Craig J. Cerny

Chairman and CEO

2

During the course of my remarks today, you will

hear me make certain predictive statements

regarding our plans and strategies and

anticipated financial results to assist you better

in understanding our company.

The forward looking statements about future

results are not absolute.

Refer to our 10K, 10Q’s and 8K’s on file with

the SEC for further detail in this regard.

3

History

Cerny was the managing principal of the bank consulting group of

Smith Breeden and Associates, Inc. (SBA) from 1985 to 1996.

Principals of SBA decided to make bank investments with personal capital

Harrington West was second bank related investment led by Cerny

Harrington West was formed to acquire Los Padres Bank in April

1996, then $140 million in assets with 4 locations on the Central Coast

of California

Initial public offering completed on November 12, 2002 to fund

further expansion

As of December 31, 2004

$1.1 billion in assets

14 banking locations in three states of CA , KS and AZ, when second AZ location

opens in early 2005.

$100.0 million market cap at December 31, 2004

4

Mission Statement

The mission of Harrington West is to be:

growth oriented

high performing on ROE and EPS growth measures

diversified and opportunistic

high product value for retail and commercial customers

relationship-driven/consultative service

emphasize safety and community involvement

use modern financial skills in risk management and

investments

5

New Product and Project Timeline

6

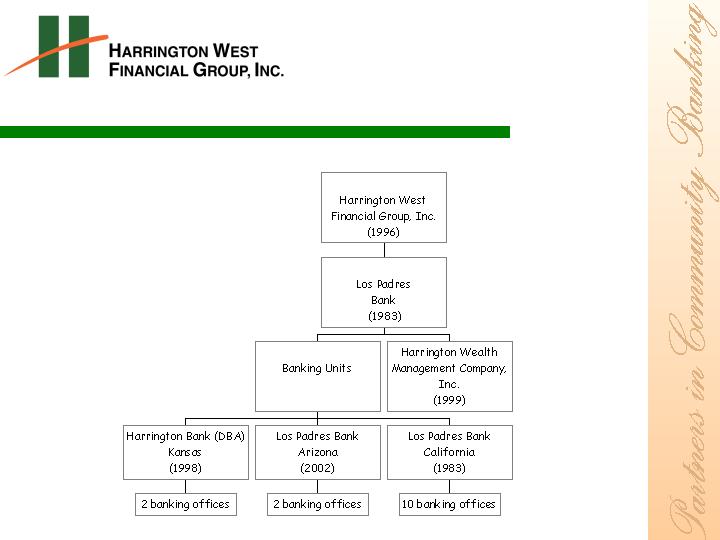

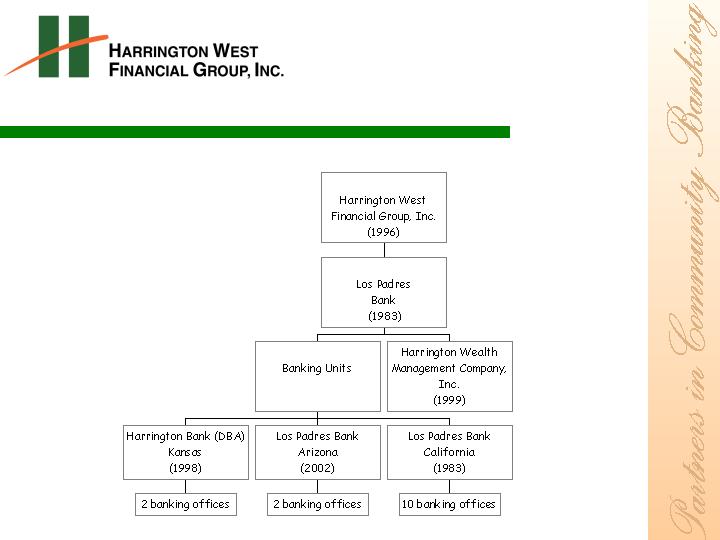

Corporate Structure

7

Why Multiple Markets?

Broad Market

Knowledge

Loan

Diversification

Local Experience

Shareholder

Wealth Creation

Options

Centralized

Administration

8

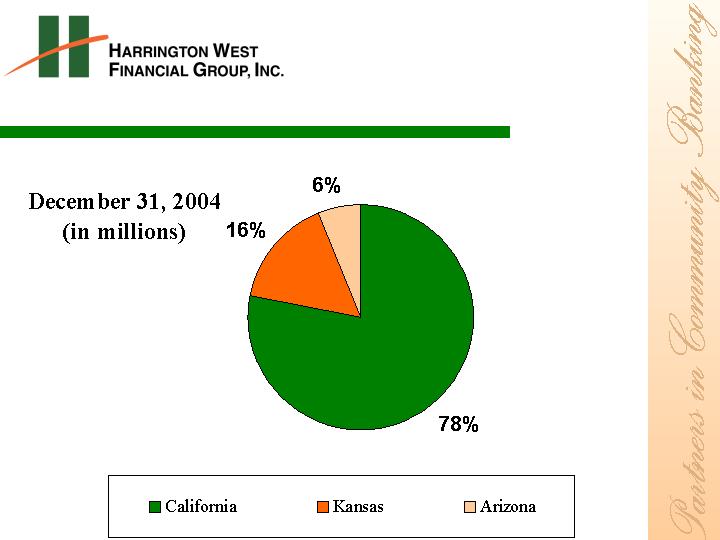

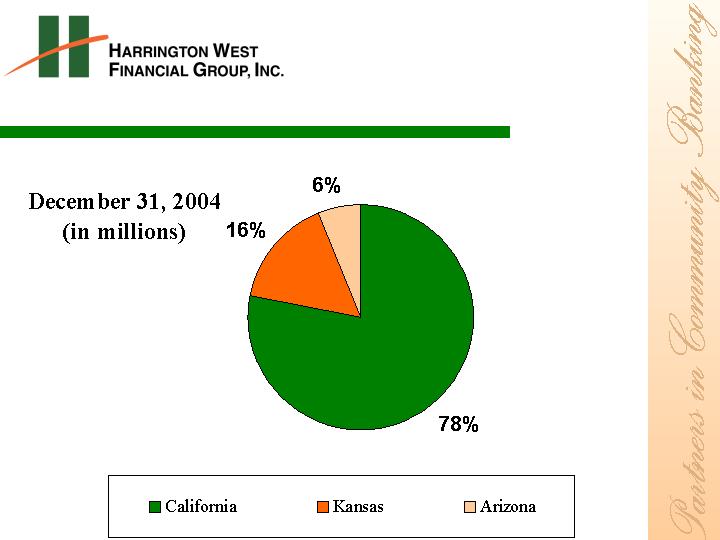

Deposits by Market

Total deposits

$598 million

9

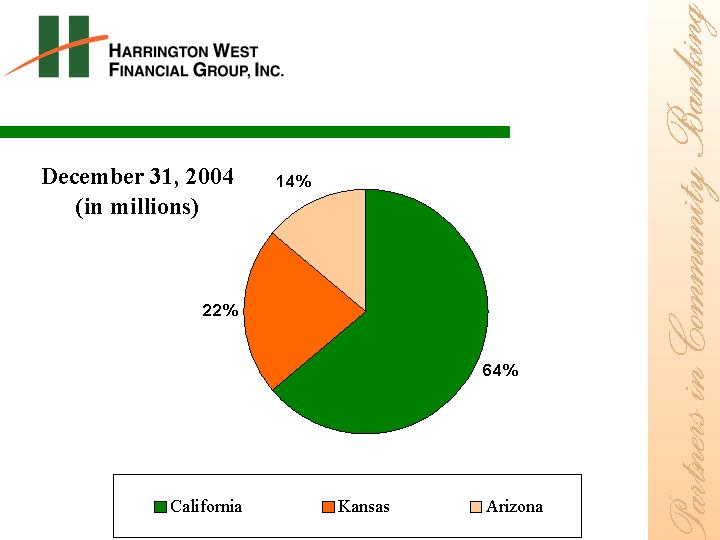

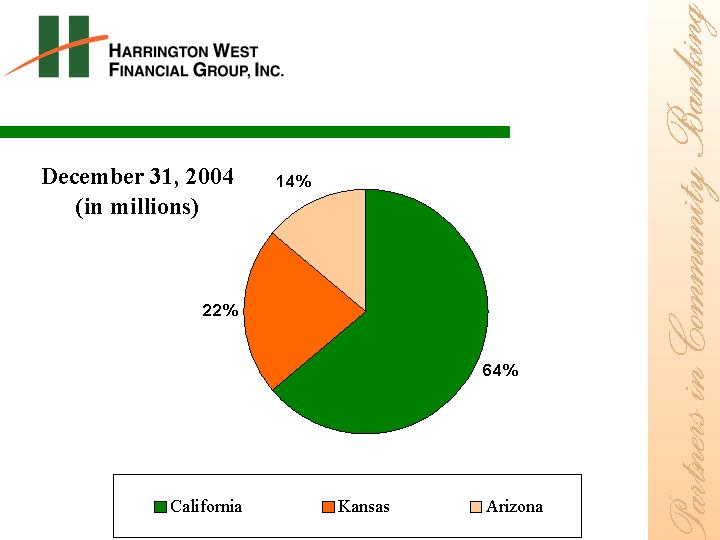

Loans by Market

Total net loans

$598 million

10

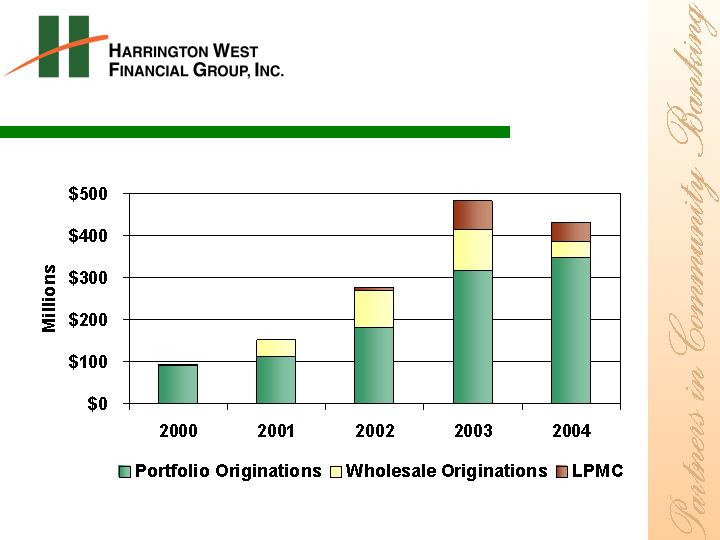

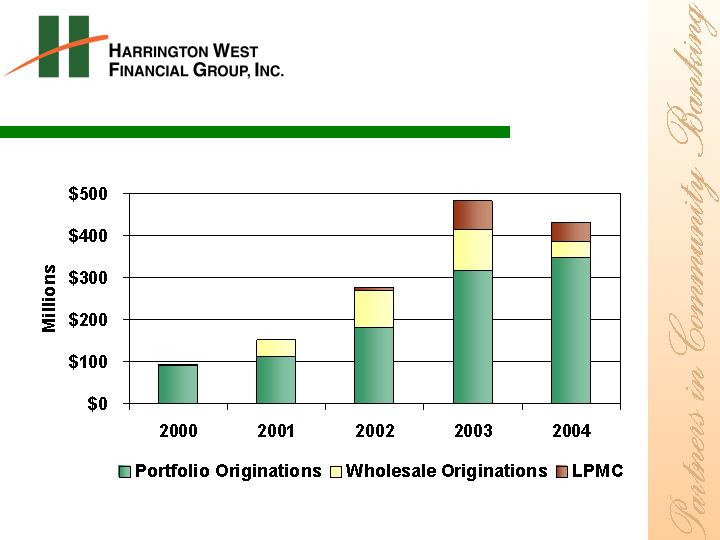

New Loan Originations

11

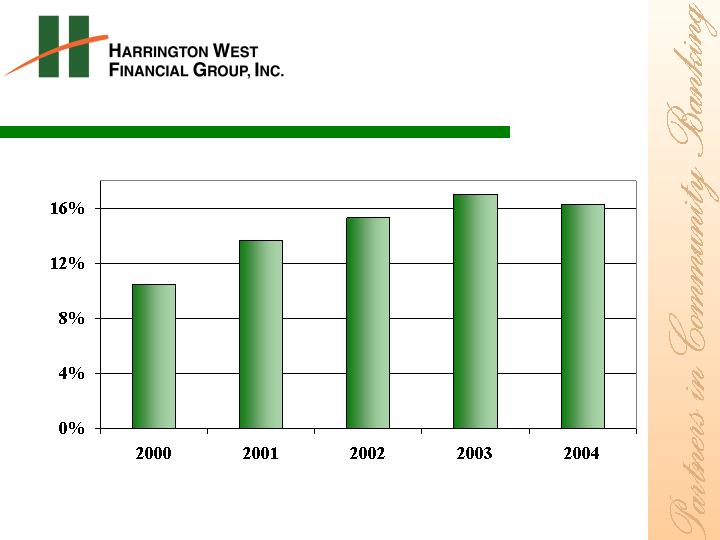

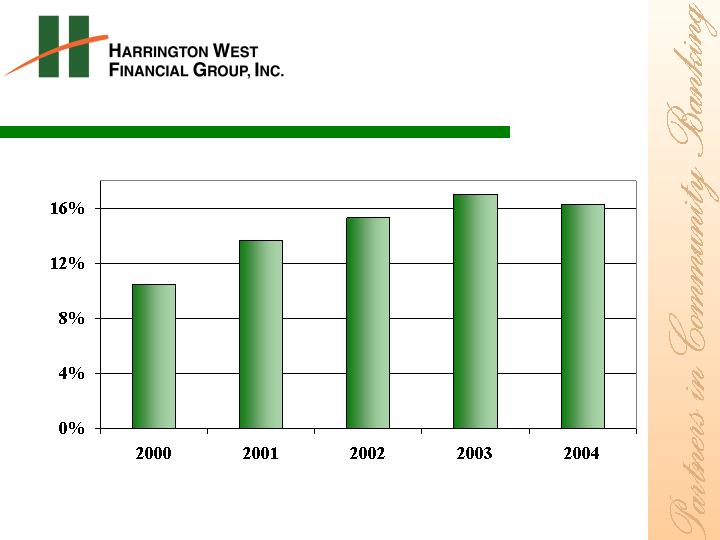

Return on Equity

12

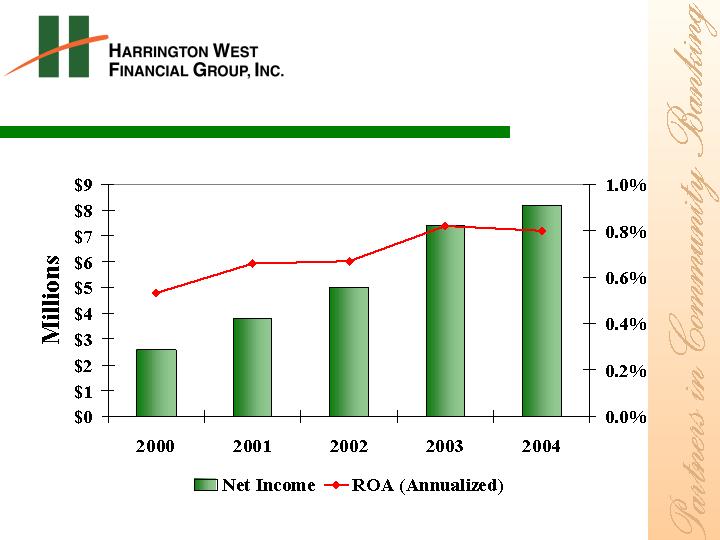

Financial Accomplishments

$2.0

million

$3.1

million

$846

thousand

$6.7

million

$7.6

million

Dec QTD

2003

10.8%

14.7%

(24.4%)

14.2%

11.2%

Change

$2.2

million

$3.4

million

$806

thousand

$7.5

million

$8.4

million

Dec QTD

2004

10.0%

$7.4

million

$8.2

million

Net Income

Core Banking

Income 4

Banking Fee

Income 3

Net Interest

Income 2

Net

Revenue 1

Financial

Measure

$13.3

million

$3.1

million

$28.9

million

$32.7

million

2004

$11.6

million

$4.1

million

$25.3

million

$29.4

million

2003

9.7%

(5.4%)

11.9%

10.5%

Change

1 Net interest income plus banking fee income

2 Net Interest Income after provision for loan losses

3 Loan, deposit, HWM, mortgage brokerage, and other fees

4 Net Revenue minus operating expenses

13

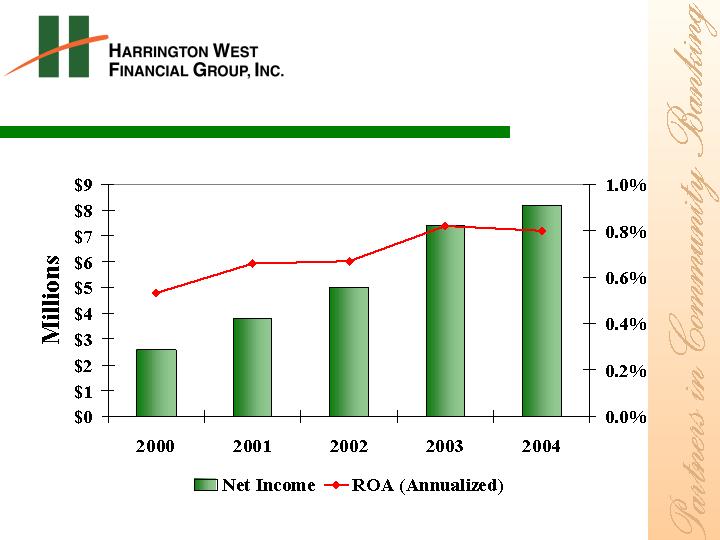

Net Income

14

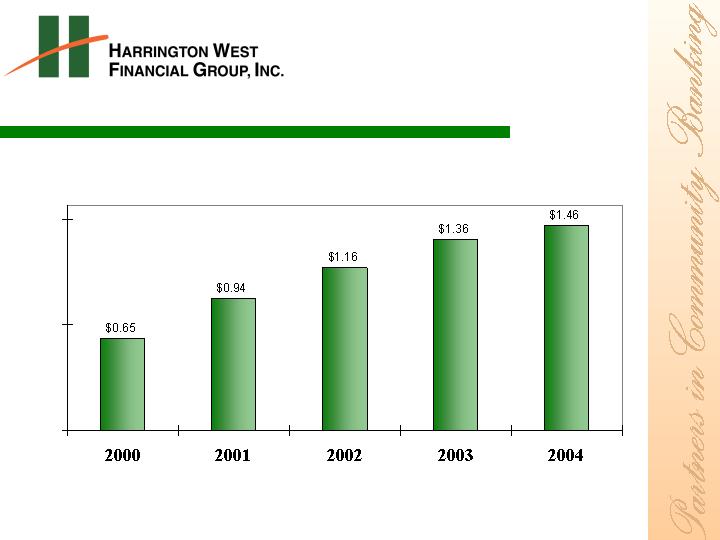

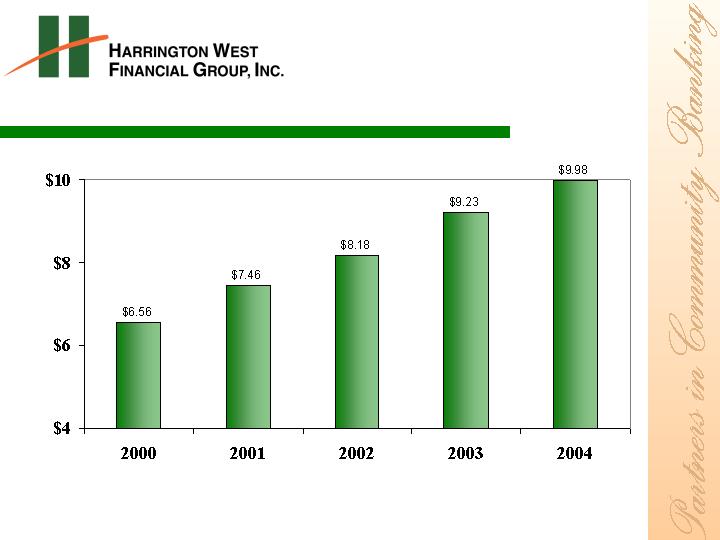

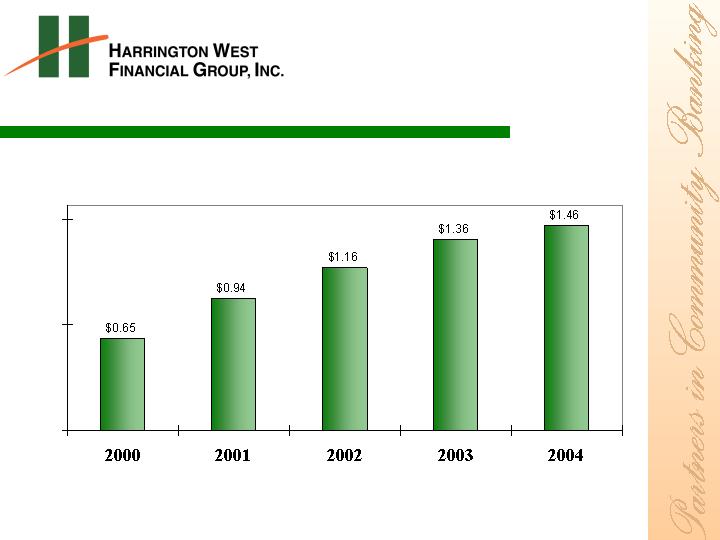

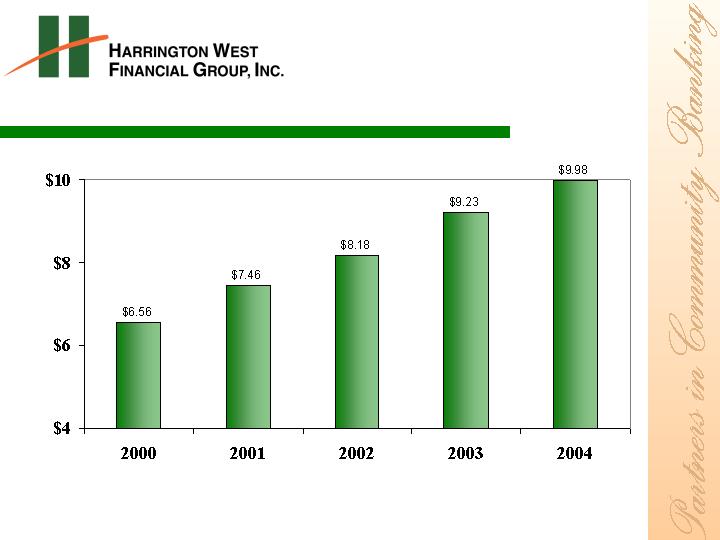

Earnings Per Share

Compounded Annualized Growth Rate from 2000 - 2004 = 22.42%

Note: The per share information above has been adjusted for the 6 for 5 stock

split in the form of a stock dividend to holders of record on February 25, 2004.

15

Book Value Per Share

16

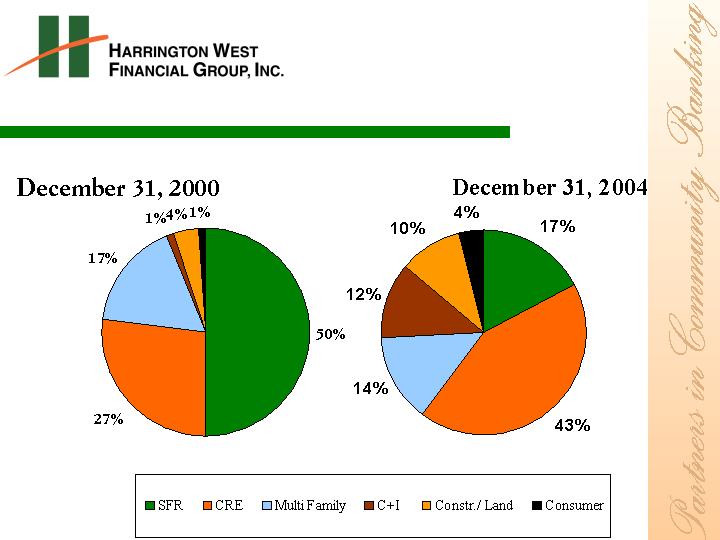

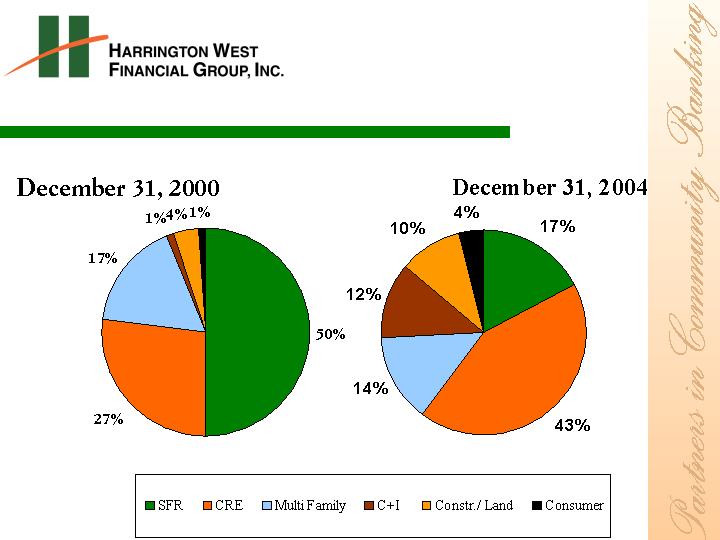

Profit Drivers

Mix Change To Higher Spread Earning Loans

17

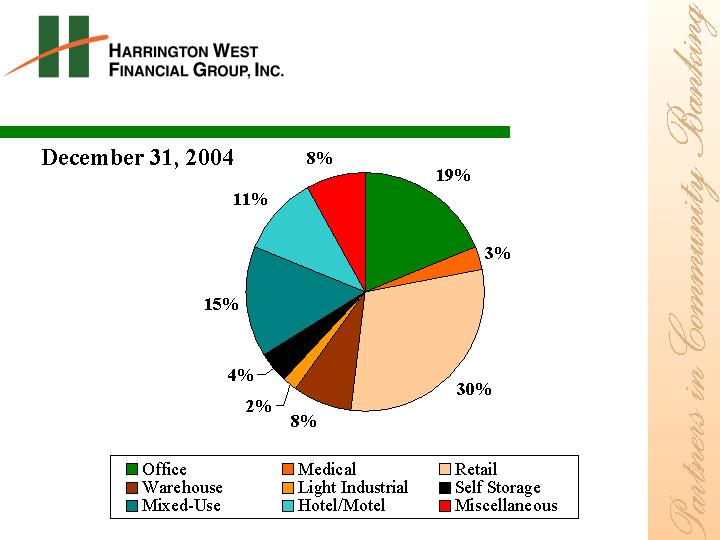

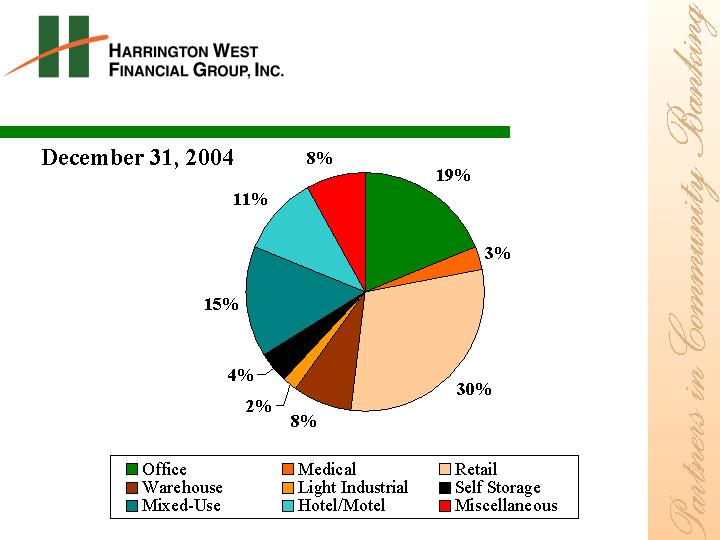

CRE Loan Mix

18

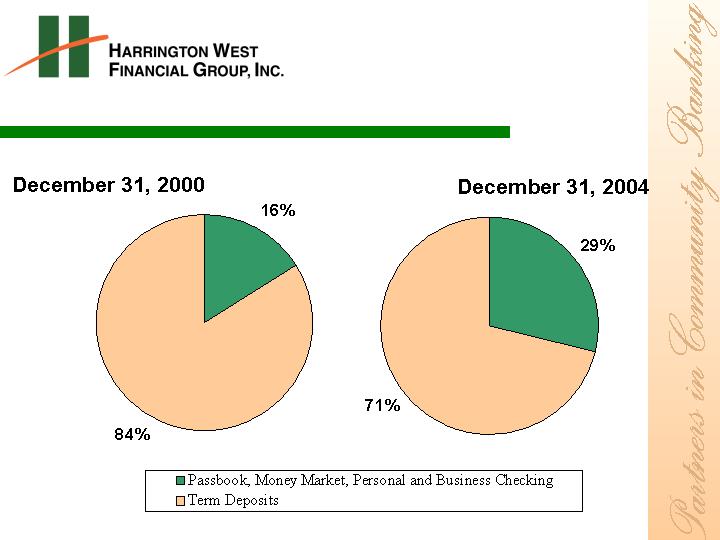

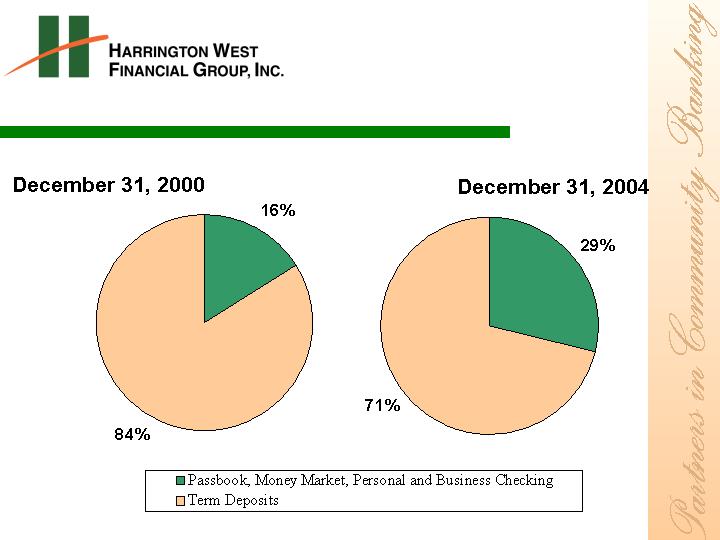

Profit Drivers

Mix Change To Lower Cost Deposits

19

Net Interest Income & Margin

Net interest income is reflected after provision for loan loss.

20

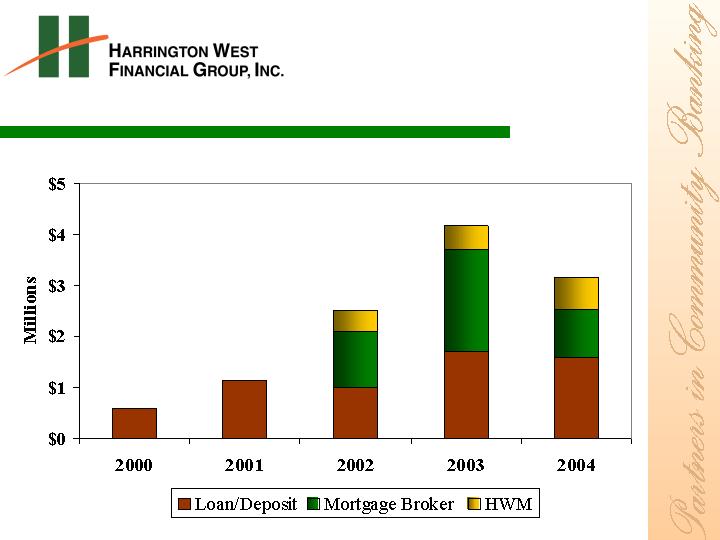

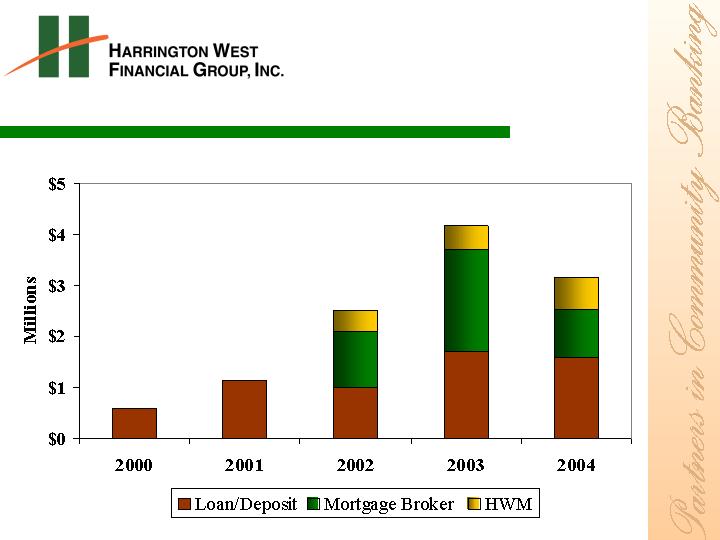

Profit Drivers

Fee Income Growth

21

Profit Drivers

Fee Income

(Dollars in thousands)

Banking Fee Type

Mortgage Brokerage

Fees and Prepayment

Penalties

$298

$260

14.6%

$495

(39.8%)

$1,290

$2,566

(49.7%)

Other Loan Fees

56

55

1.8%

40

40.0%

226

223

1.3%

Deposit, Other Retail

Banking Fee & Other

Income

289

267

8.2%

202

43.1%

1,022

863

18.4 %

Harrington Wealth

Management Fees

163

152

7.2%

109

49.5%

610

456

33.8%

Total

$ 806

$734

9.8%

$ 846

(4.7%)

$ 3,148

$ 4,108

(23.4%)

22

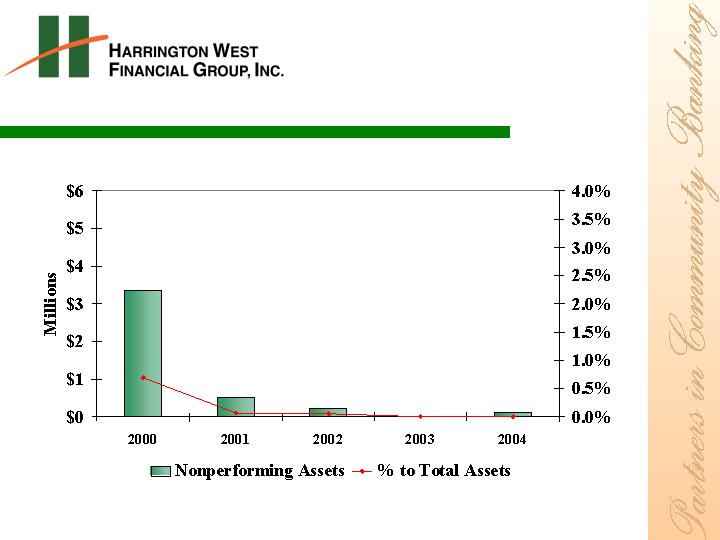

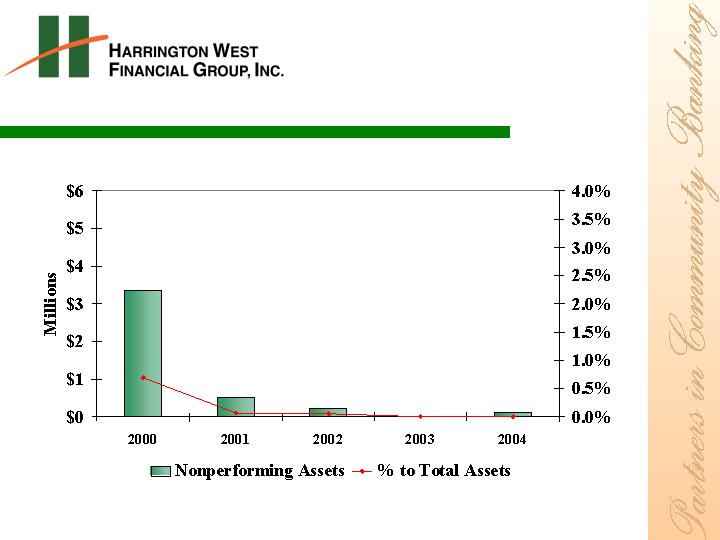

Profit Drivers

Credit Quality Maintained

23

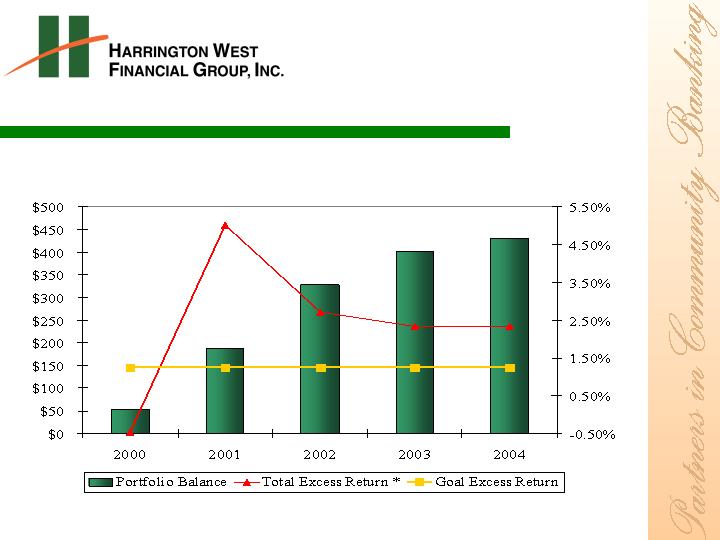

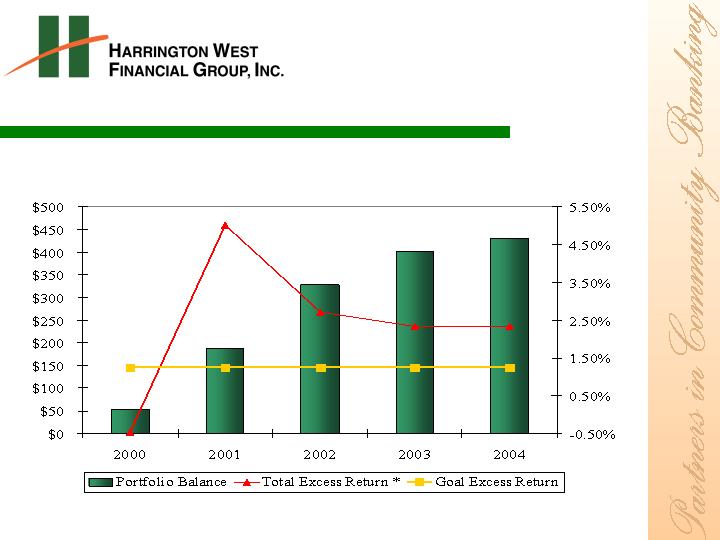

Profit Drivers

Investment Portfolio Performance

* Total Excess Return To One Month LIBOR

24

Strategic Focus for 2004 and Beyond

Maintain excellent financial and investment performance

Continue growth towards a diversified balance sheet.

Focus on expansion of Harrington Wealth Management Company,

Commercial Business Products and new fee producing products to

increase revenue growth.

Overdraft protection

Brokerage services

Focus on mortgage banking income from purchase mortgages and

new builder/realtor programs.

Develop Customer Source applications to track profitable and

opportunity customers and cross selling penetration. Continue

implementation of Sales/Service Program.

Open new banking offices –approximately 2 offices every 15

months.

25

Why Invest in Harrington West?

Track record of improving profitability with a growing franchise

Attractive markets and franchises

Credit quality

Opportunistic strategy

Shareholder focused to maximize value with high inside ownership

Risk Management processes are emphasized

Attractive valuation – January 26, 2005

Peer HWFG

EPS Multiple (LTM) 16.1X *11.81X

Book Multiple 1.91X *1.85X

Dividend Yield 1.89% *2.39%

Payout (LTM) 35% **25%

Rising Cash Dividend to Shareholders

Median of all public banks and thrifts from $500 million to $2 billion in assets per RBC Capital Markets, Inc.

*Based on December 31, 2004 financial information using January 26, 2005 stock price of $18.43 per share.

**Does not include special dividend of 50 cents paid on July 12, 2004.

(NASDAQ Symbol: HWFG)

26

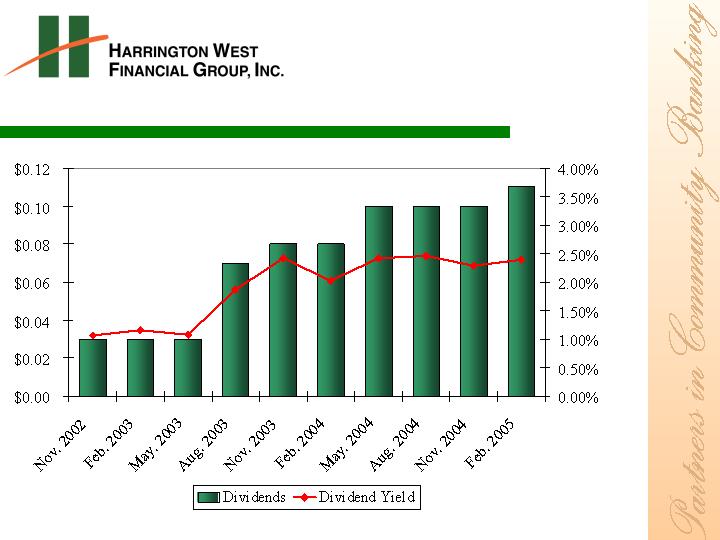

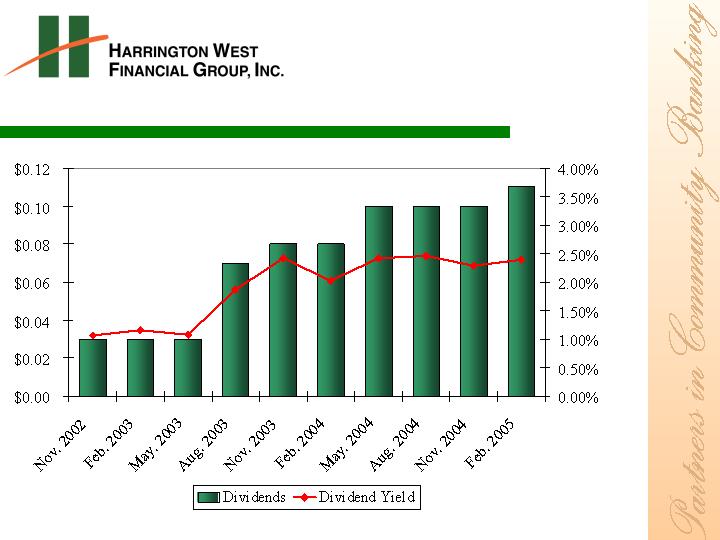

Dividend Payment Per Share

Dividends paid and dividend yield does not include special

dividend of $.50 paid July 12, 2004.

27

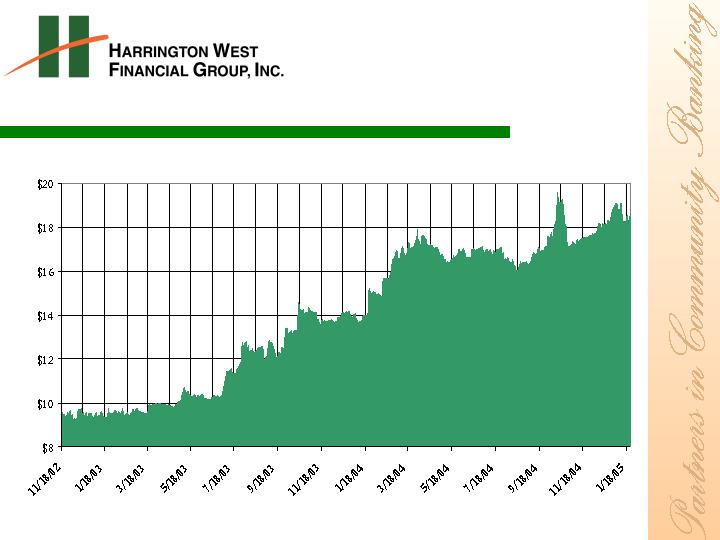

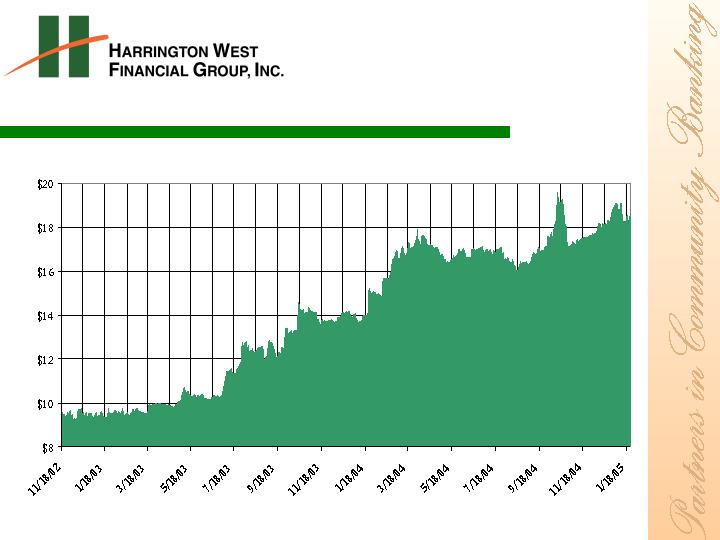

Stock Price

28