As filed with the Securities and Exchange Commission on Friday, June 05, 2015

Securities Act File No.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 x

Pre-Effective Amendment No. ¨

Post-Effective Amendment No. ¨

Voya Equity Trust

(Exact Name of Registrant as Specified in Charter)

7337 East Doubletree Ranch Road, Scottsdale, Suite 100, Arizona 85258-2034

(Address of Principal Executive Offices) (Zip Code)

1-800-262-3862

(Registrant’s Area Code and Telephone Number)

Huey P. Falgout, Jr.

Voya Investment Management

7337 East Doubletree Ranch Road

Scottsdale, AZ 85258

(Name and Address of Agent for Service)

With copies to:

Elizabeth J. Reza

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, Massachusetts 02199-3600

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective.

It is proposed that this filing will become effective on July 13, 2015, pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

Title of Securities Being Registered: Class A, Class C, Class I, Class R, Class R6, and Class W of Voya Growth Opportunities Fund

Voya Large Cap Growth Fund

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

(800) 992-0180

July 24, 2015

Dear Shareholder:

On behalf of the Board of Directors (the “Board”) of Voya Large Cap Growth Fund (“Large Cap Fund”), we are pleased to invite you to a special meeting of shareholders (the “Special Meeting”) of Large Cap Fund. The Special Meeting is scheduled for 1:00 p.m., Local time, on September 22, 2015, at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.

At the Special Meeting, shareholders of Large Cap Fund will be asked to vote on the proposed reorganization (the “Reorganization”) of Large Cap Fund with and into Voya Growth Opportunities Fund (“Growth Fund”) (together with Large Cap Fund, the “Funds”). The Funds are members of the Voya family of funds.

If the Reorganization is approved by shareholders, you will become a shareholder of Growth Fund beginning on the date the Reorganization occurs. The Reorganization would provide shareholders of Large Cap Fund with an opportunity to participate in a fund that seeks long-term capital appreciation.

Formal notice of the Special Meeting appears on the next page, followed by a combined proxy statement and prospectus (the “Proxy Statement/Prospectus”). The Reorganization is discussed in detail in the enclosed Proxy Statement/Prospectus, which you should read carefully. The Board recommends that you vote “FOR” the Reorganization.

Your vote is important regardless of the number of shares you own. To avoid the added cost of follow-up solicitations and possible adjournments, please read the Proxy Statement/Prospectus and cast your vote. It is important that your vote be received no later than September 21, 2015.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

| | Sincerely, |

| |  |

| | Shaun P. Mathews |

| | President and Chief Executive Officer |

(This page intentionally left blank)

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

OF

Voya Large Cap growth Fund

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

(800) 992-0180

Scheduled for September 22, 2015

To the Shareholders:

NOTICE IS HEREBY GIVEN that a special meeting of the shareholders (the “Special Meeting”) of Voya Large Cap Growth Fund (“Large Cap Fund”) is scheduled for 1:00 p.m., Local time, on September 22, 2015 at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.

At the Special Meeting, Large Cap Fund’s shareholders will be asked:

| 1. | To approve an Agreement and Plan of Reorganization by and between Large Cap Fund and Voya Growth Opportunities Fund (“Growth Fund”), providing for the reorganization of Large Cap Fund with and into Growth Fund (the “Reorganization”); and |

| 2. | To transact such other business, not currently contemplated, that may properly come before the Special Meeting, or any adjournments or postponements thereof, in the discretion of the proxies or their substitutes. |

Please read the enclosed combined proxy statement and prospectus (the “Proxy Statement/Prospectus”) carefully for information concerning the Reorganization to be placed before the Special Meeting.

The Board of Directors of Large Cap Fund recommends that you vote “FOR” the Reorganization.

Shareholders of record as of the close of business on June 24, 2015 are entitled to notice of, and to vote at, the Special Meeting, and are also entitled to vote at any adjournments or postponements thereof. Your attention is called to the accompanying Proxy Statement/Prospectus. Regardless of whether you plan to attend the Special Meeting, please complete, sign, and return the enclosed Proxy Ballot by September 21, 2015 so that a quorum will be present and a maximum number of shares may be voted. Proxies may be revoked at any time before they are exercised by submitting a revised Proxy Ballot, by giving written notice of revocation to Large Cap Fund or by voting in person at the Special Meeting.

| | By Order of the Board of Directors |

| |  |

| | Huey P. Falgout, Jr. |

| | Secretary |

| July 24, 2015 | |

(This page intentionally left blank)

PROXY STATEMENT/PROSPECTUS

July 24, 2015

Special Meeting of Shareholders

of Voya Large Cap Growth Fund

Scheduled for September 22, 2015

| ACQUISITION OF THE ASSETS OF: | BY AND IN EXCHANGE FOR SHARES OF: |

| | |

Voya Large Cap Growth Fund (A series of Voya Series Fund, Inc.) 7337 East Doubletree Ranch Road, Suite 100 Scottsdale, Arizona 85258-2034 (800) 992-0180 | Voya Growth Opportunities Fund (A series of Voya Equity Trust) 7337 East Doubletree Ranch Road, Suite 100 Scottsdale, Arizona 85258-2034 (800) 992-0180 |

| (each an open-end management investment company) |

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on September 22, 2015 |

| This Proxy Statement/Prospectus and Notice of Special Meeting are available at: www.proxyvote.com/voya |

| |

| The Prospectus/Proxy Statement explains concisely what you should know before voting on the matter described herein or investing in Voya Growth Opportunities Fund. Please read it carefully and keep it for future reference. |

| |

| THE U.S. SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED THAT THIS PROXY STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. |

TO OBTAIN MORE INFORMATION

To obtain more information about Voya Large Cap Growth Fund (“Large Cap Fund”) and Voya Growth Opportunities Fund (“Growth Fund,” and together with Large Cap Fund, the “Funds”), please write, call, or visit our website for a free copy of the current prospectus, statement of additional information, annual/semi-annual shareholder reports, or other information.

| By Phone: | (800) 992-0180 |

| | |

| By Mail: | Voya Investment Management 7337 East Doubletree Ranch Road, Suite 100 Scottsdale, Arizona 85258-2034 |

| | |

| By Internet: | www.voyainvestments.com/literature |

The following documents containing additional information about the Funds, each having been filed with the U.S. Securities and Exchange Commission (“SEC”), are incorporated by reference into this Proxy Statement/Prospectus:

| 1. | The Statement of Additional Information dated July 24, 2015 relating to this Proxy Statement/Prospectus; |

| 2. | The Prospectuses and Statement of Additional Information dated September 30, 2014 for Large Cap Fund; and |

| 3. | The Prospectus and Statement of Additional Information dated September 30, 2014 for Class A, Class C, Class I, Class R, and Class W shares of Growth Fund and the Prospectus and Statement of Additional Information dated May 26, 2015 for Class R6 shares of Growth Fund. |

The Funds are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, and the rules, regulations, and exemptive orders thereunder, and in accordance therewith, file reports and other information including proxy materials with the SEC.

You also may view or obtain these documents from the SEC:

In Person: | Public Reference Section 100 F Street, N.E. Washington, D.C. 20549 (202) 551-8090 |

| | |

| By Mail: | U.S. Securities and Exchange Commission Public Reference Section 100 F Street, N.E. Washington, D.C. 20549 (Duplication Fee Required) |

| | |

| By Email: | publicinfo@sec.gov (Duplication Fee Required) |

| | |

| By Internet: | www.sec.gov |

When contacting the SEC, you will want to refer to the Funds’ SEC file numbers. The file number for the document listed above as (1) is [File No. generated with N-14 filing]. The file numbers for the documents listed above as (2) and (3) are 33-41694 and 333-56881.

TABLE OF CONTENTS

Introduction

What is happening?

On March 12, 2015, the Board of Trustees/Directors (the “Board”) of Voya Large Cap Growth Fund (“Large Cap Fund”) and Voya Growth Opportunities Fund (“Growth Fund,” together with Large Cap Fund, the “Funds”) approved an Agreement and Plan of Reorganization (the “Reorganization Agreement”), which provides for the reorganization of Large Cap Fund with and into Growth Fund (the “Reorganization”). The Reorganization Agreement requires approval by shareholders of Large Cap Fund, and if approved, is expected to be effective on October 23, 2015 or such other date as the parties may agree (the “Closing Date”).

Why did you send me this booklet?

This booklet includes a combined proxy statement and prospectus (the “Proxy Statement/Prospectus”) and a Proxy Ballot for Large Cap Fund. It provides you with information you should review before providing voting instructions on the matters listed in the Notice of Special Meeting.

Because you, as a shareholder of Large Cap Fund, are being asked to approve a Reorganization Agreement that will result in a transaction in which you will ultimately hold shares of Growth Fund, this Proxy Statement also serves as a prospectus for Growth Fund. Growth Fund is an open-end management investment company, which seeks long-term capital appreciation, as described more fully below.

Who is eligible to vote?

Shareholders holding an investment in shares of Large Cap Fund as of the close of business on June 24, 2015 (the “Record Date”) are eligible to vote at the Special Meeting or any adjournments or postponements thereof.

How do I vote?

You may submit your Proxy Ballot in one of four ways:

| · | By Internet. The web address and instructions for voting can be found on the enclosed Proxy Ballot. You will be required to provide your control number located on the Proxy Ballot. |

| · | By Telephone. The toll-free number for telephone voting can be found on the enclosed Proxy Ballot. You will be required to provide your control number located on the Proxy Ballot. |

| · | By Mail. Mark the enclosed Proxy Ballot, sign and date it, and return it in the postage-paid envelope we provided. Both joint owners must sign the Proxy Ballot. |

| · | In Person at the Special Meeting. You can vote your shares in person at the Special Meeting. If you expect to attend the Special Meeting in person, please call Shareholder Services toll-free at (800) 992-0180. |

To be certain your vote will be counted, a properly executed Proxy Ballot must be received no later than 5:00 p.m., Local time, on September 21, 2015.

When and where will the Special Meeting be held?

The Special Meeting is scheduled to be held at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034, on September 22, 2015, at 1:00 p.m., Local time, and if the Special Meeting is adjourned or postponed, any adjournments or postponements of the Special Meeting will also be held at the above location. If you expect to attend the Special Meeting in person, please call Shareholder Services toll-free at (800) 992-0180.

Summary of the Proposed Reoranization

You should read this entire Proxy Statement/Prospectus, and the Reorganization Agreement, which is included in Appendix A. For more information about Growth Fund, please consult Appendix B and Growth Fund’s prospectuses dated September 30, 2014 for Class A, Class C, Class I, Class R, and Class W shares and dated May 26, 2015 for Class R6 shares.

On March 12, 2015, the Board approved the Reorganization. Subject to shareholder approval, the Reorganization Agreement provides for:

| · | the transfer of all of the assets of Large Cap Fund to Growth Fund in exchange for shares of beneficial interest of Growth Fund; |

| · | the assumption by Growth Fund of all the liabilities of Large Cap Fund; |

| · | the distribution of shares of Growth Fund to the shareholders of Large Cap Fund; and |

| · | the complete liquidation of Large Cap Fund. |

If shareholders of Large Cap Fund approve the Reorganization, each owner of Class A, Class C, Class I, Class R, Class R6, Class W shares of Large Cap Fund would become a shareholder of the corresponding share class shares of Growth Fund. The Reorganization is expected to be effective on the Closing Date. Each shareholder of Large Cap Fund will hold, immediately after the close of the Reorganization (the “Closing”), shares of Growth Fund having an aggregate value equal to the aggregate value of the shares of Large Cap Fund held by that shareholder as of the close of business on the Closing Date.

In considering whether to approve the Reorganization, you should note that:

| · | The Funds have substantially similar investment objectives. Large Cap Fund seeks long-term capital growth. Growth Fund seeks long-term capital appreciation. |

| · | The Funds have substantially identical principal investment strategies. Each Fund invests at least 80% of its net assets in common stocks of large-capitalization companies. |

| · | If shareholders of Large Cap Fund approve the Reorganization, the name of Growth Fund will be changed to Voya Large-Cap Growth Fund effective on the Closing Date. |

| · | Voya Investments, LLC (“Voya Investments” or the “Adviser”) serves as the investment adviser to both Funds. Voya Investment Management Co. LLC (“Voya IM”) serves as the investment adviser to both Funds. |

| · | Each Fund is distributed by Voya Investments Distributor, LLC (the “Distributor”). |

| · | The shareholders of Class I and Class R6 shares of Large Cap Fund are expected to benefit from a reduction in net expenses as shareholders of Growth Fund. The shareholders of all classes of Large Cap Fund are expected to benefit from an expense limitation agreement between the Adviser and Growth Fund, which contractually obligates the Adviser to limit the expenses of Growth Fund at a rate that is lower than the rate provided in the expense limitation agreement between the Adviser and Large Cap Fund. |

| · | The Reorganization will not affect a shareholder’s right to purchase, redeem, or exchange shares of the Funds. In addition, the Reorganization will not affect how shareholders purchase or sell their shares. |

| · | The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization pursuant to Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”); accordingly, pursuant to this treatment, neither Large Cap Fund nor its shareholders, nor Growth Fund nor its shareholders are expected to recognize any gain or loss for federal income tax purposes from the Reorganization. |

Proposal One – Approval of the Reorganization

What is the proposed Reorganization?

Shareholders of Large Cap Fund are being asked to approve a Reorganization Agreement, providing for the reorganization of Large Cap Fund with and into Growth Fund. If the Reorganization is approved, shareholders of Large Cap Fund will become shareholders of Growth Fund as of the Closing Date.

Why is a Reorganization proposed?

The Adviser and its affiliates are in the process of conducting a comprehensive review of the mutual funds offered within the Voya family of funds. At the March 2015 Board meeting, the Adviser presented to the Board a series of proposals, including the Reorganization, which were intended to enhance the efficiency and reduce the complexity of the Voya family of funds. In support of the Reorganization proposal, the Adviser noted that shareholders of Class I and Class R6 shares of Large Cap Fund are expected to benefit from a reduction in net expenses as shareholders of Growth Fund. Additionally, the shareholders of all classes of Large Cap Fund are expected to benefit from an expense limitation agreement between the Adviser and Growth Fund, which contractually obligates the Adviser to limit the expenses of Growth Fund at a rate that is lower than the rate provided in the expense limitation agreement between the Adviser and Large Cap Fund.

How do the Investment Objectives compare?

As described in the chart that follows, the Funds have substantially similar investment objectives.

| | | Large Cap Fund | | Growth Fund |

| Investment Objective | | The Fund seeks long-term capital growth. | | The Fund seeks long-term capital appreciation. |

Large Cap Fund’s investment objective is non-fundamental and may be changed by a vote of the Board, without shareholder approval. Large Cap Fund will provide 60 days’ prior written notice of any change in a non-fundamental investment objective. Growth Fund’s investment objective is fundamental. Any change in Growth Fund’s fundamental objective requires shareholder approval.

How do the fees and expenses compare?

These tables describe the fees and expense that you may pay if you buy and hold shares of the Funds. Pro Forma fees and expenses, which are the estimated fees and expenses of Growth Fund after giving effect to the Reorganization, assume the Reorganization occurred on November 30, 2014. The Annual Fund Operating expenses reflect the contractual fees and expenses of the Funds. Certain reimbursements may further reduce net expenses below the amounts shown below. For more information on the net expense ratios for each Fund for the fiscal period ended November 30, 2014, please see each Fund’s semi-annual report dated November 30, 2014.

Shareholders of Large Cap Fund will not pay any sales charges in connection with the Reorganization. For purposes of any contingent deferred sales charges, the purchase date of any shares received in the Reorganization will be the same as the purchase date that was applicable to your shares of Large Cap Fund.

You may qualify for sales charge discounts if you or your family invest, or agree to invest in the future, at least $50,000 in Voya mutual funds. More information about these and other discounts is available from your financial professional and in the discussion in the Sales Charges of Growth Fund’s Prospectuses and Statements of Additional Information dated September 30, 2014 for Class A, Class C, Class I, Class R, and Class W shares and dated May 26, 2015 for Class R6 and Large Cap Fund’s Prospectuses and Statement of Additional Information dated September 30, 2014.

Shareholder Fees

Expenses you pay each year as a % of the value of your investment

| | | Maximum sales charge (load) as a % of offering price | | | Maximum deferred sales charge as a % of purchase or

sales price, whichever is less | |

| Class | | Large Cap Fund | | | Growth Fund | | | Growth Fund Pro Forma | | | Large Cap Fund | | | Growth Fund | | | Growth Fund Pro Forma | |

| A | | | 5.75 | | | | 5.75 | | | | 5.75 | | | | None | 1 | | | None | 1 | | | None | 1 |

| C | | | None | | | | None | | | | None | | | | 1.00 | | | | 1.00 | | | | 1.00 | |

| I | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | |

| R | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | |

| R6 | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | |

| W | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | |

Annual Fund Operating Expenses2

Expenses you pay each year as a % of the value of your investment

| | | | | | Large

Cap Fund | | | Growth Fund | | | Growth

Fund

Pro Forma | |

| Class A | | | | | | | | | | | | | | | | |

| Management Fees | | | % | | | | 0.80 | 3 | | | 0.80 | 5 | | | 0.80 | 5 |

| Distribution and/or Shareholder Services (12b-1) Fees | | | % | | | | 0.25 | | | | 0.35 | | | | 0.35 | |

| Other Expenses | | | % | | | | 0.18 | | | | 0.33 | | | | 0.28 | |

| Total Annual Fund Operating Expenses | | | % | | | | 1.23 | | | | 1.48 | | | | 1.43 | |

| Waivers and Reimbursements | | | % | | | | (0.08 | )4 | | | (0.18 | )6 | | | (0.29 | )8 |

| Total Annual Fund Operating Expenses after Waivers and Reimbursements | | | % | | | | 1.15 | | | | 1.30 | | | | 1.14 | |

| | | | | | | | | | | | | | | | | |

| Class C | | | | | | | | | | | | | | | | |

| Management Fees | | | % | | | | 0.80 | 3 | | | 0.80 | 5 | | | 0.80 | 5 |

| Distribution and/or Shareholder Services (12b-1) Fees | | | % | | | | 1.00 | | | | 1.00 | | | | 1.00 | |

| Other Expenses | | | % | | | | 0.18 | | | | 0.33 | | | | 0.28 | |

| Total Annual Fund Operating Expenses | | | % | | | | 1.98 | | | | 2.13 | | | | 2.08 | |

| Waivers and Reimbursements | | | % | | | | (0.08 | )4 | | | (0.18 | )6 | | | (0.19 | )8 |

| Total Annual Fund Operating Expenses after Waivers and Reimbursements | | | % | | | | 1.90 | | | | 1.95 | | | | 1.89 | |

| | | | | | | | | | | | | | | | | |

| Class I | | | | | | | | | | | | | | | | |

| Management Fees | | | % | | | | 0.80 | 3 | | | 0.80 | 5 | | | 0.80 | 5 |

| Distribution and/or Shareholder Services (12b-1) Fees | | | % | | | | None | | | | None | | | | None | |

| Other Expenses | | | % | | | | 0.14 | | | | 0.11 | | | | 0.09 | |

| Total Annual Fund Operating Expenses | | | % | | | | 0.94 | | | | 0.91 | | | | 0.89 | |

| Waivers and Reimbursements | | | % | | | | (0.09 | )4 | | | None | 6 | | | (0.10 | )8 |

| Total Annual Fund Operating Expenses after Waivers and Reimbursements | | | % | | | | 0.85 | | | | 0.91 | | | | 0.79 | |

| | | | | | | | | | | | | | | | | |

| Class R | | | | | | | | | | | | | | | | |

| Management Fees | | | % | | | | 0.80 | 3 | | | 0.80 | 5 | | | 0.80 | 5 |

| Distribution and/or Shareholder Services (12b-1) Fees | | | % | | | | 0.50 | | | | 0.50 | | | | 0.50 | |

| Other Expenses | | | % | | | | 0.18 | | | | 0.33 | 7 | | | 0.28 | 7 |

| Total Annual Fund Operating Expenses | | | % | | | | 1.48 | | | | 1.63 | | | | 1.58 | |

| Waivers and Reimbursements | | | % | | | | (0.08 | )4 | | | (0.18 | )6 | | | (0.19 | )8 |

| Total Annual Fund Operating Expenses after Waivers and Reimbursements | | | % | | | | 1.40 | | | | 1.45 | | | | 1.39 | |

| | | | | | | | | | | | | | | | | |

| Class R6 | | | | | | | | | | | | | | | | |

| Management Fees | | | % | | | | 0.80 | 3 | | | 0.80 | 5 | | | 0.80 | 5 |

| Distribution and/or Shareholder Services (12b-1) Fees | | | % | | | | None | | | | None | | | | None | |

| Other Expenses | | | % | | | | 0.14 | | | | 0.06 | 7 | | | 0.06 | 7 |

| Total Annual Fund Operating Expenses | | | % | | | | 0.94 | | | | 0.86 | | | | 0.86 | |

| Waivers and Reimbursements | | | % | | | | (0.14 | )4 | | | (0.08 | )6 | | | (0.08 | )8 |

| Total Annual Fund Operating Expenses after Waivers and Reimbursements | | | % | | | | 0.80 | | | | 0.78 | | | | 0.78 | |

| | | | | | | | | | | | | | | | | |

| Class W | | | | | | | | | | | | | | | | |

| Management Fees | | | % | | | | 0.80 | 3 | | | 0.80 | 5 | | | 0.80 | 5 |

| Distribution and/or Shareholder Services (12b-1) Fees | | | % | | | | None | | | | None | | | | None | |

| Other Expenses | | | % | | | | 0.18 | | | | 0.33 | | | | 0.28 | |

| Total Annual Fund Operating Expenses | | | % | | | | 0.98 | | | | 1.13 | | | | 1.08 | |

| Waivers and Reimbursements | | | % | | | | (0.08 | )4 | | | (0.18 | )6 | | | (0.19 | )8 |

| Total Annual Fund Operating Expenses after Waivers and Reimbursements | | | % | | | | 0.90 | | | | 0.95 | | | | 0.89 | |

| 1. | A contingent deferred sales charge of 1.00% is assessed on certain redemptions of Class A shares made within 18 months after purchase where no initial sales charge was paid at the time of purchase as part of an investment of $1 million or more. |

| 2. | Expense ratios have been adjusted to reflect current contractual rates. |

| 3. | The portion of the Management Fee attributable to the advisory services is 0.70% and the portion of the Management Fee attributable to the administrative services is 0.10%. |

| 4. | The Adviser is contractually obligated to limit expenses to 1.15%, 1.90%, 0.90%, 1.40%, 0.80%, and 0.90% for Class A, Class C, Class I, Class R, Class R6, and Class W shares, respectively, through October 1, 2016. In addition, the Adviser is contractually obligated to further limit expenses to 0.85% for Class I shares through October 1, 2016. The limitations do not extend to interest, taxes, investment-related costs, leverage expenses, extraordinary expenses, and Acquired Fund Fees and Expenses. These limitations are subject to possible recoupment by the Adviser with 36 months of the waiver or reimbursement. Termination or modification of these obligations requires approval by the Board. |

| 5. | The portion of the Management Fee attributable to the advisory services is 0.70% and the portion of the Management Fee attributable to the administrative services is 0.10%. |

| 6. | The Adviser and Distributor are contractually obligated to limit expenses to 1.40%, 2.05%, 1.05%, 1.55%, 0.80%, and 1.05% for Class A, Class C, Class I, Class R, Class R6, and Class W shares, respectively, through October 1, 2017. In addition, the Adviser is contractually obligated to further limit expenses to 1.30%, 1.95%, 0.95%, 1.45%, 0.78%, and 0.95% for Class A, Class C, Class I, Class R, Class R6, and Class W shares, respectively, through October 1, 2017. The limitations do not extend to interest, taxes, investment-related costs, leverage expenses, extraordinary expenses, and Acquired Fund Fees and Expenses. These limitations are subject to possible recoupment by the Adviser within 36 months of the waiver or reimbursement. Termination or modification of these obligations requires approval by the Board. |

| 7. | Other expenses are based on estimated amounts for the current fiscal year. |

| 8. | If shareholders approve the Reorganization, the Adviser and Distributor would be contractually obligated to limit expenses to limit expenses to 1.15%, 1.90%, 0.90%, 1.40%, 0.80%, and 0.90% for Class A, Class C, Class I, Class R, Class R6, and Class W shares, respectively, through October 1, 2017. In addition, the Adviser would be contractually obligated to further limit expenses to 1.14%, 1.89%, 0.79%, 1.39%, 0.78%, and 0.89% for Class A, Class C, Class I, Class R, Class R6, and Class W shares, respectively, through October 1, 2017. The limitations would not extend to interest, taxes, investment-related costs, leverage expenses, extraordinary expenses, and Acquired Fund Fees and Expenses. These limitations would be subject to possible recoupment by the Adviser within 36 months of the waiver or reimbursement. Termination or modification of these obligations would require approval by the Board. |

Expense Examples

The Examples are intended to help you compare the costs of investing in shares of the Funds with the costs of investing in other mutual funds. The Examples assume that you invest $10,000 in the Funds for the time periods indicated. The Examples also assume that your investment had a 5% return during each year and that the Funds’ operating expenses remain the same. Although your actual costs may be higher or lower based on these assumptions your costs would be:

| | | | | | Large Cap Fund | | | Growth Fund | | | Growth Fund Pro Forma | |

| Class | | | Share Status | | 1 Yr | | | 3 Yrs | | | 5 Yrs | | | 10 Yrs | | | 1 Yr | | | 3 Yrs | | | 5 Yrs | | | 10 Yrs | | | 1 Yr | | | 3 Yrs | | | 5 Yrs | | | 10 Yrs | |

| A | | | Sold or Held | | $ | 685 | | | | 935 | | | | 1,205 | | | | 1,971 | | | | 700 | | | | 982 | | | | 1,303 | | | | 2,212 | | | | 685 | | | | 946 | | | | 1,258 | | | | 2,141 | |

| C | | | Sold | | $ | 293 | | | | 614 | | | | 1,060 | | | | 2,300 | | | | 298 | | | | 631 | | | | 1,110 | | | | 2,433 | | | | 292 | | | | 614 | | | | 1,083 | | | | 2,379 | |

| | | | Held | | $ | 193 | | | | 614 | | | | 1,060 | | | | 2,300 | | | | 198 | | | | 631 | | | | 1,110 | | | | 2,433 | | | | 192 | | | | 614 | | | | 1,083 | | | | 2,379 | |

| I | | | Sold or Held | | $ | 87 | | | | 291 | | | | 511 | | | | 1,146 | | | | 93 | | | | 290 | | | | 504 | | | | 1,120 | | | | 81 | | | | 263 | | | | 473 | | | | 1,077 | |

| R | | | Sold or Held | | $ | 143 | | | | 460 | | | | 800 | | | | 1,762 | | | | 148 | | | | 478 | | | | 852 | | | | 1,902 | | | | 142 | | | | 461 | | | | 824 | | | | 1,845 | |

| R6 | | | Sold or Held | | $ | 82 | | | | 286 | | | | 506 | | | | 1,142 | | | | 80 | | | | 258 | | | | 461 | | | | 1,046 | | | | 80 | | | | 258 | | | | 461 | | | | 1,046 | |

| W | | | Sold or Held | | $ | 92 | | | | 304 | | | | 534 | | | | 1,194 | | | | 97 | | | | 322 | | | | 587 | | | | 1,342 | | | | 91 | | | | 305 | | | | 558 | | | | 1,282 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The Examples reflect applicable expense limitation agreements and/or waivers in effect, if any, for the one-year period and the first year of the three-, five-, and ten-year periods.

How do the Principal Investment Strategies compare?

As discussed in more detail in the table below, the Funds have substantially identical principal investment strategies. Each Fund invests at least 80% of its net assets in common stocks of large-capitalization companies.

| | | Large Cap Fund | | Growth Fund |

| Investment Strategies | | Under normal market conditions, the Fund invests at least 80% of its net assets (plus borrowings for investment purposes) in common stocks of large-capitalization companies. The Fund will provide shareholders with at least 60 days’ prior notice of any change in this investment policy. The Fund’s investment strategy uses a stock selection process that combines the discipline of quantitative screens with rigorous fundamental security analysis. The quantitative screens focus the fundamental analysis by identifying the stocks of companies with strong business momentum that demonstrate relative price strength, and have a perceived value not reflected in the current price. The objective of the fundamental analysis is to confirm the persistence of the company’s revenue and earnings growth, and validate the expectations for earnings estimate revisions, particularly relative to consensus estimates. A determination of reasonable valuation for individual securities is based on the judgment of the sub-adviser (“Sub-Adviser”). For this Fund, large-capitalization companies are companies with market capitalizations which fall within the range of companies in the Russell 1000® | | Under normal market conditions, the Fund invests at least 80% of its net assets (plus borrowings for investment purposes) in common stocks of large-capitalization companies. The Fund will provide shareholders with at least 60 days’ prior notice of any change in this investment policy. The Fund’s investment strategy uses a stock selection process that combines the discipline of quantitative screens with rigorous fundamental security analysis. The quantitative screens focus the fundamental analysis by identifying the stocks of companies with strong business momentum that demonstrate relative price strength, and have a perceived value not reflected in the current price. The objective of the fundamental analysis is to confirm the persistence of the company’s revenue and earnings growth, and validate the expectations for earnings estimate revisions, particularly relative to consensus estimates. A determination of reasonable valuation for individual securities is based on the judgment of the sub-adviser (“Sub-Adviser”). For this Fund, large-capitalization companies are companies with market capitalizations which fall within the range of companies in the Russell 1000® |

| | Large Cap Fund | | Growth Fund |

| | | Growth Index at the time of purchase. The market capitalization of companies within the Russell 1000® Growth Index will change with market conditions. The market capitalization of companies in the Russell 1000® Growth Index as of March 31, 2015 ranged from $212.7 million to $724.8 billion. The Fund may also invest in derivative instruments, which include, but are not limited to, index futures and options to hedge against market risk or to enhance returns. The Fund may also invest up to 25% of its assets in foreign securities. The Fund may invest in other investment companies, including exchange-traded funds, to the extent permitted under the Investment Company Act of 1940, as amended, and the rules, regulations, and exemptive orders thereunder (“1940 Act”). The Sub-Adviser may sell securities for a variety of reasons, such as to secure gains, limit losses, or redeploy assets into opportunities believed to be more promising, among others. The Fund may lend portfolio securities on a short-term or long-term basis, up to 33 1⁄3% of its total assets. | | Growth Index at the time of purchase. The market capitalization of companies within the Russell 1000® Growth Index will change with market conditions. The market capitalization of companies in the Russell 1000® Growth Index as of March 31, 2015 ranged from $212.7 million to $724.8 billion. The Fund may also invest in derivative instruments, which include, but are not limited to, index futures and options to hedge against market risk or to enhance returns. The Fund may also invest up to 25% of its assets in foreign securities. The Fund may invest in other investment companies, including exchange-traded funds, to the extent permitted under the Investment Company Act of 1940, as amended, and the rules, regulations, and exemptive orders thereunder (“1940 Act”). The Sub-Adviser may sell securities for a variety of reasons, such as to secure gains, limit losses, or redeploy assets into opportunities believed to be more promising, among others. The Fund may lend portfolio securities on a short-term or long-term basis, up to 30% of its total assets. |

How do the Principal Risks compare

The following table summarizes and compares the principal risks of investing in the Funds. You could lose money on an investment in the Funds. Any of the following risks, among others, could affect Fund performance or cause the Funds to lose money or to underperform market averages of other funds.

| Risks | | Large Cap

Fund | | Growth Fund |

| Company The price of a given company’s stock could decline or underperform for many reasons including, among others, poor management, financial problems, or business challenges. If a company declares bankruptcy or becomes insolvent, its stock could become worthless. | | ü | | ü |

| | | | | |

| Currency To the extent that the Fund invests directly in foreign (non-U.S.) currencies or in securities denominated in, or that trade in, foreign (non-U.S.) currencies, it is subject to the risk that those foreign (non-U.S.) currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency being hedged. | | ü | | ü |

| | | | | |

| Derivative Instruments Derivative instruments are subject to a number of risks, including the risk of changes in the market price of the underlying securities, credit risk with respect to the counterparty, risk of loss due to changes in interest rates and liquidity risk. The use of certain derivatives may also have a leveraging effect which may increase the volatility of the Fund and reduce its returns. Derivatives may not perform as expected, so the Fund may not realize the intended benefits. When used for hedging, the change in value of a derivative may not correlate as expected with the currency, security or other risk being hedged. In addition, given their complexity, derivatives expose the Fund to the risk of improper valuation. | | ü | | ü |

| Risks | | Large Cap

Fund | | Growth Fund |

| Foreign Investments Investing in foreign (non-U.S.) securities may result in the Fund experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies due to: smaller markets; differing reporting, accounting, and auditing standards; nationalization, expropriation, or confiscatory taxation; foreign currency fluctuations, currency blockage, or replacement; potential for default on sovereign debt; or political changes or diplomatic developments, which may include the imposition of economic sanctions or other meaures by the United States or other governments. Markets and economies throughout the world are becoming increasingly interconnected, and conditions or events in one market, country or region may adversely impact investments or issuers in another market, country or region. | | ü | | ü |

| | | | | |

| Growth Investing Prices of growth stocks typically reflect high expectations for future company growth, and may fall quickly and significantly if investors suspect that actual growth may be less than expected. Growth companies typically lack any dividends that might cushion price declines. Growth stocks tend to be more volatile than value stocks, and may underperform the market as a whole over any given time period. | | ü | | ü |

| | | | | |

| Investment Model The manager’s proprietary model may not adequately allow for existing or unforeseen market factors or the interplay between such factors. | | ü | | ü |

| | | | | |

| Liquidity If a security is illiquid, the Fund might be unable to sell the security at a time when the Fund’s manager might wish to sell, and the security could have the effect of decreasing the overall level of the Fund’s liquidity. Further, the lack of an established secondary market may make it more difficult to value illiquid securities, which could vary from the amount the Fund could realize upon disposition. The Fund may make investments that become less liquid in response to market developments or adverse investor perception. The Fund could lose money if it cannot sell a security at the time and price that would be most beneficial to the Fund. | | ü | | ü |

| | | | | |

| Market Stock prices may be volatile and are affected by the real or perceived impacts of such factors as economic conditions and political events. Stock markets tend to be cyclical, with periods when stock prices generally rise and periods when stock prices generally decline. Any given stock market segment may remain out of favor with investors for a short or long period of time, and stocks as an asset class may underperform bonds or other asset classes during some periods. Additionally, legislative, regulatory or tax policies or developments in these areas may adversely impact the investment techniques available to a manager, add to Fund costs and impair the ability of the Fund to achieve its investment objectives. | | ü | | ü |

| | | | | |

| Other Investment Companies The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. Shares of other investment companies that are listed on an exchange may trade at a discount or premium from their NAV. In addition, because the Fund may invest in other investment companies, you will pay a proportionate share of the expenses of those other investment companies (including management fees, administration fees, and custodial fees) in addition to the expenses of the Fund. | | ü | | ü |

| | | | | |

| Securities Lending Securities lending involves two primary risks: “investment risk” and “borrower default risk.” Investment risk is the risk that the Fund will lose money from the investment of the cash collateral received from the borrower. Borrower default risk is the risk that the Fund will lose money due to the failure of a borrower to return a borrowed security in a timely manner. | | ü | | ü |

How does Large Cap Fund performance compare to Growth Fund?

The following information is intended to help you understand the risks of investing in the Funds. The following bar chart shows the changes in the Funds’ performance from year to year, and the table compares the Funds’ performance to the performance of a broad-based securities market index/indices for the same period. The Funds’ performance information reflects applicable fee waivers and/or expense limitations in effect during the period presented. Absent such fee waivers/expense limitations, if any, performance would have been lower. The bar chart shows the performance of the Funds’ Class A shares. Sales charges are not reflected in the bar chart. If they were, returns would be less than those shown. However, the table includes all applicable fees and sales charges. Other class shares’ performance would be higher or lower than Class A shares’ performance because of the higher or lower expenses paid by Class A shares. The Funds’ past performance (before and after taxes) is no guarantee of future results. For the most recent performance figures, go to www.voyainvestments.com/literature or call 1-800-992-0180.

Because Class R shares of Growth Fund did not have a full calendar year of operations and Class R6 shares of Growth Fund had not commenced operations as of the calendar year ended December 31, 2014, no performance information for Class R shares or Class R6 shares is provided below.

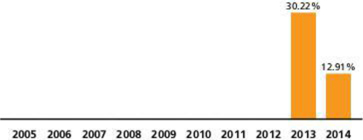

Large Cap Fund - Calendar Year Total Returns – Class A

(as of December 31 of each year) |

|

| |

| Best quarter: 4th, 2013, 9.89% and Worst quarter: 1st, 2014, -0.30% |

| The Fund’s Class A shares’ year-to-date total return as of March 31, 2015: 4.16% |

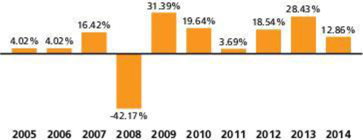

Growth Fund - Calendar Year Total Returns – Class A

(as of December 31 of each year) |

|

| |

| Best quarter: 1st, 2012, 17.72% and Worst quarter: 4th, 2008 -21.12% |

| The Fund’s Class A shares’ year-to-date total return as of March 31, 2015: 4.06% |

Average Annual Total Returns (for the periods ended December 31, 2014) |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Since

Inception | | | Inception

Date |

| Large Cap Fund | | | | | | | | | | | | | | | | | | | | |

| Class A before taxes | | % | | | 6.38 | | | | N/A | | | | N/A | | | | 13.69 | | | 03/01/12 |

| after tax on distributions | | % | | | 5.98 | | | | N/A | | | | N/A | | | | 13.26 | | | |

| after tax on distributions with sale | | % | | | 3.93 | | | | N/A | | | | N/A | | | | 10.62 | | | |

| Russell 1000® Growth Index1 | | % | | | 13.05 | | | | N/A | | | | N/A | | | | 16.92 | | | |

| Class C before taxes | | % | | | 11.17 | | | | N/A | | | | N/A | | | | 15.25 | | | 03/01/12 |

| Russell 1000® Growth Index1 | | % | | | 13.05 | | | | N/A | | | | N/A | | | | 16.92 | | | |

| Class I before taxes | | % | | | 13.39 | | | | N/A | | | | N/A | | | | 16.48 | | | 03/01/12 |

| Russell 1000® Growth Index1 | | % | | | 13.05 | | | | N/A | | | | N/A | | | | 16.92 | | | |

| Class R before taxes | | % | | | 12.73 | | | | N/A | | | | N/A | | | | 15.85 | | | 03/01/12 |

| Russell 1000® Growth Index1 | | % | | | 13.05 | | | | N/A | | | | N/A | | | | 16.92 | | | |

| Class R6 before taxes | | % | | | 13.40 | | | | N/A | | | | N/A | | | | 18.85 | | | |

| Russell 1000® Growth Index1 | | % | | | 13.05 | | | | N/A | | | | N/A | | | | 19.41 | | | |

| Class W before taxes | | % | | | 13.37 | | | | N/A | | | | N/A | | | | 16.42 | | | 03/01/12 |

| Russell 1000® Growth Index1 | | % | | | 13.05 | | | | N/A | | | | N/A | | | | 16.92 | | | |

| | | | | | | | | | | | | | | | | | | | | |

Average Annual Total Returns (for the periods ended December 31, 2014) |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Since

Inception | | | Inception

Date |

| Growth Fund | | | | | | | | | | | | | | | | | | | | |

| Class A before taxes | | % | | | 6.38 | | | | 14.98 | | | | 6.76 | | | | N/A | | | 07/21/97 |

| after tax on distributions | | % | | | 2.92 | | | | 13.78 | | | | 6.20 | | | | N/A | | | |

| after tax on distributions with sale | | % | | | 5.19 | | | | 11.74 | | | | 5.31 | | | | N/A | | | |

| Russell 1000® Growth Index1 | | % | | | 13.05 | | | | 15.81 | | | | 8.49 | | | | N/A | | | |

| Class C before taxes | | % | | | 11.15 | | | | 15.58 | | | | 6.69 | | | | N/A | | | 07/21/97 |

| Russell 1000® Growth Index1 | | % | | | 13.05 | | | | 15.81 | | | | 8.49 | | | | N/A | | | |

| Class I before taxes | | % | | | 13.26 | | | | 16.73 | | | | 7.80 | | | | N/A | | | 01/08/02 |

| Russell 1000® Growth Index1 | | % | | | 13.05 | | | | 15.81 | | | | 8.49 | | | | N/A | | | |

| Class W before taxes | | % | | | 13.19 | | | | 16.72 | | | | 7.67 | | | | N/A | | | 07/21/97 |

| Russell 1000® Growth Index1 | | % | | | 13.05 | | | | 15.81 | | | | 8.49 | | | | N/A | | | |

| 1. | The index returns do not reflect deductions for fees, expenses, or taxes. |

How do certain characteristics of the Funds compare?

The following table compares certain characteristics of the Funds as of November 30, 2014.

| | | Large Cap Fund | | Growth Fund |

| Net Assets | | $281 million | | $129 million |

| | | | | |

| Portfolio Turnover Rate | | 44% | | 32% |

| | | | | | | | | | | | | |

| Sector Diversification1 | | Information Technology | | | 28.5 | % | | Information Technology | | | 28.7 | % |

| (as a percentage of net assets) | | Consumer Discretionary | | | 20.7 | % | | Consumer Discretionary | | | 20.8 | % |

| | | Health Care | | | 16.7 | % | | Health Care | | | 16.7 | % |

| | | Industrials | | | 11.2 | % | | Industrials | | | 11.3 | % |

| | | Consumer Staples | | | 9.0 | % | | Consumer Staples | | | 9.0 | % |

| | | Financials | | | 5.3 | % | | Financials | | | 5.3 | % |

| | | Materials | | | 3.7 | % | | Materials | | | 3.7 | % |

| | | Energy | | | 3.3 | % | | Energy | | | 3.3 | % |

| | | Assets in Excess of Other Liabilities2 | | | 1.6 | % | | Assets in Excess of Other Liabilities2 | | | 1.2 | % |

| | | Net Assets | | | 100.0 | % | | Net Assets | | | 100.0 | % |

| | | | | | | | | | | | | |

| Top Ten Holdings1 | | Apple, Inc. | | | 6.3 | % | | Apple, Inc. | | | 6.5 | % |

| (as a percentage of net assets) | | Microsoft Corp. | | | 3.7 | % | | Microsoft Corp. | | | 3.7 | % |

| | | Home Depot, Inc. | | | 3.0 | % | | Home Depot, Inc. | | | 3.0 | % |

| | | PepsiCo, Inc. | | | 3.0 | % | | PepsiCo, Inc. | | | 3.0 | % |

| | | Amazon.com, Inc. | | | 2.6 | % | | Amazon.com, Inc. | | | 2.6 | % |

| | | Comcast Corp. – Class A | | | 2.4 | % | | Comcast Corp. – Class A | | | 2.4 | % |

| | | Google, Inc. – Class A | | | 2.3 | % | | Google, Inc. – Class A | | | 2.3 | % |

| | | AbbVie, Inc. | | | 2.3 | % | | AbbVie, Inc. | | | 2.3 | % |

| | | McKennson Corp. | | | 2.2 | % | | McKennson Corp. | | | 2.2 | % |

| | | Walt Disney Co. | | | 2.2 | % | | Walt Disney Co. | | | 2.2 | % |

| 1. | Portfolio holdings are subject to change daily. |

| 2. | Includes short-term investments. |

How does the management of the Funds compare?

The following table describes the management of the Funds.

| | | Large Cap Fund | | Growth Fund |

| Investment Adviser | | Voya Investments, LLC (“Voya Investments” or “Adviser”) | | Voya Investments |

Management Fee (as a percentage of average daily net assets) | | 0.80% | | 0.800% on the first $500 million; 0.775% on the next $500 million; and 0.750% thereafter |

| | | | | |

| Sub-Adviser | | Voya Investment Management Co. LLC (“Voya IM” or Sub-Adviser”) | | Voya IM |

| | | | | |

Sub-Advisory Fee (as a percentage of average daily net assets) | | 0.315% | | 0.338% on the first $500 million; 0.304% on the next $500 million; and 0.293% on assets in excess of $1 billion |

| | | | | |

| Portfolio Managers | | Jeffrey Bianchi, CFA (since 02/12) Christopher F. Corapi (since 02/12) Michael Pytosh (since 02/12) | | Jeffrey Bianchi, CFA (since 01/09) Christopher F. Corapi (since 04/10) Michael Pytosh (since 04/12) |

| | | | | |

| Distributor | | Voya Investments Distributors, LLC (“Distributor”) | | Distributor |

Adviser to the Funds

Voya Investments, an Arizona limited liability company, serves as the investment adviser to the Funds. Voya Investments provides or oversees all investment advisory and portfolio management services for the Funds and assists in managing and supervising all aspects of the general day-to-day business activities and operations of the Funds, including custodial, transfer agency, dividend disbursing, accounting, auditing, compliance, and related services. Voya Investments is registered with the SEC as an investment adviser.

The Adviser is an indirect, wholly-owned subsidiary of Voya Financial, Inc. (formerly, ING U.S., Inc.) Voya Financial, Inc. is a U.S.-based financial institution whose subsidiaries operate in the retirement, investment, and insurance industries.

Voya Investments’ principal office is located at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258. As of March 31, 2015, Voya Investments managed approximately $55.5 billion in assets.

Prior to May 2013, Voya Financial, Inc. was a wholly-owned subsidiary of ING Groep N.V. (“ING Groep”). In October 2009, ING Groep submitted a restructuring plan (the “Restructuring Plan”) to the European Commission in order to receive approval for state aid granted to ING Groep by the Kingdom of the Netherlands in November 2008 and March 2009. To receive approval for this state aid, ING Groep was required to divest its insurance and investment management businesses, including Voya Financial, Inc., before the end of 2013. In November 2012, the Restructuring Plan was amended to permit ING Groep additional time to complete the divestment. Pursuant to the amended Restructuring Plan, ING Groep was required to divest at least 25% of Voya Financial, Inc. by the end of 2013 and more than 50% by the end of 2014, and was required to divest the remaining interest by the end of 2016 (such divestment, the “Separation Plan”).

In May 2013, Voya Financial, Inc. conducted an initial public offering of its common stock (the “IPO”). In October 2013, March 2014, and September 2014, ING Groep divested additional shares in several secondary offerings of common stock of Voya Financial, Inc. and concurrent share repurchases by Voya Financial, Inc. These transactions reduced ING Groep’s ownership interest in Voya Financial, Inc. to 32%. Voya Financial, Inc. did not receive any proceeds from these offerings.

In November 2014, through an additional secondary offering and the concurrent repurchase of shares by Voya Financial, Inc., ING Groep further reduced its interest in Voya Financial, Inc. below 25% to approximately 19% (the “November 2014 Offering”). The November 2014 Offering was deemed by the Adviser to be a change of control (the “Change of Control”), which resulted in the automatic termination of the existing investment advisory and sub-advisory agreements under which the Adviser and sub-advisers provide services to the Portfolios. In anticipation of this termination, and in order to ensure that the existing investment advisory and sub-advisory services could continue uninterrupted, in 2013 the Board approved new advisory and sub-advisory agreements for the Funds in connection with the IPO. In addition, in 2013, shareholders of each Fund approved new investment advisory and affiliated sub-advisory agreements prompted by the IPO, as well as any future advisory and affiliated sub-advisory agreements prompted by the Separation Plan that are approved by the Board and that have terms not materially different from the current agreements. This meant that shareholders would not have another opportunity to vote on a new agreement with the Adviser or a current affiliated sub-adviser even upon a change of control prompted by the Separation Plan, as long as no single person or group of persons acting together gains “control” (as defined in the 1940 Act) of Voya Financial, Inc.

On November 18, 2014, in response to the Change of Control, the Board, at an in-person meeting, approved new investment advisory and sub-advisory agreements. At that meeting, the Adviser represented that the investment advisory and affiliated sub-advisory agreements approved by the Board were not materially different from the agreements approved by shareholders in 2013 and no single person or group of persons acting together was expected to gain “control” (as defined in the 1940 Act) of Voya Financial, Inc. As a result, shareholders of the Funds will not be asked to vote again on these new agreements with the Adviser and affiliated sub-advisers.

In March 2015, ING Groep divested the remainder of its interest in Voya Financial, Inc. through a secondary offering of common stock of Voya Financial, Inc. and a concurrent share repurchase by Voya Financial, Inc. Voya Financial, Inc. did not receive any proceeds from this transaction.

Sub-Adviser to the Funds

The Adviser has engaged a sub-adviser to provide the day-to-day management of each Fund’s portfolio. The sub-adviser is an affiliate of the Adviser.

The Adviser acts as a “manager-of-managers” for the Funds. The Adviser has ultimate responsibility, subject to the oversight of the Funds’ Board, to oversee any sub-advisers and to recommend the hiring, termination, or replacement of sub-advisers. The Funds and the Adviser have received exemptive relief from the SEC which permits the Adviser, with the approval of the Funds’ Board but without obtaining shareholder approval, to enter into or materially amend a sub-advisory agreement with sub-advisers that are not affiliated with the Adviser (“non-affiliated sub-advisers”) as well as sub-advisers that are indirect or direct, wholly-owned subsidiaries of the Adviser or of another company that, indirectly or directly wholly owns the Adviser (“wholly-owned sub-advisers”

Consistent with the “manager-of-managers” structure, the Adviser delegates to the sub-advisers of the Funds the responsibility for day-to-day investment management subject to the Adviser’s oversight. The Adviser is responsible for, among other things, monitoring the investment program and performance of the sub-advisers of the Funds. Pursuant to the exemptive relief, the Adviser, with the approval of the Funds’ Board, has the discretion to terminate any sub-adviser (including terminating a non-affiliated sub-adviser and replacing it with a wholly-owned sub-adviser), and to allocate and reallocate the Funds’ assets among other sub-advisers. In these instances, the Adviser may have an incentive to select or retain an affiliated sub-adviser. In the event that the Adviser exercises its discretion to replace a sub-adviser of a Fund or add a new sub-adviser to a Fund, the Fund will provide shareholders with information about the new sub-adviser and the new sub-advisory agreement within 90 days. The appointment of a new sub-adviser or the replacement of an existing sub-adviser may be accompanied by a change to the name of a Fund and a change to the investment strategies of the Fund.

Under the terms of each sub-advisory agreement, the agreement can be terminated by the Adviser or a Fund’s Board. In the event a sub-advisory agreement is terminated, the sub-adviser may be replaced subject to any regulatory requirements or the Adviser may assume day-to-day investment management of a Fund.

The “manager-of-managers” structure and reliance on the exemptive relief has been approved by each Fund’s shareholders.

Voya Investment Management Co. LLC

Voya IM, a Delaware limited liability company, was founded in 1972 and is registered with the SEC as an investment adviser. Voya IM is an indirect, wholly-owned subsidiary of Voya Financial, Inc. and is an affiliate of the Adviser. Voya IM has acted as adviser or sub-adviser to mutual funds since 1994 and has managed institutional accounts since 1972. Voya IM’s principal office is located at 230 Park Avenue, New York, New York 10169. As of March 31, 2015, Voya IM managed approximately $87 billion in assets.

The following individuals are jointly responsible for the day-to-day management of the Funds.

Jeffrey Bianchi, CFA, Portfolio Manager of Voya IM’s large cap growth and mid cap growth strategies, joined Voya IM in 1994 as a quantitative analyst and later became a fundamental research analyst in 1995. Mr. Bianchi has had primary responsibility for the health care sector as well as other growth sectors, including technology and consumer. He assumed assistant portfolio management duties on the large cap growth strategy in 2000, and was named a portfolio manager on the strategy in 2008. He also assumed portfolio manager responsibilities of the mid cap growth strategy in 2005.

Christopher F. Corapi, Portfolio Manager and Chief Investment Officer of equities, joined Voya IM in February 2004. Prior to joining Voya IM, Mr. Corapi served as global head of equity research at Federated Investors since 2002. He served as head of U.S. equities and portfolio manager at Credit Suisse Asset Management beginning in 2000 and head of emerging markets research at JPMorgan Investment Management beginning in 1998.

Michael Pytosh, Portfolio Manager and Head of Equities, joined Voya IM in 2004 as a senior analyst covering the technology sector. Prior to 2004, Mr. Pytosh was with Lincoln Equity Management, LLC, since 1996, where he started as a technology analyst and ultimately took on the role of the firm’s president. Prior to that, Mr. Pytosh was a technology analyst at JPMorgan Investment Management and an analyst at Lehman Brothers.

Distributor

Voya Investments Distributor, LLC (formerly, ING Investments Distributor, LLC) (“Distributor”) is the principal underwriter and distributor of each Fund. It is a Delaware limited liability company with its principal offices at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258.

The Distributor is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”). To obtain information about FINRA member firms and their associated persons, you may contact FINRA at www.finra.org or the Public Disclosure Hotline at 800-289-9999.

What are the key differences in the rights of shareholders of Large Cap Fund and Growth Fund?

Large Cap Fund is organized as a separate series of Voya Series Fund, Inc., an open-end management investment company organized as a Maryland corporation. Growth Fund is organized as a separate series of Voya Equity Trust, an open-end management investment company organized as a Massachusetts business trust. The Funds are governed by a Board of Trustees/Directors consisting of 11 members. For more information on the history of the Funds, please see Growth Fund’s Statements of Additional Information dated September 30, 2014 for Class A, Class C, Class I, Class R, and Class W shares and dated May 26, 2015 for Class R6 shares and Large Cap Fund’s Statement of Additional Information dated September 30, 2014.

| Large Cap Fund | | Growth Fund |

| At any meeting of shareholders duly called for the purpose, shareholders shall elect Directors by a majority vote. | | Trustees shall be elected by the shareholders owning of record a plurality of the shares voting a meeting of shareholders duly called for the purpose. |

| | | |

| At any meeting of shareholders duly called for the purpose, any Director may, by the vote of a majority of all of the shares entitled to vote be removed from office. | | A Trustee may be removed at any meeting of shareholders by two-thirds vote of the outstanding shares. |

| | | |

| In general, the Board may approve the liquidation of a series or class of the Corporation without the approval of shareholders. The Corporation may be dissolved upon a vote of a majority of the outstanding shares. | | The Trust or any series of the Trust may be terminated by a majority of the Trustees, or by the affirmative vote of the holders of a majority of the shares of the trust or series outstanding and entitled to vote, at any meeting of shareholders. |

| | | |

| In general, the transfer of all or substantially all of the assets of a Maryland corporation registered as an open-end investment company under the 1940 Act does not require shareholder approval. | | Consolidation or merger shall require the approval of a majority shareholder vote of each series affected thereby. The terms “merge” or “merger” as used therein shall not include the purchase or acquisition of any assets of any other trust, partnership, association or corporation which is an investment company organized under the laws of the Commonwealth of Massachusetts or any other state of the United States. |

| | | |

| In general, amendments to the Articles of Incorporation must be approved by the Board and by the affirmative vote of a majority of the outstanding shares, except that no action affecting the validity or assessibility of such shares shall be taken without the unanimous approval of the outstanding shares affected thereby. | | The Declaration of Trust may be amended by a vote of the holders of a majority of the shares outstanding and entitled to vote at a meeting of shareholders called for the purpose. No amendment may be made which would change any rights with respect to any shares of the Trust or series by reducing the amount payable thereon upon liquidation of the Trust or series or by diminishing or eliminating any voting rights pertaining thereto, except with the vote or consent of the holders of two-thirds of the shares of the Trust or series outstanding and entitled to vote. |

| | | |

| The Board has the power to amend the Bylaws. | | Both shareholders and the Trustees have the power to amend the Bylaws. |

Because Growth Fund is organized as a series of a Massachusetts business trust and Large Cap Fund is organized as a series of a Maryland corporation, there are some differences between the rights of shareholders of each Fund under state law. Under Massachusetts law, shareholders of a Massachusetts business trust could, under certain circumstances, be held personally liable for the obligations of the business trust. However, Growth Fund’s Declaration of Trust disclaims shareholder liability in connection with Trust property or the acts, obligations or affairs of the Trust. It also provides for indemnification by the Trust of any shareholder (or former shareholder) from and against all claims and liabilities to which such shareholder may become subject by reason of being or having been a shareholder. Pursuant to Maryland law, shareholders of Large Cap Fund generally have no personal liability as such for the Fund’s acts, obligations or affairs.

Additional Information about the Funds

Dividends and Other Distributions

The Funds generally distribute most or all of their net earnings in the form of dividends, consisting of ordinary income and capital gains distributions. Each Fund distributes capital gains, if any, annually. Each Fund also declares dividends and pays dividends consisting of ordinary income, if any, annually.

To comply with federal tax regulations, the Funds may also pay an additional capital gains distribution.

Capitalization

The following table shows on an unaudited basis the capitalization of each of the Funds as of November 30, 2014 and on a pro forma basis as of November 30, 2014, giving effect to the Reorganization.

| | | Large Cap Fund | | | Growth Fund | | | Adjustments | | | Growth Fund Pro Forma | |

| Class A | | | | | | | | | | | | | | | | |

| Net Assets | | $ | 2,958,605 | | | | 67,072,667 | | | | - | | | | 70,031,272 | |

| Net Asset Value Per Share | | $ | 15.07 | | | | 35.80 | | | | - | | | | 35.80 | |

| Shares Outstanding | | | 196,389 | | | | 1,873,486 | | | | (113,746 | )1 | | | 1,956,129 | |

| | | | | | | | | | | | | | | | | |

| Class C | | | | | | | | | | | | | | | | |

| Net Assets | | $ | 2,331,463 | | | | 26,784,098 | | | | - | | | | 29,115,561 | |

| Net Asset Value Per Share | | $ | 14.81 | | | | 32.37 | | | | - | | | | 32.37 | |

| Shares Outstanding | | | 157,415 | | | | 827,458 | | | | (85,390 | )1 | | | 899,483 | |

| | | | | | | | | | | | | | | | | |

| Class I | | | | | | | | | | | | | | | | |

| Net Assets | | $ | 240,318,945 | | | | 30,456,189 | | | | - | | | | 270,775,134 | |

| Net Asset Value Per Share | | $ | 15.17 | | | | 38.47 | | | | - | | | | 38.47 | |

| Shares Outstanding | | | 15,842,167 | | | | 791,702 | | | | (9,595,249 | )1 | | | 7,038,620 | |

| | | | | | | | | | | | | | | | | |

| Class R | | | | | | | | | | | | | | | | |

| Net Assets | | $ | 580,650 | | | | 3,321 | | | | - | | | | 583,971 | |

| Net Asset Value Per Share | | $ | 15.04 | | | | 38.42 | | | | - | | | | 38.42 | |

| Shares Outstanding | | | 38,601 | | | | 86 | | | | (23,488 | )1 | | | 15,199 | |

| | | | | | | | | | | | | | | | | |

| Class R6 | | | | | | | | | | | | | | | | |

| Net Assets | | $ | 33,064,766 | | | | N/A | 2 | | | - | | | | 33,064,766 | |

| Net Asset Value Per Share | | $ | 15.18 | | | | N/A | 2 | | | - | | | | 15.18 | |

| Shares Outstanding | | | 2,178,682 | | | | N/A | 2 | | | - | | | | 2,178,682 | |

| | | | | | | | | | | | | | | | | |

| Class W | | | | | | | | | | | | | | | | |

| Net Assets | | $ | 1,634,212 | | | | 3,544,430 | | | | - | | | | 5,178,642 | |

| Net Asset Value Per Share | | $ | 15.15 | | | | 37.76 | | | | - | | | | 37.76 | |

| Shares Outstanding | | | 107,857 | | | | 93,861 | | | | (64,578 | )1 | | | 137,140 | |

| 1. | Reflects new shares issued, net of retired shares of Large Cap Fund. (Calculation: Net Assets ÷ NAV per share.) |

| 2. | As of November 30, 2014, Class R6 had not commenced operations. |

Additional Information about the Reorganization

The Reorganization Agreement

The terms and conditions under which the proposed transaction may be consummated are set forth in the Reorganization Agreement. Significant provisions of the Reorganization Agreement are summarized below; however, this summary is qualified in its entirety by reference to the Reorganization Agreement, a form of which is attached to this Proxy Statement/Prospectus as Appendix A.

The Reorganization Agreement provides for: (i) the transfer, as of the Closing Date, of all of the assets of Large Cap Fund in exchange for shares of beneficial interest of Growth Fund and the assumption by Growth Fund of all of Large Cap Fund’s liabilities; and (ii) the distribution of shares of Growth Fund to shareholders of Large Cap Fund, as provided for in the Reorganization Agreement. Large Cap Fund will then be liquidated.

Each shareholder of Class A, Class C, Class I, Class R, Class R6, and Class W shares of Large Cap Fund will hold, immediately after the Closing, the corresponding share class shares of Growth Fund having an aggregate value equal to the aggregate value of the shares of Large Cap Fund held by that shareholder as of the close of business on the Closing Date.

The obligations of the Funds under the Reorganization Agreement are subject to various conditions, including approval of the shareholders of Large Cap Fund and that each Fund receives an opinion from the law firm of Ropes & Gray LLP to the effect that the Reorganization will qualify as a tax-free reorganization for federal income tax purposes. The Reorganization Agreement also requires that each of the Funds take, or cause to be taken, all actions, and do or cause to be done, all things reasonably necessary, proper or advisable to consummate and make effective the transactions contemplated by the Reorganization Agreement. The Reorganization Agreement may be terminated by mutual agreement of the parties or by one party on certain other grounds. Please refer to Appendix A to review the terms and conditions of the Reorganization Agreement.

Expenses of the Reorganization

The expenses of the Reorganization will be paid by the Adviser (or an affiliate). The expenses of the Reorganization are one-time, nonrecurring and include, but are not limited to, the costs associated with the preparation of necessary filings with the SEC, printing and distribution of the Proxy Statement/Prospectus and proxy materials, legal fees, accounting fees, securities registration fees, and expenses of holding the Special Meeting. The expenses of the Reorganization are estimated to be $179,000 and do not include the transition costs described in “Portfolio Transitioning” below.

Portfolio Transitioning

As discussed above, the Funds have substantially identical principal investment strategies. As a result, Voya IM does not anticipate that it will need to sell a significant portion of Large Cap Fund’s holdings if the Reorganization is approved by shareholders. If any of Large Cap Fund’s holdings are sold prior to the Closing Date, the proceeds of such sales are expected to be invested in securities that Voya IM wishes for Growth Fund to hold and in temporary investments, which will be delivered to Growth Fund at the Closing Date.

Costs of portfolio transitions are measured using implementation shortfall, which measures the change between the market value of a fund at the close of the market the day before any trading related to the portfolio transition occurs and the actual price at which the trades are executed during the portfolio transition. Implementation shortfall includes both explicit and implicit transition costs. The explicit costs include brokerage commissions, fees, and taxes. No explicit transition costs are expected to be incurred in connection with the Reorganization; however, to the extent such explicit costs are incurred they will be paid by the Adviser or its affiliates. All the other costs of transitioning the Funds are considered implicit costs. These include spread costs, market impact costs, and opportunity costs. Quantifying implicit costs is difficult and involves some degree of subjective determinations. These implicit costs will be borne by the Funds.

During the transition period, Large Cap Fund might not be pursuing its investment objective and strategies, and limitations on permissible investments and investment restrictions will not apply. After the Closing Date of the Reorganization, Voya IM, as the sub-adviser to Growth Fund, may also sell portfolio holdings that it acquired from Large Cap Fund, and Growth Fund may not be immediately fully invested in accordance with its stated investment strategies. In addition, each Fund may engage in a variety of transition management techniques to facilitate the portfolio transition process, including without limitation, the purchase and sale of baskets of securities and exchange-traded funds, and enter into and close futures contracts or other derivative transactions. Such sales and purchases by the Fund during the transition period may be made at a disadvantageous time and could result in potential losses to the Funds.

Tax Considerations

The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under Section 368 of the Code. Accordingly, pursuant to this treatment, neither Large Cap Fund nor its shareholders, nor Growth Fund nor its shareholders, are expected to recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Reorganization Agreement. As a condition to the closing of the Reorganization, the Funds will receive an opinion from tax counsel to the effect that, on the basis of existing provisions of the Code, U.S. Treasury Regulations promulgated thereunder, current administrative rules, pronouncements and court decisions, and subject to certain qualifications, the Reorganization will qualify as a tax-free reorganization for federal income tax purposes.

Because the Reorganization will end the tax year of the Large Cap Fund, it will accelerate distributions to shareholders from Large Cap Fund for its short tax year ending on the date of the Reorganization. Those tax year-end distributions will be taxable and will include any capital gains resulting from portfolio transitions in connection with and prior to the Reorganization that were not previously distributed.

Prior to the Closing Date, Large Cap Fund will pay to shareholders a distribution consisting of any undistributed investment company taxable income, any net tax-exempt income, and/or any undistributed realized net capital gains, including any net gains realized from any sales of assets prior to the Closing Date, including portfolio transitions in connection with the Reorganization. This distribution would be taxable to shareholders that are subject to tax.

As of December 31, 2014, neither Large Cap Fund nor Growth Fund had any capital loss carry forwards. In general, after the Reorganization, any losses of Large Cap Fund and Growth may be available to the combined fund, to offset its capital gains, although the amount of Growth Fund’s pre-Reorganization losses that may offset the combined fund’s capital gains in any given year may be limited due to this Reorganization. In addition, one Fund’s pre-acquisition losses cannot be used to offset unrealized gains in the other Fund that are “built in” at the time of the Reorganization and that exceed certain thresholds for five tax years. The ability of Growth Fund to use its or Large Cap Fund’s losses in the future depends on a variety of factors that

cannot be known in advance, including the existence of capital gains against which these losses may be offset. In addition, the benefits of any capital loss carryforwards and built in losses currently are available only to pre-Reorganization shareholders of each Fund. After the Reorganization, the benefit associated with any available capital losses will inure to the benefit of all post-Reorganization shareholders of Growth Fund. Furthermore, the shareholders of Large Cap Fund will receive a proportionate share of any unrealized gains in Growth Fund’s assets, as well as any taxable gains realized by Growth Fund, but not distributed to its shareholders prior to the Reorganization, when such gains are eventually distributed by Growth Fund.

This description of the federal income tax consequences of the Reorganization is made without regard to the particular facts and circumstances of any shareholder. Shareholders are urged to consult their own tax advisers as to the specific consequences to them of the Reorganization in light of their individual circumstances, and as to the applicability and effect of state, local, non-U.S., and other tax laws.

What is the Board’s recommendation?

Based upon its review, the Board, including a majority of the Trustees/Directors who are not “interested persons,” as defined by the 1940 Act (the “Independent Trustees/Directors”), determined that the Reorganization would be in the best interests of the Funds and their shareholders. In addition, the Board determined that the interests of the shareholders of the Funds would not be diluted as a result of the Reorganization.

Accordingly, after consideration of such factors and information it considered relevant, the Board, including a majority of the Independent Trustees/Directors approved the Reorganization Agreement and voted to recommend to shareholders that they approve the Reorganization Agreement. The Board is therefore recommending that Large Cap Fund’s shareholders vote “FOR” the Reorganization Agreement.

What factors did the Board consider?

The Board considered the Reorganization as part of its overall consideration of what would be in the best interest of Large Cap Fund and its shareholders. The Board determined that Large Cap Fund would benefit from being combined into Growth Fund under the day-to-day management of Voya IM.