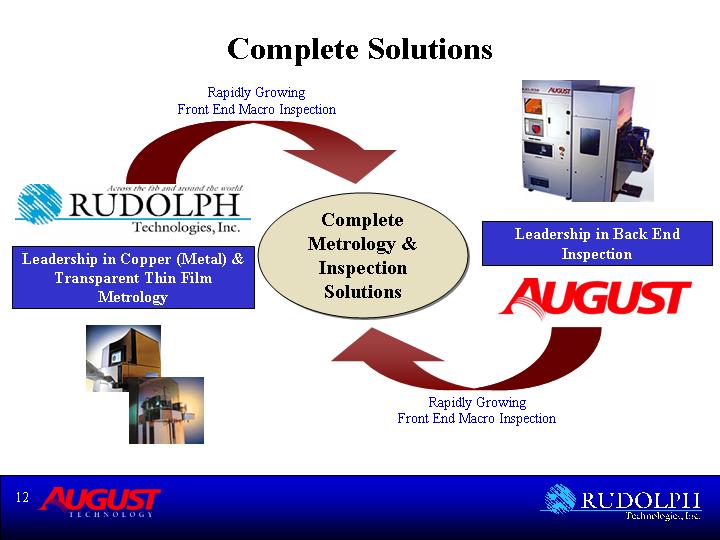

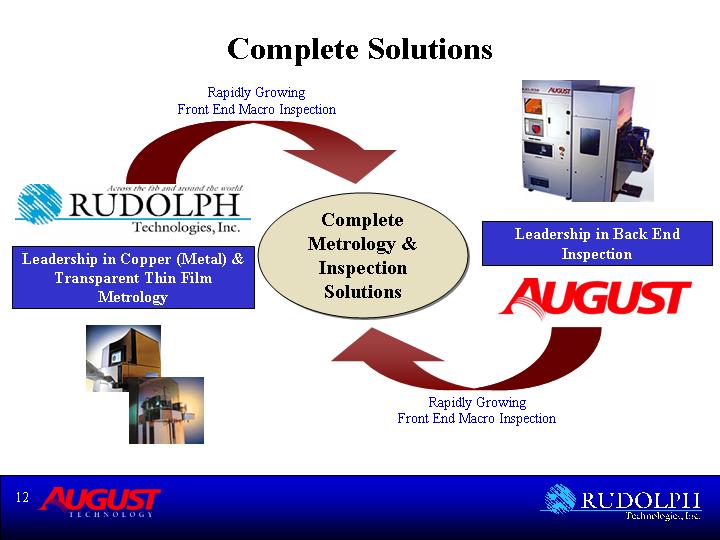

Complete Solutions

Rapidly Growing

Front End Macro Inspection | | |

[GRAPHIC] | | [GRAPHIC] |

| | |

[LOGO] | | |

| | |

Leadership in Copper (Metal) &

Transparent Thin Film

Metrology | Complete

Metrology &

Inspection

Solutions | Leadership in Back End

Inspection |

| | |

| | [LOGO] |

| | |

[GRAPHIC] | | [GRAPHIC] |

| | Rapidly Growing

Front End Macro Inspection |

12

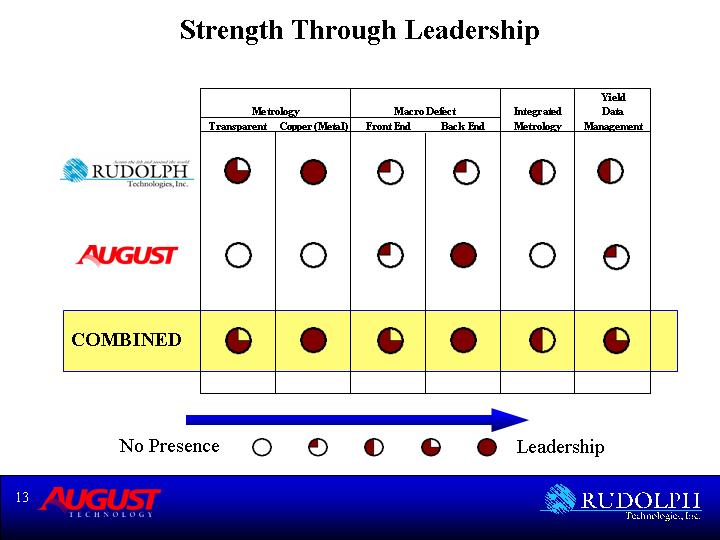

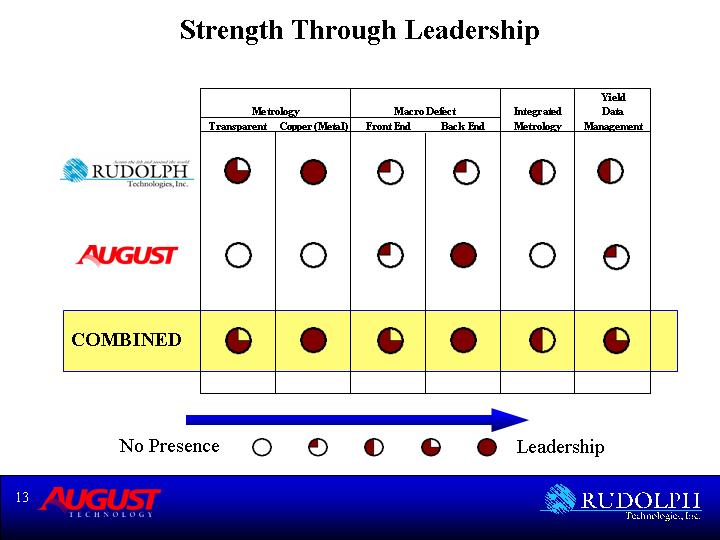

Strength Through Leadership

Strengthening Competencies

| | | | | | | | | | | | Yield | |

| | Metrology | | Macro Defect | | Integrated | | Data | |

| | Transparent | | Copper (Metal) | | Front End | | Back End | | Metrology | | Management | |

| | | | | | | | | | | | | |

[LOGO] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | |

| | | | | | | | | | | | | |

[LOGO] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | |

| | | | | | | | | | | | | |

COMBINED | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | |

No Presence | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | Leadership | |

13

SAFE HARBOR STATEMENT

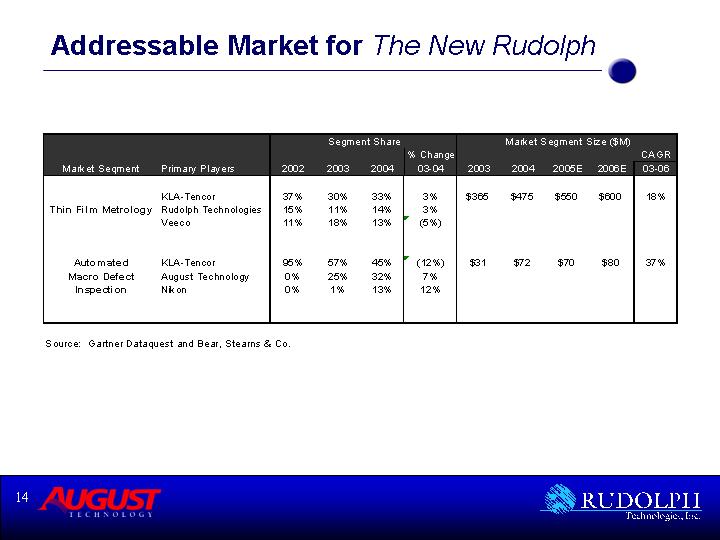

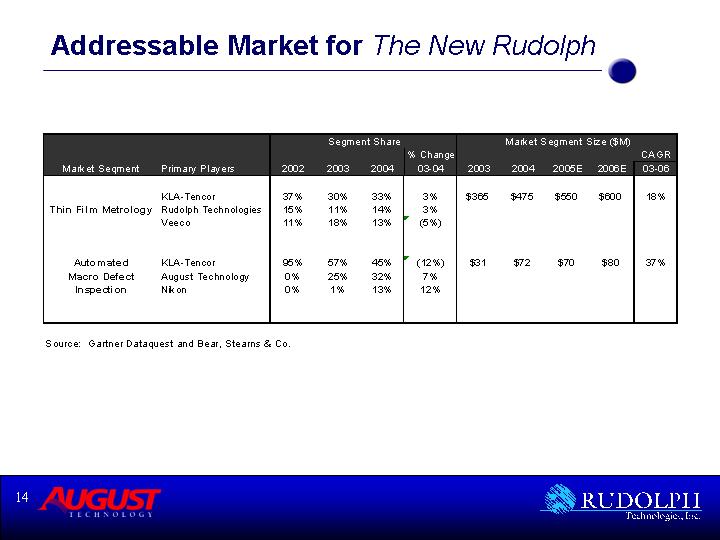

Addressable Market for | | The New Rudolph |

| | | | Segment Share | | % Change | | Market Segment Size ($M) | | CAGR | |

Market Seqment | | Primary Players | | 2002 | | 2003 | | 2004 | | 03-04 | | 2003 | | 2004 | | 2005E | | 2006E | | 03-06 | |

| | | | | | | | | | | | | | | | | | | | | |

| | KLA-Tencor | | 37 | % | 30 | % | 33 | % | 3 | % | $ | 365 | | $ | 475 | | $ | 550 | | $ | 600 | | 18 | % |

Thin Film Metrology | | Rudolph Technologies | | 15 | % | 11 | % | 14 | % | 3 | % | | | | | | | | | | |

| | Veeco | | 11 | % | 18 | % | 13 | % | (5 | )% | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Automated | | KLA-Tencor | | 95 | % | 57 | % | 45 | % | (12 | )% | $ | 31 | | $ | 72 | | $ | 70 | | $ | 80 | | 37 | % |

Macro Defect | | August Technology | | 0 | % | 25 | % | 32 | % | 7 | % | | | | | | | | | | |

Inspection | | Nikon | | 0 | % | 1 | % | 13 | % | 12 | % | | | | | | | | | | |

Source: Gartner Dataquest and Bear, Stearns & Co.

14

The New Rudolph Mission

Planned profitable growth

Be a clear leader in metrology and inspection with “best-of-breed” solutions in our chosen niches and be the overall #2 pure-play process control supplier

be a desired stock investment

15

Goals for The New Rudolph

• For our Customers – Continued market leadership in inspection and metrology providing them with an ever-expanding suite of products and services

• For our employees - Foster opportunities for personal and professional growth and successfully integrate cultures from 2 great franchises

• For our Shareholders

• Planned profitable growth by creating compelling value propositions for our customers

• Being a desired investment by enhancing shareholder value through consistently strong financial performance.

16

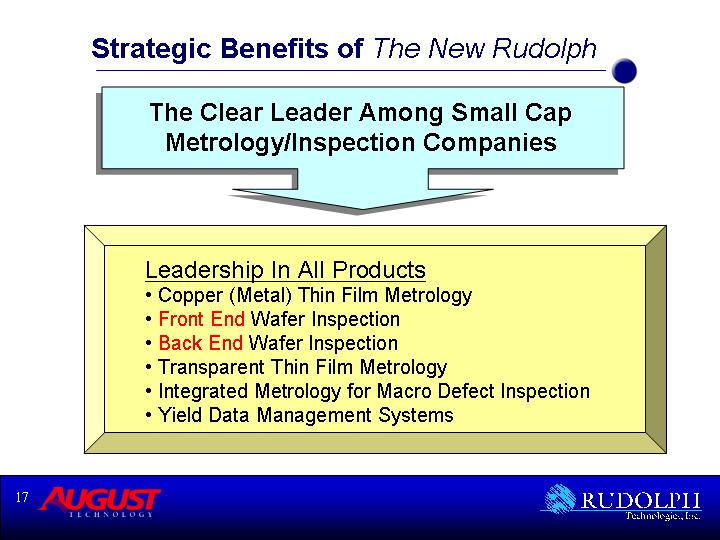

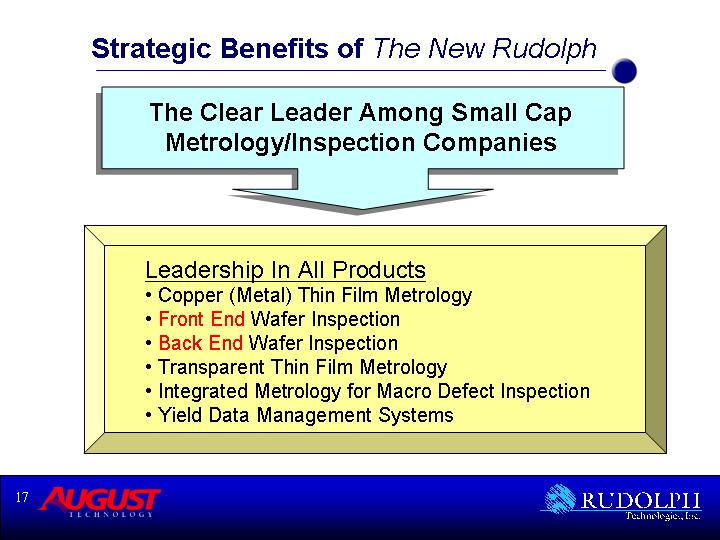

Strategic Benefits of The New Rudolph

The Clear Leader Among Small Cap

Metrology/Inspection Companies

Leadership In All Products

• Copper (Metal) Thin Film Metrology

• Front End Wafer Inspection

• Back End Wafer Inspection

• Transparent Thin Film Metrology

• Integrated Metrology for Macro Defect Inspection

• Yield Data Management Systems

17

Financial Benefits of The New Rudolph

A Tremendous Opportunity to Achieve Key

Financial Benefits

• Strong revenue synergy potential

• Improved financial position

• Pro Forma TTM revenues of $160 M – CRITICAL MASS

• Gross Margin leverage to > 50%

• Accretive Transaction

18

To Be A Market Leader The New Rudolph will

• Be a leading provider of macro-defect inspection and thin film metrology systems

• Create a one-stop resource for device manufacturers providing best-of-breed front-end and back-end solutions

• Drive to growth rates in excess of peers

• Expand our suite of products and services

19

To Create Value The New Rudolph will

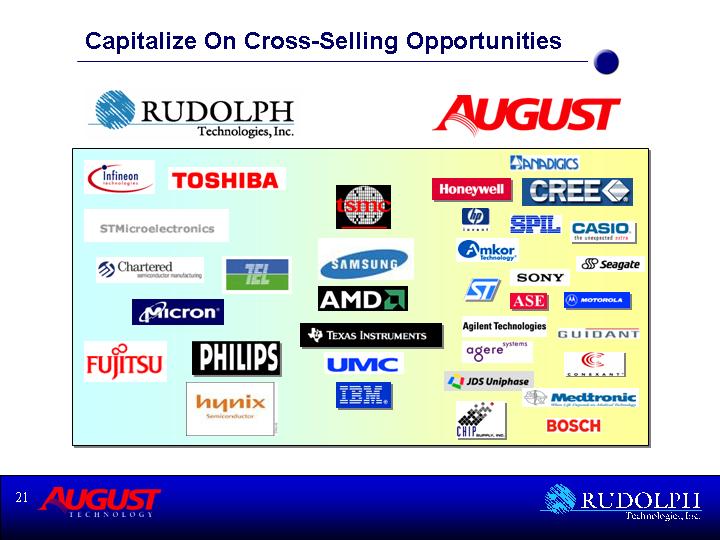

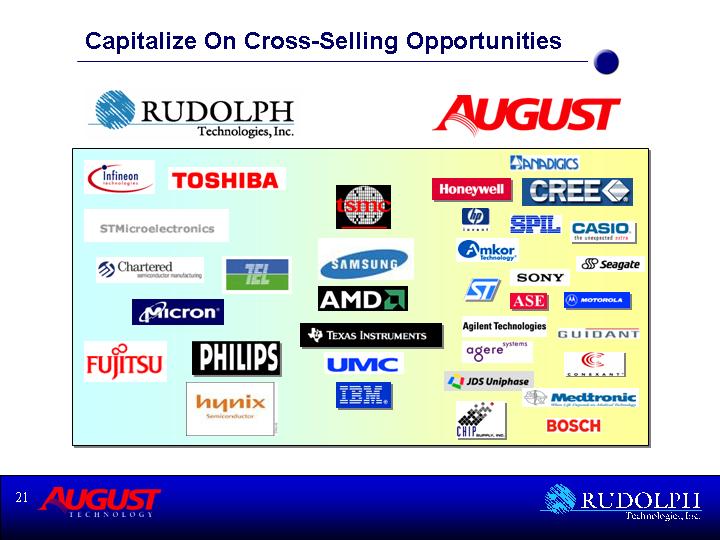

• Capitalize on Cross-Selling Opportunities

• Expand Geographical Reach

• Establish Economies of Scale

• Become an Industry Consolidator

20

Capitalize On Cross-Selling Opportunities

[GRAPHIC]

21

Expand Geographic Reach

The New Rudolph

[CHART]

22

The New Rudolph will Deliver Results by

• Realizing Cost Savings & Reducing Operating Expenses

• Using its Strong Balance Sheet

• Growth Thru Increased Sales

23

Realizing Cost Savings

• Reduce unnecessary duplicative expenses

• Technology development

• Platform development (stages and automation)

• Software and process control systems

• Sales and service infrastructure

• Expenses of being a public company

• Marketing and management expenses

• Reduce operating costs

• Savings of $10 million over time in duplicative expenses

• Create operating leverage

• Supply chain leverage

24

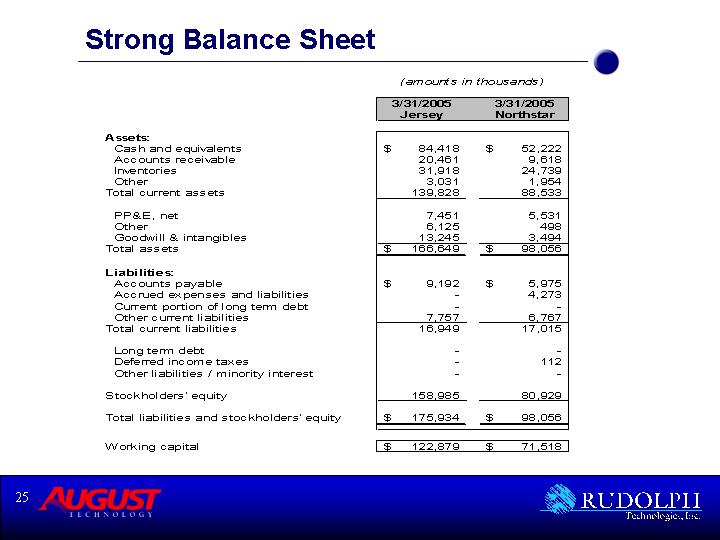

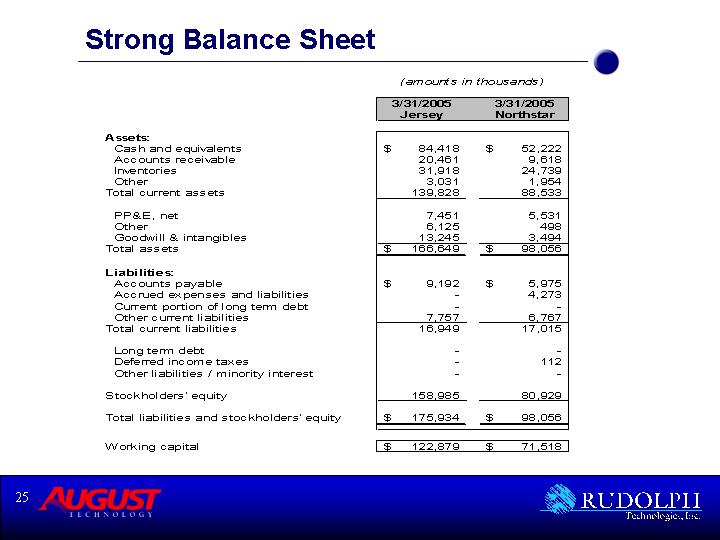

Strong Balance Sheet

| | (amounts in thousands) | |

| | 3/31/2005

Jersey | | 3/31/2005

Northstar | |

| | | | | |

Assets: | | | | | |

Cash and equivalents | | $ | 84,418 | | $ | 52,222 | |

Accounts receivable | | 20,461 | | 9,618 | |

Inventories | | 31,918 | | 24,739 | |

Other | | 3,031 | | 1,954 | |

Total current assets | | 139,828 | | 88,533 | |

| | | | | |

PP&E, net | | 7,451 | | 5,531 | |

Other | | 6,125 | | 498 | |

Goodwill & intangibles | | 13,245 | | 3,494 | |

Total assets | | $ | 166,649 | | $ | 98,056 | |

| | | | | |

Liabilities: | | | | | |

Accounts payable | | $ | 9,192 | | $ | 5,975 | |

Accrued expenses and liabilities | | — | | 4,273 | |

Current portion of long term debt | | — | | — | |

Other current liabilities | | 7,757 | | 6,767 | |

Total current liabilities | | 16,949 | | 17,015 | |

| | | | | |

Long term debt | | — | | — | |

Deferred income taxes | | — | | 112 | |

Other liabilities / minority interest | | — | | — | |

| | | | | |

Stockholders’ equity | | 158,985 | | 80,929 | |

| | | | | |

Total liabilities and stockholders’ equity | | $ | 175,934 | | $ | 98,056 | |

| | | | | |

Working capital | | $ | 122,879 | | $ | 71,518 | |

25

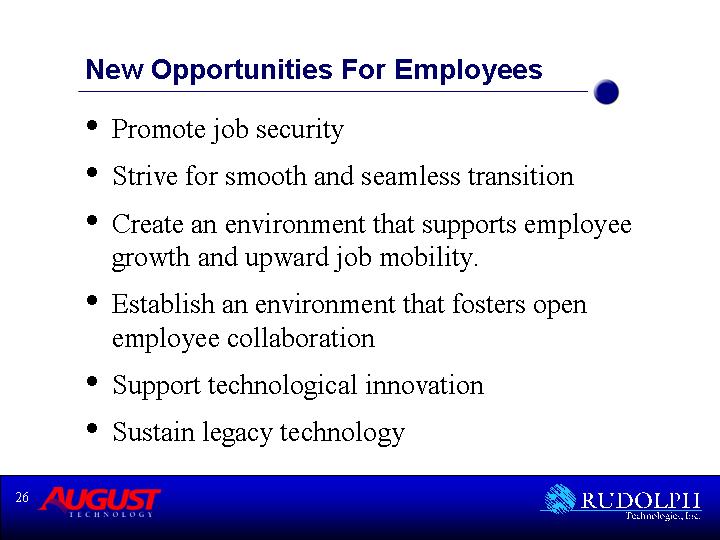

New Opportunities For Employees

• Promote job security

• Strive for smooth and seamless transition

• Create an environment that supports employee growth and upward job mobility.

• Establish an environment that fosters open employee collaboration

• Support technological innovation

• Sustain legacy technology

26

Inspection Headquarters

[GRAPHIC]

27

Clear Centers of Excellence in The New Rudolph

Corporate Headquarters

(Flanders, New Jersey) |

|

Inspection Headquarters

Bloomington, MN | | Metrology Headquarters

Flanders, NJ |

|

Data Analysis and Review |

28

Summary Of The New Rudolph

• 1 + 1 = 3 in the inspection business

• Critical Mass – it makes a difference to our customers

• Market leadership by creating value for our customers

• Personal growth for our employees worldwide

• Consistently strong financial performance

29

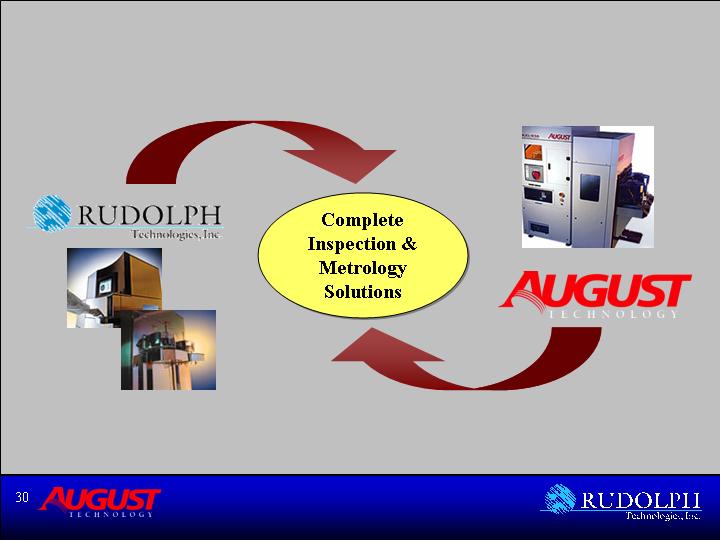

[GRAPHIC] | | |

[LOGO] | Complete Inspection & Metrology Solutions | [GRAPHIC] |

| | [LOGO] |

[GRAPHIC] | | [GRAPHIC] |

30

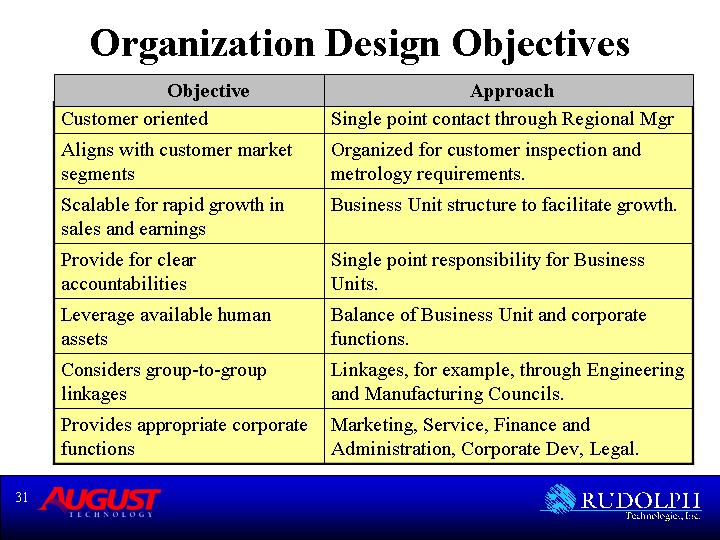

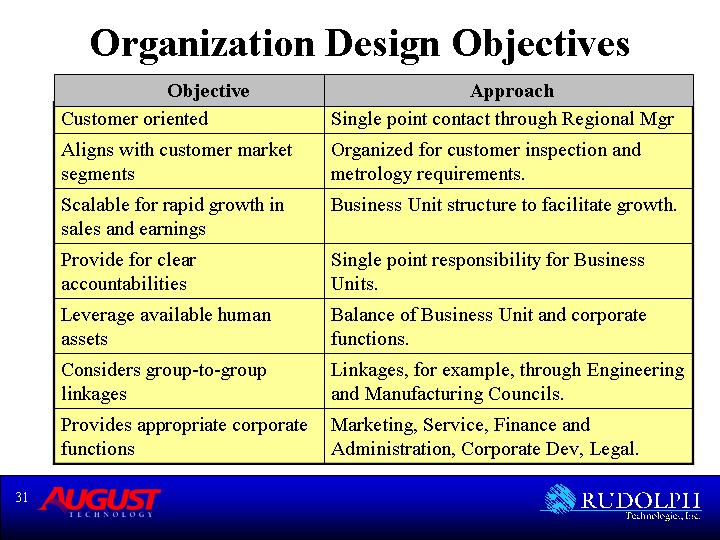

Organization Design Objectives

Objective | | Approach |

| | |

Customer oriented | | Single point contact through Regional Mgr |

| | |

Aligns with customer market segments | | Organized for customer inspection and metrology requirements. |

| | |

Scalable for rapid growth in sales and earnings | | Business Unit structure to facilitate growth. |

| | |

Provide for clear accountabilities | | Single point responsibility for Business Units. |

| | |

Leverage available human assets | | Balance of Business Unit and corporate functions. |

| | |

Considers group-to-group linkages | | Linkages, for example, through Engineering and Manufacturing Councils. |

| | |

Provides appropriate corporate functions | | Marketing, Service, Finance and Administration, Corporate Dev, Legal. |

31

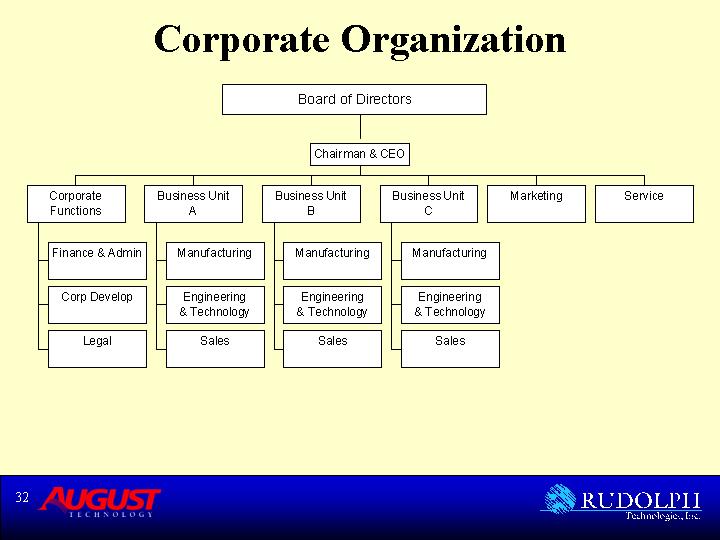

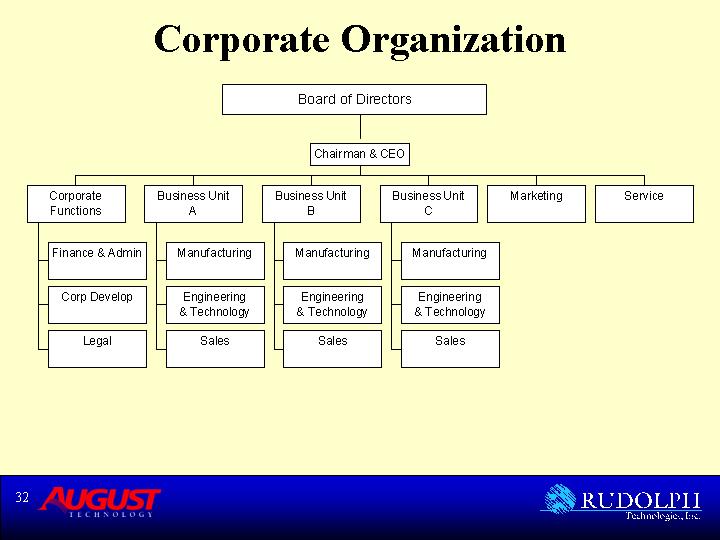

Corporate Organization

| | Board of Directors | | | |

| | | | | |

| | Chairman & CEO | | | |

| | | | | |

Corporate Functions | Business Unit A | Business Unit B | Business Unit C | Marketing | Service |

| | | | | |

Finance & Admin | Manufacturing | Manufacturing | Manufacturing | | |

| | | | | |

Corp Develop | Engineering & Technology | Engineering &

Technology | Engineering & Technology | | |

| | | | | |

Legal | Sales | Sales | Sales | | |

32

Organization & Integration

• | | Corporate Structure: Business Units (Inspection, Metrology and Decision Software) supported by corporate functions (Marketing, Customer Support, Finance and Administration, Corporate Development, Legal). | | |

| | | | |

• | | Sales: Sales management and support provided by the respective Business Units to the regional organizations. | | Business Unit Function |

| | | |

• | | Engineering & Technology: Engineering and Technology services to be provided by the Business Unit organizations, with coordination through Engineering and Technology Councils. | |

| | | |

• | | Manufacturing: Inspection and Decision Software manufacturing to continue Minnesota. Metrology manufacturing to continue in New Jersey. Activities to be coordinated through a Manufacturing Council. | |

33

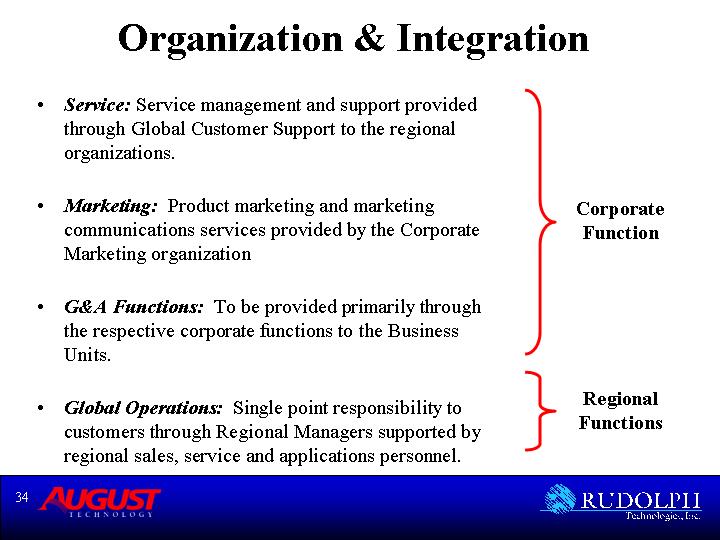

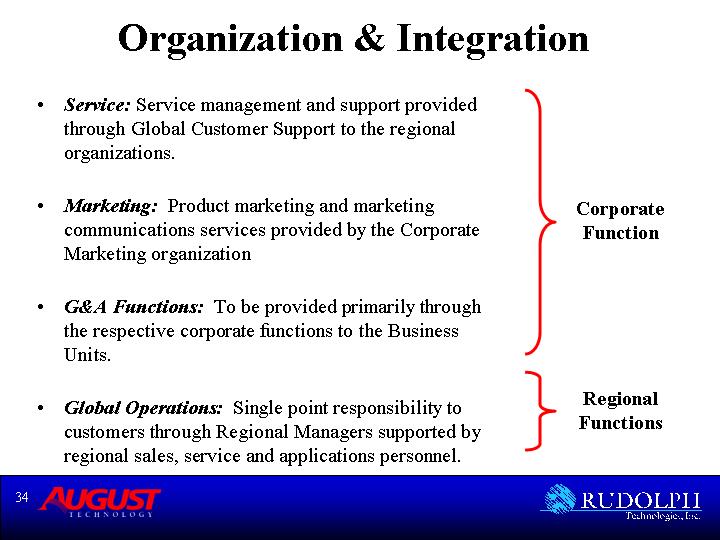

Organization & Integration

• | | Service: Service management and support provided through Global Customer Support to the regional organizations. | Corporate Function |

| | |

• | | Marketing: Product marketing and marketing communications services provided by the Corporate Marketing organization |

| | |

• | | G&A Functions: To be provided primarily through the respective corporate functions to the Business Units. |

| | | |

• | | Global Operations: Single point responsibility to customers through Regional Managers supported by regional sales, service and applications personnel. | Regional Functions |

| | | | |

34

Corporate Organization

| | Chairman & CEO

P. McLaughlin | | | |

| | | | | |

Corporate | Metrology BU

R. Loiterman | Inspection BU

N. Little | DA&R BU

M. Plisinski | Corp. Mktg

A. Johnson | Cust. Support

R. DiCrosta |

| | | | | |

SBC (1) J. O’Dell | Met Mfg J. Kurdock | Insp Mfg J. Nelson | DA&R Mfg | Marketing, Insp Product Mgrs | Service, Insp

T. Shurson |

| | | | | |

Corp Develop

S. Piekos | Met Eng

R. Loiterman | Insp Eng M. Plisinski | DA&R Eng

M. Plisinski | Marketing, Met

C. Morath | Other |

| | | | | |

Finance & Admin

S. Roth | MP PG Owner G. Tas | Insp CTO C. Watkins | DA&R CTO | Other | |

| | | | | |

Legal R. Koch | Trans PG Owner

G. Wolf | Global Sales, Insp

M. Brooks | DA&R Sales | | |

| | | | | |

| Int Sales, Met

A. Khanna | Strat Bus Fellow

J. O’Dell | | | |

| | | | | |

| Dom Sales, Met

M. Krieg | | | | |

| | | | | |

| Key Acct - Alpha

G. Collins | | | | |

Notes

1. J. O’Dell as a member of the Strategic Business Council.

2. Cross BU activities coordinated through councils; for example a Technology Council including respective CTO functions or equivalents.

35

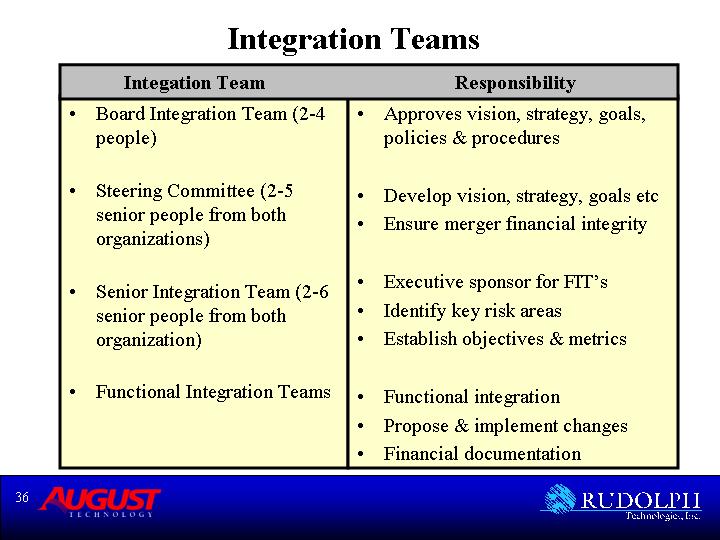

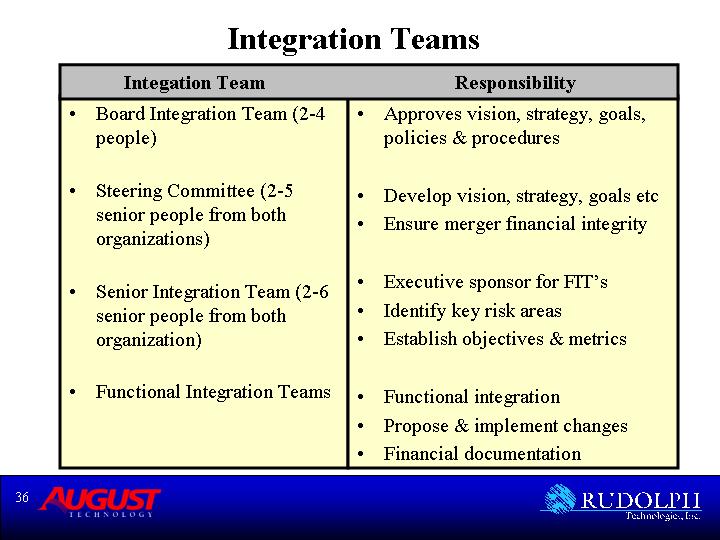

Integration Teams

Integation Team | | Responsibility |

• | Board Integration Team (2-4 people) | | • | Approves vision, strategy, goals, policies & procedures |

| | |

• | Steering Committee (2-5 senior people from both | | • | Develop vision, strategy, goals etc |

| organizations) | | • | Ensure merger financial integrity |

| | | | |

• | Senior Integration Team (2-6 senior people from both | | • | Executive sponsor for FIT’s |

| organization) | | • | Identify key risk areas |

| | | • | Establish objectives & metrics |

| | |

• | Functional Integration Teams | | • | Functional integration |

| | | • | Propose & implement changes |

| | | • | Financial documentation |

36

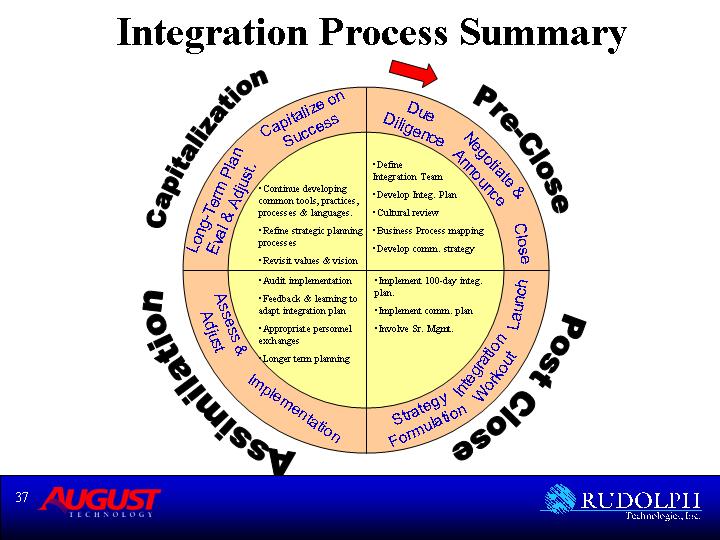

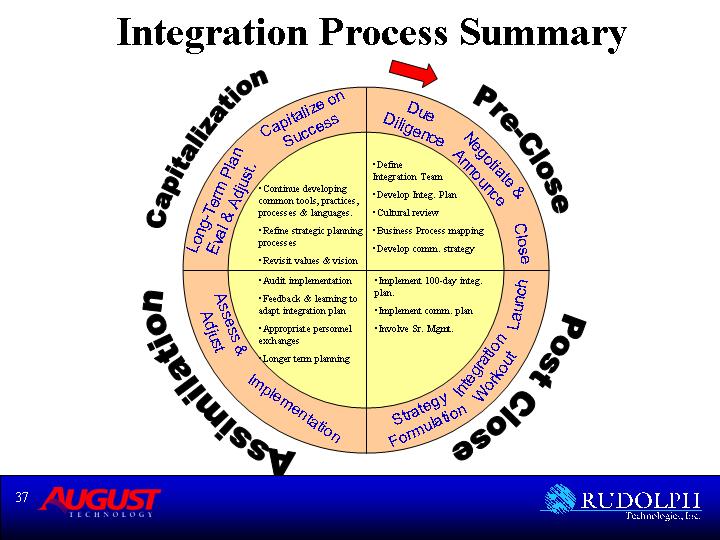

Integration Process Summary

Capitalization | | Pre-Close | | Post Close | | Assimilation |

Long-Term Plan Eval & Adjust.

Capitalize on Success | | Due Diligence

Negotiate & Announce

Close | | Strategy Formulation

Integration Workout

Launch | | Assess & Adjust

Implementation |

| | | | | | |

•Continue developing common tools, practices, processes & languages.

•Refine strategic planning processes

•Revisit values & vision | | •Define Integration Team

•Develop Integ. Plan

•Cultural review

•Business Process mapping

•Develop comm. strategy | | •Implement 100-day integ. plan.

•Implement comm. plan

•Involve Sr. Mgmt. | | •Audit implementation

•Feedback & learning to adapt integration plan

•Appropriate personnel exchanges

•Longer term planning |

37

Integration Timeline

PHASE | | 2005 | | 2006 | | 2007 | |

| | | | | | | |

1. Pre-Close | | | | | | | |

| | | | | | | |

2. Post Close | | | | | | | |

| | | | | | | |

3. Assimilation | | | | | | | |

| | | | | | | |

4. Capitalize | | | | | | | |

38

Thank You

39