September 13, 2022

Voya Investment Management

Client Talking Points

Voya SmallCap Opportunities Fund

Voya Investment Management has announced the following changes:

| | | | |

| Reorganization | October 7, 2022 | Voya SmallCap Opportunities | Voya Small Cap Growth Fund |

| Fund |

| | | |

| | | | |

The Board of Directors/Trustees (the "Board") of Voya SmallCap Opportunities Fund ("SCO Fund") and Voya Small Cap Growth Fund ("SCG Fund", and together with SCO Fund, the "Funds") approved an Agreement and Plan of Reorganization ("Reorganization Agreement"), which provides for the reorganization of SCO Fund within and into SCG Fund (the "Merger" or "Reorganization"). The approval of shareholders of SCO Fund is required before the Merger may take place.

▪What is happening?

oOn March 24, 2022, the Board approved the Reorganization Agreement.

oShareholders of SCO Fund were sent a combined proxy statement and prospectus on or about

July 22, 2022.

oA shareholder meeting will be held on or about September 27, 2022.

oPending shareholder approval, the Merger will occur as of the close of business on or about October 7, 2022 or such other date as the parties to the Reorganization Agreement may agree

(the "Closing Date").

oVoya Investment Management Co. LLC ("Voya IM") serves as sub-adviser to both SCO Fund and SCG Fund. If the Merger is approved, shareholders of SCO Fund will become shareholders of

SCG Fund as of the close of business on the Closing Date.

oA prospectus supplement was filed on April 4, 2022 to notify shareholders of the changes.

▪Why is the Merger proposed?

oEffective January 1, 2022, Voya IM acquired the investment advisory business of Tygh Capital

Management ("Tygh Capital") and Tygh Capital's portfolio management team became employees of Voya IM.

Client Talking Points

oIn connection with the acquisition, effective February 1, 2022, Tygh Capital's portfolio management assumed portfolio management responsibility for SCO Fund and SCO Fund's investment strategies were changed to their current form.

oOn March 15, 2022, shareholders of TCM Small Cap Growth Fund (the "TCM Fund" or the "Predecessor Fund") approved the reorganization of the TCM Fund with and into SCG Fund, a newly organized "shelf" fund. TCM Fund merged with and into SCG Fund on April 1, 2022.

oSCG Fund commenced operations on April 4, 2022.

oDue to the February 1, 2022 strategy change implemented for SCO Fund, both Funds have substantially similar strategies and investment risks.

oBoth Funds have the same portfolio management team.

oThe Merger would provide SCO Fund shareholders with a benefit through lower management fees and lower or identical net expenses.

oThe Merger was determined to be in the best interest of shareholders by the Board after a review of several factors.

▪Below is the share class mapping for the proposed Reorganization

| Merging Fund and Share Class | Ticker | Surviving Fund and Share Class | Ticker |

| Voya SmallCap Opportunities Fund | NSPAX | Voya Small Cap Growth Fund – | VWYFX |

| – Class A | Class A |

| |

| | |

| | | | |

| Voya SmallCap Opportunities Fund | NSPCX | Voya Small Cap Growth Fund – | VWYGX |

| – Class C | Class C |

| |

| | |

| | | | |

| Voya SmallCap Opportunities Fund | NSPIX | Voya Small Cap Growth Fund – | TCMSX |

| – Class I | Class I |

| |

| | |

| | | | |

| Voya SmallCap Opportunities Fund | VSOPX | Voya Small Cap Growth Fund – | N/A1 |

| – Class P3 | Class P31 |

| |

| | |

| | | | |

| Voya SmallCap Opportunities Fund | ISORX | Voya Small Cap Growth Fund – | VWYIX |

| – Class R | Class R |

| |

| | |

| | | | |

| Voya SmallCap Opportunities Fund | ISOZX | Voya Small Cap Growth Fund – | VLNPX |

| – Class R6 | Class R6 |

| |

| | |

| | | | |

| Voya SmallCap Opportunities Fund | ISOWX | Voya Small Cap Growth Fund – | VWYKX |

| – Class W | Class W |

| |

| | |

| | | | |

1.Although referenced in the proxy statement distributed to shareholders Class P3 shares on Voya Small Cap Growth Fund will not be launched and the share class will be dissolved.

▪How do the Investment Objectives compare?

| | SCO Fund | SCG Fund |

| Investment | The Fund seeks capital appreciation | The Fund seeks long-term capital appreciation |

| Objective |

| | |

▪What is the experience of the Voya Investment Management Co. LLC Team?

SCG Fund will be managed by Richard J. Johnson, CFA, Mitchell S. Brivic, CFA, Michael C. Coyne, CFA and Scott W. Haugan, CFA.

Client Talking Points

Richard J. Johnson, CFA

Richard J. Johnson, CFA, Portfolio Manager, joined Voya IM in 2022. Previously, Mr. Johnson was the chief executive officer and chief investment officer of Tygh Capital Management from 2004-2022. Prior to forming Tygh Capital Management, Mr. Johnson was the CIO for Columbia Management's Portland equity team and lead portfolio manager for the small/mid cap team from 1994-2004.

Mitchell S. Brivic, CFA

Mitchell S. Brivic, CFA, Portfolio Manager, joined Voya IM in 2022. Previously, Mr. Brivic was a vice president of Tygh Capital Management and a member of its investment team since 2004 and a portfolio manager since 2018. Prior to joining Tygh Capital Management in 2004, he worked at Columbia Management from 2002-2004 focusing exclusively on small/mid cap equities.

Michael C. Coyne, CFA

Michael C. Coyne, CFA, Portfolio Manager, joined Voya IM in 2022. Previously, Mr. Coyne was a vice president of Tygh Capital Management and a member of its investment team since 2004 and a portfolio manager since 2018. Prior to joining Tygh Capital Management in 2004, he worked at Columbia Management from 2002-2004 focusing exclusively on small/mid cap equities. Mr. Coyne has four additional years of experience as a financial analyst with Capital Resource Partners and Bear Stearns.

Scott W. Haugan, CFA

Scott W. Haugan, CFA, Portfolio Manager, joined Voya IM in 2022. Previously, Mr. Haugan was a vice president of Tygh Capital Management and a member of its investment team since 2007 and a portfolio manager since 2021. Prior to joining Tygh Capital Management in 2007, he worked at Columbia Management from 2003-2005 as a research analyst and also held equity analyst/institutional sales positions at Pacific Crest Securities from 2000-2003 and First Analysis Securities from 2005-2007.

▪How do the Annual Portfolio Operating Expenses compare?

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Funds. Pro forma fees and expenses, which are the estimated fees and expenses of SCG Fund after giving effect to the Reorganization, assuming the Reorganization occurred on November 30, 2021.

Shareholders of SCO Fund will not pay any sales charges or redemption fees in connection with the Reorganization.

Client Talking Points

2.The Adviser is contractually obligated to limit expenses to 1.50%, 2.25%, 1.15%, 0.00%, 1.75%, 1.05% and 1.25% for Class A, Class C, Class I, Class P3, Class R, Class R6 and Class W shares of SCO Fund, respectively, through October 1, 2024. The limitation does not extend to interest, taxes, investment related costs, leverage expenses, extraordinary expenses, and Acquired Fund Fees and Expenses. This limitation is subject to possible recoupment by the Adviser and Distributor within 36 months of the waiver or reimbursement, however following the Reorganization such recoupment will no longer be available with respect to amounts waived or reimbursed to SCO Fund. Termination or modification of this obligation requires approval by the Fund's Board.

3.The Adviser is contractually obligated to further limit expenses to 1.30%, 2.05%, 0.95%, 1.55%, 0.85% and 1.05% for Class A, Class C, Class I, Class R, Class R6 and Class W shares of SCO Fund, respectively, through October 1, 2024. The limitation does not extend to interest, taxes, investment-related costs, leverage expenses, extraordinary expenses, and Acquired Fund Fees and Expenses. This limitation is subject to possible recoupment by the Adviser and Distributor within 36 months of the waiver or reimbursement. Termination or modification of this obligation requires approval by the Fund's Board.

4.Class A, C, P3, R, T and W shares on SCG Fund will be formed as part of the Reorganization. Such classes are not currently offered but will be offered at the time of the Reorganization.

5.The Adviser is contractually obligated to limit expenses to 0.95%, and 0.85% for Class I and Class R6 shares of SCG Fund, respectively, through October 1, 2024. The limitation does not extend to interest, taxes, investment-related costs, leverage expenses, extraordinary expenses, and Acquired Fund Fees and Expenses. This limitation is subject to possible recoupment by the Adviser and Distributor within 36 months of the waiver or reimbursement. Termination or modification of this obligation requires approval by the Fund's Board.

6.If the Reorganization is approved, the Adviser would be contractually obligated to limit expenses to 1.30%, 2.05%, 0.95%, 0.00% 1.55%, 0.85% and 1.05% for Class A, Class C, Class I, Class P3, Class R, Class R6 and Class W shares, respectively, through October 1, 2024. The limitation does not extend to interest, taxes, investment-related costs, leverage expenses, extraordinary expenses, and Acquired Fund Fees and Expenses. This limitation is subject to possible recoupment by the Adviser and Distributor within 36 months of the waiver or reimbursement however, such recoupment will be limited to the lesser of any expense limitation in place at the time of recoupment or the expense limitation in place at the time of waiver or reimbursement. Termination or modification of this obligation requires approval by the Fund's Board.

7.Acquired Fund Fees and Expenses are based on estimated amounts for the current fiscal year.

Client Talking Points

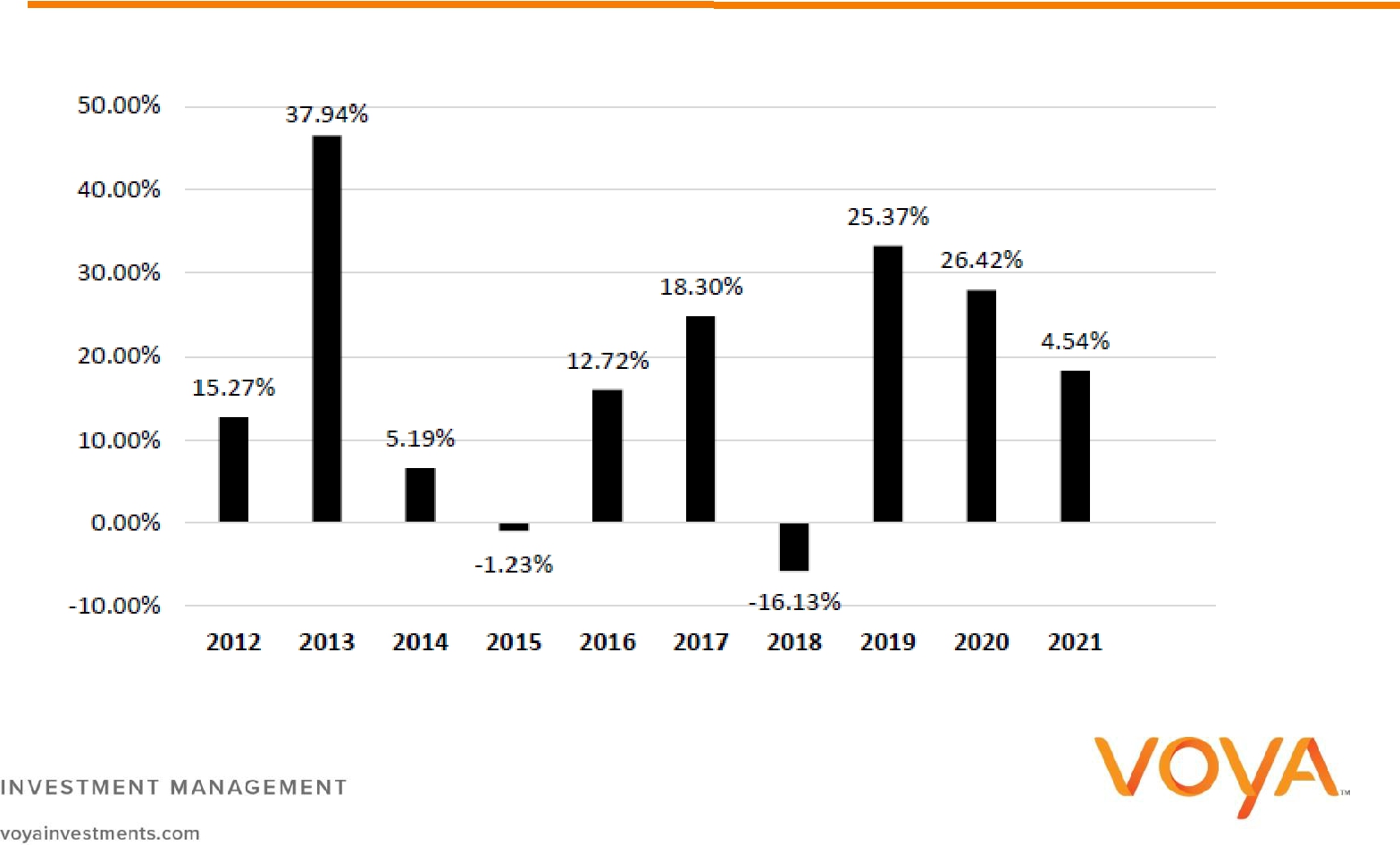

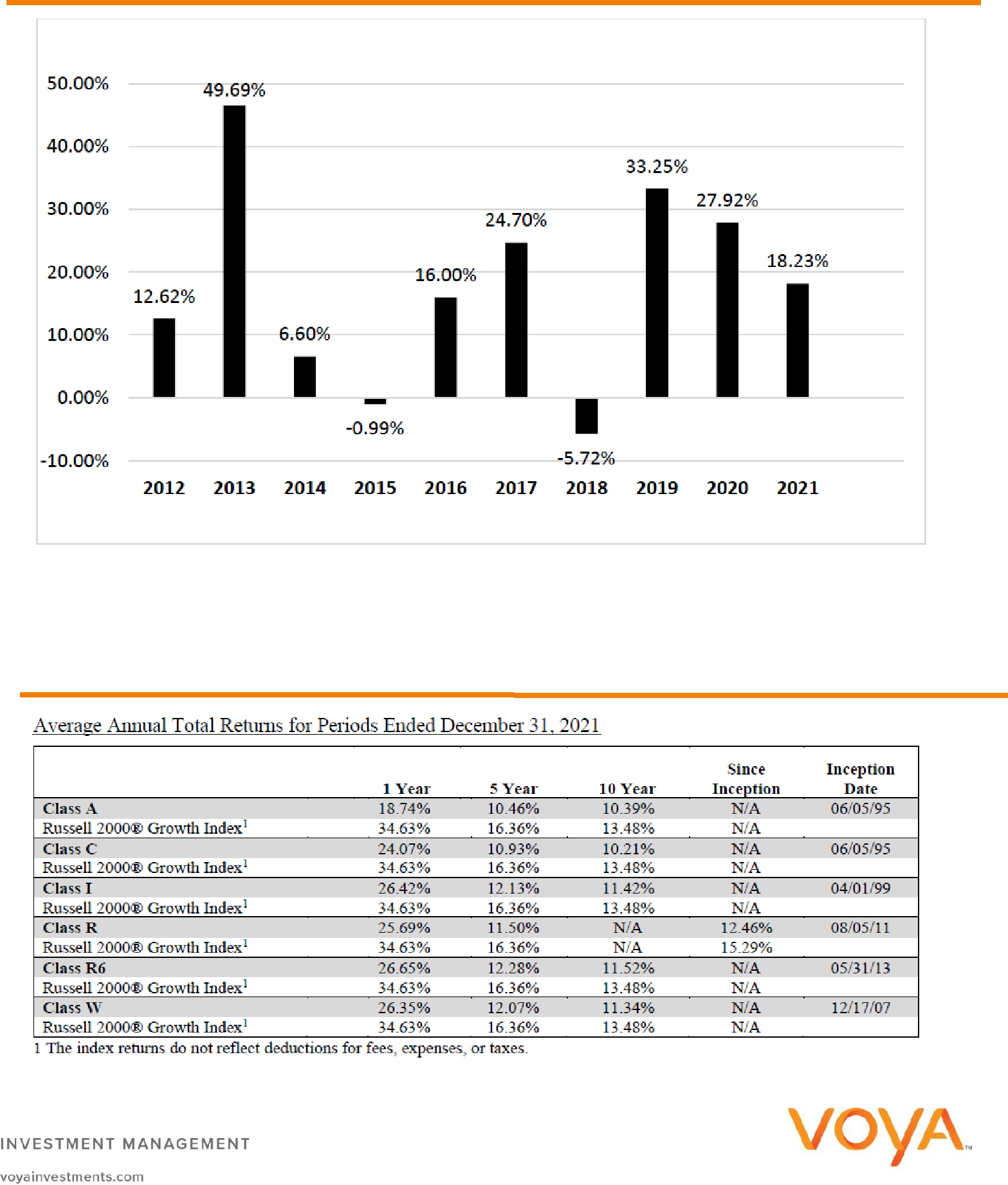

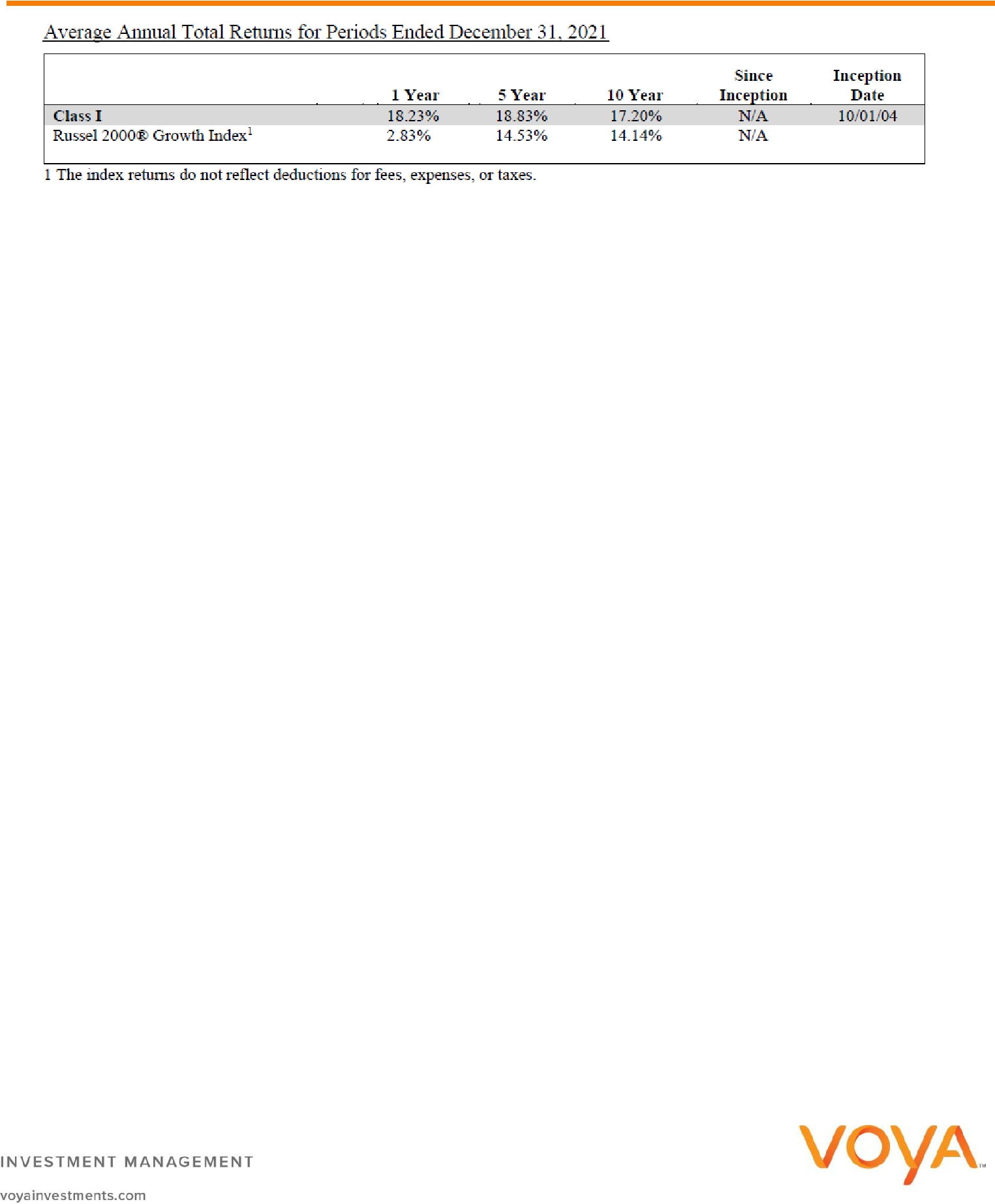

▪How does Voya SmallCap Opportunities Fund's performance compare to Voya Small Cap Growth Fund?

The following information is intended to help you understand the risks of investing in the Funds. The following bar charts show the changes in the Funds' performance from year to year, and the table compares each Fund's performance to the performance of a broad-based securities market index/indices for the same period. The Funds' performance information reflects applicable fee waivers and/or expense limitations in effect during the period presented. Absent such fee waivers/expense limitations, if any, performance would have been lower. The bar chart shows the performance of each Fund's Class I shares. Performance for other share classes would differ to the extent they have differences in their fees and expenses.

SCO Fund's performance prior to February 1, 2022 reflects returns achieved pursuant to different principal investment strategies. If the Fund's current strategies had been in place for the prior periods, the performance information shown would have been different. For SCO Fund, Class R6 shares' performance shown for the period prior to their inception date is the performance of Class I shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns would be different.

For SCG Fund, the bar chart and table reflect the Predecessor Fund's performance. Because Class R6 shares of SCG Fund had not commenced operations as of the calendar year ended December 31, 2021, no performance information for Class R6 is provided in the table below. Because Class A, C, P3, R, T and W shares of SCG Fund will be formed as part of the Reorganization, such classes are not currently offered but will be offered at the time of the Reorganization. As such, no performance information for Class A, C, P3, R, T and W shares of SCG Fund is provided in the table below.

SCO Fund - Calendar Year Total Returns (as of December 31 of each year)

Client Talking Points

SCG Fund - Calendar Year Total Returns (as of December 31 of each year)

▪Average Annual Total Returns %

(for periods ended December 31, 2021) SCO Fund - Calendar Year Total Returns

Client Talking Points

SCG Fund - Calendar Year Total Returns

The performance quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. The investment return and principal value of an investment in the Funds will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. You may obtain performance information current to the most recent month end by visiting www.voyainvestments.com.

▪Index Description

The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® Index companies with higher price-to-value ratios and higher forecasted growth values.

▪Tax Considerations

The Reorganization is expected to be a tax-free reorganization for federal income tax purposes. Accordingly, no gain or loss is expected to be recognized by SCO Fund or its shareholders as a direct result of the Reorganization. As a non-waivable condition to the Reorganization, SCO Fund will have received a legal opinion as to this and other expected U.S. federal income tax consequences of the Reorganization. It is possible that the Internal Revenue Service or a court could disagree with this legal opinion. The tax basis and holding period of a shareholder's SCO Fund shares are expected to carry over to the SCG Fund shares the shareholder receives in the Reorganization. At any time prior to the consummation of the Reorganization, a shareholder may redeem shares, likely resulting in recognition of gain or loss to such shareholder for federal income tax purposes. If SCO Fund holds securities in certain foreign jurisdictions, the Reorganization may cause SCO Fund and SCG Fund to incur stamp tax or other transfer costs or expenses.

Because the Reorganization will end the tax year of SCO Fund, it will accelerate distributions to shareholders from SCO Fund for its short tax year ending on the date of the Reorganization. Those tax year-end distributions will be taxable and will include any capital gains resulting from portfolio turnover prior to consummation of the Reorganization that were not previously distributed.

For Internal Use Only. Not for Inspection by, Distribution or Quotation to, the General Public.

The foregoing is not an offer to sell, nor a solicitation of an offer to buy, shares of any fund, nor is it a solicitation of any proxy. For information regarding SCG Fund, please call Voya Investment Management toll free at 1-800-992-0180.

Client Talking Points

For information regarding any of the funds discussed in this Client Talking Points, please call Voya Investment Management toll free at 1-800-992-0180. To receive a free copy of a Proxy Statement/Prospectus relating to the proposed merger of Voya SmallCap Opportunities Fund with and into Voya Small Cap Growth Fund, please call Voya Investment Management toll free at 1-800-992-0180. This "Client Talking Points" is qualified in its entirety by reference to the Proxy Statement/ Prospectus, and supersedes any prior Client Talking Points. The Proxy Statement/Prospectus contains important information about fund objectives, strategies, fees, expenses and risk considerations, and therefore you are advised to read it. The Proxy Statement/Prospectus and shareholder reports and other information are or will also be available for free on the SEC's website (www.sec.gov). Please read any Proxy Statement/Prospectus carefully before making any decision to invest or to approve the merger.

Contents of this communication may contain information regarding past performance, market opinions, competitor data, projections, forecasts and other forward-looking statements that cannot be shared with clients, prospective clients or current investors of Voya investment products. The information presented has been obtained from sources Voya Investment Management ("Voya IM") deems to be reliable, however, this data is subject to unintentional errors, omissions and changes prior to distribution without notice. This information is provided to Voya IM employees for internal or educational use only and cannot be used as sales or marketing material, nor can it be distributed outside of the firm. Please only use compliance- approved marketing materials with clients and prospects. These materials contain compliant sales language, appropriate risk disclosures and other relevant disclaimers that provides a sound basis for evaluating our investment products and services. This information cannot be reproduced in whole or in part in any manner without the prior permission of a Voya IM Compliance Officer.

Your clients should consider the investment objectives, risks, charges and expenses of Voya Small Cap Growth Fund carefully before investing. For a free copy of the Voya Small Cap Growth Fund prospectus, which contains this and other information, visit us at www.voyainvestments.com or call Voya Investment Management at 1-800-992-0180. Please instruct your clients to read the prospectus carefully before investing.