Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

| | | | |

EARNINGS RELEASE AND SUPPLEMENTAL INFORMATION

FOR THE QUARTER ENDED MARCH 31, 2020 |

| | PAGE | |

| | | | |

Earnings Release(1) | | | 2-12 | |

Overview | | | | |

The Company | | | 13 | |

Stock Information, Credit Ratings and Senior Unsecured Debt Covenants | | | 14 | |

Financial Data | | | | |

Selected Financial and Equity Information | | | 15 | |

Net Operating Income (NOI) Composition | | | 16 | |

Net Operating Income Overview | | | 17 | |

Reconciliations of Non-GAAP Financial Measures | | | 18 | |

Consolidated Net Income to NOI | | | 18 | |

FFO of the Operating Partnership to Funds Available for Distribution (Our Share) | | | 19 | |

Other Income, Other Expense and Capitalized Interest | | | 20 | |

Operational Data | | | | |

U.S. Malls and Premium Outlets Operating Information | | | 21 | |

The Mills and International Operating Information | | | 22 | |

U.S. Malls and Premium Outlets Lease Expirations | | | 23 | |

U.S. Malls and Premium Outlets Top Tenants | | | 24 | |

Development Activity | | | | |

Capital Expenditures | | | 25 | |

Development Activity Summary | | | 26 | |

Balance Sheet Information | | | | |

Common and Preferred Stock Information | | | 27 | |

Changes in Common Share and Limited Partnership Unit Ownership | | | 27 | |

Preferred Stock/Units Outstanding | | | 27 | |

Credit Profile | | | 28 | |

Summary of Indebtedness | | | 29 | |

Total Debt Amortization and Maturities by Year (Our Share) | | | 30 | |

Property and Debt Information | | |

31-40 | |

Other | | | | |

Non-GAAP Pro-Rata Financial Information | | | 41-43 | |

- (1)

- Includes reconciliation of consolidated net income to funds from operations.

| |

| 1Q 2020 SUPPLEMENTAL |  | 1 |

Table of Contents

EARNINGS RELEASE

| | | | |

| Contacts: | | |

| Tom Ward | | 317-685-7330 Investors | | |

| Ali Slocum | | 317-264-3079 Media | | |

SIMON PROPERTY GROUP REPORTS FIRST QUARTER 2020 RESULTS AND PROVIDES BUSINESS UPDATE

INDIANAPOLIS, May 11, 2020 - Simon, a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations, today reported results for the quarter ended March 31, 2020.

"Our thoughts are with everyone affected by COVID-19 and we salute all of the individuals on the front lines fighting the pandemic," said David Simon, Chairman, Chief Executive Officer and President. "The Simon team is meeting these unprecedented challenges with unwavering commitment to the safety of our employees, shoppers, retailers and the communities we serve. We have successfully navigated challenging times throughout our company's history, and we will endure and gain strength as we weather this disruption. The resilience of our people, our innovative business approach and our strong balance sheet with ample liquidity will serve us well."

"Business was off to a good start in January and February, with shopper traffic, tenant demand, reported retailer sales and other underlying portfolio fundamentals trending at or above our expectations," said Simon. "In March, we quickly pivoted to address the rapid spread of COVID-19, temporarily closing U.S. properties, reducing operating costs and increasing financial resources. We are beginning to reopen properties and are encouraged by the consumer response thus far."

Results for the Quarter

- •

- Net income attributable to common stockholders was $437.6 million, or $1.43 per diluted share, as compared to $548.5 million, or $1.78 per diluted share in 2019. Results for the first quarter of 2019 included a combined $83.6 million, or $0.24 per diluted share, of proceeds from an insurance settlement and a gain on the sale of our interest in a multi-family residential property. The current year period includes a $19.0 million, or $0.05 per diluted share, unrealized loss in fair value of equity instruments compared to a gain of $5.3 million, or $0.01 per diluted share, in the prior year period, from the Company's ownership of Washington Prime Group Inc. partnership units as part of the 2014 spin-off.

- •

- Funds From Operations ("FFO") was $980.6 million, or $2.78 per diluted share, as compared to $1.082 billion, or $3.04 per diluted share, in the prior year period. The first quarter 2019 results also included the $0.24 per diluted share noted above. The current year period reflects a negative impact of approximately $0.06 per diluted share (pre-tax) from the Company's investments in retailers primarily due to store closures as a result of COVID-19.

- •

- Comparable property Net Operating Income ("NOI") for the three months ended March 31, 2020 was flat and portfolio NOI declined 0.2%.

| |

| 1Q 2020 SUPPLEMENTAL |  | 2 |

Table of Contents

EARNINGS RELEASE

- •

- Operating statistics for the Company's combined U.S. Malls and Premium Outlets:

- o

- Occupancy was 94.0% at March 31, 2020.

- o

- Base minimum rent per square foot was $55.76 at March 31, 2020.

- o

- Leasing spread per square foot for the trailing 12 months ended March 31, 2020 was $2.80, an increase of 4.6%.

- o

- Reported retailer sales per square foot were $673 for the trailing twelve months ended March 31, 2020. This was an increase of 2.1%; however, it was impacted by the Company's temporary closure of its U.S. retail properties effective March 18, 2020. This impact is shown by comparing the trailing 12 months ended February 29, 2020, sales per square foot of $703, an increase of 6.5%.

Business Update—COVID-19

As we developed and implemented our response to the impact of COVID-19 on our business, our primary focus has been on the health and safety of our employees, our shoppers and the communities in which we serve. We implemented a series of actions to reduce costs and increase liquidity in light of the impacts of the pandemic, including:

- •

- Significantly reduced all non-essential corporate spending

- •

- Significantly reduced property operating expenses

- •

- Implemented a temporary furlough of certain corporate and field employees due to the closure of the Company's U.S. retail properties as a result of governmental "stay-at-home" orders; reduced certain corporate and field personnel and implemented a temporary freeze on company hiring efforts

- •

- Suspended or eliminated more than $1.0 billion of redevelopment and new development projects

- •

- David Simon, the Company's Chairman, Chief Executive Officer and President elected to reduce his base salary to zero and deferred his approved 2019 bonus until the market conditions in which the Company operates have improved

- •

- Implemented a temporary decrease to the base salary of certain of its salaried employees ranging from 10% to 30%, depending on each employee's compensation level

- •

- The Company's Board of Directors agreed to temporarily suspend payment to the independent directors of their board service cash retainer fees

- •

- Drew $3.75 billion under its Revolving Credit Facilities

In addition, we launched "Simon Supports Communities" to assist charitable organizations, hospitals and local communities impacted by COVID-19. The program deploys Simon's physical, digital and social media assets to help nonprofit organizations make a difference. Initiatives underway include utilizing parking lots at Simon centers for drive-through COVID-19 testing in local communities; hosting food banks; and deploying our network of over 200 websites and social media channels to support the American Red Cross "Sleeves Up" campaign aimed at boosting depleted blood supplies.

| |

| 1Q 2020 SUPPLEMENTAL |  | 3 |

Table of Contents

EARNINGS RELEASE

Reopening of Simon's Retail Properties

As of May 11, the Company has reopened 77 of its U.S. retail properties in markets where local and state orders have been lifted and retail restrictions have been eased. As part of the reopening process, the Company published its comprehensive "COVID-19 Exposure Control Policy", developed in conjunction with a team of leading experts in the fields of Epidemiology and Environmental Health and Safety (EHS), in order to provide a high level of safety standards at its properties.

In addition, as of May 11, twelve of Simon's Designer and international Premium Outlets properties have reopened.

Development Activity

The Company has suspended or eliminated more than $1.0 billion of capital for new and redevelopment projects. The Company will re-evaluate all suspended projects over time. Construction continues on certain redevelopment and new development projects in the U.S. and internationally that are nearing completion. Simon's share of remaining required cash funding for these projects that are currently scheduled to be completed in 2020 or 2021 is approximately $160 million.

Capital Markets and Balance Sheet Liquidity

During the quarter, the Company took certain steps to increase financial flexibility.

As previously announced in March, the Company amended and extended its $4.0 billion senior unsecured multi-currency revolving credit facility with a $6.0 billion senior unsecured credit facility comprised of a $4.0 billion multi-currency revolving credit facility and a $2.0 billion delayed draw term loan facility. Subject to additional commitments, the revolving credit facilities can be increased by $1.0 billion, for an aggregate up to $7.0 billion. The revolving facility initially matures on June 30, 2024, and the term facility initially matures on June 30, 2022.

As of March 31, 2020, Simon had approximately $8.7 billion of liquidity consisting of $4.1 billion of cash on hand, including its share of joint venture cash, and $4.6 billion of available capacity under its revolving credit facilities and term loan, net of outstanding U.S. and Euro commercial paper.

Dividends

Simon's Board of Directors will declare a common stock dividend for the second quarter before the end of June. Simon intends to maintain a common stock dividend paid in cash and expects to distribute at least 100% of its REIT taxable income.

Simon's Board of Directors declared the quarterly dividend on its 83/8% Series J Cumulative Redeemable Preferred Stock (NYSE: SPGPrJ) of $1.046875 per share, payable on June 30, 2020 to shareholders of record on June 16, 2020.

| |

| 1Q 2020 SUPPLEMENTAL |  | 4 |

Table of Contents

EARNINGS RELEASE

Withdrawal of 2020 Financial Guidance

Given the evolving nature of COVID-19 and the global economic disruption it has caused, it is not currently possible to predict with certainty the pandemic's impact on the rest of the year's financial results. As such, the Company is withdrawing its full-year 2020 guidance for estimated net income attributable to common stockholders per diluted share, estimated FFO per diluted share and comparable property NOI growth, which were provided on February 4, 2020.

Conference Call

Simon will hold a conference call to discuss the quarterly financial results today at 5:00 p.m. Eastern Time, Monday, May 11, 2020. A live webcast of the conference call will be accessible in listen-only mode at investors.simon.com. An audio replay of the conference call will be available until May 18, 2020. To access the audio replay, dial 1-855-859-2056 (international 404-537-3406) passcode 6984058.

Supplemental Materials and Website

Supplemental information on our first quarter 2020 performance is available at investors.simon.com. This information has also been furnished to the SEC in a current report on Form 8-K.

We routinely post important information online on our investor relations website, investors.simon.com. We use this website, press releases, SEC filings, quarterly conference calls, presentations and webcasts to disclose material, non-public information in accordance with Regulation FD. We encourage members of the investment community to monitor these distribution channels for material disclosures. Any information accessed through our website is not incorporated by reference into, and is not a part of, this document.

Non-GAAP Financial Measures

This press release includes FFO, FFO per share, portfolio net operating income growth and comparable property net operating income growth, which are financial performance measures not defined by generally accepted accounting principles in the United States ("GAAP"). Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are included in this press release and in Simon's supplemental information for the quarter. FFO and comparable property net operating income growth are financial performance measures widely used in the REIT industry. Our definitions of these non-GAAP measures may not be the same as similar measures reported by other REITs.

| |

| 1Q 2020 SUPPLEMENTAL |  | 5 |

Table of Contents

EARNINGS RELEASE

Forward-Looking Statements

Certain statements made in this press release may be deemed "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Although the Company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can give no assurance that its expectations will be attained, and it is possible that the Company's actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks, uncertainties and other factors. Such factors include, but are not limited to: uncertainties regarding the impact of the COVID-19 pandemic and restrictions intended to prevent its spread on our tenants' businesses, financial condition, results of operations, cash flow and liquidity and our ability to access the capital markets, satisfy our debt service obligations and make distributions to our stockholders; the inability to collect rent due to the bankruptcy or insolvency of tenants or otherwise; changes in economic and market conditions that may adversely affect the general retail environment; the intensely competitive market environment in the retail industry; changes to applicable laws or regulations or the interpretation thereof; risks associated with the acquisition, development, redevelopment, expansion, leasing and management of properties; the inability to lease newly developed properties and renew leases and relet space at existing properties on favorable terms; the potential loss of anchor stores or major tenants; decreases in market rental rates; the impact of our substantial indebtedness on our future operations; any disruption in the financial markets that may adversely affect our ability to access capital for growth and satisfy our ongoing debt service requirements; any change in our credit rating; changes in market rates of interest and foreign exchange rates for foreign currencies; general risks related to real estate investments, including the illiquidity of real estate investments; security breaches that could compromise our information technology or infrastructure; risks relating to our joint venture properties; our continued ability to maintain our status as a REIT; changes in tax laws or regulations that result in adverse tax consequences; changes in the value of our investments in foreign entities; our ability to hedge interest rate and currency risk; changes in insurance costs; the availability of comprehensive insurance coverage; risks related to international activities, including, without limitation, the impact, if any, of the United Kingdom's exit from the European Union; natural disasters; the potential for terrorist activities; environmental liabilities; the loss of key management personnel; and the transition of LIBOR to an alternative reference rate. The Company discusses these and other risks and uncertainties under the heading "Risk Factors" in its annual and quarterly periodic reports filed with the SEC. The Company may update that discussion in subsequent other periodic reports, but except as required by law, the Company undertakes no duty or obligation to update or revise these forward-looking statements, whether as a result of new information, future developments, or otherwise.

About Simon

Simon is a global leader in the ownership of premier shopping, dining, entertainment and mixed-use destinations and an S&P 100 company (Simon Property Group, NYSE:SPG). Our properties across North America, Europe and Asia provide community gathering places for millions of people every day and generate billions in annual sales. For more information, visit simon.com.

| |

| 1Q 2020 SUPPLEMENTAL |  | 6 |

Table of Contents

EARNINGS RELEASE

Simon Property Group, Inc.

Unaudited Consolidated Statements of Operations

(Dollars in thousands, except per share amounts)

| | | | | | | |

| | FOR THE THREE MONTHS

ENDED MARCH 31, | |

|---|

| |

2020 | |

2019 | |

|---|

REVENUE: | | | | | | | |

Lease income | | $ | 1,262,232 | | $ | 1,280,058 | |

Management fees and other revenues | | | 29,166 | | | 27,544 | |

Other income | | | 61,962 | | | 145,232 | |

| | | | | | | | |

Total revenue | | | 1,353,360 | | | 1,452,834 | |

| | | | | | | | |

EXPENSES: | | | | | | | |

Property operating | | | 105,624 | | | 111,549 | |

Depreciation and amortization | | | 328,262 | | | 328,643 | |

Real estate taxes | | | 117,543 | | | 115,459 | |

Repairs and maintenance | | | 24,431 | | | 27,922 | |

Advertising and promotion | | | 33,527 | | | 37,125 | |

Home and regional office costs | | | 54,370 | | | 52,560 | |

General and administrative | | | 6,894 | | | 9,136 | |

Other | | | 27,840 | | | 25,419 | |

| | | | | | | | |

Total operating expenses | | | 698,491 | | | 707,813 | |

| | | | | | | | |

OPERATING INCOME BEFORE OTHER ITEMS | | | 654,869 | | | 745,021 | |

Interest expense | | | (187,627) | | | (198,733) | |

Income and other tax benefit (expense) | | | 5,783 | | | (10,102) | |

Income from unconsolidated entities | | | 50,465 | | | 90,444 | |

Unrealized (losses) gains in fair value of equity instruments | | | (19,048) | | | 5,317 | |

Gain on sale or disposal of assets and interests in unconsolidated entities, net | | | 962 | | | — | |

| | | | | | | | |

CONSOLIDATED NET INCOME | | | 505,404 | | | 631,947 | |

Net income attributable to noncontrolling interests | | | 66,965 | | | 82,638 | |

Preferred dividends | | | 834 | | | 834 | |

| | | | | | | | |

NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | | $ | 437,605 | | $ | 548,475 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

BASIC AND DILUTED EARNINGS PER COMMON SHARE: | | | | | | | |

Net income attributable to common stockholders | | $ | 1.43 | | $ | 1.78 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| |

| 1Q 2020 SUPPLEMENTAL |  | 7 |

Table of Contents

EARNINGS RELEASE

Simon Property Group, Inc.

Unaudited Consolidated Balance Sheets

(Dollars in thousands, except share amounts)

| | | | | | | |

| | MARCH 31,

2020 | | DECEMBER 31,

2019 | |

|---|

ASSETS: | | | | | | | |

Investment properties, at cost | | $ | 37,901,273 | | $ | 37,804,495 | |

Less — accumulated depreciation | | | 14,088,615 | | | 13,905,776 | |

| | | | | | | | |

| | | 23,812,658 | | | 23,898,719 | |

Cash and cash equivalents | | | 3,724,853 | | | 669,373 | |

Tenant receivables and accrued revenue, net | | | 793,490 | | | 832,151 | |

Investment in unconsolidated entities, at equity | | | 2,414,642 | | | 2,371,053 | |

Investment in Klépierre, at equity | | | 1,628,343 | | | 1,731,649 | |

Right-of-use assets, net | | | 519,175 | | | 514,660 | |

Deferred costs and other assets | | | 1,227,953 | | | 1,214,025 | |

| | | | | | | | |

Total assets | | $ | 34,121,114 | | $ | 31,231,630 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

LIABILITIES: | | | | | | | |

Mortgages and unsecured indebtedness | | $ | 27,553,413 | | $ | 24,163,230 | |

Accounts payable, accrued expenses, intangibles, and deferred revenues | | | 1,253,757 | | | 1,390,682 | |

Cash distributions and losses in unconsolidated entities, at equity | | | 1,611,795 | | | 1,566,294 | |

Lease liabilities | | | 521,378 | | | 516,809 | |

Other liabilities | | | 457,624 | | | 464,304 | |

| | | | | | | | |

Total liabilities | | | 31,397,967 | | | 28,101,319 | |

| | | | | | | | |

Commitments and contingencies | | | | | | | |

Limited partners' preferred interest in the Operating Partnership and noncontrolling redeemable interests in properties | | | 212,194 | | | 219,061 | |

EQUITY: | | |

| | |

| |

Stockholders' Equity | | | | | | | |

Capital stock (850,000,000 total shares authorized, $0.0001 par value, 238,000,000 shares of excess common stock, 100,000,000 authorized shares of preferred stock): | | | | | | | |

Series J 83/8% cumulative redeemable preferred stock, 1,000,000 shares authorized, 796,948 issued and outstanding with a liquidation value of $39,847 | | |

42,338 | | |

42,420 | |

| | | | | | | |

Common stock, $0.0001 par value, 511,990,000 shares authorized, 320,567,121 and 320,435,256 issued and outstanding, respectively | | | 32 | | | 32 | |

| | | | | | | |

Class B common stock, $0.0001 par value, 10,000 shares authorized, 8,000 issued and outstanding | | | — | | | — | |

| | | | | | | |

Capital in excess of par value | | | 9,768,175 | | | 9,756,073 | |

Accumulated deficit | | | (5,583,485) | | | (5,379,952) | |

Accumulated other comprehensive loss | | | (119,301) | | | (118,604) | |

Common stock held in treasury, at cost, 14,819,950 and 13,574,296 shares, respectively | | | (1,926,160) | | | (1,773,571) | |

| | | | | | | | |

Total stockholders' equity | | | 2,181,599 | | | 2,526,398 | |

Noncontrolling interests | | | 329,354 | | | 384,852 | |

| | | | | | | | |

Total equity | | | 2,510,953 | | | 2,911,250 | |

| | | | | | | | |

Total liabilities and equity | | $ | 34,121,114 | | $ | 31,231,630 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| |

| 1Q 2020 SUPPLEMENTAL |  | 8 |

Table of Contents

EARNINGS RELEASE

Simon Property Group, Inc.

Unaudited Joint Venture Combined Statements of Operations

(Dollars in thousands)

| | | | | | | |

| | For the Three Months

Ended March 31, | |

|---|

| |

2020 | |

2019 | |

|---|

REVENUE: | | | | | | | |

Lease income | | $ | 743,849 | | $ | 758,979 | |

Other income | | | 74,515 | | | 75,922 | |

| | | | | | | | |

Total revenue | | | 818,364 | | | 834,901 | |

OPERATING EXPENSES: | | |

| | |

| |

Property operating | | | 147,030 | | | 144,721 | |

Depreciation and amortization | | | 171,479 | | | 170,258 | |

Real estate taxes | | | 68,390 | | | 68,717 | |

Repairs and maintenance | | | 19,615 | | | 22,376 | |

Advertising and promotion | | | 22,753 | | | 24,326 | |

Other | | | 50,229 | | | 49,316 | |

| | | | | | | | |

Total operating expenses | | | 479,496 | | | 479,714 | |

| | | | | | | | |

OPERATING INCOME BEFORE OTHER ITEMS | | |

338,868 | | |

355,187 | |

Interest expense | | | (156,640) | | | (156,016) | |

Gain on sale or disposal of assets and interests in unconsolidated entities, net | | | — | | | 21,587 | |

| | | | | | | | |

NET INCOME | | $ | 182,228 | | $ | 220,758 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Third-Party Investors' Share of Net Income | | $ | 92,859 | | $ | 112,668 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Our Share of Net Income | | | 89,369 | | | 108,090 | |

Amortization of Excess Investment (A) | | | (20,840) | | | (20,792) | |

Our Share of Gain on Sale or Disposal of Assets and Interests in Other Income in the Consolidated Financial Statements | | | — | | | (9,155) | |

| | | | | | | | |

Income from Unconsolidated Entities (B) | | $ | 68,529 | | $ | 78,143 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Note:- The above financial presentation does not include any information related to our investments in Klépierre S.A. ("Klépierre") and HBS Global Properties ("HBS"). For additional information, see footnote B.

| |

| 1Q 2020 SUPPLEMENTAL |  | 9 |

Table of Contents

EARNINGS RELEASE

Simon Property Group, Inc

Unaudited Joint Venture Combined Balance Sheets

(Dollars in thousands)

| | | | | | | |

| | March 31,

2020 | | December 31,

2019 | |

|---|

Assets: | | | | | | | |

Investment properties, at cost | | $ | 19,500,080 | | $ | 19,525,665 | |

Less — accumulated depreciation | | | 7,493,263 | | | 7,407,627 | |

| | | | | | | | |

| | | 12,006,817 | | | 12,118,038 | |

Cash and cash equivalents | | |

844,940 | | |

1,015,864 | |

Tenant receivables and accrued revenue, net | | | 445,799 | | | 510,157 | |

Right-of-use assets, net | | | 180,638 | | | 185,302 | |

Deferred costs and other assets | | | 371,875 | | | 384,663 | |

| | | | | | | | |

Total assets | | $ | 13,850,069 | | $ | 14,214,024 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Liabilities and Partners' Deficit: | | |

| | |

| |

Mortgages | | $ | 15,328,574 | | $ | 15,391,781 | |

Accounts payable, accrued expenses, intangibles, and deferred revenue | | | 789,129 | | | 977,112 | |

Lease liabilities | | | 182,465 | | | 186,594 | |

Other liabilities | | | 362,323 | | | 338,412 | |

| | | | | | | | |

Total liabilities | | | 16,662,491 | | | 16,893,899 | |

Preferred units | | |

67,450 | | |

67,450 | |

Partners' deficit | | | (2,879,872) | | | (2,747,325) | |

| | | | | | | | |

Total liabilities and partners' deficit | | $ | 13,850,069 | | $ | 14,214,024 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Our Share of: | | |

| | |

| |

Partners' deficit | | $ | (1,248,877) | | $ | (1,196,926) | |

Add: Excess Investment (A) | | | 1,504,586 | | | 1,525,903 | |

| | | | | | | | |

Our net Investment in unconsolidated entities, at equity | | $ | 255,709 | | $ | 328,977 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Note:- The above financial presentation does not include any information related to our investments in Klépierre and HBS Global Properties. For additional information, see footnote B.

| |

| 1Q 2020 SUPPLEMENTAL |  | 10 |

Table of Contents

EARNINGS RELEASE

Simon Property Group, Inc.

Unaudited Reconciliation of Non-GAAP Financial Measures (C)

(Amounts in thousands, except per share amounts)

| | | | | | | | | | |

| | Reconciliation of Consolidated Net Income to FFO

| |

| |

| |

|

|---|

| |

| | For the Three Months

Ended March 31, | |

|

|---|

| |

| |

2020 | |

2019 | |

|

|---|

| | Consolidated Net Income (D) | | $ | 505,404 | | $ | 631,947 | | |

| | Adjustments to Arrive at FFO: | | | | | | | | |

| | Depreciation and amortization from consolidated properties | | | 326,039 | | | 325,938 | | |

| | Our share of depreciation and amortization from unconsolidated entities, including Klépierre and HBS | | | 136,706 | | | 134,630 | | |

| | Gain on sale or disposal of assets and interests in unconsolidated entities, net | | | (962) | | | — | | |

| | Unrealized losses (gains) in fair value of equity instruments | | | 19,048 | | | (5,317) | | |

| | Net loss attributable to noncontrolling interest holders in properties | | | 172 | | | 917 | | |

| | Noncontrolling interests portion of depreciation and amortization | | | (4,464) | | | (4,882) | | |

| | Preferred distributions and dividends | | | (1,313) | | | (1,313) | | |

| | | | | | | | | | | |

| | FFO of the Operating Partnership | | $ | 980,630 | | $ | 1,081,920 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | Diluted net income per share to diluted FFO per share reconciliation: | | | | | | | | |

| | Diluted net income per share | | $ | 1.43 | | $ | 1.78 | | |

| | Depreciation and amortization from consolidated properties and our share of depreciation and amortization from unconsolidated entities, including Klépierre and HBS, net of noncontrolling interests portion of depreciation and amortization | | | 1.31 | | | 1.27 | | |

| | Gain on sale or disposal of assets and interests in unconsolidated entities, net | | | (0.01) | | | — | | |

| | Unrealized losses (gains) in fair value of equity instruments | | | 0.05 | | | (0.01) | | |

| | | | | | | | | | | |

| | Diluted FFO per share | | $ | 2.78 | | $ | 3.04 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | |

| | Details for per share calculations: | | | | | | | | |

| | FFO of the Operating Partnership | | $ | 980,630 | | $ | 1,081,920 | | |

| | Diluted FFO allocable to unitholders | | | (129,628) | | | (142,319) | | |

| | | | | | | | | | | |

| | Diluted FFO allocable to common stockholders | | $ | 851,002 | | $ | 939,601 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | Basic and Diluted weighted average shares outstanding | | | 306,504 | | | 308,978 | | |

| | Weighted average limited partnership units outstanding | | | 46,688 | | | 46,800 | | |

| | | | | | | | | | | |

| | Basic and Diluted weighted average shares and units outstanding | | | 353,192 | | | 355,778 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | Basic and Diluted FFO per Share | | $ | 2.78 | | $ | 3.04 | | |

| | Percent Change | | | –8.6% | | | | | |

| |

| 1Q 2020 SUPPLEMENTAL |  | 11 |

Table of Contents

EARNINGS RELEASE

Simon Property Group, Inc.

Footnotes to Unaudited Financial Information

Notes:

- (A)

- Excess investment represents the unamortized difference of our investment over equity in the underlying net assets of the related partnerships and joint ventures shown therein. The Company generally amortizes excess investment over the life of the related assets.

- (B)

- The Unaudited Joint Venture Combined Statements of Operations do not include any operations or our share of net income or excess investment amortization related to our investments in Klépierre and HBS Global Properties. Amounts included in Footnote D below exclude our share of related activity for our investments in Klépierre and HBS Global Properties. For further information on Klépierre, reference should be made to financial information in Klépierre's public filings and additional discussion and analysis in our Form 10-K.

- (C)

- This report contains measures of financial or operating performance that are not specifically defined by GAAP, including FFO and FFO per share. FFO is a performance measure that is standard in the REIT business. We believe FFO provides investors with additional information concerning our operating performance and a basis to compare our performance with those of other REITs. We also use these measures internally to monitor the operating performance of our portfolio. Our computation of these non-GAAP measures may not be the same as similar measures reported by other REITs.

We determine FFO based upon the definition set forth by the National Association of Real Estate Investment Trusts ("NAREIT") Funds From Operations White Paper — 2018 Restatement. Our main business includes acquiring, owning, operating, developing, and redeveloping real estate in conjunction with the rental of real estate. Gains and losses of assets incidental to our main business are included in FFO. We determine FFO to be our share of consolidated net income computed in accordance with GAAP, excluding real estate related depreciation and amortization, excluding gains and losses from extraordinary items, excluding gains and losses from the sale, disposal or property insurance recoveries of, or any impairment related to, depreciable retail operating properties, plus the allocable portion of FFO of unconsolidated joint ventures based upon economic ownership interest, and all determined on a consistent basis in accordance with GAAP. However, you should understand that FFO does not represent cash flow from operations as defined by GAAP, should not be considered as an alternative to net income determined in accordance with GAAP as a measure of operating performance, and is not an alternative to cash flows as a measure of liquidity.

- (D)

- Includes our share of:

- -

- Gains on land sales of $5.2 million and $4.4 million for the three months ended March 31, 2020 and 2019, respectively.

- -

- Straight-line adjustments increased income by $12.0 million and $16.7 million for the three months ended March 31, 2020 and 2019, respectively.

- -

- Amortization of fair market value of leases from acquisitions increased income by $1.3 million and $1.3 million for the three months ended March 31, 2020 and 2019.

| |

| 1Q 2020 SUPPLEMENTAL |  | 12 |

Table of Contents

OVERVIEW

THE COMPANY

Simon Property Group, Inc. (NYSE:SPG) is a self-administered and self-managed real estate investment trust ("REIT"). Simon Property Group, L.P., or the Operating Partnership, is our majority-owned partnership subsidiary that owns all of our real estate properties and other assets. In this package, the terms Simon, we, our, or the Company refer to Simon Property Group, Inc., the Operating Partnership, and its subsidiaries. We own, develop and manage premier shopping, dining, entertainment and mixed-use destinations, which consist primarily of malls, Premium Outlets®, The Mills®, and International Properties. At March 31, 2020, we owned or had an interest in 234 properties comprising 191 million square feet in North America, Asia and Europe. Additionally, at March 31, 2020, we had a 22.4% ownership interest in Klépierre, a publicly traded, Paris-based real estate company, which owns shopping centers in 15 European countries.

This package was prepared to provide operational and balance sheet information as of March 31, 2020 for the Company and the Operating Partnership.

Certain statements made in this Supplemental Package may be deemed "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained, and it is possible that our actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks, uncertainties and other factors. Such factors include, but are not limited to: uncertainties regarding the impact of the COVID-19 pandemic and restrictions intended to prevent its spread on our tenants' businesses, financial condition, results of operations, cash flow and liquidity and our ability to access the capital markets, satisfy our debt service obligations and make distributions to our stockholders; the inability to collect rent due to the bankruptcy or insolvency of tenants or otherwise; changes in economic and market conditions that may adversely affect the general retail environment; the intensely competitive market environment in the retail industry; changes to applicable laws or regulations or the interpretation thereof; risks associated with the acquisition, development, redevelopment, expansion, leasing and management of properties; the inability to lease newly developed properties and renew leases and relet space at existing properties on favorable terms; the potential loss of anchor stores or major tenants; decreases in market rental rates; the impact of our substantial indebtedness on our future operations; any disruption in the financial markets that may adversely affect our ability to access capital for growth and satisfy our ongoing debt service requirements; any change in our credit rating; changes in market rates of interest and foreign exchange rates for foreign currencies; general risks related to real estate investments, including the illiquidity of real estate investments; security breaches that could compromise our information technology or infrastructure; risks relating to our joint venture properties; our continued ability to maintain our status as a REIT; changes in tax laws or regulations that result in adverse tax consequences; changes in the value of our investments in foreign entities; our ability to hedge interest rate and currency risk; changes in insurance costs; the availability of comprehensive insurance coverage; risks related to international activities, including, without limitation, the impact, if any, of the United Kingdom's exit from the European Union; natural disasters; the potential for terrorist activities; environmental liabilities; the loss of key management personnel; and the transition of LIBOR to an alternative reference rate. We discuss these and other risks and uncertainties under the heading "Risk Factors" in our annual and quarterly periodic reports filed with the SEC. We may update that discussion in subsequent other periodic reports, but, except as required by law, we undertake no duty or obligation to update or revise these forward-looking statements, whether as a result of new information, future developments, or otherwise.

Any questions, comments or suggestions regarding this Supplemental Information should be directed to Tom Ward, Senior Vice President of Investor Relations (tom.ward@simon.com or 317.685.7330).

| |

| 1Q 2020 SUPPLEMENTAL |  | 13 |

Table of Contents

OVERVIEW

STOCK INFORMATION

The Company's common stock and one series of preferred stock are traded on the New York Stock Exchange under the following symbols:

| | | | | | | | |

| | Common Stock | | SPG | | | | |

| | 8.375% Series J Cumulative Redeemable Preferred | | SPGPrJ | | | | |

CREDIT RATINGS

|

| | Standard & Poor's | | | | | |

|

| | Corporate | | A | | (Negative Outlook) | | |

| | Senior Unsecured | | A | | (Negative Outlook) | | |

| | Commercial Paper | | A1 | | (Negative Outlook) | | |

| | Preferred Stock | | BBB+ | | (Negative Outlook) | | |

| | Moody's | | | | | |

|

| | Senior Unsecured | | A2 | | (Negative Outlook) | | |

| | Commercial Paper | | P1 | | (Negative Outlook) | | |

| | Preferred Stock | | A3 | | (Negative Outlook) | | |

SENIOR UNSECURED DEBT COVENANTS (1)

| | | | | | |

| | Required | | Actual | | Compliance

|

| | | | | | | |

Total Debt to Total Assets (1) | | £65% | | 42% | | Yes |

Total Secured Debt to Total Assets (1) | | £50% | | 17% | | Yes |

Fixed Charge Coverage Ratio | | >1.5X | | 5.1X | | Yes |

Total Unencumbered Assets to Unsecured Debt | | ³125% | | 243% | | Yes |

- (1)

- Covenants for indentures dated June 7, 2005 and later. Total Assets are calculated in accordance with the indenture and essentially represent net operating income (NOI) divided by a 7.0% capitalization rate plus the value of other assets at cost.

| |

| 1Q 2020 SUPPLEMENTAL |  | 14 |

Table of Contents

SELECTED FINANCIAL AND EQUITY INFORMATION

(In thousands, except as noted)

| | | | | | | |

| |

| THREE MONTHS ENDED

MARCH 31, | |

| | | | | | | | |

| |

| 2020 |

| | 2019 | |

Financial Highlights | | | | | | | |

Total Revenue – Consolidated Properties | | $ | 1,353,360 | | $ | 1,452,834 | |

Consolidated Net Income | |

$ |

505,404 | |

$ |

631,947 | |

Net Income Attributable to Common Stockholders | | $ | 437,605 | | $ | 548,475 | |

Basic and Diluted Earnings per Common Share (EPS) | | $ | 1.43 | | $ | 1.78 | |

Funds from Operations (FFO) of the Operating Partnership | |

$ |

980,630 | |

$ |

1,081,920 | |

Basic and Diluted FFO per Share (FFOPS) | | $ | 2.78 | | $ | 3.04 | |

Dividends/Distributions per Share/Unit | |

$ |

2.10 | |

$ |

2.05 | |

| | | | | | | |

Stockholders' Equity Information | |

| AS OF

MARCH 31,

2020 |

|

| AS OF

DECEMBER 31,

2019 | |

Limited Partners' Units Outstanding at end of period | | | 46,529 | | | 46,740 | |

Common Shares Outstanding at end of period | | | 305,755 | | | 306,869 | |

| | | | | | | | |

Total Common Shares and Limited Partnership Units Outstanding at end of period | | | 352,284 | | | 353,609 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Weighted Average Limited Partnership Units Outstanding | | | 46,688 | | | 46,744 | |

Weighted Average Common Shares Outstanding: | | | | | | | |

Basic and Diluted – for purposes of EPS and FFOPS | | | 306,504 | | | 307,950 | |

| | | | | | | |

Debt Information | | | | | | | |

Share of Consolidated Debt | | $ | 27,380,744 | | $ | 23,988,186 | |

Share of Joint Venture Debt | | | 7,178,727 | | | 7,214,181 | |

| | | | | | | | |

Share of Total Debt | | $ | 34,559,471 | | $ | 31,202,367 | |

Share of Cash and Cash Equivalents | | | 4,094,202 | | | 1,114,490 | |

| | | | | | | | |

Share of Net Debt | | $ | 30,465,269 | | $ | 30,087,877 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | |

Market Capitalization | | | | | | | |

Common Stock Price at end of period | | $ | 54.86 | | $ | 148.96 | |

Common Equity Capitalization, including Limited Partnership Units | | $ | 19,326,323 | | $ | 52,673,608 | |

Preferred Equity Capitalization, including Limited Partnership Preferred Units | | | 70,167 | | | 83,236 | |

| | | | | | | | |

Total Equity Market Capitalization | | $ | 19,396,490 | | $ | 52,756,844 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Total Market Capitalization – Including Share of Total Debt | | $ | 53,955,961 | | $ | 83,959,211 | |

| |

| 1Q 2020 SUPPLEMENTAL |  | 15 |

Table of Contents

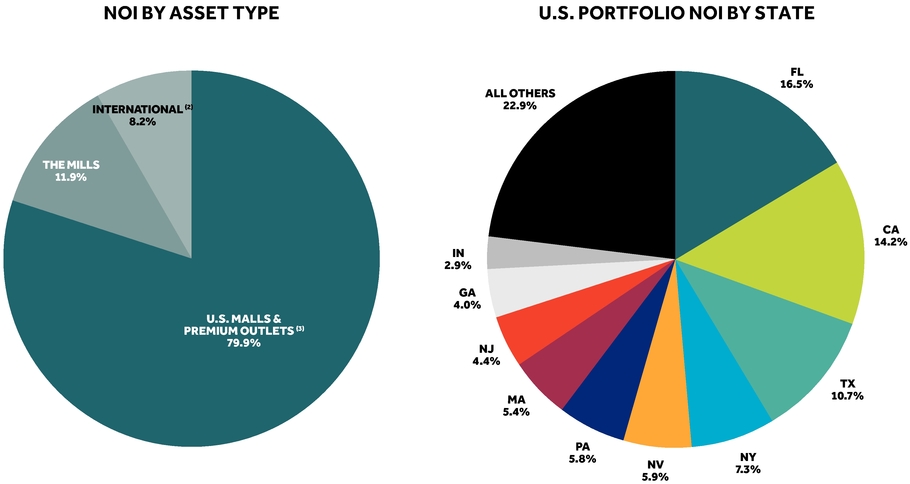

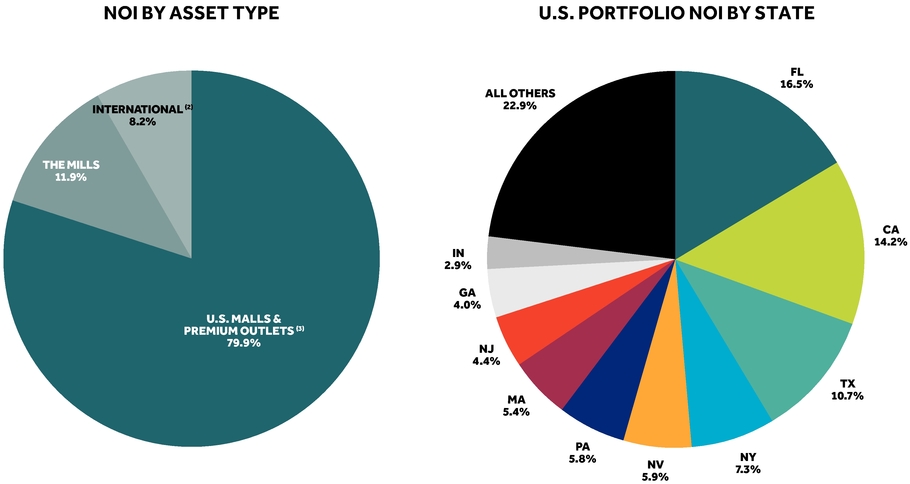

NET OPERATING INCOME (NOI) COMPOSITION (1)

For the Three Months Ended March 31, 2020

- (1)

- Based on our share of total NOI and does not reflect any property, entity or corporate-level debt.

- (2)

- Includes Klépierre, international Premium Outlets, international Designer Outlets.

- (3)

- Includes Lifestyle Centers.

| |

| 1Q 2020 SUPPLEMENTAL |  | 16 |

Table of Contents

NET OPERATING INCOME OVERVIEW(1)

(In thousands)

| | | | | | | |

| |

| FOR THE THREE MONTHS

ENDED MARCH 31, | |

| | | | | | | | |

| |

| 2020 |

| | 2019 | |

Comparable Property NOI (2) | | $ | 1,318,754 | | $ | 1,318,136 | |

NOI from New Development, Redevelopment, Expansion and Acquisitions (3) | | |

37,925 | | |

39,761 | |

International Properties (4) | | | 110,464 | | | 111,604 | |

Portfolio NOI | | $ | 1,467,143 | | $ | 1,469,501 | |

Our share of NOI from Investments (5) | | |

28,619 | | |

53,141 | |

Corporate and Other NOI Sources (6) | | | 83,457 | | | 192,838 | |

Combined NOI | | $ | 1,579,219 | | $ | 1,715,480 | |

Less: Joint Venture Partners' Share of NOI | | |

271,626 | | |

276,488 | |

| | | | | | | | |

Our Share of Total NOI | | $ | 1,307,593 | | $ | 1,438,992 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

- (1)

- All amounts are presented at gross values unless otherwise indicated as our share. See reconciliation on following page.

- (2)

- Includes Malls, Premium Outlets, The Mills and Lifestyle Centers opened and operating as comparable for the period at constant currency.

- (3)

- Includes total property NOI for properties undergoing redevelopment as well as incremental NOI for expansion properties not yet included in comparable properties.

- (4)

- Includes International Premium Outlets (except for Canadian International Premium Outlets included in Comparable NOI) and International Designer Outlets at constant currency.

- (5)

- Includes our share of NOI of Klépierre (at constant currency), HBS, and retailer investments. Substantially all of the NOI decline in the first three months of 2020 related to the impact of COVID-19 on our retailer investments operations from store closures ($17,362 reduction in NOI) as well as the impact on our share of NOI from our investment in Klépierre resulting from property closures.

- (6)

- Includes income components excluded from Portfolio NOI and Comparable Property NOI (domestic lease termination income, interest income, land sale gains, straight line lease income, above/below market lease adjustments), unrealized and realized gains/losses on non-real estate related equity instruments, Northgate, Simon management company revenues, and other assets. The three months ended March 31, 2019 includes $83,582 related to the Opry Mills settlement and a gain on the sale of Phipps residential.

| |

| 1Q 2020 SUPPLEMENTAL |  | 17 |

Table of Contents

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

(In thousands, except as noted)

| | | | | | |

RECONCILIATION OF NET INCOME TO NOI |

| | | | | | |

| |

| THREE MONTHS ENDED MARCH 31, |

| | | | | | | |

| | | 2020 | | | 2019 |

Reconciliation of NOI of consolidated entities: | | | | | | |

Consolidated Net Income | | $ | 505,404 | | $ | 631,947 |

Income and other tax (benefit) expense | | | (5,783) | | | 10,102 |

Interest expense | | | 187,627 | | | 198,733 |

Income from unconsolidated entities | | | (50,465) | | | (90,444) |

Unrealized losses (gains) in fair value of equity instruments | | | 19,048 | | | (5,317) |

Gain on sale or disposal of assets and interests in unconsolidated entities, net | | | (962) | | | – |

| | | | | | | |

Operating Income Before Other Items | | | 654,869 | | | 745,021 |

Depreciation and amortization | | | 328,262 | | | 328,643 |

Home and regional office costs | | | 54,370 | | | 52,560 |

General and administrative | | | 6,894 | | | 9,136 |

| | | | | | | |

NOI of consolidated entities | | $ | 1,044,395 | | $ | 1,135,360 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Reconciliation of NOI of unconsolidated entities: | | | | | | |

Net Income | | $ | 182,228 | | $ | 220,758 |

Interest expense | | | 156,640 | | | 156,016 |

Gain on sale or disposal of assets and interests in unconsolidated entities, net | | | – | | | (21,587) |

| | | | | | | |

Operating Income Before Other Items | | | 338,868 | | | 355,187 |

Depreciation and amortization | | | 171,479 | | | 170,258 |

| | | | | | | |

NOI of unconsolidated entities | | $ | 510,347 | | $ | 525,445 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Add: Our share of NOI from Klépierre, HBS and other corporate investments | | | 24,477 | | | 54,675 |

| | | | | | | |

Combined NOI | | $ | 1,579,219 | | $ | 1,715,480 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| |

| 1Q 2020 SUPPLEMENTAL |  | 18 |

Table of Contents

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

(In thousands, except as noted)

| | | | | |

RECONCILIATION OF FFO OF THE OPERATING PARTNERSHIP TO FUNDS AVAILABLE FOR DISTRIBUTION (OUR SHARE) | |

| | | | |

| | THREE

MONTHS ENDED

MARCH 31, 2020 | |

FFO of the Operating Partnership | | | $ | 980,630 | |

Non-cash impacts to FFO(1) | | | 5 | |

| | | | | |

FFO of the Operating Partnership excluding non-cash impacts | | | 980,635 | |

Tenant allowances | | | (44,220) | |

Operational capital expenditures | | | (18,388) | |

| | | | | |

Funds available for distribution | | | $ | 918,027 | |

| | | | | |

| | | | | |

| | | | | |

- (1)

- Non-cash impacts to FFO of the Operating Partnership include:

| | | | | |

| | | | |

| | THREE

MONTHS ENDED

MARCH 31, 2020 | |

Deductions: | | | | |

Straight-line lease income | | | (12,017) | |

Fair market value of lease amortization | | | (1,285) | |

Additions: | | | | |

Stock based compensation expense | | | 6,728 | |

Fair value of debt amortization | | | 83 | |

Mortgage, financing fee and terminated swap amortization expense | | | 6,496 | |

| | | | | |

| | | $ | 5 | |

| | | | | |

| | | | | |

| | | | | |

This report contains measures of financial or operating performance that are not specifically defined by generally accepted accounting principles (GAAP) in the United States, including FFO, FFO per share, funds available for distribution, net operating income (NOI), portfolio NOI, and comparable property NOI. FFO and NOI are performance measures that are standard in the REIT business. We believe FFO and NOI provide investors with additional information concerning our operating performance and a basis to compare our performance with the performance of other REITs. We also use these measures internally to monitor the operating performance of our portfolio. Our computation of these non-GAAP measures may not be the same as similar measures reported by other REITs.

The non-GAAP financial measures used in this report should not be considered as alternatives to net income as a measure of our operating performance or to cash flows computed in accordance with GAAP as a measure of liquidity nor are they indicative of cash flows from operating and financial activities. Reconciliations of other non-GAAP measures used in this report to the most-directly comparable GAAP measure are included in the tables on pages 17 - 19 and in the Earnings Release for the latest period.

| |

| 1Q 2020 SUPPLEMENTAL |  | 19 |

Table of Contents

OTHER INCOME, OTHER EXPENSE AND CAPITALIZED INTEREST

(In thousands)

| | | | | | |

| |

| THREE MONTHS ENDED

MARCH 31, |

| | | | | | | |

| |

| 2020 |

| | 2019 |

Consolidated Properties | | | | | | |

Other Income | | | | | | |

Interest, dividend and distribution income (1) | | $ | 4,574 | | $ | 6,786 |

Lease settlement income | | | 2,642 | | | 2,498 |

Gains on land sales | | | 5,210 | | | 2,550 |

Other (2)(3) | | | 49,536 | | | 133,398 |

| | | | | | | |

Totals | | $ | 61,962 | | $ | 145,232 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | |

Other Expense | | | | | | |

Ground leases | | $ | 10,866 | | $ | 10,245 |

Professional fees and other | | | 16,974 | | | 15,174 |

| | | | | | | |

Totals | | $ | 27,840 | | $ | 25,419 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | |

| | | | | | | |

| | | | | | |

Capitalized Interest | |

| THREE MONTHS ENDED

MARCH 31, |

| | | | | | | |

| |

| 2020 |

| | 2019 |

Interest Capitalized during the Period: | | | | | | |

Our Share of Consolidated Properties | | $ | 9,515 | | $ | 6,428 |

Our Share of Joint Venture Properties | | $ | 351 | | $ | 249 |

| | | | | | |

| | | | | | |

- (1)

- Includes distributions from other international investments.

- (2)

- Includes ancillary property revenues, gift cards, marketing, media, parking and sponsorship revenues, gains on sale of non-retail investments, non-real estate investments, insurance proceeds from business interruption and other miscellaneous income items.

- (3)

- The three months ended March 31, 2019 includes $83,582 related to the Opry Mills settlement and a gain on the sale of Phipps residential.

| |

| 1Q 2020 SUPPLEMENTAL |  | 20 |

Table of Contents

U.S. MALLS AND PREMIUM OUTLETS OPERATING INFORMATION(1)

| | | | | | |

| |

| AS OF MARCH 31, |

| | | | | | | |

| |

| 2020 |

| | 2019 |

Total Number of Properties | | | 168 | | | 176 |

Total Square Footage of Properties (in millions) | |

|

142.6 | | |

150.6 |

Ending Occupancy (2): | |

|

| | |

|

Consolidated Assets | | | 94.0% | | | 95.1% |

Unconsolidated Assets | | | 94.1% | | | 94.9% |

Total Portfolio | | | 94.0% | | | 95.1% |

Base Minimum Rent PSF (3): | |

|

| | |

|

Consolidated Assets | | $ | 53.86 | | $ | 52.70 |

Unconsolidated Assets | | $ | 61.17 | | $ | 58.67 |

Total Portfolio | | $ | 55.76 | | $ | 54.34 |

Open / Close Spread

| | | | | | | | | | | | | | | |

| | | | |

| RENT PSF

(BASE MINIMUM RENT & CAM) |

| | | | | |

| | | | | | | | | | | | | | | | |

| |

| SQUARE FOOTAGE

OF OPENINGS

|

|

| AVERAGE

OPENING RATE

PSF (4)

|

|

| AVERAGE

CLOSING RATE

PSF (4)

|

|

| LEASING

SPREAD (4)

|

|

| SPREAD TO

CLOSE % |

3/31/20 | | | 7,948,232 | | $ | 64.06 | | $ | 61.26 | | $ | 2.80 | | | 4.6% |

12/31/19 | | | 8,216,167 | | $ | 62.39 | | $ | 54.56 | | $ | 7.83 | | | 14.4% |

3/31/19 | | | 7,499,068 | | $ | 66.00 | | $ | 51.83 | | $ | 14.17 | | | 27.3% |

- (1)

- Reported retailer sales per square foot were $673 for the trailing 12 months ended March 31, 2020. This was an increase of 2.1%; however, it was impacted by the Company's temporary closure of its U.S. retail properties effective March 18, 2020. This impact is shown by comparing the trailing 12 months ended February 29, 2020, sales per square foot of $703, an increase of 6.5%.

- (2)

- Ending Occupancy is the percentage of total owned square footage (GLA) which is leased as of the last day of the reporting period. We include all company owned space except for mall anchors, mall majors, mall freestanding and mall outlots in the calculation.

- (3)

- Base Minimum Rent PSF is the average base minimum rent charge in effect for the reporting period for all tenants that would qualify to be included in Ending Occupancy as defined above.

- (4)

- The Open / Close Spread is a measure that compares opening and closing rates on all spaces. The Opening Rate is the initial cash Rent PSF for spaces leased during the trailing 12-month period, and includes new leases, renewals, amendments and relocations (including expansions and downsizings) if lease term is greater than one year. The Closing Rate is the final cash Rent PSF as of the month the tenant terminates or closes. Rent PSF includes Base Minimum Rent and Common Area Maintenance (CAM) rents.

| |

| 1Q 2020 SUPPLEMENTAL |  | 21 |

Table of Contents

THE MILLS AND INTERNATIONAL OPERATING INFORMATION

| | | | | | |

| |

| AS OF MARCH 31, |

| | | | | | | |

| |

| 2020 |

| | 2019 |

The Mills | | | | | | |

Total Number of Properties | |

|

14 | | |

14 |

Total Square Footage of Properties (in millions) | |

|

21.5 | | |

21.4 |

Ending Occupancy (1) | |

|

96.3% | | |

97.4% |

Base Minimum Rent PSF (2) | |

$ |

33.80 | |

$ |

32.87 |

Leasing Spread PSF (3) | |

$ |

7.84 | |

$ |

10.94 |

Leasing Spread (Percentage Change) (3) | |

|

21.5% | | |

27.4% |

| |

|

| | |

|

International Properties | |

|

| | |

|

Premium Outlets | |

|

| | |

|

Total Number of Properties | |

|

20 | | |

19 |

Total Square Footage of Properties (in millions) | |

|

7.7 | | |

7.3 |

Designer Outlets | |

|

| | |

|

Total Number of Properties | |

|

10 | | |

9 |

Total Square Footage of Properties (in millions) | |

|

2.6 | | |

2.2 |

Statistics for Premium Outlets in Japan (4) | |

|

| | |

|

Ending Occupancy | |

|

99.4% | | |

99.6% |

Base Minimum Rent PSF | |

|

¥ 5,307 | | |

¥ 5,184 |

- (1)

- See footnote 2 on page 21 for definition, except Ending Occupancy is calculated on all company owned space.

- (2)

- See footnote 3 on page 21 for definition.

- (3)

- See footnote 4 on page 21 for definition.

- (4)

- Information supplied by the managing venture partner; includes 9 properties.

| |

| 1Q 2020 SUPPLEMENTAL |  | 22 |

Table of Contents

U.S. MALLS AND PREMIUM OUTLETS LEASE EXPIRATIONS (1)

| | | | | | | | | | | | |

YEAR | |

| NUMBER OF

LEASES

EXPIRING |

|

| SQUARE FEET |

|

| AVG. BASE

MINIMUM

RENT

PSF AT 3/31/20 |

|

| PERCENTAGE OF

GROSS ANNUAL

RENTAL

REVENUES (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Inline Stores and Freestanding | | | | | | | | | | | | |

Month to Month Leases | | |

1,081 | | |

4,075,884 | |

$ |

49.65 | | |

3.5% |

2020 (4/1/20 - 12/31/20) | | | 1,025 | | | 2,986,392 | | $ | 58.80 | | | 3.0% |

2021 | | | 2,639 | | | 9,655,286 | | $ | 50.96 | | | 8.5% |

2022 | | | 2,405 | | | 9,104,478 | | $ | 49.67 | | | 7.9% |

2023 | | | 2,320 | | | 9,547,704 | | $ | 56.08 | | | 9.3% |

2024 | | | 1,952 | | | 7,564,687 | | $ | 59.46 | | | 7.7% |

2025 | | | 1,578 | | | 6,117,466 | | $ | 63.18 | | | 6.8% |

2026 | | | 1,301 | | | 4,865,936 | | $ | 62.62 | | | 5.4% |

2027 | | | 986 | | | 3,730,609 | | $ | 65.62 | | | 4.3% |

2028 | | | 842 | | | 3,660,329 | | $ | 60.90 | | | 3.9% |

2029 | | | 735 | | | 3,167,507 | | $ | 63.83 | | | 3.4% |

2030 | | | 263 | | | 1,291,952 | | $ | 59.52 | | | 1.2% |

2031 and Thereafter | | | 357 | | | 2,356,489 | | $ | 38.87 | | | 1.7% |

Specialty Leasing Agreements w/ terms in excess of 12 months | | | 1,808 | | | 4,596,977 | | $ | 18.29 | | | 1.5% |

| | | | | | | | | | | | |

Anchors | | | | | | | | | | | | |

2020 (4/1/20 - 12/31/20) | | |

1 | | |

138,409 | |

$ |

1.18 | | |

0.0% |

2021 | | | 7 | | | 932,523 | | $ | 4.28 | | | 0.1% |

2022 | | | 16 | | | 2,033,754 | | $ | 6.14 | | | 0.2% |

2023 | | | 17 | | | 2,386,762 | | $ | 6.46 | | | 0.3% |

2024 | | | 24 | | | 2,027,154 | | $ | 8.30 | | | 0.3% |

2025 | | | 17 | | | 1,676,634 | | $ | 6.06 | | | 0.2% |

2026 | | | 9 | | | 886,371 | | $ | 5.28 | | | 0.1% |

2027 | | | 6 | | | 920,224 | | $ | 4.16 | | | 0.1% |

2028 | | | 9 | | | 857,119 | | $ | 7.58 | | | 0.1% |

2029 | | | 4 | | | 511,660 | | $ | 2.44 | | | 0.0% |

2030 | | | 8 | | | 824,573 | | $ | 6.91 | | | 0.1% |

2031 and Thereafter | | | 21 | | | 2,057,593 | | $ | 10.70 | | | 0.4% |

- (1)

- Does not consider the impact of renewal options that may be contained in leases.

- (2)

- Annual rental revenues represent 2019 consolidated and joint venture combined base rental revenue.

| |

| 1Q 2020 SUPPLEMENTAL |  | 23 |

Table of Contents

U.S. MALLS AND PREMIUM OUTLETS TOP TENANTS

Top Inline Store Tenants(sorted by percentage of total base minimum rent for U.S. properties)

| | | | | | | | | | | | |

TENANT |

|

| NUMBER

OF

STORES |

|

| SQUARE

FEET

(000'S) |

|

| PERCENT OF

TOTAL SQ. FT. IN

U.S. PROPERTIES |

|

| PERCENT OF TOTAL

BASE MINIMUM RENT

FOR U.S. PROPERTIES |

| | | | | | | | | | | | |

The Gap, Inc. | | | 412 | | | 3,843 | | | 2.1% | | | 3.5% |

L Brands, Inc. | | | 306 | | | 1,895 | | | 1.0% | | | 2.2% |

PVH Corporation | | | 234 | | | 1,464 | | | 0.8% | | | 1.6% |

Ascena Retail Group Inc | | | 389 | | | 2,096 | | | 1.2% | | | 1.6% |

Tapestry, Inc. | | | 251 | | | 1,017 | | | 0.6% | | | 1.5% |

Signet Jewelers, Ltd. | | | 364 | | | 526 | | | 0.3% | | | 1.5% |

Foot Locker, Inc. | | | 224 | | | 1,034 | | | 0.6% | | | 1.3% |

American Eagle Outfitters, Inc | | | 203 | | | 1,314 | | | 0.7% | | | 1.2% |

Luxottica Group SPA | | | 387 | | | 694 | | | 0.4% | | | 1.2% |

Capri Holdings Limited | | | 139 | | | 534 | | | 0.3% | | | 1.2% |

Top Anchors(sorted by percentage of total square footage in U.S. properties) (1)

| | | | | | | | | | | | |

TENANT |

|

| NUMBER

OF

STORES |

|

| SQUARE

FEET

(000'S) |

|

| PERCENT OF

TOTAL SQ. FT. IN

U.S. PROPERTIES |

|

| PERCENT OF TOTAL

BASE MINIMUM RENT

FOR U.S. PROPERTIES |

| | | | | | | | | | | | |

Macy's Inc. | | | 112 | | | 21,511 | | | 11.9% | | | 0.3% |

J.C. Penney Co., Inc. | | | 63 | | | 10,201 | | | 5.6% | | | 0.3% |

Dillard's, Inc. | | | 36 | | | 6,532 | | | 3.6% | | | * |

Nordstrom, Inc. | | | 27 | | | 4,556 | | | 2.5% | | | 0.1% |

Dick's Sporting Goods, Inc. | | | 36 | | | 2,410 | | | 1.3% | | | 0.6% |

Hudson's Bay Company | | | 17 | | | 2,174 | | | 1.2% | | | 0.1% |

Sears | | | 11 | | | 2,040 | | | 1.1% | | | * |

The Neiman Marcus Group, Inc. | | | 12 | | | 1,458 | | | 0.8% | | | 0.1% |

Belk, Inc. | | | 8 | | | 1,323 | | | 0.7% | | | * |

Target Corporation | | | 6 | | | 831 | | | 0.5% | | | 0.1% |

Von Maur, Inc. | | | 6 | | | 768 | | | 0.4% | | | * |

- (1)

- Includes space leased and owned by anchors in U.S. Malls; does not include Bloomingdale's The Outlet Store, Neiman Marcus Last Call, Nordstrom Rack, and Saks Fifth Avenue Off 5th.

- *

- Less than one-tenth of one percent.

| |

| 1Q 2020 SUPPLEMENTAL |  | 24 |

Table of Contents

CAPITAL EXPENDITURES

(In thousands)

| | | | | | | | | |

| | | | |

| UNCONSOLIDATED

PROPERTIES |

| | | | | | | | | | |

| |

| CONSOLIDATED

PROPERTIES |

| | TOTAL | |

| OUR

SHARE |

New development projects | | $ | 13,127 | | $ | 56,871 | | $ | 24,561 |

Redevelopment projects with incremental square footage and/or anchor replacement | | |

168,888 | | |

72,182 | | |

35,492 |

Redevelopment projects with no incremental square footage (1) | | |

20,962 | | |

10,905 | | |

5,585 |

| | | | | | | | | | |

| | | | | | | | | |

Subtotal new development and redevelopment projects | | | 202,977 | | | 139,958 | | | 65,638 |

Tenant allowances | | |

33,888 | | |

20,198 | | |

10,332 |

Operational capital expenditures at properties: | | | | | | | | | |

CAM expenditures | | | 10,448 | | | 11,996 | | | 5,021 |

Non-CAM expenditures | | | 901 | | | 5,355 | | | 2,018 |

| | | | | | | | | | |

| | | | | | | | | |

Totals | | $ | 248,214 | | $ | 177,507 | | $ | 83,009 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Conversion from accrual to cash basis | | |

(35,000) | | |

(15,952) | | |

(7,460) |

| | | | | | | | | | |

| | | | | | | | | |

Capital Expenditures for the Three Months Ended 3/31/20 (2) | | $ | 213,214 | | $ | 161,555 | | $ | 75,549 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | |

Capital Expenditures for the Three Months Ended 3/31/19 (2) | | $ | 216,781 | | $ | 188,229 | | $ | 71,669 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

- (1)

- Includes restoration projects as a result of property damage from natural disasters.

- (2)

- Agrees with the line item "Capital expenditures" on the Combined Statements of Cash Flows for the consolidated properties. No statement of cash flows is prepared for the joint venture properties; however, the above reconciliation was completed in the same manner as the reconciliation for the consolidated properties.

| |

| 1Q 2020 SUPPLEMENTAL |  | 25 |

Table of Contents

DEVELOPMENT ACTIVITY SUMMARY (1)

As of March 31, 2020

(in thousands, except percent)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | PLATFORM

PROJECT TYPE |

| | |

| OUR SHARE

OF NET

INVESTMENT |

| | |

| EXPECTED

STABILIZED

RATE OF

RETURN |

| | |

| ACTUAL

Q1 2020

INVESTMENT |

| | |

| FORECASTED

Q2 - Q4

INVESTMENT |

| | |

| FORECASTED

FY 2020

INVESTMENT |

| | |

| FORECASTED

FY 2021

INVESTMENT |

| | |

| FORECASTED

TOTAL

INVESTMENT

2020 - 2021 |

| |

| | Malls | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Redevelopments | | | | $ | 387,717 | | | | | 7% | | | | $ | 81,347 | | | | $ | 105,675 | | | | $ | 187,022 | | | | $ | 33,771 | | | | $ | 220,793 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Premium Outlets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | New Developments—U.S. | | | | $ | 6,400 | | | | | — | | | | $ | 6,400 | | | | $ | — | | | | $ | 6,400 | | | | $ | — | | | | $ | 6,400 | | |

| | New Developments—International | | | | $ | 83,325 | | | | | 8% | | | | $ | 18,409 | | | | $ | 23,137 | | | | $ | 41,546 | | | | $ | 4,115 | | | | $ | 45,661 | | |

| | Redevelopments—U.S. | | | | $ | 35,006 | | | | | 9% | | | | $ | 9,375 | | | | $ | 17,487 | | | | $ | 26,862 | | | | $ | 966 | | | | $ | 27,828 | | |

| | Redevelopments—International | | | | $ | 98,927 | | | | | 10% | | | | $ | 3,588 | | | | $ | 43,344 | | | | $ | 46,932 | | | | $ | — | | | | $ | 46,932 | | |

| | The Mills | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Redevelopments | | | | $ | 61,981 | | | | | 10% | | | | $ | 6,027 | | | | $ | 23,744 | | | | $ | 29,771 | | | | $ | 3,957 | | | | $ | 33,728 | | |

| | Total Investment(1) | | | | $ | 673,356 | | | | | 8% | | | | $ | 125,146 | | | | $ | 213,387 | | | | $ | 338,533 | | | | $ | 42,809 | | | | $ | 381,342 | | |

| | Less funding from: Construction Loans, International Joint Venture Cash on hand, etc. | | | | $ | (246,182) | | | | | | | | | $ | (28,468) | | | | $ | (91,204) | | | | $ | (119,672) | | | | $ | (8,631) | | | | $ | (128,303) | | |

| | Total Net Cash Investment | | | | $ | 427,174 | | | | | | | | | $ | 96,678 | | | | $ | 122,183 | | | | $ | 218,861 | | | | $ | 34,178 | | | | $ | 253,039 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Notes:

- (1)

- Our share of Net Investment includes $320M of previous investment that was in construction in progress (CIP) as of December 31, 2019.

| |

| 1Q 2020 SUPPLEMENTAL |  | 26 |

Table of Contents

COMMON AND PREFERRED STOCK INFORMATION

CHANGES IN COMMON SHARE AND LIMITED PARTNERSHIP UNIT OWNERSHIP

For the Period December 31, 2019 through March 31, 2020

| | | | | | |

| |

| COMMON

SHARES (1) |

|

| LIMITED

PARTNERSHIP

UNITS (2) |

Number Outstanding at December 31, 2019 | | | 306,868,960 | | | 46,740,117 |

First Quarter Activity | | | | | | |

Exchange of Limited Partnership Units for Common Stock | | | 132,946 | | | (132,946) |

Redemption of Limited Partnership Units for Cash | | | – | | | (116,072) |

Restricted Stock Awards and Long-Term Incentive Performance (LTIP) Units Earned (3) | | | (1,081) | | | 38,148 |

Repurchase of Simon Property Group Common Stock in open market | | | (1,245,654) | | | – |

| | | | | | | |

Number Outstanding at March 31, 2020 | | | 305,755,171 | | | 46,529,247 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Number of Limited Partnership Units and Common Shares at March 31, 2020 | | | 352,284,418 | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

PREFERRED STOCK/UNITS OUTSTANDING AS OF MARCH 31, 2020

($ in 000's, except per share amounts)

| | | | | | | | | | | | | | |

ISSUER | | DESCRIPTION | |

| NUMBER OF

SHARES/UNITS |

|

| PER SHARE

LIQUIDATION

PREFERENCE |

|

| AGGREGATE

LIQUIDATION

PREFERENCE |

|

| TICKER

SYMBOL |

Preferred Stock: | | | | | | | | | | | | | | |

Simon Property Group, Inc. | | Series J 8.375% Cumulative Redeemable (4) | | | 796,948 | | $ | 50.00 | | $ | 39,847 | | | SPGPrJ |

Preferred Units: | | | | | | | | | | | | | | |

Simon Property Group, L.P. | | 7.50% Cumulative Redeemable (5) | | | 255,373 | | $ | 100.00 | | $ | 25,537 | | | N/A |

- (1)

- Excludes Limited Partnership preferred units relating to preferred stock outstanding.

- (2)

- Excludes units owned by the Company (shown here as Common Shares) and Limited Partnership Units not exchangeable for common shares.

- (3)

- Represents restricted stock awards and earned LTIP units issued pursuant to the Operating Partnership's 1998 Stock Incentive Plan and 2019 Stock Incentive Plan, net of forfeitures.

- (4)

- Each share is redeemable on or after October 15, 2027. The shares are traded on the New York Stock Exchange. The closing price on March 31, 2020 was $56.00 per share.

- (5)

- Each preferred unit is redeemable upon the occurrence of certain tax triggering events.

| |

| 1Q 2020 SUPPLEMENTAL |  | 27 |

Table of Contents

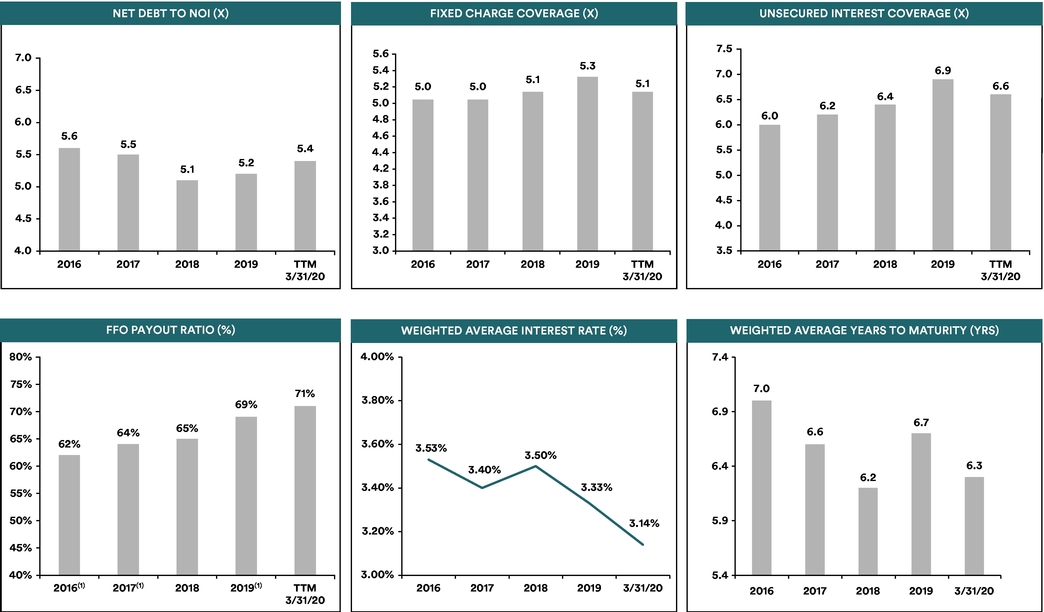

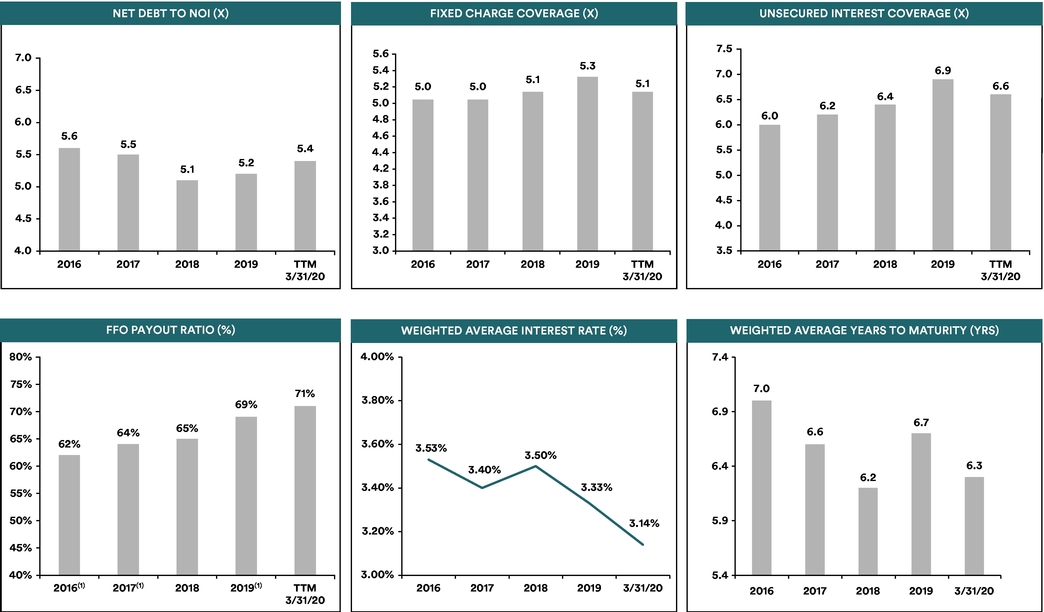

CREDIT PROFILE

(As of December 31, unless otherwise indicated)

- (1)

- Includes a charge for loss on extinguishment of debt of $0.38 per share in 2016, $0.36 per share in 2017, and $0.33 per share in 2019.

| |

| 1Q 2020 SUPPLEMENTAL |  | 28 |

Table of Contents

SUMMARY OF INDEBTEDNESS

As of March 31, 2020

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| TOTAL

INDEBTEDNESS |

| | | | |

| OUR

SHARE OF

INDEBTEDNESS |

| | | | |

| WEIGHTED

AVERAGE

END OF PERIOD

INTEREST RATE |

| | | | |

| WEIGHTED

AVERAGE

YEARS TO

MATURITY |

| |

Consolidated Indebtedness | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mortgage Debt | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fixed Rate | | $ | 6,137,725 | | | | | | $ | 5,999,815 | | | | | | | 3.87% | | | | | | | 4.5 | | |

Variable Rate Debt | | | 748,230 | | | | | | | 712,549 | | | | | | | 2.15% | | | | | | | 1.8 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Mortgage Debt | | | 6,885,955 | | | | | | | 6,712,364 | | | | | | | 3.69% | | | | | | | 4.3 | | |

Unsecured Debt | | | | |

| |

| | | | |

| |

| | | | |

| |

| | | | |

|

Fixed Rate | | | 15,837,587 | | | | | | | 15,837,587 | | | | | | | 3.07% | | | | | | | 9.1 | | |

Revolving Credit Facility – USD Currency | | | 3,000,000 | | | | | | | 3,000,000 | | | | | | | 1.63% | | | | | | | 5.2 | | |

Supplemental Credit Facility – USD Currency | | | 875,000 | | | | | | | 875,000 | | | | | | | 1.53% | | | | | | | 3.2 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Revolving Credit Facilities | | | 3,875,000 | | | | | | | 3,875,000 | | | | | | | 1.61% | | | | | | | 4.8 | | |

Global Commercial Paper – USD | | | 952,901 | | | | | | | 952,901 | | | | | | | 1.44% | | | | | | | 0.2 | | |

Global Commercial Paper – EUR | | | 91,304 | | | | | | | 91,304 | | | | | | | (0.38)% | | | | | | | 0.1 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Unsecured Debt | | | 20,756,792 | | | | | | | 20,756,792 | | | | | | | 2.71% | | | | | | | 7.8 | | |

Premium | | | 5,513 | | | | | | | 5,512 | | | | | | | | | | | | | | | | |

Discount | | | (53,225) | | | | | | | (53,225) | | | | | | | | | | | | | | | | |

Debt Issuance Costs | | | (108,877) | | | | | | | (107,954) | | | | | | | | | | | | | | | | |

Other Debt Obligations | | | 67,255 | | | | | | | 67,255 | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated Mortgages and Unsecured Indebtedness (1) | | $ | 27,553,413 | | | | | | $ | 27,380,744 | | | | | | | 2.95% | | | | | | | 7.0 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Joint Venture Indebtedness | | |

| |

| |

| | |

| |

| |

| | |

| |

| |

| | |

| |

|

Mortgage Debt | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fixed Rate | | $ | 13,491,446 | | | | | | $ | 6,420,421 | | | | | | | 3.99% | | | | | | | 4.0 | | |

Floating Rate Debt (Hedged) (1) | | | 393,558 | | | | | | | 161,941 | | | | | | | 2.05% | | | | | | | 7.2 | | |

Variable Rate Debt | | | 1,099,610 | | | | | | | 465,868 | | | | | | | 2.35% | | | | | | | 2.5 | | |

TMLP Debt (2) | | | 390,670 | | | | | | | 151,942 | | | | | | | – | | | | | | | – | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Mortgage Debt | | | 15,375,284 | | | | | | | 7,200,172 | | | | | | | 3.84% | | | | | | | 4.0 | | |

Discount | | | – | | | | | | | – | | | | | | | | | | | | | | | | |

Debt Issuance Costs | | | (46,710) | | | | | | | (21,445) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Joint Venture Mortgages and Other Indebtedness (1) | | $ | 15,328,574 | | | | | | $ | 7,178,727 | | | | | | | 3.84% | | | | | | | 4.0 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Our Share of Total Indebtedness | | | | | | | | | $ | 34,559,471 | | | | | | | 3.14% | | | | | | | 6.3 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| TOTAL

INDEBTEDNESS |

| | | | |

| OUR

SHARE OF

INDEBTEDNESS |

| | | | |

| WEIGHTED

AVERAGE

END OF PERIOD

INTEREST RATE |

| | | | |

| WEIGHTED

AVERAGE

YEARS TO

MATURITY |

| |

Summary of Our Share of Fixed and Variable Rate Debt | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fixed | | | 83.3% | | | | | | $ | 22,818,846 | | | | | | | 3.49% | | | | | | | 7.5 | | |

Variable | | | 16.7% | | | | | | | 4,561,898 | | | | | | | 1.69% | | | | | | | 4.4 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 100.0% | | | | | | | 27,380,744 | | | | | | | 2.95% | | | | | | | 7.0 | | |

Joint Venture | | |

| |

| |

| | |

| |

| |

| | |

| |

| |

| | |

| |

|

Fixed | | | 91.4% | | | | | | $ | 6,559,082 | | | | | | | 3.99% | | | | | | | 4.0 | | |

Variable | | | 8.6% | | | | | | | 619,645 | | | | | | | 2.27% | | | | | | | 3.7 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 100.0% | | | | | | | 7,178,727 | | | | | | | 3.84% | | | | | | | 4.0 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Debt | | |

| |

| |

| |

$ |

34,559,471 | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Fixed Debt | | | 85.0% | | | | | | $ | 29,377,928 | | | | | | | 3.37% | | | | | | | 6.7 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |