QuickLinks -- Click here to rapidly navigate through this document

Exhibit 99.1

SIMON PROPERTY GROUP

Overview

The Company

Simon Property Group, Inc., ("Simon," "we," "us," "our," or the "Company") (NYSE:SPG) is a self-administered and self-managed real estate investment trust ("REIT"). Simon Property Group, L.P. or the Operating Partnership is a majority-owned subsidiary partnership of the Company. Together, the Company and the Operating Partnership, or Simon Group, are engaged primarily in the ownership, development and management of retail real estate properties. Simon Group operates from five retail real estate platforms: regional malls, Premium Outlet Centers®, The Mills®, community/lifestyle centers and international properties. At December 31, 2008, we owned or had an interest in 386 properties comprising 263 million square feet of gross leasable area in North America, Europe and Asia.

This package was prepared to provide (1) ownership information, (2) certain operational information, and (3) balance sheet information as of December 31, 2008, for the Company and the Operating Partnership.

Certain statements made in this Supplemental Package may be deemed "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained, and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks, uncertainties and other factors. Such factors include, but are not limited to: our ability to meet debt service requirements, the availability and terms of financing, changes in our credit rating, changes in market rates of interest and foreign exchange rates for foreign currencies, the ability to hedge interest rate risk, risks associated with the acquisition, development, expansion, leasing and management of properties, general risks related to retail real estate, the liquidity of real estate investments, environmental liabilities, international, national, regional and local economic climates, changes in market rental rates, trends in the retail industry, relationships with anchor tenants, the inability to collect rent due to the bankruptcy or insolvency of tenants or otherwise, risks relating to joint venture properties, costs of common area maintenance, competitive market forces, risks related to international activities, insurance costs and coverage, terrorist activities, changes in economic and market conditions and maintenance of our status as a real estate investment trust. We discuss these and other risks and uncertainties under the heading "Risk Factors" in our annual and quarterly periodic reports filed with the SEC. We may update that discussion in our periodic reports, but otherwise we undertake no duty or obligation to update or revise these forward-looking statements, whether as a result of new information, future developments, or otherwise.

We hope you find this Supplemental Package beneficial. Any questions, comments or suggestions should be directed to: Shelly J. Doran, Vice President of Investor Relations-Simon Property Group, P.O. Box 7033, Indianapolis, IN 46207. Telephone: (317) 685-7330; e-mail:sdoran@simon.com

5

SIMON PROPERTY GROUP

Overview

Reporting Calendar

Results for the next three quarters will be announced according to the following approximate schedule:

| | | | |

First Quarter 2009 | | | April 30, 2009 | |

Second Quarter 2009 | | | July 31, 2009 | |

Third Quarter 2009 | | | November 2, 2009 | |

Stock Information

The Company's common stock and two issues of preferred stock are traded on the New York Stock Exchange under the following symbols:

| | | | |

Common Stock | | | SPG | |

6% Series I Convertible Perpetual Preferred | | | SPGPrI | |

8.375% Series J Cumulative Redeemable Preferred | | | SPGPrJ | |

Credit Ratings

| | | | | | |

Standard & Poor's | | | | | |

| | Corporate | | | A- | | (Stable Outlook) |

| | Senior Unsecured | | | A- | | (Stable Outlook) |

| | Preferred Stock | | | BBB | | (Stable Outlook) |

Moody's | | | | | |

| | Senior Unsecured | | | A3 | | (Stable Outlook) |

| | Preferred Stock | | | Baa1 | | (Stable Outlook) |

6

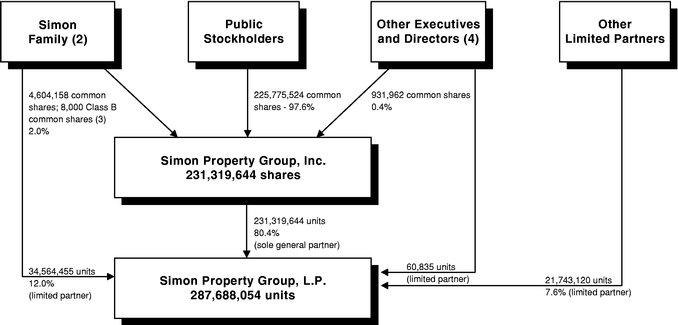

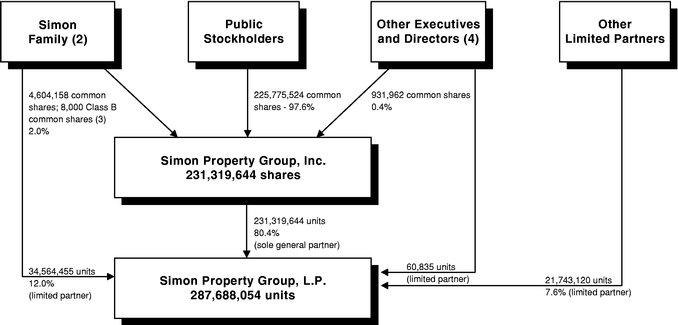

Simon Property Group Ownership Structure(1)

December 31, 2008

- (1)

- Schedule excludes Company preferred stock (see "Preferred Stock/Units Outstanding") and Operating Partnership units not convertible into common stock.

- (2)

- Consists of Melvin Simon, Herbert Simon, David Simon, and/or trusts established for the benefit of members of the Simon family and Melvin Simon & Associates, Inc.

- (3)

- Holders of Class B common stock are entitled to elect 4 of the members of the Board of Directors and also have voting rights with common stock.

- (4)

- Other executives includes directors and executive officers of the Company, other than Simon family members.

7

SIMON PROPERTY GROUP

Changes in Company Common Share and Operating Partnership Unit Ownership

For the Period from December 31, 2007 through December 31, 2008

| | | | | | | | |

| | Operating

Partnership

Units(1) | | Company

Common

Shares(2) | |

|---|

Number Outstanding at December 31, 2007 | | | 57,913,250 | | | 223,034,282 | |

Activity During the First Nine Months of 2008: | | | | | | | |

Issuance of Common Stock for Stock Option Exercises | | | — | | | 182,106 | |

Conversion of Preferred Stock into Common Stock | | | — | | | 57,175 | |

Conversion of Operating Partnership Units into Common Stock | | | (2,234,987 | ) | | 2,234,987 | |

Conversion of Operating Partnership Units into Cash | | | (144,291 | ) | | — | |

Conversion of Operating Partnership Preferred Units into Units | | | 1,101,765 | | | — | |

Restricted Stock Awards (Stock Incentive Program)(6) | | | — | | | 301,455 | |

Number Outstanding at September 30, 2008 | | |

56,635,737 | | |

225,810,005 | |

Activity During the Fourth Quarter of 2008: | | | | | | | |

Issuance of Common Stock for Stock Option Exercises | | | — | | | 100,000 | |

Conversion of Preferred Stock into Common Stock | | | — | | | 5,094,601 | |

Conversion of Operating Partnership Units into Common Stock | | | (339,621 | ) | | 339,621 | |

Conversion of Operating Partnership Units into Cash | | | (18,160 | ) | | — | |

Conversion of Operating Partnership Preferred Units into Units | | | 90,454 | | | — | |

Restricted Stock Awards (Stock Incentive Program)(6) | | | — | | | (24,583 | ) |

Number Outstanding at December 31, 2008 | | |

56,368,410 | | |

231,319,644 | |

Details for Diluted Common Shares Outstanding(5): | | | | | | | |

Company Common Shares Outstanding at December 31, 2008 | | | | | |

231,319,644 | |

Number of Common Shares Issuable Assuming Conversion of: | | | | | | | |

| | Series I 6% Convertible Perpetual Preferred Stock(3) | | | | | |

6,117,495 | |

| | Series C 7% Cumulative Convertible Preferred Units(3) | | | | | | 71,313 | |

| | Series I 6% Convertible Perpetual Preferred Units(3) | | | | | | 1,223,755 | |

Net Number of Common Shares Issuable Assuming Exercise of Stock Options(4) | | | | | |

397,177 | |

Diluted Common Shares Outstanding at December 31, 2008(5) | | | | | |

239,129,384 | |

- (1)

- Excludes units owned by the Company (shown here as Company Common Shares) and Operating Partnership units not convertible into common shares.

- (2)

- Excludes Operating Partnership preferred units relating to Company preferred stock outstanding (see Schedule of Preferred Stock Outstanding on page 59).

- (3)

- Conversion terms provided on page 59 of this document.

- (4)

- Based upon the weighted average stock price for the quarter ended December 31, 2008.

- (5)

- For FFO purposes.

- (6)

- Net of forfeitures.

8

SIMON PROPERTY GROUP

Selected Financial and Equity Information

As of December 31, 2008

Unaudited

(In thousands, except as noted)

| | | | | | | | | | | | | |

| | As of or for the

Three Months Ended

December 31, | | As of or for the

Twelve Months Ended

December 31, | |

|---|

| | 2008 | | 2007 | | 2008 | | 2007 | |

|---|

| Financial Highlights of the Company | | | | | | | | | | | | | |

| Total Revenue—Consolidated Properties | | $ | 1,029,316 | | $ | 1,035,581 | | $ | 3,783,155 | | $ | 3,650,799 | |

| Net Income Available to Common Stockholders | | $ | 145,203 | | $ | 112,929 | | $ | 422,517 | | $ | 436,164 | |

| Basic Earnings per Common Share (EPS) | | $ | 0.64 | | $ | 0.51 | | $ | 1.88 | | $ | 1.96 | |

| Diluted Earnings per Common Share (EPS) | | $ | 0.64 | | $ | 0.51 | | $ | 1.87 | | $ | 1.95 | |

| FFO of the Operating Partnership | | $ | 540,527 | | $ | 507,742 | | $ | 1,852,331 | | $ | 1,691,887 | |

| Diluted FFO of the Operating Partnership | | $ | 548,040 | | $ | 520,578 | | $ | 1,895,681 | | $ | 1,743,454 | |

| Basic FFO per Share (FFOPS) | | $ | 1.90 | | $ | 1.81 | | $ | 6.56 | | $ | 6.02 | |

| Diluted FFO per Share (FFOPS) | | $ | 1.86 | | $ | 1.76 | | $ | 6.42 | | $ | 5.90 | |

| Distributions per Share | | $ | 0.90 | | $ | 0.84 | | $ | 3.60 | | $ | 3.36 | |

| | | | | | | | |

| | December 31,

2008 | | December 31,

2007 | |

|---|

| Stockholders' Equity Information | | | | | | | |

| Limited Partner Units Outstanding at End of Period | | | 56,368 | | | 57,913 | |

| Common Shares Outstanding at End of Period | | | 231,320 | | | 223,035 | |

| | | | | | |

| Total Common Shares and Units Outstanding at End of Period | | | 287,688 | | | 280,948 | |

| | | | | | |

| Weighted Average Limited Partnership Units Outstanding | | | 57,175 | | | 58,036 | |

| Weighted Average Common Shares Outstanding: | | | | | | | |

| | Basic—for purposes of EPS and FFOPS | | | 225,333 | | | 222,998 | |

| | Diluted—for purposes of EPS | | | 225,884 | | | 223,777 | |

| | Diluted—for purposes of FFOPS | | | 238,263 | | | 237,448 | |

Simon Group's Debt Information |

|

|

|

|

|

|

|

| Share of Consolidated Debt | | $ | 17,766,316 | | $ | 16,933,771 | |

| Share of Joint Venture Debt | | | 6,632,419 | | | 6,568,403 | |

| | | | | | |

| Share of Total Debt | | $ | 24,398,735 | | $ | 23,502,174 | |

| | | | | | |

Simon Group's Market Capitalization |

|

|

|

|

|

|

|

| Common Stock Price at End of Period | | $ | 53.13 | | $ | 86.86 | |

| Common Equity Capitalization, including common operating partnership units | | $ | 15,284,866 | | $ | 24,403,103 | |

| Preferred Equity Capitalization, including preferred operating partnership units | | | 589,532 | | | 1,359,833 | |

| | | | | | |

| Total Equity Market Capitalization | | $ | 15,874,398 | | $ | 25,762,936 | |

| | | | | | |

| Total Capitalization—Including Simon Group's Share of Total Debt | | $ | 40,273,133 | | $ | 49,265,110 | |

| | | | | | |

| | | | | | | | |

| | As of or for the Twelve Months Ended December 31, | |

|---|

| | 2008 | | 2007 | |

|---|

| Miscellaneous Balance Sheet Data | | | | | | | |

| Interest Capitalized during the Period: | | | | | | | |

| | Consolidated Properties | | $ | 27,472 | | $ | 34,591 | |

| | Joint Venture Properties | | $ | 4,127 | | $ | 4,922 | |

| | Simon Group's Share of Joint Venture Properties | | $ | 2,019 | | $ | 2,106 | |

9

On the next three pages, we present balance sheet and income statement data on a pro-rata basis reflecting our proportionate economic ownership of each asset in the Simon Group portfolio.

Basis of Presentation: The consolidated amounts shown are prepared on a consistent basis with our consolidated financial statements. The Company's Share of Joint Ventures column was derived on a property-by-property basis by applying the same percentage interests used to arrive at our share of net income during the period and applying them to all financial statement line items of each property. A similar calculation was performed for minority interests.

10

SIMON PROPERTY GROUP

Unaudited Pro-Rata Statement of Operations

| | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended December 31, 2008 | |

| |

|---|

| | For the

Three Months Ended

December 31, 2007

Our Total Share | |

|---|

| | Consolidated | | Minority

Interest | | Our

Consolidated

Share | | Our

Share of

Joint Ventures | | Our

Total

Share | |

|---|

REVENUE: | | | | | | | | | | | | | | | | | | | |

| | Minimum rent | | $ | 607,100 | | $ | (9,777 | ) | $ | 597,323 | | $ | 209,518 | | $ | 806,841 | | $ | 772,476 | |

| | Overage rent | | | 39,440 | | | (302 | ) | | 39,138 | | | 23,674 | | | 62,812 | | | 67,735 | |

| | Tenant reimbursements | | | 289,290 | | | (5,817 | ) | | 283,473 | | | 109,072 | | | 392,545 | | | 385,452 | |

| | Management fees and other revenues | | | 31,222 | | | — | | | 31,222 | | | — | | | 31,222 | | | 40,371 | |

| | Other income | | | 62,264 | | | (757 | ) | | 61,507 | | | 30,380 | | | 91,887 | | | 95,325 | |

| | | | | | | | | | | | | | |

| | | Total revenue | | | 1,029,316 | | | (16,653 | ) | | 1,012,663 | | | 372,644 | | | 1,385,307 | | | 1,361,359 | |

| | | | | | | | | | | | | | |

EXPENSES: | | | | | | | | | | | | | | | | | | | |

| | Property operating | | | 103,687 | | | (3,327 | ) | | 100,360 | | | 71,691 | | | 172,051 | | | 175,565 | |

| | Depreciation and amortization | | | 268,902 | | | (2,140 | ) | | 266,762 | | | 106,962 | | | 373,724 | | | 343,588 | |

| | Real estate taxes | | | 80,586 | | | (1,351 | ) | | 79,235 | | | 26,797 | | | 106,032 | | | 97,352 | |

| | Repairs and maintenance | | | 32,621 | | | (743 | ) | | 31,878 | | | 14,696 | | | 46,574 | | | 49,672 | |

| | Advertising and promotion | | | 32,729 | | | (467 | ) | | 32,262 | | | 9,363 | | | 41,625 | | | 41,647 | |

| | Provision for credit losses | | | 6,668 | | | (198 | ) | | 6,470 | | | 3,879 | | | 10,349 | | | 8,153 | |

| | Home and regional office costs | | | 36,099 | | | — | | | 36,099 | | | — | | | 36,099 | | | 40,665 | |

| | General and administrative | | | 5,555 | | | — | | | 5,555 | | | — | | | 5,555 | | | 4,682 | |

| | Other | | | 16,651 | | | (511 | ) | | 16,140 | | | 25,347 | | | 41,487 | | | 45,599 | |

| | | | | | | | | | | | | | |

| | | Total operating expenses | | | 583,498 | | | (8,737 | ) | | 574,761 | | | 258,735 | | | 833,496 | | | 806,923 | |

| | | | | | | | | | | | | | |

OPERATING INCOME | | | 445,818 | | | (7,916 | ) | | 437,902 | | | 113,909 | | | 551,811 | | | 554,436 | |

Interest expense | | | (244,933 | ) | | 3,930 | | | (241,003 | ) | | (94,723 | ) | | (335,726 | ) | | (326,593 | ) |

Loss on extinguishment of debt | | | — | | | — | | | — | | | — | | | — | | | — | |

Minority interest in income of consolidated entities | | | (3,986 | ) | | 3,986 | | | — | | | — | | | — | | | — | |

Income tax (expense) benefit of taxable REIT subsidiaries | | | (2,005 | ) | | — | | | (2,005 | ) | | — | | | (2,005 | ) | | 12,727 | |

Income from unconsolidated entities | | | 19,186 | | | — | | | 19,186 | | | (19,186 | ) | | — | | | — | |

Impairment charge | | | (21,172 | ) | | — | | | (21,172 | ) | | — | | | (21,172 | ) | | (55,061 | ) |

Gain on sales of assets and interests in unconsolidated entities, net | | | — | | | — | | | — | | | — | | | — | | | 409 | |

Limited partners' interest in the Operating Partnership | | | (36,345 | ) | | — | | | (36,345 | ) | | — | | | (36,345 | ) | | (34,749 | ) |

Preferred distributions of the Operating Partnership | | | (4,201 | ) | | — | | | (4,201 | ) | | — | | | (4,201 | ) | | (5,362 | ) |

| | | | | | | | | | | | | | |

Income from continuing operations | | | 152,362 | | | — | | | 152,362 | | | — | | | 152,362 | | | 145,807 | |

Discontinued operations, net of limited partners' interest | | | (20 | ) | | — | | | (20 | ) | | — | | | (20 | ) | | 78 | |

Loss on sale of discontinued operations, net of limited partners' interest | | | — | | | — | | | — | | | — | | | — | | | (20,880 | ) |

| | | | | | | | | | | | | | |

NET INCOME | | | 152,342 | | | — | | | 152,342 | | | — | | | 152,342 | | | 125,005 | |

Preferred dividends | | | (7,139 | ) | | — | | | (7,139 | ) | | — | | | (7,139 | ) | | (12,076 | ) |

| | | | | | | | | | | | | | |

NET INCOME AVAILABLE TO COMMON STOCKHOLDERS | | $ | 145,203 | | $ | — | | $ | 145,203 | | $ | — | | $ | 145,203 | | | 112,979 | |

| | | | | | | | | | | | | | |

RECONCILIATION OF NET INCOME TO FFO | | | | | | | | | | | | | | | | | | | |

Net Income | | | | | | | | $ | 152,342 | | $ | — | | $ | 152,342 | | $ | 125,005 | |

Adjustments to Net Income to Arrive at FFO: | | | | | | | | | | | | | | | | | | | |

| | Limited partners' interest in the Operating Partnership and preferred distributions of the Operating Partnership | | | | | | | | | 40,546 | | | — | | | 40,546 | | | 40,111 | |

| | Limited partners' interest in Results of operations from discontinued operations | | | | | | | | | (5 | ) | | — | | | (5 | ) | | 20 | |

| | Depreciation and amortization from consolidated properties and discontinued operations | | | | | | | | | 264,465 | | | — | | | 264,465 | | | 232,162 | |

| | Simon's share of depreciation and amortization from unconsolidated entities | | | | | | | | | — | | | 96,631 | | | 96,631 | | | 109,462 | |

| | Income from unconsolidated entities | | | | | | | | | (19,186 | ) | | 19,186 | | | — | | | — | |

| | Loss on sales of interests in other assets and unconsolidated entities, net of limited partners' interest | | | | | | | | | — | | | — | | | — | | | 20,471 | |

| | Minority interest portion of depreciation and amortization | | | | | | | | | (2,112 | ) | | — | | | (2,112 | ) | | (2,051 | ) |

| | Preferred distributions and dividends | | | | | | | | | (11,340 | ) | | — | | | (11,340 | ) | | (17,438 | ) |

| | | | | | | | | | | | | | | | |

| | FFO of the Operating Partnership | | | | | | | | $ | 424,710 | | $ | 115,817 | | $ | 540,527 | | $ | 507,742 | |

| | | | | | | | | | | | | | | | |

| | | Percentage of FFO of the Operating Partnership | | | | | | | | | 78.57 | % | | 21.43 | % | | 100.00 | % | | 100.00 | % |

11

SIMON PROPERTY GROUP

Unaudited Pro-Rata Statement of Operations

| | | | | | | | | | | | | | | | | | | | | |

| | For the Twelve Months Ended December 31, 2008 | |

| |

|---|

| | For the

Twelve Months Ended

December 31, 2007

Our Total Share | |

|---|

| | Consolidated | | Minority

Interest | | Our

Consolidated

Share | | Our

Share of

Joint Ventures | | Our

Total

Share | |

|---|

REVENUE: | | | | | | | | | | | | | | | | | | | |

| | Minimum rent | | $ | 2,291,919 | | $ | (37,037 | ) | $ | 2,254,882 | | $ | 779,679 | | $ | 3,034,561 | | $ | 2,792,483 | |

| | Overage rent | | | 100,222 | | | (474 | ) | | 99,748 | | | 52,556 | | | 152,304 | | | 156,263 | |

| | Tenant reimbursements | | | 1,065,957 | | | (22,617 | ) | | 1,043,340 | | | 397,547 | | | 1,440,887 | | | 1,324,035 | |

| | Management fees and other revenues | | | 132,471 | | | — | | | 132,471 | | | — | | | 132,471 | | | 113,740 | |

| | Other income | | | 192,586 | | | (2,085 | ) | | 190,501 | | | 110,437 | | | 300,938 | | | 335,321 | |

| | | | | | | | | | | | | | |

| | | Total revenue | | | 3,783,155 | | | (62,213 | ) | | 3,720,942 | | | 1,340,219 | | | 5,061,161 | | | 4,721,842 | |

| | | | | | | | | | | | | | |

EXPENSES: | | | | | | | | | | | | | | | | | | | |

| | Property operating | | | 455,874 | | | (13,297 | ) | | 442,577 | | | 266,242 | | | 708,819 | | | 671,665 | |

| | Depreciation and amortization | | | 969,477 | | | (8,622 | ) | | 960,855 | | | 402,690 | | | 1,363,545 | | | 1,217,101 | |

| | Real estate taxes | | | 334,657 | | | (5,480 | ) | | 329,177 | | | 100,017 | | | 429,194 | | | 390,563 | |

| | Repairs and maintenance | | | 107,879 | | | (2,561 | ) | | 105,318 | | | 51,652 | | | 156,970 | | | 164,405 | |

| | Advertising and promotion | | | 96,783 | | | (1,383 | ) | | 95,400 | | | 26,645 | | | 122,045 | | | 117,441 | |

| | Provision for credit losses | | | 24,035 | | | (691 | ) | | 23,344 | | | 9,609 | | | 32,953 | | | 18,895 | |

| | Home and regional office costs | | | 144,865 | | | — | | | 144,865 | | | — | | | 144,865 | | | 136,610 | |

| | General and administrative | | | 20,987 | | | — | | | 20,987 | | | — | | | 20,987 | | | 19,587 | |

| | Other | | | 67,721 | | | (1,993 | ) | | 65,728 | | | 81,662 | | | 147,390 | | | 134,511 | |

| | | | | | | | | | | | | | |

| | | Total operating expenses | | | 2,222,278 | | | (34,027 | ) | | 2,188,251 | | | 938,517 | | | 3,126,768 | | | 2,870,778 | |

| | | | | | | | | | | | | | |

OPERATING INCOME | | | 1,560,877 | | | (28,186 | ) | | 1,532,691 | | | 401,702 | | | 1,934,393 | | | 1,851,064 | |

Interest expense | | | (947,140 | ) | | 15,755 | | | (931,385 | ) | | (369,456 | ) | | (1,300,841 | ) | | (1,237,667 | ) |

Loss on extinguishment of debt | | | (20,330 | ) | | — | | | (20,330 | ) | | — | | | (20,330 | ) | | — | |

Minority interest in income of consolidated entities | | | (12,431 | ) | | 12,431 | | | — | | | — | | | — | | | — | |

Income tax (expense) benefit of taxable REIT subsidiaries | | | (3,581 | ) | | — | | | (3,581 | ) | | — | | | (3,581 | ) | | 11,322 | |

Income from unconsolidated entities | | | 32,246 | | | — | | | 32,246 | | | (32,246 | ) | | — | | | — | |

Impairment charge | | | (21,172 | ) | | — | | | (21,172 | ) | | — | | | (21,172 | ) | | (55,061 | ) |

Gain on sales of assets and interests in unconsolidated entities, net | | | — | | | — | | | — | | | — | | | — | | | 92,044 | |

Limited partners' interest in the Operating Partnership | | | (107,214 | ) | | — | | | (107,214 | ) | | — | | | (107,214 | ) | | (120,818 | ) |

Preferred distributions of the Operating Partnership | | | (17,599 | ) | | — | | | (17,599 | ) | | — | | | (17,599 | ) | | (21,580 | ) |

| | | | | | | | | | | | | | |

Income from continuing operations | | | 463,656 | | | — | | | 463,656 | | | — | | | 463,656 | | | 519,304 | |

Discontinued operations, net of limited partners' interest | | | (20 | ) | | — | | | (20 | ) | | — | | | (20 | ) | | (93 | ) |

Loss on sale of discontinued operations, net of limited partners' interest | | | — | | | — | | | — | | | — | | | — | | | (27,972 | ) |

| | | | | | | | | | | | | | |

NET INCOME | | | 463,636 | | | — | | | 463,636 | | | — | | | 463,636 | | | 491,239 | |

Preferred dividends | | | (41,119 | ) | | — | | | (41,119 | ) | | — | | | (41,119 | ) | | (55,075 | ) |

| | | | | | | | | | | | | | |

NET INCOME AVAILABLE TO COMMON STOCKHOLDERS | | $ | 422,517 | | $ | — | | $ | 422,517 | | $ | — | | $ | 422,517 | | $ | 436,164 | |

| | | | | | | | | | | | | | |

RECONCILIATION OF NET INCOME TO FFO | | | | | | | | | | | | | | | | | | | |

Net Income | | | | | | | | $ | 463,636 | | $ | — | | $ | 463,636 | | $ | 491,239 | |

Adjustments to Net Income to Arrive at FFO: | | | | | | | | | | | | | | | | | | | |

| | Limited partners' interest in the Operating Partnership and preferred distributions of the Operating Partnership | | | | | | | | | 124,813 | | | — | | | 124,813 | | | 142,398 | |

| | Limited partners' interest in Results of operations from discontinued operations | | | | | | | | | (5 | ) | | — | | | (5 | ) | | (24 | ) |

| | Depreciation and amortization from consolidated properties and discontinued operations | | | | | | | | | 954,494 | | | — | | | 954,494 | | | 892,488 | |

| | Simon's share of depreciation and amortization from unconsolidated entities | | | | | | | | | — | | | 376,670 | | | 376,670 | | | 315,159 | |

| | Income from unconsolidated entities | | | | | | | | | (32,246 | ) | | 32,246 | | | — | | | — | |

| | Gain on sales of interests in other assets and unconsolidated entities, net of limited partners' interest | | | | | | | | | — | | | — | | | — | | | (64,072 | ) |

| | Minority interest portion of depreciation and amortization | | | | | | | | | (8,559 | ) | | — | | | (8,559 | ) | | (8,646 | ) |

| | Preferred distributions and dividends | | | | | | | | | (58,718 | ) | | — | | | (58,718 | ) | | (76,655 | ) |

| | | | | | | | | | | | | | | | |

| | FFO of the Operating Partnership | | | | | | | | $ | 1,443,415 | | $ | 408,916 | | $ | 1,852,331 | | $ | 1,691,887 | |

| | | | | | | | | | | | | | | | |

| | | Percentage of FFO of the Operating Partnership | | | | | | | | | 77.92 | % | | 22.08 | % | | 100.00 | % | | 100.00 | % |

12

SIMON PROPERTY GROUP

Unaudited Pro-Rata Balance Sheet

| | | | | | | | | | | | | | | | | | | | | | |

| | As of December 31, 2008 | |

| |

|---|

| | Consolidated | |

Minority

Interest | | Our

Consolidated

Share | | Our

Share of

Joint Ventures | | Our

Total

Share | | As of

December 31, 2007

Our Total Share | |

|---|

ASSETS: | | | | | | | | | | | | | | | | | | | |

| | Investment properties, at cost | | $ | 25,205,715 | | $ | (204,291 | ) | $ | 25,001,424 | | $ | 9,320,620 | | $ | 34,322,044 | | $ | 33,335,281 | |

| | | Less—accumulated depreciation | | | 6,184,285 | | | (80,395 | ) | | 6,103,890 | | | 1,324,389 | | | 7,428,279 | | | 6,256,587 | |

| | | | | | | | | | | | | | |

| | | 19,021,430 | | | (123,896 | ) | | 18,897,534 | | | 7,996,231 | | | 26,893,765 | | | 27,078,694 | |

| | Cash and cash equivalents | | | 773,544 | | | (5,306 | ) | | 768,238 | | | 306,335 | | | 1,074,573 | | | 782,599 | |

| | Tenant receivables and accrued revenue, net | | | 414,856 | | | (5,205 | ) | | 409,651 | | | 165,220 | | | 574,871 | | | 608,413 | |

| | Investment in unconsolidated entities, at equity | | | 1,663,886 | | | — | | | 1,663,886 | | | (1,663,886 | ) | | — | | | — | |

| | Deferred costs and other assets | | | 1,202,256 | | | (177,488 | ) | | 1,024,768 | | | 243,263 | | | 1,268,031 | | | 1,227,788 | |

| | Notes receivable from related parties | | | 520,700 | | | — | | | 520,700 | | | — | | | 520,700 | | | 548,000 | |

| | | | | | | | | | | | | | |

| | | | Total assets | | $ | 23,596,672 | | $ | (311,895 | ) | $ | 23,284,777 | | $ | 7,047,163 | | $ | 30,331,940 | | $ | 30,245,494 | |

| | | | | | | | | | | | | | |

LIABILITIES: | | | | | | | | | | | | | | | | | | | |

| | Mortgages and other indebtedness | | $ | 18,042,532 | | $ | (276,216 | ) | $ | 17,766,316 | | $ | 6,632,419 | | $ | 24,398,735 | | $ | 23,502,174 | |

| | Accounts payable, accrued expenses, intangibles, and deferred revenues | | | 1,086,248 | | | (9,804 | ) | | 1,076,444 | | | 453,346 | | | 1,529,790 | | | 1,647,163 | |

| | Cash distributions and losses in partnerships and joint ventures, at equity | | | 380,730 | | | — | | | 380,730 | | | (380,730 | ) | | — | | | — | |

| | Other liabilities, minority interest and accrued dividends | | | 179,970 | | | (25,875 | ) | | 154,095 | | | 342,128 | | | 496,223 | | | 493,655 | |

| | | | | | | | | | | | | | |

| | | | Total liabilities | | | 19,689,480 | | | (311,895 | ) | | 19,377,585 | | | 7,047,163 | | | 26,424,748 | | | 25,642,992 | |

| | | | | | | | | | | | | | |

LIMITED PARTNERS' INTEREST IN THE OPERATING PARTNERSHIP | | |

637,140 | | |

— | | |

637,140 | | |

— | | |

637,140 | | |

731,406 | |

LIMITED PARTNERS' PREFERRED INTEREST IN THE OPERATING PARTNERSHIP | | |

229,869 | | |

— | | |

229,869 | | |

— | | |

229,869 | | |

307,713 | |

STOCKHOLDERS' EQUITY: | | | | | | | | | | | | | | | | | | | |

| | CAPITAL STOCK OF SIMON PROPERTY GROUP, INC. (750,000,000 total shares authorized, $.0001 par value, 237,996,000 shares of excess common stock): | | | | | | | | | | | | | | | | | | | |

| | | All series of preferred stock, 100,000,000 shares authorized, 8,387,212 and 14,801,884 issued and outstanding, respectively with a liquidation value of $419,361 and $740,094, respectively | | |

425,545 | | |

— | | |

425,545 | | |

— | | |

425,545 | | |

746,608 | |

| | | Common stock, $.0001 par value, 400,000,000 shares authorized, 235,691,040 and 227,719,614 issued and outstanding | | |

24 | | |

— | | |

24 | | |

— | | |

24 | | |

23 | |

| | | Class B common stock, $.0001 par value, 12,000,000 shares authorized, 8,000 issued and outstanding, respectively | | |

— | | |

— | | |

— | | |

— | | |

— | | |

— | |

| | | Class C common stock, $.0001 par value, 0 and 4,000 shares authorized, issued and outstanding | | |

— | | |

— | | |

— | | |

— | | |

— | | |

— | |

| | Capital in excess of par value | | |

5,410,147 | | |

— | | |

5,410,147 | | |

— | | |

5,410,147 | | |

5,067,718 | |

| | Accumulated deficit | | | (2,444,257 | ) | | — | | | (2,444,257 | ) | | — | | | (2,444,257 | ) | | (2,055,447 | ) |

| | Accumulated other comprehensive income | | | (165,066 | ) | | — | | | (165,066 | ) | | — | | | (165,066 | ) | | 18,087 | |

| | Common stock held in treasury at cost, 4,379,396 shares and 4,697,332, respectively | | | (186,210 | ) | | — | | | (186,210 | ) | | — | | | (186,210 | ) | | (213,606 | ) |

| | | | | | | | | | | | | | |

| | | | Total stockholders' equity | | | 3,040,183 | | | — | | | 3,040,183 | | | — | | | 3,040,183 | | | 3,563,383 | |

| | | | | | | | | | | | | | |

| | $ | 23,596,672 | | $ | (311,895 | ) | $ | 23,284,777 | | $ | 7,047,163 | | $ | 30,331,940 | | $ | 30,245,494 | |

| | | | | | | | | | | | | | |

13

SIMON PROPERTY GROUP

Reconciliation of Net Income to NOI

As of December 31, 2008

(in thousands, except as noted)

Industry practice is to evaluate real estate properties on an unleveraged basis. Net Operating Income ("NOI") is a standard industry performance measure which is defined as operating income plus depreciation and amortization, both calculated in accordance with accounting principles generally accepted in the United States ("GAAP"). We consider NOI to be a key measure of our operating performance that is not specifically defined by GAAP. We believe that NOI is helpful to investors because it is a widely recognized measure of the performance of REITs and provides a relevant basis for comparison among REITs. We also use NOI internally to measure the operating performance of our portfolio.

However, you should understand that NOI:

- •

- does not represent cash flow from operations as defined by GAAP,

- •

- should not be considered as an alternative to net income determined in accordance with GAAP as a measure of operating performance,

- •

- is not an alternative to cash flows as a measure of liquidity, and

- •

- is not indicative of cash flows from operating, investing and financing activities.

The Reconciliation of Net Income to NOI provides net income, which we believe is the most directly comparable GAAP financial measure, and reconciles the amounts to "Total NOI of the Simon Group Portfolio." This schedule also provides the increase in NOI of regional malls and Premium Outlet Centers that are comparable properties for the twelve months ended December 31, 2008.

| | | | | | | | | | | | | |

| | For the Three

Months Ended

December 31, | | For the Twelve

Months Ended

December 31, | |

|---|

| | 2008 | | 2007 | | 2008 | | 2007 | |

|---|

Reconciliation of NOI of consolidated Properties: | | | | | | | | | | | | | |

Net Income | | $ | 152,342 | | $ | 125,005 | | $ | 463,636 | | $ | 491,239 | |

Preferred distributions of the Operating Partnership | | | 4,201 | | | 5,362 | | | 17,599 | | | 21,580 | |

Limited partners' interest in the Operating Partnership | | | 36,345 | | | 34,749 | | | 107,214 | | | 120,818 | |

Discontinued operations—Results of operations and (gain) loss on disposal or sale, net of limited partners' interest | | | 20 | | | 20,802 | | | 20 | | | 28,065 | |

Income tax expense (benefit) of taxable REIT subsidiaries | | | 2,005 | | | (12,727 | ) | | 3,581 | | | (11,322 | ) |

Minority interest in income of consolidated entities | | | 3,986 | | | 4,838 | | | 12,431 | | | 13,936 | |

Interest expense | | | 244,933 | | | 241,565 | | | 947,140 | | | 945,852 | |

Income from unconsolidated entities | | | (19,186 | ) | | (397 | ) | | (32,246 | ) | | (38,120 | ) |

Loss on extinguishment of debt | | | — | | | — | | | 20,330 | | | — | |

Impairment charge | | | 21,172 | | | 55,061 | | | 21,172 | | | 55,061 | |

Gain on sale of interest in unconsolidated entities | | | — | | | (409 | ) | | — | | | (92,044 | ) |

| | | | | | | | | | |

Operating Income | | | 445,818 | | | 473,849 | | | 1,560,877 | | | 1,535,065 | |

Depreciation and amortization | | | 268,902 | | | 235,092 | | | 969,477 | | | 905,636 | |

| | | | | | | | | | |

NOI of consolidated Properties | | $ | 714,720 | | $ | 708,941 | | $ | 2,530,354 | | $ | 2,440,701 | |

| | | | | | | | | | |

Reconciliation of NOI of unconsolidated entities: | | | | | | | | | | | | | |

Net Income | | $ | 92,893 | | $ | 49,482 | | $ | 211,337 | | $ | 407,841 | |

Discontinued operations—Results of operations and gain on disposal or sale, net | | | — | | | (11 | ) | | (47 | ) | | (201,720 | ) |

Interest expense | | | 242,141 | | | 259,214 | | | 969,420 | | | 853,307 | |

Loss (income) from unconsolidated entities | | | 1,340 | | | (207 | ) | | 5,123 | | | (665 | ) |

Gain on sale of asset | | | — | | | 823 | | | — | | | 6,399 | |

| | | | | | | | | | |

Operating Income | | | 336,374 | | | 309,301 | | | 1,185,833 | | | 1,065,162 | |

Depreciation and amortization | | | 203,631 | | | 227,695 | | | 775,887 | | | 627,929 | |

| | | | | | | | | | |

NOI of unconsolidated entities | | $ | 540,005 | | $ | 536,996 | | $ | 1,961,720 | | $ | 1,693,091 | |

| | | | | | | | | | |

Total consolidated and unconsolidated NOI from continuing operations | | $ | 1,254,725 | | $ | 1,245,937 | | $ | 4,492,074 | | $ | 4,133,792 | |

| | | | | | | | | | |

Adjustments to NOI: | | | | | | | | | | | | | |

NOI of discontinued consolidated and unconsolidated Properties | | | (25 | ) | | 124 | | | 22 | | | 8,105 | |

| | | | | | | | | | |

Total NOI of the Simon Group Portfolio | | $ | 1,254,700 | | $ | 1,246,061 | | $ | 4,492,096 | | $ | 4,141,897 | |

| | | | | | | | | | |

Increase in NOI from prior period | | | 0.7 | % | | 32.9 | % | | 8.5 | % | | 24.7 | % |

Less: Joint venture partner's share of NOI | | | 329,190 | | | 347,937 | | | 1,194,183 | | | 1,073,849 | |

| | | | | | | | | | |

Simon Group's Share of NOI | | $ | 925,510 | | $ | 898,124 | | $ | 3,297,913 | | $ | 3,068,048 | |

| | | | | | | | | | |

Increase in Simon Group's Share of NOI from prior period | | | 3.0 | % | | 20.9 | % | | 7.5 | % | | 16.2 | % |

NOI of Regional Malls that are Comparable Properties (1) | | | | | | | | $ | 2,530,515 | | $ | 2,511,121 | |

| | | | | | | | | | | | |

Increase in NOI of Regional Malls that are Comparable Properties (1) | | | | | | | | | 0.8 | % | | | |

| | | | | | | | | | | | | |

NOI of Premium Outlet Centers that are Comparable Properties (1) | | | | | | | | $ | 456,540 | | $ | 424,073 | |

| | | | | | | | | | | | |

Increase in NOI of Premium Outlet Centers that are Comparable Properties (1) | | | | | | | | | 7.7 | % | | | |

| | | | | | | | | | | | | |

- (1)

- Properties that were owned in both of the periods under comparison are referred to as comparable properties.

14

SIMON PROPERTY GROUP

NOI Composition(1)

For the Twelve Months Ended December 31, 2008

| | | | |

| | Percent of Simon Group's

Share of NOI | |

|---|

| U.S. Portfolio NOI by State | | | | |

| Florida | | | 13.2 | % |

| Texas | | | 10.8 | % |

| California | | | 10.3 | % |

| New York | | | 7.4 | % |

| Massachusetts | | | 7.2 | % |

| Georgia | | | 5.0 | % |

| Indiana | | | 4.7 | % |

| Nevada | | | 4.6 | % |

| Pennsylvania | | | 4.4 | % |

| New Jersey | | | 4.1 | % |

| | | | |

| Top 10 Contributors by State | | | 71.7 | % |

| | | | |

NOI by Asset Type |

|

|

|

|

| Regional Malls | | | 66.8 | % |

| Premium Outlet Centers | | | 17.9 | % |

| Mills Portfolio (2) | | | 7.3 | % |

| Community/Lifestyle Centers | | | 3.8 | % |

| International (3) | | | 4.0 | % |

| Other | | | 0.2 | % |

| | | | |

| Total | | | 100.0 | % |

| | | | |

- (1)

- Based on Simon Group's share of total NOI and does not reflect any property, entity or corporate-level debt.

- (2)

- Mills Portfolio includes The Mills®, Mills regional malls and Mills community centers.

- (3)

- International includes seven Premium Outlet Centers in Japan and one Premium Outlet Center in both Mexico and South Korea, plus the shopping centers in France, Italy, Poland, and China.

15

SIMON PROPERTY GROUP

Analysis of Other Income and Other Expense

As of December 31, 2008

(In thousands)

| | | | | | | | | | | | | |

| | For the Three Months

Ended December 31, | | For the Twelve Months

Ended December 31, | |

|---|

| | 2008 | | 2007 | | 2008 | | 2007 | |

|---|

Consolidated Properties | | | | | | | | | | | | | |

Other Income | | | | | | | | | | | | | |

Interest Income | |

$ |

11,239 | |

$ |

14,076 | |

$ |

46,884 | |

$ |

73,647 | |

Lease Settlement Income | | | 1,514 | | | 5,000 | | | 15,438 | | | 34,137 | (1) |

Gains on Land Sales | | | 3,581 | | | 4,982 | | | 11,285 | | | 11,376 | |

Other | | | 45,930 | | | 46,955 | | | 118,979 | | | 130,019 | |

| | | | | | | | | | |

Totals | | $ | 62,264 | | $ | 71,013 | | $ | 192,586 | | $ | 249,179 | |

| | | | | | | | | | |

Other Expense | | | | | | | | | | | | | |

Ground Rent | |

$ |

8,026 | |

$ |

8,773 | |

$ |

30,683 | |

$ |

31,012 | |

Professional Fees | | | 6,315 | | | 8,937 | | | 20,423 | | | 18,054 | |

Other | | | 2,310 | | | 1,526 | | | 16,615 | | | 12,888 | |

| | | | | | | | | | |

Totals | | $ | 16,651 | | $ | 19,236 | | $ | 67,721 | | $ | 61,954 | |

| | | | | | | | | | |

- (1)

- 2007 includes $19 million related to two department store locations that have been redeveloped.

16

SIMON PROPERTY GROUP

U.S. Portfolio GLA

As of December 31, 2008

| | | | | | | | | | | |

Type of Property | | GLA-Sq. Ft. | | Total Owned GLA | | % of Owned GLA | |

|---|

Regional Malls | | | | | | | | | | |

| | Mall Stores | | | 59,146,030 | | | 58,861,653 | | | 38.5 | % |

| | Freestanding | | | 4,321,845 | | | 1,673,748 | | | 1.1 | % |

| | Anchors | | | 96,727,572 | | | 26,361,240 | | | 17.3 | % |

| | | | | | | | |

Regional Mall Total | | | 160,195,447 | | | 86,896,641 | | | 56.9 | % |

Premium Outlet Centers | | |

16,383,378 | | |

16,383,378 | | |

10.7 |

% |

Community/Lifestyle Centers | | |

20,822,340 | | |

14,050,830 | | |

9.2 |

% |

| | The Mills® | | |

22,803,081 | | |

20,284,535 | | |

13.3 |

% |

| | Mills Regional Malls | | | 17,483,816 | | | 8,653,232 | | | 5.7 | % |

| | Mills Community Centers | | | 1,013,832 | | | 962,278 | | | 0.6 | % |

| | | | | | | | |

Mills Portfolio Total | | | 41,300,729 | | | 29,900,045 | | | 19.6 | % |

Office Portion of Retail | | |

2,120,523 | | |

2,120,523 | | |

1.4 |

% |

Other(1) | | |

5,216,742 | | |

3,450,421 | | |

2.2 |

% |

| | | | | | | | |

Total U.S. Properties | | | 246,039,159 | | | 152,801,838 | | | 100.0 | % |

| | | | | | | | |

- (1)

- Consists of: 1) ten other shopping centers and non-Premium outlet centers, and 2) four regional malls (Nanuet Mall, Palm Beach Mall, Raleigh Springs Mall, University Mall (FL)) which are in the process of being redeveloped. These properties contribute 0.2% of Simon Group's share of total NOI.

17

SIMON PROPERTY GROUP

U.S. Regional Mall Operational Information(1)

As of December 31, 2008

| | | | | | | | |

| | As of or for the

Twelve Months

Ended

December 31, | |

|---|

| | 2008 | | 2007 | |

|---|

Total Number of Regional Malls | | | 164 | | | 168 | |

Total Regional Mall GLA (in millions of square feet; includes office portion of retail) | | |

162.2 | | |

164.0 | |

Occupancy(2) | | | | | | | |

| | Consolidated Assets | | | 92.6 | % | | 93.9 | % |

| | Unconsolidated Assets | | | 91.9 | % | | 92.7 | % |

| | Total Portfolio | | | 92.4 | % | | 93.5 | % |

Comparable sales per square foot(3) | | | | | | | |

| | Consolidated Assets | | $ | 445 | | $ | 472 | |

| | Unconsolidated Assets | | $ | 523 | | $ | 530 | |

| | Total Portfolio | | $ | 470 | | $ | 491 | |

Average rent per square foot(2) | | | | | | | |

| | Consolidated Assets | | $ | 38.21 | | $ | 36.24 | |

| | Unconsolidated Assets | | $ | 42.03 | | $ | 38.73 | |

| | Total Portfolio | | $ | 39.49 | | $ | 37.09 | |

| | | | | | | |

Average Base Rent Per Square Foot(2) | | Mall &

Freestanding

Stores | | %

Change | |

|---|

| 12/31/08 | | $ | 39.49 | | | 6.5 | % |

| 12/31/07 | | | 37.09 | | | 4.8 | % |

| 12/31/06 | | | 35.38 | | | 2.6 | % |

| 12/31/05 | | | 34.49 | | | 3.0 | % |

| 12/31/04 | | | 33.50 | | | 3.8 | % |

| 12/31/03 | | | 32.26 | | | 5.1 | % |

Leasing Activity During the Period(2):

| | | | | | | | | | | | | |

| | Average Base Rent(4) | |

| |

| |

|---|

| | Lease

Signings | | Store Closings/

Lease Expirations | | Amount of Change

(Referred to as

"Leasing Spread") | |

|---|

2008 | | $ | 45.74 | | $ | 37.72 | | $ | 8.02 | | | 21.3 | % |

2007 | | | 44.76 | | | 39.12 | | | 5.64 | | | 14.4 | % |

2006 | | | 43.21 | | | 36.73 | | | 6.48 | | | 17.6 | % |

2005 | | | 43.18 | | | 35.78 | | | 7.40 | | | 20.7 | % |

2004 | | | 39.33 | | | 33.59 | | | 5.74 | | | 17.1 | % |

2003 | | | 41.28 | | | 32.99 | | | 8.29 | | | 25.1 | % |

- (1)

- Does not include information for the regional malls in the Mills portfolio.

- (2)

- Includes mall stores.

- (3)

- Based upon the standard definition of sales for regional malls adopted by the International Council of Shopping Centers which includes mall stores less than 10,000 square feet.

- (4)

- Represents the average base rent in effect during the period for those tenants who signed leases as compared to the average base rent in effect during the period for those tenants whose leases terminated or expired.

18

SIMON PROPERTY GROUP

U.S. Regional Mall Lease Expirations(1)(2)

As of December 31, 2008

| | | | | | | | | | |

Year | | Number of

Leases Expiring | | Square

Feet | | Avg. Base Rent

per Square Foot

at 12/31/08 | |

|---|

Mall Stores & Freestanding | | | | | | | | | | |

Month to Month Leases | | |

538 | | |

1,277,545 | |

$ |

38.47 | |

2009 | | | 1,776 | | | 4,802,566 | | $ | 37.70 | |

2010 | | | 2,212 | | | 6,374,978 | | $ | 37.45 | |

2011 | | | 2,218 | | | 5,671,427 | | $ | 35.70 | |

2012 | | | 1,563 | | | 5,274,736 | | $ | 36.19 | |

2013 | | | 1,445 | | | 4,291,127 | | $ | 41.97 | |

2014 | | | 1,297 | | | 3,985,264 | | $ | 42.36 | |

2015 | | | 1,210 | | | 4,088,851 | | $ | 43.46 | |

2016 | | | 1,369 | | | 3,962,654 | | $ | 42.08 | |

2017 | | | 1,363 | | | 4,544,236 | | $ | 43.72 | |

2018 | | | 1,201 | | | 4,646,413 | | $ | 45.76 | |

2019 and Thereafter | | | 587 | | | 3,712,254 | | $ | 36.99 | |

Specialty Leasing Agreements w/ terms in excess of 12 months | | | 1,087 | | | 2,722,383 | | $ | 15.28 | |

Anchor Tenants | | | | | | | | | | |

Month to Month Leases | | |

1 | | |

75,930 | |

$ |

1.90 | |

2009 | | | 14 | | | 1,487,792 | | $ | 3.60 | |

2010 | | | 34 | | | 4,055,343 | | $ | 2.66 | |

2011 | | | 21 | | | 2,261,008 | | $ | 4.22 | |

2012 | | | 28 | | | 3,248,412 | | $ | 4.06 | |

2013 | | | 25 | | | 3,334,115 | | $ | 4.78 | |

2014 | | | 28 | | | 2,655,555 | | $ | 5.31 | |

2015 | | | 9 | | | 752,170 | | $ | 7.11 | |

2016 | | | 10 | | | 1,090,349 | | $ | 7.68 | |

2017 | | | 6 | | | 816,723 | | $ | 2.79 | |

2018 | | | 7 | | | 687,836 | | $ | 7.16 | |

2019 and Thereafter | | | 39 | | | 4,049,524 | | $ | 6.24 | |

- (1)

- Does not include information for the regional malls in the Mills portfolio.

- (2)

- Does not consider the impact of renewal options that may be contained in leases.

19

SIMON PROPERTY GROUP

U.S. Regional Mall Top Tenants(1)

As of December 31, 2008

Top Mall Store Retail Tenants (sorted by percentage of total Simon Group base minimum rent)

| | | | | | | | | | | | | |

Tenant | | Number

of

Stores | | Square

Feet

(000's) | | Percent of

Total

Simon Group

Sq. Ft. | | Percent of

Total Simon

Group Base

Min. Rent | |

|---|

The Gap, Inc. | | | 297 | | | 3,385 | | | 1.4 | % | | 2.0 | % |

Limited Brands, Inc. | | | 321 | | | 1,802 | | | 0.7 | % | | 2.0 | % |

Abercrombie & Fitch Co. | | | 232 | | | 1,666 | | | 0.7 | % | | 1.7 | % |

Foot Locker, Inc. | | | 407 | | | 1,596 | | | 0.6 | % | | 1.5 | % |

Zale Corporation | | | 347 | | | 343 | | | 0.1 | % | | 1.0 | % |

Luxottica Group S.P.A | | | 365 | | | 729 | | | 0.3 | % | | 1.0 | % |

Express LLC | | | 116 | | | 1,045 | | | 0.4 | % | | 0.9 | % |

American Eagle Outfitters, Inc. | | | 160 | | | 908 | | | 0.4 | % | | 0.9 | % |

Sterling Jewelers, Inc. | | | 205 | | | 315 | | | 0.1 | % | | 0.8 | % |

Genesco, Inc. | | | 368 | | | 506 | | | 0.2 | % | | 0.8 | % |

Top Anchors (sorted by percentage of total Simon Group square footage)(2)

| | | | | | | | | | | | | |

Tenant | | Number

of

Stores | | Square

Feet

(000's) | | Percent of

Total

Simon Group

Sq. Ft. | | Percent of

Total Simon

Group Base

Min. Rent | |

|---|

Macy's, Inc. | | | 152 | | | 26,982 | | | 11.0 | % | | 0.4 | % |

Sears Roebuck & Co. | | | 121 | | | 18,411 | | | 7.5 | % | | 0.2 | % |

J.C. Penney Co., Inc. | | | 112 | | | 16,068 | | | 6.5 | % | | 0.7 | % |

Dillard's Dept. Stores | | | 80 | | | 12,065 | | | 4.9 | % | | 0.1 | % |

Nordstrom, Inc. | | | 25 | | | 4,301 | | | 1.7 | % | | 0.1 | % |

Belk, Inc. | | | 22 | | | 2,792 | | | 1.1 | % | | 0.3 | % |

The Bon-Ton Stores, Inc. | | | 22 | | | 2,180 | | | 0.9 | % | | 0.2 | % |

Target Corporation | | | 14 | | | 1,802 | | | 0.7 | % | | 0.0 | % |

The Neiman Marcus Group, Inc. | | | 10 | | | 1,265 | | | 0.5 | % | | 0.1 | % |

Dick's Sporting Goods, Inc. | | | 18 | | | 1,170 | | | 0.5 | % | | 0.3 | % |

Saks Incorporated | | | 9 | | | 1,053 | | | 0.4 | % | | 0.2 | % |

Boscov's Department Stores | | | 3 | | | 594 | | | 0.2 | % | | 0.0 | % |

- (1)

- Does not include information for the regional malls in the Mills portfolio.

- (2)

- Includes space leased and owned by the anchor.

20

SIMON PROPERTY GROUP

U.S. Regional Mall Anchor/Big Box Openings(1)

2008-2010

| | | | | | |

Property Name | | Location | | New Tenant | | Former Tenant |

|---|

Opened in 2008 |

Anderson Mall | | Anderson, SC | | Dillard's | | Belk Mens (relocated) |

Aventura Mall | | Miami Beach, FL | | Nordstrom | | Lord & Taylor |

Burlington Mall | | Burlington (Boston), MA | | Nordstrom | | Filene's |

Crystal Mall | | Waterford, CT | | Bed Bath & Beyond | | Macy's |

| | | | Christmas Tree Shop | | Macy's |

Fashion Mall at Keystone | | Indianapolis, IN | | Nordstrom | | Parisian |

Firewheel Town Center | | Garland, TX | | Dick's Sporting Goods | | N/A |

Laguna Hills Mall | | Laguna Hills, CA | | Nordstrom Rack | | WOW/Good Guys |

Liberty Tree Mall | | Danvers, MA | | Nordstrom Rack | | Stop and Shop |

| | | | Off Broadway Shoes | | Stop and Shop |

Livingston Mall | | Livingston, NJ | | Barnes & Noble | | N/A |

Markland Mall | | Kokomo, IN | | MC Sports | | N/A |

Montgomery Mall | | Montgomeryville, PA | | Dick's Sporting Goods | | N/A |

Northgate Mall | | Seattle, WA | | Bed Bath & Beyond | | Gottschalks |

Northlake Mall | | Atlanta, GA | | Kohl's | | Parisian |

Northshore Mall | | Peabody, MA | | Macy's Furniture | | Lord & Taylor |

| | | | Macy's Mens | | Lord & Taylor |

| | | | P.F. Chang's | | N/A |

Richardson Square | | Richardson, TX | | Lowe's | | N/A |

| | | | Ross Dress for Less (relocated) | | N/A |

Ross Park Mall | | Pittsburgh, PA | | Nordstrom | | Macy's |

| | | | L.L. Bean | | N/A |

Shops at Sunset Place, The | | Miami, FL | | Splitsville | | N/A |

Smith Haven Mall | | Lake Grove, NY | | Barnes & Noble | | Stern's |

Tacoma Mall | | Seattle, WA | | Nordstrom (relocated) | | Mervyn's |

| | | | B.J.'s Brewery & Restaurant | | N/A |

Upper Valley Mall | | Springfield, OH | | MC Sports | | N/A |

21

SIMON PROPERTY GROUP

U.S. Regional Mall Anchor/Big Box Openings(1)

2008-2010

| | | | | | |

Property Name | | Location | | New Tenant | | Former Tenant |

|---|

Openings Projected in 2009 |

Gwinnett Place | | Duluth, GA | | M Mart | | Macy's |

Midland Park Mall | | Midland, TX | | Ulta | | Party City |

Northshore Mall | | Peabody (Boston), MA | | Nordstrom | | Macy's |

Plaza Carolina | | Carolina (San Juan), PR | | Tiendas Capri (relocated) | | N/A |

| | | | Best Buy | | Tiendas Capri |

Springfield Mall | | Springfield, PA | | Target | | Macy's |

University Park Mall | | South Bend, IN | | Barnes & Noble | | Marshall Field's |

Valley Mall | | Harrisonburg, VA | | Books-A-Million | | N/A |

Openings Projected in 2010 |

Coddingtown Mall | | Santa Rosa, CA | | Whole Foods | | Ralph's Grocery |

South Shore Plaza | | Braintree (Boston), MA | | Nordstrom | | Macy's |

- (1)

- Does not include information for the regional malls in the Mills portfolio.

22

SIMON PROPERTY GROUP

U.S. Regional Mall Property Listing(1)

| | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| | Gross Leasable Area | |

|---|

| | Property Name | | State | | City (CBSA) | | Legal

Ownership | | Anchor | | Mall &

Freestanding | | Total | |

|---|

1. | | McCain Mall | | | AR | | N. Little Rock | | | 100.0 | % | | 554,156 | | | 221,043 | | | 775,199 | |

2. | | Brea Mall | | | CA | | Brea (Los Angeles) | | | 100.0 | % | | 874,802 | | | 444,766 | | | 1,319,568 | |

3. | | Coddingtown Mall | | | CA | | Santa Rosa | | | 50.0 | % | | 547,090 | | | 262,821 | | | 809,911 | |

4. | | Fashion Valley | | | CA | | San Diego | | | 50.0 | % | | 1,053,305 | | | 668,485 | | | 1,721,790 | |

5. | | Laguna Hills Mall | | | CA | | Laguna Hills (Los Angeles) | | | 100.0 | % | | 536,500 | | | 330,061 | | | 866,561 | |

6. | | Santa Rosa Plaza | | | CA | | Santa Rosa | | | 100.0 | % | | 428,258 | | | 270,535 | | | 698,793 | |

7. | | Shops at Mission Viejo, The | | | CA | | Mission Viejo (Los Angeles) | | | 100.0 | % | | 677,215 | | | 473,376 | | | 1,150,591 | |

8. | | Stanford Shopping Center | | | CA | | Palo Alto (San Francisco) | | | 100.0 | % | | 849,153 | | | 528,198 | (7) | | 1,377,351 | |

9. | | Westminster Mall | | | CA | | Westminster (Los Angeles) | | | 100.0 | % | | 716,939 | | | 495,092 | | | 1,212,031 | |

10. | | Mesa Mall(2) | | | CO | | Grand Junction | | | 50.0 | % | | 441,208 | | | 441,129 | | | 882,337 | |

11. | | Town Center at Aurora | | | CO | | Aurora (Denver) | | | 100.0 | % | | 682,169 | | | 402,375 | | | 1,084,544 | |

12. | | Crystal Mall | | | CT | | Waterford | | | 74.6 | % | | 419,405 | | | 350,390 | | | 769,795 | |

13. | | Aventura Mall(2) | | | FL | | Miami Beach (Miami) | | | 33.3 | % | | 1,283,938 | | | 815,416 | | | 2,099,354 | |

14. | | Avenues, The | | | FL | | Jacksonville | | | 25.0% | (3) | | 754,956 | | | 362,861 | | | 1,117,817 | |

15. | | Boynton Beach Mall | | | FL | | Boynton Beach (Miami) | | | 100.0 | % | | 714,210 | | | 387,123 | | | 1,101,333 | |

16. | | Coconut Point | | | FL | | Estero | | | 50.0 | % | | 691,785 | | | 504,554 | | | 1,196,339 | |

17. | | Coral Square | | | FL | | Coral Springs (Miami) | | | 97.2 | % | | 648,144 | | | 296,014 | | | 944,158 | |

18. | | Cordova Mall | | | FL | | Pensacola | | | 100.0 | % | | 395,875 | | | 459,212 | | | 855,087 | |

19. | | Crystal River Mall | | | FL | | Crystal River | | | 100.0 | % | | 302,495 | | | 121,804 | | | 424,299 | |

20. | | Dadeland Mall | | | FL | | Miami | | | 50.0 | % | | 1,132,072 | | | 342,700 | | | 1,474,772 | |

21. | | DeSoto Square | | | FL | | Bradenton | | | 100.0 | % | | 435,467 | | | 253,949 | | | 689,416 | |

22. | | Edison Mall | | | FL | | Fort Myers | | | 100.0 | % | | 742,667 | | | 308,844 | | | 1,051,511 | |

23. | | Florida Mall, The | | | FL | | Orlando | | | 50.0 | % | | 1,092,465 | | | 616,803 | | | 1,709,268 | |

24. | | Gulf View Square | | | FL | | Port Richey (Tampa) | | | 100.0 | % | | 461,852 | | | 291,089 | | | 752,941 | |

25. | | Indian River Mall | | | FL | | Vero Beach | | | 50.0 | % | | 445,552 | | | 302,604 | | | 748,156 | |

26. | | Lake Square Mall | | | FL | | Leesburg (Orlando) | | | 50.0 | % | | 296,037 | | | 262,287 | | | 558,324 | |

27. | | Melbourne Square | | | FL | | Melbourne | | | 100.0 | % | | 416,167 | | | 293,886 | | | 710,053 | |

28. | | Miami International Mall | | | FL | | Miami | | | 47.8 | % | | 778,784 | | | 294,792 | | | 1,073,576 | |

29. | | Orange Park Mall | | | FL | | Orange Park (Jacksonville) | | | 100.0 | % | | 576,051 | | | 379,174 | | | 955,225 | |

30. | | Paddock Mall | | | FL | | Ocala | | | 100.0 | % | | 387,378 | | | 169,501 | | | 556,879 | |

31. | | Port Charlotte Town Center | | | FL | | Port Charlotte | | | 80.0% | (4) | | 458,251 | | | 322,059 | | | 780,310 | |

32. | | Seminole Towne Center | | | FL | | Sanford (Orlando) | | | 45.0% | (3) | | 768,798 | | | 369,499 | | | 1,138,297 | |

33. | | Shops at Sunset Place, The | | | FL | | S. Miami | | | 37.5% | (3) | | 0 | | | 514,559 | | | 514,559 | |

34. | | St. Johns Town Center | | | FL | | Jacksonville | | | 100.0 | % | | 653,291 | | | 568,751 | | | 1,222,042 | |

35. | | Town Center at Boca Raton | | | FL | | Boca Raton (Miami) | | | 100.0 | % | | 1,164,658 | | | 589,410 | | | 1,754,068 | |

36. | | Treasure Coast Square | | | FL | | Jensen Beach | | | 100.0 | % | | 508,176 | | | 372,968 | | | 881,144 | |

37. | | Tyrone Square | | | FL | | St. Petersburg (Tampa) | | | 100.0 | % | | 725,298 | | | 370,270 | | | 1,095,568 | |

38. | | Gwinnett Place | | | GA | | Duluth (Atlanta) | | | 75.0 | % | | 843,609 | | | 436,181 | (7) | | 1,279,790 | |

39. | | Lenox Square | | | GA | | Atlanta | | | 100.0 | % | | 873,580 | | | 671,433 | | | 1,545,013 | |

40. | | Mall of Georgia | | | GA | | Buford (Atlanta) | | | 100.0 | % | | 1,069,590 | | | 727,248 | | | 1,796,838 | |

41. | | Northlake Mall | | | GA | | Atlanta | | | 100.0 | % | | 665,745 | | | 296,235 | | | 961,980 | |

42. | | Phipps Plaza | | | GA | | Atlanta | | | 100.0 | % | | 472,385 | | | 345,490 | | | 817,875 | |

43. | | Town Center at Cobb | | | GA | | Kennesaw (Atlanta) | | | 75.0 | % | | 851,346 | | | 422,808 | | | 1,274,154 | |

44. | | Lindale Mall(2) | | | IA | | Cedar Rapids | | | 50.0 | % | | 305,563 | | | 382,869 | | | 688,432 | |

45. | | NorthPark Mall | | | IA | | Davenport | | | 50.0 | % | | 650,456 | | | 422,332 | | | 1,072,788 | |

46. | | Southern Hills Mall(2) | | | IA | | Sioux City | | | 50.0 | % | | 387,553 | | | 409,172 | | | 796,725 | |

47. | | SouthRidge Mall(2) | | | IA | | Des Moines | | | 50.0 | % | | 388,752 | | | 500,676 | | | 889,428 | |

48. | | Lincolnwood Town Center | | | IL | | Lincolnwood (Chicago) | | | 100.0 | % | | 220,830 | | | 201,911 | | | 422,741 | |

49. | | Northfield Square Mall | | | IL | | Bourbonnais | | | 31.6% | (4) | | 310,994 | | | 246,180 | | | 557,174 | |

50. | | Northwoods Mall | | | IL | | Peoria | | | 100.0 | % | | 472,969 | | | 221,021 | | | 693,990 | |

51. | | Orland Square | | | IL | | Orland Park (Chicago) | | | 100.0 | % | | 773,295 | | | 436,561 | | | 1,209,856 | |

23

SIMON PROPERTY GROUP

U.S. Regional Mall Property Listing(1)

| | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| | Gross Leasable Area | |

|---|

| | Property Name | | State | | City (CBSA) | | Legal

Ownership | | Anchor | | Mall &

Freestanding | | Total | |

|---|

52. | | River Oaks Center | | | IL | | Calumet City (Chicago) | | | 100.0 | % | | 807,871 | | | 557,412 | (7) | | 1,365,283 | |

53. | | SouthPark Mall | | | IL | | Moline | | | 50.0 | % | | 578,056 | | | 440,798 | | | 1,018,854 | |

54. | | White Oaks Mall | | | IL | | Springfield | | | 80.7 | % | | 556,831 | | | 375,516 | | | 932,347 | |

55. | | Castleton Square | | | IN | | Indianapolis | | | 100.0 | % | | 908,481 | | | 472,986 | | | 1,381,467 | |

56. | | Circle Centre | | | IN | | Indianapolis | | | 14.7% | (3) | | 350,000 | | | 432,196 | | | 782,196 | |

57. | | College Mall | | | IN | | Bloomington | | | 100.0 | % | | 356,887 | | | 278,499 | | | 635,386 | |

58. | | Eastland Mall | | | IN | | Evansville | | | 50.0 | % | | 489,144 | | | 375,323 | | | 864,467 | |

59. | | Fashion Mall at Keystone | | | IN | | Indianapolis | | | 100.0 | % | | 249,721 | | | 433,766 | | | 683,487 | |

60. | | Greenwood Park Mall | | | IN | | Greenwood (Indianapolis) | | | 100.0 | % | | 754,928 | | | 525,162 | | | 1,280,090 | |

61. | | Markland Mall | | | IN | | Kokomo | | | 100.0 | % | | 273,094 | | | 141,811 | | | 414,905 | |

62. | | Muncie Mall | | | IN | | Muncie | | | 100.0 | % | | 435,756 | | | 204,085 | | | 639,841 | |

63. | | Tippecanoe Mall | | | IN | | Lafayette | | | 100.0 | % | | 537,790 | | | 323,632 | | | 861,422 | |

64. | | University Park Mall | | | IN | | Mishawaka | | | 100.0 | % | | 499,876 | | | 361,446 | | | 861,322 | |

65. | | Washington Square | | | IN | | Indianapolis | | | 100.0 | % | | 616,109 | | | 347,167 | | | 963,276 | |

66. | | Towne East Square | | | KS | | Wichita | | | 100.0 | % | | 779,490 | | | 357,310 | | | 1,136,800 | |

67. | | Towne West Square | | | KS | | Wichita | | | 100.0 | % | | 619,269 | | | 333,237 | | | 952,506 | |

68. | | West Ridge Mall | | | KS | | Topeka | | | 100.0 | % | | 716,811 | | | 280,991 | | | 997,802 | |

69. | | Prien Lake Mall | | | LA | | Lake Charles | | | 100.0 | % | | 644,124 | | | 177,244 | | | 821,368 | |

70. | | Arsenal Mall | | | MA | | Watertown (Boston) | | | 100.0 | % | | 191,395 | | | 312,205 | (7) | | 503,600 | |

71. | | Atrium Mall | | | MA | | Chestnut Hill (Boston) | | | 49.1 | % | | 0 | | | 205,058 | | | 205,058 | |

72. | | Auburn Mall | | | MA | | Auburn | | | 49.1 | % | | 417,620 | | | 173,282 | | | 590,902 | |

73. | | Burlington Mall | | | MA | | Burlington (Boston) | | | 100.0 | % | | 780,411 | | | 537,396 | | | 1,317,807 | |

74. | | Cape Cod Mall | | | MA | | Hyannis | | | 49.1 | % | | 420,199 | | | 303,391 | | | 723,590 | |

75. | | Copley Place | | | MA | | Boston | | | 98.1 | % | | 150,847 | | | 1,091,967 | (7) | | 1,242,814 | |

76. | | Emerald Square | | | MA | | North Attleboro (Providence, RI) | | | 49.1 | % | | 647,372 | | | 375,129 | | | 1,022,501 | |

77. | | Greendale Mall | | | MA | | Worcester (Boston) | | | 49.1 | % | | 132,634 | | | 298,247 | (7) | | 430,881 | |

78. | | Liberty Tree Mall | | | MA | | Danvers (Boston) | | | 49.1 | % | | 498,000 | | | 359,835 | | | 857,835 | |

79. | | Mall at Chestnut Hill | | | MA | | Chestnut Hill (Boston) | | | 47.2 | % | | 297,253 | | | 178,093 | | | 475,346 | |

80. | | Northshore Mall | | | MA | | Peabody (Boston) | | | 49.1 | % | | 677,433 | | | 743,622 | | | 1,421,055 | |

81. | | Solomon Pond Mall | | | MA | | Marlborough (Boston) | | | 49.1 | % | | 538,812 | | | 370,420 | | | 909,232 | |

82. | | South Shore Plaza | | | MA | | Braintree (Boston) | | | 100.0 | % | | 547,287 | | | 618,678 | | | 1,165,965 | |

83. | | Square One Mall | | | MA | | Saugus (Boston) | | | 49.1 | % | | 608,601 | | | 321,524 | | | 930,125 | |

84. | | Bowie Town Center | | | MD | | Bowie (Washington, D.C.) | | | 100.0 | % | | 355,557 | | | 328,829 | | | 684,386 | |

85. | | St. Charles Towne Center | | | MD | | Waldorf (Washington, D.C.) | | | 100.0 | % | | 631,602 | | | 348,307 | | | 979,909 | |

86. | | Bangor Mall | | | ME | | Bangor | | | 67.4% | (6) | | 416,582 | | | 236,322 | | | 652,904 | |

87. | | Maplewood Mall | | | MN | | St. Paul (Minneapolis) | | | 100.0 | % | | 588,822 | | | 342,278 | | | 931,100 | |

88. | | Miller Hill Mall | | | MN | | Duluth | | | 100.0 | % | | 429,508 | | | 376,119 | | | 805,627 | |

89. | | Battlefield Mall | | | MO | | Springfield | | | 100.0 | % | | 770,111 | | | 432,352 | | | 1,202,463 | |

90. | | Independence Center | | | MO | | Independence (Kansas City) | | | 100.0 | % | | 499,284 | | | 532,170 | | | 1,031,454 | |

91. | | SouthPark | | | NC | | Charlotte | | | 100.0 | % | | 1,044,742 | | | 580,866 | | | 1,625,608 | |

92. | | Crossroads Mall | | | NE | | Omaha | | | 100.0 | % | | 522,119 | | | 188,403 | | | 710,522 | |

93. | | Mall at Rockingham Park, The | | | NH | | Salem (Boston) | | | 24.6 | % | | 638,111 | | | 382,133 | | | 1,020,244 | |

94. | | Mall of New Hampshire, The | | | NH | | Manchester | | | 49.1 | % | | 447,887 | | | 363,127 | | | 811,014 | |

95. | | Pheasant Lane Mall | | | NH | | Nashua | | | | (5) | | 555,474 | | | 314,194 | | | 869,668 | |

96. | | Brunswick Square | | | NJ | | East Brunswick (New York) | | | 100.0 | % | | 467,626 | | | 297,365 | | | 764,991 | |

97. | | Livingston Mall | | | NJ | | Livingston (New York) | | | 100.0 | % | | 616,128 | | | 368,275 | | | 984,403 | |

98. | | Menlo Park Mall | | | NJ | | Edison (New York) | | | 100.0 | % | | 527,591 | | | 796,382 | (7) | | 1,323,973 | |

99. | | Ocean County Mall | | | NJ | | Toms River (New York) | | | 100.0 | % | | 616,443 | | | 273,778 | | | 890,221 | |

24

SIMON PROPERTY GROUP

U.S. Regional Mall Property Listing(1)

| | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| | Gross Leasable Area | |

|---|

| | Property Name | | State | | City (CBSA) | | Legal

Ownership | | Anchor | | Mall &

Freestanding | | Total | |

|---|

100. | | Quaker Bridge Mall | | | NJ | | Lawrenceville | | | 38.0% | (6) | | 686,760 | | | 412,070 | | | 1,098,830 | |

101. | | Rockaway Townsquare | | | NJ | | Rockaway (New York) | | | 100.0 | % | | 786,626 | | | 456,927 | | | 1,243,553 | |

102. | | Cottonwood Mall | | | NM | | Albuquerque | | | 100.0 | % | | 631,556 | | | 409,270 | | | 1,040,826 | |

103. | | Forum Shops at Caesars, The | | | NV | | Las Vegas | | | 100.0 | % | | 0 | | | 635,410 | | | 635,410 | |

104. | | Chautauqua Mall | | | NY | | Lakewood | | | 100.0 | % | | 213,320 | | | 218,794 | | | 432,114 | |

105. | | Jefferson Valley Mall | | | NY | | Yorktown Heights (New York) | | | 100.0 | % | | 310,095 | | | 277,309 | | | 587,404 | |

106. | | Mall at The Source, The | | | NY | | Westbury (New York) | | | 25.5% | (3) | | 210,798 | | | 515,580 | | | 726,378 | |

107. | | Roosevelt Field | | | NY | | Garden City (New York) | | | 100.0 | % | | 1,430,425 | | | 778,892 | (7) | | 2,209,317 | |

108. | | Smith Haven Mall | | | NY | | Lake Grove (New York) | | | 25.0 | % | | 794,310 | | | 513,192 | | | 1,307,502 | |

109. | | Walt Whitman Mall | | | NY | | Huntington Station (New York) | | | 100.0 | % | | 742,214 | | | 284,871 | | | 1,027,085 | |

110. | | Westchester, The | | | NY | | White Plains (New York) | | | 40.0 | % | | 349,393 | | | 477,979 | (7) | | 827,372 | |

111. | | Great Lakes Mall | | | OH | | Mentor (Cleveland) | | | 100.0 | % | | 869,454 | | | 378,492 | | | 1,247,946 | |

112. | | Lima Mall | | | OH | | Lima | | | 100.0 | % | | 541,861 | | | 203,650 | | | 745,511 | |

113. | | Richmond Town Square | | | OH | | Richmond Heights (Cleveland) | | | 100.0 | % | | 685,251 | | | 331,498 | | | 1,016,749 | |

114. | | Southern Park Mall | | | OH | | Youngstown | | | 100.0 | % | | 811,858 | | | 382,235 | | | 1,194,093 | |

115. | | Summit Mall | | | OH | | Akron | | | 100.0 | % | | 432,936 | | | 337,198 | | | 770,134 | |

116. | | Upper Valley Mall | | | OH | | Springfield | | | 100.0 | % | | 479,418 | | | 264,686 | | | 744,104 | |

117. | | Penn Square Mall | | | OK | | Oklahoma City | | | 94.5 | % | | 588,137 | | | 462,654 | | | 1,050,791 | |

118. | | Woodland Hills Mall | | | OK | | Tulsa | | | 94.5 | % | | 700,235 | | | 391,539 | | | 1,091,774 | |

119. | | Century III Mall | | | PA | | West Mifflin (Pittsburgh) | | | 100.0 | % | | 831,439 | | | 458,780 | (7) | | 1,290,219 | |

120. | | Granite Run Mall | | | PA | | Media (Philadelphia) | | | 50.0 | % | | 500,809 | | | 535,889 | | | 1,036,698 | |

121. | | King of Prussia Mall | | | PA | | King of Prussia (Philadelphia) | | | 12.4% | (6) | | 1,545,812 | | | 1,067,674 | (7) | | 2,613,486 | |

122. | | Lehigh Valley Mall | | | PA | | Whitehall | | | 37.6% | (6) | | 564,353 | | | 604,338 | (7) | | 1,168,691 | |

123. | | Montgomery Mall | | | PA | | North Wales (Philadelphia) | | | 60.0% | (6) | | 734,855 | | | 413,531 | | | 1,148,386 | |

124. | | Oxford Valley Mall | | | PA | | Langhorne | | | 65.0% | (6) | | 762,558 | | | 556,708 | (7) | | 1,319,266 | |

125. | | Ross Park Mall | | | PA | | Pittsburgh | | | 100.0 | % | | 701,477 | | | 510,243 | | | 1,211,720 | |

126. | | South Hills Village | | | PA | | Pittsburgh | | | 100.0 | % | | 655,987 | | | 481,287 | (7) | | 1,137,274 | |

127. | | Springfield Mall(2) | | | PA | | Springfield (Philadelphia) | | | 38.0% | (6) | | 367,176 | | | 220,803 | | | 587,979 | |

128. | | Plaza Carolina | | | PR | | Carolina (San Juan) | | | 100.0 | % | | 504,796 | | | 588,878 | (7) | | 1,093,674 | |

129. | | Anderson Mall | | | SC | | Anderson | | | 100.0 | % | | 480,209 | | | 190,817 | | | 671,026 | |

130. | | Haywood Mall | | | SC | | Greenville | | | 100.0 | % | | 902,400 | | | 328,561 | | | 1,230,961 | |

131. | | Empire Mall(2) | | | SD | | Sioux Falls | | | 50.0 | % | | 497,341 | | | 576,797 | | | 1,074,138 | |

132. | | Rushmore Mall(2) | | | SD | | Rapid City | | | 50.0 | % | | 470,660 | | | 364,935 | | | 835,595 | |

133. | | Knoxville Center | | | TN | | Knoxville | | | 100.0 | % | | 597,028 | | | 383,212 | | | 980,240 | |

134. | | Oak Court Mall | | | TN | | Memphis | | | 100.0 | % | | 532,817 | | | 317,713 | (7) | | 850,530 | |

135. | | West Town Mall | | | TN | | Knoxville | | | 50.0 | % | | 868,295 | | | 468,455 | | | 1,336,750 | |

136. | | Wolfchase Galleria | | | TN | | Memphis | | | 94.5 | % | | 761,648 | | | 505,572 | | | 1,267,220 | |

137. | | Barton Creek Square | | | TX | | Austin | | | 100.0 | % | | 922,266 | | | 506,721 | | | 1,428,987 | |

138. | | Broadway Square | | | TX | | Tyler | | | 100.0 | % | | 427,730 | | | 200,338 | | | 628,068 | |

139. | | Cielo Vista Mall | | | TX | | El Paso | | | 100.0 | % | | 793,716 | | | 449,571 | | | 1,243,287 | |

140. | | Domain, The | | | TX | | Austin | | | 100.0 | % | | 220,000 | | | 411,101 | (7) | | 631,101 | |

141. | | Firewheel Town Center | | | TX | | Garland (Dallas) | | | 100.0 | % | | 295,532 | | | 705,571 | (7) | | 1,001,103 | |

142. | | Galleria, The | | | TX | | Houston | | | 31.5 | % | | 1,233,802 | | | 1,116,505 | | | 2,350,307 | |

143. | | Highland Mall(2) | | | TX | | Austin | | | 50.0 | % | | 718,741 | | | 355,213 | | | 1,073,954 | |

144. | | Ingram Park Mall | | | TX | | San Antonio | | | 100.0 | % | | 750,888 | | | 374,818 | | | 1,125,706 | |

145. | | Irving Mall | | | TX | | Irving (Dallas) | | | 100.0 | % | | 637,415 | | | 405,299 | | | 1,042,714 | |

146. | | La Plaza Mall | | | TX | | McAllen | | | 100.0 | % | | 776,397 | | | 422,987 | | | 1,199,384 | |

147. | | Lakeline Mall | | | TX | | Cedar Park (Austin) | | | 100.0 | % | | 745,179 | | | 352,627 | | | 1,097,806 | |

148. | | Longview Mall | | | TX | | Longview | | | 100.0 | % | | 440,917 | | | 209,282 | | | 650,199 | |

25

SIMON PROPERTY GROUP

U.S. Regional Mall Property Listing(1)

| | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| | Gross Leasable Area | |

|---|

| | Property Name | | State | | City (CBSA) | | Legal

Ownership | | Anchor | | Mall &

Freestanding | | Total | |

|---|

149. | | Midland Park Mall | | | TX | | Midland | | | 100.0 | % | | 339,113 | | | 280,088 | | | 619,201 | |

150. | | North East Mall | | | TX | | Hurst (Dallas) | | | 100.0 | % | | 1,191,930 | | | 452,253 | | | 1,644,183 | |

151. | | Rolling Oaks Mall | | | TX | | San Antonio | | | 100.0 | % | | 596,308 | | | 292,169 | (7) | | 888,477 | |

152. | | Sunland Park Mall | | | TX | | El Paso | | | 100.0 | % | | 575,837 | | | 341,829 | | | 917,666 | |

153. | | Valle Vista Mall | | | TX | | Harlingen | | | 100.0 | % | | 389,781 | | | 262,863 | | | 652,644 | |

154. | | Apple Blossom Mall | | | VA | | Winchester | | | 49.1 | % | | 229,011 | | | 211,193 | | | 440,204 | |

155. | | Charlottesville Fashion Square | | | VA | | Charlottesville | | | 100.0 | % | | 381,153 | | | 189,694 | | | 570,847 | |

156. | | Chesapeake Square | | | VA | | Chesapeake (Virginia Beach) | | | 75.0% | (4) | | 534,760 | | | 268,873 | | | 803,633 | |

157. | | Fashion Centre at Pentagon City, The | | | VA | | Arlington (Washington, DC) | | | 42.5 | % | | 472,729 | | | 517,516 | (7) | | 990,245 | |

158. | | Valley Mall | | | VA | | Harrisonburg | | | 50.0 | % | | 315,078 | | | 191,738 | | | 506,816 | |

159. | | Virginia Center Commons | | | VA | | Glen Allen | | | 100.0 | % | | 506,639 | | | 280,964 | | | 787,603 | |

160. | | Columbia Center | | | WA | | Kennewick | | | 100.0 | % | | 408,052 | | | 365,186 | | | 773,238 | |

161. | | Northgate Mall | | | WA | | Seattle | | | 100.0 | % | | 612,073 | | | 446,815 | | | 1,058,888 | |

162. | | Tacoma Mall | | | WA | | Tacoma (Seattle) | | | 100.0 | % | | 804,262 | | | 443,450 | | | 1,247,712 | |

163. | | Bay Park Square | | | WI | | Green Bay | | | 100.0 | % | | 425,773 | | | 274,241 | | | 700,014 | |

164. | | Forest Mall | | | WI | | Fond Du Lac | | | 100.0 | % | | 327,260 | | | 172,914 | | | 500,174 | |

| | | | | | | | | | | | | | | | | | |

| | Total Regional Mall GLA | | | | | | | | | | | 96,727,572 | | | 65,455,103 | | | 162,182,675 | |

| | | | | | | | | | | | | | | | | | |

FOOTNOTES:

- (1)

- Does not include the regional malls in the Mills portfolio or four regional malls (Nanuet Mall, Palm Beach Mall, Raleigh Springs Mall, University Mall (FL)) which are in the process of being redeveloped.

- (2)

- This property is managed by a third party.

- (3)

- The Operating Partnership's direct and indirect interests in some of the properties held as joint venture interests are subject to preferences on distributions in favor of other partners or the Operating Partnership.

- (4)

- The Operating Partnership receives substantially all the economic benefit of the property due to a preference or advance.

- (5)

- The Operating Partnership owns a mortgage note that encumbers Pheasant Lane Mall that entitles it to 100% of the economics of this property.

- (6)

- The Operating Partnership's indirect ownership interest is through an approximately 76% ownership interest in Kravco Simon Investments.

- (7)

- Mall & Freestanding GLA includes office space as follows:

Arsenal Mall—107,188 sq. ft.

Century III Mall—39,119 sq. ft.

Copley Place—867,500 sq. ft.

Fashion Centre at Pentagon City, The—169,089 sq. ft.

Firewheel Town Center—74,999 sq. ft.

Granite Run—4,000 sq. ft.

Greendale Mall—119,860 sq. ft.

Gwinnett Place—32,603 sq. ft.

King of Prussia Mall—13,646 sq. ft.

Lehigh Valley Mall—11,754 sq. ft.

Menlo Park Mall—52,424 sq. ft.

Oak Court Mall—127,411 sq. ft.

Oxford Valley Mall—111,160 sq. ft.

Plaza Carolina—28,436 sq. ft.

River Oaks Center—116,162 sq. ft.

Rolling Oaks Mall—6,383 sq. ft.

Roosevelt Field—1,610 sq. ft.

South Hills Village—4,361 sq. ft.

Stanford Shopping Center—5,748 sq. ft.

The Domain—92,955 sq. ft.

The Westchester—820 sq. ft.

26

SIMON PROPERTY GROUP

U.S. Premium Outlet Centers Operational Information

As of December 31, 2008

| | | | | | | |

| | As of or for the

Twelve Months Ended

December 31, | |

|---|

| | 2008 | | 2007 | |

|---|

Total Number of U.S. Premium Outlet Centers | | | 40 | | | 38 | |

Total U.S. Premium Outlet Centers GLA (in millions of square feet) | | | 16.4 | | | 15.0 | |

Occupancy(1) | | | 98.9 | % | | 99.7 | % |

Comparable sales per square foot(1) | | $ | 513 | | $ | 504 | |

Average base rent per square foot(1) | | $ | 27.65 | | $ | 25.67 | |

Average Base Rent Per Square Foot(1)

|

|

Total

Center |

|

%

Change |

|

|---|

12/31/08 | | $ | 27.65 | | | 7.7 | % |

12/31/07 | | | 25.67 | | | 5.9 | % |

12/31/06 | | | 24.23 | | | 4.6 | % |

12/31/05 | | | 23.16 | | | 6.0 | % |

12/31/04 | | | 21.85 | | | 7.3 | % |

12/31/03 | | | 20.36 | | | n/a | |

Leasing Activity During the Period(1):

| | | | | | | | | | | | | |

| | Average Base Rent(2) | |

| |

| |

|---|

| | Lease

Signings | | Store Closings/

Lease Expirations | | Amount of Change

(Referred to as

"Leasing Spread") | |

|---|

2008 | | $ | 38.07 | | $ | 25.59 | | $ | 12.48 | | | 48.8% | |

2007 | | | 31.43 | | | 23.64 | | | 7.79 | | | 33.0% | |

2006 | | | 29.95 | | | 22.87 | | | 7.08 | | | 31.0% | |

2005 | | | 26.48 | | | 21.91 | | | 4.57 | | | 20.9% | |

2004 | | | 22.78 | | | 20.02 | | | 2.76 | | | 13.8% | |

2003 | | | 25.41 | | | 22.62 | | | 2.79 | | | 12.3% | |

- (1)

- For all owned gross leasable area.

- (2)

- Represents the average base rent for tenants who signed leases as compared to the average base rent in effect for tenants whose leases terminated or expired in the same space.

27

SIMON PROPERTY GROUP

U.S. Premium Outlet Centers Lease Expirations(1)

As of December 31, 2008

| | | | | | | | | | |

Year | | Number of

Leases Expiring | | Square

Feet | | Avg. Base Rent

per Square Foot

at 12/31/08 | |

|---|

2009 | | | 437 | | | 1,555,695 | | $ | 22.21 | |

2010 | | | 483 | | | 2,118,948 | | $ | 25.26 | |

2011 | | | 462 | | | 2,016,767 | | $ | 24.98 | |

2012 | | | 469 | | | 1,967,357 | | $ | 27.34 | |

2013 | | | 461 | | | 2,187,855 | | $ | 28.09 | |

2014 | | | 322 | | | 1,271,798 | | $ | 30.03 | |

2015 | | | 238 | | | 845,429 | | $ | 33.68 | |

2016 | | | 238 | | | 775,587 | | $ | 36.76 | |

2017 | | | 279 | | | 906,732 | | $ | 37.79 | |

2018 | | | 390 | | | 1,411,003 | | $ | 45.03 | |

2019 and Thereafter | | | 281 | | | 1,054,696 | | $ | 46.39 | |

- (1)

- Does not consider the impact of renewal options that may be contained in leases.

28

SIMON PROPERTY GROUP

U.S. Premium Outlet Centers Top Tenants

As of December 31, 2008

(Sorted by percentage of total Simon Group base minimum rent)

| | | | | | | | | | | | | |

Tenant | | Number

of

Stores | | Square

Feet

(000's) | | Percent of

Total

Simon Group

Sq. Ft. | | Percent of

Total Simon

Group Base

Min. Rent | |

|---|

| Phillips—Van Heusen Corporation | | | 194 | | | 926 | | | 0.4 | % | | 0.7 | % |

| The Gap, Inc. | | | 90 | | | 869 | | | 0.4 | % | | 0.6 | % |